4.1. Descriptive Statistics

The results of the research are collected in

Table 1,

Table 2 and

Table 3 and

Figure 1,

Figure 2,

Figure 3,

Figure 4,

Figure 5,

Figure 6,

Figure 7,

Figure 8,

Figure 9,

Figure 10,

Figure 11,

Figure 12,

Figure 13,

Figure 14,

Figure 15,

Figure 16,

Figure 17 and

Figure 18.

Between October 2018 and February 2019, the survey was distributed to individuals having, at that moment, workplaces in the Romanian territory. Some of the surveys were administered collectively to our study population, while others were distributed online; in addition, others were distributed in printed form (in-house surveys, which indicates the questionnaires were distributed at the individuals’ place of work or home) and in some cases even via e-mail. It should be emphasized that, at all times, the identity of the surveyed individuals was kept private, since we were aware, at all times, of the importance of offering our respondents a high degree of anonymity. Out of the total number of distributed surveys, we received 687 of them back. From the surveys gathered, we have eliminated those belonging to respondents stating that they do not wish to be part of this analysis (see, in this matter,

Appendix A, Question 1), or are unaware of the concepts of corporate social responsibility (see, in this matter,

Appendix A, Question 9) and intellectual capital (see, in this matter,

Appendix A, Question 10). In consequence, we were able to select 642 surveys fully completed as well as correctly filled in. In March 2019 we started processing and analyzing the data obtained in the programs for statistics and data science SPSS 14.0, Stata, Eviews and Excel. With reference to SPSS Statistics we mention that it is a software package used for interactive or batched, statistical analysis. We used in our study the version of year 2007: SPSS 14.0.

The design of the survey included two major parts. The first part of the survey contained 10 closed questions, requiring only one response, focused on determining the respondents age, gender, level of education, position at the current place of work, monthly gross income, number of years spent working in the organization, and current work location in the Romanian territory. The second part of the survey had 22 questions. Out of these questions, 18 offered the respondents the possibility to tick only one answer from a given list (the structure respecting the style of closed questions), while for four questions (the structure being specific, in this case, to a complex form of the Likert scale, with seven degrees of options) the respondents were asked to state, according to them, the degree of importance for some specific concepts, criteria, or definitions, using the following scale: 1—very important; 2—important, 3—somewhat important; 4—undecided; 5—somewhat unimportant; 6—unimportant; 7—very unimportant.

In the lines below we have described the results that we obtained from the first part of the survey. The first question of the survey had the purpose of determining individuals’ will to take part in our survey, and can be considered an eliminatory query (

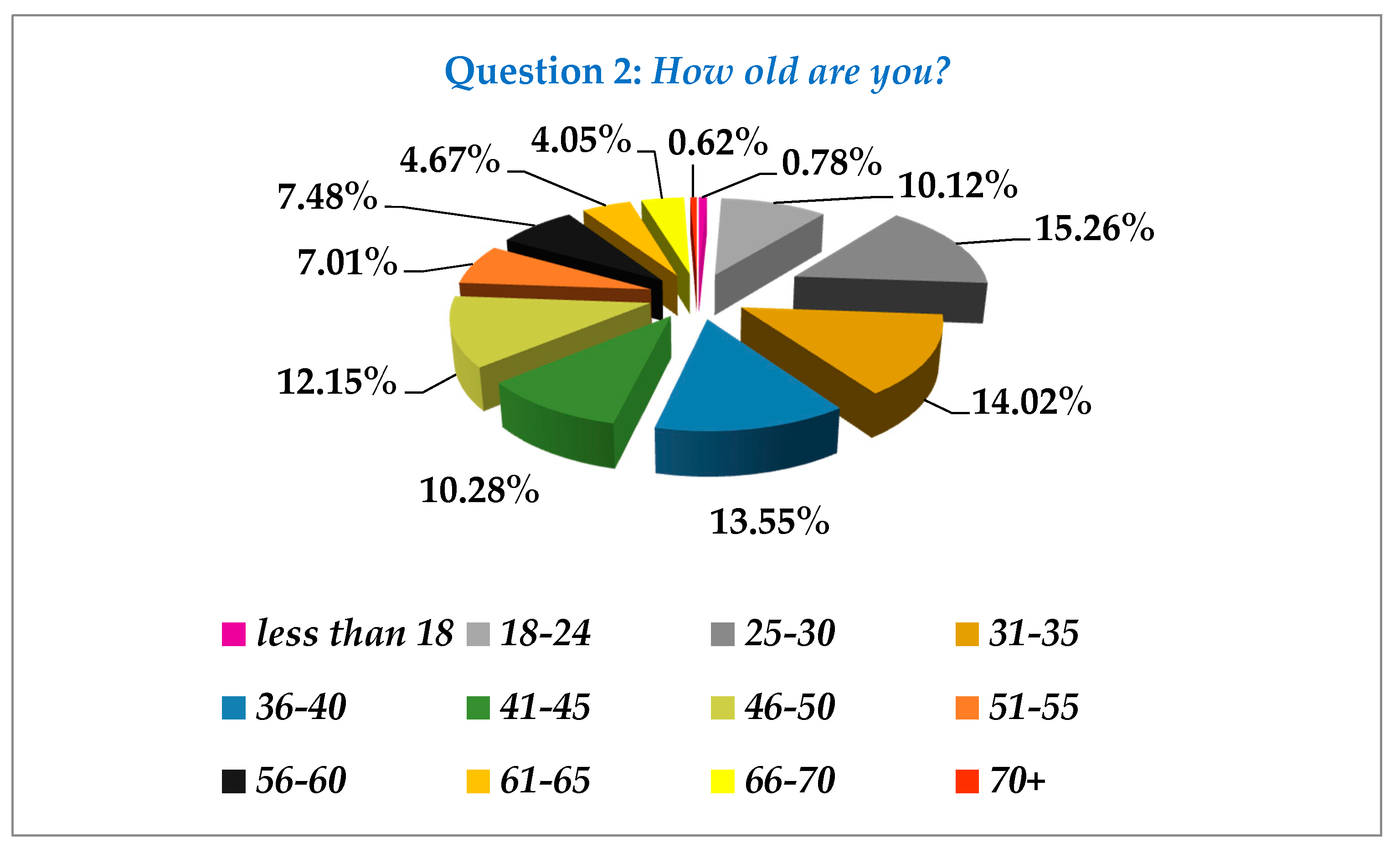

Appendix A, Question 1). If the answer provided by the respondents was no, the respondent were forwarded to the conclusion, in order to respect their decision not to be part of our target population. In response to Question 2 “How old are you?” most of those surveyed (15.26%) were between 25–30 years old, immediately followed by 14.02% respondents between 31–35 years old, and 13.55% between 36–40 years old. At the opposite pole, 4.67% respondents were between 61–65 years old, while 4.05% were between 66–70 years old, 0.78% were less than 18 years old, and 0.62% were more than 70 years old. The figures are displayed in

Appendix B,

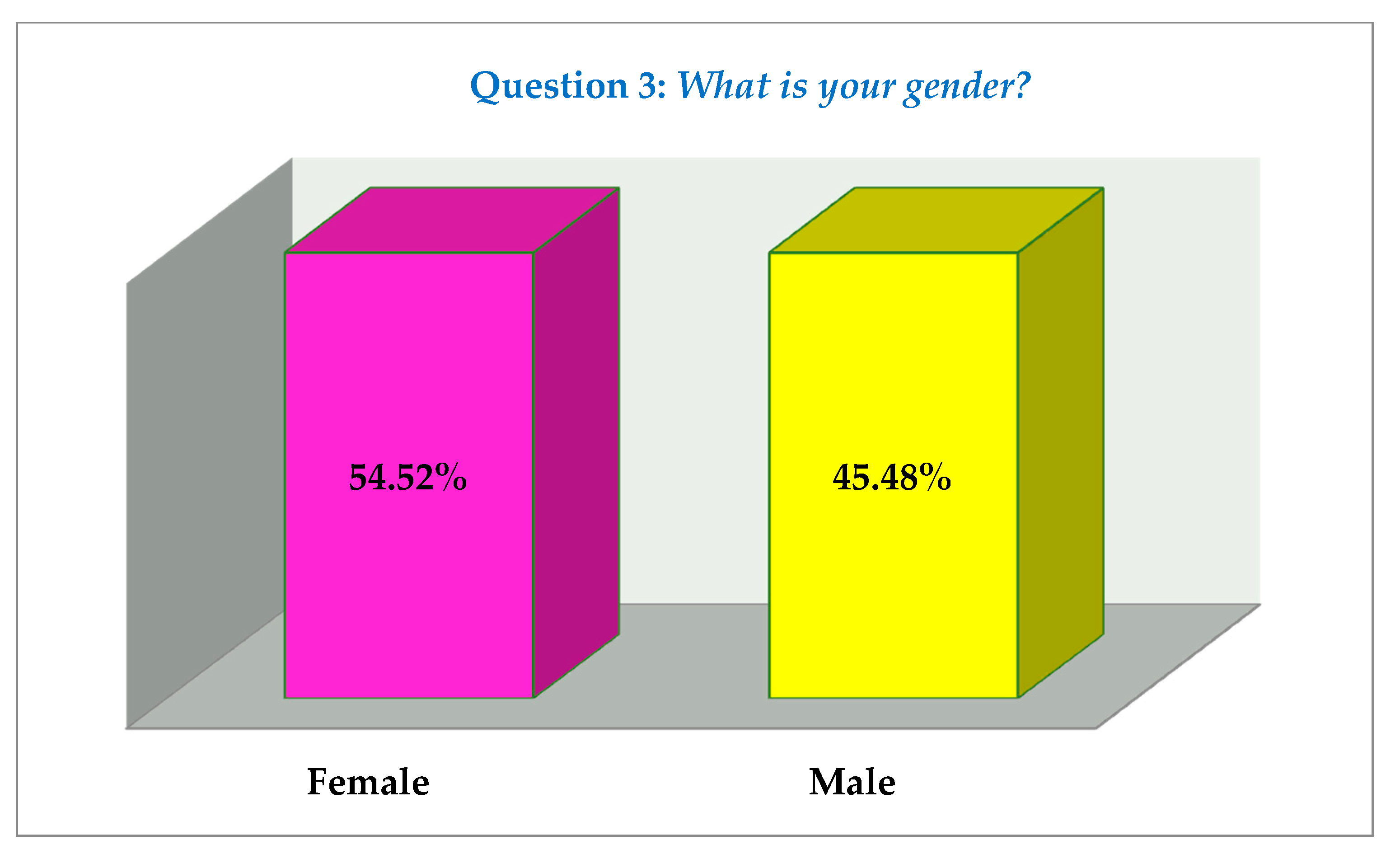

Figure A1. Of the study population, 350 subjects were female (54.52%), while the rest were male (45.48%). The figures are shown in

Appendix B,

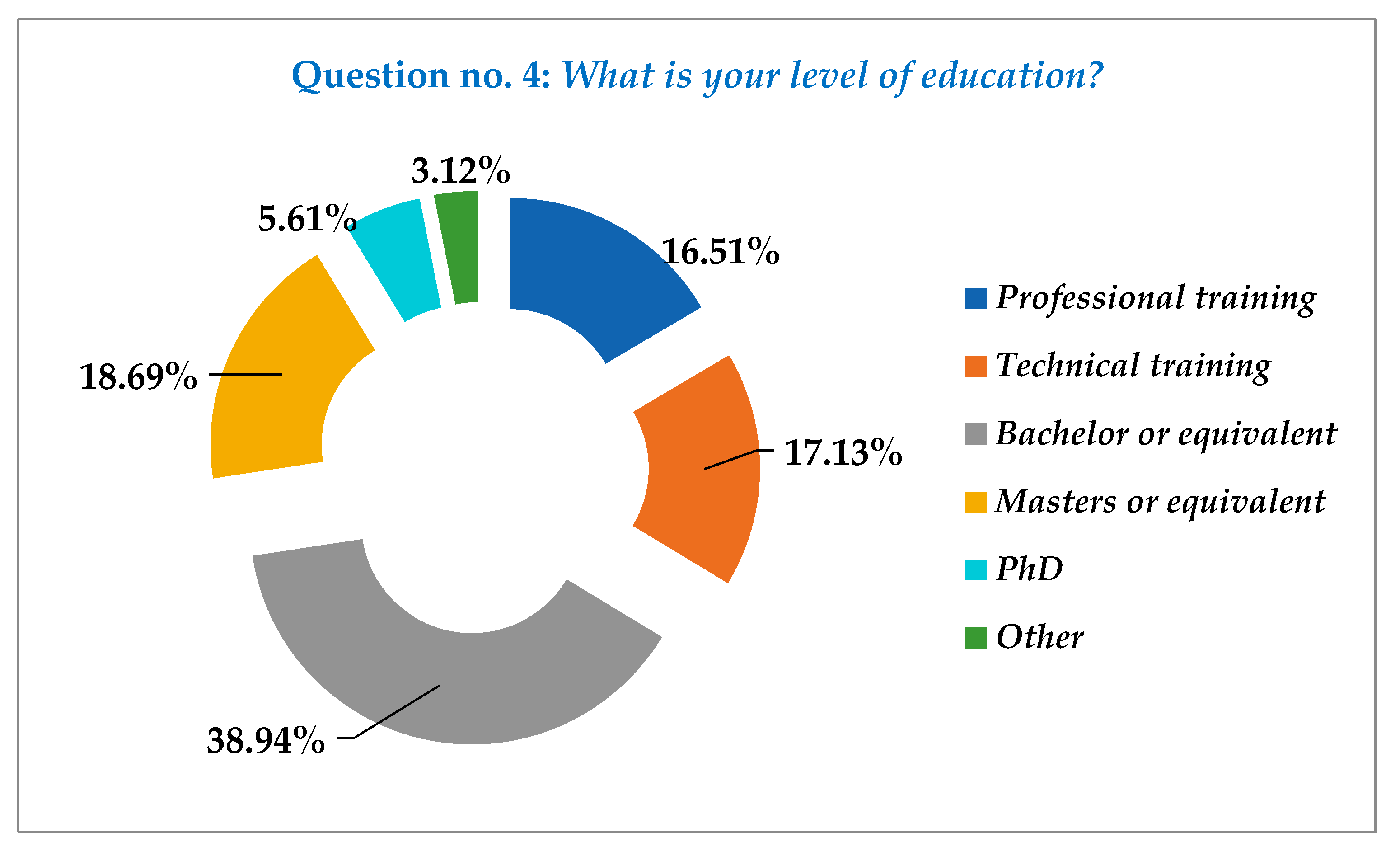

Figure A2. Respondents were asked to indicate their level of education (see, in this matter,

Appendix A, Question 4). The acquired results reflect that 38.94% of the respondents possess a bachelor diploma or equivalent and 18.69% a masters or equivalent, while 17.13% received technical training and 16.51% professional training, followed by 5.61% that had gained PhD titles, and 3.12% stated having a different educational background. The figures are displayed in

Appendix B,

Figure A3. In response to the question “What is your career level at the current place of work?” (

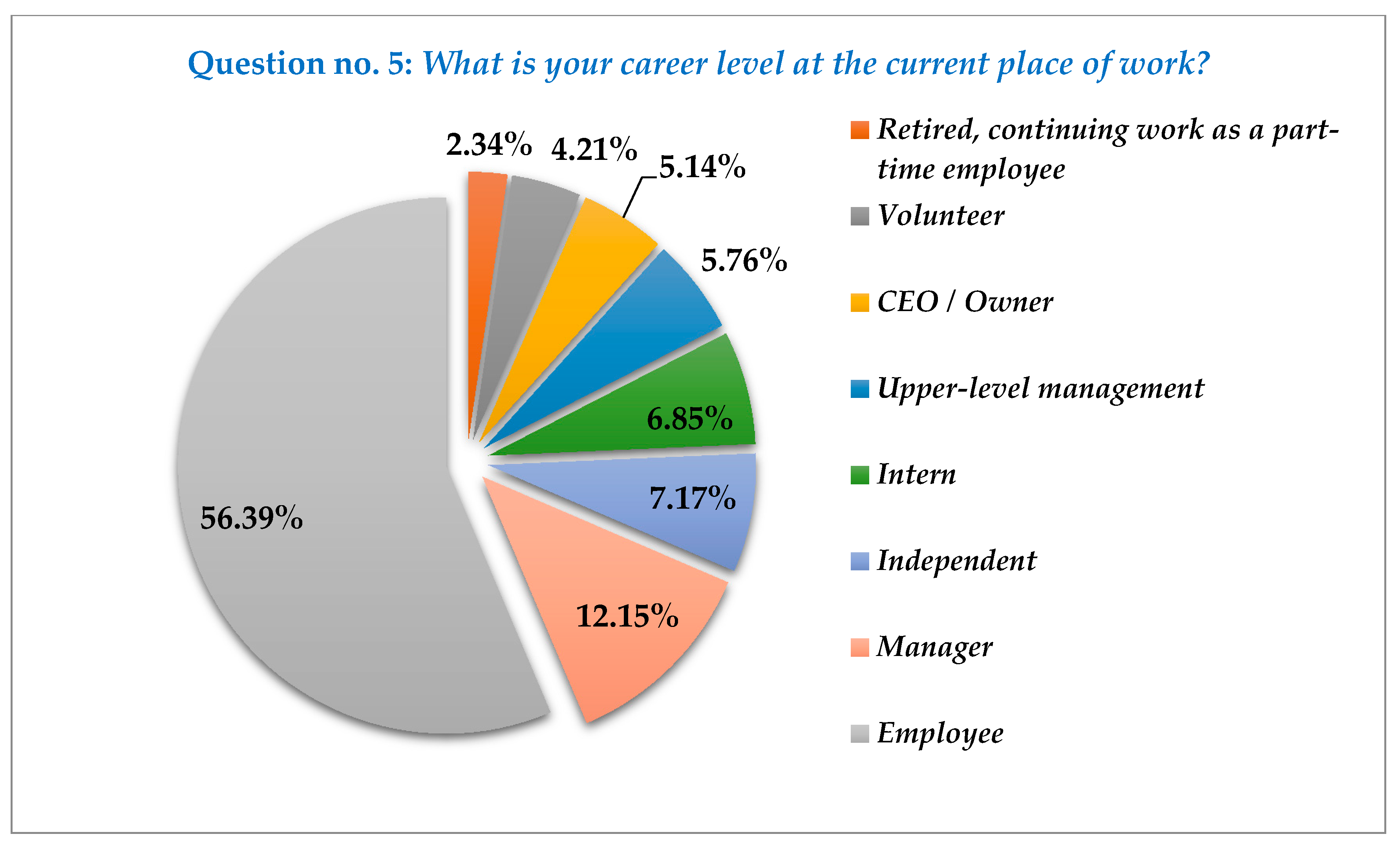

Appendix A, Question 5), a range of responses were elicited: The majority (56.39%) of those who replied to this item were employees, without any administrative or decision-making positions, 12.15% indicated having a managerial function, 7.17% declared being involved in independent working activities, and 6.85% acknowledged occupying an intern job. Other responses to this question reflected that 5.76% of the participants were implicated in upper-management tasks, while 4.21% acted as volunteers in their organizations, and 2.34% were retired, however still continuing work on a part-time basis. The figures are revealed in

Appendix B,

Figure A4. Concerning the monthly gross income (

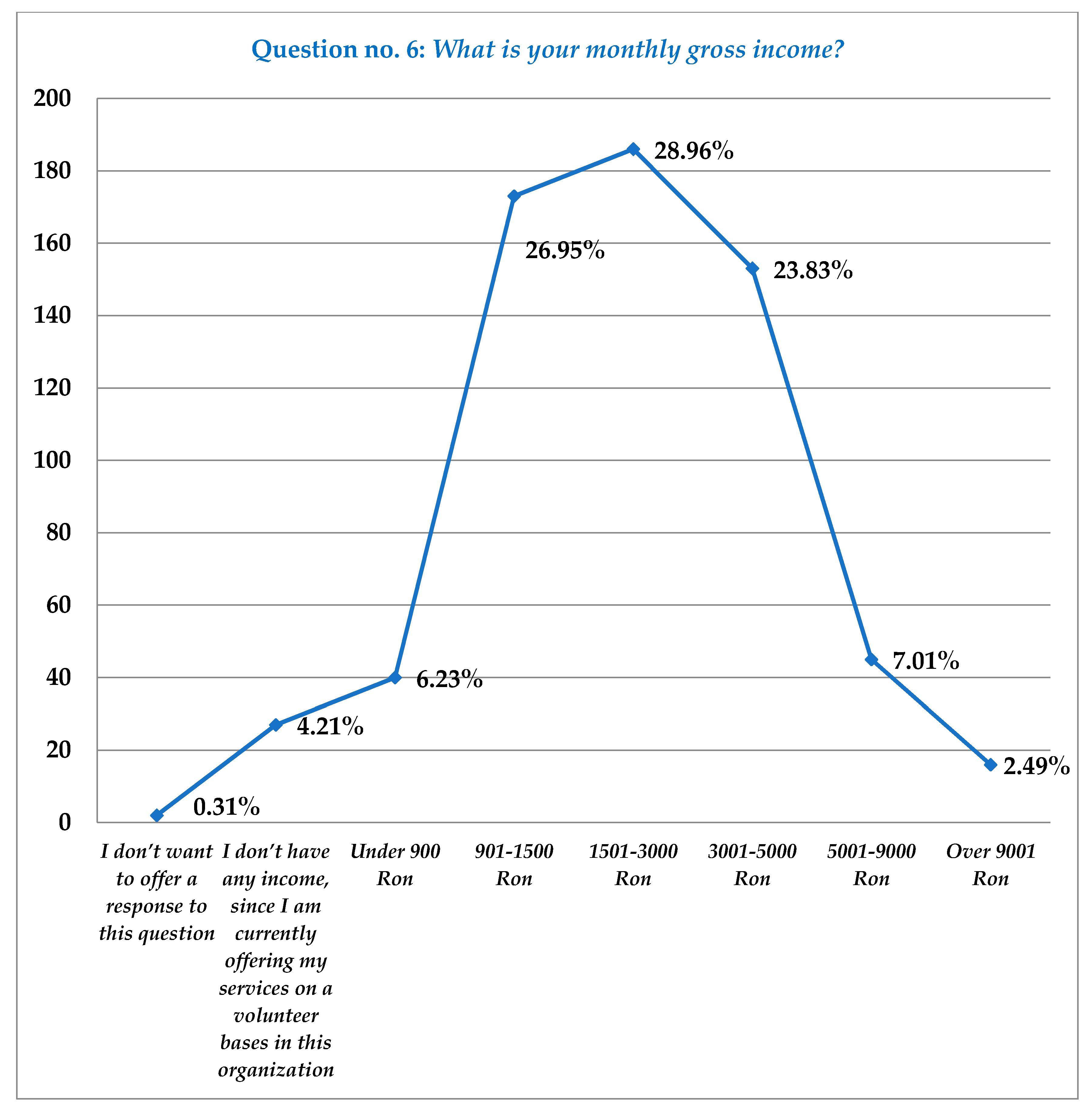

Appendix A, Question 6), almost one-third of the participants (28.97%) said that their level of income falls between 1501–3000 Ron, 26.92% declared between 901–1500 Ron, and 23.83% received sums between 3001–5000 Ron. Only a small number (7.10% and 2.49%) of respondents indicated that their wages are somewhere between 5001–9000 Ron and over 9001 Ron, respectively. A minority of participants (6.23%) expressed possessing salaries under 900 Ron. Other responses to this question included 4.21% persons without any income, currently offering their services on a volunteer basis in their organization, and 0.31% which felt unease at offering a response to this question. The figures are uncovered in

Appendix B,

Figure A5. At this point, respondents were asked to indicate how long have they been working in their current organizations (

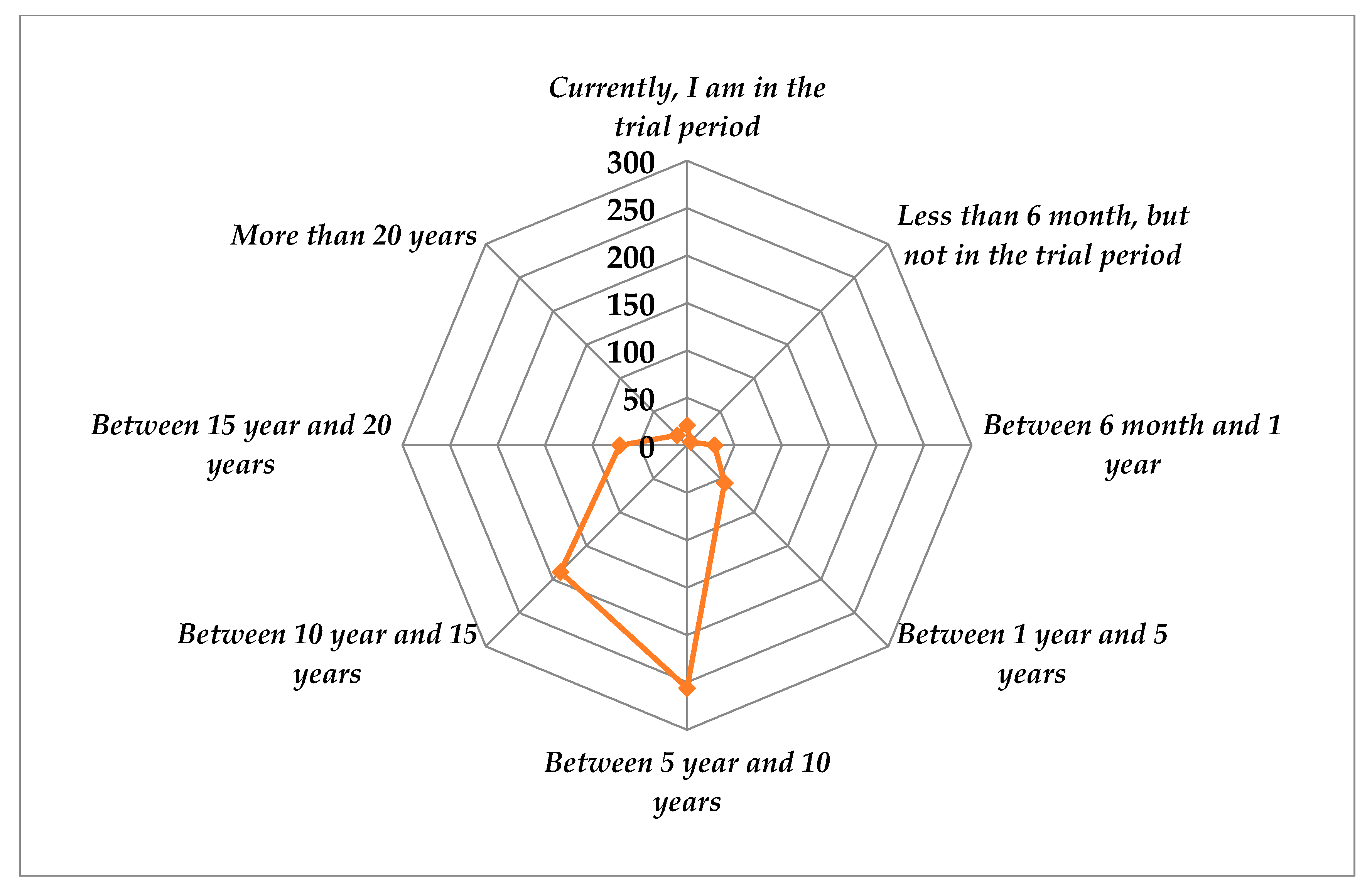

Appendix A, Question 7). The data illustrated that 39.88% of the respondents have been working in the same institutions between 5 and 10 years, 29.49% between 10 and 15 years, 11.06% between 15 and 20 years, 8.72% between 1 and 5 years, and 4.52% between 6 months and 1 year. In comparison, 3.27% of the answers pointed to individuals that were during their trial period, while 0.78% of them held their present positions for less than 6 months, yet not being in the trial period. The figures are disclosed in

Appendix B,

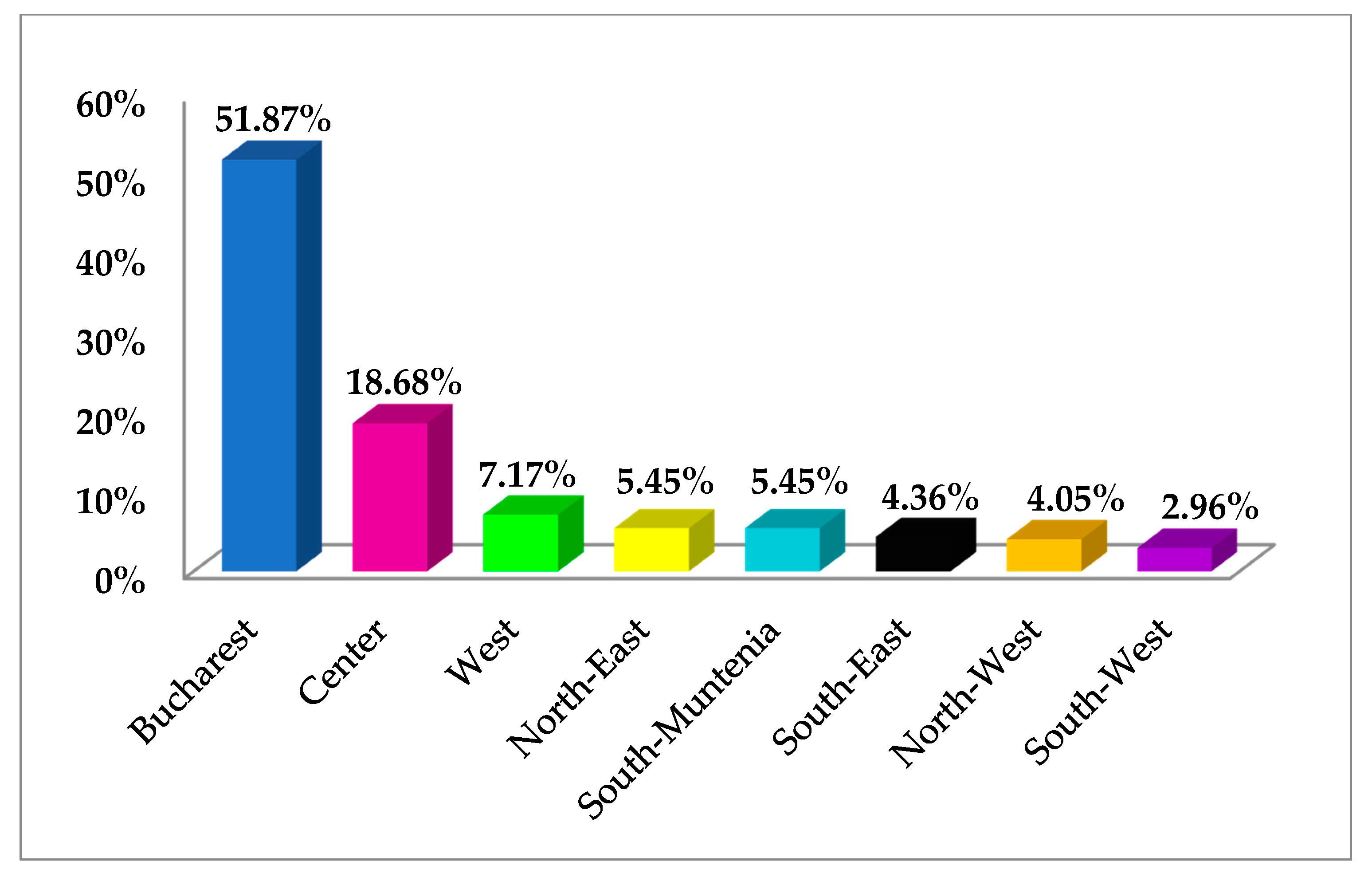

Figure A6. It is apparent from the answers to the question “Where is your current place of work located on the Romanian territory?” (

Appendix A, Question 8) that more than half of the answerers were located in Bucharest (51.87%), and 18.68% of the participants were positioned in the Centre, while very few were from the West (7.17%), North-East (5.45%), South-Muntenia (5.45%), South-East (4.36%), North-West (4.05%), or South-West (2.96%). The figures are represented in

Appendix B,

Figure A7. Questions 9 and 10 (

Appendix A) positioned at the end of the first part of the survey can be regarded as eliminatory queries, since the ninth question attempts to determine whether the respondents are aware of the term corporate social responsibility and the tenth has the purpose of establishing whether the surveyed population is aware of the term intellectual capital. In the case that at either the ninth question or tenth question the individuals’ answer stresses their lack of knowledge concerning the concepts of corporate social responsibility and/or intellectual capital, they are forwarded to the conclusion.

Starting from this moment on, we have stressed the results that we have obtained from the second part of the survey, in our attempt to discover the respondents’ perception concerning three key concepts: corporate social responsibility, intellectual capital, and financial and non-financial performance.

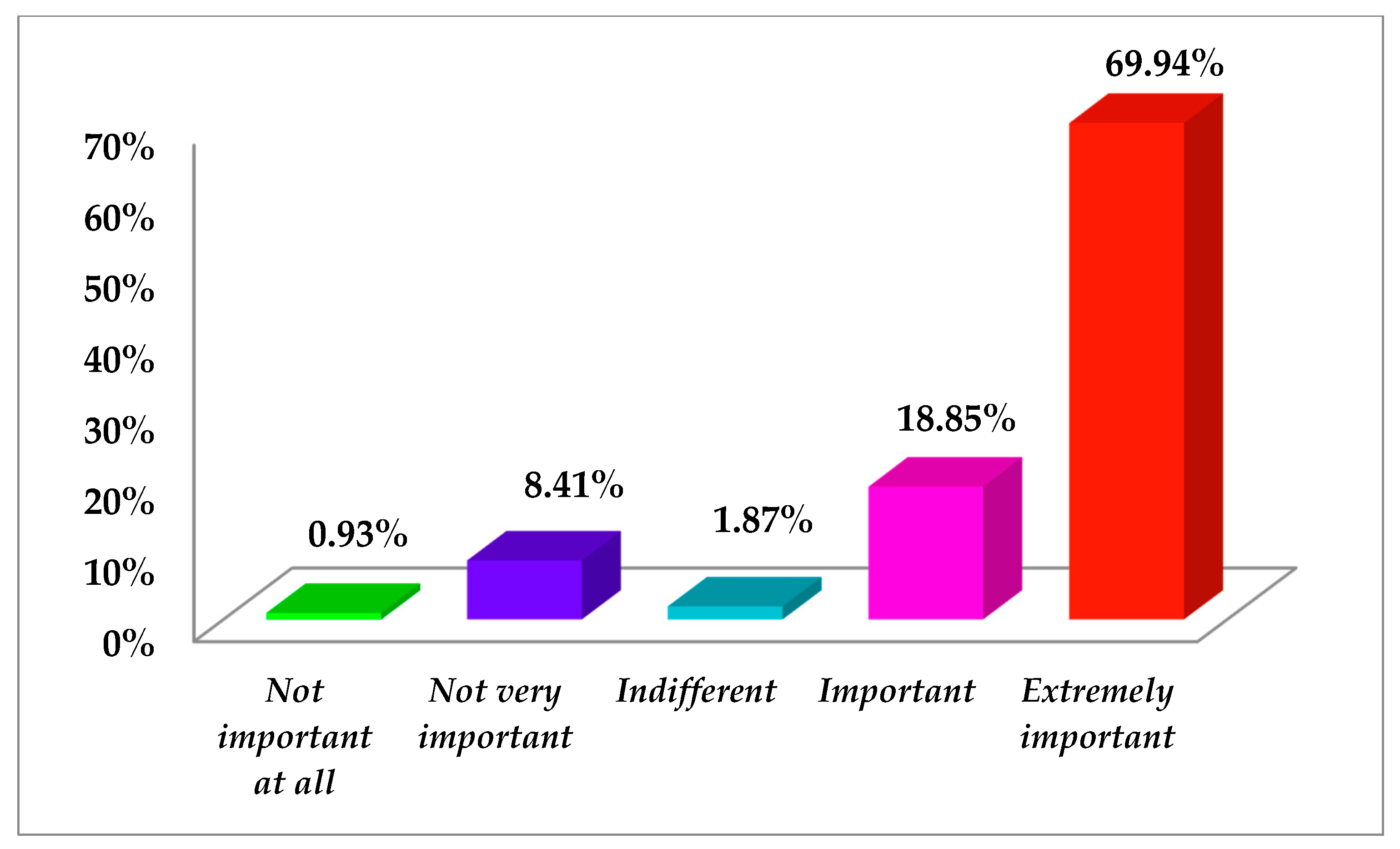

The eleventh question of the survey “How important is it for you, as an employee, that companies, in general, operate on a socially responsible level?”, was centered on determining people’s awareness concerning the manner in which companies choose to operate on the marketplace, focusing on the socially responsible levels (

Appendix A, Question 11). On the one hand, more than two-thirds of the participants (69.94%) declared that it is extremely important for them that companies, in general, operate on a socially responsible level. In like manner, for 18.85% of the respondents, knowing that companies, in general, operate on a socially responsible level proved to be important. On the other hand, however, 8.41% reported it as not very important for them that companies, in general, operate on a socially responsible level, while 1.87% stated their indifferent position towards this matter, and 0.93% thought it was not important at all. The figures are illustrated in

Figure 1.

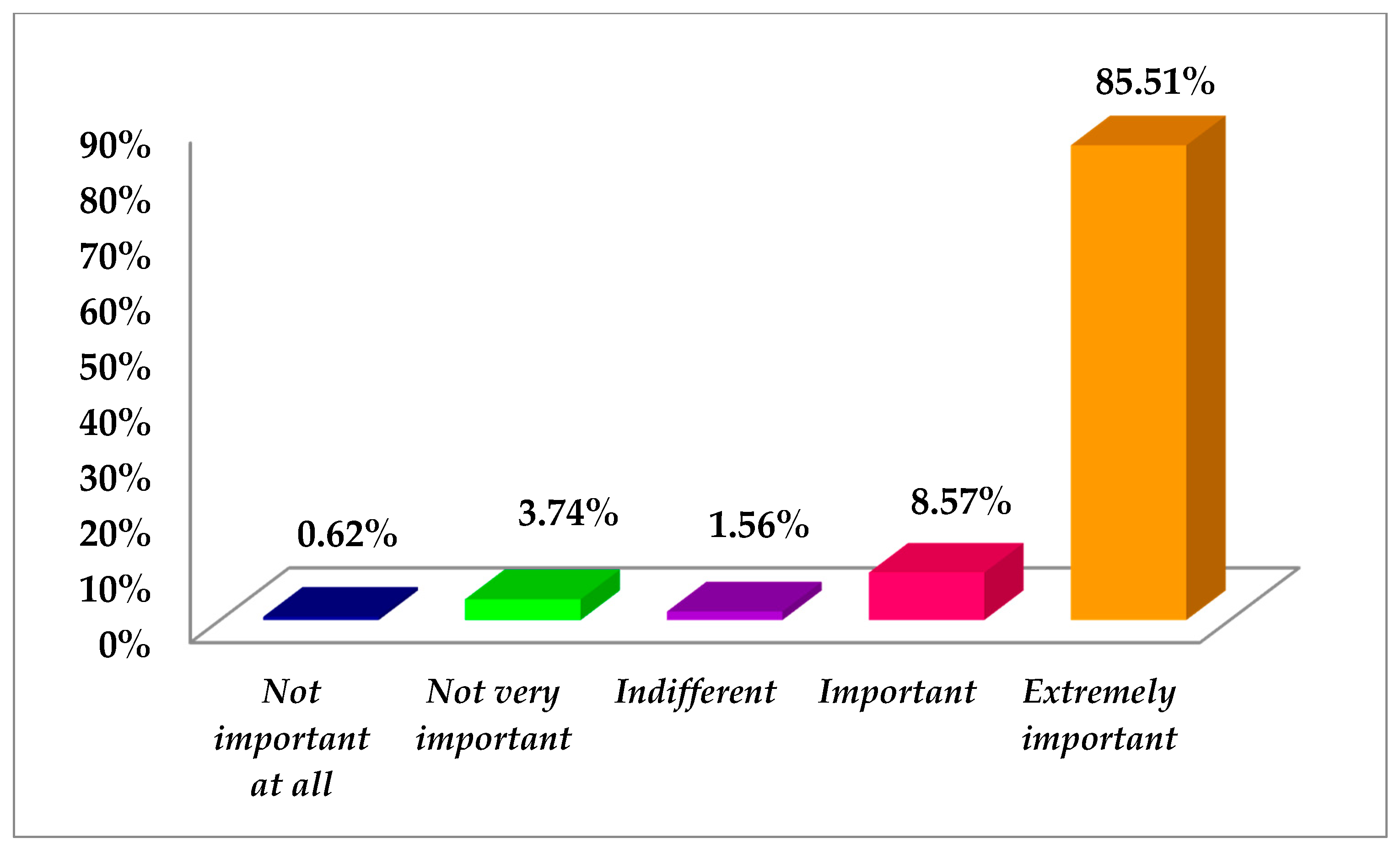

In continuation, the following question was “How important is it for you, as an employee, that the organization in which you are currently working operates on a socially responsible level?” (

Appendix A, Question 12). As expected, there were no significant differences between the answers offered to this question while compared to the ones offered at the previous one. On the contrary, this time 85.51% of the participants emphasized as extremely important that the organization in which they are currently working operates on a socially responsible level, and 8.57% stressed, in turn, as important that the organization in which they are currently working operates on a socially responsible level. Finally, 3.74% declared it not very important if the organization in which they are currently working operates on a socially responsible level, immediately followed by 1.56% who expressed their indifference, and 0.62% who acknowledged it as not important at all if the organization in which they are currently working operates on a socially responsible level. The numbers are mentioned in

Figure 2.

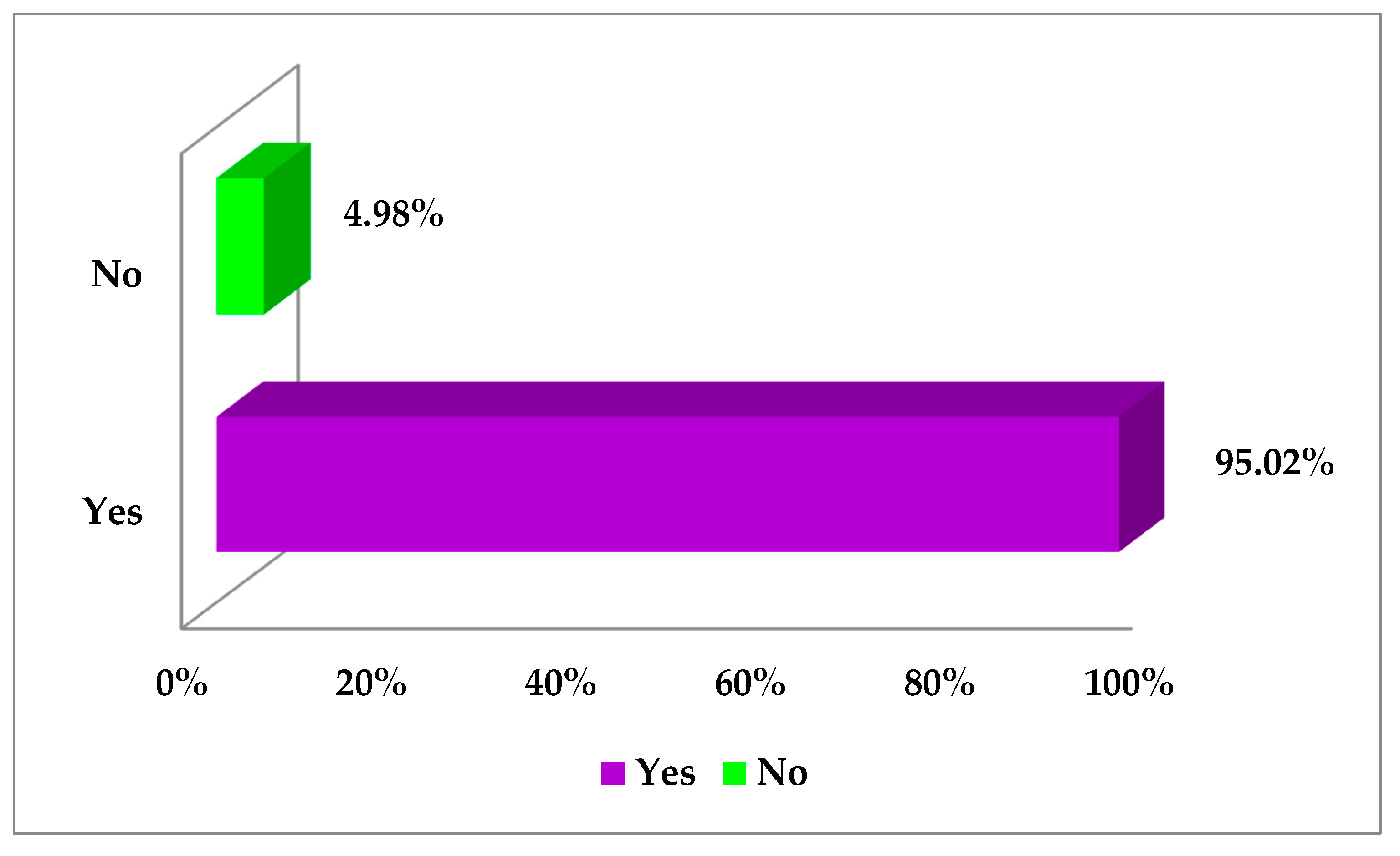

Afterward, the next query “In the situation in which you would be currently seeking a job, would you prefer to work for a socially responsible organization?” intended to prospect the respondents’ view in the case in which they would seek employment and whether they would incline or not towards a socially responsible organization (

Appendix A, Question 13). It is apparent from the information gathered that very few of the individuals (only 4.98%) would prefer to work for a non-socially responsible organization. Hence, from the data obtained, it can be clearly seen that by far the greatest preference of the answers (95.02%) is to work for a socially responsible organization. These details are charted in

Figure 3.

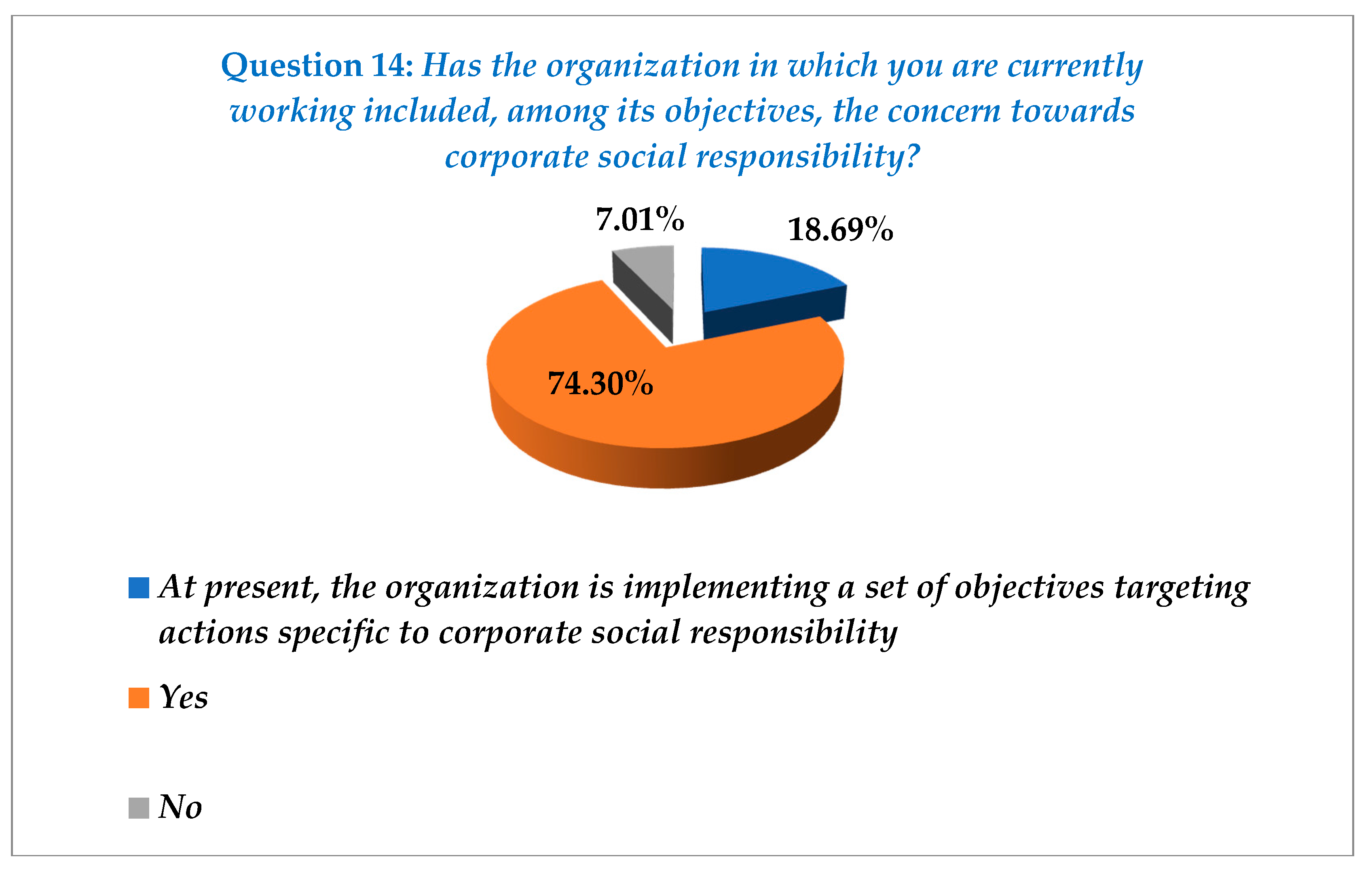

The answers to the question “Has the organization in which you are currently working included, among its objectives, the concern towards corporate social responsibility?” are quite revealing in several ways (

Appendix A, Question 14). First, the top position (74.30%) in the chart is occupied by those respondents who told that corporate social responsibility is among their organization’s objectives. Secondly, it is apparent from the same chart, that the immediate position (18.69%) is held by those respondents who noticed that even though, at present, corporate social responsibility is not among their existing organization’s objectives, the organization is on the verge of implementing a set of objectives targeting actions specific to corporate social responsibility. Thirdly, at the opposite pole in the chart, 7.01% individuals specified that corporate social responsibility is not among their organization’s objectives. This information is acknowledged in

Figure 4. Interestingly, we can see a correlation concerning both respondents and organizations concerns towards corporate social responsibility, since the majority of the answerers stressed the importance of social responsibility in their daily lives as well as at the place of work.

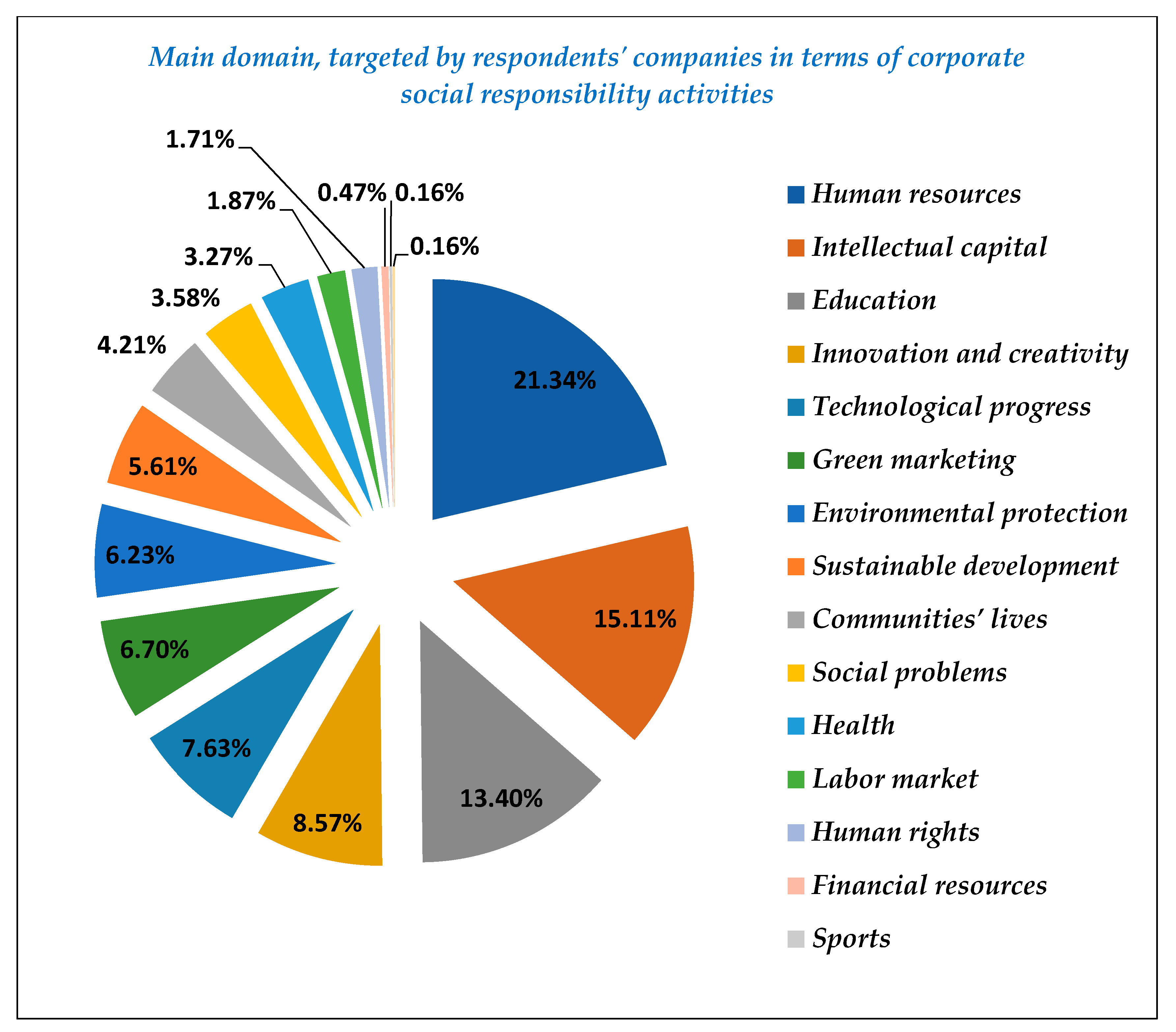

A number of issues were identified after analyzing the surveyed responses to the question “In the situation in which at the question above the answer is either yes or currently a set of corporate social responsibility rules is under implementation, which is the main domain, targeted by your company in terms of corporate social responsibility activities?” (

Appendix A, Question 15). A variety of perspectives were expressed, since the respondents were offered the possibility to choose one of the following options: labor market, human rights, environmental protection, technological progress, human resources, financial resources, sustainable development, communities’ lives, culture, sports, education, health, green marketing, intellectual capital, innovation and creativity, and social problems. These views surfaced mainly on what domain the activities of the companies where the participants to the enquiry were working, were focused on in terms of corporate social responsibility, starting with 21.34% establishing as fundamental for their institutions human resources, 15.11% considering paramount intellectual capital, 13.30% enforcing education, 8.57% supporting innovation and creativity, 7.63% technological progress, and 6.70% green marketing. Issues related to environmental protection (6.23%), sustainable development (5.61%), communities’ lives (4.21%), social problems (3.58%), health (3.27%), labor market (1.87%), human rights (1.71%), financial resources (0.47%), sports (0.16%), and culture (0.16%) were not particularly prominent in the survey data. In summation, a common view amongst 21.34% of the participants was that the top position belonged to human resources, while the next two positions were occupied by intellectual capital (15.11%), and education (13.30%), respectively.

Figure 5 offers the major data with regard to the main domain targeted by the companies in terms of corporate social responsibility activities.

Turning now to the next question, the respondents answering Question number 14 with either yes or currently a set of corporate social responsibility rules is under implementation in their company, were requested to give points starting from 1—very important and ending with 7—very unimportant (namely, 1—very important, 2—important, 3—somewhat important, 4—undecided, 5—somewhat unimportant, 6—unimportant, and 7—very unimportant) to 32 criteria associated with corporate social responsibility in order to describe the importance for the organization (

Appendix A, Question 16). Overall, the most relevant results concerning some of the key criteria are commented in the lines below (the whole range of data is displayed in

Appendix B,

Table A1):

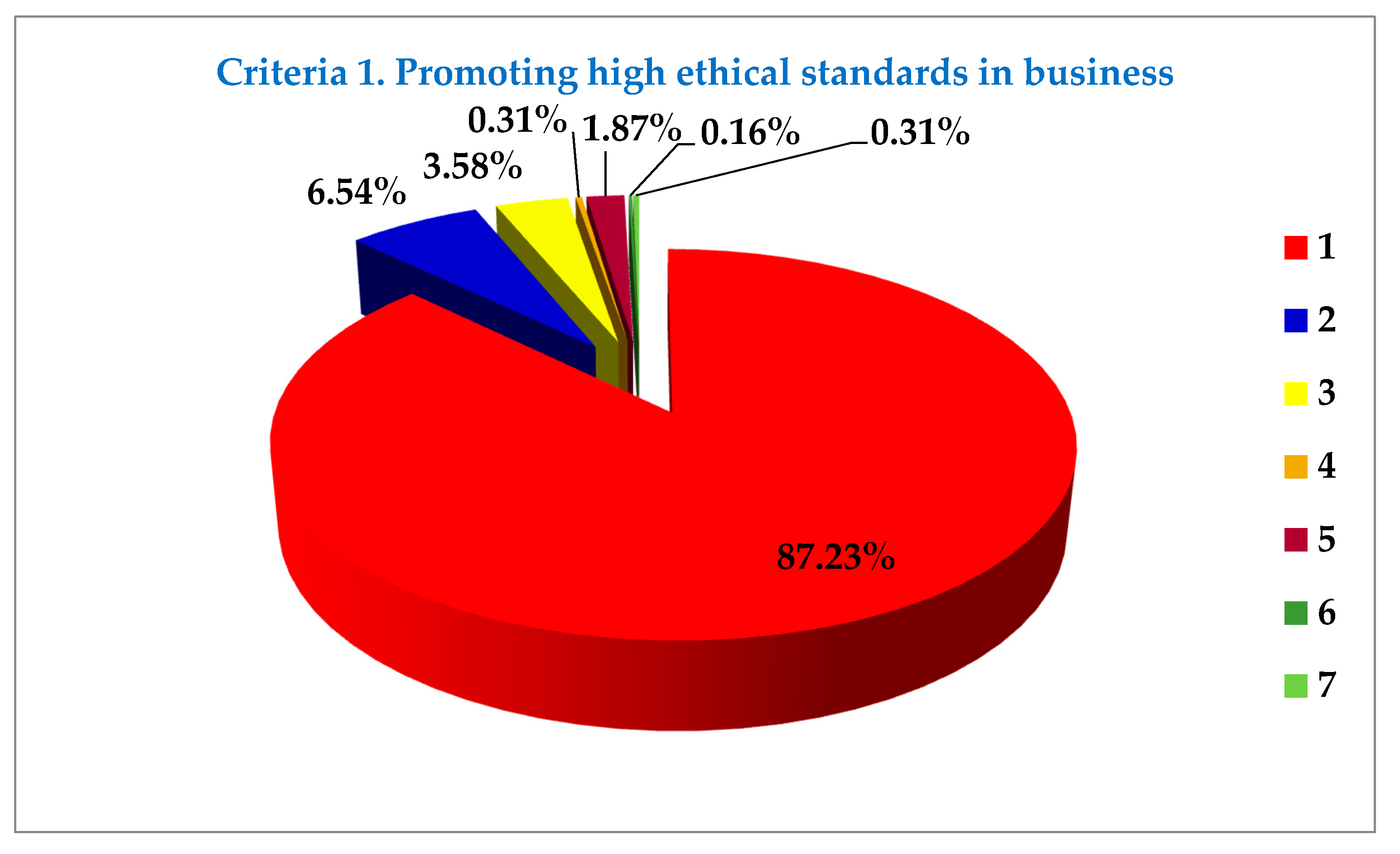

Promoting high ethical standards in business: Comparing the results, it can be seen that 85.23% of the answerers remarked that for their institution, promoting high ethical standards in business is very important, 6.54% perceived it as important, 3.58% said it was somewhat important, while 0.31% declared themselves undecided in this matter, followed by 1.87% viewing it as somewhat unimportant, in comparison with 0.16% presenting this issue as unimportant, and 0.31% as very unimportant. The results on promoting high ethical standards in business can be seen in

Appendix B,

Figure A8.

Informing constantly the shareholders about the organization’s business model, vision, objectives and steps taken for acquiring better corporate social responsibility knowledge: In short, peoples’ perception towards their company’s informing constantly the shareholders about the business model, vision, objectives and steps taken for acquiring better corporate social responsibility knowledge revealed that 55.45% noted it was very important, followed by 20.87% important, 15.26% somewhat important, 2.18% undecided, 1.56% somewhat unimportant, while 2.34% saw this action as unimportant and the same percentage (2.34%) as very unimportant.

Informing constantly the stakeholders about the organization’s business model, vision, objectives and steps taken for acquiring better corporate social responsibility knowledge: The results at this point are similar to those reflecting the importance of informing constantly the shareholders about the organization’s business model, vision, objectives and steps taken for acquiring better corporate social responsibility knowledge. Thus, peoples’ perception towards their company’s informing constantly the stakeholders about the organization’s business model, vision, objectives and steps taken for acquiring better corporate social responsibility knowledge revealed that 54.36% noted it was very important, followed by 20.56% important, 15.58% somewhat important, 2.65% undecided, 3.89% somewhat unimportant, while 2.18% saw this action as unimportant and 0.78% as very unimportant.

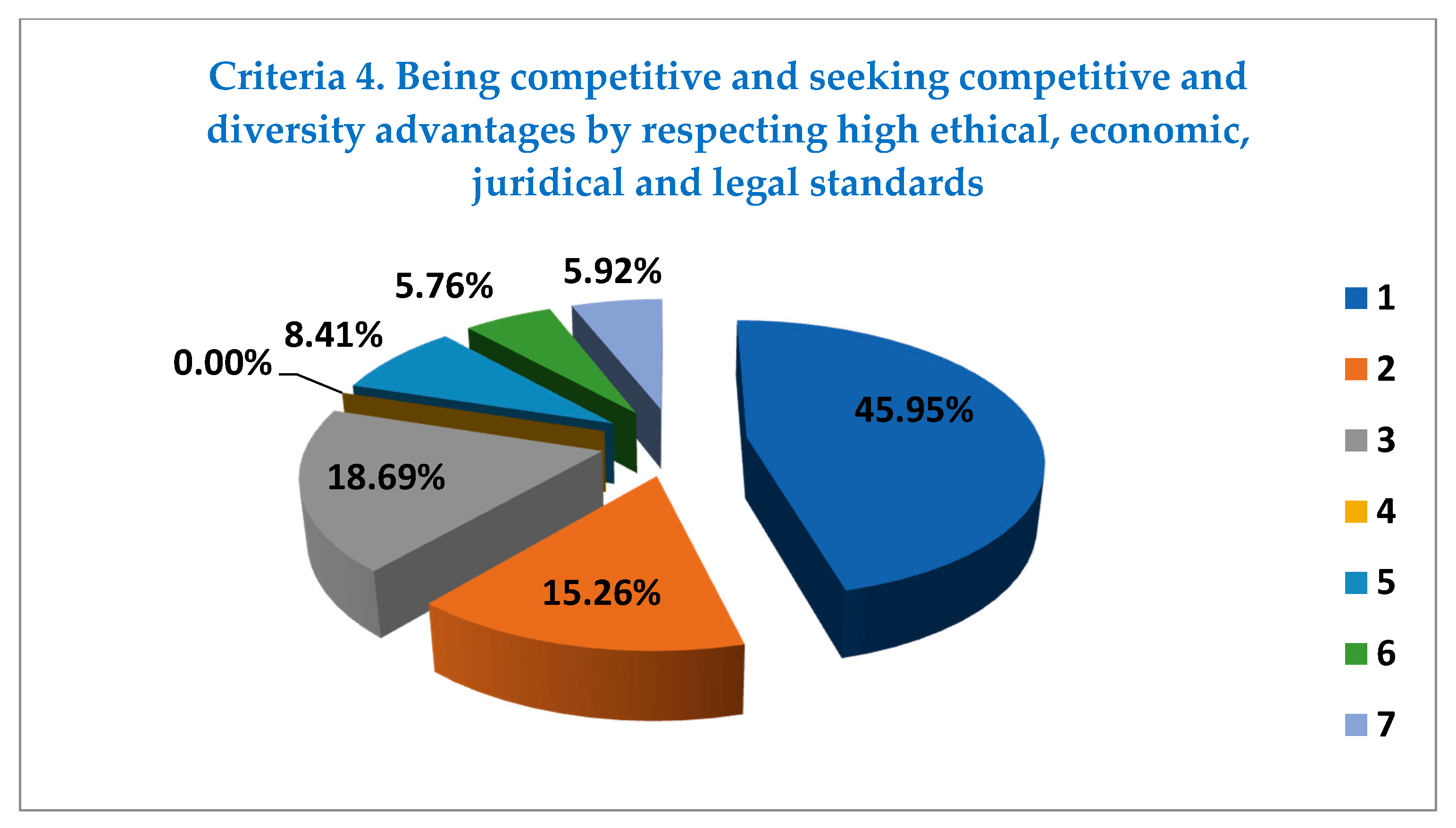

Being competitive and seeking competitive and diversity advantages by respecting high ethical, economic, juridical and legal standards: Interestingly, only 45.95% individuals said that for their company it is very important to be competitive and seek competitive and diversity advantages by respecting high ethical, economic, juridical and legal standards, 15.26% considered this aspect as being important for their organization, and 18.69% reported this criteria as somewhat important. However, in contrast, this time nobody felt undecided, and there was an increase in the percentages reflecting somewhat unimportant, unimportant and very unimportant views. Hence, 8.41% of the answerers said this issue was somewhat unimportant, while 5.76% saw this action as unimportant, and 5.92% as very unimportant. In

Appendix B,

Figure A9 indicates exactly the values compared at this point.

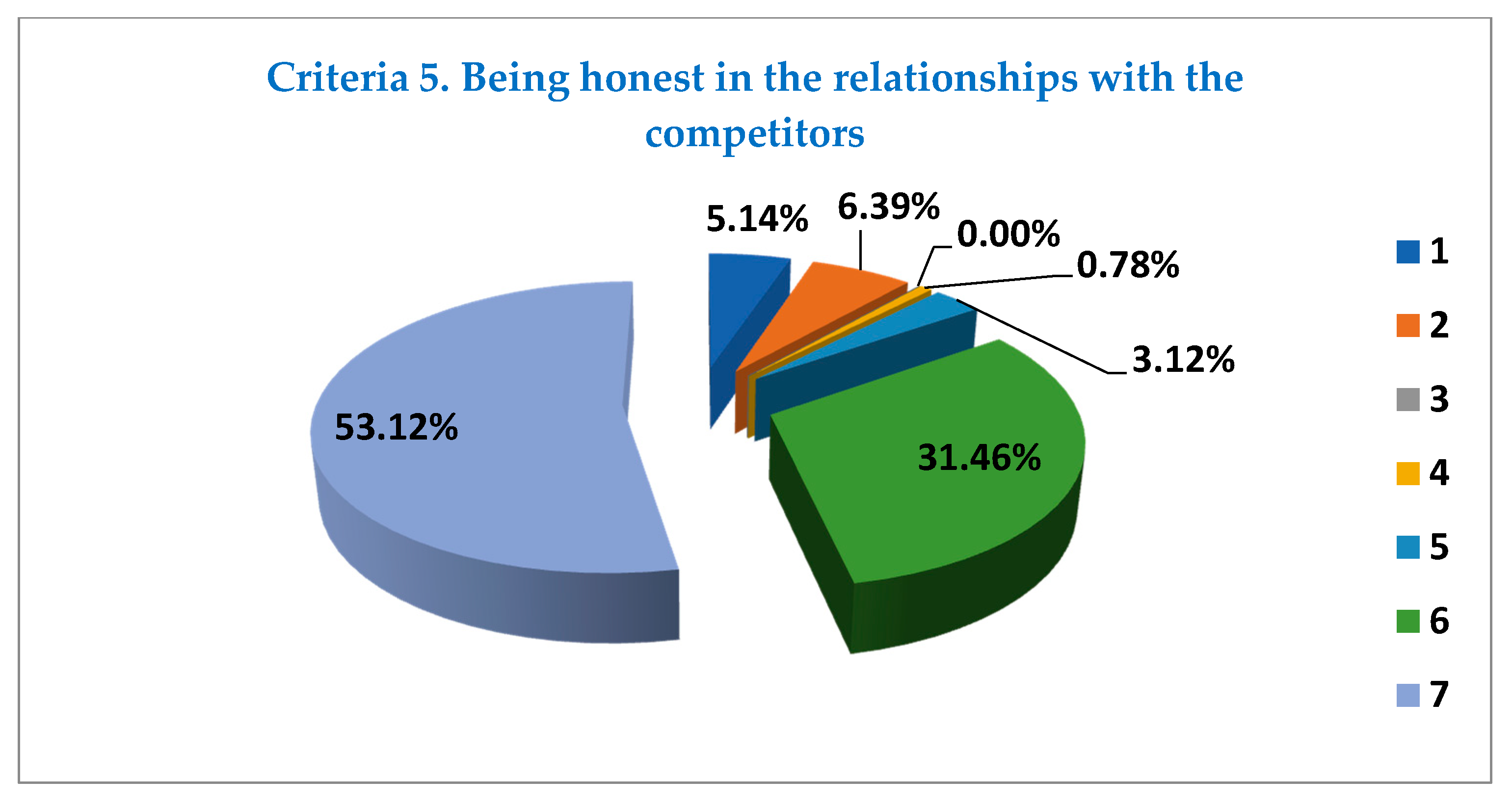

Being honest in the relationships with the competitors: A most striking observation to emerge from the data comparison was the employees’ perception concerning the honesty of their organization in the relationships with their competitors. Although the organizations were described by the employees as keen on promoting high ethical standards in business, as seen in the description of the first criteria above (see, in this matter, that 85.23% of the answerers remarked that for their institution promoting high ethical standards in business is very important, 6.54% perceived it as important, 3.58% said it was somewhat important), being honest in the relationships with their competitors seems not to be among the values of their institutions. By way of illustration, it can be remarked that only 3.12% respondents declared that being honest in the relationships with their competitors is very important for their organization, 6.39% reported being important, 0.00% proved to be somewhat important, while 0.78% were undecided and 5.14% acknowledged this aspect as somewhat unimportant. Nevertheless, most striking, 31.46% declared that being honest in the relationships with their competitors is unimportant for their organization and, even more worrying, 53.12% reported it is very unimportant. In

Appendix B,

Figure A10 pinpoints exactly the values compared at this section.

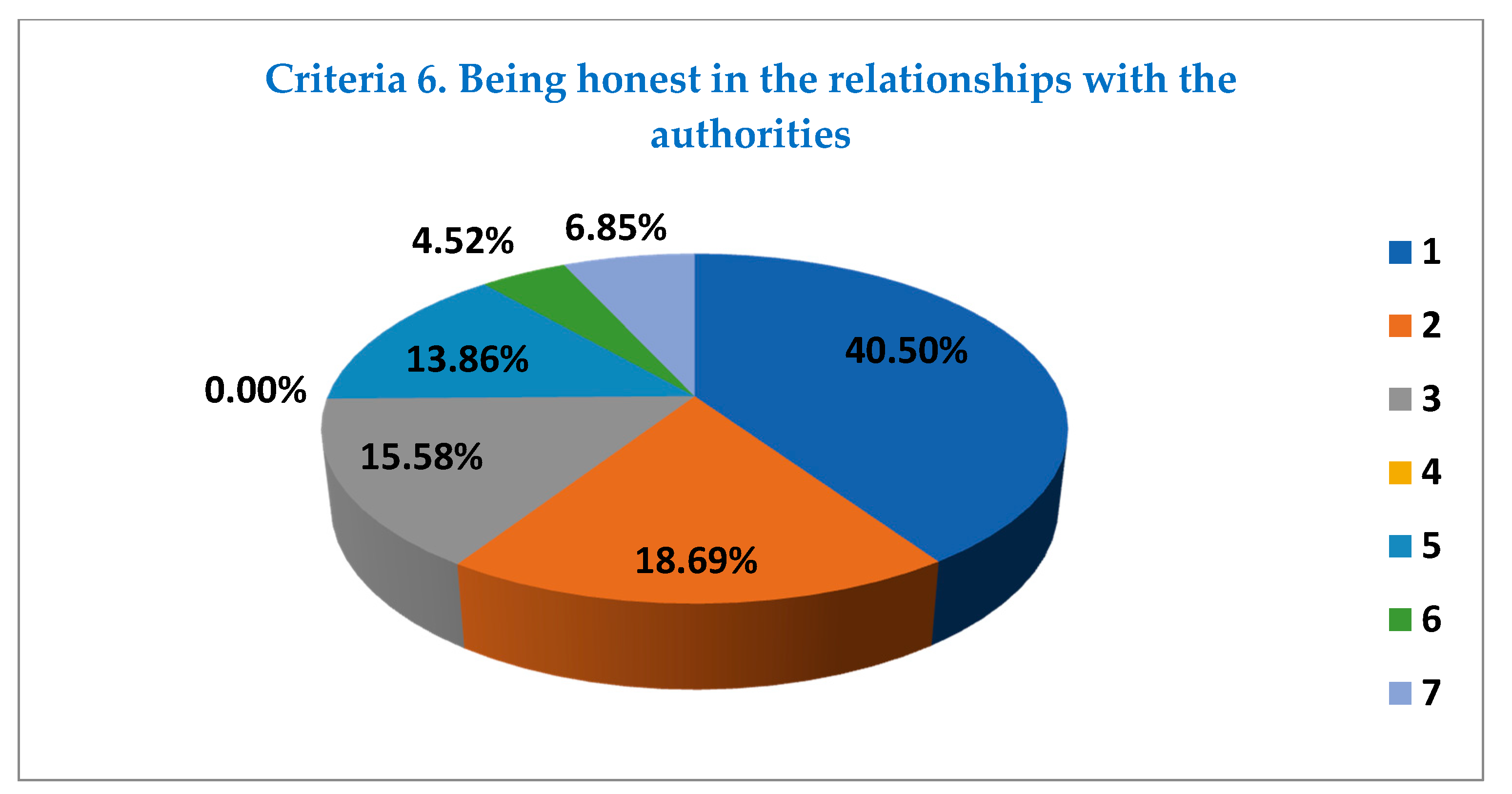

Being honest in the relationships with the authorities: When the respondents were asked to describe the importance of being honest in the relationships with the authorities in the eyes of their organizations, a significant difference was detected in comparison to the answers offered at the fifth criteria (see, in this matter, the criteria above, namely being honest in the relationships with their competitors). Most of the answerers (40.05%) established as very important for their companies being honest in the relationships with the authorities, while 18.69% named this criteria only as important, immediately followed by 15.58% evaluating this issue as somewhat important, while 0.00% were undecided and 13.86% acknowledged this aspect as somewhat unimportant, 4.52% unimportant, and 6.85% very unimportant. In

Appendix B,

Figure A11 highlights exactly the values targeted here.

Paying taxes and respecting the legal framework of the business environment where active: The overall answers concerning companies paying taxes and respecting the legal framework of the business environment where active were very positive. For instance, 46.88% of the respondents positioned paying taxes and respecting the legal framework of the business environment among the top priorities for their organizations, declaring this aspect as very important, while 21.18% presented this element as important, and 9.81% as somewhat unimportant. Yet, 5.14% were undecided in this matter. However, 7.48% demonstrated that this issue is somewhat unimportant for their organization, 5.30% unimportant, and 4.21% very unimportant.

Being honest in the relationships with the local communities: The findings highlight that 31.93% respondents presented being honest in the relationships with the local communities very important for their companies, 15.26% important, 15.89% somewhat important, 0.78% undecided, while 16.04% considered being honest in the relationships with the local communities somewhat unimportant for their organizations, 14.80% unimportant, and 5.30% very unimportant. In this matter, the study offers some important insights into the people’s perception with regard to their organizations being honest in the relationships with the local communities; the top three positions occupied show 31.93% acknowledging this corporate social criterion as very important, while surprisingly 16.04% view it as somewhat unimportant and 15.89% somewhat important. In

Appendix B,

Figure A12 demonstrates exactly the values discussed and analyzed here.

Ensuring the safety and health of employees: On the one hand, ensuring the safety and health of employees was for 70.40% individuals very important for their organizations, 12.93% saw this criterion as important, 10.59% somewhat important and 0.00% were undecided. On the other hand, ensuring the safety and health of employees was for 3.12% people somewhat unimportant for their companies, 2.65% unimportant, and 0.31% very unimportant. In our opinion, this question provided an important opportunity to advance the understanding of ensuring the safety and health of employees.

Ensuring high quality working conditions for employees: Ensuring and maintaining high quality working conditions for employees was acknowledged by 34.58% respondents as very important for their organizations, immediately followed by 31.31% that stated that it is an important criterion and 31.00% that described it as somewhat important, while 0.78% were undecided, 1.56% noted it was somewhat unimportant, 0.78% unimportant, and 0.00% very unimportant. In summation, organizations concern in ensuring and maintaining high quality working conditions for employees was substantiated once more by the fact that none of the respondents declared this criterion as very unimportant for their organization.

Protecting employees’ rights: According to the data gathered, protecting employees’ rights holds a great significance on the agenda of organizations. Commenting on protecting employees’ rights it could be determined that 31.31% respondents stated it was very important for their organizations, 30.06% perceived it as important, and 27.73% noted it as somewhat important. However, 1.25% respondents were undecided, 6.54% saw protecting employees’ rights as somewhat unimportant for their companies, 6.12% as unimportant, while 0.00% as very unimportant, which turned out to be a very promising description of the current situation in Romania.

Promoting employees’ diversity concerning gender, religion, (…): In view of the data obtained, we could observe that 69.16% of the answerers described promoting employees’ diversity concerning gender, religion, as very important for the organizations, 18.69% important and 8.72% somewhat important, while 0.31% were undecided, 2.18% considered this aspect as somewhat unimportant, 0.31% unimportant, and 0.61% very unimportant.

Creating and promoting programs to prevent employee discrimination: The evidence presented in this section suggests that 60.75% of the respondents saw creating and promoting programs to prevent employee discrimination as very important for their institutions, 17.13% important, 10.59% somewhat important and 0.16% were undecided. Yet, 10.28% declared that creating and promoting programs to prevent employee discrimination represents a somewhat unimportant criterion for their organization, 0.78% unimportant one, and 0.31% very unimportant.

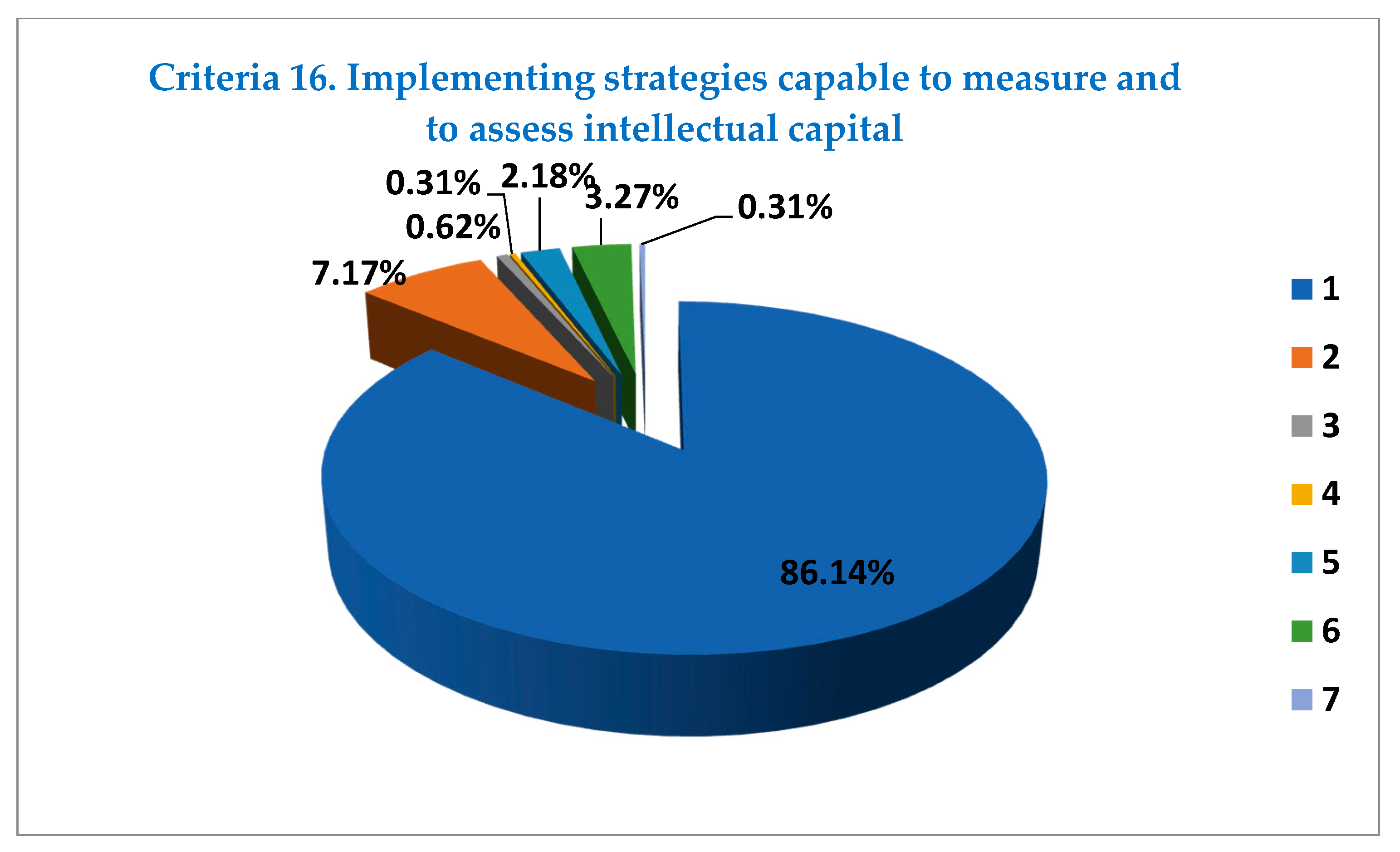

Implementing strategies capable to measure and to assess intellectual capital: By comparing the scores concerning implementing strategies capable to measure and to assess intellectual capital, the results showed that 86.14% respondents viewed this matter as very important, 7.17% important, while 0.62% somewhat important. In addition, 0.31% was undecided, while 2.18% shared the vision that it is somewhat unimportant, 3.27% unimportant, and 0.31% very unimportant. In

Appendix B,

Figure A13 demonstrates exactly the values discussed and analyzed here.

Solving customer questions and showing constant respect for consumer suggestions: After closely examining the data, our conclusion was that solving customer questions and showing constant respect for consumer suggestions was of utmost importance for the employees: 53.43% said this was a very important issue in their organization, 27.88% important, and 17.29% somewhat important. Additionally, 0.00% was undecided, while 0.62% saw this aspect as somewhat unimportant, 0.47% unimportant, and 0.31% very unimportant.

Developing customer education programs: This point provides employees’ perception concerning the importance of developing customer education programs for the institution where they are currently working. The information gathered pinpoints that 27.73% of the respondents believed that developing customer education programs is very important, 17.29% important and 23.36% somewhat important, while, in contrast, 0.00% were undecided, 12.46% indicated that it is somewhat unimportant, 8.72% unimportant, and 10.44% very unimportant.

Implementing strategies capable to help investigate consumer satisfaction: The percentages calculated according to the responses identified that for 51.87% of the individuals implementing strategies capable to help investigate consumer satisfaction plays a very important role in their organizations, for 38.63% important, and for 3.74% somewhat important, while 0.00% turned out to be undecided, 4.67% emphasized it was somewhat unimportant, 1.09% unimportant, and 0.00% very unimportant.

Monitoring closely green promotional actions: In terms of monitoring closely green promotional actions, companies were described as showing a great concern in this regard. Thus, 10.28% of the respondents stated this aspect as very important, 26.01% as important, and 46.42% as somewhat important. In comparison, 0.78% was undecided, while 12.15% noted this issue as somewhat unimportant, 2.18% unimportant, and 2.18% very unimportant.

Providing important data for green product design: The results on providing important data for green product design pinpointed that 8.88% of the respondents acknowledged the 22 criterion on our list as very important, while 26.17% reported it as important and 35.05% as somewhat important. Additionally, 1.07% of the responses stressed that they were undecided, 13.86% emphasized that this criteria was for them somewhat unimportant, 13.86% unimportant, and 1.09% very unimportant. Under these circumstances, by adding the data gathered from the respondents choosing as preferences on the Likert scale, in this case, the degrees very important, important and somewhat important, we can conclude that providing important data for green product design occupies a key position in the companies’ organizational agenda.

Focusing on developing research on increasing product safety: The data revealed that 54.05% of the surveyed population considered very important focusing on developing research on increasing product safety, 27.41% acknowledged this issue as important, while 15.58% stated it was somewhat important. In continuation, 0.00% was undecided, 2.96% presented somewhat unimportant focusing on developing research on increasing product safety, while 0.00% illustrated it was unimportant, and 0.00% very unimportant.

Participating in the protection of the environment and promotion of biodiversity: We observed from the information processed that participating in the protection of the environment and promotion of biodiversity was declared as very important for 96.57% of the surveyed individuals, while 2.04% of the answerers said it was important and 1.40% somewhat important. Interestingly, the numbers showed that a total of 0.00% were undecided, or considered this issue as somewhat unimportant, unimportant, and very unimportant.

Supporting art, educational institutions, health, medicine: If we now turn to supporting art, educational institutions, health, medicine, 97.98% of the respondents declared that it is very important in terms of corporate social responsibility measures, while 1.71% looked at this criteria as important, and 0.31% somewhat important. However, we considered extremely positive the fact that 0.00% of the answerers were undecided, or considered this issue as somewhat unimportant, unimportant and very unimportant.

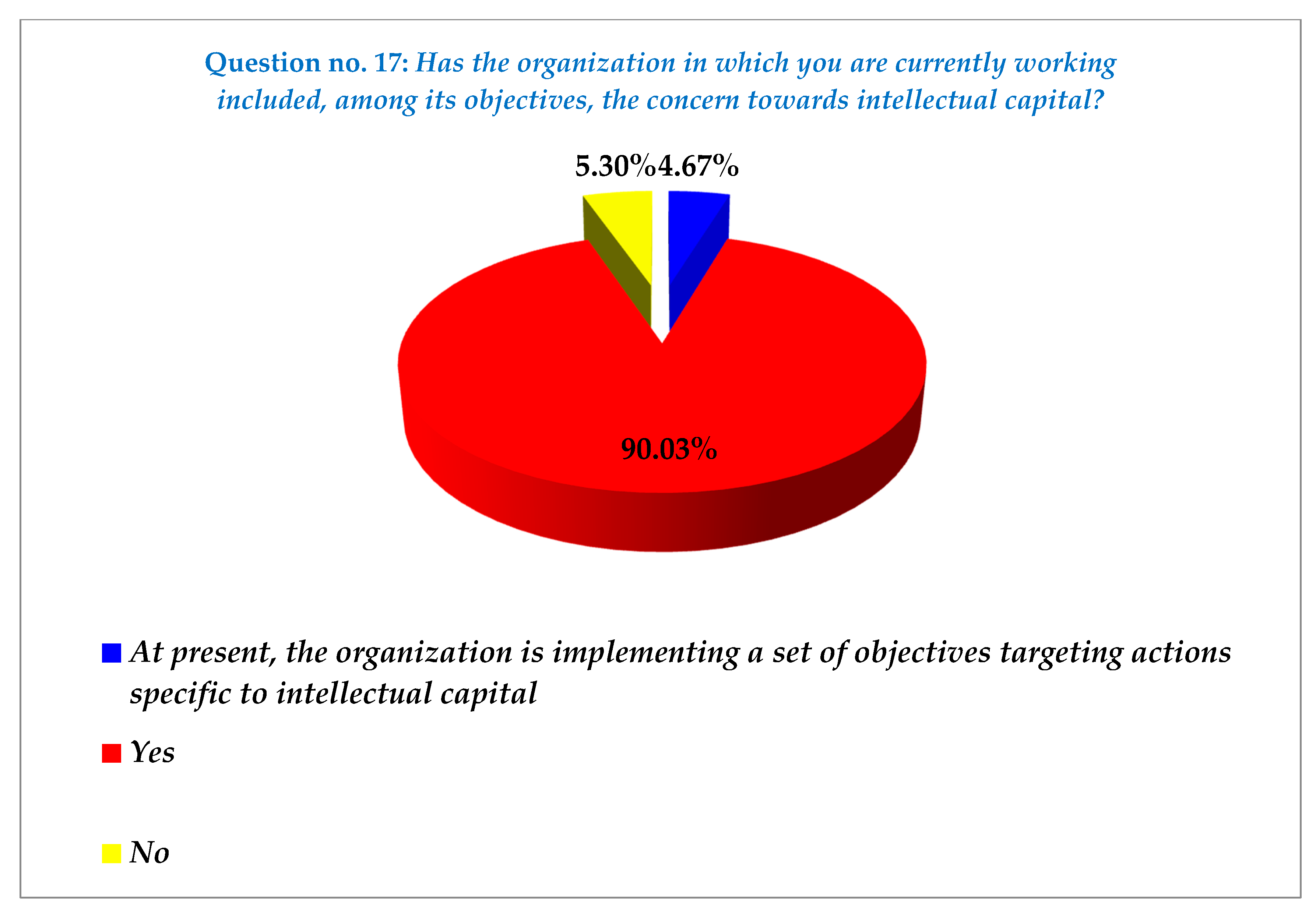

When the subjects were asked whether or not their organization included, among its objectives, the concern towards intellectual capital (

Appendix A, Question 17), the majority (90.03%) commented that their companies were aware of intellectual capital benefits, which determined them to acknowledge it in their programs. Moreover, 4.67% stated that even though at present, their organization has not implemented already a set of objectives targeting actions specific to intellectual capital, they are on the point of doing so. Yet, 5.30% individuals advanced the idea that their companies did not place intellectual capital among their priorities. These figures are highlighted in

Figure 6.

Let us now look at Question 18 (

Appendix A), which was specially designed for those individuals who answered either yes or stated that currently a set of intellectual capital rules was under implementation in their organization at Question 17 (

Appendix A). In this matter, the surveyed individuals were asked to say which of the statements given as part of a predefined set of options reflected best their organization’s vision and perception towards intellectual capital. In total, the set contained 15 sentences. Thus, they were asked to rank these statements in the order of their importance, using the following scale: 1—very important; 2—important, 3—somewhat important; 4—undecided; 5—somewhat unimportant; 6—unimportant; 7—very unimportant. The overall responses to this query were quite positive, since we discovered that almost all the respondents acknowledged the importance of both intellectual capital as well as financial and non-financial performance at the level of their organization and the implications that both intellectual capital as well as financial and non-financial performance have on corporate social responsibility. This set of analysis confirmed the great impact that intellectual capital has on companies’ corporate social responsibility and also strengthen our belief that it plays a paramount role in enhancing institutions’ efficiency and performance. These results are presented in detail in the lines below (while the respondents’ preferences are displayed in

Appendix B,

Table A2):

The majority of the surveyed population (98.85%) declared that the first statement “Knowledge circulates at every level of a business, either at the human resources level, structural or at the clients’ level” is very important, while 0.66% considered this element as important and 0.49% as somewhat important.

Moving on to the second statement “Knowledge circulates at every level of a business, either at the human resources level, structural or at the clients’ level”, 98.85% believed that it was very important, while 0.66% revealed it was important and 0.49% somewhat important.

According to the answerers, there was a total agreement (100.00%) that knowledge represents one of the main assets of an organization.

With regard to the statement “Human resources represent one of the main assets of an organization”, 99.67% of the individuals considered it was very important, reflecting best their organization’s vision and perception towards intellectual capital, while 0.16% emphasized it was very important and 0.16% important.

The results for the fifth statement “Intellectual capital represents one of the main assets of an organization” showed that 99.67% detected this aspect reflected best their organization’s vision and perception towards intellectual capital, while 0.16% emphasized it was very important and 0.16% important.

Concerning the statement “Intellectual capital offers competitive advantages for an organization”, 99.67% of the surveyed population remarked that this issue reflected best their organization’s vision and perception towards intellectual capital, while 0.16% emphasized it was very important and 0.16% important.

The fact that “Intellectual capital offers diversity advantages for an organization” was considered by 99.67% of the surveyed population as very important when discussing about their organization’s vision and perception towards intellectual capital, while 0.16% emphasized it was very important and 0.16% important.

Remarkably, in the case of the statement “The intellectual capital possessed by the organization must be well managed”, 98.68% of the individuals were fully aware that intellectual capital possessed by the organization must be well managed, this being of crucial importance for any institution, while 0.82% of the population said it was important and 0.49% somewhat important.

It is fundamental, in our opinion, that the statement “The intellectual capital possessed by the organization must be measured” was regarded as very important by 93.42% of the respondents, while 3.95% saw this matter as important and 0.16% somewhat important. In opposition, 0.33% of the answerers were undecided, and 2.14% considered this aspect as somewhat unimportant in relation with their organization’s vision and perception towards intellectual capital.

The most striking result to emerge from the data is that the respondents indicated the lack of intellectual capital measuring tools in their organizations. Hence, in the case of the statement “The organization does not possess all the necessary tools in order to measure its intellectual capital by using financial and economic analysis”, 22.04% stressed it was very important, 22.70% argued it was important, 38.49% somewhat important, 1.15% were undecided, while 5.59% said this issue was somewhat unimportant, 9.38% unimportant and 0.66% very unimportant.

Importantly, the statement “The intellectual capital possessed by the organization must be properly exploited in order to enhance success on the marketplace” was acknowledged by 98.52% of the surveyed individuals as very important, while only a small minority (1.48%) said it was important.

Further on, the results strengthened our confidence in the importance of intellectual capital in organizations, due to the fact that 98.36% of the respondents considered the statement “The intellectual capital has a strong impact on an organizations corporate social responsibility decisions and actions” as very important in terms of reflecting their organization’s vision and perception towards intellectual capital. Nonetheless, 1.32% declared that this matter was important; while 0.33% stressed that it was somewhat important.

The twelfth sentence “The organizational practices associated with intellectual capital strengthen the organization’s position towards innovation and creative processes” was considered by 99.41% as very important when analyzing their organization’s vision and perception towards intellectual capital, while 0.49% asserted it was important.

While analyzing the statement “The notions of production and productivity need to be totally revised in order to offer a better adaptation to the information age”, we discovered that 81.58% of the individuals regarded this issue as very important for their organization, while 3.78% presented it as important, 10.69% as somewhat important, 0.00% declared themselves as part of the undecided category, 3.29% somewhat unimportant, 0.33% unimportant, and 0.33% very unimportant.

Moreover, speaking in synthesis, the results for the statement “The notion of performance needs to be totally revised in order to offer a better adaptation to the information age” showed that 81.58% of the surveyed population declared it reflected best their organization’s vision and perception towards intellectual capital, while 5.43% acknowledged it as important, 10.69% as somewhat important, while 0.00% were undecided, 1.64% stated it was somewhat unimportant, 0.33% unimportant, and 0.33% very unimportant.

The data gathered for the last statement “The notion of efficiency needs to be totally revised in order to offer a better adaptation to the information age” is somewhat similar to the aforementioned statement, namely 81.58% of the surveyed population declared it reflected best their organization’s vision and perception towards intellectual capital, while 5.43% acknowledged it as important, 10.69% as somewhat important, while 0.00% were undecided, 1.64% stated it was somewhat unimportant, 0.33% unimportant, and 0.33% very unimportant.

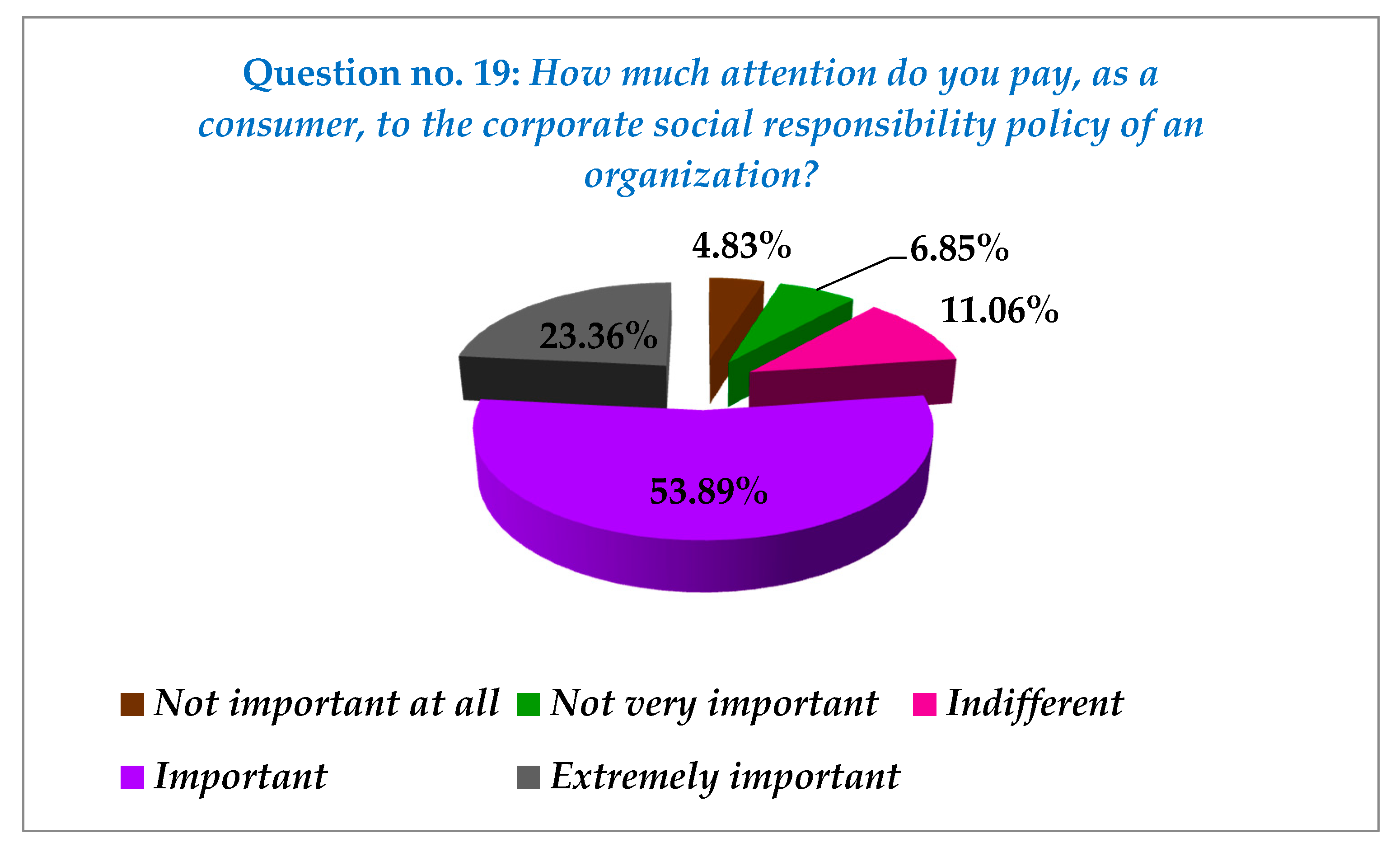

In response to Question 19 (

Appendix A), nearly all of those surveyed indicated that, as consumers, they pay a lot of importance to the corporate social responsibility policy of an organization. In our opinion, it is fundamental to note that 53.89% of the respondents considered it as important for a company to have a corporate social responsibility policy and 23.36% identified this aspect as extremely important. However, as far as we were aware, for 11.06% of the answerers this topic was indifferent in their opinion, 6.85% viewed this point as not very important, while 4.83% indicated it was not important at all. These figures are illustrated in

Figure 7.

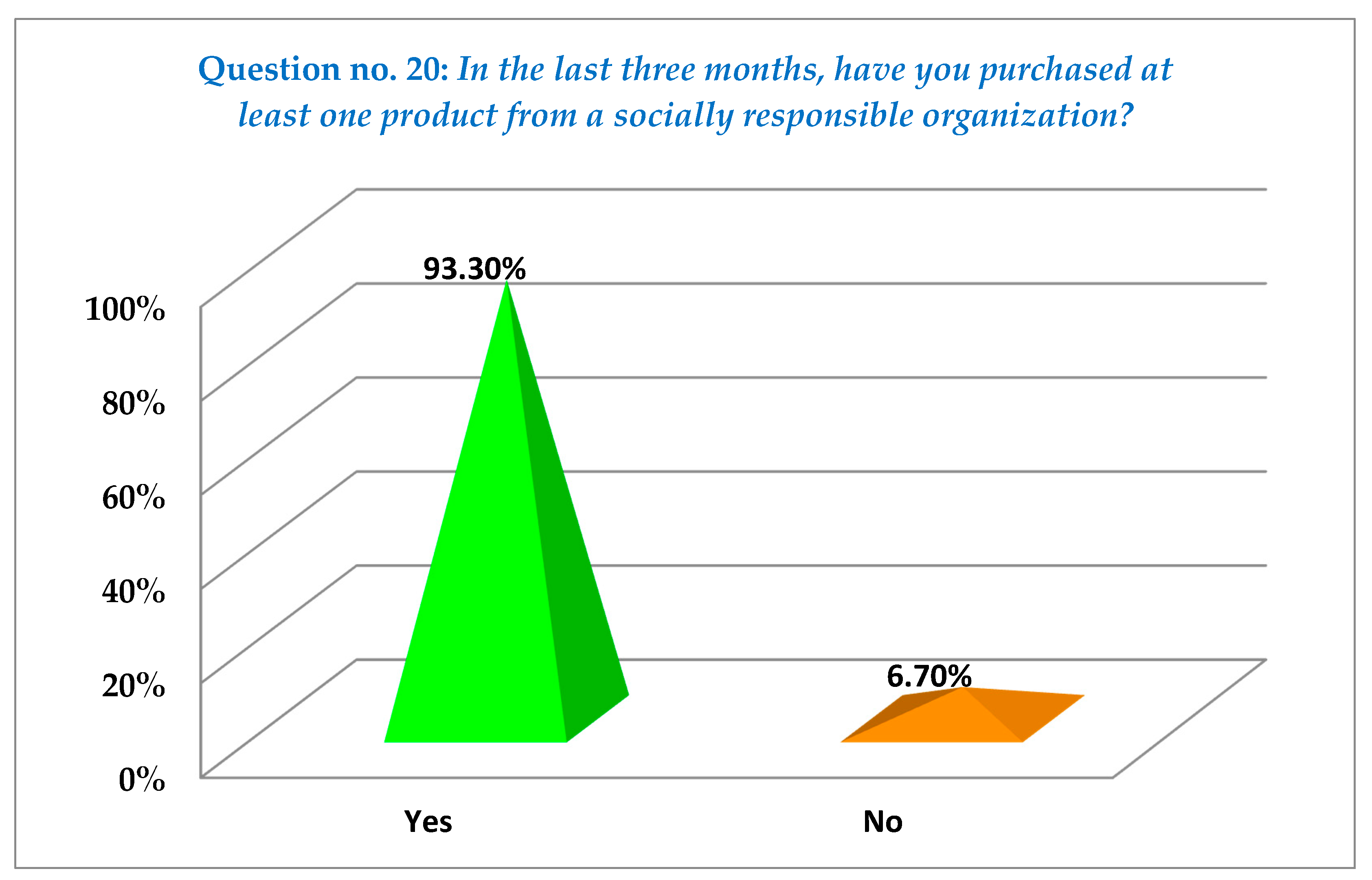

Our study provides additional evidence concerning individuals’ perspectives about the importance of acting socially responsible (

Appendix A, Question 20). Thus, the next question “In the last three months, have you purchased at least one product from a socially responsible organization?” investigated customers purchasing habits, targeting to discover weather, in the last three months, they acquired at least one product from a socially responsible organization. These results offer indisputable evidence for supporting the idea that people show a tremendous concern for sustainability and social responsibility: 93.30% of the respondents purchased, in the last three months, at least one product from a socially responsible organization, while a small minority of answers (6.70%) said that they did not buy, in the last three months, at least one product from a socially responsible organization. These results are evidenced in

Figure 8.

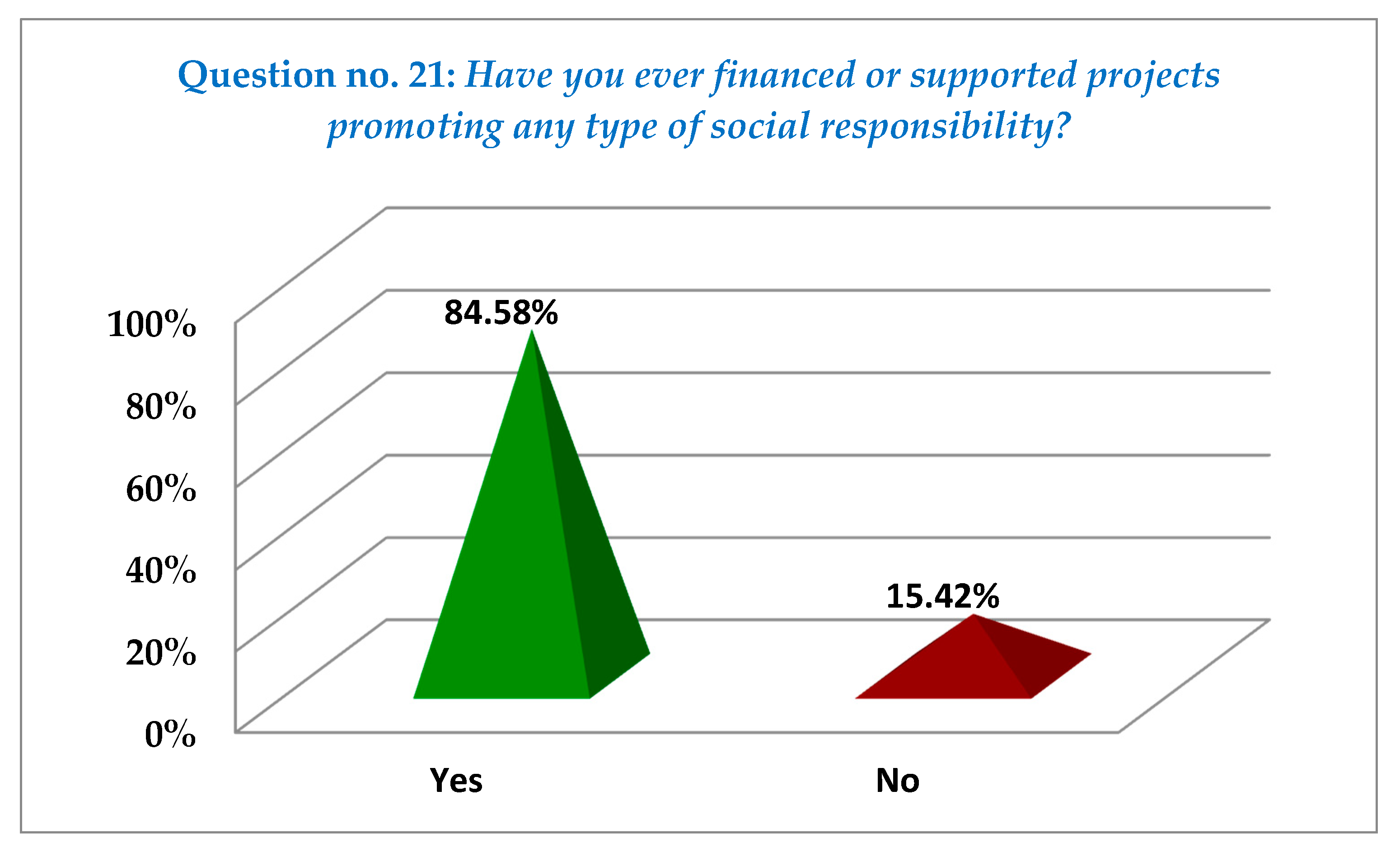

In response to Question 21 (

Appendix A), nearly all of those surveyed (84.58%) indicated that, until present, they financed or supported projects promoting any type of social responsibility. In opposition, very few participants (15.41%) said that until that moment they did not finance or support projects promoting any type of social responsibility. Broadly speaking, at the level of Romania, we found the value of those that financed or supported projects promoting any type of social responsibility encouraging. These results are presented in

Figure 9. Moreover, as a special note to this query, if the answer was yes, the respondents were asked to state the number of projects and to mention weather they were currently involved or not in such an activity. Generally speaking, 60% of the respondents declared that they were part of one such a program, while the rest (40%) were already at their second or third activity of this type.

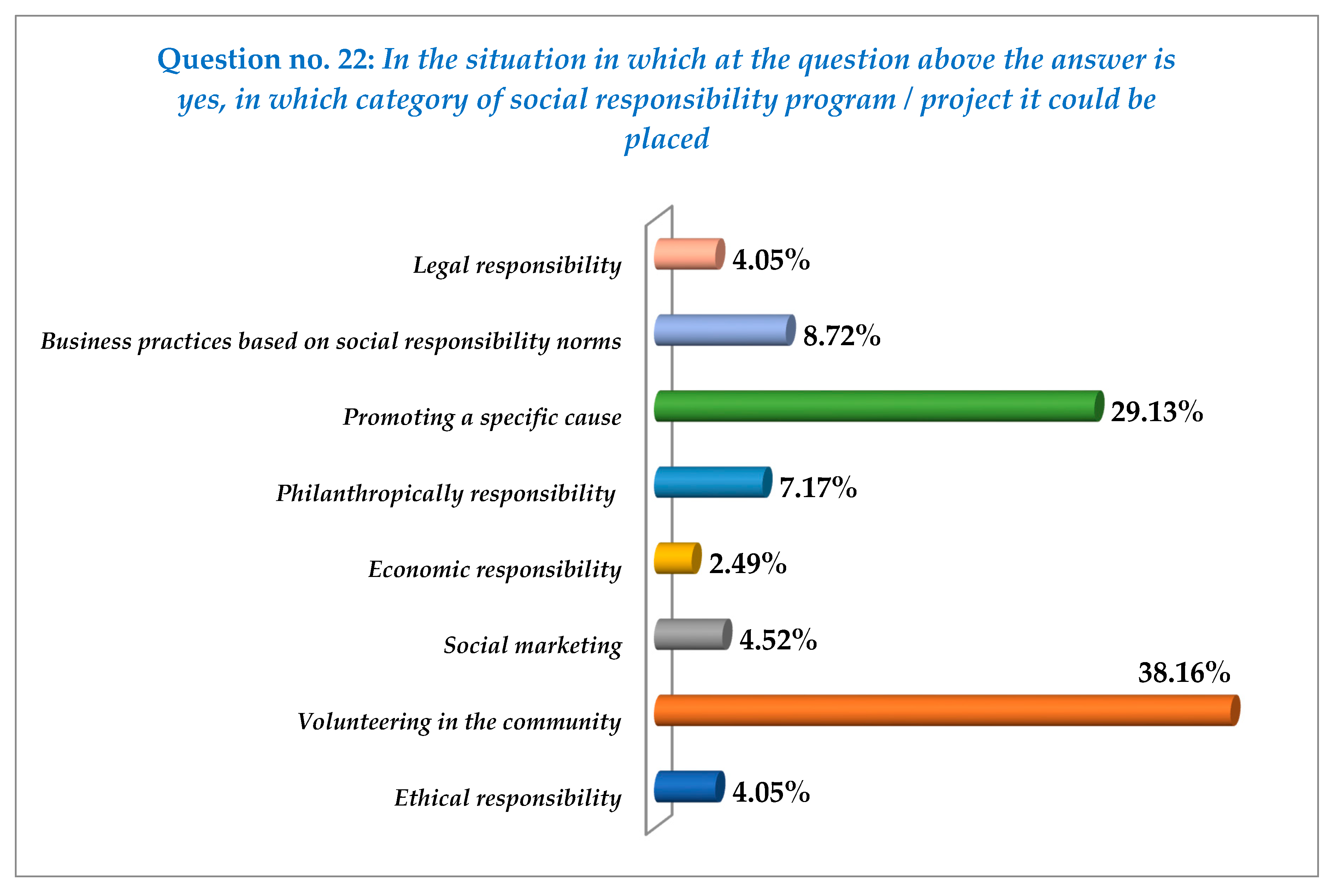

In addition, the individuals answering positively to Question 21 (

Appendix A), were asked in the next query (

Appendix A, Question 22) to state in which category of social responsibility program/project it could be placed. They were given the following list with possible options: ethical responsibility, volunteering in the community, social marketing, economic responsibility, philanthropically responsibility, promoting a specific cause, business practices based on social responsibility norms, and legal responsibility. Interestingly, the results revealed that 38.16% were involved in programs or projects specially designed for volunteering in the community activities, immediately followed by 29.13% that were promoting a specific cause, 8.72% were involved in business practices based on social responsibility norms, and 7.17% acknowledged being part of philanthropically responsibility programs. In continuation, on average, we also found several encouraging values for other types of projects, programs and activities, namely: 4.52% for social marketing; 4.05% for legal responsibility, which turned out to be equal with the value for ethical responsibility (also 4.05%); and 2.49% economic responsibility. These results are displayed in

Figure 10.

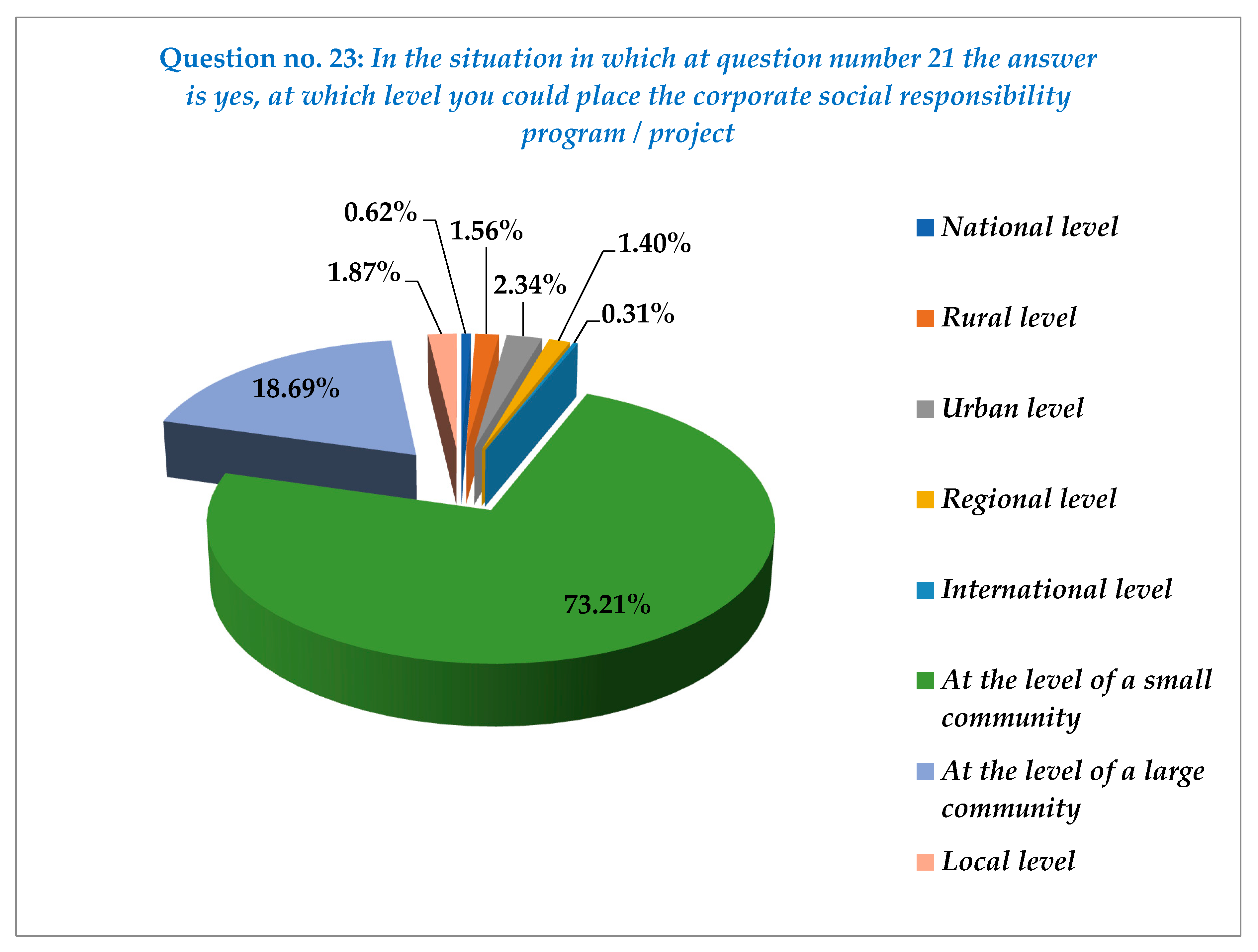

Moreover, in continuation to Question 21 (

Appendix A), the individuals answering positively in that situation, had to indicate at Question 23 (

Appendix A) at which level they could place the corporate social responsibility program or project, having the following possibilities: national level, rural level, urban level, regional level, international level, at the level of a small community, at the level of a large community, or local level. The overall response to this question was at a level of a small community (73.21%), followed by 18.69% at the level of a large community, 2.34% urban level, 1.87% local level, 1.56% rural level, 1.40% regional level, 0.72% national level, and 0.31% international level. These results are displayed in

Figure 11.

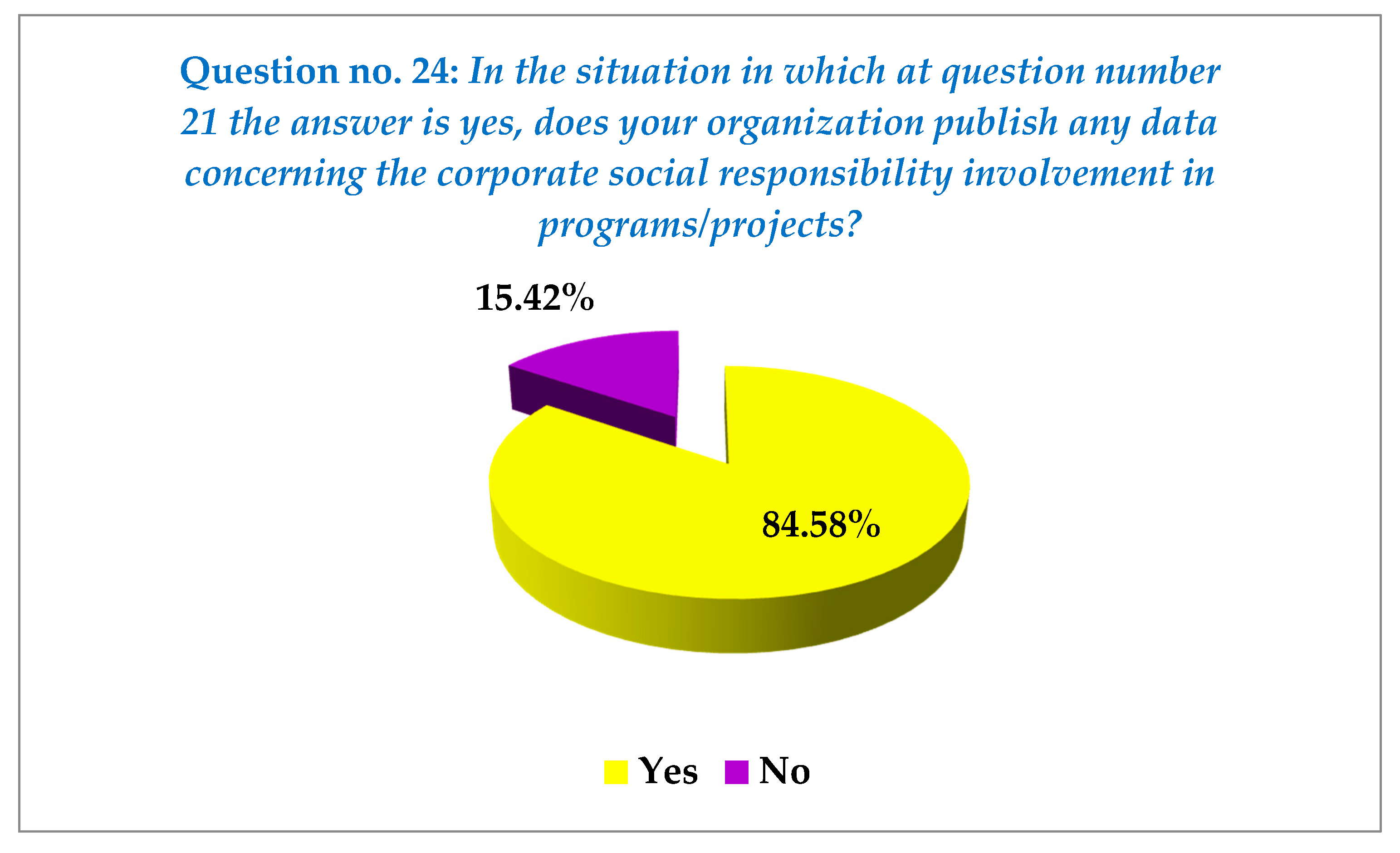

Furthermore, those who provided a positive answer to Question 21 had to say whether or not their organization was publishing any data concerning corporate social responsibility involvement in programs/projects (

Appendix A, Question 24). According to our examination, we concluded that 84.58% respondents said that their organization was publishing data concerning corporate social responsibility involvement in programs/projects, while 15.42% indicated that their organization was not publishing any data concerning corporate social responsibility involvement in programs/projects. If the answer to this question was yes, we considered it essential to ask the respondent to state where their organization published this type of information, offering them the possibility to choose one or more answers, as fits the case: on-line, directly on the web page of the organization, visible to public; on-line, visible only internally, from the intranet space; printed documents, published by the organization, mainly distributed to competent authorities, stakeholders, shareholders, business partners, employees, and clients; information notes and other documentation, specially prepared for mass-media; social reports; annual reports; annual strategic reports for sustainable development; integrated (consolidated) annual reports; corporate social responsibility reports; sustainable development reports; sustainable development and equal opportunities reports; or others. As a result, the respondents emphasized the fact that their organizations took the opportunity to acknowledge in as many sources as possible their actions concerning corporate social responsibility involvement in programs/projects. Hence, all the disseminations methods above were used by the companies, almost in an equal proportion. These results are displayed in

Figure 12.

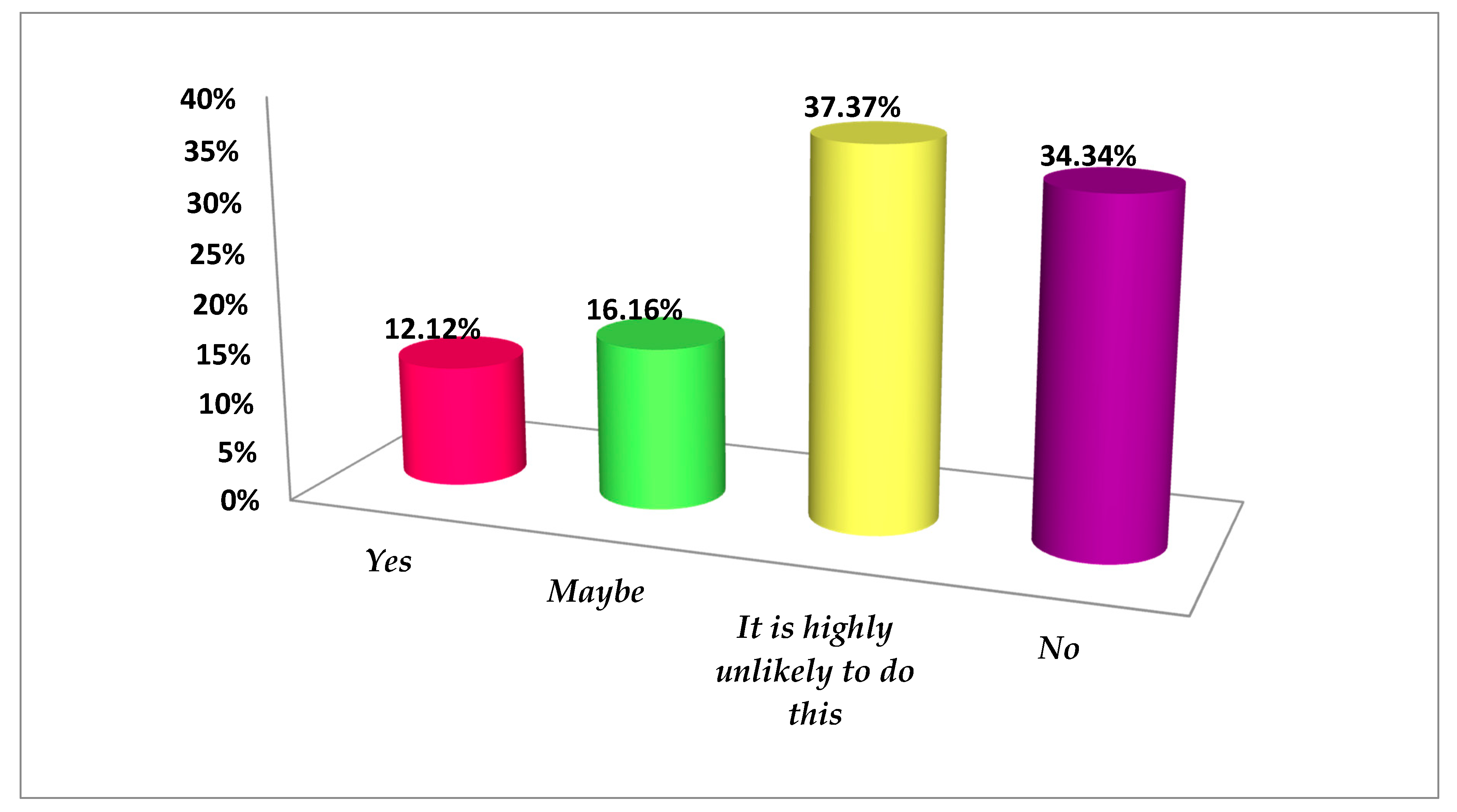

However, those who provided a negative answer to Question 21, were asked in this stage to say if they would be interested to become involved, in the future, in social responsibility activities (

Appendix A, Question 25). Our findings showed that 12.12% of the respondents were willing to get involved, in the future, in social responsibility activities, 16.16% were not very sure about their future plans, reporting that their answer in this case is that they might get involved, in the future, in social responsibility activities. Yet, surprisingly, in opposition, 34.34% of the answerers said they were not interested to get involved, in the future, in social responsibility activities and 37.37% stressed that it is highly unlikely for them to do this. These results are displayed in

Figure 13.

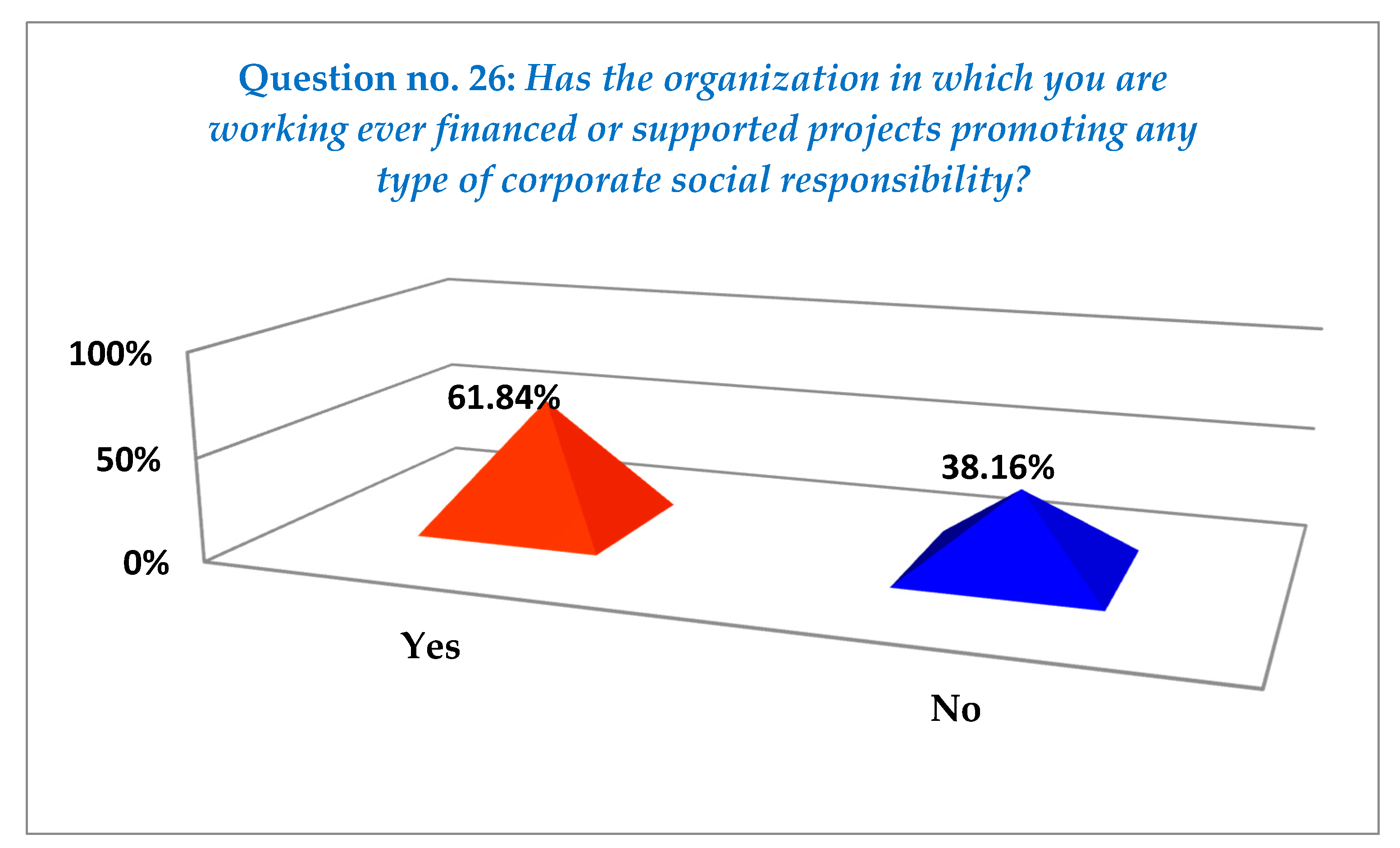

To assess whether the organization in which the individuals surveyed were currently working had ever financed or supported projects promoting any type of corporate social responsibility, the respondents were asked to choose between a positive and a negative option (

Appendix A, Question 26). Of the study population, 61.84% offered a positive response. However, 38.16% of answerers highlighted that the organization in which the individuals surveyed were currently working had never financed or supported projects promoting any type of corporate social responsibility. Since if the answer chosen was yes, the individuals were asked to state the number projects in which their organization was involved, over half of those surveyed reported two or more than two such activities. These results are displayed in

Figure 14.

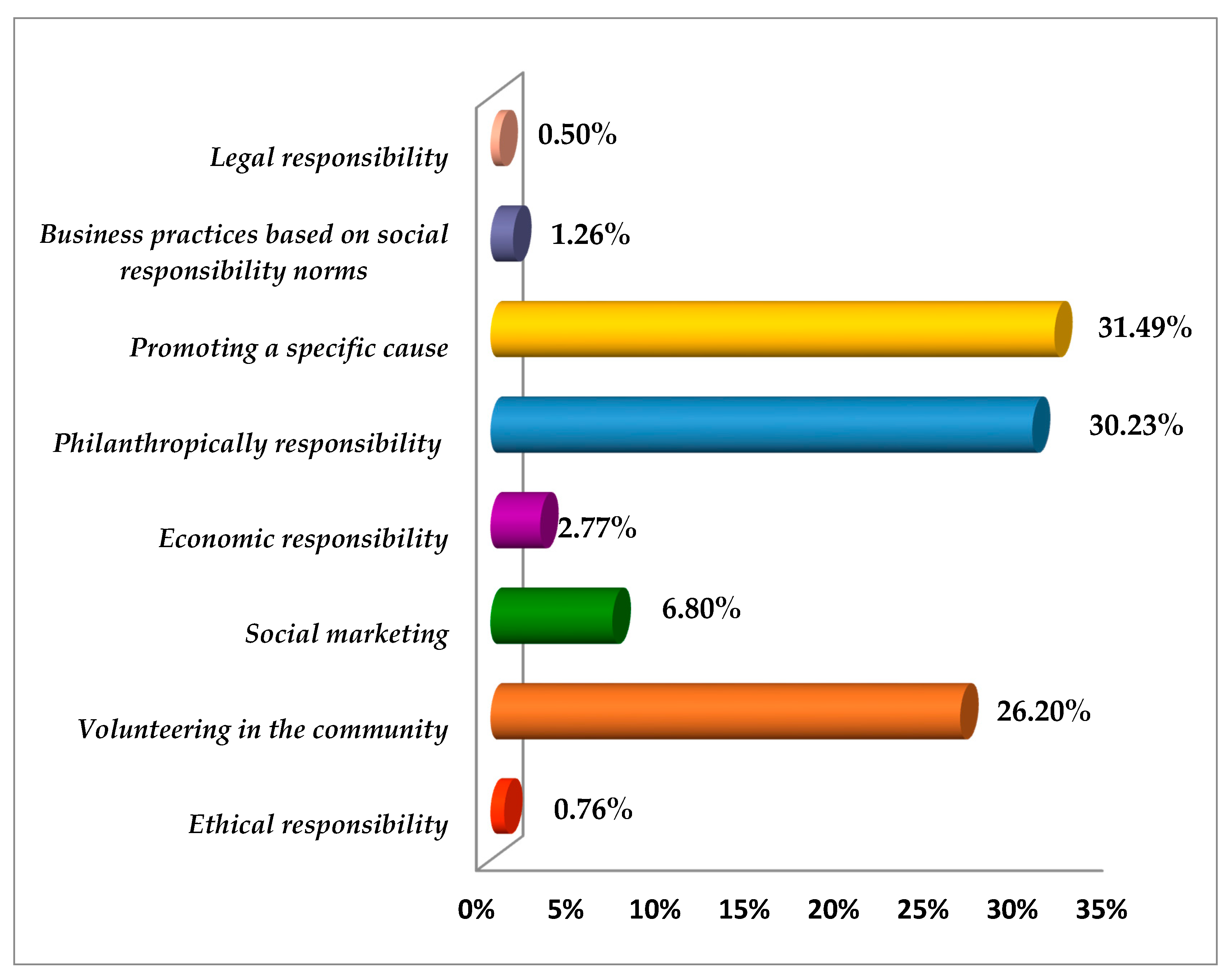

Importantly, at the next step of the questioner, in the situation in which Question 26 the answer was yes, the individuals surveyed had to point out in which category of corporate social responsibility program/project could it be placed (

Appendix A, Question 27). The data gathered proved that the first position (31.49%) implicated promoting a special cause, the second one (30.23%) referred to philanthropically responsibility, while the third one (26.20%) was centered on volunteering in the community. The next positions in the chart were occupied by social marketing (6.80%), economic responsibility (2.77%), business practices based on social responsibility norms (1.26%), ethical responsibility (0.76%), and legal responsibility (0.50%). These results are displayed in

Figure 15.

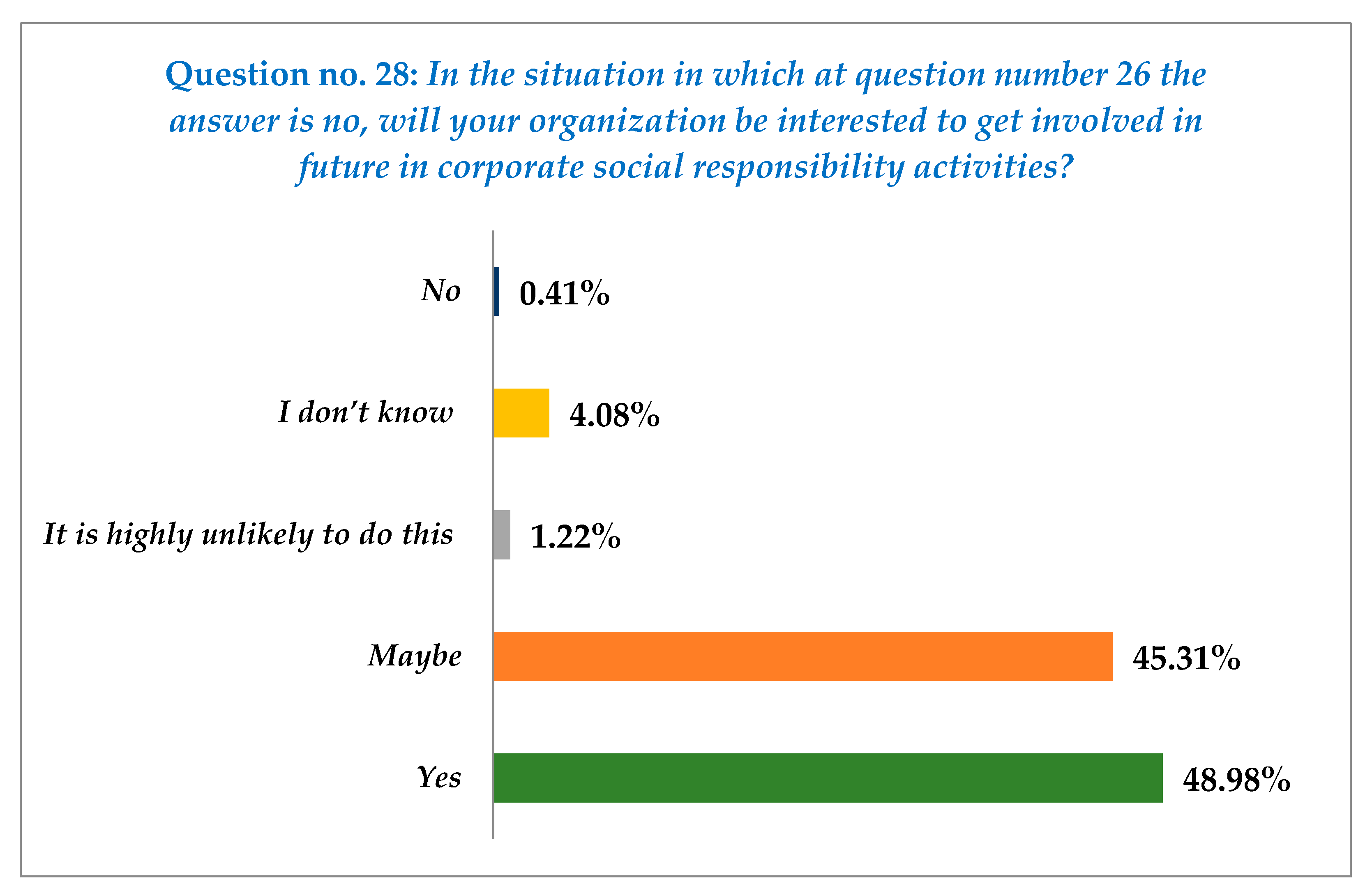

In the situation in which at Question 26 the answer was no, the respondents were asked to present their opinion concerning their organizations’ interest to becoming involved in the future in corporate social responsibility activities (

Appendix A, Question 28). Our study provides additional support into the organizations’ interest to getting involved in the future in corporate social responsibility activities, displaying 48.98% positive answers in this regard, followed by 45.31% feedbacks stating that their organizations might become involved in such activities. It was found that 4.08% had no knowledge at that moment concerning the organizations intentions with regard to the future in corporate social responsibility activities, while 1.22% respondents pointed out that their organizations are highly unlikely to do this and 0.41% simply offering a negative statement in this context. These results are displayed in

Figure 16.

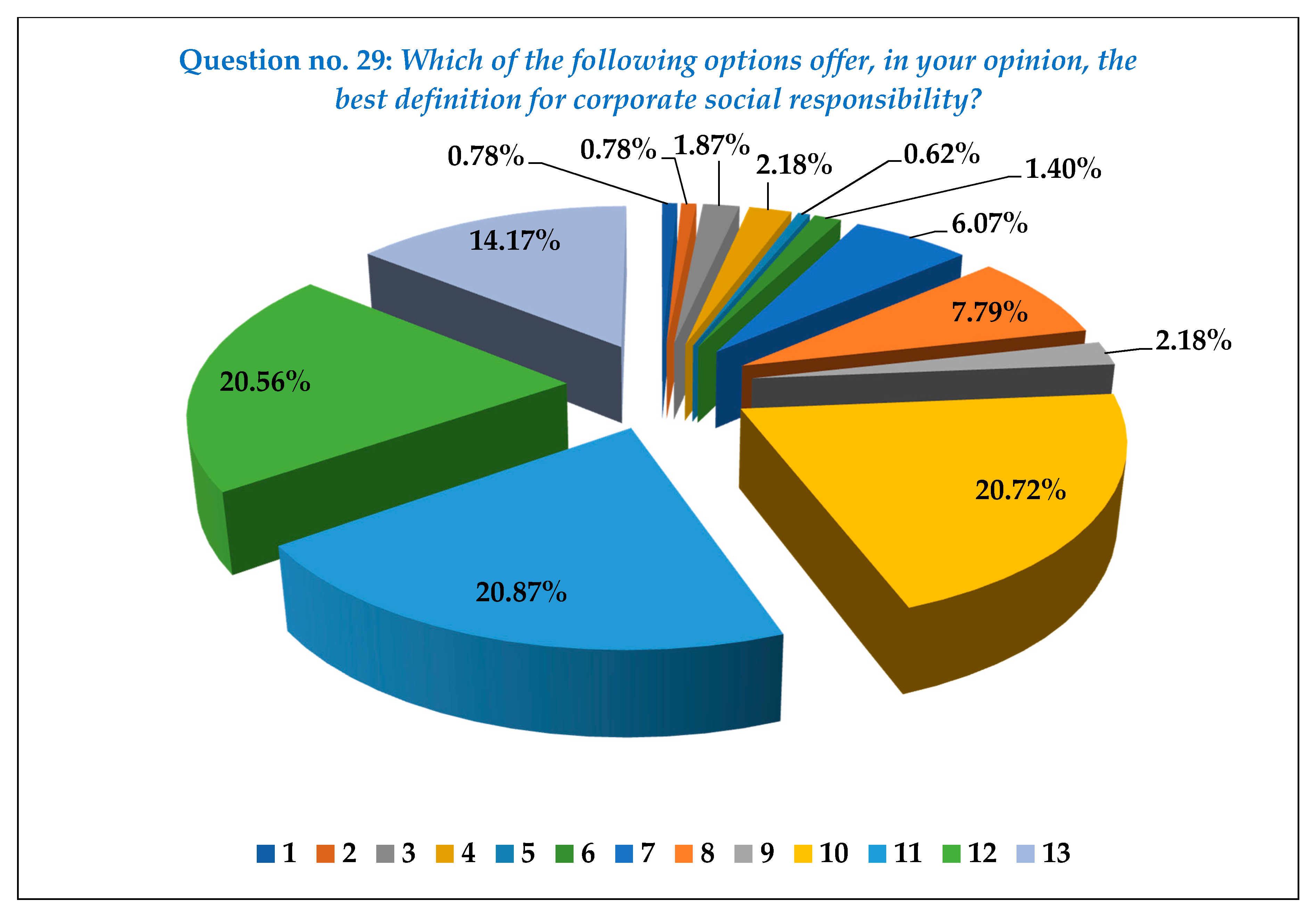

In our opinion, Question 29 turned out to be extremely important for our scientific work, since the surveyed population had to choose, from a given list, the best definition for corporate social responsibility (

Appendix A). In

Table 2 we have displayed the options that we have offered in terms of possible definitions for corporate social responsibility as well as the respondents’ perceptions concerning these definitions. Also, these results are displayed graphically in

Figure 17.

We are of the opinion that it was of outmost importance for our study to seek the opinion of individuals with regard to several components connected with corporate social responsibility. Thus, we introduce in our survey the question “Which of the following components would you agree to be connected with corporate social responsibility?” (

Appendix A, Question 30) Hence, the respondents were given the following scale which enabled them to rank the set of components given: 1—strongly agree; 2—agree, 3—agree somewhat; 4—undecided; 5—disagree somewhat; 6—disagree; 7—strongly disagree. In

Appendix B,

Table A3 we have displayed the results of our work. Moreover, the findings validate the connections between the components chosen for the analysis and corporate social responsibility, as follows:

Concerning good governance 93.15% of the respondents declared that they strongly agree it is connected with corporate social responsibility, while 4.05% agreed and 2.80% agreed somewhat.

While analyzing the case of gender balance 91.74% acknowledged the fact that they strongly agree it is a component in relation to corporate social responsibility, while 3.89% declared they agree with this, 2.49% somewhat agreed, and 1.87% were undecided.

The results offer compelling evidence concerning environment protection considering the fact that 93.77% of the surveyed population strongly agreed it is connected to corporate social responsibility, 4.36% agreed, and 1.87% somewhat agreed with this matter.

The data gathered concerning sustainable performance shows indisputable evidence for the connection between this component and corporate social responsibility, since 93.61% strongly agreed, 3.58% agreed, and 2.80% somewhat agreed that there exists a link between sustainable performance and corporate social responsibility.

Correct labor standards are, according to the answerers, connected with corporate social responsibility, since 77.26% strongly agree that correct labor standards represents a component connected with corporate social responsibility, 11.37% agree, and 11.37% somewhat agrees.

Additionally, our technique showed that sustainable employer and employees relations are connected with corporate social responsibility, 71.96% declaring there is a connection between these two elements, while 15.26% agreed, and 12.77% somewhat agreed.

As expected, intellectual capital is strongly connected to corporate social responsibility, 93.15% stating that they strongly agree that there is a link between intellectual capital and corporate social responsibility, 4.05% agreed with the existence of such a link, and 2.80% stressed the fact that they somewhat agree with the existence of such a bond.

With a few exceptions (represented by 3.43% of the respondents which agreed and 2.96% which somewhat agreed), the anti-corruption measures were acknowledged by 93.61% of the surveyed population as strongly connected with the concept of corporate social responsibility.

It is worth mentioning that sustainable productivity is in the opinion of 97.98% strongly connected with corporate social responsibility. However, 1.71% of the total number of the respondents said that they agree with the existence of a bond between sustainable productivity and corporate social responsibility, while 0.31% somewhat agree.

Significantly, eco-efficiency was acknowledged by 88.47% of the individuals as strongly linked to corporate social responsibility, while 10.59% agreed with the existence of this type of bond and 0.93% stated that they somewhat agree.

Importantly, respect for human rights was presented by 87.85% of the surveyed population as strongly agreeing to be linked to corporate social responsibility, and in the meanwhile 8.41% emphasized they agree with the existence of such bond, while 3.74% somewhat agree with this type of connection.

Remarkably, 81.78% of the respondents strongly agreed that between responsible production and corporate social responsibility there is a connection, while 17.60% agreed and 0.62% somewhat agreed.

It is critical to note that 53.74% of the respondents believed that between stakeholder engagement and corporate social responsibility it is a connection, while 20.72% agreed, 23.92% somewhat agreed, and 2.02% were undecided.

It was found that according to 72.43% of the surveyed individuals responsible working conditions are strongly connected with corporate social responsibility, while 24.30% agreed with the existence of such link, and 3.27% somewhat agreed.

As anticipated, sustainable employees and community relations are strongly connected with corporate social responsibility. In this matter, 84.58% of the population strongly agreed, while 5.76% agreed and 9.66% somewhat agreed when asked about the existence of a bond between sustainable employees and community relations and corporate social responsibility.

It was discovered that, according to 60.59% of the respondents, shareholder engagement and corporate social responsibility are strongly connected, while 5.14% agreed to this, 32.40% somewhat agreed and 1.87% turned out to be undecided.

Critically, 67.13% of the answerers stressed that they strongly considered that between social and gender equity and corporate social responsibility there is a connection, while 2.65% declared they agreed, 28.82% somewhat agreed, and 1.40% were undecided.

With regard to the environmental and social performance and corporate social responsibility connection, 92.68% of the respondents strongly agreed, 4.67% agreed, and 2.65% somewhat agreed.

In this part of our article, we presented the results gathered from the analysis of the thirty-first question of the survey (

Appendix A): “Constant corporate social responsibility activities may bring a variety of benefits for the organizations. Which of the following elements represent competitive advantages for organizations acting in favor of corporate social responsibility activities?” The majority of those who responded felt that all the following elements constituted competitive advantages for organizations acting in favor of corporate social responsibility activities, namely: enhanced consumer loyalty, improved products and services quality, efficient human resources actions, increased intellectual capital value, taking better decisions, acting more cautiously while managing risks, improved brad image, improved reputation, operational cost savings, profitability, added values, maximizing performance, maximizing growth, increased sales, increased profit, enhancing productivity, effectiveness, and enhanced cooperation. Notwithstanding, for us it was of utmost importance to establish the connections between corporate social responsibility, intellectual capital and performance, with appropriate evidence from the Romanian business environment. Thus, according to the processed data, in terms of the connections between corporate social responsibility and intellectual capital it should be acknowledged that of the study population, 93.61% of the respondents stated that increased intellectual capital value is a competitive advantage for organizations acting in favor of corporate social responsibility activities, 4.21% agreed, 0.16% somewhat agreed and 1.56% were undecided. In addition, over 90% of the surveyed population strongly agreed with the fact that the following components competitive advantages for organizations acting in favor of corporate social responsibility activities: enhanced consumer loyalty; improved products and services quality; increased intellectual capital value; improved brad image; improved reputation; profitability; added values; maximizing performance; maximizing growth; increased sales; increased profit; enhancing productivity; effectiveness; and enhanced cooperation. Broadly speaking, since we are taking into consideration issues such as enhanced consumer loyalty, improved products and services quality, increased intellectual capital value, improved brand image, improved reputation, profitability, added values, maximizing growth, increased sales, increased profit, enhancing productivity, effectiveness, and enhanced cooperation, all of them appearing to be key elements for maximizing performance, our conclusion is that between corporate social responsibility and financial and non-financial performance of organizations there exists a strong connection. The complete set of data obtained may be seen in

Appendix B,

Table A4.

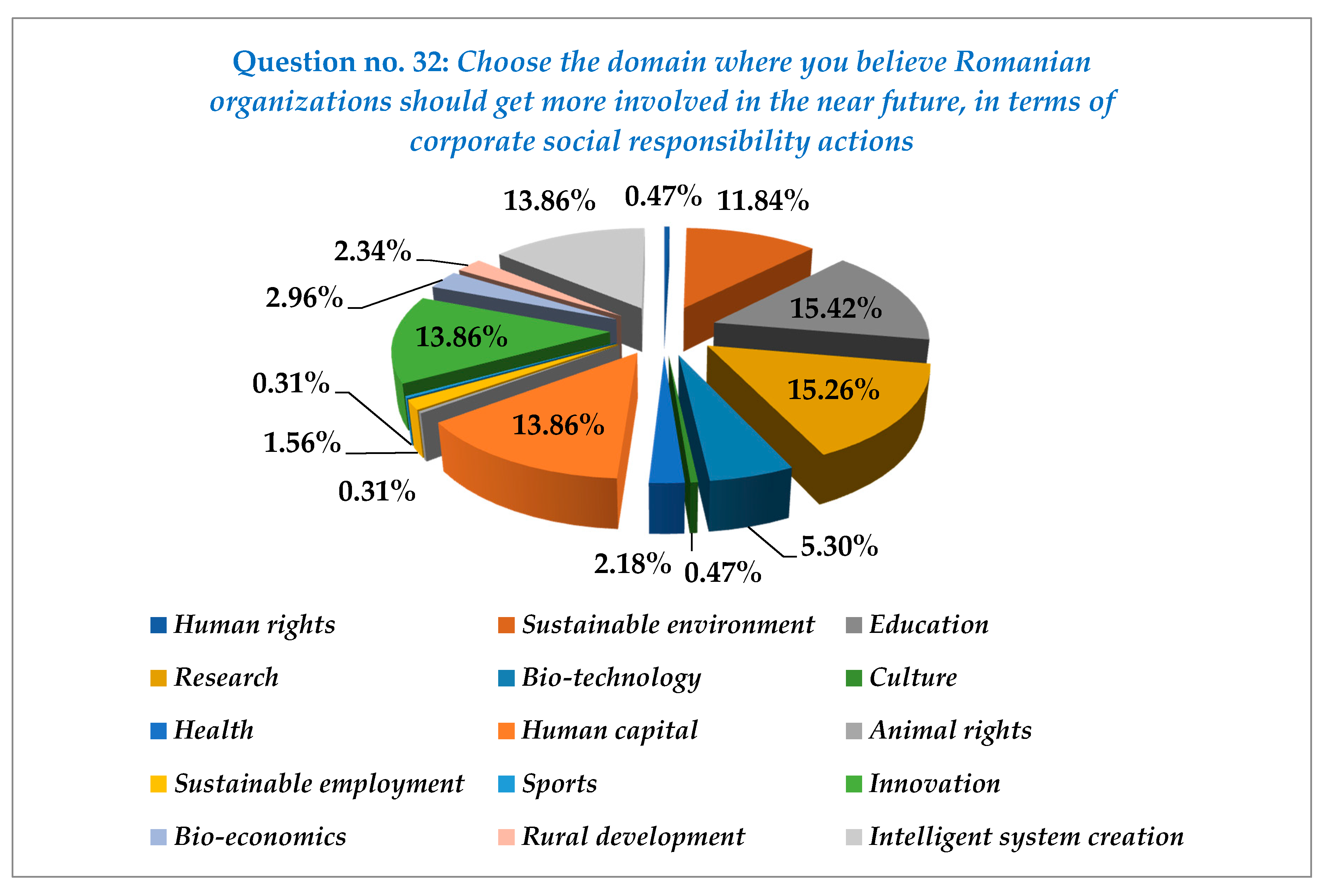

Finally, the respondents were required to choose the domain where they believed Romanian organizations should get more involved in the near future, in terms of corporate social responsibility actions, being offered the following choices: human rights, sustainable environment, education, research, bio-technology, culture, health, human capital, animal rights, sustainable employment, sports, innovation, bio-economics, rural development, and intelligent system creation (

Appendix A, Question 32). In

Table 3 we emphasized those domains where Romanian organizations should get more involved in terms of corporate social responsibility actions and we highlighted the strategic positions, while we also distinguished between the sectors that require immediate attention, such as education, research, human capital and intelligent system creation, sustainable environment, bio-technology, bio-economics, rural development and health. These results are displayed in

Figure 18.