A Sketch of Bolivia’s Potential Low-Carbon Power System Configurations. The Case of Applying Carbon Taxation and Lowering Financing Costs

Abstract

1. Introduction

2. Short Background of Power Generation and Climate Policy in Bolivia

3. Methodology

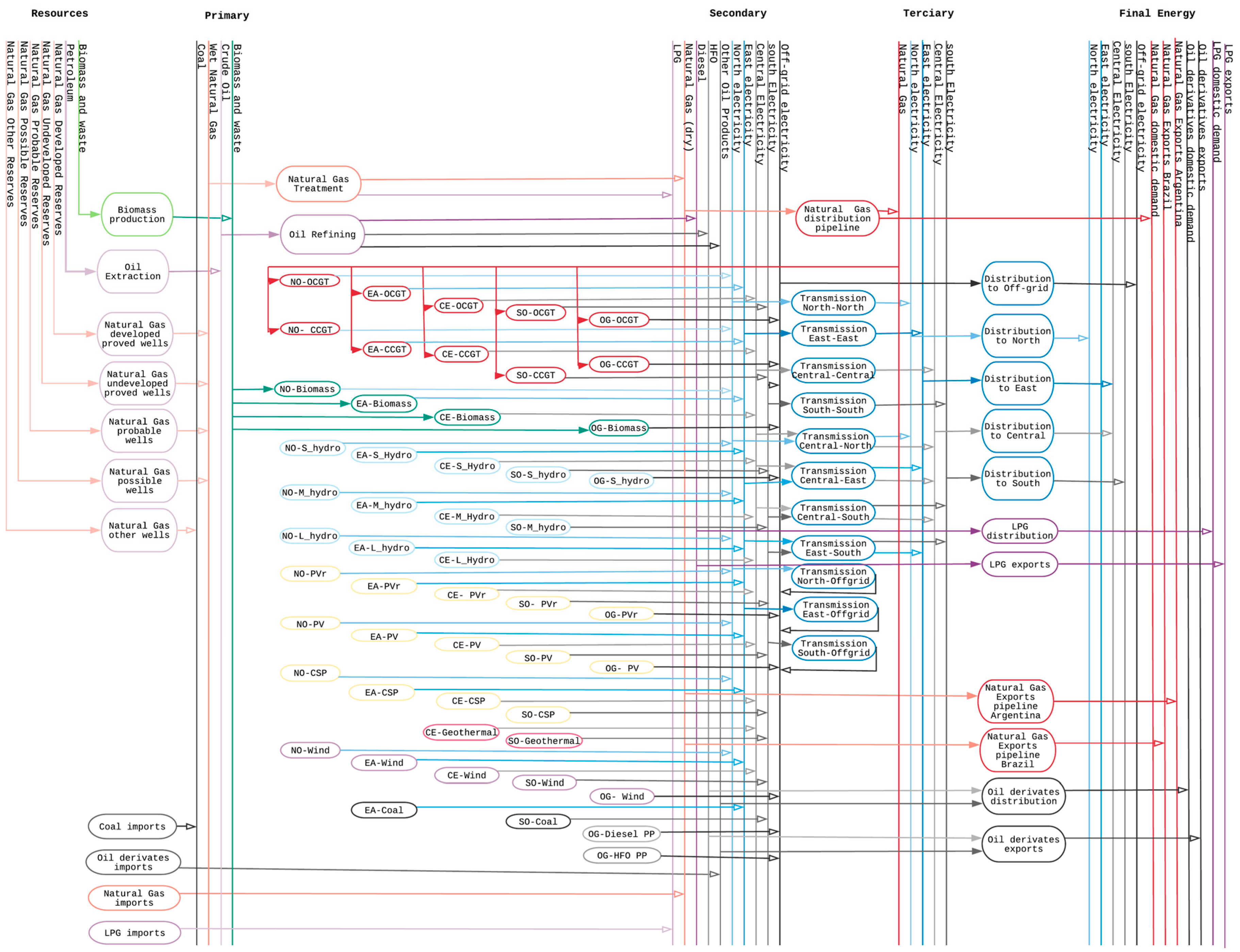

3.1. Energy System Model

3.1.1. Key Assumptions and Reference Energy Scenario

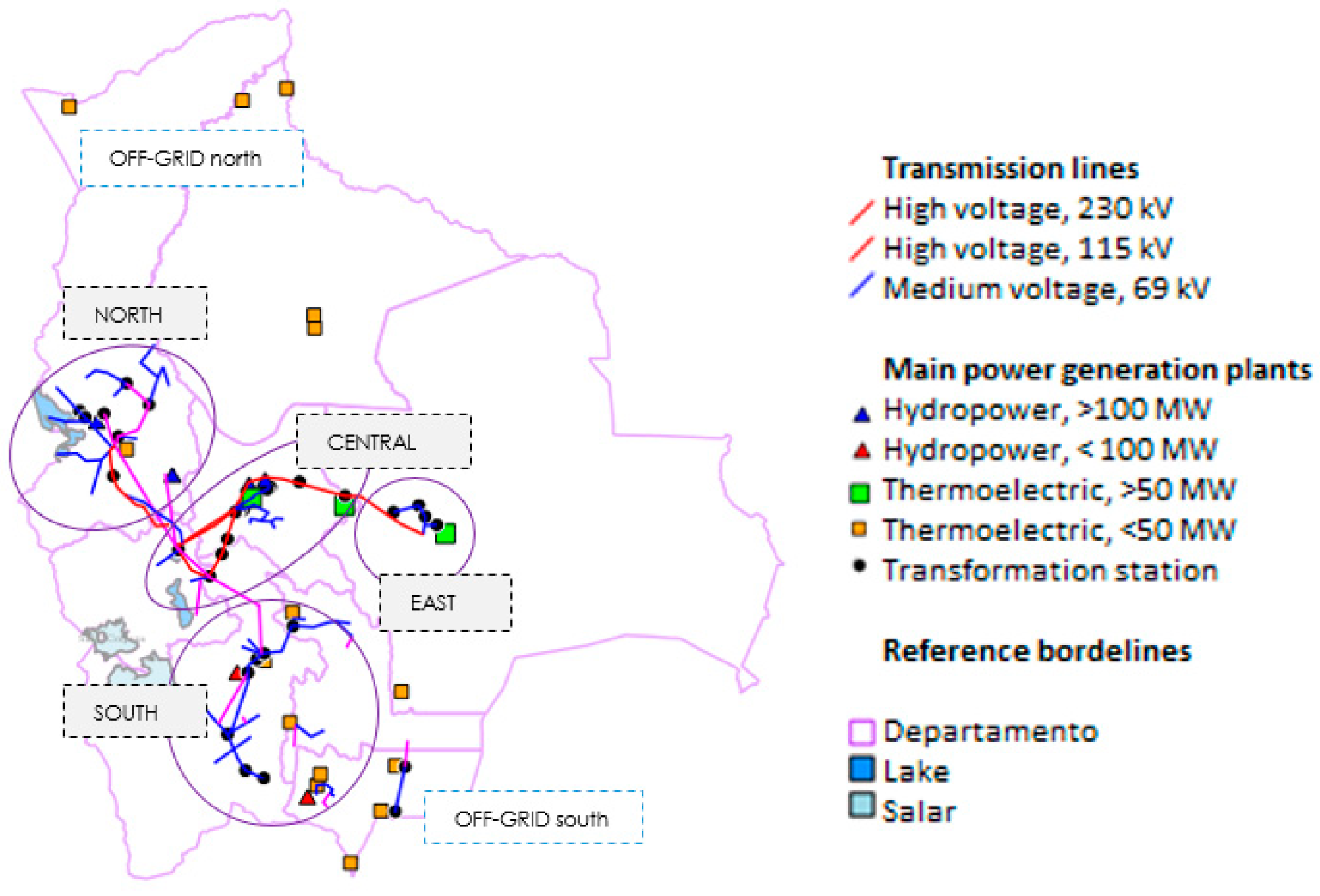

3.1.2. Model Spatial and Temporal Resolution

3.1.3. Technologies and Costs

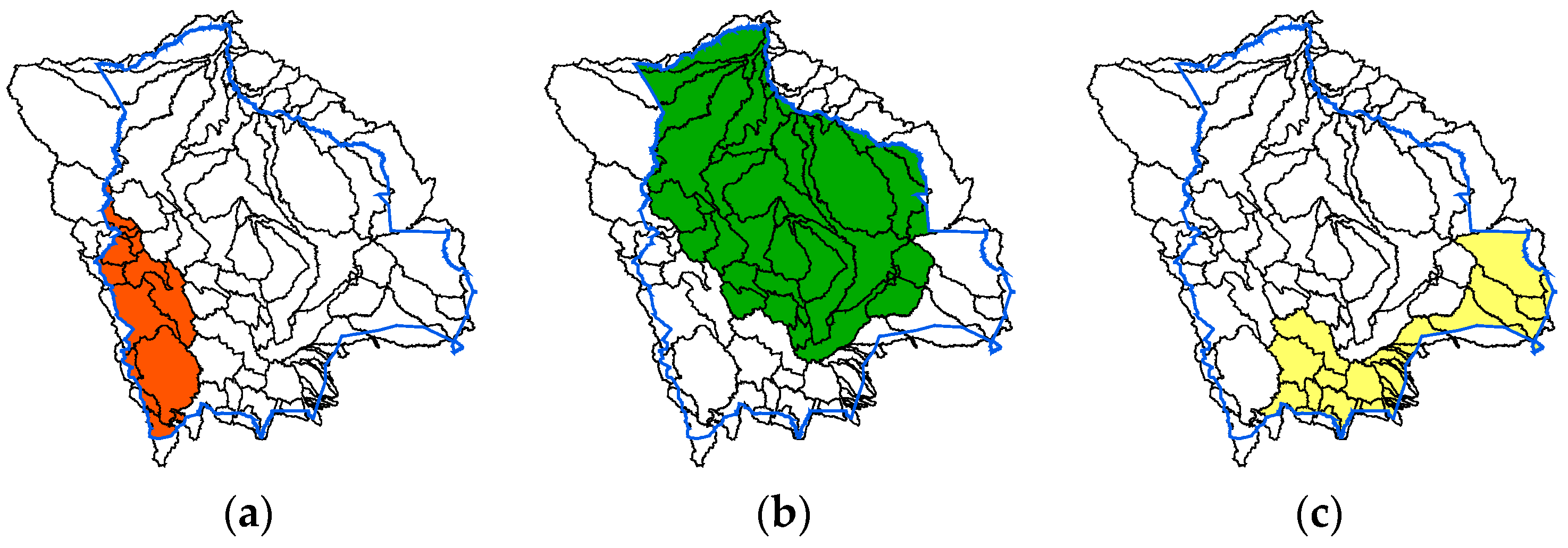

3.1.4. Renewable Energy Sources and Capacity Factors

3.1.5. Natural Gas Reserves and Exports

3.1.6. Opportunity Cost of Gas

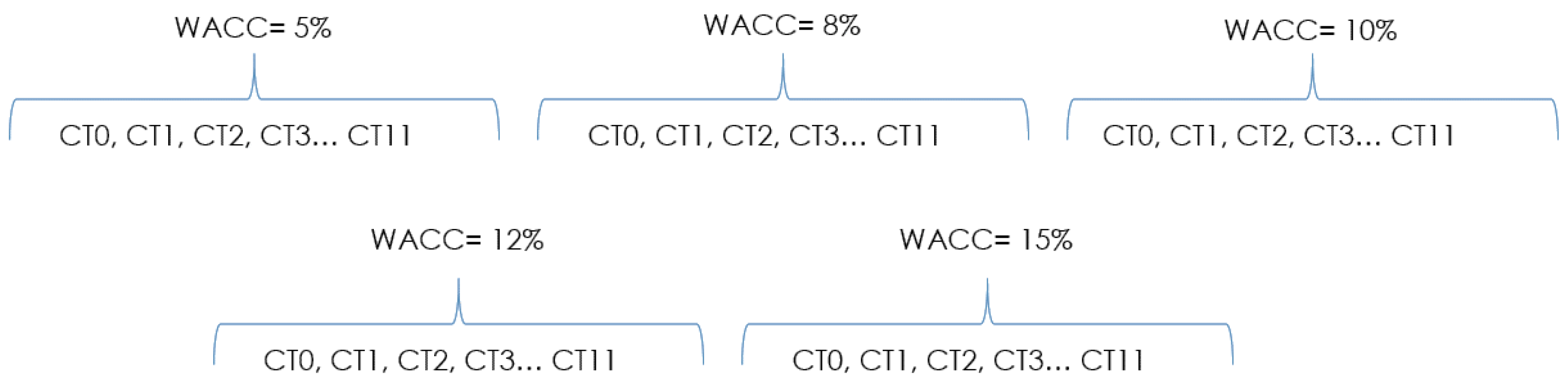

3.1.7. Discount Rate and Financial Risk

3.2. Carbon Tax Scenario Description

3.3. Metrics

3.3.1. Net Present Value (NPV)

3.3.2. Average Carbon Intensity, CI

3.3.3. Average Marginal Abatement Costs (MAC)

3.4. Sensitivity Analysis

3.5. Modelling Platform

4. Results

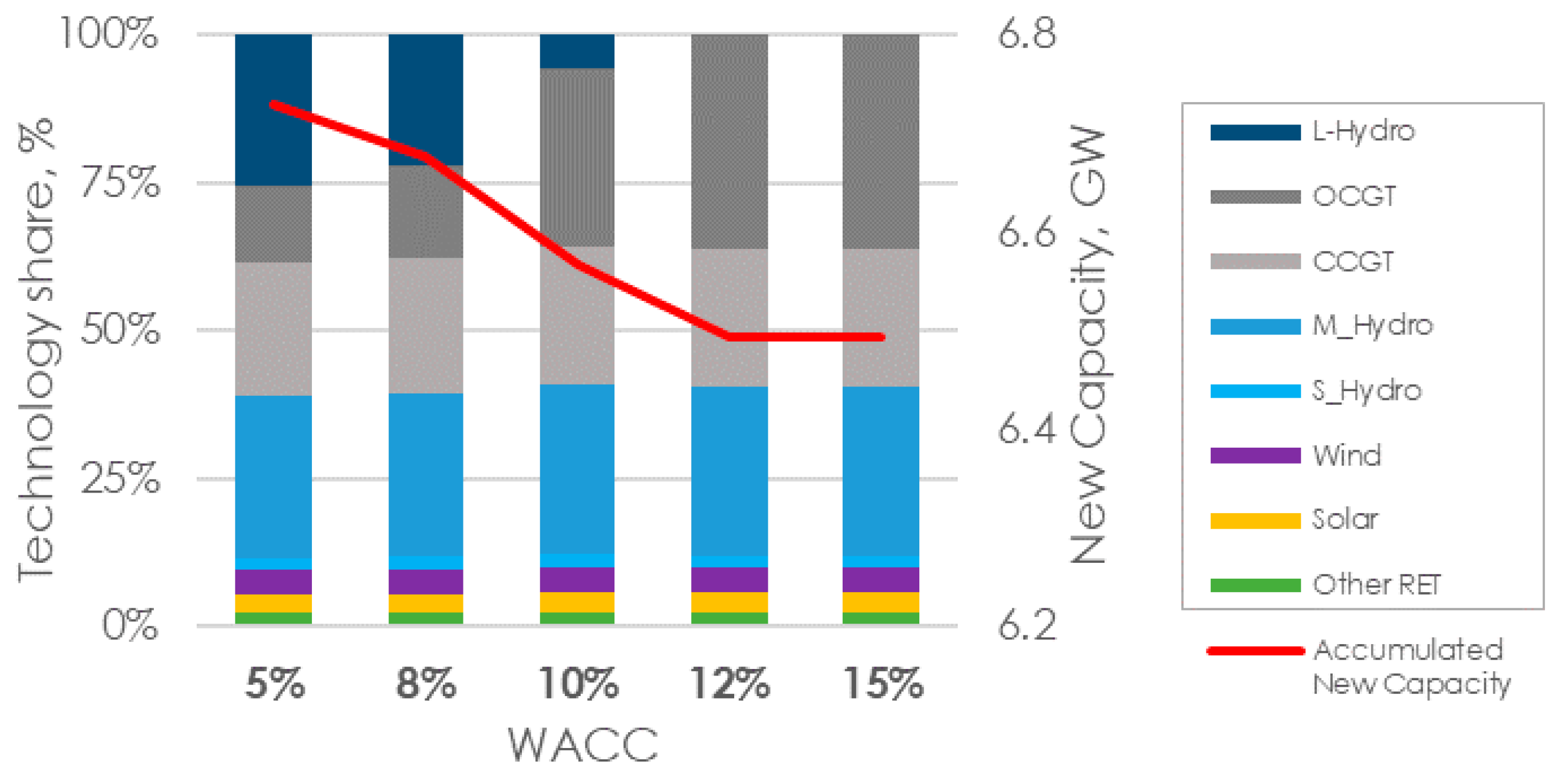

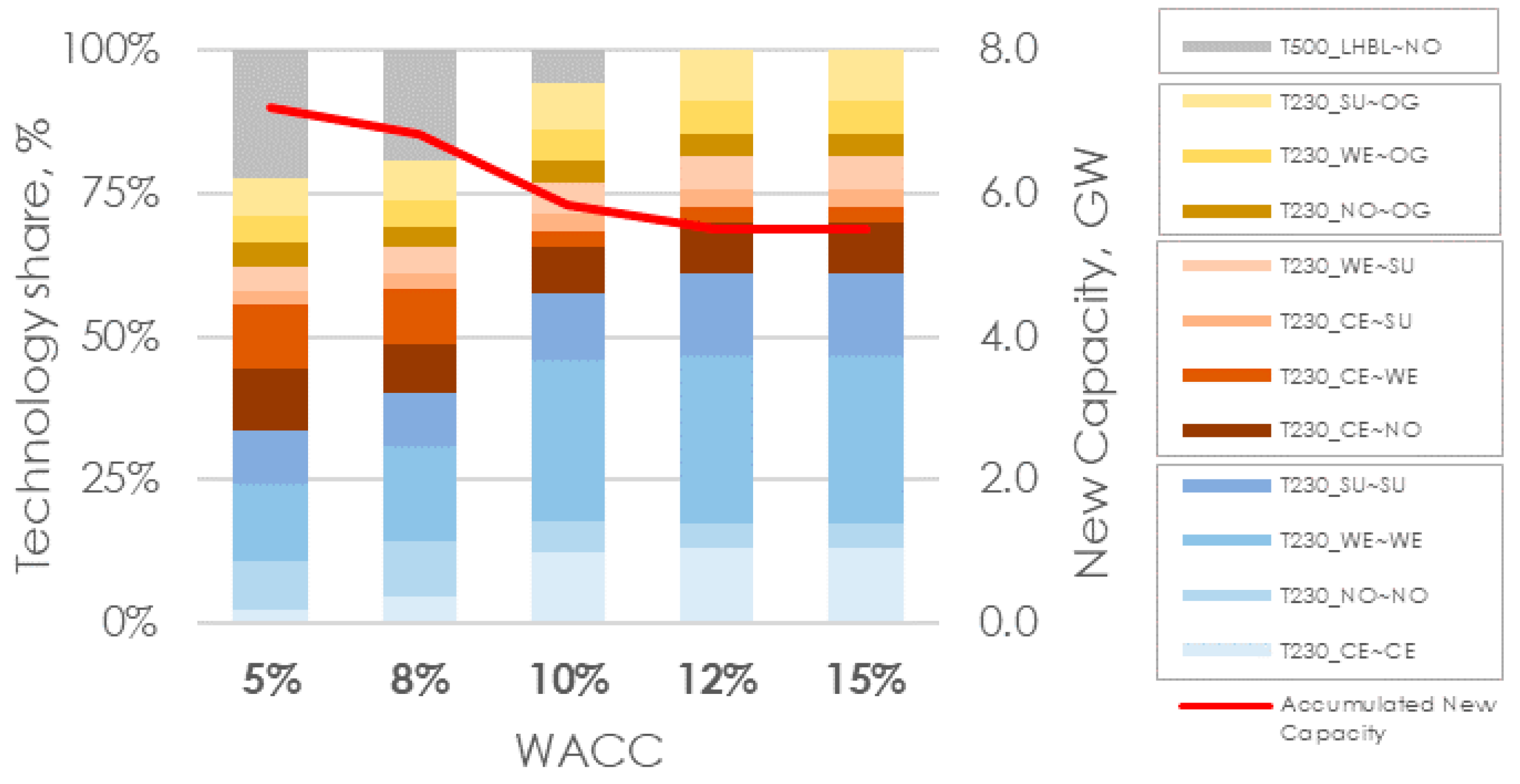

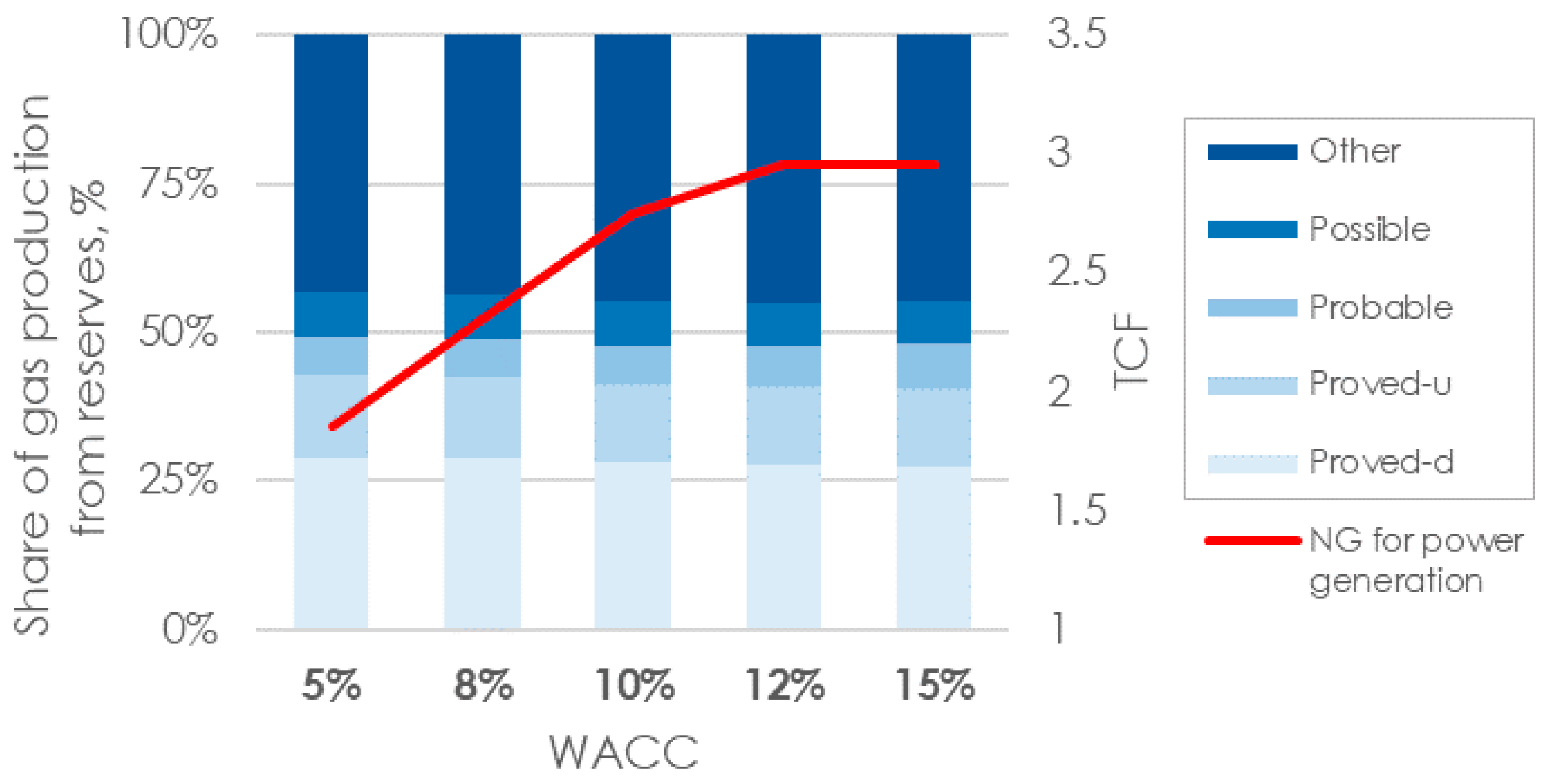

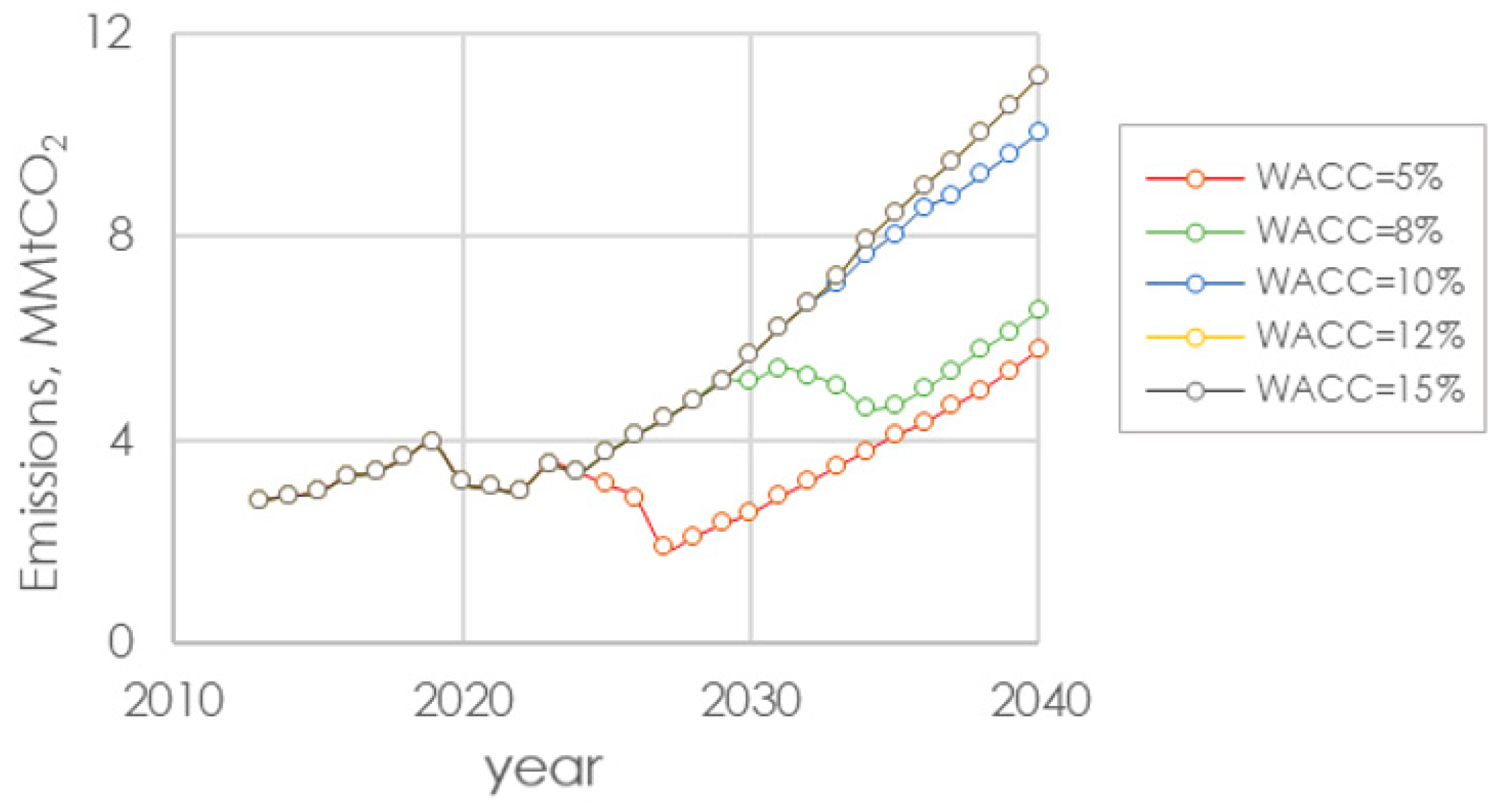

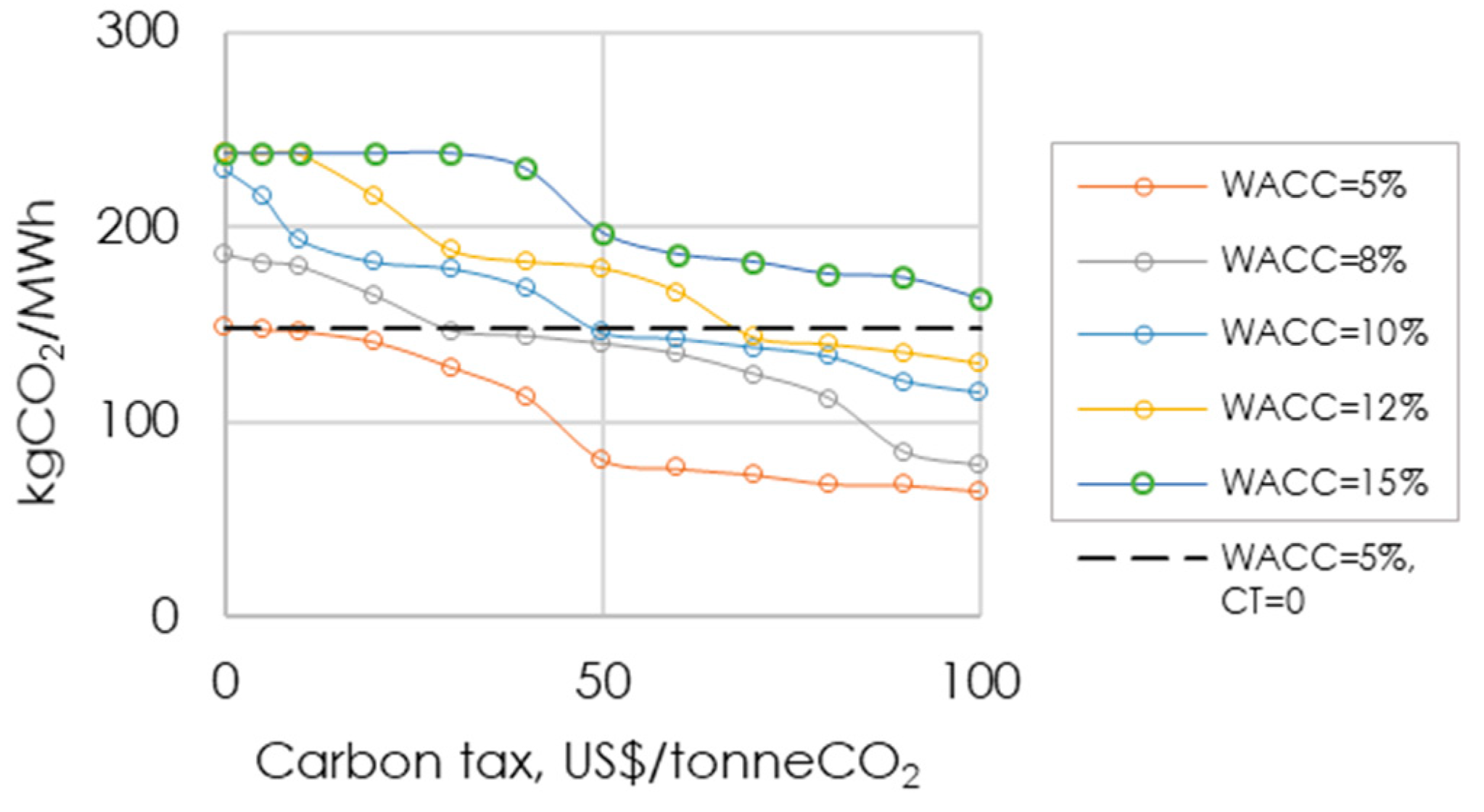

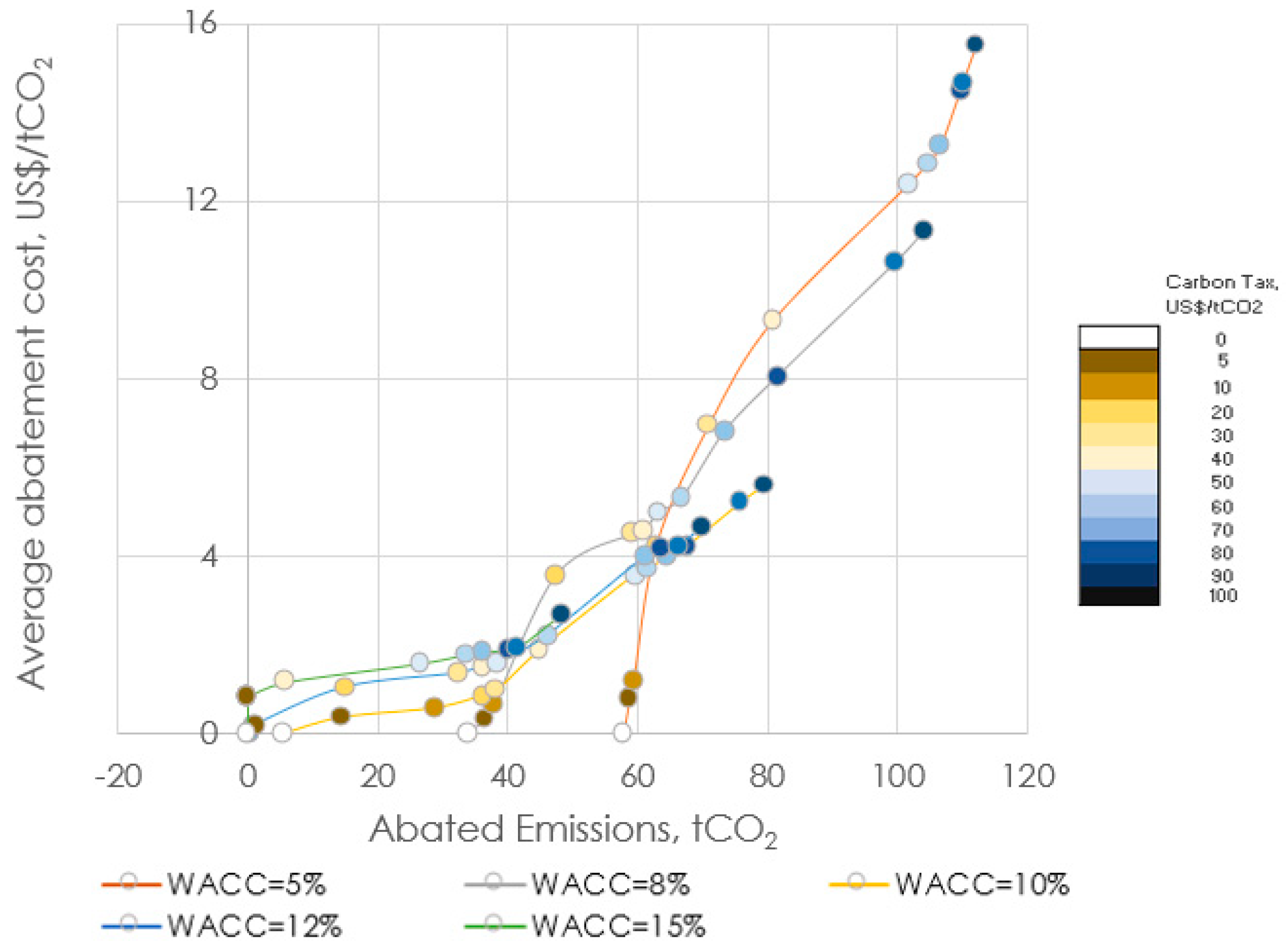

4.1. Discount Rate Scenarios

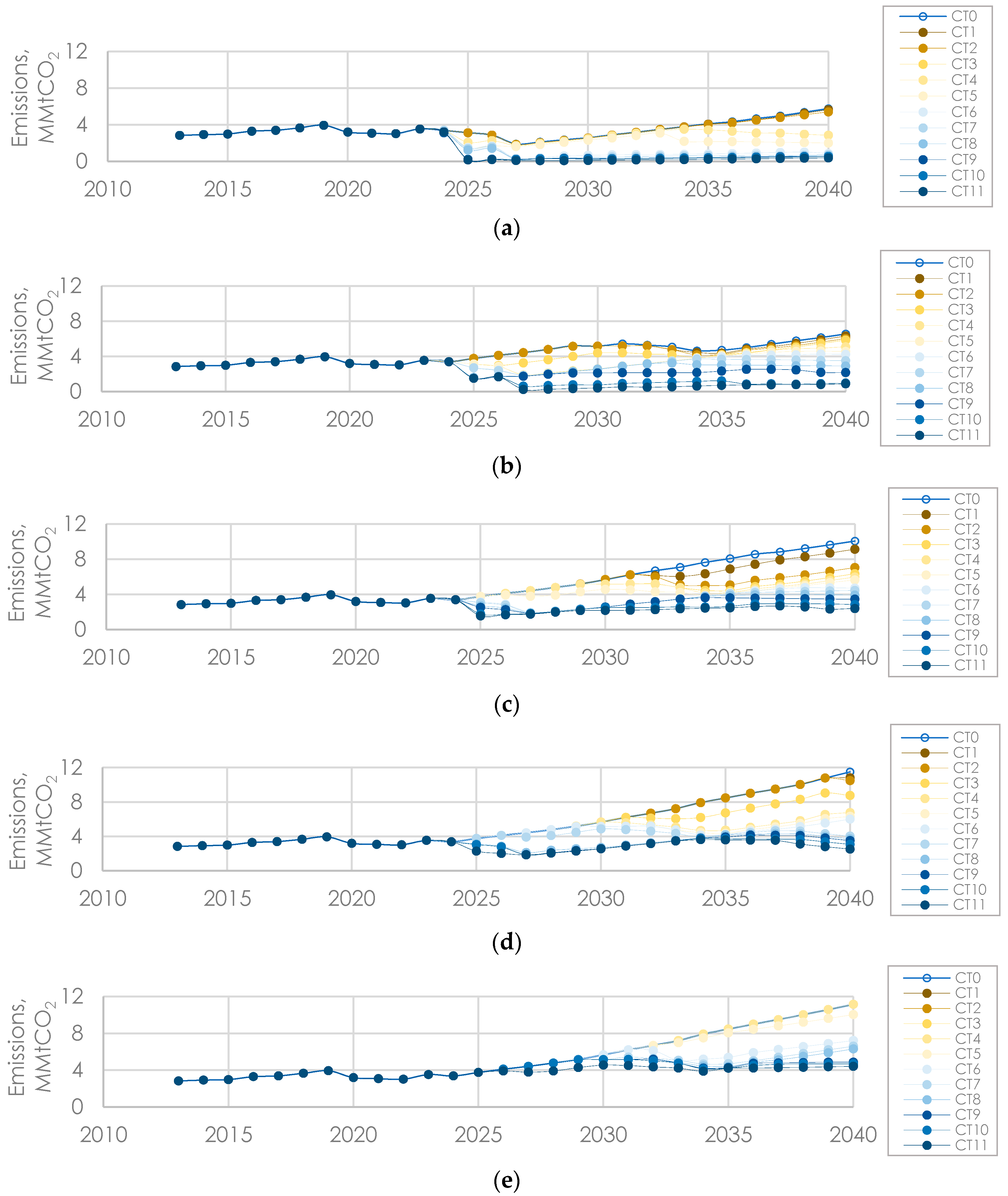

4.2. Carbon Tax Scenarios

4.3. Parameter Sensitivity Analysis

5. Discussion

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- IPCC. Climate Change 2014; Synthesis Report. Contribution of Working Groups I, II and III to the Fifth Assesment Report of the Intergovernmental Panel on Climate Change; Core Writing Team; Pachauru, R.K., Meyer, L.A., Eds.; IPCC: Geneva, Switzerland, 2014. [Google Scholar]

- International Energy Agency. World Energy Outlook 2016; International Energy Agency: Paris, France, 2016. [Google Scholar]

- Goyal, R.; Gray, S.; Kallhauge, A.C.; Nierop, S.; Berg, T.; Leuschner, P. State and Trends of Carbon Pricing 2018; The World Bank: Washington, DC, USA, 2018. [Google Scholar]

- Zachariadis, T. Proposal for a Green Tax Reform in Cyprus. Cyprus Econ. Policy Rev. 2016, 10, 127–139. [Google Scholar]

- IRENA. The Power to Change: Solar and Wind Cost Reduction Potential to 2025; IRENA: Abu Dhabi, UAE, 2016. [Google Scholar]

- Schmidt, T.S. Low-carbon investment risks and de-risking: Nature Climate Change: Nature Research. Nat. Clim. Chang. 2014, 1, 237–239. [Google Scholar] [CrossRef]

- Ellerman, A.D.; Decaux, A. Analysis of Post-Kyoto CO2 Emissions Trading Using Marginal Abatement Curves. Available online: http://web.mit.edu/globalchange/www/MITJPSPGC_Rpt40.pdf (accessed on 10 October 2018).

- Criqui, P.; Mima, S.; Viguier, L. Marginal abatement costs of CO2 emission reductions, geographical flexibility and concrete ceilings: An assessment using the POLES model. Energy Policy 1999, 27, 585–601. [Google Scholar] [CrossRef]

- Kesicki, F.; Strachan, N. Marginal abatement cost (MAC) curves: Confronting theory and practice. Environ. Sci. Policy 2011, 14, 1195–1204. [Google Scholar] [CrossRef]

- Huang, S.K.; Kuo, L.; Chou, K.-L. The applicability of marginal abatement cost approach: A comprehensive review. J. Clean. Prod. 2016, 127, 59–71. [Google Scholar] [CrossRef]

- Gollop, F.M.; Roberts, M.J. Cost-Minimizing Regulation of Sulfur Emissions: Regional Gains in Electric Power. Rev. Econ. Stat. 1985, 67, 81–90. [Google Scholar] [CrossRef]

- Van den Bergh, K.; Delarue, E. Quantifying CO2 abatement costs in the power sector. Energy Policy 2015, 80, 88–97. [Google Scholar] [CrossRef]

- Intended Nationally Determined Contribution from the Plurinational State of Bolivia. Available online: http://www.planificacion.gob.bo/uploads/4.BOLIVIA_INDC_ENGLISH.pdf (accessed on 10 October 2018).

- Comité Nacional de Despacho de Carga. Generation and Transmission Capacity Bolivia. 2017. Available online: https://www.cndc.bo/agentes/generacion.php (accessed on 15 July 2018).

- USGS. Hydropower Assessment of Bolivia—A Multisource Satellite Data and Hydrologic Modeling Approach; USGS: Reston, VA, USA, 2016.

- Coady, D.; Parry, I.W.; Sears, L.; Shang, B. How Large Are Global Energy Subsidies? Working Paper No. 15/105; International Monetary Fund: Washington, DC, USA, 2015; p. 42. [Google Scholar]

- Ministry of Hydrocarbons and Energy. Plan Eléctrico del Estado Plurinacional de Bolivia 2015–2025; Ministry of Hydrocarbons and Energy: La Paz, Bolivia, 2014.

- Plurinational State of Bolivia. Plan de Desarrollo Economico y Social 2016–2020. Available online: http://www.planificacion.gob.bo/uploads/PDES_INGLES.pdf (accessed on 10 October 2018).

- Countries in Latin American and the Caribbean Region Leading Climate Action. Available online: https://unfccc.int/news/countries-in-latin-american-and-the-caribbean-region-leading-climate-action (accessed on 10 July 2018).

- Balderrama, J.G.P.; Broad, O.; Sevillano, R.C.; Alejo, L.; Howells, M. Techno-economic demand projections and scenarios for the Bolivian energy system. Energy Strategy Rev. 2017, 16, 96–109. [Google Scholar] [CrossRef]

- Comité Nacional de Despacho de Carga. Plan de Expansión del Sistema Interconectado Nacional; Comité Nacional de Despacho de Carga: Cochabamba, Bolivia, 2012. [Google Scholar]

- ENDE Coorporación. Proyectos en Estudio. Available online: http://www.ende.bo/proyectos/estudio (accessed on 11 July 2017).

- Autoridad de Electricidad. Anuario Estadistico 2015; Autoridad de Electricidad: Cochabamba, Bolivia, 2015. [Google Scholar]

- Yacimientos Petrolíferos Fiscales Bolivianos. Plan Estratégico Corporativo (PEC) 2015–2019; Yacimientos Petrolíferos Fiscales Bolivianos: La Paz, Bolivia, 2014. [Google Scholar]

- EIA. Technically Recoverable Shale Oil and Shale Gas Resources; EIA: Washington, DC, USA, 2015.

- USGS. Assessment of Undiscovered Conventional Oil and Gas Resources of South America and the Caribbean; World Petroleum Resources Project; USGS: Reston, VA, USA, 2012.

- Ministerio de Hidrocarburos y Energía. Balance Energético Nacional 2000–2013; Ministerio de Hidrocarburos y Energía: La Paz, Bolivia, 2014.

- Boletín Estadístico Gestión 2013. Available online: http://www.cedla.org/sites/default/files/Boletin%20Estadistico%20Enero%20Diciembre%202013.pdf (accessed on 10 October 2018).

- Pfenninger, S.; Staffell, I. Long-term patterns of European PV output using 30 years of validated hourly reanalysis and satellite data. Energy 2016, 114, 1251–1265. [Google Scholar] [CrossRef]

- Staffell, I.; Pfenninger, S. Using bias-corrected reanalysis to simulate current and future wind power output. Energy 2016, 114, 1224–1239. [Google Scholar] [CrossRef]

- Agencia-Nacional-de-Hidrocarburos. Anuario Estadístico 2016; Agencia-Nacional-de-Hidrocarburos: Cochabamba, Bolivia, 2017.

- Chávez-Rodríguez, M.F.; Garaffa, R.; Andrade, G.; Cárdenas, G.; Szklo, A.; Lucena, A.F.P. Can Bolivia keep its role as a major natural gas exporter in South America? J. Nat. Gas Sci. Eng. 2016, 33, 717–730. [Google Scholar] [CrossRef]

- Lucena, A.F.P.; Clarke, L.; Schaeffer, R.; Szklo, A.; Rochedo, P.R.; Nogueira, L.P.; Daenzer, K.; Gurgel, A.; Kitous, A.; Kober, T. Climate policy scenarios in Brazil: A multi-model comparison for energy. Energy Econ. 2016, 56, 564–574. [Google Scholar] [CrossRef]

- Rudnick, H.; Barroso, L.; Cunha, G.; Mocarquer, S. Electricity-gas integration challenges in South America. IEEE Power Energy Mag. 2014, 12, 29–39. [Google Scholar] [CrossRef]

- EIA. Annual Energy Outlook. Energy Prices by Sector and Source; U.S. Energy Information Administration: Washington, DC, USA, 2016.

- Harrison, M. Valuing the Future: The Social Discount Rate in Cost-Benefit Analysis; Productivity Comission: Melbourne, Australian, 2010.

- Zhuang, J.; Liang, Z.; Lin, T.; de Guzman, F. Theory and Practice in the Choice of Social Discount Rate for Cost-Benefit Analysis: A Survey; Economics and Research Department, Asian Development Bank: Manila, Philippines, 2007. [Google Scholar]

- Simshauser, P. The cost of capital for power generation in atypical capital market conditions. Econ. Anal. Policy 2014, 44, 184–201. [Google Scholar] [CrossRef]

- Ondraczek, J.; Komendantova, N.; Patt, A. WACC the dog: The effect of financing costs on the levelized cost of solar PV power. Renew. Energy 2015, 75, 888–898. [Google Scholar] [CrossRef]

- UNDP. Derisking Renewable Energy Investment | UNDP; UNDP: New York, NY, USA, 2013. [Google Scholar]

- Hirth, L.; Steckel, J.C. The role of capital costs in decarbonizing the electricity sector. Environ. Res. Lett. 2016, 11, 114010. [Google Scholar] [CrossRef]

- Plurinational State of Bolivia. Ley de Electricidad. Artículo 48: 1994. Available online: https://www.lexivox.org/norms/BO-RE-DS24043D.xhtml (accessed on 10 October 2018).

- Perspectives for the energy transition: Investment Needs for a Low-Carbon Energy System. 2017. Available online: https://www.iea.org/publications/insights/insightpublications/ (accessed on 10 October 2018).

- EIA. Carbon Dioxide Emissions Coefficients; U.S. Energy Information Administration: Washington, DC, USA, 2016. Available online: https://www.eia.gov/environment/emissions/co2_vol_mass.php (accessed on 14 February 2018).

- Ibrahim, N.; Kennedy, C. A Methodology for Constructing Marginal Abatement Cost Curves for Climate Action in Cities. Energies 2016, 9, 227. [Google Scholar] [CrossRef]

- Howells, M.; Rogner, H.; Strachan, N.; Heaps, C.; Huntington, H.; Kypreos, S.; Hughes, A.; Silveira, S.; DeCarolis, J.; Bazillian, M.; et al. OSeMOSYS: The Open Source Energy Modeling System. Energy Policy 2011, 39, 5850–5870. [Google Scholar] [CrossRef]

- Soloveitchik, D.; Ben-Aderet, N.; Grinman, M.; Lotov, A. Multiobjective optimization and marginal pollution abatement cost in the electricity sector—An Israeli case study. Eur. J. Oper. Res. 2002, 140, 571–583. [Google Scholar] [CrossRef]

- Delarue, E.D.; Ellerman, A.D.; D’haeseleer, W.D. Robust MACCs? The topography of abatement by fuel switching in the European power sector. Energy 2010, 35, 1465–1475. [Google Scholar] [CrossRef]

- Kesicki, F.; Ekins, P. Marginal abatement cost curves: A call for caution. Clim. Policy 2012, 12, 219–236. [Google Scholar] [CrossRef]

- Baranzini, A.; van den Bergh, J.C.J.M.; Carattini, S.; Howarth, R.B.; Padilla, E.; Roca, J. Carbon pricing in climate policy: Seven reasons, complementary instruments, and political economy considerations. Wiley Interdisciplin. Rev. Clim. Chang. 2017, 8, e462. [Google Scholar] [CrossRef]

- Carattini, S.; Carvalho, M.; Fankhauser, S. Overcoming public resistance to carbon taxes. Wiley Interdisciplin. Rev. Clim. Chang. 2018, 9, e531. [Google Scholar] [CrossRef]

- Baranzini, A.; Carattini, S. Effectiveness, earmarking and labeling: Testing the acceptability of carbon taxes with survey data. Environ. Econ. Policy Stud. 2017, 19, 197–227. [Google Scholar] [CrossRef]

- Zhang, Z.; Baranzini, A. What do we know about carbon taxes? An inquiry into their impacts on competitiveness and distribution of income. Energy Policy 2016, 32, 507–518. [Google Scholar] [CrossRef]

- Shah, A.; Larsen, B. Carbon Taxes, the Greenhouse Effect, and Developing Countries. Available online: http://documents.worldbank.org/curated/en/460851468739298164/Carbon-taxes-the-greenhouse-effect-and-developing-countries (accessed on 10 October 2018).

- Creutzig, F.; Agoston, P.; Goldschmidt, J.C.; Luderer, G.; Nemet, G.; Pietzcker, R.C. The underestimated potential of solar energy to mitigate climate change. Nat. Energy 2017, 2, 17140. [Google Scholar] [CrossRef]

- Painuly, J. Barriers to renewable energy penetration; a framework for analysis. Renew. Energy 2001, 24, 73–89. [Google Scholar] [CrossRef]

- UNEPFI. Financing Renewable Energy in Developing Countries; Drivers and Barriers for Private Finance in Sub-Saharan Africa Financing Renewable Energy in Developing Countries; United Nations Environment Programme Finance Initiative: Geneva, Switzerland, 2012. [Google Scholar]

- Steckel, J.C.; Jakob, M. The role of financing cost and de-risking strategies for clean energy investment. Int. Econ. 2018, 155, 19–28. [Google Scholar] [CrossRef]

| Technology | Capacity Limits | Activity Limits | Data Source | Comments |

|---|---|---|---|---|

| Natural Gas Reserves | Yes | No | [24,25,26] | 1P1+2P+3P a certified gas reserves in 2013 (18.1 TCF b) and yet-to-find shale reserves (36.4 TCF) |

| Natural Gas Export | No | Yes | [27,28] | Constant export under the latest volume contracts. After such export is decided by cost-optimization. |

| Oil refinery | Yes | Yes | [28] | Country oil refinery capacity and average annual diesel and heavy fuel oil production. Oil 1P+2P+3P certified reserves in 2013. |

| Fossil fuel imports | No | No | [27,28] | Import to supply unmet demands with local resources. |

| Renewable sources | Yes | No | [15] | Renewable potential by region. |

| Thermal power plants | No | Yes | [21] | Annual production limited by technology thermal efficiency. Altitude correction factors were used to calculate the efficiency in each sub-region. |

| Hydro power plants | Yes | Yes | [15,17] | Three hydropower size options were modelled. Activity was limited by regional resource availability (capacity factors). Storage in dams was not modelled. |

| Renewable power plants | No | Yes | [2] | Annual production limited by technology efficiency and capacity. |

| Parameter | Scenarios | Description |

|---|---|---|

| Demand | High and Low | From 2025–2040 two demand scenarios, high and low, were aligned with +10% and −10% of the reference electricity demand. |

| Fuel costs | High and Low | Variations in +10% and −10% in natural gas production costs (fixed and variable costs) were proposed for a high and low price scenario. |

| Renewable technologies costs | High and Low | Based on scenario assumptions (high and low) from economic learning curves from the International Atomic Energy Agency [2]. No efficiency improvements were included. Renewable technologies included: wind, solar PV, residential PV, CSP, biomass and geothermal. |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Peña Balderrama, J.G.; Alfstad, T.; Taliotis, C.; Hesamzadeh, M.R.; Howells, M. A Sketch of Bolivia’s Potential Low-Carbon Power System Configurations. The Case of Applying Carbon Taxation and Lowering Financing Costs. Energies 2018, 11, 2738. https://doi.org/10.3390/en11102738

Peña Balderrama JG, Alfstad T, Taliotis C, Hesamzadeh MR, Howells M. A Sketch of Bolivia’s Potential Low-Carbon Power System Configurations. The Case of Applying Carbon Taxation and Lowering Financing Costs. Energies. 2018; 11(10):2738. https://doi.org/10.3390/en11102738

Chicago/Turabian StylePeña Balderrama, Jenny Gabriela, Thomas Alfstad, Constantinos Taliotis, Mohammad Reza Hesamzadeh, and Mark Howells. 2018. "A Sketch of Bolivia’s Potential Low-Carbon Power System Configurations. The Case of Applying Carbon Taxation and Lowering Financing Costs" Energies 11, no. 10: 2738. https://doi.org/10.3390/en11102738

APA StylePeña Balderrama, J. G., Alfstad, T., Taliotis, C., Hesamzadeh, M. R., & Howells, M. (2018). A Sketch of Bolivia’s Potential Low-Carbon Power System Configurations. The Case of Applying Carbon Taxation and Lowering Financing Costs. Energies, 11(10), 2738. https://doi.org/10.3390/en11102738