1. Introduction

Recent global disruptions, particularly the COVID-19 pandemic, have underscored the substantial risks that large-scale health crises pose not only to public health systems, but also to economic stability, household financial security, and individual risk management decisions. Beyond the immediate medical consequences, pandemic-related uncertainties have intensified perceptions of vulnerability, triggered widespread psychological responses, and reshaped consumer behavior in various financial domains. Empirical evidence has documented that heightened risk perception and emotional reactions during crises significantly influence individuals’ adoption of protective strategies, including insurance and other financial risk-mitigation tools (

Slovic et al., 2004;

Zhang et al., 2021). As such, understanding what leads individuals to make protection-related financial decisions during the COVID-19 pandemic has become an increasingly important topic within risk and financial management research. However, despite growing attention to crisis-driven financial behavior, prior research has not sufficiently examined the psychological mechanisms that motivate protection-related financial decisions during the COVID-19 pandemic, which serves as the focal crisis context of the present study.

Perceived severity and anxiety are two key psychological mechanisms that shape individuals’ responses to the COVID-19 pandemic, a crisis characterized by simultaneous health threats and financial uncertainty. Perceived severity reflects an individual’s assessment of the potential consequences of a threat, influencing the extent to which the threat is viewed as financially and personally harmful. Anxiety, in contrast, represents an affective response triggered by uncertainty and potential loss, and has been shown to heighten attention to risk and influence financial decision-making. According to Protection Motivation Theory (PMT), both cognitive evaluations of threat severity and emotional reactions play central roles in motivating protective behavior (

Bish & Michie, 2010;

Floyd et al., 2000;

Milne et al., 2000;

Rogers & Prentice-Dunn, 1997). The COVID-19 pandemic, which simultaneously heightens perceptions of health risk and economic insecurity, provides a particularly appropriate context for examining these PMT mechanisms. Although PMT has been widely applied in public health and safety contexts, its implications for financial protection behavior remain underexplored. Existing PMT studies focus largely on health behaviors (e.g.,

Floyd et al., 2000), and only a small number have examined financial or insurance-related decisions. However, these studies seldom investigate how cognitive and emotional threat-appraisal processes operate together to shape financial protection behaviors during the COVID-19 pandemic.

In the context of insurance markets, protection insurance products such as life, accident, and health-related coverage are essential instruments for mitigating financial losses associated with unforeseen risks. During large-scale crises, demand for such products often fluctuates as individuals reassess their vulnerability and financial exposure. However, prior research has not sufficiently examined how cognitive and emotional responses during public health emergencies translate into insurance-related decisions, despite evidence that crisis-induced risk perception and affective responses play an important role in shaping financial protection behavior (

Dryhurst et al., 2020;

Heo et al., 2021;

Slovic et al., 2004). In particular, research to date has not investigated how perceived severity and anxiety jointly influence protection motivation and insurance purchase intentions within a PMT-based framework, leaving a key theoretical mechanism empirically untested. Addressing this gap is important for understanding consumer behavior under heightened uncertainty and for informing insurers’ strategies in risk communication, product design, and crisis management.

To address this research gap, the present study develops a Protection Motivation Theory-based framework to examine how perceived severity and anxiety during a public health crisis influence consumers’ intentions to purchase protection insurance products. Specifically, we investigate the direct effects of these two psychological antecedents on purchase intention and the mediating role of protection motivation in shaping insurance-related decisions. Using survey data collected during the COVID-19 pandemic and applying partial least squares structural equation modeling (PLS-SEM), we empirically test the proposed relationships. By integrating cognitive and emotional determinants within a financial protection context, this study contributes to the literature on risk perception, insurance behavior, and crisis-driven financial decision-making.

2. Literature Reviews and Hypotheses Development

This section presents the theoretical foundation of the study by introducing Protection Motivation Theory (PMT) and prior research on perceived severity, anxiety, and protective behavior. Based on these studies, we develop research hypotheses related to insurance purchase intentions during public health crises.

2.1. Protection Motivation Theory

PMT represents a widely used framework for explaining how individuals evaluate threats and adopt protective measures. According to PMT, protective behavior arises from two primary appraisal processes: threat appraisal and coping appraisal (

Rogers & Prentice-Dunn, 1997). Threat appraisal involves evaluating the perceived severity and susceptibility of a potential threat, whereas coping appraisal assesses the perceived response efficacy and self-efficacy of protective actions. These appraisals jointly determine individuals’ protection motivation, which serves as the psychological driver of adaptive behavior.

PMT has been applied extensively to research on risk communication, safety compliance, and decision-making under uncertainty. Prior studies have shown that protection motivation influences a range of preventive behaviors, including health protection and actions aimed at reducing potential losses (

Floyd et al., 2000;

Eppright et al., 1994). Recent findings also indicate that psychological responses triggered by crises—such as perceived risk, uncertainty, and financial anxiety—affect individuals’ decisions to adopt risk-mitigation tools, including insurance and other financial protection mechanisms (

Grima et al., 2021;

Heo et al., 2021;

Xiao & Meng, 2024).

These insights suggest that PMT is particularly applicable to the COVID-19 pandemic, a crisis in which health-related threats and financial uncertainty intensify simultaneously. This makes PMT an appropriate framework for examining how psychological mechanisms drive financial decisions, such as purchasing protection insurance, within the COVID-19 pandemic in Taiwan as the focal crisis context of this study. Building on this perspective, the present study adopts a reduced PMT framework that emphasizes the threat-appraisal components most relevant during public health crises. Rather than employing the full PMT structure, the model focuses on perceived severity and crisis-induced anxiety—two immediate psychological responses that shape consumers’ protection motivation and subsequently influence their intentions to purchase protection insurance products. The lack of empirical exploration into how these threat-appraisal components jointly influence insurance purchase intention via protection motivation constitutes the primary research gap this study addresses.

2.2. The Impact of Perceived Severity on Protection Motivation

Perceived severity refers to an individual’s assessment of the seriousness and potential consequences of a particular threat. Within the PMT framework, perceived severity is a key component of threat appraisal and plays a central role in shaping individuals’ protective responses (

Rogers, 1975;

Floyd et al., 2000). When individuals view a threat as severe, they tend to anticipate a higher level of potential harm, which increases their motivation to adopt protective measures.

Prior research shows that perceived severity influences risk-preventive choices and behavioral adjustments, particularly during crisis situations. Studies have also found that when individuals anticipate that a threat will have significant personal or financial consequences, they are more likely to strengthen their protective behaviors—such as increasing savings, purchasing insurance, or reducing exposure to potential losses (

Heo et al., 2021;

Xiao & Meng, 2024). These findings reinforce that, in uncertain environments, perceived severity not only affects health-related responses, but also shapes financial protection behaviors.

Given that public health crises simultaneously heighten health-related and financial risks, individuals who perceive such crises as highly severe are likely to experience stronger protection motivation. Accordingly, the following hypothesis is proposed:

H1. Perceived severity has a positive impact on protection motivation.

2.3. Impact of Anxiety on Protection Motivation

Anxiety is an emotional response characterized by unease, worry, and heightened alertness when an individual anticipates a threat. State anxiety, which reflects situational emotional reactions, tends to increase in contexts of uncertainty or perceived vulnerability (

Spielberger, 1983). Psychological research indicates that anxiety heightens individuals’ sensitivity to risk and motivates them to engage in behaviors intended to reduce potential harm (

Loewenstein et al., 2001).

Within the PMT framework, anxiety can amplify threat appraisal and strengthen protection motivation by directing attention toward negative outcomes and increasing perceived need for protective actions. This mechanism is consistent with findings from the literature on risk and financial behavior, which show that crisis-induced anxiety and uncertainty influence individuals’ adoption of financial protection measures, including insurance purchases and other risk-mitigation strategies (

Grima et al., 2021;

Xiao & Meng, 2024).

Because public health crises generate significant informational ambiguity and perceived vulnerability, individuals experiencing higher anxiety are likely to form stronger motivation to protect themselves through both behavioral and financial actions. Based on this reasoning, the following hypothesis is proposed:

H2. Anxiety has a positive impact on protection motivation.

2.4. Impact of Perceived Severity on Intentions to Purchase

Perceived severity reflects the extent to which individuals believe a threat may result in serious negative consequences. In the context of public health crises, individuals who perceive a situation as severe tend to anticipate not only health impacts but also disruptions to financial security and household stability. According to PMT, higher perceived severity increases the likelihood that individuals will consider and adopt protective measures, including those related to financial-risk mitigation (

Floyd et al., 2000).

Research on consumer behavior during crises indicates that individuals who perceive greater severity are more inclined to engage in precautionary financial actions. Prior studies have shown that heightened perceptions of threat severity stimulate demand for financial protection mechanisms, including insurance purchases, savings adjustments, and risk-reducing behaviors (

Heo et al., 2021;

Grima et al., 2021). These findings suggest that, when individuals encounter threats that may generate substantial financial or personal loss, they are more motivated to secure insurance coverage to mitigate potential future risks.

In the context of health-related crises, perceived severity may further influence individuals’ assessment of the value and necessity of protection insurance products. As the perceived magnitude of potential losses increases, insurance becomes a more attractive tool for safeguarding financial well-being. Therefore, individuals who view a crisis as highly severe are expected to exhibit stronger intentions to purchase or enhance their existing protection insurance coverage. Based on this reasoning, the following hypothesis is proposed:

H3. Perceived severity has a positive impact on intentions to purchase protection insurance products.

2.5. Impact of Anxiety on Intentions to Purchase

Anxiety is an emotion that emerges when individuals face uncertainty or potential loss, and it often heightens attention to risk. Prior research indicates that anxiety influences how individuals evaluate uncertain environments, leading them to adopt more cautious or protective financial behaviors (

Loewenstein et al., 2001). In crisis contexts, anxiety can increase perceptions of vulnerability and amplify concerns regarding both personal safety and financial well-being. This heightened sense of vulnerability may, in turn, strengthen the perceived value of insurance as a mechanism for mitigating future risks.

In the field of financial risk management, studies have found that anxiety plays a critical role in shaping consumers’ responses to uncertain situations. Empirical evidence suggests that individuals experiencing stronger anxiety tend to exhibit higher risk aversion and stronger preferences for financial protection tools such as insurance (

Grima et al., 2021;

Xiao & Meng, 2024). These findings demonstrate that emotional states triggered by crises can directly influence insurance-related decision-making, as individuals seek to manage their perceived exposure to potential future losses.

During public health crises, anxiety arising from unpredictable developments, economic tension, and health-related uncertainties may increase individuals’ motivation to secure additional protection. As insurance serves as a key instrument for reducing financial uncertainty, anxious individuals are more likely to perceive insurance as an effective means to safeguard themselves and their families. Consequently, anxiety is expected to positively influence consumers’ intentions to purchase protection insurance products. Based on this reasoning, the following hypothesis is proposed:

H4. Anxiety has a positive impact on intentions to purchase protection insurance products.

2.6. Impact of Protection Motivation on Intentions to Purchase

Protection motivation reflects individuals’ cognitive and emotional readiness to adopt behaviors that reduce or prevent harm. Within the PMT framework, protection motivation emerges when individuals perceive a threat to be significant and believe that available protective actions are effective and feasible (

Rogers & Prentice-Dunn, 1997). As such, protection motivation serves as the immediate antecedent of adaptive behavioral responses, including those aimed at mitigating financial risk.

In the context of financial decision-making, research indicates that protection motivation influences individuals’ willingness to adopt risk-reducing strategies such as insurance purchases, savings adjustments, and other precautionary actions. Prior findings have shown that protection-related cognitions significantly shape consumers’ adoption of financial protection tools, particularly in environments characterized by heightened uncertainty or crisis conditions (

Heo et al., 2021;

Xiao & Meng, 2024). These studies demonstrate that, when individuals develop strong intentions to protect themselves from potential threats, they are more likely to engage in behaviors aligned with financial-risk mitigation.

Protection insurance products are designed to offer financial security in the face of health, safety, or income-related risks. When individuals experience elevated protection motivation, driven by their assessment of the threat and their desire to reduce future losses, they are more likely to perceive insurance as a necessary and effective safeguard. Therefore, individuals with stronger protection motivation are expected to demonstrate higher intentions to purchase or increase their existing coverage of protection insurance products. Based on this reasoning, the following hypothesis is proposed:

H5. Protection motivation has a positive impact on intentions to purchase protection insurance products.

2.7. The Mediating Effect of Protection Motivation Between Perceived Severity and Intentions to Purchase

PMT suggests that individuals evaluate the seriousness of a threat and are subsequently motivated to take protective actions. Perceived severity increases the perceived magnitude of potential harm, which strengthens the psychological drive to adopt behaviors that mitigate risk (

Floyd et al., 2000). When individuals perceive a crisis as highly severe, they are more likely to view protective actions as necessary, which can enhance their protection motivation.

Prior studies have shown that perceived severity shapes various precautionary behaviors and influences individuals’ decisions to adopt risk-reducing strategies. Research examining behavior under uncertainty has also demonstrated that stronger threat appraisals increase consumers’ inclination to adopt financial protection mechanisms, including insurance (

Grima et al., 2021;

Heo et al., 2021). These findings imply that perceived severity not only affects decisions directly but can also shape underlying motivational processes that lead to protective financial behaviors.

Protection motivation serves as the proximate determinant of adaptive responses within the PMT framework. When individuals perceive severity to be high, they develop a stronger desire to minimize potential future losses. This heightened motivation is expected to influence how they evaluate insurance as a protective tool, thereby strengthening their intention to purchase protection insurance products. Consequently, protection motivation is likely to mediate the relationship between perceived severity and insurance purchase intentions. Based on this reasoning, the following hypothesis is proposed:

H6. Protection motivation mediates the relationship between perceived severity and intentions to purchase protection insurance products.

2.8. The Mediating Effect of Protection Motivation Between Anxiety and Intentions to Purchase

Anxiety reflects an emotional reaction to uncertainty and perceived vulnerability. In situations involving ambiguous or threatening circumstances, anxiety heightens individuals’ attention to potential risks and increases their motivation to perform actions that can reduce future harm (

Spielberger, 1983;

Loewenstein et al., 2001). Within the PMT framework, anxiety can amplify threat appraisal by intensifying perceived vulnerability, thereby strengthening protection motivation.

Research on financial behavior under crisis conditions has shown that anxiety influences how individuals evaluate risk and the need for protective financial measures. Several empirical studies indicate that individuals experiencing higher levels of anxiety tend to adopt more cautious financial strategies, including purchasing insurance and other risk-mitigating products (

Grima et al., 2021;

Xiao & Meng, 2024). These findings suggest that anxiety does not merely affect decisions directly, but also shapes the processes that drive individuals to adopt protective financial behaviors.

When anxiety intensifies concerns about personal or financial well-being, individuals become more motivated to adopt precautionary actions. This elevated protection motivation may increase their perceived need for insurance as a means of safeguarding against undesirable outcomes. Therefore, protection motivation is expected to serve as a mechanism through which anxiety influences consumers’ intentions to purchase protection insurance products. Based on this reasoning, the following hypothesis is proposed:

H7. Protection motivation mediates the relationship between anxiety and intentions to purchase protection insurance products.

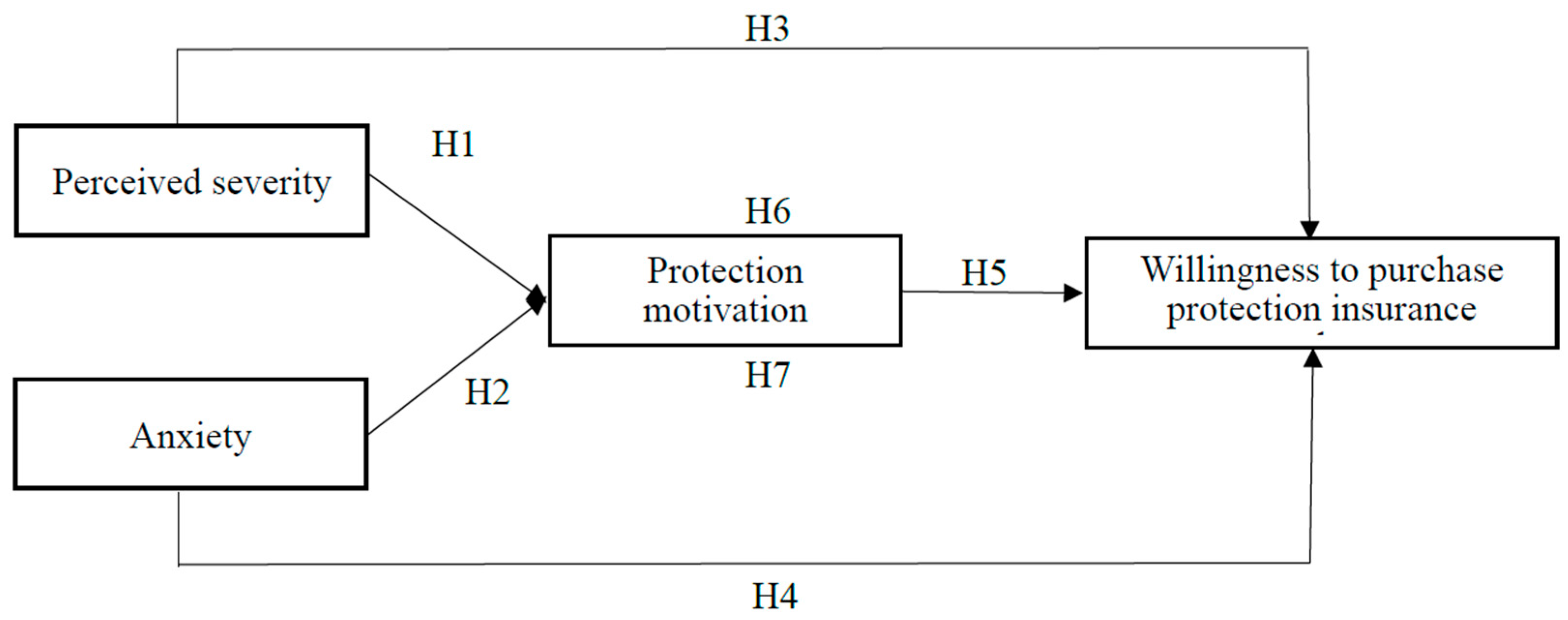

The above literature review highlights perceived severity and anxiety as key antecedents shaping consumers’ intentions to purchase protection insurance products. Grounded in PMT, this study proposes that protection motivation functions as an important psychological mechanism through which these two factors influence insurance-related decisions. Based on this theoretical foundation, the research framework integrates the constructs into a single model that specifies both their direct and indirect relationships.

Figure 1 presents the conceptual framework of the study, illustrating the hypothesized links among perceived severity, anxiety, protection motivation, and purchase intentions.

5. Discussion and Conclusions

5.1. Key Findings and Discussion

The results of this study reveal a coherent pattern in how individuals respond to public health crises when making insurance-related financial decisions. Perceived severity emerged as a particularly influential factor, demonstrating a strong association with protection motivation. This suggests that individuals who regard a crisis as highly consequential are more inclined to adopt a protective mindset, a pattern consistent with the assumptions of PMT, which emphasizes that cognitive appraisals of threat severity play a central role in shaping protective behaviors (

Floyd et al., 2000). The strength of this relationship underscores the importance of cognitive evaluations in driving consumers’ decisions, even in situations characterized by significant uncertainty.

Anxiety also showed a meaningful effect on protection motivation, although to a lesser degree than perceived severity. This finding illustrates that emotional reactions contribute to protective decision-making, but their influence may be more complementary than dominant. Earlier studies in behavioral economics and risk psychology suggest that anxiety sensitizes individuals to potential losses and increases their attention to uncertainty (

Grima et al., 2021;

Loewenstein et al., 2001). The current findings reaffirm this view and indicate that emotional responses operate alongside cognitive assessments in shaping protective tendencies.

Both perceived severity and anxiety were found to directly influence intentions to purchase protection insurance products. This indicates that individuals respond to public health threats not only behaviorally but also financially, by seeking mechanisms capable of reducing future uncertainty. Similarly, previous research has indicated that heightened perceptions of risk, as well as crisis-related stress, can increase consumers’ interest in insurance as a form of financial protection (

Heo et al., 2021). The results of this study strengthen our understanding of this topic by demonstrating that cognitive and emotional evaluations can independently stimulate financial protection behaviors.

Protection motivation was further shown to partially mediate the effects of perceived severity and anxiety on purchase intentions. This pattern suggests that while consumers may respond directly to risk perceptions and emotional discomfort, their decision-making process involves a more deliberate motivational mechanism. The presence of partial mediation highlights a dual pathway: consumers may act out of immediate concern, yet their intentions are largely shaped by an internalized drive to protect themselves from potential losses. This expands the applicability of PMT by illustrating its relevance beyond traditional health behaviors and into the realm of financial decision-making under crisis conditions.

Taken together, these findings reveal that consumers’ responses to public health threats are shaped by a dynamic interplay between cognitive assessments, emotional reactions, and protective motivations, offering a more integrated understanding of insurance purchase behavior during periods of heightened uncertainty. Nevertheless, the influence of perceived severity and anxiety on purchase intentions should be interpreted with caution, as these psychological mechanisms may operate differently for consumers with limited financial capacity. Individuals who face tight budget constraints or debt obligations may not be able to convert heightened threat perceptions into actual insurance purchases. Accordingly, solvency-related constraints represent an important boundary condition of the present findings.

5.2. Theoretical Contributions

This study advances our theoretical understanding of protection-related decision-making in the context of public health crises. By applying PMT to the domain of financial protection behavior, it extends the scope of a framework that has traditionally been used to explain health-related and safety-oriented behaviors. The results demonstrate that the psychological mechanisms described by PMT—particularly the influence of threat appraisal and protection motivation—are equally relevant in shaping consumers’ intentions to purchase protection insurance products. This application directly addresses the gap regarding the underexplored implications of PMT for financial protection behavior under crisis conditions, establishing the framework’s validity in a new domain. This cross-domain extension underscores the versatility of PMT and highlights its value in explaining financial behaviors under conditions of heightened uncertainty. Moreover, the identification of protection motivation as a partial mediator provides a more nuanced theoretical understanding of how cognitive and emotional factors jointly influence financial decisions. This finding is crucial as it empirically demonstrates how perceived severity and anxiety translate into insurance purchase intentions via a motivational mechanism, thus directly addressing the lack of evidence on the joint influence of these psychological antecedents on protection motivation and subsequent purchase intention. The mediation results imply that individuals’ intentions to purchase insurance may stem not only from direct responses to perceived risk or emotional discomfort, but also from a more internalized motivation to protect themselves. This dual-pathway mechanism offers a refined perspective on decision-making under uncertainty and supports a broader interpretation of PMT as a framework capable of accounting for both immediate and deliberate forms of protective financial behavior.

The findings of this study also contribute to the literature on risk perception by showing that perceived severity operates not only as a determinant of physical precautionary behaviors, but also as a driver of financial insurance decisions. Prior research has documented the importance of perceived severity in behavioral compliance and self-protective actions; however, its impact on financial protection behaviors has received less attention. By demonstrating a strong and significant relationship between perceived severity and both protection motivation and purchase intention, this study suggests that risk-related perceptions influence financial behavior in ways that parallel their influence in public health contexts.

In addition, this study enriches the growing body of research on emotional determinants of financial decision-making. Anxiety has been widely examined in the literature of psychological and behavioral economics, yet its role in shaping insurance-related decisions during crisis situations remains underexplored. The findings of this study show that anxiety meaningfully contributes to both protection motivation and insurance purchase intention, indicating that emotional activation can act as an antecedent to financial-risk mitigation. This insight helps bridge theoretical perspectives from psychology and finance, suggesting that emotionally driven responses may play a more complex role in financial protection behavior than previously recognized.

Finally, the identification of protection motivation as a partial mediator provides a more nuanced theoretical understanding of how cognitive and emotional factors jointly influence financial decisions. The mediation results imply that individuals’ intentions to purchase insurance may stem not only from direct responses to perceived risk or emotional discomfort, but also from a more internalized motivation to protect themselves. This dual-pathway mechanism offers a refined perspective on decision-making under uncertainty and supports a broader interpretation of PMT as a framework capable of accounting for both immediate and deliberate forms of protective financial behavior.

5.3. Managerial Implications

The findings of this study offer several actionable insights for managers in the insurance sector, particularly in environments characterized by public health uncertainty. The strong influence of perceived severity on both protection motivation and purchase intention suggests that insurers should prioritize effective risk communication that accurately conveys the seriousness of emerging threats without inducing unnecessary alarm. Clear, credible, and timely information can provide consumers with a realistic understanding of the risks they face, which may increase their appreciation of protection insurance’s possible role in mitigating potential financial consequences.

The results of this study also underscore the importance of addressing consumers’ emotional responses during crises. Anxiety, while not as influential as perceived severity, still contributes meaningfully to consumers’ motivation to consider protective actions. Insurance managers can leverage this insight by developing communication strategies that acknowledge and validate consumer concerns while emphasizing the protective value of insurance products. Messages that combine reassurance with practical guidance may help consumers channel their anxiety toward constructive financial planning rather than avoidance or indecision.

The mediating role of protection motivation further highlights the need for insurers to clearly articulate the specific benefits and relevance of protection insurance products. When consumers understand how insurance aligns with their broader goals of safeguarding personal and financial well-being, they are more likely to view such products as integral components of their risk management strategy. Therefore, marketing messages and product descriptions should emphasize the direct connection between insurance coverage and a reduction in future uncertainty, especially during periods of public health threats.

Additionally, insurers may benefit from developing or refining crisis-responsive insurance products that align more closely with consumers’ heightened risk perceptions. During public health events, consumers often seek policies that offer coverage for a wider range of contingencies, including medical expenses, income protection, or unexpected quarantine-related costs. Product innovation that reflects these evolving needs can enhance the perceived relevance of insurance offerings and strengthen consumer engagement.

Collectively, these managerial implications suggest that insurers who proactively address both the cognitive and emotional dimensions of consumer decision-making are likely to more effectively foster demand for protection insurance products during periods of heightened uncertainty.

5.4. Limitation and Future Research

Although this study provides valuable insights into the psychological mechanisms shaping consumers’ intentions to purchase protection insurance products during public health crises, several limitations should be acknowledged. The first limitation concerns the sample composition. The data were collected exclusively from consumers in Taiwan, and cultural context has been shown to in-fluence risk perception, emotional responses, and financial protection behavior (

Xiao & Meng, 2024). Because the demographic distribution in this study is weighted toward middle-aged and older adults, future research could broaden the sampling frame to include younger populations or cross-national samples to improve generalizability.

The second limitation relates to the contextual scope of the study. This research is intentionally grounded in the COVID-19 pandemic in Taiwan, which constitutes the central empirical and theoretical context of the analysis. Rather than aiming to generalize across different types of public health crises, the findings are theorized within the specific psychological, social, and financial conditions induced by COVID-19. Risk perception, emotional responses, and financial decision-making processes may differ across crisis types; therefore, any extension of the proposed framework to other public health events should be regarded as a separate theory-testing endeavor, rather than an implication of the present study.

The third limitation arises from the cross-sectional design. Risk perception and crisis-related emotions often evolve over time as individuals gain new information or as the severity of a crisis changes (

Li et al., 2020). Future studies could adopt longitudinal research designs to capture the dynamic interplay between perceived severity, anxiety, protection motivation, and purchase intentions across different stages of a public health event.

The fourth limitation relates to the scope of variables included in the research model. Although the study focuses on perceived severity, anxiety, protection motivation, and purchase intention, prior research indicates that financial literacy, trust in insurance providers, previous insurance experience, and media exposure may also influence financial behavior under uncertainty (

Grima et al., 2021;

Heo et al., 2021). Incorporating such variables into future models may provide a more comprehensive account of consumer decision-making during crises. Moreover, the study did not include socioeconomic indicators such as income adequacy, debt burden, or financial stress, which may confound or moderate the psychological effects observed in the model. Future research should incorporate these constraints to better capture consumers’ actual decision environments. In addition, the present study did not include coping-appraisal components of PMT, including response efficacy, self-efficacy, and response cost, which constitute essential elements of the full PMT framework. Incorporating these constructs would allow future studies to evaluate the complete cognitive mechanisms underlying protection motivation. Furthermore, protection motivation in this study was measured using behavioral tendency items rather than intention-based motivational constructs, which may introduce conceptual overlap between motivation and behavior. Future research should refine this measurement approach by distinguishing motivation from actual protective behavior.

Finally, the reliance on self-reported data introduces the possibility of response bias. Self-reported psychological constructs, particularly anxiety and perceived severity, may be influenced by social desirability or recall bias (

Nikčević & Spada, 2020). Therefore, future studies should supplement survey-based approaches with experimental methods, behavioral data, or administrative insurance records.

5.5. Conclusions

This study successfully developed and tested a Protection Motivation Theory-based framework to examine consumers’ intentions to purchase protection insurance products during the COVID-19 pandemic in Taiwan. The empirical findings underscore the significant role of both perceived severity (cognitive factor) and anxiety (affective factor) as key antecedents driving financial protection decisions. Crucially, the results confirm that protection motivation partially mediates these effects, revealing a dual pathway—direct and motivated—through which psychological responses lead to insurance purchase intentions. These findings extend the theoretical application of PMT to the financial domain and provide actionable insights for insurance practitioners regarding risk communication, product development, and crisis management strategies. Despite limitations related to the event-specific context and cross-sectional design, this study offers a foundational understanding of crisis-driven financial behavior under heightened uncertainty.