Audit 5.0 in Risk and Materiality Assessment: An Ethnographic Approach

Abstract

1. Introduction

2. Audit Quality in Financial Auditing: Theoretical Framework

2.1. Key Risks to Audit Quality

2.2. Risk Assessment in Auditing

2.3. Determination of Materiality in Auditing

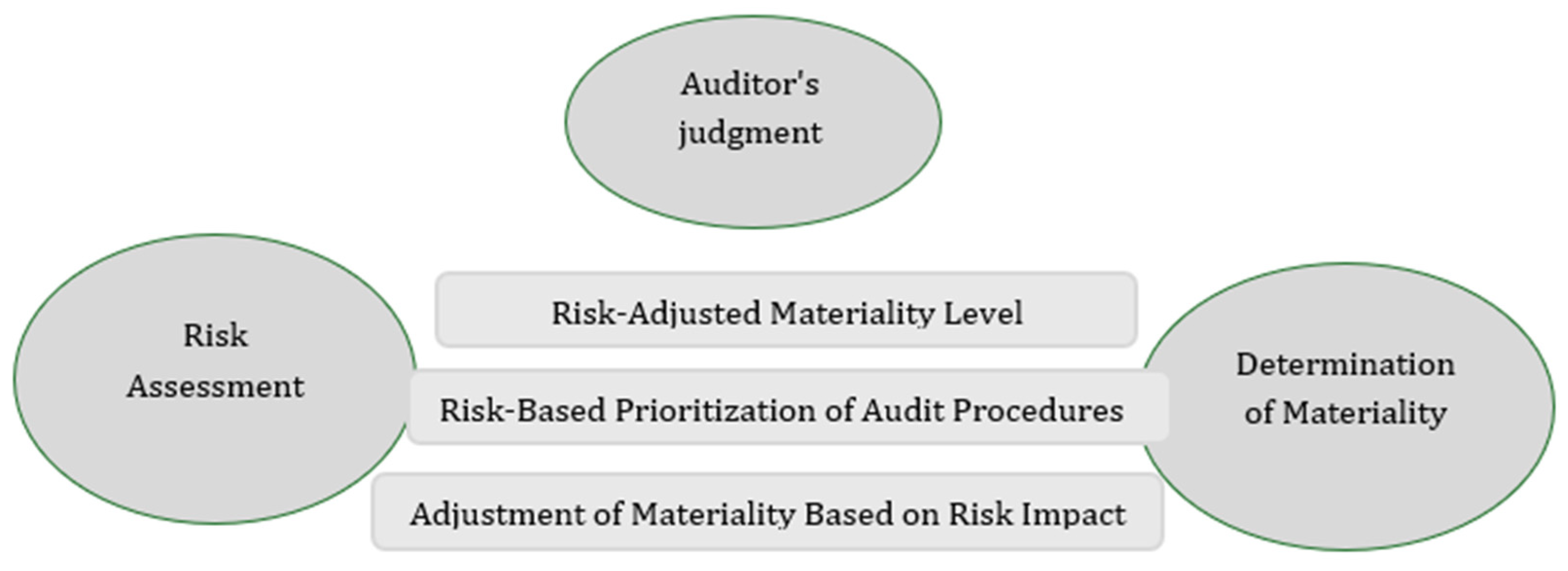

2.4. Materiality vs. Risk Assessment

3. The Era of Smart Auditing

3.1. Audit 5.0 in Risk Assessment

3.2. Audit 5.0 in Materiality Determination

4. Research Methodology

5. Analysis in the Context of Audit 5.0

5.1. Ethnography of Auditing Practice

5.2. Risk Assessment and Materiality

6. Discussion

7. Final Considerations

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aitkazinov, A. (2023). The role of artificial intelligence in auditing: Opportunities and challenges. International Journal of Research in Engineering, Science and Management, 6(6), 117–119. [Google Scholar]

- Aksoy, T., & Gurol, B. (2021). Artificial intelligence in computer-aided auditing techiques and technologies (CAATTs) and an application proposal for auditors. In T. Aksoy, & U. Hacioglu (Eds.), Auditing ecosystem and strategic accounting in the digital era: Contributions to finance and accounting (pp. 361–384). Springer. [Google Scholar] [CrossRef]

- Ali-Abdel, W. N., Shehata, S. E., & Zaki, N. M. (2024). The effect of the fourth industrial revolution from the perspective of the auditing profession. Alexandria Journal of Managerial Research and Information Systems, 2(2), 1–10. [Google Scholar] [CrossRef]

- Allen, R. D., Hermanson, D. R., Kozloski, T. M., & Ramsay, R. J. (2006). Auditor risk assessment: Insights from the academic literature. Accounting Horizons, 20(2), 157–177. [Google Scholar] [CrossRef]

- Alsughayer, S. A. (2021). Impact of auditor competence, integrity, and ethics on audit quality in Saudi Arabia. Open Journal of Accounting, 10(4), 423–436. [Google Scholar] [CrossRef]

- Appelbaum, D., Kogan, A., Vasarhelyi, M., & Yan, Z. (2017). Impact of business analytics and enterprise systems on managerial accounting. International journal of accounting information systems, 25, 29–44. [Google Scholar] [CrossRef]

- Arens, A. A., Elder, R. J., Beasley, M. S., & Hogan, C. E. (2023). Auditing and assurance services (16th ed.). Pearson. [Google Scholar]

- Australian Accounting Standards Board (AASB). (2013, August 23). ED243: Withdrawal of AASB 1031 materiality. Australian Government. Available online: https://www.aasb.gov.au/admin/file/content105/c9/ACCED243_06-13.pdf (accessed on 23 February 2024).

- Azizi, M., Hakimi, M., Amiri, F., & Shahidzay, A. K. (2024). The role of IT (Information Technology) audit in digital transformation: Opportunities and challenges. Open Access Indonesia Journal of Social Sciences, 7(2), 1473–1482. [Google Scholar] [CrossRef]

- Badruzaman, J. (2023). Unveiling the link between audit planning and audit quality: The mediating role of audit work program and internal auditor competence. The Journal of Modern Project Management, 11(1), 108–119. [Google Scholar]

- Belinda, C., Pangaribuan, L., & Prastio, W. (2024). The influence of professional skepticism, time budget pressure, and materiality on audit quality: Empirical study of public accounting firms in DKI Jakarta for the 2023 period. Journal Scientia, 13(01), 306–316. [Google Scholar]

- Bierstaker, J., Janvrin, D., & Lowe, D. J. (2014). What factors influence auditors’ use of computer-assisted audit techniques? Advances in Accounting, 30(1), 67–74. [Google Scholar] [CrossRef]

- Bradley, L. (2023). Unlocking the opportunities of AI as audit enters a new age. KPMG. Available online: https://kpmg.com/xx/en/blogs/home/posts/2023/12/unlocking-the-opportunities-of-ai-as-audit-enters-a-new-age.html (accessed on 23 February 2024).

- Chartered Professional Accountants of Canada (CPA Canada) & American Institute of CPAs (AICPA). (2020). The data-driven audit: How automation and AI are changing the audit and the role of the auditor. CPA Canada. [Google Scholar]

- Costa, C. B. (2023, Janeiro). Auditoria financeira—Teoria & Prática (13th ed.). Rei dos Livros. [Google Scholar]

- Creswell, J. W., & Creswell, J. D. (2017). Research design: Qualitative, quantitative, and mixed methods approaches (4th ed.). Sage Publications. [Google Scholar]

- David, R., & Abeysekera, I. (2021). Auditor judgements after withdrawal of the materiality accounting standard in Australia. Journal of Risk and Financial Management, 14(6), 268. [Google Scholar] [CrossRef]

- DeAngelo, L. E. (1981). Auditor independence, ‘low balling’, and disclosure regulation. Journal of Accounting and Economics, 3(2), 113–127. [Google Scholar] [CrossRef]

- Deloitte. (n.d.). Deloitte launches innovative ‘DARTbot’ internal chatbot. Deloitte. Available online: https://www2.deloitte.com/us/en/pages/about-deloitte/articles/press-releases/deloitte-launches-innovative-dartbot-internal-chatbot.html (accessed on 23 February 2024).

- Djafar, H., Yunus, R., Pomalato, S. W. D., & Rasid, R. (2021). Qualitative and quantitative paradigm constellation in educational research methodology. International Journal of Educational Research & Social Sciences, 2(2), 339–345. [Google Scholar] [CrossRef]

- du Toit, E., Marx, B., & Smith, R. (2023). The impact of industries 4.0 and 5.0 on the professional accountant and auditor’s integrated thinking skills skillset and other pervasive skills. International Journal of Business Innovation, 2(24), 1–24. Available online: https://proa.ua.pt/index.php/ijbi (accessed on 22 July 2025).

- Earley, C. E. (2015). Data analytics in auditing: Opportunities and challenges. Business horizons, 58(5), 493–500. [Google Scholar] [CrossRef]

- Eulerich, M., Georgi, C., & Schmidt, A. (2020). Continuous auditing and risk-based audit planning—An empirical analysis. Journal of Emerging Technologies in Accounting, 17(2), 141–155. [Google Scholar] [CrossRef]

- Fakhfakh, I., & Jarboui, A. (2023). Research on the relationship between audit risk assessment and risk governance: Evidence from Tunisia. Journal of African Business, 24(1), 95–110. [Google Scholar] [CrossRef]

- Fukukawa, H., & Mock, T. J. (2011). Audit risk assessments using belief versus probability. Auditing: A Journal of Practice & Theory, 30(1), 75–99. [Google Scholar] [CrossRef]

- Goodson, L., & Vassar, M. (2011). An overview of ethnography in healthcare and medical education research. Journal of Educational Evaluation for Health Professions, 8, 1–5. [Google Scholar] [CrossRef]

- Grzesiak, L. (2023). An adversary or an ally? Perceptions of internal auditors: A narrative analysis. Scientific Papers of Silesian University of Technology. Organization and Management, 175, 149–167. [Google Scholar] [CrossRef]

- Halibas, A. S., Mehtab, S., Al-Attili, A., Alo, B., Cordova, R., & Cruz, M. E. L. T. (2020). A thematic analysis of the quality audit reports in developing a framework for assessing the achievement of the graduate attributes. International Journal of Educational Management, 34(5), 917–935. [Google Scholar] [CrossRef]

- Han, N., & Um, J. (2024). Risk management strategy for supply chain sustainability and resilience capability. Risk Management, 26(2), 6. [Google Scholar] [CrossRef]

- Houghton, K. A., Jubb, C., & Kend, M. (2011). Materiality in the context of audit: The real expectations gap. Managerial Auditing Journal, 26(6), 482–500. [Google Scholar] [CrossRef]

- Huang, Y., Li, N., Zhang, J., & Zhou, X. (2024). The economic consequences of heightened materiality uncertainty: An auditing perspective. The Accounting Review, 99(4), 225–249. [Google Scholar] [CrossRef]

- IAASB (International Auditing and Assurance Standards Board). (2022). Handbook of international quality management, auditing, review, other assurance, and related services pronouncements. International Federation of Accountants. [Google Scholar]

- IFAC (International Federation of Accountants). (2020). The role of accountants in sustainable business. IFAC. [Google Scholar]

- Imoniana, J. O., Filho, D. C. N., Cornacchione, E. B., Reginato, L., & Benetti, C. (2023). Impact of technological advancements on auditing of financial statements. European Research Studies Journal, 26(4), 131–159. Available online: https://www.um.edu.mt/library/oar/handle/123456789/116238 (accessed on 22 July 2025).

- International Standard on Auditing. (2018a). Acontecimentos Subsequentes (ISA Standard No. 560). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018b). Acordar os Termos de Trabalhos de Auditoria (ISA Standard No. 210). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018c). A Materialidade no Planeamento e na Execução de uma Auditoria (ISA Standard No. 320). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018d). As Responsabilidades do Auditor Relativas a Fraude numa Auditoria de Demonstrações Financeiras (ISA Standard No. 240). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018e). As Respostas do Auditor a Riscos Avaliados (ISA Standard No. 330). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018f). Auditar estimativas contabilísticas e respetivas divulgações (ISA Standard No. 540). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018g). Comunicação com os encarregados da governação (ISA Standard No. 260). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018h). Confirmações externas (ISA Standard No. 505). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018i). Documentação de auditoria (ISA Standard No. 230). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018j). Identificar e avaliar os riscos de distorção material através do conhecimento da entidade e do seu ambiente (ISA Standard No. 315). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018k). Objetivos gerais do auditor independente e condução de uma auditoria de acordo com as normas internacionais de auditoria (ISA Standard No. 200). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018l). Planear uma auditoria de demonstrações financeiras (ISA Standard No. 300). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2018m). Prova de auditoria (ISA Standard No. 500). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- International Standard on Auditing. (2019). Formar uma opinião e relatar sobre demonstrações finaceiras (ISA Standard No. 700). Manual das Normas Internacionais de Controlo de Qualidade, Auditoria, Revisão, Outros Trabalhos de Garantia de Fiabilidade e Serviços Relacionados.

- Irish Auditing and Accounting Supervisory Authority (IAASA). (2021). Glossary of terms. Irish Auditing and Accounting Supervisory Authority (IAASA). [Google Scholar]

- ISO. (2018). Guidelines for auditing management systems (ISO 19011:2018). International Organization for Standardization. Geneva, Switzrland. Available online: https://www.iso.org/standard/70017.html (accessed on 1 September 2024).

- Jeremić, N., & Luka, S. (2024). Artificial intelligence—Challenges of use in auditing. REVIZOR—Journal of Organizational Management, Finance and Auditing, 27(107), 29–55. [Google Scholar] [CrossRef]

- Karagül, A. A., & Selİmoğlu, S. (2025). Smart audit practices in sustainable internal audit for government. EDPACS, 70(7), 164–184. [Google Scholar] [CrossRef]

- Kearns-Manolatos, D., Scoble-Williams, N., & Darbyshire, R. (2024, July 10). The importance of digital change capabilities. Deloitte. Available online: https://www2.deloitte.com/us/en/blog/human-capital-blog/2024/digital-business-transformation-and-data.html (accessed on 1 September 2024).

- Knapp, M. C. (2014). Contemporary auditing (10th ed.). Cengage Learning. [Google Scholar]

- Knechel, W. R. (2016). Audit quality and regulation. International Journal of Auditing, 20(3), 215–223. [Google Scholar] [CrossRef]

- Knežević, S., Mitrović, A., & Cvetković, D. (2019). The role of auditing profession in detecting frauds in financial statements. NBP. Nauka, bezbednost, policija, 24(2), 97–109. Available online: https://casopisrevizor.rs/index.php/revizor/article/view/172/162 (accessed on 1 September 2024). [CrossRef]

- Kocziszky, G., Veres Somosi, M., & Kobielieva, T. O. (2017). Compliance risk in the enterprise [Ph.D. thesis, Instituto Politécnico de Korkiv]. Available online: https://repository.kpi.kharkov.ua/home (accessed on 1 September 2024).

- Kokina, J., & Davenport, T. H. (2017). The emergence of artificial intelligence: How automation is changing auditing. Journal of emerging technologies in accounting, 14(1), 115–122. [Google Scholar] [CrossRef]

- KPMG. (2023). KPMG and MindBridge announce alliance to power KPMG audits with AI technology. Available online: https://kpmg.com/xx/en/media/press-releases/2023/04/kpmg-and-mindbridge-announce-alliance-to-power-kpmg-audits-with-ai-technology.html (accessed on 1 February 2024).

- Leng, A., & Zhang, Y. (2024). The effect of enterprise digital transformation on audit efficiency—Evidence from China. Technological Forecasting and Social Change, 201(4), 1–12. [Google Scholar] [CrossRef]

- Levytska, S., Pershko, L., Akimova, L., Akimov, O., Havrilenko, K., & Kucherovskii, O. (2022). A risk-oriented approach in the system of internal auditing of the subjects of financial monitoring. International Journal of Applied Economics, Finance and Accounting, 14(2), 194–206. [Google Scholar] [CrossRef]

- Lin, J. W., & Hwang, M. I. (2010). Audit quality, corporate governance, and earnings management: A meta-analysis. International Journal of Auditing, 14(1), 57–77. [Google Scholar] [CrossRef]

- Lopes, I. T. (2022). Auditoria financeira: Do controlo interno ao controlo externo independente (2nd ed.). Almedina. [Google Scholar]

- Louwers, T. J., Blay, A. D., Sinason, D. H., Strawser, J. R., & Thibodeau, J. C. (2018). Auditing & assurance services (7th ed.). McGraw-Hill Education. [Google Scholar]

- Manetti, G., & Becatti, L. (2009). Assurance services for sustainability reports: Standards and empirical evidence. Journal of business ethics, 87(Suppl. 1), 289–298. [Google Scholar] [CrossRef]

- Messier, W. F., Jr., Glover, S. M., & Prawitt, D. F. (2017). Auditing & assurance services: A systematic approach. McGraw-Hill. [Google Scholar]

- Mitan, J. (2024). Enhancing audit quality through artificial intelligence: An external auditing perspective [Master’s thesis, University of Arkansas]. ScholarWorks@UARK. Available online: https://scholarworks.uark.edu/acctuht/58 (accessed on 1 September 2024).

- Moffitt, K. C., Rozario, A. M., & Vasarhelyi, M. A. (2018). Robotic process automation for auditing. Journal of emerging technologies in accounting, 15(1), 1–10. [Google Scholar] [CrossRef]

- Mpofu, F. (2023). The application of Artificial Intelligence in external auditing and its implications on audit quality? A review of the ongoing debates. International Journal of Research in Business and Social Science, 12(9), 496–512. [Google Scholar] [CrossRef]

- Müller, F. (2021). Design ethnography: Epistemology and methodology. Springer Nature. [Google Scholar]

- Nikolovski, P., Zdravkoski, I., Menkinoski, G., Dicevska, S., & Karadjova, V. (2016). The concept of audit risk. International Journal of Sciences: Basic and Applied Research (IJSBAR), 27(1), 22–31. [Google Scholar]

- Nugrahanti, T. P. (2023). Analyzing the evolution of auditing and financial insurance: Tracking developments, identifying research frontiers, and charting the future of accountability and risk management. West Science Accounting and Finance, 1(02), 59–68. [Google Scholar] [CrossRef]

- Oroud, Y., Almashaqbeh, M., Almahadin, H., Hashem, A., & Altarawneh, M. (2023). The effect of audit quality as a moderator on the relationship between financial performance indicators and the stock return. Decision Science Letters, 12(2), 191–198. [Google Scholar] [CrossRef]

- Owolabi, S. A., & Olagunju, A. O. (2020). Historical evolution of audit theory and practice. International Journal of Management Excellence, 16(1), 2254–2259. [Google Scholar] [CrossRef]

- Pizoń, J., Witczak, M., Gola, A., & Świć, A. (2023). Challenges of human-centered manufacturing in the aspect of Industry 5.0 assumptions. IFAC-PapersOnLine, 56(2), 156–161. [Google Scholar] [CrossRef]

- Power, M. K. (2003). Auditing and the production of legitimacy. Accounting, organizations and society, 28(4), 379–394. [Google Scholar] [CrossRef]

- Public Company Accounting Oversight Board (PCAOB). (2024). AS 1101: Audit risk. Available online: https://pcaobus.org/oversight/standards/auditing-standards/details/AS1101 (accessed on 1 September 2024).

- PwC. (n.d.). Harnessing the power of AI to transform the detection of fraud and error. Available online: https://www.pwc.com/gx/en/about/stories-from-across-the-world/harnessing-the-power-of-ai-to-transform-the-detection-of-fraud-and-error.html (accessed on 1 September 2024).

- Qader, K. S., & Cek, K. (2024). Influence of blockchain and artificial intelligence on audit quality: Evidence from Turkey. Heliyon, 10(9), e30166. [Google Scholar] [CrossRef]

- Repenning, N., & DeMott, K. (2025). Navigating the emotional challenges of ethnographic accounting research: Notes from first-time ethnographers. Qualitative Research in Accounting & Management, 22(1), 37–64. [Google Scholar] [CrossRef]

- Rittenberg, L. E., Johnstone, K. M., & Gramling, A. A. (2013). Auditing: A business risk approach (9th ed.). Cengage Learning. [Google Scholar]

- Rodrigues, L., Pereira, J., da Silva, A. F., & Ribeiro, H. (2023). The impact of artificial intelligence on audit profession. Journal of Information Systems Engineering and Management, 8(1), 19002. [Google Scholar] [CrossRef]

- Roring, R. S., Indrayani, N., & Safii, M. (2022). The impact of artificial neural network (ANN) developments for the accountant profession in facing the industrial era 4.0 and society 5.0. NeuroQuantology, 20(10), 8502–8512. [Google Scholar]

- Rozario, A. M., & Vasarhelyi, M. A. (2018). Auditing with smart contracts. International Journal of Digital Accounting Research, 18. [Google Scholar] [CrossRef] [PubMed]

- Saliha, J. I., & Flayyih, H. H. (2020). Impact of audit quality in reducing external audit profession risks. International Journal of Innovation, Creativity and Change, 13(7), 176–199. [Google Scholar]

- Samiolo, R., Spence, C., & Toh, D. (2024). Auditor judgment in the fourth industrial revolution. Contemporary Accounting Research, 41(1), 498–528. [Google Scholar] [CrossRef]

- Seethamraju, R., & Hecimovic, A. (2020). Impact of artificial intelligence on auditing: An exploratory study. Americas Conference on Information Systems (AMCIS) Proceedings. 8. Virtual Conference. Available online: https://aisel.aisnet.org/amcis2020/accounting_info_systems/accounting_info_systems/8 (accessed on 1 February 2024).

- Sepeng, T. D., Lourens, A., Van der Merwe, K., & Gerber, R. (2024). Certification bodies’ interpretation and application of the ISO 19011 audit process guidelines. International Journal of Quality & Reliability Management, 42(1), 339–355. [Google Scholar] [CrossRef]

- Sinha, V. K., & Arena, M. (2020). Manifold conceptions of the internal auditing of risk culture in the financial sector. Journal of Business Ethics, 162, 81–102. [Google Scholar] [CrossRef]

- Sistema de Normalização Contabilística (SNC). (2015). SNC—Sistema de Normalização Contabilística (6th ed.). Porto Editora. [Google Scholar]

- Sitorus, R. R., & Tambun, S. (2023). Challenges, strategies and qualifications of auditors in the Society 5.0 Era. Jurnal Riset Akuntansi Kontemporer, 15(2), 228–240. [Google Scholar] [CrossRef]

- Soh, D. S., & Martinov-Bennie, N. (2015). Internal auditors’ perceptions of their role in environmental, social and governance assurance and consulting. Managerial Auditing Journal, 30(1), 80–111. [Google Scholar] [CrossRef]

- Suddaby, R., Gendron, Y., & Lam, H. (2009). The organizational context of professionalism in accounting. Accounting, organizations and society, 34(3–4), 409–427. [Google Scholar] [CrossRef]

- Sujana, E., & Dharmawan, N. A. S. (2023). Audit quality improvement and the role of risk: Audit as a moderator. Australasian Accounting, Business and Finance Journal, 17(4), 213–228. [Google Scholar] [CrossRef]

- Sun, G., & Guan, B. (2024). Enterprise audit risk assessment and prevention based on AHP analysis. Scalable Computing: Practice and Experience, 25(3), 2013–2020. [Google Scholar] [CrossRef]

- Tagliaro, C., Orel, M., & Hua, Y. (2023). Methodological approaches for workplace research and management. Taylor & Francis. [Google Scholar]

- Tavares, M. C., Azevedo, G., Marques, R. P., & Bastos, M. A. (2023). Challenges of education in the accounting profession in the Era 5.0: A systematic review. Cogent Business & Management, 10(2), 2220198. [Google Scholar] [CrossRef]

- Teck-Heang, L., & Md Ali, A. (2008). The evolution of auditing: An analysis of the historical development. Journal of Modern Accounting and Auditing, 4(12), 1–8. Available online: https://www.researchgate.net/publication/339251518_The_evolution_of_auditing_An_analysis_of_the_historical_development (accessed on 1 May 2024).

- Vona, L. W. (2012). Fraud risk assessment: Building a fraud audit program. John Wiley & Sons. [Google Scholar]

- Vuković, B., Tica, T., & Jakšić, D. (2024). Challenges of using digital technologies in audit. Anali Ekonomskog Fakulteta u Subotici, 60(51), 15–30. [Google Scholar] [CrossRef]

- Whittington, R., & Pany, K. (2021). Principles of auditing and other assurance services (22nd ed.). McGraw-Hill Education. [Google Scholar]

- Wilamsari, F., Rahmadhany, U., & Musriati, T. (2023). IT capability, audit risk and the role of internal control. Assets: Jurnal Ilmiah Ilmu Akuntansi, Keuangan dan Pajak, 7(2), 17–21. [Google Scholar] [CrossRef]

| Dimension | Technology | Human Judgment |

|---|---|---|

| Tools and Systems | ASD, anomaly detection algorithms, automation of confirmations | Interpretation of system-generated data, critical selection of relevant areas |

| Risk Assessment | Systematic data analysis, standardization of procedures according to ISA | Business knowledge, judgment on specific risks, strategic weighting |

| Materiality Determination | Application of automated quantitative criteria | Qualitative assessment, sector context, entity history |

| Team Organization and Structure | Digitization of working papers, traceability of actions | Mentorship, progressive delegation, transmission of tacit knowledge |

| Audited Areas | Automation of repetitive and low value-added tasks | Assessment of fixed assets, impairments, and complex accounting estimates |

| Quality and Supervision | Automatic review systems, compliance with regulations | Culture of systematic review, continuous supervision |

| Professional Development | Requirement of digital skills, use of digital training platforms | Continuous training, situational learning, and critical adaptation to new technologies |

| Dimension | Description | Impact on Risk and Materiality Assessment | Practical Example |

|---|---|---|---|

| Technology | Integration of software and AI in auditing | Automation of tasks and anomaly detection | Use of ASD for automatic opening of analysis areas |

| Professional Judgment | Decisions based on critical and ethical analysis | Qualitative and contextual risk assessment | Asset impairments require interpretation beyond algorithms |

| Organizational Structure | Functional hierarchy and situational learning | Transfer of tacit knowledge and validation of decisions | Senior supervision in operational flow analysis |

| Human Interactions | Team communication and collaboration | Validation of critical decisions and consistency in standards application | Discussion of complex cases (e.g., financing contracts) |

| Organizational Culture | Emphasis on rigor, quality, and ethics | Strengthens risk management and internal control | Well-documented circularizations and cut-offs |

| Emerging Risks | Cybersecurity, data protection, and ESG | Broadening of the materiality concept | Increasing relevance of environmental and reputational factors |

| Auditor Profile | Technical, digital, and ethical competencies | Demand for a hybrid and critical role | Adapting to ethical technology use and sensitive judgment |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tavares, M.C.; Almeida, M.F.R.; Vale, J.; Kapo, A. Audit 5.0 in Risk and Materiality Assessment: An Ethnographic Approach. J. Risk Financial Manag. 2025, 18, 419. https://doi.org/10.3390/jrfm18080419

Tavares MC, Almeida MFR, Vale J, Kapo A. Audit 5.0 in Risk and Materiality Assessment: An Ethnographic Approach. Journal of Risk and Financial Management. 2025; 18(8):419. https://doi.org/10.3390/jrfm18080419

Chicago/Turabian StyleTavares, Maria C., Maria F. R. Almeida, José Vale, and Amra Kapo. 2025. "Audit 5.0 in Risk and Materiality Assessment: An Ethnographic Approach" Journal of Risk and Financial Management 18, no. 8: 419. https://doi.org/10.3390/jrfm18080419

APA StyleTavares, M. C., Almeida, M. F. R., Vale, J., & Kapo, A. (2025). Audit 5.0 in Risk and Materiality Assessment: An Ethnographic Approach. Journal of Risk and Financial Management, 18(8), 419. https://doi.org/10.3390/jrfm18080419