1. Introduction

Over the past few decades, derivatives have been a key driver in advancing global financial markets, helping investors manage risk and enhance market efficiency. Futures contracts commit both parties to trade at a fixed price on a future date, exposing them to unlimited risk. Options differ in that they grant the holder the right, but not the obligation, to buy or sell the underlying asset, with losses limited to the premium paid. This limited risk feature appeals strongly to retail investors and institutions seeking to manage downside exposure without the risk of unlimited losses. Furthermore, options allow for a wide range of strategies including income generation, volatility trading, spread strategies, as well as portfolio insurance. Since the capital required to trade options is limited to the premium paid, they are more accessible to investors with limited funds compared to futures contracts, which require a margin deposit. Such characteristics have contributed to the growing preference for options over futures among a broader range of market participants. As shown in

Table A1 of

Appendix A, options trading volumes in 2024 far exceeded those of futures, with 177.24 billion and 29.54 billion contracts traded, respectively. The Asia-Pacific region overwhelmingly dominated the global derivatives market, accounting for 169.2 billion contracts traded, of which over 93% (158.2 billion contracts) were options. In contrast, futures trading volumes in Asia-Pacific totaled only 11.0 billion contracts, highlighting a clear regional preference for options. North America also demonstrated a strong preference for options trading, though the imbalance was less pronounced compared to Asia–Pacific. In contrast, Latin America, Europe, and other regions exhibited a clear dominance of futures trading activity. In addition, this pattern was not observed across the broader derivatives market; only the equity asset class exhibited higher options trading volume compared to futures, recording 172.56 billion and 11.64 billion contracts, respectively (see

Table A2 in

Appendix A). This pronounced disparity highlights the surging popularity of equity options, driven in large part by active retail participation in markets such as the U.S., India, and South Korea. While equity options generally surpass equity futures in trading volume worldwide, Thailand presents a notable deviation from this global trend.

Despite its location in the options-dominated Asia-Pacific region, Thailand exhibits a distinctive market structure in which SET50 Index Futures consistently accounts for the majority of derivatives trading activity, while SET50 Index options remain relatively underutilized. Although the Thailand Futures Exchange introduced SET50 Index Futures and Options in 2006 and 2007, respectively, investor participation has remained disproportionately concentrated in futures contracts. Consequently, options trading constitutes only a minor share of total volume, highlighting a persistent imbalance in product adoption that contrasts with regional trends. This imbalance persisted through 2024, with options never exceeding 4.2% of total volume (see

Table A3 in

Appendix A). It raises important questions about the underlying drivers of trading behavior in Thailand’s derivatives market. Specifically, what structural, behavioral, or macroeconomic factors have contributed to the persistent dominance of futures over options? These questions motivate a deeper examination of the factors influencing volume dynamics in Thailand’s equity derivatives market, where trading behavior diverges from common trends in the region.

Despite the extensive literature on derivatives markets (e.g.,

Wang et al., 2024;

Qian et al., 2025, for futures;

S P et al., 2022;

Blanc et al., 2025, for options), research specifically addressing the volume dynamics between futures and options remains relatively limited, especially within emerging markets such as Thailand. Most existing studies tend to focus on pricing models, hedging effectiveness, or volatility transmission between spot and futures markets. However, few investigations explore how structural, behavioral, and macroeconomic factors affect trading volumes. This gap is particularly evident in Thailand, where the dominance of SET50 Index Futures contrasts sharply with global trends in which options typically lead in trading volume. As a result, exploring the trading volume relationship between SET50 Index Futures and Options in Thailand is crucial for policymakers, investors, and exchange operators, especially in the context of emerging markets where financial innovation and retail participation are evolving rapidly.

The remainder of the paper is organized as follows.

Section 2 reviews the relevant literature and outlines the research hypotheses.

Section 3 describes the data and methodology used to analyze the trading volume relationship between SET50 Index Futures and Options.

Section 4 and

Section 5 present empirical results and provide a discussion of the findings, respectively, while

Section 6 concludes the study.

2. Literature Review and Hypotheses

The relationship between trading volumes in derivatives markets, particularly between futures and options, has attracted substantial academic attention due to its implications for market liquidity, information transmission, and investor behavior. Previous research on derivatives markets largely concentrated on price discovery (e.g.,

Stoll & Whaley, 1990;

Hasbrouck, 1995;

Sharma et al., 2023;

Zou et al., 2024), hedging effectiveness (e.g.,

Ederington, 1979;

Howard & D’Antonio, 1984;

Buyukkara et al., 2022;

Chen et al., 2025), and market efficiency (e.g.,

Bae et al., 2004;

C. L. Lee et al., 2014;

Milian, 2023;

Bohl et al., 2023), while trading volume dynamics were often overlooked. However, recent studies (e.g.,

Ahn et al., 2025;

Gousgounis et al., 2025) increasingly emphasize volume relationships as proxies for market liquidity and trader preferences.

One key stream of research uses trading volume as a proxy for market liquidity. For example,

Locke and Sarkar (

2001) investigate how liquidity in U.S. futures markets responds to periods of increased price volatility. Trading volume is separated into two primary participant groups, which include customers and floor traders. The results for the T-bond futures (active futures contracts) show that floor traders continue to supply liquidity during volatile periods. On the other hand, in less active contracts (hogs and soybean oil futures), customers increasingly provide liquidity by trading with one another as volatility increases.

Ahn et al. (

2025) investigate how futures trading affects the informational efficiency of the U.S. real estate investment trust (REIT) market. Using relative trading volume as a proxy for liquidity and the hedging–speculative demand ratio to measure speculative activity, they find that the futures market has not yet matured enough to gain efficiency benefits from higher liquidity. Instead, the increase in speculative demand outweighs hedging pressure, limiting the role of futures in the price discovery process. In addition,

Gousgounis et al. (

2025) analyze how liquidity conditions in the U.S. Treasury futures market evolved during the market stress caused by COVID-19 in March 2020. While overall trading volume remains high, principal trading firms reduce their share of liquidity-providing trades, though they still account for the largest portion overall. Conversely, bank and non-bank dealers increase their provision share, but their activity does not significantly enhance overall market liquidity.

The literature also explores trader preferences, particularly regarding how various types of futures contracts, such as equity index, currency, and commodity futures, are employed either as complementary instruments or as substitutes. For example,

Jongadsayakul (

2024) examines the dynamic relationships between the trading volumes of three currency futures, including EUR/USD futures, USD/JPY futures, and USD futures. The findings show that USD futures trading volumes decrease in response to prior increases in trading of USD/JPY futures as a substitute product. Investors in USD/JPY futures consider USD/JPY, EUR/USD, and USD futures to be substitute products. On the other hand,

Jongadsayakul (

2022b) finds that, in Thailand’s gold futures market, a past increase in the trading volume of 50 Baht gold futures contributes to a rise in current trading volumes of both 10 Baht gold futures and gold online futures. Previous literature (e.g.,

H. S. Lee, 2013) further examines whether futures and options serve similar roles, investigating whether traders use them jointly or as substitutes depending on spot market conditions, risk preferences, and strategic objectives. Empirical evidence from

H. S. Lee (

2013) indicates that the Korea Composite Stock Price Index 200 (KOSPI 200) futures and options markets exhibit a statistically significant positive bidirectional relationship in trading volumes. In addition, greater volatility in the underlying stock market is associated with increased trading volumes in the KOSPI 200 futures and options markets, reflecting a rise in both hedging needs and speculative opportunities under volatile conditions. Stock market trading volume influences the trading volume in the KOSPI200 futures market, with no significant effect observed in the KOSPI 200 options market.

Regarding the positive relationship between underlying market volatility and trading volumes in derivatives markets, several studies provide empirical support across various markets, including the agricultural futures market (e.g.,

Brorsen & Fofana, 2001;

Agrawal et al., 2019), the equity futures market (e.g.,

Ciner et al., 2006;

Hung et al., 2011;

Jongadsayakul, 2022a), and the interest rate futures market (e.g.,

Frino et al., 2010).

Jongadsayakul (

2022a) employs panel regression analysis and finds that the characteristics of underlying assets, including size, volatility, and liquidity, are key determinants of single stock futures trading volumes in Thailand. The analysis by

Frino et al. (

2010) also indicates that futures trading volume is positively linked to the underlying market demands. In addition, a substantial body of literature (e.g.,

Banerjee et al., 2020;

Sreenu et al., 2021;

Ye, 2025;

Lu et al., 2025) explores how macroeconomic variables affect trading activity in derivatives markets.

While Carlton (

1983) emphasizes the role of uncertainty caused by inflation in stimulating futures trading,

Malliaris and Urrutia (

1991) extend this perspective by showing that both inflation and economic activity are statistically significant determinants of trading volume in futures markets. Their findings indicate that inflation negatively affects trading volume, while economic activity contributes positively.

Şendeniz-Yüncü et al. (

2018) find that in high-income countries, economic growth Granger-causes the development of stock index futures markets. In contrast,

Vo et al. (

2019) report no causal relationship between economic growth and derivatives market development in China and Japan, while identifying a unidirectional causal effect from economic growth to the derivatives market in India. Additionally, they find a unidirectional effect from trade openness to the derivatives market in the U.S., and a bidirectional causal relationship between interest rates and the derivatives market in India. In the case of option markets,

Poufinas and Pappas (

2021) find that trading volume tends to be higher in countries with higher levels of business freedom, market capitalization, total stock market turnover, and gross domestic product (GDP) per capita, as well as with a lower corporate tax rate.

Samarakoon et al. (

2024) identify several macro-environmental factors that are positively associated with trading volume in equity derivatives markets. These include government effectiveness, political stability and lack of violence, the rule of law, voice and accountability, the Corruption Perception Index, ease of doing business, educational attainment, internet usage, globalization, and the technology achievement index. The study further finds that inflation positively influences derivatives trading volume, indicating that investors tend to rely more on derivatives for risk management in inflationary environments. Additionally, economic policy uncertainty has a significant positive effect on derivatives trading volume, suggesting that increased policy uncertainty leads to greater use of derivatives.

While these studies offer valuable insights, relatively few have examined emerging markets such as Thailand, where SET50 Index Futures dominate derivatives trading. This contrasts with broader Asia-Pacific trends, where options typically lead, suggesting that underlying market structures and macroeconomic conditions may significantly influence the trading volume dynamics between futures and options. Based on these considerations, the following hypotheses are proposed:

H1. There is a bidirectional relationship between the trading volumes of SET50 Index Futures and SET50 Index Options.

H2. Underlying market factors such as liquidity and volatility are associated with the trading volumes of SET50 Index Futures and Options.

H3. Macroeconomic factors such as future economic activity, private investment, inflation rate, interest rate, and exchange rate are associated with the trading volumes of SET50 Index Futures and SET50 Index Options.

3. Data and Methodology

This study utilizes secondary data covering the period from May 2014 to December 2024. The sample begins in 2014 because the Thailand Futures Exchange revised the contract multiplier for SET50 Index Futures from 1000 to 200 per index point in May 2014, aligning it with the multiplier used for SET50 Index Options. Although SET50 Index Futures were first introduced in 2006 and Options in 2007, focusing on the post-2014 period avoids distortions arising from differences in contract specifications before that time. Monthly data on the trading volumes of SET50 Index Futures (VF), SET50 Index Options (VO), and the SET50 Index were obtained from SETSMART. To capture macroeconomic influences, the study incorporates the leading economic index (LEI), private investment index (PII), inflation rate (INF), interest rate (INT), and exchange rate (EX), all sourced from the Bank of Thailand website. These variables serve as proxies for future economic activity, trends in private investment activity, and monetary conditions that may influence derivatives trading behavior. Underlying market factors are also considered. Market liquidity (LIQ) is proxied by the trading volume of the SET50 Index. Market volatility (VOL) is proxied by the square root of the conditional variance obtained from an Exponential Generalized Autoregressive Conditional Heteroskedasticity (EGARCH(1,1)) model, as proposed by

Nelson (

1991), estimated using monthly SET50 Index returns. The model specification and estimated parameters are provided in

Appendix B. All variables are transformed into logarithmic form to address scale differences and mitigate heteroscedasticity, except for the inflation rate, interest rate, and volatility, which were retained in their original scale for interpretability and consistency with prior literature.

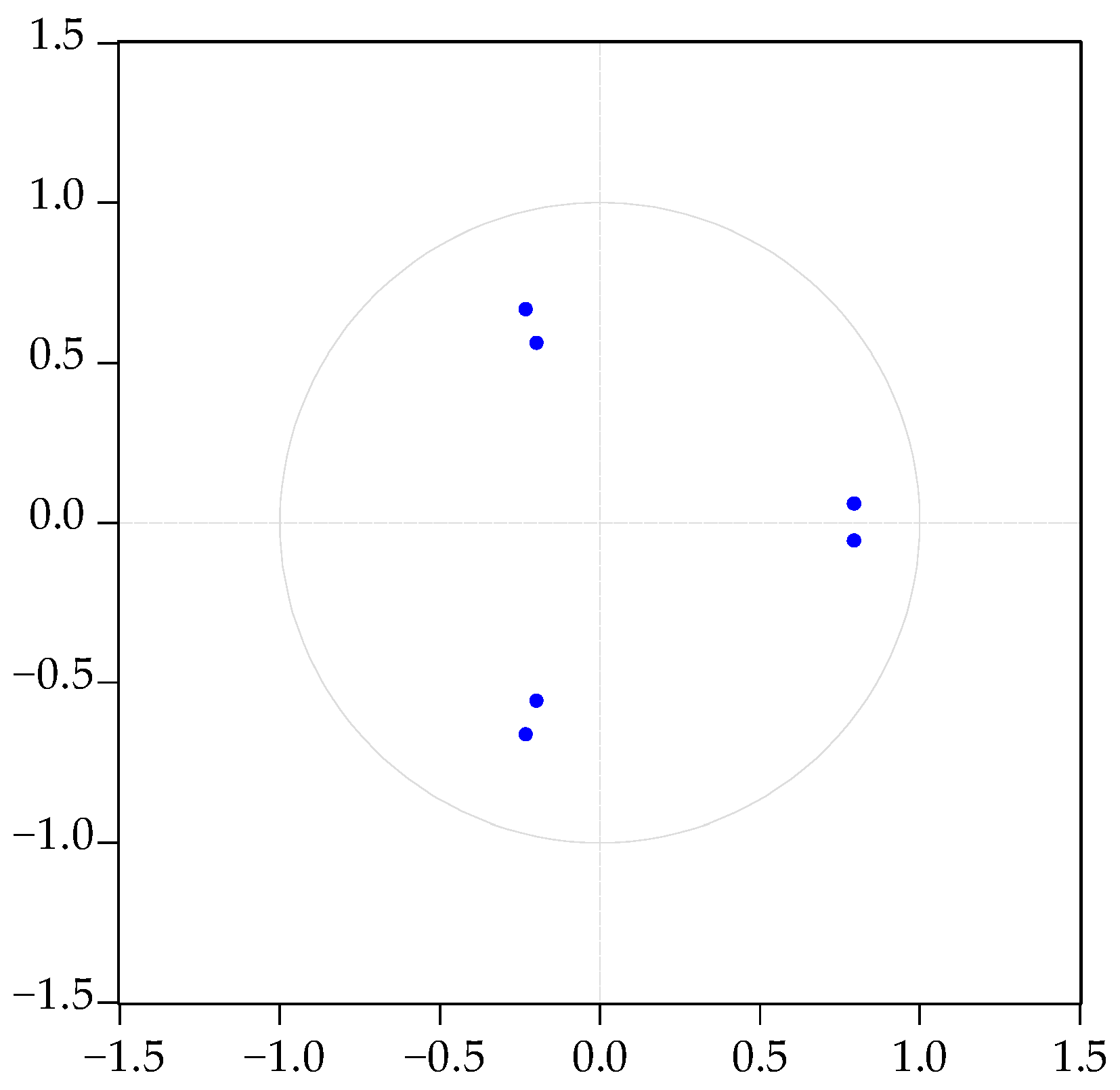

The study employs a Vector Autoregressive (VAR) framework to examine the dynamic relationship between the natural logarithm of SET50 Index Futures trading volume and the natural logarithm of SET50 Index Options trading volume. The optimal lag length is determined using the Akaike Information Criterion (AIC), Schwarz Information Criterion (SIC), and Hannan–Quinn Criterion (HQ). The stability of the VAR system is verified by examining the inverse roots of the characteristic polynomial to ensure that all roots lie within the unit circle. The Lagrange Multiplier (LM) serial correlation test is then applied to confirm the absence of autocorrelation in the residuals, indicating that the model is dynamically well-specified.

To test the first hypothesis, the Granger causality test assesses whether a bidirectional relationship exists between the natural logarithms of SET50 Index Futures and Options trading volumes. The significance of VAR model coefficients is examined for the second and third hypotheses, with p-values determining statistical significance. Impulse response functions and variance decomposition further analyze trading volume dynamics. Impulse response functions trace the effects of shocks in futures on options trading volumes, and vice versa, capturing the magnitude and duration of these responses. Variance decomposition quantifies the relative contribution of innovations in futures trading volumes to the forecast error variance of options trading volumes, and vice versa. All estimations and analyses are conducted using EViews version 10.

4. Results

Table 1 presents the mean, median, minimum, maximum, standard deviation, and Augmented Dickey-Fuller (ADF) test results for each variable, including the trading volumes of SET50 Index Futures and Options (VF and VO), underlying market factors (LIQ and VOL), and macroeconomic indicators (LEI, PII, INF, INT, and EX). For variables found to be non-stationary in levels, the ADF test is conducted on their first differences.

The average monthly trading volume of SET50 Index Futures, in natural logarithmic terms (15.0145), exceeds that of SET50 Index Options (11.3775), reflecting the futures-dominated structure of the Thai derivatives market. The lower standard deviation of the natural logarithm of monthly trading volume for SET50 Index Futures (0.4173) indicates more stable trading activity compared to that of options (0.9301). However, when comparing the natural logarithms of the trading volumes for both SET50 Index Futures and Options to that of the SET50 Index itself, the relatively low variability in the latter (standard deviation = 0.2935) indicates greater market stability and more consistent investor participation in the underlying equity market. Furthermore, the standard deviation of the stock market volatility series (1.0512%) is substantially higher than that of key macroeconomic indicators, including the inflation rate (0.4728%) and the interest rate (0.6185%). This indicates that stock market volatility exhibited greater variation over the study period, in contrast to the relative consistency of monetary conditions.

The Augmented Dickey–Fuller (ADF) test results indicate that all variables, except the private investment index (PII), interest rate (INT), and exchange rate (EX), are stationary at the level. PII, INT, and EX are non-stationary in their level form but become stationary after the first difference. Therefore, the first differences of these variables, denoted as DPII, DINT, and DEX, respectively, are used in the subsequent analysis to ensure stationarity.

To examine the dynamic relationships between the natural logarithms of trading volumes for SET50 Index Futures (VF) and Options (VO), a vector autoregressive (VAR) model with three lags is employed, with the lag length selected based on the lowest values of the Akaike Information Criterion (AIC), Schwarz Information Criterion (SIC), and Hannan–Quinn Criterion (HQ), as reported in

Table 2.

To assess the appropriateness of the estimated VAR(3) model, two key diagnostic checks are performed. First, the inverse roots of the characteristic polynomial are examined to ensure model stability. As shown in

Figure 1, all inverse roots lie within the unit circle, confirming that the model is dynamically stable. Second, the Lagrange Multiplier (LM) test is applied using two formulations. The first tests the null hypothesis of no serial correlation at a specific lag h, while the second tests the joint null hypothesis of no serial correlation from lag 1 to h. As reported in

Table 3, both null hypotheses cannot be rejected at the 1% significance level, indicating that the VAR residuals do not exhibit serial correlation.

Although Juselius (

2006) recommends using two lags as a general guideline for VAR models, the empirical results in this study indicate that a three-lag specification better fits the data. The VAR(2) model exhibits residual autocorrelation, whereas the VAR(3) model satisfies all diagnostic tests, confirming that three lags provide a dynamically well-specified and stable model for this dataset.

The VAR(3) model with two exogenous underlying market factors, market liquidity (LIQ) and volatility (VOL), and five exogenous macroeconomic variables, including the natural logarithm of leading economic index (LEI), the growth rate of private investment index (DPII), the inflation rate (INF), the change in interest rate (DINT), and the growth rate of exchange rate (DEX), can be represented by the following equations:

where

VFt and

VOt are the natural logarithms of the trading volumes of SET50 Index Futures and Options at time

t,

and

are intercepts,

and

are the coefficients of the

-th lag of

VF and

VO, respectively, in Equation (1),

and

are the coefficients of the

-th lag of

VF and

VO, respectively, in Equation (2),

and

are the coefficients of the underlying market factors in Equations (1) and (2) with

i = 1, 2,

and

are the coefficients of the macroeconomic factors in Equations (1) and (2) with

k = 1, 2, 3, 4, 5, and

and

are white-noise error terms.

Table 4 (Panel A) reports the estimated coefficients from the VAR(3) model. In addition, the Granger causality test is conducted using a lag length of three, consistent with the VAR specification, to examine potential lead–lag relationships. The results are presented in Panel B of

Table 4.

The VAR(3) model shows significant dynamic relationships between the natural logarithms of trading volumes for SET50 Index Futures (VF) and Options (VO). The equation for VF yields an R2 of 0.8141, while the equation for VO has an R2 of 0.9173. These values indicate that more than 80% of the variation in either VF or VO is explained by the lagged values of both VF and VO, underlying market factors (LIQ and VOL), and macroeconomic factors (LEI, DPII, INF, DINT, and DEX).

In the equation for VF, the coefficient of its own lagged value (VF(−3)) is positive and statistically significant at the 1% level. The first lag of VO is also positively and significantly associated with VF at the 1% level. It suggests that an increase in SET50 Index Options trading volume in the previous month leads to higher SET50 Index Futures trading volume in the current period, implying a potential lead-lag relationship from SET50 Index Options to SET50 Index Futures. In contrast, the equation for VO shows that the trading volume of SET50 Index Options is positively influenced by its own lagged values (VO(−1) and VO(−3)), with statistical significance at the 1% level. However, the first lag of VF exhibits a negative and statistically significant effect on VO at the 1% level. It suggests that an increase in SET50 Index Futures trading volume in the previous month leads to a reduction in SET50 Index Options trading volume in the current period, implying a potential substitution effect. Investors in SET50 Index Futures market may crowd out participation in SET50 Index Options market. In support of the VAR findings, the Granger causality test results reveal a bidirectional relationship between the trading volumes of SET50 Index Futures and SET50 Index Options. The null hypotheses that VO does not Granger-cause VF and that VF does not Granger-cause VO are both rejected at the 1% significance level. The empirical findings from the VAR(3) model and Granger causality tests provide a potential explanation for the observed disparity in trading volumes between SET50 Index Futures and Options. The positive and significant influence of lagged options volume on futures volume suggests that options traders use futures as a complementary instrument. Conversely, the negative and significant influence of lagged futures volume on options volume indicates that futures traders view options as a substitute instrument. This asymmetric investor behavior helps explain why the options market remains underutilized relative to the futures market in Thailand. SET50 Index Futures is perceived as more accessible, liquid, or efficient for speculative and hedging purposes, leading to their dominance in overall trading activity.

The inclusion of underlying market factors (LIQ and VOL) and macroeconomic factors (LEI, DPII, INF, DINT, and DEX) contributes to a better understanding of the trading volume dynamics between SET50 Index Futures and Options. Underlying market liquidity (LIQ) has a positive and significant influence on both SET50 Index Futures and Options trading volumes at the 1% level, indicating that enhanced liquidity in the underlying market attracts investors to derivative market, encouraging the use of both SET50 Index Futures and Options as hedging instruments. Additionally, the coefficient of market volatility (VOL) is positive and statistically significant at the 5% level only in the SET50 Index Futures market, but not in the SET50 Index Options market. This indicates that during periods of increased uncertainty, investors tend to use SET50 Index Futures rather than Options. For macroeconomic factors, the positive and statistically significant impact of the natural logarithm of the leading economic index (LEI) on SET50 Index Options trading volume suggests that investors interpret strengthening LEI values as a signal of future economic growth and market opportunities, thereby increasing their use of SET50 Index Options for both speculative and hedging purposes. While the coefficient of LEI is not statistically significant in the SET50 Index Futures market, the coefficients of both inflation rate (INF) and the first difference of the interest rate (DINT) are statistically significant, indicating that SET50 Index Futures trading activity is more influenced by contemporaneous macroeconomic fundamentals than by forward-looking economic trends. The negative relationship with inflation rate may reflect investor concerns over rising costs and declining real returns, while the positive effect of change in interest rate indicates increased SET50 Index Futures trading activity in response to tightened monetary policy conditions. For private investment conditions, the coefficient of the growth rate of private investment index (DPII) is positive and statistically significant at the 1% level in both SET50 Index Futures and Options markets, implying that private investment growth stimulates the use of derivatives for both hedging and speculative purposes. The growth rate of the exchange rate (DEX) has no statistically significant impact on the trading volumes of either SET50 Index Futures or Options.

Next, impulse response analysis is employed to explore the dynamic relationship between the trading volumes of SET50 Index Futures (VF) and Options (VO) over a 24-month horizon (

Figure 2). Panel A focuses on responses involving VF. The response of VF to its own shock is positive and high in the first month, then declines rapidly and turns negative by the third month, indicating a short-lived positive impact followed by a correction. The response of VF to a shock in VO begins at zero in the first month, turns positive in the second month, and fluctuates within the positive range for several months before gradually returning to zero. This pattern suggests a delayed but sustained positive influence of options trading on futures volume. Panel B shows the corresponding responses for VO. The reaction of VO to its own shock is strong and positive initially, then declines more gradually and steadily approaches zero over the 24-month horizon, suggesting a slower adjustment in options trading activity compared with futures. In contrast, the response of VO to a shock in VF begins with a strong positive reaction in the first month, turns negative in the second month, and remains negative for several months before gradually approaching zero. This reversal indicates that the longer-term impact is negative, possibly reflecting shifting trading strategies or portfolio rebalancing away from options following periods of intense futures activity. Therefore, the results of the impulse response analysis are consistent with the sign results from the VAR(3) model.

The variance decomposition results are presented in

Table 5. On the 12-month forecast horizon, the variation in the trading volumes of SET50 Index Futures (VF) and Options (VO) is largely explained by their own innovations, accounting for over 85% for VF and around 71–79% for VO. While shocks to VO account for 0% in first month and increase to 13% of the variation in VF by month 12, shocks to VF explain a substantially larger share, about 23% of the variation in VO throughout the 12-month horizon. These results indicate that futures trading activity has a stronger influence on options volume than the reverse.

5. Discussion

The analysis of the dynamic relationship between the trading volumes of SET50 Index Futures and Options shows that traders of SET50 Index Futures view SET50 Index Options as a substitute product rather than a complementary one. This is supported by both the VAR(3) model estimation and the impulse response analysis. The VAR results indicate that an increase in SET50 Index Futures trading volume in the previous month is associated with a decline in SET50 Index Options trading volume in the current month. Similarly, the impulse response analysis shows that a shock to SET50 Index Futures trading volume results in a brief initial increase in SET50 Index Options trading volume, which quickly turns into a sustained negative response over the following months. On the other hand, traders of SET50 Index Options may view SET50 Index Futures as a complementary tool, using futures in conjunction with options strategies. This interpretation is supported by the positive coefficient of lagged options trading volume in the futures volume equation, reflecting the potential use of SET50 Index Futures contracts to hedge or adjust risk associated with positions in the SET50 Index Options market. The impulse response analysis reinforces this finding, showing that a shock to SET50 Index Options trading volume results in a delayed but positive response in SET50 Index Futures trading volume. These conclusions are further supported by the Granger causality test, which confirms the existence of a bidirectional relationship between the trading volumes of SET50 Index Futures and SET50 Index Options. This result is consistent with

H. S. Lee (

2013), who finds a bidirectional relationship in trading volumes between the KOSPI 200 futures and options markets. Unlike Lee’s findings of a positive relationship in both directions, the interdependency between the SET50 Index Futures and Options markets is asymmetric. Trading in options increases futures volume, while trading in futures reduces options volume. This asymmetry also differs from

Jongadsayakul (

2024) on currency futures, which shows that traders treat contracts with different underlyings as substitutes. For the SET50 Index, by contrast, options traders treat futures as complements, while futures traders treat options as substitutes. The variance decomposition results further reinforce this asymmetry by showing the unequal contribution of each derivatives market to the variation in the other over the forecast horizon.

Consistent with prior studies (e.g.,

Brorsen & Fofana, 2001;

Ciner et al., 2006;

Frino et al., 2010;

Hung et al., 2011;

Agrawal et al., 2019) that find a positive relationship between underlying market volatility and trading volumes across various futures markets, the trading activity in SET50 Index Futures is strongly influenced by volatility in the underlying equity market. This pattern helps explain why Thai derivatives market dynamics diverge from global trends. When volatility increases, investors turn to SET50 Index Futures rather than options for hedging, and the contract’s greater liquidity and simplicity also make it a preferred instrument for speculation. This dual function clarifies why futures trading dominates in Thailand. Like

Frino et al. (

2010), the trading volumes of SET50 Index Futures and Options are positively related to the underlying market demands. In addition, this study contributes to the literature on how macroeconomic variables influence trading activity in derivatives markets. The results support the findings by

Malliaris and Urrutia (

1991), emphasizing the impact of inflation and economic activity on trading volumes in derivatives markets. Inflation rate has a negative influence on the trading volume of SET50 Index Futures, while future economic growth has a positive influence on the trading volume of SET50 Index Options. Previous studies identify business freedom (

Poufinas & Pappas, 2021) and ease of doing business (

Samarakoon et al., 2024) as factors that positively affect trading volumes in derivatives markets. This study, in contrast, uses the growth rate of the private investment index and finds a positive effect on the trading volumes of both SET50 Index Futures and Options. Building on the study by

Vo et al. (

2019), which identifies a bidirectional causal relationship between interest rates and the derivatives market in India, this study finds that change in interest rate has a positive influence on the trading volume of SET50 Index Futures.

6. Conclusions

This study investigates the determinants of trading volume dynamics in Thailand’s equity derivatives market using a VAR(3) model with monthly data from May 2014 to December 2024. The results reveal a bidirectional but asymmetric interdependency between the SET50 Index Futures and Options markets. Trading in options stimulates futures activity, while trading in futures reduces options activity. The impulse response and variance decomposition analyses confirm this asymmetry, with futures shocks explaining a larger share of variability in options trading than the reverse.

The analysis also highlights the influence of market conditions and macroeconomic factors. Both futures and options trading volumes increase with stock market liquidity and private investment, while futures trading responds negatively to inflation and positively to change in interest rate. Options trading, in contrast, is positively affected by the leading economic index.

Although this study,

Jongadsayakul (

2024), and

H. S. Lee (

2013) all employ VAR models to analyze derivatives market dynamics, the present study extends the framework by incorporating macroeconomic variables and underlying equity market conditions as explanatory factors. This broader design leads to three main contributions. First, it provides a more comprehensive perspective on the determinants of derivatives trading activity. Second, the application of the VAR framework to the SET50 Index Futures and Options reveals Thai market dynamics that diverge from global patterns. In periods of heightened volatility, investors prefer futures over options for hedging, and the greater liquidity and simplicity of futures also make them attractive for speculation. This dual function helps explain why futures dominate trading in Thailand. Third,

Jongadsayakul (

2024) shows that traders in currency futures treat contracts with different underlyings as substitutes. In contrast, this study finds that, in the SET50 Index market, options traders treat futures as complements, while futures traders regard options as substitutes. This asymmetry also differs from the findings of

H. S. Lee (

2013), who reports a positive bidirectional relationship between KOSPI 200 futures and options. The evidence here supports the futures-dominated structure of the Thai derivatives market, while Lee’s findings may help explain Korea’s option-dominated market. Taken together, these results suggest that cross-market differences in the futures–options relationship can be an important factor in shaping whether a derivatives market becomes futures- or option-dominated.

The findings also carry implications for both regulators and market participants. For investors, the evidence suggests that futures trading can reduce liquidity in the options market, making it an important factor to monitor when taking options positions. Futures traders should also be cautious during periods of high inflation, which tends to depress futures activity. For regulators, the results highlight the importance of macroeconomic indicators such as the leading economic index, private investment, inflation, and interest rates in shaping derivatives activity. Policies that foster economic growth and private investment may help strengthen confidence in the SET50 Index Options market.

Despite these implications, this study has some limitations. It relies on monthly data with 128 observations, while key macroeconomic variables such as GDP are typically available on a quarterly basis. Using quarterly data over a longer time span could provide a more accurate reflection of the current economic situation. Future research could employ such data and consider underlying asset prices, such as the SET50 Index returns, as potential market factors in the VAR model, which may offer additional insights into the dynamics among the variables.