Short-Term Impact of COVID-19 on Indian Stock Market

Abstract

:1. Introduction

2. Literature Review

3. Data and Methodology

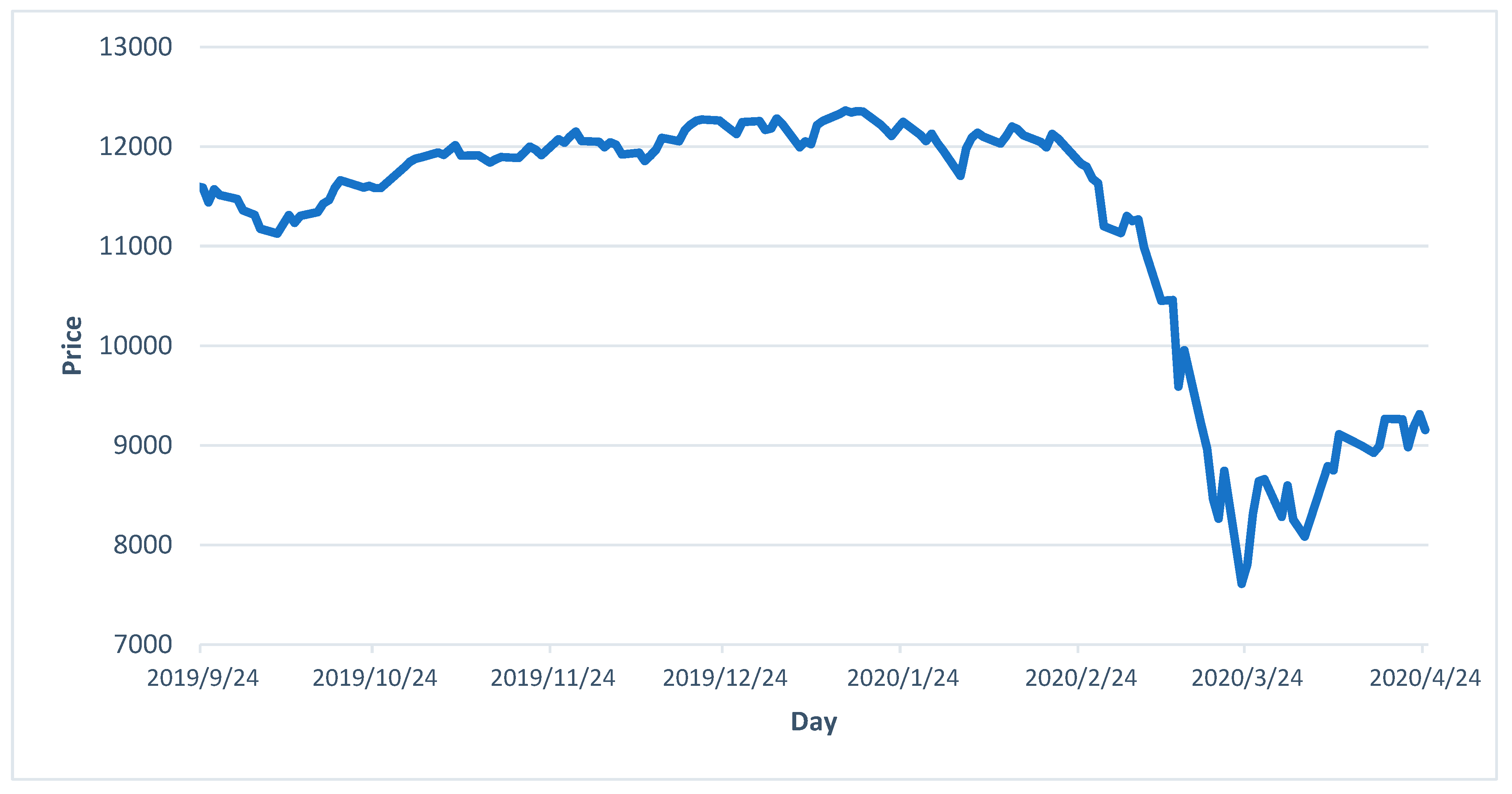

3.1. Data

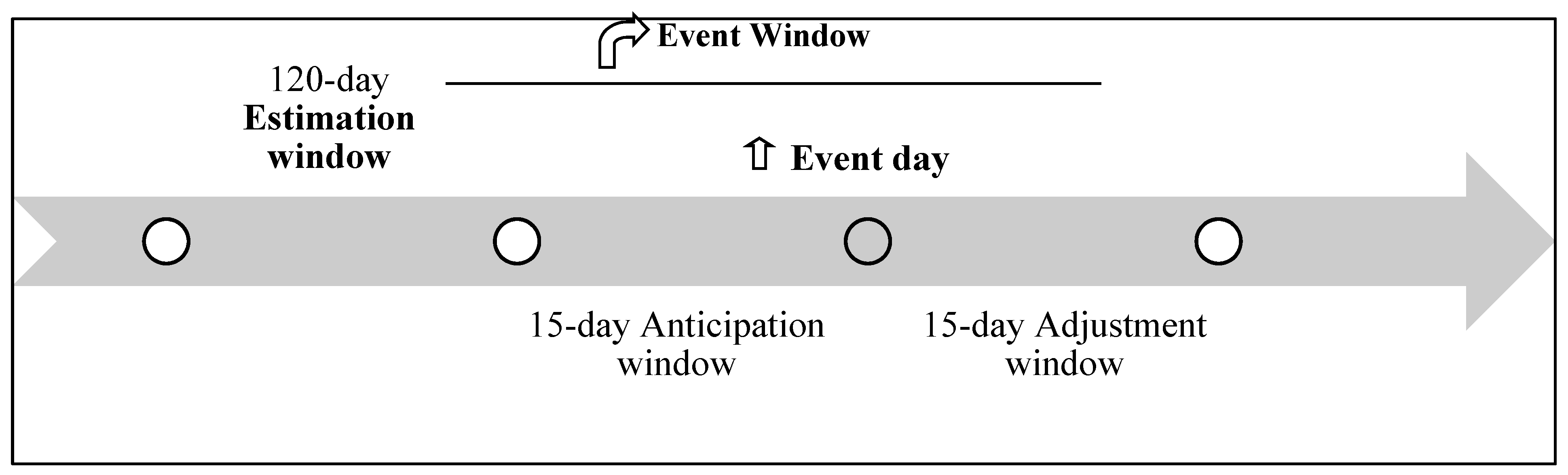

3.2. Methodology

3.2.1. Constant Mean Return Model

3.2.2. Market Model

3.2.3. Market Adjusted Model

4. Results and Discussions

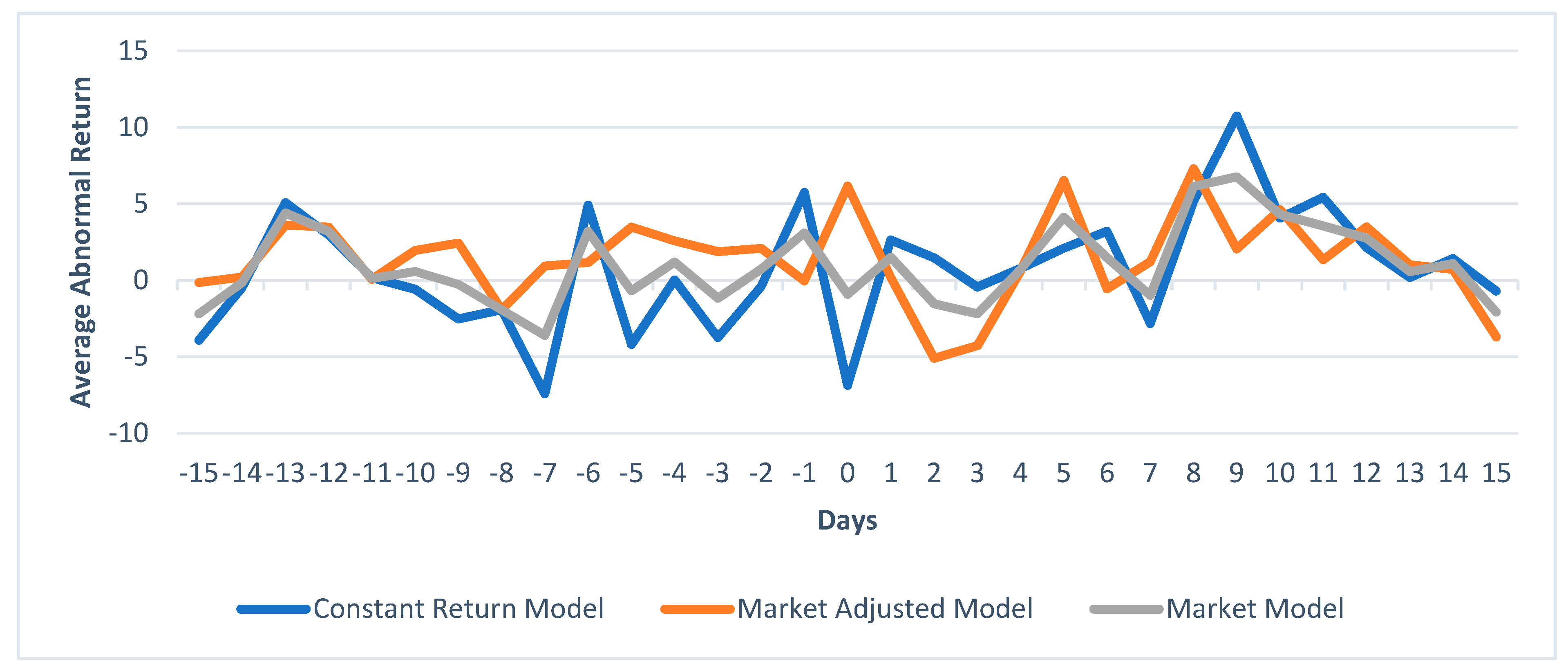

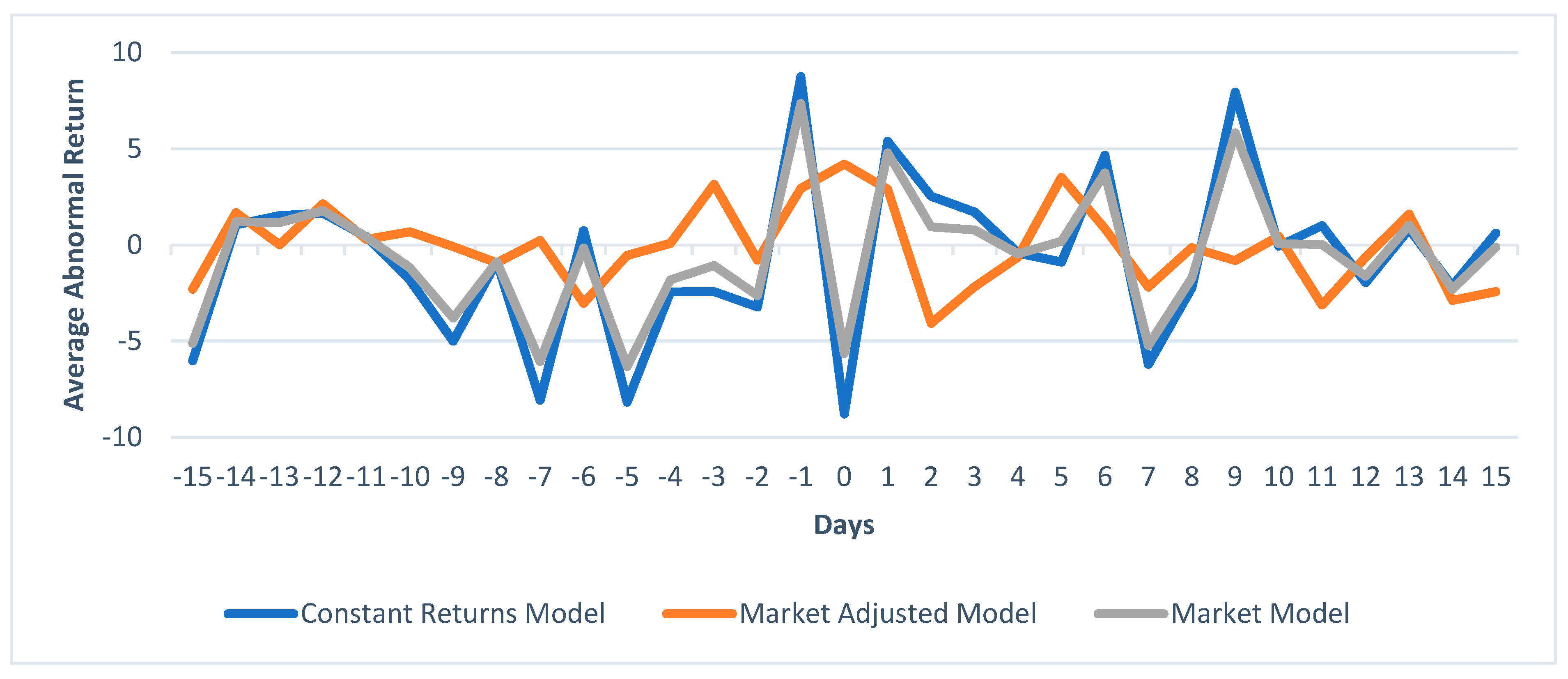

4.1. Average Abnormal Returns from NIFTY50 Index Components

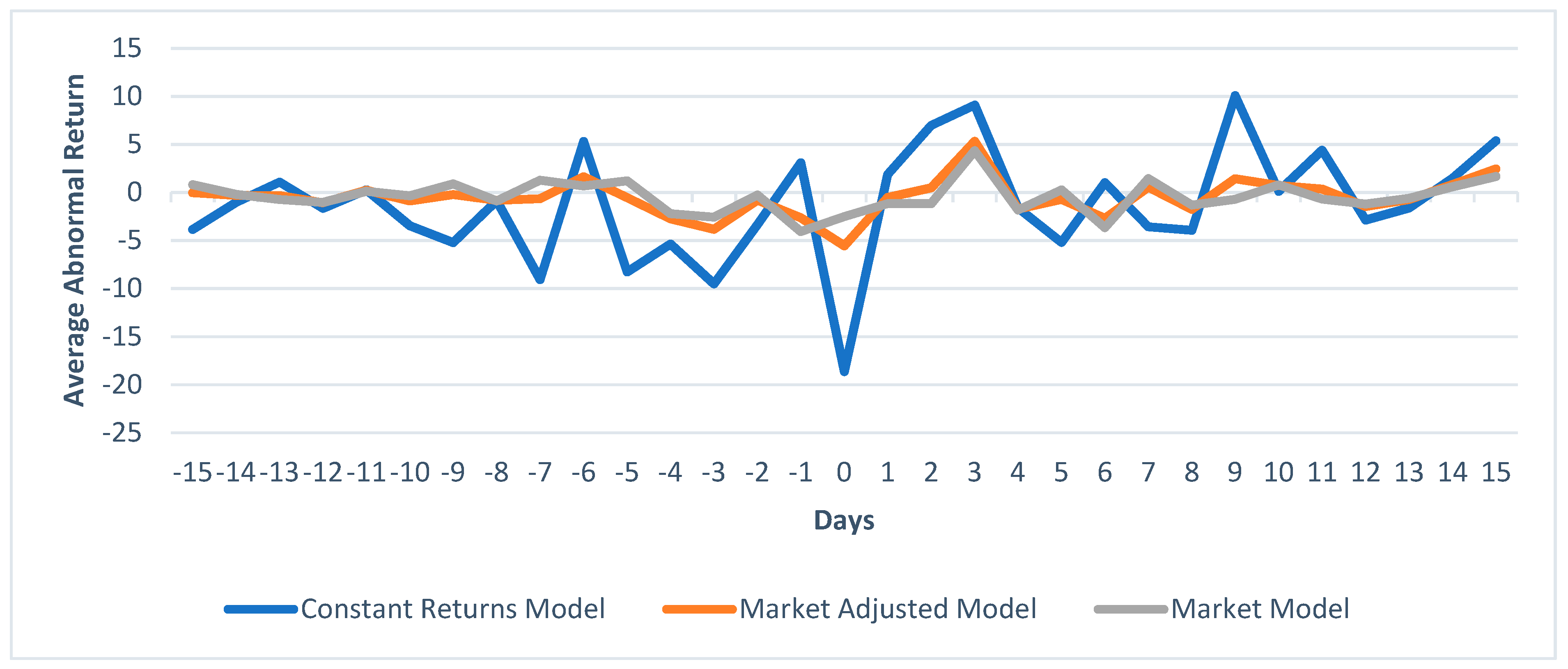

4.2. Impact of the Pandemic in Different Sectors of the NIFTY50 Index

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | https://www.moneycontrol.com/ (accessed on 1 February 2021). |

| 2 | National Stock Exchange. |

| 3 | Financial express. |

| 4 | KPMG Global: The impact of COVID-19 on the banking sector. |

References

- Adda, Jérôme. 2016. Economic activity and the spread of viral diseases: Evidence from high frequency data. The Quarterly Journal of Economics 131: 891–941. [Google Scholar] [CrossRef] [Green Version]

- Alam, Mohammad Noor, Md Shabbir Alam, and Kavita Chavali. 2020. Stock market response during COVID-19 lockdown period in India: An event study. The Journal of Asian Finance, Economics, and Business 7: 131–37. [Google Scholar] [CrossRef]

- Al-Awadhi, Abdullah M., Khaled Alsaifi, Ahmad Al-Awadhi, and Salah Alhammadi. 2020. Death and contagious infectious diseases: Impact of the COVID-19 virus on stock market returns. Journal of Behavioral and Experimental Finance 27: 100326. [Google Scholar] [CrossRef] [PubMed]

- Albuquerque, Rui, Yrjo Koskinen, Shuai Yang, and Chendi Zhang. 2020. Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash. The Review of Corporate Finance Studies 9: 593–621. [Google Scholar] [CrossRef]

- Arin, K. Peren, Davide Ciferri, and Nicola Spagnolo. 2008. The price of terror: The effects of terrorism on stock market returns and volatility. Economics Letters 101: 164–67. [Google Scholar] [CrossRef]

- Ashley, John W. 1962. Stock prices and changes in earnings and dividends: Some empirical results. Journal of Political Economy 70: 82–85. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J Davis, Kyle Kost, Marco Sammon, and Tasaneeya Viratyosin. 2020. The unprecedented stock market reaction to COVID-19. The Review of Asset Pricing Studies 10: 742–58. [Google Scholar] [CrossRef]

- Ball, Ray, and Philip Brown. 1968. An empirical evaluation of accounting income numbers. Journal of Accounting Research, 159–78. [Google Scholar] [CrossRef] [Green Version]

- Barker, C. Austin. 1956. Effective stock splits. Harvard Business Review 34: 101–6. [Google Scholar]

- Bash, Ahmad, and Khaled Alsaifi. 2019. Fear from uncertainty: An event study of Khashoggi and stock market returns. Journal of Behavioral and Experimental Finance 23: 54–58. [Google Scholar] [CrossRef]

- Beaulieu, Marie-Claude, Jean-Claude Cosset, and Naceur Essaddam. 2006. Political uncertainty and stock market returns: Evidence from the 1995 Quebec referendum. Canadian Journal of Economics/Revue Canadienne D’économique 39: 621–42. [Google Scholar] [CrossRef]

- Binder, John. 1998. The event study methodology since 1969. Review of Quantitative Finance and Accounting 11: 111–37. [Google Scholar] [CrossRef]

- Bora, Debakshi, and Daisy Basistha. 2021. The outbreak of COVID-19 pandemic and its impact on stock market volatility: Evidence from a worst-affected economy. Journal of Public Affairs, e2623. [Google Scholar] [CrossRef] [PubMed]

- Brown, Stephen J., and Jerold B. Warner. 1980. Measuring security price performance. Journal of Financial Economics 8: 205–58. [Google Scholar] [CrossRef]

- Brown, Stephen J., and Jerold B. Warner. 1985. Using daily stock returns: The case of event studies. Journal of Financial Economics 14: 3–31. [Google Scholar] [CrossRef]

- Cepoi, Cosmin-Octavian. 2020. Asymmetric dependence between stock market returns and news during COVID-19 financial turmoil. Finance Research Letters 36: 101658. [Google Scholar] [CrossRef] [PubMed]

- Chen, Ming-Hsiang, SooCheong Shawn Jang, and Woo Gon Kim. 2007. The impact of the SARS outbreak on Taiwanese hotel stock performance: An event-study approach. International Journal of Hospitality Management 26: 200–12. [Google Scholar] [CrossRef] [PubMed]

- Conlon, Thomas, and Richard McGee. 2020. Safe haven or risky hazard? Bitcoin during the COVID-19 bear market. Finance Research Letters 35: 101607. [Google Scholar] [CrossRef]

- Conlon, Thomas, Shaen Corbet, and Richard J. McGee. 2020. Are cryptocurrencies a safe haven for equity markets? An international perspective from the COVID-19 pandemic. Research in International Business and Finance 54: 101248. [Google Scholar] [CrossRef]

- Corrado, Charles J. 2011. Event studies: A methodology review. Accounting & Finance 51: 207–34. [Google Scholar]

- De Bandt, Olivier, and Philipp Hartmann. 2000. Systemic Risk: A Survey. European Central Bank Working Paper No. 35. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp035.pdf (accessed on 1 April 2021).

- De Bandt, Werner F. M., and Richard H. Thaler. 1987. Further evidence on investor overreaction and stockmarket sensitivity. Journal of Finance 42: 557–81. [Google Scholar] [CrossRef]

- Dolley, James C. 1933. Open market buying as a stimulant for the bond market. Journal of Political Economy 41: 513–29. [Google Scholar] [CrossRef]

- Drakos, Konstantinos. 2010. Terrorism activity, investor sentiment, and stock returns. Review of Financial Economics 19: 128–35. [Google Scholar] [CrossRef]

- Duca, Marco Lo, and Tuomas A. Peltonen. 2013. Assessing systemic risks and predicting systemic events. Journal of Banking & Finance 37: 2183–95. [Google Scholar]

- Fama, Eugene F. 1991. Time, salary, and incentive payoffs in labor contracts. Journal of Labor Economics 9: 25–4. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1995. Size and book-to-market factors in earnings and returns. The Journal of Finance 50: 131–55. [Google Scholar] [CrossRef]

- Fama, Eugene F., Lawrence Fisher, Michael C. Jensen, and Richard Roll. 1969. The adjustment of stock prices to new information. International Economic Review 10: 1–21. [Google Scholar] [CrossRef]

- Goh, Carey, and Rob Law. 2002. Modeling and forecasting tourism demand for arrivals with stochastic nonstationary seasonality and intervention. Tourism Management 23: 499–510. [Google Scholar] [CrossRef]

- Goldberg, Pinelopi Koujianou, and Tristan Reed. 2020. The effects of the coronavirus pandemic in emerging market and developing economies: An optimistic preliminary account. Brookings Papers on Economic Activity 2020: 161–235. [Google Scholar] [CrossRef]

- Gormsen, Niels Joachim, and Ralph S. J. Koijen. 2020. Coronavirus: Impact on stock prices and growth expectations. The Review of Asset Pricing Studies 10: 574–97. [Google Scholar] [CrossRef]

- Guru, Biplab Kumar, and Amarendra Das. 2021. COVID-19 and uncertainty spillovers in Indian stock market. MethodsX 8: 101199. [Google Scholar] [CrossRef] [PubMed]

- Harjoto, Maretno Agus, Fabrizio Rossi, and John K. Paglia. 2021. COVID-19: Stock market reactions to the shock and the stimulus. Applied Economics Letters 28: 795–801. [Google Scholar] [CrossRef]

- He, Pinglin, Yulong Sun, Ying Zhang, and Tao Li. 2020. COVID–19′s impact on stock prices across different sectors—An event study based on the Chinese stock market. Emerging Markets Finance and Trade 56: 2198–212. [Google Scholar] [CrossRef]

- Hendricks, Kevin B., and Vinod R. Singhal. 2003. The effect of supply chain glitches on shareholder wealth. Journal of Operations Management 21: 501–22. [Google Scholar] [CrossRef]

- Ichev, Riste, and Matej Marinč. 2018. Stock prices and geographic proximity of information: Evidence from the Ebola outbreak. International Review of Financial Analysis 56: 153–66. [Google Scholar] [CrossRef]

- Iyke, Bernard Njindan. 2020. Economic policy uncertainty in times of COVID-19 pandemic. Asian Economics Letters 1: 17665. [Google Scholar]

- Kawashima, Shingo, and Fumiko Takeda. 2012. The effect of the Fukushima nuclear accident on stock prices of electric power utilities in Japan. Energy Economics 34: 2029–38. [Google Scholar] [CrossRef]

- Kothari, Sagar P., and Jerold B. Warner. 2006. Econometrics of event studies. In Handbook of Corporate Finance: Empirical Corporate Finance, Forthcoming (vol. A, ch. 1.). Edited by Espen Eckbo. Handbooks in Finance Series; Amsterdam: Elsevier. [Google Scholar]

- Lee, Wayne Y., Christine X. Jiang, and Daniel C. Indro. 2002. Stock market volatility, excess returns, and the role of investor sentiment. Journal of Banking & Finance 26: 2277–99. [Google Scholar]

- Liu, H., Aqsa Manzoor, CangYu Wang, Lei Zhang, and Zaira Manzoor. 2020. The COVID-19 outbreak and affected countries stock markets response. International Journal of Environmental Research and Public Health 17: 2800. [Google Scholar] [CrossRef] [Green Version]

- Lyon, John D., Brad M. Barber, and Chih-Ling Tsai. 1999. Improved methods for tests of long-run abnormal stock returns. The Journal of Finance 54: 165–201. [Google Scholar] [CrossRef]

- Mackinlay, A. Craig. 1997. Event studies in economics and finance. Journal of Economic Literature 35: 13–39. [Google Scholar]

- Maiti, Moinak, Darko Vuković, Amrit Mukherjee, Pavan D. Paikarao, and Janardan Krishna Yadav. 2021. Advanced data integration in banking, financial, and insurance software in the age of COVID-19. Software: Practice and Experience. [Google Scholar] [CrossRef]

- Maiti, Moinak, Zoran Grubisic, and Darko B. Vukovic. 2020. Dissecting Tether’s Nonlinear Dynamics during COVID-19. Journal of Open Innovation: Technology, Market, and Complexity 6: 161. [Google Scholar] [CrossRef]

- Maiti, Moinak. 2020. A critical review on evolution of risk factors and factor models. Journal of Economic Surveys 34: 175–84. [Google Scholar] [CrossRef]

- Maiti, Moinak. 2021. Threshold Autoregression. In Applied Financial Econometrics. Singapore: Palgrave Macmillan. [Google Scholar] [CrossRef]

- McWilliams, Abagail, and Donald Siegel. 1997. Event studies in management research: Theoretical and empirical issues. Academy of Management Journal 40: 626–57. [Google Scholar]

- Moskowitz, Tobias J., and Mark Grinblatt. 1999. Do industries explain momentum? The Journal of Finance 54: 1249–90. [Google Scholar] [CrossRef]

- Myers, John H., and Archie J. Bakay. 1948. Influence of stock split-ups on market price. Harvard Business Review 26: 251–55. [Google Scholar]

- Orleéan, André. 2004. What is a collective belief? In Cognitive Economics. Edited by Paul Bourgine and Jean-Pierre Nadal. Berlin/Heidelberg and New York: Springer, pp. 199–212. [Google Scholar]

- Orleéan, André. 2008. Knowledge in finance: Objective value versus convention. In Handbook of Knowledge and Economics. Edited by Richard Arena and Agnès Festré. Cheltenham and Northampton: Edward Elgar. [Google Scholar]

- Ozili, Peterson K., and Thankom Arun. 2020. Spillover of COVID-19: Impact on the Global Economy. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3562570 (accessed on 1 April 2021).

- Ramelli, Stefano, and Alexander F. Wagner. 2020. Feverish stock price reactions to COVID-19. The Review of Corporate Finance Studies 9: 622–55. [Google Scholar] [CrossRef]

- Salisu, Afees A., and Xuan Vinh Vo. 2020. Predicting stock returns in the presence of COVID-19 pandemic: The role of health news. International Review of Financial Analysis 71: 101546. [Google Scholar] [CrossRef]

- SG, Janani Sri, and Parthajit Kayal. 2020. Going Beyond Gold: Can Equities be Safe-Haven? Madras School of Economics Working Paper no. 203. Available online: https://www.mse.ac.in/wp-content/uploads/2020/11/Working-Paper-203.pdf (accessed on 1 April 2021).

- Shankar, Rishika, and Priti Dubey. 2021. Indian Stock Market during the COVID-19 Pandemic: Vulnerable or Resilient?: Sectoral analysis. Organizations and Markets in Emerging Economies 12: 131–59. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. The Journal of Finance 19: 425–42. [Google Scholar]

- Thanh, Su Dinh, Nguyen Phuc Canh, and Moinak Maiti. 2020. Asymmetric effects of unanticipated monetary shocks on stock prices: Emerging market evidence. Economic Analysis and Policy 65: 40–55. [Google Scholar] [CrossRef]

- Topcu, Mert, and Omer Serkan Gulal. 2020. The impact of COVID-19 on emerging stock markets. Finance Research Letters 36: 101691. [Google Scholar] [CrossRef] [PubMed]

- Verma, Rakesh Kumar, Abhishek Kumar, and Rohit Bansal. 2021. Impact of COVID-19 on Different Sectors of the Economy Using Event Study Method: An Indian Perspective. Journal of Asia-Pacific Business 22: 109–20. [Google Scholar] [CrossRef]

- Vukovic, Darko, Moinak Maiti, Zoran Grubisic, Elena M. Grigorieva, and Michael Frömmel. 2021. COVID-19 Pandemic: Is the Crypto Market a Safe Haven? The Impact of the First Wave. Sustainability 13: 8578. [Google Scholar] [CrossRef]

- World Economic Forum. 2018. Global Risk Report 2018. Available online: https://www.weforum.org/reports/the-global-risks-report-2018 (accessed on 1 April 2021).

- Zhang, Dayong, Min Hu, and Qiang Ji. 2020. Financial markets under the global pandemic of COVID-19. Finance Research Letters 36: 101528. [Google Scholar] [CrossRef] [PubMed]

| Constant Return Model | |||

|---|---|---|---|

| Day | AAR | p-Value | Median |

| −15 | −3.9075 | 0.0003 | −3.7883 |

| −14 | −0.9435 | 0.3461 | −0.8835 |

| −13 | 2.5322 | 0.0138 | 1.9477 |

| −12 | −0.3179 | 0.7499 | −0.3824 |

| −11 | 0.1801 | 0.8567 | 0.0740 |

| −10 | −2.3608 | 0.0212 | −2.1408 |

| −9 | −4.3327 | 0.0001 | −4.3044 |

| −8 | −0.8893 | 0.3742 | −0.7925 |

| −7 | −8.4939 | 0.0000 | −8.1839 |

| −6 | 3.3572 | 0.0014 | 3.4589 |

| −5 | −6.9487 | 0.0000 | −6.8194 |

| −4 | −2.0126 | 0.0478 | −1.8790 |

| −3 | −5.4523 | 0.0000 | −5.0853 |

| −2 | −3.4991 | 0.0009 | −3.5709 |

| −1 | 5.7786 | 0.0000 | 5.9868 |

| 0 | −12.8067 | 0.0000 | −12.9117 |

| 1 | 2.1497 | 0.0351 | 1.6780 |

| 2 | 4.8656 | 0.0000 | 3.8818 |

| 3 | 3.7934 | 0.0004 | 2.9943 |

| 4 | −0.6171 | 0.5366 | −0.2112 |

| 5 | −2.7408 | 0.0080 | −2.5794 |

| 6 | 3.5554 | 0.0008 | 3.9330 |

| 7 | −3.4137 | 0.0012 | −3.5644 |

| 8 | −1.5683 | 0.1202 | −1.8574 |

| 9 | 8.7703 | 0.0000 | 8.8821 |

| 10 | 0.0995 | 0.9205 | −0.2617 |

| 11 | 4.1997 | 0.0001 | 3.7250 |

| 12 | −0.6202 | 0.5346 | −0.9234 |

| 13 | 0.2874 | 0.7732 | 0.0819 |

| 14 | 0.9406 | 0.3475 | 1.2790 |

| 15 | 2.0956 | 0.0397 | 1.3415 |

| Market Adjusted Model | Market Model | |||||

|---|---|---|---|---|---|---|

| Day | AAR | p-Value | Median | AAR | p-Value | Median |

| −15 | −0.1293 | 0.6178 | 0.0564 | −0.1388 | 0.5922 | −0.0822 |

| −14 | −0.2589 | 0.3197 | −0.1646 | −0.2764 | 0.2883 | −0.3256 |

| −13 | 1.0688 | 0.0001 | 0.4584 | 1.0458 | 0.0002 | 0.5044 |

| −12 | 0.2134 | 0.4113 | 0.0782 | 0.1955 | 0.4514 | 0.2275 |

| −11 | 0.0887 | 0.7320 | 0.0540 | 0.0692 | 0.7893 | −0.0144 |

| −10 | 0.1885 | 0.4675 | 0.4055 | 0.1758 | 0.4979 | 0.1528 |

| −9 | 0.6315 | 0.0178 | 0.7591 | 0.6250 | 0.0189 | 1.0219 |

| −8 | −0.8871 | 0.0012 | −0.7450 | −0.9064 | 0.0009 | −0.8152 |

| −7 | −0.1233 | 0.6341 | 0.1617 | −0.1210 | 0.6405 | −0.1552 |

| −6 | −0.3807 | 0.1457 | −0.3582 | −0.4097 | 0.1180 | −0.4701 |

| −5 | 0.7320 | 0.0065 | 0.8211 | 0.7326 | 0.0065 | 0.7971 |

| −4 | 0.5606 | 0.0343 | 0.7200 | 0.5479 | 0.0384 | 0.6191 |

| −3 | 0.1728 | 0.5054 | 0.5783 | 0.1680 | 0.5172 | −0.5460 |

| −2 | −1.0057 | 0.0003 | −1.0815 | −1.0186 | 0.0002 | −1.0812 |

| −1 | 0.0143 | 0.9559 | 0.1633 | −0.0198 | 0.9389 | −0.3792 |

| 0 | 0.2424 | 0.3511 | 0.1772 | 0.2568 | 0.3235 | 0.0706 |

| 1 | −0.2888 | 0.2675 | −0.6913 | −0.3144 | 0.2279 | −0.7162 |

| 2 | −1.6905 | 0.0000 | −2.6865 | −1.7267 | 0.0000 | −1.5993 |

| 3 | −0.0285 | 0.9125 | −0.6826 | −0.0576 | 0.8239 | −0.5200 |

| 4 | −0.7660 | 0.0045 | −0.3449 | −0.7857 | 0.0037 | −0.4052 |

| 5 | 1.7059 | 0.0000 | 1.7648 | 1.6981 | 0.0000 | 1.7452 |

| 6 | −0.1997 | 0.4417 | 0.3024 | −0.2287 | 0.3788 | 0.8310 |

| 7 | 0.6553 | 0.0141 | 0.3035 | 0.6466 | 0.0154 | 0.9920 |

| 8 | 0.5600 | 0.0345 | 0.2276 | 0.5462 | 0.0390 | 0.2145 |

| 9 | 0.0757 | 0.7701 | 0.2106 | 0.0339 | 0.8957 | 0.6737 |

| 10 | 0.6623 | 0.0132 | 0.3425 | 0.6445 | 0.0157 | 0.2997 |

| 11 | 0.1174 | 0.6504 | −0.4657 | 0.0876 | 0.7351 | −0.2594 |

| 12 | 0.7440 | 0.0057 | 0.4835 | 0.7282 | 0.0068 | 0.2387 |

| 13 | 1.1182 | 0.0001 | 0.7501 | 1.1011 | 0.0001 | 0.6618 |

| 14 | 0.2529 | 0.3308 | 0.6241 | 0.2319 | 0.3722 | 0.5030 |

| 15 | −0.8821 | 0.0012 | −1.6177 | −0.9091 | 0.0009 | −1.7541 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Varma, Y.; Venkataramani, R.; Kayal, P.; Maiti, M. Short-Term Impact of COVID-19 on Indian Stock Market. J. Risk Financial Manag. 2021, 14, 558. https://doi.org/10.3390/jrfm14110558

Varma Y, Venkataramani R, Kayal P, Maiti M. Short-Term Impact of COVID-19 on Indian Stock Market. Journal of Risk and Financial Management. 2021; 14(11):558. https://doi.org/10.3390/jrfm14110558

Chicago/Turabian StyleVarma, Yashraj, Renuka Venkataramani, Parthajit Kayal, and Moinak Maiti. 2021. "Short-Term Impact of COVID-19 on Indian Stock Market" Journal of Risk and Financial Management 14, no. 11: 558. https://doi.org/10.3390/jrfm14110558

APA StyleVarma, Y., Venkataramani, R., Kayal, P., & Maiti, M. (2021). Short-Term Impact of COVID-19 on Indian Stock Market. Journal of Risk and Financial Management, 14(11), 558. https://doi.org/10.3390/jrfm14110558