Unveiling Energy Finance Market: A Bibliometric and Content Analysis

Abstract

1. Introduction

2. Materials and Methods

3. Results and Discussion

3.1. Performance Metrics Review

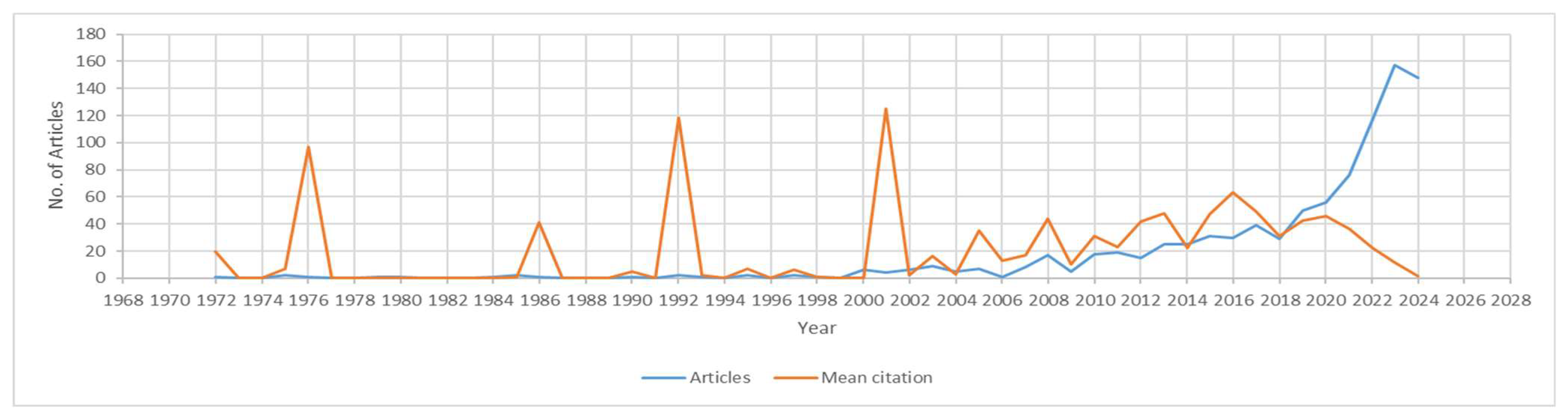

3.1.1. Articles and Citation Growth

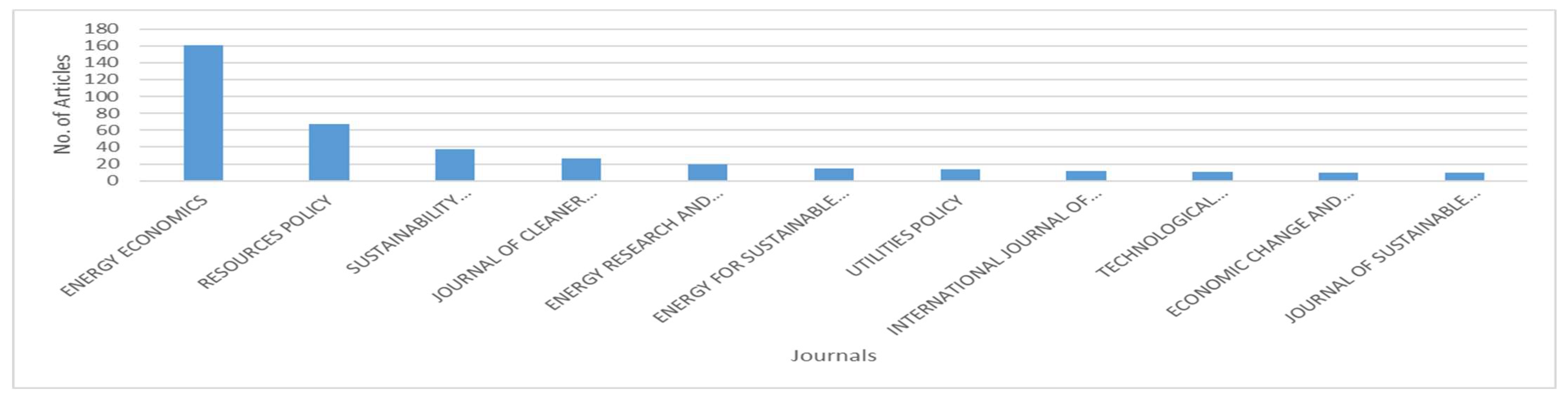

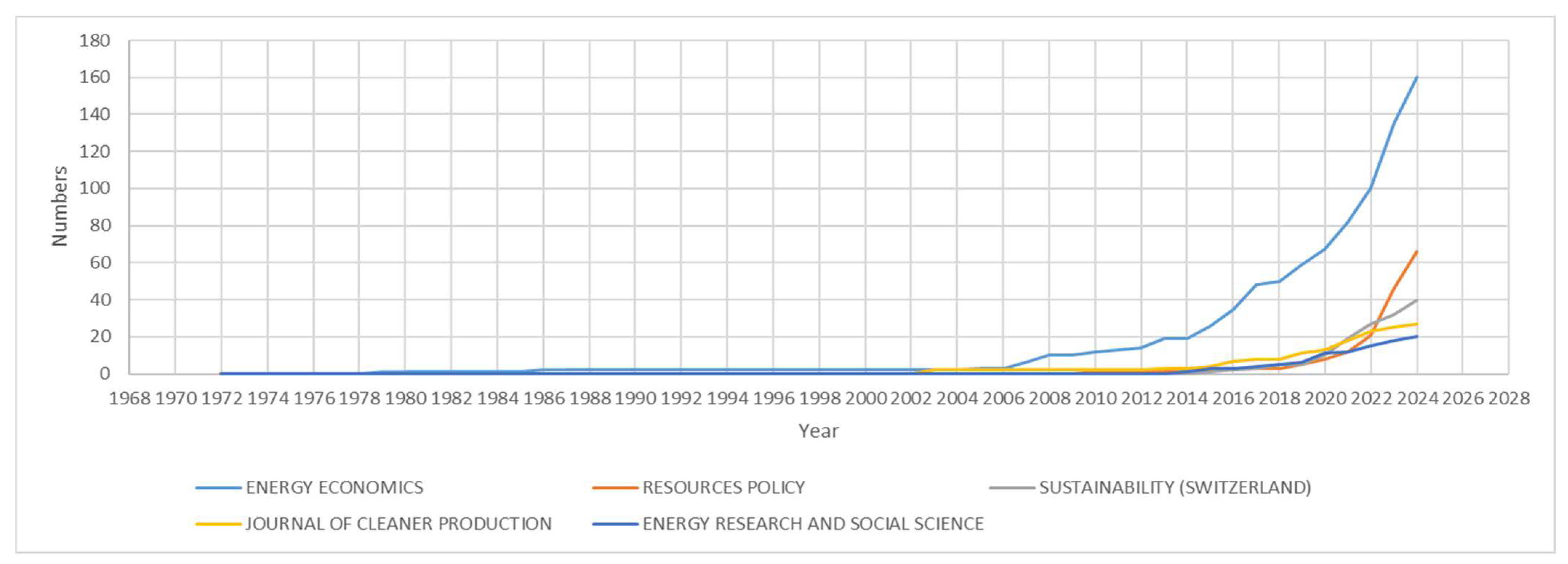

3.1.2. Top Journal Performance (Article-Based)

3.1.3. Top Journal Performance (Biennial)

3.1.4. Review of Literature of Top 20 Articles

3.1.5. 15 Leading Authors, Institutions, and Countries

3.2. Graphical Representation of Collaborative Networks (Authors, Keywords, and Countries)

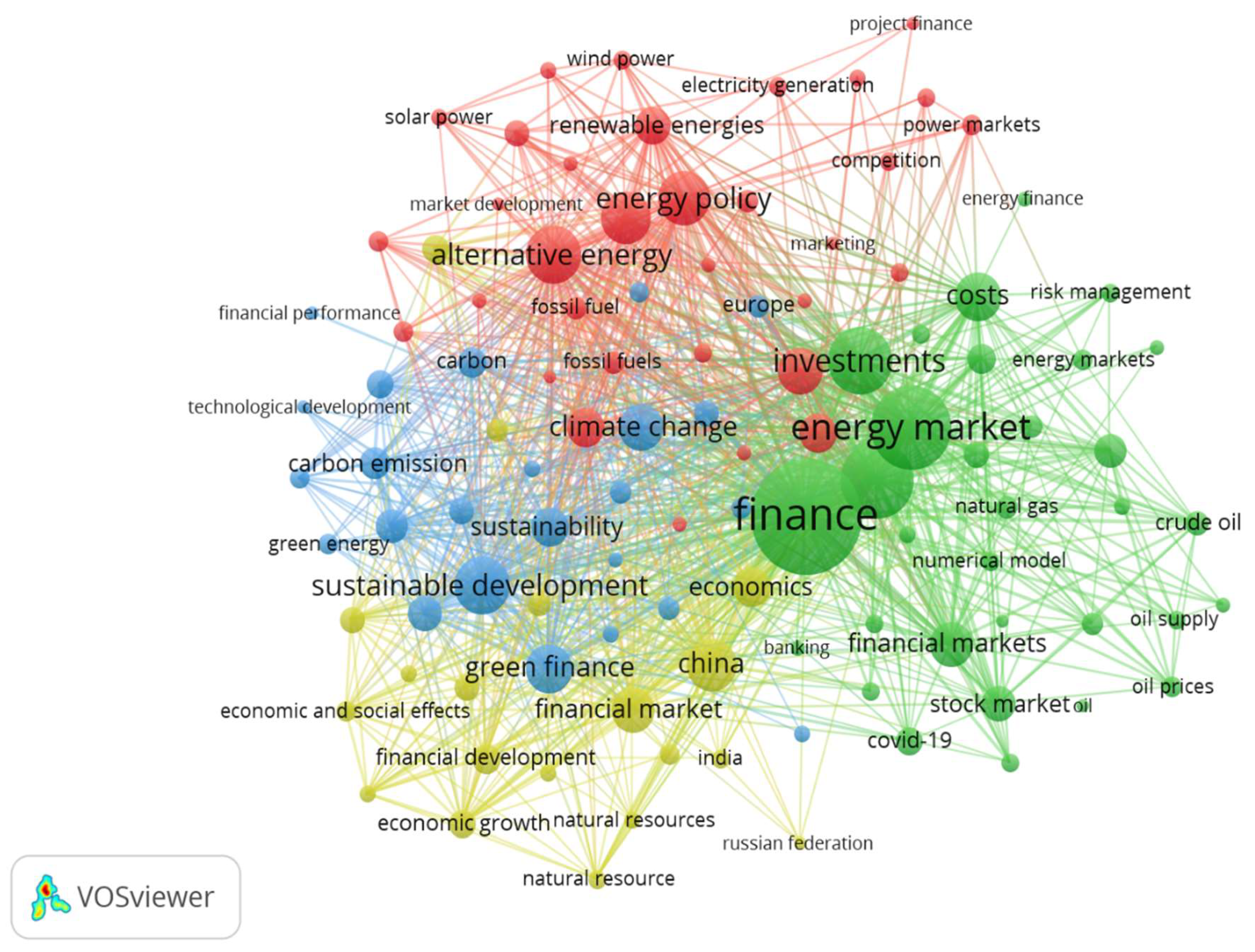

3.2.1. Keyword Co-Occurrence Analysis

- Cluster 1 (Red zone, 33 items): Energy policy and transition strategies.

- Cluster 2 (Green zone, 32 items): Energy Finance, market volatility, and risk assessment.

- Cluster 3 (Blue zone, 24 items): Sustainable finance, green economy, and climate policy for carbon reduction.

- Cluster 4 (Yellow zone, 19 items): Economic progress and environmental sustainability in international markets.

3.2.2. Co-Authorship Analysis

3.2.3. Highest Citation Authors (First Five)

3.2.4. Co-Authorship by Countries

3.3. Methodological Trends

4. Conclusions and Future Research

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Energy and financial markets, pricing mechanisms, derivative markets, green finance, and energy infrastructure investment. |

References

- Acheampong, A. O. (2019). Modelling for insight: Does financial development improve environmental quality? Energy Economics, 83, 283–297. [Google Scholar] [CrossRef]

- Aria, M., & Cuccurullo, C. (2017). bibliometrix: An R-tool for comprehensive science mapping analysis. Journal of Informetrics, 11(4), 959–975. [Google Scholar] [CrossRef]

- Baker, H. K., Kumar, S., & Pandey, N. (2020a). A bibliometric analysis of managerial finance: A retrospective. Managerial Finance, 46(11), 1495–1517. [Google Scholar] [CrossRef]

- Baker, H. K., Kumar, S., & Pattnaik, D. (2019). Twenty-five years of Review of Financial Economics: A bibliometric overview. Review of Financial Economics, 38(1), 3–23. [Google Scholar] [CrossRef]

- Baker, H. K., Kumar, S., & Pattnaik, D. (2020b). Fifty years of The Financial Review: A bibliometric overview. Financial Review, 55(1), 7–24. [Google Scholar] [CrossRef]

- Belachew, A. (2023). Impacts of results-based financing improved cookstove intervention on households’ livelihood: Evidence from Ethiopia. Forest Policy and Economics, 158, 103096. [Google Scholar] [CrossRef]

- Bhide, A. (1992). Bootstrap finance: The art of start-ups. Harvard Business Review, 70(6), 109–117. [Google Scholar]

- Cao, S., Nie, L., Sun, H., Sun, W., & Taghizadeh-Hesary, F. (2021). Digital finance, green technological innovation and energy-environmental performance: Evidence from China’s regional economies. Journal of Cleaner Production, 327, 129458. [Google Scholar] [CrossRef]

- Chen, X. Q., Ma, C. Q., Ren, Y. S., Lei, Y. T., Huynh, N. Q. A., & Narayan, S. (2023). Explainable artificial intelligence in finance: A bibliometric review. Finance Research Letters, 56, 104145. [Google Scholar] [CrossRef]

- Cheng, J., Mohammed, K. S., Misra, P., Tedeschi, M., & Ma, X. (2023). Role of green technologies, climate uncertainties and energy prices on the supply chain: Policy-based analysis through the lens of sustainable development. Technological Forecasting and Social Change, 194, 122705. [Google Scholar] [CrossRef]

- CME Group. (n.d.). Futures & options trading for risk management. Available online: https://www.cmegroup.com/ (accessed on 25 April 2025).

- Creti, A., Joëts, M., & Mignon, V. (2013). On the links between stock and commodity markets’ volatility. Energy Economics, 37, 42–52. [Google Scholar] [CrossRef]

- Çoban, S., & Topcu, M. (2013). The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis. Energy Economics, 39, 81–88. [Google Scholar] [CrossRef]

- Demailly, D., & Quirion, P. (2007). European Emission Trading Scheme and competitiveness: A case study on the iron and steel industry. Energy Economics, 30(4), 2009–2027. [Google Scholar] [CrossRef]

- Di Maio, F., Rem, P. C., Baldé, K., & Polder, M. (2017). Measuring resource efficiency and circular economy: A market value approach. Resources Conservation and Recycling, 122, 163–171. [Google Scholar] [CrossRef]

- Donthu, N., Kumar, S., Mukherjee, D., Pandey, N., & Lim, W. M. (2021). How to conduct a bibliometric analysis: An overview and guidelines. Journal of Business Research, 133, 285–296. [Google Scholar] [CrossRef]

- Dullien, S. (2010). The financial and economic crisis of 2008–2009 and developing countries. United Nations eBooks. Available online: http://www.gbv.de/dms/zbw/656722401.pdf (accessed on 25 April 2025).

- Elie, L., Granier, C., & Rigot, S. (2021). The different types of renewable energy finance: A Bibliometric analysis. Energy Economics, 93, 104997. [Google Scholar] [CrossRef]

- Emich, K. J., Kumar, S., Lu, L., Norder, K., & Pandey, N. (2020). Mapping 50 years of small group research through Small Group Research. Small Group Research, 51(6), 659–699. [Google Scholar] [CrossRef]

- Fasanya, I., Adekoya, O., Oyewole, O., & Adegboyega, S. (2022). Investor sentiment and energy futures predictability: Evidence from feasible quasi generalized least squares. The North American Journal of Economics and Finance, 63, 101830. [Google Scholar] [CrossRef]

- Fleming, J., & Ostdiek, B. (1999). The impact of energy derivatives on the crude oil market. Energy Economics, 21(2), 135–167. [Google Scholar] [CrossRef]

- Frecautan, I. (2022). Performance of green bonds in emerging capital markets: An analysis of academic contributions. Journal of Corporate Finance Research/Кoрпoративные Финансы, 16(3), 111–130. [Google Scholar] [CrossRef]

- Gatfaoui, H. (2015). Linking the gas and oil markets with the stock market: Investigating the U.S. relationship. Energy Economics, 53, 5–16. [Google Scholar] [CrossRef]

- Ghoddusi, H., Creamer, G. G., & Rafizadeh, N. (2019). Machine learning in energy economics and finance: A review. Energy Economics, 81, 709–727. [Google Scholar] [CrossRef]

- Gianfrate, G., & Peri, M. (2019). The green advantage: Exploring the convenience of issuing green bonds. Journal of Cleaner Production, 219, 127–135. [Google Scholar] [CrossRef]

- Gorkhali, A., & Chowdhury, R. (2022). Blockchain and the Evolving Financial Market: A Literature Review. Journal of Industrial Integration and Management, 7(1), 47–81. [Google Scholar] [CrossRef]

- Hammoudeh, S., & McAleer, M. (2015). Advances in financial risk management and economic policy uncertainty: An overview. International Review of Economics & Finance, 40, 1–7. [Google Scholar] [CrossRef]

- IEA. (n.d.-a). History-about-IEA. Available online: https://www.iea.org/about/history (accessed on 25 April 2025).

- IEA. (n.d.-b). Overview and key findings–world energy investment 2024—Analysis. Available online: https://www.iea.org/reports/world-energy-investment-2024/overview-and-key-findings (accessed on 25 April 2025).

- IEA. (2021, May 1). Net zero by 2050—Analysis—IEA. Available online: https://www.iea.org/reports/net-zero-by-2050 (accessed on 25 April 2025).

- Intergovernmental Panel on Climate Change (IPCC). (2022). Climate change 2022: Mitigation of climate change. Intergovernmental Panel on Climate Change (IPCC). [Google Scholar]

- International Energy Agency (IEA). (2022). Financing clean energy transitions in emerging economies. International Energy Agency (IEA). [Google Scholar]

- International Renewable Energy Agency (IRENA). (2020). Renewable energy and jobs—Annual review 2020. International Renewable Energy Agency (IRENA). [Google Scholar]

- International Renewable Energy Agency (IRENA). (2021). World energy transitions outlook 2021. International Renewable Energy Agency (IRENA). [Google Scholar]

- Jensen, M. (2001). Value maximization, stakeholder theory, and the corporate objective function. European Financial Management, 7(3), 297–317. [Google Scholar] [CrossRef]

- Khalfaoui, R., Boutahar, M., & Boubaker, H. (2015). Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis. Energy Economics, 49, 540–549. [Google Scholar] [CrossRef]

- Khan, A., Goodell, J. W., Hassan, M. K., & Paltrinieri, A. (2022). A bibliometric review of finance bibliometric papers. Finance Research Letters, 47, 102520. [Google Scholar] [CrossRef]

- Khan, M. A., Pattnaik, D., Ashraf, R., Ali, I., Kumar, S., & Donthu, N. (2021). Value of special issues in the journal of business research: A bibliometric analysis. Journal of Business Research, 125, 295–313. [Google Scholar] [CrossRef]

- Kim, J., & Park, K. (2016). Financial development and deployment of renewable energy technologies. Energy Economics, 59, 238–250. [Google Scholar] [CrossRef]

- Koomson, I., & Danquah, M. (2020). Financial inclusion and energy poverty: Empirical evidence from Ghana. Energy Economics, 94, 105085. [Google Scholar] [CrossRef]

- Kou, M., Zhang, M., Yang, Y., & Shao, H. (2024). Energy finance research: What happens beneath the literature? International Review of Financial Analysis, 95, 103402. [Google Scholar] [CrossRef]

- Langston, C., Wong, F. K., Hui, E. C., & Shen, L. (2007). Strategic assessment of building adaptive reuse opportunities in Hong Kong. Building and Environment, 43(10), 1709–1718. [Google Scholar] [CrossRef]

- Liu, Y., Dong, L., & Fang, M. M. (2023). Advancing ‘Net Zero Competition’ in Asia-Pacific under a dynamic era: A comparative study on the carbon neutrality policy toolkit in Japan, Singapore and Hong Kong. Global Public Policy and Governance, 3(1), 12–40. [Google Scholar] [CrossRef]

- Liu, Z., Chen, S., Zhong, H., & Ding, Z. (2024). Coal price shocks, investor sentiment, and stock market returns. Energy Economics, 135, 107619. [Google Scholar] [CrossRef]

- Lomax, D. F. (1986). The Second Oil Shock: 1979–80. In The developing country debt crisis. Palgrave Macmillan. [Google Scholar] [CrossRef]

- Ma, Y. R., Zhang, D., Ji, Q., & Pan, J. (2019). Spillovers between oil and stock returns in the US energy sector: Does idiosyncratic information matter? Energy Economics, 81, 536–544. [Google Scholar] [CrossRef]

- Maria, M. R., Ballini, R., & Souza, R. F. (2023). Evolution of green finance: A bibliometric analysis through complex networks and machine learning. Sustainability, 15(2), 967. [Google Scholar] [CrossRef]

- Mbarki, I., Khan, M. A., Karim, S., Paltrinieri, A., & Lucey, B. M. (2023). Unveiling commodities-financial markets intersections from a bibliometric perspective. Resources Policy, 83, 103635. [Google Scholar] [CrossRef]

- Megginson, W., Farnsworth, H., & Xu, B. (2022, April 20). Energy finance. Oxford Research Encyclopedia of Economics and Finance. Available online: https://oxfordre.com/economics/view/10.1093/acrefore/9780190625979.001.0001/acrefore-9780190625979-e-780 (accessed on 20 September 2025).

- Meng, B., Chen, S., Haralambides, H., Kuang, H., & Fan, L. (2023). Information spillovers between carbon emissions trading prices and shipping markets: A time-frequency analysis. Energy Economics, 120, 106604. [Google Scholar] [CrossRef]

- Mentel, G., Lewandowska, A., Berniak-Woźny, J., & Tarczyński, W. (2023). Green and renewable energy innovations: A comprehensive bibliometric analysis. Energies, 16(3), 1428. [Google Scholar] [CrossRef]

- Mongeon, P., & Paul-Hus, A. (2015). The journal coverage of Web of Science and Scopus: A comparative analysis. Scientometrics, 106(1), 213–228. [Google Scholar] [CrossRef]

- Muhmad, S. N., Cheema, S., Mohamad Ariff, A., Nik Him, N. F., & Muhmad, S. N. (2024). Systematic literature review and bibliometric analysis of green finance and renewable energy development. Sustainable Development, 32(6), 7342–7355. [Google Scholar] [CrossRef]

- Mulatu, K. A., Nyawira, S. S., Herold, M., Carter, S., & Verchot, L. (2023). Nationally determined contributions to the 2015 Paris Agreement goals: Transparency in communications from developing country Parties. Climate Policy, 24(2), 211–227. [Google Scholar] [CrossRef]

- Naeem, M. A., Karim, S., Rabbani, M. R., Bashar, A., & Kumar, S. (2023). Current state and future directions of green and sustainable finance: A bibliometric analysis. Qualitative Research in Financial Markets, 15(4), 608–629. [Google Scholar] [CrossRef]

- Narong, D. K., & Hallinger, P. (2023). A keyword co-occurrence analysis of research on service learning: Conceptual foci and emerging research trends. Education Sciences, 13(4), 339. [Google Scholar] [CrossRef]

- Norris, M., & Oppenheim, C. (2007). Comparing alternatives to the Web of Science for coverage of the social sciences’ literature. Journal of Informetric, 1(2), 161–169. [Google Scholar] [CrossRef]

- Odell, P. R. (1975). Oil and world power: Background to the oil crisis. Available online: https://ci.nii.ac.jp/ncid/BA27325961 (accessed on 25 April 2025).

- Ouyang, M., & Xiao, H. (2024). Tail risk spillovers among Chinese stock market sectors. Finance Research Letters, 62, 105233. [Google Scholar] [CrossRef]

- Ouyang, Y., & Li, P. (2018). On the nexus of financial development, economic growth, and energy consumption in China: New perspective from a GMM panel VAR approach. Energy Economics, 71, 238–252. [Google Scholar] [CrossRef]

- Ozturk, O., Kocaman, R., & Kanbach, D. K. (2024). How to design bibliometric research: An overview and a framework proposal. Review of Managerial Science, 18(11), 3333–3361. [Google Scholar] [CrossRef]

- Pangalos, G. (2023). Financing for a sustainable dry bulk shipping industry: What are the potential routes for financial innovation in sustainability and alternative energy in the dry bulk shipping industry? Journal of Risk and Financial Management, 16(2), 101. [Google Scholar] [CrossRef]

- Paramati, S. R., Mo, D., & Gupta, R. (2017). The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries. Energy Economics, 66, 360–371. [Google Scholar] [CrossRef]

- Paramati, S. R., Ummalla, M., & Apergis, N. (2016). The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies. Energy Economics, 56, 29–41. [Google Scholar] [CrossRef]

- Passas, I. (2024). Bibliometric Analysis: The main steps. Encyclopedia, 4(2), 1014–1025. [Google Scholar] [CrossRef]

- Patel, R. (2025). Analyzing the energy markets and financial markets linkage: A bibliometric analysis and future research agenda. Review of Financial Economics, 43, 23–61. [Google Scholar] [CrossRef]

- Pavitt, K. (1972). Technology in Europe’s future. Research Policy, 1(3), 210–273. [Google Scholar] [CrossRef]

- Ren, X., Shao, Q., & Zhong, R. (2020). Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model. Journal of Cleaner Production, 277, 122844. [Google Scholar] [CrossRef]

- Robiou du Pont, Y., & Meinshausen, M. (2018). Warming assessment of the bottom-up Paris Agreement emissions pledges. Nature Communications, 9(1), 4810. [Google Scholar] [CrossRef]

- Rodrigues, G. a. P., Serrano, A. L. M., Saiki, G. M., De Oliveira, M. N., Vergara, G. F., Fernandes, P. a. G., Gonçalves, V. P., & Neumann, C. (2024). Signs of fluctuations in energy prices and energy Stock-Market volatility in Brazil and in the US. Econometrics, 12(3), 24. [Google Scholar] [CrossRef]

- Shahbaz, M., Mallick, H., Mahalik, M. K., & Sadorsky, P. (2016). The role of globalization on the recent evolution of energy demand in India: Implications for sustainable development. Energy Economics, 55, 52–68. [Google Scholar] [CrossRef]

- Shakil, M. H. (2024). Environmental, social and governance controversies: A bibliometric review and research agenda. Finance Research Letters, 70, 106325. [Google Scholar] [CrossRef]

- Singh, B. (2021). A bibliometric analysis of behavioral finance and behavioral accounting. American Business Review, 24(2), 198–230. [Google Scholar] [CrossRef]

- Singh, V. K., Singh, P., Karmakar, M., Leta, J., & Mayr, P. (2021). The journal coverage of Web of Science, Scopus and Dimensions: A comparative analysis. Scientometrics, 126(6), 5113–5142. [Google Scholar] [CrossRef]

- Sinha, A., Ghosh, V., Hussain, N., Nguyen, D. K., & Das, N. (2023). Green financing of renewable energy generation: Capturing the role of exogenous moderation for ensuring sustainable development. Energy Economics, 126, 107021. [Google Scholar] [CrossRef]

- Su, C.-W., Qin, M., Tao, R., & Umar, M. (2020). Financial implications of fourth industrial revolution: Can bitcoin improve prospects of energy investment? Technological Forecasting and Social Change, 158, 120178. [Google Scholar] [CrossRef] [PubMed]

- Sun, L., Li, X., & Wang, Y. (2023). Digital trade growth and mineral resources in developing countries: Implications for green recovery. Resources Policy, 88, 104338. [Google Scholar] [CrossRef]

- TCFD. (2023, December 5). Task force on climate-related financial disclosures | TCFD. Available online: https://www.fsb-tcfd.org/ (accessed on 24 April 2025).

- United Nations. (1992, June 3–14). [A new blueprint for international action on environment]. United Nations Conference on Environment and Development, Rio de Janeiro, Brazil. Available online: https://www.un.org/en/conferences/environment/rio1992 (accessed on 24 April 2025).

- United Nations. (2022). Affordable and clean energy (SDG 7). United Nations. [Google Scholar]

- United States Congress. (2005). Energy policy act of 2005. Available online: https://www.congress.gov/109/plaws/publ58/PLAW-109publ58.pdf (accessed on 24 April 2025).

- UNTC. (n.d.). Available online: https://treaties.un.org/pages/viewdetails.aspx?src=treaty&mtdsg_no=xxvii-7-a&chapter=27&clang=_en (accessed on 24 April 2025).

- US EPA. (2024, December 17). 1990 clean air act amendment summary | US EPA. Available online: https://www.epa.gov/clean-air-act-overview/1990-clean-air-act-amendment-summary (accessed on 24 April 2025).

- Van Eck, N. J., & Waltman, L. (2010). Software survey: VOSviewer, a computer program for bibliometric mapping. Scientometrics, 84(2), 523–538. [Google Scholar] [CrossRef]

- Van Eck, N. J., & Waltman, L. (2014). Visualizing bibliometric networks. In Measuring scholarly impact: Methods and practice (pp. 285–320). Springer International Publishing. [Google Scholar]

- Verma, S., & Gustafsson, A. (2020). Investigating the emerging COVID-19 research trends in the field of business and management: A bibliometric analysis approach. Journal of Business Research, 118, 253–261. [Google Scholar] [CrossRef]

- Waltman, L., Van Eck, N. J., & Noyons, E. C. (2010). A unified approach to mapping and clustering of bibliometric networks. Journal of Informetrics, 4(4), 629–635. [Google Scholar] [CrossRef]

- Wang, J., Qiang, H., Liang, Y., Huang, X., & Zhong, W. (2023a). How carbon risk affects corporate debt defaults: Evidence from Paris agreement. Energy Economics, 129, 107275. [Google Scholar] [CrossRef]

- Wang, K., Wang, Z., Yunis, M., & Kchouri, B. (2023b). Spillovers and connectedness among climate policy uncertainty, energy, green bond and carbon markets: A global perspective. Energy Economics, 128, 107170. [Google Scholar] [CrossRef]

- Wang, M., Li, X., & Wang, S. (2021). Discovering research trends and opportunities of green finance and energy policy: A data-driven scientometric analysis. Energy Policy, 154, 112295. [Google Scholar] [CrossRef]

- Wang, Y., Liu, C., & Sun, Y. (2024). No more coal abroad! Unpacking the drivers of China’s green shift in overseas energy finance. Energy Research & Social Science, 111, 103456. [Google Scholar] [CrossRef]

- Welbers, K., Van Atteveldt, W., & Benoit, K. (2017). Text analysis in R. Communication Methods and Measures, 11(4), 245–265. [Google Scholar] [CrossRef]

- Wen, X., Wei, Y., & Huang, D. (2012). Measuring contagion between energy market and stock market during financial crisis: A copula approach. Energy Economics, 34(5), 1435–1446. [Google Scholar] [CrossRef]

- World Bank. (2022). Global economic prospects: Energy price dynamics. World Bank. [Google Scholar]

- Xu, J., Liu, Q., Wider, W., Zhang, S., Fauzi, M. A., Jiang, L., Udang, L. N., & An, Z. (2024). Research landscape of energy transition and green finance: A bibliometric analysis. Heliyon, 10(3), e24783. [Google Scholar] [CrossRef] [PubMed]

- Yang, J., Li, Y., & Sui, A. (2023). From black gold to green: Analyzing the consequences of oil price volatility on oil industry finances and carbon footprint. Resources Policy, 83, 103615. [Google Scholar] [CrossRef]

- Yousfi, M., & Bouzgarrou, H. (2024). Quantile network connectedness between oil, clean energy markets, and green equity with portfolio implications. Environment Economics Policy Studies, 1–32. [Google Scholar] [CrossRef]

- Zadeh, O. R., & Romagnoli, S. (2024). Financing sustainable energy transition with algorithmic energy tokens. Energy Economics, 132, 107420. [Google Scholar] [CrossRef]

- Zakeri, B., Paulavets, K., Barreto-Gomez, L., Echeverri, L. G., Pachauri, S., Boza-Kiss, B., Zimm, C., Rogelj, J., Creutzig, F., Ürge-Vorsatz, D., Victor, D. G., Bazilian, M. D., Fritz, S., Gielen, D., McCollum, D. L., Srivastava, L., Hunt, J. D., & Pouya, S. (2022). Pandemic, war, and global energy transitions. Energies, 15(17), 6114. [Google Scholar] [CrossRef]

- Zhai, P., Fan, Y., Ji, Q., & Ma, Y.-R. (2024). Climate risks and financial markets: A review of the literature. Climate Change Economics, 15(04), 2440008. [Google Scholar] [CrossRef]

- Zhang, D., & Ji, Q. (2019). Energy finance: Frontiers and future development. Energy Economics, 83, 290–292. [Google Scholar] [CrossRef]

- Zhang, D., Zhang, Z., & Managi, S. (2019). A bibliometric analysis on green finance: Current status, development, and future directions. Finance Research Letters, 29, 425–430. [Google Scholar] [CrossRef]

- Zhu, Q., Zhou, X., & Liu, S. (2023). High return and low risk: Shaping composite financial investment decision in the new energy stock market. Energy Economics, 122, 106683. [Google Scholar] [CrossRef]

- Zupic, I., & Cater, T. (2014). Bibliometric methods in management and organization. Organizational Research Methods, 18(3), 429–472. [Google Scholar] [CrossRef]

| Steps | Query Criteria | Description | Sample | First Qualifying Paper Year | Range |

|---|---|---|---|---|---|

| 1 | Keyword | “energy”, “finance”, “market” | 2924 | 1972 | No range |

| 2 | Not limited by period range | No range (Automated) | 2924 | 1972 | |

| 3 | Limited by Subject area | ECON, BUSI, SCOI | 1291 | 1972 | |

| 4 | Limited by document type | Article and Review | 959 | 1972 | |

| 5 | Limited by source type | Journal and trade Journal | 953 | 1972 |

| Event | Year | References |

|---|---|---|

| The first oil crisis was announced by the Organization of Arab Exporting Countries (OAPEC) | 1973 | (Odell, 1975) |

| Formation of the International Energy Agency | 1974 | History-About (IEA, n.d.-a) |

| Second Oil Crisis | 1979 | Lomax, D.F., 1986 (Lomax, 1986) |

| Establishment of the New York Mercantile Exchange | 1982 | Futures and Options Trading for Risk Management (CME Group, n.d.) |

| Financialization and development Energy market | 1986 | Fleming and Ostdiek (1999) |

| Amendments to the Clean Air Act | 1990 | (US EPA, 2024) |

| UNFCCC and the Rio Earth Summit | 1992 | (United Nations, 1992) |

| Kyoto Protocol | 1997 | (UNTC, n.d.) |

| Trading Scheme under the European Emissions | 2002 | Demailly and Quirion (2007) |

| Energy Policy Act | 2005 | (United States Congress, 2005) |

| Global Great Recession | 2008 | Dullien (2010) |

| Nationally Determined Contributions | 2015 | Mulatu et al. (2023) |

| Task Force on Climate Financial Disclosures | 2017 | Task Force on Climate-Related Financial Disclosures | TCFD), 2023 (TCFD, 2023) |

| Net Zero Commitments | 2020 | Net Zero by 2050—Analysis (IEA, 2021) |

| Heavy Investments in Clean Energy | 2024 | Overview and Key Findings–World Energy Investment 2024—Analysis (IEA, n.d.-b) |

| Name of the Journal | Total Number of Articles | Impact Factor |

|---|---|---|

| Energy Economics | 161 | 13.6 |

| Resources Policy | 67 | 13.4 |

| Sustainability (Switzerland) | 37 | 3.3 |

| Journal of Cleaner Production | 27 | 9.8 |

| Energy Research and Social Science | 20 | 6.9 |

| Energy for Sustainable Development | 15 | 4.4 |

| Utilities Policy | 14 | 3.8 |

| International Journal of Energy Sector Management | 12 | 2.5 |

| Technological Forecasting and Social Change | 11 | 12.9 |

| Economic Change and Restructuring | 10 | 4 |

| Journal of Sustainable Finance and Investment | 10 | 3.8 |

| Sr. No. | Title of the Paper | Authors | Year | Journal | Citations | TC/Year | Publisher | First 10 Keywords | ABDC Ranking | University/Institutions | Country | Key Findings |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Value maximization, stakeholder theory, and the corporate objective function | Jensen M. (Jensen, 2001) | 2001 | European Financial Management | 497 | 21 | John Wiley & Sons Ltd. | Balanced scorecard; Corporate governance; Corporate objective function; Corporate purpose; Multiple objectives; Social responsibility; Social welfare; Special interest groups; Stakeholder theory | ABDC A | Monitor Group, Harvard Business School | United States | This article summarizes enlightened value maximization that combines stakeholder theory’s framework with long-term value maximization as the corporate objective. |

| 2 | Digital finance, green technological innovation, and energy-environmental performance: Evidence from China’s regional economies | Cao S.; Nie L.; Sun H.; Sun W.; Taghizadeh-Hesary F. (Cao et al., 2021) | 2021 | Journal of Cleaner Production | 415 | 104 | Elsevier Ltd. | China; Difference-in-difference model; Digital finance; Energy-environmental performance; Green technological innovation | ABDC A | College of Management and Economics, Tianjin University; College of Management and Economics, Ma Yinchu School of Economics, Tianjin University; School of Finance and Economics, Jiangsu University; Institute for China Common Prosperity Research, Jiaxing University; Department of Economics and Management, Yuncheng University; Social Science Research Institute, Tokai University | China and Japan | While digital finance affects technical efficiency only, it does not affect scale efficiency and poses a stronger stimulating effect in regions with underdeveloped credit and capital markets. China should digitize its financial markets and promote energy saving and emission reduction. |

| 3 | The nexus between financial development and energy consumption in the EU: A dynamic panel data analysis | Çoban S.; Topcu M. (Çoban & Topcu, 2013) | 2013 | Energy Economics | 415 | 35 | Elsevier Ltd. | Energy consumption; EU; Financial development; System-GMM | ABDC A* | Nevşehir University, Department of Economics | Türkiye | The purpose of this article is to assess the connection between financial development and energy use, using the system-GMM model in the EU over the period from 1990–2011. There are no significant impacts on the overall energy use of EU27 countries; however, stronger financial development in the older EU member states was associated with more energy use, independent of banking or stock market proxy. |

| 4 | On the links between stock and commodity markets’ volatility | Creti A.; Joëts M.; Mignon V. (Creti et al., 2013) | 2013 | Energy Economics | 401 | 33 | Elsevier Ltd. | Commodities; Correlations; DCC-GARCH; Financial crisis; Stock market; Volatility | ABDC A* | EconomiX-CNRS, University of Paris Ouest; Ecole Polytechnique; CEPII | France | The paper investigates the relationship between price returns for 25 commodities and stocks for the period 2001- 2011, for energy raw materials. It shows that volatility of correlations is very high, especially after the 2007–2008 financial crisis, and notes the financialization of commodity markets. |

| 5 | Modelling for insight: Does financial development improve environmental quality? | Acheampong A.O. (Acheampong, 2019) | 2019 | Energy Economics | 398 | 66 | Elsevier B.V. | CO2 emissions; Economic growth; Energy intensity; Financial development | ABDC A* | Newcastle Business School, University of Newcastle | Australia | The study finds that domestic credit to private sector, and banks all positively contributed to increase in carbon emissions; however, FDI, liquid liabilities and domestic credit to private sector had no impact on carbon emissions are found in the study. |

| 6 | Nexus between green finance, non-fossil energy use, and carbon intensity: Empirical evidence from China based on a vector error correction model | Ren X.; Shao Q.; Zhong R. (Ren et al., 2020) | 2020 | Journal of Cleaner Production | 312 | 62 | Elsevier Ltd. | Carbon intensity; Emission reduction; Green finance development index; Non-fossil energy use; Vector error correction model | ABDC A | School of Economics, Shanxi University of Finance and Economics; China Center for Special Economic Zone Research, Shenzhen University | China | The study demonstrated that increasing carbon intensity reduced non-fossil fuel consumption and flow into investments in the green finance sector of China. In conclusion, the study offers the means to improve the implementation of their green finance policies, expand the use of non-fossil energy consumption, and develop the carbon trading market. |

| 7 | The effect of foreign direct investment and stock market growth on clean energy use across a panel of emerging market economies | Paramati S.R.; Ummalla M.; Apergis N. (Paramati et al., 2016) | 2016 | Energy Economics | 310 | 34 | Elsevier B.V. | Clean energy consumption; Emerging market economies; FDI inflows; Stock market growth | ABDC A* | International Institute for Financial Studies, Jiangxi University of Finance and Economics; School of Economics, University of Hyderabad; Department of Banking and Financial Management, University of Piraeus | China, India, and Greece | The research investigates the effects of foreign direct investment (FDI) inflows and stock market growth on the consumption of clean energy in 20 developing market economies for 1991–2012. The findings of this research point to a positive relationship between economic output (FDI) inflows and stock market growth with the consumption of clean energy. |

| 8 | The green advantage: Exploring the convenience of issuing green bonds | Gianfrate G.; Peri M. (Gianfrate & Peri, 2019) | 2019 | Journal of Cleaner Production | 294 | 49 | Elsevier Ltd. | Climate change; Fixed income; Green bonds; Propensity score; Responsible investment; Sustainability | ABDC A | EDHEC Business School; Bocconi University | Italy | Green bonds are coming up as a potential mechanism to direct finance to clean investments. A study of 121 green bonds in Europe issued between 2013 and 2017 concludes that green bonds are cheaper than non-green bonds for corporate issuers, and that green bonds continue in a secondary market. |

| 9 | The effects of stock market growth and renewable energy use on CO2 emissions: Evidence from G20 countries | Paramati S.R.; Mo D.; Gupta R. (Paramati et al., 2017) | 2017 | Energy Economics | 284 | 36 | Elsevier B.V. | CO2 emissions; FDI inflows; G20 nations; Renewable energy; Stock market growth | ABDC A* | International Institute for Financial Studies, Jiangxi University of Finance and Economics; Department of Accounting, Finance and Economics, Griffith University | Australia | The purpose of this research is to analyze how responses to stock market growth, Foreign Direct Investment (FDI) inflows, and the consumption of renewable energy fluctuate CO2 emissions and economic output in the G20 member countries. In the long run, stock market growth may benefit CO2 emissions in developing economies, FDI flows may enhance economic output, and renewable energy consumption may produce the same effects. |

| 10 | Strategic assessment of building adaptive reuse opportunities in Hong Kong | Langston C.; Wong F.K.W.; Hui E.C.M.; Shen L.-Y. (Langston et al., 2007) | 2008 | Building and Environment | 280 | 16 | Elsevier B.V. | Adaptive reuse; Building age; Obsolescence; Refurbishment potential; Sustainability; Useful life | NA | Department of Building and Real Estate, The Hong Kong Polytechnic University | Hong Kong | This article examines the relationships of financial, environmental, and social factors in real estate portfolio decisions. The model intends to identify buildings with the highest potential to reuse Hong Kong’s energy and natural resources. It results in a real case study that demonstrates how existing resources can be used more efficiently. |

| 11 | The role of globalization on the recent evolution of energy demand in India: Implications for sustainable development | Shahbaz M.; Mallick H.; Mahalik M.K.; Sadorsky P. (Shahbaz et al., 2016) | 2016 | Energy Economics | 266 | 30 | Elsevier B.V. | Energy demand; F62; Financial development; Globalization; India; Q43 | ABDC A* | Energy Research Center, Department of Management Sciences, COMSATS Institute of Information Technology; Montpellier Business School; IPAG Business School; Centre for Development Studies (CDS); Department of Humanities and Social Sciences (DHS), National Institute of Technology (NIT); Schulich School of Business, York University | Pakistan, France, India, and Canada | It finds that globalization promotes economic growth, financial development, and urbanization, and the long-term effect is usually a reduction in energy consumption |

| 12 | Machine learning in energy economics and finance: A review | Ghoddusi H.; Creamer G.G.; Rafizadeh N. (Ghoddusi et al., 2019) | 2019 | Energy Economics | 257 | 43 | Elsevier B.V. | Artificial Neural Network; Crude oil; Electricity price; Energy finance; Energy markets; Forecasting; Machine learning; Support Vector Machine | ABDC A* | School of Business, Stevens Institute of Technology; Independent Researcher of Sharif University of Technology | Iran | The field of energy economics and finance is undergoing a revolution with the use of machine learning (ML) for price predictions, demand forecasting, risk assessment, trading strategies, data management, and macro trend analysis. Existing research has reported success, challenges, and research gaps while offering guidance for future research. |

| 13 | Financial development and deployment of renewable energy technologies | Kim J.; Park K. (Kim & Park, 2016) | 2016 | Energy Economics | 250 | 28 | Elsevier B.V. | Deployment of renewable energy technologies; External financing; Financial development | ABDC A* | Korea Advanced Institute of Science and Technology (KAIST) | South Korea | The research’s findings suggest that developed countries experience a faster transformation in the renewable energy space, where debt and equity financing are favored compared to those countries with developing financial markets, which enables them to achieve lower CO2 emissions. |

| 14 | On the nexus of financial development, economic growth, and energy consumption in China: New perspective from a GMM panel VAR approach | Ouyang Y.; Li P. (Y. Ouyang & Li, 2018) | 2018 | Energy Economics | 249 | 36 | Elsevier B.V. | Economic growth; Energy consumption; Financial development; GMM panel VAR; PCA | ABDC A* | University of International Business and Economics, School of International Trade and Economics | China | The study examines the relationship between financial development, energy consumption, and economic growth amongst 30 provinces in China over the period of 1996Q1 to 2015Q4. Findings suggest that financial development negatively affects economic growth; however, energy consumption is positive for economic growth across all regions. |

| 15 | Bootstrap finance: the art of start-ups | Bhide A. (Bhide, 1992) | 1992 | Harvard business review | 237 | 7 | Harvard Business Publishing | Capital Financing; Commerce; Data Collection; Decision Making, Organizational; Entrepreneurship; Evaluation Studies; Financing, Personal; Investments; | Harvard Business School, United States | United States | Governments and policymakers recognize the use of start-ups in job creation and economic development and often pursue some variant of the “big money” model. As a result, books and courses on new venture creation make elements of fundraising highly prominent. | |

| 16 | Measuring contagion between energy market and stock market during financial crisis: A copula approach | Wen X.; Wei Y.; Huang D. (Wen et al., 2012) | 2012 | Energy Economics | 217 | 17 | Elsevier Ltd. | Contagion; Energy market; Stock market; Time-varying copula | ABDC A* | School of Economics and Management, Southwest Jiao Tong University | China | In this research, time-varying copulas are employed in order to investigate the contagion effect between energy markets and stock markets during the episode of financial crisis. The results indicate an increasing dependence between the Islamic financial crises and stock markets, regardless of economic conditions. |

| 17 | Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis | (Khalfaoui et al., 2015); Boutahar M.; Boubaker H. | 2015 | Energy Economics | 216 | 22 | Elsevier | BEKK-GARCH; Crude oil prices; Discrete wavelet analysis; Hedge ratio; Stock prices; Volatility spillovers; Wavelet coherence | ABDC A* | IMM; IPAG LAB-IPAG Business School | France | The study investigates the relationship between the crude oil market (WTI) and stock markets in the G-7 countries by employing the “wavelet-based MGARCH” technique. The analysis shows that these markets experience a considerable number of volatility spillovers, where WTI leads volatility spillovers in most of the markets. |

| 18 | Financial inclusion and energy poverty: Empirical evidence from Ghana | Koomson I.; Danquah M. (Koomson & Danquah, 2020) | 2021 | Energy Economics | 208 | 52 | Elsevier B.V. | Consumption poverty; Education; Energy poverty; Financial inclusion; Household income | ABDC A* | UNE Business School, Faculty of Science, Agriculture, Business and Law, University of New England; Network for Socioeconomic Research and Advancement (NESRA) | Ghana | The evidence shows that greater financial inclusion results in lower energy poverty, and despite the variation in households, this was consistent for rural households as well as male-headed households. In terms of differential benefits for employees, they received the greatest gain from increased financial inclusion. |

| 19 | Measuring resource efficiency and circular economy: A market value approach | Di Maio F.; Rem P.C.; Baldé K.; Polder M. (Di Maio et al., 2017) | 2017 | Resources, Conservation and Recycling | 203 | 25 | Elsevier B.V. | Agriculture; Energy; Manufacturing; Mining; Services | NA | Delft University of Technology; Statistics Netherlands (CBS) | Netherland | This paper presents a new value-based indicator for determining the performance of supply chain actors in resource efficiency and the circular economy. The assessment focuses on the resources and resource efficiency performance indicators measured in terms of the market value of valued ‘stressed’ resources—that is, regarded in the sense of scarcity versus competition; including the market indicators of taxes representing social and environmental externalities. |

| 20 | Financial implications of fourth industrial revolution: Can bitcoin improve prospects of energy investment? | Su C.-W.; Qin M.; Tao R.; Umar M. (Su et al., 2020) | 2020 | Technological Forecasting and Social Change | 184 | 37 | Elsevier Inc. | Bitcoin price; Granger causal relationship; Oil price; Rolling-window | ABDC A | School of Economics, Qingdao University; Graduate Academy, Party School of the Central Committee of the Communist Party of China (National Academy of Governance); Qingdao Municipal Center for Disease Control and Prevention; School of Business, Qingdao University | China | This study finds that Bitcoin is viewed as an asset that can provide insulation from high oil prices, while the adverse effects of high oil prices typically show weak hedging abilities of the Bitcoin bubble. By anticipating oil price volatility and providing regulation toward Bitcoin bubble formation, governments can help facilitate and protect the proper development of both the Bitcoin market and the energy market. |

| Sr. No. | Leading Authors | TA | Institutions | TA | Countries | TA | Cited Countries | TA |

|---|---|---|---|---|---|---|---|---|

| 1 | TAGHIZADEH-HESARY F | 14 | CHINA UNIVERSITY OF GEOSCIENCES | 21 | CHINA | 165 | CHINA | 4961 |

| 2 | LIU Y | 9 | UNIVERSITY OF INTERNATIONAL BUSINESS AND ECONOMICS | 16 | USA | 86 | USA | 2287 |

| 3 | LI X | 7 | QINGDAO UNIVERSITY | 15 | UNITED KINGDOM | 54 | AUSTRALIA | 1596 |

| 4 | WANG J | 7 | UNIVERSITY OF SUSSEX | 14 | GERMANY | 30 | FRANCE | 1403 |

| 5 | WANG Y | 7 | CHINA UNIVERSITY OF MINING AND TECHNOLOGY | 13 | INDIA | 30 | UNITED KINGDOM | 1261 |

| 6 | CHEN Y | 6 | GRIFFITH UNIVERSITY | 12 | FRANCE | 29 | NETHERLANDS | 750 |

| 7 | MIRZA N | 6 | SCHOOL OF BUSINESS | 11 | AUSTRALIA | 28 | TÜRKIYE | 743 |

| 8 | SUN Y | 6 | TOKAI UNIVERSITY | 11 | ITALY | 28 | JAPAN | 593 |

| 9 | WANG X | 6 | XI’AN JIAOTONG UNIVERSITY | 11 | NETHERLANDS | 18 | ITALY | 563 |

| 10 | ZHANG Y | 6 | ANHUI UNIVERSITY OF FINANCE AND ECONOMICS | 10 | CANADA | 17 | PAKISTAN | 534 |

| 11 | DONG X | 5 | SAPIENZA UNIVERSITY OF ROME | 10 | JAPAN | 17 | GERMANY | 521 |

| 12 | LEE C-C | 5 | TECHNICAL UNIVERSITY OF DENMARK | 10 | SPAIN | 11 | INDIA | 502 |

| 13 | SIMSHAUSER P | 5 | SOUTHWESTERN UNIVERSITY OF FINANCE AND ECONOMICS | 9 | SWITZERLAND | 11 | CANADA | 439 |

| 14 | ZHAO J | 5 | UNIVERSITY OF EDINBURGH | 9 | TÜRKIYE | 11 | NORWAY | 424 |

| 15 | Ghosh B. | 4 | NANJING UNIVERSITY OF INFORMATION SCIENCE AND TECHNOLOGY | 8 | KOREA | 10 | KOREA | 394 |

| Cluster | Keywords | Top Three Keywords | References |

|---|---|---|---|

| Cluster 1 (red zone, 33 items) | Africa, alternative energy, competition, decision making, developing countries, electricity, electricity generation, electricity supply, energy, energy efficiency, energy management, energy policy, energy transition, environmental impact, fossil fuel, governance approach, housing, infrastructure, investment, market development, marketing, power generation, power markets, project finance, renewable energies, renewable energies, renewable resource, solar energy, solar power, sub-Saharan Africa, wind power | Alternative energy (108 times) Energy policy (96 times) Renewable energies (91 times) | (Pangalos, 2023; Hammoudeh & McAleer, 2015; Zhai et al., 2024; Belachew, 2023) |

| Cluster 2 (green zone, 32 items) | Banking, commerce, commodity price, costs, COVID-19, crude oil, empirical analysis, energy finance, energy market, energy markets, exchange rate, finance, financial crisis, financial markets, financialization, forecasting, investments, market conditions, natural gas, numerical model, oil, oil prices, price dynamics, profitability, regression analysis, risk assessment, spillover effect, stock market, uncertainty analysis, United States | Finance (283 times) Energy market (183 times) Commerce (156 times) | (Yousfi & Bouzgarrou, 2024; Patel, 2025; Sun et al., 2023) |

| Cluster 3 (blue zone, 24 items) | Carbon, Carbon dioxide, Carbon emission, clean energy, climate change, climate finance, emission control, environmental economies, environmental policy, Europe, European union, financial performance, financial system, green bonds, green economy, green energy, green finance, innovation, panel data, sustainability, sustainable development, sustainable developments, sustainable finance, technological development | Sustainable development (105 times) Green finance (84 times) Climate change (81 times) | (J. Wang et al., 2023a; K. Wang et al., 2023b; Meng et al., 2023) |

| Cluster 4 (yellow zone, 19 items) | China, economic analysis, economic and social effects, economic development, economic growth, economic growths, economics, energy resource, energy use, energy utilization, environmental protection, financial development, financial market, India, natural resource, natural resources, public policy, renewable energy resources, Russian Federation | China (91 times) Economics (62 times) Financial market (75) | (Y. Liu et al., 2023; Zakeri et al., 2022; Fasanya et al., 2022) |

| Author | Total Link Strength | Document |

|---|---|---|

| Cluster 1, Red zone, 7 items | ||

| Rizvi, Syed Kumail Abbas | 5 | 3 |

| Boubaker, Sabri | 5 | 3 |

| Cluster 2, Green color, 6 items | ||

| Dong, Kangyin | 9 | 4 |

| Liu, Yang | 7 | 4 |

| Cluster 3, Blue color, 5 items | ||

| Taghizadeh-Hesary, Farhad | 21 | 14 |

| Yoshino, Naoyuki | 6 | 4 |

| Cluster 4, Yellow color, 4 items | ||

| Paltrinieri, Andrea | 3 | 2 |

| Cluster 5, Purple color, 4 items | ||

| Mirza, Nawazish | 8 | 6 |

| Umar, Muhammad | 4 | 3 |

| Cluster 6, Light blue color, 4 items | ||

| Karim, Sitara | 9 | 4 |

| Naeem, Muhammad Abubakr | 5 | 3 |

| Cluster 7, Orange color, 3 items | ||

| Moussa, Faten | 5 | 3 |

| Cluster 8, Brown color, 3 items | ||

| Mohsin, Muhammad | 4 | 2 |

| Cluster 9, Light pink, 2 items | ||

| Alvarado, Rafael | 2 | 3 |

| Author | Articles | Citations | Total Link Strength |

|---|---|---|---|

| Taghizadeh-Hesary, Farhad | 14 | 953 | 21 |

| Paramati, Sudharshan Reddy (Paramati et al., 2016) | 3 | 757 | 4 |

| Apergis, Nicholas | 2 | 473 | 4 |

| Ummalla, Mallesh | 2 | 473 | 4 |

| Mirza, Nawazish | 6 | 435 | 8 |

| Country | Articles | Citations | Total Link Strength | Country | Articles | Citations | Total Link Strength |

|---|---|---|---|---|---|---|---|

| China | 204 | 6609 | 155 | Kenya | 8 | 260 | 13 |

| United States | 156 | 4274 | 117 | South Africa | 12 | 234 | 15 |

| France | 68 | 3125 | 102 | Nigeria | 8 | 234 | 13 |

| United Kingdom | 119 | 2554 | 118 | Sweden | 12 | 233 | 17 |

| Australia | 60 | 2497 | 73 | Poland | 11 | 232 | 22 |

| Pakistan | 36 | 1571 | 87 | New Zealand | 9 | 215 | 9 |

| India | 58 | 1516 | 56 | Switzerland | 14 | 208 | 20 |

| Japan | 24 | 1195 | 30 | Thailand | 7 | 195 | 15 |

| Türkiye | 25 | 1151 | 54 | Czech Republic | 4 | 183 | 13 |

| Italy | 44 | 1070 | 48 | Lebanon | 10 | 160 | 30 |

| Germany | 52 | 1055 | 43 | Slovenia | 3 | 150 | 9 |

| Netherlands | 33 | 1004 | 45 | Singapore | 4 | 149 | 5 |

| Canada | 31 | 880 | 35 | Ecuador | 4 | 113 | 15 |

| Spain | 24 | 740 | 26 | Chile | 4 | 105 | 10 |

| Vietnam | 15 | 682 | 47 | Brazil | 10 | 94 | 3 |

| Saudi Arabia | 20 | 669 | 55 | Russian Federation | 14 | 80 | 15 |

| South Korea | 18 | 653 | 32 | Romania | 8 | 69 | 9 |

| Greece | 11 | 574 | 17 | Egypt | 6 | 61 | 14 |

| Ireland | 12 | 542 | 23 | Macao | 2 | 61 | 3 |

| Taiwan | 19 | 514 | 28 | Tanzania | 4 | 60 | 5 |

| Norway | 14 | 513 | 5 | Qatar | 6 | 50 | 7 |

| United Arab Emirates | 15 | 449 | 40 | Bangladesh | 4 | 43 | 11 |

| Denmark | 12 | 424 | 9 | Belgium | 8 | 42 | 7 |

| Hong Kong | 10 | 390 | 10 | Colombia | 4 | 32 | 8 |

| Iran | 9 | 373 | 7 | Oman | 3 | 28 | 6 |

| Malaysia | 26 | 368 | 60 | Argentina | 2 | 26 | 2 |

| Tunisia | 14 | 361 | 27 | Israel | 3 | 23 | 2 |

| Finland | 7 | 314 | 8 | Algeria | 2 | 19 | 5 |

| Ghana | 8 | 307 | 14 | Ukraine | 8 | 12 | 1 |

| Indonesia | 15 | 305 | 21 | Uzbekistan | 2 | 9 | 5 |

| Portugal | 12 | 295 | 19 | Ethiopia | 3 | 7 | 1 |

| Austria | 12 | 277 | 19 | Morocco | 2 | 3 | 4 |

| Method | Frequency | Method | Frequency | Method | Frequency |

|---|---|---|---|---|---|

| Survey | 29 | GMM | 13 | Deep Learning | 4 |

| Case Study | 27 | Monte Carlo Simulation | 12 | Machine Learning | 4 |

| GARCH | 26 | Event Study | 10 | Random Effect | 3 |

| Forecasting | 23 | Bibliometric | 8 | Panel Regression | 3 |

| Time Series | 18 | Fixed Effect | 6 | Multiple Regression | 3 |

| Simulation | 18 | Vector Autoregressive | 6 | Meta-literature | 1 |

| Optimization | 15 | GMM | 13 | ||

| DID | 13 | Content Analysis | 4 |

| Authors | Future Research Questions |

|---|---|

| 1. Reviewing energy prices for firm, sector, and stock market performance | |

| (Gatfaoui, 2015) | 1. What are the endogenous and exogenous commodity prices that affect the energy sector? |

| (Gatfaoui, 2015) | 2. How much do energy prices affect firm performance and the economy? |

| (Gatfaoui, 2015) | 3. Is there a relationship between energy prices and the stock market regime? |

| Z. Liu et al. (2024) | 4. Are there any time-lag effects of coal prices, investor sentiment, and the stock market? |

| (Gatfaoui, 2015) | 5. Do stock market, monetary policy, and macro-economic variables depend on the price of energy? |

| 2. Exploring the role of machine learning (ML) algorithms in energy markets | |

| Ghoddusi et al. (2019) | 1. Can we use ML techniques to predict the energy market stock prices? |

| Ghoddusi et al. (2019) | 2. Can we use ML to predict optimal bidding strategies in the energy market? |

| Ghoddusi et al. (2019) | 3. Can we use machine learning (ML) algorithms to predict energy market risk and volatility? |

| Frecautan (2022) | 4. Assess the role of Fintech in the energy finance markets. |

| Yang et al. (2023) | 5. Can we use artificial intelligence to predict the oil price shocks? |

| Gorkhali and Chowdhury (2022) | 6. What role does blockchain technology play in the energy finance market to protect the privacy and security of investors’ data? |

| (Ghoddusi et al., 2019) | 7. Do the textual and spatial data predict the amount of electricity consumed? |

| 3. Unravelling the link between energy and the stock market | |

| Frecautan (2022) | 1. What impact does investor sentiment have on the stock performance of energy firms? |

| Z. Liu et al. (2024) | 2. Do fossil fuel and renewable energy stocks perform differently? |

| Z. Liu et al. (2024) | 3. Do energy and non-energy stocks perform differently? |

| M. Ouyang and Xiao (2024) | 4. How do macro-economic variables impact tail risk spillovers in different energy stocks? |

| Frecautan (2022) | 5. What is the role of financial and non-financial factors in energy markets’ performance? |

| Ghoddusi et al. (2019) | 6. Is the internet mood forecast the volatility of the energy price? |

| Z. Liu et al. (2024) | 7. Can the economic policy uncertainty index measure the energy stock volatility? |

| Rodrigues et al. (2024) | 8. Do industry-specific factors cause volatility in energy stocks: a comparative analysis of the normal and distress period. |

| Zhu et al. (2023) | 9. Do ESG factors maximize portfolio returns for the energy stock market? |

| 4. Investigating the relationship between energy and financial dynamics | |

| Mbarki et al. (2023) | 1. Are fossil fuels, renewable energy, and financial assets interconnected in any way? |

| Z. Liu et al. (2024) | 2. Examine how financially viable fossil fuel and renewable energy projects are. |

| Z. Liu et al. (2024) | 3. What are the different financial products that promote the energy market? |

| Z. Liu et al. (2024) | 4. Can we investigate the relationship between the energy-based commodities and the financial market using a copula model, time frequency, wavelet, or TVP-VAR models? |

| Authors’ suggestion | 5. Comparison between the financial performance of projects based on renewable energy and fossil fuels. |

| Yang et al. (2023) | 6. Can mixed-method approaches explain interconnectedness among oil price shocks, CO2 emissions, and financial market dynamics? |

| Authors’ suggestion | 7. What role do insurance companies play in promoting renewable energy projects? |

| Zadeh and Romagnoli (2024) | 8. What are the different financing mechanisms other than debt and equity for financing sustainable energy transition? |

| Authors’ suggestion | 9. What is the role of corporate governance in the financial performance of energy firms? |

| 5. Analyzing the role of government in the energy market | |

| Ghoddusi et al. (2019) | 1. Is there a causal relationship between energy consumption and economic progress, using cross-sectional and panel data? |

| Frecautan (2022) | 2. Can the renewable energy market in developed and emerging markets be compared? |

| Cheng et al. (2023) | 3. How are supply chain logistics impacted by the geopolitical crisis in the energy sector? |

| Authors’ suggestion | 4. What role does government play in promoting green investment: a comparative analysis of developed and developing economies? |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Prasad, S.S.; Verma, A.; Bakhshi, P. Unveiling Energy Finance Market: A Bibliometric and Content Analysis. J. Risk Financial Manag. 2025, 18, 634. https://doi.org/10.3390/jrfm18110634

Prasad SS, Verma A, Bakhshi P. Unveiling Energy Finance Market: A Bibliometric and Content Analysis. Journal of Risk and Financial Management. 2025; 18(11):634. https://doi.org/10.3390/jrfm18110634

Chicago/Turabian StylePrasad, Saroj Shantanu, Ashutosh Verma, and Priti Bakhshi. 2025. "Unveiling Energy Finance Market: A Bibliometric and Content Analysis" Journal of Risk and Financial Management 18, no. 11: 634. https://doi.org/10.3390/jrfm18110634

APA StylePrasad, S. S., Verma, A., & Bakhshi, P. (2025). Unveiling Energy Finance Market: A Bibliometric and Content Analysis. Journal of Risk and Financial Management, 18(11), 634. https://doi.org/10.3390/jrfm18110634