1. Introduction

Addressing climate change and promoting low-carbon development are the two key goals of energy policy in China. In an effort to join international action to address climate change at a national level, the Chinese government has set the ambitious target of cutting CO

2 emissions per unit of GDP by 60–65% of the 2005 level by the year 2030. This target has been submitted to the United Nations Framework Convention on Climate Change (UNFCCC) via the Intended Nationally Determined Contribution (INDC). China has also announced its intention for 20% of total energy consumption to be derived from non-fossil sources by 2030, in order to promote renewable energy development. As of now, the primary tools to meet these two targets are emissions trading schemes (ETS) and renewable energy source (RES) policies [

1,

2]. Being the most important instrument for emissions reduction, the ETS was first implemented in seven pilots at provincial and city levels in China, and a nationwide carbon market is to be launched in late 2017. Besides its main intention of emissions reduction, the nationwide carbon market is also intended to transfer wealth across regions, thereby promoting economic development in central and western China. The market-based mechanism of the ETS provides an opportunity for the central and western regions to benefit from quota sales. These regions are less developed but they are rich in natural resources, and thereby these regions have lower marginal abatement costs than eastern regions. By reducing emissions in low abatement costs and selling the excessive quotas in a higher carbon price to eastern regions in the ETS, the central and western regions would obtain trading revenues from eastern regions, causing wealth transfer across regions. Thus, the design of nationwide carbon market to include quota allocation and cap setting is essential to policy makers in China. Prior to the ETS, the RES policy was adopted in 2006 in the form of feed-in tariffs (FITs) for renewable energy power generation, with the goal of developing renewable energy in China.

The European Union’s emissions trading scheme (EU ETS) demonstrated that its impacts on renewables and demand-side energy savings are limited, and it may not provide sufficient incentives for technology innovation. The EU experience teaches that it is necessary to have a specific renewable target in addition to an ETS system [

3,

4,

5]. This is of great significance to the climate change strategy in China.

The design efforts for the nationwide carbon market are currently underway. However, the multiple INDC targets and policy instruments create uncertainty regarding the impacts of the ETS. This uncertainty creates a challenge for the design process. Due to the overlapping sectoral coverage of these policies, the policy objectives are interrelated and there is interaction between policy instruments [

6]. The coexisting multiple policy instruments may have a synergistic effect; for example, the RES policy promotes the substitution of fossil fuels by renewable energy and reduces CO

2 emissions while increasing the supply of renewable energy [

7,

8,

9,

10]. However, the mixed policies may also have conflicts and even lead to the failure of some policy instruments and, in turn, increase the social costs of policy implementation. Experience from the EU ETS demonstrated that the implementation of a RES policy adjusting resulted in additional CO

2 emissions reduction and decreased the demand for CO

2 permits. These effects were not considered in the EU ETS design and, thus, led to an unexpectedly low carbon price [

11,

12,

13,

14].

The EU ETS experience has sparked intense debates about the overlap between ETS and RES policies. Fischer and Preonas [

15] suggested that the effects of RES policy on the ETS should be acknowledged; the RES policy makes it easier to meet the emissions cap and drive down carbon prices to the benefit of the relatively dirty sources. Koch et al. [

16] conducted an empirical analysis of Phase II and the first year of Phase III of the EU ETS. They found that the coexistence of EU ETS and RES deployment targets work at cross-purposes in deed. But it could, together with the economic recession and the use of international credits, only explain 10% of the variations of the EU Allowances (EUAs) price changes. Using Spain as a case study, Del Rio [

17] found that the combination of the ETS and FITs generally leads to higher consumer costs. He also suggested that renewable energy targets should be considered when deciding on the quantities of EUAs to be allocated.

Some scholars explore the possibility of achieving the multiple climate goals by a single ETS or RES policy, as opposed to a combination of the two, through a long-term simulation. Anandarajah and Strachan [

18] analyzed the effects of renewable policy on the UK’s 2020 and 2050 emissions reduction targets. They found that, although renewable policies can reduce emissions, such policies alone cannot meet the long-term 2050 CO

2 mitigation target. Likewise, the long-term emissions reduction policy cannot meet the UK’s renewable targets without concurrent renewable policies. Linares et al.’s [

19] analysis of the EU example also supported the notation that both ETS and RES policies are required to meet the emissions reduction and renewable energy targets.

Other analyses focus on the policy design and consider the interaction of mixed policies. Fais et al. [

20] asserted that the German FITs will cause a reduction in EU ETS certificate prices by 1.9 E/tCO

2 to 6.1 E/tCO

2 between 2015 and 2030. They further suggested that the impact of RES policy on emission mitigation should be considered when defining the long-term ETS targets, to avoid weakening the CO

2 price signal. Some studies applied the partial or computable general equilibrium model to evaluate the socio-economic impacts of the ETS or the combination of ETS and RES policies, as seen in Fujimori et al. [

21,

22], Zhang et al. [

23], Hübler et al. [

24], Morris [

25], Böhringer and Behrens [

26], and Del Rio [

27]. Cheng et al. [

28], Wang et al. [

29], and Wu et al. [

30] each assessed the ETS in Guangdong and Shanghai from a regional perspective, using a two-region CGE model. Brink et al. [

31] evaluated various options to support CO

2 prices in the EU ETS using a CGE model. They suggested that, while a tighter cap increases the EUA price under various economic growth assumptions, a fixed or variable CO

2 tax and an auction reserve price are better in guaranteeing a floor in the effective CO

2 price.

The ETS pilots in China showed that the over-allocation risk of emissions permits is one of the challenges for a carbon market, which will lead to low carbon price and reduce the efficiency of market [

32]. Therefore, it is extremely important to design a nationwide carbon market under the full consideration of the possible interaction between the ETS and RES policies. Lin et al. [

33] discussed how ETS and FIT policies harmonize in China. However, their discussion lacks a quantitative analysis on ETS and RES policy interaction. Mittal et al. [

34] quantified the impacts of renewable energy on emissions reduction targets and mitigation costs in China using the Asian-Pacific Integrated Model/Computable General Equilibrium (AIM/CGE) model, but their study did not address the ETS policy.

In the present paper, we analyze the interactions between ETS and RES policies in China using a multi-regional CGE model, which is able to capture the economy-wide impacts. Focusing on the design of the nationwide carbon market, we analyze a FIT in combination with an ETS to determine the national- and regional-level impacts on the carbon market, the social costs, and the electricity industry.

The paper is organized as follows:

Section 2 describes the CGE model used and how ETS and RES policies are implemented in this model.

Section 3 presents the data and policy scenarios.

Section 4 explores the effects of an ETS alone and an ETS in combination with an RES, and

Section 5 further discusses the two sensitivity analyses.

Section 6 presents the conclusions.

2. Methodology

The quantitative analysis is based on the CEEP Multi-Regional Energy-Environment-Economy Modelling System (CE

3MS) that was mainly used in climate mitigation and impact analysis [

35,

36,

37]. The CE

3MS classifies 30 regions in mainland China (excluding Tibet due to a lack of data) and 17 industrial classifications in each region, including one agricultural, five energy, seven non-energy, and four service sectors (shown in

Table 1).

2.1. Basic Structure of CE3MS

Two kinds of regions constitute the CE

3MS: 30 Chinese economic regions and one representing the rest of the world (ROW). The model accounts for economic activities including production, consumption, investment, export and import, inter-regional commodity trading, and factor mobility. Wu et al. [

36] provide the mathematical formulas for these economic activities. There are six modules in CE

3MS: production, emissions trading, commodity trading, institution, labor and capital mobility, and macro closure.

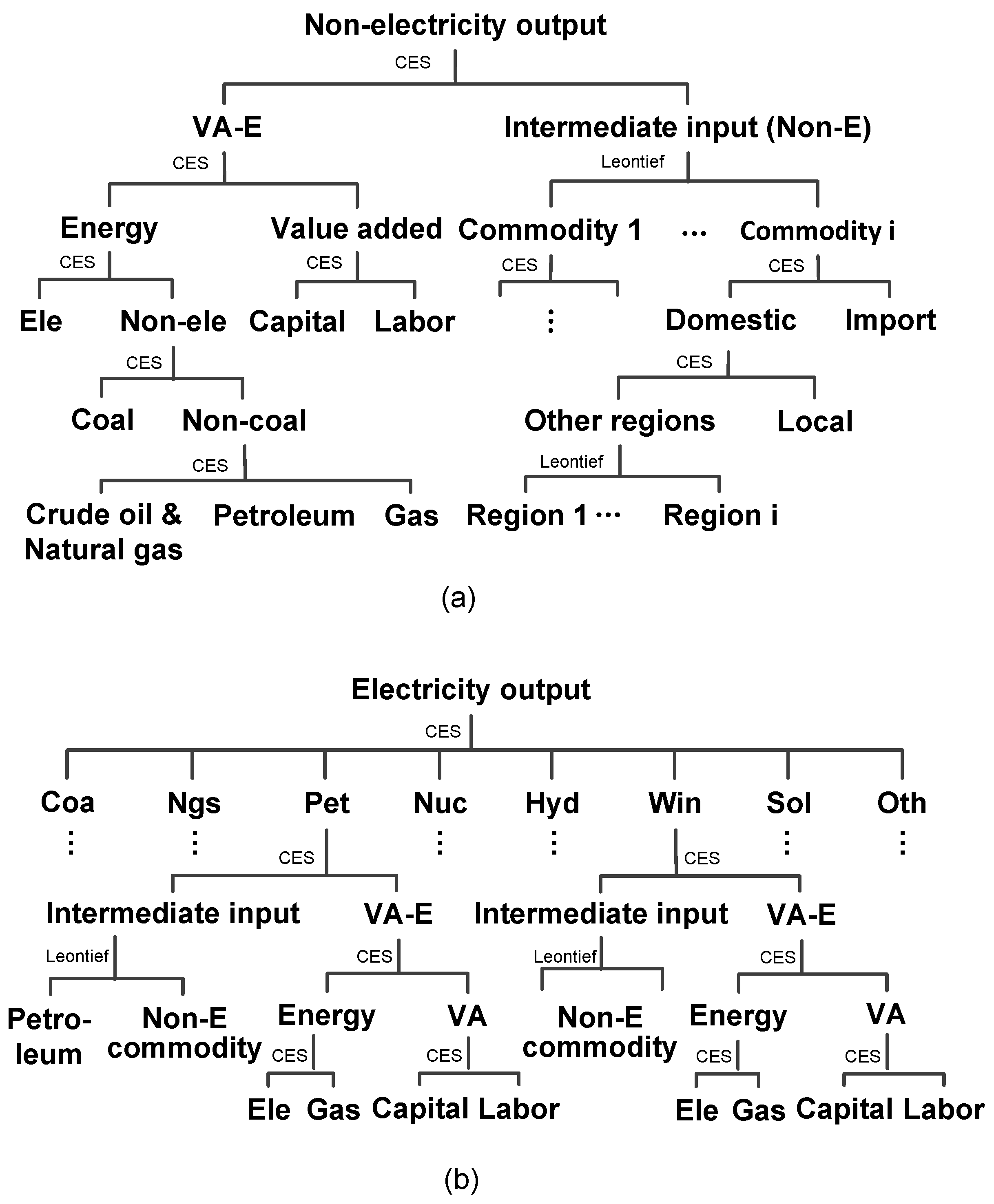

The production module describes the production activities of different sectors under the assumption of cost minimization. A nested structure of the constant elasticity substitution (CES) function is adopted to formulate the production structure. For non-electricity sectors, the output is composed of non-energy intermediate inputs and the capital-labor-energy inputs (

Figure 1a).

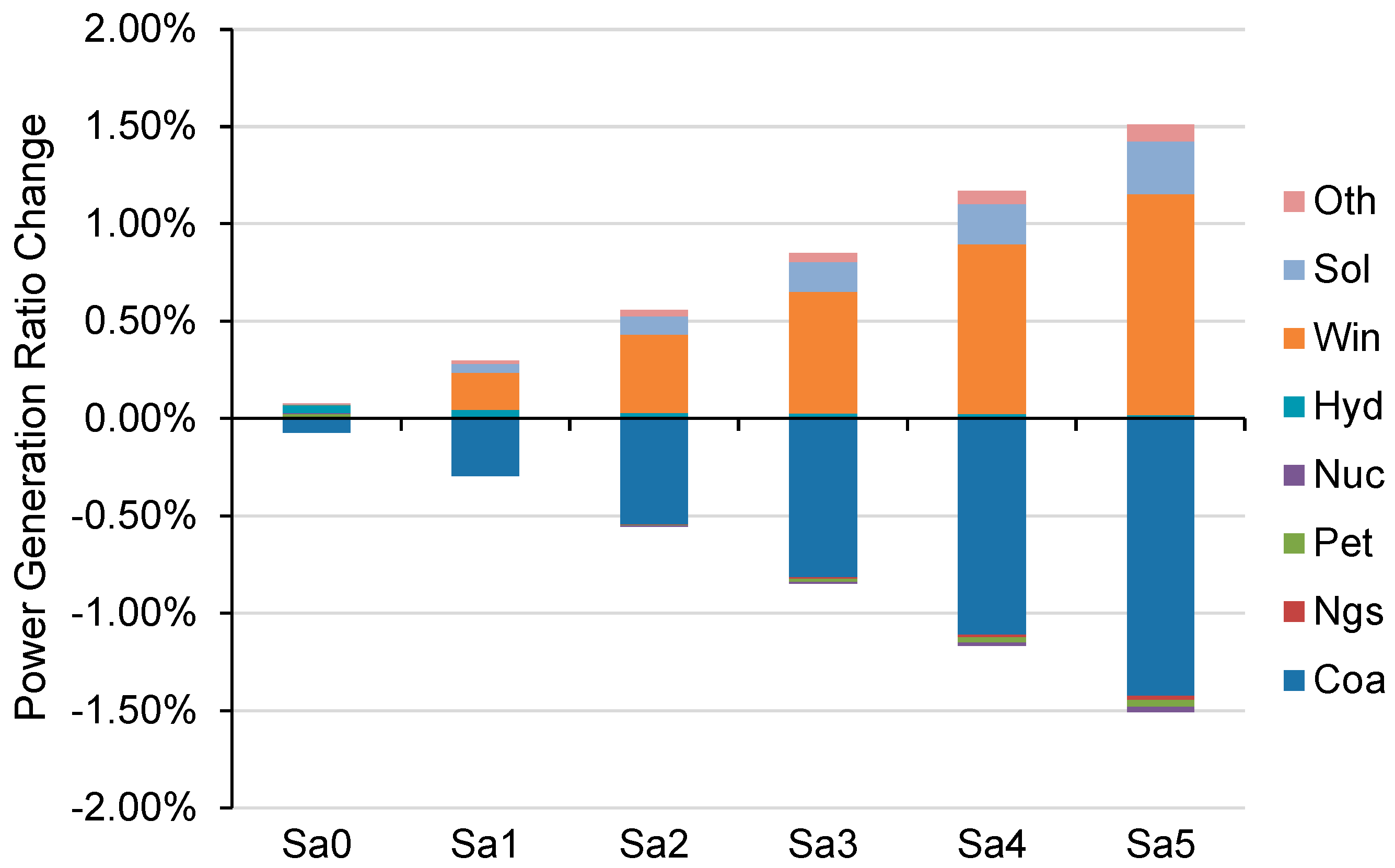

It is important that the industrial classification of the power generation sector is disaggregated in detail, as technological description is crucial for the RES policy implementation in this study. For that reason, the electric power generation is represented by eight technologies in CE

3MS: coal power (

Coa), natural gas power (

Ngs), petroleum power (

Pet), nuclear power (

Nuc), hydropower (

Hyd), wind power (

Win), solar power (

Sol), and other renewable technologies (

Oth), as well as their technological and cost parameters in the CES functions.

Figure 1b represents the nested CES structure of electricity production. Particularly, the input of coal, crude oil, and natural gas are considered as intermediate inputs which could not be substituted by other energy as raw materials in the coal-powered (

Coa), natural gas-powered (

Ngs), and petroleum-powered (

Pet) generation.

In the commodity trading module, consisting of domestic trade and international trade, the Armington assumption is adopted to describe the imperfect substitutions between domestic commodities (including local commodities and commodities from other regions in China) and import from the ROW. The distribution of domestically produced commodities between exports and domestic sales is expressed by the constant elasticity transformation (CET) function. The “small country” assumption is adopted in international trade, where we assume that the export and import prices of commodities will not be affected by their supply and demand in China.

The institution module describes the economic activities of institutions—income, expenditure, and savings—including rural and urban households, the representative enterprise, regional governments, and the central government. Both households and regional governments have commodity consumption and the utility functions of households and local governments are assumed as Cobb-Douglas functions in this model.

In the labor and capital mobility module, labor and capital are assumed to transfer across sectors and regions based on the changes in relative wage and returns on capital. In the macroeconomic balance, the “neoclassical closure” is introduced that investment is determined by the sum of households, government, and foreign savings in CE3MS.

As the ETS and RES policies are focused in this study, we summarize the key aspects in ETS and RES policy modelling in the

Section 2.2,

Section 2.3 and

Section 2.4.

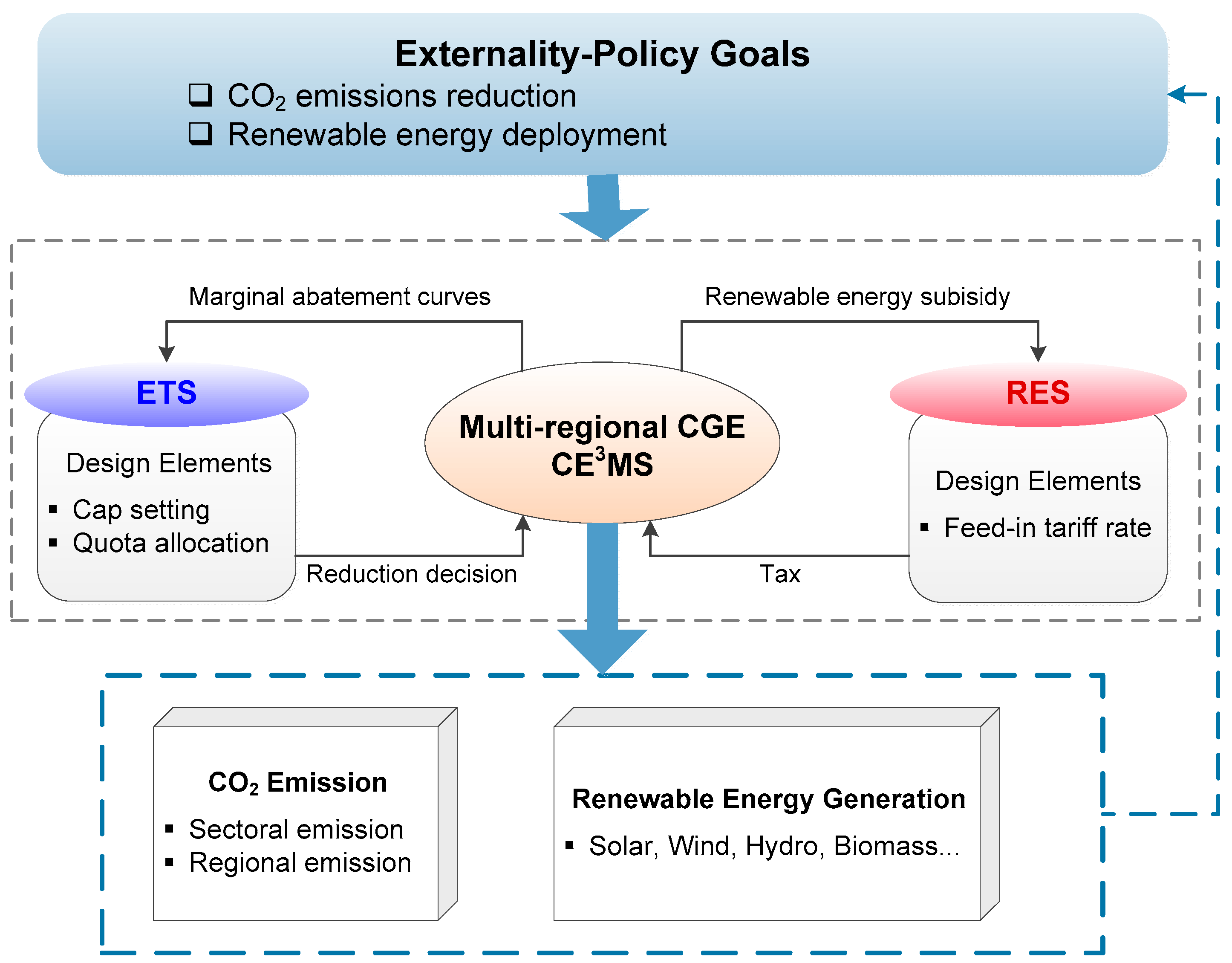

Figure 2 presents the framework for combining ETS and RES policies in CE

3MS.

2.2. Description of the INDC Targets in CE3MS

As CE

3MS is a static model, one of the problems we encounter in this analysis is how to deal with the long-term mitigation targets in a static model. Rather than making the model dynamic in a recursive dynamic manner as many literatures [

21,

22,

28,

29,

30], we choose a simple way to decompose the long-term target into a single-year target which could be modeled in a static model. The main reason is that it is difficult to decide the growth of related parameters across different regions making a multi-regional model dynamic, including capital stock, labor force, energy efficiency improvement, and the total factor productivity in different regions. Based on the projection of CO

2 intensity reduction and renewable energy generation from International Energy Agency (IEA) and other literatures [

38,

39,

40], we convert the INDC targets into single-year targets.

The emissions reduction target of 65% in the INDC is adopted in this analysis, and we simply assume that CO

2 intensity is anticipated to decrease at an annual rate in China for the 2007–2030 period. According to the historic CO

2 intensity data during 2005–2010 from International Energy Agency and an assumed CO

2 intensity reduction induced by autonomous energy efficiency improvement (AEEI) without any mitigation policies during 2010–2030 from Zhang et al. [

38], it is calculated that an additional 20.52% decrease in CO

2 intensity between 2007 and 2030 is needed to achieve the INDC target (

Table 2). Therefore, we adopt an annual rate of 0.99% under the assumption of a linear decrease in CO

2 intensity. In the base case, the total CO

2 emissions are 6381.30 Mt in year 2007. For simplicity, we count the 0.99% of 6381.30 Mt, 63.17 Mt, as the quantity target for emissions reduction in this study.

To achieve the RES target of 20% in INDC, the share of renewable energy generation including wind power (

Win), solar power (

Sol), and other renewable technologies (

Oth) in the total power generation should be 15.5% by 2030 according to China Energy Research Society [

40]. The initial renewable energy ratio in total electricity generation in the base case is about 14.95%. Therefore, the need to install additional renewable capacity to meet a renewable generation target is 15.17% in total. We assume the same growth of renewable energy generation proportion for the 2007–2030 period, and thereby derive the single-year growth of 0.66%.

2.3. Modelling Approach for ETS

The ETS modelling in the CGE model is usually handled by implementing an endogenous carbon tax or treating allowance as a special input factor [

21,

22,

23,

24,

28,

29,

30,

42,

43,

44,

45,

46]. Although the impacts of implementing an ETS or an endogenous carbon tax on economies are the same theoretically, emissions trading is a decision optimization process for each trader under the principle of cost minimization. The scholarly discourse on ETS is lacking in this kind of description in ETS. To improve the characterization of ETS policy, an optimization modelling approach has been developed in CE

3MS so as to reflect the decision-making process of emissions traders and the formation of equilibrium carbon price (Equations (1) and (2)):

denotes the total costs related to emissions reduction of the trading sector tj in region r. is the abatement cost function which is derived from the marginal abatement cost curves. and are the emissions in the base case and real emissions under the ETS policy, respectively. is the equilibrium CO2 price, and is the initial emission quota.

In this optimization model, each trading sector decides on emission reductions by comparing its marginal abatement costs with the CO

2 price to minimize total abatement costs. Comprehensive data on sectoral marginal abatement costs in each region are required to implement this optimization approach. The marginal abatement cost curves used in this analysis are estimated by applying a unified carbon tax in CE

3MS. The detailed results are provided by Fan et al. [

37]. Eight sectors—five energy (

Coal,

Coil,

Petro,

Ele,

Gas) and three energy-intensive (

Chem,

Nmm,

Metal)—are considered as emissions traders.

With regard to the quota allocation in the ETS design, all quotas are allocated by Grandfathering, which means that the quotas are allocated to sectors in regions according to the sectoral historic emissions (emissions in the base case year 2007 in this study).

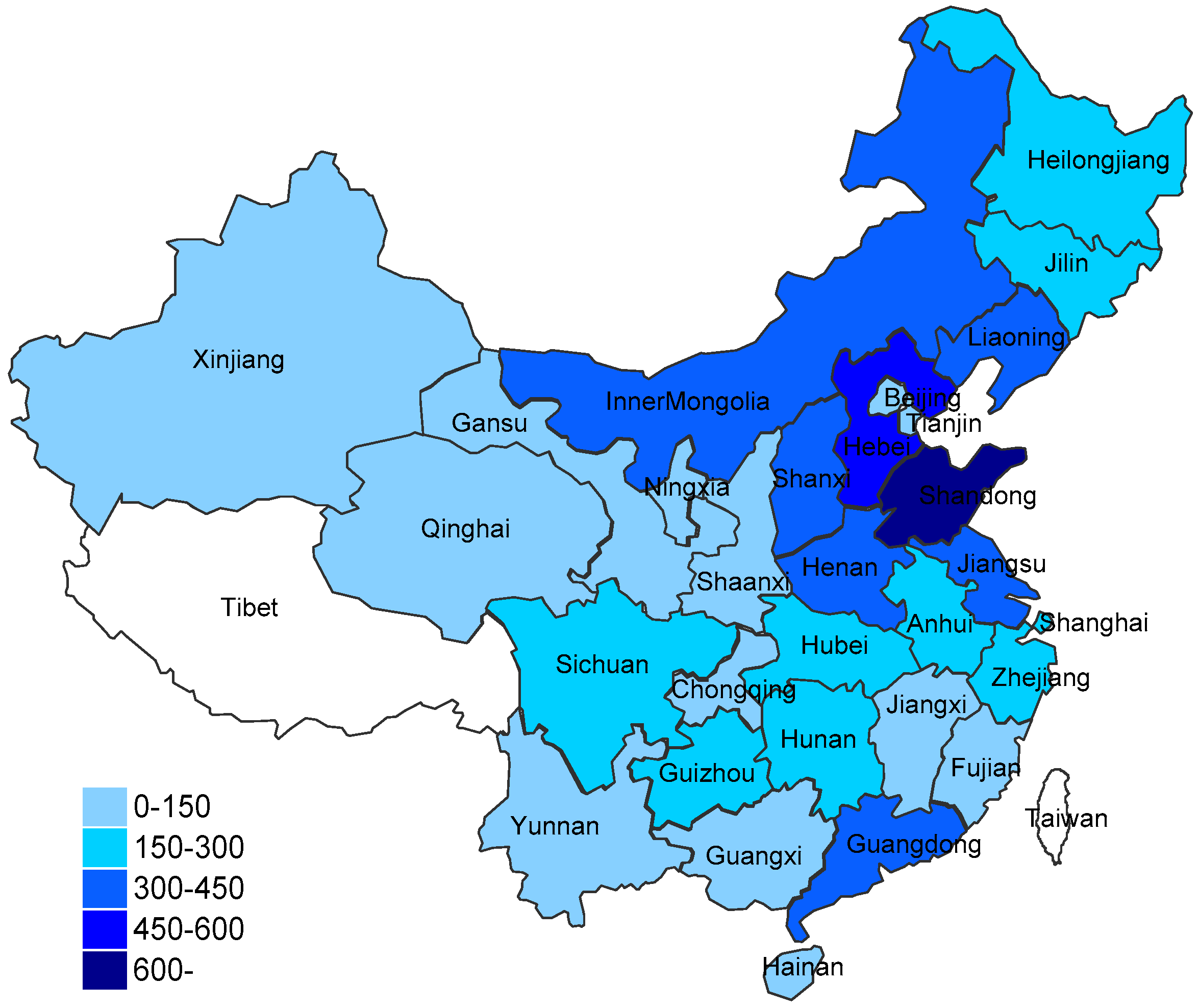

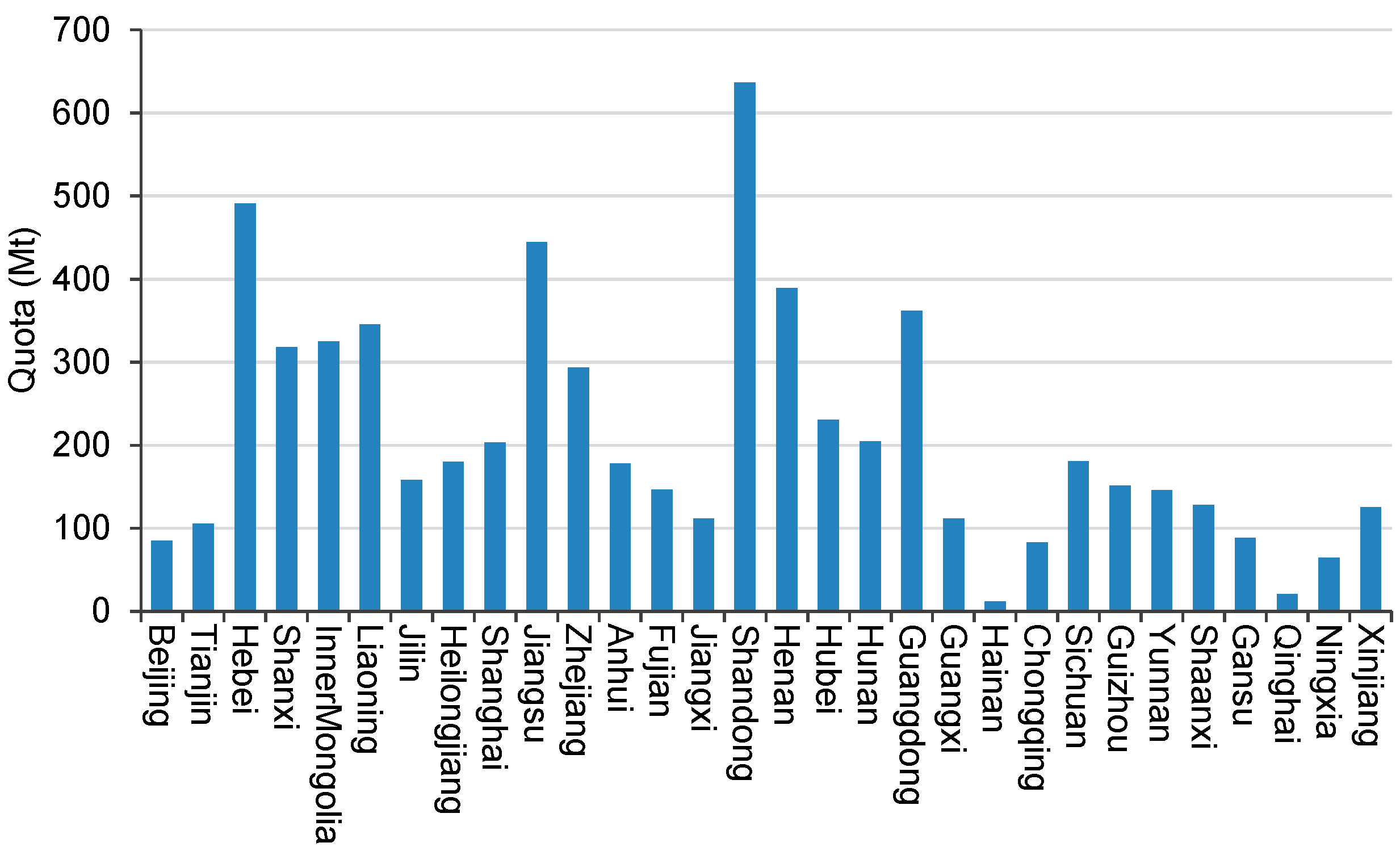

Figure 3 shows the regional CO

2 emissions in the base case, and

Figure 4 shows the allocation of quotas across regions. A hybrid allocation method is adopted: free allocation for energy sectors and full auction for energy-intensive sectors. A perfect auction, where the quota’s auction price is equal to the CO

2 price in carbon market, is assumed for energy-intensive sectors. A fixed proportion of auction revenues are returned to households while the rest are used for local government savings.

2.4. Modelling Approach for RES

As the total electricity output is composed of eight power generation technologies by a CES function in CE

3MS, the changes in relative generation costs will cause substitutions of different technologies. Regarding the generation side, a fixed tariff in the form of subsidy is introduced into the renewable power generation process for each unit of electricity generated. The subsidies lower the cost of renewable generation and, thus, cause the substitution of renewable energy for fossil energy. With reference to Paltsev et al. [

47] and Sue Wing [

48], the substitution elasticity of different generation technologies in the CES function of total electricity output is set to 2 in this analysis. Regarding the electricity demand side, the renewable generation subsidy costs are eventually passed to consumers (including households, regional government, and production sectors which use electricity as intermediate input) via a tax on electricity consumption. The tax rate of electricity consumption is endogenously adjusted in order to meet the required total renewable energy subsidies. In this way, the burden of renewable subsidies is shifted from electricity producers to electricity consumers.

3. Data and Scenarios

The CE

3MS database derives from the China 2007 regional social accounting matrices (SAMs). The following scenarios are adopted to assess the impact of RES policy on ETS policy (

Table 3). Due to the limitation of a static model, we simply use the quantity target calculated in

Section 2.2 (63.17 Mt) as the emissions reduction target in this study. For the benchmark scenario, there is no ETS policy or RES policy. A nationwide carbon market is assumed to be in place under scenarios Sa0 to Sa5, and the CO

2 price is adjusted endogenously until the emissions reduction target is achieved. The RES policy is adopted under scenarios Sa1 to Sa5, with a RES production subsidy rate ranging from 20 to 100%, which means that 20 to 100% of the renewable power generation costs (i.e., production costs of renewable technologies) would be subsidized. Considering that hydropower has the lowest generation cost and high competitiveness compared with other renewable energy technologies in China, it is not included in the RES policy in this study. Due to the interaction of RES policy and ETS policy on CO

2 emissions, the CO

2 price on the carbon market will be adjusted to a new level to meet the emissions reduction target when a RES policy is in place.

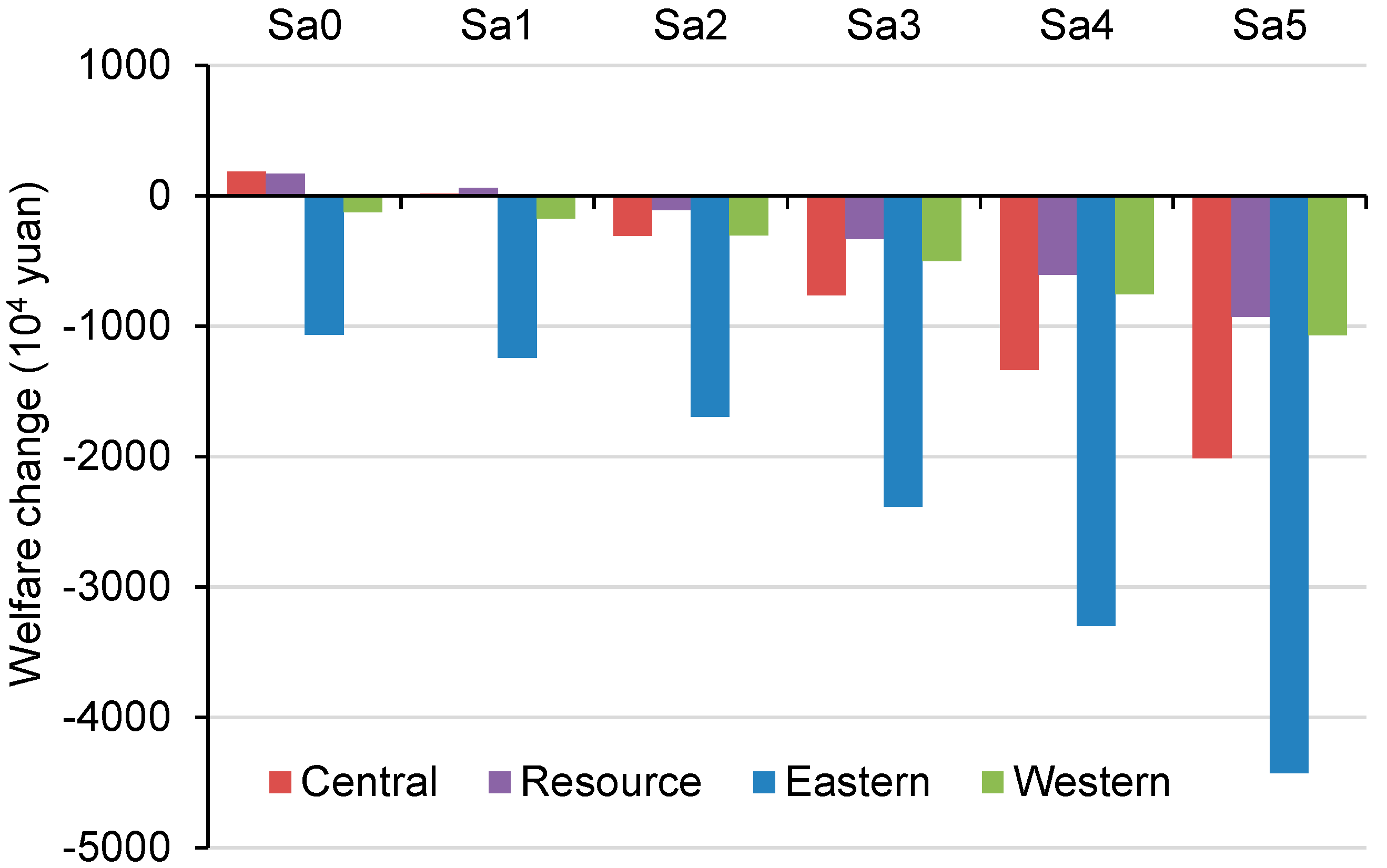

For simplicity of presenting the results, the 30 regions are classified into three areas—eastern, central, and western regions—based on the regional divisions used by the National Bureau of Statistics of China. In addition, six regions (Shanxi, Inner Mongolia, Heilongjiang, Sichuan, Shaanxi, and Xinjiang) are further regarded as resource regions, given that they are rich in coal, crude oil, and natural gas.

Table 4 shows the classification of regions.

6. Conclusions and Discussion

An emissions trading scheme and renewable energy policies have been considered as two important market-based instruments for CO2 abatement in China. Since it is expected that a nationwide carbon market will be implemented in late 2017, the interaction between RES and ETS policies is a central issue for the design of China’s nationwide carbon market. Therefore, this paper explored the interaction between the two policies via a multi-regional CGE framework and captured the full economy-wide impacts of such policy interaction.

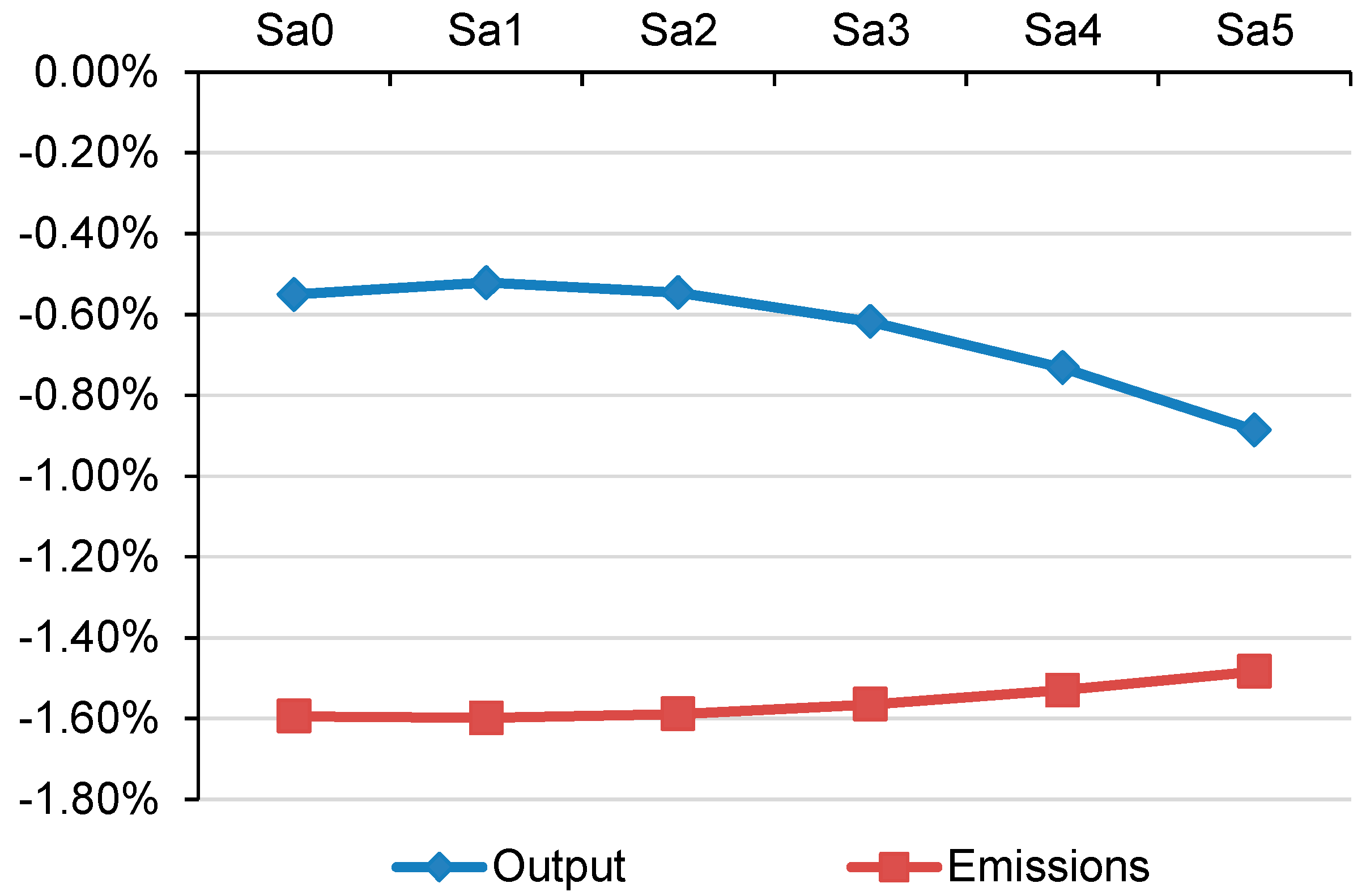

We simulated six policy scenarios for the implementation of ETS and RES policies: a nationwide carbon market alone, to reduce carbon intensity by 65% below the 2005 level by 2030; and five scenarios for the cap, combined with a FIT subsidy ranging from 20 to 100%, to achieve both the 65% reduction in carbon intensity and a 20% share of non-fossil sources in total energy consumption by 2030. Several conclusions emerged.

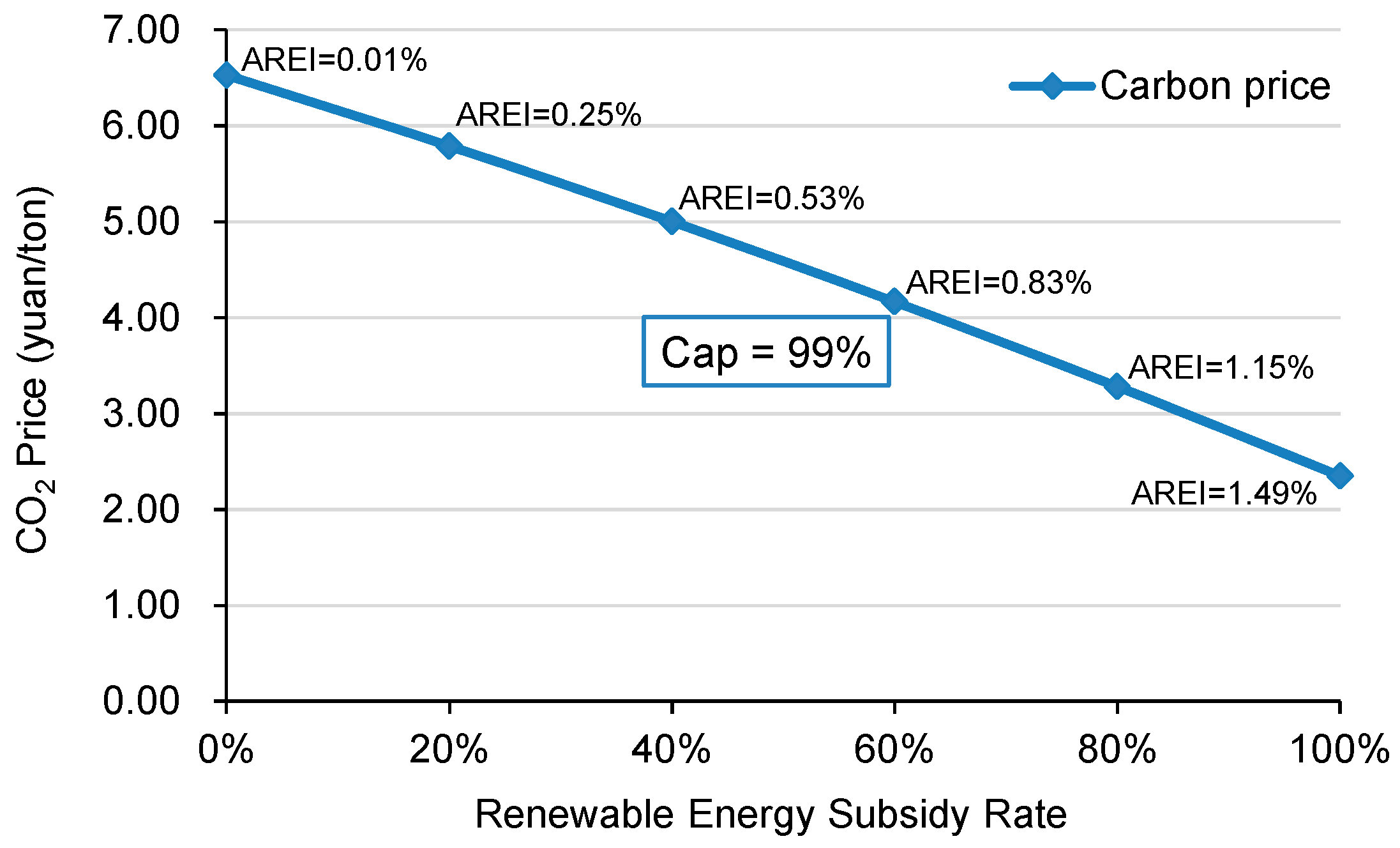

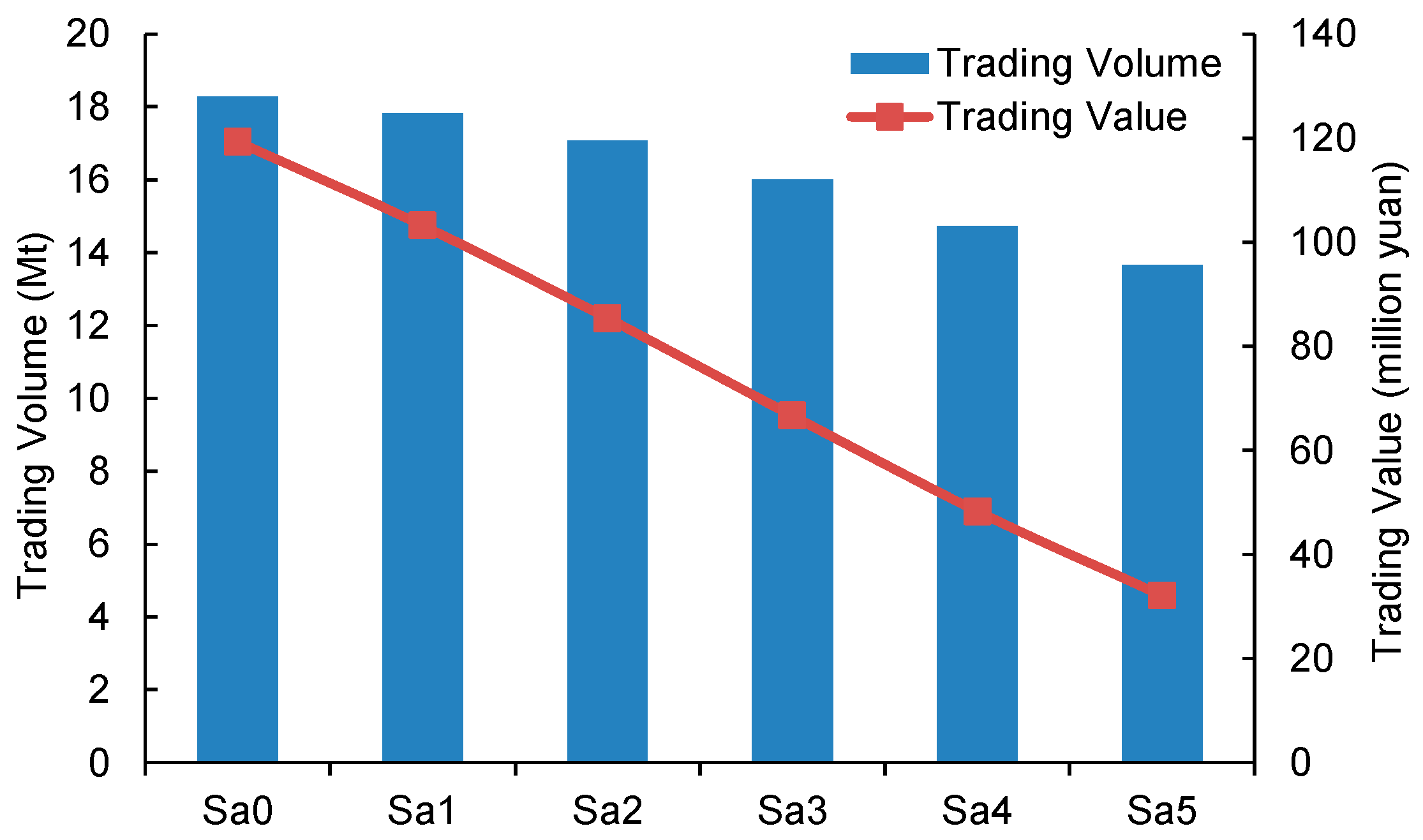

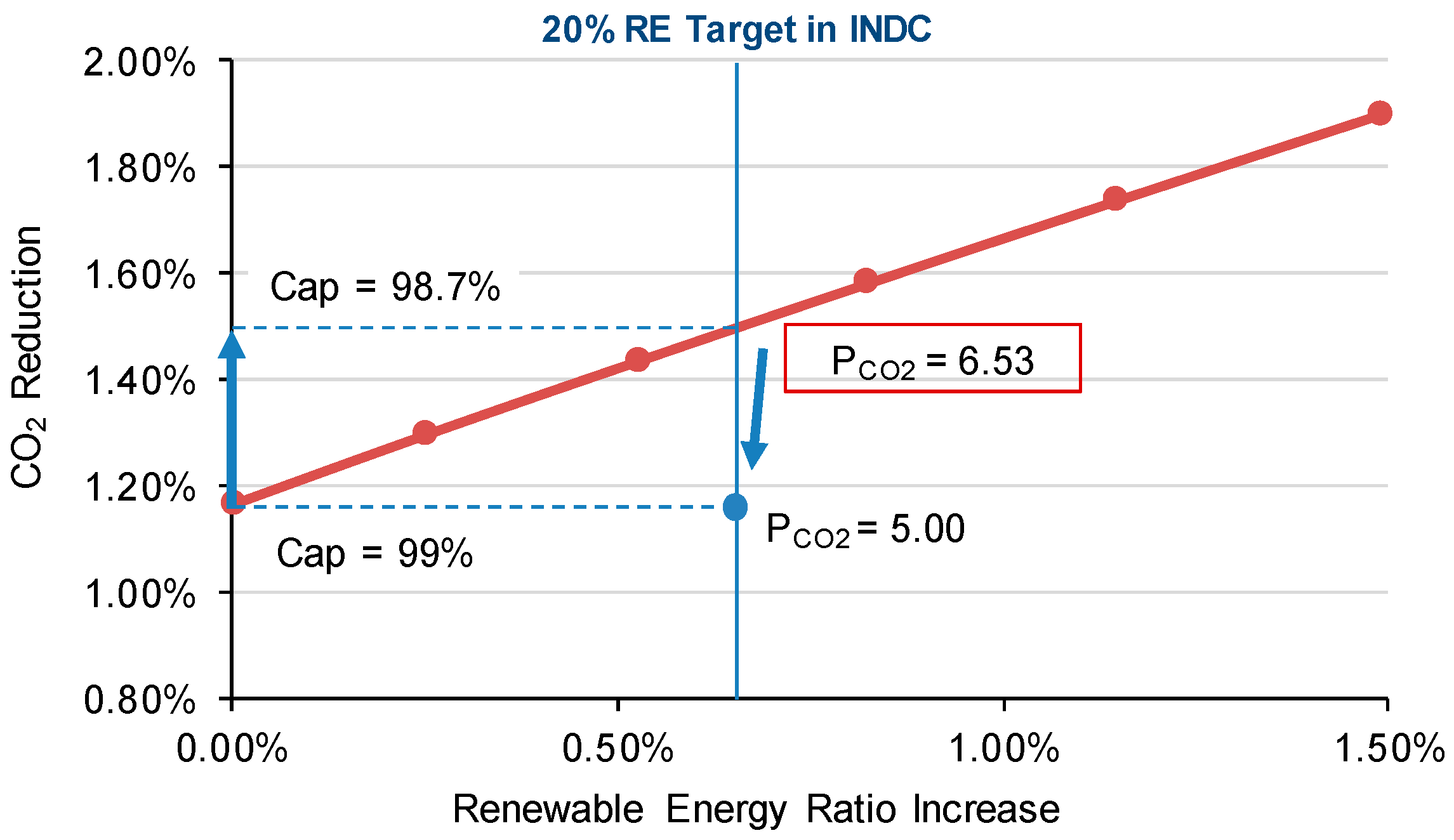

Firstly, the annual ETS emissions cap in China should decrease by 0.3% to maintain a stable CO2 price and achieve the INDC targets. The results show that CO2 price on the nationwide carbon market would decrease between 11% and 64% with increasing a renewable energy subsidy, thereby disincentivizing the carbon market for low-carbon investment. The total trading volume is predicted to decrease between 3% and 25%.

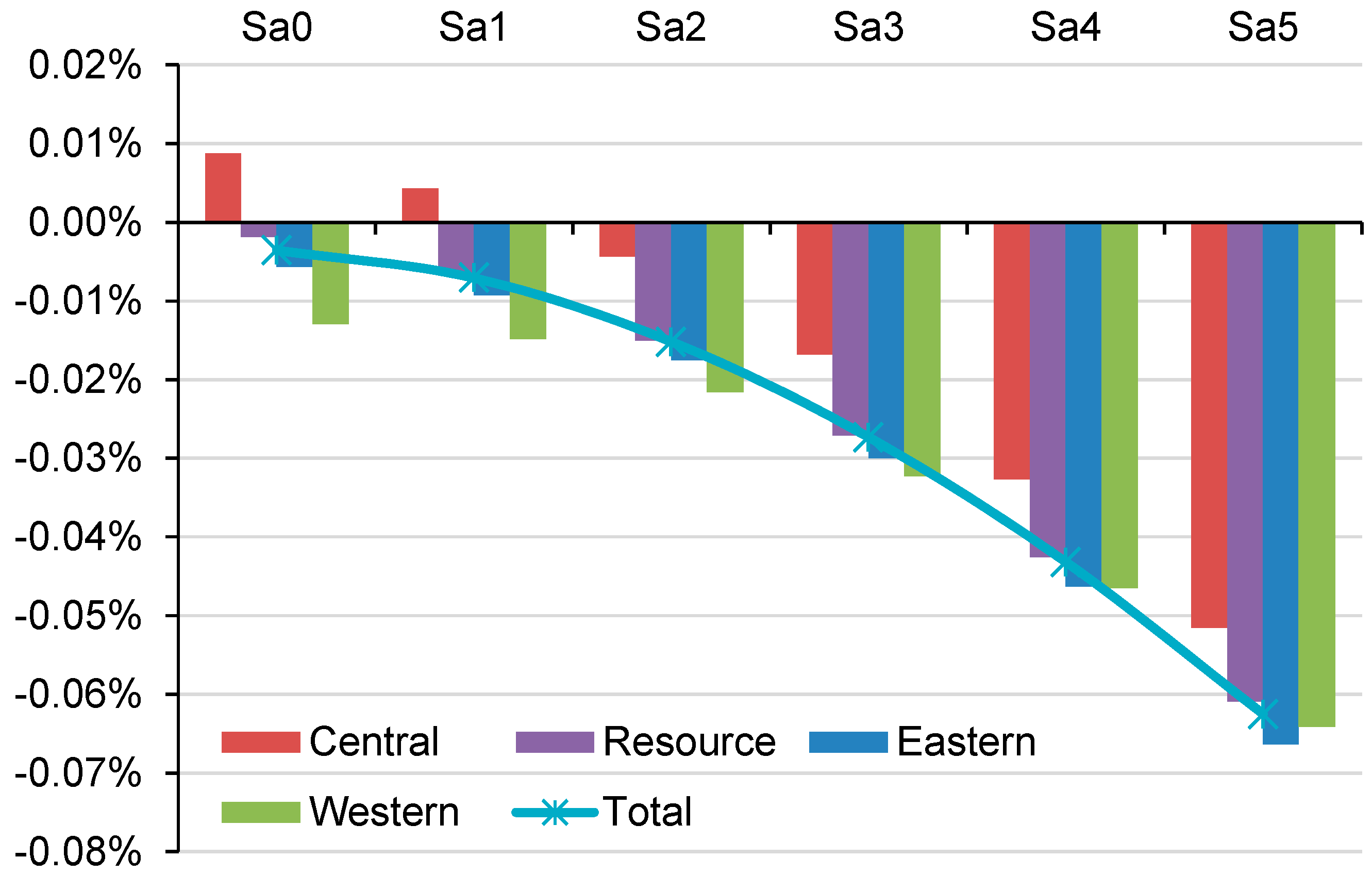

Secondly, adding a FIT to an ETS imposes additional GDP costs and welfare losses in all regions, thereby increasing the cost of the policy by 0.01 to 0.06%. Eastern regions, which have higher abatement costs and lower potential for developing renewable energy, face more significant social costs under the combined ETS and RES policies than with ETS alone.

Lastly, the electricity industry faces a decline in total output. However it experiences lower reduction of CO2 emissions under the combination of ETS and RES policies than with ETS alone. This highlights another issue; the renewable subsidy reduces the shadow cost of CO2 emissions and may stimulate emissions by the most energy-intensive technologies.

The interpretation of the findings in this analysis is limited due to the use of a static model, which thereby could not provide numerical results in each year for the 2007–2030 period. For example, the relation between CO

2 price and the renewable energy subsidy rate in

Figure 5 are approximately linear as it only presents the result for one year. In addition, as the changes in CO

2 intensity and renewable energy generation are assumed to be linear, our numerical results are not sufficient to show the accurate annual changes in economic variables such as CO

2 price, GDP growth and capital stock. However, this will not change our qualitative conclusions for the interactions between ETS and RES policies.

As the implementation of the nationwide carbon market is imminent, policymakers should not ignore the economic impacts of the overlap between ETS and RES policies in China. A tighter emissions cap could be considered to achieve the targets both for emissions reduction and renewable energy development in the INDC, while guaranteeing an effective CO

2 price to maintain the advantages of the ETS in investment incentives for low-carbon technologies. The adjustment of cap depends on various assumptions and, thus, it will be difficult to determine the appropriate adjustment rate. A carbon price floor to the ETS, instead, may play a better role in guaranteeing a minimum CO

2 price level, irrespective of the economic circumstances or impact of overlapping policies [

31,

51]. The option of carbon price floor is not discussed in this study and therefore remains to be investigated in further studies.