1. Introduction

In an era marked by intensifying climate challenges, technological acceleration, and systemic financial transformation, the intersection of green finance and artificial intelligence (AI) has emerged as a critical arena for scholarly and practical innovation. Green finance, aimed at channeling investments toward environmentally sustainable projects, increasingly relies on AI to enhance the precision, efficiency, and transparency of its instruments. From real-time carbon tracking and ESG portfolio optimization to the automation of climate risk assessment, AI is not only supporting but amplifying the effectiveness of green financial mechanisms.

Recent studies (e.g.,

Omri et al., 2025) demonstrate that the relationship between green finance and sustainability outcomes is often partially mediated by AI and renewable energy innovations. When these two elements act as enablers, the overall impact of green finance becomes significantly stronger. For policymakers, especially in developing economies, this implies a need to invest in AI-powered clean energy ecosystems, while designing inclusive, decentralized, and innovation-driven financial strategies.

Despite growing academic interest, the current literature on the green finance–AI nexus remains conceptually fragmented and methodologically scattered. There is a lack of comprehensive studies that map its structural evolution, intellectual foundations, and future research trajectories. Insufficient attention has been paid to identifying who contributes to this field, what tools they employ, which themes dominate, and how the field has matured over time.

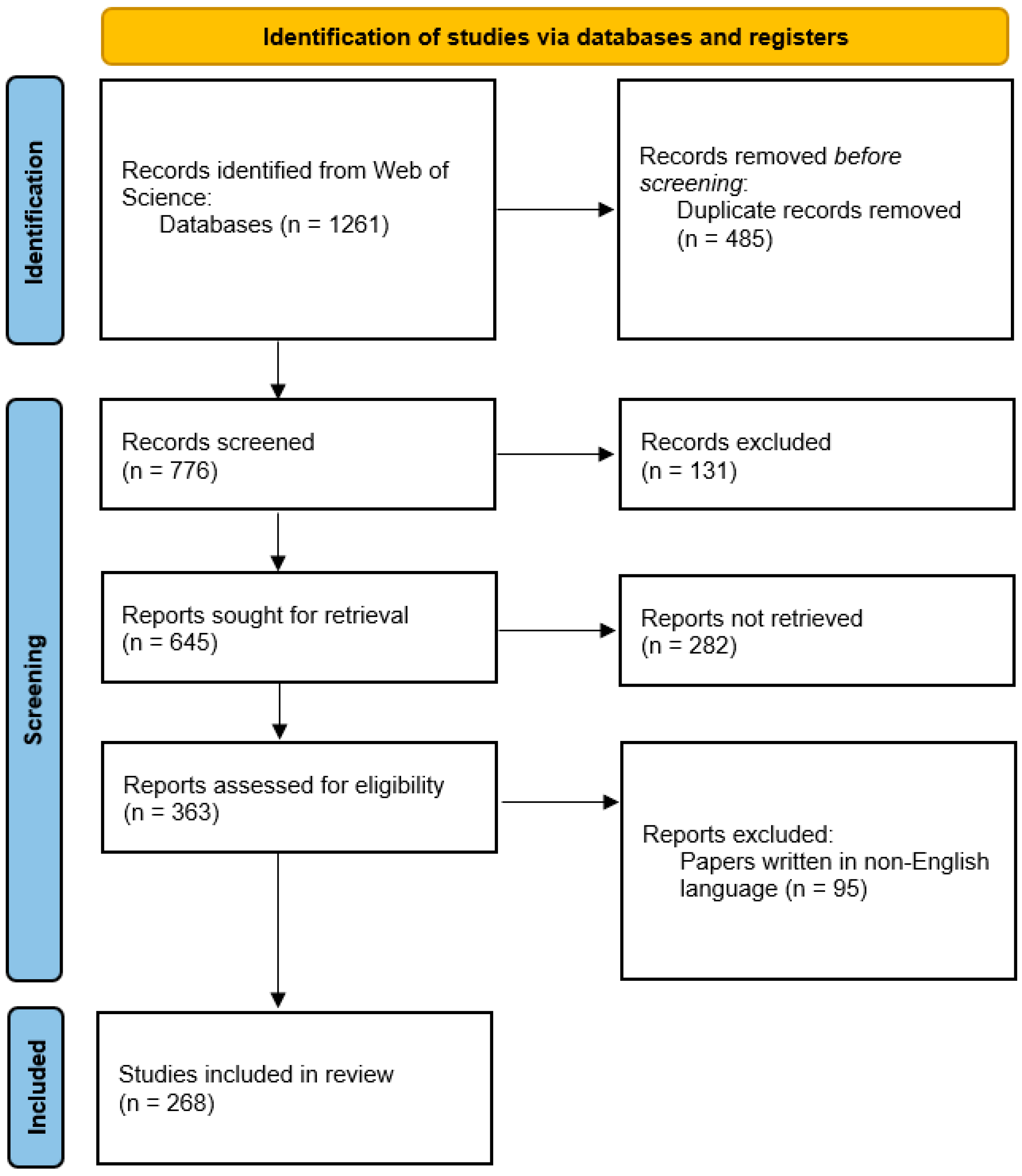

To address these gaps, this paper conducts a science mapping and bibliometric analysis of 268 peer-reviewed publications from the Web of Science Core Collection, spanning the years 2014 to 30 June 2025. Using Bibliometrix (R) and VOSviewer 1.6.20, the study analyzes patterns in scientific production, thematic clusters, co-citation networks, and methodological preferences. It provides a multi-layered understanding of the field’s conceptual, geographic, and analytical structure.

The paper is driven by three central research questions:

What are the key trends, themes, and contributors in the literature on green finance and artificial intelligence?

How have the conceptual and methodological approaches within this field evolved over time?

What underexplored areas and future directions can be identified for advancing research at this intersection?

To answer these, the paper is organized into seven sections.

Section 2, after the introduction, provides a theoretical background on both green and sustainable climate finance and artificial intelligence.

Section 3 unveils the methodology used, and the results are presented in

Section 4. A discussion is opened in

Section 5, and the research hotspots, methods, techniques, and models are given in

Section 6. The last section gives concluding remarks and outlines guidelines for future work.

By delivering a systematic and visually enriched analysis of the green finance–AI knowledge ecosystem, this study makes a significant contribution to a field that is still coalescing but holds enormous promise. It serves as a foundational reference for academics, industry experts, and policymakers committed to aligning technological innovation with sustainable finance in pursuit of climate-resilient global development.

4. Results

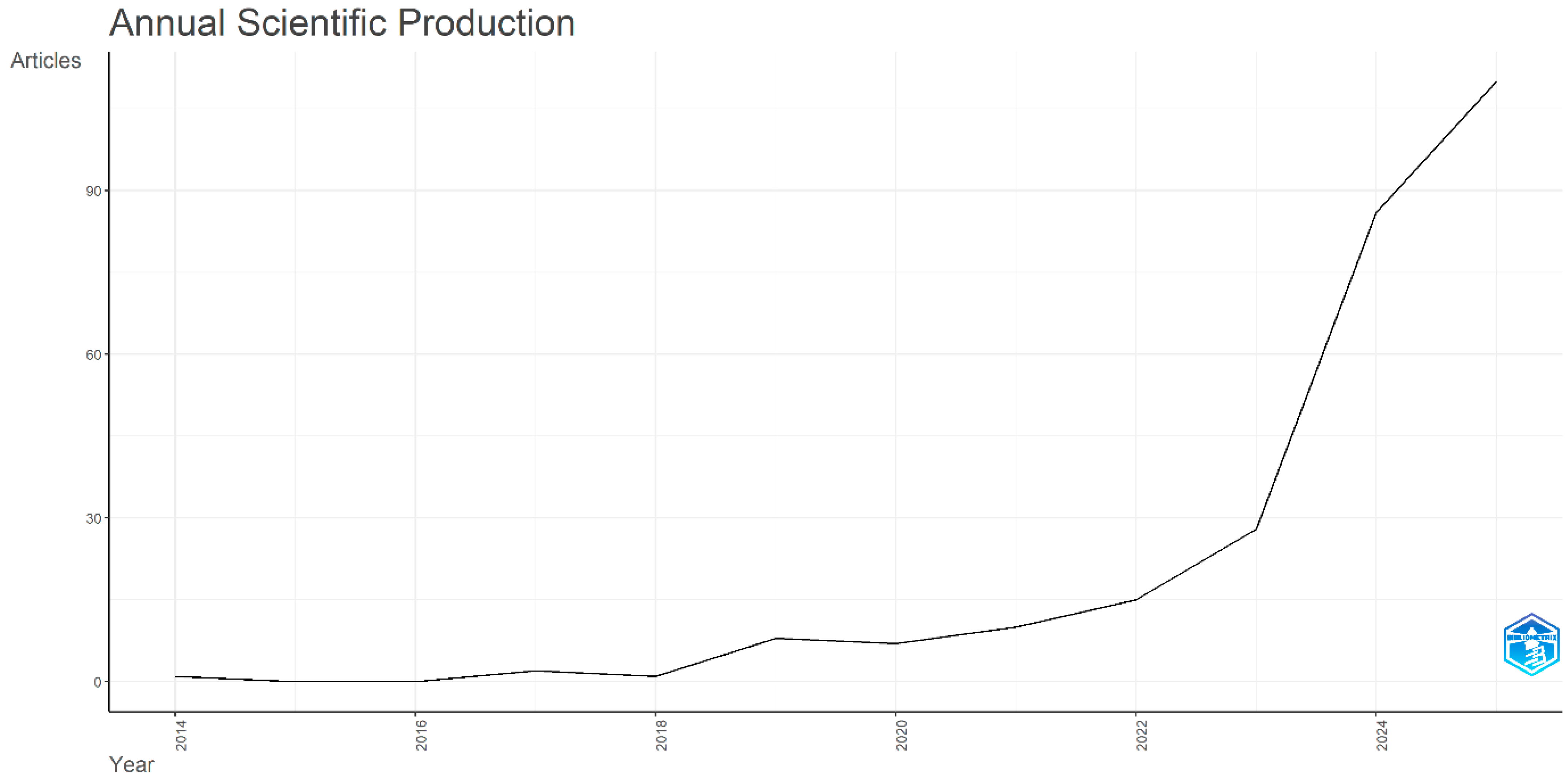

As

Figure 3 shows, there is an increasing trend in the publication of articles on the topic. Since it is a quite recent topic, the pattern of publications shows that it is still in its seminal stage, establishing the main grounds for its maturation with forthcoming studies. However, since 2023, publications have been boosted by the increasing number of articles on the topic revolving around green/sustainable finance and/or fintech and AI. There are 1192 different authors, and they co-authored the majority of the articles (98.2%). In the elaboration of their articles, they utilized 15,970 references in the entire sample. A total of 1192 authors published 268 documents on green sustainable finance and artificial intelligence, with an average of 5.03 authors per document, as shown in

Table 1.

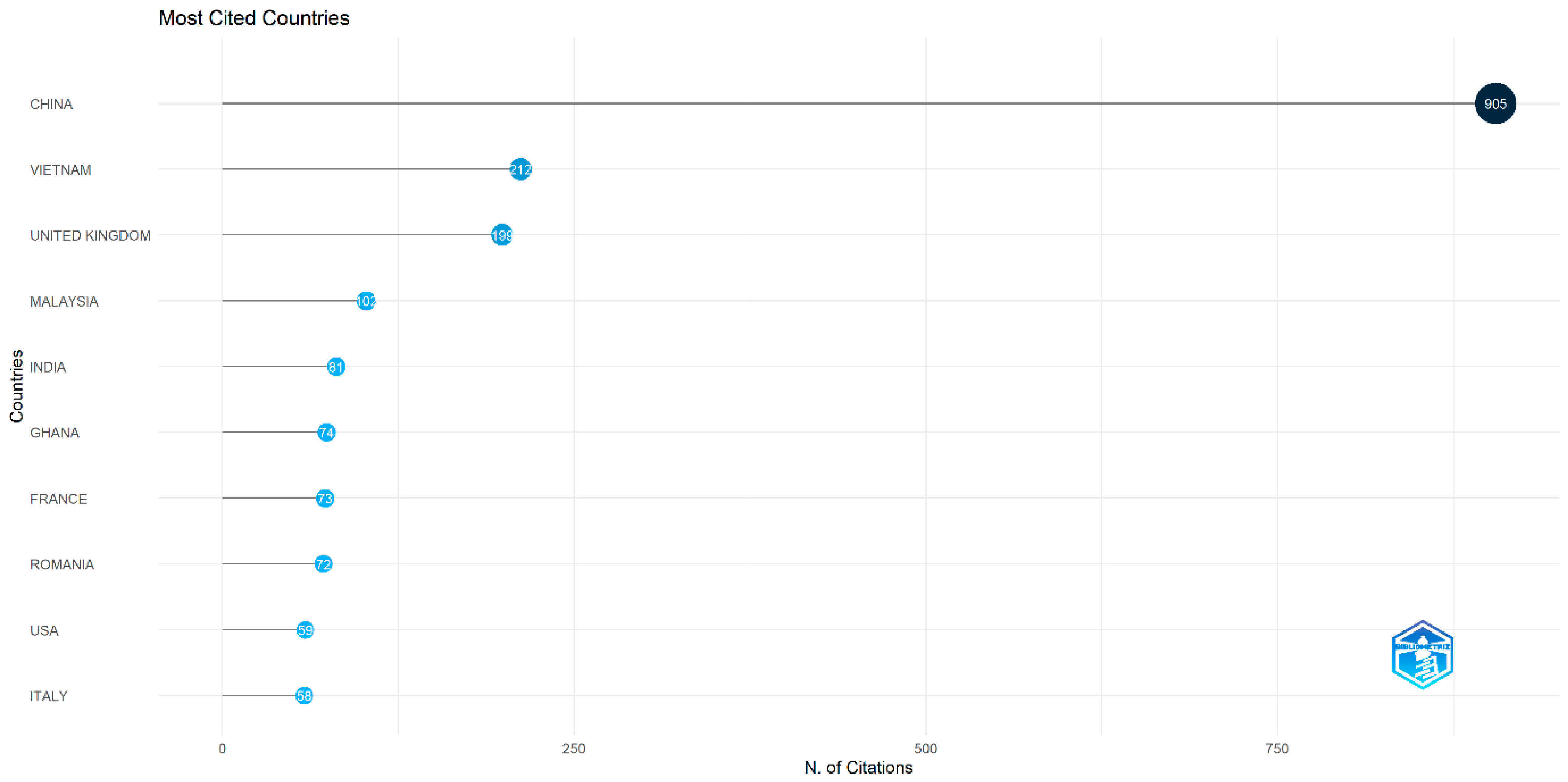

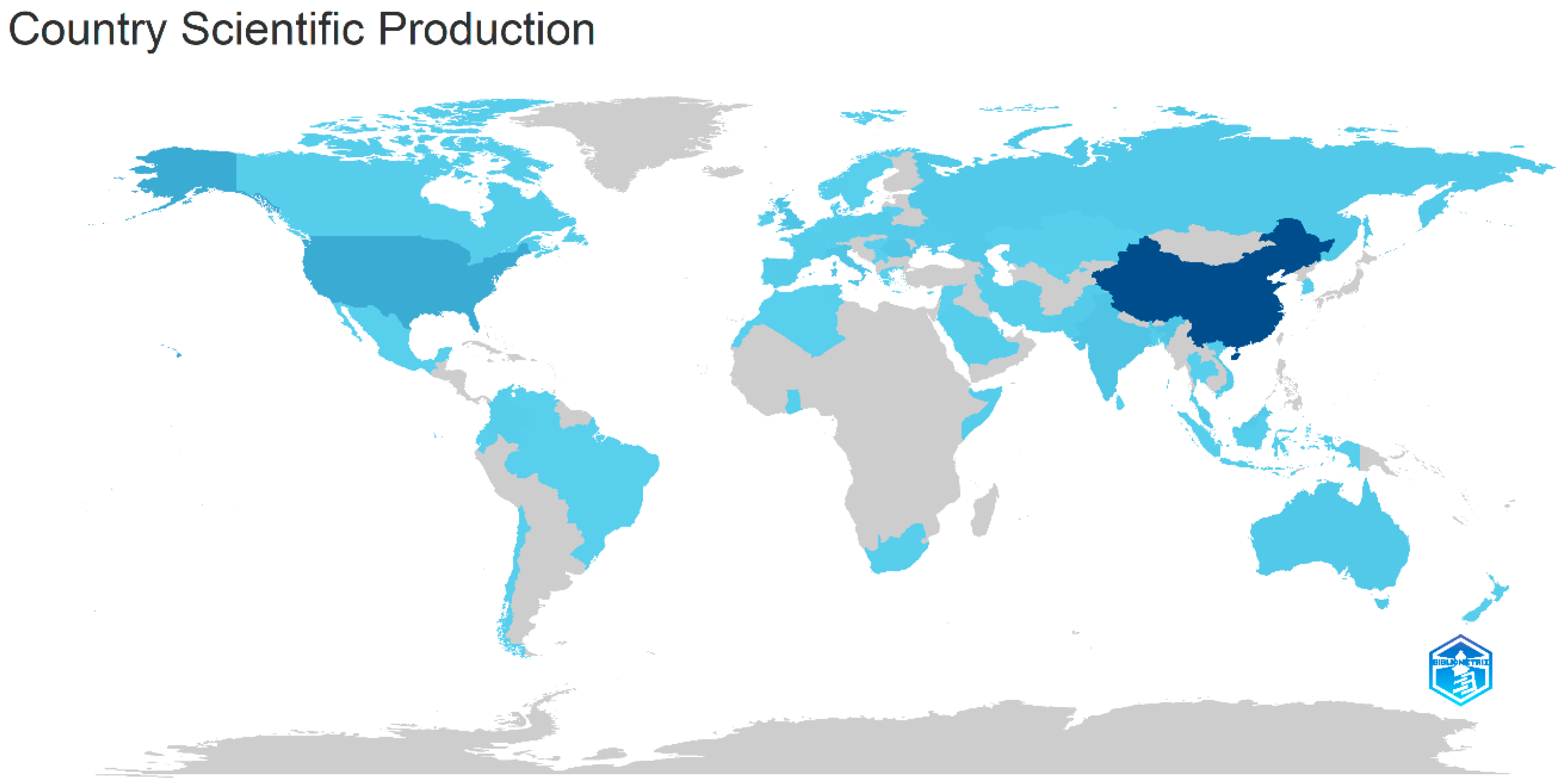

Figure 4 shows the most cited countries, and these are China (with 905 citations), followed by Vietnam (with 212 citations) and the United Kingdom (with 199 citations).

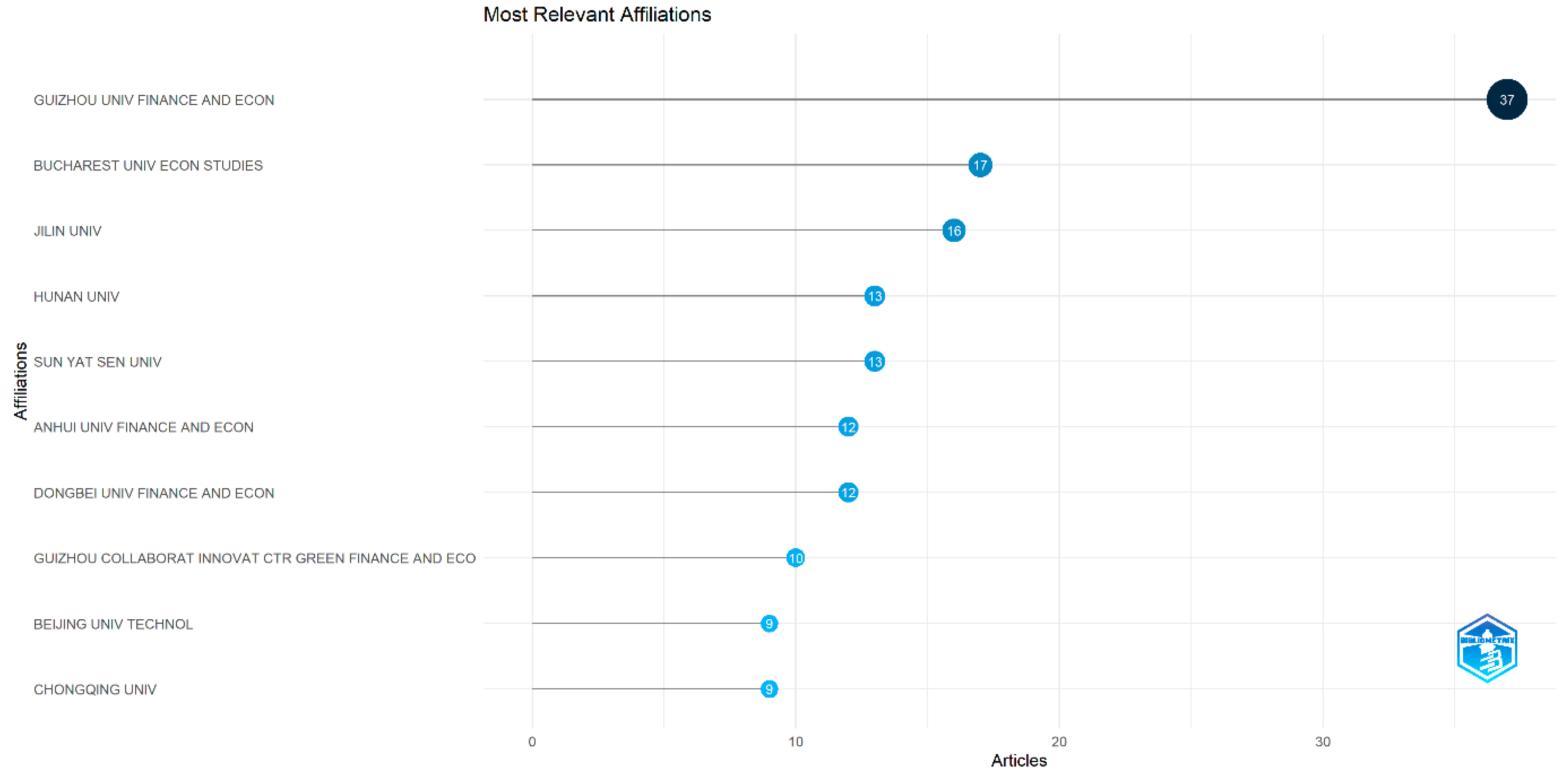

Figure 5 represents the most relevant affiliations regarding publications in the Web of Science database on the topic and intersection of AI and green, sustainable finance. These are Guizhou University (China, n = 37), followed by Bucharest University (Romania, n = 17) and Jilin University (China, n = 16). Therefore, it is somewhat interesting to highlight two out of the top three affiliations in this research area come from China.

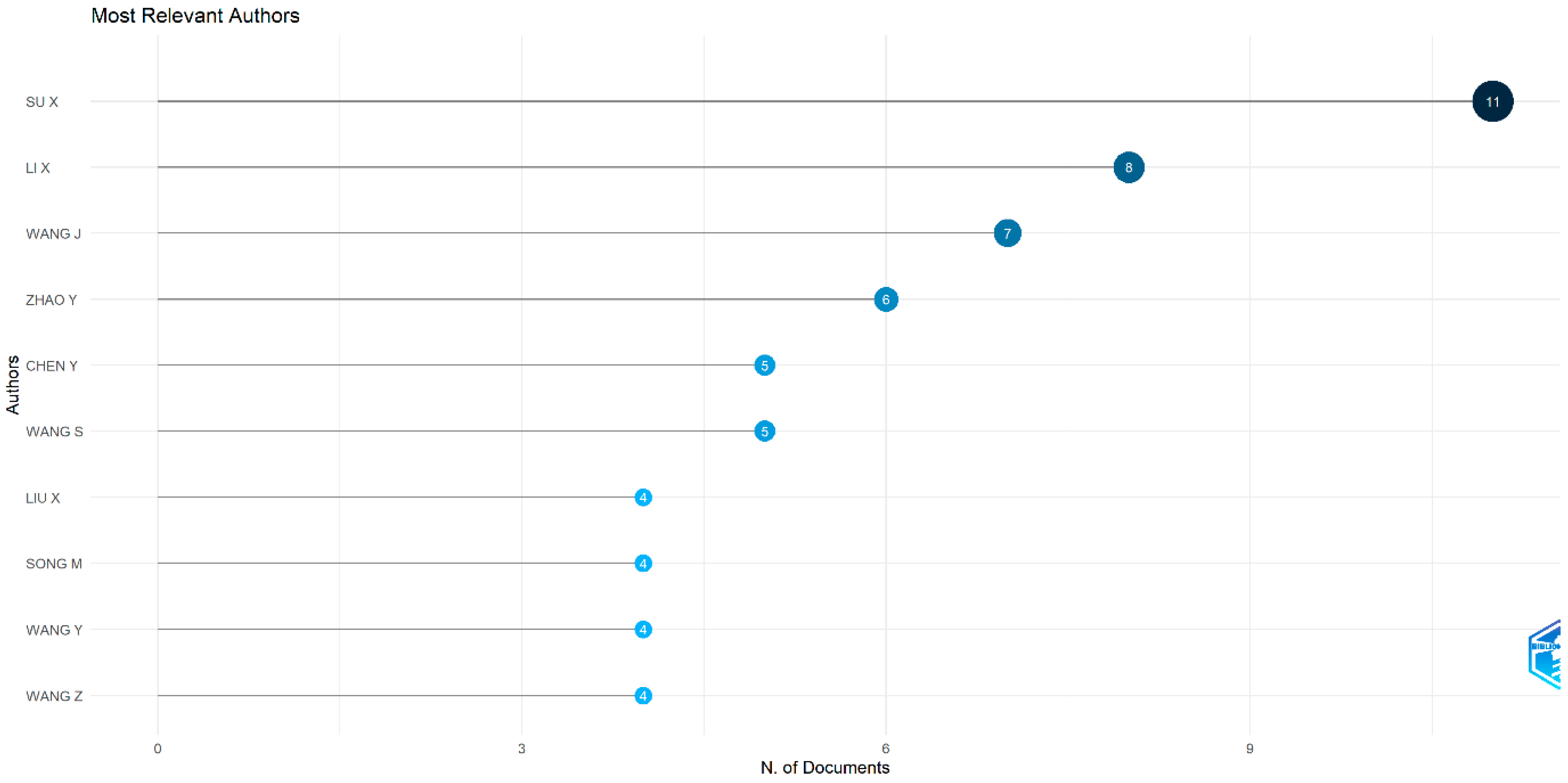

As for the most relevant authors tackling this research area, the results are also in line with

Figure 4 regarding the affiliations. Namely, the top three most relevant authors are Su X., Li X. and Wang J., all from China. The rest of the authors publishing in this research area are presented in

Figure 6. One of the most influential figures in this research area is Su X., whose work has significantly shaped discussions regarding green finance and AI.

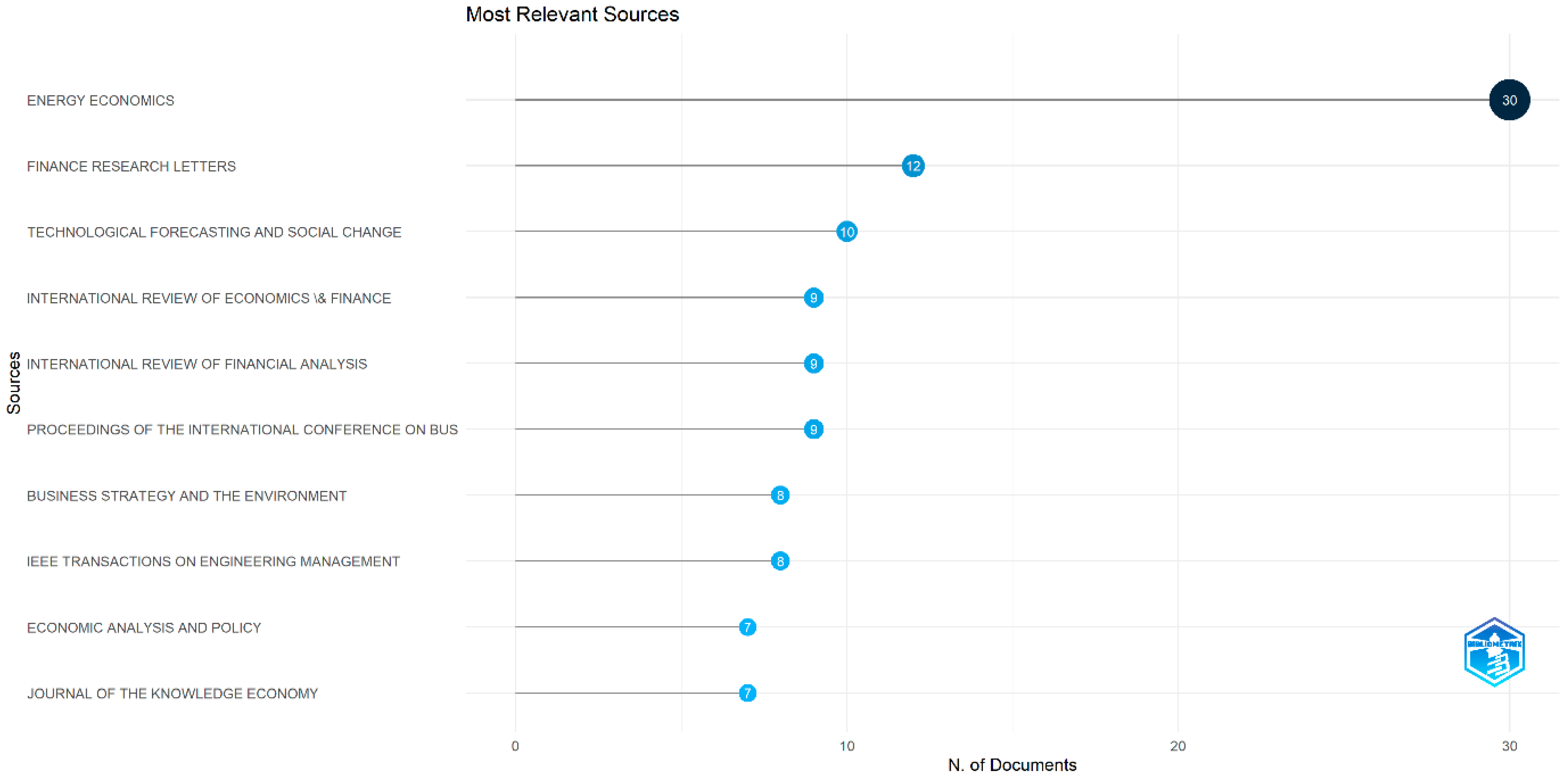

Figure 7 presents the most relevant sources, i.e., journals in the research area. Namely, these are

Energy Economics (with 30 publications),

Finance Research Letters (with 12 publications) and

Technological Forecasting and Social Change (with 10 publications).

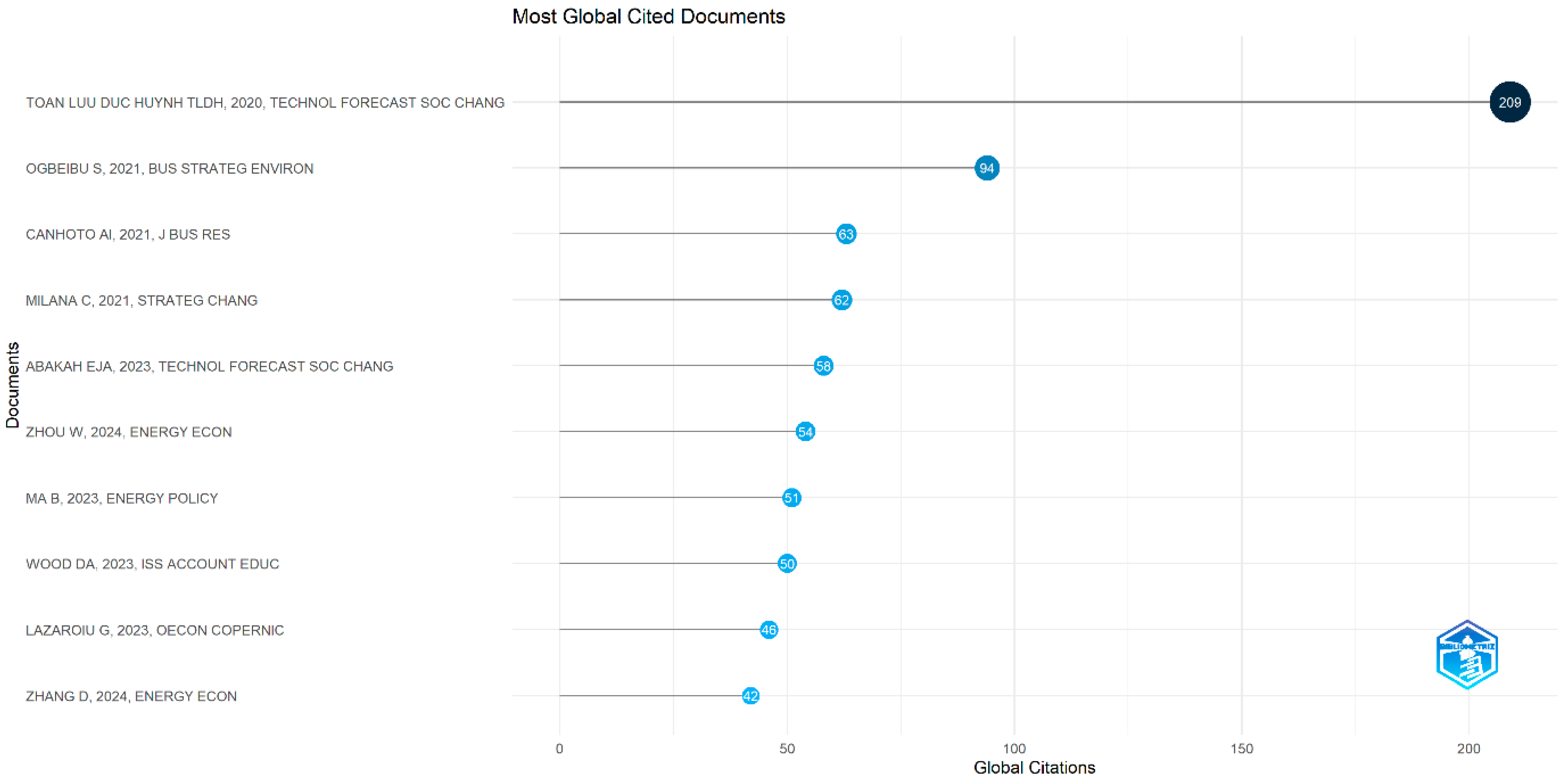

According to the seminal paper of

Wallin (

2005), “citation analysis is a good example of this, since this type of bibliometric analysis is the most often used to couple a quantitative parameter to an evaluation of research performance”. Therefore,

Figure 8 reveals the most cited global documents. The most cited document is the paper by

Liang et al. (

2022) on climate policy uncertainty and world renewable energy index volatility forecasting,

Technological Forecasting and Social Change,

182, 121,810, with 209 citations.

The country-specific production reveals China as the most productive country in this research area (

Figure 9).

5. Discussion

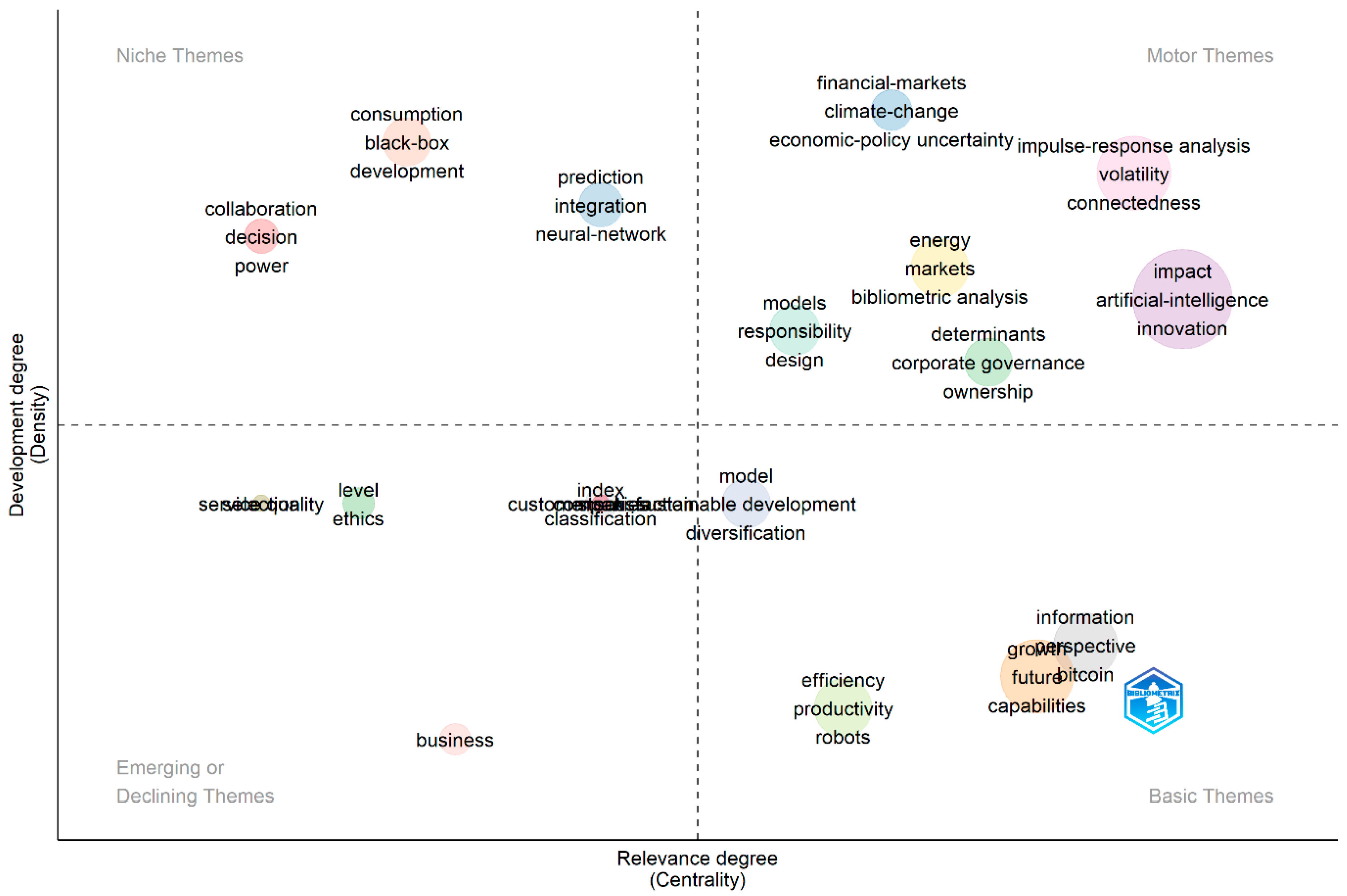

The thematic map generated from the Bibliometrix, shown in

Figure 10, reveals very interesting insights regarding the intersection of green finance and AI in scholarly literature. A thematic map in Bibliometrix (or Biblioshiny, its Shiny web interface in R) is a powerful visual tool used in bibliometric analysis to explore and interpret the structure of research themes within a scientific field, revealing how themes or topics are distributed, their level of development, and how central they are to the field. Thus, the Motor themes quadrant reveals the themes with high centrality and high density, meaning these are well-developed and important themes that are driving this field. These are as follows: “energy + markets + bibliometric analysis”, “impact + artificial intelligence + innovation”, “financial markets + climate-change + economic-policy uncertainty”, “impulse-response analysis + volatility + connectedness”, “models + responsibility + design” and “determinants + corporate governance + ownership”. The Niche themes quadrant includes highly specialized and well-developed themes, but not central to the field. These are as follows: “collaboration + decision + power”, “consumption + black-box + development” and “prediction + integration + neural-network”. The Emerging or Declining Themes quadrant includes underdeveloped and marginal themes, and the last quadrant is the bottom right quadrant titled Basic themes. The Basic themes include important but not well-developed themes, and these are “efficiency + productivity + robots”, “information + perspective + bitcoin”, and “growth + future + capabilities”.

Figure 11 presents the word map, which is a visual display of the most commonly used terms—usually drawn from keywords, titles, or abstracts—within a bibliographic dataset. The word map offers a fast and intuitive way to grasp the key vocabulary and emerging topics that characterize a particular research area. The words with the largest fonts are the words mostly used, and in this research, these are “impact”, “innovation”, “artificial intelligence”, “performance”, and “management”.

A tree map in Bibliometrix represents a hierarchical visual tool used to represent the distribution and relative importance of elements such as keywords, authors, institutions, countries, or sources within the bibliographic dataset (

Figure 12).

The trend topics in

Figure 13 reveal the popularity of certain topics in recent years. For instance, the year 2024 was characterized with the topics impact, artificial intelligence and innovation.

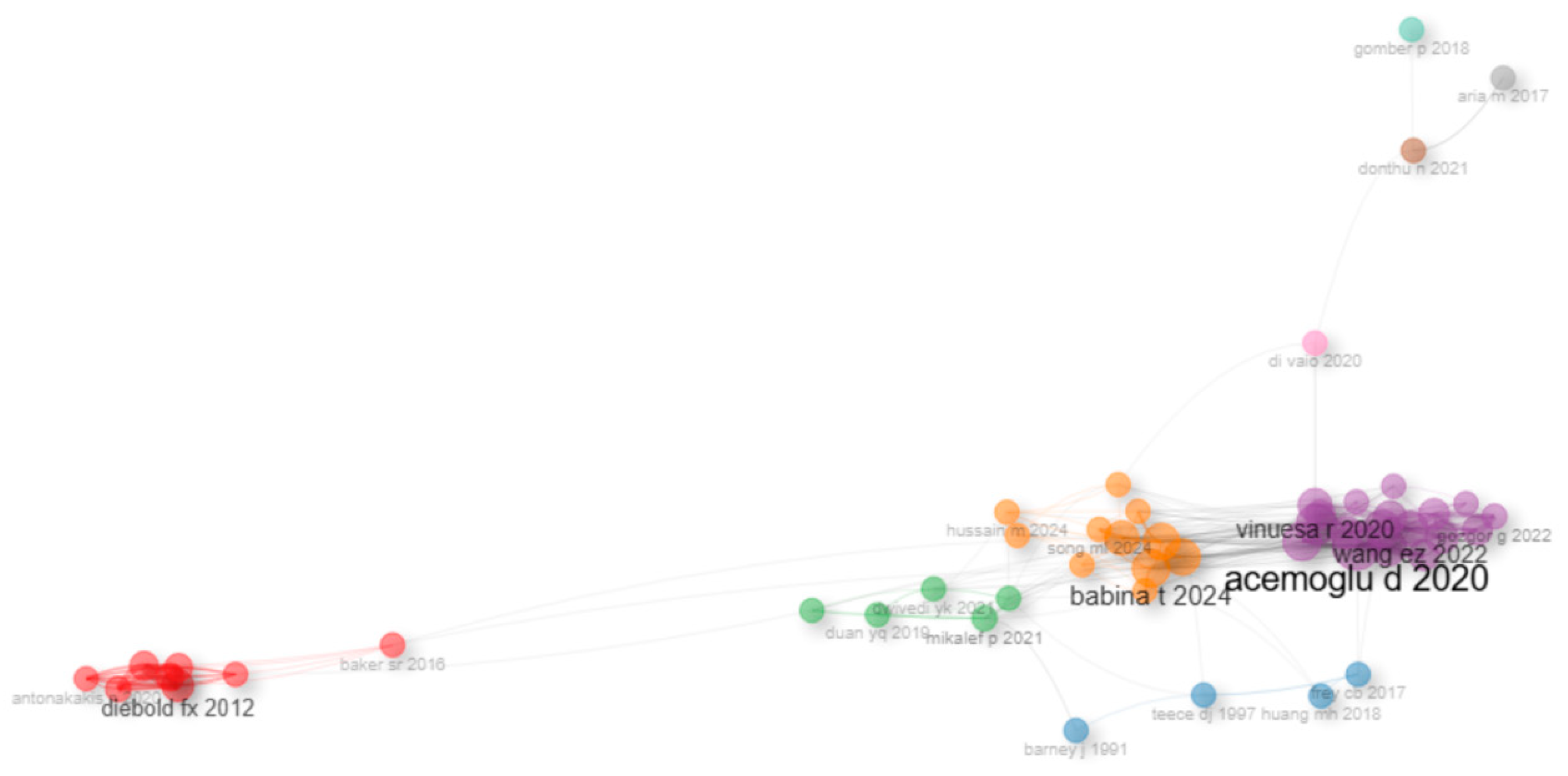

As shown in

Figure 14, the co-citation visualization map reveals three dominant different groups with different colors. In each group (cluster), there is an author who was dominant in its cluster, and these are Babina (orange cluster), Acemoglu (purple cluster) and Diebold (green cluster).

6. Research Hotspots, Methods, Techniques, and Models: A Deep Dive into the Green Finance–AI Knowledge Ecosystem

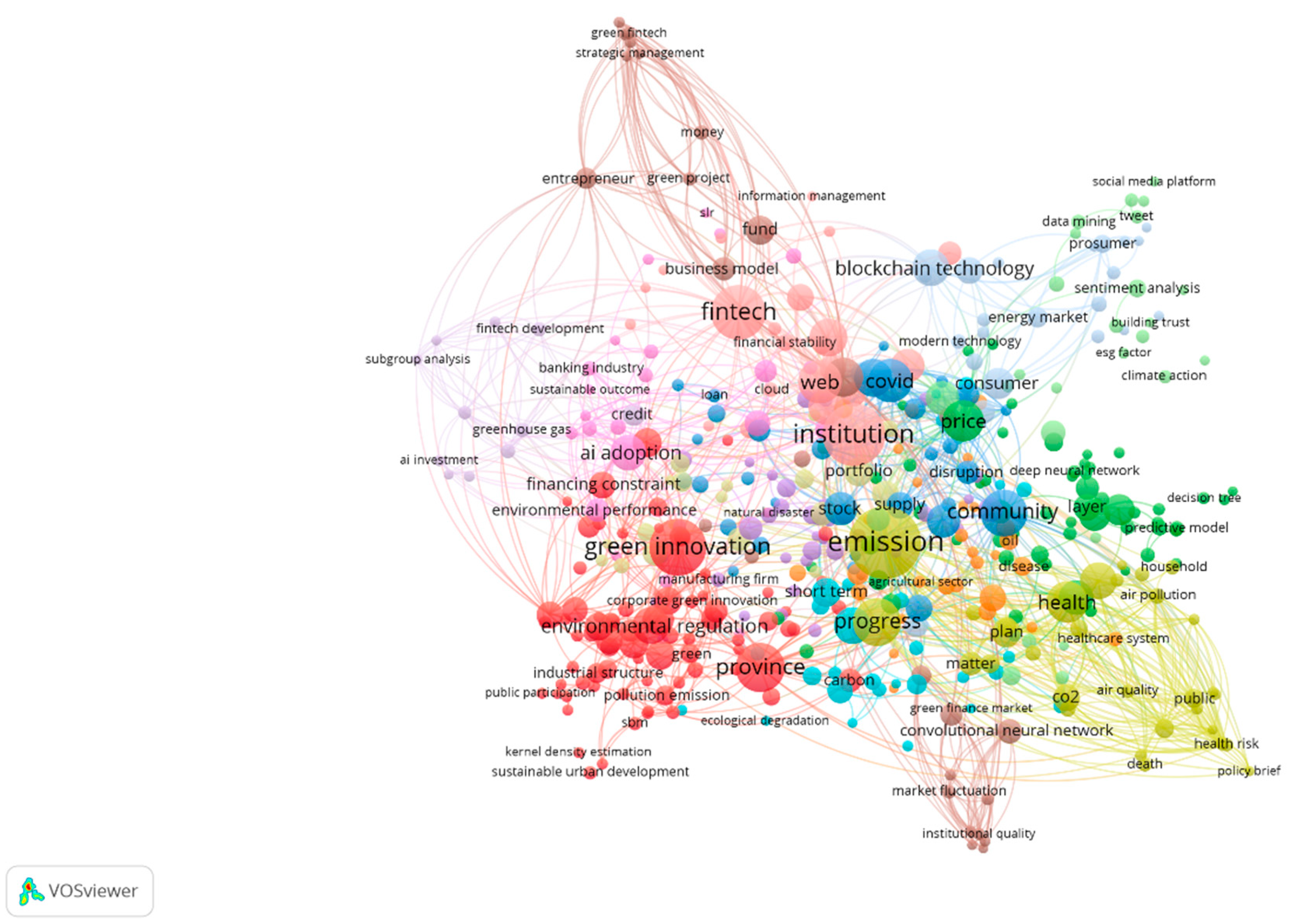

To unravel the evolving intellectual structure and methodological foundations at the intersection of green finance and artificial intelligence, a bibliometric analysis was conducted using data retrieved from the Web of Science Core Collection. The analysis was supported by VOSviewer, a widely recognized tool for constructing and visualizing bibliometric networks. This section presents a dual-layered investigation: first, identifying the key thematic clusters (research hotspots), and second, analyzing the dominant methods, techniques, and models shaping the field.

6.1. Identifying Research Hotspots Through Co-Occurrence Network Mapping

The initial dataset comprised 24,961 terms, extracted from abstracts. A filtering threshold was applied; only terms occurring at least five times were retained, yielding 1710 terms. To enhance focus and interpretability, a relevance score for each term and the top 60% most relevant terms were preserved, reducing the dataset to 1026 terms.

Following this, a qualitative cleaning process was applied, excluding general or redundant terms such as country names already addressed in the paper, as well as terms like major dimension, depth research, highest level, key issue, overall impact, etc., which were deemed too generic or insufficiently connected to the core research focus. The resulting refined set of terms formed the basis for a co-occurrence network, visualized in

Figure 15, which revealed 17 clusters and 457 items, each representing an emerging or established sub-theme in the literature. In this study, we focus on three key clusters: those containing the largest items in the network map, Cluster 4 (emission), the pink cluster (institution), and the red cluster (green innovation), as they represent the most influential thematic concentrations within the overall research landscape.

Yellow Cluster: Emission, Health, and Environmental Risk

This cluster is anchored by the term emission (103 occurrences), the most dominant node in the entire network. It reflects the central role of environmental sustainability concerns within the AI–green finance nexus. The surrounding terms, CO2, air pollution, air quality, healthcare system, health risk, progress, and household, underscore a strong focus on how AI is deployed for monitoring, modeling, and mitigating environmental and public health risks. Research in this cluster typically examines predictive tools for air quality management, AI-driven carbon tracking systems, and the broader health economics implications of environmental degradation.

Pink Cluster: Institutional and Technological Infrastructure

The pink cluster orbits around institution, reflecting the importance of governance, regulation, and technological infrastructure. Terms such as fintech, web, and financial stability signal a vibrant research stream focused on the deployment of AI and blockchain in financial ecosystems, especially within green financing instruments like green bonds, climate funds, and ESG-integrated fintech platforms.

Red Cluster: Innovation, Regulation, and Urban Sustainability

In this cluster, green innovation serves as the core node, with related terms like environmental regulation, corporate green innovation, pollution emission, province, industrial structure, and sustainable urban development. This cluster encapsulates studies that explore how AI enhances innovation in clean technologies, industrial upgrading, and the design of smart, sustainable cities. Regulatory dynamics and the role of policy frameworks are also prominent within this stream, pointing to a critical intersection between institutional design and technological advancement.

Across these and other clusters, the knowledge ecosystem displays a clear shift from isolated disciplinary inquiries toward interdisciplinary, impact-driven research, often grounded in real-time data analysis, decision support systems, and digital innovation.

6.2. Analytical Arsenal: Methods, Techniques, and Models in Use

A complementary layer of analysis focused exclusively on identifying the most used analytical tools, methods, and models across the selected sample of 1026 terms. This helps capture not only what is being studied, but also how scholars are engaging with the AI–green finance interface.

Dominant Tools and Trends:

The most frequently cited term was blockchain technology (37 occurrences), confirming its transformational role in transparency, traceability, and decentralization of green financial flows. Applications include smart contracts for green bonds, tokenization of carbon credits, and ESG data tracking systems.

Content analysis and convolutional neural networks (CNNs) (20 each) illustrate a dual methodological orientation: the former rooted in qualitative inquiry and policy or media framing analysis, and the latter reflecting advances in machine vision and pattern detection for tasks such as satellite image processing and infrastructure monitoring.

Large language models (LLMs) and sentiment analysis (13 and 12 occurrences, respectively) indicate growing use of natural language processing (NLP) in understanding market narratives, investor sentiment, and public discourse on environmental finance.

A diverse set of modeling approaches, such as structural equation modeling, genetic algorithms, panel quantile regression, support vector machines (SVM), and decision trees demonstrate that the field incorporates both statistical rigor and computational intelligence, supporting hybrid analytical designs.

The presence of performance metrics like mean absolute error (MAE), root mean square error (RMSE), and mean absolute percentage error (MAPE) underscores the field’s increasing emphasis on predictive accuracy, model evaluation, and decision-support validation.

Emerging paradigms such as generative AI, computer vision, and deep learning methods further reveal that the field is at the frontier of advanced AI adoption, integrating state-of-the-art techniques for high-dimensional data analysis.

The bibliometric findings reveal a multi-dimensional, rapidly evolving research ecosystem, where green finance is being reimagined through the lens of artificial intelligence. The clustering analysis highlights an intellectual convergence around three broad domains: environmental risk and health, technological infrastructure and financial stability, and innovation and urban sustainability. Meanwhile, the methodological mapping (

Table 2) reveals a broad and deep analytical toolkit, drawing from both traditional econometric techniques and modern AI-driven algorithms.

These insights provide a critical foundation for future research by identifying not only the thematic priorities of the field but also the tools best suited to interrogate them. As the dual imperatives of sustainability and digital transformation intensify, this intersection will continue to be a strategic research frontier for scholars, policymakers, and practitioners alike.

7. Conclusions

Science mapping has increasingly become a vital methodological tool for researchers across a wide range of scientific disciplines, facilitating the systematic analysis of knowledge structures, research trends, and intellectual developments within a field (

Aria & Cuccurullo, 2017). In this study, we applied this approach to a rapidly expanding and impactful domain, the intersection of green finance and artificial intelligence. Through a rigorous bibliometric and network analysis of 268 peer-reviewed publications indexed in the Web of Science Core Collection, we offered a multidimensional perspective on the evolution, dynamics, and future potential of this interdisciplinary nexus.

Our findings demonstrate that scholarly activity in this area has accelerated substantially, with an annual growth rate exceeding 53%, positioning it as a strategic frontier in sustainability and technological innovation. The landscape is shaped predominantly by Chinese institutions and authors, whose output and citations dominate, while the most relevant journals, such as

Energy Economics and

Finance Research Letters, reflect a strong blend of applied and policy-oriented research. The most cited global paper by

Liang et al. (

2022) emphasizes the central role of policy uncertainty in shaping renewable energy finance, anchoring much of the current discourse.

It is vital to acknowledge and highlight that the findings of this bibliometric study reveal a geographic concentration of research activity in China, Vietnam, and the United Kingdom, with limited representation from Africa, Latin America, and parts of North America. This is also reflected in the reference base, which largely consists of publications from Europe and Asia. While this mirrors the current publishing landscape in the global scientific databases, it may risk underrepresenting valuable contributions from emerging economies. To promote a more inclusive research ecosystem, future studies should deliberately incorporate multi-database approaches and regional case studies that highlight localized applications of AI in green finance, particularly in underserved or climate-vulnerable regions.

Thematic mapping revealed three dominant knowledge clusters: the first centered on emissions and environmental health, where AI supports modeling of air quality, carbon tracking, and public health risks; the second on institutional and technological infrastructure, highlighting the role of fintech, blockchain, and web-based systems in greening the financial sector; and the third on green innovation and urban sustainability, where AI intersects with industrial transformation and smart city planning. These clusters reflect the deepening integration of environmental science, digital finance, and policy innovation, illustrating how AI is becoming embedded in the mechanisms of sustainable development.

On the methodological side, the field demonstrates remarkable diversity and depth. Researchers are leveraging an extensive analytical arsenal, from blockchain technology, large language models, and convolutional neural networks to structural equation modeling, genetic algorithms, and panel quantile regression. Validation tools such as mean absolute error (MAE) and root mean square error (RMSE) signal a mature awareness of precision, interpretability, and computational rigor. The trend topics analysis confirms a research focus on impact, innovation, and performance showing clear alignment between the theoretical and applied dimensions of the field.

Despite the robustness of the findings, this study has limitations. The bibliometric analysis draws exclusively from the Web of Science database. Therefore, future studies should include ScienceDirect, Scopus, IEEE Xplore, or Google Scholar to enhance coverage. This narrows the scope of global coverage and may lead to the underrepresentation of work from emerging economies or technical disciplines such as engineering, law, or data ethics. Moreover, the dataset used in this study was filtered to include only publications categorized under Business Economics within the Web of Science Core Collection. This decision was made to maintain focus on the financial and economic dimensions of the green finance–AI nexus. However, the authors acknowledge that some relevant interdisciplinary research studies published in other domains, such as environmental science, computer science, and engineering, were thus excluded from this study. Future research would benefit from incorporating additional databases such as Scopus, which can be integrated with WoS in Bibliometrix, to allow for broader thematic coverage and enhanced geographic and disciplinary diversity. Furthermore, the predominance of English-language publications may create a linguistic bias, limiting the visibility of non-English contributions. Finally, while bibliometric methods excel at identifying trends and structures, they lack the depth of contextual interpretation offered by in-depth qualitative or case-based studies.

These limitations also serve as signposts for future research. Scholars are encouraged to adopt multi-database approaches to capture broader academic contributions. Longitudinal studies using dynamic topic modeling could offer temporal insights into how priorities are shifting. More granular, regional case studies would help explore the real-world application of AI in green finance, particularly in developing or climate-vulnerable regions. As AI technology is accelerating its application into green finance, various ethical considerations become increasingly vital. Algorithmic transparency, fairness, and AI governance in sustainable finance, remain underexplored and should be prioritized in future work. Namely, algorithmic transparency ensures that AI-driven decision-making—such as ESG scoring, carbon credit allocation, or sustainable investment screening—is understandable and accountable. The possibility of algorithmic bias could unintentionally increase already existing inequalities, for example, by disadvantaging smaller organizations or regions with less digital infrastructure. It is vital to recognize the importance of fairness and inclusivity as a means to prevent the marginalization of low-income or climate-vulnerable communities. Lastly, data management, which includes consent, security, and the ethical use of publicly sourced environmental data, must also be addressed, since AI systems increasingly rely on large-scale, often unregulated datasets. Most importantly, future research should dive into new frameworks for responsible AI application in green finance, with the focus on ethical auditing, stakeholder engagement and regulatory oversight to enhance sustainability as well as social equity.

This paper provides both a roadmap and a mirror. It maps the current terrain of academic inquiry, while also reflecting a field that is increasingly grounded in data-rich, interdisciplinary, and solution-oriented research. As

C. Wang et al. (

2025) suggest, leveraging artificial intelligence within the financial sector could be a strategic approach to boosting green finance and meeting sustainability targets. Realizing this promise, however, will depend on more than just technical progress. It will require global collaboration, inclusive innovation, and a shared commitment to using AI not just to optimize finance, but to transform it into a force for climate resilience, equity, and long-term prosperity.

Based on the new findings and insights gained through this bibliometric study, several areas for future research emerge. Namely, interdisciplinary studies should dive deeper into the legal, ethical, and management perspectives of AI use in sustainable and green finance. Also, and more importantly, there is a need to delve into comparative studies across different financial systems to identify how different conditions and regulations impact the success of AI in green finance.

This study stands as a foundational contribution to that transformation, charting the contours of a field in motion and illuminating the paths forward for academics, practitioners, and policymakers seeking to harness the full potential of AI for a sustainable financial future.