1. Introduction

As nations undergo a low-carbon energy transition, including large-scale electrification and a shift toward a more efficient transportation system, the need for mineral raw materials (ore and concentrates), some of which are critical, are expected to increase [

1,

2]. Japan is a nation which is highly dependent on the import of such raw materials for industry, and the need to conserve limited resources and maintaining resource security are considered important to the Japanese public [

3]. Japan is completely dependent on imports of raw materials such as for ferrous and non-ferrous metal ores and concentrates (e.g., iron, copper, lead and zinc), which makes it vulnerable to potential global supply disruptions. Such disruptions may occur for various political, economic and environmental reasons. Recent discourse around resource security has been focused on critical materials, essential for industry, civil life and military applications for which alternative materials are not available and which use minerals whose probability of supply restriction is elevated or, in some cases, whose environmental implications of supply are high [

4]. “Critical materials” can be broadly defined as relating to materials that fulfil an important (or vital) role in society and for which there is a high possibility of supply restriction, which could lead to higher prices (economic scarcity) or physical unavailability (physical scarcity). A variety of factors are typically included in the evaluation of “criticality”, which includes factors of economic importance or reliance (vulnerability to supply restriction, including the number of people using, the importance to economic sectors and the potential for substitution) and supply risk (factors that affect this might include the level of monopolization of supply chains, environmental intensity of production and governance in producing countries). Taking copper for example, it is vital to some applications such as electric wire but can be substituted with aluminum with some loss of performance; at the same time, the global production of copper ore is quite diversified, giving a potentially lower supply risk. Due to increasing demand and potential for lagging supply, ore grade decline in terrestrial mines and potential subsequent cost increases per ton of metal, it may face both economic and physical scarcity.

The specific definition of a critical material differs from nation to nation, depending on the applied evaluation criteria although materials such as rare earth elements (REE) and Platinum group metals (PGM) are common among materials considered as critical in most nations. In Japan, as a country that is almost entirely dependent on imports of raw materials, apart from the concept of “criticality”, other metals are considered “strategic” due to their economic importance (regardless of the likelihood of global supply disruptions which is included in criticality), including copper, lead, nickel and zinc [

5,

6,

7]. This reasoning underpins their consideration as strategic materials in Japan.

Resource importing countries have severe limits on their ability to exert control over political, economic or environmental issues which are occurring in resource exporting countries. Cognizant of this limitation and, as metals play an important role in achieving a low-carbon society [

8], many import-reliant countries have seen the need to develop a resource acquisition or resource security strategy. Application of these strategic metals to renewable energy includes, for example, photovoltaic panel requiring copper, indium, gallium and selenium and wind turbines requiring nickel, molybdenum, neodymium and boron as functional materials [

8]. As renewable energy installation increases, battery demand will also likely increase. Lithium-ion batteries are one key storage option in renewable energy societies, and these also include potentially critical minerals such as cobalt and lithium [

8]. In order to improve low levels of raw-material self-sufficiency, each country needs to decide their own approach. For example, the USA drew up the Critical Materials Strategy [

7], the EU developed the Critical raw materials for the EU [

5], while the Japanese government outlined their strategy in the Strategic Energy Plan [

9]. This plan includes a raft of measures, such as, supply diversification, recycling of end-of-life products and research and development for extraction from unestablished or alternative materials [

6]. Of these measures, all are dependent on other nations, except for research and development and domestic recycling of end-of-life products. In order to ameliorate this issue, domestic mineral production needs to be considered alongside domestic recycling in order to achieve resource security, critical to the low-carbon energy transition. The circular economy is one tightly-linked concept to maximize resource efficiency and minimize waste production, within the context of sustainable economic and social development [

10]. Promoting recycling is one of the key components of the circular economy, as well as a key strategy for critical material resource security.

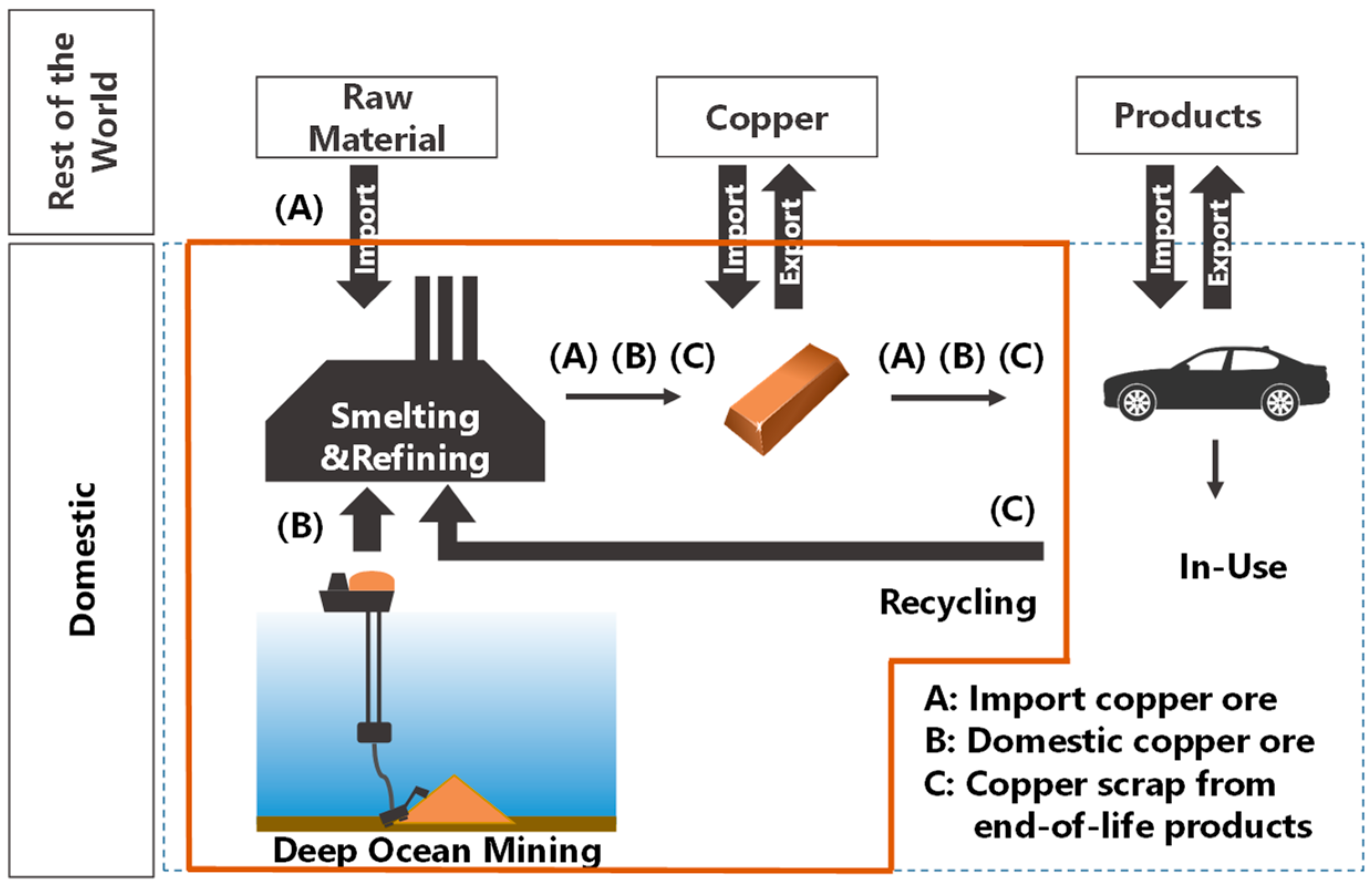

This research focuses on the effects of domestic copper production and recycling in Japan. Copper is selected from among the group of critical materials as it has many applications and demand is expected to increase due to expanded renewable energy deployment such as CIGS photovoltaic panel and CIS (copper (C), indium (I) and selenium (S)) photovoltaic panel [

11]. Recently, the United States published a federal strategy, which focuses on the improvement of critical mineral supply by: Identifying new sources of critical minerals, enhancing activity at all levels of the supply chain, seeking to stimulate private sector investment and growth of domestic downstream value-added processing and manufacturing, ensuring that miners, producers, and land managers have access to the most advanced mapping data; and outlining a path to streamline leasing and permitting processes in a safe and environmentally responsible manner [

12]. Resource acquisition options for an import-reliant country include (1) on-land mining, (2) imports of raw materials, (3) recycling, and (4) unconventional resource exploration. In the context of Japan, because of its lack of on-land mines, option (1) is unlikely. In terms of improving resource security, option (2) does not relieve the vulnerability to export restrictions by exporting countries. Lacking known deposits on land or near shore, development of domestic primary production is focused on ore production by means of deep ocean seafloor massive sulfide (SMS) mining. Thus, recycling and deep sea mining (which is a subset of option (4)) are the options to be discussed in this study.

This study aims to assess the constraints of energy, material, economic and labor under domestic mineral production.

2. Background and Literature Review

In recent history, mineral resource security policy in Japan has been highly dependent on the acquisition of mining rights in resource exporting countries [

13]. For example, Japan Oil, Gas and Metals National Corporation (JOGMEC), the organization in charge of contributing to a stable supply of petroleum, natural gas and mineral products, undertakes joint exploration for copper and gold in Australia. Through this project JOGMEC expects to contribute toward resource security in Japan [

14]. Although Japan‘s defined self-sufficiency rate reflects the acquisition of mining rights in resource exporting countries (so that the apparent self-sufficiency rate of base metals in Japan is about 50%) [

9], for most metals there is no domestic mining, and there is no policy promoting the extraction of minerals in Japan.

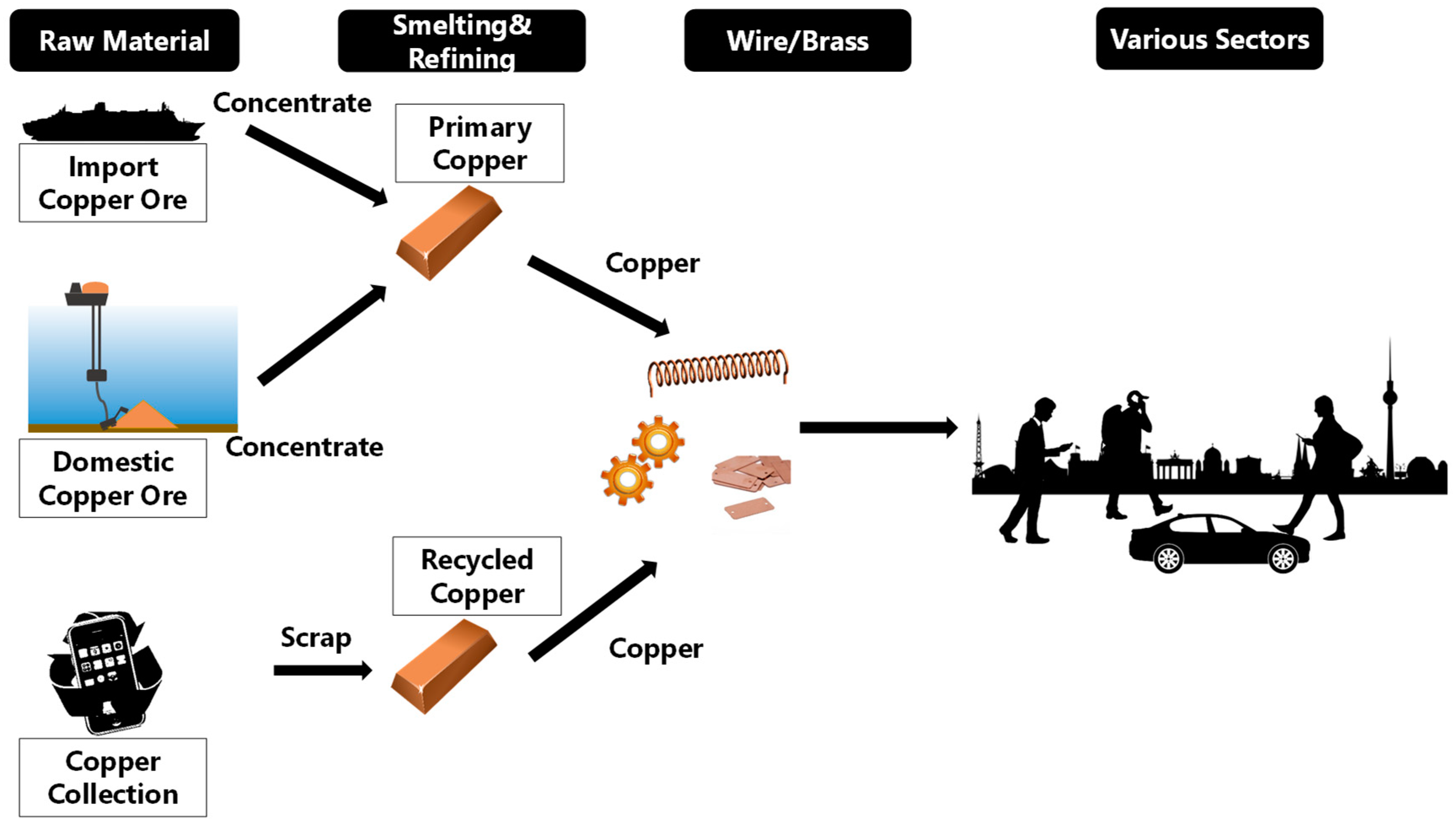

With regards to copper in Japan, 100% of mineral concentrate is imported, and the annual production of copper in Japan in 2017 was 1488 kt, split between the end uses of wire (64%), brass (35%), and casting (1%) [

15]. The recycling rate for 2017 was reported as 32% [

15]. The recycling rate reflects the percentage of copper produced utilizing copper scrap. In-process scrap, which is scrap generated during wire or brass production, is utilized at the rate of almost 100% and the wire and brass industry also utilizes end-of-life product scrap, which is generated from waste copper products, for production [

16]. Scrap produced in Japan was distributed to the wire, brass, copper smelting and export industries [

16]. Wire and brass industries use scrap so that they can reduce material input costs [

16]. The smelting industry uses scrap to productively utilize the excess heat created by the converting reaction in converter furnaces [

17]. Copper smelting and export industries currently process lower grade scrap, whereas high grade scrap was recycled in the wire and brass sectors [

16]. China has consistently been a major importer of Japan’s scrap—particularly scrap which required labor inputs in order to be economically recycled (such as plastic-coated cables). However, scrap imports, including not only copper scrap but also various kinds of metal scrap, slag and plastic imports were banned by China in 2018, in order to protect the environment [

18]. This outcome means that Japan will need to process lower grade scrap domestically or find an alternative processing destination.

In the EU, following China’s scrap import ban, waste paper and plastics which were anticipated to be shipped to China were shifted to other countries such as Vietnam, Thailand and India [

19]. Copper scrap export data after China’s policy change is not yet available, however it is expected that overflows of copper scrap will be sent to third parties.

Lack of an export market for scrap, with a shift to processing within Japan could potentially create new industry activities such as end-of-life product collection.

Considering the dual issues of resource security and environmental protection in both scrap producing and importing nations, recycling more copper within Japan could help ameliorate resource security and environmental issues.

One issue that arises from a strategy of greater domestic recycling is the downgrading of copper scrap due to impurities. Currently, the wire and brass industries both seek to prevent impurities and maintain a high-quality product, cognizant of the fact that no dedicated recycled copper refineries exist in Japan. According to the Metal Economic Research Institute Japan (MERIJ), two-thirds of brass makers maintain their own standards for scrap metals, 80% of which are stricter than the current Japanese Industrial Standard (JIS) [

16]. MERIJ has also identified the issue of the increasing difficulty faced in securing employees for the typical techniques required to ensure high-quality copper scrap that are highly dependent on labor [

16].

In addition to scrap recycling and direct imports, an alternative supply source for raw materials in Japan is provided by extraction of unconventional ores which lie on the seafloor using deep ocean mining. Deep ocean resources with Japan’s exclusive economic zone (EEZ) such as SMS, manganese nodules and rare earth rich deep-sea muds have been widely studied [

20]. The key reason for this is Japan’s lack of commercial terrestrial domestic mining, which makes importing the only way for Japan to supply its mineral concentrate needs. Under this constraint, the current supply system is vulnerable to supply disruptions from external parties and this may engender significant economic damage to the manufacturing industry if key mineral inputs are affected. Although modern-day deep ocean mining technologies and the current deposit levels are not yet economically competitive with land-based mining, utilizing these resources in the future may ease the potential for untoward impacts should supply disruptions occur. The strength of deep ocean mining is its lower waste footprint. Land-based mining requires land clearing and, removal of overburden before extraction of the valuable ore. On the other hand, deep ocean mining does not need to remove much overburden for extraction. When deep ocean resources are extracted, waste rock is expected to be significantly lower than terrestrial mining [

21]. Of course, there are many uncertainties around deep ocean mining, across all fronts—technical, environmental, economic and social. Notably, most studies consider the biodiversity and direct ecosystem impacts of deep ocean mining, which are difficult to compare adequately with land-based mining because of the lack of environmental baselines as well as the lack of commercial deep ocean mines as precedents. Thus, these aspects—which may be negative for deep ocean mining—are left out of the present examination.

One of Japan’s well-studied potential deep ocean ore bodies lies approximately 110 km offshore from Okinawa Island [

22]. It is reported that this deposit has 0.4% of copper (3000 kt), 1.4% of lead (10,000 kt), 5.8% of zinc (43,000 kt), 1.5g/t of gold (11 t), and 95.6 g/t of silver (1 kt) [

23]. Although the total quantity of copper in this deposit is not large considering Japan’s annual copper demand is approximately 1500 kt [

15], combined production with other metals such as zinc, lead, gold and silver could contribute positively toward overall national resource security.

This study aims to contribute to the debate surrounding resource security for nations reliant on raw material imports, and to specifically investigate recycling approaches, deep ocean mining, and a combination of the two. This approach is applicable to not only copper but also other non-ferrous minerals. Copper has been chosen as a case study because of following reasons. Lead, which is used in applications such as automobile batteries or large-scale batteries, is already recycled effectively, giving only marginal potential for improvement. On the other hand, zinc is typically used in alloys, or for additives in galvanization or paints or as sacrificial anodes, which can be considered dissipative uses. Generally speaking, it is difficult to recover zinc metal by itself, but it is recovered in the steel recycling process. Unlike these metals, copper is used as the main material in products, in relatively pure form, and there is still room for improvement in recycling rates. Copper is therefore chosen as a case study, although this approach could be applied to these and other metals that are found in unconventional ore deposits.

4. Results

The results are expressed in three parts beginning with I-O analysis, final energy consumption and CO2 emissions, followed by labor impacts.

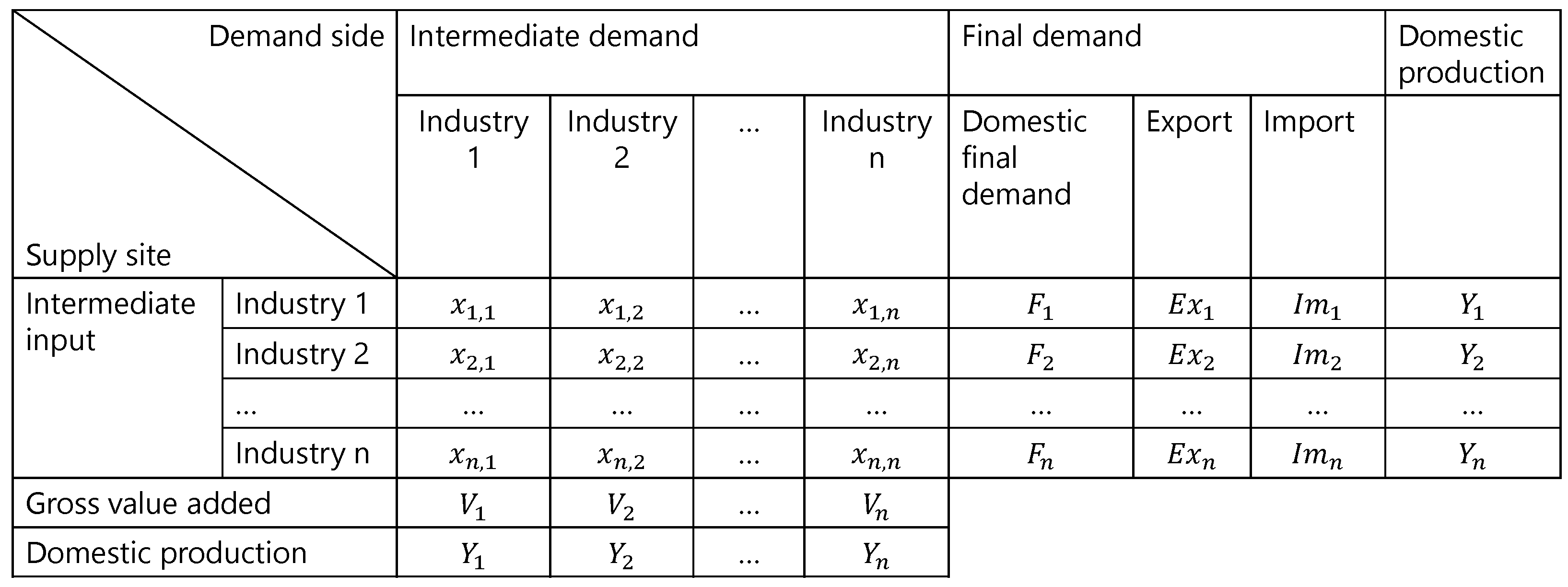

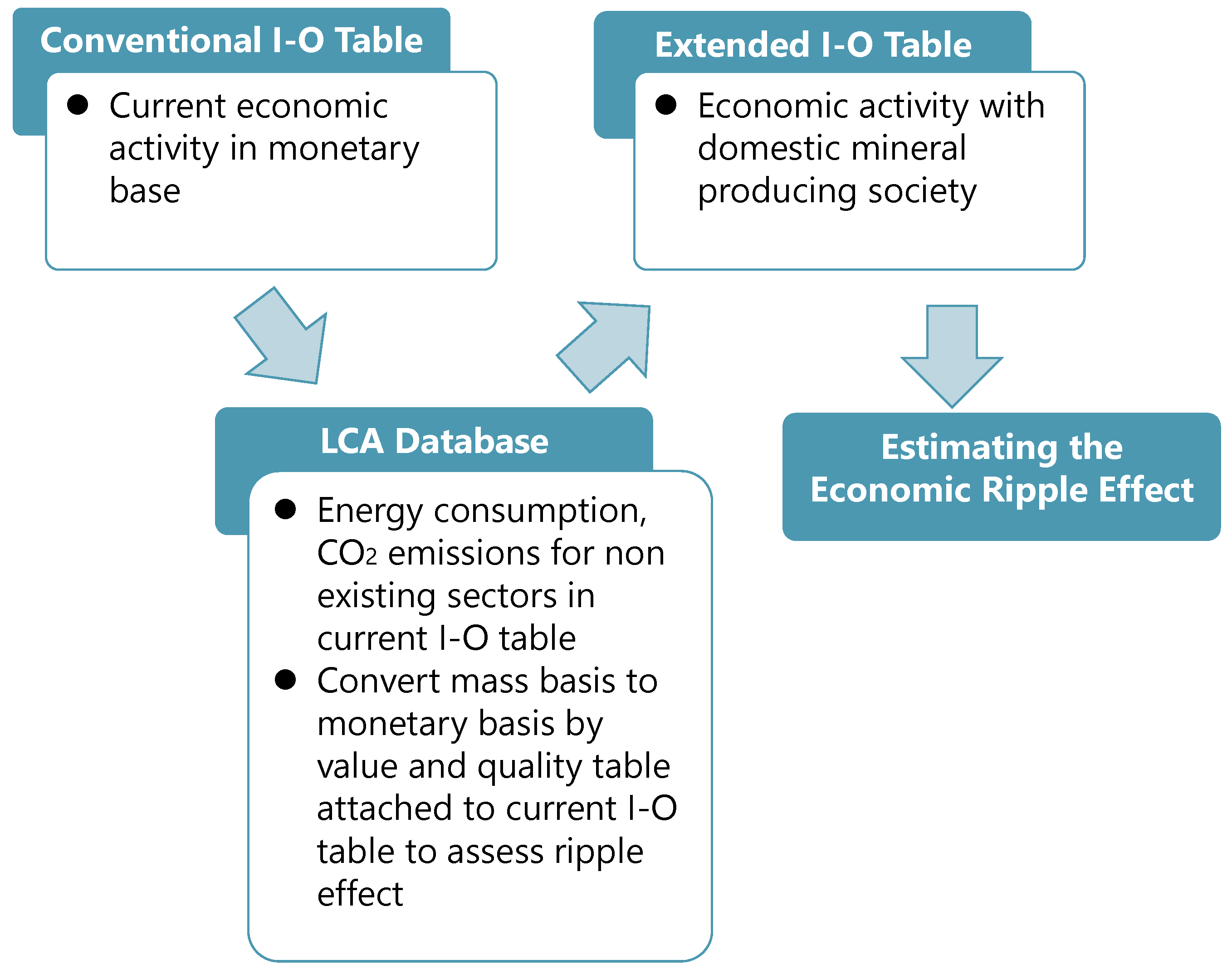

4.1. I-O Analysis

I-O analysis reveals industries that will be affected by domestic mineral production. This study considers two extremes; 100% SMS production and 100% recycling. I-O analysis reveals that in a recycling society, 1 unit increase of final demand of recycled copper engenders 1.43 overall units.

Table 2 shows the top five industries that will be affected.

On the other hand, an increase in deep ocean mining on final demand engenders a 1.75 unit increase, with the top 5 industries shown at

Table 3.

The estimated ripple effect in either case is smaller than for other industries, since the average ripple effect of all industries is 2.40. However, observing these impacts, deep ocean mining will relatively increase the output (on a monetary basis) of other industries more than copper recycling alone, as demand for copper increases.

4.2. Final Energy Consumption and CO2 Emissions

Final energy consumption is estimated based on I-O and material flow analysis. In each process, multiple minerals are produced and this study allocates energy consumption and CO2 emissions by the ratio of mass of final products.

Figure 6 indicates domestic energy consumption for the copper recycling scenario. A recycling rate of up to 10% only requires conventional copper smelting due to the relatively low capacity. For rates of 20% and above both conventional and recycled copper processing are required. As the recycling rate increases, the amount of energy required for transportation (collecting end-of-life products) increases rapidly.

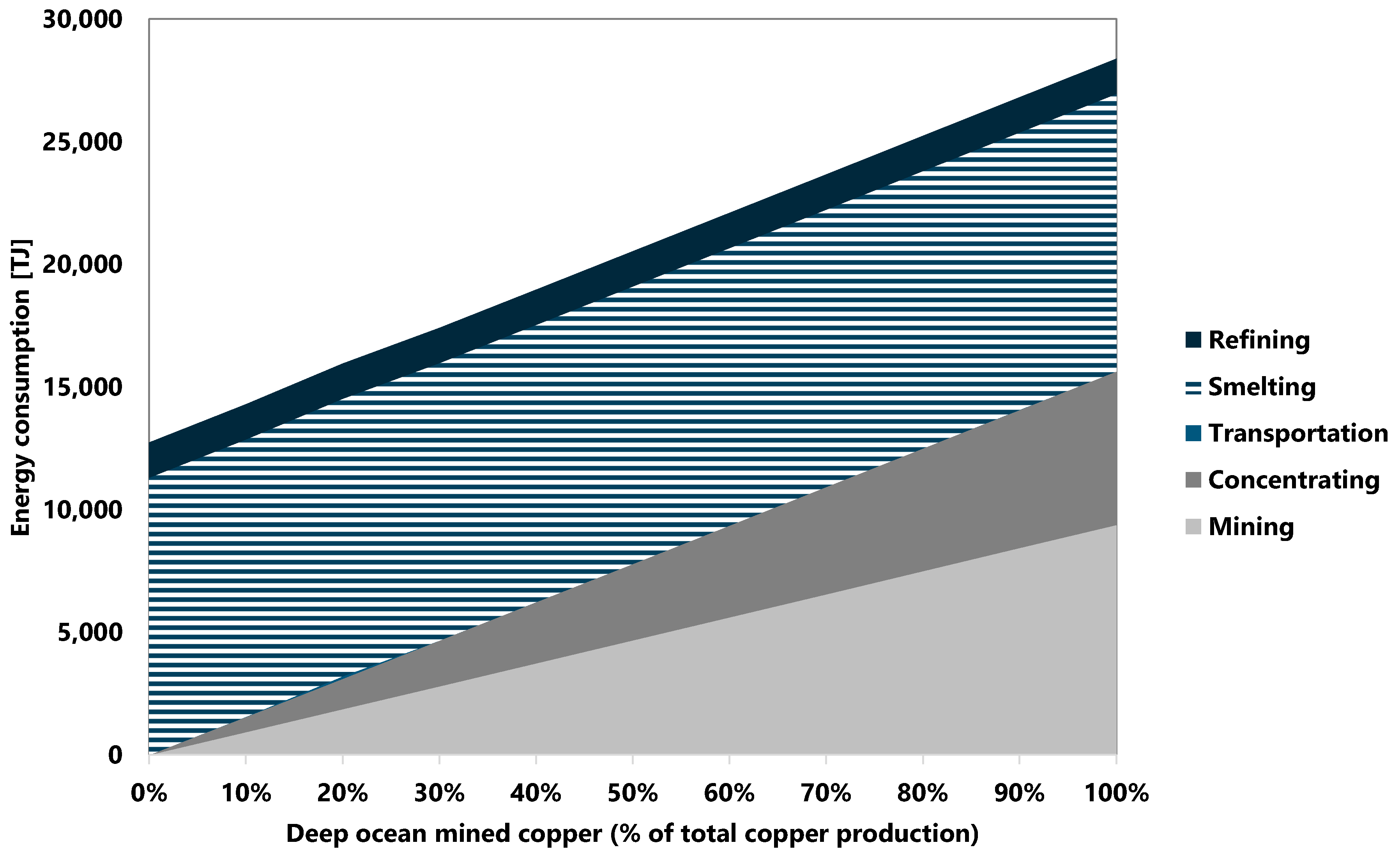

Figure 7 shows energy consumption required for deep ocean mining. Although the reserves of deep ocean ore are very small relative to the total copper demand in Japan, this limitation is deliberately ignored here. Basically, the deep ocean mining scenario can be considered to be using conventional smelting and refining processes with added domestic mining and ore concentration. Thus, the energy required for mining and concentration processes increases as the supply provided by deep ocean ores increases.

According to this result, domestic mineral production will increase overall energy consumption. In the case of recycling, energy for smelting succeeds in reducing energy consumption due to the utilization of waste plastics and the absence of an oxidization process. However, transportation of end-of-life products consumes the most energy across all processes. In the case of deep ocean mining, mining and concentration processes are added to the current copper production system. The mining processes require more energy than concentration processes. Note that the current import-based system estimate does not consider mining, transportation and concentration processes because these are all currently conducted abroad. As our estimates only encompass the domestic impacts, actual total energy consumption will be greater than our estimate due to international energy consumption.

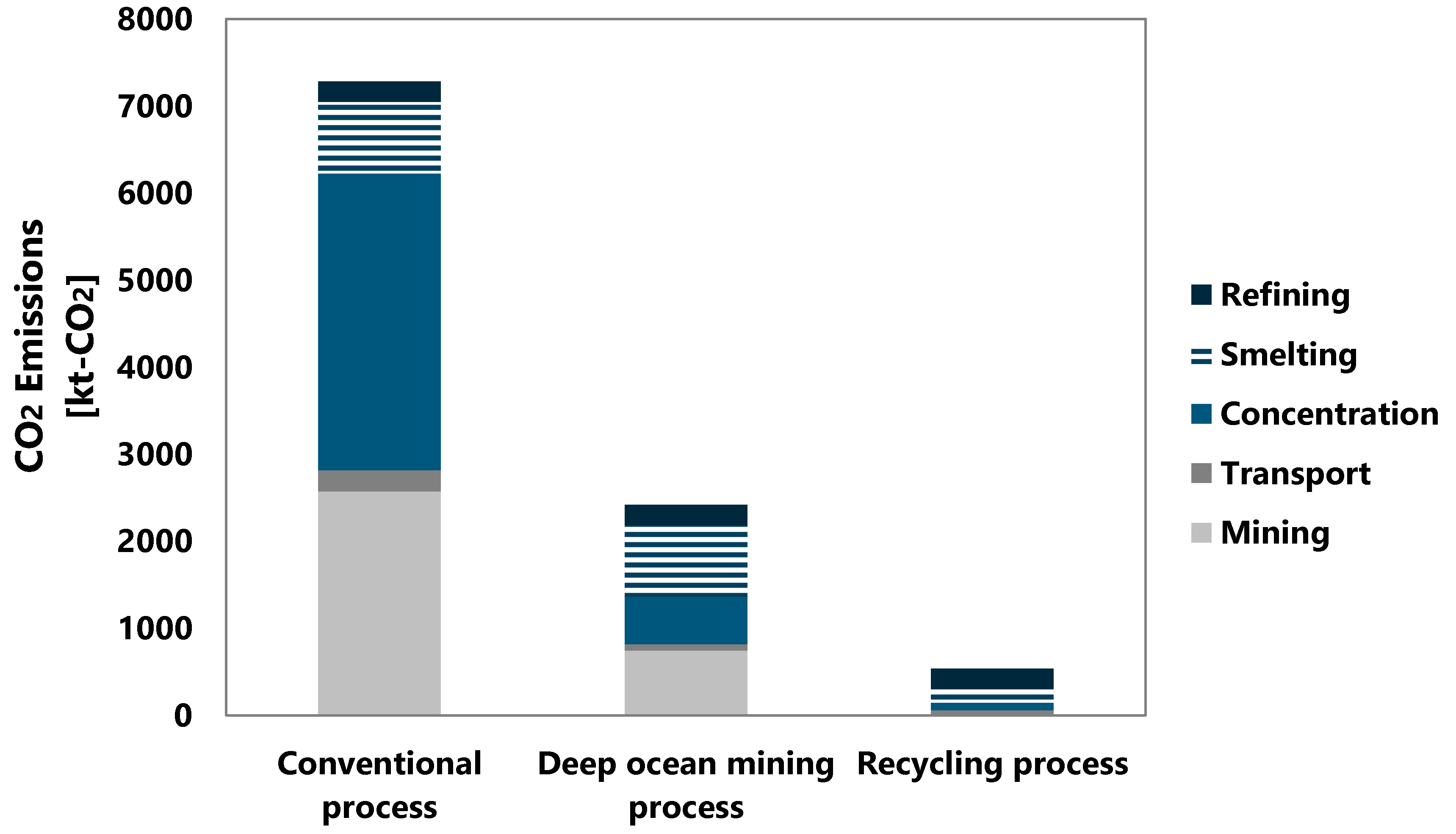

Contrarily, CO

2 emissions in domestic mineral production may be less than for conventional copper processing.

Figure 8 shows CO

2 emissions, incorporating those from overseas. It can be seen that deep ocean mining will contribute additional CO

2 emissions when compared with current copper production, however, considering the available reserves it is likely not a feasible method to supply Japan’s copper ore needs solely from SMS deposits. It is more likely that domestic mineral production will utilize recycling, leading to a reduction in CO

2 emissions from copper production. Note that since environmental impact allocation is based on the mass balance, CO

2 emissions in mining and concentration of deep ocean mining process are smaller than those in conventional processes. A value-based allocation may change these outcomes.

In addition, Japan’s population is forecast to continue to decrease into the future. According to the National Institute of Population and Social Security Research, by 2055, the population in Japan will reduce to roughly 100 million people, approximately 80% of the current population [

28].

Table 4 shows the population change observed and forecasted in Japan [

28,

29]. Following the assumption that copper consumption per person will remain constant, Japan’s overall requirements for copper will decrease. Thus, by 2055 we anticipate that environmental impacts will be limited to those shown at an 80% DOM or recycling level in

Figure 6 and

Figure 7, although alternatively exports could increase to take-up additional copper production. This study assumed that copper consumption per capita and GDP is constant. It has been shown that copper consumption is strongly correlated to GDP per capita [

30]. Following the assumption that copper consumption per capita is stable, it is more important to maintain the GDP per capita when considering an aging society, which could lead to a decline in copper consumption commensurate with population decrease.

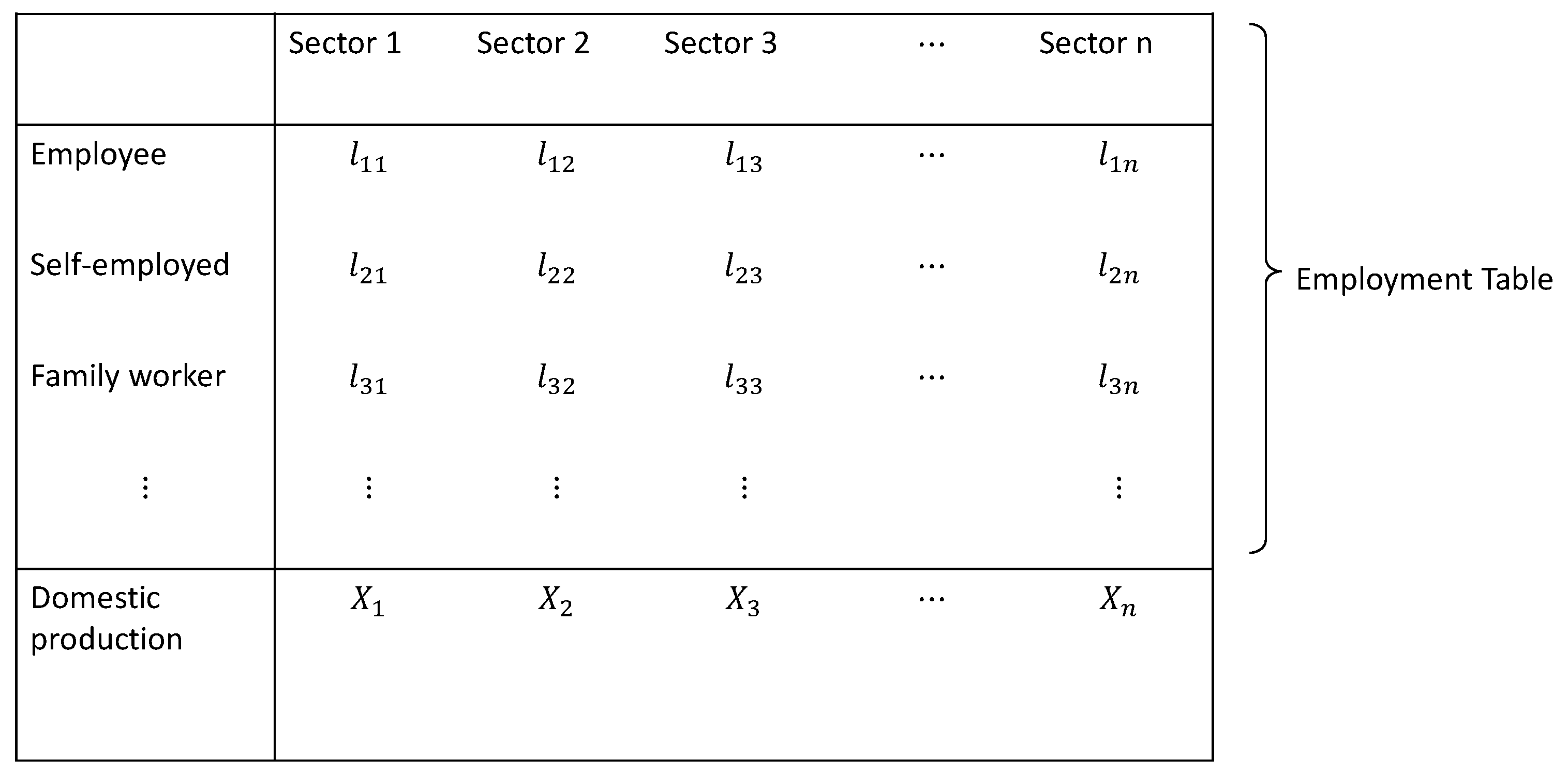

4.3. Labor

Based on the I-O analysis, employment induced by recycling will make it the third largest sector next to textiles and construction. This indicates that the demand increase for recycled copper will lead to a larger labor demand.

When the final demand increased by 1 unit (1 million yen), 0.17 people are required as labor. Comparing to other industries under the same assumptions, recycling is the industry which requires labor force the most.

Average annual income per person in the recycling industry is estimated to be about three million yen, the second lowest income level in Japan. This industry may struggle to attract employees under these conditions

5. Discussion

In terms of economic ripple effect, it is estimated that copper ore production via deep ocean SMS mining will give a larger effect than that yielded by recycling alone. Demand increase for recycled copper leads to a commensurate demand increase for copper collection. It is also estimated that this demand increase for copper collection will also lead to a larger labor demand. It is unclear from the methodology applied in this study as to whether the recycling sector will increase the overall number of employees or simply extend the working hours of the current employee pool. This is one of the limitations of I-O analysis and an issue faced by Japan as a whole. Another limitation of the I-O table is the limitation of bottom-up estimation of input coefficients. As this study mainly employed bottom-up analysis based on LCA data, it does not consider industries which do not appear in the LCA for the given technologies (e.g., service industry). In that sense, energy consumption or CO

2 emissions can be considered as a conservative estimate. Regarding LCA, allocation in this study employed mass balance allocation assuming multiple mineral recovery the likelihood may be very low of its actual occurrence, but when only copper is recovered, the environmental impacts of deep ocean mining are much larger than the conventional process.

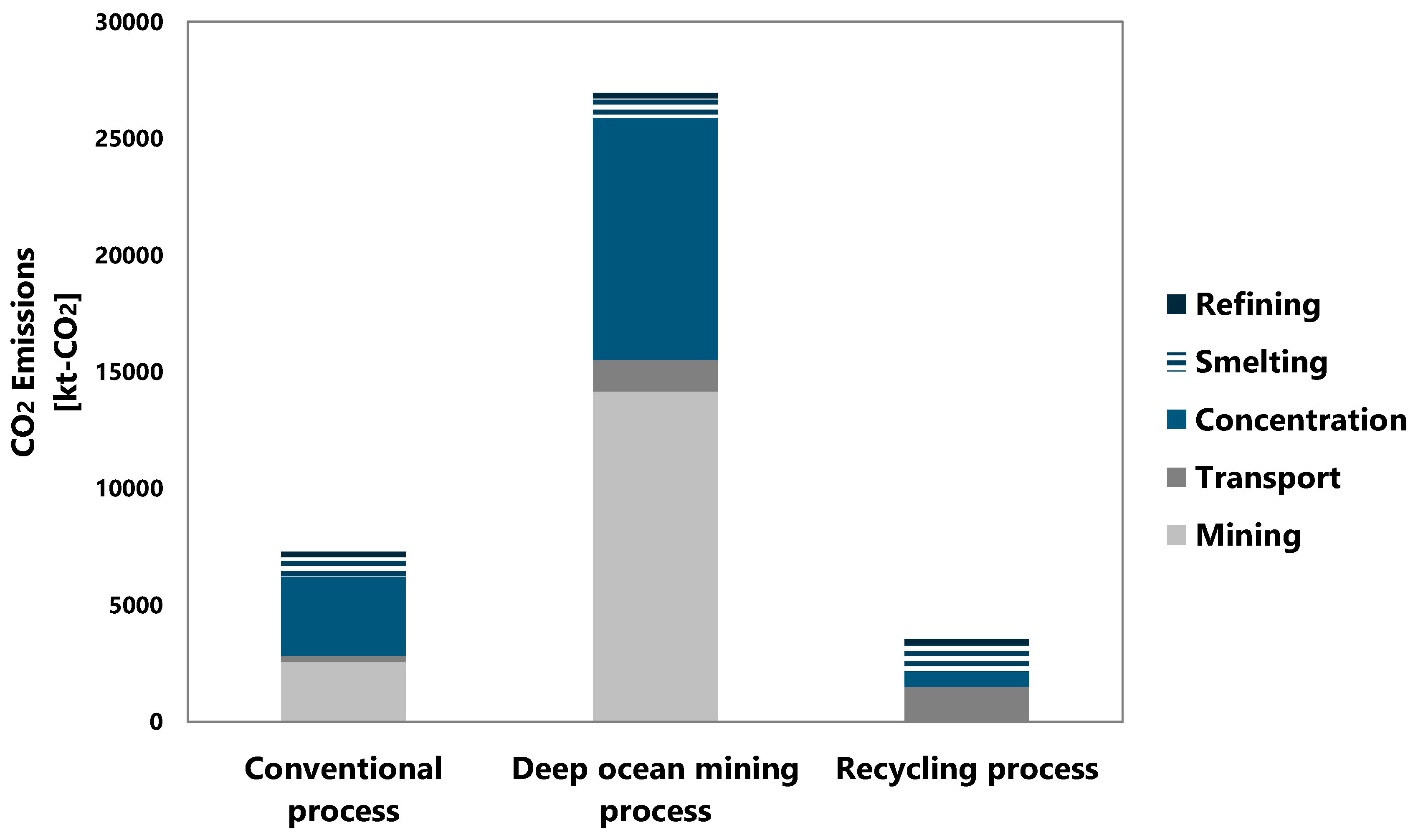

Figure 9 shows the comparison of CO

2 emissions when only copper is recovered. CO

2 emissions from the recycling process are smaller than the conventional process though, unlike multiple mineral recovery, domestic emissions will become larger than what they are today. In the case of deep ocean mining, it will not be able to reduce CO

2 emissions across the entire copper supply chain.

As mentioned in the introduction, up until the end of 2018, Japan had been exporting lower grade copper scrap to China [

31]. In the context of Japanese resource security, processing scrap in Japan could contribute to building a more stable supply chain and build a measure of resilience against inopportune external events including political, economic or environmental restrictions. A measure of independence from importing raw materials will result in resource security improvements. Also, according to the results of this study, a national approach to recycling or deep ocean mining, or a combination of the two can also contribute toward decreasing CO

2 emissions across the entire copper supply chain. Although some positive aspects are identified, we also find that the available working population may be a limitation for Japan’s copper recycling capacity. In order to address these issues, we assessed three mitigatory measures, as follows.

Sensitivity Analysis

Process 1. Smelter Process End-of-Life Products Scraps

This study assumed that all scrap is dismantled and separated, and then processed in a smelting plant. Under this type of recycling regime, generally, high-quality separation is not required since impurities are treated at the smelting and refining process. Processed end-of-life copper scrap by smelters proposes that smelters disassemble end-of-life products and collect scrap by utilizing shredders and separation machinery. This type of recycling is expected to decrease energy requirements for concentration and labor when compared to the recycling option assessed in this study. The labor and energy needs of each facility is based on previous studies [

32] and it is assumed that all pre-treatment processes such as crushing are conducted close to the smelting plant, so that energy for transportation is negligible.

Process 2. Producing Sector Processes Collected Waste

Since smelters play an important role in recycling in this study, it is assumed to be preferential to maintain smelters’ profits under any future regime. One way to achieve this is to improve the recovery rate from scrap. Smelters’ recycling process proposed that the smelter would be responsible for scrap collection, however, the mixture of materials will likely cause a lower recovery level of materials. Thus, in processed end-of-life products by producing sectors, producers of final products are made responsible for dismantling and sorting. This is achieved by producers installing mechanical dismantling facilities in their production factories. Metals and a certain amount of plastics will be provided to the recycled copper sector, with producers able to collect desirable materials. As the wire industry is able to reuse their end-of-life products, only scrap for brass production theoretically needs to be recycled. Generally, brass scrap contains about 60% copper. Copper demand for the brass industry was approximately 30% of total copper production in 2011 [

15]. Thus, energy consumption for transportation is allocated at 60%, with smelting and refining at 30%. In this case zinc from brass scrap is also assumed to be recovered. Since this recycling process requires careful dismantling processes, the labor requirements are assumed to be the same as for the production stream. It is expected to improve the smelters’ profit rate compared to the recycling process by smelters, but it may reduce overall profits due to a reduced quantity of available scrap. Moreover, this approach will increase system costs and energy for transportation. This approach also requires a large investment for producing industries, as it is assumed that the labor requirements for this process are the same amount as for the production process, i.e. securing the labor base is critical to its success. This type of recycling does not necessarily produce copper and may not increase the recycling rate according to the current Japanese definition [

15].

Process 3. Local Recycling

The above two recycling process options both rely on hardware. However, this process encourages community level (including residential and commercial) recycling by consumers. This approach does not consider disassembling and sorting as full-time work. By consigning the disassembling and sorting process to consumers, the copper collection industry will not require large amounts of labor as is necessary for options (1) and (2). Finalizing scrap before the smelting process is a major function for the copper collection process within this process. According to the Ministry of Environment of Japan, copper accounts for 7% of end-of-life household electronic appliance materials after removing plastic and ferrous metals [

33]. For this process, instead of hiring workers, the copper collection industry will provide incentives to consumers who separate their end-of-life products prior to recycling. Labor used for disassembling is not considered in the same way as options (1) and (2), but as a voluntary practice. Labor within this process only includes the workers in the copper finalizing processes. As we assume rapid aging in Japan, the retiring generations will likely play an important role in this proposed process. In addition, consumer driven recycling may provide non-traditional employment opportunities for those wishing to continue working past the retirement age.

Table 5 illustrates a comparison among the three proposed mitigatory processes and the recycling of copper through traditional channels in Japan when 1 unit of final demand increase.

Comparing these three process, we observe the existence of an energy-emissions-labor trade-off. Process 1 increase energy, however it is able to produce comparable amounts of copper with a relatively small labor force. Process 2 increase energy consumption and the estimated labor requirement the most, it may be impossible to realize under Japan’s current demographic restrictions, i.e. an aging, shrinking society. Process 3 seems to be the ideal process approach with a moderate energy and emissions contribution and the smallest labor (actually hired) requirements of the three proposed approaches. Process 3 is unlikely to be realized unless consumers are willing to cooperate, as separating and sorting processes are dependent on consumers under this process. Note that CO2 emissions in each process is less than 1 kg.

6. Conclusions

Japan is facing a number of challenges, among them, an aging shrinking population, and over-dependence on raw material imports from foreign nations. This study seeks to provide policy implications and recommendations for improving resource security in Japan, incorporating both recycling and indigenous deep ocean mining operations. Findings show that although deep ocean mining may have strong flow-on economic impacts, the overall quantity of copper extracted may not contribute strongly to Japan’s resource security. On the other hand, I-O analysis of domestic copper production scenarios provides a new finding, that labor may be a constraint of realizing a recycling-centric society. Although producing copper by recycling eases environmental impacts, it requires significant manpower.

In order to overcome these shortcomings of individual resource security policies, this study provides three processes, complemented by economic, environmental and social analyses—considering employment, demographics and societal norms.

The analysis undertaken in this study enables a deeper understanding of the effect of demand increase for new industries under constant technological coefficients. However, I-O table-based analysis has some limitations. Since the I-O table is a snapshot of a single year, the effect of investment over the long-term is not recognized. A model to analyze the effect of longer-term investments, such as recycling plant construction which takes longer than a single I-O period will allow for the further development of this research