An Economical Evaluation of Anaerobic Digestion Plants Fed with Organic Agro-Industrial Waste

Abstract

:1. Introduction

2. Materials and Methods

2.1. Feeding Practice and Technical Parameters of Co-Digestion Systems

2.2. Economic Parameters and Economic Simulation Model

- -

- The cost categories and costs selected for setting up the business plan were divided into the ordinary costs for plant management and the financial costs for reimbursing the investment;

- -

- The cost structure contained in the business plan followed the model proposed by the Authorities for Electricity Gas and Water System (AEEG) [20];

- -

- The assumptions and the values adopted for the simulation were derived from the cost model for biogas production plants of the AEEG National Authority [20].

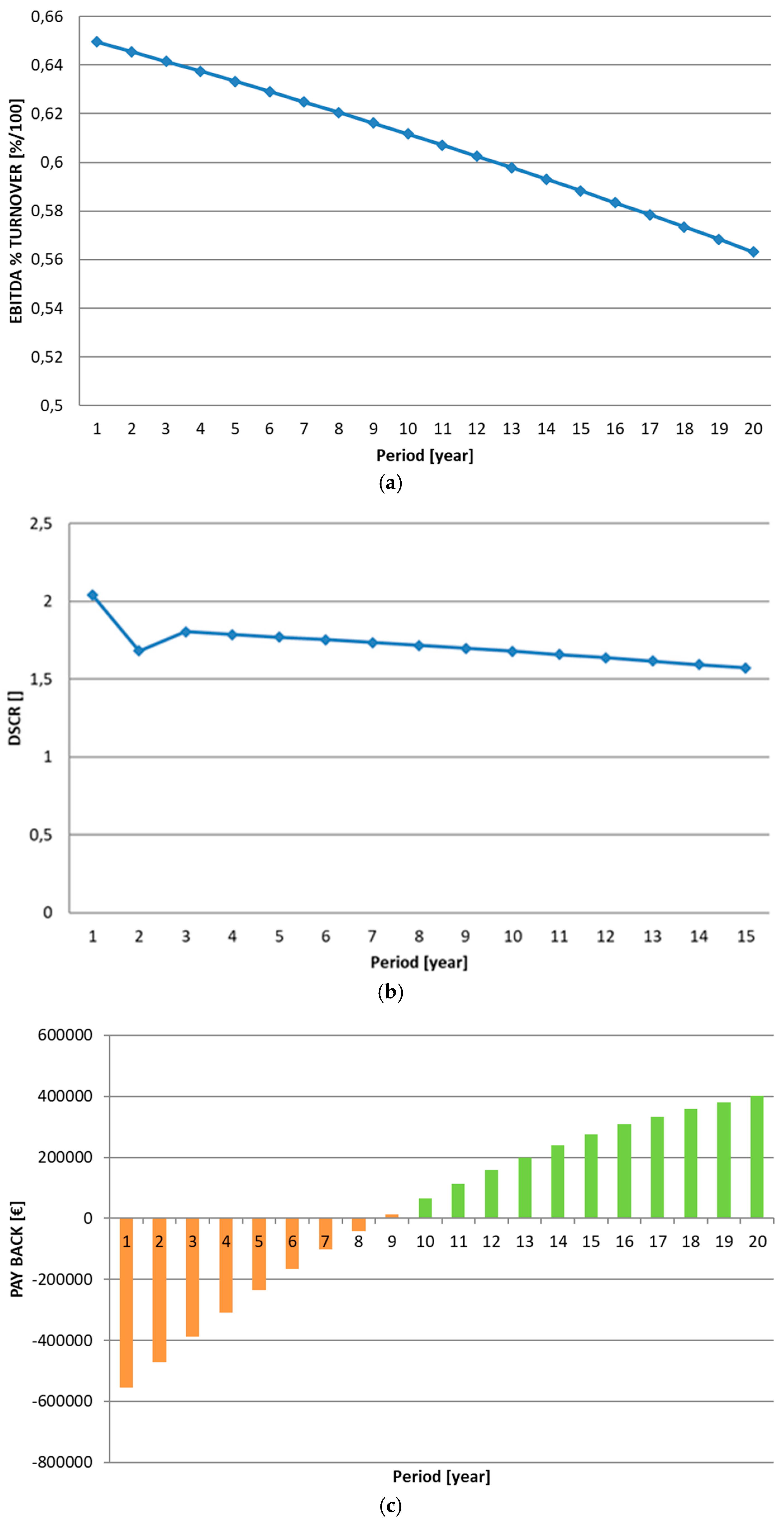

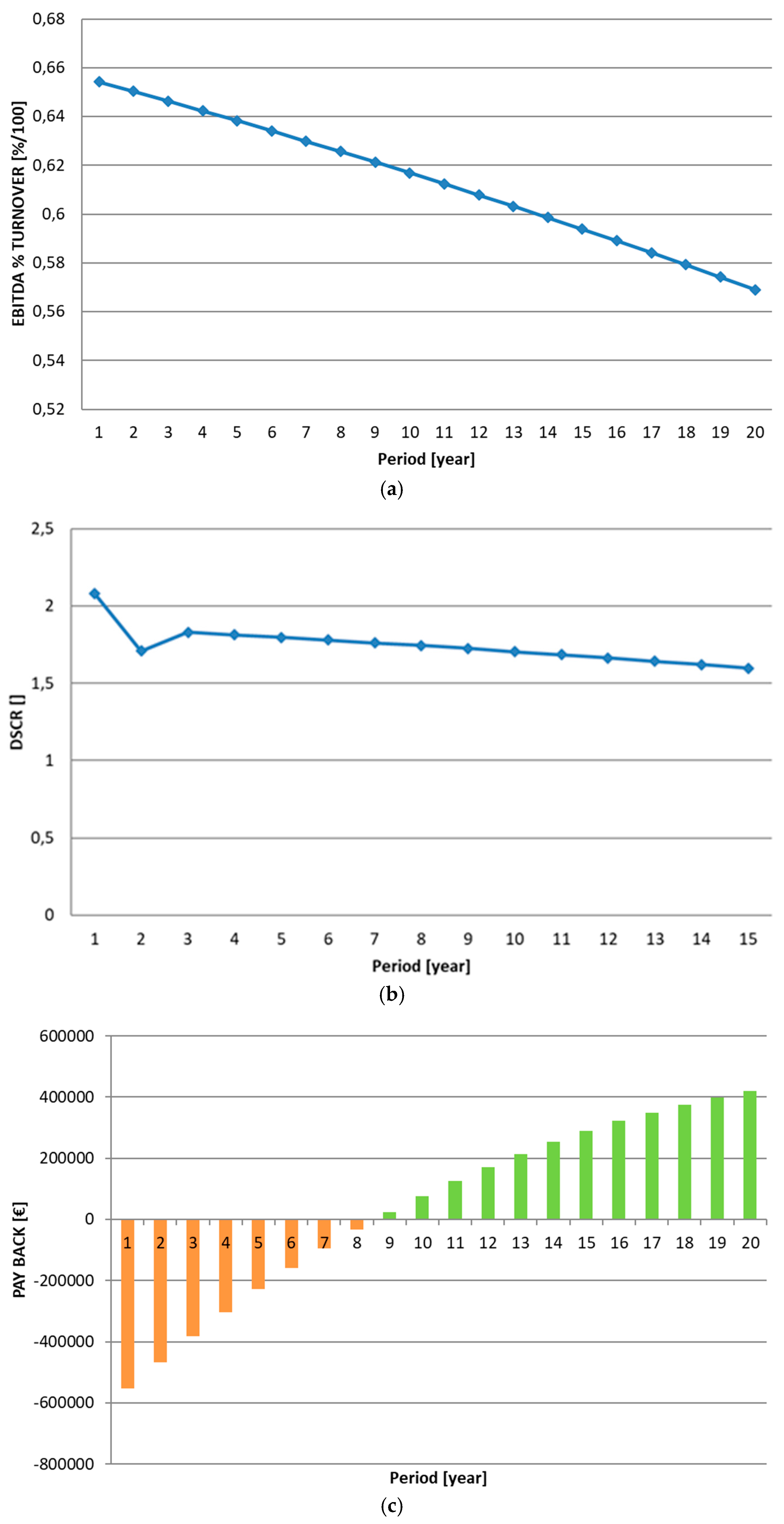

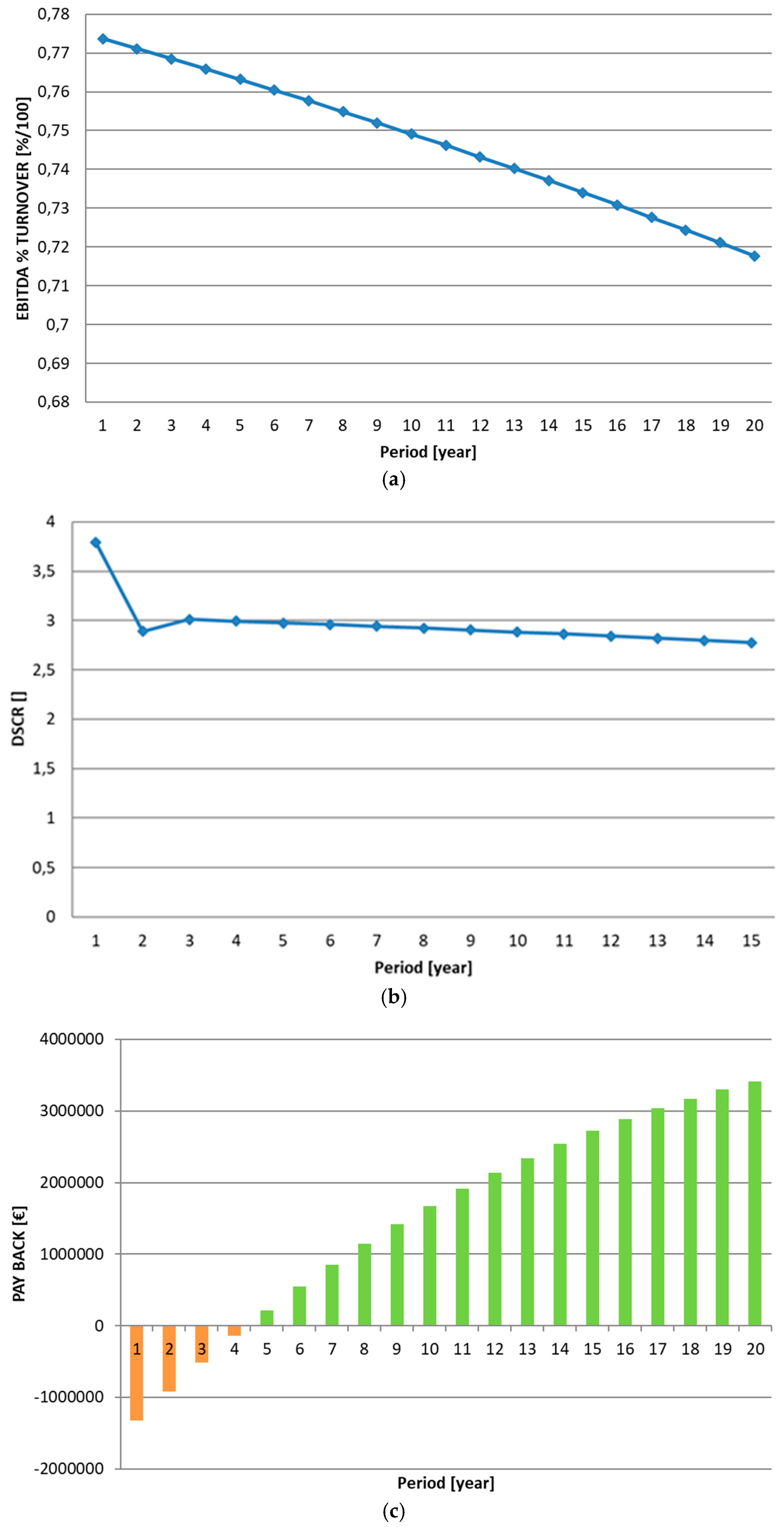

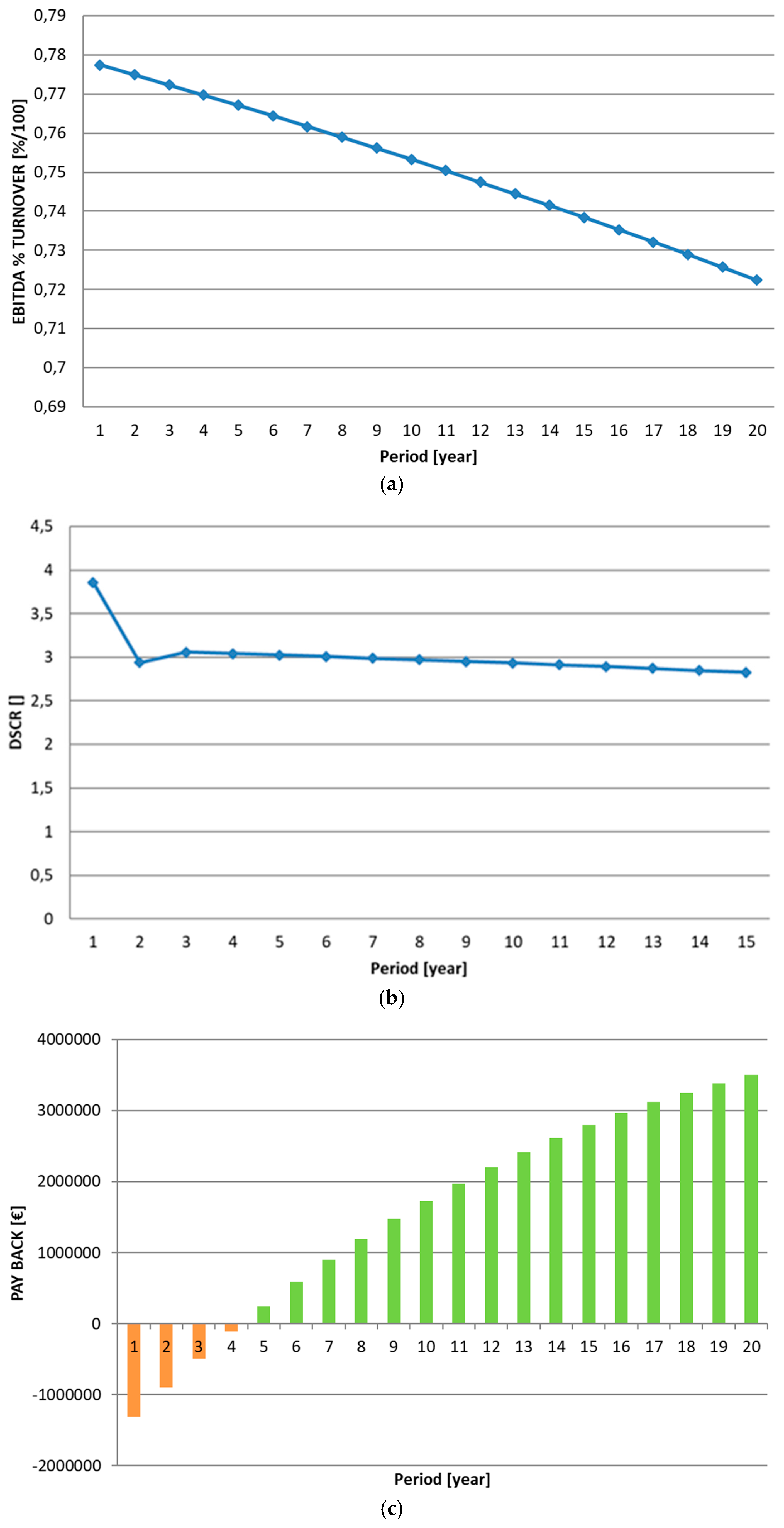

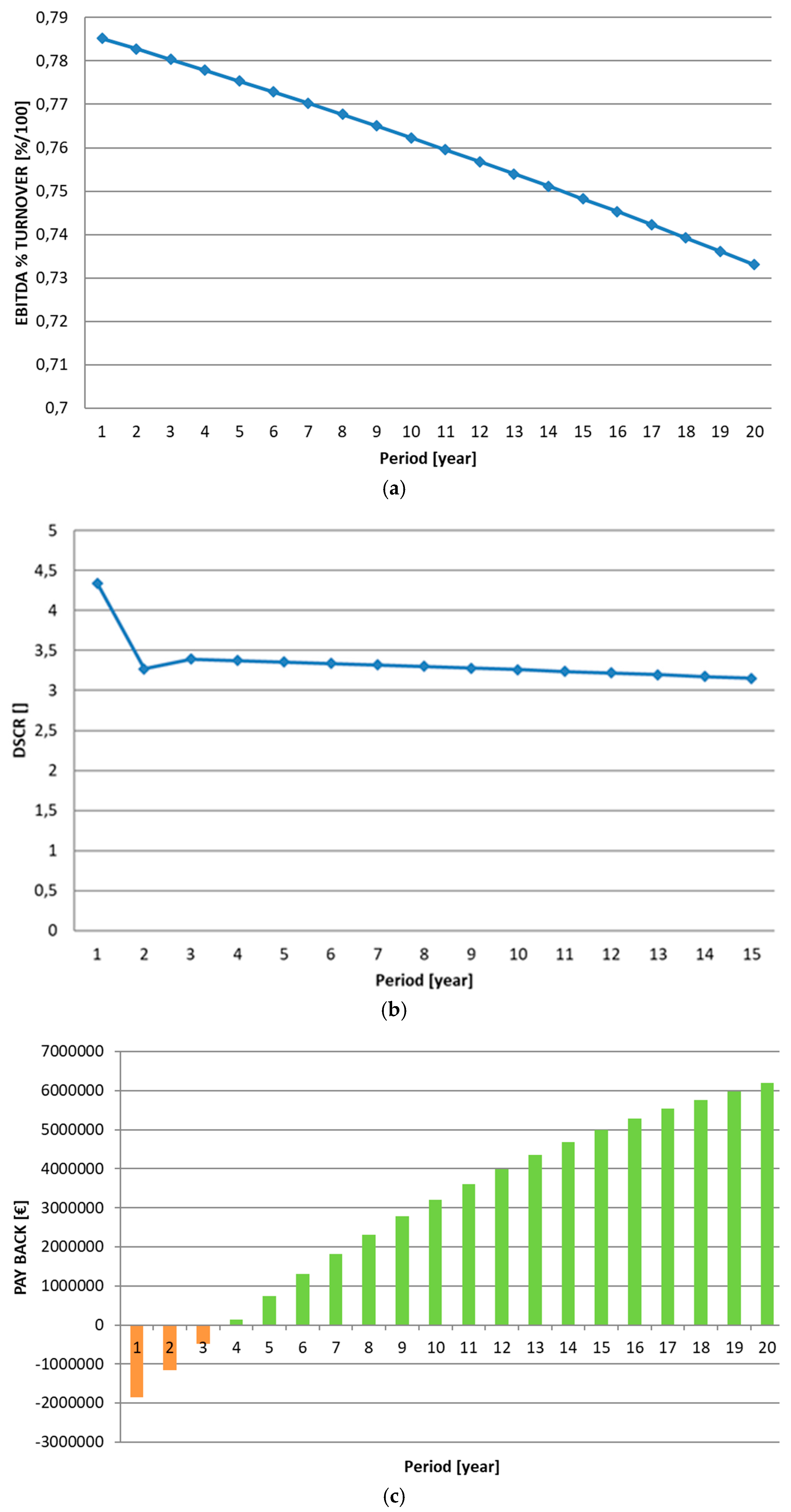

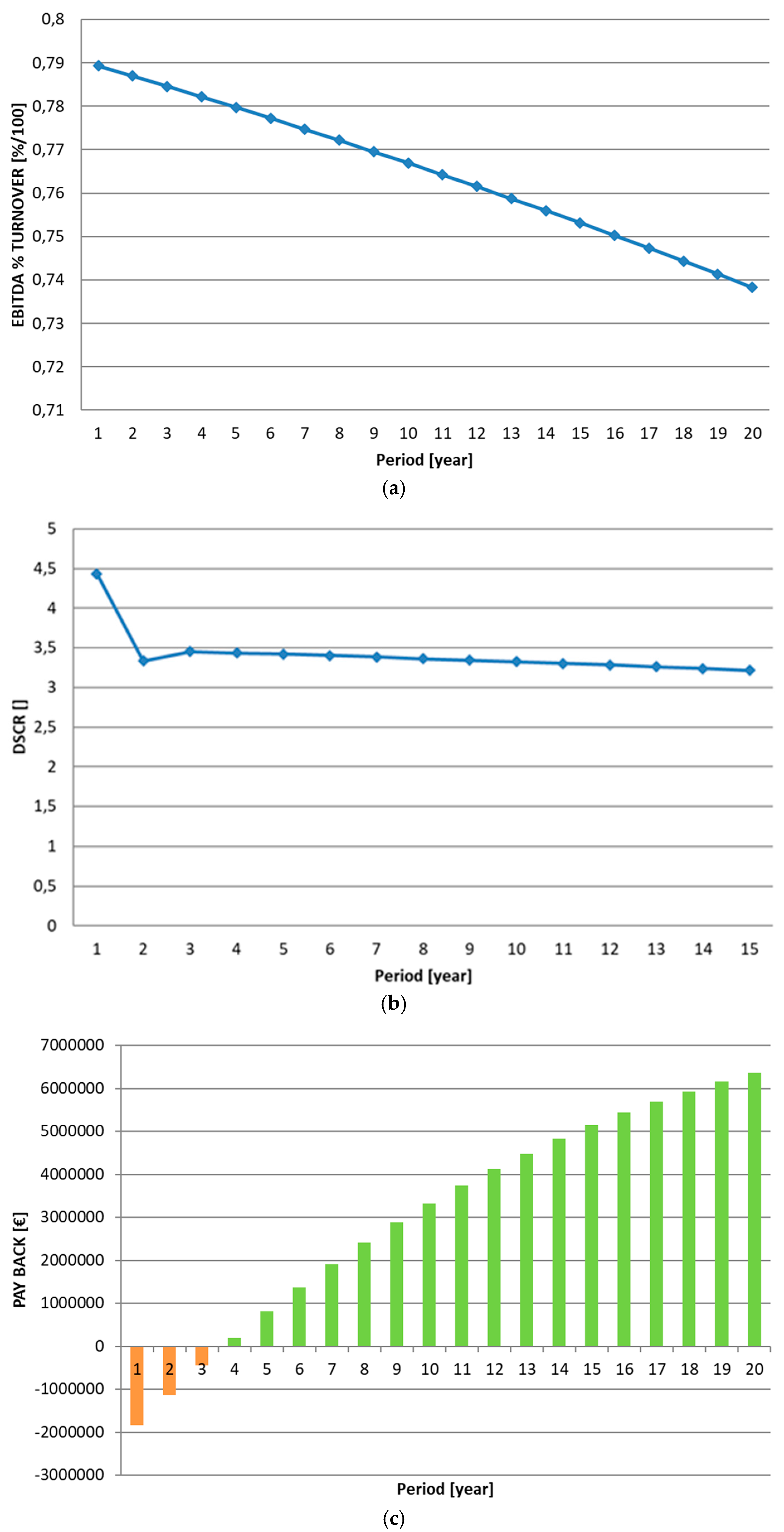

3. Results

4. Conclusions

Author Contributions

Conflicts of Interest

Abbreviations

| AD | Anaerobic digestion |

| CHP | Combined heat and power |

| OMWW | Olive mill waste water |

| OMSW | Olive mill solid waste |

| CM | Cattle manure |

| CS | Cattle slurry |

| BMP | Bio methane potential |

| BFT | Basic feed-in tariff |

| AIFT | All-inclusive feed-in tariff |

| BP | Break point |

| BEP | Break-even point |

| EBITDA | Earnings before interest taxes, depreciation, and amortization |

| EBITDA % | Earnings before interest taxes, depreciation, and amortization as a % of turnover |

| IRR | Internal rate of return |

| WACC | Weighted average cost of capital |

| DSCR | Debt service coverage ratio |

References

- Gestore Servizi Energetici (GSE). Rapporto Statistico. 2014. Available online: http://www.gse.it/it/Statistiche/RapportiStatistici/Pagine/default.aspx (accessed on 4 May 2017).

- Gestore Servizi Energetici (GSE). Incentivazione Delle Fonti Rinnovabili. 2015. Available online: http://www.gse.it/it/Dati%20e%20Bilanci/GSE_Documenti/Bollettino%20informativo/Bollettino%202%20semestre%202015.pdf (accessed on 3 May 2017).

- Decreto Ministeriale. Incentivi per Energia da Fonti Rinnovabili; Italian Republic: Rome, Italy, 2012.

- Torquati, B.; Venanzi, S.; Ciani, A.; Diotallevi, F.; Tamburi, V. Environmental sustainability and economic benefits of dairy farm biogas energy production: A case study in Umbria. Sustainability 2014, 6, 6696–6713. [Google Scholar] [CrossRef]

- Holm-Nielsen, J.B.; Al Seadi, T.; Oleskowicz-Popiel, P. The future of anaerobic digestion and biogas utilization. Bioresour. Technol. 2009, 100, 5478–5484. [Google Scholar] [CrossRef] [PubMed]

- Weiland, P. Biogas production: Current state and perspectives. Appl. Microbiol. Biotechnol. 2010, 85, 849–860. [Google Scholar] [CrossRef] [PubMed]

- Xie, S.; Lawlo, P.G.; Frost, J.P.; Hu, Z.; Zhan, X. Effect of pig manure to grass silage ratio on methane production in batch anaerobic co-digestion of concentrated pig manure and grass silage. Bioresour. Technol. 2011, 102, 5728–5733. [Google Scholar] [CrossRef] [PubMed]

- Carlini, M.; Castellucci, S.; Cocchi, S.; Allegrini, E. Slaughterhouse wastes: A review on regulations and current technologies for biogas production. Adv. Mater. Res. 2013, 827, 91–98. [Google Scholar] [CrossRef]

- Ruffino, B.; Fiore, S.; Roati, C.; Campo, G.; Novarino, D.; Zanetti, M. Scale effect of anaerobic digestion tests in fed-batch and semi continuous mode for the technical and economic feasibility of a full scale digester. Bioresour. Technol. 2015, 182, 302–313. [Google Scholar] [CrossRef] [PubMed]

- Carlini, M.; Castellucci, S.; Moneti, M. Biogas production from poultry manure and cheese whey wastewater under mesophilic conditions in batch reactor. Energy Procedia 2015, 82, 811–818. [Google Scholar] [CrossRef]

- Roig, A.; Cayuela, M.L.; Sánchez-Monedero, M.A. An overview on olive mill wastes and their valorization methods. Waste Manag. 2006, 26, 960–969. [Google Scholar] [CrossRef] [PubMed]

- Carlini, M.; Castellucci, S.; Moneti, M. Anaerobic co-digestion of olive-mill solid waste with cattle manure and cattle slurry: Analysis of bio-methane potential. Energy Procedia 2015, 81, 354–367. [Google Scholar] [CrossRef]

- Caputo, A.C.; Scacchia, F.; Pelagagge, P.M. Disposal of by-products in olive oil industry: Waste-to-energy solutions. Appl. Therm. Eng. 2003, 23, 197–214. [Google Scholar] [CrossRef]

- Fountoulakis, M.S.; Dokianakis, S.N.; Kornaros, M.E.; Aggelis, G.G.; Lyberatos, G. Removal of phenolics in olive mill wastewaters using the white-rot fungus Pleurotus ostreatus. Water Res. 2002, 36, 4735–4744. [Google Scholar] [CrossRef]

- Doymaz, I.; Gorel, O.; Akgun, N.A. Drying Characteristics of the Solid By-product of Olive Oil Extraction. Biosyst. Eng. 2004, 88, 213–219. [Google Scholar] [CrossRef]

- Mata-Alvarez, J.; Dosta, J.; Romero-Güiza, M.S.; Fonoll, X.; Peces, M.; Astals, S. A critical review on anaerobic co-digestion achievements between 2010 and 2013. Renew. Sustain. Energy Rev. 2014, 36, 412–427. [Google Scholar] [CrossRef]

- Dermeche, S.; Nadour, M.; Larroche, C.; Moulti-Mati, F.; Michaud, P. Olive mill wastes: Biochemical characterizations and valorization strategies. Process Biochem. 2013, 48, 1532–1552. [Google Scholar] [CrossRef]

- Ministry of Agricultural Food and Forestry Policies. Olive-Oil Sector Plan; European Union: Rome, Italy, 2016. [Google Scholar]

- Blumenstein, B.; Siegmeier, T.; Moller, D. Economics of anaerobic digestion in organic agriculture: Between system constraints and policy regulation. Biomass Bioenergy 2016, 86, 105–119. [Google Scholar] [CrossRef]

- Marchesi, R.; Bombarda, P.; Bresciani, F.; Casalegno, A.; Guilizzoni, M.; Manfredi, G.; Escobar, P.; Rota, A.; Zago, M. Electricity Production from Renewable Sources; Politecnico di Milano-Energy Department: Milan, Italy, July 2013. [Google Scholar]

- Javanovic, P. Application of sensitivity analysis in investment project evaluation under uncertainty and risk. Int. J. Proj. Manag. 1999, 17, 217–222. [Google Scholar] [CrossRef]

- Associazione Iavoratori Pensionati Autonomi Italian. Contratto Collettivo Nazionale Dell’agricoltura (Operai e Florvivaisti); Confederazione Generale dell’agricoltura Italiana: Roma, Italy, 2016. [Google Scholar]

- Agenzia per la Protezione dell’Ambientee per i servizi Tecnici (APAT). La Valutazione del Prezzo dello Smaltimento dei Rifiuti; Istituto Superiore per la Protezione e la Ricerca Ambientale: Roma, Italy, 2011.

- Žižlavskýa, O. Net Present Value Approach: Method for Economic Assessment of Innovation Projects. In Proceedings of the 19th International Scientific Conference Economics and Management, Riga, Latvia, 23–25 April 2014. [Google Scholar]

- Gestore dei Mercati Energetici (GME). Available online: http://www.mercatoelettrico.org/it/ (accessed on 5 May 2017).

- Zambon, I.; Colosimo, F.; Monarca, D.; Cecchini, M.; Gallucci, F.; Proto, A.R.; Lord, R.; Colantoni, A. An innovative agro-forestry supply chain for residual biomass: Physicochemical characterization of biochar from olive and hazelnut pellets. Energies 2016, 9, 526. [Google Scholar] [CrossRef] [Green Version]

- Civitarese, V.; Spinelli, R.; Barontini, M.; Gallucci, F.; Santangelo, E.; Acampora, A.; Scarfone, A.; del Giudice, A.; Pari, L. Open-Air Drying of Cut and Windrowed Short-Rotation Poplar Stems. BioEnergy Res. 2015, 8, 1614–1620. [Google Scholar] [CrossRef]

- Colantoni, A.; Evic, N.; Lord, R.; Retschitzegger, S.; Proto, A.R.; Gallucci, F.; Monarca, D. Characterization of biochars produced from pyrolysis of pelletized agricultural residues. Renew. Sustain. Energy Rev. 2016, 64, 187–194. [Google Scholar] [CrossRef] [Green Version]

| Biomass Properties | ||||||

|---|---|---|---|---|---|---|

| Biomass | Dry Matter (%) | Moisture (Wet Basis) (%) | Ashes (Dry Basis) (%) | Organic Matter (Dry Basis) (%) | Volatile Solid (Dry Basis) (%) | Substrate Ratio of Fresh Weight (%) |

| Cattle slurry | 1.04 ± 0.01 | 98.96 ± 0.02 | 35.02 ± 0.05 | 64.73 ± 0.01 | 61.73 ± 0.01 | 70 |

| Cattle manure | 18.46 ± 0.04 | 81.54 ± 0.03 | 15.96 ± 0.002 | 84.04 ± 0.03 | 75.63 ± 0.01 | 5 |

| OMSW | 54.12 ± 0.02 | 45.89 ± 0.01 | 4.75 ± 0.006 | 95.25 ± 0.02 | 94.07 ± 0.01 | 25 |

| Mixture properties | ||||||

| Total dry matter: 14% | ||||||

| Initial pH: 7.07 | ||||||

| Total organic matter on dry basis: 93.6% | ||||||

| Total organic matter on wet basis: 13.03% BMP (Bio-Methane Potential test) (L/gsv): 0.1034 (Liter/volatile solid) | ||||||

| Technical Parameters | Units | Power | Power | Power |

|---|---|---|---|---|

| Installed electrical performance | kW | 100 | 500 | 1000 |

| CHP efficiency | - | - | - | - |

| Electrical | % | 36.5 | 41.6 | 40.7 |

| Thermal | % | 37.5 | 41.6 | 42.8 |

| CHP operating hours | h a−1 | 8000 | 8000 | 8000 |

| Average retention times | d | 55 | 55 | 55 |

| OMSW | t | 260 | 820 | 1800 |

| CS | t | 806 | 2542 | 5580 |

| CM | t | 52 | 164 | 360 |

| Net fermenter volume | m3 | 1300 | 4100 | 9000 |

| Electricity needs | % | 2 | 2 | 2 |

| Heat needs | % | 25 | 25 | 25 |

| Installed Electrical Performance (kW) | AIFT (€/MWh) | BFT (€/MWh) |

|---|---|---|

| 100 | 222.11 | 185.31 |

| 500 | 193.88 | 157.08 |

| 1000 | 167.53 | 130.73 |

| Costs | Power (kW) | Power (kW) | Power (kW) |

|---|---|---|---|

| Investment cost (€/Kw) | 100 | 500 | 1000 |

| Total investment cost (€) | 7000 | 4000 | 3000 |

| Annual cost (€/annum) | 700,000 | 2,000,000 | 3,000,000 |

| Repair and maintenance | 16,000 | 45,000 | 70,000 |

| Labor | 13,000 | 26,000 | 52,000 |

| Substrate input | 10,000 | 40,000 | 50,000 |

| Management plant | 2000 | 10,000 | 20,000 |

| Insurance | 3000 | 10,000 | 15,000 |

| Book-keeping counselling | 2000 | 2000 | 2000 |

| Concessions and royalties | 5000 | 5000 | 5000 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Carlini, M.; Mosconi, E.M.; Castellucci, S.; Villarini, M.; Colantoni, A. An Economical Evaluation of Anaerobic Digestion Plants Fed with Organic Agro-Industrial Waste. Energies 2017, 10, 1165. https://doi.org/10.3390/en10081165

Carlini M, Mosconi EM, Castellucci S, Villarini M, Colantoni A. An Economical Evaluation of Anaerobic Digestion Plants Fed with Organic Agro-Industrial Waste. Energies. 2017; 10(8):1165. https://doi.org/10.3390/en10081165

Chicago/Turabian StyleCarlini, Maurizio, Enrico Maria Mosconi, Sonia Castellucci, Mauro Villarini, and Andrea Colantoni. 2017. "An Economical Evaluation of Anaerobic Digestion Plants Fed with Organic Agro-Industrial Waste" Energies 10, no. 8: 1165. https://doi.org/10.3390/en10081165