The Co-Movement of JSE Size-Based Indices: Evidence from a Time–Frequency Domain

Abstract

1. Introduction

2. Literature Review

2.1. Theoretical Conceptualization

2.2. Empirical Review

3. Data and Methodology

3.1. Data

3.2. Methodology

3.2.1. The Maximal Overlap Discrete Wavelet Transform

3.2.2. Continuous Wavelet Transform

3.2.3. Wavelet Phase Angle

3.2.4. Multivariant GARCH Model

4. Results and Discussion

4.1. Preliminary Tests

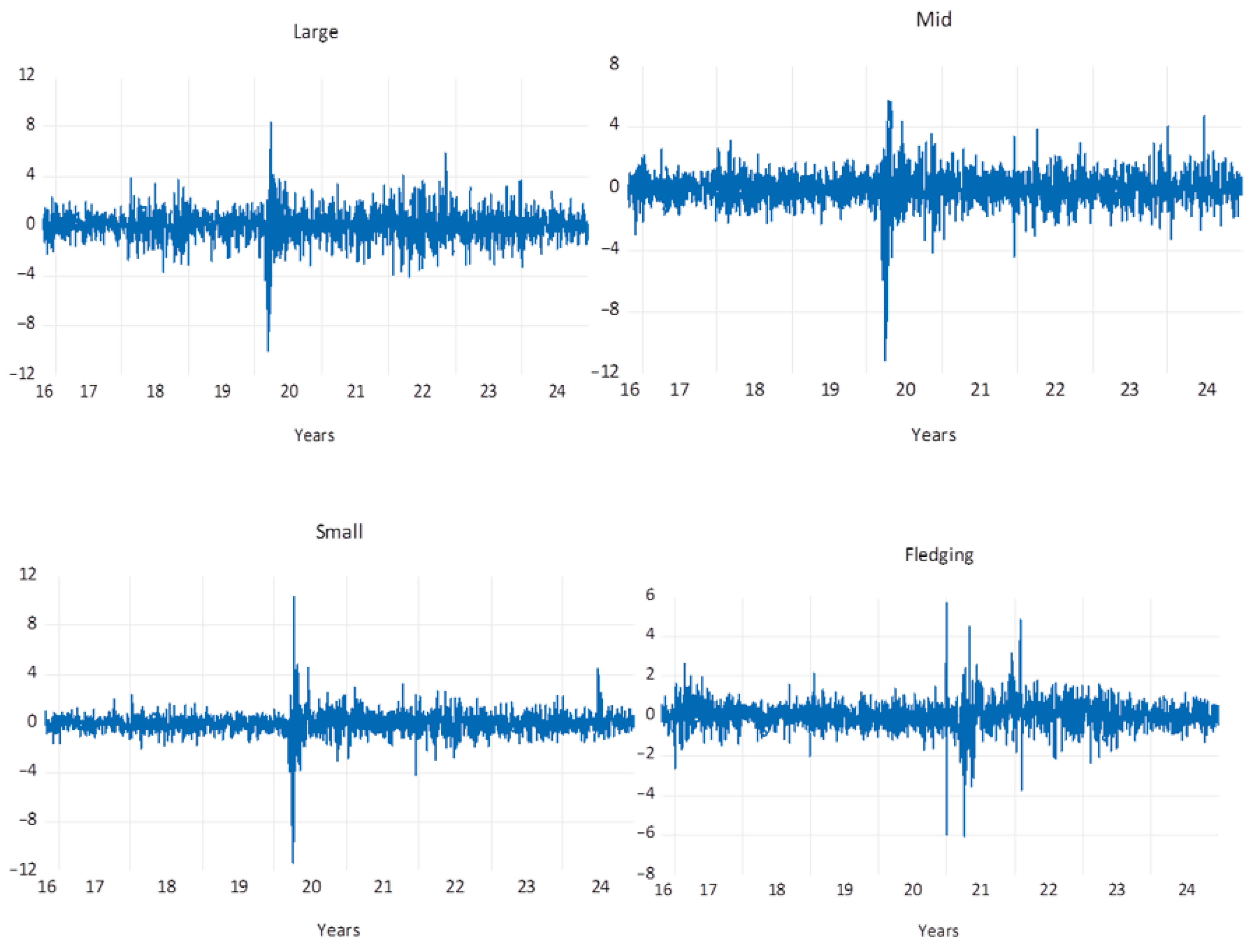

4.1.1. JSE Size-Based Plots

4.1.2. Descriptive Statistics

4.2. Empirical Model Results

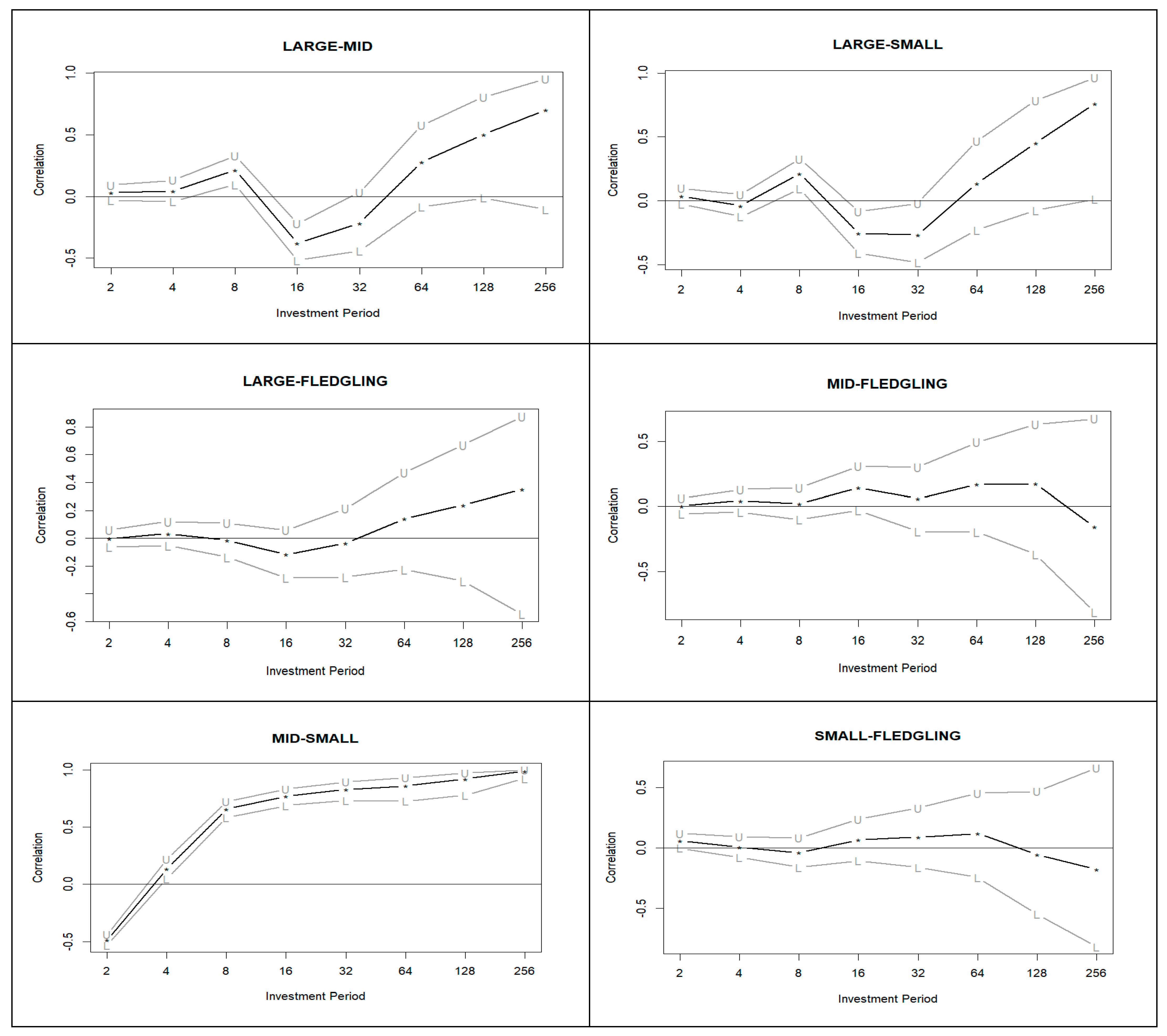

4.2.1. MODWT Results

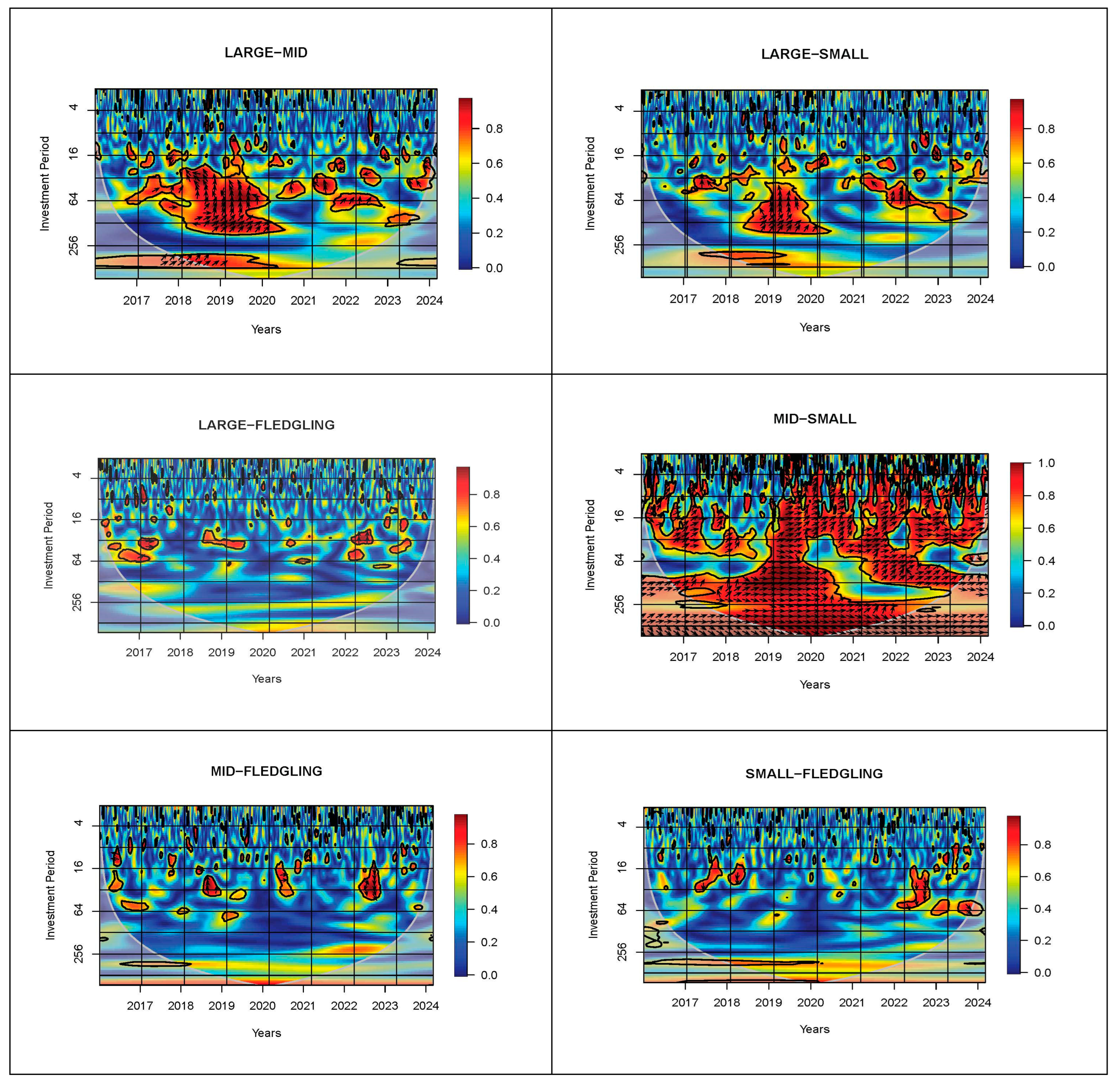

4.2.2. WCT and WPA Results

5. Robustness Tests

5.1. Univariant GARCH Specification

5.2. MGARCH-ADCC Results

6. Discussion of Results

6.1. MODWT

6.2. CWT

6.3. WPA

6.4. Macroeconomic Drivers

7. Conclusions and Implications

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Anyikwa, I., & Le Roux, P. (2020). Integration of African stock markets with the developed stock markets: An analysis of co-movements, volatility and contagion. International Economic Journal, 34(2), 279–296. [Google Scholar] [CrossRef]

- Bloomfield, D. S., McAteer, R. T. J., Lites, B. W., Judge, P. G., Mathioudakis, M., & Keenan, F. P. (2004). Wavelet phase coherence analysis: Application to a quiet-sun magnetic element. The Astrophysical Journal, 617, 623–632. [Google Scholar] [CrossRef]

- Boako, G., & Alagidede, P. (2017). Co-movement of Africa’s equity markets: Regional and global analysis in the frequency–time domains. Physica A: Statistical Mechanics and Its Applications, 46(8), 359–380. [Google Scholar] [CrossRef]

- Bredin, D., Conlon, T., & Potì, V. (2015). Does gold glitter in the long-run? Gold as a hedge and safe haven across time and investment horizon. International Review of Financial Analysis, 41, 320–328. [Google Scholar] [CrossRef]

- Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American Economic Review, 112(4), 1194–1225. [Google Scholar] [CrossRef]

- Cappiello, L., Engle, R. F., & Sheppard, K. (2006). Asymmetric dynamics in the correlations of global equity and bond returns. Journal of Financial Econometrics, 4(4), 537–572. [Google Scholar] [CrossRef]

- Cornish, C. R., Bretherton, C. S., & Percival, D. B. (2006). Maximal overlap wavelet statistical analysis with application to atmospheric turbulence. Boundary-Layer Meteorology, 119, 339–374. [Google Scholar] [CrossRef]

- De Beer, J., Keyser, N., & Van der Merwe, I. (2015). The Johannesburg stock exchange (JSE) returns, political development and economic forces: A historical perspective. Journal for Contemporary History, 40(2), 1–24. [Google Scholar]

- Engle, R. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20(3), 339–350. [Google Scholar]

- Gençay, R., Selçuk, F., & Whitcher, B. (2002). An introduction to wavelets and other filtering methods in finance and economics. Waves in Random Media, 12, 399. [Google Scholar] [CrossRef]

- Haddad, V., Huebner, P., & Loualiche, E. (2025). How competitive is the stock market? theory, evidence from portfolios, and implications for the rise of passive investing. American Economic Review, 115(3), 975–1018. [Google Scholar] [CrossRef]

- In, F., & Kim, S. (2013). An introduction to wavelet theory in finance: A wavelet multiscale approach. World Scientific. [Google Scholar]

- JSE. (2025). Headline. Available online: https://www.jse.co.za/headline (accessed on 4 March 2025).

- Kalu, E. U., Arize, A. C., Guru-Gharana, K. K., & Udemezue, N. (2024). Modelling sustainable market co-movement between Nigeria (NSE) and South Africa stock markets (JSE). World Review of Entrepreneurship, Management and Sustainable Development, 20(2), 235–255. [Google Scholar] [CrossRef]

- Karim, M. M., Chowdhury, M. A. F., & Masih, M. (2022). Re-examining oil and BRICS’ stock markets: New evidence from wavelet and MGARCH-DCC. Macroeconomics and Finance in Emerging Market Economies, 15(2), 196–214. [Google Scholar] [CrossRef]

- Karim, M. M., & Masih, M. (2019). Do the Islamic stock market returns respond differently to the realized and implied volatility of oil prices? Evidence from the time–frequency analysis. Emerging Markets Finance and Trade, 57, 2616–2631. [Google Scholar] [CrossRef]

- Kunjal, D. (2025). Geopolitical risks and equity returns: Does size matter? The Journal of Accounting and Management, 15(2), 82–94. [Google Scholar]

- Lawrence, B., Moodley, F., & Ferreira-Schenk, S. (2024). Macroeconomic determinants of the JSE size-base industries connectedness: Evidence from changing market conditions. Cogent Economics & Finance, 12(1), 2397454e. [Google Scholar] [CrossRef]

- Lo, A. W. (2004). The adaptive markets hypothesis: Market efficiency from an evolutionary perspective. Journal of Portfolio Management, 30, 15–29. [Google Scholar]

- Maiti, M., Vukovic, D., Vyklyuk, Y., & Grubisic, Z. (2022). BRICS capital markets co-movement analysis and forecasting. Risks, 10(5), 88. [Google Scholar] [CrossRef]

- Mandelbrot, B. (1966). Forecasts of future prices, unbiased markets, and “martingale” models. The Journal of Business, 39, 242–255. [Google Scholar] [CrossRef]

- Moodley, F., Ferreira-Schenk, S., & Matlhaku, K. (2024). Time–frequency co-movement of South African asset markets: Evidence from an MGARCH-ADCC wavelet analysis. Journal of Risk and Financial Management, 17(10), 471. [Google Scholar] [CrossRef]

- Muzindutsi, P. F., Mbili, S., Molefe, N., Ngcobo, H., & Dube, F. (2023). The JSE size-based indices and country risk components under bullish and bearish market conditions. International Journal of Economic Policy in Emerging Economies, 18(3–4), 237–246. [Google Scholar] [CrossRef]

- Naidoo, T., Moores-Pitt, P., Muzindutsi, P. F., & O Isah, K. (2025). Analysing investor sentiment and stock market volatility of the JSE size-based indices: A GARCH-MIDAS approach. Risk Management, 27(3), 14. [Google Scholar] [CrossRef]

- Niu, H., Lu, Y., & Wang, W. (2023). Does investor sentiment differently affect stocks in different sectors? Evidence from China. International Journal of Emerging Markets, 18, 3224–3244. [Google Scholar] [CrossRef]

- Percival, D. B., & Walden, A. T. (2000). Wavelet methods for time series analysis. Cambridge University Press. [Google Scholar]

- Sayed, A., & Charteris, A. (2024). Integration among the BRICS stock markets: Filtering out global factors. Investment Analysts Journal, 53(3), 207–230. [Google Scholar] [CrossRef]

- Torrence, C., & Webster, P. J. (1999). Interdecadal changes in the ENSO–monsoon system. Journal of Climate, 12(8), 2679–2690. [Google Scholar] [CrossRef]

- Yonis, M. (2011). Stock market co-movement and volatility spillover between USA and South Africa [Masters Dissertation, UMEA University]. [Google Scholar]

- Zhu, H., Deng, X., Ren, Y., & Huang, X. (2024). Time-frequency co-movement and cross-quantile connectedness of exchange rates: Evidence from ASEAN+3 countries. The Quarterly Review of Economics and Finance, 98(1), 101920. [Google Scholar] [CrossRef]

| Variable | Abbreviation | Start Date | Full Market Capitalization |

|---|---|---|---|

| JSE Large-Cap index | LARGE | 2016 | 85% |

| JSE Mid-Cap index | MID | 1995 | 86% to 96% |

| JSE Small-Cap index | SMALL | 1995 | 97–99% |

| JSE Fledgling index | FLEDLGING | 2002 | 1% |

| Wavelet Decomposed Series | Time-Frequencies | Investment Periods |

|---|---|---|

| R(1) | 2–4 days (intraweek) | Short-term |

| R(2) | 4–8 days(weekly) | Short-term |

| R(3) | 8–16 days (fortnightly) | Medium-term |

| R(4) | 16–32 days (monthly) | Medium-term |

| R(5) | 32–64 days (quarterly) | Long-term |

| S(5) | 64 days beyond | Long-term |

| LARGE | MID | SMALL | FLEDGLING | |

|---|---|---|---|---|

| Panel A: Descriptive Statistics | ||||

| Mean | 0.025530 | 0.009321 | 0.019863 | 0.007201 |

| Median | 0.030611 | 0.025209 | 0.021838 | 0.013693 |

| Maximum | 8.285119 | 5.649510 | 10.29176 | 5.602304 |

| Minimum | −10.08809 | −11.21429 | −11.29942 | −6.070189 |

| Std. Dev. | 1.217714 | 1.117906 | 0.927825 | 0.710083 |

| Skewness | −0.354270 | −1.282014 | −1.125886 | −0.400180 |

| Kurtosis | 9.384159 | 16.63764 | 32.78999 | 13.69863 |

| Jarque–Bera | 3517.374 | 16,415.69 | 76,086.80 | 9812.389 |

| Probability | 0.000000 | 0.000000 | 0.000000 | 0.000000 |

| Sum | 52.23443 | 19.07159 | 40.63996 | 14.73301 |

| Sum Sq. Dev. | 3032.382 | 2555.665 | 1760.458 | 1031.125 |

| Observations | 2046 | 2046 | 2046 | 2046 |

| Panel B: Unit Root and Stationarity Tests | ||||

| ADF | −45.78315 *** | −43.17247 *** | −17.84580 *** | −23.65352 *** |

| KPSS | 0.019022 | 0.120849 | 0.472772 | 0.238610 |

| ADF-Break | −46.71941 *** | −44.30006 *** | −43.46352 *** | −48.12083 *** |

| Break Period | 3/12/2020 | 3/27/2020 | 11/25/2020 | 4/06/2021 |

| Panel A: ARCH-LM Test | ||||||

|---|---|---|---|---|---|---|

| JSE Large cap | 49.89612 *** | |||||

| JSE Mid-cap | 34.06005 *** | |||||

| JSE Small cap | 203.5878 *** | |||||

| JSE Fledgling | 105.4491 *** | |||||

| Panel B: Univariant GARCH Results | ||||||

| GARCH | GJR GARCH | EGARCH | ||||

| Variables | Normal | Student T | Normal | Student T | Normal | Student T |

| JSE Large cap | 3.038386 | 3.013679 | 3.018423 | 2.999912 | 3.015851 | 2.997680 |

| JSE Mid-cap | 2.795550 | 2.767149 | 2.789174 | 2.763422 | 2.797625 | 2.767205 |

| JSE Small cap | 2.235977 | 2.189697 | 2.231781 | 2.187683 | 2.232626 | 2.190691 |

| JSE Fledgling | 1.937624 | 1.873130 | 1.939644 | 1.876596 | 1.944442 | 1.873302 |

| MGARCH-ADCC | ||||||

|---|---|---|---|---|---|---|

| ρi,j (min) | ρi,j (max) | ρi,j (σ) | ||||

| Large-Mid | 0.010782 (0.462873) | 0.713210 *** (4.457261) | −0.071128 (−1.573314) | −0.371487 | 0.084342 | 0.042047 |

| Large-Small | −0.020323 *** (−20.29546) | 0.676119 *** (2.795003) | 0.033091 (1.379061) | −0.602008 | 0.187703 | 0.027752 |

| Large-Fledgling | −0.007732 *** (−7.995101) | 0.837378 *** (6.775756) | −0.024971 (−1.043880) | −0.245873 | 0.069988 | 0.030574 |

| Mid-Small | −0.009484 (−0.886693) | 0.686468 ** (2.153044) | 0.000813 (0.044908) | −0.082260 | 0.312961 | 0.015202 |

| Mid-Fledgling | −0.009090 *** (−4.42 × 109) | 0.826384 *** (9908.892) | −0.004026 *** (−26.46234) | −0.089452 | 1.682405 | 0.041441 |

| Small-Fledgling | −0.006691 (0.2983) | 0.877240 *** (0.0000) | 0.012873 (0.4473) | −0.059651 | 0.142695 | 0.014304 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Moodley, F. The Co-Movement of JSE Size-Based Indices: Evidence from a Time–Frequency Domain. J. Risk Financial Manag. 2025, 18, 633. https://doi.org/10.3390/jrfm18110633

Moodley F. The Co-Movement of JSE Size-Based Indices: Evidence from a Time–Frequency Domain. Journal of Risk and Financial Management. 2025; 18(11):633. https://doi.org/10.3390/jrfm18110633

Chicago/Turabian StyleMoodley, Fabian. 2025. "The Co-Movement of JSE Size-Based Indices: Evidence from a Time–Frequency Domain" Journal of Risk and Financial Management 18, no. 11: 633. https://doi.org/10.3390/jrfm18110633

APA StyleMoodley, F. (2025). The Co-Movement of JSE Size-Based Indices: Evidence from a Time–Frequency Domain. Journal of Risk and Financial Management, 18(11), 633. https://doi.org/10.3390/jrfm18110633