1. Introduction

The purpose of the portfolio selection problem is to find combinations of investment possibilities which best meet the objectives of the investor. This analysis needs various types of information and should be based on criteria which can provide some guidance about what is important and unimportant, or what is relevant and irrelevant. Although the weighting of these objectives and the criteria depend on the type of investor, the two that are common to all investors are expected return maximization and risk minimization. If investors are rational, they want the return to be high and prefer certainty to uncertainty. Moreover, the optimal portfolio enables the investor to mitigate risk and opportunities with respect to a wide range of alternatives.

The foundation of modern portfolio analysis was laid by Harry Markowitz in the middle of the 20th century [

1]. He considered returns of assets as random variables and introduced the mean-variance approach. He identified the portfolio return as an expected return, which is a sum of the product between the asset’s expected return and its shares in the portfolio, and the risk measured as the volatility (variance) of the (stochastic) value of the expected return. Furthermore, he assumed the multivariate normal distribution for the rates of return and the quadratic form for the investor’s utility (preferences) function. The purpose of mean-variance portfolio (MVP) analysis is the maximization of the portfolio’s expected return and the minimization of the portfolios’s risk. Searching for efficient portfolios (“efficient” in this context means there exists no other portfolio with the same or a smaller variance that has a larger return, and no portfolio with the same or a larger return that has a smaller risk) could be conducted by solving one of two problems: (1) maximization of the portfolio’s expected return by a given accepted risk level or (2) minimization of the portfolio’s risk by some given required portfolio return level.

The methodology proposed by Markowitz has seen an extensive development since 1952 but also a lot of criticism. Trying to avoid some of the rigid assumptions of MVP analysis and to simplify the solution methodology, a number of alternative approaches have been proposed and applied. For example, the computational complexity connected with the mean-variance model (necessity of estimation of the variance and covariance matrix) led to the linearization of the objective function. Furthermore, the popularity among investors of other risk measures, such as mean absolute deviation (MAD), value at risk (VaR), expected shortfall (conditional value at risk—CVaR), or semi-variance, is growing.

The MAD model is one of the alternatives to the classic mean-variance model in which the measure of risk (variance) is replaced by the absolute deviation. Konno and Yamazaki [

2] proposed the MAD model as a linear model for portfolio selection and tested its application on data from the Tokyo stock market. These authors observed that the MAD model can be used as an alternative to the Markowitz model because the calculated optimal portfolios and their performances are quite similar to each other. Moreover, a linear problem could be solved more easily than a quadratic one. Furthermore, the authors noticed that the MAD model could be used to tackle large-scale problems where a dense covariance matrix can occur, and that it does not require any specific type of return distribution. They also showed that the proposed method encompasses all properties of the MVP analysis. However, the method and its advantages were not widely appreciated in the financial engineering community and were criticized by statisticians. Konno and Koshizuka [

3] reviewed some of the more important properties of the MAD portfolio optimization model. They pointed out that the MAD model is superior to the MVP model both theoretically and computationally, and that this model belongs to a class of mean-lower partial risk models, which are more adequate to problems with asymmetric return distributions. The MAD model proposed by Konno and Yamazaki [

2] found interest among other researchers and applicaton to other financial markets. Application of the MAD model (based on the linear semi-mean-absolute deviation risk function) enabled Mansini and Speranza [

4] to introduce new specifications derived from market structure and from operative constraints into the portfolio selection model of the Milan stock exchange. De Silva et al. [

5] applied the MAD as well as the CVaR approach in order to avoid inefficient, low return, and/or high-risk portfolios on the Brazilian stock exchange. Furthermore, Liu [

6] used the concept of the mean-absolute deviation function proposed by [

2] when the asset returns from financial markets are represented by interval data. The author noticed that the ability to calculate the bounds of the investment return can help initiate wider applications in portfolio selection problems. A brief review of the variety of solvable linear programming portfolio optimization models presented in the literature, where several different risk measures (such as MAD or CVaR) were applied, can be found by Mansini et al. [

7]. The authors discussed the relative and absolute form of these models and their applications.

The mean-variance portfolio selection model, and other existing portfolio selection models, are based on probability theory. However, as a number of empirical studies have shown, those probabilistic approaches only partly capture reality, in contrast to fuzzy sets theory. Fuzzy sets theory can be used for a better description of real systems (situations) that are very often uncertain and vague in different ways [

8]. Zimmermann, in his seminal book [

8], explains the vagueness, fuzziness, and uncertainty in real-world systems as well as the usefulness of the application of fuzzy sets theory in order to model uncertainty. He develops the formal framework of fuzzy mathematics and presents the survey of the most interesting applications of the theory.

Fuzzy sets theory and fuzzy logic, the latter of which is an extension of classic argumentation (conventional logic) to argumentation that is closer to humans, was introduced by Lotfi A. Zadeh [

9]. In the classical set theory, objects can either belong to a set or not, and there are no intermediate steps of membership. In contrast, a fuzzy set also allows for blurred states. Zadeh ([

9], p. 338) defines a fuzzy set as follows:

“A fuzzy set is a class of objects with a continuum of grades of membership. Such a set is characterized by a membership (characteristic) function which assigns to each object a grade of membership ranging between zero and one”. The extension of fuzzy logic is possibility theory, introduced also by Zadeh [

10] and advanced by Dubois and Prade [

11]. Zadeh tries to explore some of the elementary properties of the possibility distribution concept and explains the importance of possibility theory, which arises from the fact that the information for the decisions is possibilistic rather than probabilistic in nature. Moreover, possibility theory is not a substitute for probability theory but deals with another kind of uncertainty. In possibility theory, the fuzzy variables are associated with possibility distributions in a similar way as random variables are with probability distributions. In contrast to probability theory, the possibility distribution function is defined by a so-called ‘membership function’ which describes the degree of affiliation of fuzzy variables. Membership functions which is a fundamental part of fuzzy sets theory, allows the gradual assessment of the membership of elements into the set and can characterize the fuzziness, have different forms. The most popular ones used are triangular, trapezoidal, or parabolic. However, other membership functions are hyperbolic, inverse-hyperbolic, exponential, logistic, or piecewise-linear.

Application areas for fuzzy sets theory are broad, ranging from different control systems, engineering, and consumer electronics to business economics, including decision theory [

12], or financial problems, such as portfolio selection [

13]. By using a fuzzy approach, the knowledge of experts, investors’ subjective opinions, but also quantitative and qualitative analysis, can be better integrated into decision problems. Wang and Zhu [

14] and Fang et al. [

13] give a survey of the progress made in recent years in the direction of fuzzy portfolio optimization. They present different portfolio selection models with fuzzy objectives and/or fuzzy constraints. One of the possibilities is that of using fuzzy numbers to define the coefficients of the objectives and constraints; another one is applying the so-called aspiration (or satisfaction) level. Another concept of fuzzy portfolio problems considers models with interval coefficients, where expected returns are treated as interval numbers, and where so-called pessimistic and optimistic satisfaction indices are introduced (for more information, see [

15]). Furthermore, Tanaka and Guo [

16] proposed the use of possibility distributions in order to model uncertainty in returns. They defined upper and lower possibility distributions which should reflect experts’ knowledge with regard to the portfolio selection problem.

The aim of this paper is to present a portfolio selection model for energy utilities by employing alternative risk measures, such as semi-mean-absolute deviation, which is one of the first attempts at the linearization of portfolio selection models, and comparing it with the standard mean-variance approach. Moreover, the contribution of this paper is an application of fuzzy sets theory to portfolio optimization problems in combination with alternative portfolio risk measures that can be more adequate for portfolios of real assets (such as power plants). The argument is that, in the case of power generation assets, the distribution of the power plant’s return measure and commodity prices as well as other parameters taken into consideration differ from the normal distribution assumed in the standard mean-variance portfolio approach, potentially causing biased results.

The remainder of this paper is organized as follows:

Section 2 deals with the application of portfolio analysis to the energy sector and in particular to power generation mixes. In

Section 3, fuzzy semi-mean-absolute deviation portfolio selection models and a “return” definition for power generation mixes are introduced.

Section 4 shows an empirical example for the presented methodologies.

Section 5 provides some conclusions.

2. Applications of Portfolio Analysis to Power Generation Assets

The energy utilities are confronted with a very diverse range of resource options in their energy planning, but also a dynamic, complex, and uncertain future. Financial investors are used to dealing with uncertainty and commonly evaluate such problems with portfolio theory. According to portfolio theory, they could choose a specific risk level and then aim to maximize the portfolio’s return. Furthermore, the diversification of portfolio assets is the best means of hedging future risk. Therefore, mean-variance portfolio theorists have found a new application field in the energy sector, and the theory seems to be a well-suited complementary methodology to the problem of planning and evaluating power portfolios and strategies.

The first application of portfolio theory to the energy sector was presented by Bar-Lev and Katz [

17]. They applied the Markowitz portfolio approach to optimize the fossil fuel mix for electric utilities in the US market and examined whether the power utilities are efficient users of fossil fuels. More specifically, they considered a two-dimensional optimization problem with fuel cost and risk minimization. More recent literature contains further applications of portfolio theory to energy markets in different countries or regions from a utility point of view (for a recent review, see [

18]). For example, Awerbuch and Berger [

19] used MVP analysis for the electricity market in the European Union. They proposed a more complex model where fuel costs and also operating and capital costs were explicitly considered. Their results indicate that the current EU electricity mix is sub-optimal from a risk-return perspective. Furthermore, they conclude that fixed-cost technologies, such as many of those based on renewables, must be a part of any efficient portfolio. Roques et al. [

20] considered the portfolio problem based on the MVP methodology from a cost perspective, but also added revenues and included the net present value (NPV) of the investment. They analyzed energy markets in the UK, and concluded that the optimal portfolio consists of natural-gas-combined cycle (NGCC) and a few nuclear power plants. Further applications of portfolio theory to the energy sector can be found in [

18,

21]. In [

21], the cost approach was again applied and electricity production costs considered, which included fuel costs together with operating, capital, and external costs. Moreover, for this study of the Swiss and the U.S. energy market, the authors adopted seemingly unrelated regression estimation (SURE). The Swiss power generation mix was also the goal of the analysis presented in [

22]. They are the first to implement the NPV criterion for portfolio analysis, following the Markowitz model. Moreover, they explicitly differentiated between base-load and peak-load technologies. In the work of Borchert and Schemm [

23], the application of the CVaR as a risk measure in portfolio analysis for wind power projects in Germany was presented. Glensk et al. [

24] also applied CVaR as a risk measure, but instead of power generation assets they analyzed portfolios of contracts from the European Energy Exchange (EEX) and the Polish Power Exchange (POLPX). They further pointed out that the proposed approach can be useful, especially for retailers on both markets, but that the impact of negative energy prices, as found e.g., on the EEX, should also be investigated.

The studies mentioned above reflect a considerable and growing interest in applying portfolio analysis on (liberalized) energy markets. Moreover, they point out different definitions of return and risk used by authors applying MVP theory to power generation portfolios. Analogically to the financial markets, the decision-making process in energy planning is complex and multidimensional. Economic, social, and environmental aspects; technical parameters; and different risks have to be taken into account. Regarding all these different aspects, the risk connected to electricity price, fuel cost, carbon dioxide cost, operation and maintenance costs, capital cost, but also to the capacity factor of a power plant, affect the measure of return and thus also the decision-making process and outcome. Application of portfolio theory can help to eliminate these risks and to explain the complex interactions between these parameters.

When applying portfolio theory to power generation mixes, appropriate definitions of return and risk are needed. Project evaluation methods and measures (such as net present value, internal and modified internal rate of return, profitability index, payback or discounted payback time) commonly used in finance management could also be useful proxies for the construction of power generation mixes. Each of these measures give different pieces of relevant and valuable information needed in the decision-making process. However, the net present value and the internal rate of return are the most often ones used. According to the short literature review presented, the NPV criterion is already one useful profitability indicator for energy projects and power generation selection problems, next to the annual expected return.

5. Conclusions

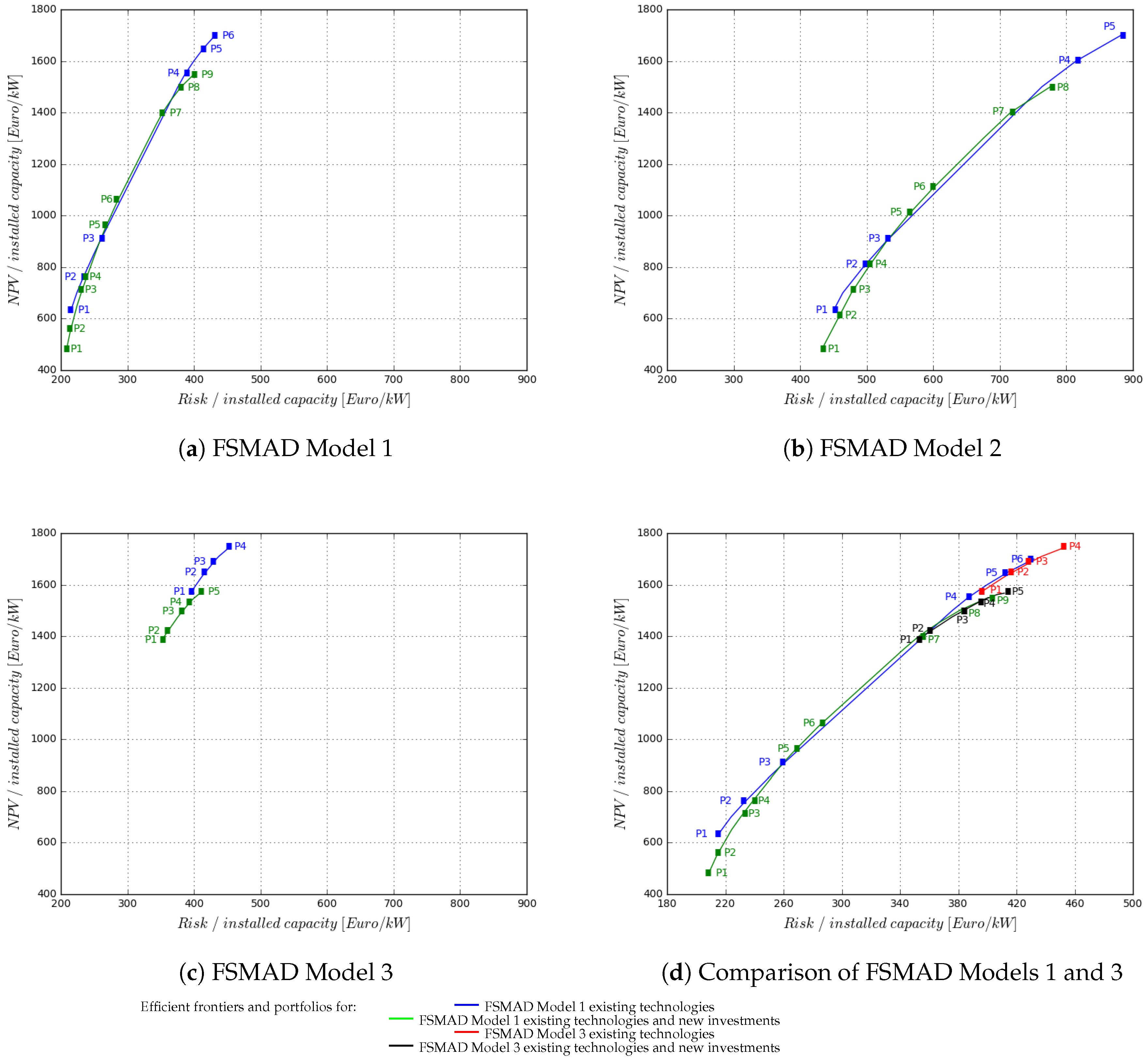

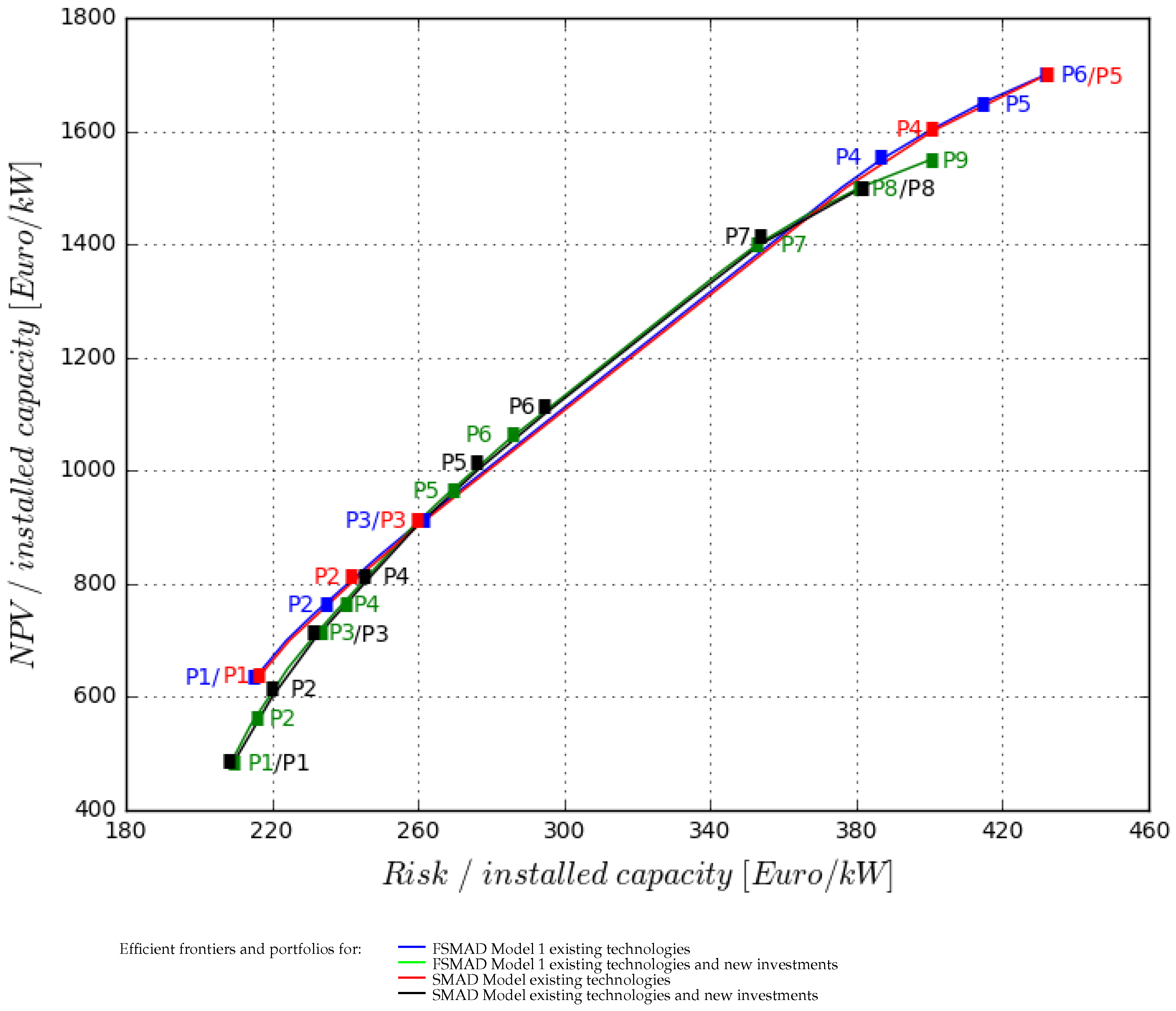

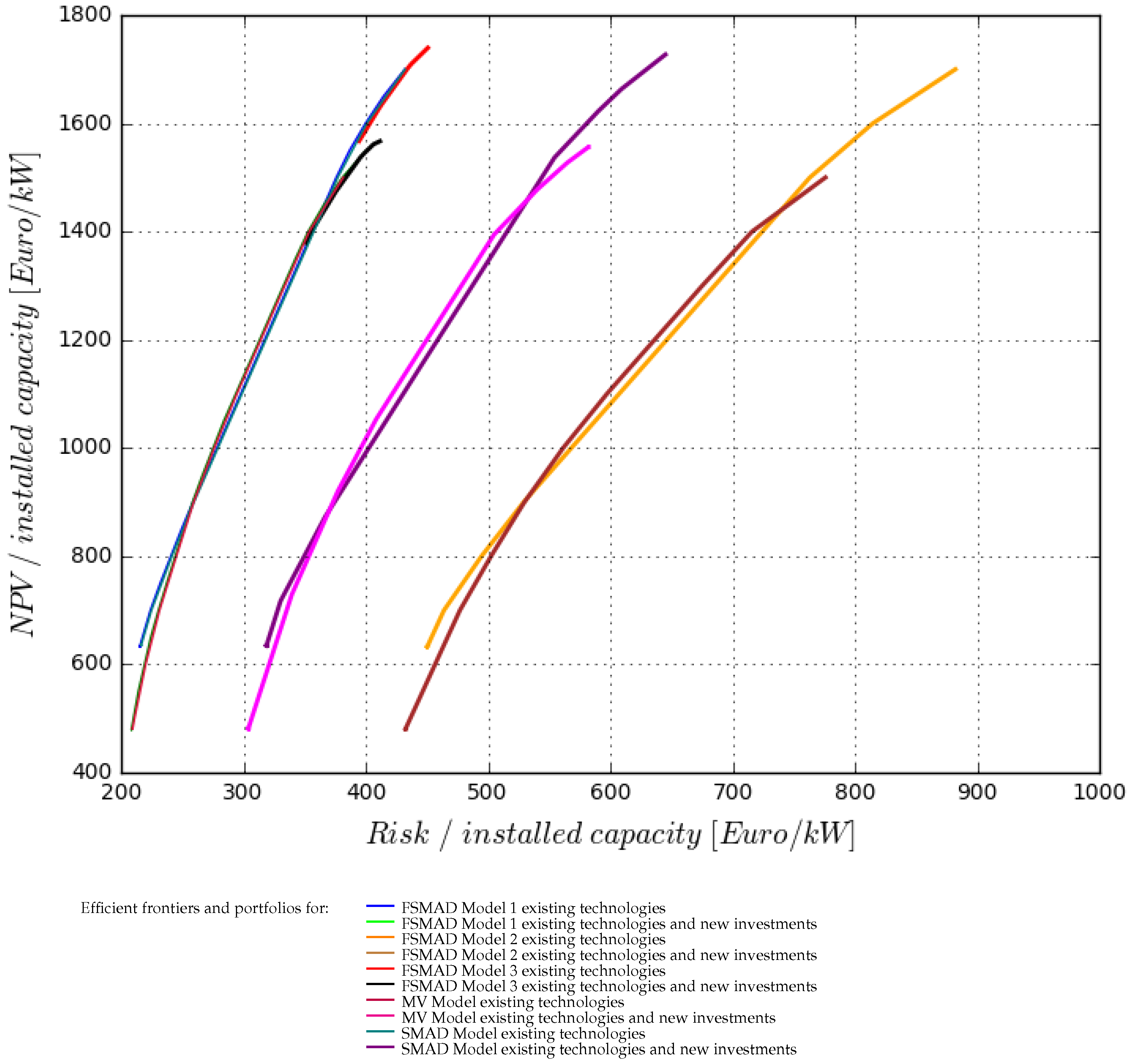

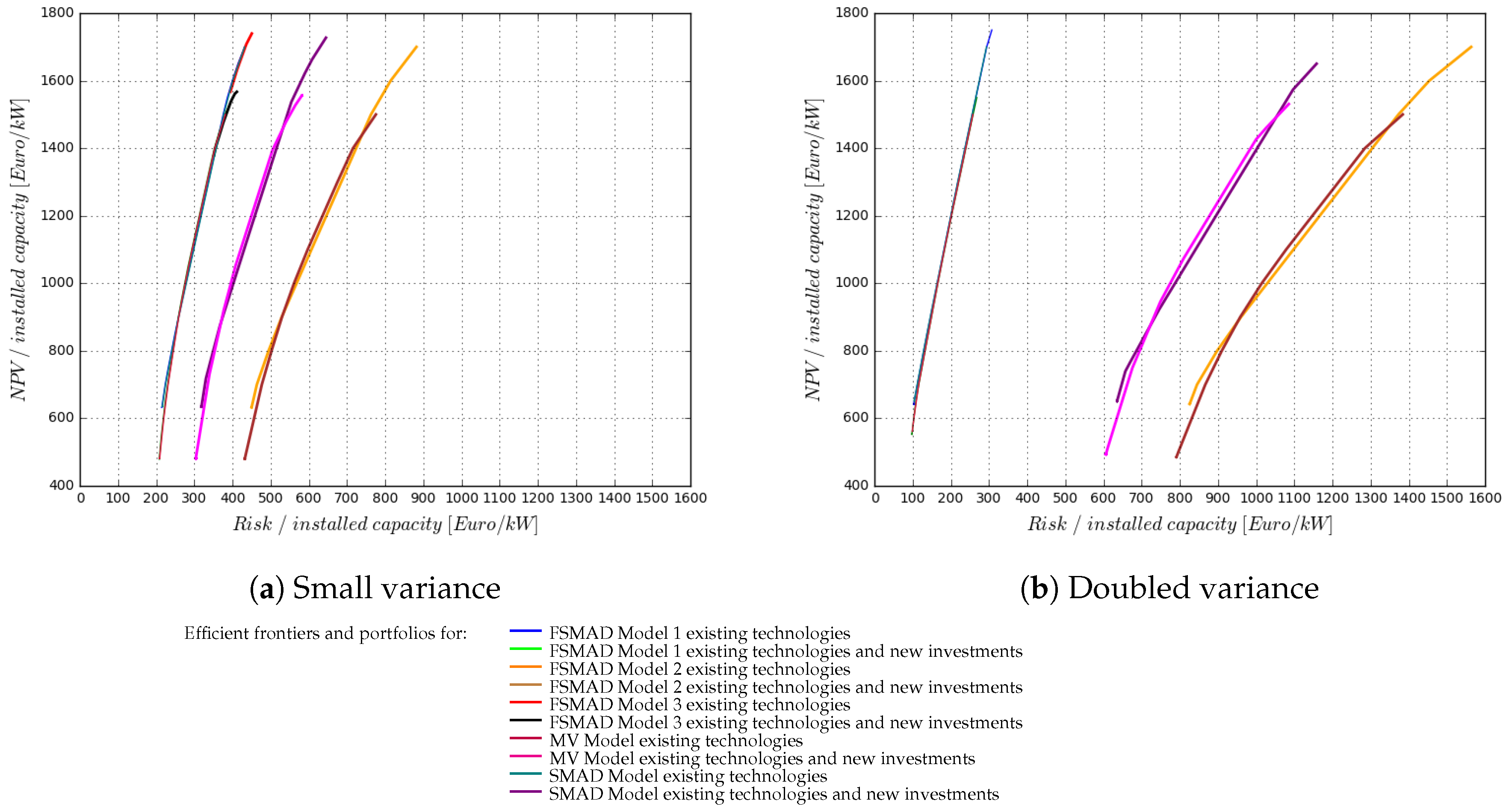

In this paper, we have presented several alternative portfolio selection models for power generation assets based on fuzzy sets theory and semi-mean-absolute deviation as a risk measure. On the one hand, the use of another risk measure than the standard deviation (as it is used in the standard Markowitz model) was already suggested by Markowitz himself, but the first application only emerged in the aftermath of post-modern portfolio theory. On the other hand, measures such as the semi-variance or semi-absolute deviation, from an investor’s point of view, describe the expected losses and thus the part of the risk (the downside risk) that really matters risk. For this reason, the consideration of these measures in decision-making processes seems to be necessary, or even indispensable. In the presented results, the use of the SMAD Model caused a shift of the efficient frontier along the risk axis. More precisely, the efficient portfolios for the same return level have a smaller risk than portfolios obtained with the MV Model. For a decision-maker with risk aversion, such a shift can positively affect the decision-making outcome.

The analysis carried out in this paper illustrates the application possibilities of fuzzy portfolio selection models for power generation assets. Specifically, introducing membership functions for the description of investors’ aspiration levels for the expected return and risk (FSMAD Model 3) shows how the knowledge of experts, and an investor’s subjective opinions, can be better integrated into the decision-making process. In the cases presented, we have shown that using one of these models affects the size of the set of efficient portfolios (the set is smaller than when using FSMAD, SMAD or MV models). The sparse set of alternatives, which is considered in the decision-making process, can push on and relieve this process. Moreover, in FSMAD Model 3, the decision-maker can help to exactly determine the so-called sufficiency and necessity levels and obtain the optimal solution.

The fuzzy portfolio selection models and the model that uses the semi-mean-absolute deviation as a risk measure presented in this paper illustrated their application for energy utilities, just as they exist for other industries and the financial markets. The complexity of the energy markets, the uncertain environment, the vagueness or some other type of fuzziness, can overall be better captured with fuzzy sets theory. However, the further development of these models especially for the energy sector is required, which calls for more research in this field as well as applications of other alternative risk measures, such as, e.g., the CVaR.