ISA 701 and Materiality Disclosure as Methods to Minimize the Audit Expectation Gap

Abstract

:“Capitalism without bankruptcy is like Christianity without hell”Frank Borman—American astronaut

1. Introduction

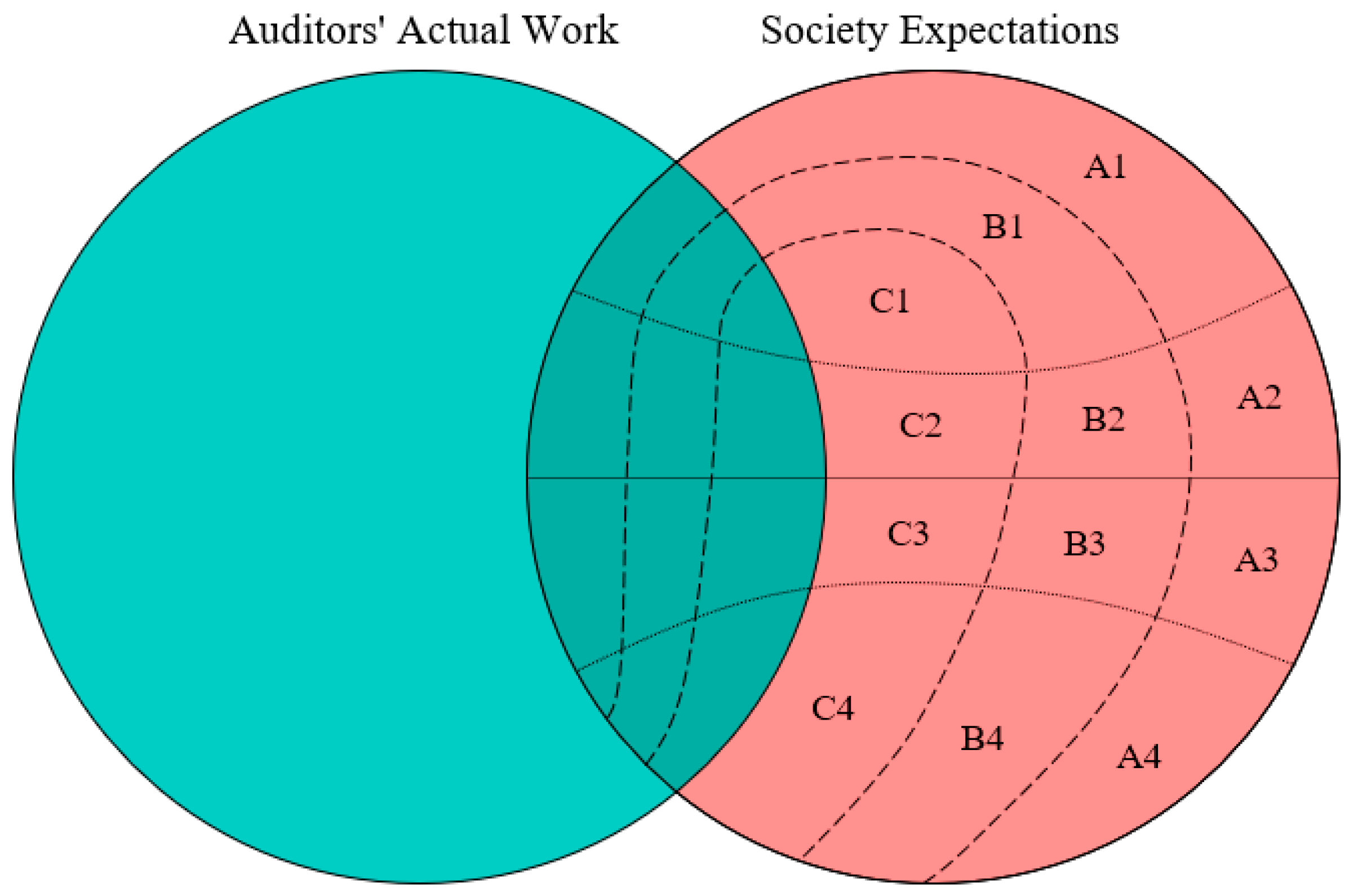

- reporting (area ‘1’),

- assurance being provided (area ‘2’),

- regulation and liability (area ‘3’),

- audit independence (area ‘4’).

2. Literature Review

- emphasing the need to educate the public and reassure them about the exaggerated public outcries over isolated audit failures,

- codifying existing practices to legitimize them,

- attempting to control the audit expectation gap debate and repeatedly propounding the views of the profession,

- emphasing an awareness of the objective of the audit,

- readiness to extend the scope of an audit.

- areas of higher risk of material misstatement or in which significant risks were identified (IAASB 2009e, ISA 315),

- financial statement areas, which involve substantial management judgment (e.g., accounting estimates),

- effects of significant events or transactions, which occurred during the audited period.

- discuss this with the engagement quality control reviewer (if appointed),

- explain in the report that there are no KAM to be reported, including the rationale for such a conclusion (IAASB 2009c, ISA 230),

- communicate this with those charged with governance.

3. Research Methodology

- annual consolidated financial statements (annual reports)4,

- independent auditor reports,

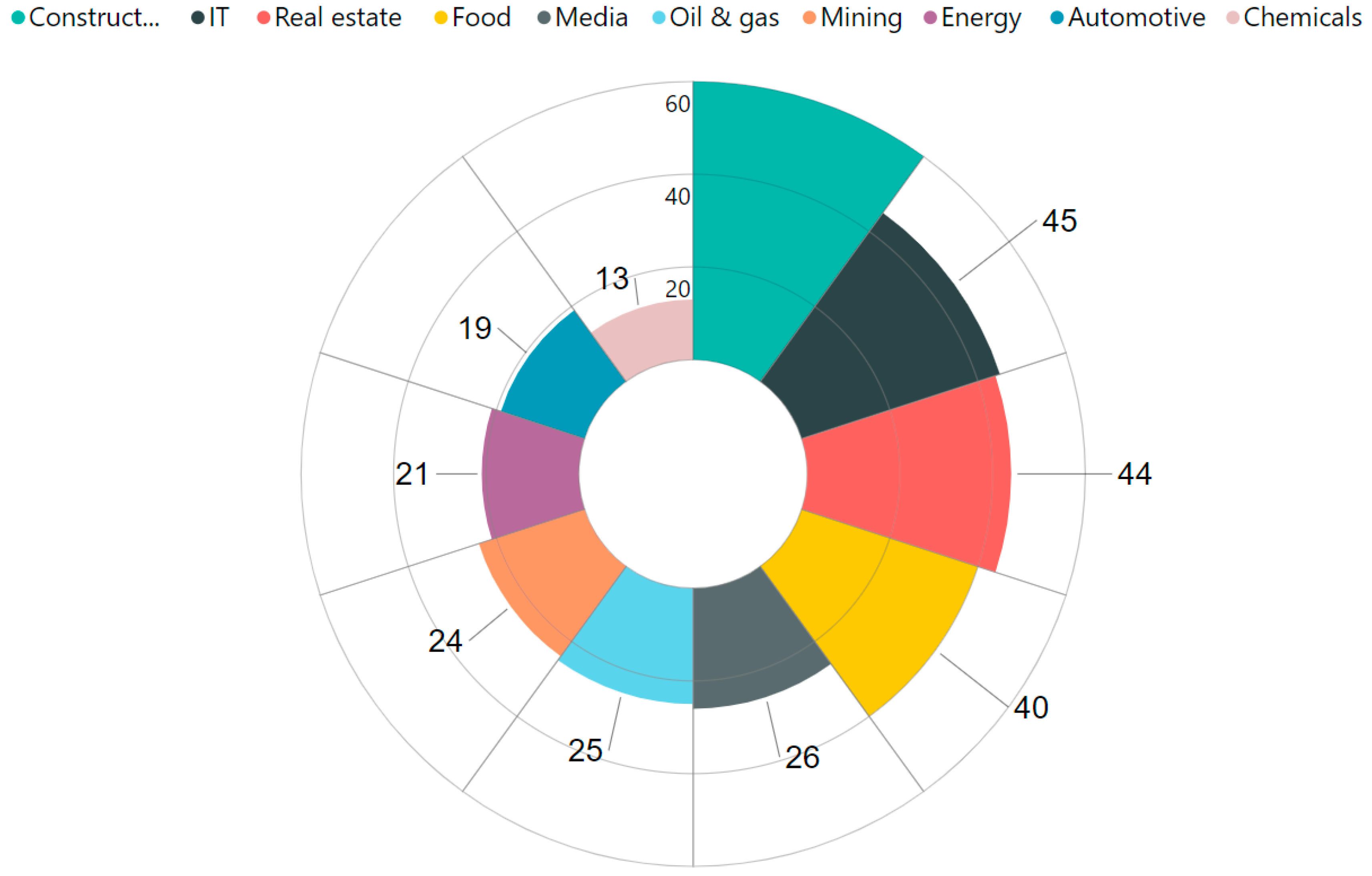

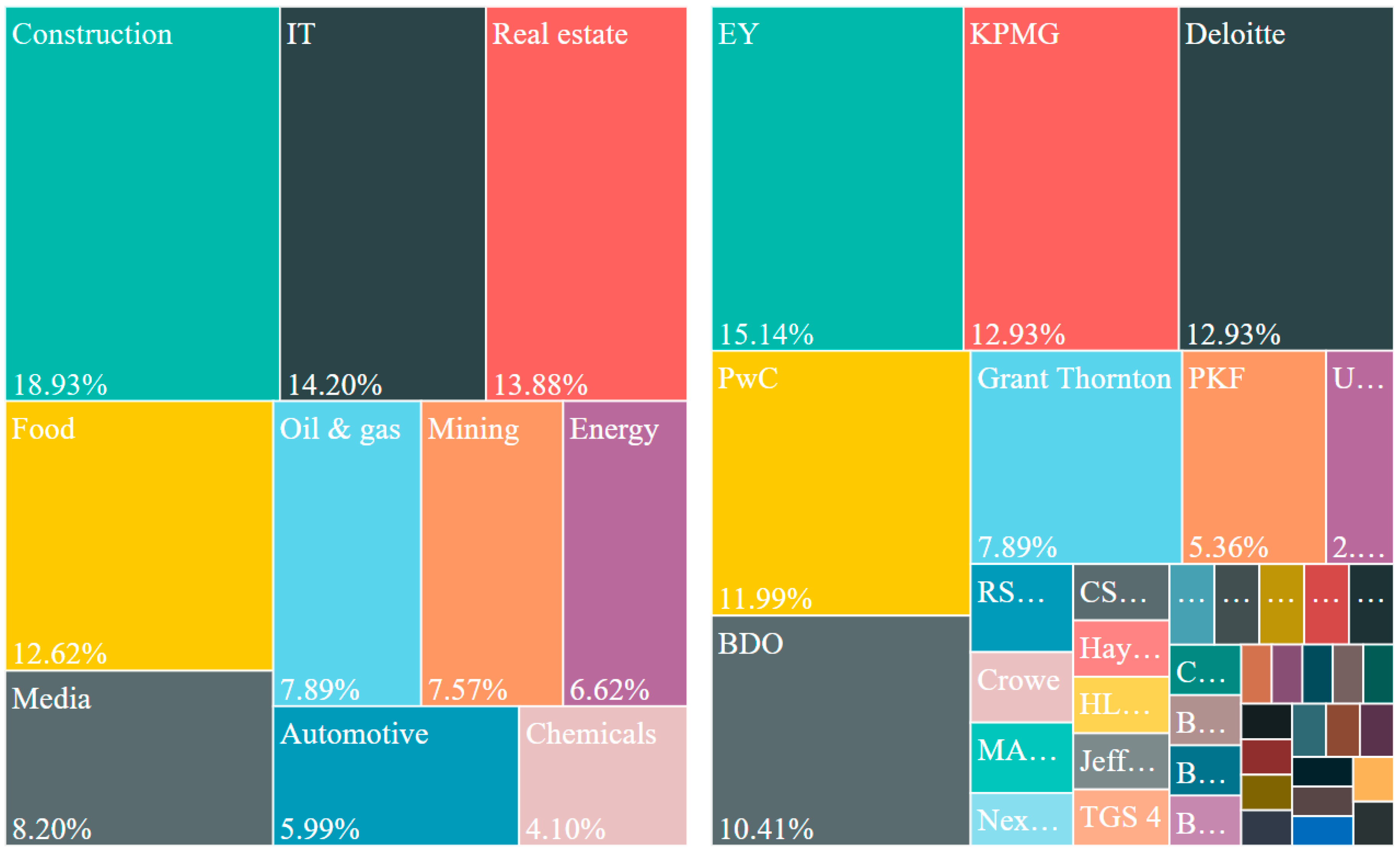

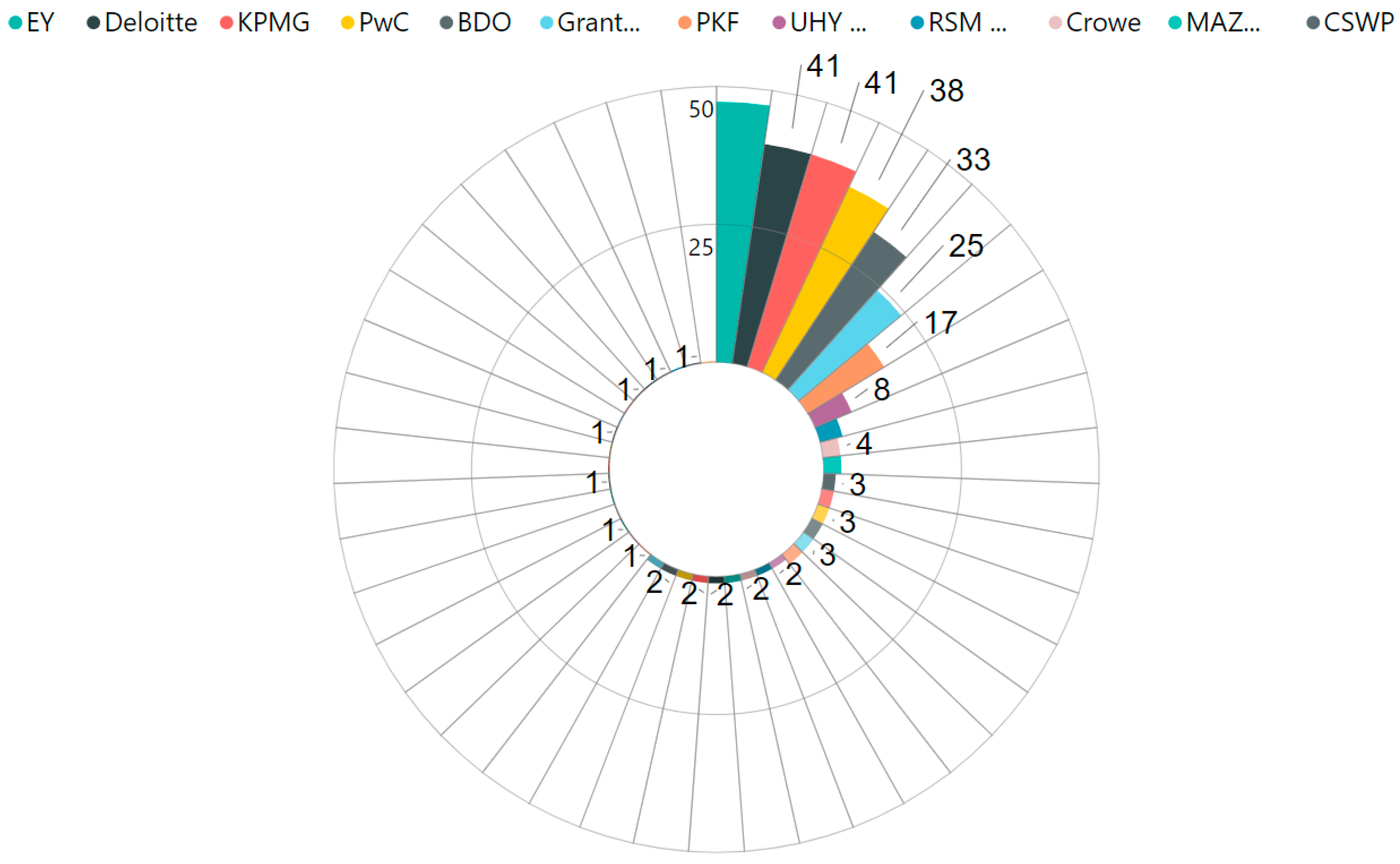

- BDO (33, i.e., 10%);

- Grant Thornton (25, i.e., 8%);

- PKF (17, i.e., 5%).

- values of selected financial statements line items;

- detailed description of all KAMs reported;

- overall materiality levels and applied calculation methods.

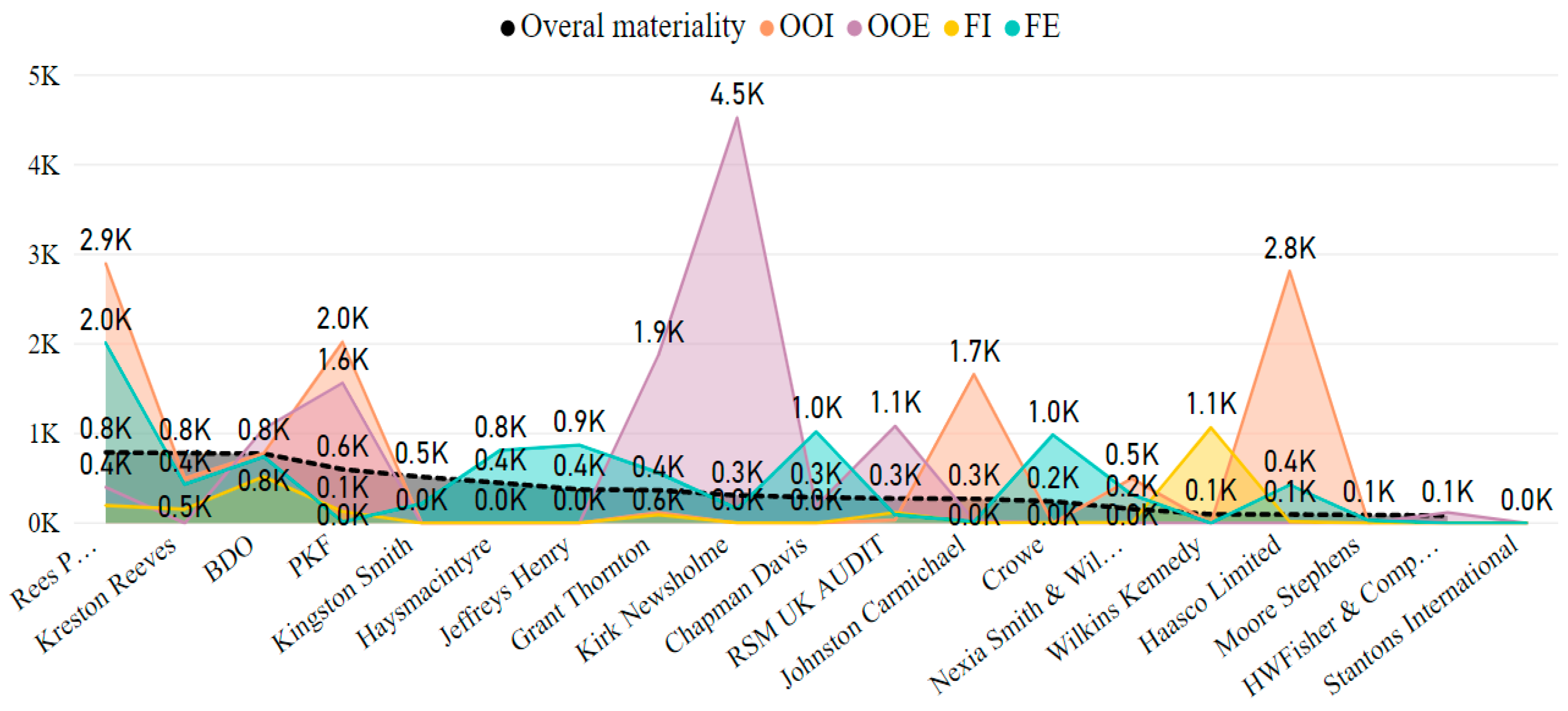

4. Presentation of Research Results

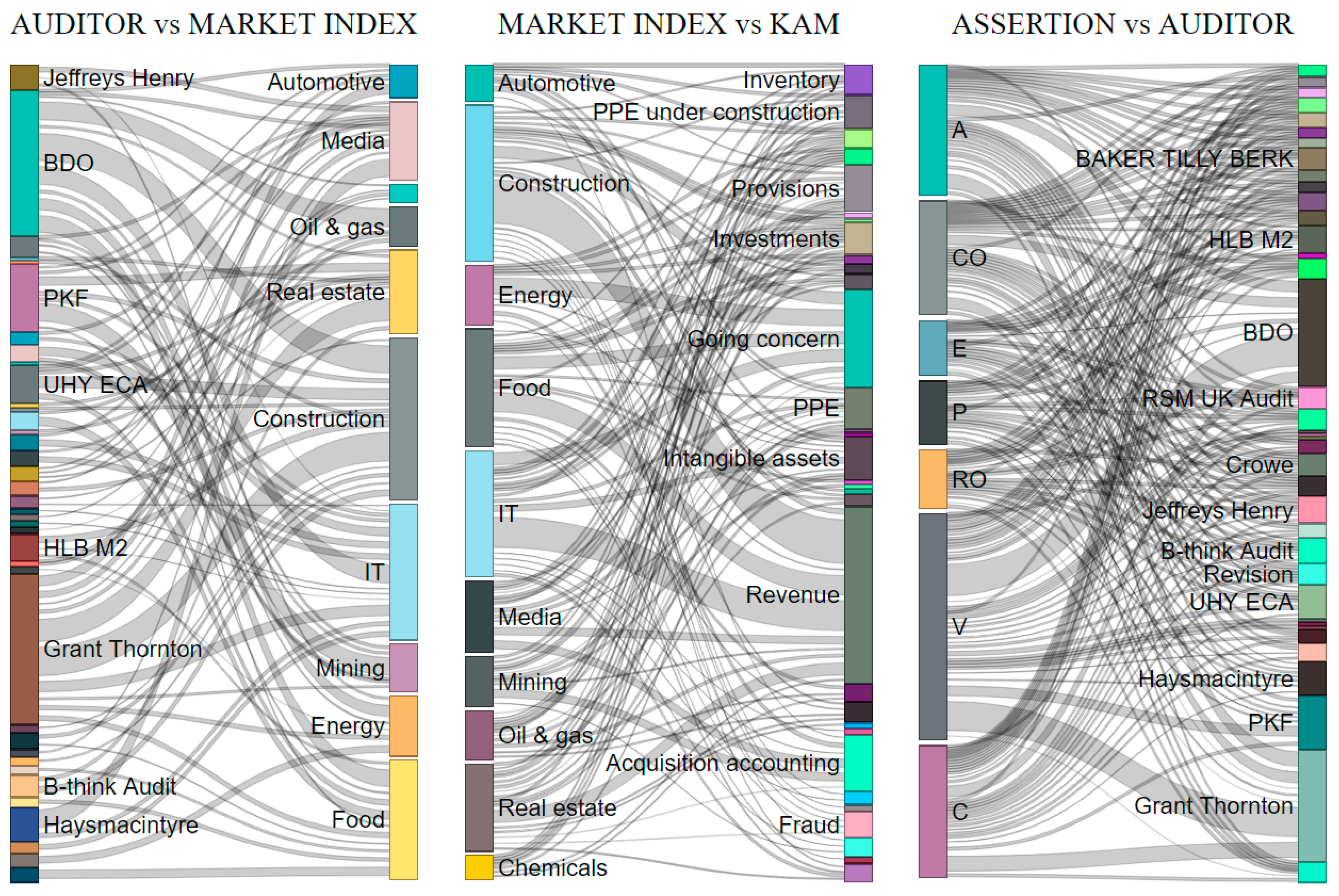

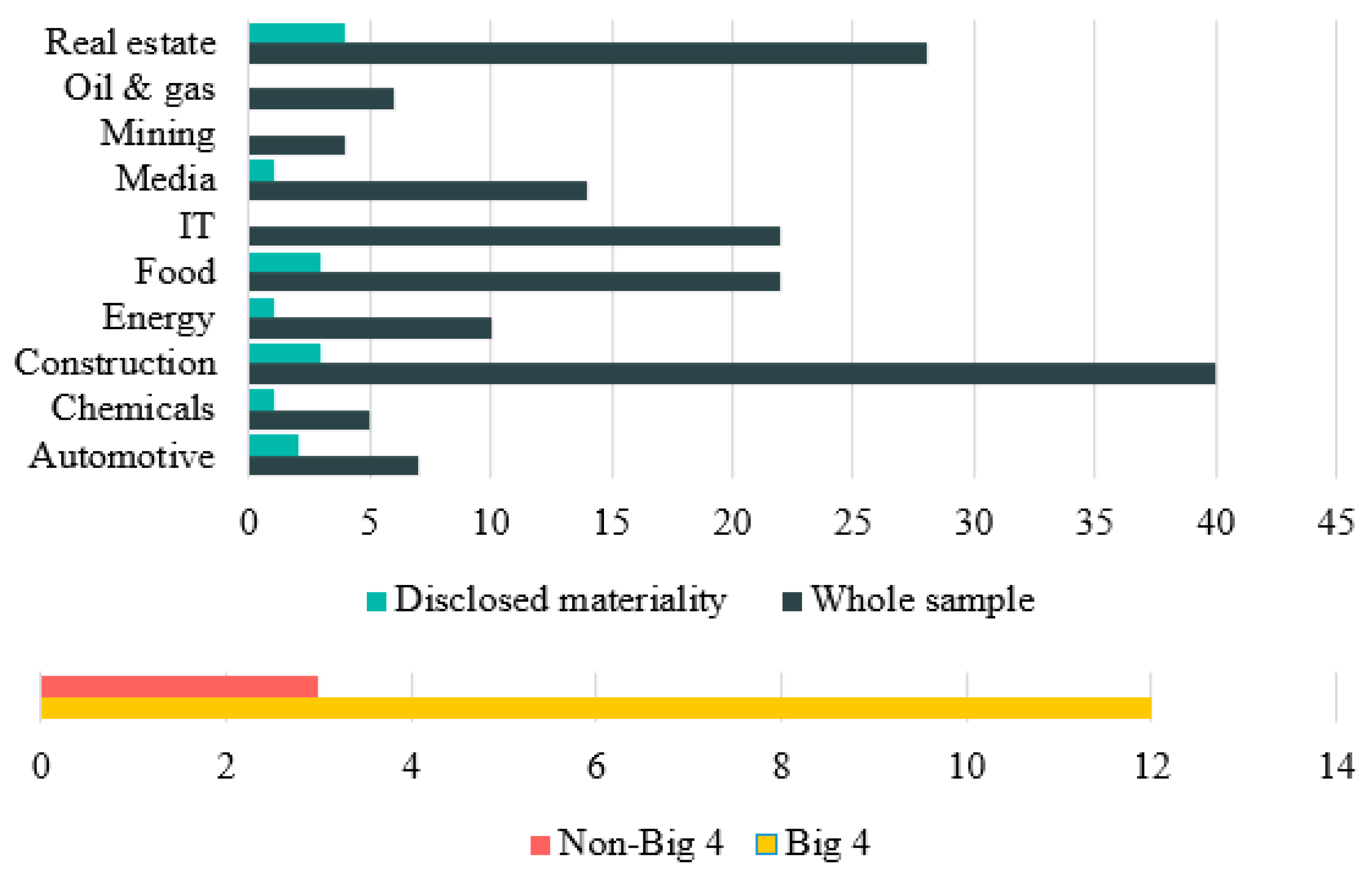

- for five businesses (1.6% of the tested sample) no KAMs were reported by the auditors,

- revenue is the most vastly used as a KAM category (45.3% of auditors’ reports contained this KAM),

- the following 9 KAMs referred to all seven assertions: accounting policy, acquisition accounting, covenants, discontinued operations, first time adoption, fraud, going concern, initial audit and initial public offering (IPO),

- the valuation was the most frequently appearing assertion (745 items from a total of 2094, 35.6%);

- there is no clear differentiation in terms of presented patterns between Big 4 and non-Big 4 audit firms.

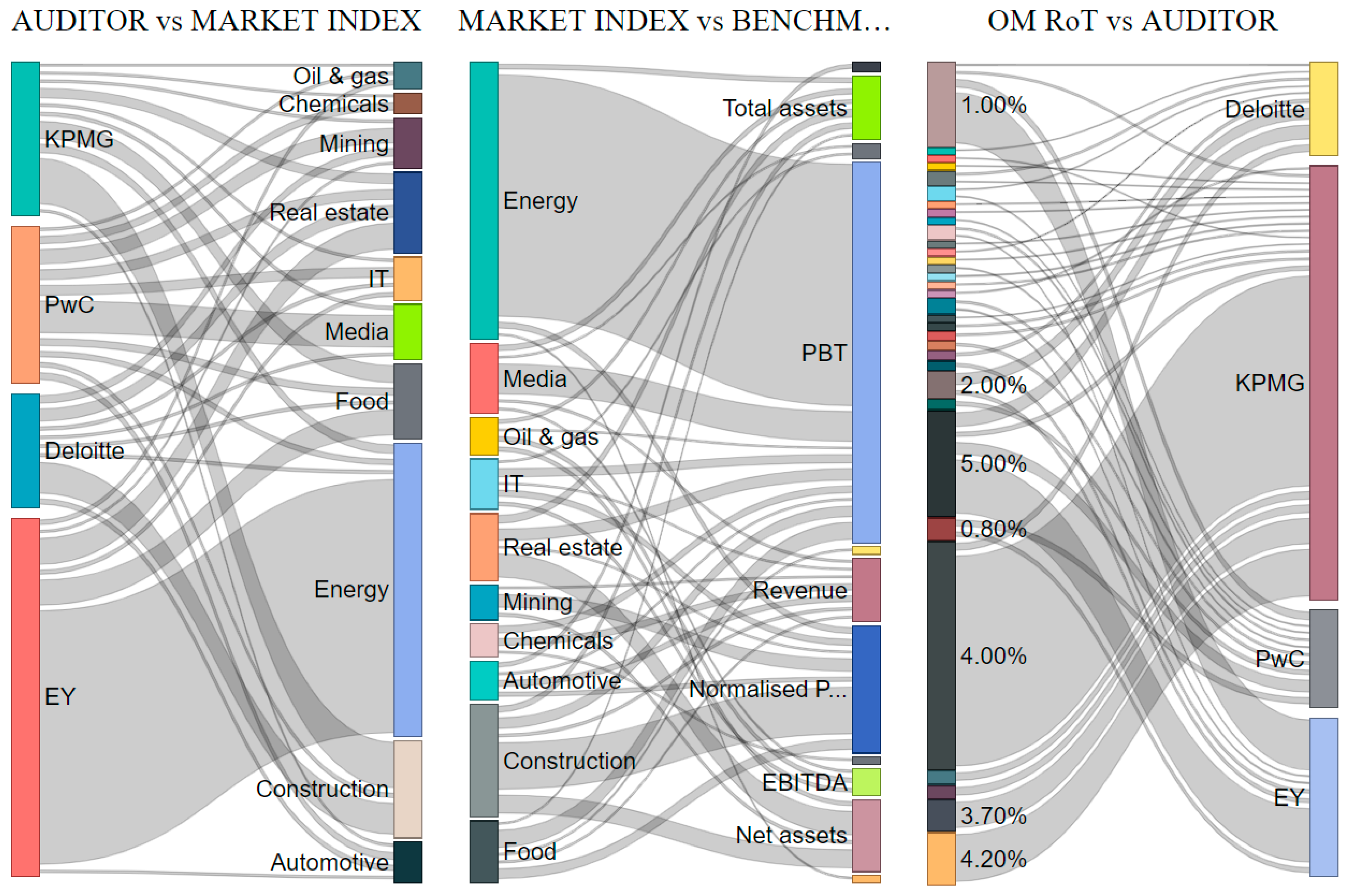

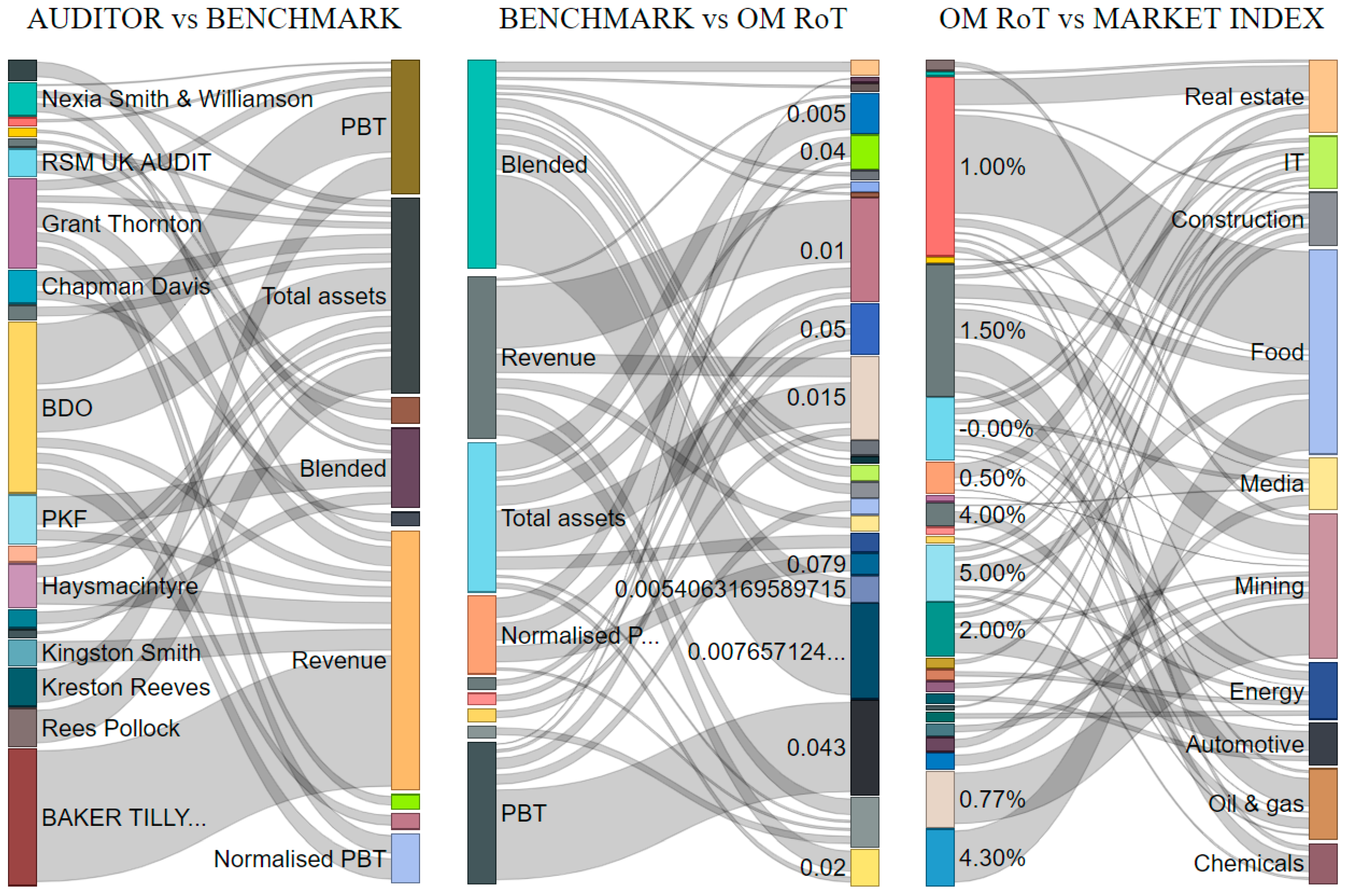

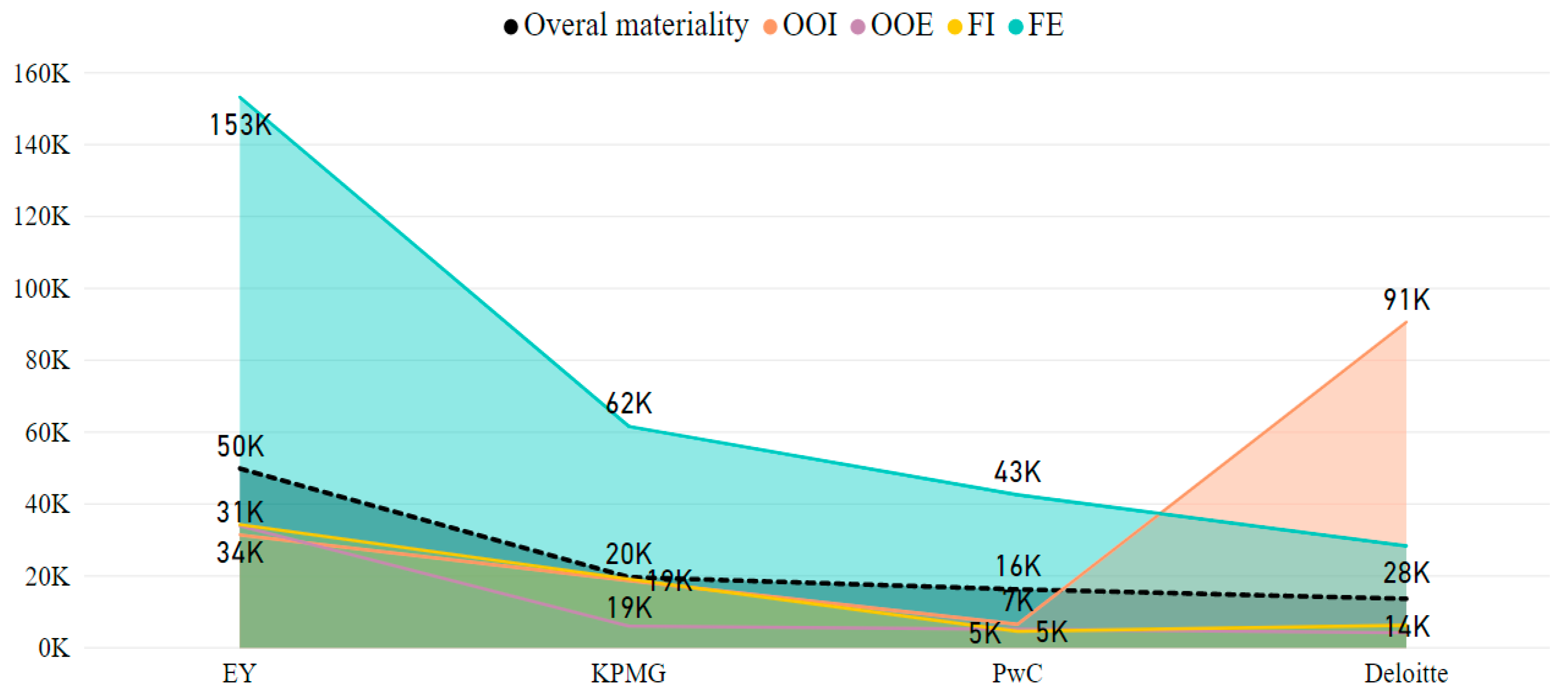

- coverage of sectors by Big 4 representatives was fairly even, with the exception of the energy, which was dominated by EY,

- specialization of auditors may be observed (Baker Tilly’s portfolio comprises mostly of food WIG) but no concentration over any particular auditor is visible within any sector,

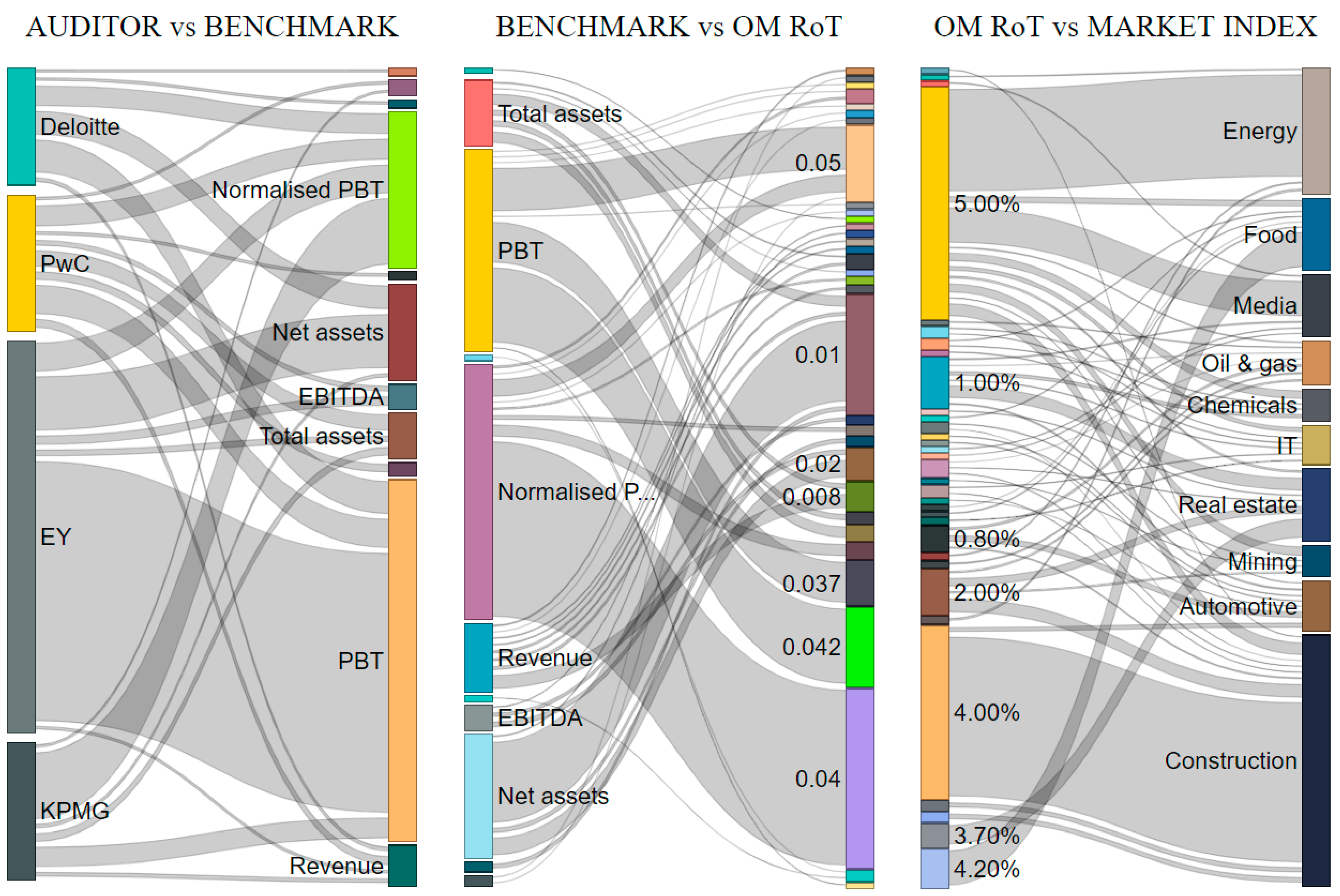

- the most broadly used OM RoT was 4%, which was applied primarily:

- ■

- by KPMG,

- ■

- for normalized PBT,

- ■

- in construction WIG;

- relatively, among Big 4, EY has the least differentiated benchmarks, with PBT being the main variable used to determine materiality,

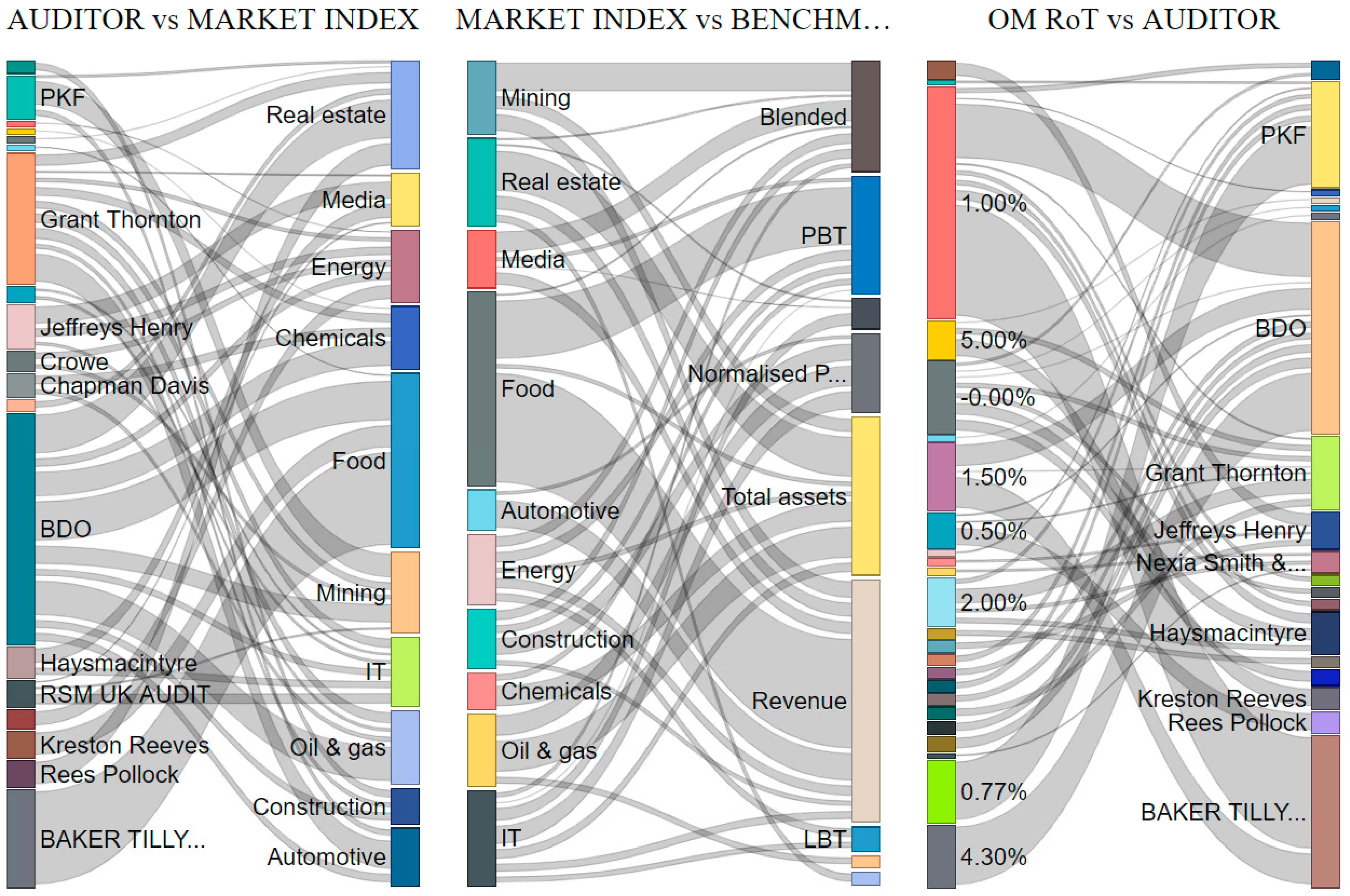

- among Big 4, profit before tax (PBT) was the most commonly used benchmark, followed by normalized PBT, while among non-Big 4 it was revenue and total assets respectively,

- there was no other clear differentiation in terms of presented patterns between Big 4 and non-Big 4 audit firms.

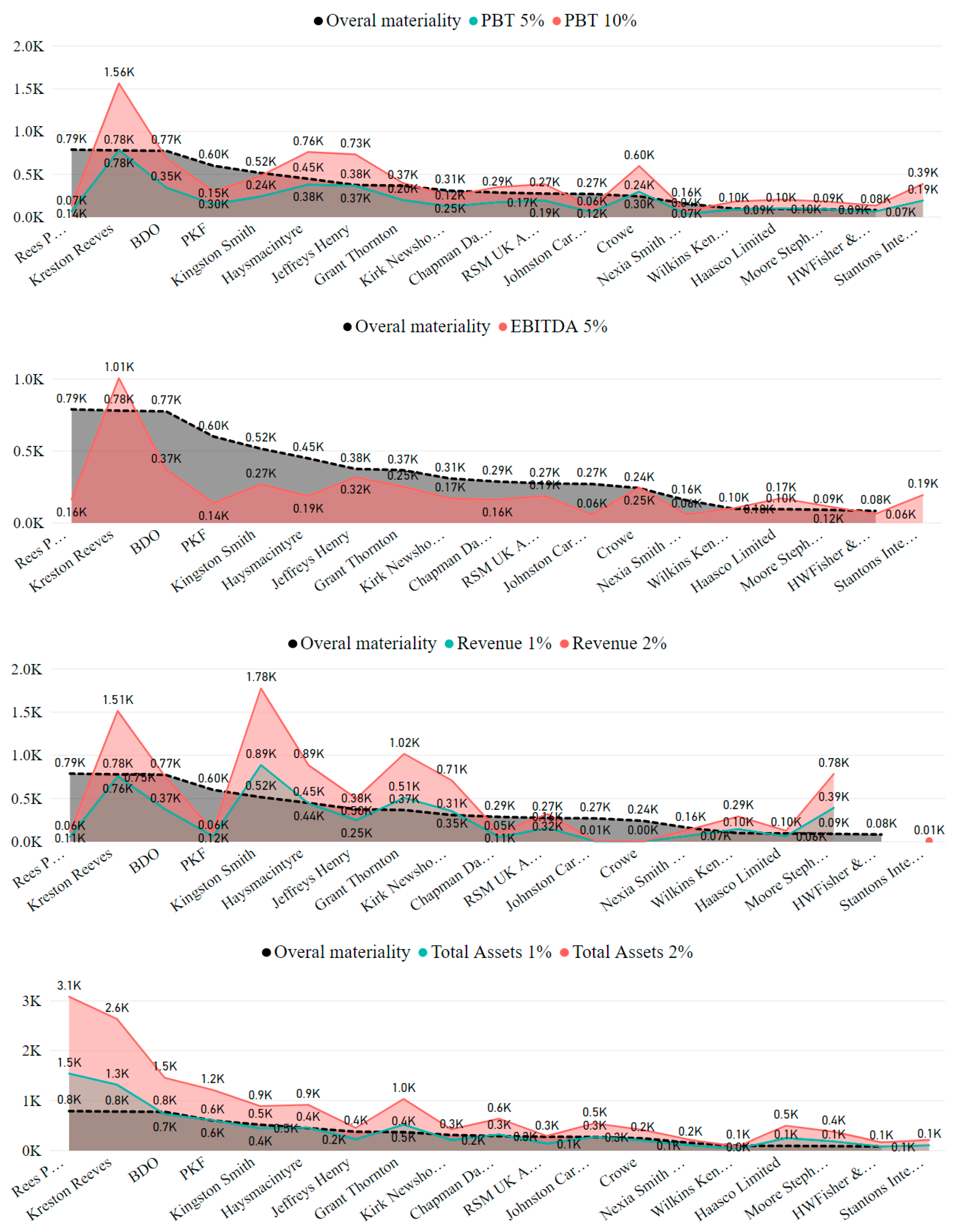

- for PBT, KPMG is 28.6% and PwC is 12.5% below the bottom threshold of 5% PBT, which means that they are even more detailed and conservative than as per the example presented in ISA 320, EY keeps it almost in the middle between the lower and upper limits, while Deloitte maintains its OM 27.3% over this base,

- for EBITDA, Deloitte stands out from the competition by getting close to the upper limit of the threshold, while the remainders keep it in the middle of the scale,

- for revenue, all Big 4 auditors except for Deloitte set up their OM below 1% revenue as per the example presented in ISA 320,

- finally, the situation for total assets is akin to the one for the revenue.

5. Summary and Conclusions

- among Big 4, profit before tax (PBT) was the most commonly used benchmark, followed by normalized PBT, while among non-Big 4 it was revenue and total assets respectively,

- there were identified the following Key Audit Matters which are related with all assertions: going concern, business combination accounting, fraud risk, first-year audit and discontinued operations,

- under the current approach, some financial statement items, such as other operating expenses, are not audited at all, it should be noted that this particular category is quite capacious and can easily hide undesirable “surprises”,

- although many individual Key Audit Matters were identified by auditors, they were fairly little differentiated, key categories, applied to most of the companies, were the same as benchmarks used for calculation of overall materiality,

- valuation stands out as the assertion, which is of utmost significance to the auditors, what clearly drives the way in which audit procedures are designed and performed,

- the extent of caution applied by non-Big 4 auditors, expressed by the level of overall materiality and its relation to relevant guidelines, is, in general, lower than the one exercised by their Big 4 colleagues, this means that audits performed by lesser firms may be less diligent than the ones conducted by market leaders.

Author Contributions

Funding

Conflicts of Interest

References

- Akinbuli, Sylvester F. 2010. The effect of audit expectation gap on the work of auditors, the profession and users of financial information. The Nigerian Accountants 43: 37–40. [Google Scholar]

- Aljaaidi, Khaled. 2009. Reviewing the Audit Expectation Gap Literature from 1974 to 2007. International Postgraduate Business Journal (IPBJ) 1: 41–75. [Google Scholar]

- Baldacchino, Peter J., Norbert Tabone, and Ryan Demanuele. 2017. Materiality Disclosures in Statutory Auditing: A Maltese Perspective. Journal of Accounting, Finance and Auditing Studies 3: 116–57. [Google Scholar]

- Deloitte. 2016. Benchmarking the New Auditor’s Report. Key Audit Matters and Other Additional Information. Available online: https://www2.deloitte.com/content/dam/Deloitte/ch/Documents/audit/ch-en-audit-benchmarking-auditors-report.pdf (accessed on 15 March 2019).

- Doxey, Marcus M. 2013. The Effect of Increased Audit Disclosure on Investors’ Perceptions of Management, Auditors, and Financial Reporting: An Experimental Investigation. Lexington: University of Kentucky, Available online: http://uknowledge.uky.edu/accountancy_etds/2 (accessed on 22 March 2019).

- Ebimobowei, Appah. 2010. An evaluation of audit expectation gap: Issues and challenges. International Journal of Economic Development Research and Investment 1: 129–41. [Google Scholar]

- Gupta, Kamal. 2005. Contemporary Auditing, 6th ed. New Delhi: Tata McGraw Hill. [Google Scholar]

- International Auditing and Assurance Standards Board (IAASB). 2009a. ISA 200 Overall Objectives of the Independent Auditor and the Conduct of an Audit in Accordance with International Standards on Auditing. New York: The International Federation of Accountants (IFAC). [Google Scholar]

- International Auditing and Assurance Standards Board (IAASB). 2009b. ISA 320 Materiality in Planning and Performing and Audit. New York: The International Federation of Accountants (IFAC). [Google Scholar]

- International Auditing and Assurance Standards Board (IAASB). 2009c. ISA 230 Audit Documentation. New York: The International Federation of Accountants (IFAC). [Google Scholar]

- International Auditing and Assurance Standards Board (IAASB). 2009d. ISA 705 Modifications to the Opinion in the Independent Auditor’s Report. New York: The International Federation of Accountants (IFAC). [Google Scholar]

- International Auditing and Assurance Standards Board (IAASB). 2009e. ISA 315 Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment. New York: The International Federation of Accountants (IFAC). [Google Scholar]

- International Auditing and Assurance Standards Board (IAASB). 2016a. ISA 701 Communicating Key Audit Matters in the Independent Auditor’s Report. New York: The International Federation of Accountants (IFAC). [Google Scholar]

- International Auditing and Assurance Standards Board (IAASB). 2016b. ISA 570 (Revised) Going Concern. New York: The International Federation of Accountants (IFAC). [Google Scholar]

- Institute of Chartered Accountants in England and Wales (ICAEW). 2006. Expectation Gaps. London: Audit and Assurance Faculty, Available online: https://www.icaew.com/-/media/corporate/files/technical/audit-andassurance/audit-quality/audit-quality-forum/expectation-gaps.ashx (accessed on 22 March 2019).

- The International Federation of Accountants (IFAC). 2019. Proposed Strategy for 2020–2023 and Work Plan for 2020–2021. p. 7. Available online: http://www.ifac.org/publications-resources/proposed-strategy-2020-2023-and-work-plan-2020-2021 (accessed on 8 March 2019).

- Jedidi, Imen, and Chrystelle Richard. 2009. The Social Construction of the Audit Expectation Gap: The Market of Excuses. Strasbourg: La place de la dimension europeenne dans la Comptabillite controle Audit. [Google Scholar]

- Kearns, Francis. 2007. Materiality & the Audit Report: It’s Time for Disclosure. Available online: https://scholarworks.rit.edu/other/640 (accessed on 1 March 2019).

- Kiedrowska, Maria, and Elżbieta Izabela Szczepankiewicz. 2011. Internal Control in the Concept of Integrated Enterprise Risk Management (ERM) System in Insurance Undertakings. Finanse, Rynki Finansowe, Ubezpieczenia 640: 695–706. [Google Scholar]

- Chye Koh, Hian, and E-Sah Woo. 1998. The expectation gap in auditing. Managerial Auditing Journal 13: 147–54. [Google Scholar] [CrossRef]

- Kutera, Małgorzata. 2018. Nowy raport biegłego rewidenta—Implementacja przy audycie spółek WIG-20. Prace Naukowe Uniwersytetu Ekonomicznego We Wrocławiu 503: 281–92. [Google Scholar] [CrossRef]

- Kutera, Małgorzata. 2019. Kluczowe kwestie badania—Nowy element w raportowaniu biegłych rewidentów. Zeszyty Teoretyczne Rachunkowości 101: 79–94. [Google Scholar] [CrossRef]

- Lee, Teck Heang, Azham Md. Ali, and Juergen Dieter Gloeck. 2009. The Audit Expectation Gap in Malaysia: An Investigation into its Causes and Remedies. South African Journal of Accountability and Auditing Research 9: 57–88. [Google Scholar]

- McEnroe, John, and Stanley C. Martens. 2001. Auditors’ and Investors’ Perceptions of the “Expectation Gap”. Accounting Horizons 15: 345–58. [Google Scholar] [CrossRef]

- Ojo, Marianne. 2006. Eliminating the Audit Expectations Gap: Myth or Reality? Available online: https://mpra.ub.uni-muenchen.de/232/1/MPRA_paper_232.pdf (accessed on 15 March 2019).

- Ptak-Chmielewska, Aneta. 2019. Predicting Micro-Enterprise Failures Using Data Mining Techniques. Journal of Risk and Financial Management 12: 6. [Google Scholar] [CrossRef]

- Saeidi, Fatemeh. 2012. Audit expectations gap and corporate fraud: Empirical evidence from Iran. African Journal of Business Management 6: 7031–41. [Google Scholar]

- Salehi, Mahdi. 2009. Audit Independence and Expectation Gap: Empirical Evidences from Iran. Journal of Economics and Finance 1: 165. [Google Scholar] [CrossRef]

- Salehi, Mahdi, and Vahab Rostami. 2009. Audit Expectation Gap: International Evidence. International Journal of Academic Research 1: 140–46. [Google Scholar]

- Schelluch, Peter, and Grant Gay. 2006. Assurance provided by auditors’ reports on prospective financial information: Implications for the expectation Gap. Accounting and Finance 46: 653–76. [Google Scholar] [CrossRef]

- Shbeilat, Mohammad, Waleed Abdel-Qader, and Donald Ross. 2017. The Audit Expectation gap: Does Accountability Matter? International Journal of Management and Applied Science 3: 75–84. [Google Scholar]

- Szczepankiewicz, Elżbieta Izabela. 2011. The Role of the Audit Committee, the Internal Auditor and the Statutory Auditor as the Bodies Supporting Effective Corporate Governance in Banks. Finanse, Rynki Finansowe, Ubezpieczenia 640: 885–97. [Google Scholar]

- Szczepankiewicz, Elżbieta Izabela. 2012. The role and tasks of the Internal Audit and Audit Committee as bodies supporting effective Corporate Governance in Insurance Sector Institutions in Poland. Oeconomia Copernicana 4: 23–39. [Google Scholar] [CrossRef]

- Vorhies, James Brady. 2005. The New Importance of Materiality: CPAs Can Use This Familiar Concept to Identify Key Control Exceptions. Journal of Accountancy 199: 53. [Google Scholar]

- Whittington, Ray O., and Kurt Pany. 2004. Principles of Auditing and Other Assurance Services, 14th ed. New York: McGraw-Hill Education. [Google Scholar]

- Zikmund, Paul E. 2008. Reducing the Expectation Gap. CPA Journal 78: 12. [Google Scholar]

| 1 | Referring to what society expects of auditors and what can reasonably be expected of auditors to accomplish. |

| 2 | The gap between the responsibilities that society reasonably expects auditors to perform and auditors’ actual responsibilities under statute. |

| 3 | The difference between the expected standard of performance of auditors and the actual performance of responsibilities by auditors. |

| 4 | The research was executed based on the analysis of the annual consolidated financial statements or standalone financial statements in situations where there was no capital group. The tested sample consisted of 317 financial statements (both consolidated and standalone). |

| 5 | The following types of assertions were defined and analysed: C—completeness; A—accuracy; V—valuation; CO—cut-off; PD—presentation and disclosures; E—existence; RO—rights and obligations. |

| Balance Sheet | |

|---|---|

| Fixed assets | 1570 |

| Intangible assets | 270 |

| Tangible assets | 985 |

| Long-term receivables | 36 |

| Long-term investments | 231 |

| Long-term prepayments | 48 |

| Current assets | 641 |

| Inventory | 168 |

| Short-term receivables | 228 |

| Short-term investments | 218 |

| Short-term prepayments | 27 |

| Total assets | 2211 |

| Equity | 1013 |

| Provisions for liabi. and accruals | 44 |

| Long-term liabilities | 701 |

| Short-term liabilities | 453 |

| Total equity and liabilities | 2211 |

| Profit and Loss | |

| Net revenues from sales | 1570 |

| Operating expenses, incl. | 1407 |

| Amortization and depreciation | 90 |

| Other operating income | 14 |

| Other operating expenses | 9 |

| Financial income | 9 |

| Financial expenses | 23 |

| Gross profit (loss) | 154 |

| Net profit (loss) | 106 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Iwanowicz, T.; Iwanowicz, B. ISA 701 and Materiality Disclosure as Methods to Minimize the Audit Expectation Gap. J. Risk Financial Manag. 2019, 12, 161. https://doi.org/10.3390/jrfm12040161

Iwanowicz T, Iwanowicz B. ISA 701 and Materiality Disclosure as Methods to Minimize the Audit Expectation Gap. Journal of Risk and Financial Management. 2019; 12(4):161. https://doi.org/10.3390/jrfm12040161

Chicago/Turabian StyleIwanowicz, Tomasz, and Bartłomiej Iwanowicz. 2019. "ISA 701 and Materiality Disclosure as Methods to Minimize the Audit Expectation Gap" Journal of Risk and Financial Management 12, no. 4: 161. https://doi.org/10.3390/jrfm12040161

APA StyleIwanowicz, T., & Iwanowicz, B. (2019). ISA 701 and Materiality Disclosure as Methods to Minimize the Audit Expectation Gap. Journal of Risk and Financial Management, 12(4), 161. https://doi.org/10.3390/jrfm12040161