Mapping the Relationship Between Financial Inclusion and Undergraduate Students: A Scoping Review

Abstract

1. Introduction

- How many scientific journal publications exist on the relationship between financial inclusion and undergraduate students?

- How have financial literacy and financial well-being been studied concerning financial inclusion?

- What main concepts have been studied regarding the relationship between financial inclusion and undergraduate students?

- What aspects of the relationship between financial inclusion and undergraduate students have been studied in our context of interest?

2. Materials and Methods

2.1. Expanding the Context Approach

2.2. Comparison of Methods for Literature Review

3. Contextual Constellations

3.1. Research Process

3.1.1. Research Context

3.1.2. Keywords Co-Occurrence Matrix

3.1.3. Search Criteria

3.1.4. Data Collection and Selection Criteria

3.1.5. Analysis of Accepted Publications

3.2. Software Use

3.2.1. Mapping Instructions

3.2.2. Types of Mapping

- (a)

- Type I: General Mapping

- (b)

- Type II: Keyword Selection Mapping

- (c)

- Type III: Component Mapping

- (d)

- Type IV: Components Merging Mapping

- (e)

- Type V. Mapping of Detected Publications in a Contextual Constellation

- (e)

- Graphs obtained from the mappings

4. Results

4.1. Emergent Method

4.1.1. Research Context Found

4.1.2. Developed Matrix of Keyword Co-Occurrence

4.1.3. Applied Search Criteria

4.1.4. Selection Criteria and Data Collection

4.1.5. Analysis of the Database Obtained

4.2. Research Questions

4.2.1. Relationship Between Financial Inclusion and Undergraduate Students

4.2.2. Financial Inclusion, Financial Literacy, and Financial Well-Being

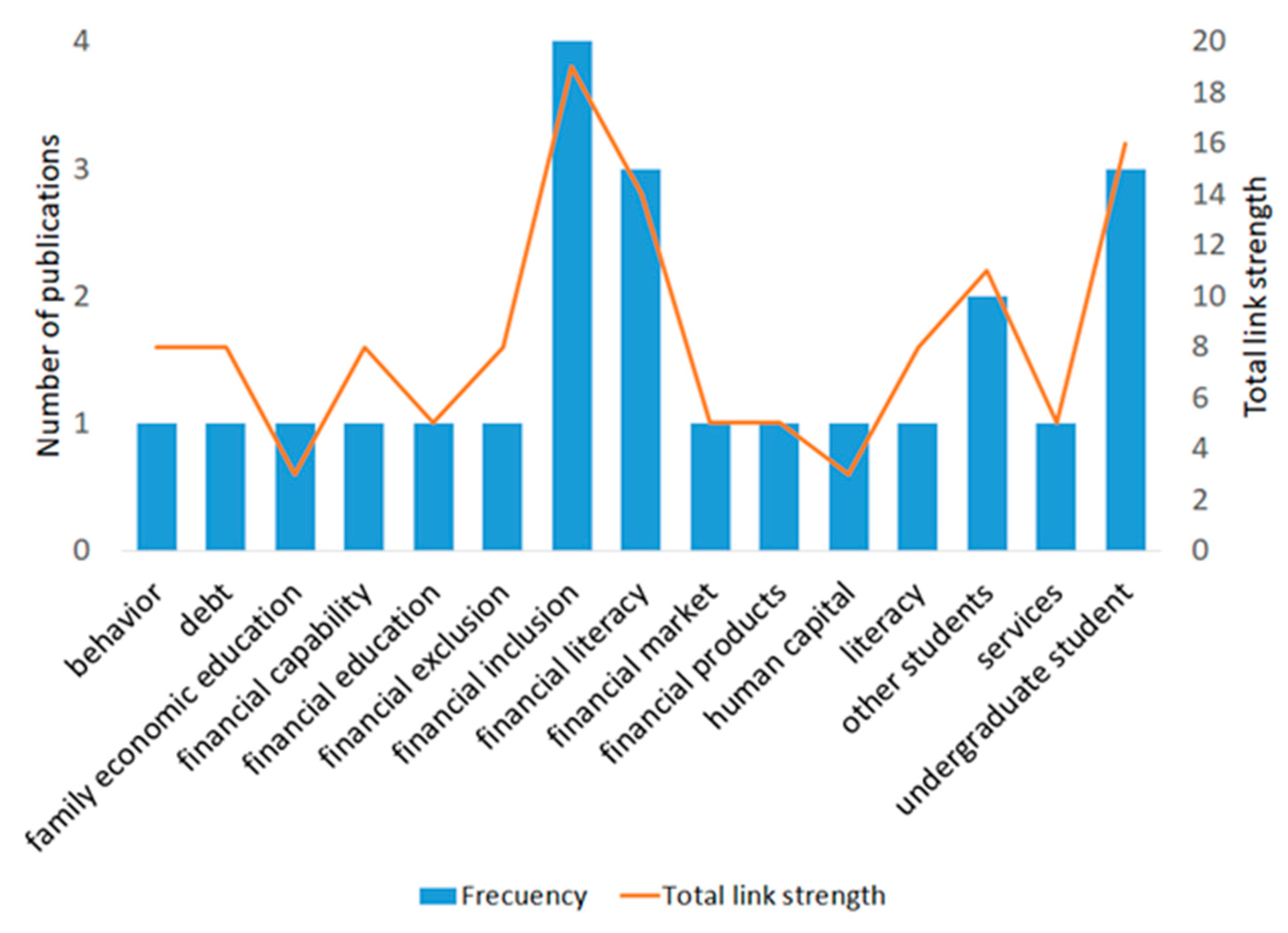

4.2.3. Concepts Around the Relationship FI-St

4.2.4. Contextual Relationship Between Financial Inclusion and Undergraduate Students

5. Discussion

5.1. Previous Reviews

5.2. Discussion of the Findings

5.3. Research Gaps

5.4. Approach to Contextual Constellations

5.5. Use of VOSviewer

5.6. Strengths and Limitations

5.7. Future Research

6. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| FI | Financial Inclusion |

| FL | Financial Literacy |

| FWB | Financial Well-Being |

| St | Students |

| Exp | Experiment |

| Beh | Behavior |

| SDG | Sustainable Development Goals |

| SSE | Social and Solidarity Economy |

| Dec | Decision |

| Inn | Innovation |

Appendix A

| Systematic Literature Review (Koutsos et al., 2019) | Systematic Mapping (Liu et al., 2024) | Contextual Constellations (This Study) |

|---|---|---|

| 1. Scoping 1.1 Review protocol 1.2 Few relevant studies 1.3 Previous systematic reviews | 1. Exploration and preliminary work 1.1 Establish research aim 1.2 Ensure research scope 1.3 Definition of research question | 1. Research context 1.1 Objectives and scope 1.2 Query questions 1.3 Previous reviews |

| 2. Planning 2.1 Search strategy | 2. Search strategy 2.1 Identifying keywords | 2. Keyword co-occurrence Matrix 2.1 First group of keywords 2.2 Pairwise search in databases 2.3 Keyword co-occurrence Matrix |

| 2.2 Eligibility criteria 2.3 Strength of evidence 3. Identification/Search 3.1 Implementation of the pre-defined search strategy 3.2 Examination of resulted articles 3.3 Make changes to the search strategy if needed 3.4 Performing additional searches 3.5 Search for additional sources for identifying articles 3.6 Manually selection sources for identifying articles 4. Screening 4.1 Export of citations as the resulting studies of the search queries. 4.2 Import the exported citation into a citation manager 4.3 Remove of duplicates 4.4 Update article information | 2.2 Selecting databases 2.3 Defining search string strategy 3. Research execution 3.1 Conducting search with inclusion criteria 3.2 Obtain a list of papers 3.3 Remove duplicates 3.4 (a) Screening of papers 3.4 (b) Removing inconsistent paper with exclusion criteria | 3. Search criteria 3.1 Choose search profile 3.2 Collect and download the list of results 3.3 Join and clean the list of the result to remove duplicates |

| 4.5 Thorough examination of the selected articles 5. Eligibility/Assessment 5.1 Setting inclusion and exclusion criteria 5.2 Defining the strategy for the strength of evidence 5.3 Assessing articles based on their strength of evidence | 4. Coding and analysis 4.1 (a) Conducting classification scheme | 4. Selection criteria and data collection 4.1 Describe the evidence strength strategy 4.2 Establish and apply relevance, inclusion and exclusion criteria 4.3 Obtain a list of accepted publications 4.4 Collect a list of accepted in full-text |

| 5.4 Assessing the types of bias that may exist 5.5 Reading in depth the selected full-text of the articles 6. Presentation/Interpretation 6.1 Synopsis of the systematic review finding 6.2 Study of the heterogeneity of the studies included 6.3 Presentation of the results 6.4 Interpretation of the findings 6.5 Discussion on the generalization of the conclusions 6.6 Limitations of the systematic review 6.7 Recommendations for further research | 4.1 (b) Data extraction and mapping | 5. Analysis of accepted publications 5.1 Create the Evidence Strength Strategy 5.2 Obtain a list of co-occurrence keywords 5.3 Create thesaurus 5.4 Choose the type of map 5.5 Obtain nodes and relations Analysis of the contextual constellations |

References

- Abramova, I., Nedilska, L., Kurovska, N., Kovalchuk, O., & Poplavskyi, P. (2023). Modern state and post-war prospects of financial inclusion in ukraine considering the eu experience. Financial and Credit Activity: Problems of Theory and Practice, 6(53), 318–333. [Google Scholar] [CrossRef]

- Arksey, H., & O’Malley, L. (2005). Scoping studies: Towards a methodological framework. International Journal of Social Research Methodology: Theory and Practice, 8(1), 19–32. [Google Scholar] [CrossRef]

- Arner, D. W., Buckley, R. P., Zetzsche, D. A., & Veidt, R. (2020). Sustainability, FinTech and financial inclusion. European Business Organization Law Review, 21(1), 7–35. [Google Scholar] [CrossRef]

- Álvarez-Gamboa, J., Cabrera-Barona, P., & Jácome-Estrella, H. (2023). Territorial inequalities in financial inclusion: A comparative study between private banks and credit unions. Socio-Economic Planning Sciences, 87, 101561. [Google Scholar] [CrossRef]

- Bashir, I., & Qureshi, I. H. (2023). Examining theories, mediators and moderators in financial well-being literature: A systematic review and future research agenda. Qualitative Research in Organizations and Management: An International Journal, 18(4), 265–290. [Google Scholar] [CrossRef]

- Bates, S., Clapton, J., & Coren, E. (2007). Systematic maps to support the evidence base in social care. Evidence and Policy, 3(4), 539–551. [Google Scholar] [CrossRef]

- Buckland, J., Daniels, C., & Godinho, V. (2020). Does Australia have an advantage in promoting financial well-being and what might Canada and other countries learn? Canadian Journal of Urban Research, 29(1), 39–54. [Google Scholar] [CrossRef]

- Campanella, F., Serino, L., & Crisci, A. (2022). Governing Fintech for sustainable development: Evidence from Italian banking system. Qualitative Research in Financial Markets, 15(4), 557–571. [Google Scholar] [CrossRef]

- Cassimon, S., Maravalle, A., Pandiella, A. G., & Turroques, L. (2022). Determinants of and barriers to people’s financial inclusion in Mexico. In OECD economics department (OECD Economics Department Working Papers No. 1728). OECD. [Google Scholar] [CrossRef]

- Choowan, P., Daovisan, H., & Suwanwong, C. (2025). Effects of financial literacy and financial behavior on financial well-being: Meta-analytical review of experimental studies. International Journal of Financial Studies, 13(1), 1. [Google Scholar] [CrossRef]

- Choung, Y., Chatterjee, S., & Pak, T. Y. (2023). Digital financial literacy and financial well-being. Finance Research Letters, 58, 104438. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, A., & Klapper, L. (2013). Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brookings Papers on Economic Activity, 2013(1), 279–340. [Google Scholar] [CrossRef]

- El Bied, S., Ros Mcdonnell, L., de-la-Fuente-Aragón, M. V., & Ros Mcdonnell, D. (2024). A comprehensive bibliometric analysis of real estate research trends. International Journal of Financial Studies, 12(3), 95. [Google Scholar] [CrossRef]

- Epstein, D., & Klerman, J. A. (2016). On the “When” of social experiments: The tension between program refinement and abandonment. New Directions for Evaluation, 2016(152), 33–45. [Google Scholar] [CrossRef]

- Escobar, L., & Grubbauer, M. (2021). Housing microfinance, saving and credit cooperatives, and community development in low-income settings in Mexico. Community Development Journal, 56(1), 141–160. [Google Scholar] [CrossRef]

- Esmaeilpour Moghadam, H., & Karami, A. (2023). Financial inclusion through FinTech and women’s financial empowerment. International Journal of Social Economics, 50(8), 1038–1059. [Google Scholar] [CrossRef]

- Febriana, R. N., & Damayanti, S. M. (2017). The relationship between demographic factors towards financial literacy and financial inclusion among financially educated student in Institut Teknologi Bandung. Advanced Science Letters, 23(8), 7204–7206. [Google Scholar] [CrossRef]

- Ferrada, L. M., & Montaña, V. (2022). Inclusion and financial literacy: The case of higher education student workers in Los Lagos, Chile. Estudios Gerenciales, 38(163), 211–221. [Google Scholar] [CrossRef]

- Gálvez-Sánchez, F. J., Lara-Rubio, J., Verdú-Jóver, A. J., & Meseguer-Sánchez, V. (2021). Research advances on financial inclusion: A bibliometric analysis. Sustainability, 13(6), 3156. [Google Scholar] [CrossRef]

- Ghosh, M. (2024). Financial inclusion studies bibliometric analysis: Projecting a sustainable future. Sustainable Futures, 7, 100160. [Google Scholar] [CrossRef]

- Gough, D., Thomas, J., & Oliver, S. (2012). Clarifying differences between review designs and methods. Systematic Reviews, 1(1), 28. [Google Scholar] [CrossRef] [PubMed]

- Gómez, W. (2023). Assessing PrEP messaging and communication: A review of the qualitative literature. Current Opinion in Psychology, 51, 101586. [Google Scholar] [CrossRef]

- GRADE Working Group. (2024). Education and debate. BMJ, 328, 1–8. [Google Scholar]

- Ha, D., Le, P., & Nguyen, D. K. (2025). Financial inclusion and fintech: A state-of-the-art systematic literature review. Financial Innovation, 11(69), 2–42. [Google Scholar] [CrossRef]

- Haddaway, N. R., Page, M. J., Pritchard, C. C., & McGuinness, L. A. (2022). PRISMA2020: An R package and Shiny app for producing PRISMA 2020-compliant flow diagrams, with interactivity for optimised digital transparency and Open Synthesis. Campbell Systematic Reviews, 18(2), e1230. [Google Scholar] [CrossRef] [PubMed]

- Jan van Eck, N., & Waltman, L. (2023). VOSviewer manual. Available online: https://www.vosviewer.com/ (accessed on 23 December 2025).

- Jungo, J., Madaleno, M., & Botelho, A. (2023). Financial literacy, financial innovation, and financial inclusion as mitigating factors of the adverse effect of corruption on banking stability indicators. Journal of the Knowledge Economy, 15(2), 8842–8873. [Google Scholar] [CrossRef]

- Kamble, P. A., Mehta, A., & Rani, N. (2024). Financial inclusion and digital financial literacy: Do they matter for financial well-being? Social Indicators Research, 171(3), 777–807. [Google Scholar] [CrossRef]

- Kocornik-Mina, A., Bastida-Vialcanet, R., & Eguigurenhuerta, M. (2021). Social impact of value-based banking: Best practises and a continuity framework. Sustainability, 13(14), 7681. [Google Scholar] [CrossRef]

- Koutsos, T. M., Menexes, G. C., & Dordas, C. A. (2019). An efficient framework for conducting systematic literature reviews in agricultural sciences. Science of the Total Environment, 682, 106–117. [Google Scholar] [CrossRef] [PubMed]

- Kumar, S., Rao, S., Goyal, K., & Goyal, N. (2022). Journal of behavioral and experimental finance: A bibliometric overview. Journal of Behavioral and Experimental Finance, 34, 100652. [Google Scholar] [CrossRef]

- León-Cuanalo, G., Hernández-Rivera, A., & Haro-Álvarez, G. (2022). Financial Inclusion in Bachelor Students in Mexico, 2017–2018. Revista Mexicana de Economia y Finanzas Nueva Epoca, 17(1), e716. [Google Scholar] [CrossRef]

- Liu, Q., Chan, K. C., & Chimhundu, R. (2024). Fintech research: Systematic mapping, classification, and future directions. Financial Innovation, 10(1), 24. [Google Scholar] [CrossRef]

- López-Cortes, O. D., Betancourt-Nuñez, A., Bernal-Orozco, M. F., & Vizmanos, B. (2022). Scoping review: Una nueva forma de síntesis de la evidencia. Investigación en Educación Media, 11(44), 98–104. [Google Scholar] [CrossRef]

- Luhmann, N. (1994). Inclusión-exclusión. Acta Sociológica, 12, 11–39. [Google Scholar]

- Malkina, M. Y., & Rogachev, D. Y. (2019). Influence of Personal Characteristics on the Financial Behavior of Youth. Journal of Institutional Studies, 11(3), 135–152. [Google Scholar] [CrossRef]

- Mirza, N., Umar, M., Afzal, A., & Firdousi, S. F. (2023). The role of fintech in promoting green finance, and profitability: Evidence from the banking sector in the euro zone. Economic Analysis and Policy, 78, 33–40. [Google Scholar] [CrossRef]

- Moher, D., Liberati, A., Tetzlaff, J., & Altman, D. G. (2010). Preferred reporting items for systematic reviews and meta-analyses: The PRISMA statement. International Journal of Surgery, 8(5), 336–341. [Google Scholar] [CrossRef]

- Nogueira Silva, B., Viera Silva, W., Pereira de Macêdo, A. F., de Almeida Levino, N., Dalazen, L. L., Kaczam, F., & Pereira da Veiga, C. (2023). A systematic review on social currency: A one-decade perspective. Journal of Financial Services Marketing, 29(2), 636–652. [Google Scholar] [CrossRef]

- Orduña-Malea, E., & Costas, R. (2021). Link-based approach to study scientific software usage: The case of VOSviewer. Scientometrics, 126(9), 8153–8186. [Google Scholar] [CrossRef]

- Pavlovskaya, M., & Eletto, R. (2021). Credit unions, class, race, and place in New York City. Geoforum, 127, 335–348. [Google Scholar] [CrossRef]

- Pranajaya, E., Alexandri, M. B., Chan, A., & Hermanto, B. (2024). Examining the influence of financial inclusion on investment decision: A bibliometric review. Heliyon, 10(3), e25779. [Google Scholar] [CrossRef] [PubMed]

- Rahmawati, S. A., Narmaditya, B. S., Wibowo, A., Wulandari, D., Hardinto, P., Prayintno, P., & Utomo, S. H. (2019). Family economy education, financial literacy and financial inclusion among university students in Indonesia. International Journal of Scientific & Technoilogy Research, 8(12), 1291–1294. [Google Scholar]

- Rastogi, S., Singh, K., & Kanoujiya, J. (2023). Do countries capture their inclusive growth, sustainability, and poverty correctly? A study on statistical performance indicators defined by World Bank. Social Responsibility Journal, 19(10), 1935–1951. [Google Scholar] [CrossRef]

- Respati, D. K., Widyastuti, U., Nuryati, T., Musyaffi, A. M., Handayani, B. D., & Ali, N. R. (2023). How do students’ digital financial literacy and financial confidence influence their financial behavior and financial well-being? Nurture, 17(2), 40–50. [Google Scholar] [CrossRef]

- Suryavanshi, U., Chaudhry, R., Arora, M., & Mittal, A. (2024). Mapping the evolution of financial inclusion: A retrospective overview using bibliometric analysis. Global Knowledge, Memory and Communication. [Google Scholar] [CrossRef]

- Şenol, D., & Onay, C. (2023). Impact of gamification on mitigating behavioral biases of investors. Journal of Behavioral and Experimental Finance, 37, 100772. [Google Scholar] [CrossRef]

- Tay, L. Y., Tai, H. T., & Tan, G. S. (2022). Digital financial inclusion: A gateway to sustainable development. Heliyon, 8(6), e09766. [Google Scholar] [CrossRef]

- Tricco, A. C., Lillie, E., Zarin, W., O’Brien, K. K., Colquhoun, H., Levac, D., Moher, D., Peters, M. D. J., Horsley, T., Weeks, L., Hempel, S., Akl, E. A., Chang, C., McGowan, J., Stewart, L., Hartling, L., Aldcroft, A., Wilson, M. G., Garritty, C., … Straus, S. E. (2018). PRISMA extension for scoping reviews (PRISMA-ScR): Checklist and explanation. Annals of Internal Medicine, 169(7), 467–473. [Google Scholar] [CrossRef]

- Vijay Kumar, V. M., & Senthil Kumar, J. P. (2023). Insights on financial literacy: A bibliometric analysis. Managerial Finance, 49(7), 1169–1201. [Google Scholar] [CrossRef]

- Wang, Y., Wang, Z., Liu, G., Wang, Z., Wang, Q., Yan, Y., Wang, J., Zhu, Y., Gao, W., Kan, X., Zhang, Z., Jia, L., & Pang, X. (2022). Application of serious games in health care: Scoping review and bibliometric analysis. Frontier in Public Health, 10, 896974. [Google Scholar] [CrossRef]

- Williams, A. J., & Oumlil, B. (2015). College student financial capability: A framework for public policy, research and managerial action for financial exclusion prevention. International Journal of Bank Marketing, 33(5), 637–653. [Google Scholar] [CrossRef]

- Xiao, J. J., Huang, J., Goyal, K., & Kumar, S. (2022). Financial capability: A systematic conceptual review, extension and synthesis. International Journal of Bank Marketing, 40(7), 1680–1717. [Google Scholar] [CrossRef]

- Yeo, K. H. K., Lim, W. M., & Yii, K. J. (2023). Financial planning behaviour: A systematic literature review and new theory development. Journal of Financial Services Marketing, 29(3), 979–1001. [Google Scholar] [CrossRef]

- Zhang, Y., Tadesse, A., & Huang, J. (2025). How to improve the efficiency of financial inclusion for poverty alleviation in China? An empirical analysis. Journal of Poverty, 29(5), 437–455. [Google Scholar] [CrossRef]

| Feature | Narrative Review | Systematic Review | Meta-Analysis Review | Scoping Review | Systematic Mapping | Contextual Constellations |

|---|---|---|---|---|---|---|

| Short description | Selective review type is usually prone to bias and broadly covers a specific topic, following no strict search methods to locate or evaluate relevant articles | Review type based on search strategies. Aim to ensure that the maximum extent of relevant articles has been considered and synthesized | Review type based on search strategies. Aim to ensure that the maximum extent of relevant articles has been considered and synthesized | Exhaustive literature review that answers a broad research question | Systematic maps gather together existing literature in a specific topic area and categorize it according to predefined keywords to create a coded database of literature | This review explores a specific topic in a particular context and uses elements of systematic mapping to improve a scoping review. |

| Registered protocol | No | Yes | Yes | Yes | No | Yes |

| Standardization | No | PRISMA | PRISMA | PRISMA-ScR | No | PRISMA-ScR |

| Research question | Often broad in scope | Focused research question | Focused research question | Often a broad research question | Can be broad or narrow depending on the needs of the project. | Can be broad or narrow depending on the context of the project. |

| Type of research question 1 | Not establish | PICO | PICO | PICO/PCC | Not establish | PCC |

| Data sources and search strategy | Not usually specified, potentially biased and not provided | Explicit and comprehensive search strategy with a detailed list of data sources | Previously conducted quantitative studies or systematic reviews | Explicit and comprehensive search strategy | It is generally considered less stringent, as it usually focuses on the big picture and covers a large number of relevant articles in the field of study | It is based on explicit strategy search, but it focuses on a particular picture from a context and covers a large number of articles in the field of study to select the most relevant according to such a context. |

| Selection criteria | Not usually specified, potentially biased | Uniformly and consistently applied inclusion and exclusion criteria | Uniformly and consistently applied inclusion and exclusion criteria | Uniformly and consistently applied inclusion and exclusion criteria | Uniformly and consistently applied inclusion and exclusion criteria | Uniformly and consistently applied relevance, inclusion and exclusion criteria |

| Appraisal of included articles | Variable | Meticulous critical appraisal | Meticulous critical appraisal | Rigorous critical appraisal | Critical appraisal | Meticulous critical appraisal |

| Synthesis | Narrative | Quantitative | Quantitative | Informative | Illustrative on coding (keywording) tools and process | Quantitative, informative and illustrative on coding (keywording) tools and process |

| Inference | Sometime evidence-based | Usually evidence-based | Always evidence-based | Usually evidence-based | Usually evidence-based | Usually evidence-based |

| Classification | Can exist or not | Results are classified based on the strength of evidence | Results are classified based on the statistical analysis conducted | Results are classified based on the strength of evidence | Use individual judgment and interpretation to group and categorize the data, considering the frequency and coverage of the selected articles both geographically and thematically | Results are classified based on the strength of evidence and categorize the data, considering the frequency and coverage of the selected articles both geographically and thematically |

| Replicability | No | Yes | Yes | Yes | Yes | Yes |

| Analysis of bias risk | No | Yes | Yes | No | No | No |

| Key references | (Koutsos et al., 2019; López-Cortes et al., 2022) | (Gough et al., 2012; Ha et al., 2025; Koutsos et al., 2019; López-Cortes et al., 2022; Nogueira Silva et al., 2023) | (Gough et al., 2012; Koutsos et al., 2019) | (Gough et al., 2012; López-Cortes et al., 2022; Wang et al., 2022) | (Bates et al., 2007; Gough et al., 2012) | (Koutsos et al., 2019; Liu et al., 2024) |

| Framework | Description |

|---|---|

| Population (P) | Studies about the relationship between financial inclusion and undergraduate students: Including keywords: such as financial inclusion, students, financial literacy, financial well-being, experiments, decisions, behavior, Sustainable Development Goals, Social and Solidarity Economy, and innovation. |

| Concept (C) | Research on making financial decisions among undergraduate students to reach financial inclusion: Including keywords such as financial inclusion, students, financial literacy, and financial well-being. |

| Context (C) | It considers research that includes keywords such as experiment, behavior, Sustainable Development Goals, Social and Solidarity Economy, Decisions, and Innovation, regarding the relationship between financial inclusion and undergraduate students. |

| Search 1 | Applied Strategy |

|---|---|

| Filter 1: “Keyword 1” AND “Keyword 2” |

|

| Filter 2: Only Article or Review |

|

| Filter 3: AND “financial inclusion” OR “financial literacy” OR “financial well-being” |

|

| Relevance Criteria | Values | Description |

|---|---|---|

| Strength of evidence | 5 | The article is too relevant to study the relationship between financial inclusion and undergraduate students |

| 4 | The article is relevant to study the relationship between financial inclusion and undergraduate students | |

| 3 | The article is mildly relevant to studying the relationship between financial inclusion and undergraduate students | |

| 2 | The article is not so relevant to studying the relationship between financial inclusion and undergraduate students | |

| 1 | The article is not at all relevant to studying the relationship between financial inclusion and undergraduate students | |

| Type of evidence | A | The article refers to the relationship of students with financial inclusion, financial literacy, or financial well-being |

| B | The article refers to the relationship between financial inclusion, financial literacy, and financial well-being | |

| C | The article directly addresses the relationship of these topics: financial inclusion, financial literacy, and/or financial well-being | |

| D | The article tangentially refers to one of the topics: financial inclusion, financial literacy, or financial well-being | |

| E | The article addresses any topics other than financial inclusion, financial literacy, or financial well-being |

| Characteristics of Evidence | Inclusion Criteria | Exclusion Criteria |

|---|---|---|

| Relevance by category | 5A, 4A, 3A, 2A, 5B, 4B, 3B, 5C, 4C, 5D | 5E, 4E, 3E, 2E, 1E, 4D, 3D, 2D, 1D, 3C, 2C, 1C, 2B,1B, 1A |

| Accessibility | Open Access or Institutional access | Not available without prior payment |

| Extension | Full-text publications | Only abstract |

| Procedure | Options | Indication |

|---|---|---|

| Requirement | List of accepted publications in CSV formatFree software VOSviewer | |

| Create a map | Create a first map of keywords co-ocurrenceCreate a map of keywords to obtain a Contextual Constellation | |

| 1.1 Choose type of data | Select: Create a map based on bibliographic data | Choose this option to create a: co-authorship, keyword co-ocurrence, citation, bibliographic coupling, or, co-citation map based on bibliographic data 1. |

| 1.2 Choose data sources | Read data from bibliographic databases files | Supported files type: Web of Sciences (TXT), Scopus (CVS), Dimension (CVS), Lends (CVS), and PubMed (TXT) |

| 1.3 Select file (Scopus) | Upload list of accepted publications in CSV format | |

| 1.4 Choose type of analysis and counting method | Type of analysis: Co-occurrence | 1. If this one is the first map, it is not necessary to use a thesaurus file 2. If this one is the map to obtain a Contextual constellation, it’s recommended to use a thesaurus file |

| Unit of analysis: All keywords | ||

| Counting method: Full counting | ||

| VOSviewer thesaurus file (optional) | ||

| 1.5 Choose threshold | Minimum number of occurrences of a keyword: | Choose the number that best fits the needs of the research. |

| 1.6 Choose number of keywords | Number of keywords to be selected | For each of the keywords from the threshold, the total strength of the co-occurrence links with other keywords will be calculated. The keywords with the greatest total link strength will be selected. |

| 1.7 Verify selected keywords | It displays a table with Selected, Keywords, Occurrences, and Total link strength. | It is possible to select and deselect each keyword, and right-click the mouse button it is possible to export the selection of keywords and relations, both in format TXT. 1. If this one is the first map, it is necessary to download all the keywords (nodes) and relations to create a thesaurus 2. If this one is the map to obtain a contextual constellation, it’s recommended to select only the interest keywords and then download the nodes and relations to analyze |

| 1.8 Visualization of a map | Network visualization | Show a map divided by colors that identify clusters |

| Overlay visualization | Show a map divided by colors that identify the publication year. | |

| Density visualization | Show a map like a heat footprint, where the clusters take a lighter color when they have more density |

| Title | Objective | Keywords | Main Features |

|---|---|---|---|

| Financial inclusion studies bibliometric analysis: Projecting a sustainable future. (Ghosh, 2024) | Scientifically reviews and analyzes the existing literature on financial inclusion using a bibliometric approach | Bibliometric Analysis Financial Inclusion Technology Digital Inclusion Inclusivity Society Sustainable Development | Scopus 206 considered articles VOSviewer Search period from 2013 to 2022 |

| Examining the influence of financial inclusion on investment decision: A bibliometric review. (Pranajaya et al., 2024) | It delves into the contemporary landscape of potential financial inclusion in investment decision-making, leveraging bibliometric research methods. | Financial Inclusion Investment decisions Bibliometric analysis Research trends | Scopus 161 considered articles VOSviewer, version 1.6.20 and Biblioshiny R Studio, version 4.3.1 Search period from 2006 to 2023 |

| Digital financial inclusion: A gateway to sustainable Development. (Tay et al., 2022) | Provide an overview of how the COVID-19 pandemic has affected digital financial eco-systems by accelerating the process of broad-based digitalization of financial services, which has already been partly implemented in developed and developing countries. | Digital financial inclusion Development Mechanism Systematic literature review | ProQuest Scopus Springer Science Direct Emerald 34 articles considered Search period: Not specified |

| Mapping the evolution of financial inclusion: a retrospective overview using bibliometric analysis. (Suryavanshi et al., 2024) | Analyze the existing literature in the field of financial inclusion and highlight future trends. Examine recent literature and assess its geographic distribution, identifying well-known authors, publications, journals, and keyword occurrences. | Network visualization Bibliometrics VOS viewer Financial inclusion Co-citation analysis Bibliographic linking | Scopus 2125 considered articles Search period: 2004–2022. |

| Categories and Relevance | A | B | C | D | E | Total |

|---|---|---|---|---|---|---|

| Too relevant | 76 | 23 | 135 | 135 | 36 | 405 |

| Relevant | 98 | 36 | 384 | 127 | 31 | 676 |

| Mildly relevant | 236 | 180 | 633 | 200 | 70 | 1319 |

| Not so relevant | 235 | 35 | 368 | 291 | 197 | 1126 |

| Not at all relevant | 39 | 5 | 542 | 365 | 986 | 1937 |

| Total | 684 | 279 | 2062 | 1118 | 1320 | 5463 |

| Strength of Evidence | Authors/Year/Language/ Citation/ Filter by | Objective | Design | Context | Findings and Conclusions |

|---|---|---|---|---|---|

| 5A | (León-Cuanalo et al., 2022) Spanish Citation: 2 Filter by: VOSviewer and Excel | This article analyzes students from twelve universities in Mexico, to estimate the levels and factors that limit or promote inclusion financial | Scoring Model Statistical and econometric techniques. Stratified and subsequently clustered sampling method Sample: 3600 students from Economics and Business Administration programs at public and private Higher Education Institutions | Inequalities between States and Zones in Mexico, regarding higher education institutions. | Students from more economically developed metropolitan areas generally achieved better inclusion rankings than those living in rural areas. If university students studying economics and finance are unable to achieve financial inclusion, it will likely be even more difficult for them in other fields of study. |

| 3A | (Rahmawati et al., 2019) English Citation: 4 Filter by: VOSviewer and Excel | This article determines the level of both financial literacy and financial inclusion of students and the relationship between family economic education toward financial literacy. | Path analysis. Unit analysis: students in several universities in Indonesia. 188 questionnaires were filled out. | The context focuses on providing a comprehensive perspective on causal phenomena in social studies, capturing the levels of university students’ financial literacy and financial inclusion, and how these relate to one another, in Indonesia. | The findings indicate that family economic education significantly affects financial literacy and financial inclusion. Educating parents on how to manage money and make good decisions can teach children to save money within the family, which will significantly influence children’s behavior, particularly in their economic activities. |

| 5A | (Ferrada & Montaña, 2022) Spanish Citation: 49 Filter by: Excel | This article measures the association between literacy and financial inclusion, and analyses whether there is an advantage of inclusion to evaluate the impact of financial literacy on inclusion | Survey Sample: 470 people. Sampling was stratified; each stratum corresponded to a city. Inclusion criteria: only students enrolled in technical-professional programs who were also employed. The financial inclusion index and financial literacy index were calculated. Correlation coefficients (Pearson and Spearman) | The context target focused on workers who held employment contracts and were simultaneously pursuing a higher-level professional or technical degree in the Los Lagos Region of Chile, to study the sociodemographic characteristics, financial literacy, and financial inclusion of the respondents. | It was found that higher levels of schooling are not necessarily linked to financial literacy. A significant and positive association was also found between inclusion and all components of financial literacy; however, low levels of financial literacy were observed despite high levels of schooling and work experience. Only 25% of those surveyed reached at least the minimum standard literacy indicator to be considered financially literate. |

| 4A | (Williams & Oumlil, 2015) English Citation: 48 Filter by: VOSviewer and Excel | This paper analyses a model of college students’ financial capabilities enhancement to partially alleviate some of the problems related to deficits in financial knowledge among this population. | The model is built on the foundation of previous models Suggestions of broad topical areas that might be included in a college student financial literacy program. | The development context of the model of university students’ financial capabilities focuses on preventing their financial exclusion through institutional decision-making processes. This study was focused in the USA | The model can be adapted to meet unique institutional circumstances and culture. It offers the potential to improve the overall quality of financial health among college students and young adults. |

| Strength of Evidence | Authors/Year/ Filter by | Title | Source Title | Citation | Keywords |

|---|---|---|---|---|---|

| 4A | (Respati et al., 2023) Filter by: Excel | How do students’ digital financial literacy and financial confidence influence their financial behavior and financial well-being? | Nurture | 4 | Digital financial literacy; Financial behavior; Financial confidence; Financial well-being; Indonesia; SEM-PLS; Students |

| 3B | (Abramova et al., 2023) Filter by: Excel | Modern state and post-war prospects of financial inclusion in Ukraine considering the EU experience | Financial and Credit Activity-Problems of Theory and Practice | 31 | financial inclusion; financial well-being; financial behavior; financial literacy; post-war recovery |

| 3A | (Malkina & Rogachev, 2019) Filter by: Excel | Influence of personal characteristics on the financial behavior of youth | Journal of Institutional Studies | 21 | young people; students, financial behavior; financial literacy; risk preference; optimism; credulity; propensity for innovation; extravagance; propensity for illegal actions |

| 4B | (Xiao et al., 2022) Filter by: Excel | Financial capability: a systematic conceptual review, extension and synthesis | International Journal of Bank Marketing | 222 | Systematic literature review; Financial capability; Financial behavior; Financial inclusion; Financial literacy; Financial well-being |

| 3B | (Zhang et al., 2025) Filter by: Excel | How to Improve the Efficiency of Financial Inclusion for Poverty Alleviation in China? An Empirical Analysis | Journal of Poverty | 31 | Financial behavior; financial inclusion; financial literacy; financial usage; financial well-being; poverty alleviation |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2026 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license.

Share and Cite

Flores-Vasconcelos, A.; Rivera-Gonzalez, I.A.; Díaz de León, D.; Pérez-Salazar, M.d.R.; Zacarías, A.; Cruz, J.M. Mapping the Relationship Between Financial Inclusion and Undergraduate Students: A Scoping Review. J. Risk Financial Manag. 2026, 19, 23. https://doi.org/10.3390/jrfm19010023

Flores-Vasconcelos A, Rivera-Gonzalez IA, Díaz de León D, Pérez-Salazar MdR, Zacarías A, Cruz JM. Mapping the Relationship Between Financial Inclusion and Undergraduate Students: A Scoping Review. Journal of Risk and Financial Management. 2026; 19(1):23. https://doi.org/10.3390/jrfm19010023

Chicago/Turabian StyleFlores-Vasconcelos, Alicia, Igor Antonio Rivera-Gonzalez, Denise Díaz de León, María del Rosario Pérez-Salazar, Alejandro Zacarías, and José Michael Cruz. 2026. "Mapping the Relationship Between Financial Inclusion and Undergraduate Students: A Scoping Review" Journal of Risk and Financial Management 19, no. 1: 23. https://doi.org/10.3390/jrfm19010023

APA StyleFlores-Vasconcelos, A., Rivera-Gonzalez, I. A., Díaz de León, D., Pérez-Salazar, M. d. R., Zacarías, A., & Cruz, J. M. (2026). Mapping the Relationship Between Financial Inclusion and Undergraduate Students: A Scoping Review. Journal of Risk and Financial Management, 19(1), 23. https://doi.org/10.3390/jrfm19010023