Influence of Wind Power on Intraday Electricity Spot Market: A Comparative Study Based on Real Data

Abstract

:1. Introduction

2. Electricity Production and Transmission Costs

2.1. Electricity Production Costs Overview

2.2. Electricity Production Incentives

- WP—The average incentive rate for the existing WP farms is around 75 €/MWh. However, the Portuguese Government has established a compensation return scheme that implies the return of part of those incomes to the National Electrical System. Regarding small production, this support corresponds to 70% of an annual reference tariff, which, for 2017, it was set at 95 €/MWh.

- Solar—The indicative average rate of incentives for solar power farms is around 257 €/MWh. In the case of a solar power plant with a limit up to 5 MW of installed power, the average value is 380 €/MWh. For installed power between 5 and 10 MW, the average value is 270 €/MWh. Regarding small production, the tariff corresponds to 100% from the reference tariff, which for the year 2017, was set at 95 €/MWh.

- Hydro—The indicative average rate of incentives for traditional hydropower plants has an average value of 93 €/MWh. For tidal power plants, in the case of pilot projects with a capacity of more than 4 MW, this average incentive is 260 €/MWh. In other cases, for the first 20 MW of installed power, the value is 191 €/MWh, from 20 to 100 MW the marginal value is 131 €/MWh, and for the subsequent 150 MW the marginal value is 101 €/MWh. In the case of small productions, the tariff corresponds to 60% of the reference, which for 2017, had a fixed value of 95 €/MWh.

2.3. CO2 Emission Costs

2.4. WP Production and Transmission Costs

3. Wind Power Influence in the MIBEL Intraday Spot Market

3.1. Proposed Model and Data Collection

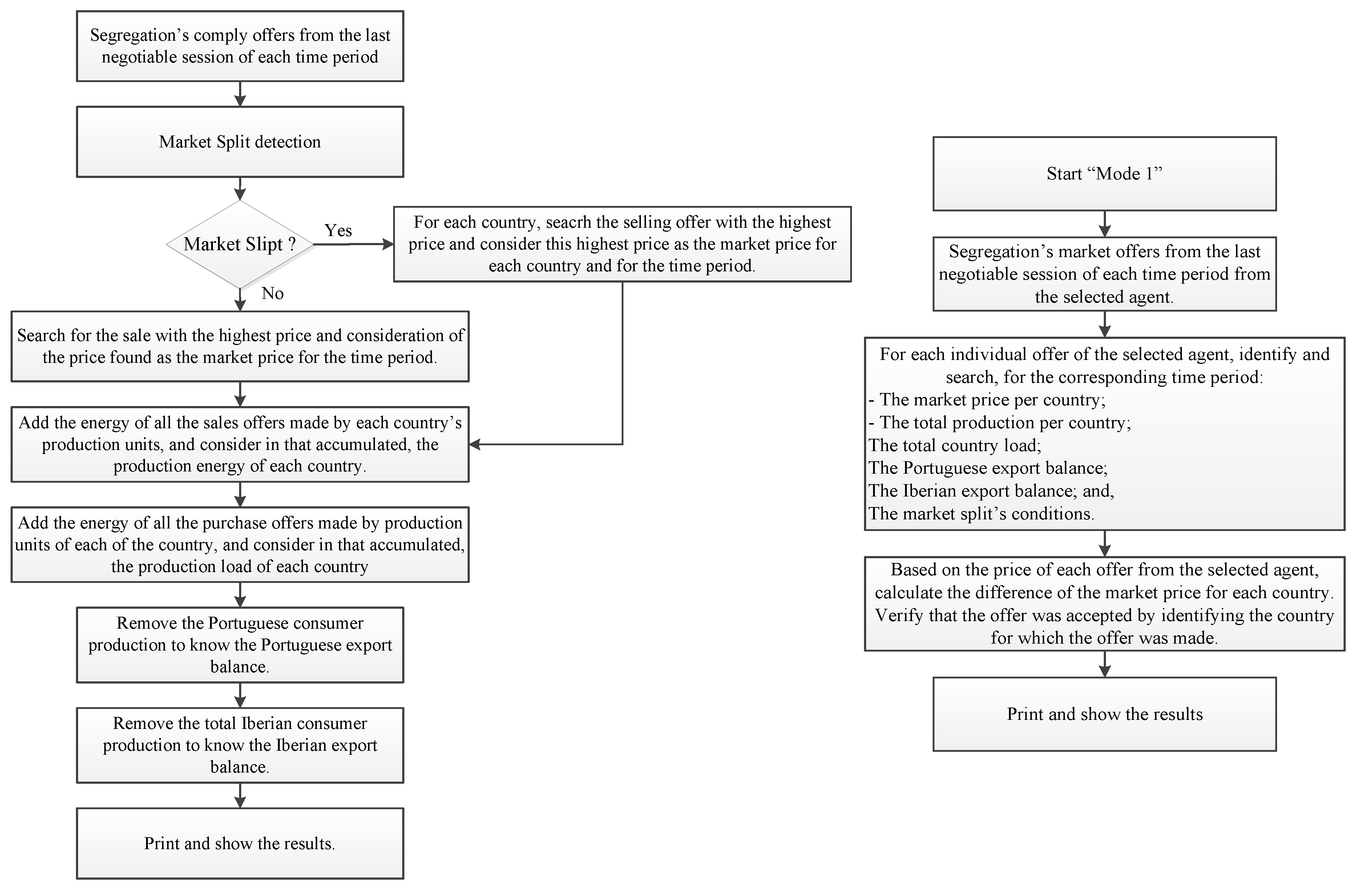

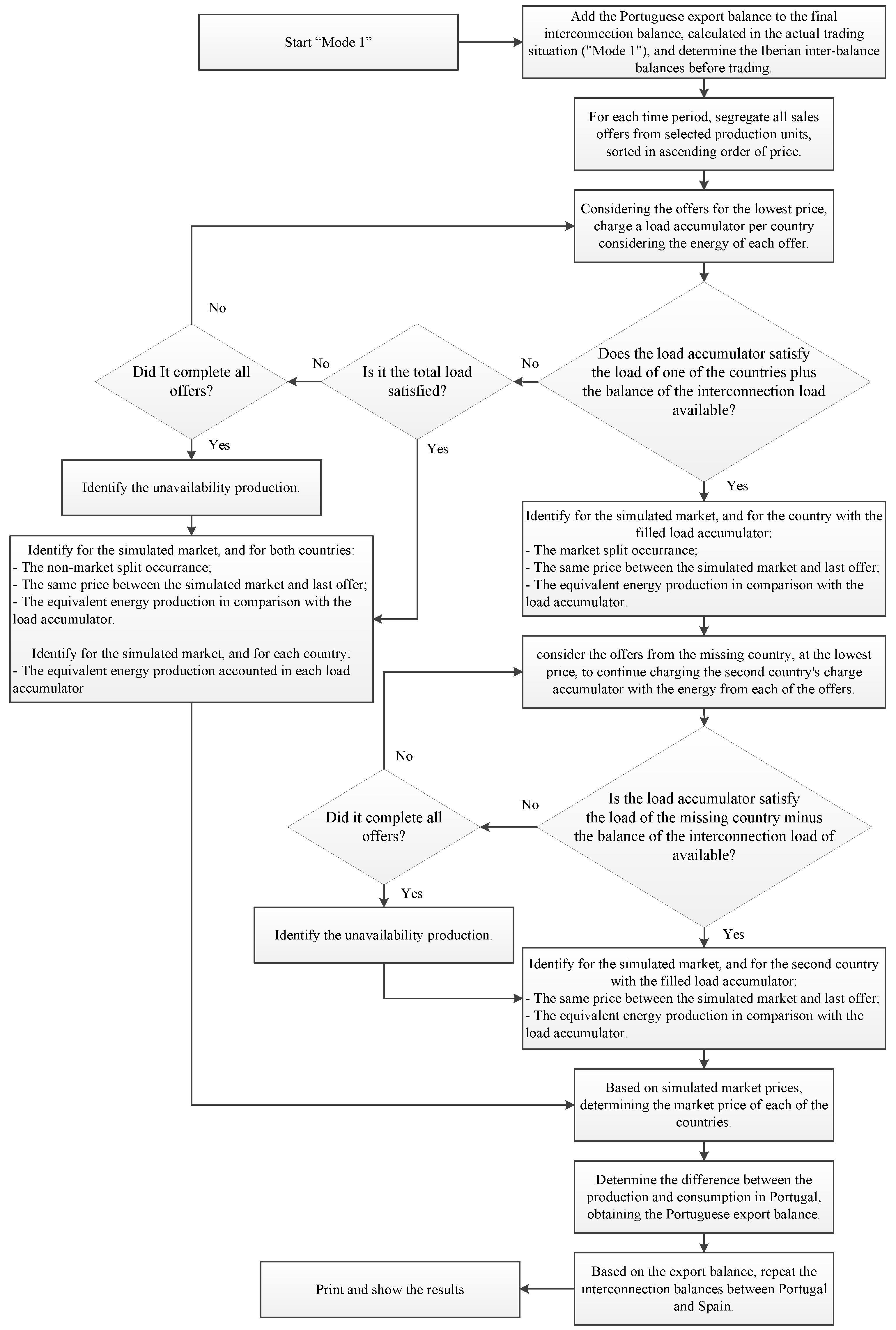

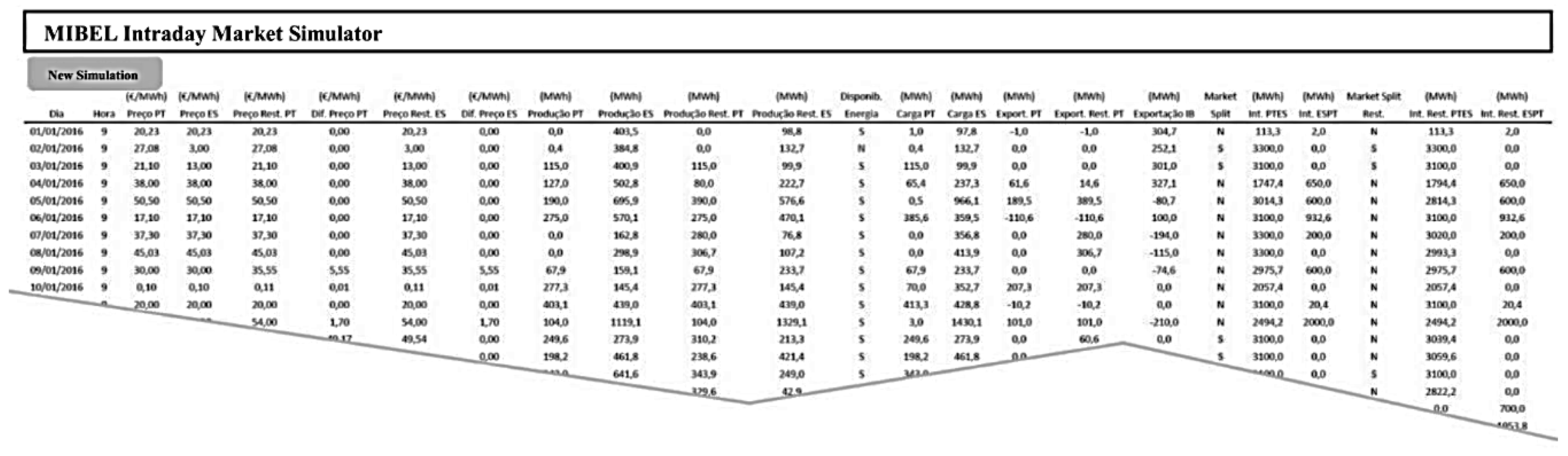

3.2. Market Simulator Model

3.3. Data Structure and Market Simulator Functionalities

- Agents;

- Properties;

- Units;

- Offers;

- Interconnection energy balances.

- The agents are the owners, totally or partially, of units through which agents make offers to the market;

- The agents and the units have a unique code assigned by OMIE [34];

- Each unit is registered in a specific market area, i.e., Portugal, Spain or the Iberian Peninsula borders.

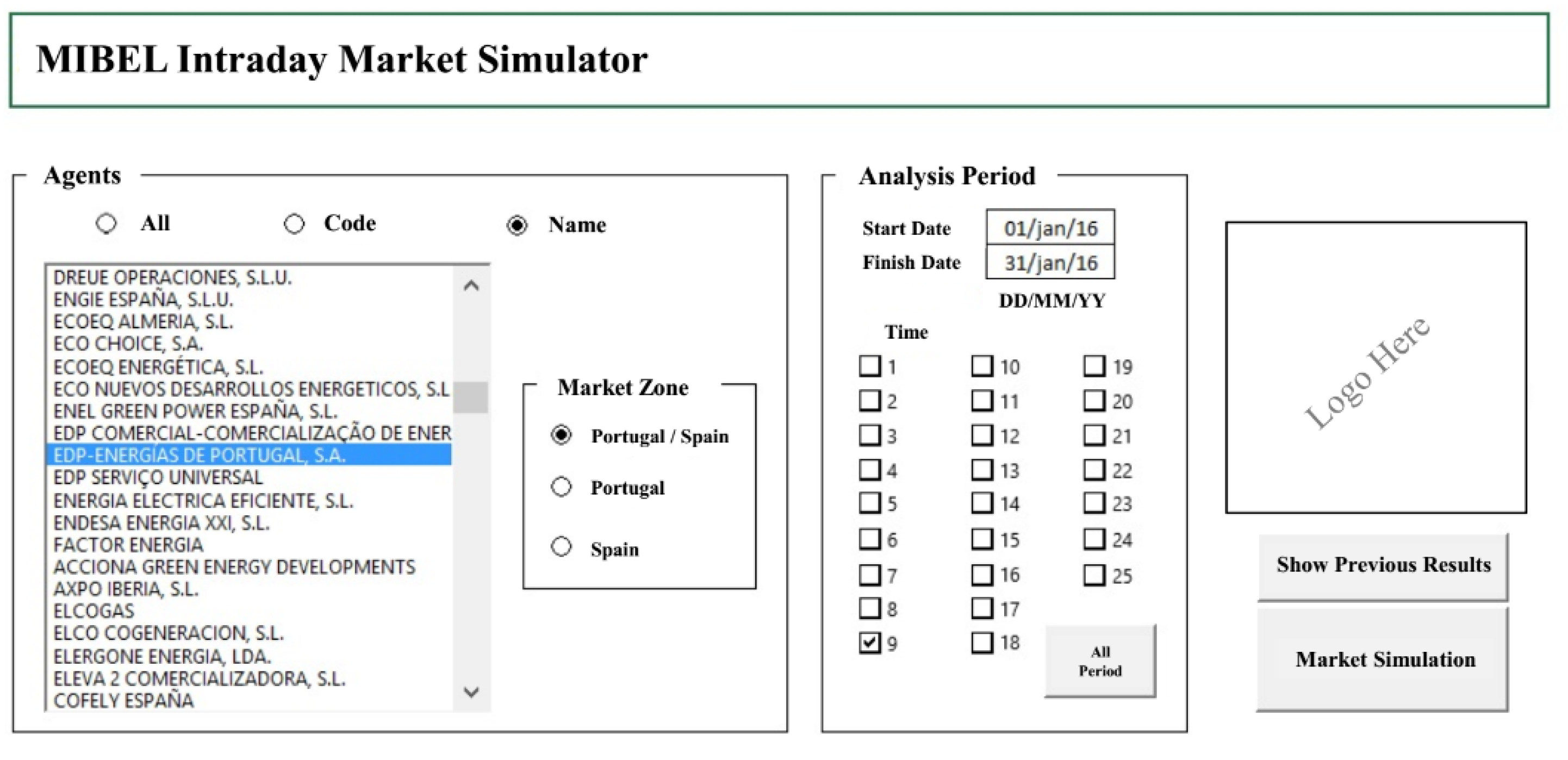

- “Mode 1”: in this mode, it is proposed that the market simulator may present, based on the offers made to the market, the results obtained in the actual trading of the market, at any time. For this functional mode, the user interface is shown in Figure 2.

- “Mode 2”: it allows the user to know all the information related to “Mode 1” and it also allows the selection of a particular agent, with the addition of having the possibility of knowing the agent’s interaction with each offer to the market. This mode is illustrated in Figure 3 and Figure 4, respectively. The user interface for this functional mode presents two alternatives in the agent’s selection, allowing each alternative the possibility of segregation by target country:

- ○

- Agent code selection or;

- ○

- Selection by Agent name.

- “Mode 3”: it enables the selection of the technology or technologies used in the electricity production. With this mode, the EM is simulated by withdrawing the bids from the deprecated production technologies. This interface display is similar to Figure 2.

4. Intraday Spot Market Simulation Results

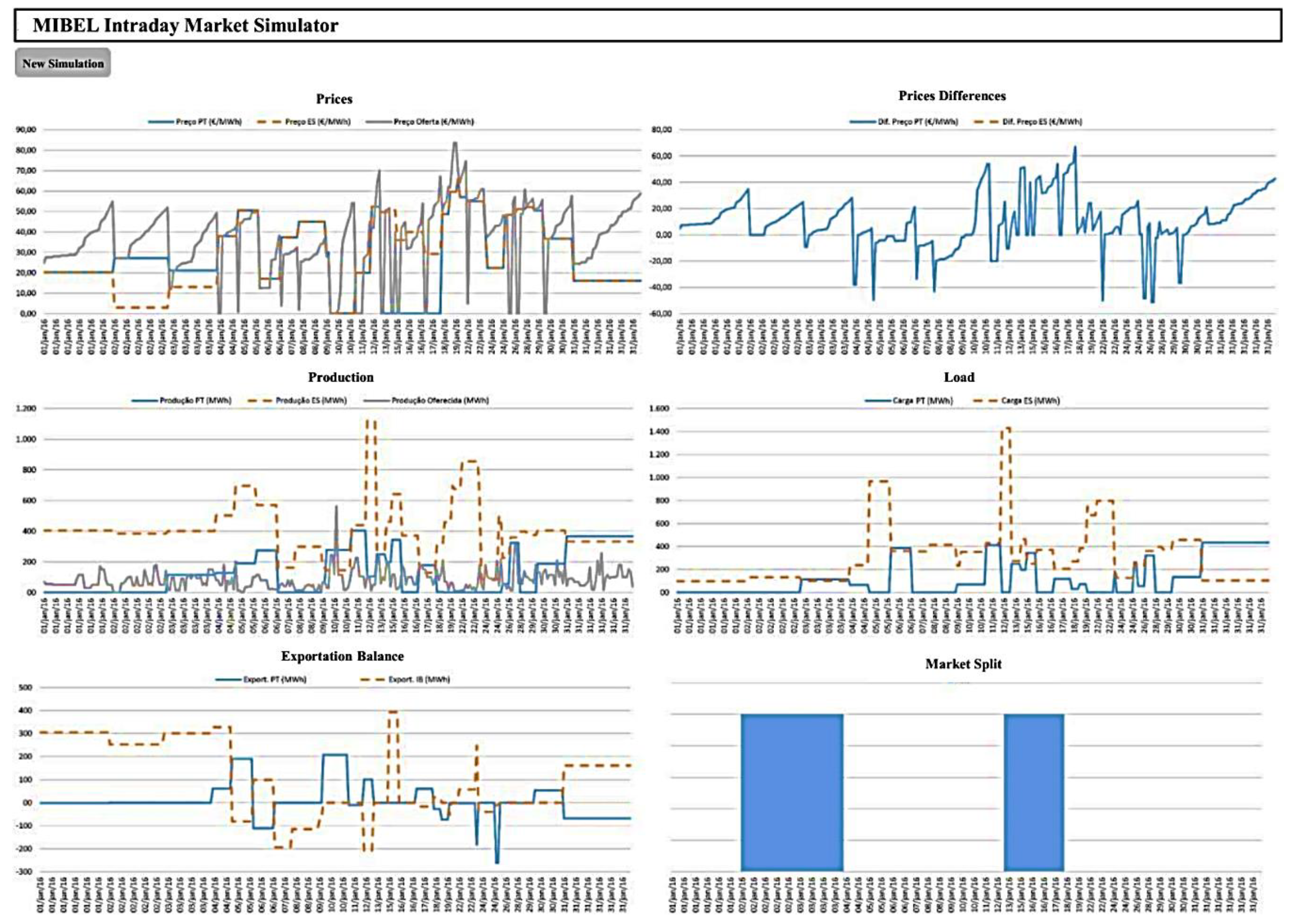

4.1. Market Simulator Layout

4.2. Market Simulator Analysis

- Real Production and EMP with the WP integration restriction;

- EMP differences with the restriction of the real EM;

- Loads to be met in the EM;

- The condition of the energy’s availability in the system with restriction;

- The condition of the market split, with and without restriction;

- Transits of energy in the Portugal-Spain interconnection.

4.3. Market Simulator Results Treatment

- Time period;

- Time period with aggregation per day of the week and per month;

- Aggregation by day of the week and per month.

4.4. Results Analysis

- There is a worsening of 1.56 €/MWh in the Portuguese EMP, and of 1.12 €/MWh in the Spanish one;

- There is less EMP volatility;

- There are less market splitting conditions;

- There were no relevant variations in the maximum transits interconnection between Portugal and Spain;

- There are more conditions for partial power outages.

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Disclaimer

Abbreviations

| APREN | Portuguese Association for Renewable Energy. |

| DBMS | Database management system. |

| DSO | Distribution System Operator. |

| EDP | Portuguese energy enterprise. |

| EM | Electricity markets. |

| EMP | Electricity market prices. |

| GARCH | Generalized auto regressive conditional heteroscedasticity. |

| IESM | Intraday electricity spot market. |

| MIBEL | Iberian Electricity Market. |

| OMIE | Iberian Electricity Market Operator. |

| PT | Portugal. |

| REN | Portuguese Transmission System Operator. (Redes Energéticas Nacionais). |

| RES | Renewable energy sources. |

| SP | Spain. |

| SQL | Simple query language. |

| TSO | Transmission System Operator. |

| WP | Wind power. |

References

- US Energy Information Administration. International Energy Outlook 2017. 2017. Available online: https://www.eia.gov/outlooks/ieo/pdf/0484(2017) (accessed on 31 May 2018).

- BP British Petroleum P.L.C. BP Energy Outlook 2018. 2018. Available online: https://www.bp.com/en/global/corporate/energy-economics/energy-outlook.html (accessed on 31 October 2018).

- World Nuclear Association. Information Library and Country Profiles. Available online: http://www.world-nuclear.org/information-library/country-profiles.aspx (accessed on 31 May 2018).

- Azofra, D.; Jiménez, E.; Blanco, J.; Saenz-Díez, J.C. Wind power merit-order and feed-in-tariffs effect: A variability analysis of the Spanish electricity market. Energy Convers. Manag. 2014, 83, 19–27. [Google Scholar] [CrossRef]

- Evangelos KAndersson, J.; Serletis, A. Electricity prices, large-scale renewable integration, and policy implications. Energy Policy 2017, 101, 550–560. [Google Scholar] [Green Version]

- Red Eléctrica de España. Spanish Electrical System Report. 2017. Available online: http://www.ree.es/es/estadisticas-del-sistema-electrico-espanol/informe-anual/informe-del-sistema-electrico-espanol-2017 (accessed on 1 June 2018).

- REN. REN Technical Data. 2016. Available online: http://www.centrodeinformacao.ren.pt/PT/InformacaoTecnica/DadosTecnicos/REN%20Dados%20T%C3%A9cnicos%202016.pdf (accessed on 1 June 2018).

- International Renewable Energy Agency (IRENA). Renewable Power Generation Costs in 2017; IRENA: Abu Dhabi, United Arab Emirates, 2018; Available online: http://www.irena.org/publications/2018/Jan/Renewable-power-generation-costs-in-2017 (accessed on 1 June 2018).

- Wind Europe. Wind in Power 2017: Annual Combined Onshore and Offshore Wind Energy Statistics. 2018. Available online: https://windeurope.org/wp-content/uploads/files/about-wind/statistics/WindEurope-Annual-Statistics-2017.pdf (accessed on 4 June 2018).

- Ibrahim, H.; Ghandourb, M.; Dimitrovaa, M.; Ilincac, A.; Perrond, J. Integration of wind energy into electricity systems: Technical challenges and actual solutions. Energy Procedia 2011, 6, 815–824. [Google Scholar] [CrossRef]

- Katzenstein, W.; Apt, J. The cost of wind power vaiability. Energy Policy 2012, 51, 233–243. [Google Scholar] [CrossRef]

- Renewables Grid Initiative. RGI Annual Report 2015. 2015. Available online: https://renewables-grid.eu/fileadmin/user_upload/Files_RGI/RGI_Publications/RGI_Annual_Report_2015.pdf (accessed on 4 June 2018).

- Hirth, L.; Ueckerdt, F.; Edenhofer, O. Integration costs revisited: An economic framework for wind and solar variability. Renew. Energy 2015, 54, 925–939. [Google Scholar] [CrossRef]

- Público Newspaper. Falta de Água Nas Barragens Faz Disparar Importação de Eletricidade. 2012. Available online: https://www.publico.pt/2012/04/23/economia/noticia/falta-de-agua-nas-barragens-faz-disparar-importacao-de-electricidade-1543271 (accessed on 5 June 2018).

- Ketterer, J.C. The impact of wind power generation on the electricity price in Germany. Energy Econ. 2014, 44, 270–280. [Google Scholar] [CrossRef] [Green Version]

- Ocker, F.; Ehrhart, K.-M. The “German Paradox” in the balancing power markets. Renew. Sustain. Energy Rev. 2017, 67, 892–898. [Google Scholar] [CrossRef]

- Cludius, J.; Hermann, H.; Matthes, F.C.; Graichen, V. The merit order effect of wind and photovoltaic electricity generation in Germany 2008–2016: Estimation and distributional implications. Energy Econ. 2014, 44, 302–313. [Google Scholar] [CrossRef]

- Hildmann, M.; Ulbig, A.; Andersson, G. Empirical analysis of the merit-order effect and the missing money problem in power markets with high RES shares. IEEE Trans. Power Syst. 2015, 30, 1560–1570. [Google Scholar] [CrossRef]

- Dilling, M.; Jung, M.; Karl, J. The impact of renewables on electricity prices in Germany—An estimation based on historic spot prices in the years 2011–2013. Renew. Sustain. Energy Rev. 2016, 57, 7–15. [Google Scholar] [CrossRef]

- Wirdemo, A. The Impact of Wind Power Production on Electricity Price Volatility: A Time-Series Analysis; Luleå Tekniska Universitet: Luleå, Sweden, 2017; p. 66. Available online: http://www.diva-portal.org/smash/get/diva2:1128192/FULLTEXT01.pdf (accessed on 6 June 2018).

- Holttinen, H.; Koreneff, G. Imbalance costs of wind power for a hydro power producer in Finland. Wind. Eng. 2012, 36, 53–68. [Google Scholar] [CrossRef]

- Nieuwenhout, F.; Brand, A. The Impact of Wind Power on Day-Ahead Electricity Prices in The Netherlands; Energy Research Centre of the Netherlands: Petten, The Netherlands, 2011; pp. 1–5. Available online: https://www.ecn.nl/docs/library/report/2011/m11111.pdf (accessed on 6 June 2018).

- Ferreira, J.E.B. O Impacto da Produção Eólica no Preço de Mercado; ISCTE Business School, IUL: Lisboa, Portugal, 2016; p. 81. Available online: https://repositorio.iscte-iul.pt/handle/10071/13740 (accessed on 7 June 2018).

- Cepisca, C.; Morcovescu, M.; Seritan, G.; Bardis, N.; Grigorescu, S.D.; Banica, C. Software solution implementation for regional balancing mechanism of electrical energy. Appl. Mech. Mater. 2013, 291–294, 1308–1311. [Google Scholar] [CrossRef]

- Clò, S.; Cataldi, A.; Zoppoli, P. The merit-order effect in the Italian power market: The impact of solar and wind generation on national wholesale electricity prices. Energy Policy 2015, 77, 79–88. [Google Scholar] [CrossRef]

- Wo, C.K.; Moore, J.; Schneiderman, B.; Ho, T.; Olson, A.; Alagappan, L.; Chawla, K.; Toyama, N.; Zarnikau, J. Merit-order effects of renewable energy and price divergence in California’s day-ahead and real-time electricity markets. Energy Policy 2016, 92, 299–312. [Google Scholar] [CrossRef]

- González-Aparicio, I.; Kapetaki, Z.; Tzimas, E. Wind energy and carbon dioxide utilisation as an alternative business model for energy producers: A case study in Spain. Appl. Energy 2018, 222, 216–227. [Google Scholar] [CrossRef]

- Browne, O.; Poletti, S.; Young, D. How does market power affect the impact of large scale wind investment in ‘energy only’ wholesale electricity markets? Energy Policy 2015, 87, 17–27. [Google Scholar] [CrossRef]

- Portuguese Association for Renewable Energy (APREN). Potenciar as Renováveis em Portugal. 2017. Available online: http://www.apren.pt/ (accessed on 1 June 2018).

- Breeze, P. The Cost of Power Generation: The Current and Future Competitiveness of Renewable and Traditional Technologies; Business Insights: Warwick, NY, USA, 2010; p. 147. [Google Scholar]

- Portuguese Decree Law. Decreto-Lei No. 225/2007, Diário da República No. 105/2007, Série I, 31 de Maio de 2007. 2007. Available online: https://dre.pt/pesquisa/-/search/638769/details/maximized (accessed on 31 May 2018).

- Den Bergh, K.V.; Delarue, E. Quantifying CO2 abatement costs in the power sector. Energy Policy 2015, 80, 88–97. [Google Scholar] [CrossRef]

- Chaves-Ávila, P.; Würzburg, K.; Gómez, T.; Linares, P. How renewable sources are changing EU electricity prices. IEEE Power Energy Mag. 2015, 29–40. [Google Scholar] [CrossRef]

- Iberian Electricity Market Operator (OMIE). Available online: https://www.omie.es (accessed on 1 June 2018).

- Spanish Market Operator (OMEL). Available online: https://www.omel.es (accessed on 4 June 2018).

- Iberian Electricity Market (MIBEL). Descrição do Funcionamento do MIBEL, Conselho de Reguladores do MIBEL. 2009. Available online: http://mibel.com/ (accessed on 7 June 2018).

- Spanish Government. Reglas de Funcionamiento de los Mercados Diario e Intradiario de Producción de Energía Eléctrica, Ministerio de Energía, Turismo y Agenda Digital, Boletín Oficial del Estado, No. 115, Sec. I. 2018. Available online: https://www.boe.es/boe/dias/2018/05/11/pdfs/BOE-A-2018-6295.pdf (accessed on 7 June 2018).

- Nielsen, P.; White, M.; Parui, U. Microsoft SQL Server 2008 Bible; Wiley Publishing, Inc.: Indianapolis, IN, USA, 2009; p. 1680. [Google Scholar]

- Golov, N.; Ronnback, L. Big data normalization for massively parallel processing databases. Comput. Stand. Interfaces 2017, 54, 86–93. [Google Scholar] [CrossRef]

- Green, J.; Bullen, S.; Bovey, R.; Alexander, M. Excel 2007 VBA Programmer’s Reference; Wiley Publishing, Inc.: Indianapolis, IN, USA, 2011; p. 1066. [Google Scholar]

- Linoff, G. Data analysis Using SQL and Excel; Wiley Publishing, Inc.: Indianapolis, IN, USA, 2008; p. 690. [Google Scholar]

| (€/MWh) | EMP in PT | EMP in SP | EMP with WP Restriction in PT | EMP with WP Restriction in SP | EMP Difference in PT | EMP Difference in SP | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Time | Mean | σ | Mean | σ | Mean | σ | Mean | σ | Mean | % | Δσ (%) | Mean | % | Δσ (%) |

| 1 | 44.62 | 14.41 | 44.91 | 13.84 | 46.19 | 13.81 | 46.31 | 13.51 | 1.57 | 3.5 | −4.2 | 1.40 | 3.1 | −2.4 |

| 2 | 41.22 | 13.92 | 41.49 | 13.28 | 42.71 | 13.43 | 42.86 | 13.10 | 1.49 | 3.6 | −3.5 | 1.37 | 3.3 | −1.4 |

| 3 | 39.09 | 13.88 | 39.35 | 13.11 | 40.39 | 13.61 | 40.69 | 12.97 | 1.30 | 3.3 | −1.9 | 1.35 | 3.4 | −1.1 |

| 4 | 37.55 | 14.25 | 37.70 | 13.28 | 38.79 | 13.94 | 39.10 | 13.19 | 1.24 | 3.3 | −2.2 | 1.40 | 3.7 | −0.7 |

| 5 | 37.40 | 14.34 | 37.09 | 13.55 | 38.92 | 13.92 | 38.92 | 13.35 | 1.52 | 4.1 | −2.9 | 1.84 | 4.9 | −1.5 |

| 6 | 38.28 | 14.15 | 38.17 | 13.47 | 39.84 | 13.73 | 39.96 | 13.20 | 1.57 | 4.1 | −2.9 | 1.79 | 4.7 | −2.0 |

| 7 | 41.60 | 14.26 | 41.90 | 13.66 | 42.93 | 13.74 | 43.16 | 13.27 | 1.33 | 3.2 | −3.7 | 1.27 | 3.0 | −2.8 |

| 8 | 45.28 | 16.65 | 46.49 | 15.23 | 46.86 | 15.57 | 47.34 | 15.01 | 1.58 | 3.5 | −6.5 | 0.85 | 1.8 | −1.4 |

| 9 | 46.81 | 17.65 | 49.09 | 15.30 | 49.11 | 15.59 | 49.76 | 15.04 | 2.30 | 4.9 | −11.7 | 0.67 | 1.4 | −1.7 |

| 10 | 49.11 | 17.08 | 50.88 | 15.15 | 50.73 | 15.57 | 51.35 | 14.98 | 1.62 | 3.3 | −8.8 | 0.47 | 0.9 | −1.2 |

| 11 | 49.95 | 16.22 | 51.23 | 14.83 | 51.24 | 15.08 | 51.69 | 14.68 | 1.30 | 2.6 | −7.0 | 0.46 | 0.9 | −1.0 |

| 12 | 49.58 | 15.62 | 50.47 | 14.56 | 51.40 | 14.67 | 51.52 | 14.47 | 1.82 | 3.7 | −6.1 | 1.05 | 2.1 | −0.6 |

| 13 | 49.37 | 15.65 | 50.09 | 14.62 | 50.88 | 14.74 | 50.97 | 14.55 | 1.51 | 3.1 | −5.8 | 0.88 | 1.8 | −0.4 |

| 14 | 49.08 | 15.53 | 49.88 | 14.43 | 50.42 | 14.72 | 50.65 | 14.39 | 1.33 | 2.7 | −5.2 | 0.78 | 1.6 | −0.3 |

| 15 | 47.75 | 15.13 | 48.20 | 14.62 | 48.79 | 14.65 | 48.88 | 14.61 | 1.05 | 2.2 | −3.2 | 0.68 | 1.4 | −0.1 |

| 16 | 46.40 | 15.60 | 46.73 | 15.21 | 47.75 | 15.30 | 47.92 | 15.12 | 1.35 | 2.9 | −2.0 | 1.20 | 2.6 | −0.6 |

| 17 | 46.06 | 15.80 | 46.40 | 15.45 | 47.37 | 15.44 | 47.43 | 15.34 | 1.31 | 2.8 | −2.3 | 1.04 | 2.2 | −0.8 |

| 18 | 47.46 | 15.93 | 47.82 | 15.65 | 48.67 | 15.51 | 48.81 | 15.40 | 1.21 | 2.6 | −2.6 | 0.99 | 2.1 | −1.6 |

| 19 | 49.32 | 16.46 | 49.92 | 16.06 | 50.80 | 15.99 | 50.95 | 15.82 | 1.48 | 3.0 | −2.8 | 1.03 | 2.1 | −1.5 |

| 20 | 50.94 | 16.36 | 51.92 | 15.34 | 52.67 | 15.61 | 52.93 | 15.32 | 1.73 | 3.4 | −4.5 | 1.00 | 1.9 | −0.1 |

| 21 | 52.32 | 15.26 | 53.13 | 14.26 | 53.76 | 14.68 | 54.12 | 14.13 | 1.45 | 2.8 | −3.8 | 0.99 | 1.9 | −1.0 |

| 22 | 52.21 | 15.40 | 53.34 | 13.80 | 54.53 | 13.91 | 54.71 | 13.62 | 2.33 | 4.5 | −9.7 | 1.37 | 2.6 | −1.3 |

| 23 | 49.57 | 14.94 | 50.47 | 13.67 | 51.57 | 13.97 | 51.76 | 13.56 | 2.00 | 4.0 | −6.5 | 1.29 | 2.6 | −0.8 |

| 24 | 44.99 | 14.49 | 45.37 | 13.81 | 47.02 | 14.09 | 47.15 | 13.79 | 2.03 | 4.5 | −2.7 | 1.78 | 3.9 | −0.2 |

| Average | 46.08 | 15.37 | 46.75 | 14.42 | 47.64 | 14.64 | 47.87 | 14.27 | 1.56 | 3.4 | −4.7 | 1.12 | 2.5 | −1.1 |

| Time | Energy Availability | Market Split | Market Split with WP Restriction |

|---|---|---|---|

| 1 | 98.7% | 3.2% | 1.6% |

| 2 | 98.3% | 4.7% | 2.6% |

| 3 | 98.3% | 6.4% | 3.7% |

| 4 | 97.1% | 8.2% | 5.7% |

| 5 | 97.1% | 8.1% | 4.8% |

| 6 | 98.5% | 6.4% | 3.7% |

| 7 | 98.6% | 4.3% | 2.4% |

| 8 | 98.8% | 6.3% | 2.4% |

| 9 | 98.3% | 9.9% | 2.1% |

| 10 | 98.9% | 7.3% | 2.0% |

| 11 | 99.0% | 4.4% | 1.1% |

| 12 | 99.2% | 4.0% | 1.1% |

| 13 | 99.1% | 3.7% | 0.9% |

| 14 | 98.6% | 4.5% | 1.3% |

| 15 | 98.4% | 3.7% | 1.2% |

| 16 | 98.9% | 3.9% | 1.7% |

| 17 | 99.0% | 3.9% | 1.5% |

| 18 | 99.5% | 3.8% | 1.6% |

| 19 | 99.4% | 3.7% | 1.4% |

| 20 | 99.3% | 4.3% | 1.4% |

| 21 | 99.1% | 4.8% | 2.0% |

| 22 | 99.2% | 6.0% | 1.4% |

| 23 | 99.6% | 4.9% | 1.0% |

| 24 | 98.9% | 2.6% | 1.3% |

| Average | 98.7% | 5.1% | 2.1% |

| Month/Year | EMP in PT | EMP in SP | EMP with WP Restriction in PT | EMP Difference in PT | EMP with WP Restriction in SP | EMP Difference in SP | |

|---|---|---|---|---|---|---|---|

| 1st Quarter | Jan./15 | 51.57 | 51.65 | 52.96 | 1.40 | 53.20 | 1.56 |

| Fev./15 | 41.15 | 41.31 | 43.15 | 2.00 | 43.14 | 1.84 | |

| Mar./15 | 41.74 | 41.75 | 42.70 | 0.96 | 42.72 | 0.97 | |

| 2nd Quarter | Apr./15 | 45.95 | 45.92 | 47.20 | 1.24 | 47.20 | 1.28 |

| May/15 | 44.51 | 44.39 | 45.89 | 1.38 | 45.84 | 1.46 | |

| Jun./15 | 54.29 | 54.16 | 55.22 | 0.93 | 55.18 | 1.02 | |

| 3rd Quarter | Jul./15 | 58.44 | 58.43 | 59.37 | 0.93 | 59.37 | 0.93 |

| Aug./15 | 53.66 | 53.69 | 54.54 | 0.88 | 54.62 | 0.94 | |

| Sep./15 | 49.54 | 49.53 | 50.38 | 0.84 | 50.38 | 0.84 | |

| 4th Quarter | Oct./15 | 48.72 | 48.89 | 49.80 | 1.07 | 49.88 | 0.99 |

| Nov./15 | 51.18 | 51.05 | 52.69 | 1.51 | 52.75 | 1.70 | |

| Dec./15 | 51.44 | 51.25 | 52.56 | 1.12 | 52.58 | 1.33 | |

| 1st Quarter | Jan./16 | 32.59 | 34.52 | 35.40 | 2.81 | 35.84 | 1.31 |

| Fev./16 | 26.08 | 26.79 | 27.55 | 1.47 | 27.82 | 1.03 | |

| Mar./16 | 27.15 | 27.64 | 28.13 | 0.98 | 28.35 | 0.71 | |

| 2nd Quarter | Apr./16 | 21.71 | 23.40 | 23.97 | 2.26 | 24.95 | 1.55 |

| May/16 | 22.84 | 25.21 | 25.72 | 2.88 | 26.50 | 1.29 | |

| Jun./16 | 34.10 | 38.43 | 37.88 | 3.79 | 39.13 | 0.70 | |

| 3rd Quarter | Jul./16 | 39.50 | 40.46 | 41.08 | 1.59 | 41.32 | 0.86 |

| Aug./16 | 39.99 | 40.00 | 40.75 | 0.76 | 40.75 | 0.75 | |

| Sep./16 | 42.51 | 42.97 | 43.65 | 1.15 | 43.70 | 0.73 | |

| 4th Quarter | Oct./16 | 52.15 | 52.34 | 53.07 | 0.92 | 53.32 | 0.97 |

| Nov./16 | 56.20 | 56.43 | 57.77 | 1.57 | 57.98 | 1.55 | |

| Dec./16 | 58.11 | 60.04 | 60.57 | 2.46 | 61.19 | 1.15 | |

| 1st Quarter | Jan./17 | 71.17 | 72.65 | 74.27 | 3.10 | 74.52 | 1.86 |

| Fev./17 | 46.15 | 49.90 | 49.64 | 3.49 | 51.19 | 1.28 | |

| Mar./17 | 43.35 | 42.87 | 44.32 | 0.97 | 44.24 | 1.37 | |

| 2nd Quarter | Apr./17 | 43.28 | 43.48 | 44.49 | 1.21 | 44.72 | 1.24 |

| May/17 | 46.80 | 46.80 | 47.72 | 0.92 | 47.72 | 0.92 | |

| Jun./17 | 49.31 | 49.68 | 49.91 | 0.61 | 50.15 | 0.48 | |

| 3rd Quarter | Jul./17 | 47.54 | 47.75 | 48.25 | 0.70 | 48.31 | 0.56 |

| Aug./17 | 46.09 | 46.19 | 46.83 | 0.75 | 46.86 | 0.66 | |

| Sep./17 | 48.14 | 48.19 | 48.67 | 0.53 | 48.72 | 0.53 | |

| 4th Quarter | Oct./17 | 56.02 | 55.97 | 57.03 | 1.00 | 56.96 | 0.99 |

| Nov./17 | 60.38 | 60.49 | 61.36 | 0.97 | 61.64 | 1.15 | |

| Dec./17 | 57.68 | 57.42 | 59.01 | 1.34 | 59.35 | 1.93 |

| Day | EMP in PT | EMP in SP | EMP with WP Restriction in PT | EMP Difference in PT | EMP with WP Restriction in SP | EMP Difference in SP |

|---|---|---|---|---|---|---|

| Monday | 47.39 | 47.70 | 48.75 | 1.36 | 48.89 | 1.18 |

| Tuesday | 48.95 | 49.50 | 50.15 | 1.20 | 50.44 | 0.94 |

| Wednesday | 48.73 | 49.24 | 50.19 | 1.46 | 50.39 | 1.16 |

| Thursday | 48.73 | 49.43 | 50.19 | 1.46 | 50.40 | 0.97 |

| Friday | 47.67 | 48.87 | 49.33 | 1.66 | 49.73 | 0.86 |

| Saturday | 43.36 | 44.07 | 45.08 | 1.72 | 45.37 | 1.30 |

| Sunday | 38.54 | 38.49 | 39.84 | 1.30 | 39.95 | 1.45 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Frade, P.M.S.; Vieira-Costa, J.V.G.A.; Osório, G.J.; Santana, J.J.E.; Catalão, J.P.S. Influence of Wind Power on Intraday Electricity Spot Market: A Comparative Study Based on Real Data. Energies 2018, 11, 2974. https://doi.org/10.3390/en11112974

Frade PMS, Vieira-Costa JVGA, Osório GJ, Santana JJE, Catalão JPS. Influence of Wind Power on Intraday Electricity Spot Market: A Comparative Study Based on Real Data. Energies. 2018; 11(11):2974. https://doi.org/10.3390/en11112974

Chicago/Turabian StyleFrade, Pedro M. S., João V. G. A. Vieira-Costa, Gerardo J. Osório, João J. E. Santana, and João P. S. Catalão. 2018. "Influence of Wind Power on Intraday Electricity Spot Market: A Comparative Study Based on Real Data" Energies 11, no. 11: 2974. https://doi.org/10.3390/en11112974

APA StyleFrade, P. M. S., Vieira-Costa, J. V. G. A., Osório, G. J., Santana, J. J. E., & Catalão, J. P. S. (2018). Influence of Wind Power on Intraday Electricity Spot Market: A Comparative Study Based on Real Data. Energies, 11(11), 2974. https://doi.org/10.3390/en11112974