1. Introduction

Technological innovation and development continually transform the financial ecosystem (

Frost et al., 2021). Advances in digital technology have contributed significantly to the emergence of financial alternatives, the evolution of business models, and the transformation of services (

Alfonso et al., 2021). Bitcoin, launched in 2009, represents a digital revolution. Built on blockchain technology, it aimed to provide an alternative to the global financial system by offering decentralized finance, a limited supply, pseudonymity, secure cryptographically protected transactions, and a programmable digital currency. Bitcoin’s functionalities later paved the way for Ethereum, Litecoin, Ripple, and other cryptocurrencies (

Alam et al., 2024). Cryptocurrencies support investor portfolio diversification and operate outside the jurisdiction of governments and regulatory authorities (

Jagtiani et al., 2021). However, the cryptocurrency system’s lack of regulation and oversight can attract individuals seeking to conceal their actions, evade taxes, or commit financial crimes (

Bunjaku et al., 2017). Cryptocurrencies possess the characteristics of a unit of account, a medium of exchange, and a store of value; however, they are often viewed as speculative assets expected to yield returns through capital gains. This perception stems from their inelastic supply, which is dictated by protocol rules, the recording of transactions on decentralized ledgers, and their inherent volatility, all of which hinder their effectiveness as a medium of exchange (

Claeys et al., 2018).

Although cryptocurrencies are volatile and carry high risks, they continue to attract investors’ attention due to their potential for portfolio diversification (

Ghorbel & Jeribi, 2021). The growing demand for cryptocurrencies has prompted professional investors and hedge funds to explore this market (

Fletcher, 2021). As a form of financial technology (fintech), cryptocurrencies can provide high long-term returns. When central banks introduce highly liquid assets to the market through quantitative easing (QE), cryptocurrencies with limited supply structures can protect investors against inflation (

Zhao et al., 2023). More than 17,000 volatile cryptocurrencies are traded on the market, with a total market value of approximately three trillion US dollars (

CoinGecko, 2025).

Unlike volatile cryptocurrencies, which are unstable and illiquid, stablecoins with liquid properties maintain the benefits of cryptocurrencies while also providing interest income to investors. Stablecoins are designed to support a fixed value relative to a specific asset, usually gold or US dollars (

Ito et al., 2020). Their low volatility structure provides convenience in payments with fast and low transaction costs. Stablecoins eliminate the flaws of fluctuating cryptocurrencies and excel in trading, exchanging, and serving as a store of value (

Hoang & Baur, 2024). In addition, shocks in the volatile cryptocurrency market can increase the popularity of stablecoins (

Łęt et al., 2023). Despite these advantages, their profit potential is low, and they are subject to collateral and regulatory risk. Currently, there are approximately 200 coins in the stablecoin market, such as Tether, USD Coin, and Binance USD, and their total market value is around

$200 billion (

CoinGecko, 2025).

As explained above, there are differences between unstable and stable coins in terms of yield, liquidity, volatility, speculation, and risk factors. However, both types of coins are based on innovative technology as decentralized financial instruments. These technologies accelerate cross-border banking transactions and reduce transaction costs (

Hassani et al., 2018). Cryptocurrencies can balance excessive money demand through market mechanisms, providing an efficient tool for expanding the money supply (

Caton, 2020). Nonetheless, cryptocurrencies can cause environmental pollution due to their high energy consumption based on “proof-of-work” mechanisms (

Laimon et al., 2025). In addition, regulatory uncertainties and security gaps are perhaps the most critical factors. These factors can lead to tax evasion and the growth of the informal economy. As cryptocurrencies gain wider acceptance in decentralized electronic financial markets, central banks increasingly struggle to control the money supply. Consequently, they are losing their ability to develop effective political instruments against high volatility and speculative attacks. Furthermore, states are losing money due to seigniorage revenues, which are still significant to them (

Demir & Odabaşı, 2022).

Lowering costs and augmenting usability encourage consumers to adopt digital payments (

Jakobsen, 2018). The rise of digital payments and the increasing popularity of cryptocurrencies raise questions about the future of money. The expectation that cryptocurrencies will replace fiat currencies could significantly undermine trust in fiat money (

Claeys et al., 2018). In addition, this development may lead to a decline in the authority of central banks. To this end, many central banks are working to implement a central bank digital currency (CBDC). Various central banks focus on the benefits of cryptocurrency and blockchain technologies for retail and large-value payments (

Kvedaravičiūtė & Šapkauskienė, 2025). For example, the Central Bank of China has completed nationwide pilot programs for the digital yuan (e-CNY) based on blockchain technology (

Bai et al., 2025). The central banks of the EU, Russia, India, and many other countries are also following this trend (

Mikhalev et al., 2021). These digital currencies, issued by central banks, will modernize payment systems with technological innovations. They will function like cash, enabling fast, simple, and risk-free transactions (

Bech & Garratt, 2017). Thus, central banks that are prepared to act in the cryptocurrency market will gain the support of a specific segment of crypto investors and users. Central banks could enhance the competitive structure of the cryptocurrency market by implementing practices that reduce the sector’s speculative and volatile nature.

Central banks can intervene directly in the cryptocurrency market by staying abreast of technological innovations and engaging with the market. However, the impact of central banks on the crypto market may extend beyond this development. For example, the US Federal Reserve System (Fed), one of the most prominent forces in the global economy and financial markets, can indirectly affect cryptocurrencies. However, such insight must be analyzed empirically. In this context, our research questions are as follows: Does the Fed influence cryptocurrencies through monetary policy variables, such as real interest rates, the monetary base, and the dollar? Furthermore, do the effects differ between volatile and stablecoins? Addressing these questions is crucial for evaluating the Fed’s current impact on cryptocurrencies and their stability. It can also aid in identifying the features of CBDCs. To answer these questions, this paper employs a robust time series econometric method, such as the autoregressive distributed lag (ARDL) bounds test approach. The primary purpose of this study is to investigate the influence of the Fed on cryptocurrencies and to analyze whether these effects differ between stable and volatile cryptocurrencies. Herewith, we summarize the primary contributions of this paper to the literature as follows: (i) We contribute to the literature that will guide the future of money. (ii) We analyze and compare in detail the impact of the Fed’s monetary policy instruments on volatile and stable cryptocurrencies. Finally, (iii) to shape the future of money, we offer policymakers novel and robust evidence-based policy solutions that will contribute to the stability of cryptocurrencies and thus strengthen financial functioning. The rest of this paper is organized as follows:

Section 2 documents the literature review.

Section 3 introduces the methodology and data used in the study.

Section 4 presents the results of the empirical analysis and discussion. At last,

Section 5 concludes.

2. Literature Review

Undoubtedly, new digital technologies will shape the future of money. Central banks cannot ignore this tendency. For this reason, many central banks are preparing to introduce their own digital currencies. This means a centrally controlled currency will be traded in markets as an alternative to existing digital currencies. Additionally, the influence of central authorities on existing cryptocurrencies is being discussed. Such an impact, even if it occurs through various market mechanisms, may mean that the central authority has control over the cryptocurrencies traded in the market. In this context, we are conducting a review of studies focusing on the impact of the monetary policy tools of central banks on crypto assets. In a study analyzing the influence of various macroeconomic factors of developing countries on Bitcoin prices for the period 2010–2017,

Sadraoui et al. (

2022) show that the exchange rate positively affects Bitcoin prices; on the contrary, financial openness negatively affects Bitcoin prices. In a study examining the effect of the US federal funds rate and the Chinese interbank rate on the behavior of stable and volatile coins,

Nguyen et al. (

2022) find that both factors tighten the price volatility of stablecoins. In contrast, these factors enhance the prices of volatile coins. Finally, the empirical evidence indicates that the US federal funds rate affects both coins more strongly than the Chinese interbank rate.

Focusing on the links between Asian currencies, such as the Chinese yuan, Thai baht, and Taiwanese dollar, and cryptocurrencies,

Corelli (

2018) detects that these currencies are correlated with six major cryptocurrencies (Bitcoin, Ethereum, Ripple, Litecoin, Monero, and Dash).

Karau (

2023), who empirically examined the influence of monetary policy on Bitcoin, reveals that the impact varies over time. Although the analysis findings confirm the contractionary effect of the US monetary tightening on Bitcoin in the post-2020 period, they show that historically, US tightening has consistently increased Bitcoin prices rather than decreased them. Employing high-frequency monetary surprises associated with decisions taken by the Fed and the European Central Bank (ECB),

Pietrzak (

2023) demonstrates that Bitcoin responds systematically to monetary and central bank information shocks. The study reveals that responses change over time and can sometimes even switch signs. Moreover, the study finds that disinflationary shocks from the Federal Reserve lead to an increase in Bitcoin prices, while those from the European Central Bank tend to lower them. This result suggests that Bitcoin offers minimal support as an inflation hedge.

Peciulis and Vasiliauskaite (

2024) explore the influence of monetary policy on major cryptocurrencies, such as Bitcoin, Ethereum, and Binance. They find that monetary policy decisions and announcements significantly affect cryptocurrency prices.

Alam et al. (

2024) investigate the complex relationship between cryptocurrencies and monetary policy, focusing particularly on long-term volatility dynamics. They analyze the daily returns of three major cryptocurrencies (Bitcoin, Binance Coin, and XRP) using monthly monetary policy data from the United States and South Africa. Their analysis revealed that conventional cryptocurrencies are more sensitive to structural breaks in exogenous variables than newer counterparts. In an empirical study examining the nexus between cryptocurrencies and various aspects of the financial system,

Saleem et al. (

2024) reveal a positive link between cryptocurrency market capitalization and key financial indicators, such as the Dow Jones Industrial Average, the Consumer Price Index, and traditional banking transactions.

Aldasoro et al. (

2025) unveil that US monetary policy shocks drive developments in both crypto and traditional markets. The analysis results show that the response of money market fund assets and stablecoin market capitalization to monetary policy shocks differs. The study detects that primary money market fund assets increased after the tightening of monetary policy, while stablecoin market capitalization decreased. Empirically analyzing whether there is a time-varying connection between the stablecoin market and the currencies of emerging markets and economies with significant cryptocurrency penetration,

Napari et al. (

2025) demonstrate that the return shocks from the currencies of these countries before and after the COVID-19 pandemic spilled over into the stablecoin market. The findings indicate that stablecoins serve as a safe haven for currencies in emerging markets and economies.

Some studies in the empirical literature have reached findings that contradict those of the studies analyzed above. These studies imply that the effects of major central bank monetary policy variables, inflation data, and other crucial factors are not substantial on Bitcoin’s prices. For instance,

Fama et al. (

2019) investigated the dominant role of Bitcoin in the market and found that Bitcoin returns depend solely on financial contracts, indicating that cryptocurrency acts as a highly speculative asset. Another study, which analyzes Bitcoin employing the Structural Vector Autoregression (SVAR) method, reveals that Bitcoin prices are affected mainly by their own volatility (

Köse et al., 2024). To address the inconsistency in the literature, we review some studies that explore the influence of monetary policy shocks on cryptocurrencies. Comprehending how monetary policy affects cryptocurrencies during times of shock is vital for gaining insight into this topic.

Ma et al. (

2022) examined the impact of US monetary policy shocks on Bitcoin prices. They revealed that a hypothetical unexpected one-basis-point monetary tightening in the two-year Treasury yield on the day of a Federal Open Market Committee (FOMC) meeting is associated with a 0.25% decrease in Bitcoin prices.

Buthelezi (

2025) conducted a thorough analysis and concluded that US monetary policy shocks lead to a decline in cryptocurrency prices. It also indicates that US monetary policy tightening stabilizes the market at lower cryptocurrency prices. However, at higher price levels, interest rate hikes are associated with reduced cryptocurrency prices and increased volatility.

Matkovskyy et al. (

2020) demonstrated the investment appeal of Bitcoin as a hedge against uncertainty in US economic policy through various statistical techniques. Furthermore,

Hodula (

2025) found that monetary tightening decreases the demand for Bitcoin when examining the effects of US monetary policy shocks on cryptocurrency demand. As a result, the aforementioned studies provide evidence that US monetary policy influences cryptocurrencies.

Some studies have investigated the impact of an expanding monetary base on cryptocurrencies. For instance,

Zhao et al. (

2023) examined the influence of US quantitative easing (QE) policies on Bitcoin prices using the time-varying parameter vector autoregression (TVP-VAR) model. They unveiled that the effects of these policies on Bitcoin prices vary over time and observe a temporary positive impact through different channels. Empirical evidence from the study showed that QE has a long-term positive influence on Bitcoin through the liquidity channel.

Aloui et al. (

2024) questioned whether the low-interest-rate environment resulting from quantitative easing (QE) indirectly encouraged investors to move toward Bitcoin. Using a Bayesian VAR model with time-varying coefficients and stochastic volatility (TVP-BVAR-SV), the study revealed that, despite a high-uncertainty and low-interest-rate environment, Bitcoin declined more steeply during the pandemic period than in the preceding period.

Extensive reviews have been conducted on the impact of major central bank monetary policy variables and inflation on major cryptocurrencies. Our literature review provides a comprehension of the existing gaps in the literature. Firstly, empirical studies predominantly focus on Bitcoin while overlooking other volatile and stable coins, such as Ethereum and Tether. Secondly, we find that empirical studies do not sufficiently examine empirical analyses separately in the long and short term. Finally, we discover that few studies have comprehensively analyzed volatile and stable coins separately. As a result, this study aims to address these gaps in the literature.

3. Methodology and Data

We conduct robust and contemporary time series econometric procedures over the period from January 2019 to April 2025. For this purpose, we employ the EViews 13 statistical package to perform econometric analyses. Herewith, this study analyzes the influence of the Fed’s monetary policy variables on the major cryptocurrencies shown below. The descriptions, units of measurement, symbols, and data sources for all variables are presented in

Table 1.

EXUSEU, RIR, and BOGMBASE are independent variables consisting of monthly announced data, whereas cryptocurrency prices (dependent variables) are updated daily. At first glance, this may appear to be an inconsistency between the two data types. However, we harmonized all data using the monthly basis prices of the cryptocurrencies we analyzed. As a result, no other transformations were applied to the data besides taking the logarithm.

Table 2 presents the descriptive statistics for the variables analyzed. Volatile coins (BTC and ETH) and BOGMBASE exhibit significantly higher mean and maximum values compared to the other variables. For example, the mean value of BTC exceeds 35,000, while ETH and BOGMBASE average around 1736 and 5179, respectively. In contrast, stablecoin TETH has a mean close to 1. Due to the high variability of BTC, ETH, and BOGMBASE, the natural logarithms of these variables are used in empirical analysis. Additionally, since the dependent variables are expressed in natural logarithm form across all models, TETH is also used in its logarithmic form. This transformation is a common practice in econometric modeling, particularly when dealing with financial time series data, as it helps to stabilize variance and linearize exponential growth patterns (

Gujarati & Porter, 2009).

4. Analysis, Results, and Discussion

In time series econometrics, a unit root test assesses whether a variable exhibits a stochastic trend, indicating non-stationarity, or if it reverts to a constant mean over time. This study employs the Augmented Dickey–Fuller (ADF) and Phillips–Perron (PP) unit root tests to explore the stationarity properties of the variables, thereby providing a robust framework for determining their suitability for further econometric modeling.

Table 3 shows the results of PP and ADF unit root tests.

Based on the results of unit root tests, almost all variables are found to be non-stationary at the levels yet to become stationary after first differencing, indicating they are integrated to an order of one I(1). Specifically, LBTC, LBOGMBASE, LETH, EXUSEU, and RIR are non-stationary at the level but stationary at the first difference in both PP and ADF tests. However, LTETH is stationary at the level under all specifications (with constant, trend, and none), indicating it is I(0). These mixed orders of integration—where some variables are I(0), and others are I(1)—justify the use of the ARDL (Autoregressive Distributed Lag) bounds testing approach, which can accommodate such combinations without requiring all variables to be integrated of the same order. As noted by

Pesaran et al. (

2001), the ARDL model is particularly suitable when variables are a mix of I(0) and I(1) but none are I(2), ensuring the robustness and consistency of long-run and short-run estimations in small samples. Given this mix of integration orders, it is appropriate to select the ARDL modeling approach for testing the long-run nexus.

The general model is presented below in Equation (1). In Equation (1), the price displays the price of the volatile coins BTC and ETH and the stablecoin TETH, which uses the natural logarithm (L).

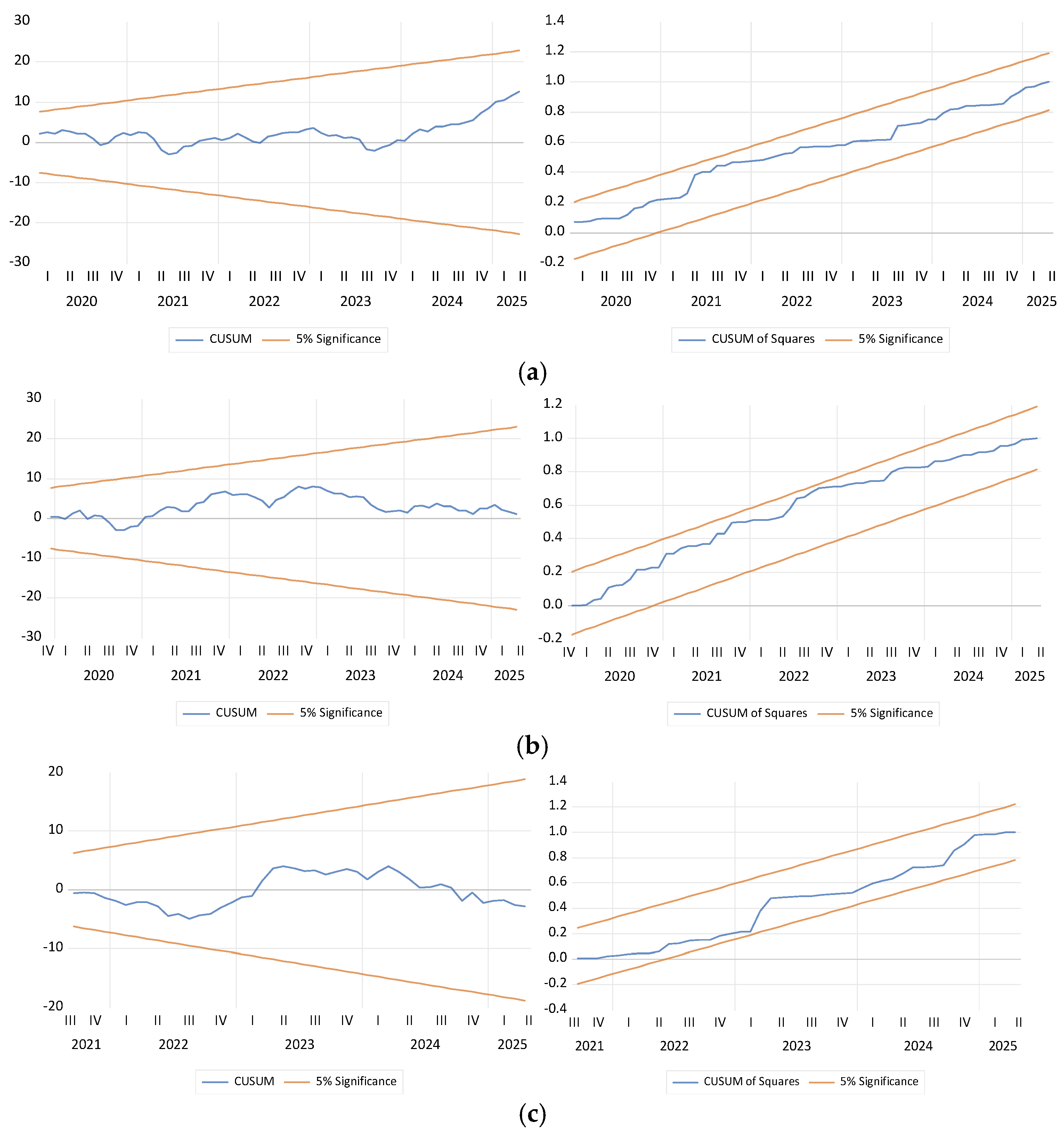

We also explain why certain analysis methods, such as the Vector Error Correction Model (VECM), Structural Vector Autoregression (SVAR), and Time-Varying Parameter Vector Autoregression (TVP-VAR), are not suitable for our research. (i) The VECM model requires time series to be integrated at the I(1) level. (ii) The SVAR model, which is used for shock-based analyses, relies on structural constraints grounded in robust theoretical foundations. However, it was not possible to identify these constraints in our empirical study. (iii). Finally, the TVP-VAR requires a long-term, larger dataset for shock-based analysis. In contrast, the Autoregressive Distributed Lag (ARDL) model can produce reliable estimates even with limited data and is well suited for series integrated at different levels, specifically I(0) and I(1). Additionally, the ARDL model is ideal for incorporating lagged variables in analyses involving macroeconomic factors, providing directly interpretable coefficients for both short-term and long-term effects. These considerations led us to employ the ARDL bounds test in our study. Nonetheless, it may be stated that the ARDL lacks robustness, particularly in the presence of the stability of long-run coefficients. To address this challenge, stability tests, such as CUSUM and CUSUMSQ, are conducted.

The bounds test examines the joint significance of the coefficients of one lagged level of the variables, which are

,

,

,

, and

; thus, the hypothesis is:

Table 4 presents F-statistics that strongly confirm the existence of a long-run cointegration nexus among LBTC, LETH, and LTETH at the 1% significance level. Finally, short-run parameters are defined using the error correction model (ECM) (

Narayan, 2005).

Table 5 presents the long-run results of the ARDL models, which consist of three models: (i) the first model for LBTC, (ii) the second model for LETH, and (iii) the third model for LTETH. In the first two models—LBTC and LETH—all independent variables are statistically significant at the 1% level. Both models indicate that LBOGMBASE has a positive effect, suggesting that an expansion in the US monetary base is associated with an increase in Bitcoin and Ethereum prices. Among these independent variables, EXUSEU has the most potent positive effect on Bitcoin prices. Similarly, EXUSEU (lagged by one period) has a strong positive impact on Ethereum prices in the long run. These findings indicate that an appreciation of the euro against the US dollar is associated with higher prices for both Bitcoin and Ethereum. Moreover, RIR has a positive and statistically significant impact on the prices of Bitcoin and Ethereum, showing that rising real interest rates are associated with upward movements in their prices. In the model estimated for LTETH, the variable LBOGMBASE (lagged one period) is statistically significant at the 1% level yet shows a negative nexus, suggesting that an increase in the US monetary base is associated with a slight decrease in Tether prices.

As a result, we reveal that while the US central bank policy variables positively influence major volatile coins in the long run, the US monetary base negatively influences the stablecoin Tether at a low level. We note that the primary finding of our study aligns with

Nguyen et al. (

2022). In addition, we emphasize that our empirical outcomes regarding the EXUSEU and BOGMBASE align with the conventional portfolio theory. According to this theory, investors can incorporate alternative, high-risk, and high-yield assets into their portfolios to hedge against potential dollar losses. Rising inflation and an expanding monetary base may lead investors to turn to high-risk alternative assets, such as volatile cryptocurrencies, to safeguard against the dollar’s depreciation. Similarly, the USD/EUR exchange rate may encourage investors to seek out these volatile cryptocurrencies for portfolio profit maximization in the long term. Conversely, Tether, which is pegged to the dollar and remains stable over time, may not offer investors the same level of portfolio diversification or relatively higher profit in the long run. On the other hand, we underline that our empirical findings concerning the RIR variable do not align with traditional portfolio theory. We developed three arguments to account for this discrepancy:

- (i)

The Fed may not have raised real interest rates enough to dampen demand for volatile cryptocurrencies in the long run.

- (ii)

Even if the Fed raises real interest rates during a specific period, the adverse effects of these increases on the real economy and financial flows may reinforce market expectations of an expanding monetary policy, thereby influencing investors’ decisions.

- (iii)

Even if the Fed increases real interest rates, capital or private companies in other countries may turn to cryptocurrencies. Herewith, we emphasize that our empirical findings should be taken into consideration by central banks and financial authorities worldwide.

Following the long-run model, the short-run model is estimated and presented in

Table 6.

In the short-run model estimated for LBTC, the lagged dependent variable is statistically significant at the 1% level and has a negative sign, indicating a partial adjustment in Bitcoin prices. Among the explanatory variables, EXUSEU (lagged one period) and RIR (lagged one period) are both statistically significant and positively signed. Additionally, LBOGMBASE is significant at the 5% level and also positively signed. In terms of short-run dynamics, we show that all independent variables have a positive influence on Bitcoin prices, consistent with the long-run effects.

The LETH model shows a significant, negatively signed lagged dependent variable, indicating partial price adjustment. Similar to Bitcoin, the independent variables (LBOGMBASE, EXUSEU(−1), and RIR) have a positive effect on Ethereum prices in the short term. Our findings indicate that the Fed’s monetary policy variables contribute positively to the prices of major volatile cryptocurrencies in both the short and long term. These results are consistent with those of

Aldasoro et al. (

2025), who found that US monetary policy drives cryptocurrency prices.

The LTETH model shows a stronger adjustment, with a significant and larger negative coefficient for the lagged dependent variable. Interestingly, LBOGMBASE has become negatively signed and significant, suggesting that the expanding monetary base in the US may slightly reduce Tether prices. This finding aligns with the work of

Nguyen et al. (

2022) and suggests that the increasing US monetary base, driven by liquidity, imposes price constraints on the stablecoin Tether. Consequently, the price structure of stablecoins remains stable and experiences less volatility during periods of expanding liquidity. We also highlight that the negative nexus between the US monetary base and Tether prices is low. The price of Tether, pegged to the US dollar, fluctuates within a limited range in the free market (i.e., between 0.998 and 1.003). Alongside US monetary policy, this limited shift may be influenced by various factors, such as reserve transparency, investor interest in alternative cryptocurrencies, a liquidity crisis, or substantial transfers.

In the final stage, we address the multicollinearity and diagnostic test results that we applied while following the estimation procedure. Firstly, (i) we assessed whether multicollinearity existed among the independent variables. As shown in

Appendix A.2 (VIF values), no multicollinearity issues were found that could adversely impact our estimation process. Secondly, the Breusch–Godfrey LM (BG-LM) test is employed to detect the presence of serial correlation under the null hypothesis of no autocorrelation. In

Table 6, the absence of significance stars next to the BG-LM test statistics indicates that we fail to reject the null hypothesis, suggesting that all the models do not suffer from autocorrelation. Finally, (iii) the results of the CUSUM and CUSUM of Squares (CUSUMSQ) tests are presented in

Appendix A.1. Since none of the test statistics cross the critical bounds, we conclude that the models are structurally stable. Model stability is denoted with the letter “S” in

Table 6. Overall, the diagnostic results support the validity and robustness of all models. Finally, (iv) the error correction term is negative and statistically significant at the 1% level, indicating a valid error correction mechanism in all models. This result confirms that the short-run dynamics effectively capture the adjustment process toward long-run equilibrium, supporting the overall validity of the short-run model specification.

5. Conclusions

We are witnessing the rapid evolution of digital technologies that are shaping the future. The cryptocurrency trend started with the launch of Bitcoin in 2009, and since then, the cryptocurrency market has diversified and grown at an impressive pace. In recent years, central banks have accelerated their efforts to issue their digital currencies, following this trend. Central banks’ introduction of these digital currencies signifies their direct influence on the crypto market. However, the impact of central banks on the cryptocurrency market may extend beyond this development. For instance, the Fed’s monetary policy, a major driver of the global economy and financial markets, can indirectly influence cryptocurrency prices. Comprehending how the Fed’s monetary policy affects cryptocurrency values is crucial for maintaining financial market stability and assessing the future of the cryptocurrency sector. In this context, this study examines the influence of the Fed’s key monetary policy variables on major volatile and stable currencies. The results of the empirical analysis indicate that the Fed’s monetary policy variables have an impact on the prices of both types of cryptocurrencies. Over the long term, the effects on the prices of volatile coins are positive, while the prices of Tether experience a minor negative impact. Conventional portfolio theory appears to be generally sound based on these findings. Moreover, our findings uncover that the US monetary base suppresses the prices of Tether in the long run, unlike the major volatile cryptocurrencies. Finally, our empirical findings show that the Fed’s monetary policy has different effects on the primary stable and volatile cryptocurrencies.

Our empirical findings align with those of

Sadraoui et al. (

2022),

Nguyen et al. (

2022),

Karau (

2023), and

Aldasoro et al. (

2025). In addition, recent studies, such as

Hodula (

2025) and

Buthelezi (

2025), indicate that the Fed’s monetary policy shocks influence cryptocurrencies. Nonetheless, our results contradict the findings of

Fama et al. (

2019), who found that Bitcoin prices fluctuate solely based on financial contracts, and

Köse et al. (

2024), who revealed that Bitcoin prices are primarily influenced by their volatility. Consequently,

Fama et al. (

2019) and

Köse et al. (

2024) imply that the roles of the major central bank monetary policy, inflation data, and other crucial external factors are insignificant, considering the internal dynamics of Bitcoin. Based on our empirical results, we formulate our policy recommendations item by item as follows: (i) The loose monetary policies of the Fed and other major central banks may encourage the use of cryptocurrencies as a hedge against inflation. This can potentially lead to a speculative bubble in the crypto market, which may result in financial disappointment for some investors. To address these risks, the financial stability units of central banks, in collaboration with official financial authorities, should create a monitoring and risk reporting system. This system should provide investors with regularly updated information on cryptocurrency volatility and risks. Secondly, (ii) central banks can introduce a Central Bank Digital Currency (CBDC) by implementing an effective design. CBDC can serve as an alternative investment option to cryptocurrencies if it offers relatively attractive returns in the long term for investors. Finally, (iii) we emphasize the significance of stablecoins and central bank digital currencies having mechanisms that are more responsive to changes in monetary policy tools set by major central banks. After presenting our suggestions, we discussed some challenges faced with this study. While the Fed’s monetary policy variables and inflation data are typically published monthly and quarterly, daily cryptocurrency data is accessible. If we had daily access to all relevant variables, we could perform more comprehensive analyses. Another concern is that there is a low-level autocorrelation concern in Tether’s estimates. Finally, we recommend that future studies try different approaches to estimating Tether and other stablecoins.