An Improved Fuzzy C-Means Algorithm for the Implementation of Demand Side Management Measures

Abstract

:1. Introduction

- The present paper aims to fully connect the DSM targets with price-based DR. The latter is widely regarded in the literature as an efficient mechanism to alter the demand patterns of the consumers. The model developed in the paper outputs tariffs that emphasize on achieving a pre-defined DSM objective. Therefore, the benefits of RTP are evident in power grid scale and not restricted to the load serving entity.

- The flexibility of the consumer to alter the demand according to the tariff is expressed by the elasticity. This parameter is part of the model’s operation. A novel technique is proposed to derive dynamic elasticities that more accurately capture the changes in the demand according to tariffs.

- A part of the model’s operation is the utilization of unsupervised machine learning techniques such as soft clustering for a two-fold purpose: (a) to extract the representative load curves or load profiles of the consumers and (b) to track similarities in historical loads for the purpose of drawing the dynamic elasticities curves.

2. Literature Review and Method

2.1. State of the Art

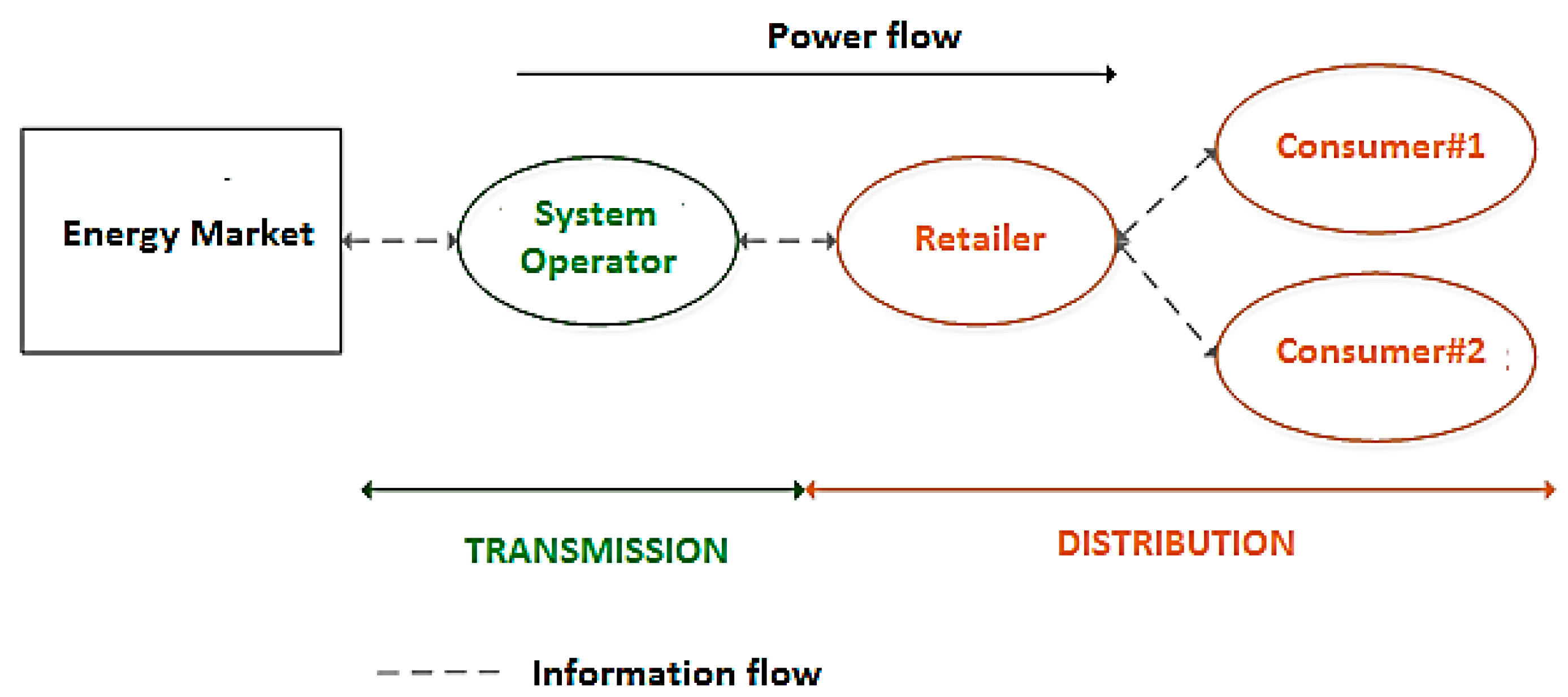

- In profit maximization problems, no attention is placed on meeting specific goals on shaping the load curves of the consumers. In the present paper, RTP is utilized not as a part of profit maximization for electricity retailers, but as a tool for the implementation of DSM targets. Therefore, price-based DR is used to achieve a load management target. A single case study of a Retailer that interacts with the wholesale market environment and serves the consumers is investigated. For each hour period in an intra-day basis, the Retailer is asked by the System Operator (SO) to deliver specific load modifications refer to as DSM strategy goals, i.e., Peak Clipping, Valley Filling, Load Shifting, Strategic Conservation, Strategic Load Growth and Flexible Load Shape [69,70]. The Retailer implements the appropriate strategy based on the load profiles and the price elasticity of the consumers, market prices and other conditions. The strategy is interpreted as RTP schemes that are transferred to the elastic consumers. The term “elastic” characterizes the consumers that take full advantage the selling price by the Retailer and modify their demand accordingly. Hence, the consumers react to the selling price and achieve the pre-defined DSM objective. The proposed DSM strategy implementation is formed as a single linear constrained optimization task. The decision variables are the prices of the specific hour for the consumers. The price approach of the proposed strategy is consumer oriented; each consumer is offered a specific price profile based on the load profile and price elasticity. This leads to more accurate pricing, not only in terms of transferring the actual generation costs mirrored in the wholesale market, but also in designing consumer-specific tariff products based on the consumer demand patterns.

- A novel method is proposed to derive time variant price elasticities. The term “dynamic” price elasticity is used to indicate price elasticity curves that express different values per hour. This approach not only represents the actual behavior of the consumer but consumer oriented price elasticities profiles can be drawn.

- While many crisp algorithms have been proposed in the load profiling literature, the potential of soft clustering has not been adequately demonstrated, since only FCM has been examined. In the present paper, a detailed comparison takes place between two fuzzy algorithms, and their performance is checked by a set of adequacy measures that have been proposed in the load profiling related literature. The goal is to use soft clustering not only for load profiling aims but also to design and implement RTP schemes to meet predefined DSM targets in day-ahead electricity markets.

2.2. Methodological Approach

3. Proposed Model

3.1. Concept

3.2. Demand Response Models

3.2.1. Linear Price/Demand Function

3.2.2. Exponential Price/Demand Function

3.2.3. Logarithmic Price/Demand Function

3.3. Demand Side Management Objectives

3.3.1. Strategic Conservation

3.3.2. Load Shifting

3.3.3. Valley Filling

3.4. Price Elasticity Extraction

- Step 1.

- The SO sets the DSM objective and informs the Retailer the day before. Depending on the type of the objective, the quantities R(h), I(i’), I(i’’), R(i’) and R(i’’) are determined.

- Step 2.

- The Retailer selects a price/demand function to simulate the consumer behavior towards the offered prices. Also, based on the DSM objective, the Retailer sets upper prices limits u(h), u(i), u(i’) and u(i’’).

- Step 3.

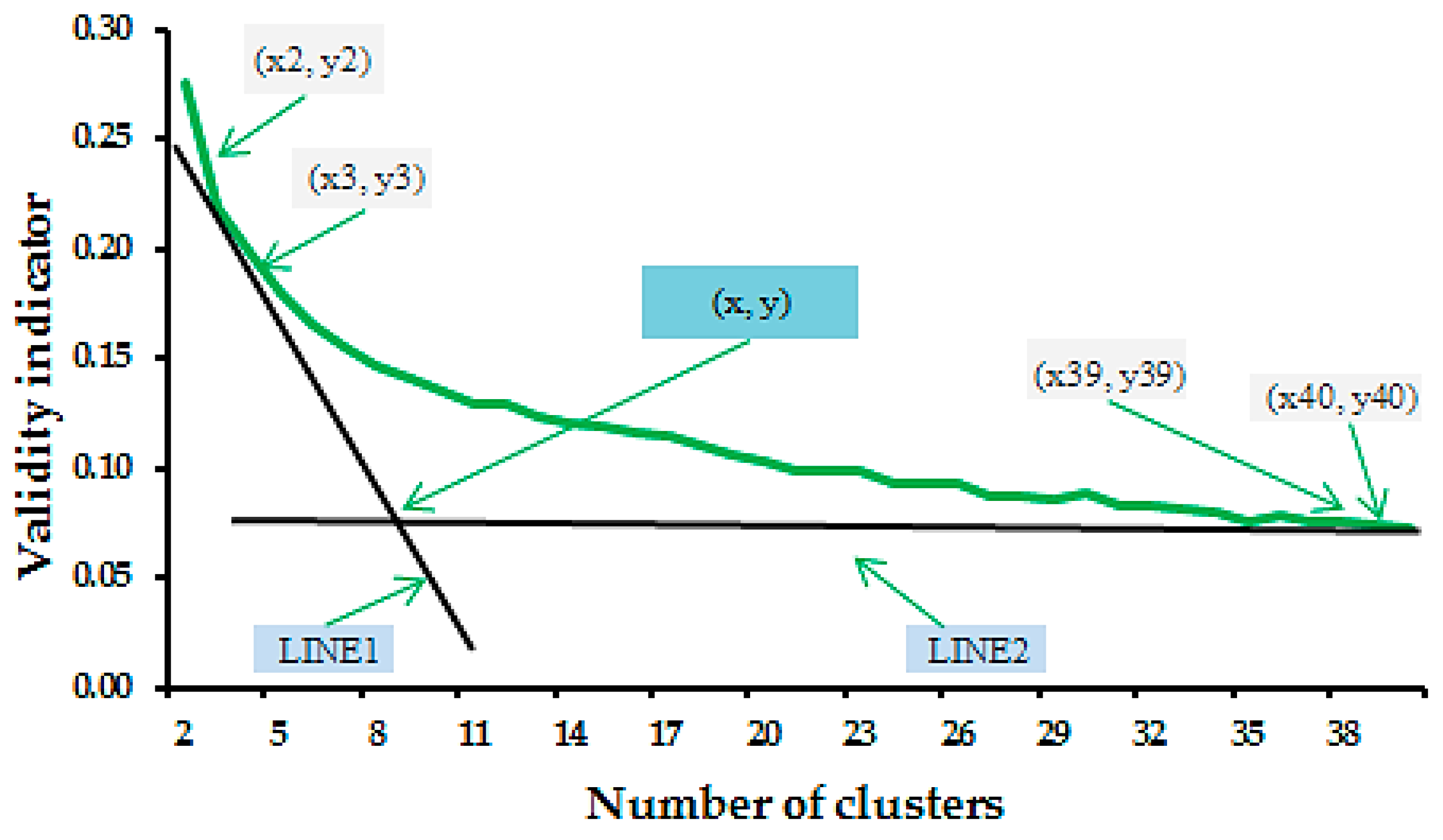

- The Retailer calculates the price elasticity of each consumer. The price elasticity parameter is an indication of the flexibility of the demand to price signals. In the present paper, a novel method of price elasticity estimation is proposed. Let n be the day that the SO asks the Retailer to exercise a DSM objective. A clustering takes place on the available daily load curves of the consumer up to day n − 1. If the DSM is exercised at day n, all the same days of the previous years are searched in order to track the corresponding clusters. In the present paper, the available data set of each consumer covers the period of 2003–2011. For instance, if the target day refers to 15 May 2011, a search in the clusters that the days 15 May 2010, 15 May 2009, …, 15 May 2003 belong to is conducted. Next, depending on the selected demand function, a 1st order polynomial, exponential or logarithmic model to fit the hourly loads of all days that belong to the selected clusters is used and the corresponding prices p0(h). By taking into account all the days that belong to the same cluster with the selected day, for instance the 15 May 2009, the extraction of the price elasticity is held using similar days and hence, the seasonal variations and periodicities of the load are integrated. The hourly price elasticities using a linear, exponential and logarithmic model are given by the following expressions [46]:The parameters alin, blin, aexp, bexp, alog and blog are derived via the fitting procedure. According to Equations (23)–(25), the price elasticities vary per hour, a concept that corresponds to a more reliable modeling of the consumer’s responsiveness on the price signals. The hourly price elasticities of day n are obtained by averaging the price elasticities of the days that belong to the same cluster with day n.

- Step 4.

- Depending on the DSM objective, the Retailer solves for each hour h the optimization problems of Equations (5)–(7), Equations (8)–(16) or Equations (17)–(22). In the present paper, a binary coded Genetic Algorithm (GA) is utilized [74]. The outputs of the aforementioned optimization problems are prices p1(h), p2(h), p1(i), p2(i), p1(i’), p2(i’), p1(i’’) and p2(i’’).

3.5. Improved Fuzzy C-Means Algorirthm

3.5.1. Load Profiling Fundamentals

- The Euclidean distance between and

- The subset of that belong to the cluster Ck is denoted as Sk. The Euclidean distance between the centroid ck of the kth cluster and the subset Sk is the geometric mean of the Euclidean distances deucl(ck, Sk) between ck and each member of Sk:

- The geometric mean of the inner-distances between the patterns and members of the subset Sk is:

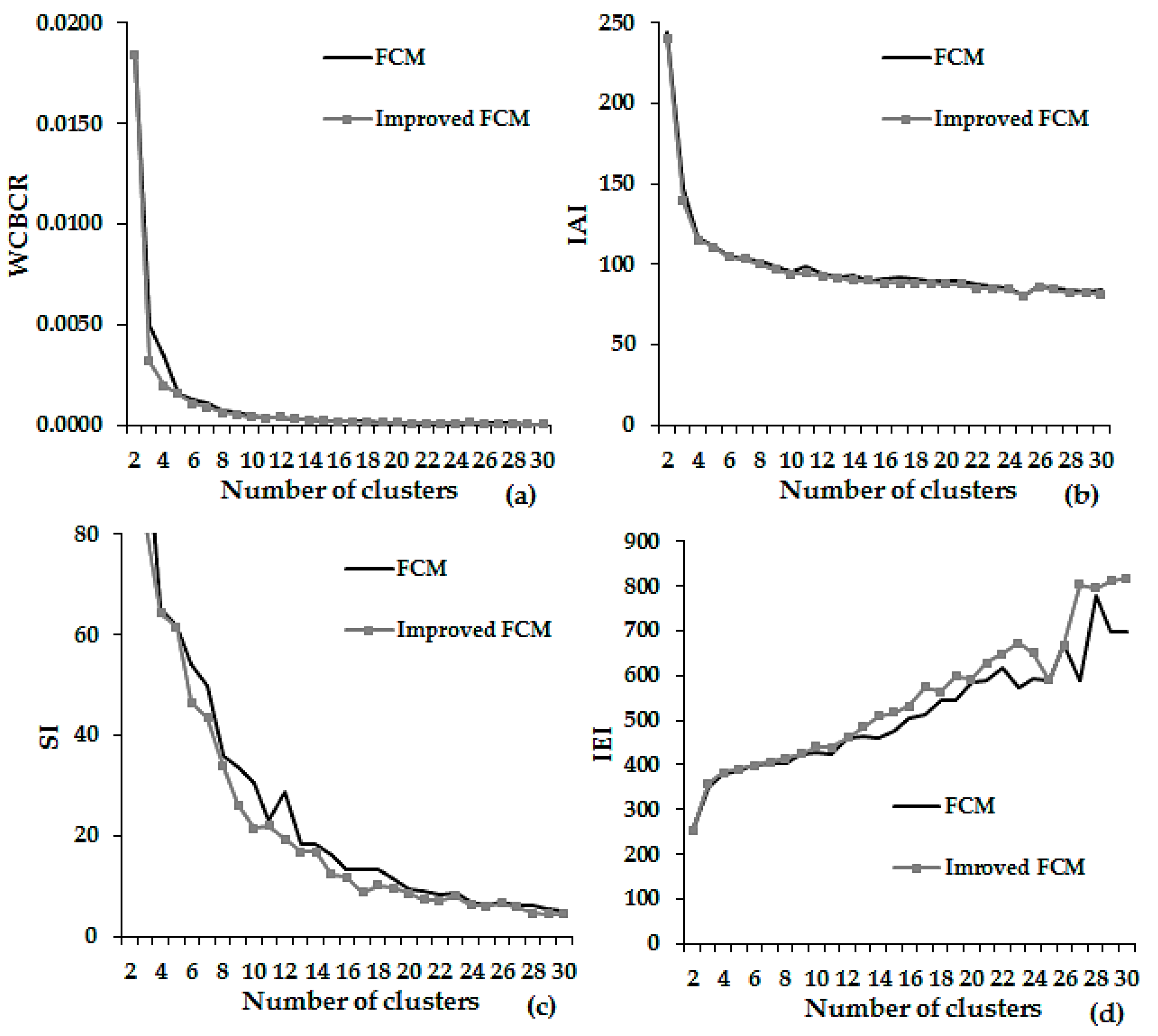

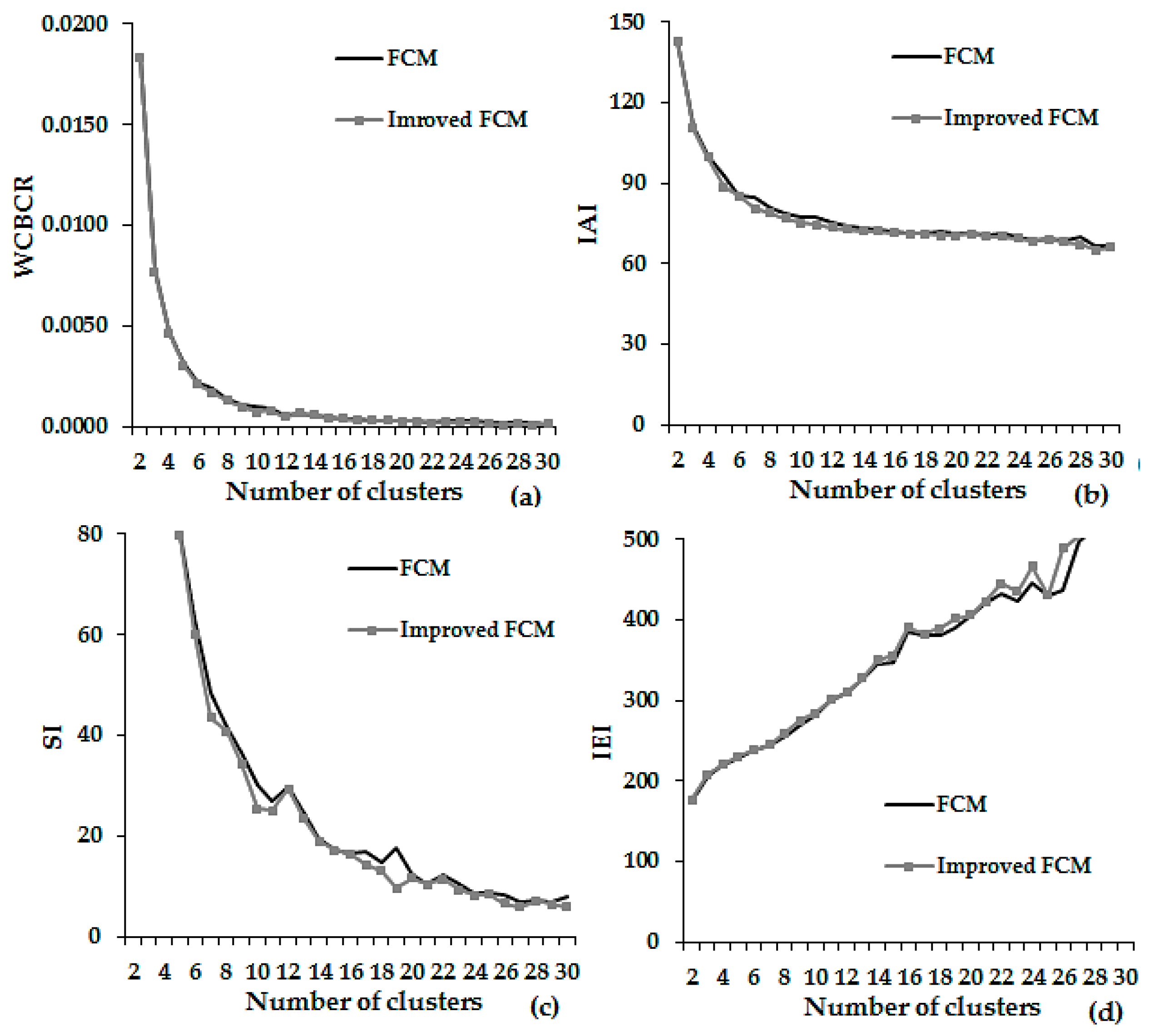

- The ratio of Within Cluster Sum of Squares to Between Cluster Variation (WCBCR), which corresponds to the ratio of the distance of each pattern from its cluster centroid and the sum of distances of the set Ck:

- The Intra Cluster Index (IAI), which corresponds to the overall sum of the distances between patterns and centroids:

- The Scatter Index (SI), which corresponds to the ratio of distances between the patterns and the arithmetic mean to the distances between the centroids and the arithmetic mean:where p is the arithmetic mean of set .

- The Inter Cluster Index (IEI), which corresponds to the sum of distances between the cluster centroids and the arithmetic mean:

3.5.2. Description of the Algorithm

- Phase 1.

- Randomly select values in the [0, 1] range for the elements of U so that the following constrains are satisfied:where the binary variable unk indicates if the pattern belongs to cluster Ck (unk = 1) or not (unk = 0).

- Phase 2.

- Calculate the centroids ck, k = 1, …, K, with Equation (36).

- Phase 3.

- Calculate the cost function with Equation (35). Terminate the algorithm if the value of J is smaller than a pre-defined threshold. Else, go to Phase 4.

- Phase 4.

- Calculate a new matrix U with Equation (36) and go to Phase 2.

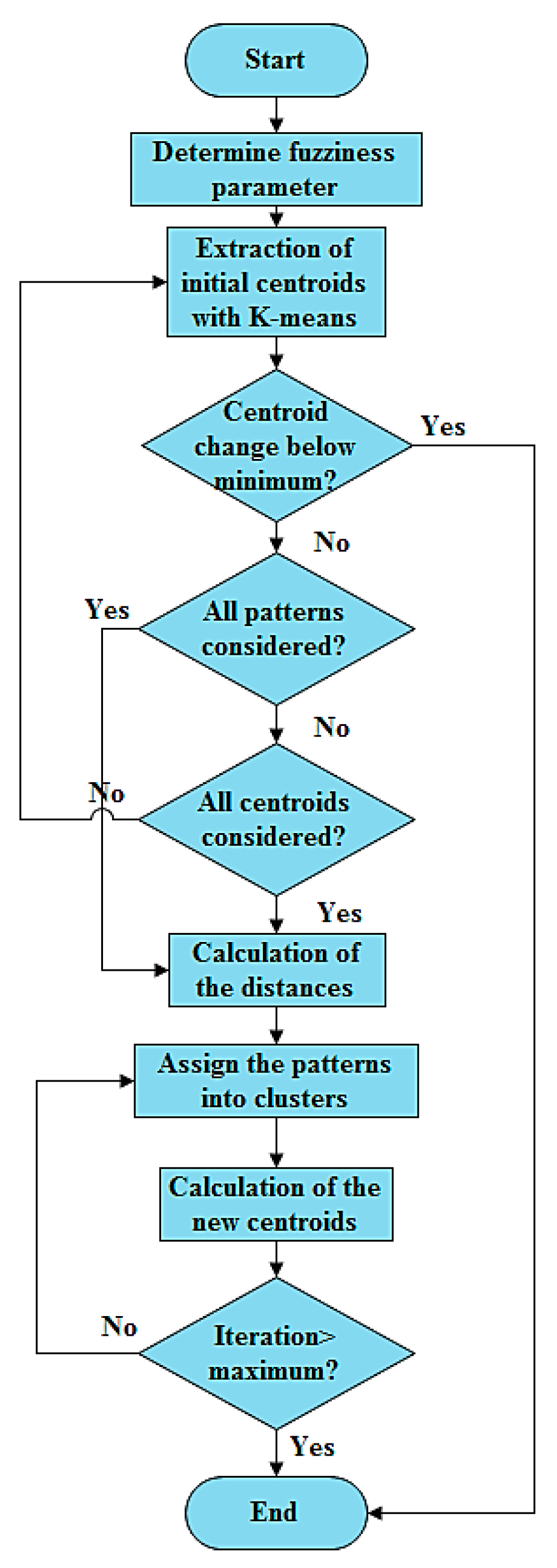

- Phase 1.

- Conduct an initial clustering of for a pre-defined number of clusters (i.e., k) using the K-means algorithm [75]. The initial ck centroids are obtained. Potentially, in this phase every clustering algorithm can be used to produce the initial centroids. K-means is used since it is a fast and efficient algorithm that has been applied to many clustering problems [76,77].

- Phase 2.

- For each pattern of the set , calculate the Euclidean distances between the patterns and centroids ck.

- Phase 3.

- Divide each distance dkn with the sum of all distances sum(dkn). Build the matrix U by setting its elements as:All elements ukn are within the [0, 1] range.

- Phase 4.

- Same as Phase 3 of the FCM.

- Phase 5.

- Same as Phase 4 of the FCM.

4. Simulation Results

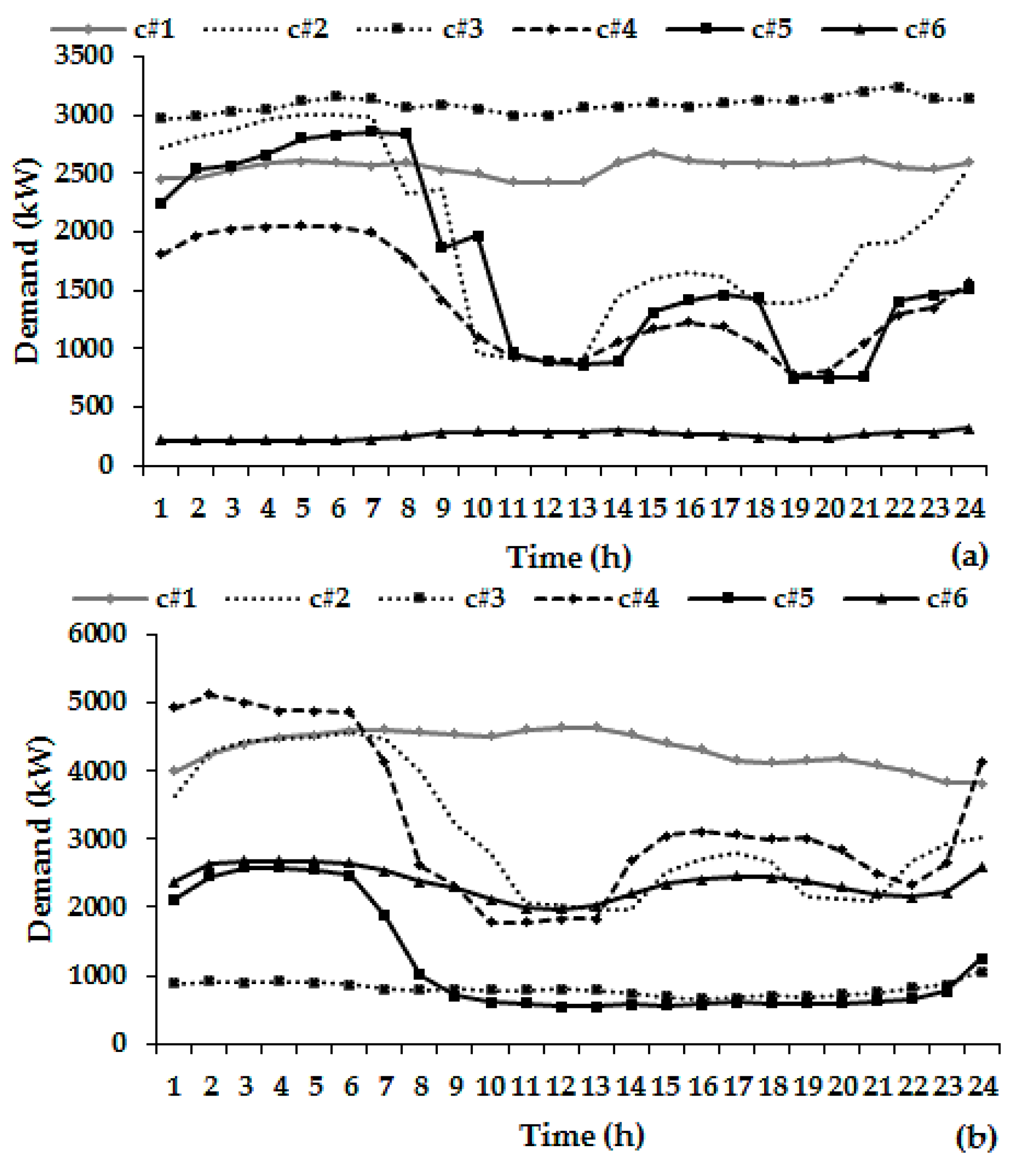

4.1. Load Profiling of HV Consumers

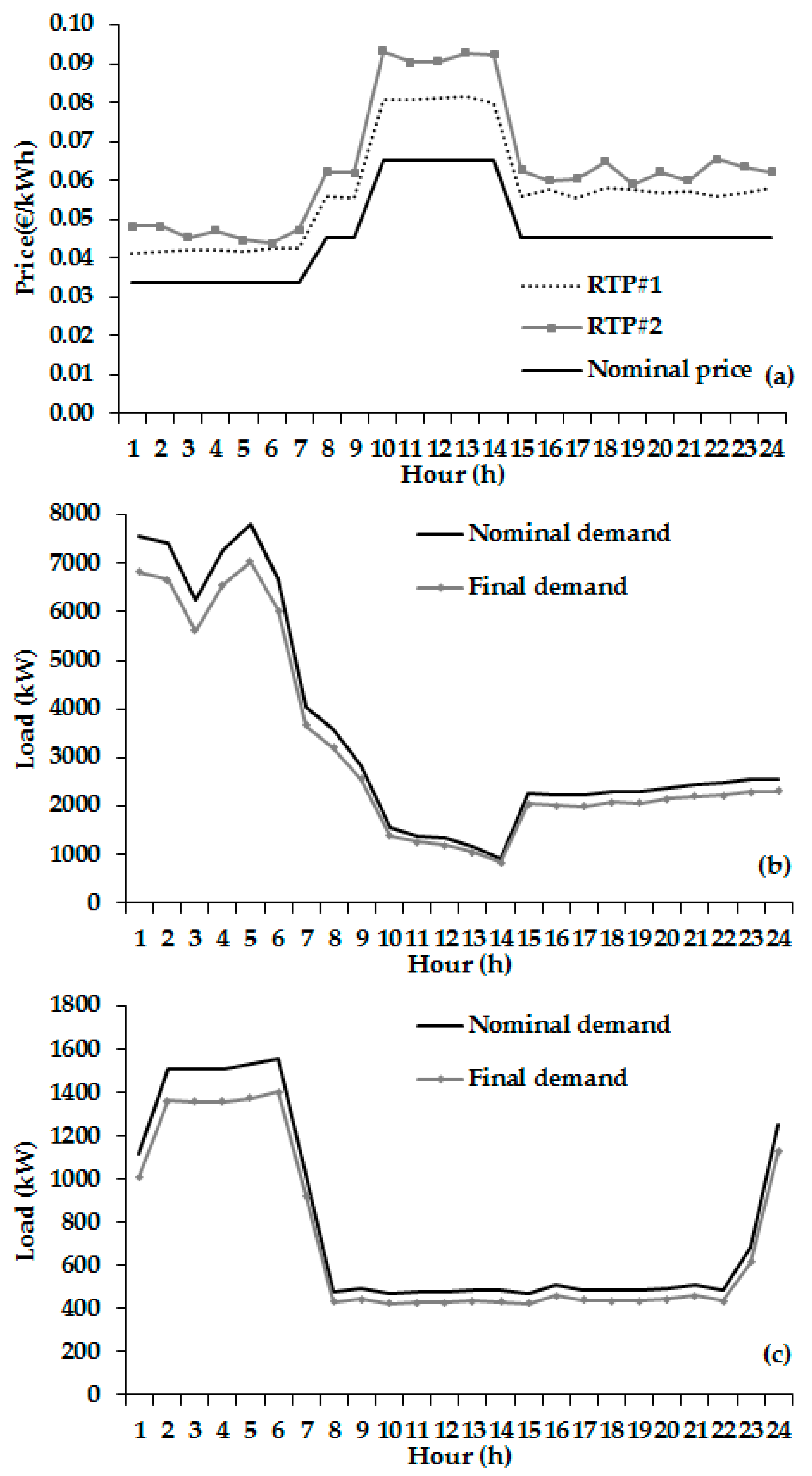

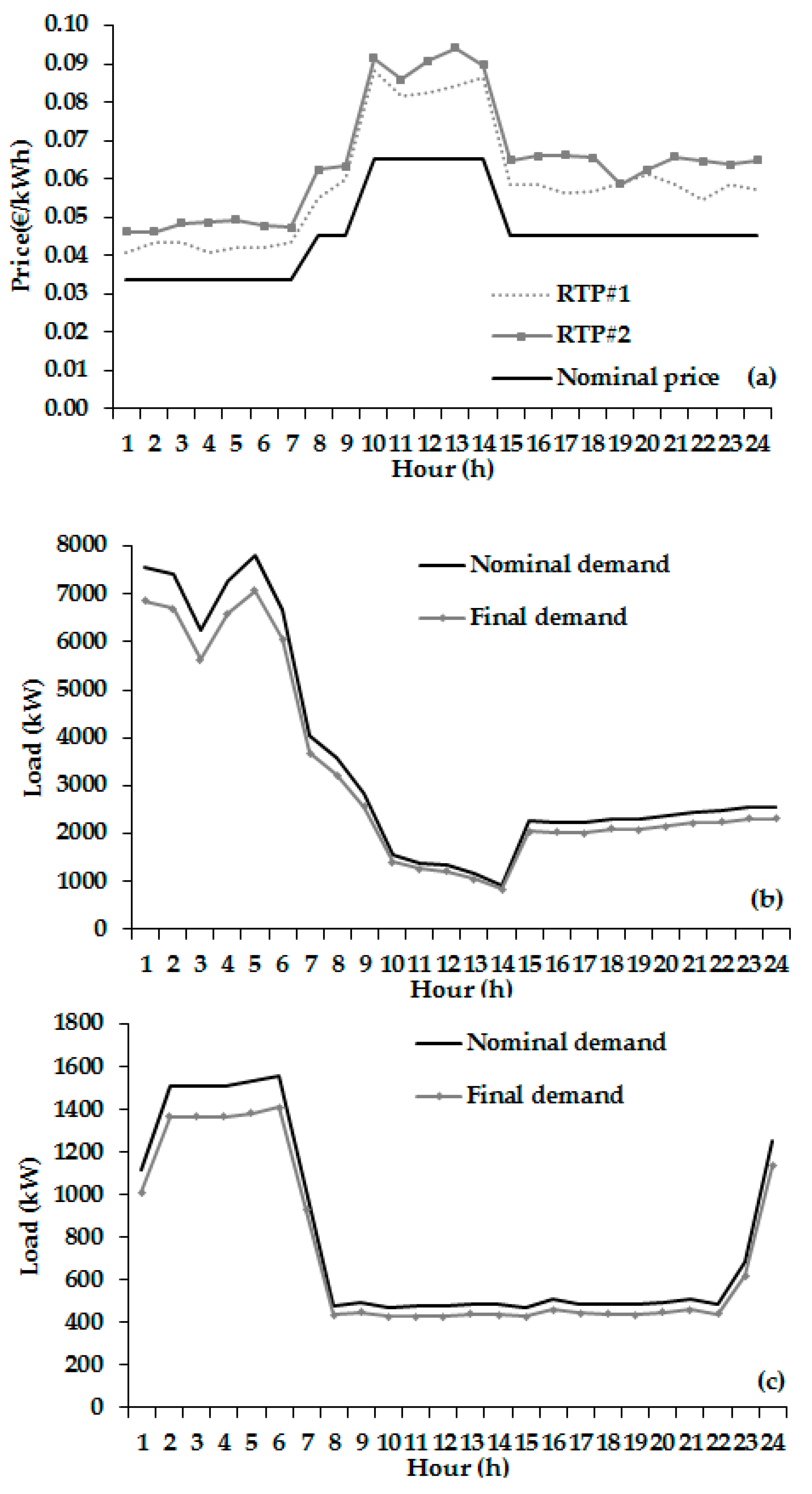

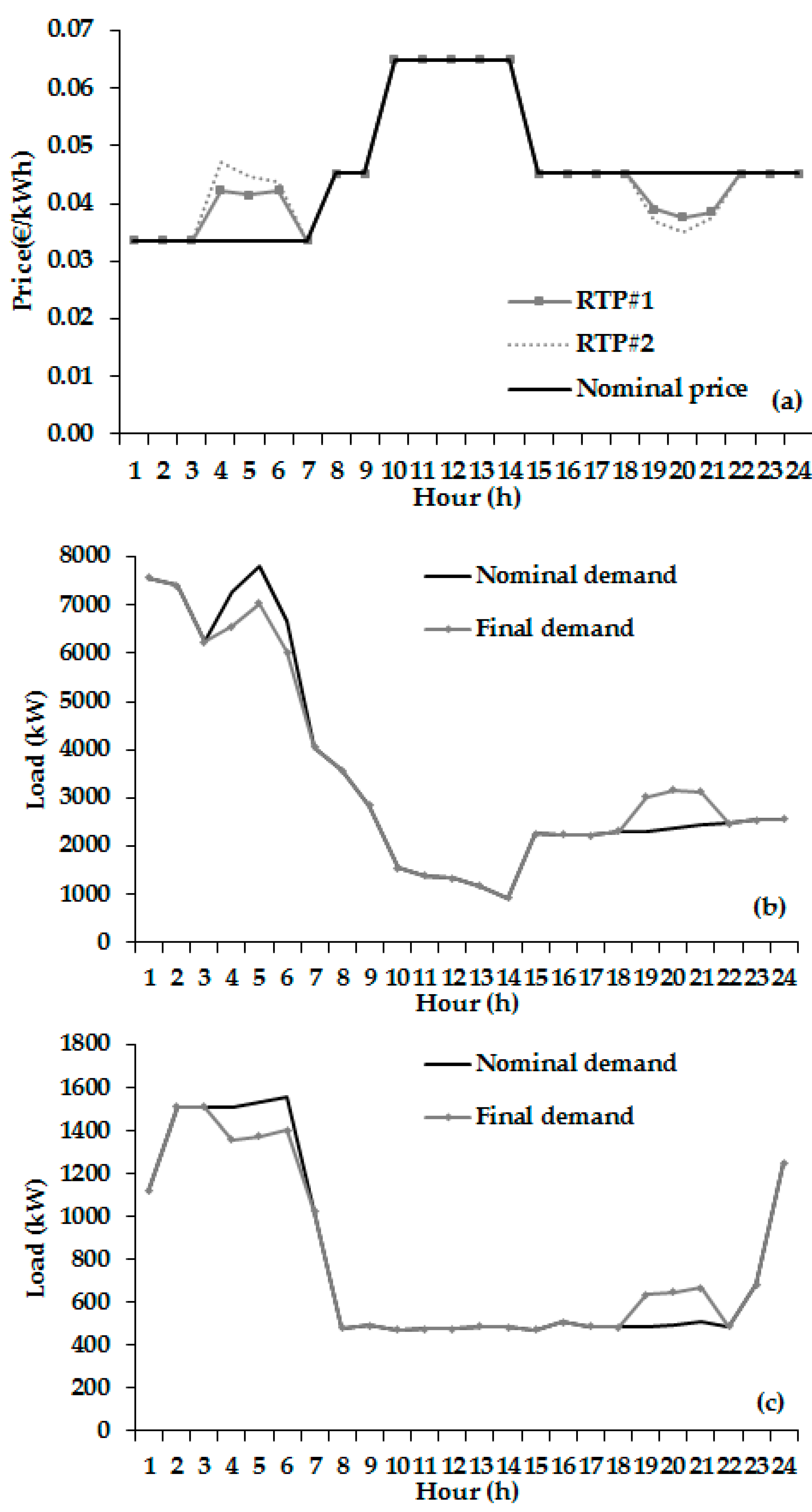

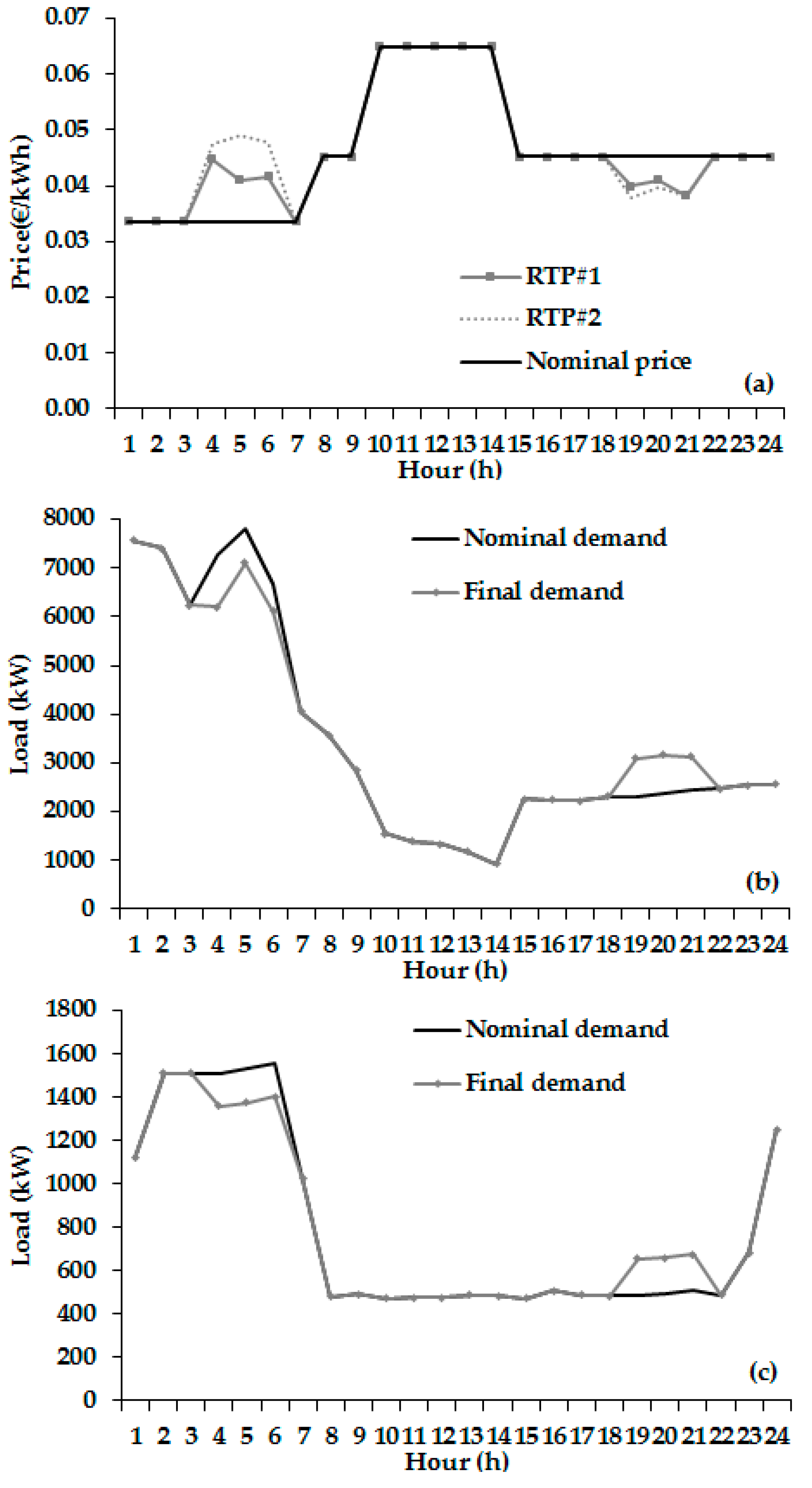

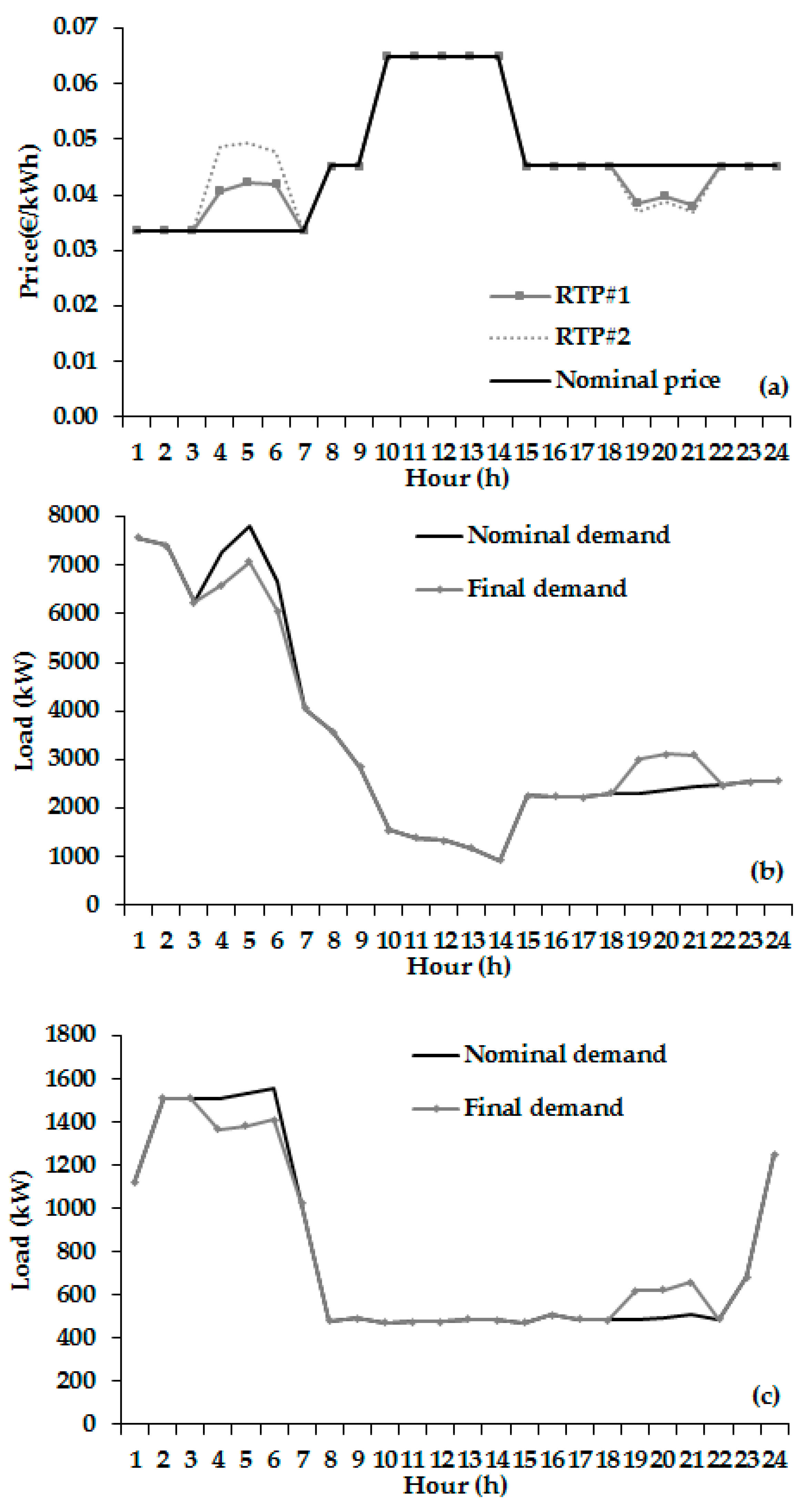

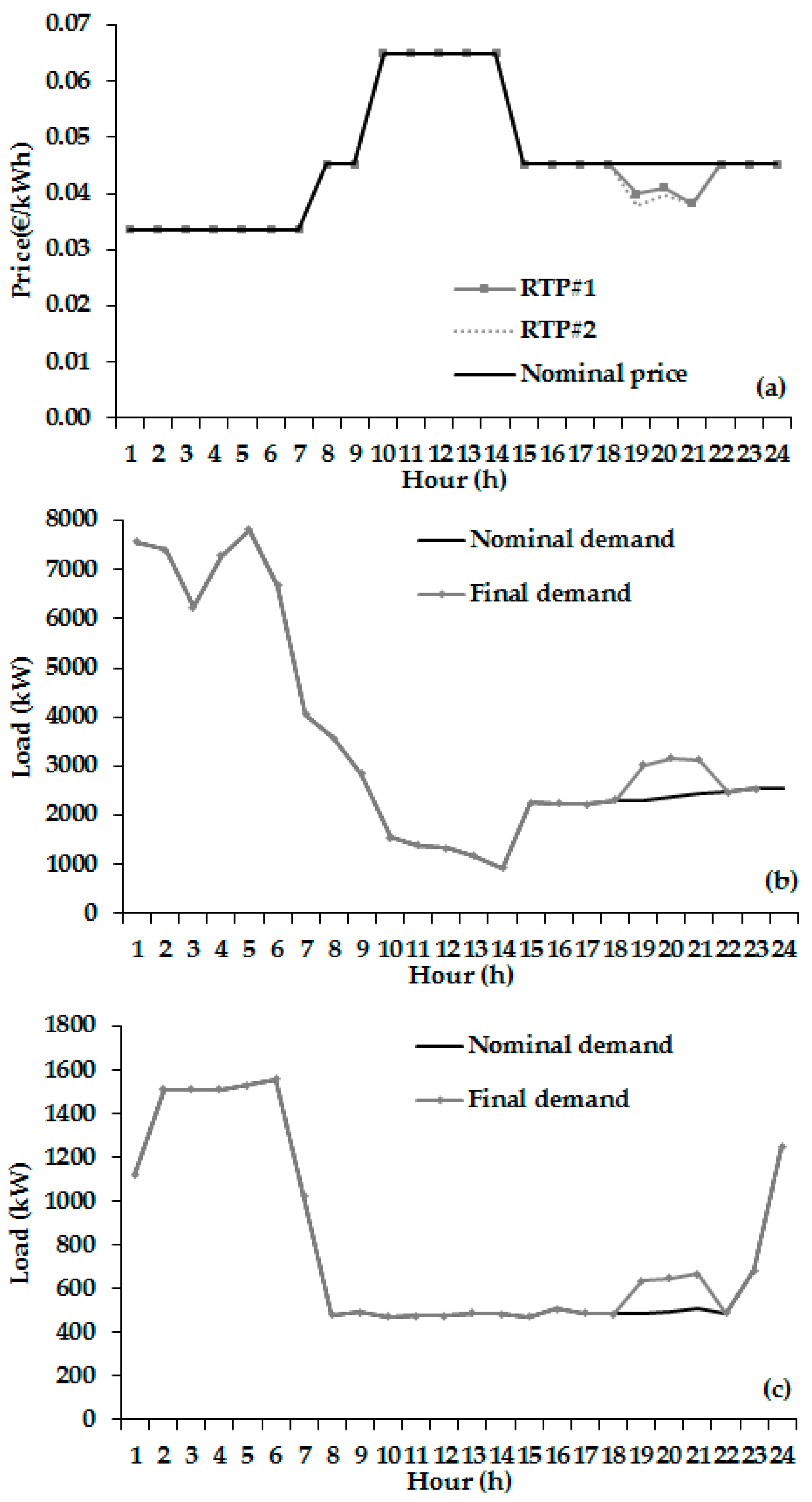

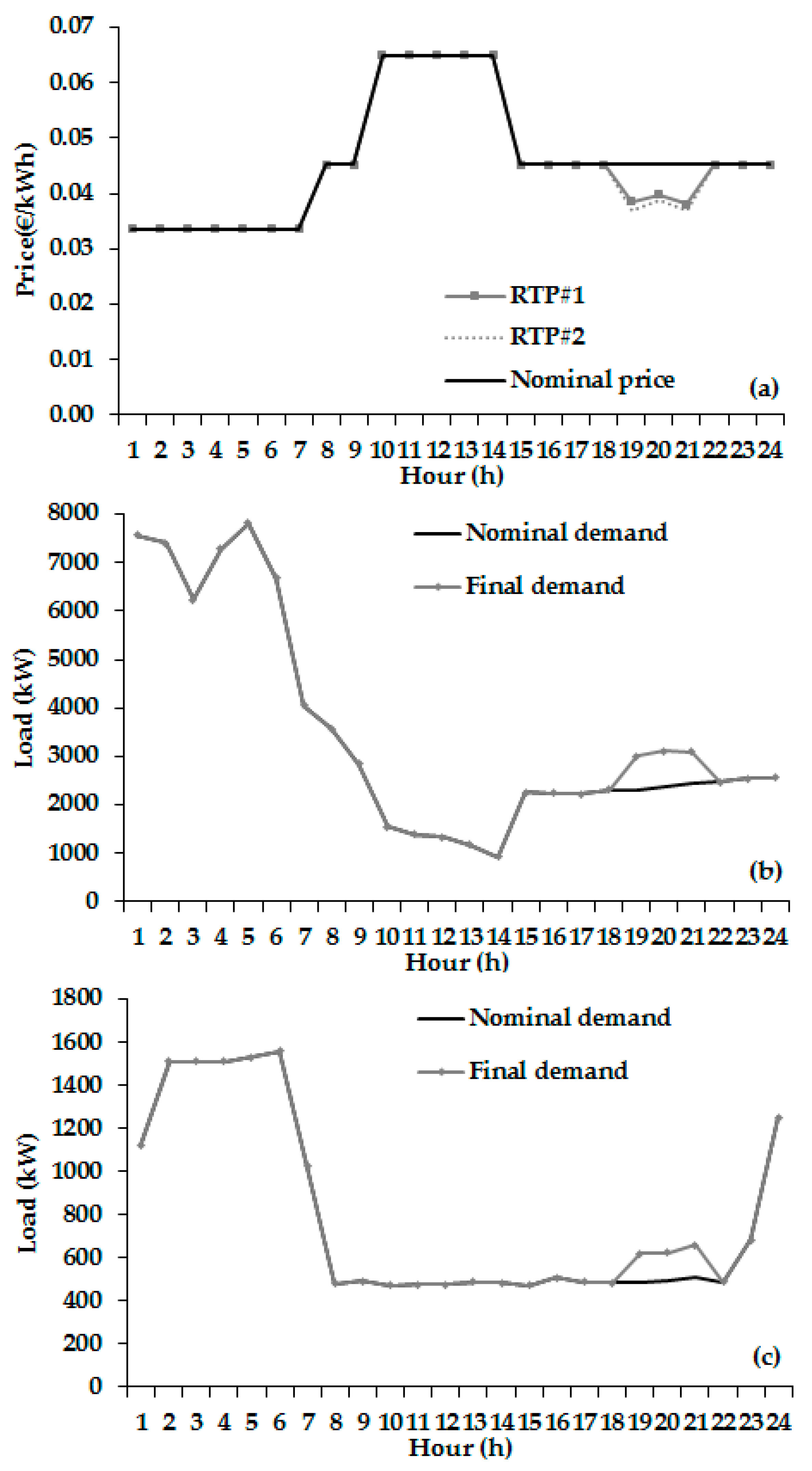

4.2. DSM Objective: SC

4.3. DSM Objective: LS

4.4. DSM Objective: VF

5. Conclusions

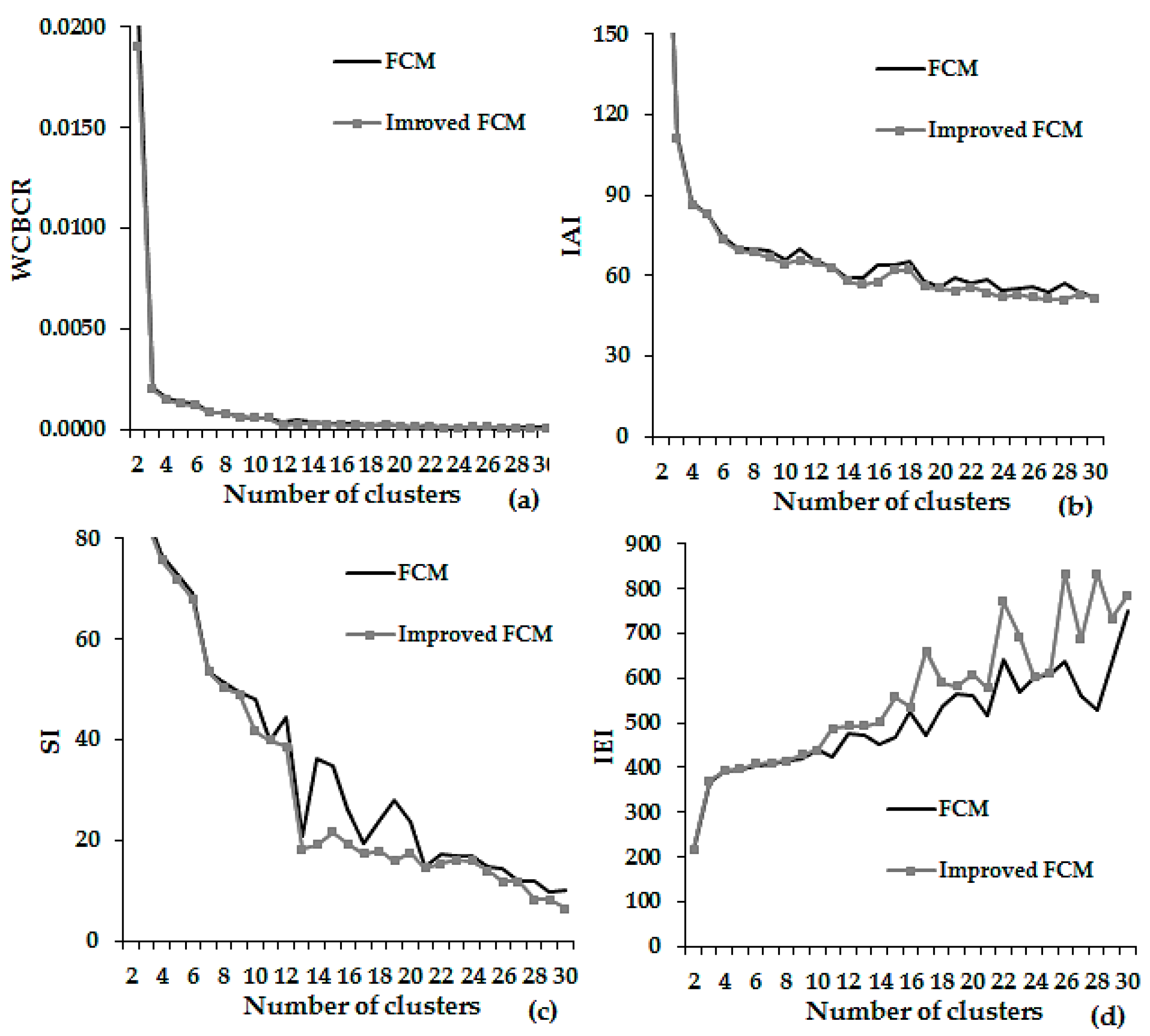

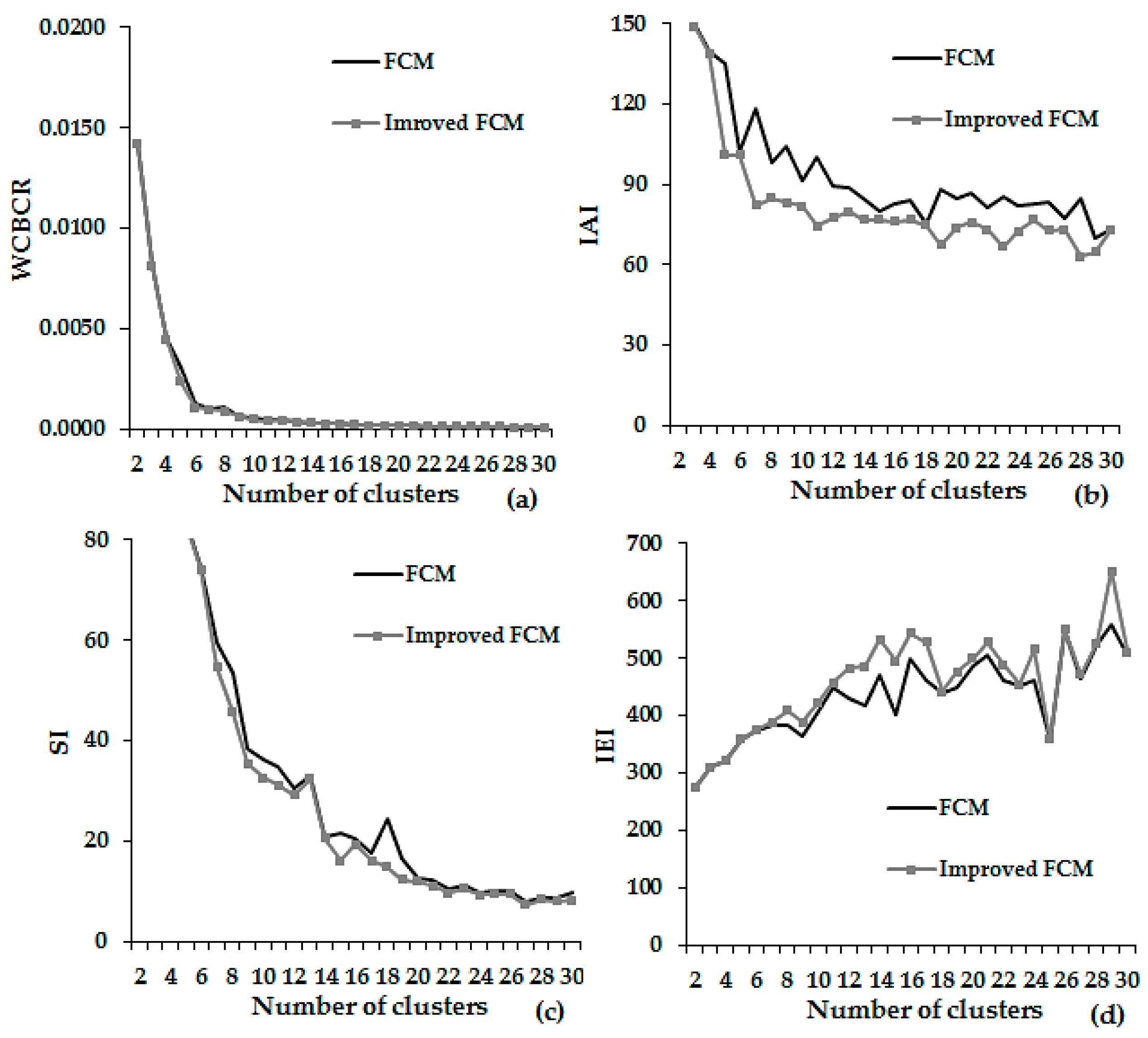

- In all cases examined, the proposed FCM algorithm leads to lower clustering errors. Therefore, a specific initialization formula of the partition matrix is favorable over the random one as it is the case in the conventional form of the algorithm. The K-means algorithm was used for the initialization due to its proven efficiency in many clustering problems. However, virtually every clustering algorithm can be used.

- It is necessary to include a variety of assessment criteria to reach safe conclusions regarding the superiority of the algorithm. The criteria can be categorized into two types: (a) mathematical indicators that measure the Euclidean distances; and (b) parameters that are related with complexity. The term complexity may refer to a wide range of definitions. If complexity is related with required execution time, the time elapsed to run the algorithm for variable number of clusters expresses the suitability of an algorithm. The two algorithms compared in the paper, lead to comparable execution times. The conventional form of the algorithm is slightly faster since the proposed FCM includes an initial clustering with the K-means. If it is required to decrease the execution time of the proposed algorithm, it is recommended to use hierarchical agglomerative clustering algorithms instead of the K-means. Also, if the complexity is expressed as input parameters requirements to be defined prior to the execution of the algorithm, the proposed algorithm needs two additional parameters to be set by the user: (a) The objective function improvement threshold of the K-means and (b) the number of iterations of the K-means.

- A variety of indicators have been used for the algorithm comparison. These indicators can be found in the load profiling-related literature. A reliable indicator should provide information about the optimal number of clusters. Theoretically, the optimal number of clusters is the largest possible. But in practical terms the number of optimal number should satisfy two contradictory conditions: (a) low clustering error and (b) number of clusters with considerable number of patterns. A large number of clusters are generally not recommended as it increases the difficulty of the exploitation of the clustering results. Among the indicators used in the study, the WCBCR measure is suggested. This is due to the following reasons: (a) it exhibits a decreasing tendency that it some cases it becomes monotonic and therefore, it is suitable for the application of the “knee” point detection method and (b) it measures both the compactness and the separation of the generated clusters. The IEI measure is the least suitable due its volatile shape. Both SI and IAI are preferred if the WCBCR is not considered.

- The optimal number of clusters for both consumers is below 10. According to the shapes of the load profiles, the demand is high during night hours, again due to the nominal tariff structures. The load profiles do not display sudden peaks.

- In order to derive the price elasticity curves, it is recommended to use data that cover all seasons within the year. The weekly and seasonal variations of the demand changes with respect to prices are included if the calculation covers all seasons.

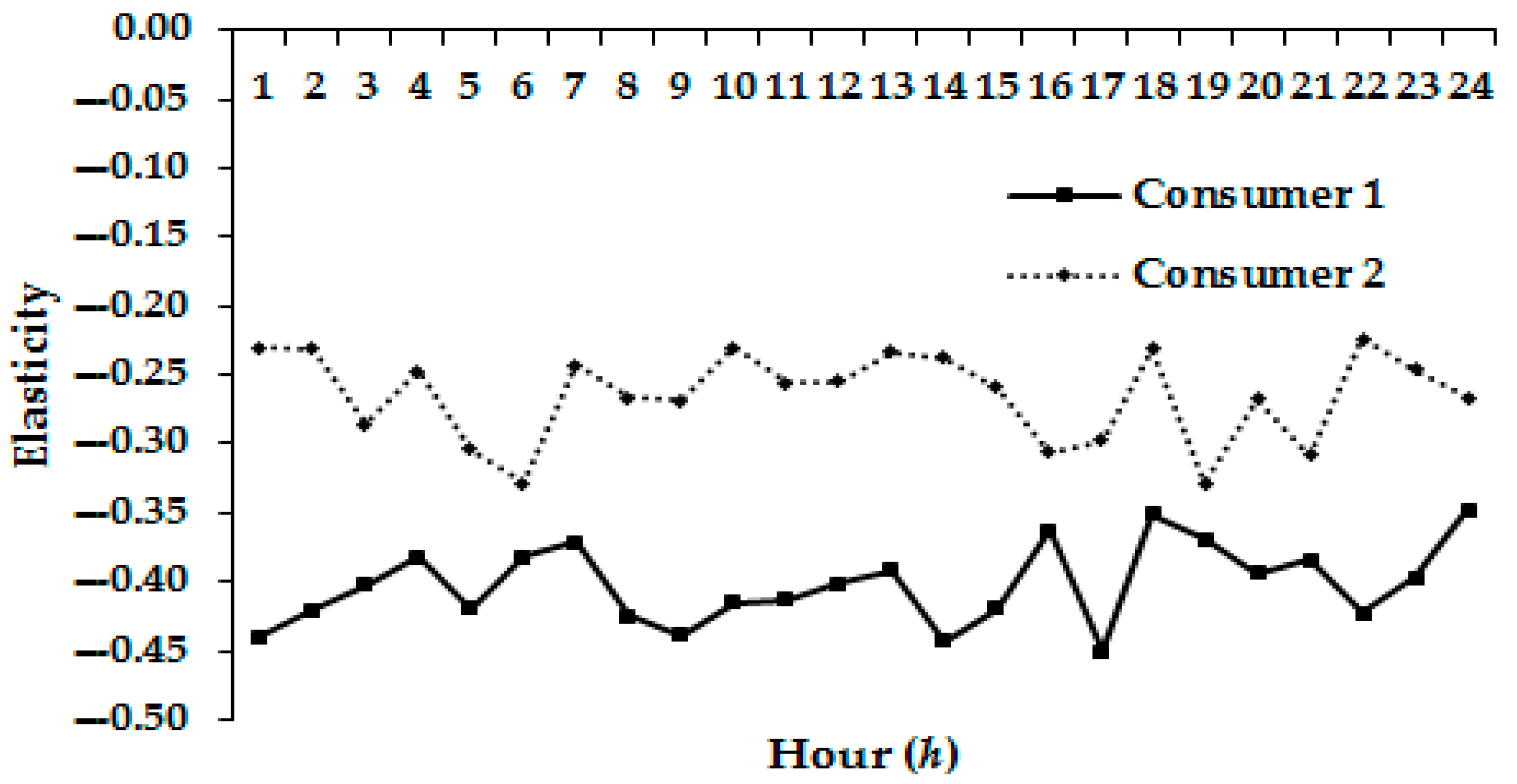

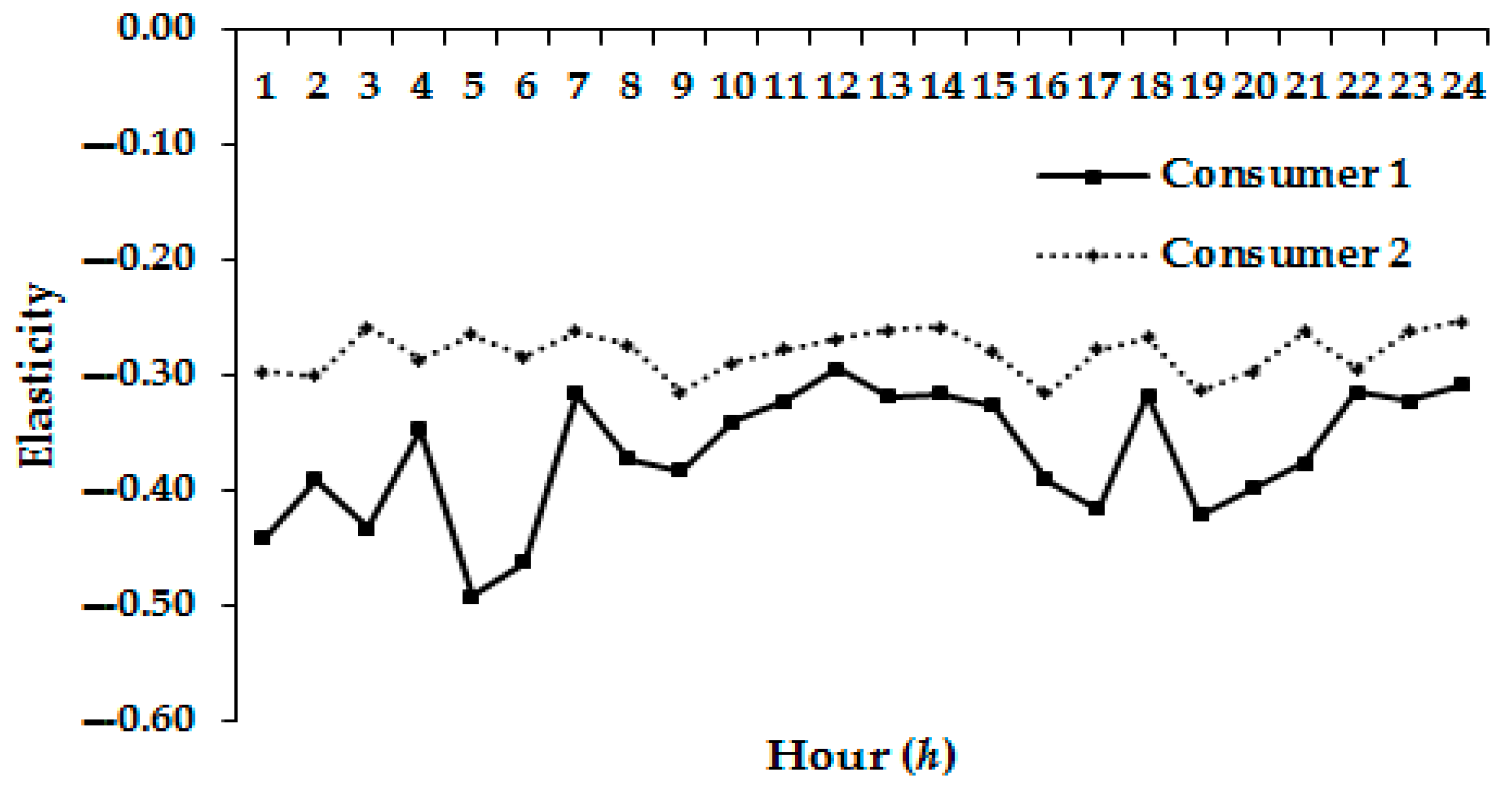

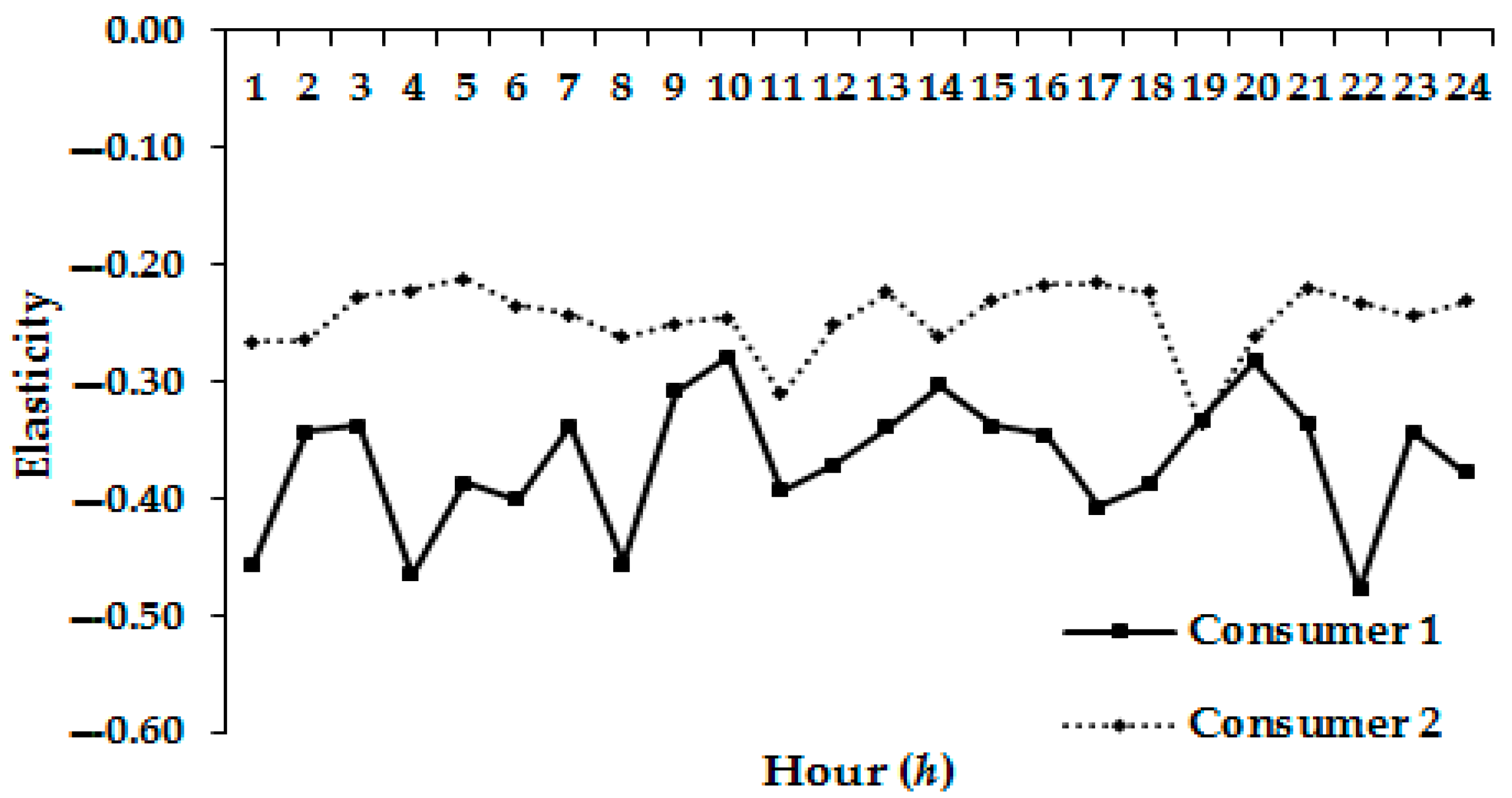

- The type of the DR model affects the price elasticity curves. The linear DR model results in lower values of price elasticities. It can be noticed that there are large differences between the hourly values. This is more evident in Consumer#1. Therefore, it is recommended to form consumer specific curves instead of using pre-defined constant values.

- To provide a robust modelling of the demand behavior, it is recommended to update the price elasticity curves periodically or in special cases of demand changes. For instance if large demand variations are observed or expected due to various reason, prior to the implementation of a DSM objective, a re-calculation of the hourly elasticities is advised.

- The formulation of the optimization problem is robust; in all cases examined reaches into feasible solution that satisfy the limitations imposed by the user.

- All the DSM objectives presented in Figure 2 can be implemented in the model. Three cases have been examined. The prices offered by the Retailer depend on the price limits, the type of the price/demand function and the type of model used to derive the price elasticity curves. The elasticity is the most significant factor that determines the level of success of the DSM objective. A careful selection of price limits makes a Retailer competitive within the retail market competition.

- The proposed model makes it feasible to achieve a DSM goal with no intervention in the apparatus of the consumers. It is up to the consumer to decide which loads will be cut off or shifted within the daily period. Therefore, the industrial consumer has more control upon its equipment and production processes.

- The proposed model is highly flexible and can be applied to various types of consumers (e.g., buildings, residential consumer clusters and others). Also, different pricing schemes can be included, such as TOU rates as long as result in the satisfaction of the DSM target.

- In the case of the load profiling, dimensionality reduction techniques can be examined such as principal component analysis, for the purpose of lowering the clustering execution time. The patterns can be represented with a reduced set of features and this concept, at least theoretically, should reduce the clustering duration. This would be more noticeable in cases with large amounts of data gathered by smart meters.

- To modify the proposed model in order to simulate the Retailer’s economic benefit. For instance, the demand reduction level in the SC objective can be negotiable among the System Operator and the Retailer. If the SC objective is partially fulfilled a penalty can be applied in the Retailer.

- Another expansion of the model should take into account cases where self-production units, such as biomass or photovoltaics in the part of the consumer are present.

Acknowledgments

Author Contributions

Conflicts of Interest

Nomenclature

| Symbol | Description |

| m | Consumer index |

| M | Total number of consumers |

| n | Day index |

| P(n,M) | Total consumption in day n |

| D | Dimension of vector |

| Daily load curve vector in physical units of consumer m | |

| h | Hour index |

| p0(h) | Nominal price in hour h |

| d0(h) | Nominal demand in hour h |

| p1(h) | Price in hour h of the 1st consumer |

| p2(h) | Price in hour h of the 2nd consumer |

| d(p(h)) | Demand in hour h |

| p(h) | Price in hour h |

| dlin(p(h) | Demand in hour h according to linear demand function |

| alin | Coefficient of the linear demand function |

| blin | Coefficient of the linear demand function |

| Nominal demand in hour h according to the linear demand function | |

| Nominal consumer benefit in hour h according to the linear demand function | |

| dlin(p(h)) | Demand in hour h according to the linear demand function |

| Bc(dlin(p(h))) | Consumer benefit in hour h according to the linear demand function |

| Elin(h) | Hourly price elasticity according to the linear demand response model |

| dexp(p(h)) | Demand in hour h according to the exponential demand function |

| aexp | Coefficient of the exponential demand function |

| bexp | Coefficient of the exponential demand function |

| Nominal demand in hour h according to the exponential demand function | |

| Nominal consumer benefit in hour h according to the exponential demand function | |

| dexp(p(h)) | Demand in hour h according to the exponential demand function |

| Bc(dexp(p(h))) | Consumer benefit in hour h according to the exponential demand function |

| Eexp(h) | Hourly price elasticity according to the exponential demand response model |

| dlog(p(h)) | Demand in hour h according to the logarithmic demand function |

| alog | Coefficient of the logarithmic demand function |

| blog | Coefficient of the logarithmic demand function |

| Nominal demand in hour h according to the logarithmic demand function | |

| Nominal consumer benefit in hour h according to the logarithmic demand function | |

| dlog(p(h)) | Demand in hour h according to the logarithmic demand function |

| Bc(dlog(p(h))) | Consumer benefit in hour h according to the logarithmic demand function |

| Elog(h) | Hourly price elasticity using the logarithmic model. |

| R(h) | Percentage reduction of the nominal demand in hour h |

| Nominal demand in hour h of the 1st consumer | |

| Nominal demand in hour h of the 2nd consumer | |

| d1(p1(h)) | Demand in hour h of the 1st consumer |

| d2(p2(h)) | Demand in hour h of the 2nd consumer |

| u(h) | Upper price limit in hour h |

| i | Instance within day n |

| i’ | Instance within day n |

| i’’ | Instance within day n |

| R(i) | Percentage reduction of the nominal demand in instance i |

| R(i’) | Percentage reduction of the nominal demand in instance i’ |

| R(i’’) | Percentage reduction of the nominal demand in instance i’’ |

| I(i’) | Load increment of the nominal demand in instance i’ |

| I(i’’) | Load increment of the nominal demand in instance i’’ |

| Nominal demand in instance i of the 1st consumer | |

| Nominal demand in instance i’ of the 1st consumer | |

| Nominal demand in instance i’’ of the 1st consumer | |

| Nominal demand in instance i of the 2nd consumer | |

| Nominal demand in instance i’ of the 2nd consumer | |

| Nominal demand in instance i’’ of the 2nd consumer | |

| d1(p1(i)) | Demand in instance i of the 1st consumer |

| d1(p1(i’)) | Demand in instance i’ of the 1st consumer |

| d1(p1(i’’)) | Demand in instance i’’ of the 1st consumer |

| d2(p2(i)) | Demand in instance i of the 2nd consumer |

| d2(p2(i’)) | Demand in instance i’ of the 2nd consumer |

| d2(p2(i’’)) | Demand in instance i’’ of the 2nd consumer |

| p0(i) | Nominal price in instance i |

| p0(i’) | Nominal price in instance i’ |

| p0(i’’) | Nominal price in instance i’’ |

| p1(i) | Price in instance i of the 1st consumer |

| p1(i’) | Price in instance i’ of the 1st consumer |

| p1(i’’) | Price in instance i’’ of the 1st consumer |

| p2(i) | Price in instance i of the 2nd consumer |

| p2(i’) | Price in instance i’ of the 2nd consumer |

| p2(i’’) | Price in instance i’’ of the 2nd consumer |

| u(i) | Upper price limit in instance i |

| u(i’) | Upper price limit in instance i’ |

| u(i’’) | Upper price limit in instance i’’ |

| Load data set of consumer m in physical units | |

| N | Number of patterns of consumer m |

| xmin | Minimum value of set |

| xmax | Maximum value of set |

| Daily load curve vector in the [0, 1] range of consumer m | |

| Load data set of consumer m in the [0, 1] range | |

| k | Number of clusters |

| K | Total number of clusters |

| ck | Centroid of cluster k |

| Ck | Set of k centroids |

| Random pattern of set | |

| Random pattern of set | |

| Nk | Number of patterns of cluster Ck |

| d | Dimension index |

| Euclidean distance | |

| Element of pattern | |

| Element of pattern | |

| Sk | Subset of Nk |

| p | Arithmetic mean of subset |

| Random pattern of set Sk | |

| Random pattern of set Sk | |

| Element of pattern | |

| Element of pattern | |

| Objective function of the Fuzzy C-Means | |

| Objective function of the Fuzzy C-Means corresponding to cluster k | |

| q | Fuziness parameter |

| U | Partition matrix |

| Element of matrix U | |

| x | Coordinate of the x-axis |

| y | Coordinate of the y-axis |

| a | Intercept on y-axis |

| b | Slope of the line |

| Set of cluster labels of test days | |

| Set of days that belong to the same cluster with test day | |

| day | Day index |

| Intersection of sets | |

| Intersection of sets |

List of Acronyms

| Acronym | Description |

| FCM | Fuzzy C-Means |

| IFCM | Improved Fuzzy C-Means |

| DSM | Demand Side Management |

| RTP | Real-Time Pricing |

| SSM | Supply Side Management |

| RES | Renewable Energy Sources |

| DR | Demand Response |

| TOU | Time-Of-Use |

| CPP | Critical Peak Pricing |

| SOM | Self-Organizing Map |

| CLA | Competitive Leaky Algorithm |

| SO | System Operator |

| SC | Strategic Conservation |

| LS | Load Shifting |

| VF | Valley Filling |

| WCBCR | Within Cluster Sum of Squares to Between Cluster Variation |

| IAI | Intra Cluster Index |

| SI | Scatter Index |

| IEI | Inter Cluster Index |

| HV | High Voltage |

References

- Karunanithi, K.; Saravanan, S.; Prabakar, B.R.; Kannan, S.; Thangaraj, C. Integration of demand and supply side management strategies in generation expansion planning. Renew. Energy 2017, 73, 966–982. [Google Scholar] [CrossRef]

- Hu, Z.; Han, X.; Wen, Q. Integrated Resource Strategic Planning and Power Demand-Side Management, 1st ed.; Springer: Berlin, Germany, 2013; pp. 63–133. [Google Scholar]

- Srinivasan, D.; Rajgarhia, S.; Radhakrishnan, B.M.; Sharma, A.; Khinch, H.P. Game-theory based dynamic pricing strategies for demand side management in smart grids. Energy 2017, 126, 132–143. [Google Scholar] [CrossRef]

- Gelazanskas, L.; Gamage, K.A.A. Demand side management in smart grid: A review and proposals for future direction. Sustain. Cities Soc. 2014, 11, 22–30. [Google Scholar] [CrossRef]

- Shaaban, M.F.; Osman, A.H.; Hassan, M.S. Day-ahead Optimal Scheduling for Demand Side Management in Smart Grids. In Proceedings of the 2016 European Modelling Symposium, Pisa, Italy, 24–26 October 2016; pp. 124–129. [Google Scholar]

- Soumya, P.; Swarup, K.S. Reliability Improvement Considering Reactive Power Aspects in a Smart Grid with Demand Side Management. In Proceedings of the 2016 National Power Systems Conference, Bhubaneswar, India, 19–21 December 2016; pp. 1–6. [Google Scholar]

- Muralitharan, K.; Sakthivel, R.; Shi, Y. Multiobjective optimization technique for demand side management with load balancing approach in smart grid. Neurocompting 2016, 177, 110–119. [Google Scholar] [CrossRef]

- Derakhshan, G.; Shayanfar, H.A.; Kazemi, A. The optimization of demand response programs in smart grids. Energy Policy 2016, 94, 295–306. [Google Scholar] [CrossRef]

- Haider, H.T.; See, O.H.; Elmenreich, W. A review of residential demand response of smart grid. Renew. Sustain. Energy Rev. 2016, 59, 166–178. [Google Scholar] [CrossRef]

- Mohasse, R.R.; Fung, A.; Mohammadi, F.; Raahemifar, K. A survey on Advanced Metering Infrastructure. Int. J. Electr. Power Energy Syst. 2014, 63, 473–484. [Google Scholar] [CrossRef]

- Ghasempour, A. Optimized Advanced Metering Infrastructure Architecture of Smart Grid based on Total Cost, Energy, and Delay. In Proceedings of the 2016 IEEE Power & Energy Society Innovative Smart Grid Technologies Conference, Mineapolis, MN, USA, 6–9 September 2016; pp. 1–6. [Google Scholar]

- Parvez, I.; Abdul, F.; Sarwat, A.I. A Location Based Key Management System for Advanced Metering Infrastructure of Smart Grid. In Proceedings of the 2016 IEEE Green Technologies Conference, Kansas City, MO, USA, 6–8 April 2016; pp. 62–67. [Google Scholar]

- Albadi, M.H.; El-Saadany, E.F. A summary of demand response in electricity markets. Electr. Power Syst. Res. 2008, 78, 1989–1996. [Google Scholar] [CrossRef]

- Qadrdan, M.; Cheng, M.; Wu, J.; Jenkins, N. Benefits of demand-side response in combined gas and electricity networks. Appl. Energy 2017, 192, 360–369. [Google Scholar] [CrossRef]

- O’Connell, N.; Pinson, P.; Madsen, H.; O’Malley, M. Benefits and challenges of electrical demand response: A critical review. Renew. Sustain. Energy Rev. 2014, 39, 686–699. [Google Scholar] [CrossRef]

- Nezamoddini, N.; Wang, Y. Real-time electricity pricing for industrial customers: Survey and case studies in the United States. Appl. Energy 2017, 195, 1023–1037. [Google Scholar] [CrossRef]

- Yang, J.; Zhang, G.; Ma, K. Matching supply with demand: A power control and real time pricing approach. Appl. Energy 2014, 61, 111–117. [Google Scholar] [CrossRef]

- Brown, T.; Newell, S.A.; Oates, D.L.; Spees, K. International Review of Demand Response Mechanisms; Australian Energy Market Commission: Sydney, Australia, 2015; pp. 1–83. [Google Scholar]

- Yusta, J.M.; Khodr, H.M.; Urdaneta, A.J. Optimal pricing of default customers in electrical distribution systems: Effect behavior performance of demand response models. Electr. Power Syst. Res. 2007, 77, 548–558. [Google Scholar] [CrossRef]

- Miara, A.; Tarr, C.; Spellman, R.; Vörösmarty, C.J.; Macknick, J.E. The power of efficiency: Optimizing environmental and social benefits through demand-side-management. Energy 2014, 74, 502–512. [Google Scholar] [CrossRef]

- Viola, F.; Romano, P.; Miceli, R.; Cascia, D.L.; Longo, M.; Sauba, G. Economical evaluation of ecological benefits of the demand side management. In Proceedings of the 2014 International Conference on Renewable Energy Research and Application, Madrid, Spain, 19–22 October 2014; pp. 995–1000. [Google Scholar]

- Sharifi, R.; Fathia, S.H.; Vahidinasab, V. A review on Demand-side tools in electricity market. Renew. Sustain. Energy Rev. 2017, 72, 565–572. [Google Scholar] [CrossRef]

- Mahmoudi-Kohan, N.; Parsa Moghaddam, M.; Sheikh-El-Eslami, M.K.; Shayesteh, E. A three-stage strategy for optimal price offering by a retailer based on clustering techniques. Int. J. Electr. Power Energy Syst. 2010, 32, 1135–1142. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, Y.; Zhao, B.; Huang, F.; Chen, Y.; Shuaijie, R. Optimal energy flow control strategy for a residential energy local network combined with demand-side management and real-time pricing. Energy Build. 2017, 150, 177–188. [Google Scholar] [CrossRef]

- Campillo, J.; Dahlquist, E.; Wallin, F.; Vassileva, I. Is real-time electricity pricing suitable for residential users without demand-side management? Energy 2016, 109, 310–325. [Google Scholar] [CrossRef]

- Zhang, Q.; Grossmann, I.E. Enterprise-wide optimization for industrial demand side management: Fundamentals, advances, and perspectives. Chem. Eng. Res. Des. 2016, 116, 114–131. [Google Scholar] [CrossRef]

- Huang, X.; Hong, S.H.; Li, Y. Hour-ahead price based energy management scheme for industrial facilities. IEEE Trans. Ind. Inf. 2017, in press. [Google Scholar] [CrossRef]

- Mitra, S.; Grossmann, I.E.; Pinto, J.M.; Arora, N. Optimal production planning under time-sensitive electricity prices for continuous power-intensive processes. Comput. Chem. Eng. 2012, 38, 171–184. [Google Scholar] [CrossRef]

- Ding, Y.M.; Hong, S.H.; Li, X.H. A Demand response energy management scheme for industrial facilities in smart grid. IEEE Trans. Ind. Inf. 2014, 10, 2257–2269. [Google Scholar] [CrossRef]

- Karwana, M.H.; Keblis, M.F. Operations planning with real time pricing of a primary input. Comput. Oper. Res. 2007, 34, 848–867. [Google Scholar] [CrossRef]

- Yu, M.; Lu, R.; Hong, S.H. A real-time decision model for industrial load management in a smart grid. Appl. Energy 2016, 183, 1488–1497. [Google Scholar] [CrossRef]

- Xenos, D.P.; Noor, I.M.; Matloubi, M.; Cicciotti, M.; Haugen, T.; Thornhill, N.F. Demand-side management and optimal operation of industrial electricity consumers: An example of an energy-intensive chemical plant. Appl. Energy 2016, 182, 418–433. [Google Scholar] [CrossRef]

- Reka, S.S.; Ramesh, V. Industrial demand side response modelling in smart grid using stochastic optimisation considering refinery process. Energy Build. 2016, 127, 84–94. [Google Scholar] [CrossRef]

- Carpinelli, G.; Mottola, F.; Perrotta, L. Energy management of storage systems for industrial applications under real time pricing. In Proceedings of the International Conference on Renewable Energy Research and Applications, Madrid, Spain, 20–23 October 2013; pp. 884–889. [Google Scholar]

- Hatami, R.A.; Seifi, H.; Sheikh-El-Eslami, M.K. Optimal selling price and energy procurement strategies for a retailer in an electricity market. Electr. Power Syst. Res. 2009, 79, 246–254. [Google Scholar] [CrossRef]

- Yusta, J.M.; Rosado, I.J.R.; Navarro, J.A.D.; Vidal, J.M.P. Optimal electricity price calculation model for retailers in a deregulated market. Int. J. Electr. Power Energy Syst. 2005, 27, 437–447. [Google Scholar] [CrossRef]

- Gabriel, S.A.; Genc, M.F.; Balakrishnan, S. A simulation approach to balancing annual risk and reward in retail electrical power markets. IEEE Trans. Power Syst. 2002, 17, 1050–1057. [Google Scholar] [CrossRef]

- Gabriel, S.A.; Conejo, A.J.; Plazas, M.A.; Balakrishnan, S. Optimal price and quantity determination for retail electric power contracts. IEEE Trans. Power Syst. 2006, 21, 180–187. [Google Scholar] [CrossRef]

- Carrión, M.; Conejo, A.J.; Arroyo, J.M. Forward contracting and selling price determination for a retailer. IEEE Trans. Power Syst. 2007, 22, 2105–2114. [Google Scholar] [CrossRef]

- Carrión, M.; Arroyo, J.M.; Conejo, A.J. A bilevel stochastic programming approach for retailer futures market trading. IEEE Trans. Power Syst. 2009, 24, 1446–1456. [Google Scholar] [CrossRef]

- Mahmoudi-Kohan, N.; Parsa Moghaddam, M.; Sheikh-El-Eslami, M.K. An annual framework for clustering-based pricing for an electricity retailer. Electr. Power Syst. Res. 2010, 80, 1042–1048. [Google Scholar] [CrossRef]

- Panapakidis, I.; Dagoumas, A. Day-ahead electricity price forecasting via the application of artificial neural network based models. Appl. Energy 2016, 172, 132–151. [Google Scholar] [CrossRef]

- Dagoumas, A.; Koltsaklis, N.; Panapakidis, I. An integrated model for risk management in electricity trade. Energy 2017, 124, 350–363. [Google Scholar] [CrossRef]

- Yousefi, S.; Moghaddam, M.P.; Majd, V.J. Optimal real time pricing in an agent-based retail market using a comprehensive demand response model. Energy 2011, 36, 5716–5727. [Google Scholar] [CrossRef]

- Dagoumas, A.; Polemis, M. An integrated model for assessing electricity retailer’s profitability with demand response. Appl. Energy 2017, 198, 49–64. [Google Scholar] [CrossRef]

- Wang, Y.; Chen, Q.; Kang, C.; Zhang, M.; Wang, K.; Zhao, Y. Load profiling and its application to demand response: A review. Tsinghua Sci. Technol. 2015, 20, 117–129. [Google Scholar] [CrossRef]

- Panapakidis, I.P.; Christoforidis, G.C.; Papagiannis, G.K. Modifications of the clustering validity indicators for the assessment of the load profiling procedure. In Proceedings of the 4th International Conference on Power Engineering, Energy and Electrical Drives (POWERENG2013), Istanbul, Turkey, 13–17 May 2013; pp. 1–6. [Google Scholar]

- Chicco, G.; Napoli, R.; Piglione, F. Comparisons among clustering techniques for electricity customer classification. IEEE Trans Power Syst. 2006, 21, 933–940. [Google Scholar] [CrossRef]

- Mori, H.; Yuihara, A. Deterministic annealing clustering for ANN-based short-term load forecasting. IEEE Trans. Power Syst. 2011, 16, 545–551. [Google Scholar] [CrossRef]

- Chicco, G.; Ilie, I.S. Support vector clustering of electrical load pattern data. IEEE Trans. Power Syst. 2009, 24, 1619–1628. [Google Scholar] [CrossRef]

- Chicco, G.; Akilimali, J.S. Renyi entropy-based classification of daily electrical load patterns. IET Gener. Trans. Distrib. 2010, 4, 736–745. [Google Scholar] [CrossRef]

- López, J.J.; Aguado, J.A.; Martín, F.; Munoz, F.; Rodríguez, A.; Ruiz, J.E. Hopfield–K-means clustering algorithm: A proposal for the segmentation of electricity customers. Electr. Power Syst. Res. 2011, 81, 716–722. [Google Scholar] [CrossRef]

- Zakaria, Z.; Lo, K.L.; Sohod, M.H. Application of fuzzy clustering to determine electricity consumers’ load profiles. In Proceedings of the First International Power and Energy Conference 2006, Putrajaya, Malaysia, 28–29 November 2006; pp. 99–103. [Google Scholar]

- Benabbas, F.; Khadir, M.T.; Fay, D.; Boughrira, A. Kohonen map combined to the K-means algorithm for the identification of day types of Algerian electricity load. In Proceedings of the 7th Computer Information Systems and Industrial Management Applications, Ostrava, Czech Republic, 26–28 June 2008; pp. 78–83. [Google Scholar]

- Binh, P.T.T.; Ha, N.H.; Tuan, T.C.; Khoa, L.D. Determination of representative load curve based on fuzzy K-means. In Proceedings of the 4th International Power Engineering and Optimization Conference, Shah Alam, Selangor, Malaysia, 23–24 June 2010; pp. 281–286. [Google Scholar]

- Panapakidis, I.P.; Alexiadis, M.C.; Papagiannis, G.K. Enhancing the clustering process in the category model load profiling. IET Gener. Trans. Distrib. 2015, 9, 655–665. [Google Scholar] [CrossRef]

- Lo, K.L.; Zakaria, Z.; Sohod, M.H. Determination of consumers’ load profiles based on two-stage fuzzy C-means. In Proceedings of the 5th WSEAS International Conference on Power Systems and Electromagnetic Compatibility, Corfu, Greece, 23–25 August 2005; pp. 212–217. [Google Scholar]

- Anuar, N.; Zakaria, Z. Electricity load profile determination by using Fuzzy C-Means and Probability Neural Network. Energy Procedia 2012, 14, 1861–1869. [Google Scholar] [CrossRef]

- Anuar, N.; Zakaria, Z. Determination of fuzziness parameter in load profiling via Fuzzy C-Means. In Proceedings of the 2011 IEEE Control and System Graduate Research Colloquium, Shah Alam, Malaysia, 27–28 June 2011; pp. 139–142. [Google Scholar]

- Gerbec, D.; Gasperic, S.; Smon, I.; Gubina, F. Allocation of the load profiles to consumers using probabilistic neural networks. IEEE Trans. Power Syst. 2005, 20, 548–555. [Google Scholar] [CrossRef]

- Chang, R.F.; Lu, C.N. Load profile assignment of low voltage customers for power retail market applications. IEE Gener. Trans. Distrib. 2003, 150, 263–267. [Google Scholar] [CrossRef]

- Marques, D.Z.; de Almeida, K.A.; de Deus, A.M.; da Silva Paulo, A.R.G.; da Silva Lima, W. A comparative analysis of neural and fuzzy cluster techniques applied to the characterization of electric load in substations. In Proceedings of the 2004 IEEE/PES Transmission and Distribution Conference and Exposition Latin America, Sao Paolo, Brazil, 8–11 November 2004; pp. 908–913. [Google Scholar]

- Prahastono, I.; King, D.J.; Ozveren, C.S.; Bradley, D. Electricity load profile classification using fuzzy C-means method. In Proceedings of the 43rd International Universities Power Engineering Conference, Padova, Italy, 1–4 September 2008; pp. 1–5. [Google Scholar]

- Gerbec, D.; Gasperic, S.; Smon, I.; Gubina, F. Determination and allocation of typical load profiles to the eligible consumers. In Proceedings of the 2003 IEEE PowerTech, Bologna, Italy, 21–26 June 2003; pp. 1–5. [Google Scholar]

- Gerbec, D.; Gasperic, S.; Smon, I.; Gubina, F. Consumers’ load profile determination based on different classification methods. In Proceedings of the 2003 IEEE Power Engineering Society General Meeting, Toronto, ON, Canada, 13–17 July 2003; pp. 990–995. [Google Scholar]

- Ferraro, P.; Crisostomi, E.; Tucci, M.; Raugi, M. Comparison and clustering analysis of the daily electrical load in eight European countries. Electr. Power Syst. Res. 2016, 14, 114–123. [Google Scholar] [CrossRef]

- De Oliveria, J.V.; Pedrycz, W. Advances in Fuzzy Clustering and Its Applications, 1st ed.; John Wiley & Sons: Chichester, UK, 2007; pp. 373–424. [Google Scholar]

- Sato-Ilic, M.; Jain, L.C. Innovations in Fuzzy Clustering: Theory and Applications, 1st ed.; Springer: Dordrecht, The Netherlands, 2006; pp. 105–117. [Google Scholar]

- Chuang, A.S.; Gellings, C.W. Demand-Side Integration in a Restructured Electric Power Industry; Electric Power Research Institute: Palo Alto, CA, USA, 2008. [Google Scholar]

- Kailas, A.; Cecchi, V.; Mukherjee, A. A Survey of communications and networking technologies for energy management in buildings and home automation. J. Comput. Netw. Commun. 2012, 2012, 932181. [Google Scholar] [CrossRef]

- Public Power Corporation SA. Available online: http://www.dei.gr (accessed on 13 September 2017).

- Regulatory Authority for Energy (RAE). 2012 National Report to the European Commission; Regulatory Authority for Energy (RAE): Athens, Greece, 2012. [Google Scholar]

- Lindberg, C.F.; Zahediana, K.; Solgia, M.; Lindkvist, R. Potential and limitations for industrial demand side management. Energy Procedia 2014, 61, 415–418. [Google Scholar] [CrossRef]

- Kramer, O. Genetic Algorithm Essentials, 1st ed.; Springer: Berlin, Germany, 2017; pp. 11–19. [Google Scholar]

- Khan, S.S.; Ahmad, A. Cluster center initialization algorithm for K-means clustering. Pattern Recogn. Lett. 2004, 25, 1293–1302. [Google Scholar] [CrossRef]

- Steinley, D. K-means clustering: A half-century synthesis. Br. J. Math. Stat. Psychol. 2006, 59, 1–34. [Google Scholar] [CrossRef] [PubMed]

- Xu, R.; Wunsch, D. Clustering, 1st ed.; John Wiley & Sons Inc.: Hoboken, NJ, USA, 2006; pp. 63–109. [Google Scholar]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Panapakidis, I.; Asimopoulos, N.; Dagoumas, A.; Christoforidis, G.C. An Improved Fuzzy C-Means Algorithm for the Implementation of Demand Side Management Measures. Energies 2017, 10, 1407. https://doi.org/10.3390/en10091407

Panapakidis I, Asimopoulos N, Dagoumas A, Christoforidis GC. An Improved Fuzzy C-Means Algorithm for the Implementation of Demand Side Management Measures. Energies. 2017; 10(9):1407. https://doi.org/10.3390/en10091407

Chicago/Turabian StylePanapakidis, Ioannis, Nikolaos Asimopoulos, Athanasios Dagoumas, and Georgios C. Christoforidis. 2017. "An Improved Fuzzy C-Means Algorithm for the Implementation of Demand Side Management Measures" Energies 10, no. 9: 1407. https://doi.org/10.3390/en10091407

APA StylePanapakidis, I., Asimopoulos, N., Dagoumas, A., & Christoforidis, G. C. (2017). An Improved Fuzzy C-Means Algorithm for the Implementation of Demand Side Management Measures. Energies, 10(9), 1407. https://doi.org/10.3390/en10091407