Benefits of a Demand Response Exchange Participating in Existing Bulk-Power Markets †

Abstract

1. Introduction

- price volatility is increased using real-time pricing (RTP) [14];

- additional investment is required for advanced metering to communicate RTP to customers [15];

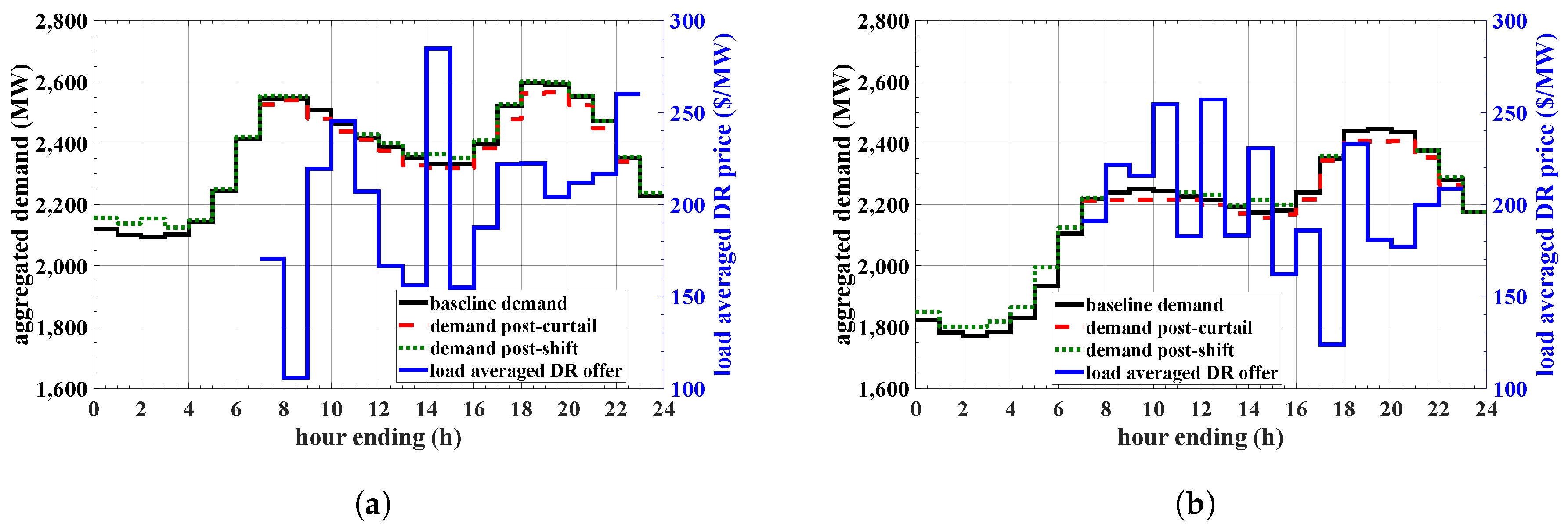

- RTP requires customers’ prompt response in consumption to reduce billing [16]; and

- a new peak may be formed during off-peak hours, commonly known as the rebound-effect [17].

- an extended review of integrating DR-as-a-service to the bulk-power market, describing the benefits and challenges to bulk-power market entities;

- an investigative study to determine the factors that influence the impact of DR on reducing utility payments in a day-ahead market; and

- the design of a multi-period DR market clearing technique that considers the monetary impact of demand rebound.

2. Electricity Markets

2.1. Day-Ahead Market

2.2. DR in Electricity Markets

3. DR-as-a-Service

3.1. DR Service Buyers

3.1.1. Generators

3.1.2. Utilities/Retailers

3.1.3. ISO/RTO

3.2. DR Service Sellers

3.2.1. Demand Response Aggregator

3.2.2. Electricity Consumers

3.3. Challenges Integrating DR-as-a-Service

3.3.1. Compensation, Incentives, and Penalties

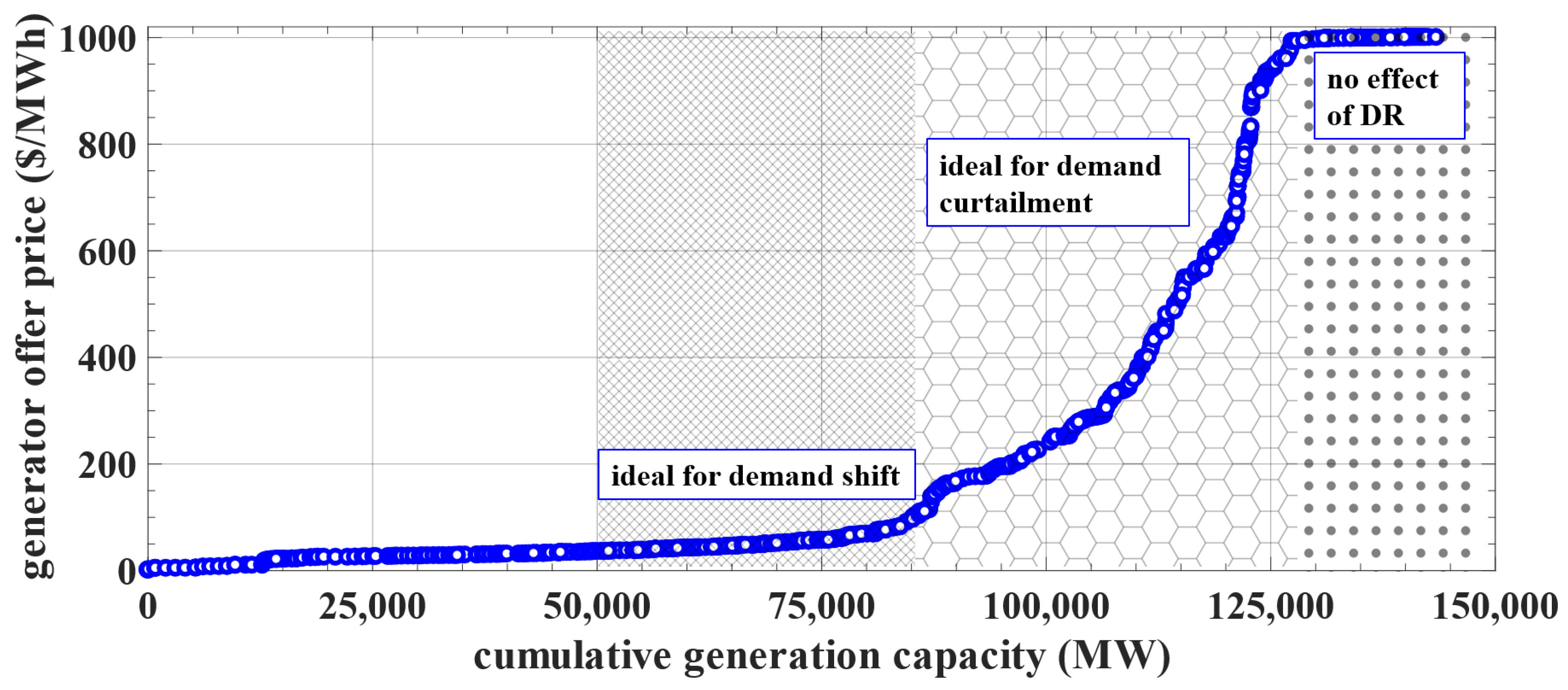

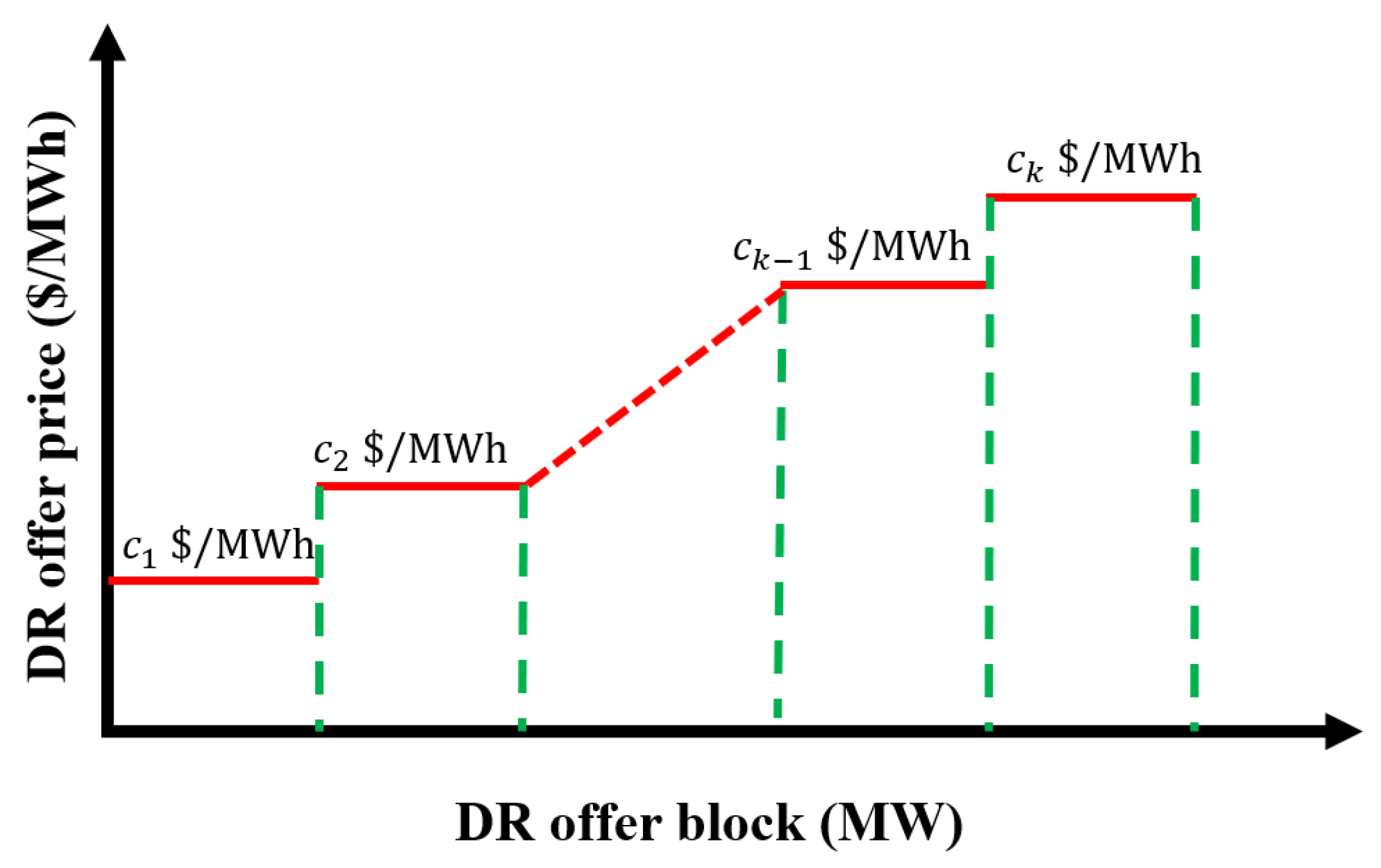

3.3.2. DR Offer Structure

3.3.3. DR Trigger

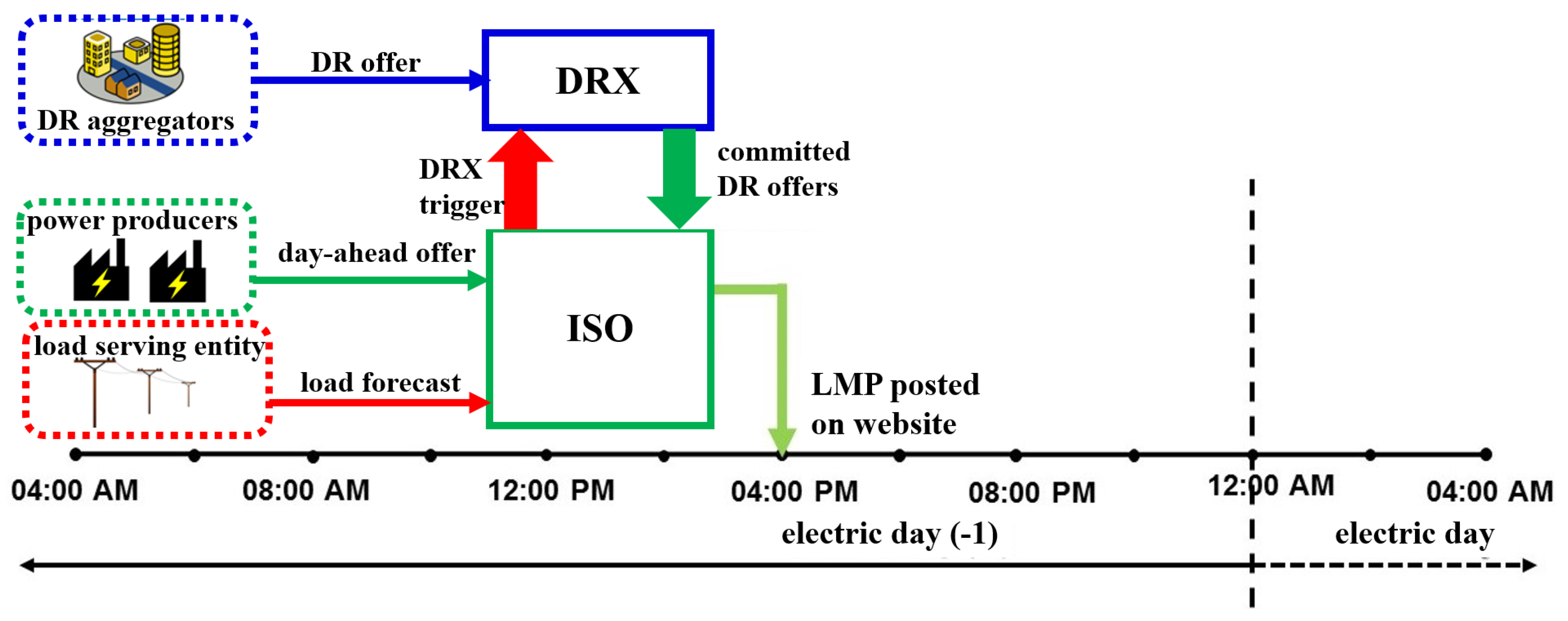

4. DRX in the Day-Ahead Market

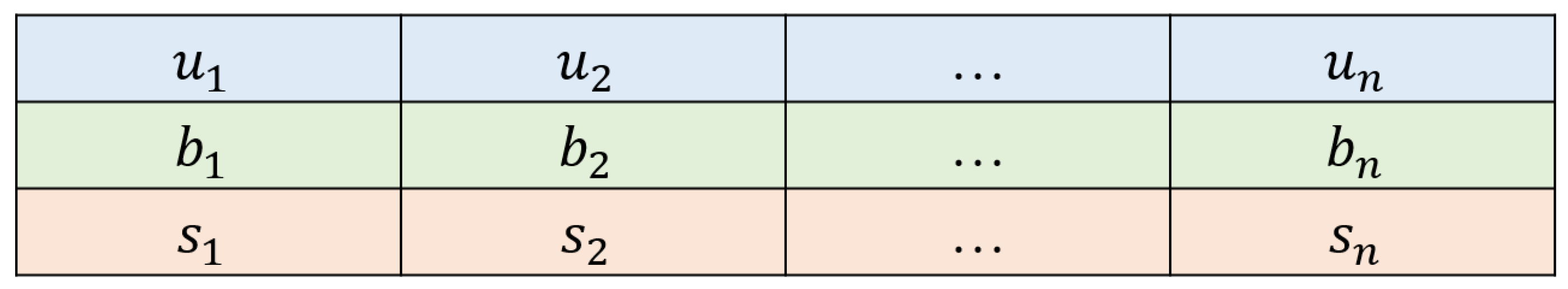

| Algorithm 1 Algorithm to select day-ahead DR offers using GA |

|

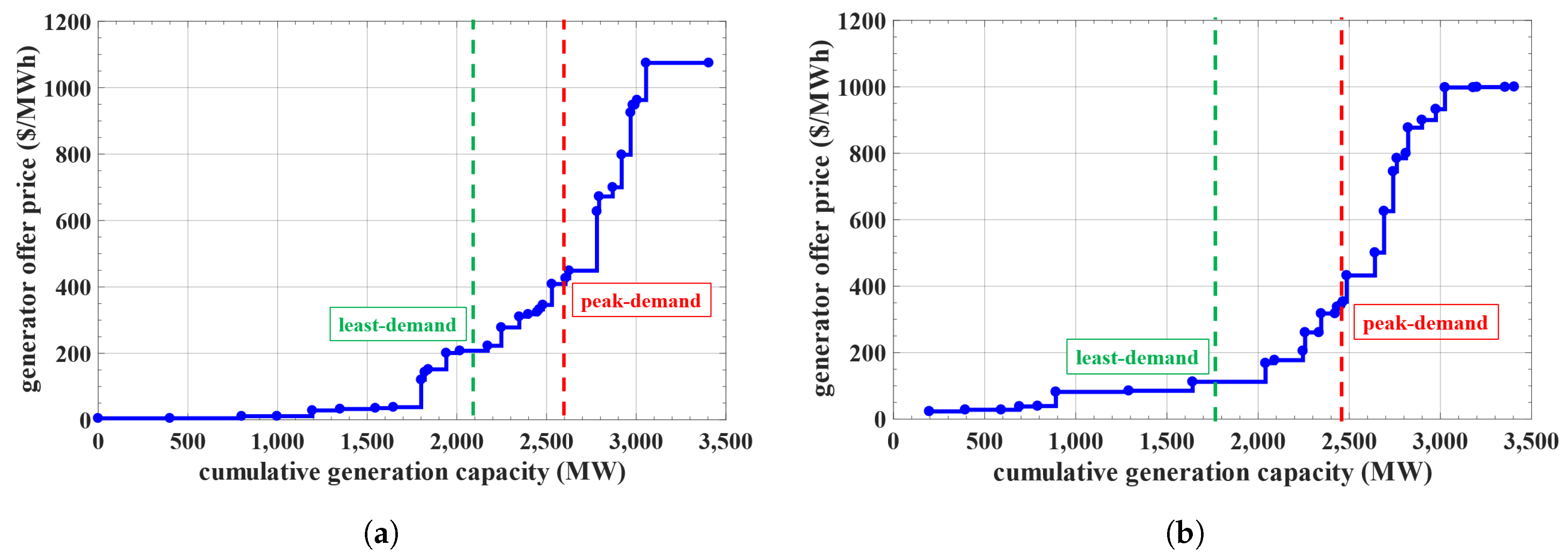

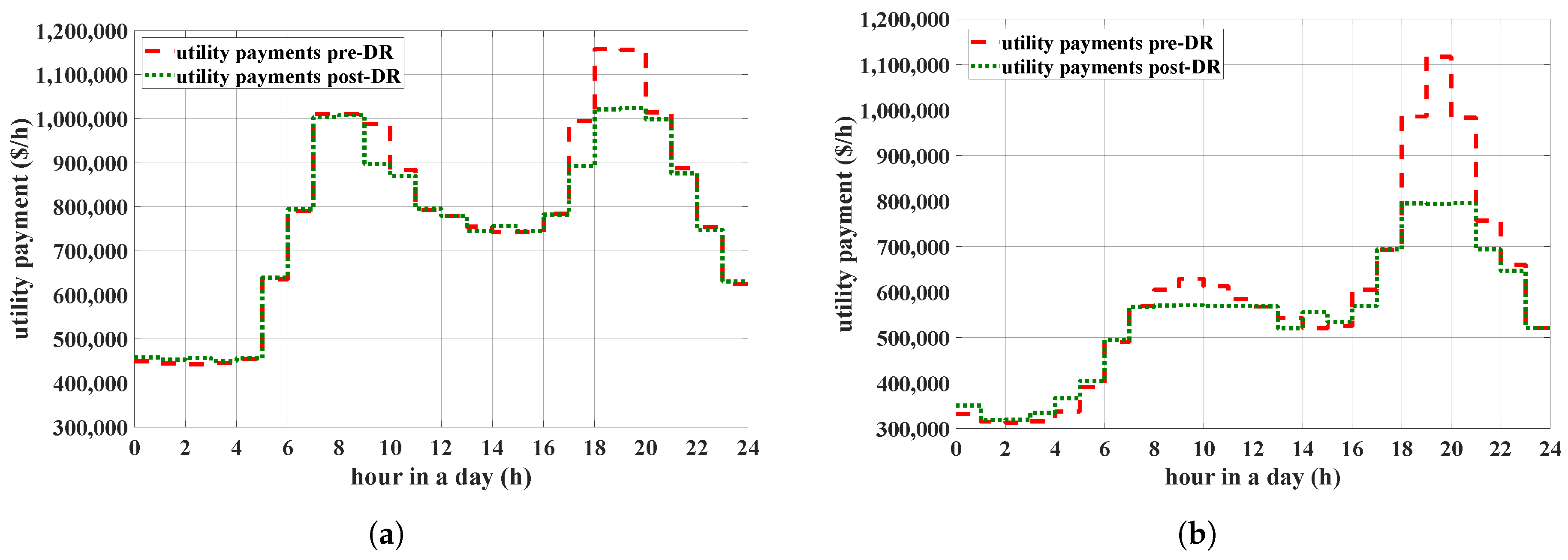

5. Experimental Setup and Case Study

5.1. Simulation Setup

5.1.1. Power System Test Case

5.1.2. DRX Offer Data

5.1.3. GA Parameters

5.2. Simulation Results and Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- U.S. Federal Energy Regulatory Commission. Order No. 888, Promoting Wholesale Competition through Open Access Non-Discriminatory Transmission Services by Public Utilities; FERC: Washington, DC, USA, 1996. Available online: http://www.ferc.gov/legal/maj-ord-reg/land-docs/rm95-8-00v.txt (accessed on 10 October 2018).

- U.S. Department of Energy. Benefits of Demand Response in Electricity Markets and Recommendations for Achieving Them; A Report to the United States Congress Pursuant to Section 1252 of the Energy Policy Act of 2005; U.S. DoE: Washington, DC, USA, 2006. Available online: http://eetd.lbl.gov/ea/EMP/reports/congress-1252d.pdf (accessed on 10 October 2018).

- Albadi, M.; El-Saadany, E. A Summary of Demand Response in Electricity Markets. Electr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Aghaei, J.; Alizadeh, M.I. Demand response in smart electricity grids equipped with renewable energy sources: A review. Renew. Sustain. Energy Rev. 2013, 18, 64–72. [Google Scholar] [CrossRef]

- Siano, P. Demand response and smart grids—A survey. Renew. Sustain. Energy Rev. 2014, 30, 461–478. [Google Scholar] [CrossRef]

- Wang, F.; Xu, H.; Xu, T.; Li, K.; Shafie-khah, M.; Catalão, J.P. The values of market-based demand response on improving power system reliability under extreme circumstances. Appl. Energy 2017, 193, 220–231. [Google Scholar] [CrossRef]

- Dehnavi, E.; Abdi, H. Determining Optimal Buses for Implementing Demand Response as an Effective Congestion Management Method. IEEE Trans. Power Syst. 2017, 32, 1537–1544. [Google Scholar] [CrossRef]

- Reddy, S.S. Multi-Objective Based Congestion Management Using Generation Rescheduling and Load Shedding. IEEE Trans. Power Syst. 2017, 32, 852–863. [Google Scholar]

- Stern, F.; Shober, M.; Tanner, M.; Violette, D. Greenhouse Gas Reductions from Demand Response: Impacts in Three U.S. Markets. In Proceedings of the 2016 International Energy Policies and Programmes Evaluation Conference, Amsterdam, The Netherlands, 7–9 June 2016; 15p. [Google Scholar]

- Sharma, S.; Durvasulu, V.; Celik, B.; Suryanarayanan, S.; Hansen, T.M.; Maciejewski, A.A.; Siegel, H.J. Metrics- Based Assessment of Sustainability in Demand Response. In Proceedings of the IEEE 15th International Conference on Smart City, Bangkok, Thailand, 18–20 December 2017; 8p. [Google Scholar]

- Cappers, P.; Goldman, C.; Kathan, D. Demand response in U.S. electricity markets: Empirical evidence. Energy 2010, 35, 1526–1535. [Google Scholar] [CrossRef]

- Federal Energy Regulatory Commission Staff Team. Assessment of Demand Response and Advanced Metering; FERC: Washington, DC, USA, 2017. Available online: https://www.ferc.gov/legal/staff-reports/2017/DR-AM-Report2017.pdf (accessed on 10 October 2018).

- Ponnaganti, P.; Pillai, J.R.; Bak-Jensen, B. Opportunities and challenges of demand response in active distribution networks. Wiley Interdiscip. Rev. Energy Environ. 2018, 7, 16. [Google Scholar] [CrossRef]

- Zhong, H.; Xie, L.; Xia, Q. Coupon Incentive-Based Demand Response: Theory and Case Study. IEEE Trans. Power Syst. 2013, 28, 1266–1276. [Google Scholar] [CrossRef]

- Cappers, P.; Hans, L.; Scheer, R. American Recovery and Reinvestment Act of 2009: Interim Report on Customer Acceptance, Retention, and Response to Time-Based Rates from the Consumer Behavior Studies; Energy Analysis and Environmental Impacts Division Lawrence Berkeley National Laboratory: Berkely, CA, USA, 2015. Available online: https://emp.lbl.gov/sites/all/files/lbnl1830290.pdf (accessed on 10 October 2018).

- Haider, H.T.; See, O.H.; Elmenreich, W. A review of residential demand response of smart grid. Renew. Sustain. Energy Rev. 2016, 59, 166–178. [Google Scholar] [CrossRef]

- Palensky, P.; Dietrich, D. Demand Side Management: Demand Response, Intelligent Energy Systems, and Smart Loads. IEEE Trans. Ind. Inform. 2011, 7, 381–388. [Google Scholar] [CrossRef]

- Chen, Z.; Wu, L.; Fu, Y. Real-Time Price-Based Demand Response Management for Residential Appliances via Stochastic Optimization and Robust Optimization. IEEE Trans. Smart Grid 2012, 3, 1822–1831. [Google Scholar] [CrossRef]

- U.S. Federal Energy Regulatory Commission. Order No. 719, Wholesale Competition in Regions with Organized Electric Markets; FERC: Washington, DC, USA, 2008. Available online: https://www.ferc.gov/whats-new/comm-meet/2008/101608/E-1.pdf (accessed on 10 October 2018).

- Hu, Q.; Li, F.; Fang, X.; Bai, L. A Framework of Residential Demand Aggregation with Financial Incentives. IEEE Trans. Smart Grid 2018, 9, 497–505. [Google Scholar] [CrossRef]

- Kang, J.; Lee, J.H. Data-Driven Optimization of Incentive-based Demand Response System with Uncertain Responses of Customers. Energies 2017, 10, 17. [Google Scholar] [CrossRef]

- Asadinejad, A.; Tomsovic, K. Optimal use of incentive and price based demand response to reduce costs and price volatility. Electr. Power Syst. Res. 2017, 144, 215–223. [Google Scholar] [CrossRef]

- U.S. Federal Energy Regulatory Commission. Order No. 745, Demand Response Compensation in Organized Wholesale Energy Markets; FERC: Washington, DC, USA, 2011. Available online: https://www.ferc.gov/EventCalendar/Files/20110315105757-RM10-17-000.pdf (accessed on 10 October 2018).

- Su, C.; Kirschen, D. Quantifying the Effect of Demand Response on Electricity Markets. IEEE Trans. Power Syst. 2009, 24, 1199–1207. [Google Scholar]

- Khodaei, A.; Shahidehpour, M.; Bahramirad, S. SCUC with Hourly Demand Response Considering Intertemporal Load Characteristics. IEEE Trans. Smart Grid 2011, 2, 564–571. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Negnevitsky, M.; de Groot, M. Pool-Based Demand Response Exchange—Concept and Modeling. IEEE Trans. Power Syst. 2011, 26, 1677–1685. [Google Scholar] [CrossRef]

- Wu, H.; Shahidehpour, M.; Alabdulwahab, A.; Abusorrah, A. Demand Response Exchange in the Stochastic Day-Ahead Scheduling with Variable Renewable Generation. IEEE Trans. Sustain. Energy 2015, 6, 516–525. [Google Scholar] [CrossRef]

- Shafie-khah, M.; Heydarian-Forushani, E.; Golshan, M.E.H.; Moghaddam, M.P.; Sheikh-El-Eslami, M.K.; Catalão, J.P.S. Strategic Offering for a Price-Maker Wind Power Producer in Oligopoly Markets Considering Demand Response Exchange. IEEE Trans. Ind. Inform. 2015, 11, 1542–1553. [Google Scholar] [CrossRef]

- Nguyen, H.T.; Le, L.B.; Wang, Z. A Bidding Strategy for Virtual Power Plants with the Intraday Demand Response Exchange Market Using the Stochastic Programming. IEEE Trans. Ind. Appl. 2018, 54, 3044–3055. [Google Scholar] [CrossRef]

- Hansen, T.M.; Roche, R.; Suryanarayanan, S.; Maciejewski, A.A.; Siegel, H.J. Heuristic Optimization for an Aggregator-Based Resource Allocation in the Smart Grid. IEEE Trans. Smart Grid 2015, 6, 1785–1794. [Google Scholar] [CrossRef]

- Nguyen, D.T.; Negnevitsky, M.; de Groot, M. Walrasian Market Clearing for Demand Response Exchange. IEEE Trans. Power Syst. 2012, 27, 535–544. [Google Scholar] [CrossRef]

- Reddy, S.; Panwar, L.K.; Panigrahi, B.K.; Kumar, R. Computational Intelligence for Demand Response Exchange Considering Temporal Characteristics of Load Profile via Adaptive Fuzzy Inference System. IEEE Trans. Emerg. Top. Comput. Intell. 2018, 2, 235–245. [Google Scholar]

- Luh, P.B.; Blankson, W.E.; Chen, Y.; Yan, J.H.; Stern, G.A.; Chang, S.C.; Zhao, F. Payment cost minimization auction for deregulated electricity markets using surrogate optimization. IEEE Trans. Power Syst. 2006, 21, 568–578. [Google Scholar] [CrossRef]

- Durvasulu, V.; Syahril, H.; Hansen, T.M. A Framework for Integrating Demand Response into Bulk Power Markets. In Proceedings of the 7th International Conference & Workshop REMOO 2017, Venice, Italy, 10–12 May 2017; 15p. [Google Scholar]

- Durvasulu, V.; Syahril, H.; Hansen, T.M. A genetic algorithm approach for clearing aggregator offers in a demand response exchange. In Proceedings of the 2017 IEEE Power Energy Society General Meeting, Chicago, IL, USA, 16–20 July 2017; 5p. [Google Scholar]

- The Market Monitoring Unit, PJM. State of the Market Report for PJM 2016. Technical Report. Monitoring Analytics LLC, 2017. Available online: http://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2016/2016-som-pjm-volume2.pdf (accessed on 10 October 2018).

- Yin, H.; Powers, N. Do state renewable portfolio standards promote in-state renewable generation? Energy Policy 2010, 38, 1140–1149. [Google Scholar] [CrossRef]

- O’Connell, N.; Pinson, P.; Madsen, H.; O’Malley, M. Benefits and challenges of electrical demand response: A critical review. Renew. Sustain. Energy Rev. 2014, 39, 686–699. [Google Scholar] [CrossRef]

- California ISO. What the Duck Curve Tells Us about Managing a Green Grid. Available online: https://www.caiso.com/Documents/FlexibleResourcesHelpRenewables_FastFacts.pdf (accessed on 10 October 2018).

- Zhao, Z.; Wu, L. Impacts of High Penetration Wind Generation and Demand Response on LMPs in Day- Ahead Market. IEEE Trans. Smart Grid 2014, 5, 220–229. [Google Scholar] [CrossRef]

- Rahimi, F.; Ipakchi, A. Demand Response as a Market Resource Under the Smart Grid Paradigm. IEEE Trans. Smart Grid 2010, 1, 82–88. [Google Scholar] [CrossRef]

- Wu, L. Impact of price-based demand response on market clearing and locational marginal prices. IET Gener. Transm. Distrib. 2013, 7, 1087–1095. [Google Scholar] [CrossRef]

- Liu, Z.; Wierman, A.; Chen, Y.; Razon, B.; Chen, N. Data center demand response: Avoiding the coincident peak via workload shifting and local generation. Perform. Eval. 2013, 70, 770–791. [Google Scholar] [CrossRef]

- Ma, O.; Alkadi, N.; Cappers, P.; Denholm, P.; Dudley, J.; Goli, S.; Hummon, M.; Kiliccote, S.; MacDonald, J.S.; Matson, N. Demand Response for Ancillary Services. IEEE Trans. Smart Grid 2013, 4, 1988–1995. [Google Scholar] [CrossRef]

- Safdarian, A.; Fotuhi-Firuzabad, M.; Lehtonen, M. Integration of Price-Based Demand Response in DisCos’ Short-Term Decision Model. IEEE Trans. Smart Grid 2014, 5, 2235–2245. [Google Scholar] [CrossRef]

- Wijaya, T.K.; Vasirani, M.; Aberer, K. When Bias Matters: An Economic Assessment of Demand Response Baselines for Residential Customers. IEEE Trans. Smart Grid 2014, 5, 1755–1763. [Google Scholar] [CrossRef]

- Lee, J.; Yoo, S.; Kim, J.; Song, D.; Jeong, H. Improvements to the customer baseline load (CBL) using standard energy consumption considering energy efficiency and demand response. Energy 2018, 144, 1052–1063. [Google Scholar] [CrossRef]

- Sarker, M.R.; Ortega-Vazquez, M.A.; Kirschen, D.S. Optimal Coordination and Scheduling of Demand Response via Monetary Incentives. IEEE Trans. Smart Grid 2015, 6, 1341–1352. [Google Scholar] [CrossRef]

- Asadinejad, A.; Rahimpour, A.; Tomsovic, K.; Qi, H.; Chen, C.F. Evaluation of residential customer elasticity for incentive based demand response programs. Electr. Power Syst. Res. 2018, 158, 26–36. [Google Scholar] [CrossRef]

- Hansen, T.M.; Chong, E.K.P.; Suryanarayanan, S.; Maciejewski, A.A.; Siegel, H.J. A Partially Observable Markov Decision Process Approach to Residential Home Energy Management. IEEE Trans. Smart Grid 2018, 9, 1271–1281. [Google Scholar] [CrossRef]

- Durvasulu, V.; Hansen, T.M. Classifying day-ahead electricity markets using pattern recognition for demand response. In Proceedings of the North American Power Symposium (NAPS), Denver, CO, USA, 18–20 September 2016; 6p. [Google Scholar]

- PJM, Cost Development Subcommittee. PJM Manual 15: Cost Development Guidelines. Available online: http://www.pjm.com/~/media/documents/manuals/m15.ashx (accessed on 10 October 2018).

- Whitley, L.D. The GENITOR Algorithm and Selection Pressure: Why Rank-Based Allocation of Reproductive Trials is Best. In Proceedings of the Third International Conference on Genetic Algorithms, Fairfax, VA, USA, 4–7 June 1989; Volume 89, pp. 116–123. [Google Scholar]

- Vardakas, J.S.; Zorba, N.; Verikoukis, C.V. A Survey on Demand Response Programs in Smart Grids: Pricing Methods and Optimization Algorithms. IEEE Commun. Surv. Tutor. 2015, 17, 152–178. [Google Scholar] [CrossRef]

- Zhao, Z.; Lee, W.C.; Shin, Y.; Song, K. An Optimal Power Scheduling Method for Demand Response in Home Energy Management System. IEEE Trans. Smart Grid 2013, 4, 1391–1400. [Google Scholar] [CrossRef]

- Neves, D.; Silva, C.A. Optimal electricity dispatch on isolated mini-grids using a demand response strategy for thermal storage backup with genetic algorithms. Energy 2015, 82, 436–445. [Google Scholar] [CrossRef]

- IEEE RTS Task Force of APM Subcommittee. IEEE Reliability Test System. IEEE PAS 1979, 98, 2047–2054. [Google Scholar]

- PJM Interconnection. Daily Energy Market Offer Data. Available online: http://www.pjm.com/markets-and-operations/energy/real-time/historical-bid-data/unit-bid.aspx (accessed on 10 October 2018).

- Durvasulu, V.; Hansen, T.M. Market-Based Generator Cost Functions for Power System Test Cases. IET Res. J. 2015, 1–12. [Google Scholar] [CrossRef]

- The Market Monitoring Unit, PJM. State of the Market Report for PJM 2014. Technical Report. Monitoring Analytics LLC, 2015. Available online: http://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2014/2014-som-pjm-volume2.pdf (accessed on 10 October 2018).

- Zimmerman, R.D.; Murillo-Sánchez, C.E.; Thomas, R.J. MATPOWER: Steady-state operations, planning, and analysis tools for power systems research and education. IEEE Trans. Power Syst. 2011, 26, 12–19. [Google Scholar] [CrossRef]

| Date | Case | Utility Payments | Generator Revenue | Surplus | DR Operation Cost | Payment Benefit |

|---|---|---|---|---|---|---|

| 23 January | pre-DR | 18,738,809 | 18,333,623 | 405,186 | N.A | N.A |

| post-DR | 18,345,743 | 17,912,338 | 433,405 | 68,092 | 393,066 | |

| 27 January | pre-DR | 13,980,014 | 13,051,626 | 928,388 | N.A | N.A |

| post-DR | 13,115,815 | 12,269,865 | 845,950 | 69,955 | 864,199 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Durvasulu, V.; Hansen, T.M. Benefits of a Demand Response Exchange Participating in Existing Bulk-Power Markets. Energies 2018, 11, 3361. https://doi.org/10.3390/en11123361

Durvasulu V, Hansen TM. Benefits of a Demand Response Exchange Participating in Existing Bulk-Power Markets. Energies. 2018; 11(12):3361. https://doi.org/10.3390/en11123361

Chicago/Turabian StyleDurvasulu, Venkat, and Timothy M. Hansen. 2018. "Benefits of a Demand Response Exchange Participating in Existing Bulk-Power Markets" Energies 11, no. 12: 3361. https://doi.org/10.3390/en11123361

APA StyleDurvasulu, V., & Hansen, T. M. (2018). Benefits of a Demand Response Exchange Participating in Existing Bulk-Power Markets. Energies, 11(12), 3361. https://doi.org/10.3390/en11123361