Strategic Corporate Social Responsibility, Sustainable Growth, and Energy Policy in China

Abstract

:1. Introduction

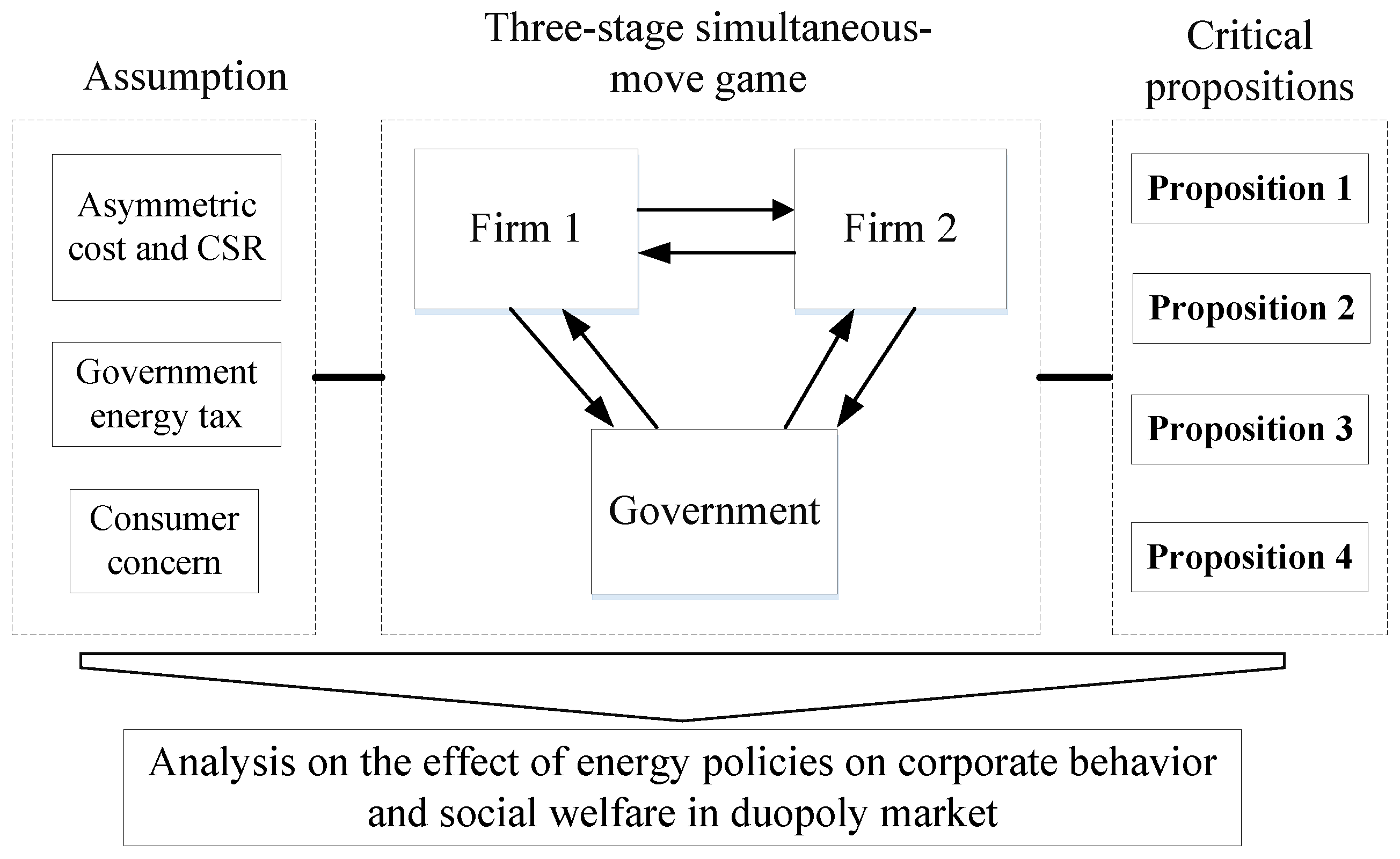

2. Materials and Methods

2.1. Assumptions

2.2. Theoretical Model

3. Results

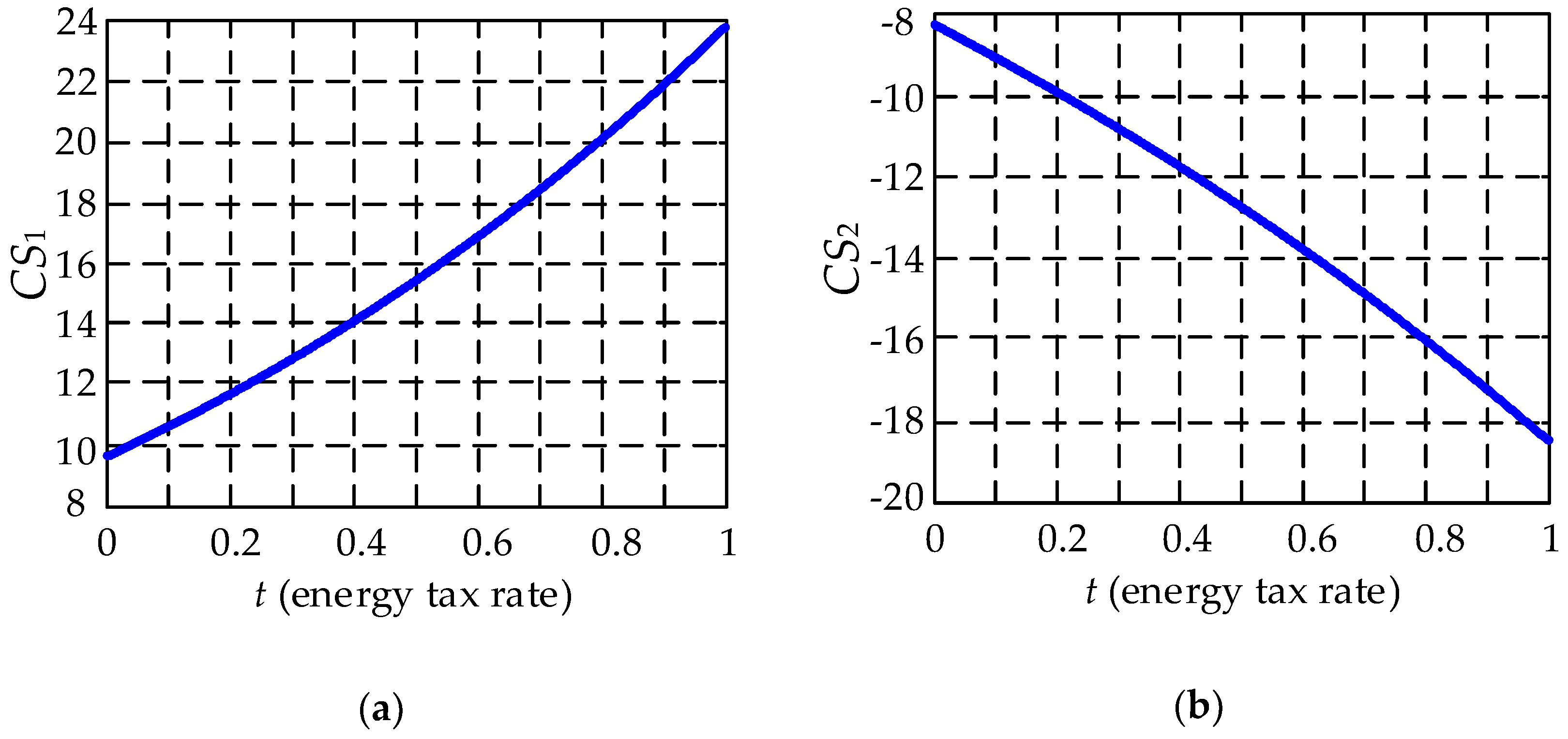

3.1. Consumer Surplus and Energy Policy

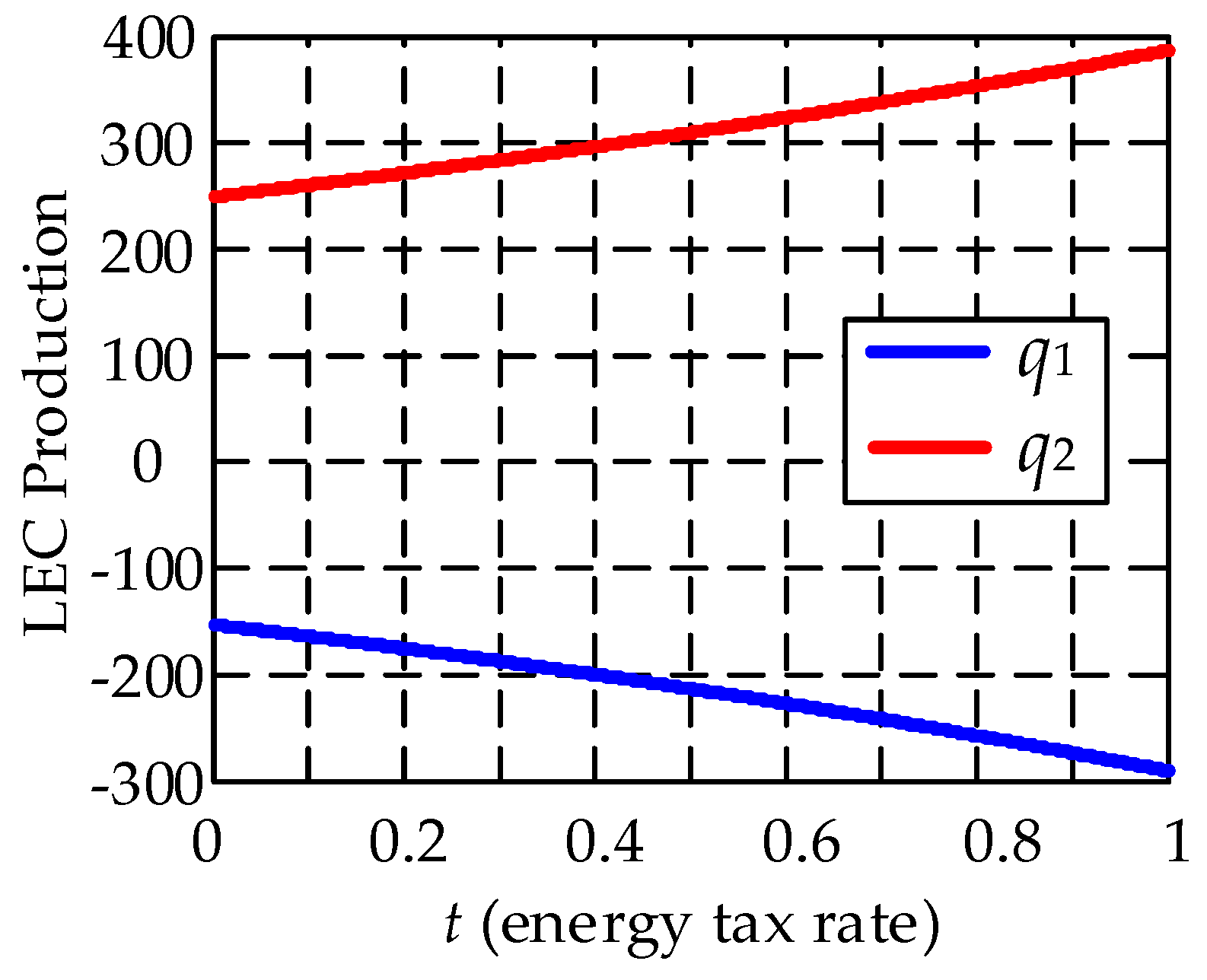

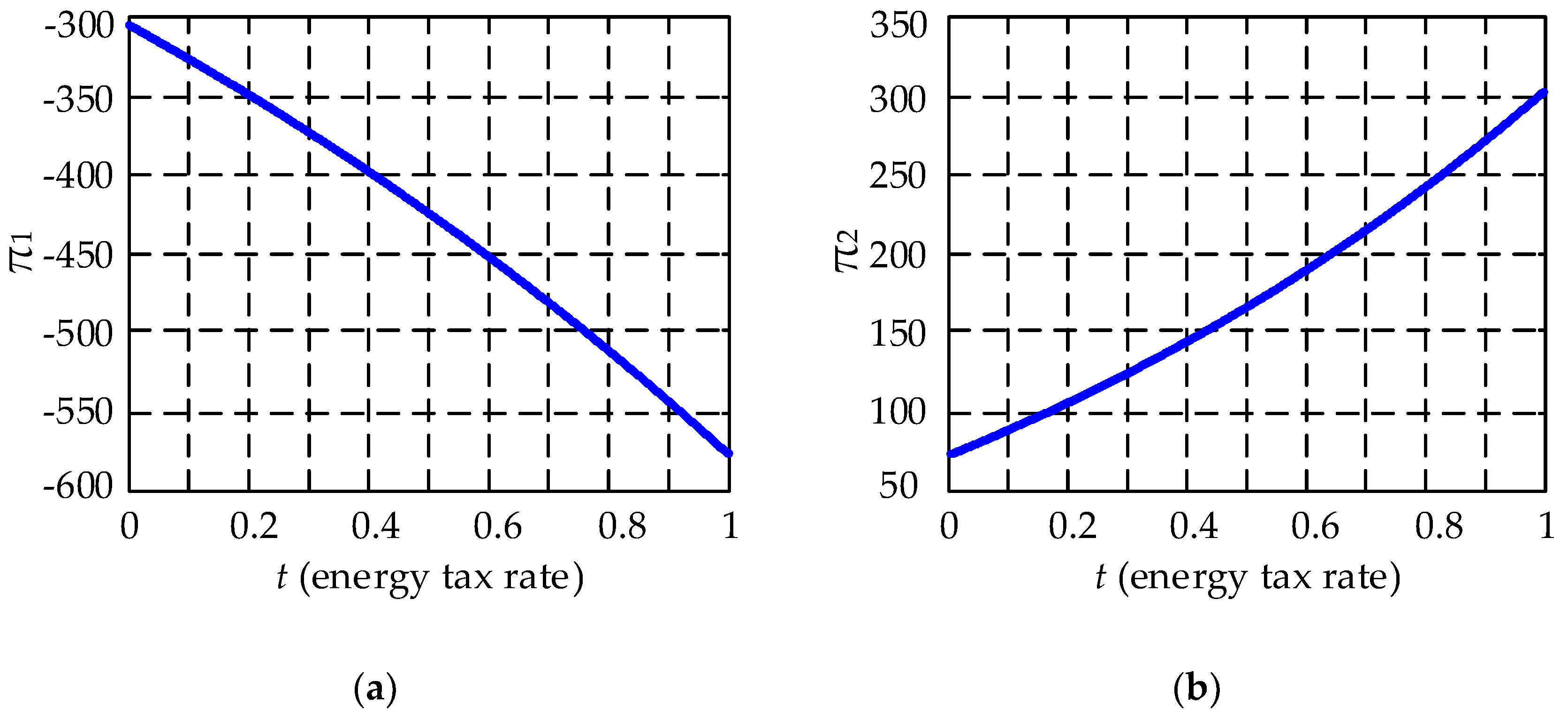

3.2. Firm Performance and Energy Policy

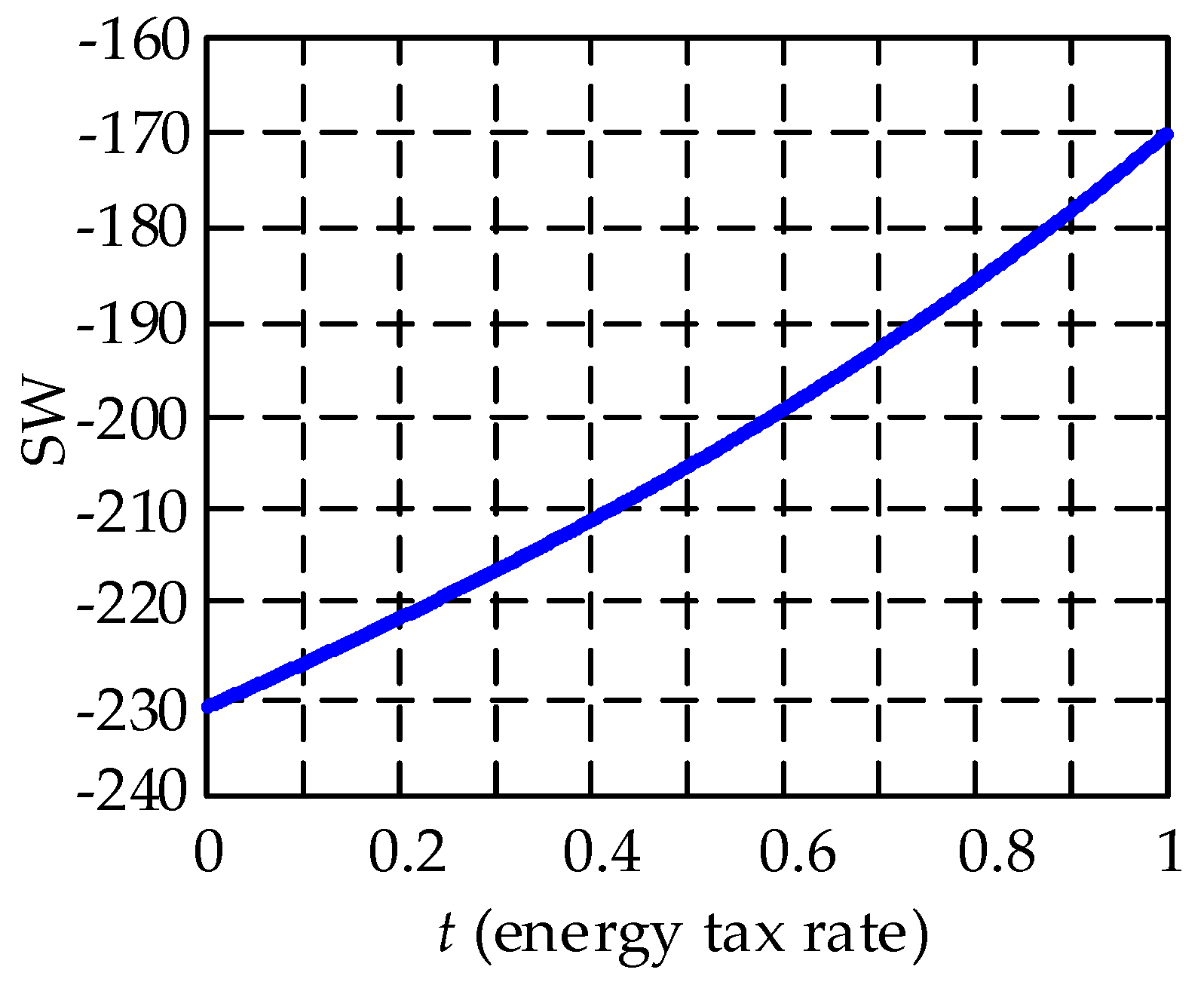

3.3. Social Welfare and Energy Policy

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Isaksson, R.; Steimle, U. What does GRI Reporting tell us about Corporate Sustainability? TQM J. 2008, 21, 168–181. [Google Scholar] [CrossRef]

- Wilson, M. Corporate Sustainability: What is it and where does it come from? Ivey Bus. J. 2003, 67, 1–5. [Google Scholar]

- Song, M.L.; Zhang, W.; Wang, S.H. Inflection point of environmental Kuznets curve in Mainland China. Energy Policy 2013, 57, 14–20. [Google Scholar] [CrossRef]

- Angela, C.; Wang, L.F.S. Industrial Policies and Partial Privatization in mixed oligopoly. J. Xi’an Jiaotong Univ. (Soc. Sci.) 2018, 38, 21–29. (In Chinese) [Google Scholar]

- Bryane, M. Corporate social responsibility in international development: An overview and critique. Corp. Soc. Responsib. Environ. Manag. 2003, 10, 115–128. [Google Scholar]

- Xu, S.K.; Yang, R.D. A conclusive analysis with in the conceptive scope of corporate social responsibility. China Ind. Econ. 2007, 5, 73–81. (In Chinese) [Google Scholar]

- Friedman, M. The Social Responsibility of Business is to Increase Its Profits. N. Y. Times Mag. 1970, 32–33, 173–178. [Google Scholar]

- Freeman, R.E. Strategic Management: A Stakeholder Approach; Cambridge University Press: Boston, MA, USA, 1984. [Google Scholar]

- Carroll, A.B. A three-dimensional Conceptual Model of Corporate Social Performance. Acad. Manag. Rev. 1979, 4, 497–505. [Google Scholar] [CrossRef]

- Carroll, A.B. The Pyramid of Corporate Social Responsibility: Toward the Moral Management of Organizational Stakeholders. Bus. Horiz. 1991, 34, 7–9. [Google Scholar] [CrossRef]

- Wang, L.; Juslin, H. The effects of value on the perception of corporate social responsibility implementation: A study of Chinese Youth. Corp. Soc. Responsib. Environ. Manag. 2011, 18, 246–262. [Google Scholar] [CrossRef]

- Wang, L.; Juslin, H. Values and corporate social responsibility perceptions of Chinese University Students. J. Acad. Ethics 2012, 10, 57–82. [Google Scholar] [CrossRef]

- Porter, M.E.; Kramer, M.R. Strategy and Society: The Link between Competitive Advantage and Corporate Social Responsibility. Harv. Bus. Rev. 2006, 84, 78–92. [Google Scholar] [PubMed]

- Liu, C.C.; Wang, L.F.S.; Lee, S.H. Strategic environmental corporate Social esponsibility in a differentiated duopoly market. Econ. Lett. 2015, 129, 108–111. [Google Scholar] [CrossRef]

- Hirose, K.; Lee, S.H.; Matsumura, T. Environmental corporate social responsibility: A note on the first-mover advantage under price competition. Econ. Bull. 2017, 37, 214–221. [Google Scholar]

- Abraham, L.; Zenu, S. Environmental corporate social responsibility and financial performance: Disentangling direct and indirect effects. Ecol. Econ. 2012, 78, 100–111. [Google Scholar]

- Anderson, C.L.; Bieniaszewska, R.L. The role of corporate social responsibility in an oil company’s expansion into new territories. Corp. Soc. Responsib. Environ. Manag. 2005, 12, 1–9. [Google Scholar] [CrossRef]

- Weng, H.-H.; Chen, J.-S.; Chen, P.-C. Effects of Green Innovation on Environmental and Corporate Performance: A Stakeholder Perspective. Sustainability 2015, 7, 4997–5026. [Google Scholar] [CrossRef] [Green Version]

- Li, Z. A study on relation of corporate social responsibility and corporate value-Empirical evidence from Shanghai Securities Exchange. China Ind. Econ 2006, 2, 77–83. (In Chinese) [Google Scholar]

- Ohori, S. Price and Quantity competition in a mixed Duopoly with Emission Tax. Theor. Econ. Lett. 2014, 2, 133–138. [Google Scholar] [CrossRef]

- Wang, L.F.S.; Wang, J. Environmental Taxes in a Differentiated Mixed Duopoly. Econ. Syst. 2009, 33, 389–396. [Google Scholar] [CrossRef]

- Angela, C.; Pu, Z. Corporate Social Responsibility and Environmentally Sound Technology in Endogenous Firm Growth. Sustainability 2017, 9. [Google Scholar] [CrossRef]

- Manasakis, C.; Mitrokostas, E. Certification of Corporate Social Responsibility Activities in Oligopolistic Markets. Can. J. Econ. 2013, 46, 282–309. [Google Scholar] [CrossRef]

- Manasakis, C.; Mitrokostas, E. Strategic Corporate Social Responsibility Activities and Corporate Governance in Imperfectly Competitive Markets. Manag. Decis. Econ. 2014, 35, 460–473. [Google Scholar] [CrossRef] [Green Version]

- Song, M.; Zhang, W.; Wang, Z. Environmental efficiency and energy consumption of highway transportation systems in China. Int. J. Prod. Econ. 2016, 181, 441–449. [Google Scholar] [CrossRef]

- Baron, D.P. Private Politics, Corporate Social Responsibility, and Integrated Strategy. J. Econ. Manag. Strateg. 2001, 10, 7–45. [Google Scholar] [CrossRef]

- Baron, D.P. A Positive Theory of Moral Management, Social Pressure and Corporate Social Performance. J. Econ. Manag. Strateg. 2009, 18, 7–45. [Google Scholar] [CrossRef]

- Bénabou, R.; Tirole, J. Individual and corporate social responsibility. Economica 2010, 77, 1–19. [Google Scholar] [CrossRef] [Green Version]

- Lambertini, L.; Tampieri, A. On the Stability of MIxed Oligopoly Equilibria with CSR Firms. Tech. Rep. wp768. Dipartimento Scienze Economiche, Universita´ di Bologna, 2011. Available online: http://ideas.repec.org/p/bol/bodewp/wp768.html (accessed on 16 September 2018).

- Michelon, G.; Boesso, G.; Kumar, K. Examining the link between Strategic corporate social responsibility and company performance: An analysis of the best corporate citizens. Corp. Soc. Responsib. Environ. Manag. 2013, 20, 81–94. [Google Scholar] [CrossRef]

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hong, L.; Chao, A. Strategic Corporate Social Responsibility, Sustainable Growth, and Energy Policy in China. Energies 2018, 11, 3024. https://doi.org/10.3390/en11113024

Hong L, Chao A. Strategic Corporate Social Responsibility, Sustainable Growth, and Energy Policy in China. Energies. 2018; 11(11):3024. https://doi.org/10.3390/en11113024

Chicago/Turabian StyleHong, Lucheng, and Angela Chao. 2018. "Strategic Corporate Social Responsibility, Sustainable Growth, and Energy Policy in China" Energies 11, no. 11: 3024. https://doi.org/10.3390/en11113024

APA StyleHong, L., & Chao, A. (2018). Strategic Corporate Social Responsibility, Sustainable Growth, and Energy Policy in China. Energies, 11(11), 3024. https://doi.org/10.3390/en11113024