The Impact of Self-Sufficiency in Basic Raw Materials of Metallurgical Companies on Required Return and Capitalization: The Case of Russia

Abstract

1. Introduction

2. Literature Review

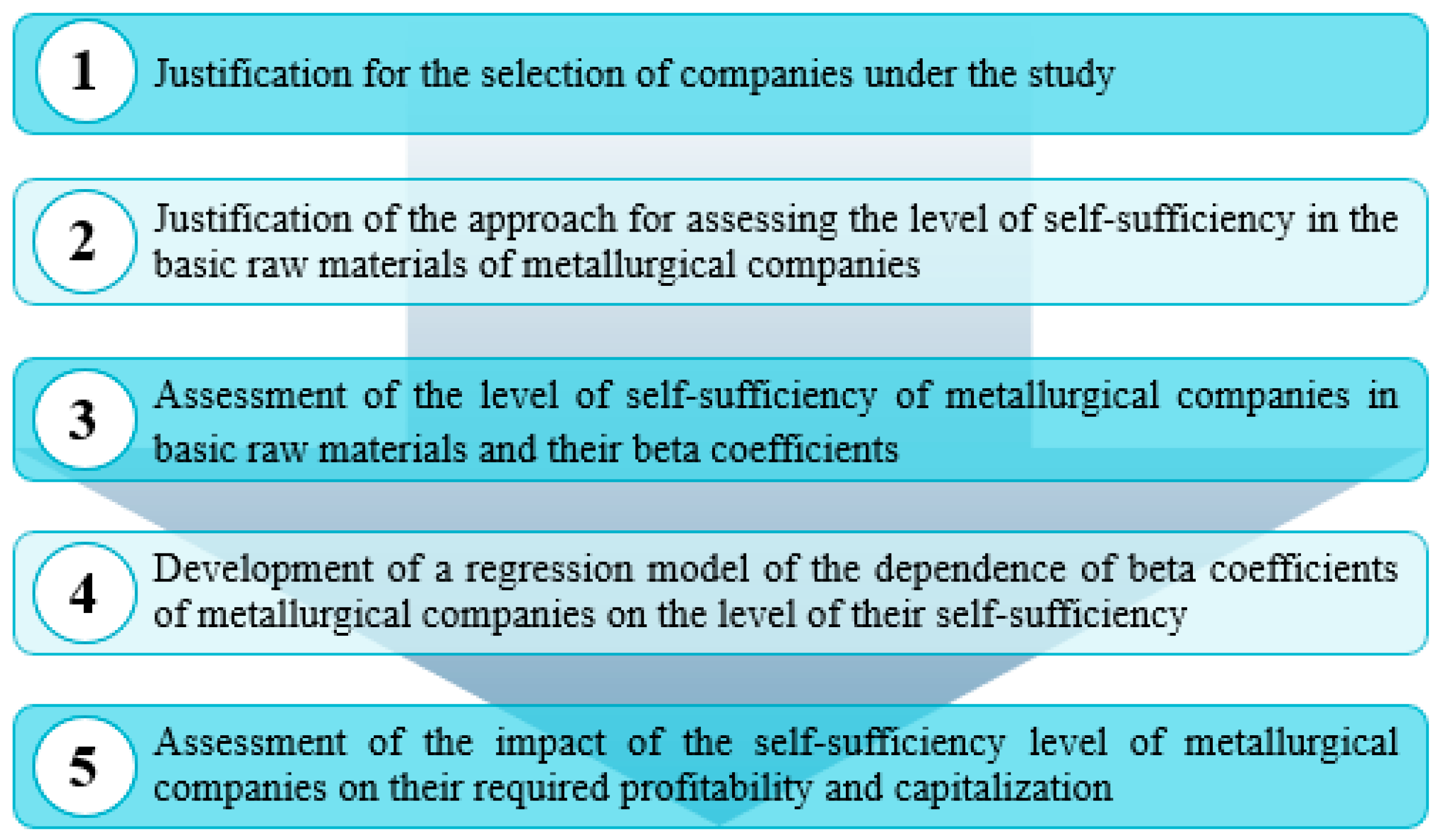

3. Materials and Methods

3.1. Sample Selection

- The expansion of the list of Russian ferrous metallurgy companies by foreign ones does not consider the problem of comparability of basic national economic indicators. Inflation levels, government bond yield rates, risk premiums and other indicators differ significantly among the markets of different countries, which affects the values of beta coefficients.

- Inclusion of companies from other industries in the list contradicts the purpose of the study, since the need for the main types of raw materials differs by industry. The main types of raw materials for ferrous metallurgy companies are iron ore and coking coal, while non-ferrous metallurgy companies are subject to significant differentiation depending on the product they produce—for example, in the production of aluminum, the main share of costs falls on alumina and electricity (up to 60%), with electricity alone accounting for up to 40% (Elka Mehr Kimiya, 2025).

- World commodity markets are oligopolies. Even in countries such as the United States and Australia, production is concentrated at the level of a limited number of large national and transnational companies. This fact limits the possibility of expanding the sample.

- Most of the companies listed in paragraph 3 are multi-product, which creates additional difficulties in determining the cost structure for each type of product manufactured and selecting companies in accordance with the purpose of the study.

3.2. Regression Model Development

4. Results and Discussion

- Greater stability in small samples (Gelman et al., 2013; Smid et al., 2020);

- Greater stability to heteroscedasticity of the residuals (Kruschke, 2013; Zuur et al., 2009).

5. Discussion

- Retrospective analysis (collecting and analyzing past data and calculating the “historical” beta coefficient);

- Analog method;

- Influencing factors analysis.

6. Conclusions

- A formula for assessing the self-sufficiency of ferrous metallurgy companies in the basic raw materials (iron ore and coking coal) is proposed.

- The existence of an inverse relationship between the level of self-sufficiency of a metallurgical company and the level of its systematic risk (beta coefficient) is substantiated, and a regression model describing this relationship is obtained.

- It has been demonstrated that the consideration of self-sufficiency is necessary when assessing the required return and capitalization of metallurgical companies, what is especially important in the context of vertical integration transactions. As a rule, the main focus when assessing such transactions falls on additional cash flows from integrated assets. By ignoring the effect of a decrease in the required return, investors may underestimate the incentives to implement these transactions and make unjustified management decisions.

- It is necessary to take into account that the quality of the obtained regression model is limited by a small sample. The reasons for the limited sample size and the lack of opportunity to expand it are presented in detail in Section 3.1 «Sample Selection».

- There is a reason to believe that the obtained dependence has an industry and country linkage; therefore, for companies of another industry or another country of affiliation, it will be necessary to adjust the obtained model.

- The proposed approach is relevant for companies with high material intensity of production, since the influence of self-sufficiency creates any visible effect on the required return and capitalization only with a significant share of material costs in the cost structure.

- Country diversification of the sample. It seems appropriate to test the results of this study on a sample of metallurgical companies from such countries as China (the world leader in ferrous metallurgy), India, Japan and the USA.

- Sectoral diversification of the sample. This is relevant for material-intensive industries such as construction, heavy engineering, chemical and food industries.

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| PJSC | Public Joint Stock Company |

| CAPM | Capital Asset Pricing Model |

| DM | Diamond mining |

| FM | Ferrous metallurgy |

| NFM | Non-ferrous metallurgy |

| Al | Aluminum |

| E | Energy |

| M | Mining |

| Ni | Nickel |

| Pt | Platinum |

| Pd | Palladium |

| Cu | Copper |

| CM | Coal mining |

| GM | Gold mining |

| PP | Pipe Production |

| Ti | Titanium |

| IO | Iron ore |

| CC | Coking coal |

References

- Afanaseva, O., Neyrus, S., Navatskaya, V., Perezhogina, A., Afanaseva, M. O., Neyrus, S., Navatskaya, V., & Perezhogina, A. (2023). Risk assessment of investment projects using the simulation decomposition method. In International scientific conference fundamental and applied scientific research in the development of agriculture in the far east (Vol. 706, pp. 776–785). Lecture Notes in Networks and Systems (LNNS). Springer. [Google Scholar] [CrossRef]

- Amiram, D., Kalay, A., & Sadka, G. (2017). Industry characteristics, risk premiums, and debt pricing. The Accounting Review, 92(1), 1–27. [Google Scholar] [CrossRef]

- Bank of Russia. (2025). Russian government bond zero coupon yield curve, graph. Available online: https://www.cbr.ru/eng/hd_base/zcyc_params/zcyc/?UniDbQuery.Posted=True&UniDbQuery.To= (accessed on 10 May 2025).

- Banz, R. W. (1981). The relationship between return and market value of common stocks. Journal of Financial Economics, 9(1), 3–18. [Google Scholar] [CrossRef]

- Barry, C. B., Goldreyer, E., Lockwood, L., & Rodriguez, M. (2002). Robustness of size and value effects in emerging equity markets, 1985–2000. Emerging Markets Review, 3(1), 1–30. [Google Scholar] [CrossRef]

- Bekaert, G., & Harvey, C. (1995). Time-varying world market integration. The Journal of Finance, 50(2), 403–444. [Google Scholar] [CrossRef]

- Bekaert, G., & Harvey, C. R. (2000). Foreign speculators and emerging equity markets. The Journal of Finance, 55(2), 565–613. [Google Scholar] [CrossRef]

- Bolek, M. (2019). Net working capital strategy influencing beta coefficient based on companies listed on newconnect alternative exchange in Warsaw. E-Finanse, 15(2), 36–47. [Google Scholar] [CrossRef]

- Bora, P., & Vanek, M. (2017). Estimating the cost of equity using a mining build-up model. Acta Universitatis Agriculturae et Silviculturae Mendelianae Brunensis, 65(5), 1643–1653. [Google Scholar] [CrossRef]

- Bora, P., Vanek, M., & Špakovská, K. (2016). Risk premium and cost of capital: Application in mining industry. VSB Technical University of Ostrava. [Google Scholar] [CrossRef]

- Boudreaux, D. O., Rao, S., Underwood, J., & Rumore, N. (2011). A new and better way to measure the cost of equity capital for small closely held firms. Journal of Business & Economics Research (JBER), 9(1), 91. [Google Scholar] [CrossRef]

- Brounen, D., de Jong, A., & Koedijk, K. C. G. (2004). Corporate finance in Europe: Confronting theory with practice. Financial Management, 33(4), 71–101. Available online: https://www.jstor.org/stable/3666329 (accessed on 10 May 2025). [CrossRef]

- Bruner, R. F., Li, W., Kritzman, M., Myrgren, S., & Page, S. (2008). Market integration in developed and emerging markets: Evidence from the CAPM. Emerging Markets Review, 9(2), 89–103. [Google Scholar] [CrossRef]

- Bukhvalov, A. V., & Okulov, V. L. (2006a). Capital asset pricing models and Russian stock market. Part 1. CAPM empirical testing (36p). Scientific Reports of Institute of Management. Saint Petersburg State University. Available online: https://www.researchgate.net/publication/46449590_Capital_asset_pricing_models_and_Russian_stock_market_Part_1_CAPM_Empirical_Testing (accessed on 10 May 2025). (In Russian)

- Bukhvalov, A. V., & Okulov, V. L. (2006b). Capital asset pricing models and russian stock market. Part 2. Modified CAMP applicability (36p). Scientific Reports of Institute of Management. Saint Petersburg State University. Available online: https://www.researchgate.net/publication/46449623_Capital_asset_pricing_models_and_Russian_stock_market_Part_2_Modified_CAPM_applicability (accessed on 10 May 2025). (In Russian)

- Carnegie. (2024). Western sanctions are pushing russian metals producers into China’s arms. Available online: https://carnegieendowment.org/russia-eurasia/politika/2024/07/china-russia-metal-partners?lang=en (accessed on 10 May 2025).

- Chen, J., He, C., & Zhang, J. (2017). Time-varying variance risk premium and the predictability of chinese stock market return. Emerging Markets Finance and Trade, 53(8), 1734–1748. [Google Scholar] [CrossRef]

- Cherepovitsyn, A. E., Dorozhkina, I. P., & Solov’eva, V. M. (2024). Forecasts of rare-earth elements consumption in Russia: Basic and emerging industries. Studies on Russian Economic Development, 35(5), 688–696. [Google Scholar] [CrossRef]

- Chvileva, T. A., & Golovina, E. I. (2017). Publication of reporting of metallurgical companies in context of the concept of corporate sustainable development. Journal of Industrial Pollution Control, 33(1), 926–930. [Google Scholar]

- Damodaran, A. (2002a). Equity risk premiums. In R. M. Levich, G. Majnoni, & C. M. Reinhart (Eds.), Ratings, rating agencies and the global financial system (pp. 269–285). The New York University Salomon Center Series on Financial Markets and Institutions. [Google Scholar] [CrossRef]

- Damodaran, A. (2002b). Investment valuation: Tools and techniques for determining the value of any asset (2nd ed.). John Wiley & Sons, Inc. [Google Scholar]

- Damodaran, A. (2025). Aswath damodaran: Official site. Available online: https://pages.stern.nyu.edu/~adamodar/ (accessed on 1 June 2025).

- Dmitrieva, D., & Solovyova, V. (2024). A taxonomy of mineral resource projects in the arctic: A path to sustainable financing? Sustainability, 16(11), 4867. [Google Scholar] [CrossRef]

- Elka Mehr Kimiya. (2025). The impact of energy costs on aluminum production: A 2025 outlook. Available online: https://elkamehr.com/en/the-impact-of-energy-costs-on-aluminum-production-a-2025-outlook/#:~:text=References-,Introduction,engineering%20and%20rigorous%20quality%20control (accessed on 1 June 2025).

- Estrada, J. (1999). The cost of equity in emerging markets: A downside risk approach. SSRN Electronic Journal, 1–20. [Google Scholar] [CrossRef]

- Estrada, J. (2001). The cost of equity in emerging markets: A downside risk approach (II). SSRN Electronic Journal, 1–15. [Google Scholar] [CrossRef]

- Estrada, J. (2002). Systematic risk in emerging markets: The D-CAPM. Emerging Markets Review, 3(4), 365–379. [Google Scholar] [CrossRef]

- Finam.ru. (2023). The acquisition of the Tikhov coal mine could increase MMK’s self-sufficiency in coal to 50%. Available online: https://www.finam.ru/publications/item/priobretenie-ugolnoy-shakhty-im-tikhova-mozhet-povysit-samoobespechennost-mmk-uglem-do-50-20230607-1310/ (accessed on 10 May 2025). (In Russian).

- Galevskii, S. G. (2020). A binary model of discounting cash flows to correct risk assessment for real assets evaluation. Vestnik Tomskogo Gosudarstvennogo Universiteta. Ekonomika, 49, 122–140. [Google Scholar] [CrossRef]

- Galevskiy, S. (2019). CAPM modification for correct risk assessment in discounted cash flow method. π-Economy, 12(1), 201–212. (In Russian) [Google Scholar] [CrossRef]

- Gelman, A., Carlin, J. B., Stern, H. S., Dunson, D. B., Vehtari, A., & Rubin, D. B. (2013). Bayesian data analysis (3rd ed.). Chapman and Hall/CRC. [Google Scholar] [CrossRef]

- Gitman, L., & Vandenberg, P. (2000). Cost of capital techniques used by major US firms: 1997 vs. 1980. Financial Practice and Education, 10(2), 53–68. Available online: http://faculty.bus.olemiss.edu/dhawley/mba622/costofcapartical.pdf (accessed on 10 May 2025).

- Glukhov, V., Schepinin, V., Luebeck, Y., Babkin, I., & Karimov, D. (2023). Assessment of the impact of services and digitalization level on the infrastructure development in oil and gas regions. International Journal of Technology, 14(8), 1810–1820. [Google Scholar] [CrossRef]

- Godfrey, S., & Espinosa, R. (1996). A practical approach to calculating costs of equity for investments in emerging markets. Journal of Applied Corporate Finance, 9(3), 80–90. [Google Scholar] [CrossRef]

- Graham, J. R., & Harvey, C. R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of Financial Economics, 60(2–3), 187–243. [Google Scholar] [CrossRef]

- Hamada, R. S. (1969). Portfolio analysis, market equilibrium and corporation finance. The Journal of Finance, 24(1), 13–31. [Google Scholar] [CrossRef]

- Hamada, R. S. (1972). The effect of the firm’s capital structure on the systematic risk of common stocks. The Journal of Finance, 27(2), 435–452. [Google Scholar] [CrossRef]

- Harlanov, A. S. (2019). Policy of M&A and strategic alliences of the global metellurgical industry. Innovation & Investment, 8, 56–58. Available online: https://cyberleninka.ru/article/n/politika-sliyaniy-i-pogloscheniy-i-strategicheskie-alyansy-globalnoy-metallurgicheskoy-otrasli (accessed on 10 May 2025). (In Russian).

- Harris, R. S., & Marston, F. C. (2013). Changes in the market risk premium and the cost of capital: Implications for practice. Journal of Applied Finance, 23(1), 14. Available online: https://ssrn.com/abstract=2686739 (accessed on 10 May 2025).

- Ilyushin, Y., Nosova, V., & Krauze, A. (2025). Application of systems analysis methods to construct a virtual model of the field. Energies, 18(4), 1012. [Google Scholar] [CrossRef]

- Ilyushin, Y., & Talanov, N. (2025). Development of methods and models for assessing technical condition of mines and underground structures. International Journal of Engineering, 38(7), 1659–1666. [Google Scholar] [CrossRef]

- Investing.com. (2021). Iron ore fines 62% Fe CFR futures—(TIOc1). Available online: https://www.investing.com/commodities/iron-ore-62-cfr-futures (accessed on 10 May 2025).

- Isheisky, V. A., Ryadinskii, D. E., & Magomedov, G. S. (2025). Calculation of burden by the first row of blastholes in complex-structure rock mass blasting with regard to cracked zone radii. Mining Informational and Analytical Bulletin, 3, 64–79. Available online: https://www.giab-online.ru/en/catalog/raschet-linii-naimenshego-soprotivleniya-po-pervomu-ryadu-skvazh?CatalogArticlesSearch%5Bkeywords%5D=%D0%B8%D1%88%D0%B5%D0%B9%D1%81%D0%BA%D0%B8%D0%B9 (accessed on 10 May 2025). (In Russian).

- Karpus, N. P., & Ivashkevich, A. S. (2010). Lessons of crisis and way of overcoming its negative consequences in corporate strategy of development. RUDN Journal of Economics, 4, 59–67. Available online: https://journals.rudn.ru/economics/article/view/11887 (accessed on 10 May 2025). (In Russian).

- Kashina, O. I. (2015). On the possibilities of using factor return models on the Russian stock market. Young Scientist, 22(102), 402–405. Available online: https://moluch.ru/archive/102/23534/ (accessed on 10 May 2025). (In Russian).

- Kolouchová, P., & Novák, J. (2010). Cost of equity estimation techniques used by valuation experts. IES Working Paper, 8, 1–33. Available online: https://core.ac.uk/reader/6447918 (accessed on 10 May 2025).

- Kommersant.ru. (2019). Cost price extraction. Available online: https://www.kommersant.ru/doc/4187716 (accessed on 10 May 2025). (In Russian).

- Kostyukhin, Y. Y. (2022). Strategic management of Russian metallurgy in the context of challenges and risks. Management Sciences, 12(2), 21–32. [Google Scholar] [CrossRef]

- Kruschke, J. K. (2013). Bayesian estimation supersedes the t test. Journal of Experimental Psychology: General, 142(2), 573–603. [Google Scholar] [CrossRef]

- Lebedev, A., & Cherepovitsyn, A. (2024). Waste management during the production drilling stage in the oil and gas sector: A feasibility study. Resources, 13(2), 26. [Google Scholar] [CrossRef]

- Lessard, D. R. (1996). Incorporating country risk in the valuation of offshore projects. Journal of Applied Corporate Finance, 9(3), 52–63. [Google Scholar] [CrossRef]

- Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. The Review of Economics and Statistics, 47(1), 13. [Google Scholar] [CrossRef]

- Malozyomov, B. V., Martyushev, N. V., Babyr, N. V., Pogrebnoy, A. V., Efremenkov, E. A., Valuev, D. V., & Boltrushevich, A. E. (2024). Modelling of reliability indicators of a mining plant. Mathematics, 12(18), 2842. [Google Scholar] [CrossRef]

- Mariscal, J., & Lee, R. (1993). The valuation of mexican stocks: An extension of the capital asset pricing model. Goldman Sachs. Available online: https://people.duke.edu/~charvey/Teaching/BA456_2006/GS_The_valuation_of_mexican_stocks.pdf (accessed on 10 May 2025).

- Massel, L., Komendantova, N., Massel, A., Tsvetkova, A., Zaikov, K., & Marinina, O. (2024). Resilience of socio-ecological and energy systems: Intelligent information technologies for risk assessment of natural and technogenic threats. Journal of Infrastructure, Policy and Development, 8(7), 4700. [Google Scholar] [CrossRef]

- Materova, E. S., Aksenova, Z. A., Nikiforov, A. A., Abdulganiev, F. S., & Safiullin, N. Z. (2024). Development potential of the mining sector in the Russian Federation. Ugol, 12, 41–46. Available online: https://www.ugolinfo.ru/Jour/122024.pdf (accessed on 10 May 2025). (In Russian).

- Melastiani, N. P., & Sukartha, I. M. (2021). The effect of cash flow volatility, sales volatility, and the operating cycle on earnings persistence. American Journal of Humanities and Social Sciences Research (AJHSSR), 5(4), 288–296. Available online: https://www.ajhssr.com/wp-content/uploads/2021/04/ZJ2154288296.pdf (accessed on 1 June 2025).

- Michalak, A. (2014, June 25–27). The application of build-up approach in cost of equity calculation of mining enterprises. Management, Knowledge and Learning International Conference 2014 (pp. 175–183), Portorož, Slovenia. Available online: https://ideas.repec.org/h/tkp/mklp14/175-183.html (accessed on 1 June 2025).

- MOEX (Moscow Exchange). (n.d.-a). Moscow exchange indices (MOEX russia index and RTS index). Available online: https://www.moex.com/en/index/RTSI/constituents (accessed on 12 March 2025).

- MOEX (Moscow Exchange). (n.d.-b). Sectoral indices (metals & mining). Available online: https://www.moex.com/en/index/MOEXMM/constituents (accessed on 12 March 2025).

- Mossin, J. (1966). Equilibrium in a capital asset market. Econometrica, 34(4), 768. [Google Scholar] [CrossRef]

- Nevskaya, M., Shabalova, A., Kosovtseva, T., & Nikolaychuk, L. (2024). Applications of simulation modeling in mining project risk management: Criteria, algorithm, evaluation. Journal of Infrastructure, Policy and Development, 8(8), 5375. [Google Scholar] [CrossRef]

- Nikolaichuk, L., Ignatiev, K., Filatova, I., & Shabalova, A. (2023). Diversification of portfolio of international oil and gas assets using cluster analysis. International Journal of Engineering, 36(10), 1783–1792. [Google Scholar] [CrossRef]

- Osvaldo, M., Ravin, K., Tomas, C., & Thomas, W. (2024). BAyesian model building interface in python. Available online: https://pypi.org/project/bambi/ (accessed on 1 June 2025).

- Pashkevich, N. V., Khloponina, V. S., Pozdnyakov, N. A., & Avericheva, A. A. (2024). Analysing the problems of reproducing the mineral resource base of scarce strategic minerals. Journal of Mining Institute, 270, 1004–1023. Available online: https://pmi.spmi.ru/pmi/article/view/16430?setLocale=en_US (accessed on 10 May 2025).

- Peng, X., & Alam, P. (2011). R&D expenditures and implied equity risk premium. Review of Quantitative Finance and Accounting, 43(3), 441–462. [Google Scholar] [CrossRef]

- Pereiro, L. E. (2001). The valuation of closely-held companies in Latin America. Emerging Markets Review, 2(4), 330–370. [Google Scholar] [CrossRef]

- Perveitalov, O. G., & Nosov, V. V. (2025). An approach to evaluate the fatigue life of the material of liquefied gases’ vessels based on the time dependence of acoustic emission parameters: Part 1. Metals, 15(2), 148. [Google Scholar] [CrossRef]

- PJSC MMK. (2023). Annual report. Available online: https://mmk.ru/upload/iblock/7a1/55rfmcjv4ys006cs3ir3324ml53vc0y4/MMK_Integrated_Annual_Report_2023_ENG.pdf (accessed on 1 June 2025).

- PJSC MMK. (2025). Market capitalization. Available online: https://smart-lab.ru/q/MAGN/MSFO/market_cap/en (accessed on 10 May 2025).

- PJSC NLMK. (2023). Annual report. Available online: https://nlmk.com/en/ir/results/annual-reports/ (accessed on 1 June 2025).

- PJSC Severstal. (2023). Annual report. Available online: https://severstal.com/eng/ir/indicators-reporting/annual-reports/ (accessed on 1 June 2025).

- PJSC Severstal. (2025). Yakovlevskiy GOK. Available online: https://severstal.com/eng/about/structure/businesses/yakovlevskiy-gorno-obogatitelnyy-kombinat/ (accessed on 10 May 2025).

- Prokhorova, E. A., Gendler, S. G., & Fazylov, I. R. (2024). Influence of ecological conditions on risk of injuries and occupational illness in Russia’s Arctic Zone. Mining Informational and Analytical Bulletin, 6, 105–122. (In Russian) [Google Scholar] [CrossRef]

- Rajhans, R. K. (2015). Equity risk premium puzzle: Case of Indian stock market. The IUP Journal of Applied Finance, 21(3), 50–56. Available online: https://ssrn.com/abstract=2691855 (accessed on 1 June 2025). [CrossRef]

- Semenova, T., & Martínez Santoyo, J. Y. (2025). Determining priority areas for the technological development of oil companies in Mexico. Resources, 14(1), 18. [Google Scholar] [CrossRef]

- Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance, 19(3), 425–442. [Google Scholar] [CrossRef]

- Sleptsov, A., Medvedeva, L., Marinina, O., & Savenok, O. (2024). Feasibility study on the applicability of intelligent well completion. Processes, 12(8), 1565. [Google Scholar] [CrossRef]

- Smid, S. C., McNeish, D., Miočević, M., & van de Schoot, R. (2020). Bayesian versus frequentist estimation for structural equation models in small sample contexts: A systematic review. Structural Equation Modeling: A Multidisciplinary Journal, 27(1), 131–161. [Google Scholar] [CrossRef]

- Smirnov, V. V. (2016). Business models peculiarities and their impact on corporations’ development. Management Sciences, 6(3), 95–108. Available online: https://managementscience.fa.ru/jour/article/view/74 (accessed on 10 May 2025). (In Russian).

- Sorin, V. (2009). Build–up model as a discount rate for a private sector investment. The Annals of the University of Oradea. Economic Sciences, 18(3), 445–450. Available online: https://anale.steconomiceuoradea.ro/volume/2009/v3-finances-banks-and-accountancy/75.pdf (accessed on 1 June 2025).

- Stroykov, G. A., Babyr, N. V., Ilin, I. V., & Marchenko, R. S. (2021). System of comprehensive assessment of project risks in the energy industry. International Journal of Engineering, 34(7), 1778–1784. [Google Scholar] [CrossRef]

- Sutyagin, V. Y., Radyukova, Y. Y., & Chernyshova, O. N. (2016). Practice of use of the CAPM model in the assessment of the non-public Russian companies. Social—Economic Phenomena and Processes, 11(6), 69–75. [Google Scholar] [CrossRef]

- Suvorova, L. V., Suvorova, T. E., & Kuklina, M. V. (2016). Analysis of models for assessing the cost of capital. Vestnik of Lobachevsky University of Nizhni Novgorod, Social Sciences, 1(41), 38–47. (In Russian). [Google Scholar]

- Teplova, T. V., & Selivanova, N. V. (2010). DCAPM model applicability on emerging markets: Empirical research. Journal of Corporate Finance Research, 1(3), 5–25. (In Russian) [Google Scholar] [CrossRef]

- Teplova, T. V., & Shutova, E. (2011). A higher moment downside framework for conditional and unconditional capm in the russian stock market. Eurasian Economic Review, 1(2), 157–178. [Google Scholar] [CrossRef]

- Truong, G., Partington, G., & Peat, M. (2008). Cost-of-capital estimation and capital-budgeting practice in australia. Australian Journal of Management, 33(1), 95–121. [Google Scholar] [CrossRef]

- van Bulck, H. E. (2007). An examination of the applicability of the build up method in estimating the cost of equity capital for small, closely-held businesses. Available online: https://ssrn.com/abstract=1877848 (accessed on 1 June 2025).

- Welfare-economy.com. (2021). How the ferrous metallurgy economy is structured in Russia and in the world: Investment market review. Available online: https://welfare-economy.com/article.php?idarticle=176 (accessed on 10 May 2025). (In Russian).

- Wood Mackenzie. (2024). How do Western sanctions on Russia impact the global metals, mining and coal markets? Available online: https://www.woodmac.com/news/opinion/how-do-western-sanctions-on-russia-impact-the-global-metals-mining-and-coal-markets/ (accessed on 10 May 2025).

- Zhdaneev, O. V., & Ovsyannikov, I. R. (2024). From import substitution to technological leadership: How local content policy accelerates the development of the oil and gas industry. Journal of Mining Institute, 1–18. Available online: https://pmi.spmi.ru/pmi/article/view/16561?setLocale=en_US (accessed on 10 May 2025).

- Zuur, A. F., Ieno, E. N., Walker, N., Saveliev, A. A., & Smith, G. M. (2009). Mixed effects models and extensions in ecology with R. Springer. [Google Scholar] [CrossRef]

| № | Issuer Name | Activity 1 | Capitalization, RUB 2 bln | Free-Float |

|---|---|---|---|---|

| 1 | PJSC ALROSA | DM | 389 | 0.34 |

| 2 | PJSC Severstal | FM | 1094 | 0.23 |

| 3 | EN+ GROUP IPJSC | NFM (Al), E | 213 | 0.14 |

| 4 | PJSC MMC NORILSK NICKEL | NFM, M (Ni, Pt, Pd, Cu) | 1681 | 0.32 |

| 5 | PJSC MMK | FM | 507 | 0.2 |

| 6 | PJSC Mechel | FM, M (CM), E | 49 | 0.43 |

| 7 | PJSC Mechel (preferred shares) | FM, M (CM), E | 17 | 0.6 |

| 8 | PJSC NLMK | FM | 890 | 0.21 |

| 9 | PJSC Polyus | GM | 1854 | 0.22 |

| 10 | PJSC Raspadskaya | CM | 195 | 0.07 |

| 11 | United Company RUSAL IPJSC | NFM (Al) | 493 | 0.18 |

| 12 | PJSC Seligdar | GM | 59 | 0.25 |

| 13 | PJSC TMK | FM (PP) | 124 | 0.08 |

| 14 | PJSC UGC | GM | 168 | 0.1 |

| 15 | PJSC VSMPO-AVISMA Corporation | NFM (Ti) | 318 | 0.1 |

| Date | MCFTR (Moscow Exchange Index) | RGBITR (Russian Government Bonds Index) | Severstal Shares | NLMK Shares | MMK Shares |

|---|---|---|---|---|---|

| 8 January 2013 | 1765.99 | 312.91 | 389.9 | 65.38 | 10.739 |

| 9 January 2013 | 1767.38 | 314.6 | 389.7 | 64.77 | 10.756 |

| 10 January 2013 | 1757.06 | 317.48 | 388 | 65.3 | 11.091 |

| 11 January 2013 | 1761.35 | 316.89 | 392 | 65.81 | 11.079 |

| 14 January 2013 | 1781.92 | 317.16 | 397.9 | 68.14 | 11.369 |

| … | … | … | … | … | … |

| 25 December 2023 | 7208.41 | 614.64 | 1366.8 | 195.3 | 51.97 |

| 26 December 2023 | 7222.22 | 611.97 | 1378.8 | 195.94 | 52.22 |

| 27 December 2023 | 7142.44 | 607.88 | 1356.8 | 191.22 | 51.775 |

| 28 December 2023 | 7148.49 | 610.48 | 1360 | 190.94 | 51.735 |

| 29 December 2023 | 7090.61 | 611.97 | 1350.8 | 189.92 | 51.4 |

| Issuer Name | Iron Ore Self-Sufficiency | Coking Coal Self-Sufficiency | Beta Coefficients |

|---|---|---|---|

| PJSC «Severstal» | 130% | 80% | 0.646 |

| PJSC «NLMK» | 90% | 100% | 0.745 |

| PJSC «MMK» | 17% | 40% | 0.843 |

| Parameter | Mean | Standard Deviation | Low 3% | High 97% |

|---|---|---|---|---|

| Intercept | 0.947 | 0.108 | 0.721 | 1.141 |

| SR | −0.315 | 0.157 | −0.613 | −0.003 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Galevskiy, S.; Ponomarenko, T.; Tsiglianu, P. The Impact of Self-Sufficiency in Basic Raw Materials of Metallurgical Companies on Required Return and Capitalization: The Case of Russia. J. Risk Financial Manag. 2025, 18, 318. https://doi.org/10.3390/jrfm18060318

Galevskiy S, Ponomarenko T, Tsiglianu P. The Impact of Self-Sufficiency in Basic Raw Materials of Metallurgical Companies on Required Return and Capitalization: The Case of Russia. Journal of Risk and Financial Management. 2025; 18(6):318. https://doi.org/10.3390/jrfm18060318

Chicago/Turabian StyleGalevskiy, Sergey, Tatyana Ponomarenko, and Pavel Tsiglianu. 2025. "The Impact of Self-Sufficiency in Basic Raw Materials of Metallurgical Companies on Required Return and Capitalization: The Case of Russia" Journal of Risk and Financial Management 18, no. 6: 318. https://doi.org/10.3390/jrfm18060318

APA StyleGalevskiy, S., Ponomarenko, T., & Tsiglianu, P. (2025). The Impact of Self-Sufficiency in Basic Raw Materials of Metallurgical Companies on Required Return and Capitalization: The Case of Russia. Journal of Risk and Financial Management, 18(6), 318. https://doi.org/10.3390/jrfm18060318