4.1. Preliminary Results

This section presents the study’s key findings.

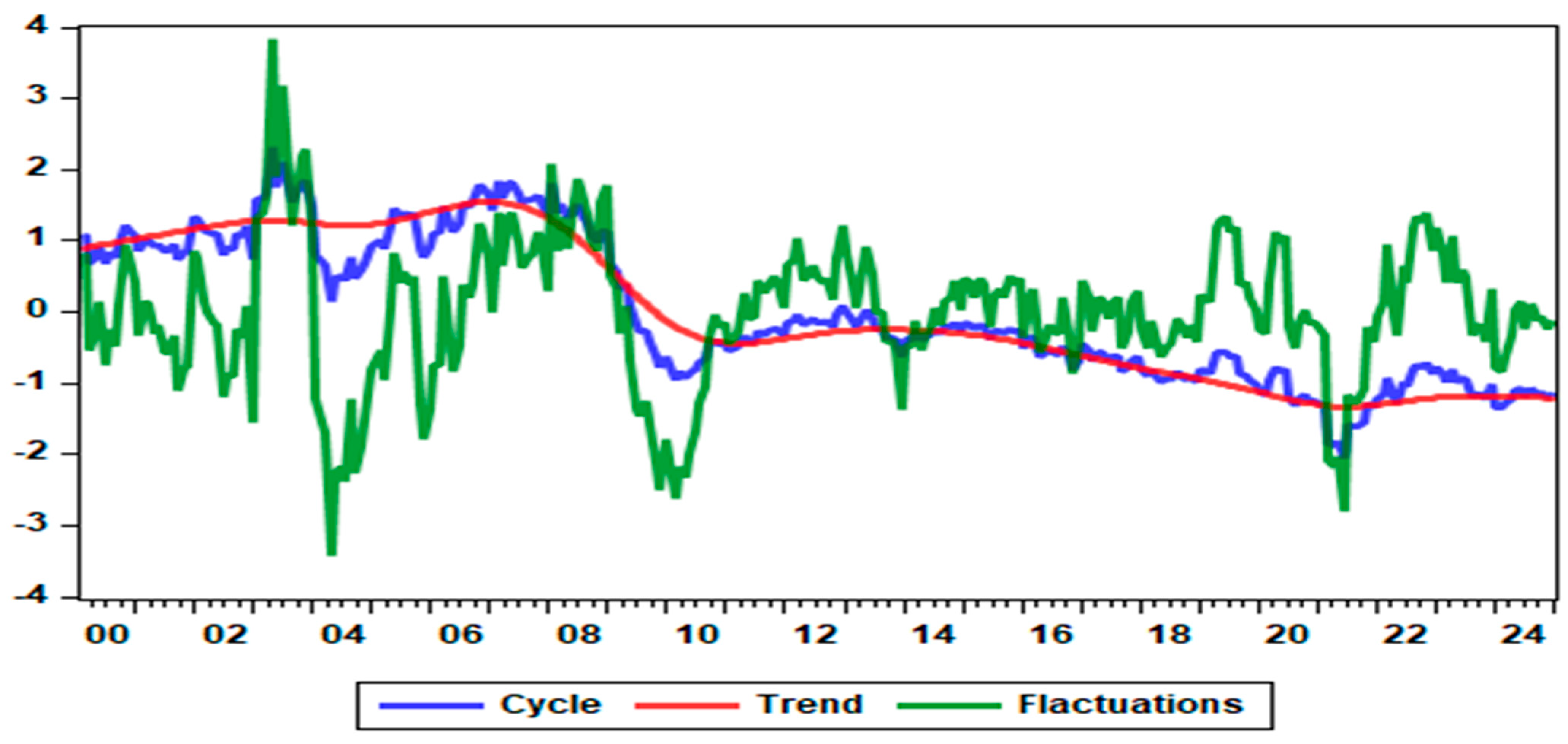

Figure 1 illustrates the South African financial cycle, decomposed into its long-term trend and short-term fluctuations using the Hodrick–Prescott Filter (HP filter). As shown in the figure, the long-term trend has been on a persistent downward trajectory since the early 2000s, indicating a gradual weakening in the underlying dynamics of financial development over time. A downward trend in financial development reflects a deterioration in the ability of the financial system to effectively support economic growth, allocate capital efficiently, mobilize savings, and extend credit to households and businesses. This trend has serious implications in developing economies, like South Africa—it may result in reduced access to financial services, lower investor confidence, and weaker economic performance. Financial development is critical in enabling productivity gains and supporting entrepreneurship and long-term investment. Therefore, when financial systems begin to contract or lose efficiency, the broader macroeconomic implications can be substantial.

Beck and Levine (

2004) argue that well-functioning financial systems are vital in fostering economic development by reducing transaction costs and improving risk-sharing. Thus, a downward trend signals the reversal of these gains.

Recent developments in South Africa mirror this concern. The South African rand (ZAR) has experienced significant depreciation and volatility over the past decade, driven by domestic political uncertainty, tightening of global monetary policy, and episodes of capital flight. The “Nenegate” incident in 2015 in which a finance minister was unexpectedly replaced, led to a sharp fall in the rand and signaled weakening institutional credibility. Similar pressures resurfaced during the COVID-19 pandemic and the 2021 unrest, leading to further currency instability and capital outflows. These events discouraged long-term investment and undermined investor confidence, consistent with the findings of

Aye and Odhiambo (

2021), who note that currency volatility in South Africa is strongly associated with lower financial market efficiency and reduced private investment.

Stagnation in private sector credit extension also indicates a weakening financial system. According to the South African Reserve Bank, real growth in private sector credit extension has been below historical averages since 2020. Lending to households and corporates remains cautious amid high debt levels, weak consumer confidence, and rising interest rates. This stagnation restricts investment and consumption, ultimately constraining economic recovery.

Mlachila et al. (

2013) similarly observe that in low- and middle-income economies, a reduction in credit growth often reflects deeper structural issues in financial intermediation, including risk aversion among lenders and a lack of innovative financial products.

South Africa’s housing market shows further evidence of a downward trend. House price growth has remained below inflation in many parts of the country, pointing to weak demand and affordability constraints. Real house prices have declined in several metropolitan areas, particularly where unemployment and credit access are limited (

Mwanyepedza & Mishi, 2024). The housing sector is typically a driver of wealth accumulation and collateral formation, especially for middle-income households. Weakness in this sector constrains both consumer wealth and borrowing capacity, thereby limiting financial system depth and development. This observation is supported by

Aron and Muellbauer (

2016), who find that real house price stagnation negatively affects consumption and loan demand.

Financial inclusivity, a key component of financial development, has also seen setbacks despite improvements in digital financial services. Many low-income households remain unbanked or underbanked, particularly in rural areas. The FinScope Consumer Survey in 2022 revealed that significant population segments still lack access to formal savings instruments, credit facilities, and insurance products (

Nanziri & Gbahabo, 2025). These patterns highlight barriers, such as limited financial literacy, high transaction costs, and weak infrastructure.

Sahay et al. (

2015) argue that financial inclusion is critical to achieving broader financial development and that exclusion undermines economic equality and limits the effectiveness of monetary policy transmission.

In summary, South Africa’s financial development trajectory has shown signs of decline, with multiple indicators reflecting the financial sector’s reduced efficiency, inclusivity, and resilience. These findings align with the empirical literature pointing to a growing disconnect between financial sector performance and real economic outcomes in emerging markets (

De la Torre et al., 2017). Reversing this trend will require strengthening institutional frameworks, promoting financial literacy, improving credit infrastructure, and restoring macroeconomic stability.

The cyclical component of the South African financial cycle reveals several noteworthy dynamics with important implications for academic inquiry and macroprudential policy design. Notably, the peaks of the financial cycle coincide with key periods of financial stress, underscoring the cycle’s procyclical nature and its role in amplifying systemic risk. Three distinct episodes are aligned with these peaks. The first occurred in 2002–2003 during a domestic banking crisis that saw the collapse of institutions, such as Saambou Bank and BOE Bank, precipitated by liquidity shortages, poor asset quality, and a loss of depositor confidence. Although the crisis was relatively contained, it led to significant consolidation in the sector and prompted enhanced supervisory frameworks (

Van der Merwe, 2004).

The second major peak occurred during the global financial crisis from 2007 to 2009. While South Africa’s banking system remained solvent, the economy experienced sharp declines in credit growth, portfolio investment, and consumer confidence. Asset prices fell markedly, and the rand depreciated significantly as global risk aversion surged. These events were mirrored in the financial cycle, which peaked before the crisis, providing early signals of the impending slowdown. This evidence supports the broader literature that views the financial cycle as a leading indicator of macro-financial vulnerabilities (

Aikman et al., 2015;

Drehmann et al., 2012).

The third peak of the financial cycle aligns with the 2019–2020 COVID-19 pandemic, which triggered a global economic shock. South Africa, already facing fiscal constraints and sluggish growth, experienced a sharp contraction in GDP, deterioration in household and corporate balance sheets, and a spike in financial market volatility. The South African Reserve Bank intervened through rate cuts and liquidity support, but financial conditions remained fragile. The turning point in the financial cycle accurately captured this phase of financial distress, further validating its use as a real-time monitoring tool.

In addition to signaling crises, the cyclical component captures episodes of rapid financial expansion. Between 2004 and 2007, the South African economy experienced a credit and housing boom supported by accommodative monetary policy, strong global demand for commodities, and positive domestic sentiment. Household debt as a share of disposable income rose sharply, and residential property prices surged, developments that were reflected in the steep upward trajectory of the financial cycle during this period. Similar, albeit more moderate, recoveries were observed in the post-GFC and post-COVID-19 periods, as indicated by the rebound in the cyclical component driven by policy stimulus and renewed credit demand.

These findings highlight the analytical value of the financial cycle as a medium-term macro-financial indicator. While traditional indicators, such as GDP or inflation, provide snapshots of economic conditions, they often fail to capture latent financial risks. By aggregating information on credit volumes, asset prices, and leverage, the financial cycle offers a richer understanding of systemic dynamics (

C. Borio, 2014;

Claessens et al., 2011). Its historical alignment with crises in South Africa strengthens the case for its incorporation into early-warning frameworks and financial stability assessments.

From a policy perspective, these insights suggest that macroprudential authorities should closely monitor the financial cycle and calibrate their tools accordingly. Time-varying instruments—such as countercyclical capital buffers (CCyB), dynamic loan-to-value (LTV) ratios, and debt-to-income (DTI) caps—should be tightened during the upswing to contain excess credit growth and loosened during downturns to avoid credit crunches. This approach is consistent with international recommendations from the Basel Committee on Banking Supervision and empirical studies showing that pre-emptive tightening of macroprudential policy can reduce the probability and severity of financial crises (

Cerutti et al., 2017).

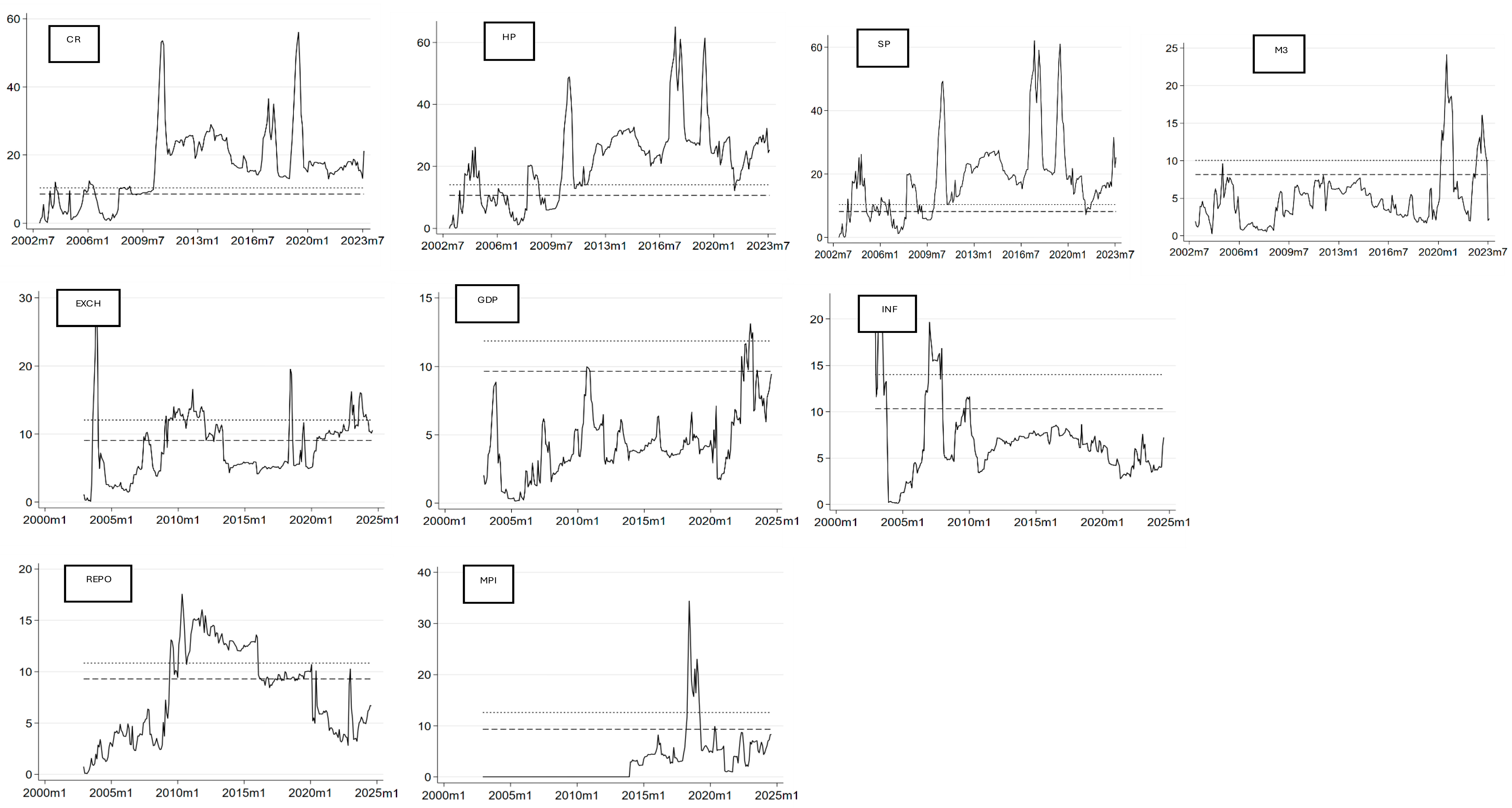

Unit root tests using the Augmented Dickey–Fuller (ADF) method were employed to determine the stationarity properties of all variables. The results in

Table 3 reveal that the variables exhibit a mixed order of integration. Specifically, the financial cycle, share price index, and the policy interest rate are stationary at level—indicating they are integrated of order zero, I(0). The remaining variables, namely the real effective exchange rate, real GDP, inflation, credit-to-GDP ratio, house prices, broad money supply, and the macroprudential policy index, became stationary only after first differencing and are, therefore, classified as integrated of order one, I(1). None of the variables were found to be integrated of order two, I(2), thus satisfying a key prerequisite for applying the autoregressive distributed lag (ARDL) modelling framework.

Econometric theory, as established by

Pesaran et al. (

1999) and

Pesaran et al. (

2001), demonstrates that the ARDL bounds testing approach to cointegration is robust in the presence of a combination of I(0) and I(1) variables. Unlike traditional methods, such as Johansen or Engle–Granger, which require all variables to be integrated of the same order, the ARDL method can accommodate regressors with differing levels of integration without compromising the validity of long-run relationships. Accordingly, this study estimates the model using I(0) and I(1) variables without transforming them to the same order of integration.

Based on the unit root test results presented above, it is evident that some variables are stationary at level I(0), such as SP and Repo, while others become stationary only after first differencing I(1), such as EXCH, GDP, and INF. In line with standard econometric practice, the I(1) variables were differenced before estimation to achieve stationarity. However, the I(0) variables were not transformed, as differencing them would unnecessarily strip the data of valuable long-run information.

This approach is consistent with the ARDL bounds testing methodology, which, according to

Pesaran et al. (

1999) and

Pesaran et al. (

2001), remains valid when applied to a mix of I(0) and I(1) variables. Unlike traditional cointegration techniques, such as Johansen or Engle–Granger, which require all series to be integrated of the same order, the ARDL framework allows for the inclusion of variables with differing orders of integration without compromising the validity of the long-run estimations. Consequently, this study estimates the model using both I(0) and I(1) variables in their respective forms—levels for stationary series and first differences for non-stationary series—reflecting both empirical evidence and methodological soundness.

The Zivot–Andrews (ZA) unit root test was employed alongside the ADF test to address the possibility of structural breaks within the time series data. The ZA test accounts for a single endogenous structural break in either the intercept or trend of a series, offering a more robust stationarity assessment in contexts where economic variables may be subject to sudden shifts due to policy changes, crises, or structural transformations (

Zivot & Andrews, 2002). This methodological refinement is particularly relevant given the historical volatility observed in emerging market economies.

Table 4 presents the findings. The ZA results confirm that several variables become stationary once structural breaks are accounted for, even though they appeared non-stationary under the ADF test. Notably, CYCLE, which was already stationary at level in the ADF test, remains stationary under ZA, with a structural break identified in 2007M5. This date coincides with the initial phase of the global financial crisis, which began unfolding in mid-2007, triggering widespread financial stress globally (

C. Borio, 2011). Similarly, EXCH, which was non-stationary in the ADF test, is found to be stationary under ZA with a break in 2006M5—likely linked to the commodity price boom and the surge in capital flows to emerging markets that characterized this period (

Akinboade & Makina, 2009). By contrast, GDP and INF remain non-stationary under ZA, with break dates in 2011M7 and 2006M5, respectively. The persistence of unit roots in these series even after allowing for breaks suggests a strong underlying trend component. For GDP, the 2011M7 break may correspond with the lagged effects of the GFC on real economic activity and the onset of fiscal consolidation measures. For INF, the break coincides with a transitional period in the SARB’s inflation-targeting regime, which may have altered the dynamic path of inflation without achieving mean reversion (

Aron & Muellbauer, 2013).

The ZA test also affirms the stationarity of CR, HP, SP, Repo, and MPI, all of which exhibit statistically significant breaks between 2007 and 2016. For instance, the structural break in Repo in 2009M2 aligns with SARB’s response to the domestic recession through aggressive interest rate cuts. Similarly, the 2016M1 break in MPI corresponds with a period of intensified global emphasis on macroprudential policy frameworks following the GFC (

Claessens et al., 2013). In contrast, M3 remains non-stationary under both ADF and ZA tests, with a structural break identified in 2017M2. This likely reflects continued shifts in monetary aggregates during a period marked by investor uncertainty, political volatility, and credit rating downgrades in South Africa (

Meyer et al., 2018). Taken together, the ZA results corroborate the findings from the ADF test while providing additional insight into the timing and nature of structural breaks affecting the data. They confirm that the dataset consists of a combination of I(0) and I(1) variables, validating the use of the ARDL bounds testing approach.

The ZA test results reveal that many of the variables exhibit structural breaks around the global financial crisis (GFC) period, notably between 2006 and 2009. However, it is important to note that this study did not directly incorporate structural breaks into the QARDL model specification. This decision was motivated by several important considerations. First, the available sample size is relatively small, and the QARDL framework already includes a sizable number of variables and quantile partitions. Introducing multiple break dummies or interaction terms would significantly reduce degrees of freedom, heighten the risk of overparameterization, and potentially lead to overfitting, thereby undermining the reliability and interpretability of the model (

Pesaran et al., 1999;

Narayan & Popp, 2010).

Moreover, the ZA test results show that structural breaks do not occur uniformly across all variables or at a common point; instead, they are heterogeneous and span different dates, reflecting the uneven transmission of external shocks and internal dynamics across variables and economies. This lack of synchronicity makes it difficult to apply a single dummy variable or breakpoint uniformly across the model without introducing identification problems or misrepresenting the nature of regime shifts. Recognizing these limitations, the study also estimates the time-varying Granger causality test to corroborate the findings of the QARDL.

To assess the existence of a long-run relationship between the financial cycle and the macroeconomic and financial variables, the ARDL bounds test for cointegration was conducted.

Table 5 presents the findings. The results returned a highly significant F-statistic of 68.432 (***), which exceeds the critical upper bounds at the 1% level, confirming the presence of a long-run cointegrating relationship between the financial cycle (the dependent variable) and its regressors, including GDP, inflation, credit, house prices, monetary policy, and macroprudential policy. This result is consistent with the theoretical expectation that these variables share stable long-term relationships, despite short-term fluctuations (

Pesaran et al., 2001;

Narayan, 2005). The finding aligns with previous studies that emphasize the financial cycle as an important indicator of economic stability and financial health (

C. Borio, 2011;

Drehmann et al., 2012).

Several diagnostic tests were performed to ensure the robustness and validity of the ARDL model estimates (see

Table 5). First, the Breusch–Pagan–Godfrey test for heteroscedasticity yielded an F-statistic of 3.127 (***), which is statistically significant. This finding suggests that the model suffers from heteroscedasticity and that the residuals have constant variance across observations. This result is crucial for ensuring that standard errors are consistent and reliable, which is essential for valid hypothesis testing and inference (

Breusch & Pagan, 1979). The Jarque–Bera test was conducted to assess the normality of residuals. Its main advantage lies in its ability to jointly test for both skewness and kurtosis. The test statistic, i.e., 47.893 (see

Table 5), is statistically insignificant, indicating that the study fails to reject the null hypothesis of normally distributed residuals. Hence, the study concludes that the estimated residuals are normally distributed.

The Breusch–Godfrey LM test for serial correlation returned an F-statistic of 41.562 (***), indicating the presence of autocorrelation in the residuals. Autocorrelation is common in macroeconomic time series data and may arise due to omitted dynamics or lagged effects not captured in the model. To ensure that the model returns robust standard errors in our model in the presence of heteroscedasticity and autocorrelation, the heteroskedasticity and autocorrelation consistent (HAC) estimator was employed when estimating the QARDL. This approach corrects for potential heteroskedasticity and autocorrelation in the error terms, ensuring more reliable inference. The HAC estimator was applied by first estimating the model at each quantile to obtain residuals, then computing a kernel-weighted covariance matrix of these residuals that adjusts for heteroskedasticity and autocorrelation. These robust covariance matrices were used to calculate standard errors for each quantile’s coefficients, ensuring valid inference despite serial correlation and changing error variance in the time series data. This adjustment helped to improve the estimated coefficients’ reliability and the results’ consistency.

The T Wald test for joint significance yielded an F-statistic of 9.784, indicating that the combined short-run and long-run coefficients are jointly significant in explaining variations in the financial cycle. This confirms that the selected macroeconomic and financial variables collectively influence financial cycle dynamics across the entire conditional distribution, supporting the robustness of the QARDL model. The long-run Wald test (T Waldlr) produced a highly significant F-statistic of 125.47, affirming the presence of strong long-run equilibrium relationships between the financial cycle and its determinants. Similarly, the short-run Wald test (T Waldsr) with an F-statistic of 198.34 confirms that short-term fluctuations significantly affect the financial cycle.

Lastly, the Ramsey RESET test for model specification returned an insignificant F-statistic of 10.011, indicating no evidence of functional form misspecification. Together, these results validate the model’s reliability and appropriateness in capturing both the short- and long-run dynamics of South Africa’s financial cycle. Despite autocorrelation, the model remains robust regarding long-run relationships, absence of heteroscedasticity, and overall explanatory power. These findings support using the ARDL methodology to model the dynamics of the financial cycle and its interaction with macroeconomic and financial variables, such as monetary policy, credit, and house prices, in the South African context. This approach is particularly suitable for assessing the role of financial cycles in policy formulation, as it allows for the simultaneous estimation of both short-run and long-run effects, which is crucial for understanding the effectiveness of monetary and macroprudential policies in maintaining economic stability (

C. E. Borio & Drehmann, 2009).

4.2. Main Results

Table 6 presents the results of the QARDL model. The observed error correction term of −0.257, particularly its statistical significance, provides a critical insight into the dynamics of the financial cycle index, which serves as the dependent variable in this analysis. The negative sign of the coefficient is paramount, as it unequivocally confirms the existence of a long-run cointegrating relationship between the financial cycle index and its identified macroeconomic drivers. This implies that any short-term deviation from the established long-run equilibrium will naturally trigger a corrective mechanism, steering the financial cycle back towards its sustainable path. Conversely, a positive coefficient would suggest a divergent system where imbalances are amplified rather than resolved.

The magnitude of this coefficient, −0.257, quantifies the speed at which this adjustment occurs. Specifically, it indicates that roughly 25.7% of any disequilibrium in the financial cycle index observed in the previous period is corrected within the current period. This rate suggests a moderate speed of adjustment. For instance, a coefficient closer to −1 would signify a rapid, almost immediate, correction, whereas a value near zero (though still significant) would point to a sluggish return to equilibrium. The statistical significance of this EC further validates the reliability of this adjustment mechanism, confirming that the observed reversion to equilibrium is not merely a product of random fluctuations.

In practical terms, this finding suggests that if the financial cycle index were to deviate above its long-run equilibrium—perhaps indicating a period of unsustainable financial expansion or a “boom”—approximately 25.7% of that excess would be naturally unwound in the subsequent period, guiding the cycle back towards balance. Conversely, during a financial downturn or “bust,” where the index falls below its equilibrium, a similar proportion of the deficit would be recovered in the next period. For policymakers in South Africa, this implies that the financial system possesses an inherent self-correcting tendency. While this automatic adjustment is beneficial, its moderate speed suggests that significant or prolonged deviations might still necessitate timely and well-calibrated policy interventions, such as macroprudential measures, to prevent an extended overheating or deep contraction of the financial cycle.

Turning to specific variables, the results reveal that GDP growth exhibits a negative relationship with the financial cycle in the long run, despite its generally accepted positive role in financial development according to standard economic theory (

Levine, 2005). This counterintuitive finding may be interpreted within the South African context, where prolonged sluggish growth and high levels of public and household debt have arguably limited productive investment and constrained financial intermediation (

Adusei, 2013). However, GDP demonstrates a positive short-run effect on the financial cycle, particularly at higher quantiles, suggesting that economic expansions may fuel financial booms in the late stages of the cycle, in line with the procyclical financial behavior documented in the boom–bust literature (

Claessens et al., 2011).

The exchange rate negatively impacts the financial cycle in both the long and short run, especially at lower quantiles. However, the short-run effect is not statistically significant at higher quantiles. This finding implies that currency depreciations are generally associated with financial instability and hinder long-term financial development. This finding is theoretically consistent with the view that exchange rate volatility undermines investor confidence, raises borrowing costs, and deters foreign capital inflows (

Ranciere et al., 2008). For instance, during the Asian Financial Crisis 1997, severe currency devaluations in certain countries, like Thailand and Indonesia, led to banking collapses and reversed years of financial sector gains. In South Africa, the “Nenegate” incident of December 2015, when then-Finance Minister Nhlanhla Nene was abruptly fired, led to a sharp depreciation of the rand and a subsequent loss of market confidence, reflecting the vulnerability of financial development to currency shocks.

Similarly, inflation negatively affects the financial cycle throughout, reinforcing its destabilizing role. High inflation erodes the real value of financial assets and discourages long-term saving and lending, corroborating the classical view of inflation as a tax on financial intermediation (

Boyd et al., 2001). This finding aligns with studies showing that inflation thresholds exist beyond which financial development deteriorates, particularly in emerging markets (

Khan et al., 2006).

Contrary to the positive role of credit expansion in many development models, the results show that credit has a negative long-run effect on the cycle. This finding may reflect excessive household indebtedness and unproductive lending practices that fuel consumption rather than investment (

Beck et al., 2000). However, credit contributes positively to short-term financial booms across all quantiles, suggesting a cyclical pattern where credit expansions precede financial upswings. This finding is consistent with

Schularick and Taylor (

2012), who emphasize the role of credit booms in generating financial instability. A similar duality is observed with share prices and housing prices. While the long-run effect of share prices is negative—possibly due to speculative and volatile equity markets—their short-run impact is positive, consistent with the wealth effect and increased liquidity during market rallies (

Mishkin, 2007).

In contrast, the housing sector appears to promote financial development in the long term, reflecting its role in asset-backed lending and capital formation (

Green & Malpezzi, 2003). However, in the short-term, rising housing prices can contribute to burst phases, consistent with the experiences of housing-led financial crises. For instance, the 2007–2008 global financial crisis, which began in the U.S. subprime mortgage market, illustrates how housing bubbles can amplify credit booms and ultimately trigger systemic collapses. The empirical results affirm this view by showing the negative short-run effect of housing prices, despite their long-run contribution to financial development.

Turning to policy variables, the repo rate positively affects the financial cycle in both the short and long term. However, the short-run effect is not statistically significant. This suggests that tighter monetary policy—often aimed at controlling inflation and stabilizing macroeconomic conditions—supports financial development by fostering credibility and reducing volatility (

Bernanke & Gertler, 1995). However, the insignificant short-term effect underscores the limitation of monetary policy alone in managing financial cycle fluctuations. In contrast, the macroprudential policy index consistently exerts an adverse effect across all periods. While this supports the notion that strict macroprudential regulations may restrict credit and financial activity, they appear to play a stabilizing role by mitigating short-term fluctuations. This result aligns with

Claessens (

2015), who argues that macroprudential tools are designed more for financial stability than for promoting financial development per se.

The combined interpretations and results show that the drivers of financial development in South Africa appear to be monetary policy and the housing sector, which have shown positive long-term effects. On the other hand, other variables, such as exchange rate movements, inflation, money supply, and macroprudential policy, constrain financial development. Regarding triggers of short-term financial booms and bursts, the evidence points to GDP growth, credit, share prices, and, to some extent, housing prices, as sources of temporary upswings in financial activity. Conversely, money supply and inflation are more closely associated with burst phases and financial volatility. These findings stress the importance of policy coordination—particularly between monetary and macroprudential authorities—to balance promoting financial development and ensuring financial stability in emerging markets.

Figure 2 presents the results of the cumulative sum (CUSUM) and cumulative sum of squares (CUSUMSQ) tests, which assess the stability of model parameters over time. The left panel displays the CUSUM test, which plots the cumulative sum of recursive residuals against the 5% significance bounds. The CUSUM line remains within these bounds throughout the sample period, indicating parameter stability. Similarly, the right panel shows the results of the CUSUMSQ test, which evaluates the constancy of residual variance. The CUSUMSQ line also stays well within the 5% critical bounds, suggesting no evidence of heteroskedasticity or variance instability. Taken together, these diagnostics indicate that the model maintains stable parameters and a consistent error variance over time.

The stability in

Figure 2 and

Figure 3 adds robustness to the study’s findings. It confirms that the relationships identified—namely the variables that drive long-term financial development and those that trigger short-run cyclical deviations—are significant and stable across time. This stability enhances the model’s utility for policy analysis and forecasting, assuring macroprudential authorities that the estimated relationships can be relied upon when designing interventions to manage financial cycles and promote financial stability in South Africa.

Table 7 presents the results of the variance inflation factor (VIF) analysis to assess the degree of multicollinearity among explanatory variables. The uncentered VIFs are moderately high for some variables, notably MPI (10.48), CR (10.18), HP (6.45), and EXCH (6.37), indicating potential collinearity concerns when the model is not mean-centered or lacks an intercept.

After centering the variables, the VIF values decline across the board. Importantly, all centered VIFs fall at or below the conventional threshold of 10, which indicates no severe multicollinearity. The highest centered VIFs are observed for M3 (7.87), MPI (7.05), HP (5.11), and INF (3.41), while variables, such as EXCH (2.16), GDP (2.17), CR (2.74), SP (1.12), and REPO (1.10), exhibit minimal collinearity concerns. Multicollinearity is a typical feature of macroeconomic datasets, as certain variables, like M3, INF, HP, and MPI, often co-move due to shared structural and cyclical dynamics (

Wooldridge, 2016;

Gujarati & Porter, 2009). Although such correlations can inflate standard errors and affect coefficient precision in OLS models (

Kennedy, 2008), the centered VIF results—none of which exceed the threshold of 10—indicate that multicollinearity is not a concern in this study.

The time-varying Granger causality (TVGC) test was used to corroborate the findings of the QARDL. The TVGC test offers a distinct advantage over fixed-parameter and Fourier causality approaches, particularly in contexts characterized by structural breaks, regime shifts, and episodic causal relationships. Unlike Fourier causality, which is designed to capture gradual and smooth structural changes by approximating nonlinearities with trigonometric terms (

Jones & Enders, 2016), TVGC is more adept at identifying abrupt, temporary, and nonrepetitive changes in causal dynamics that often arise in emerging market economies exposed to frequent shocks. This flexibility is achieved by estimating causality in a rolling or recursive window framework, allowing for the detection of both the emergence and disappearance of causal linkages over time (

Balcilar et al., 2010). Empirical applications—such as

Lu et al. (

2017) on oil price–growth dynamics,

Iyke and Ho (

2021) on monetary policy–inflation interactions, and

Baum et al. (

2025) on industrial production—have consistently demonstrated that TVGC uncovers nuanced, time-varying causality patterns that are otherwise obscured in models assuming constant parameters.

Turning to the empirical results for the South African financial cycle in

Figure 3, the plots show the time-varying Wald test statistics (solid black line) relative to the bootstrapped 10% (short dash) and 5% (long dash) critical values. The null hypothesis of no Granger causality is rejected whenever the test statistic exceeds either critical value. For Exch, there is strong and persistent causality from around 2010 onwards, with particularly elevated influence during the 2020–2022 period, coinciding with pandemic-driven exchange rate volatility and capital flow reversals. GDP exhibits intermittent causality, with clear episodes of influence in the early 2010s and again around the mid-2010s, but the effect largely disappears after 2020, suggesting weakened macroeconomic transmission to the financial cycle. Inflation weak sustained causality around 2012, after which the relationship disappears, possibly reflecting a decoupling due to unconventional policy measures and external shocks.

Broad money supply exerts episodic but notable causality, particularly around 2010–2012 and in short bursts post-2018, consistent with liquidity expansions feeding asset price cycles. The repo rate’s influence is strongest in the immediate post-2008 period and resurfaces briefly around 2015–2017 before fading, indicating time-specific effectiveness of monetary tightening or easing on the financial cycle. The macroprudential policy index shows sharp spikes of causality—especially a pronounced peak around 2016—highlighting targeted regulatory interventions affecting systemic risk. Credit displays persistent causality from 2012 to 2020, aligning with credit cycle dynamics driving leverage and asset market fluctuations. House prices show multiple causality episodes, peaking around 2020, consistent with property market sensitivity to macro-financial conditions. Share prices reveal a clear and sustained causal link from 2014 onward, reflecting the increasing integration of equity markets into the broader financial cycle.

The TVGC results corroborate the QARDL findings by confirming that the relationships between the financial cycle and its drivers are time-dependent and shaped by economic shocks. The QARDL model’s negative long-run and positive short-run effect of GDP is mirrored in the TVGC, where GDP causality appears only in specific periods, especially in the early and mid-2010s. Persistent post-2010 causality from the exchange rate in the TVGC reinforces the QARDL model’s long-run negative link, capturing such events as “Nenegate” in 2015 and pandemic-induced volatility in 2020. Sustained inflation causality from 2010–2019 in the TVGC supports the QARDL model’s finding of its destabilizing effect. Credit and asset prices show episodic but strong causality in the TVGC, consistent with the QARDL model’s negative long-run and positive short-run effects linked to boom–bust cycles. Housing price causality peaks in 2020 in the TVGC align with the QARDL model’s view of its long-run support for financial development but short-run instability. Intermittent policy rate causality in the TVGC mirrors its long-run positive but short-run insignificant role in the QARDL, while brief macroprudential policy causality episodes support the QARDL model’s stabilization view. Overall, the TVGC validates the QARDL model’s equilibrium-based insights, showing that key macro-financial drivers exert influence episodically, warranting state-dependent policy responses.