1. Introduction

During a long-run production, a common phenomenon is the production of defective items even though the production is considered under a smart manufacturing system under the consideration of proper energy consumption. The rate of production of defective items may be of two types: constant defective rate and random defective rate. In constant defective rate, the total number of defective items are fixed, whereas in random defective rate, the number of defective items varies based on several conditions of the production system. In reality, both defective rates are available constant defective rate (see for reference [

1]) and random defective rate [

2]. Until now, no author considered random defective rate for multi-item smart production under energy consideration with budget and space constraints. Though the major contribution is the concept of failure rate of a smart production system under energy consideration being introduced with the random time movement from in-control state to out-of-control state. The failure rate is defined as the total number of failures divided by total number of working hours. The failure rate of a smart production system is considered as a system reliability indicator because a lower failure rate indicates more reliable systems and a higher failure rate indicates less reliable systems. Therefore, the proposed model gives a new direction of random defective rate with an indication of system reliability for multi-item smart production and energy consumption with budget and space constraints. Usually, for any long-run production system, it may contain production of both perfect and imperfect products. The imperfect products can either be discarded or can be reworked to make them perfect. This imperfection occurs when the system moves to

out-of-control state, which is due to the factors such as machine breakdown, program inaccuracy, machine operator’s inefficiency, and defective raw material supply. Several researchers have proposed inventory and production models with imperfect production systems. Kim and Hog [

3] extended the Rossenblat and Lee [

4] model within imperfect production systems by considering deteriorating production processes to obtain optimal production run length. They introduced the concept of system movement to

out-of-control state from

in-control state and producing defective items with three different deteriorating processes: constant, linearly increasing and exponentially increasing. Giri and Dohi [

5] considered a random time of machine failure in an imperfect production system, where machine failure time and preventive time are random variables assuming stochastic machine breakdown and repair. They considered a net present value (NPV) approach for exact financial implications of the lot sizing to develop the EMQ model.

Sana et al. [

6] extended the concept of an imperfect production system to introduce a new research dimension by considering a reduced selling-price for imperfect products. Reworking of the imperfect production items to make them as good as perfect quality items was introduced by Chiu et al. [

7] and they proposed a model in which a portion of imperfect quality items is discarded, while the other portion is reworked by spending some costs. They optimized the finite production rate considering scrap production, reworking, and stochastic machine breakdown. The main research gap in this literature up to now is that no author utilized the concept of energy consumption and corresponding cost within any smart production system. Gonz

lez et al. [

8] developed a model on turbomachinery components which are using for grinding flank tools. Egea et al. [

9] implemented a short-cut method to measure the available energy in a required load capacity of a forging machine. They estimated the total energy during the friction of two screws.

Sarkar [

10] developed an inventory model for retailers with a stock-depended demand and delay-in-payments considering that the replenished items are not all perfect presuming that the production system is imperfect and the inventory is replenished at a finite rate. An important managerial insight was added by Sarkar [

11] by introducing a time dependent rate of product deterioration in an inventory system, where an inventory replenishment rate is finite and the customer is offered quantity discounts to attract a large order size in order to maximize the profit. Production of imperfect items depends upon the system reliability. The greater the investment in system development to increase its reliability, the lesser the production of imperfect items will be. System reliability-dependent imperfect production was discussed by Sarkar [

12] for an inflationary economic manufacturing quantity (EMQ) system, where demand depends upon the product price and advertisement. Chakraborty and Giri [

13] modeled an imperfect production system, where system shifts to

out-of-control state during preventive maintenance and, during the state, some imperfect items are produced, which are inspected and reworked at the end of the production run. They also assumed that some of the reworked items cannot be repaired.

An economic production quantity model with random defective rate of imperfect items’ production was investigated by Sarkar et al. [

14] with rework process and planned backorders. They considered three different distribution density functions to calculate the rate of defective items and compared the results. Sarkar and Saren [

15] studied deteriorating/imperfect production process, which randomly moves to an

out-of-control state. They suggested that lot inspection policy should be adopted rather than full inspection policy to reduce the inventory costs. They also considered state of quality inspectors, who may falsely choose imperfect items as perfect and vice versa, which are designated as Type 1 and Type 2 errors. They also considered warranty policy over fixed time periods.

Pasandideh et al. [

16] developed an inventory model for a multi-item single-machine lot size system with imperfect items’ production. Those imperfect items are further classified on the basis of their failure severity for reworking and scrap. They considered that product shortages are backlogged, in order to make it more realistic. Purohit et al. [

17] conducted a comprehensive detailed analysis of a lot size problem, an inventory control system for non-stationary stochastic demand considering constraints of carbon emissions and cycle service level using carbon cap-and-trade regulatory mechanism. They generalized the study on effects of emission parameters and properties of product as well as the performance on supply chain. Due to involvement of labor in production and considering their influence on production of defective items, it is considered important to invest in personnel training according to the adopted system. Sana [

18] investigated with production of defective items and developed an economic production lot size model with the environment of production system when it moves to

out-of-control state. C

rdenas-Barr

n et al. [

19] studies on optimal inventory with corrections and complements. Tiwari et al. [

20,

21] developed two models on deteriorating and partial backlogging.

Limited storage capacity for the inventory warehouse is now becoming a critical issue due to increasing costs of the storage facilities. This constraint is being considered by many researchers in situations where bulk production is being done. Huang et al. [

22] developed an inventory model and investigated the optimal retailer’s lot sizing policy under partially permissible delay-in-payments and space constraints. They considered extra cost payment for rental warehouse, when the capacity of the existing warehouse is full. Pasandideh and Niaki [

23] developed a nonlinear integer programming model to solve an inventory model considering multi-items with space limitations. They found the optimal solution of the model within the available warehouse space by adding a space constraint. Hafshejani et al. [

24] solved a multi-stage inventory model with a nonlinear cost function and space constraint through a genetic algorithm. Mahapatra et al. [

25] introduced an inventory model with demand and reliability dependent unit production cost under limited space availability. They supposed that available space is limited with fuzzy variable and solved the storage space goal using an intuitionistic fuzzy optimization technique.

The manufacturers have a limited budget and resources based on a periodic budget plan. Hence, consideration of budget constraints into the model is more realistic. Some researchers already analyzed budget constrained situations. For example, Mohan et al. [

26] developed an optimal replenishment policy for multi-item ordering under conditions of permissible delay-in-payments, a budget constraint, and permissible partial-payment at a penalty. Hou and Lin [

27] calculated the optimal lot size and optimal capital investment in setup costs with a limited capital budget to minimize the expected total annual cost and to reduce the yield variability for random yield. Taleizadeh et al. [

28] studied a multi-item production system considering imperfect items and reworking thereof. They included a service level and a budget constraint within the model and calculated the global minimum. C

rdenas-Barr

n et al. [

29] studied a production-inventory model in a just-in-time (JIT) system constrained with a maximum available budget and proposed a simple alternative heuristic algorithm to solve the model. Du et al. [

30] and Todde et al. [

31] developed models on energy analysis and energy consumption. Tomi

and Schneider [

32] explained the method of how energy can be recovered from waste by a closed-loop. Haraldsson and Johansson [

33] studied on measures of different types of energy efficiency during production. Xu et al. [

34] discussed the production of bio-fuel oil from pyrolysis products of plants. This model is extended in the direction of energy. See

Table 1 for the contribution of the different authors.

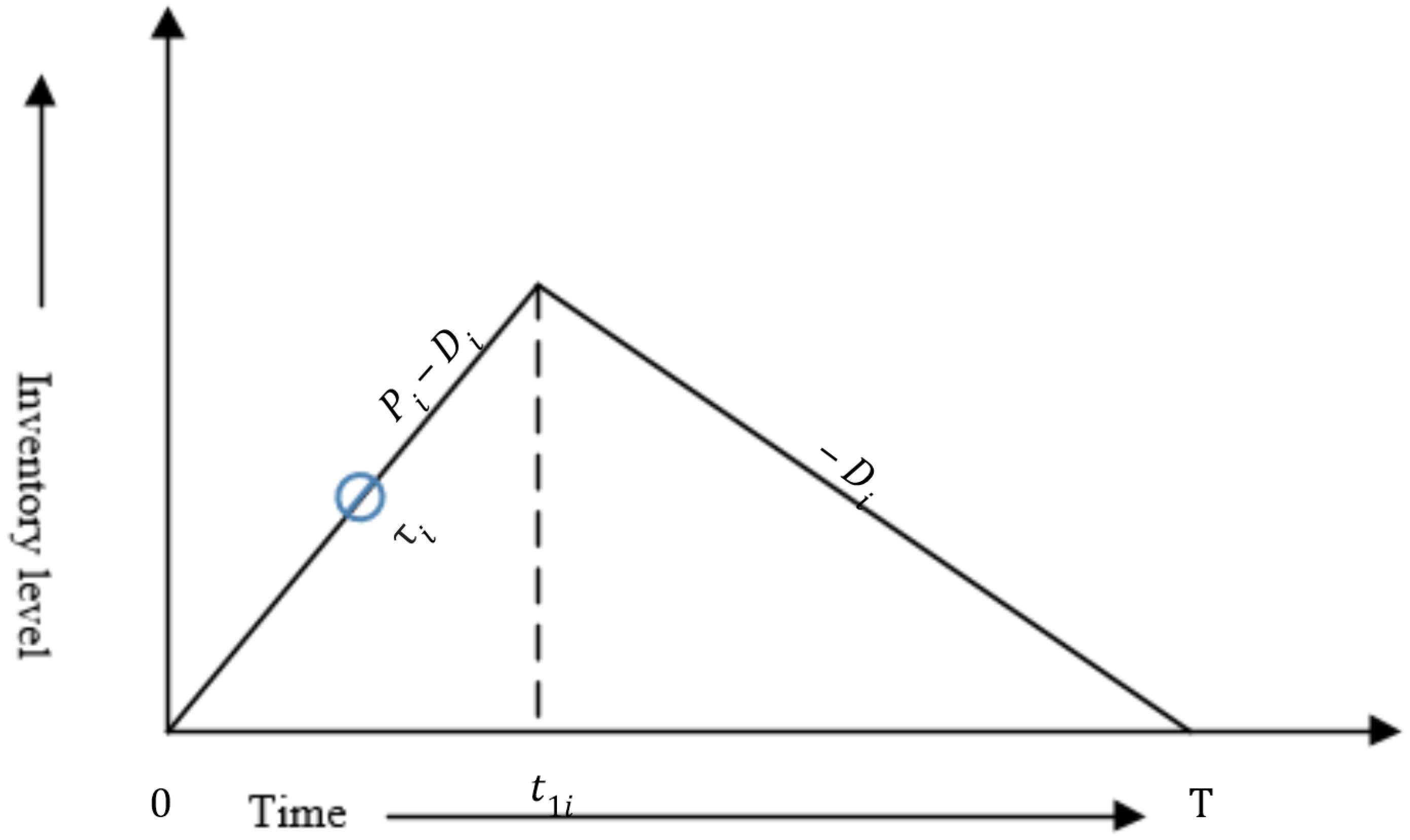

3. Mathematical Model

This study contains a production-inventory model with a multi-item under energy consideration. The smart production continues from

to

for multi-item with a finite rate, where

. The inventory piles up within the interval

and depletes within the interval

with demand

. The model considers that, after a random time

, the system moves from

in-control state to

out-of-control state and produces imperfect products. See

Figure 2 for the description of the production system.

The governing differential equation of the on-hand inventory is given by

The present state of inventories are given by

The model now considers the following costs to calculate the profit of the smart production system.

3.1. Setup Cost (SC)

Setup cost plays a very important role for multi-item smart production systems as each item contains a different setup system with different energy consumption. Thus, the model assumes that the setup cost for

item is considered as

per setup with

as energy consumption cost per setup. Therefore, the average setup cost per unit cycle is

3.2. Holding Cost (HC)

To calculate the holding cost for a smart multi-item production system, the average inventory for ith item has to calculate and, by taking summation over to n, one can obtain the total inventory over the cycle length of the smart production system. Therefore, the total inventory divided by the cycle length of the production cycle gives the average inventory and per unit holding cost multiplied by the average inventory gives the average holding cost per cycle.

Hence, for calculating the total inventory, one has

As energy consumption is calculated with the appropriate costs, the holding cost for average inventory per unit time under the presence of cost for energy consumption is

3.3. Inspection Cost (IC)

During a long-run process, the smart production system may move to

out-of-control state, thus an inspection of each product is necessary. By inspection, the industry can assure the good quality of products, which generally maintain the brand image of the industry. If inspection cost per unit is

and

is the cost per unit for energy consumed due to inspection, then the inspection cost per unit cycle under energy consideration is

3.4. Rework Cost (RC)

After inspection of each product, those items, detected as defective, are considered for reworking to make them as if they are perfect. To calculate the rework cost, the number of defective items and the rate of defective items production are needed.

The rate of defective items

is considered (see, for instance, [

2]) as

There is a quality level of smart production defined by the management system of the smart production industry, below which a product will not remain qualitative. The items that do not qualify the requirements of quality are imperfect items and cannot be forwarded to customers before reworking. The production system produces defective from random time till time , which is the time for maximum inventory.

There is no imperfect items within the interval

and all imperfect items produce within

. Thus, number of imperfect items within the interval

is

Therefore, the number of imperfect items within the full cycle is

where the random time

follows the exponential distribution.

The distribution function of

within the

out-of-control state is considered as

where

is the failure rate, known as system design variable. The lower value of

indicates a higher value of system reliability. Now, to ensure the distribution function, it can be found easily

Generally, the rate of defective items’ production cannot be determined. However, on the basis of previous data, an expected number of defective items’ production can be calculated. We are adding those expected number of produced defective items to calculate the cost of imperfect products. Thus, the density function for the random time

has to consider for calculation of the expected number of defective items within a full cycle. Hence, the expected number of imperfect items for the full cycle is

To change the status of defective products, the rework cost along with the cost for energy consumption during reworking is used to make them perfect as new. The rework cost per unit cycle (RC) is

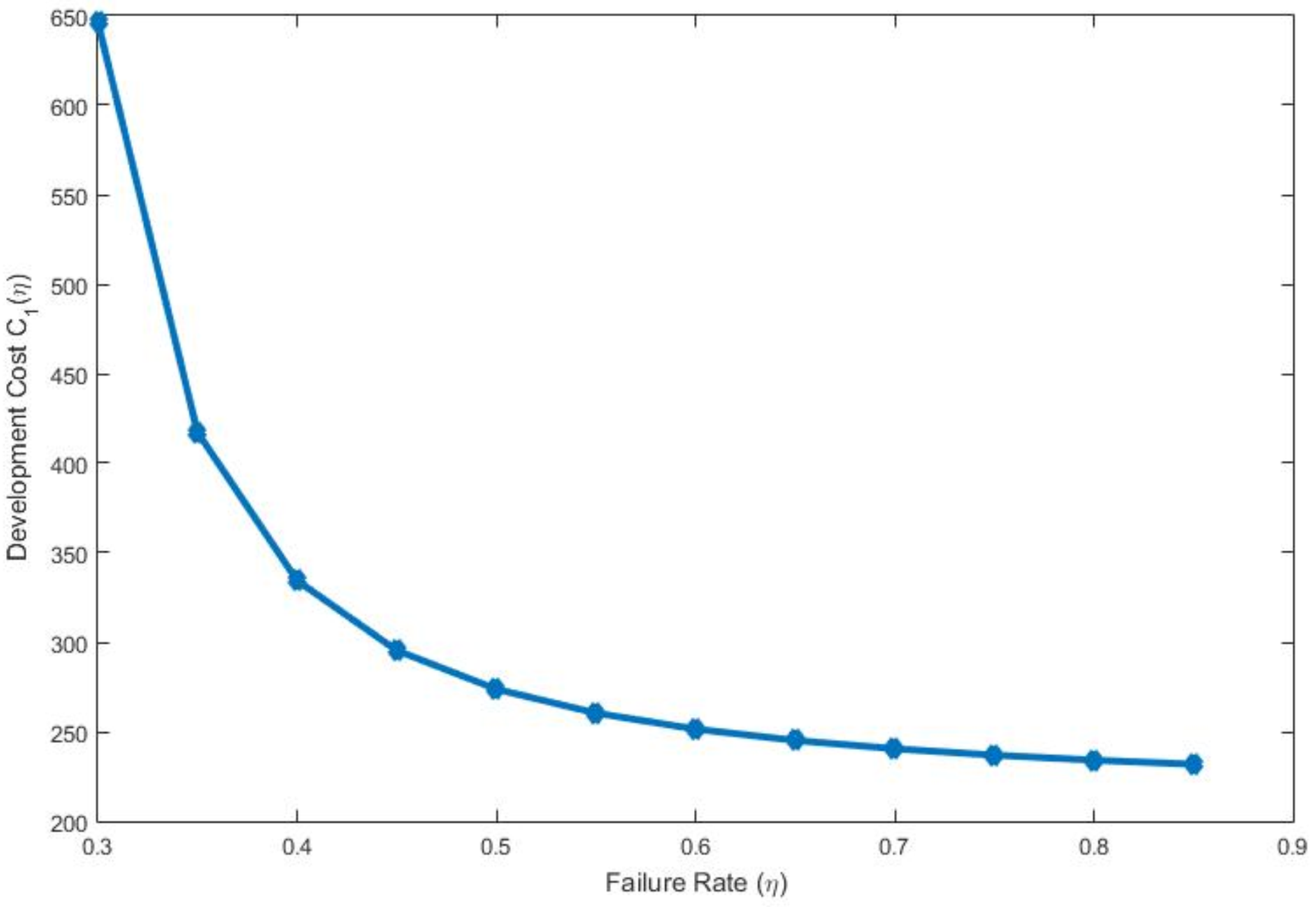

3.5. Development Cost (DC)

To make the system more reliable, the failure rate, which in turn indicates the system reliability, is considered within the development cost of products. The labor cost and energy resource cost are included within it. Thus, the development cost per unit time is considered as

3.6. Unit Production Cost (UPC)

Unit production cost is considered as the sum of raw material cost per product, development cost per product and tool/die cost. The unit production is directly proportional to the material cost as the increasing raw material cost indicates the increasing value of the unit production cost. It is also directly proportional to development cost and tool/die cost, as increasing the value of these costs results in more unit production cost. Unit production cost per unit time is assumed as

where

is the material cost per unit item, whose quality helps to make the system more reliable.

is the development cost which depends on failure rate

. With the increasing percentage of failure rate, the development cost increases, which indicates more reliable system as

, the failure rate, indicates the system reliability, and, when it decreases, development cost decreases.

is the tool/die cost.

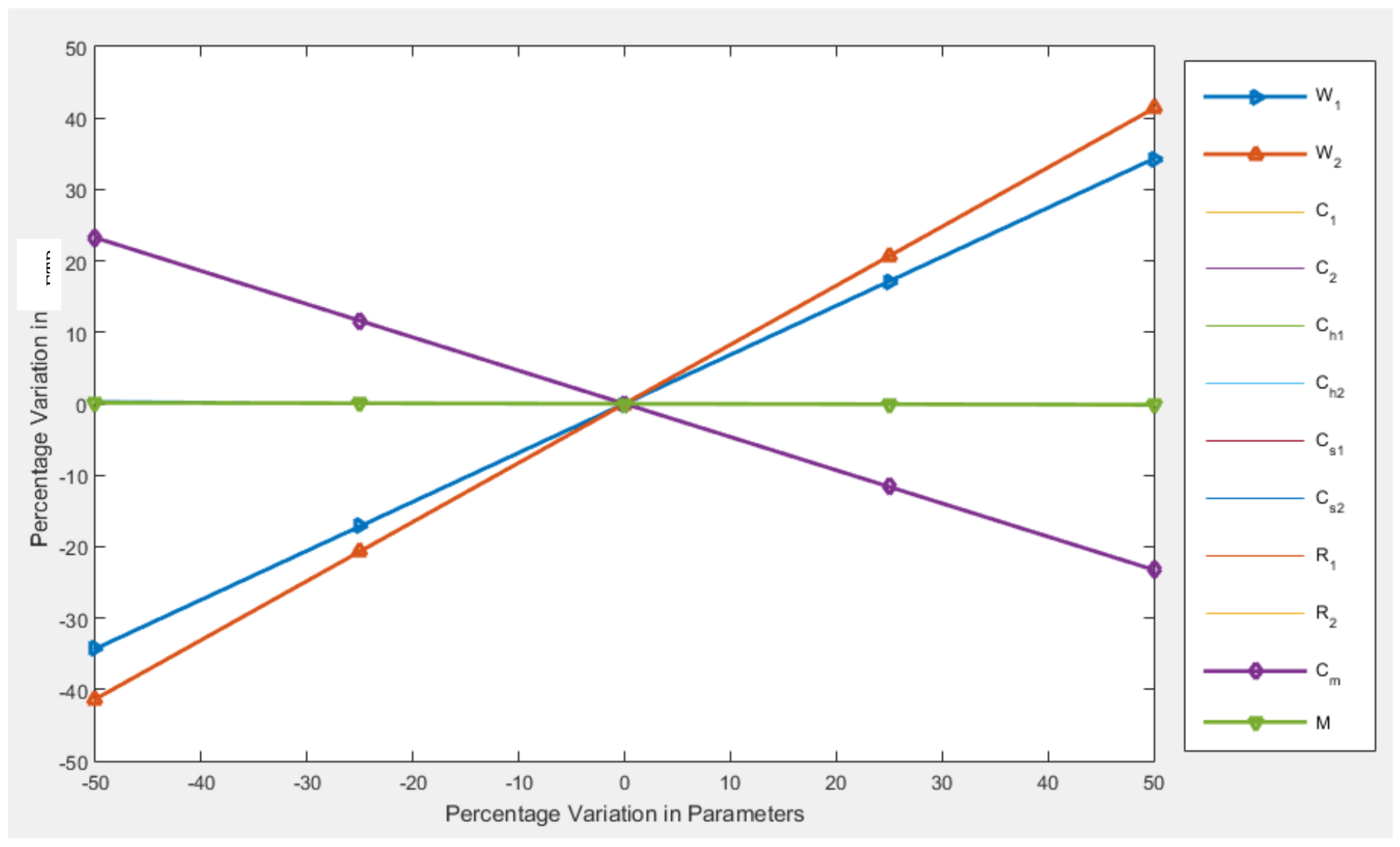

3.7. Expected Total Profit (ETP)

The expected total profit per unit cycle is ETP (

) = Revenue−HC−SC−IC−RC

as

, (see

Appendix A for the value of

).

3.8. Constraints

In any business system, investment is not unlimited. With the available capital, a manufacturer can buy the plausible combinations of materials and services to satisfy the demand of its customer. Similarly, in an imperfect production system, only a specific percentage of budget can be allocated for inspection and reworking of imperfect items. There is a certain quality level, below which the threshold of the allocated budget is crossed and that imperfect item will not be reworked. This model considers a budget constraint and the managers define a specific quality level/threshold quality level to separate the imperfect products, which can be reworked or not chosen for reworking. Like budget, space is also a constraint in any type of production system. Excess inventory and space are used and trigger additional costs and thus the aims to eliminate excess space and inventory. For an imperfect production system, a limited space is allocated to store and rework the imperfect production.

Thus, considering budget and space constrains, the profit equation becomes

where the first term indicates revenues, the second term gives the holding cost and energy consumption cost due to holding products, the third term provides a setup cost and energy consumption of setup cost, the fourth term indicates inspection cost and energy utilization cost for inspection, the fifth cost is for reworking and the use of energy cost for reworking, and the next two terms are for space and budget constraints.

To obtain the maximum profit with respect to the optimum production quantity, production rate, and failure rate, the model has to solve with the best solution approach, which is described in the next section.

4. Solution Methodology

The profit function is highly nonlinear and it contains inequality constraints. Thus, the Kuhn–Tucker method is the best approach to solve this model.

Therefore, using the Kuhn–Tucker condition, the solution can be obtained as follows:

Lagrange equation of the above profit function is given by

where

and

are Lagrange multiplier and

.

From the necessary condition of optimization of the Kuhn–Tucker method, one can obtain

From the Kuhn–Tucker condition, one can write

To show the global optimality of the profit function, the sufficient condition from the Kuhn–Tucker condition must be satisfied. To obtain the global optimal solution, a lemma is established as follows:

Lemma 1. (i) If , , or (ii) , , then at will be maximum, when Proof. To find the sufficient condition of the global optimality, taking 2nd order derivatives of Equations (13)–(15) with respect to

,

, and

, it becomes

and

Now, taking derivatives of Equation (13) with respect to

and

, one can obtain

and

Now, taking a derivative of Equation (14) with respect to

, one has

□

To show the global maximum, the principle minors must be alternative in sign. Thus, the conditions are made like this way: either (i) satisfies or (ii) satisfies; then, the profit function contains a global maximum at the optimum value of the decision variables.

The model is tested through numerical experiments and the global optimality is tested at the optimal points.