The Future of Sustainable Energy Production in Pakistan: A System Dynamics-Based Approach for Estimating Hubbert Peaks

Abstract

1. Introduction

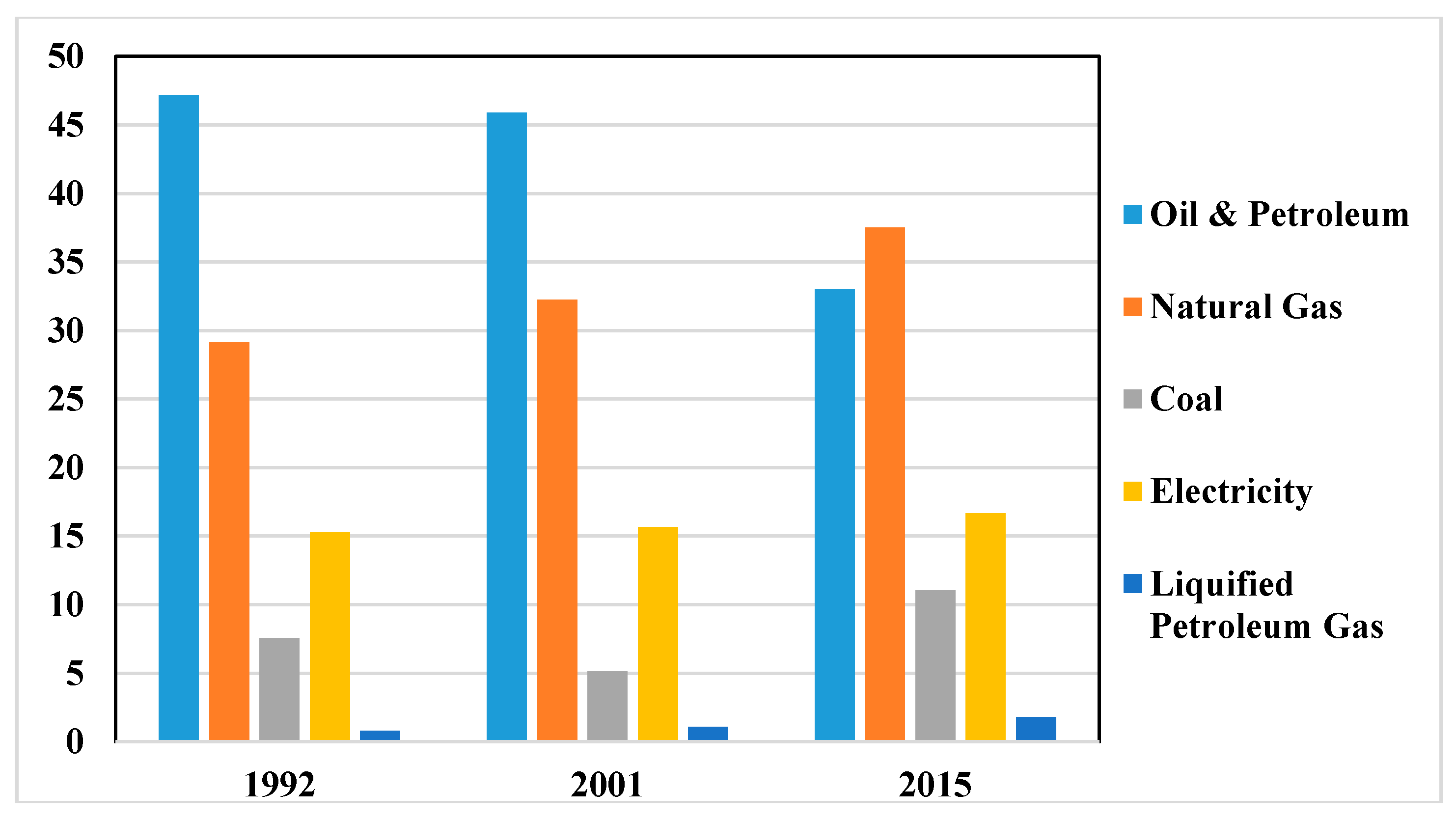

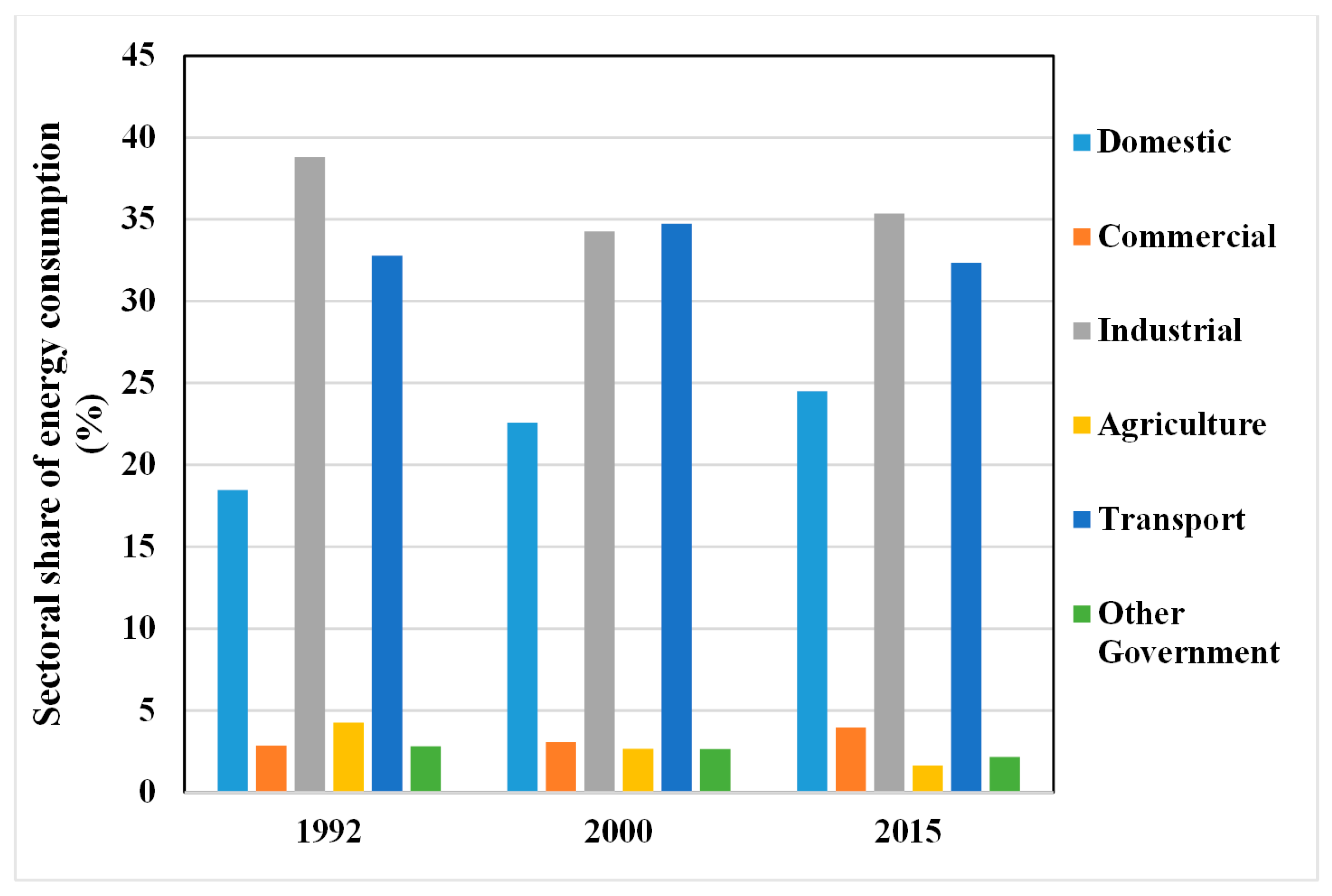

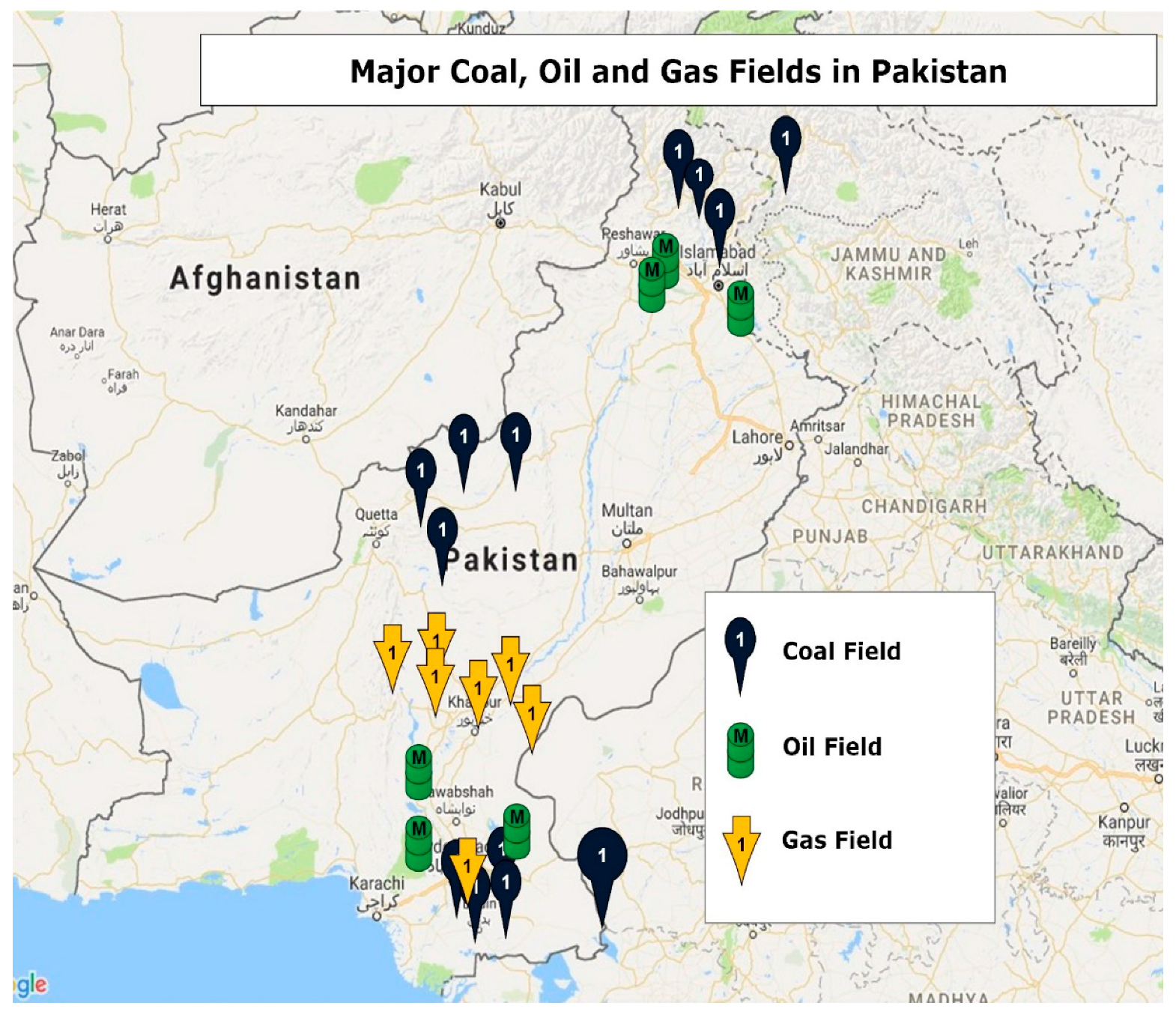

2. Primary Energy Resources of Pakistan

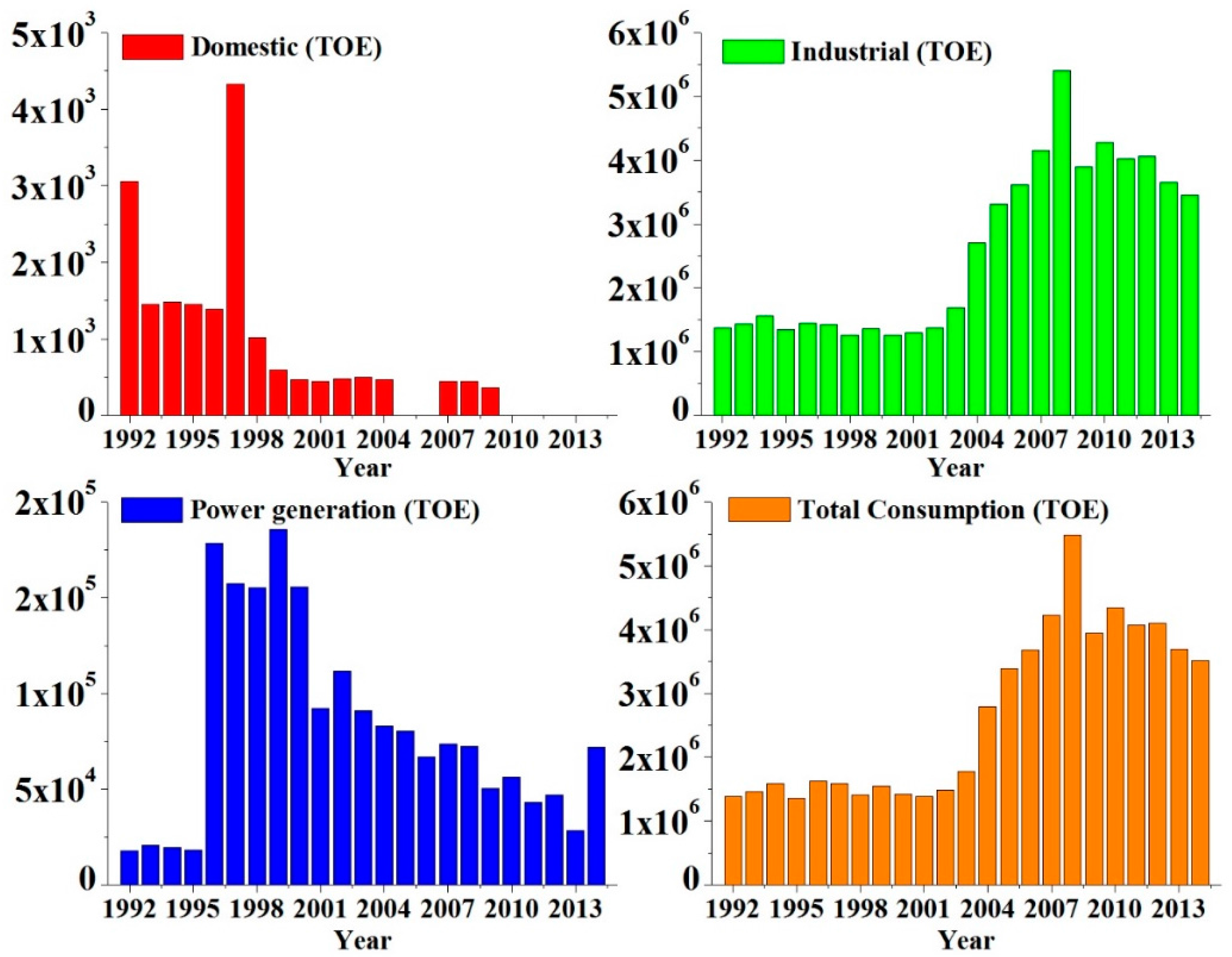

2.1. Coal

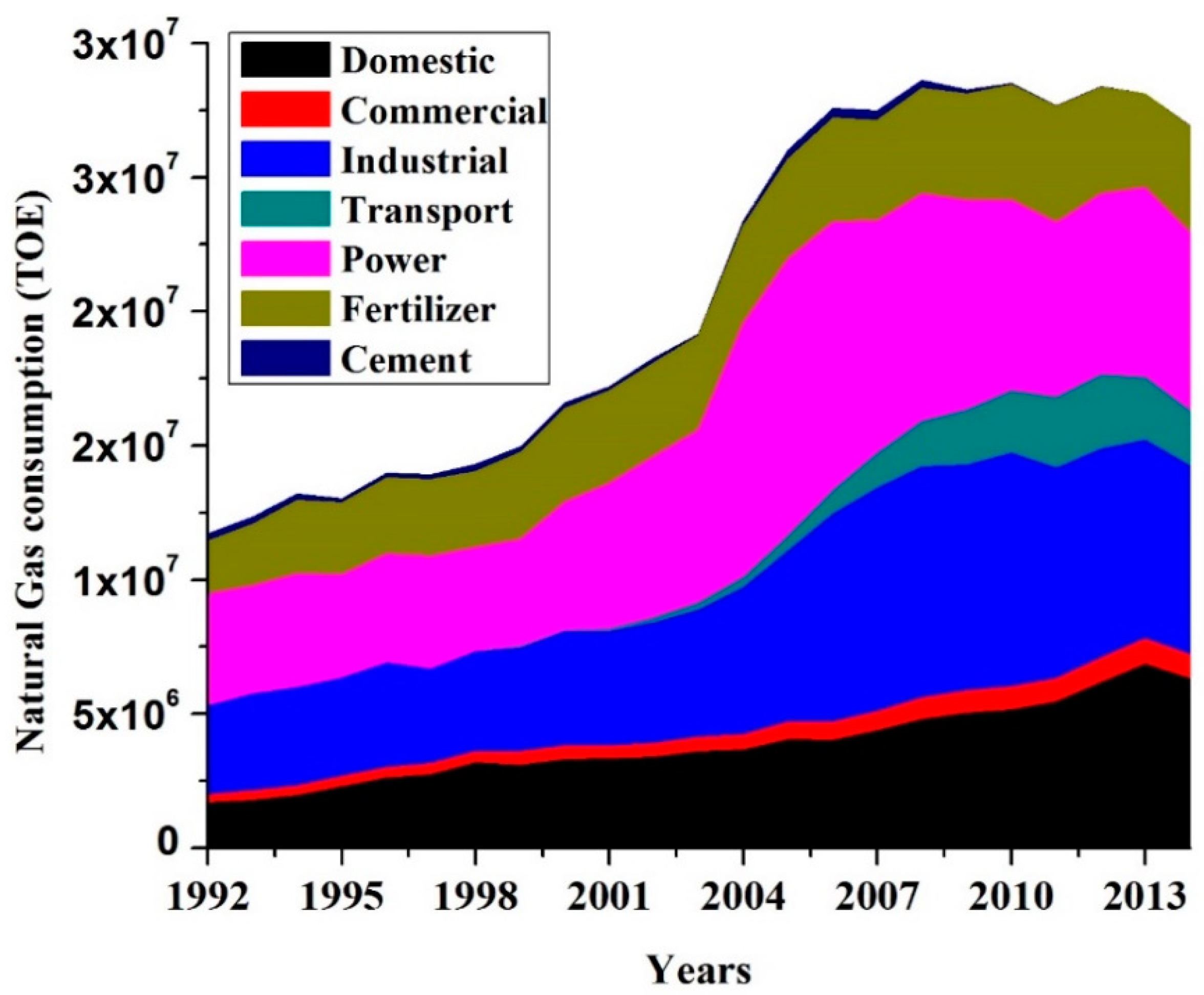

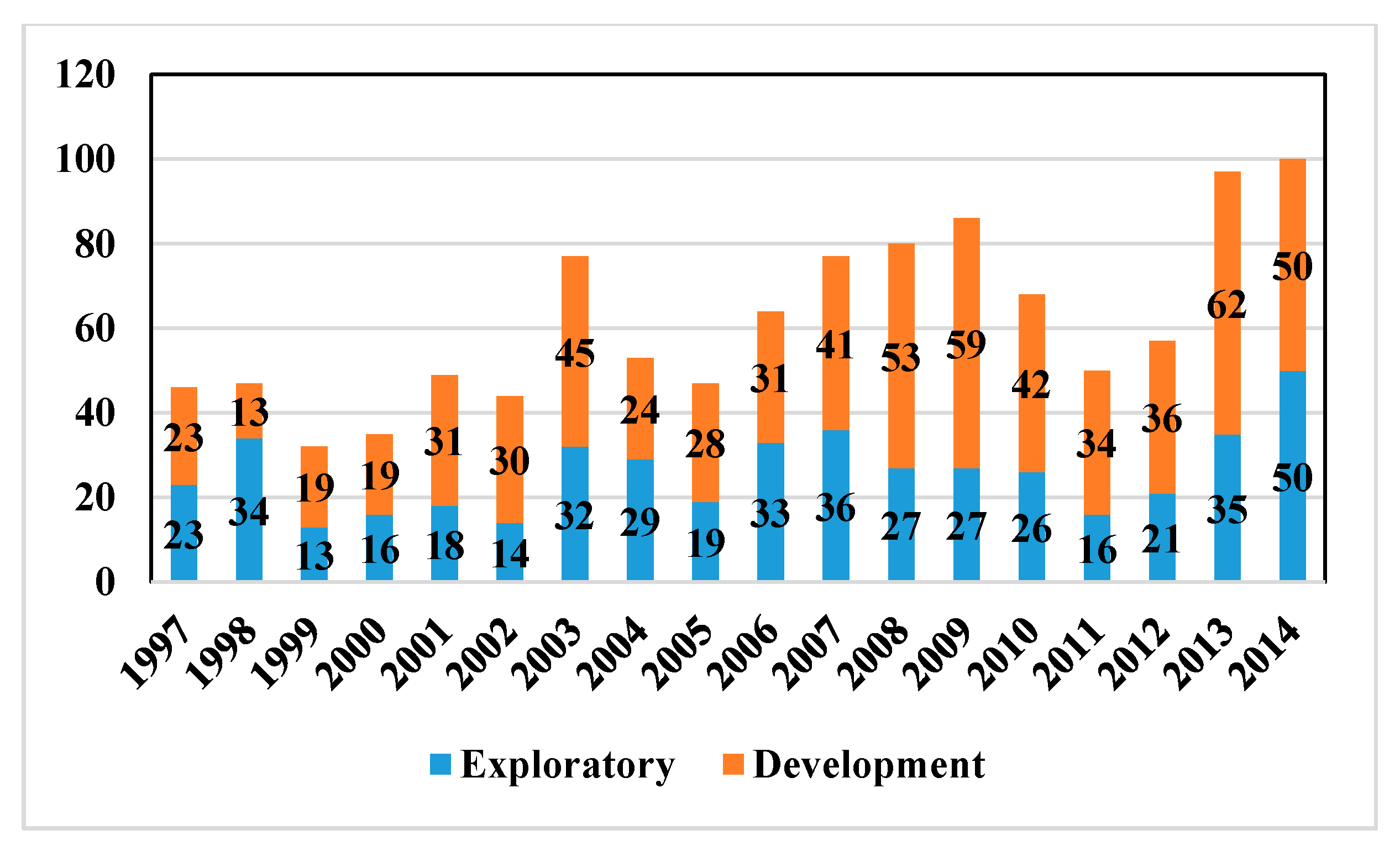

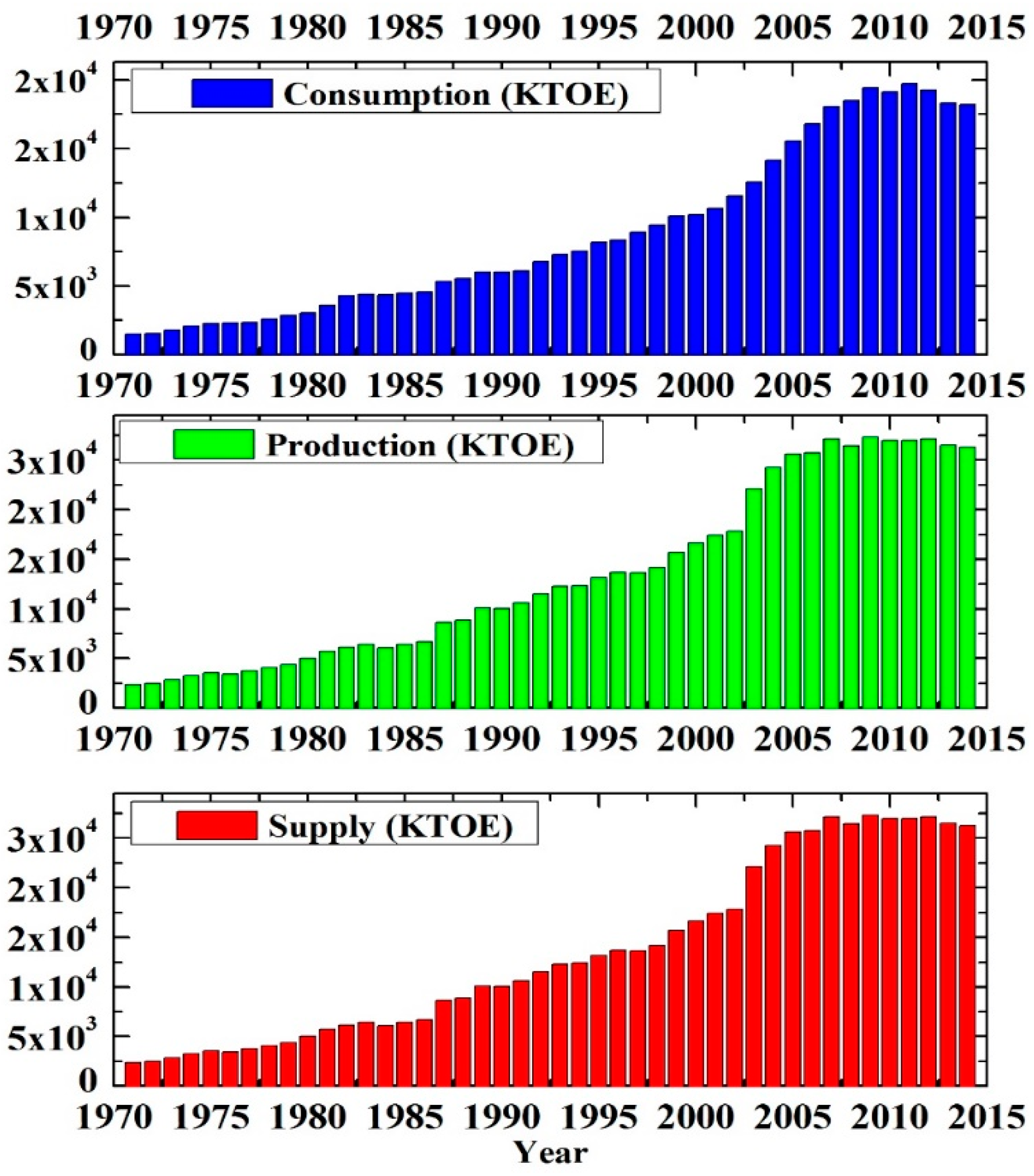

2.2. Natural Gas

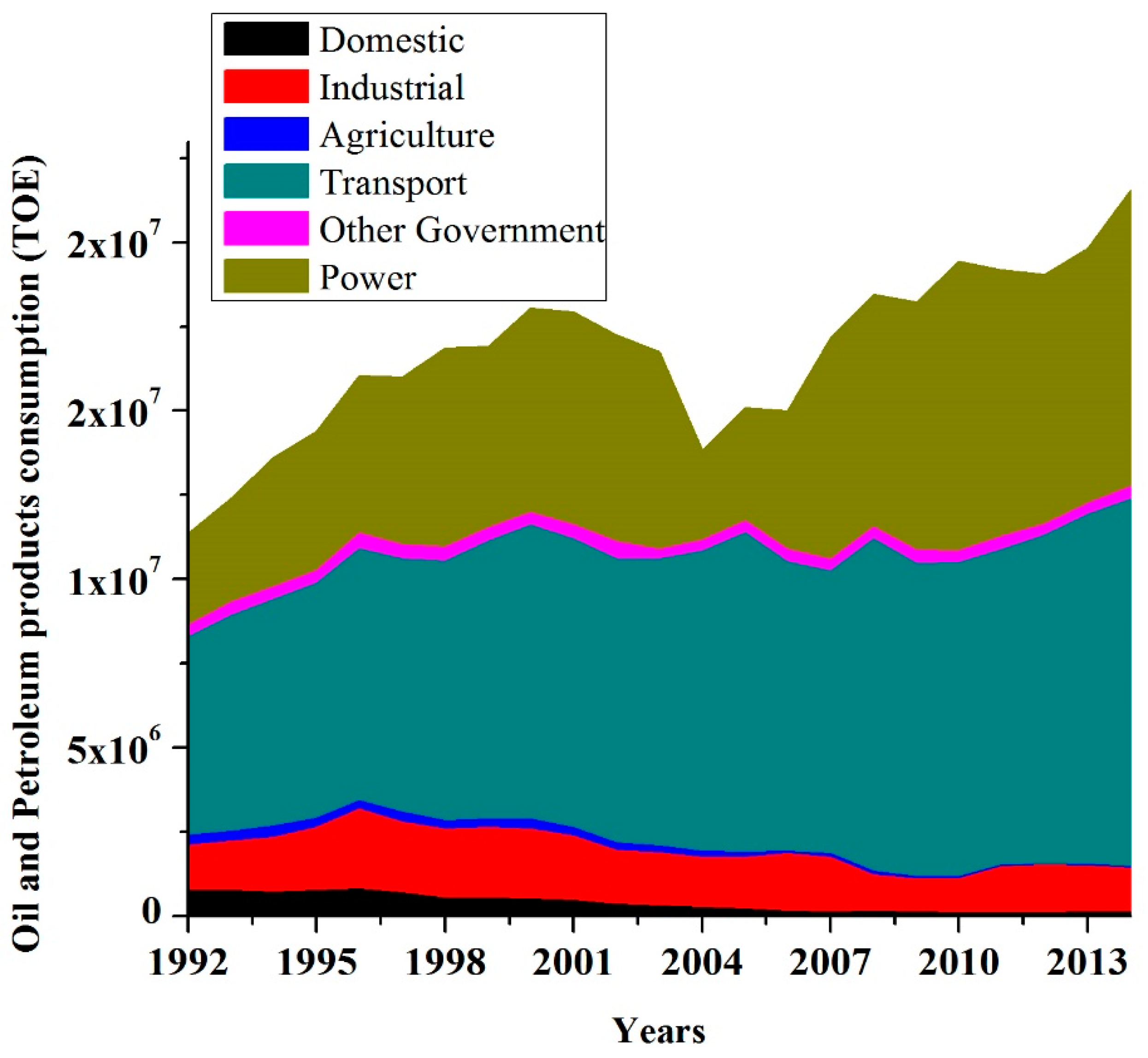

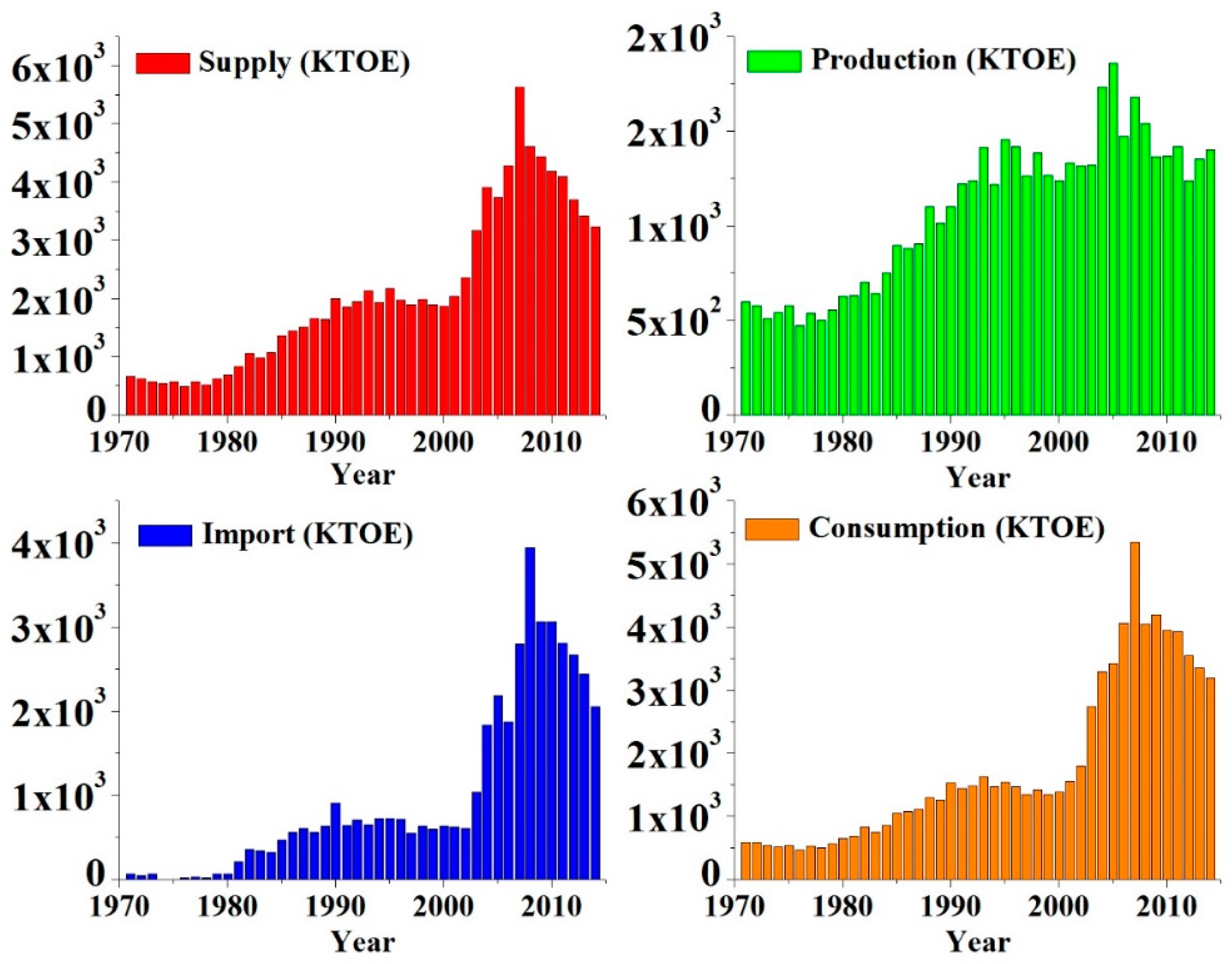

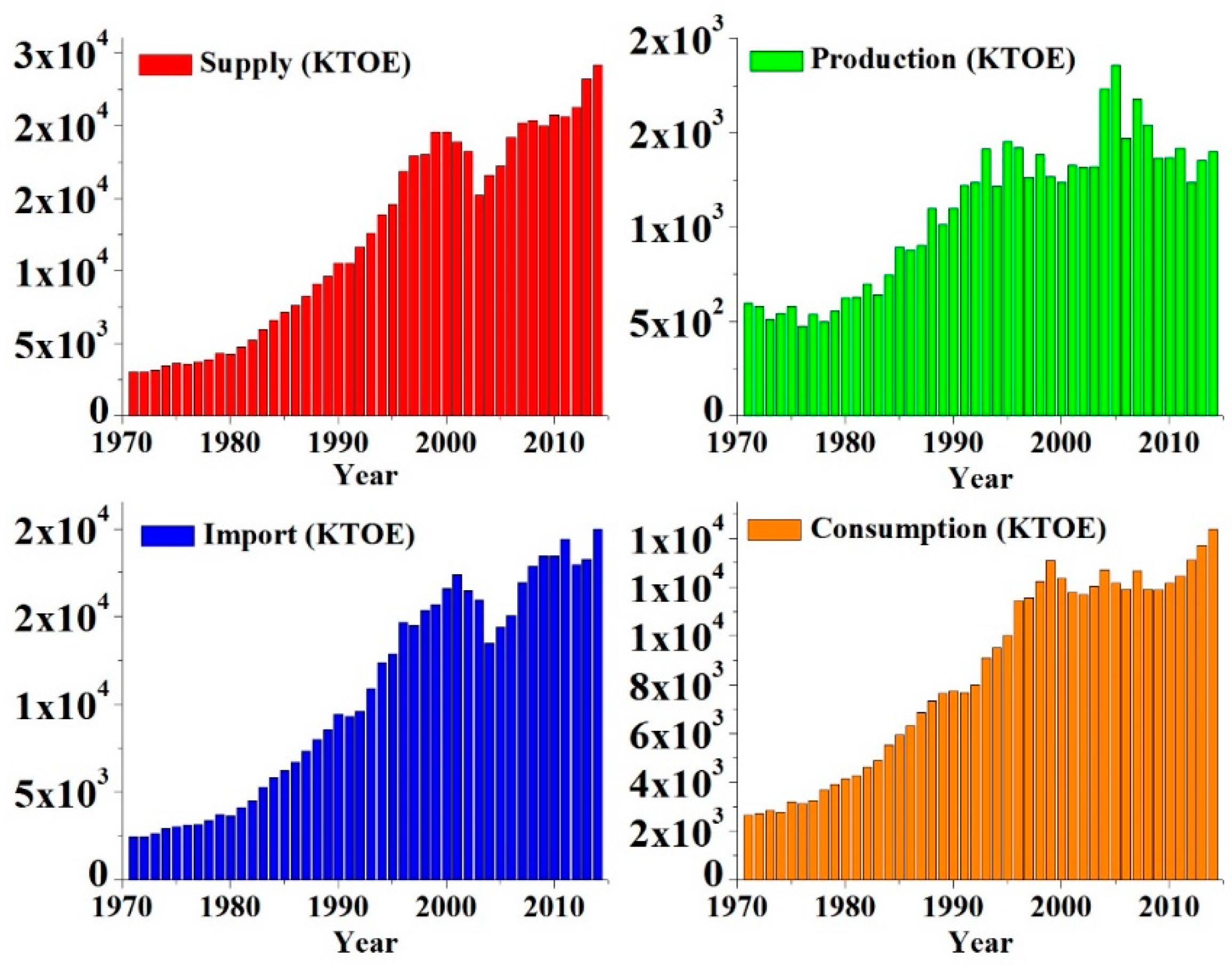

2.3. Crude Oil and Petroleum Products

3. Hubbert Peaks and Its Applications

3.1. History and Rationale

3.2. Comparisons of Hubbert Peak for Forecasting Fossil Fuel Production

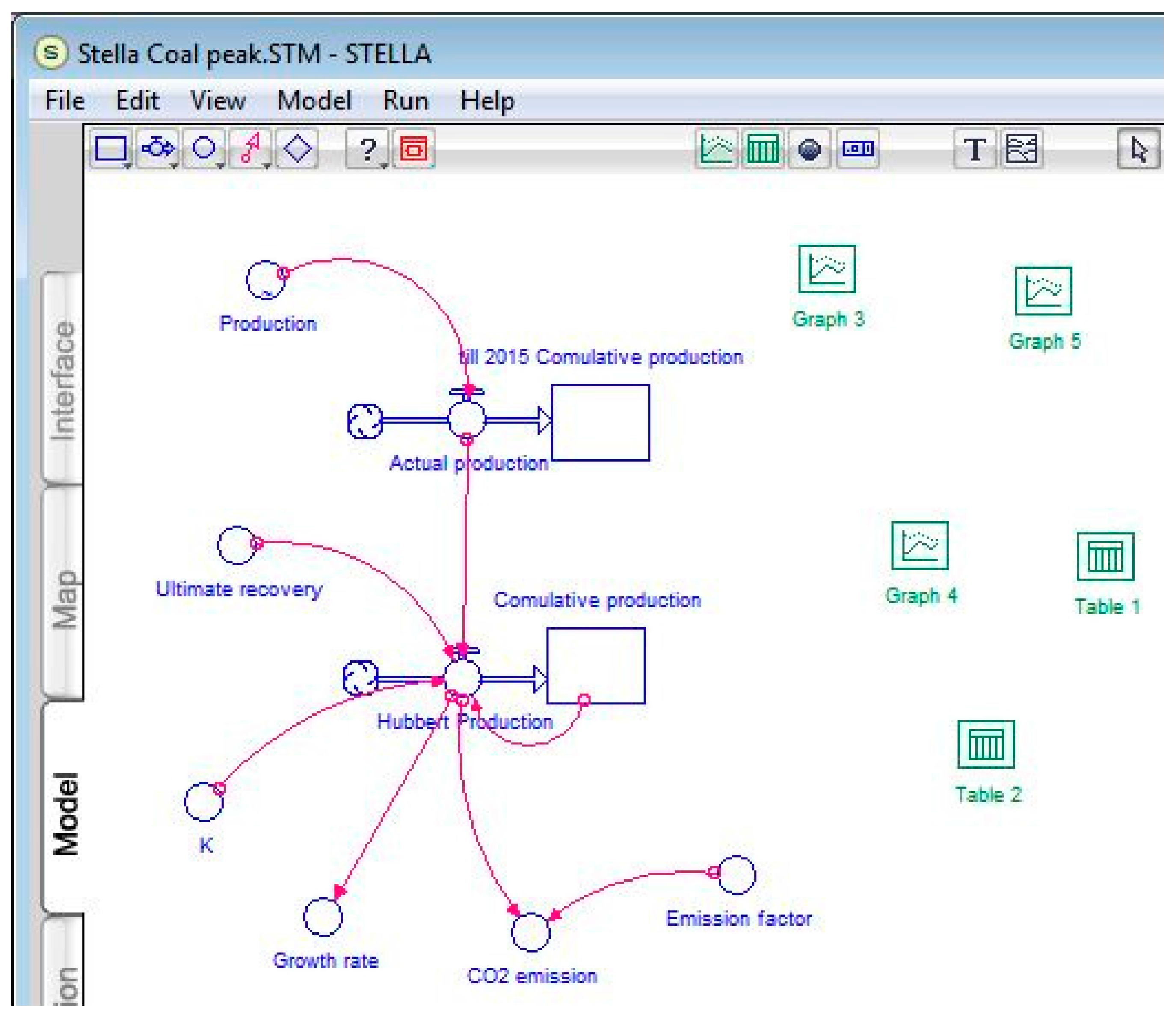

4. Theoretical and Methodological Framework

5. Results and Discussion

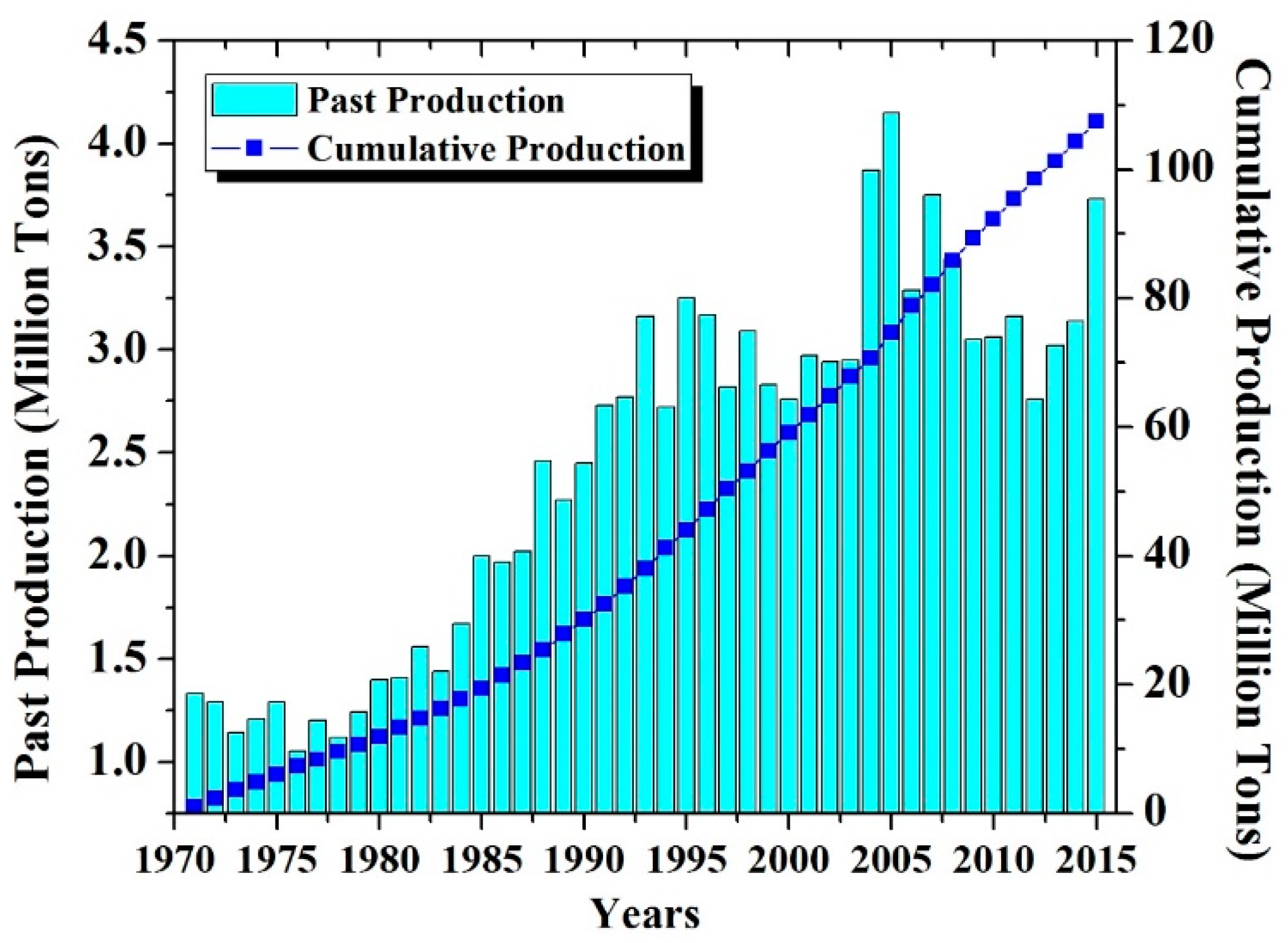

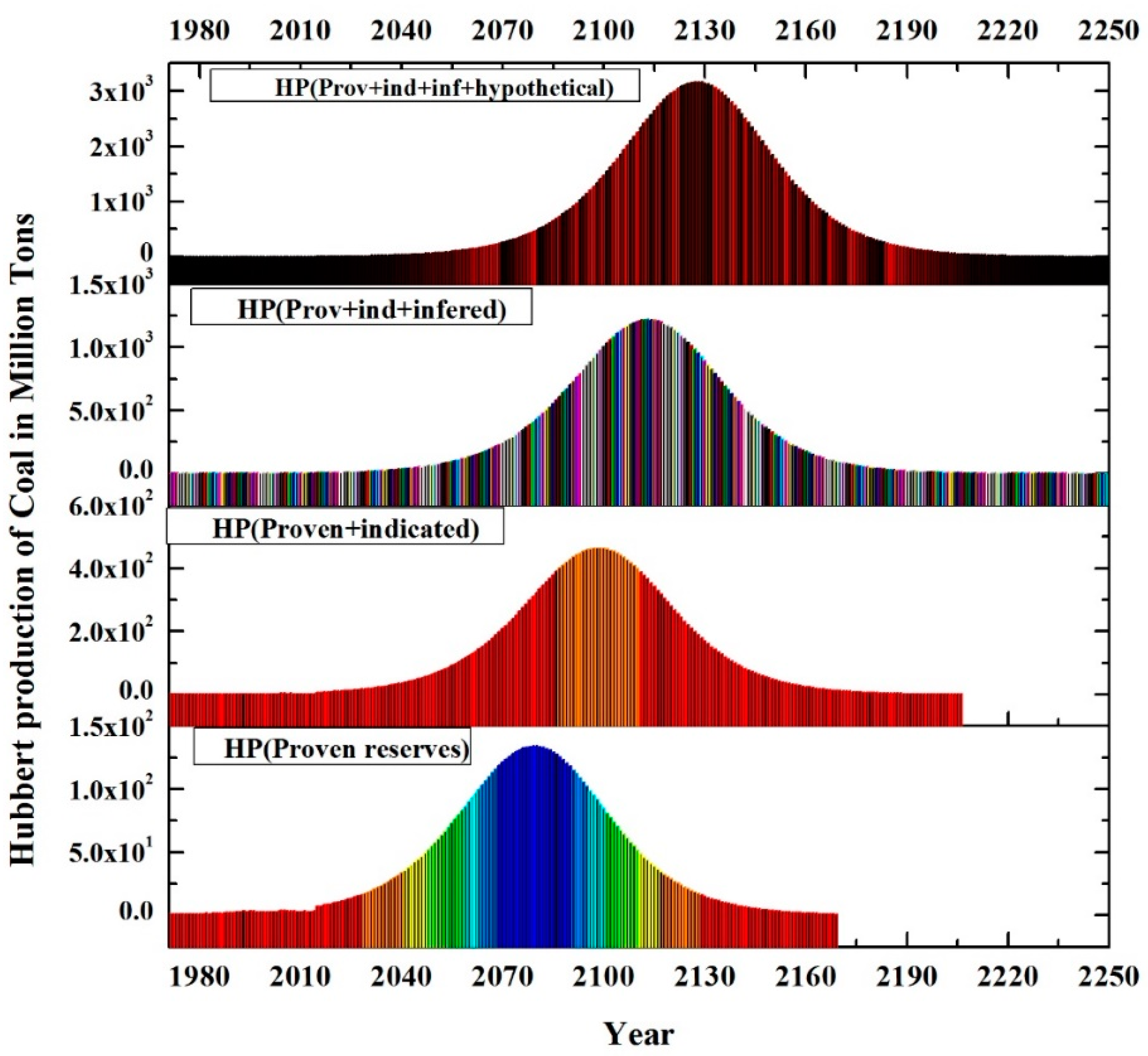

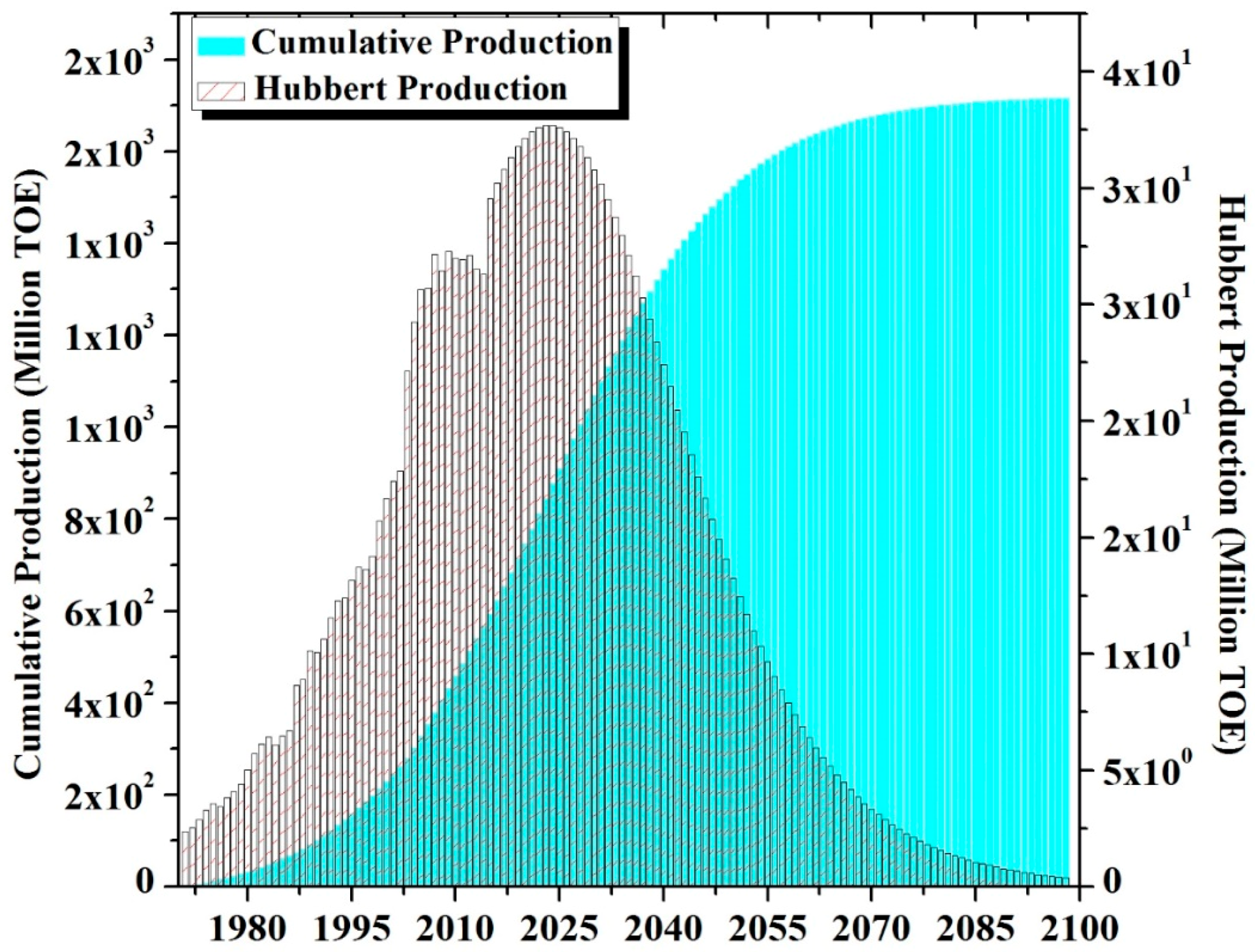

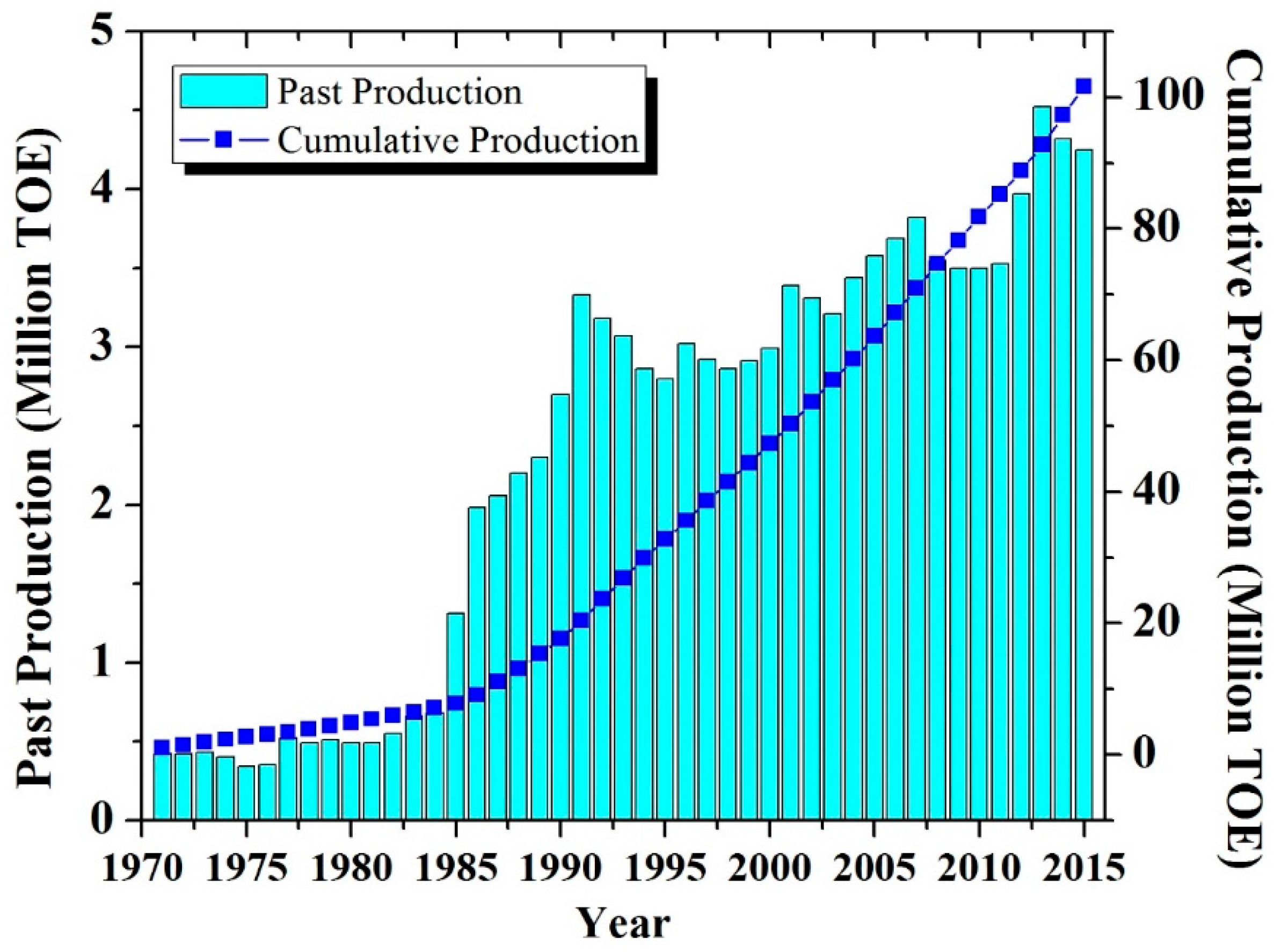

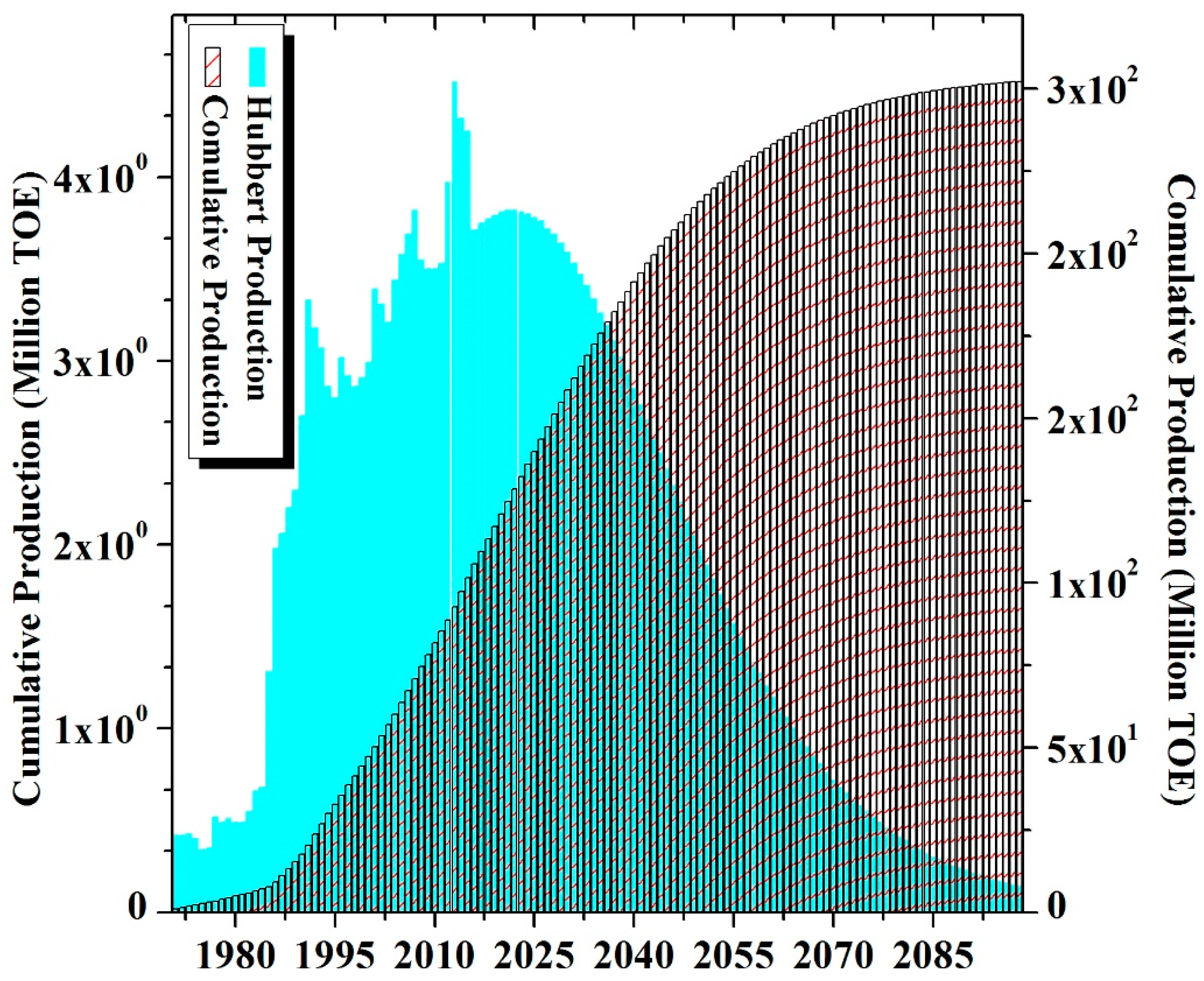

5.1. The Peak Production of Coal

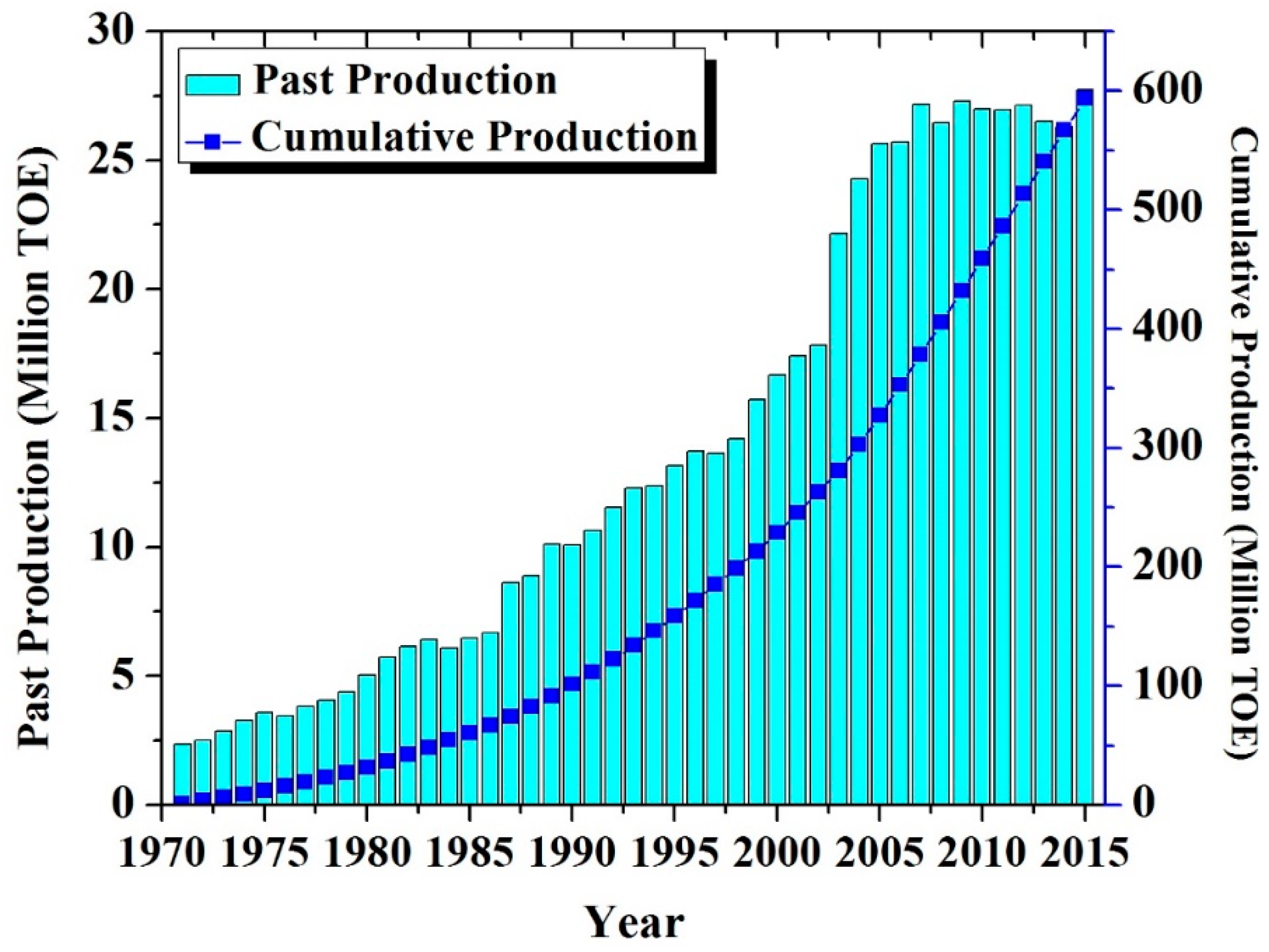

5.2. The Peak Production of Natural Gas

5.3. The Peak Production of Crude Oil

6. Conclusions and Policy Recommendations

Acknowledgments

Author Contributions

Conflicts of Interest

References

- Bhutto, A.W.; Bazmi, A.A.; Zahedi, G. Greener energy: Issues and challenges for Pakistan—Biomass energy prospective. Renew. Sustain. Energy Rev. 2011, 15, 3207–3219. [Google Scholar] [CrossRef]

- Douggar, M.G. Energy situation in Pakistan: Options and issues. Renew. Energy 1995, 6, 151–157. [Google Scholar] [CrossRef]

- Valasai, G.; Uqaili, M.; Memon, H.; Samoo, S.; Mirjat, N.; Harijan, K. Assessment of Renewable Energy for Electricity Generation: Using Pakistan TIMES Energy Model. Sindh Univ. Res. J. 2016, 48, 775–778. [Google Scholar]

- Valasai, G.D.; Uqaili, M.A.; Memon, H.R.; Samoo, S.R.; Mirjat, N.H.; Harijan, K. Overcoming electricity crisis in Pakistan: A review of sustainable electricity options. Renew. Sustain. Energy Rev. 2017, 72, 734–745. [Google Scholar] [CrossRef]

- Khan, H.A.; Pervaiz, S. Technological review on solar PV in Pakistan: Scope, practices and recommendations for optimized system design. Renew. Sustain. Energy Rev. 2013, 23, 147–154. [Google Scholar] [CrossRef]

- Muneer, T.; Asif, M. Prospects for secure and sustainable electricity supply for Pakistan. Renew. Sustain. Energy Rev. 2007, 11, 654–671. [Google Scholar] [CrossRef]

- Shaikh, F.; Ji, Q.; Fan, Y. The diagnosis of an electricity crisis and alternative energy development in Pakistan. Renew. Sustain. Energy Rev. 2015, 52, 1172–1185. [Google Scholar] [CrossRef]

- Baloch, M.H.; Abro, S.A.; Sarwar Kaloi, G.; Mirjat, N.H.; Tahir, S.; Nadeem, M.H.; Gul, M.; Memon, Z.A.; Kumar, M. A Research on Electricity Generation from Wind Corridors of Pakistan (Two Provinces): A Technical Proposal for Remote Zones. Sustainability 2017, 9, 1611. [Google Scholar] [CrossRef]

- Energy-Yearbook, P. Pakistan Energy Yearbook; Hydrocarbon Development Institute of Pakistan: Islamabad, Pakistan, 2015; p. 142. [Google Scholar]

- Memon, T.A.; Harijan, K.; Soomro, M.I.; Meghwar, S.; Valasai, G.D.; Khoharo, H. Potential of Electricity Generation from Rice Husk-A Case Study of Rice Mill. Sindh Univ. Res. J. 2017. [Google Scholar] [CrossRef]

- Hydrocarbon Development Institute of Pakistan (HDIP). Pakistan Energy Yearbook 1997; Hydrocarbon Development Institute of Pakistan, Ministry of Petroleum and Natural Resources, Government of Pakistan: Islamabad, Pakistan, 1998; p. 75.

- Hydrocarbon Development Institute of Pakistan (HDIP). Pakistan Energy Yearbook 2002; Hydrocarbon Development Institute of Pakistan, Ministry of Petroleum and Natural Resources, Government of Pakistan: Islamabad Pakistan, 2003; p. 91.

- Hydrocarbon Development Institute of Pakistan (HDIP). Pakistan Energy Yearbook 2007; Hydrocarbon Development Institute of Pakistan, Ministry of Petroleum and Natural Resources, Government of Pakistan: Islamabad, Pakistan, 2008; p. 120.

- Hydrocarbon Development Institute of Pakistan (HDIP). Pakistan Energy Yearbook 2012; Hydrocarbon Development Institute of Pakistan, Ministry of Petroleum and Natural Resources, Government of Pakistan: Islamabad, Pakistan, 2013; p. 125.

- Hydrocarbon Development Institute of Pakistan (HDIP). Pakistan Energy Yearbook 2015; Hydrocarbon Development Institute of Pakistan, Ministry of Petroleum and Natural Resources, Government of Pakistan: Islamabad, Pakistan, 2016; p. 147.

- Uddin, W.; Khan, B.; Shaukat, N.; Majid, M.; Mujtaba, G.; Mehmood, A.; Ali, S.M.; Younas, U.; Anwar, M.; Almeshal, A.M. Biogas potential for electric power generation in Pakistan: A survey. Renew. Sustain. Energy Rev. 2016, 54, 25–33. [Google Scholar] [CrossRef]

- Mirjat, N.H.; Uqaili, M.A.; Harijan, K.; Valasai, G.D.; Shaikh, F.; Waris, M. A review of energy and power planning and policies of Pakistan. Renew. Sustain. Energy Rev. 2017, 79, 110–127. [Google Scholar] [CrossRef]

- Valasai, G.D.; Mirjat, N.H.; Uqaili, M.A.; Memon, H.U.R.; Samoo, S.R.; Harijan, K. Decarbonization of Electricity Sector of Pakistan—An Application of Times Energy Model. J. Clean Energy Technol. 2017, 5. [Google Scholar] [CrossRef]

- Javaid, M.A.; Hussain, S.; Maqsood, A.; Arshad, Z.; Arshad, M.A.; Idrees, M. Electrical Energy Crisis in Pakistan and Their Possible Solutions. Int. J. Basic Appl. Sci. 2011, 11, 38–52. [Google Scholar]

- Malkani, M.S. A review of coal and water resources of Pakistan. Sci. Tech. Dev. 2012, 31, 202–218. [Google Scholar]

- Karim, S.; Bhutto, A.W. Coal gasification for sustainable development of the energy sector in Pakistan. Energy Sustain. Dev. 2005, 9, 60–68. [Google Scholar]

- Kumar, S.; Shahbaz, M. Coal Consumption and Economic Growth Revisited: Structural Breaks, Cointegration and Causality Tests for Pakistan. Energy Explor. Exploit. 2012, 30, 499–522. [Google Scholar] [CrossRef]

- Rauf, O.; Wang, S.; Yuan, P.; Tan, J. An overview of energy status and development in Pakistan. Renew. Sustain. Energy Rev. 2015, 48, 892–931. [Google Scholar] [CrossRef]

- Malik, S.N.; Sukhera, O.R. Management of natural gas resources and search for alternative renewable energy resources: A case study of Pakistan. Renew. Sustain. Energy Rev. 2012, 16, 1282–1290. [Google Scholar] [CrossRef]

- Zuberi, M.J.S.; Torkmahalleh, M.A.; Ali, S.M.H. A comparative study of biomass resources utilization for power generation and transportation in Pakistan. Int. J. Hydrog. Energy 2015, 40, 11154–11160. [Google Scholar] [CrossRef]

- Khan, M.A. Modelling and forecasting the demand for natural gas in Pakistan. Renew. Sustain. Energy Rev. 2015, 49, 1145–1159. [Google Scholar] [CrossRef]

- Alahdad, Z. Pakistan’s Energy Sector: From Crisis to Crisis-Breaking the Chain; Pakistan Institute of Development Economics: Islamabad, Pakistan, 2012; p. 50. [Google Scholar]

- Sorrell, S.; Speirs, J. Using growth curves to forecast regional resource recovery: Approaches, analytics and consistency tests. Philos. Trans. A Math. Phys. Eng. Sci. 2014, 372, 20120317. [Google Scholar] [CrossRef] [PubMed]

- Al-Husseini, M. The debate over Hubbert’s Peak: A review. GeoArabia 2006, 11, 181–210. [Google Scholar]

- Zhao, L.; Feng, L.; Hall, C.A.S. Is peakoilism coming? Energy Policy 2009, 37, 2136–2138. [Google Scholar] [CrossRef]

- Brandt, A.R. Testing Hubbert. Energy Policy 2007, 35, 3074–3088. [Google Scholar] [CrossRef]

- Bardi, U.; Lavacchi, A. A Simple Interpretation of Hubbert’s Model of Resource Exploitation. Energies 2009, 2, 646–661. [Google Scholar] [CrossRef]

- Rehrl, T.; Friedrich, R. Modelling long-term oil price and extraction with a Hubbert approach: The LOPEX model. Energy Policy 2006, 34, 2413–2428. [Google Scholar] [CrossRef]

- Nashawi, I.S.; Malallah, A.; Al-Bisharah, M. Forecasting World Crude Oil Production Using Multicyclic Hubbert Model. Energy Fuels 2010, 24, 1788–1800. [Google Scholar] [CrossRef]

- Gallagher, B. Peak oil analyzed with a logistic function and idealized Hubbert curve. Energy Policy 2011, 39, 790–802. [Google Scholar] [CrossRef]

- Lin, B.-Q.; Liu, J.-H. Estimating coal production peak and trends of coal imports in China. Energy Policy 2010, 38, 512–519. [Google Scholar] [CrossRef]

- Maggio, G.; Cacciola, G. When will oil, natural gas, and coal peak? Fuel 2012, 98, 111–123. [Google Scholar] [CrossRef]

- Keith, D.; Moreno-Cruz, J. Pitfalls of coal peak prediction. Nature 2011, 469. [Google Scholar] [CrossRef] [PubMed]

- Jakobsson, K.; Bentley, R.; Söderbergh, B.; Aleklett, K. The end of cheap oil: Bottom-up economic and geologic modeling of aggregate oil production curves. Energy Policy 2012, 41, 860–870. [Google Scholar] [CrossRef]

- Giraud, P.-N. A Note on Hubbert’s Thesis on Mineral Commodities Production Peaks and derived Forecasting Techniques. Procedia Eng. 2012, 46, 22–26. [Google Scholar] [CrossRef]

- Szklo, A.; Machado, G.; Schaeffer, R. Future oil production in Brazil—Estimates based on a Hubbert model. Energy Policy 2007, 35, 2360–2367. [Google Scholar] [CrossRef]

- Tao, Z.; Li, M. System dynamics model of Hubbert Peak for China’s oil. Energy Policy 2007, 35, 2281–2286. [Google Scholar] [CrossRef]

- Tao, Z.; Li, M. What is the limit of Chinese coal supplies—A STELLA model of Hubbert Peak. Energy Policy 2007, 35, 3145–3154. [Google Scholar] [CrossRef]

- Lin, B.; Wang, T. Forecasting natural gas supply in China: Production peak and import trends. Energy Policy 2012, 49, 225–233. [Google Scholar] [CrossRef]

- Saraiva, T.A.; Szklo, A.; Lucena, A.F.P.; Chavez-Rodriguez, M.F. Forecasting Brazil’s crude oil production using a multi-Hubbert model variant. Fuel 2014, 115, 24–31. [Google Scholar] [CrossRef]

- Chavez-Rodriguez, M.F.; Szklo, A.; de Lucena, A.F.P. Analysis of past and future oil production in Peru under a Hubbert approach. Energy Policy 2015, 77, 140–151. [Google Scholar] [CrossRef]

- Wang, J.; Jiang, H.; Zhou, Q.; Wu, J.; Qin, S. China’s natural gas production and consumption analysis based on the multicycle Hubbert model and rolling Grey model. Renew. Sustain. Energy Rev. 2016, 53, 1149–1167. [Google Scholar] [CrossRef]

- Wang, J.; Feng, L. Curve-fitting models for fossil fuel production forecasting: Key influence factors. J. Nat. Gas Sci. Eng. 2016, 32, 138–149. [Google Scholar] [CrossRef]

- Reynolds, D.B. World oil production trend: Comparing Hubbert multi-cycle curves. Ecol. Econ. 2014, 98, 62–71. [Google Scholar] [CrossRef]

- Brecha, R. Ten Reasons to Take Peak Oil Seriously. Sustainability 2013, 5, 664–694. [Google Scholar] [CrossRef]

- Petroleum Institute of Pakistan (PIP). Pakistan Energy Outlook, 2015; Petroleum Institute of Pakistan: Karachi, Pakistan, 2015; p. 148. [Google Scholar]

| Province | Measured | Indicated | Inferred | Hypothetical | Total |

|---|---|---|---|---|---|

| Sindh | 7664 | 19,370 | 44,290 | 114,132 | 185,456 |

| Balochistan | 54 | 13 | 134 | 16 | 217 |

| Punjab | 55 | 24 | 11 | 145 | 235 |

| Khyber Pakhtunkhwa | 1.5 | 4.5 | 84 | - | 90 |

| Azad Kashmir | 1 | 1 | 7 | - | 9 |

| Grand Total | 7775.5 | 19,412.5 | 44,524 | 114,293 | 186,007 |

| Supply of Gas from Company/Operator | Share in Gas (%) | Country of Origin | Numbers of Non-Associated Gas Fields in Pakistan | Production (2014) | ||||

|---|---|---|---|---|---|---|---|---|

| Punjab | Sindh | KPK | Baluchistan | Total | Million CFt | |||

| Oil and Gas Development Company Limited | 28.75 | Pakistan | 7 | 42 | 1 | 4 | 54 | 427,579 |

| Pakistan Petroleum Limited | 15.90 | Pakistan | 1 | 6 | 0 | 1 | 8 | 236,445 |

| Mari Petroleum Limited | 14.56 | Pakistan | 0 | 6 | 0 | 1 | 7 | 216,448 |

| ENI Pakistan Limited | 2.01 | Italy | 0 | 4 | 0 | 0 | 4 | 178,612 |

| BHP Billiton Pakistan | 7.03 | Multi-national | 0 | 1 | 0 | 0 | 1 | 104,570 |

| MOL Pakistan | 7.05 | Hungary | 0 | 0 | 4 | 0 | 4 | 104,838 |

| OMV Maurice | 7.60 | Austria | 0 | 4 | 0 | 0 | 4 | 112,980 |

| OPL | 0.23 | Pakistan | 1 | 0 | 0 | 0 | 1 | 3431 |

| PEL | 0.48 | Pakistan | 0 | 6 | 0 | 0 | 6 | 7133 |

| POGC | 0.25 | Poland | 0 | 0 | 0 | 0 | 0 | 3726 |

| POL | 0.36 | Pakistan | 2 | 0 | 0 | 0 | 2 | 5358 |

| Tullow | 0.00 | UK | 0 | 2 | 0 | 0 | 2 | - |

| UEPL | 5.05 | Pakistan | 0 | 69 | 0 | 0 | 69 | 75,126 |

| Dewan Petroleum | 0.45 | Pakistan | 2 | 0 | 0 | 0 | 2 | 6684 |

| PETRONAS | 0.00 | Malaysia | 0 | 3 | 0 | 0 | 3 | - |

| Hycarbex | 0.27 | USA | 0 | 1 | 0 | 0 | 1 | 4063 |

| Grand Total | 1,486,993 | |||||||

| Activities/Information | Response |

|---|---|

| Exploratory wells | 891 |

| Development wells | 1214 |

| Sedimentary area | 827,268 km2 |

| Exploratory drilling density | One well per 928 km2 |

| Discoveries | 288 |

| • Oil | 80 |

| • Gas/condensate | 108 |

| Overall success rate | 1:3.1 |

| Reserves Type | Reserves Quantity 1 | Cumulative Production Till 2015 2 | Ultimate Recovery 3 | Peak Production 4 | Peak Year |

|---|---|---|---|---|---|

| Measure or Proven | 7776 | 110 | 7886 | 134 | 2080 |

| Proven + Indicated | 27,188 | 110 | 27,298 | 464 | 2099 |

| Proven + Indicated + Inferred | 71,714 | 110 | 71,824 | 1221 | 2114 |

| Proven + Indicated + Inferred + Hypothetical | 186,007 | 110 | 186,117 | 3164 | 2128 |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rehman, S.A.U.; Cai, Y.; Mirjat, N.H.; Walasai, G.D.; Shah, I.A.; Ali, S. The Future of Sustainable Energy Production in Pakistan: A System Dynamics-Based Approach for Estimating Hubbert Peaks. Energies 2017, 10, 1858. https://doi.org/10.3390/en10111858

Rehman SAU, Cai Y, Mirjat NH, Walasai GD, Shah IA, Ali S. The Future of Sustainable Energy Production in Pakistan: A System Dynamics-Based Approach for Estimating Hubbert Peaks. Energies. 2017; 10(11):1858. https://doi.org/10.3390/en10111858

Chicago/Turabian StyleRehman, Syed Aziz Ur, Yanpeng Cai, Nayyar Hussain Mirjat, Gordhan Das Walasai, Izaz Ali Shah, and Sharafat Ali. 2017. "The Future of Sustainable Energy Production in Pakistan: A System Dynamics-Based Approach for Estimating Hubbert Peaks" Energies 10, no. 11: 1858. https://doi.org/10.3390/en10111858

APA StyleRehman, S. A. U., Cai, Y., Mirjat, N. H., Walasai, G. D., Shah, I. A., & Ali, S. (2017). The Future of Sustainable Energy Production in Pakistan: A System Dynamics-Based Approach for Estimating Hubbert Peaks. Energies, 10(11), 1858. https://doi.org/10.3390/en10111858