Assessing Digital Transformation Strategies in Retail Banks: A Global Perspective

Abstract

1. Introduction

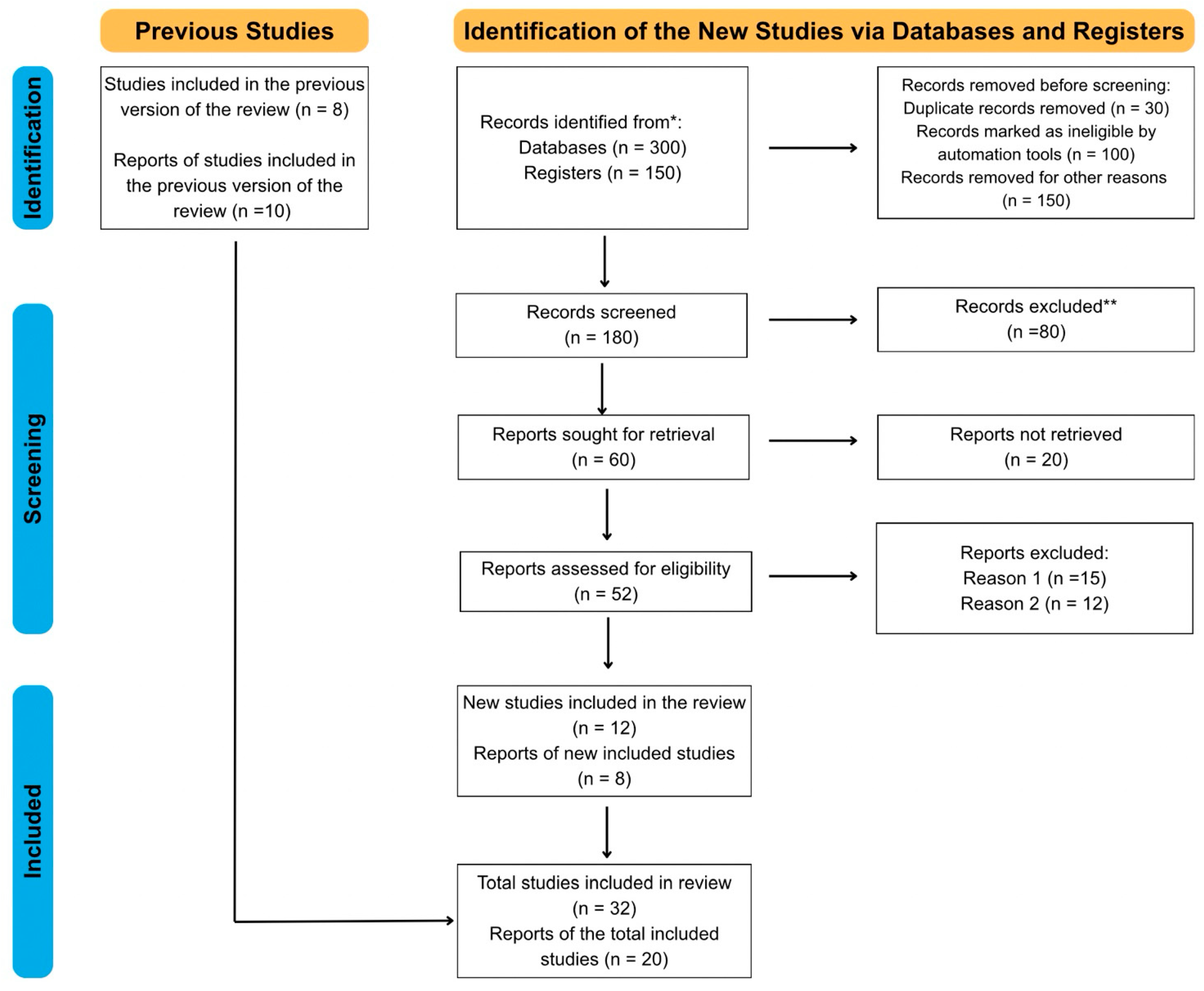

2. Methodology

2.1. Search Strategy & Databases

2.2. Inclusion & Exclusion Criteria

2.3. Data Extraction & Synthesis Approach

3. Theoretical Framework

3.1. Digital Transformation Theories

3.2. Role of FinTech and Digital Ecosystems

3.3. Comparison of Digital Transformation Strategies Across Different Regions

4. Digital Transformation Strategies in Retail Banks

5. Value Creation for Customers

6. Challenges in Implementing Digital Transformation Strategies

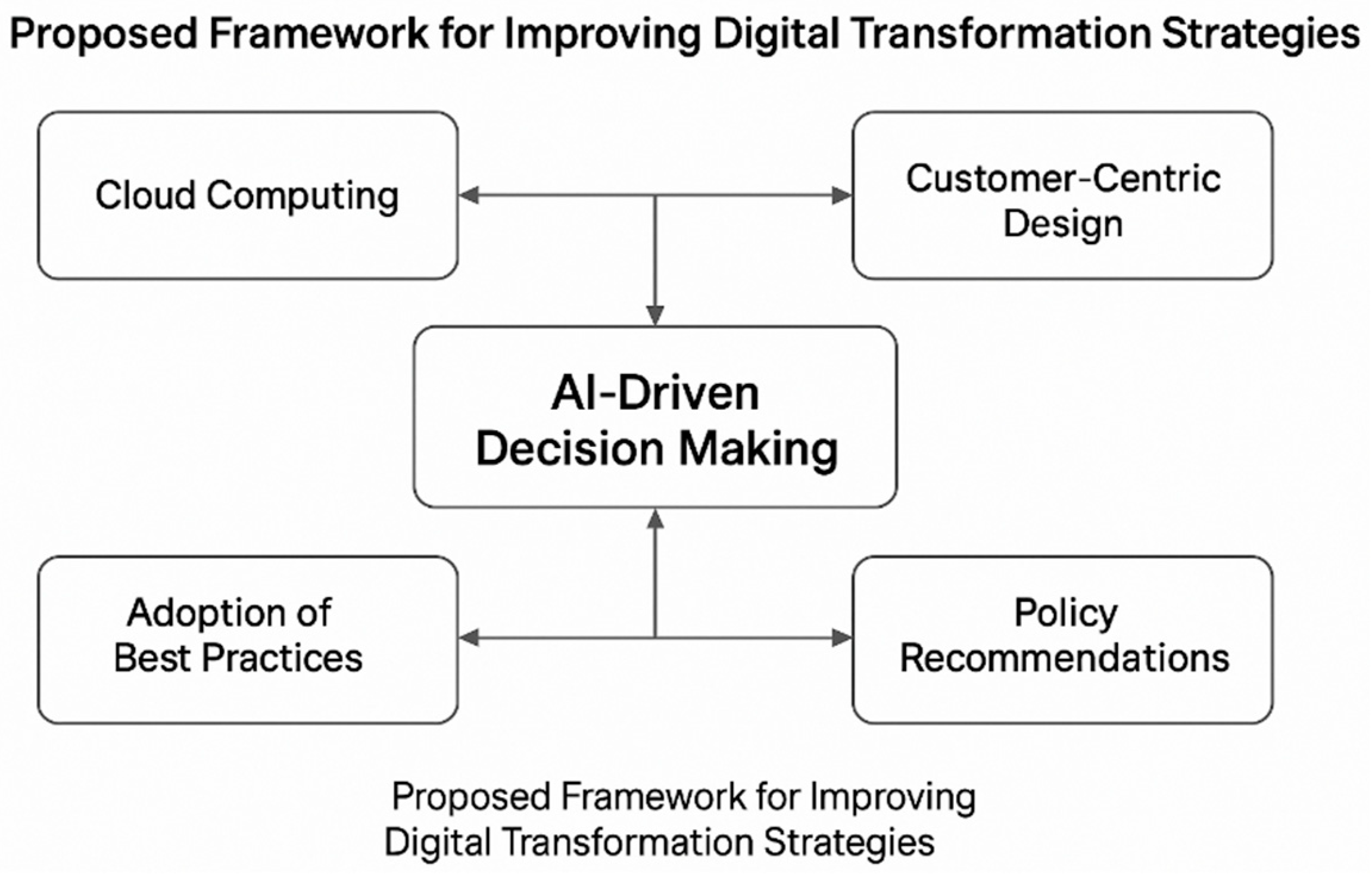

7. Proposed Framework for Improving Digital Transformation Strategies

8. Future Research Directions

9. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdullah, M. (2023). The cutting edge technologies in computer science: A review. International Journal of Advanced Research in Computer Science, 14, 13–22. [Google Scholar] [CrossRef]

- Adewumi, A., Ewim, S., Sam-Bulya, N., & Ajani, O. (2024). Advancing business performance through data-driven process automation: A case study of digital transformation in the banking sector. International Journal of Multidisciplinary Research Updates, 8, 12–22. [Google Scholar] [CrossRef]

- Agarwal, M. (2020). The role of fintech in disrupting traditional banking models. In Unified visions: Collaborative paths in multidisciplinary research (1st ed., Vol. 1). Scribe and Scroll Publishing. [Google Scholar] [CrossRef]

- Ahmad, M. (2018). Review of the technology acceptance model (TAM) in internet banking and mobile banking. Available online: https://www.semanticscholar.org/paper/Review-of-The-Technology-Acceptance-Model-(TAM)-in-Ahmad/7a2c94a07ddc0427eeb23afe56e359ac7ef85063 (accessed on 6 October 2025).

- Ahmed, G., Al Amiri, N., & Abudaqa, A. (2024). Strategic leadership and economic transformation: The United Arab Emirates (UAE) model. Journal of Global Business Research and Practice, 1(1), 60–77. [Google Scholar] [CrossRef]

- Al Nuaimi, M. (2019). An omnichannel digital banking platform for smart city services: UAE case study. The British University in Dubai (BUiD). Available online: https://bspace.buid.ac.ae/handle/1234/1621 (accessed on 6 October 2025).

- Alsemaid, O. M., Atri, P., Kande, S. K., & Lembhe, P. (2024). Cutting-edge innovations in technology and security. Available online: https://carijournals.org/product/cutting-edge-innovations-in-technology-and-security/?srsltid=AfmBOopZ6llSF_JHb7skEn_EntWxezPim5F4HC8dhUajfA-MPeF1QzOP (accessed on 6 October 2025).

- Avianto, W., Siregar, H., Ratnawati, A., & Siregar, M. E. (2024). Determinants of digital bank transformation: A systematic literature review with prisma and bibliometrics. JPPI (Jurnal Penelitian Pendidikan Indonesia), 10(4), 296–307. [Google Scholar] [CrossRef]

- Bankuoru Egala, S., Boateng, D., & Aboagye Mensah, S. (2021). To leave or retain? An interplay between quality digital banking services and customer satisfaction. International Journal of Bank Marketing, 39(7), 1420–1445. [Google Scholar] [CrossRef]

- Barney, J. (1991). Firm resources and sustained competitive advantage. Journal of Management, 17(1), 99–120. [Google Scholar] [CrossRef]

- Bellantuono, N., Nuzzi, A., Pontrandolfo, P., & Scozzi, B. (2021). Digital transformation models for the I4.0 transition: Lessons from the change management literature. Sustainability, 13(23), 12941. [Google Scholar] [CrossRef]

- Benali, S., & Boumenkar, D. (2024). Contribution of chatbot applications to attaining digital financial inclusion -analysis and evaluation of america’s chatbot erica experience. Management & Economics Research Journal, 6(3), 497–516. [Google Scholar]

- Berber, L. K., & Atabey, A. (2021). Open banking & banking-as-a-service (BaaS): A delicate turnout for the banking sector. Global Privacy Law Review, 2(1), 59–82. [Google Scholar]

- Best, J., & King, B. (2018). Breaking digital gridlock, + website: Improving your bank’s digital future by making technology changes now. Wiley. [Google Scholar]

- Bhuiyan, M. R. I. (2024). Examining the digital transformation and digital entrepreneurship: A PRISMA based systematic review. Pakistan Journal of Life and Social Sciences (PJLSS), 22(1), 1136–1150. [Google Scholar] [CrossRef]

- Bisri, A., Putri, A., & Rosmansyah, Y. (2023). A systematic literature review on digital transformation in higher education: Revealing key success factors. International Journal of Emerging Technologies in Learning (iJET), 18(14), 164–187. [Google Scholar] [CrossRef]

- Boot, A., Hoffmann, P., Laeven, L., & Ratnovski, L. (2021). Fintech: What’s old, what’s new? Journal of Financial Stability, 53, 100836. [Google Scholar] [CrossRef]

- Brunetti, F., Matt, D. T., Bonfanti, A., De Longhi, A., Pedrini, G., & Orzes, G. (2020). Digital transformation challenges: Strategies emerging from a multi-stakeholder approach. The TQM Journal, 32(4), 697–724. [Google Scholar] [CrossRef]

- Chauhan, S., Akhtar, A., & Gupta, A. (2022). Customer experience in digital banking: A review and future research directions. International Journal of Quality and Service Sciences, 14(2), 311–348. [Google Scholar] [CrossRef]

- Christou, P. A. (2022). How to use thematic analysis in qualitative research. Journal of Qualitative Research in Tourism, 3(2), 79–95. [Google Scholar] [CrossRef]

- Coelho, L., & Cachola, G. (2023). Hyper-personalisation: Inducing behaviours through data—How machine learning and automation can help customers make valuable and informed decisions. Journal of Digital Banking, 8(3), 198–209. Available online: https://hstalks.com/article/8294/hyper-personalisation-inducing-behaviours-through-/ (accessed on 6 October 2025). [CrossRef]

- Davis, F. D. (1989). Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly, 13(3), 319. [Google Scholar] [CrossRef]

- Davradakis, E., & Santos, R. (2019). Blockchain, fintechs and their relevance for international financial institutions (Working Paper No. 2019/01). EIB Working Papers.

- Diener, F., & Špaček, M. (2021). Digital transformation in banking: A managerial perspective on barriers to change. Sustainability, 13(4), 2032. [Google Scholar] [CrossRef]

- Donnellan, J., & Rutledge, W. L. (2019). A case for resource-based view and competitive advantage in banking. Managerial and Decision Economics, 40(6), 728–737. [Google Scholar] [CrossRef]

- Eccles, R. G., & Krzus, M. P. (2018, August 6). Constructing bank of America’s 2017 mock integrated report: Experiment no. 3. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3226953 (accessed on 6 October 2025).

- Eyers. (2019). Open banking: Implications for the financial landscape. Journal Payments Strategy System, 13(1), 56–68. [Google Scholar]

- Faisal, N. A., Nahar, J., Waliullah, M., & Borna, R. S. (2024). The role of digital banking features in bank selection an analysis of customer preferences for online and mobile banking. Frontiers in Applied Engineering and Technology, 1(1), 41–58. [Google Scholar] [CrossRef]

- Gajula, S. (2025). Architectural transformation of legacy financial systems: A framework for microservices, cloud, and api integration. International Journal of Information Technology and Management Information Systems, 16(2), 1201–1218. [Google Scholar] [CrossRef]

- Garg, P., Srivastava, T., Goel, A., & Gupta, N. (2024). Accelerating financial inclusion in developing economies (India) through digital financial technology. In AI-driven decentralized finance and the future of finance (pp. 205–228). IGI Global Scientific Publishing. [Google Scholar] [CrossRef]

- Ghosh, A., Mukhopadhyay, I., & Chakraborty, S. (2024). Design and architectural implementation of consortium blockchain based framework for open banking customer consent and data handling. SN Computer Science, 5(2), 271. [Google Scholar] [CrossRef]

- Gomber, P., Kauffman, R. J., Parker, C., & Weber, B. W. (2018). On the fintech revolution: Interpreting the forces of innovation, disruption, and transformation in financial services. Journal of Management Information Systems, 35(1), 220–265. [Google Scholar] [CrossRef]

- Hosen, M. S., Islam, R., Naeem, Z., Folorunso, E. O., Chu, T. S., Mamun, M. A. A., & Orunbon, N. O. (2024). Data-driven decision making: Advanced database systems for business intelligence. Nanotechnology Perceptions, 20(3), 687–704. [Google Scholar]

- Imran, F., Shahzad, K., Butt, A., & Kantola, J. (2021). Digital transformation of industrial organizations: Toward an integrated framework. Journal of Change Management, 21(4), 451–479. [Google Scholar] [CrossRef]

- Javaid, M., Haleem, A., Singh, R. P., Suman, R., & Khan, S. (2022). A review of blockchain technology applications for financial services. BenchCouncil Transactions on Benchmarks, Standards and Evaluations, 2(3), 100073. [Google Scholar] [CrossRef]

- Kaur, D. J., & Gill, N. S. (2019). Artificial intelligence and deep learning for decision makers: A growth hacker’s guide to cutting edge technologies. BPB Publications. [Google Scholar]

- Kaur, S. J., Ali, L., Hassan, M. K., & Al-Emran, M. (2021). Adoption of digital banking channels in an emerging economy: Exploring the role of in-branch efforts. Journal of Financial Services Marketing, 26(2), 107–121. [Google Scholar] [CrossRef]

- Kitsios, F., Giatsidis, I., & Kamariotou, M. (2021). Digital transformation and strategy in the banking sector: Evaluating the acceptance rate of e-services. Journal of Open Innovation: Technology, Market, and Complexity, 7(3), 204. [Google Scholar] [CrossRef]

- Klein, V. B., & Todesco, J. L. (2021). COVID-19 crisis and SMEs responses: The role of digital transformation. Knowledge and Process Management, 28(2), 117–133. [Google Scholar] [CrossRef]

- Koroleva, E. (2022). FinTech business models and their linkages with customers and founders [Ph.D. thesis, Tallinna Tehnikaülikool Tallinn University of Technology]. [Google Scholar]

- Kothari, U., Grandhi, B., & Thrassou, A. (2024). Digital transformation of retail banking in the United Arab Emirates. Journal of Asia Business Studies, 19(1), 163–181. [Google Scholar] [CrossRef]

- Kraus, S., Jones, P., Kailer, N., Weinmann, A., Chaparro-Banegas, N., & Roig-Tierno, N. (2021). Digital transformation: An overview of the current state of the art of research. Sage Open, 11(3), 21582440211047576. [Google Scholar] [CrossRef]

- Kronblad, C. (2020). How digitalization changes our understanding of professional service firms. Academy of Management Discoveries, 6(3), 436–454. [Google Scholar] [CrossRef]

- Li, Y., Yi, J., Chen, H., & Peng, D. (2021). Theory and application of artificial intelligence in financial industry. Data Science in Finance and Economics, 1(2), 96–116. [Google Scholar] [CrossRef]

- Luigi, W., Lee, J., & Thomsett, M. C. (2020). Disruptions and digital banking trends. Journal of Applied Finance and Banking, 10(6), 15–56. [Google Scholar]

- Mbama, C. I., & Ezepue, P. O. (2018). Digital banking, customer experience and bank financial performance: UK customers’ perceptions. International Journal of Bank Marketing, 36(2), 230–255. [Google Scholar] [CrossRef]

- Munira, M. S. K. (2025). Digital transformation in banking: A systematic review of trends, technologies, and challenges (SSRN Scholarly Paper No. 5161354). Social Science Research Network. [Google Scholar] [CrossRef]

- Murinde, V., Rizopoulos, E., & Zachariadis, M. (2022). The impact of the FinTech revolution on the future of banking: Opportunities and risks. International Review of Financial Analysis, 81, 102103. [Google Scholar] [CrossRef]

- Nadkarni, S., & Prügl, R. (2021). Digital transformation: A review, synthesis and opportunities for future research. Management Review Quarterly, 71(2), 233–341. [Google Scholar] [CrossRef]

- Naimi-Sadigh, A., Asgari, T., & Rabiei, M. (2022). Digital transformation in the value chain disruption of banking services. Journal of the Knowledge Economy, 13(2), 1212–1242. [Google Scholar] [CrossRef]

- Offiong, U. P., Szopik-Depczyńska, K., Cheba, K., & Ioppolo, G. (2024). FinTech as a digital innovation in microfinance companies—Systematic literature review. European Journal of Innovation Management, 27(9), 562–581. [Google Scholar] [CrossRef]

- Ofosu-Ampong, K. (2021). Determinants, barriers and strategies of digital transformation adoption in a developing country COVID-19 era. Journal of Digital Science, 3(2), 67–83. [Google Scholar] [CrossRef]

- Ononiwu, M. I., Onwuzulike, O. C., & Shitu, K. (2024). The role of digital business transformation in enhancing organizational agility. World Journal of Advanced Research and Reviews, 23(3), 285–308. [Google Scholar] [CrossRef]

- Osei, L. K., Cherkasova, Y., & Oware, K. M. (2023). Unlocking the full potential of digital transformation in banking: A bibliometric review and emerging trend. Future Business Journal, 9(1), 30. [Google Scholar] [CrossRef]

- Ozili, P. (2025). Financial inclusion in banking: A literature review and future research directions. Modern Finance, 3(1), 91–109. [Google Scholar] [CrossRef]

- Ozili, P. K. (2023). Central bank digital currency research around the world: A Review of literature. Journal of Money Laundering Control, 26(2), 215–226. [Google Scholar] [CrossRef]

- Panke, D. (2018). Research design & method selection. SAGE Publications. Available online: https://uk.sagepub.com/en-gb/mst/research-design-method-selection/book260462 (accessed on 6 October 2025).

- Pundareeka Vittala, K. R., Ahmad, S. S., Seranmadevi, R., & Tyagi, A. K. (2024). Emerging technology adoption and applications for modern society towards providing smart banking solutions. In A. K. Sharma, N. Chanderwal, S. Tyagi, P. Upadhyay, & A. K. Tyagi (Eds.), Advances in medical technologies and clinical practice (pp. 315–329). IGI Global. [Google Scholar] [CrossRef]

- Rane, N. (2023, October 13). Enhancing customer loyalty through Artificial Intelligence (AI), Internet of Things (IoT), and Big Data technologies: Improving customer satisfaction, engagement, relationship, and experience. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4616051 (accessed on 6 October 2025).

- Shaikh, A. A., & Karjaluoto, H. (2015). Mobile banking adoption: A literature review. Telematics and Informatics, 32(1), 129–142. [Google Scholar] [CrossRef]

- Shanti, R., Avianto, W., & Wibowo, W. A. (2022). A systematic review on banking digital transformation. Jurnal Ad’ministrare, 9(2), 543. [Google Scholar] [CrossRef]

- Sugiarno, Y., & Novita, D. (2022). Resources-Based View (RBV) as a strategy of company competitive advantage: A literature review. International Conference on Economics Business Management and Accounting (ICOEMA), 1, 656–666. [Google Scholar]

- Tanda, A., & Schena, C.-M. (2019). FinTech, BigTech and banks: Digitalisation and its impact on banking business models. Springer International Publishing. [Google Scholar] [CrossRef]

- Tekic, Z., & Koroteev, D. (2019). From disruptively digital to proudly analog: A holistic typology of digital transformation strategies. Business Horizons, 62(6), 683–693. [Google Scholar] [CrossRef]

- Treiblmaier, H., & Beck, R. (Eds.). (2019). Business transformation through blockchain: Volume I (Vol. 1). Springer International Publishing. [Google Scholar]

- Vanaparthi, N. R. (2025). The roadmap to mainframe modernization: Bridging legacy systems with the cloud. International Journal of Scientific Research in Computer Science, Engineering and Information Technology, 11(1), 125–133. [Google Scholar] [CrossRef]

- Wansleben, L. (2023). The rise of central banks: State power in financial capitalism. Harvard University Press. [Google Scholar]

- Yusif, S., & Hafeez-Baig, A. (2024). Evidence-based information systems (IS) research: The case of systematic literature review (SLR). Authorea. [Google Scholar]

- Zhao, Q., Tsai, P.-H., & Wang, J.-L. (2019). Improving financial service innovation strategies for enhancing China’s banking industry competitive advantage during the fintech revolution: A hybrid MCDM model. Sustainability, 11(5), 1419. [Google Scholar] [CrossRef]

- Zornetta, A. (2024). Quantum-safe global encryption policy. International Journal of Law and Information Technology, 32, eaae020. [Google Scholar] [CrossRef]

- Zouari, G., & Abdelhedi, M. (2021). Customer satisfaction in the digital era: Evidence from islamic banking. Journal of Innovation and Entrepreneurship, 10(1), 9. [Google Scholar] [CrossRef]

| No. | Author(s) | Title |

|---|---|---|

| 1 | (Abdullah, 2023) | The Cutting Edge Technologies in Computer Science: A Review |

| 2 | (Adewumi et al., 2024) | Advancing Business Performance Through Data-Driven Process Automation: A Case Study of Digital Transformation in the Banking Sector |

| 3 | (Ahmad, 2018) | Review of the Technology Acceptance Model (TAM) in Internet Banking and Mobile Banking |

| 4 | (Ahmed et al., 2024) | Strategic Leadership and Economic Transformation: The United Arab Emirates (UAE) Model |

| 5 | (Faisal et al., 2024) | The Role of Digital Banking Features in Bank Selection |

| 6 | (Alsemaid et al., 2024) | Cutting-Edge Innovations in Technology and Security |

| 7 | (Berber & Atabey, 2021) | Open Banking & Banking-as-a-Service (BaaS): A Delicate Turnout for the Banking Sector |

| 8 | (Bankuoru Egala et al., 2021) | To Leave or Retain? An Interplay Between Quality Digital Banking Services and Customer Satisfaction |

| 9 | (Bellantuono et al., 2021) | Digital Transformation Models for the I4.0 Transition: Lessons from the Change Management Literature |

| 10 | (Best & King, 2018) | Breaking Digital Gridlock: Improving Your Bank’s Digital Future by Making Technology Changes Now |

| 11 | (Bhuiyan, 2024) | Examining the Digital Transformation and Digital Entrepreneurship: A PRISMA-Based Systematic Review |

| 12 | (Bisri et al., 2023) | A Systematic Literature Review on Digital Transformation in Higher Education |

| 13 | (Boot et al., 2021) | FinTech: What’s Old, What’s New? |

| 14 | (Brunetti et al., 2020) | Digital Transformation Challenges: Strategies Emerging from a Multi-Stakeholder Approach |

| 15 | (Chauhan et al., 2022) | Customer Experience in Digital Banking: A Review and Future Research Directions |

| 16 | (Christou, 2022) | How to Use Thematic Analysis in Qualitative Research |

| 17 | (Davradakis & Santos, 2019) | Blockchain, FinTechs and Their Relevance for International Financial Institutions |

| 18 | (Donnellan & Rutledge, 2019) | A Case for Resource-Based View and Competitive Advantage in Banking |

| 19 | (Garg et al., 2024) | Accelerating Financial Inclusion in Developing Economies (India) Through Digital Financial Technology |

| 20 | (Ghosh et al., 2024) | Design and Architectural Implementation of Consortium Blockchain-Based Framework for Open Banking Customer Consent and Data Handling |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alsobai, B.; Aassouli, D. Assessing Digital Transformation Strategies in Retail Banks: A Global Perspective. J. Risk Financial Manag. 2025, 18, 710. https://doi.org/10.3390/jrfm18120710

Alsobai B, Aassouli D. Assessing Digital Transformation Strategies in Retail Banks: A Global Perspective. Journal of Risk and Financial Management. 2025; 18(12):710. https://doi.org/10.3390/jrfm18120710

Chicago/Turabian StyleAlsobai, Bothaina, and Dalal Aassouli. 2025. "Assessing Digital Transformation Strategies in Retail Banks: A Global Perspective" Journal of Risk and Financial Management 18, no. 12: 710. https://doi.org/10.3390/jrfm18120710

APA StyleAlsobai, B., & Aassouli, D. (2025). Assessing Digital Transformation Strategies in Retail Banks: A Global Perspective. Journal of Risk and Financial Management, 18(12), 710. https://doi.org/10.3390/jrfm18120710