Abstract

Advanced technologies, such as robotic process automation, blockchain, and machine learning, increase audit efficiency. Nonetheless, some Supreme Audit Institutions (SAIs) have not undergone digital transformation. This research aimed to develop a comprehensive framework for supreme audit institutions to adopt and integrate emerging technologies into their auditing processes using a hybrid theoretical approach based on the TAM (Technology Acceptance Model) and TOE (Technology–Organisation–Environment) models. The framework was informed by insights from nineteen highly experienced experts in the field from eight countries. Through a two-round Delphi questionnaire, the experts provided valuable input on the key factors, challenges, and strategies for successful technology adoption by public sector audit organisations. The findings of this research reveal that technology adoption in SAIs starts with solid management support led by the chief technology officer. They must evaluate the IT infrastructure and readiness for advanced technologies, considering the budget and funding. Integrating solutions like the SAI of Ghana’s Audit Management Information System can significantly enhance audit efficiency. Continuous staff training is essential to build a positive attitude toward new technologies, covering areas like data algorithm auditing and big data analysis. Assessing the complexity and compatibility of new technologies ensures ease of use and cost-effectiveness. Continuous support from technology providers and monitoring advancements will keep SAIs aligned with technological developments, enhancing their auditing capabilities.

1. Introduction

Will all public sector audit institutions digitally transform? Clara, an intelligent AI-powered audit platform useful for audit automation and anomaly finding, is an example of how the Big 4 audit firms (Ernst and Young, Deloitte, Price Waterhouse Coopers, and KPMG) have digitally transformed (Ng, 2024). The Big 4 audit firms use fourth-industrial-revolution (4IR) technologies, such as robotic process automation, blockchain, and machine learning, to increase auditing efficiency with the global shift toward Industry 4.0 (Nouaje & Benazzou, 2025). Notable research has been conducted on the use and adoption of cutting-edge technologies by top auditing firms and reveals that Supreme Audit Institutions (SAIs) are making strides in adopting advanced technologies in public sector audits (Nouaje & Benazzou, 2025; Ceki & Moloi, 2024; Grossi et al., 2023). International SAIs, including the SAIs of Brazil, Norway, China, the United States, Belgium, and the European Court of Auditors, have embraced digitisation, artificial intelligence, and data analytics (Ceki & Moloi, 2025). However, most African SAIs have yet to adopt advanced technologies (Ceki & Moloi, 2025). While no single comprehensive global framework exists for SAI technology adoption, this research provides a technology adoption framework that reflects diverse views, as nineteen experts from eight countries have confirmed it. The World Bank (2021) discusses the benefits of data analytics for effective audits globally. It shows that the main challenge for SAIs, especially in Africa, is the lack of quality IT infrastructure and expertise and poor and unreliable data collection and security. The World Bank (2021) provides mostly an analysis of the documents of SAIs and summaries of meetings held by INTOSAI and AFROSAI-E, offering recommendations on how SAIs can be assisted in using data analytics and automation and not a step-by-step process of what should be done when adopting technologies. Al Marzooqi (2022) also provides the actions taken by the SAI of the UAE in digitally transforming their paper-based system to a technology-driven environment. The lessons from the SAI of the UAE’s UiPath software adoption have been included in this research, including the factors for technology adoption; however, it does not provide a comprehensive framework of what must be done when adopting technologies. It is against this lack of an empirical framework that this research positions itself to fill the gap. This research was motivated by the need for SAIs in developing countries on the African continent to adopt advanced technologies. The following research questions are explored in this paper:

- What are the key factors and processes critical for adopting advanced technologies to conduct audits by supreme audit institutions?

- Which key processes and factors are relevant, valid, and important for adopting technologies by supreme audit institutions?

The first question was answered by examining the literature and conducting a content analysis of SAI documents, and Tables 1 and 2 contain the results answering the question. The factors and processes were then sent to experts for validation and ranking of importance through two Delphi questionnaires. Table 3 and Figure 5 contain the results for the second research question. Partial guidelines within INTOSAI and AFROSAI-E, as well as adoption factors from the literature, were included in the Delphi questionnaires sent to experts to develop a comprehensive SAI adoption framework that may be useful for SAIs that are yet to adopt advanced technologies. Therefore, this research developed a framework for supreme audit institutions’ adoption of technologies. The framework is based on an enquiry of nineteen highly experienced experts from SAIs and academia, including IT experts, chief audit technology officers, and auditors, using a two-round Delphi questionnaire. These experts were from eight countries, providing the framework with an international perspective.

2. Theoretical Framework

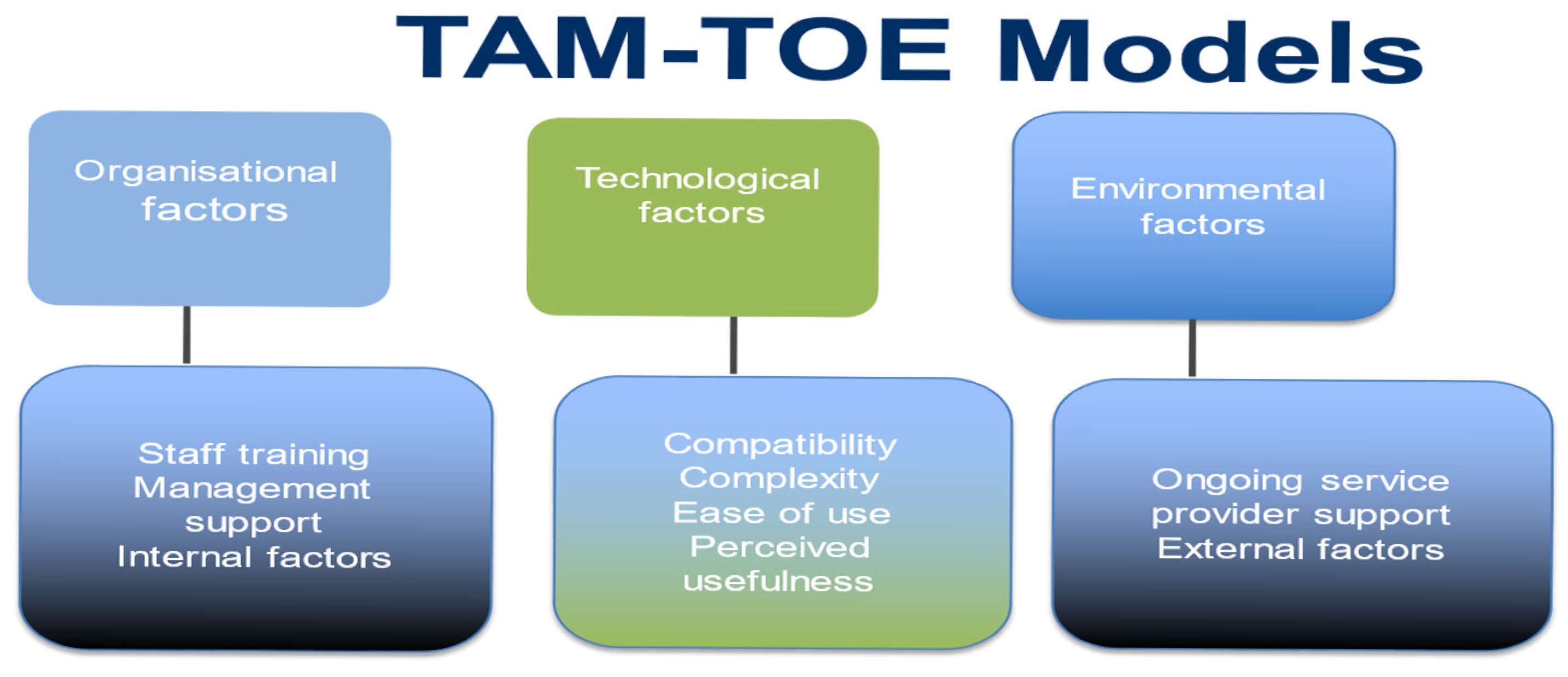

The Technology Acceptance Model (TAM) is used in this research, as it informs top management on what to look for from users of technology. The TAM focuses mainly on the user acceptance factors influencing the decision and intention to adopt technologies (Karahanna et al., 1999). The perceived ease of use and the perceived utility of new technology are the two variables presented in the original Technology Acceptance Model (TAM) (Davis et al., 1989). As per Davis et al. (1989), the first aspect, perceived ease of use, concerns how much effort a prospective user expects to put in when using the technology or system. Users consider an information system more straightforward to use and more beneficial for the work at hand when it is easy to use and has no learning curve (Briggs et al., 1998). There is a positive correlation between new technologies’ perceived utility and simplicity of use. Put another way, people view technology as having a greater value when it is easier to use (Szajna, 1996).

Venkatesh and Davis (2000) extended the TAM to incorporate system usability and an individual’s comfort level and expertise with computer systems as determinants of perceived system ease of use (Venkatesh & Davis, 2000). According to Dasgupta et al. (2002), experience enhances the intention to utilise new technologies; people familiar with the latest technology are likelier to adopt it than people with no digital experience (Dasgupta et al., 2002).

Meanwhile, the Technology, Organisation, and Environment (TOE) model focuses on the factors affecting the decision to adopt at an organisational level (Chatterjee et al., 2021). It encompasses external elements such as social and environmental aspects and technological and organisational characteristics (Chatterjee et al., 2021). These factors include various components, such as the organisation’s structure, culture, resources, and capabilities. The model recognises that an organisation’s readiness and ability to adopt new technology are influenced by its internal dynamics. By analysing these factors, the TOE model provides insights into how organisational factors can facilitate or hinder adoption.

Furthermore, the TOE model considers environmental factors that can impact technology adoption. These factors include industry trends, market conditions, and regulatory frameworks (Gangwar et al., 2015). Understanding the external environment is crucial, as it helps organisations assess the potential risks and opportunities associated with adopting a particular technology. By considering these factors, organisations can enhance their decision-making processes and increase their chances of successful technology adoption. In summary, the TOE model offers a comprehensive approach to understanding technology adoption by integrating technological, organisational, and environmental factors.

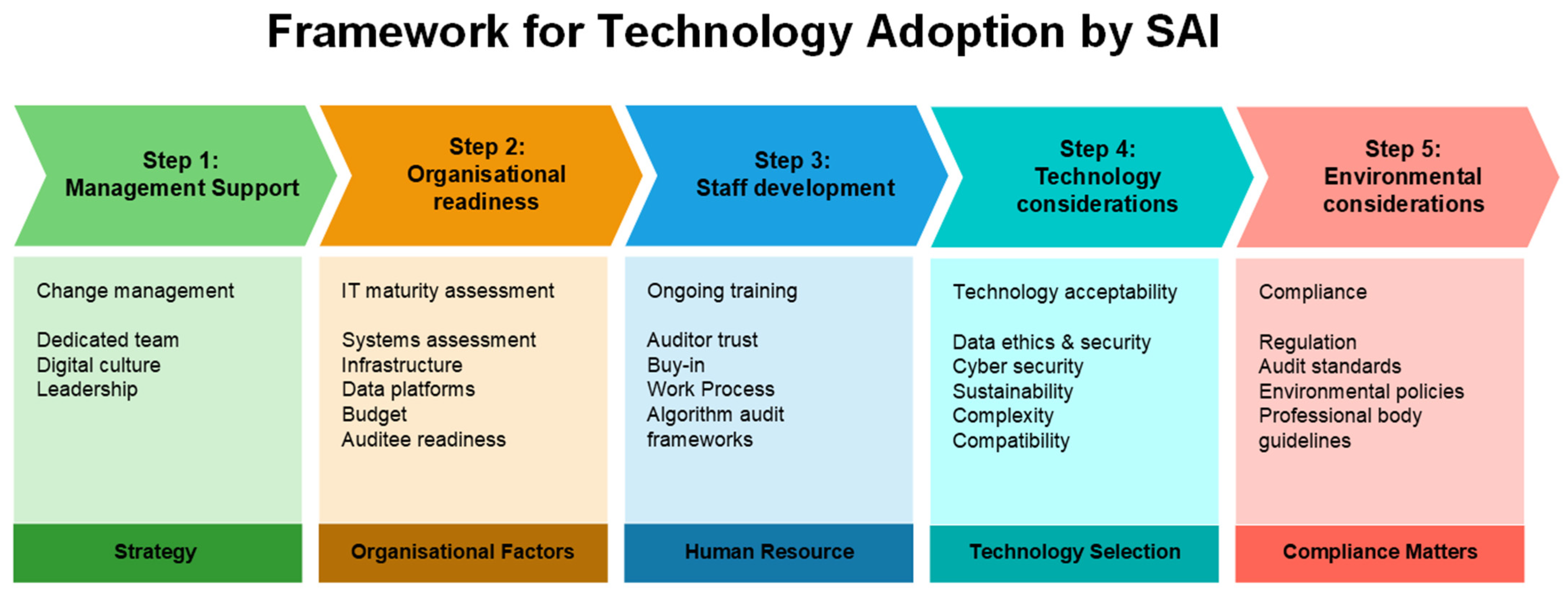

The TAM-TOE hybrid model has been used in AI adoption research within manufacturing to determine the factors influencing AI adoption by manufacturing firms (Chatterjee et al., 2021). It has also been used in adoption studies of cloud computing and e-commerce (Chatterjee et al., 2021; Jingjing & Idris, 2024). The TAM focuses mainly on internal technology adoption factors, while the TOE model incorporates internal and external factors. Although the TOE model has internal organisational factors, other constructs in the TAM explicitly define the factors influencing technology acceptance by users that are deemed necessary for this research; hence, the TOE model alone is insufficient. Combining the two models ensures the comprehensive inclusion of internal and external technology adoption factors. The model incorporates organisational, technological, and environmental aspects to understand technology adoption in Industry 4.0 comprehensively. Therefore, combining the TOE model and TAM was better suited for the present research, since the internal and external factors affecting technology adoption by supreme audit institutions are considered. Figure 1 depicts the factors for the TOE model and TAM.

Figure 1.

TAM-TOE models. Source: Adapted from Ceki (2023).

3. Literature Review

Supreme audit institutions are public organisations that audit the efficient use of public funds by government to enable the transparency and accountability of public officials to society (Hay & Cordery, 2021). They audit government entities’ financial statements, evaluating their integrity and adherence to regulatory requirements, conducting performance audits, and advising parliamentary steering committees (Slobodyanik et al., 2022). SAIs have three common goals, despite the fact that organisational and constitutional structures vary from country to country, as follows: assisting the legislative branch in keeping an eye on how the public budget is being implemented, encouraging government accountability, and minimising information asymmetry in public financial management. Digitally transforming existing systems to incorporate advanced technologies could improve financial performance due to cost savings from the automation of auditing tasks (Zhou et al., 2023). The issues hindering technology’s adoption, among others, are employee resistance, lack of leadership, and unclear implementation plans (Syed et al., 2023). The transition of emerging technologies into mainstream auditing practice is not solely a technical challenge but a complex interplay of human, organisational, and strategic factors. Addressing perceived complexity requires user-centric design, robust training, and transparent methodologies. Simultaneously, articulating clear value propositions demands quantifiable benefits, compelling use cases, and alignment with the core principles and the objectives of auditing. Works by Syed et al. (2023), Yusif et al. (2020), and Hamdy et al. contribute to this nuanced understanding, providing empirical backing and theoretical frameworks for navigating these critical barriers.

According to the technology acceptance model, compatibility, complexity, simplicity of use, effort expectations, and facilitating conditions are crucial technology adoption factors from an employee’s viewpoint (Sethibe & Naidoo, 2021). Technology adoption is believed to be significantly influenced by social variables, such as IT proficiency, organisational support with top management’s active engagement, and training (Ceki & Moloi, 2025). Solid digital leadership that encourages innovation and is not afraid to take measured risks is essential for a great digital culture (Syed et al., 2023; Ceki & Moloi, 2024). SAIs should have digital cultures that support experimentation, innovation, and tryouts (Otia & Bracci, 2022). In a culture like this, auditors can try new things, and failing might be necessary to improve one’s skills.

According to INTOSAI, well-developed, extensive data audit systems are required to deploy big data analytics (INTOSAI, 2022a) efficiently. Another recommendation is to have platforms for gathering data where auditee data are controlled and kept for audit evidence. Regulations on data applications are of the utmost importance. It is recommended that working groups of specialists within SAIs be formed to facilitate ongoing training and opportunities for sharing data analytics knowledge with INTOSAI and other professionals (INTOSAI, 2022b). People can become frustrated when not given proper training or direction when using new technology. Therefore, it is essential to conduct training workshops to alleviate people’s fears (Yusif et al., 2020).

It is crucial to have dedicated technical support when using technology and a well-defined plan for implementing the new system, as a lack of a plan might lead to failures in technology adoption (Syed et al., 2023). An implementation plan can be prepared with the input of auditors. Strong system controls during technology adoption and digital transformation are necessary to reduce the risks related to data security, unauthorised transactions, and system breaches negatively affecting data (Hamdy et al., 2025). The adoption of audit tools is influenced by an auditee’s AIS complexity, business size, support from senior management, professional body support, and the IT expertise of employees (Ceki & Moloi, 2024). However, compatibility affects the technological components of internal audit departments’ adoption of CAATT (Al-Okaily et al., 2022). Governments are advised to provide financial and policy support to manage technology use and security concerns related to data access. According to the diffusion of innovation concepts, external or environmental determinants include the size of the audit business and backing by professional bodies.

To effectively address such issues and ensure successful implementation, the readiness of auditees in the public sector to use cutting-edge technology in auditing must be considered. According to the features of the TOE model, Table 1 below lists the studies that examine the factors influencing technology adoption from organisational, technological, and environmental perspectives.

Table 1.

Key technology adoption studies.

Table 2 covers several other crucial and practical technologies deployed by SAIs, showing further technology adoption factors identified from the INTOSAI and AFROSAI-e documents. The table shows the name of the audit tool or technology adopted, how it assists in auditing, and the adoption factors deployed. These factors were included in the questionnaires sent to experts.

Table 2.

SAIs’ technology adoption factors.

4. Methodology

4.1. Delphi Inquiry

This paper used two rounds of a Delphi questionnaire to collect data. According to Weaver (1971), the Delphi method is a research technique whereby experts are consulted about a subject and make decisions based on their expertise and experience to reach a consensus. According to Iqbal and Pipon-Young (2009), a Delphi process is an iterative process incorporating organised discussion among subject-matter experts. The Delphi technique uses an organised, iterative process to achieve expert consensus on possible trends and developments in a particular field of knowledge (Carley et al., 1999). As experts are asked to reply to questionnaires until an agreement is obtained, iterative Delphi rounds allow experts to rework and reconsider their opinions. Although there are no specifications, two to four rounds are usually required. Polit and Beck (2008) state that going past a second round is irrational.

4.2. Delphi Process Adoption

Expert consensus on the factors and procedures influencing SAIs’ technology adoption was obtained through two iterative rounds of a Delphi questionnaire, which helped to improve and evaluate the technology’s applicability and relevance, similar to Denhere (2019). Data from a literature review and SAI document analysis were used to create the first Delphi questionnaire. Experts were asked to confirm the validity and appropriateness of a questionnaire containing factors influencing the adoption of technologies by supreme audit institutions and suggest additional necessary processes and factors. This was conducted during the first round of the Delphi process. Analysing the first round’s data produced a list of reliable and suitable adoption variables. By assigning a value to each item on the first round’s list of adoption procedures and variables, the experts in the second round arrived at a consensus on which factors and processes are first-rank or second-rank in terms of importance. The two Delphi surveys were created using Google Forms, since they are accessible from anywhere at any time and are a well-liked choice for online survey research.

5. Population and Sampling

Experts from various institutions, including universities, government agencies, internal audit institutions, SAIs, INTOSAI, and AFROSAI-e, composed the population for the Delphi procedure. Purposive sampling was used. Nineteen experts answered the first Delphi questionnaire, compared with the original aim of fifteen. The second round involved twelve experts. Ludwig (1997) states that using a sample size of 15–20 people is the standard procedure for Delphi research. In contrast, Sourani and Sohail (2015) recommend a minimum of seven to eight individuals. Since the number of experts involved in this study is within the range permitted by the literature, it is acceptable (Sourani & Sohail, 2015). Participants were selected based on their availability, willingness to engage, and experience with information technologies, auditing, and adopting new technologies. The experts included the following:

- Government officials;

- Qualified internal auditors;

- IT specialists;

- Chief technology officers;

- Chief information officers;

- Innovation leaders;

- Experienced external auditors.

They also included members of working groups on big data and IT audits. The same experts were given the questions in both rounds of the Delphi process used to create the technology adoption framework.

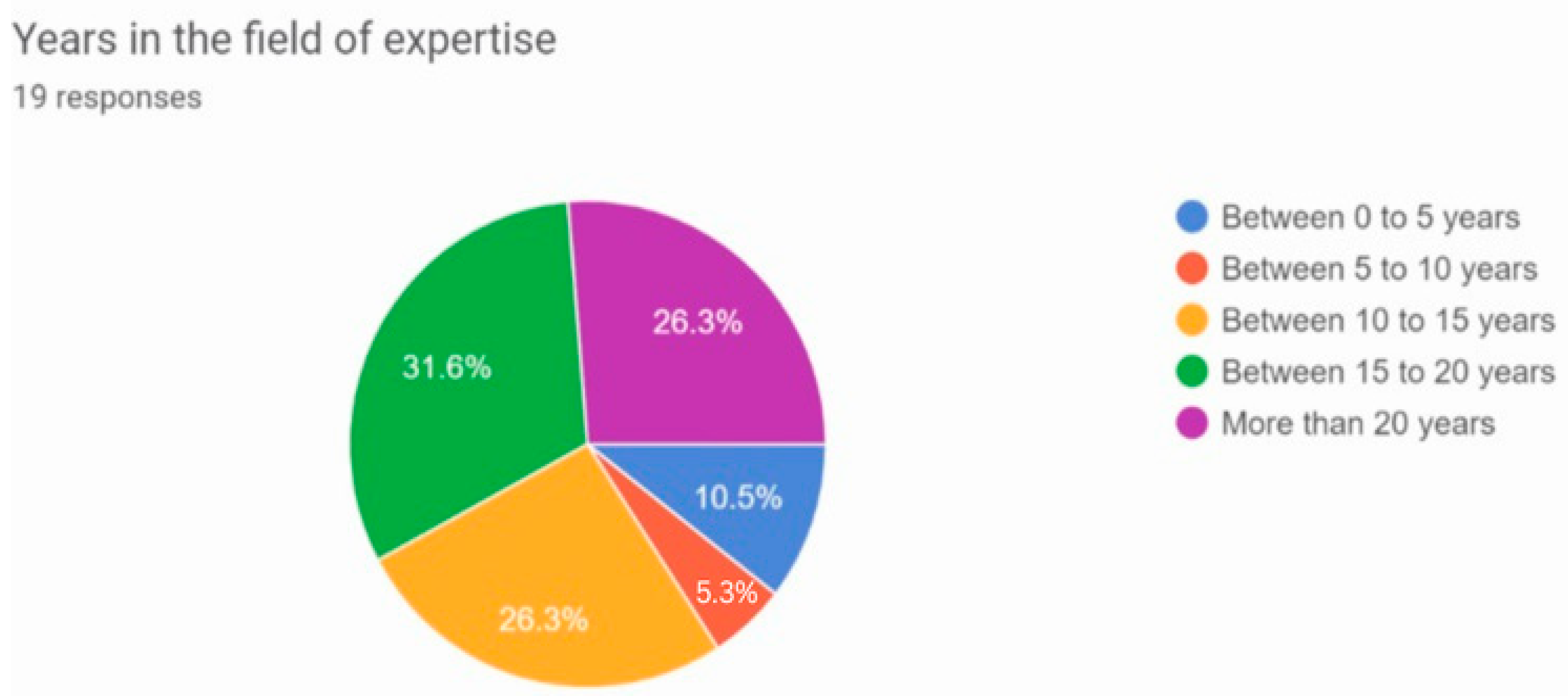

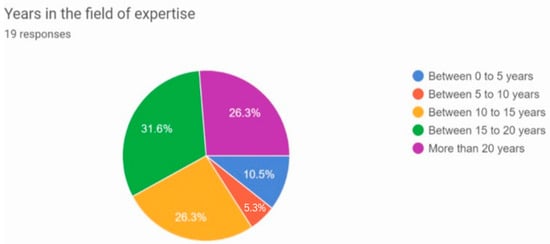

The participants are experts in their field, as shown in Figure 2, as 84.2% had more than ten years of experience, with only 15.8% having less than ten years of experience. A total of 31.6% of experts had between 15 and 20 years of work experience; 26.3% had more than 20 years of work experience; another 26.3% had between 15 and 20 years of work experience; 5.3% had between 5 and 10 years of experience; and 10.5% had between 0 and 5 years of experience.

Figure 2.

Experience of the experts. Source: Ceki (2023).

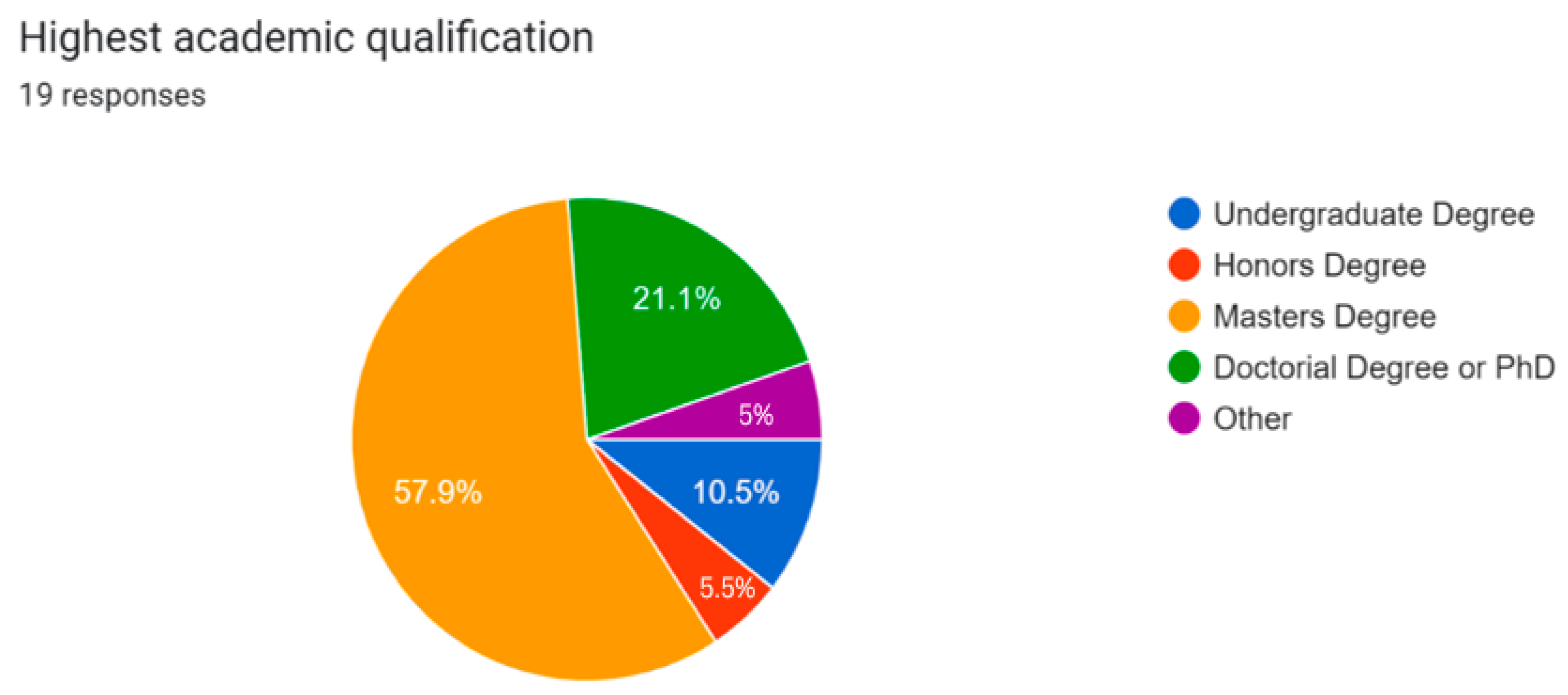

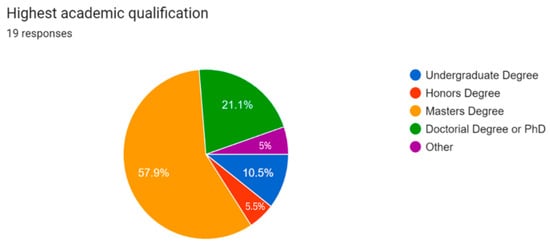

As shown in Figure 3, 57.9% of the experts hold a master’s degree, 21.1% have a doctoral degree, honours and postgraduate qualification holders are 10.5% in total, and 10.5% hold an undergraduate degree. The experts’ high literacy levels and experience were highly valuable, as they enabled informed and insightful expressions on the validity and level of importance of the factors for adopting technology by SAIs.

Figure 3.

Academic qualifications of the experts. Source: Ceki (2023).

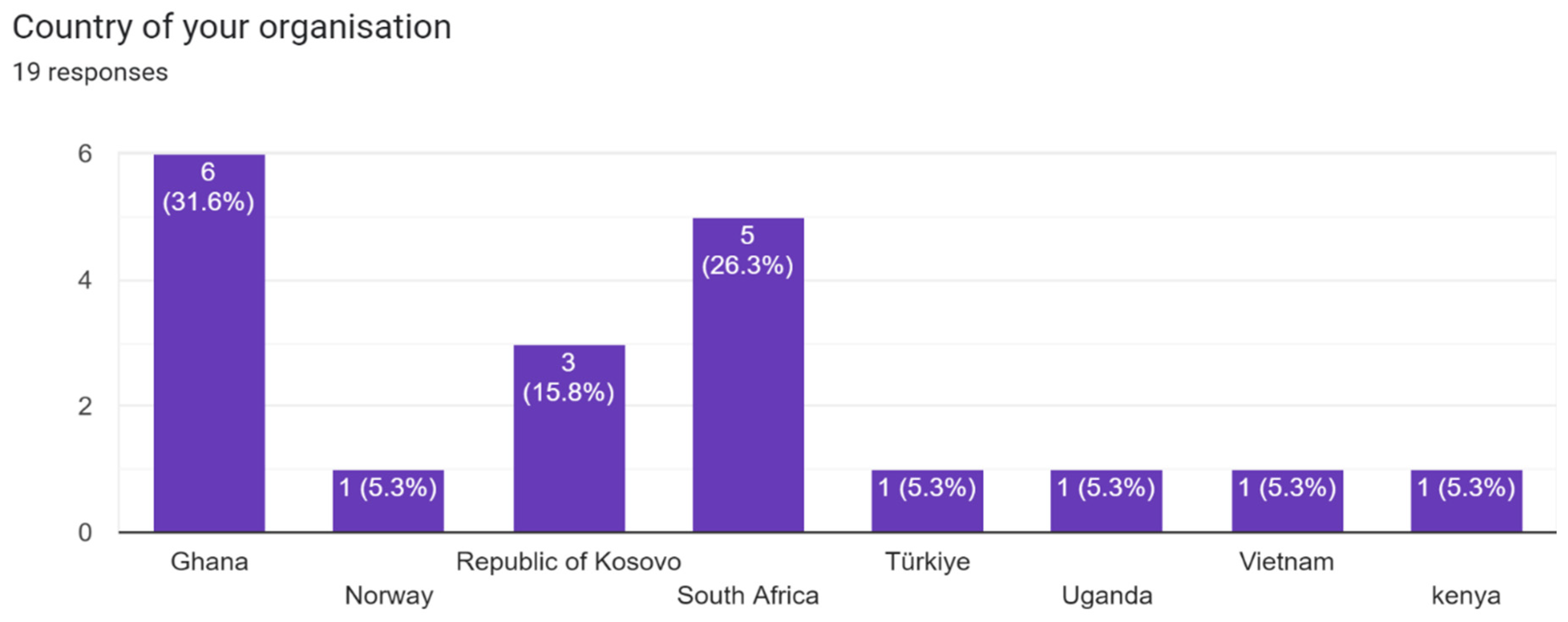

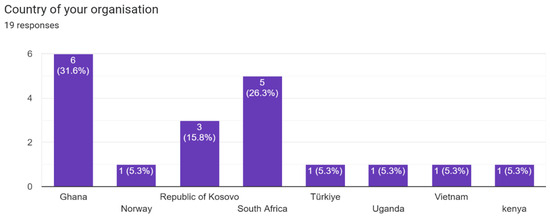

As depicted in Figure 4, six participants were from Ghana, five were from South Africa, three were from the Republic of Kosovo, and one each was from Türkiye, Norway, Uganda, Vietnam, and Kenya.

Figure 4.

Countries where the experts reside. Source: Ceki (2023).

5.1. Data Analysis

To gather and arrange expert opinions and impressions, decision guidelines for the data analysis in the Delphi procedure must be established, and a set of criteria must be followed to define and reach a consensus (Hsu & Sandford, 2007). Cuhls (2005) states that the votes cast must fall within a predefined range for a consensus. When 80% of the participants’ votes fall within the two groups on a seven-point scale, a consensus is said to have been formed (Hasson et al., 2000). Another viewpoint is that the survey’s median should be at least 3.25, and at least 70% of Delphi participants should have rated their satisfaction as a three or above on a scale of 1 to 4 (Ludwig, 1997).

In line with Ludwig (1997), all of the factors that scored a 3 or 4 by at least 75% of the experts were, therefore, deemed legitimate and appropriate in the analysis of the questionnaires, and they were included in the second questionnaire. The exact same process was used when examining the second questionnaire. The framework for technology adoption was developed using the factors and processes ranked 3 and 4, since they were considered highly significant.

5.2. Findings

The 1st questionnaire was sent to twenty participants, of which nineteen experts responded, which makes it a 95% response rate. The second questionnaire was sent to the nineteen experts, and twelve responded, making it a 63% response rate.

Table 3 demonstrates the ranking and response rates for each factor included in the first Delphi questionnaire.

Table 3.

Responses of experts to the 1st Delphi questionnaire.

The results show a consensus among experts, as almost all of the factors were accepted by more than 75% of the experts as valid, practical, and at either medium- or high-importance levels. The majority of experts accepted these factors as critical at a high-importance level of 3 or 4.

The results from the first questionnaire were used to draft a second Delphi questionnaire, which was sent to the same experts. The purpose of the second Delphi questionnaire was to achieve a consensus on the ranking of the technology adoption factors in terms of importance to create the conceptual framework. All factors rated 3 or 4, as well as the additional processes added by the experts from the first questionnaire, were included in the second questionnaire. Twelve experts responded to the second questionnaire. The ranked technology adoption factors and processes from their responses were used to develop the conceptual framework discussed below.

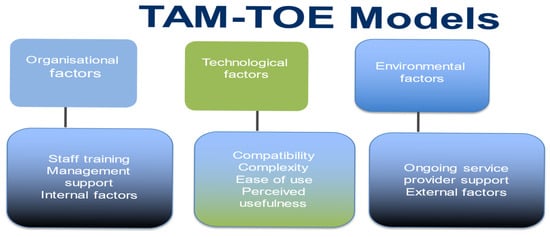

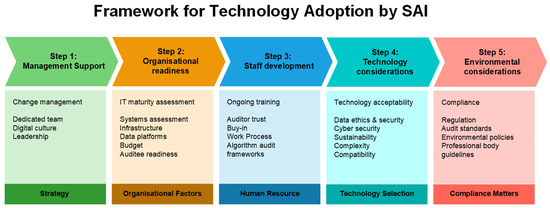

The conceptual framework recommends the following five steps for technology adoption: management support, organisational readiness, staff development, technology, and environmental considerations, as depicted in Figure 5.

Figure 5.

Technology adoption framework. Source: Ceki (2023).

6. Discussion of the Framework

6.1. Management Support

The first stage of technology adoption is led by senior executives, who play a pivotal role in setting the strategic direction and fostering a culture of technology adoption within supreme audit institutions. Their collaboration with the chief technology officer, who oversees the technical aspects, is instrumental in this process. Research consistently underscores the significance of top management’s commitment to shaping the organisational atmosphere (Al-Okaily et al., 2022; Pedrosa et al., 2020). This collaboration within SAIs can foster a readiness and eagerness to utilise technology, thereby instilling a digital culture. A dedicated team for technology adoption is crucial.

6.2. Organisational Readiness

Incorporating advanced technology capable of analysing vast quantities of data and automating auditing tasks is essential. Evaluating the IT capabilities and infrastructure is also a necessity. For instance, the SAI of Ethiopia has started to utilise IT Maturity Assessment software, provided by AFROSAI, which SAIs can employ to assess current systems (AFROSAI-E, 2023b). When high-level management strategically decides to use complex technology, they must consider factors such as readiness for IT, budget availability, and backing—internal or external—for procurement and execution.

Integrating advanced software solutions, such as the SAI of Ghana’s Audit Management Information System or the IT Audit Management program, can yield significant benefits. This step can streamline audit procedures, from planning to reporting, and enhance the overall efficiency and effectiveness of audits. Implementing algorithm audits can also effectively address any issues related to data ethics. It is strongly recommended that an audit model be adopted, designed explicitly for scrutinising data algorithms, similar to the one used by the Netherlands Court of Audits. This adoption can substantially improve audit efficiency and effectiveness, enhancing credibility and trust in the audit process.

The second phase’s final step involves assessing auditee platforms, which refer to the systems or platforms used by the auditee organisation, for their readiness for advanced technology audits. This step is pivotal for driving technology adoption and enhancing audit effectiveness. Verifying the possibility of extracting data from auditee systems or platforms is essential. UiPath, a tool extensively used by the SAI of the UAE for this purpose, is a highly recommended system and program for automating auditing and data extraction from auditees. Further research should focus on exploring additional software or systems used for data extraction, as the technology adoption team may consider them based on the preparedness level of the auditee’s systems and platforms.

6.3. Staff Training

In step three, SAIs should conduct continuous staff training on using new technology to encourage a positive attitude and digital culture, as confirmed in the theoretical frame and the literature, and ongoing training on advanced technologies, such as data algorithm auditing, cloud-based auditing, and big data analysis (Awuah et al., 2021). A work process for the change management team responsible for technology adoption is recommended. The auditors’ independence should remain intact while training and using advanced technologies. Pre-existing technological proficiency and foundational knowledge of data analytics, AI principles, and information systems among individual auditors directly influence their receptiveness and capability to adopt new technologies. This also incorporates the impact of varying levels of digital literacy and the “digital native” versus “digital immigrant” dynamic on technology acceptance and effective utilisation.

7. Technology Aspects

When deciding on the technology to acquire, a recommendation is to evaluate its complexity and compatibility for ease of use and efficiency, as well as cost–benefit analysis, as confirmed by the theoretical model of this research. SAIs should request ongoing technical assistance from technology service providers. Continuous monitoring and scanning of new technology developments are also recommended to ensure staying abreast of new and relevant technology. Compatibility with different auditee systems should be evaluated. The new system or technology intended to be adopted should assess and address data security, cybersecurity, and sustainability risks. Advanced technology should not be too complex but compatible and easy to use, along with ongoing technical support provided by the service/technology provider.

Environmental Considerations and Additional Recommendations

Before purchasing new technology, SAIs should consider whether it will foster compliance with regulations, environmental policies, audit efficiency, and other government regulations on adopting technology. The latest technology audit activities, such as planning, audit procedures, and reporting, should comply with quality, reporting, and auditing standards. SAIs should also consider professional bodies’ guidelines and policies.

The additional factors that ranked low but were considered valid and practical by the experts and in the literature are worth considering when adopting technologies and are, therefore, recommended to be considered. They include providing staff incentives for acquiring tech skills (Al-Hiyari, 2019), communicating the benefits of adopting new technology, and considering the availability of change agents or departmental heads to drive technology adoption (Yusif et al., 2020). Hiring data scientists or using SAI experts to create audit algorithms was rated low, because using an audit model for algorithm auditing is preferred and highly ranked instead. Therefore, SAIs should use the audit model for algorithm auditing.

Another factor for consideration is partnering with academics and external partners for technology adoption. Re-engineering processes to integrate technologies in auditors’ work and not focusing only on automating current processes was a recommendation by some experts, even though it was rated low. Monitoring and scanning for new technology solutions and usage on an ongoing basis after technology adoption is implemented is recommended. Considering whether data extraction from auditee systems is feasible is essential.

The experts highlighted the importance of professional scepticism and independence, as varying degrees of scepticism among auditors can both foster a critical evaluation of new technologies (leading to demand for greater transparency and robustness) and potentially act as a barrier if auditors are overly cautious or distrustful of tools perceived as “black boxes” or those lacking clear accountability. Auditors can explore how technologies can be designed and implemented to build trust and leverage scepticism constructively to enhance audit quality.

8. Conclusions

This research developed a framework for supreme audit institutions to adopt technologies based on the views of international experts from eight countries. Using the framework as a strategic tool for technology adoption can help SAIs. Adopting 4IR technologies impacts the quality of the auditing performed by SAIs, which can increase audit efficiency and effectiveness.

This research offers important insights and recommendations for audit organisations navigating the complex landscape of technology adoption. Key findings from an enquiry of experts reveal that the chief technology officer (CTO) plays a pivotal role in facilitating technology adoption and implementing a purposeful plan for technology integration. The effective utilisation of cutting-edge technologies in audit firms depends on a holistic strategy that integrates leadership, culture, and strategic planning with the goals and needs of the company. An organisation’s auditors and upper management set the tone with their dedication, fostering a digital culture and readiness for technological integration. Before introducing complex technologies, it is essential to assess current systems for compliance with rules, the ability to incorporate new technologies, and organisational-wide readiness. Tools like the IT Maturity Assessment program can be used to evaluate the IT infrastructure and capabilities efficiently. Budget and financial assistance from internal and external sources are essential when deciding whether to implement modern technology. Employee training and change management programs should be implemented to guarantee continual improvement and adaptability to new procedures and technologies. This promotes a culture of ongoing learning and development within a company and assists the team in staying current with the most recent industry standards and practices.

Incorporating the audit of algorithms is essential for reducing the risks associated with data ethics, a critical aspect of technology adoption. The CTO should lead the technology adoption team in evaluating the viability of data extraction from auditee systems. Adopting new technology should prioritise compliance with laws, environmental policies, and audit standards to guarantee that audit quality is not jeopardised. The significance of sustainability, cybersecurity, and data security cannot be overstated. Technology appraisal is a crucial component when acquiring new technical solutions. Complexity, compatibility, cost–benefit analysis, and continuing technical support must be evaluated to make well-informed decisions. It is also advisable to monitor technological developments to ensure the organisation stays current and relevant.

The conceptual framework contributes to the literature and can be used by supreme auditing institutions and the broader community in the public and commercial sectors for technology adoption, informing decision making. The identified processes and factors for technology adoption contribute to theory and can be added as additional factors or constructs in the TOE model and TAM.

A limitation of this paper is that the experts were mainly from developing countries, and this could present a geographical bias, which could result in the findings not being generally applicable to all countries and organisations. Selection bias is also possible, as most experts were from supreme audit institutions.

Future research can be further expanded by analysing the traits of top management from companies that have embraced technology to evaluate their ability to promote a digital culture. Additionally, piloting the framework in SAIs and examining how supreme audit institutions are putting the framework into practice could add a valuable contribution to the literature and SAIs. A thorough assessment of public sector auditees’ and supreme audit institutions’ data platforms, IT maturity level, data accessibility, and IT infrastructure readiness will provide valuable insights.

Author Contributions

Conceptualisation, B.C. and T.M.; methodology, B.C. and T.M.; validation, T.M.; formal analysis, B.C.; investigation, B.C.; data curation, B.C.; writing—original draft preparation, B.C.; writing—review and editing, B.C.; visualisation, B.C. and T.M.; supervision, T.M.; project administration, B.C. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding, and the APC was funded by Moloi.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the School of Accounting Research Ethics Committee of the University of Johannesburg (SAREC20230621/02 on 21 June 2023).

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors on request.

Conflicts of Interest

The authors declare no conflict of interest.

References

- AFROSAI-E. (2022). SAI automation and technology adoption. Available online: https://afrosai-e.org.za/wp-content/uploads/2024/07/A-SEAT-Brochure.pdf (accessed on 15 October 2024).

- AFROSAI-E. (2023a). A-SEAT. Available online: https://afrosai-e.org.za/articles/driving-audit-efficiency-afrosai-es-development-workshop-on-a-seat-optimisation/ (accessed on 1 October 2024).

- AFROSAI-E. (2023b). Ethiopia SAI ITMA application workshop. Available online: https://afrosai-e.org.za/articles/wgisam-meeting-focused-on-sais-becoming-data-driven/ (accessed on 2 September 2024).

- Al-Hiyari, A. (2019). The value relevance of purchased goodwill in Malaysian firms: The pre-and post-IFRS evidence. Available online: https://www.researchgate.net/publication/326711731 (accessed on 30 October 2024).

- Al Marzooqi, S. A. (2022). SAI UAE implements ambitious digital transformation program. International Journal of Government Auditing, 49(1), 1–52. [Google Scholar]

- Al-Okaily, M., Alqudah, H. M., Al-Qudah, A. A., & Alkhwaldi, A. F. (2022). Examining the critical factors of computer-assisted audit tools and techniques adoption in the post-COVID-19 period: Internal auditors’ perspective. VINE Journal of Information and Knowledge Management Systems, 54, 1062–1091. [Google Scholar] [CrossRef]

- Awuah, B., Onumah, J. M., & Duho, K. C. T. (2021). Information technology adoption within internal auditing in Ghana: Empirical analysis. SSRN Electronic Journal, 4(4). [Google Scholar] [CrossRef]

- Briggs, R. O., Adkins, M., Mittleman, D., Kruse, J., Miller, S., & Nunamaker, J. F. (1998). A technology transition model derived from field investigation of GSS use aboard the U.S.S. CORONADO. Journal of Management Information Systems, 15(3), 151–195. [Google Scholar] [CrossRef]

- Carley, S. D., Mackway-Jones, K., & Donnan, S. (1999). Delphi study into planning for care of children in major incidents. Archives of Disease in Childhood, 80(5), 406–409. [Google Scholar] [CrossRef] [PubMed]

- Ceki, B. (2023). A model for the adoption of technologies by supreme audit institutions. University of Johannesburg (South Africa). [Google Scholar]

- Ceki, B., & Moloi, T. (2024). Technology adoption factors for supreme audit institutions. Journal of Accounting Research, Organization and Economics, 7(3), 413–428. [Google Scholar] [CrossRef]

- Ceki, B., & Moloi, T. (2025). Technology adoption and digital transformation by supreme audit institutions: A content analysis study. EDPACS, 70, 209–225. [Google Scholar] [CrossRef]

- Chatterjee, S., Rana, N. P., Dwivedi, Y. K., & Baabdullah, A. M. (2021). Understanding AI adoption in manufacturing and production firms using an integrated TAM-TOE model. Technological Forecasting and Social Change, 170, 120880. [Google Scholar] [CrossRef]

- Cuhls, K. (2005). Delphi surveys. In Teaching material for UNIDO foresight seminars. United Nations Industrial Development Organization. [Google Scholar]

- Dasgupta, S., Granger, M., & McGarry, N. (2002). User acceptance of e-collaboration technology: An extension of the technology acceptance model. Group Decision and Negotiation, 11(2), 87–100. [Google Scholar] [CrossRef]

- Davis, F. D., Bagozzi, R. P., & Warshaw, P. R. (1989). User acceptance of computer technology: A Comparison of two theoretical models. Management Science, 35(8), 982–1003. [Google Scholar] [CrossRef]

- Denhere, V. (2019). The development of an engagement risk management instrument for Zimbabwean audit firms [Doctoral Thesis, University of Johannesburg]. [Google Scholar]

- Eulerich, M., Pawlowski, J., Waddoups, N. J., & Wood, D. A. (2022). A framework for using robotic process automation for audit tasks. Contemporary Accounting Research, 39(1), 691–720. [Google Scholar] [CrossRef]

- Gangwar, H., Date, H., & Ramaswamy, R. (2015). Understanding determinants of cloud computing adoption using an integrated TAM-TOE model. Journal of Enterprise Information Management, 28(1), 107–130. [Google Scholar] [CrossRef]

- Grossi, G., Hay, D. C., Kuruppu, C., & Neely, D. (2023). Changing the boundaries of public sector auditing. Journal of Public Budgeting, Accounting & Financial Management, 35(4), 417–430. [Google Scholar] [CrossRef]

- Hamdy, A., Diab, A., & Eissa, A. M. (2025). Digital transformation and the quality of accounting information systems in the public sector: Evidence from developing countries. International Journal of Financial Studies, 13(1), 30. [Google Scholar] [CrossRef]

- Hasson, F., Keeney, S., & McKenna, H. (2000). Research guidelines for the Delphi survey technique. Journal of Advanced Nursing, 32(4), 1008–1015. [Google Scholar] [CrossRef] [PubMed]

- Hay, D. C., & Cordery, C. J. (2021). Evidence about the value of financial statement audit in the public sector. Public Money Management, 41, 304–314. [Google Scholar] [CrossRef]

- Hsu, C. C., & Sandford, B. A. (2007). Minimising non-response in the Delphi process: How to respond to non-response—Practical assessment. Research & Evaluation, 12(1), 17. [Google Scholar]

- INTOSAI. (2022a). OAG Nepal launches audit management system. International Journal of Government Auditors, 49(1), 7. Available online: https://www.intosai.org/fileadmin/downloads/about_us/IJGA_Issues/former_years/2022/EN_2022_v49n1.pdf (accessed on 20 May 2023).

- INTOSAI. (2022b). INTOSAI grant program helps more than 50 Sais during the pandemic. International Journal of Government Auditors, 49(1), 30. Available online: https://www.intosai.org/fileadmin/downloads/about_us/IJGA_Issues/former_years/2022/EN_2022_v49n1.pdf (accessed on 20 May 2023).

- INTOSAI. (2022c). SAI UAE Implements an Ambitious Digital Transformation Program. International Journal of Government Auditors, 49(1), 49. [Google Scholar]

- Iqbal, S., & Pipon-Young, L. (2009). The Delphi method. The British Psychological Society, 22, 598–606. [Google Scholar]

- Jingjing, Z., & Idris, S. (2024). Technological context and organisational context cross-border e-commerce SMEs’ performance in Hebei. International Journal of Accounting, Finance and Business, 9(54), 151–159. [Google Scholar]

- Juma’h, A. H., & Li, Y. (2023). The effects of auditors’ knowledge, professional skepticism, and perceived adequacy of accounting standards on their intention to use blockchain. International Journal of Accounting Information Systems, 51, 100650. [Google Scholar] [CrossRef]

- Karahanna, E., Straub, D. W., & Chervany, N. L. (1999). Information technology adoption across time: A cross-sectional comparison of pre-adoption and post-adoption beliefs. MIS Quarterly, 23(2), 183–213. [Google Scholar] [CrossRef]

- Leijsen, E. M., Verhulst, J., Oosterwijk, P., & Pirkovski, M. (2021). Developing an audit model for algorithms. International Journal of Government Auditing, 48(2), 1–42. [Google Scholar]

- Li, H., Dai, J., Gershberg, T., & Vasarhelyi, M. A. (2018). Understanding usage and value of audit analytics for internal auditors: An organizational approach. International Journal of Accounting Information Systems, 28, 59–76. [Google Scholar] [CrossRef]

- Li, Y., & Juma’h, A. H. (2022). The effect of technological and task considerations on auditors’ acceptance of blockchain technology. Journal of Information Systems, 36(3), 129–151. [Google Scholar] [CrossRef]

- Ludwig, B. (1997). Predicting the future: Have you considered using the Delphi methodology? Journal of Extension, 35(5), 1–4. [Google Scholar]

- Manrai, R., & Gupta, K. P. (2023). Investor’s perceptions on artificial intelligence (AI) technology adoption in investment services in India. Journal of Financial Services Marketing, 28(1), 1–14. [Google Scholar] [CrossRef]

- Ng, A. (2024). AI-based audit. Available online: https://assets.kpmg.com/content/dam/kpmgsites/ch/pdf/audit-with-ai-en.pdf (accessed on 22 October 2024).

- Nouaje, F., & Benazzou, L. (2025). Exploring the adoption of digital transformation in supreme audit institutions: A comprehensive literature review. Moroccan Journal of Quantitative and Qualitative Research, 7(1), 1–17. [Google Scholar]

- Otia, J. E., & Bracci, E. (2022). Digital transformation and the public sector auditing: The SAI’s perspective. Financial Accountability and Management, 38(2), 252–280. [Google Scholar] [CrossRef]

- Pedrosa, I., Costa, C. J., & Aparicio, M. (2020). Determinants adoption of computer-assisted auditing tools (CAATs). Cognition, Technology and Work, 22(3), 565–583. [Google Scholar] [CrossRef]

- Polit, D. F., & Beck, C. T. (2008). Nursing research: Generating and assessing evidence for nursing practice. Lippincott Williams & Wilkins. [Google Scholar]

- Sayginer, C., & Ercan, T. (2020). Understanding determinants of cloud computing adoption using an integrated diffusion of innovation (Doi)-technological, organizational and environmental (Toe) MODEL. Humanities & Social Sciences Reviews, 8(1), 91–102. [Google Scholar] [CrossRef]

- Seethamraju, R., & Hecimovic, A. (2023). Adoption of artificial intelligence in auditing: An exploratory study. Australian Journal of Management, 48(4), 780–800. [Google Scholar] [CrossRef]

- Sethibe, T., & Naidoo, E. (2021). The adoption of robotics in the auditing profession. The South African Journal of Information Management, 24(1), 1441. [Google Scholar] [CrossRef]

- Slobodyanik, Y., Zdyrko, N., Kuzyk, N., Sysiuk, S., & Benko, I. (2022). Audit of public finances: Methodological issues and the case of Ukraine. Independent Journal of Management & Production, 13(3), S76–S92. [Google Scholar]

- Sourani, A., & Sohail, M. (2015). The Delphi method: Review and use in construction management research. International Journal of Construction Education and Research, 11(1), 54–76. [Google Scholar] [CrossRef]

- Syed, R., Bandara, W., & Eden, R. (2023). Public sector digital transformation barriers: A developing country experience. Information Polity, 28(1), 5–27. [Google Scholar] [CrossRef]

- Szajna, B. (1996). Empirical evaluation of the revised technology acceptance model. In Source: Management science (Vol. 42, Issue 1). Available online: https://www.jstor.org/stable/2633017 (accessed on 21 September 2024).

- Venkatesh, V., & Davis, F. D. (2000). Theoretical extension of the technology acceptance model: Four longitudinal field studies. Management Science, 46(2), 186–204. [Google Scholar] [CrossRef]

- Weaver, W. T. (1971). The Delphi forecasting method. The Phi Delta Kappan, 52(5), 267–271. [Google Scholar]

- Widuri, R., Ferdiansyah, I., & Kongchan, P. (2021). The influence of culture, technology, organization, and environment on the adoption of computer-assisted audit techniques. PalArch’s Journal of Archaeology of Egypt/Egyptology, 18(1), 494–504. [Google Scholar]

- World Bank. (2021). Supreme audit institutions’ use of information technology globally for more effective audits (pp. 1–58). EFI Insight-Governance. [Google Scholar]

- Yang, R., & Wibowo, S. (2022). User trust in artificial intelligence: A comprehensive conceptual model. Electronic Markets, 32(4), 2053–2077. [Google Scholar] [CrossRef]

- Yusif, S., Hafeez-Baig, A., & Soar, J. (2020). Change management and adoption of health information technology (HIT)/eHealth in public hospitals in Ghana: A qualitative paper. Applied Computing and Informatics, 18(3/4), 279–289. [Google Scholar] [CrossRef]

- Zhou, Y., Ock, Y. S., Alnafrah, I., & Dagestani, A. A. (2023). What aspects explain the relationship between digital transformation and financial performance of firms? Journal of Risk and Financial Management, 16(11), 479. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).