Appendix B

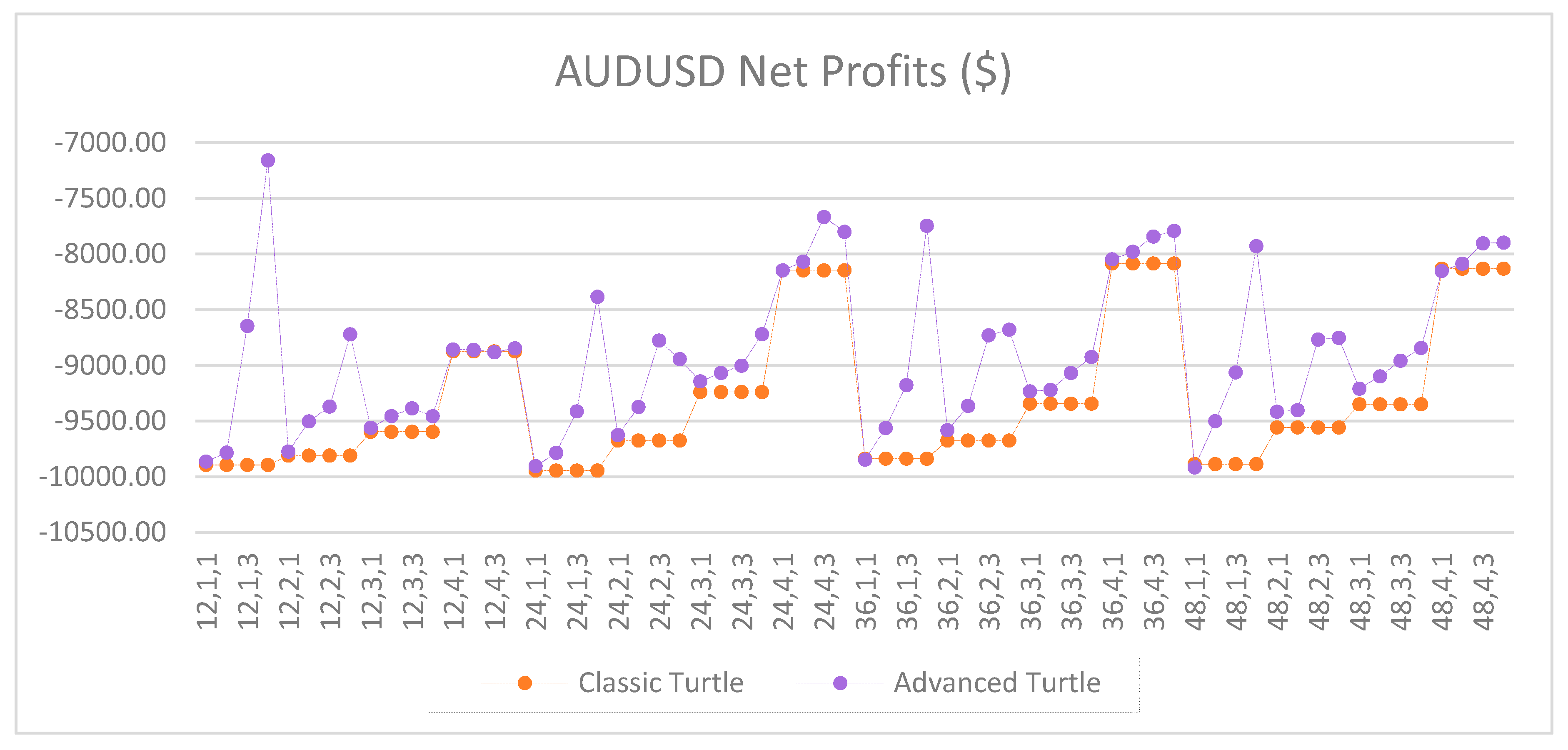

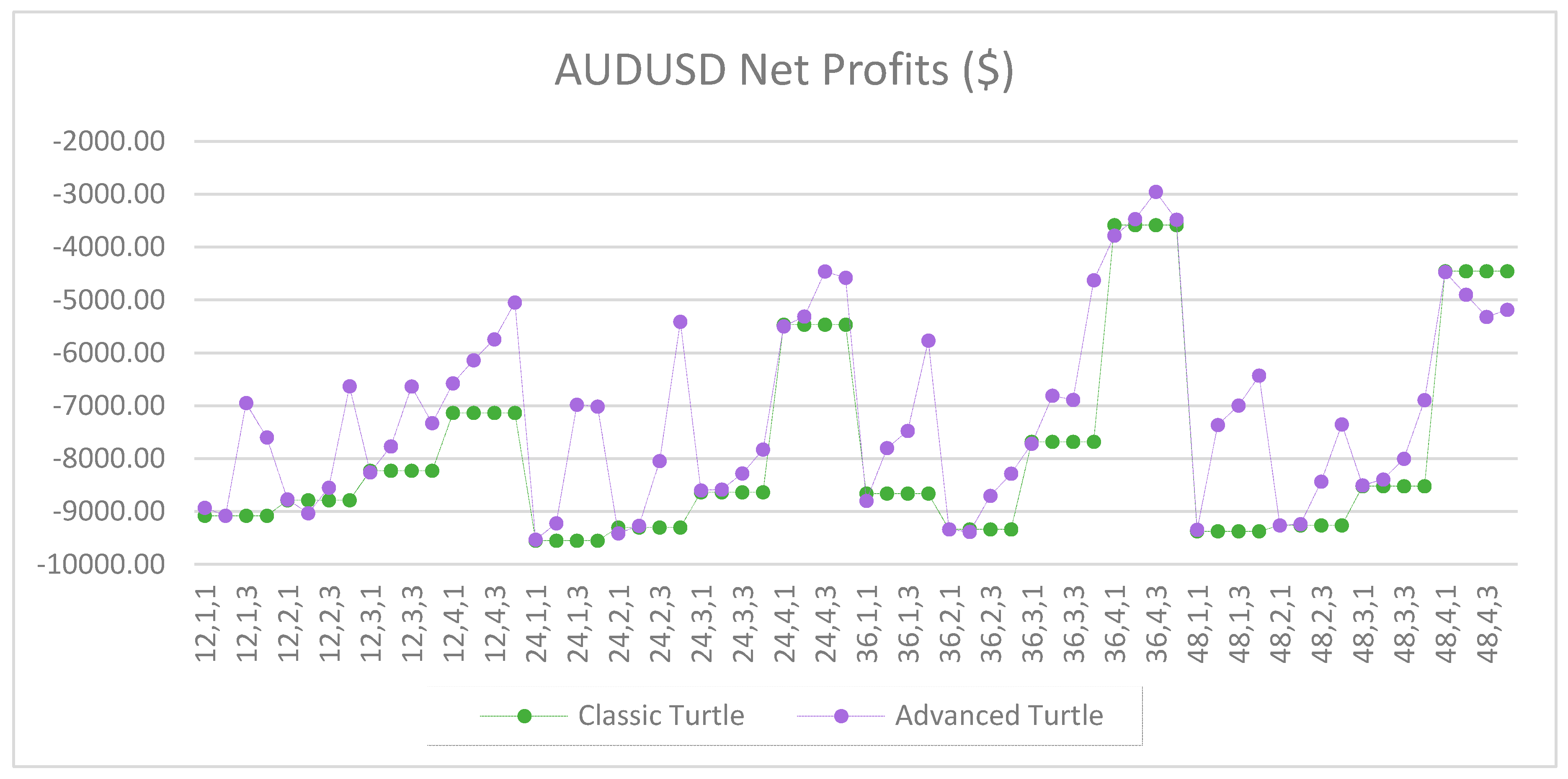

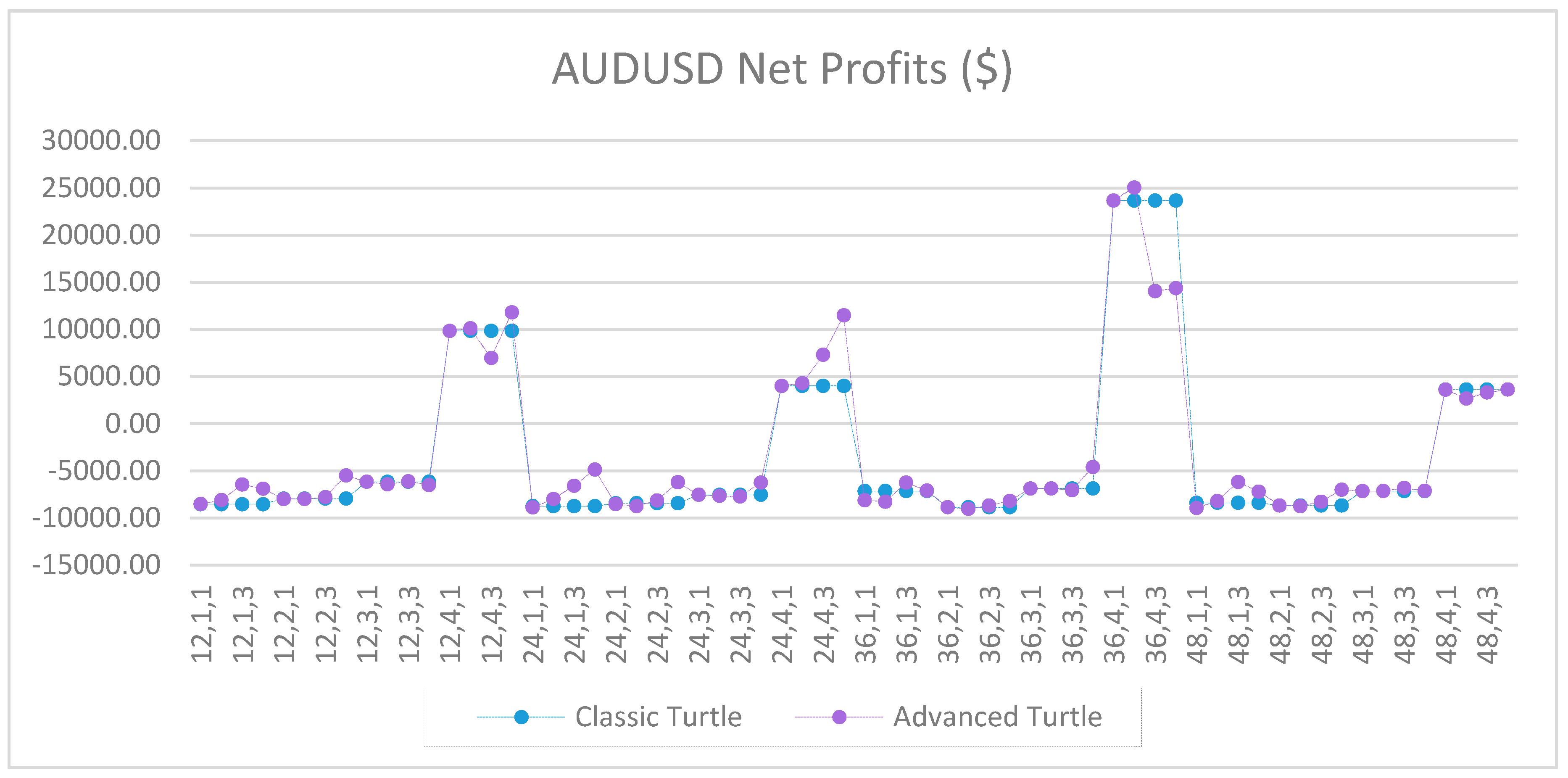

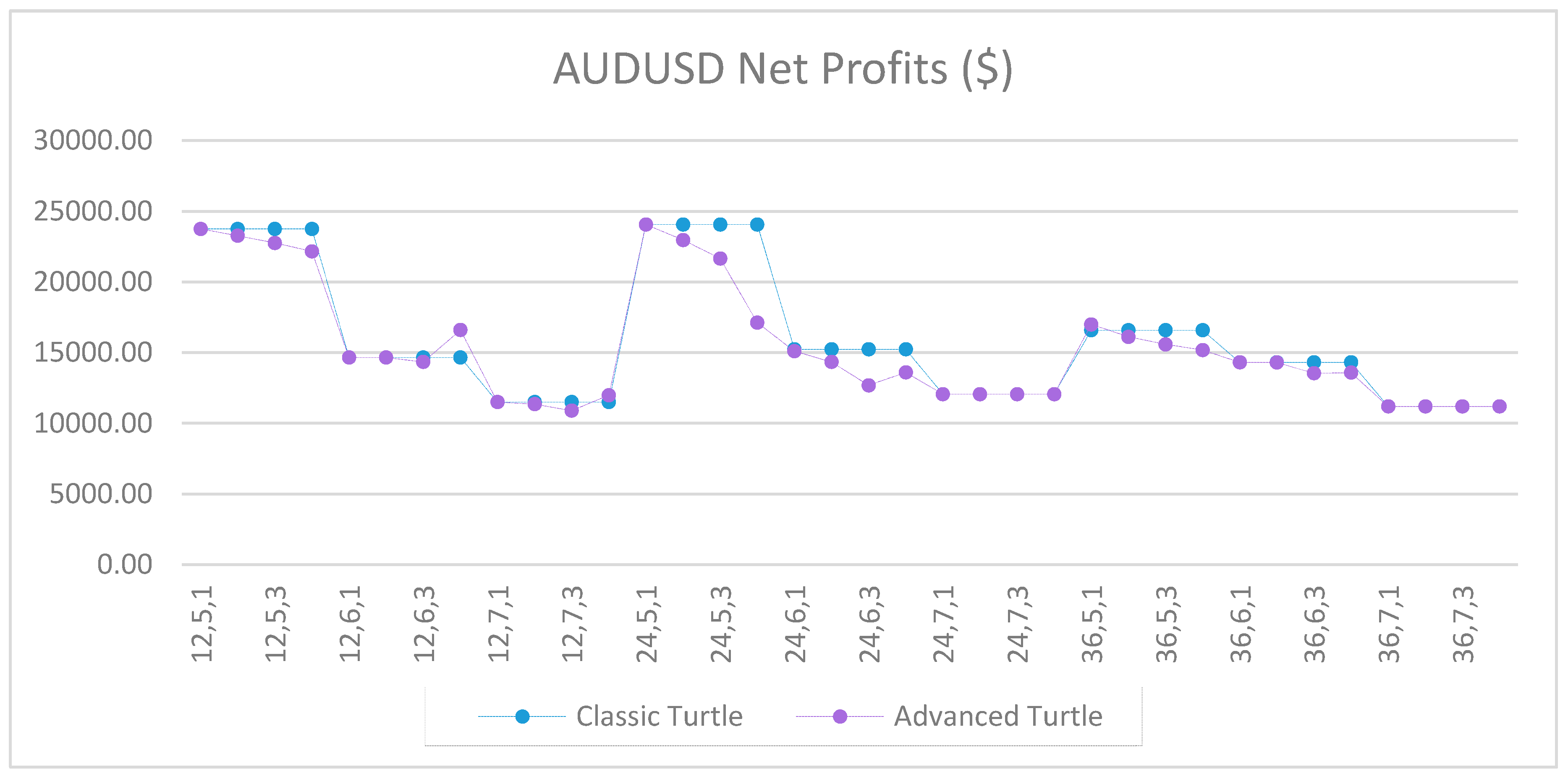

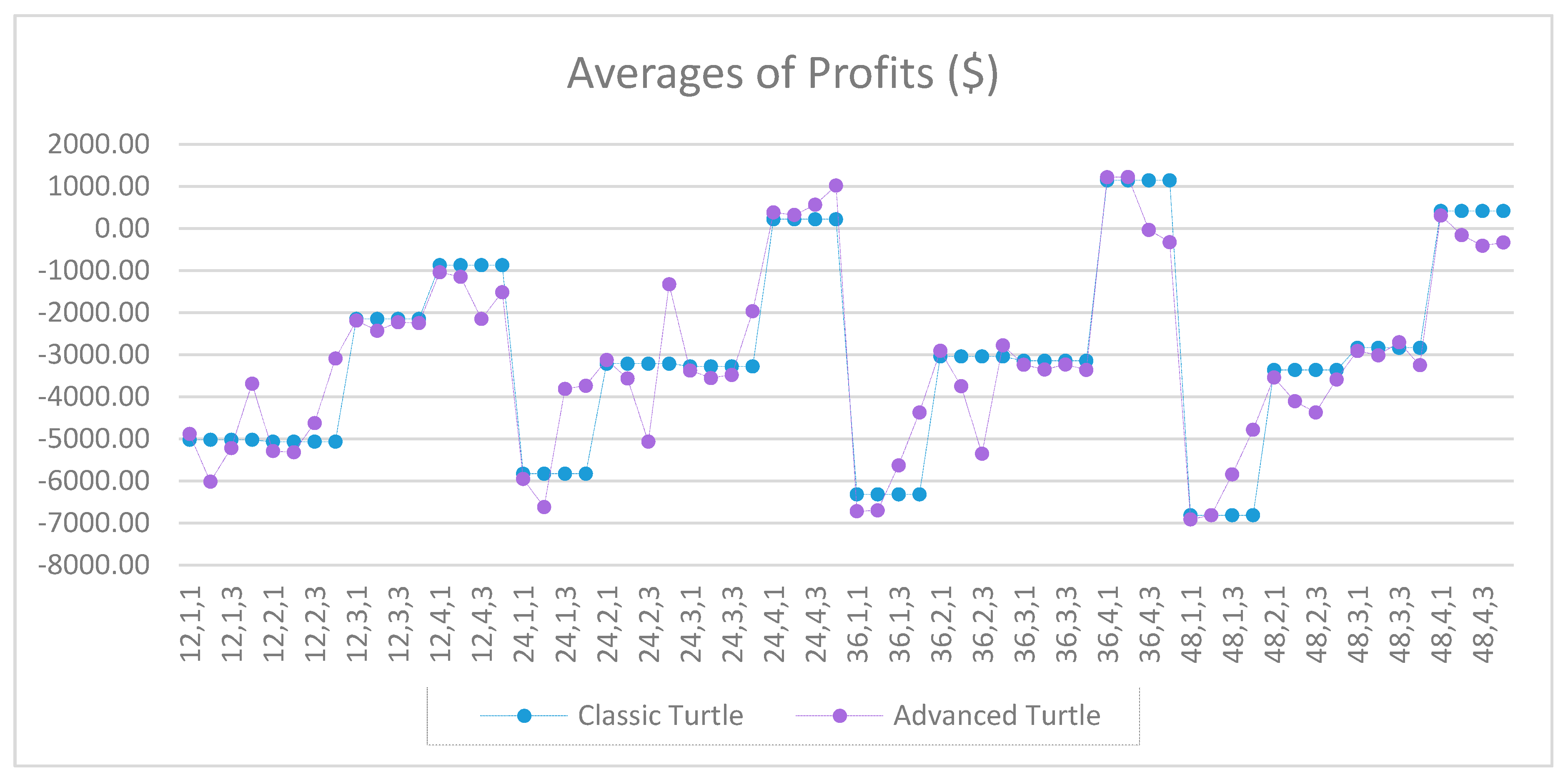

Figure A1.

Net profits of AUDUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A1.

Net profits of AUDUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

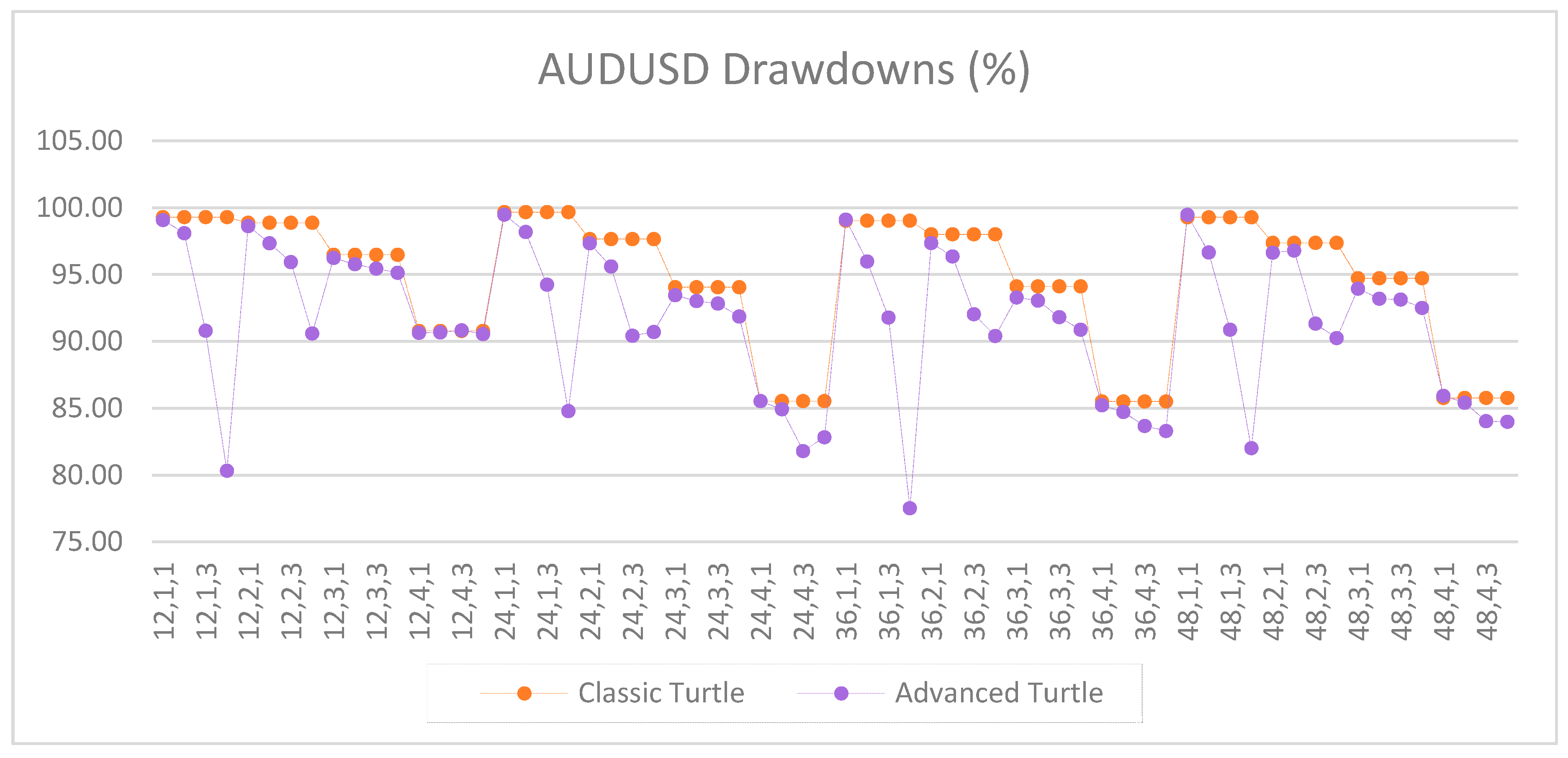

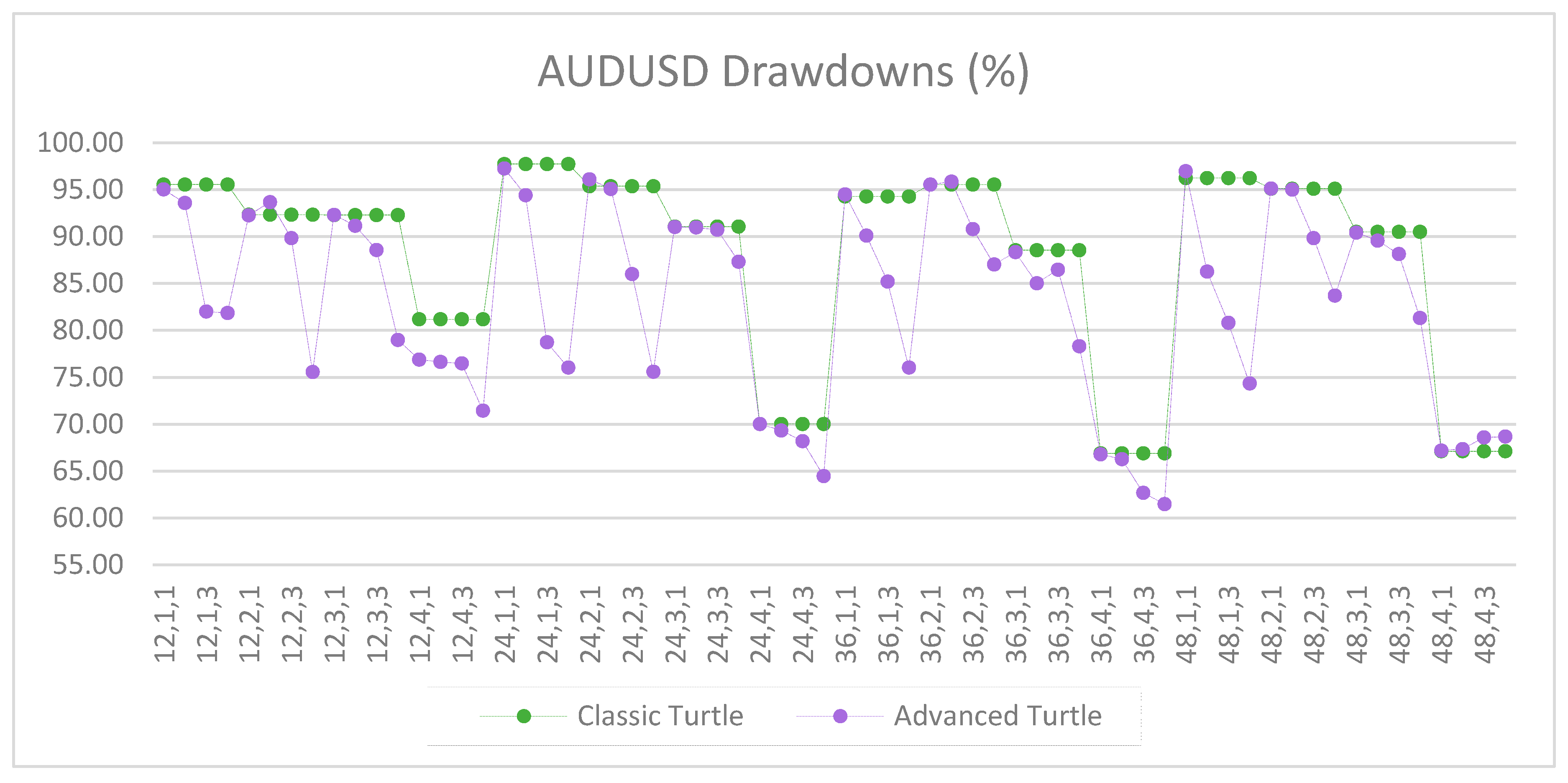

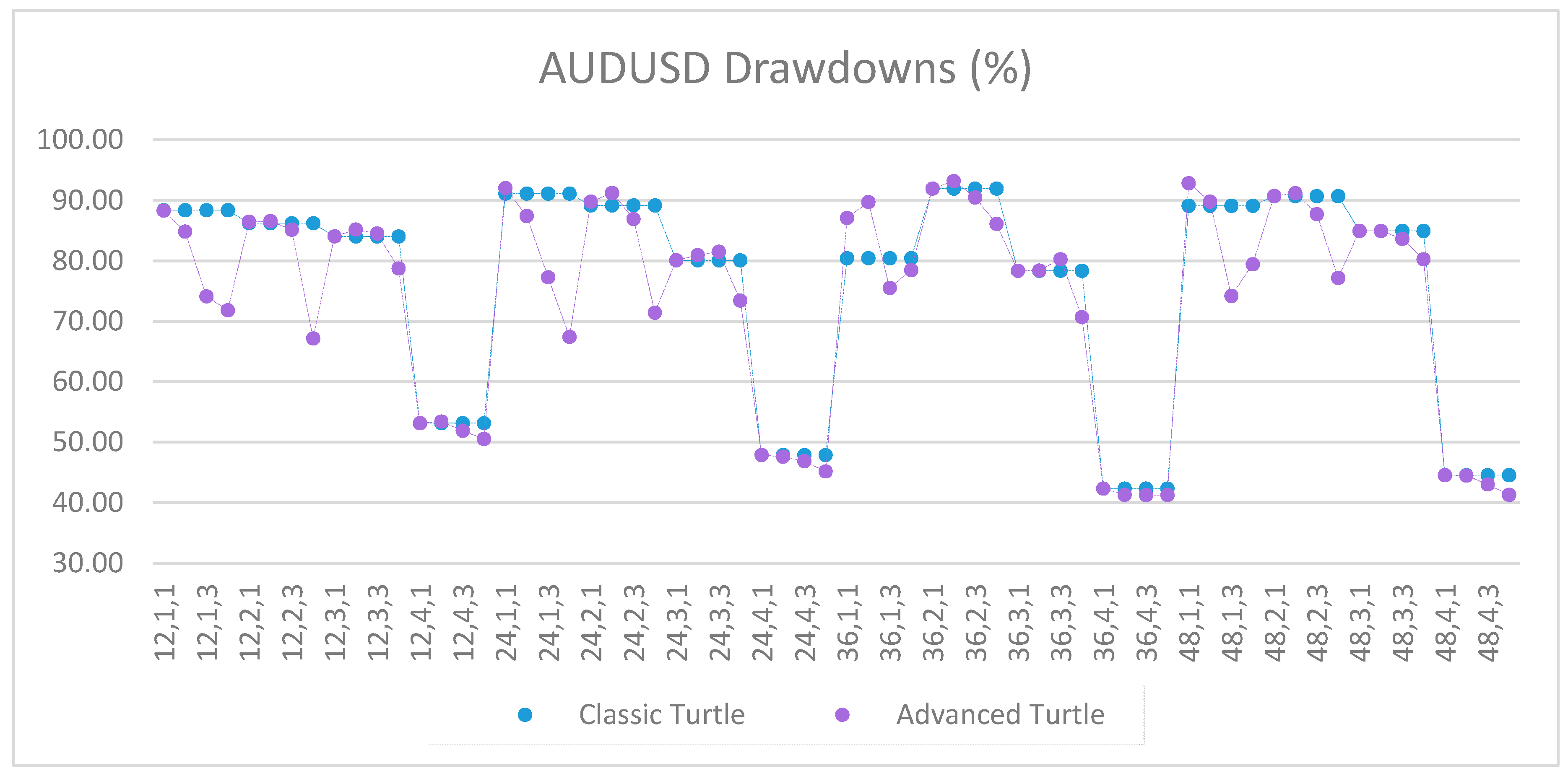

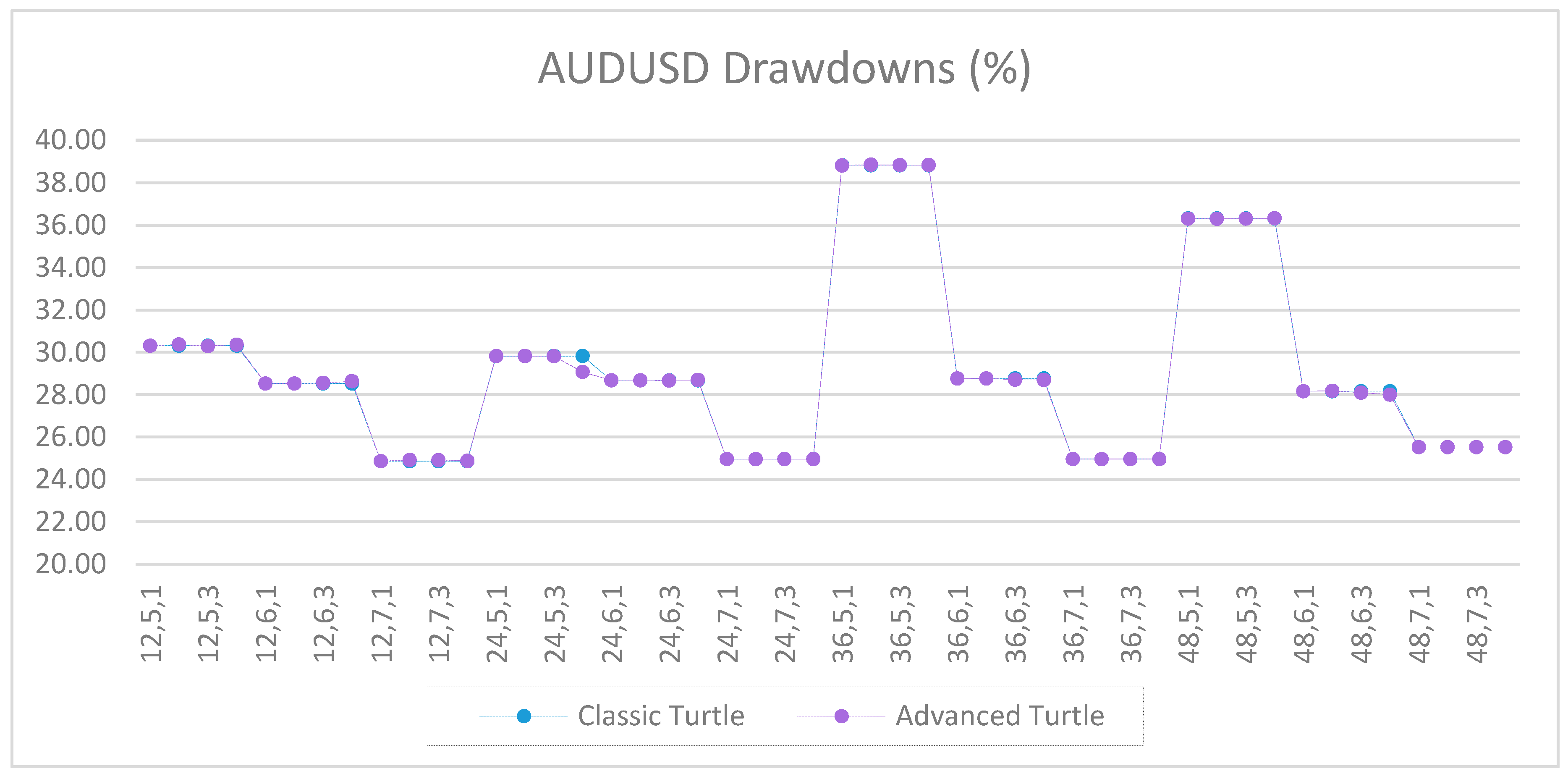

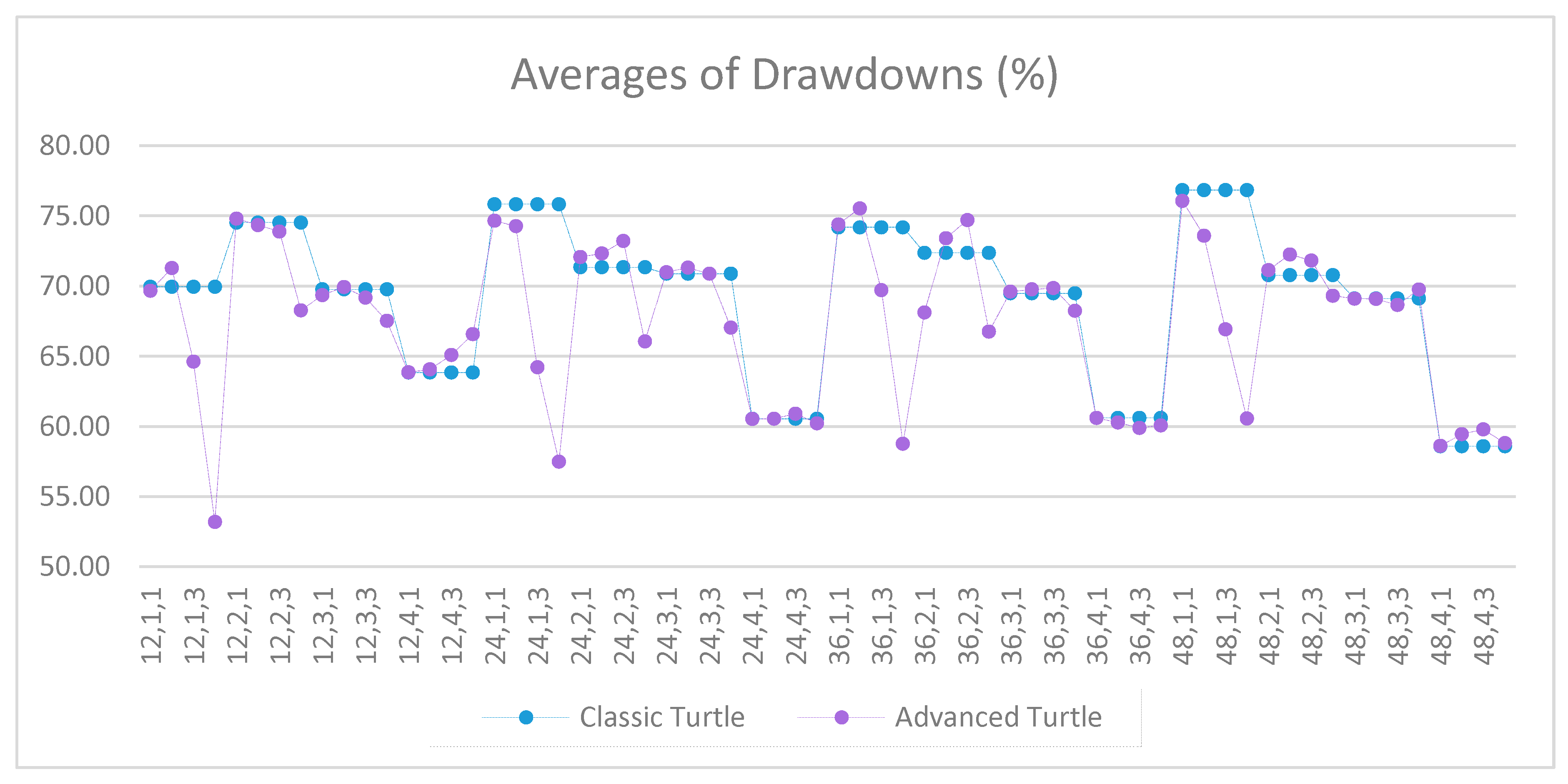

Figure A2.

Drawdowns of AUDUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A2.

Drawdowns of AUDUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

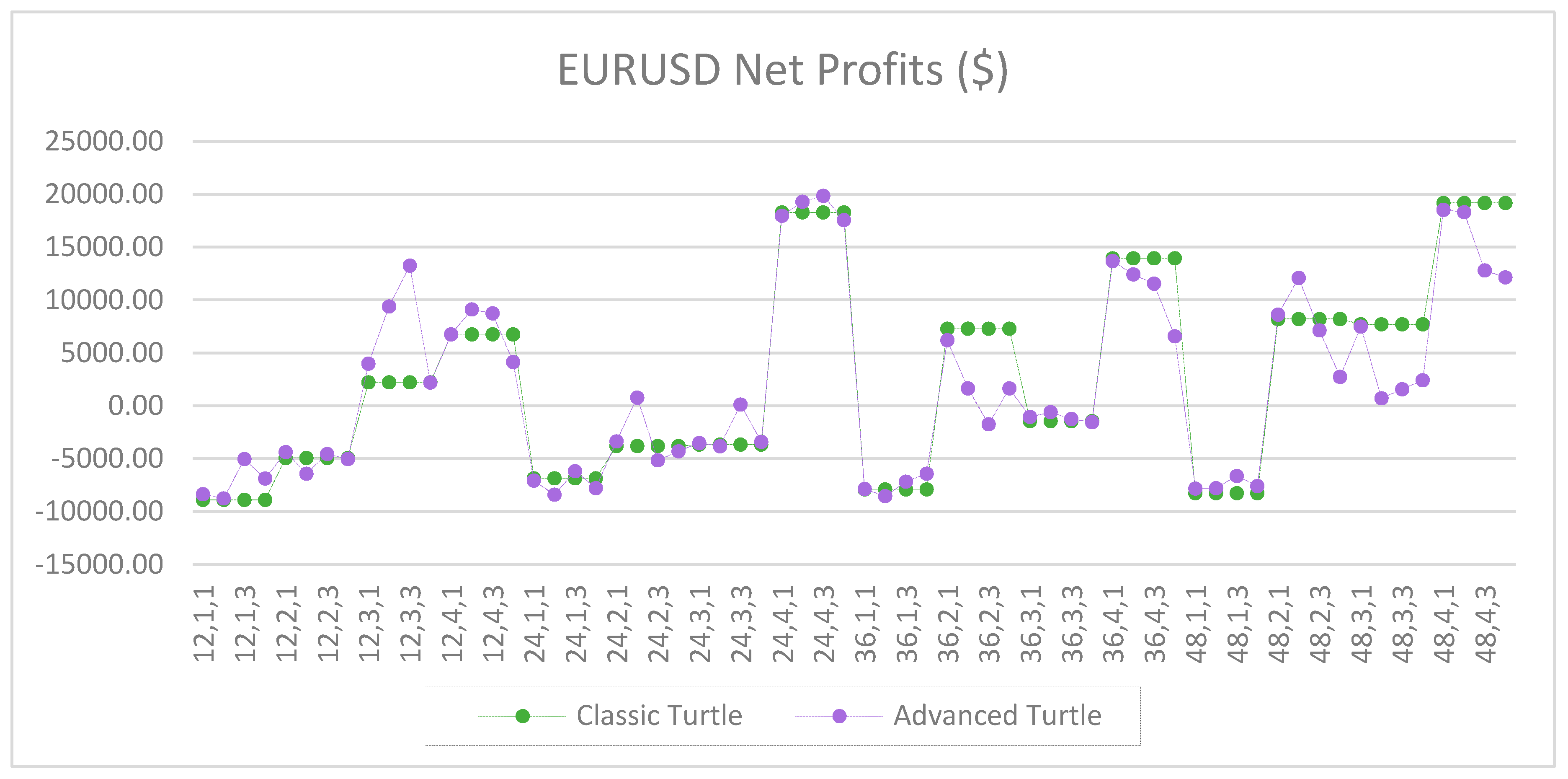

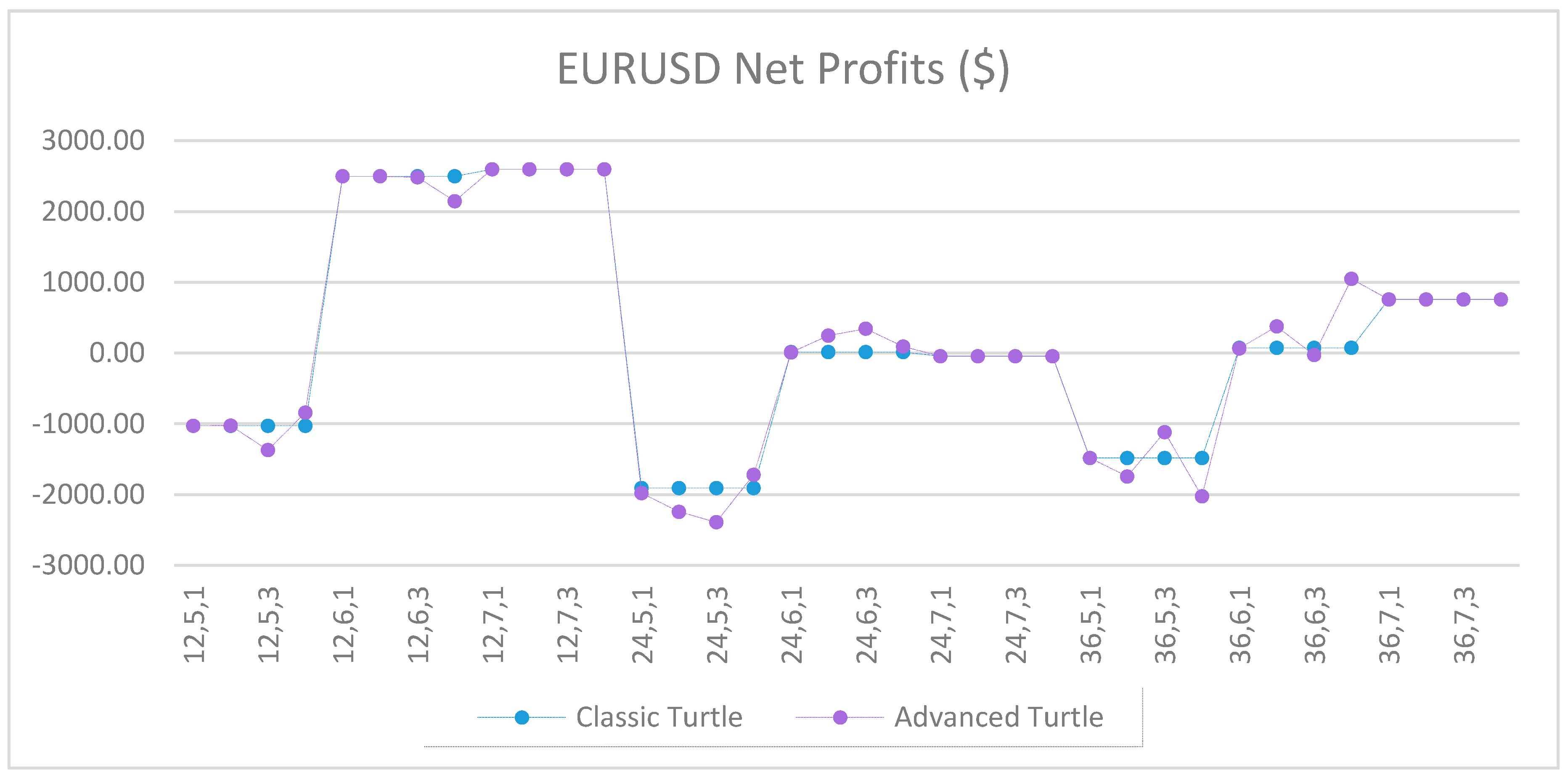

Figure A3.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A3.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

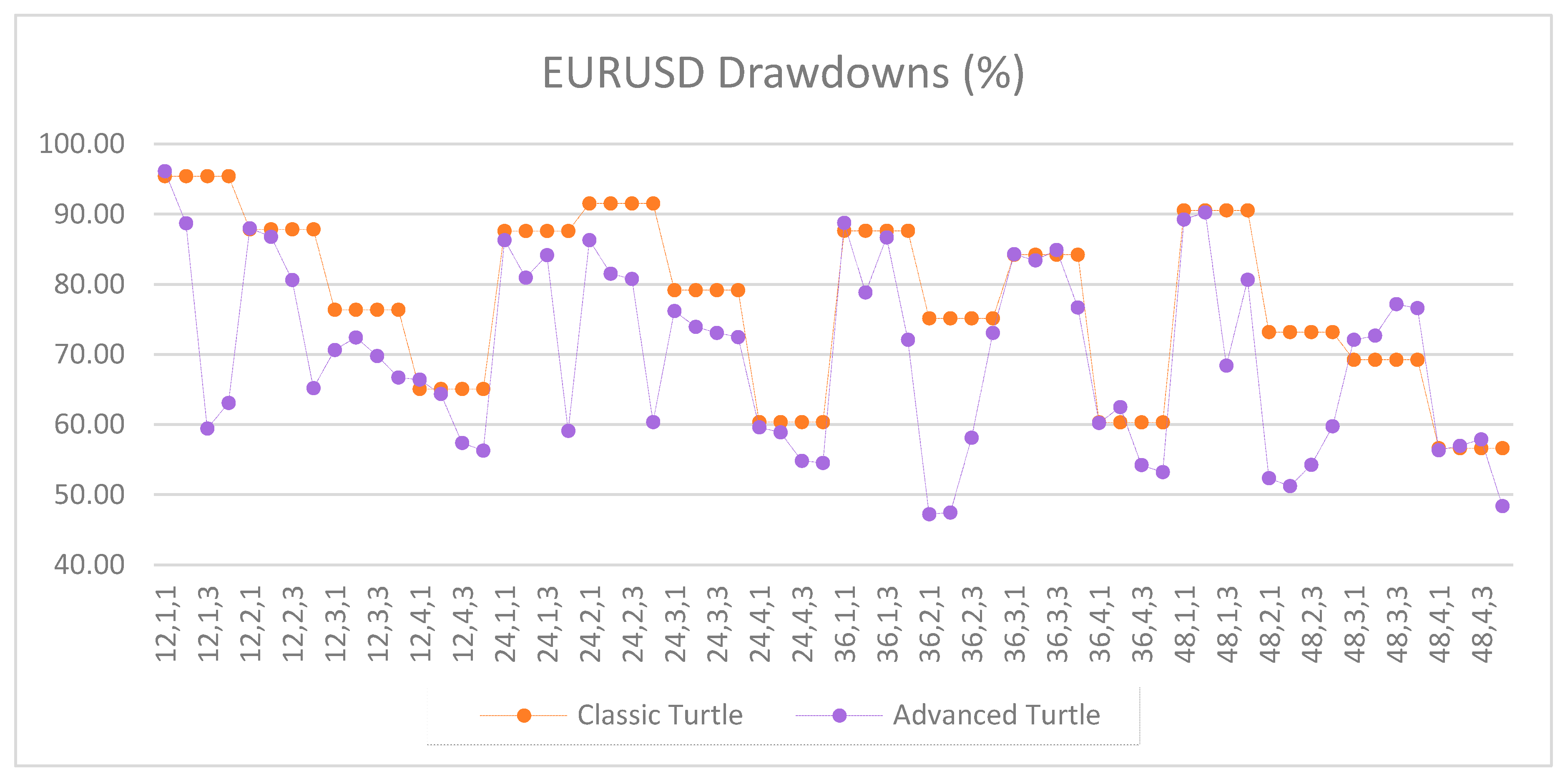

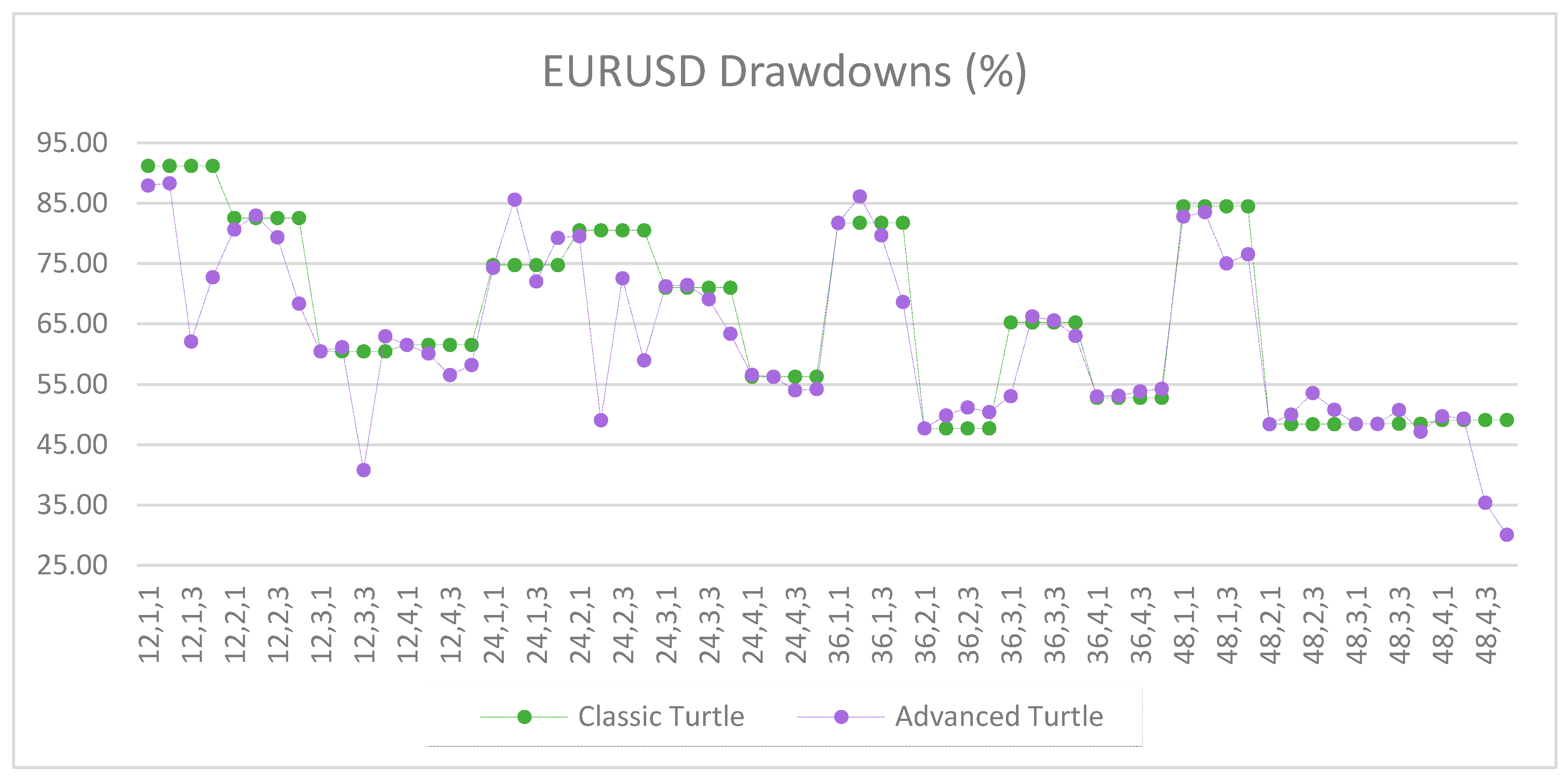

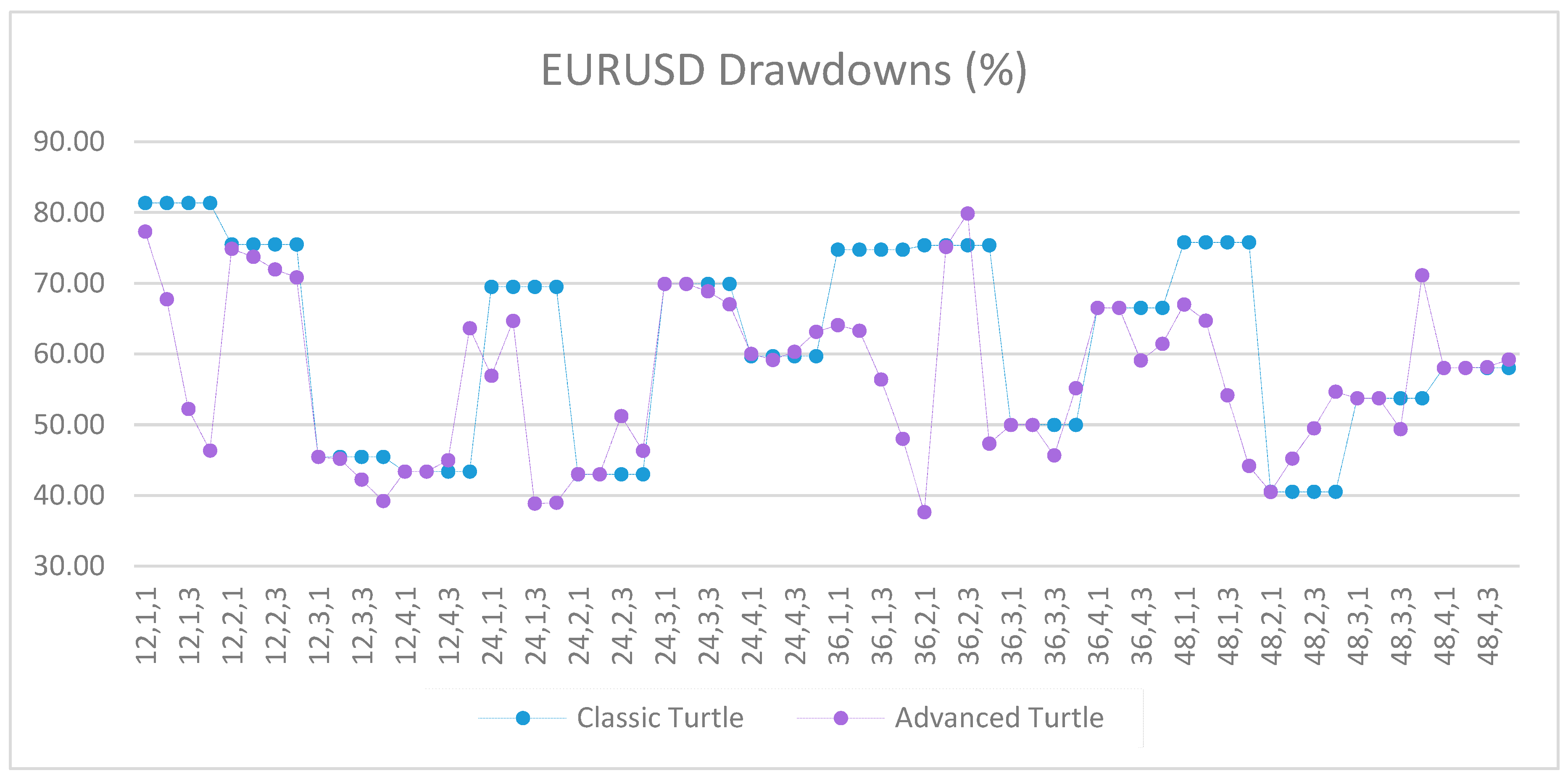

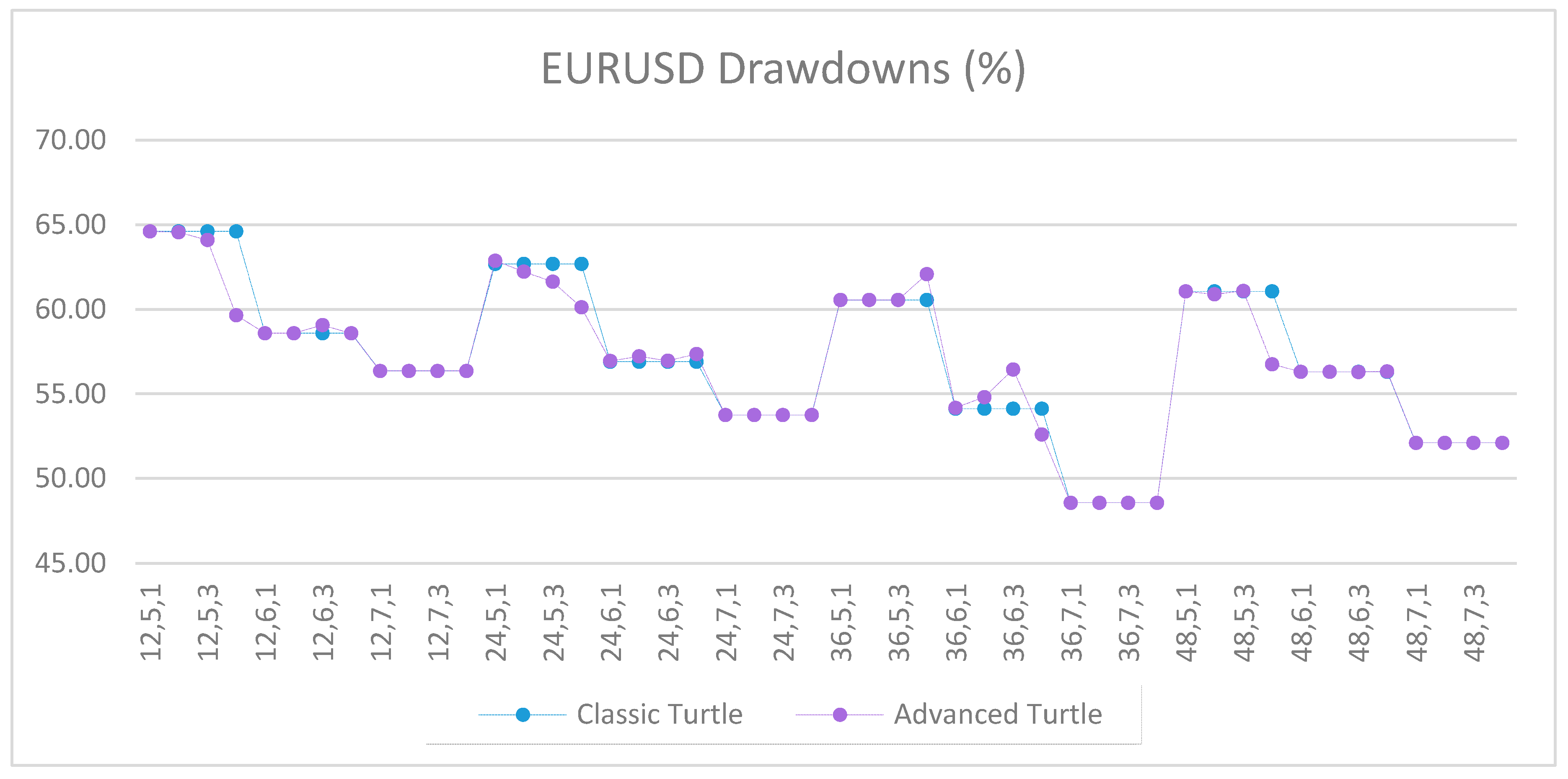

Figure A4.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A4.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

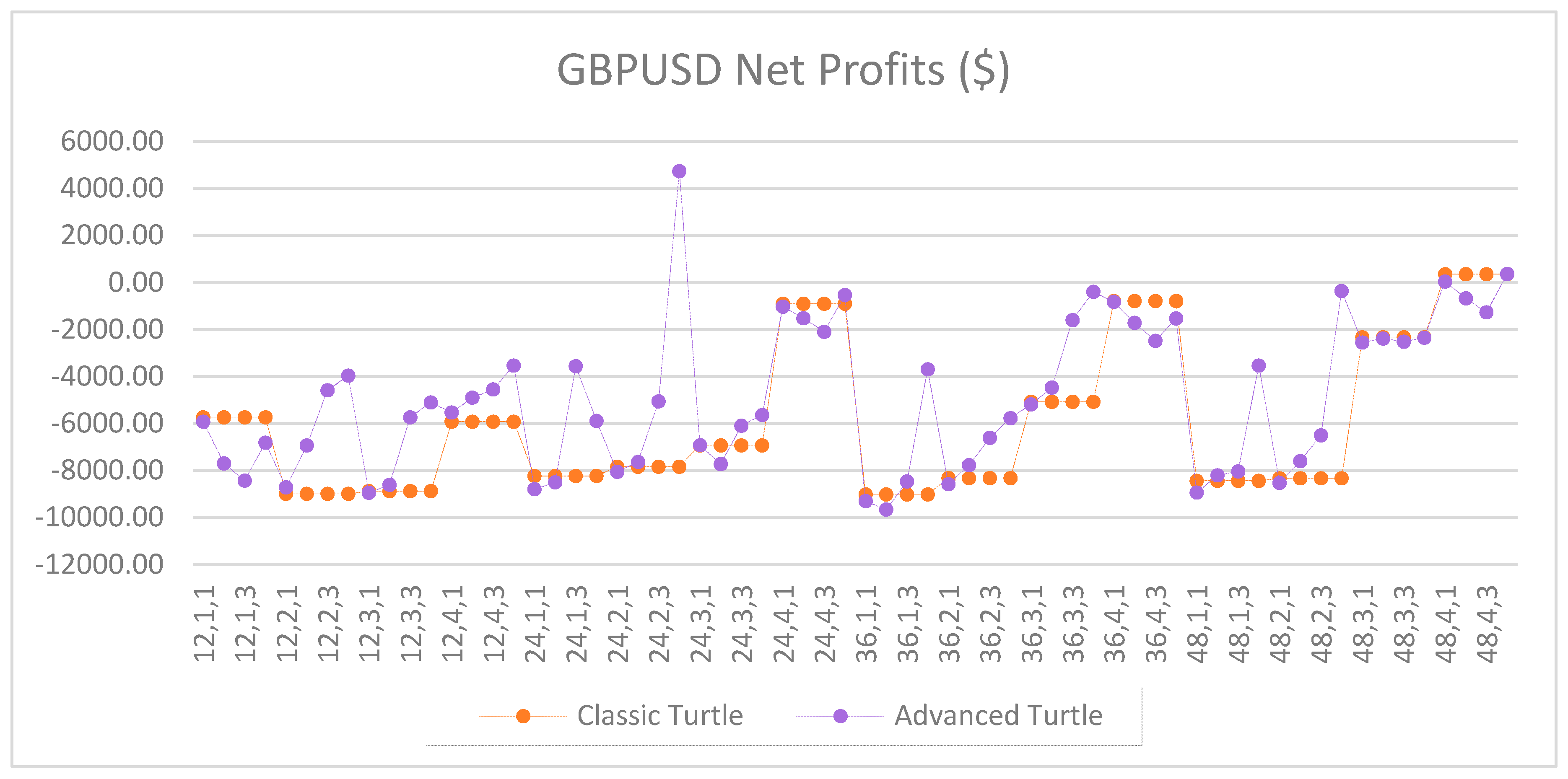

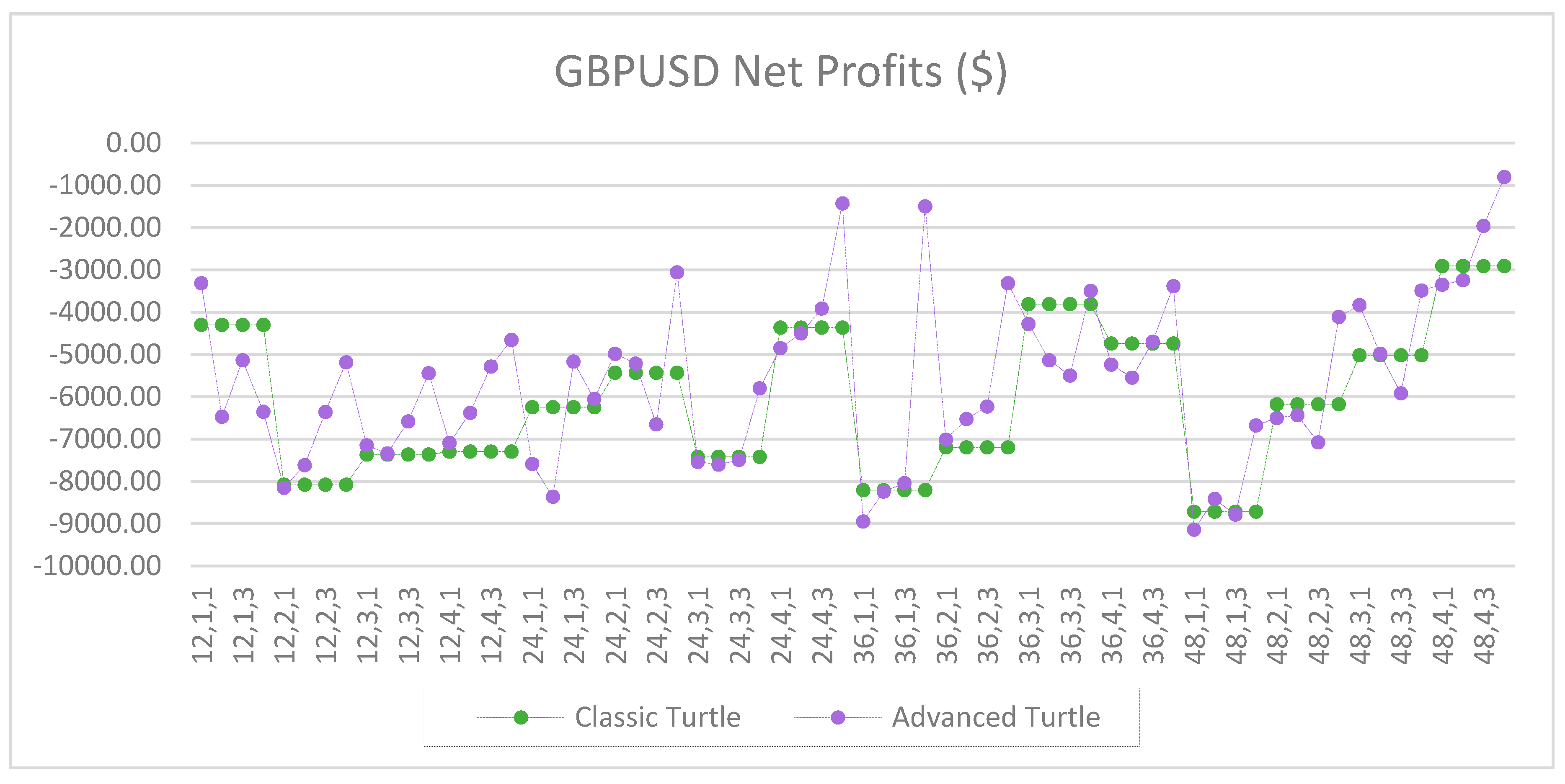

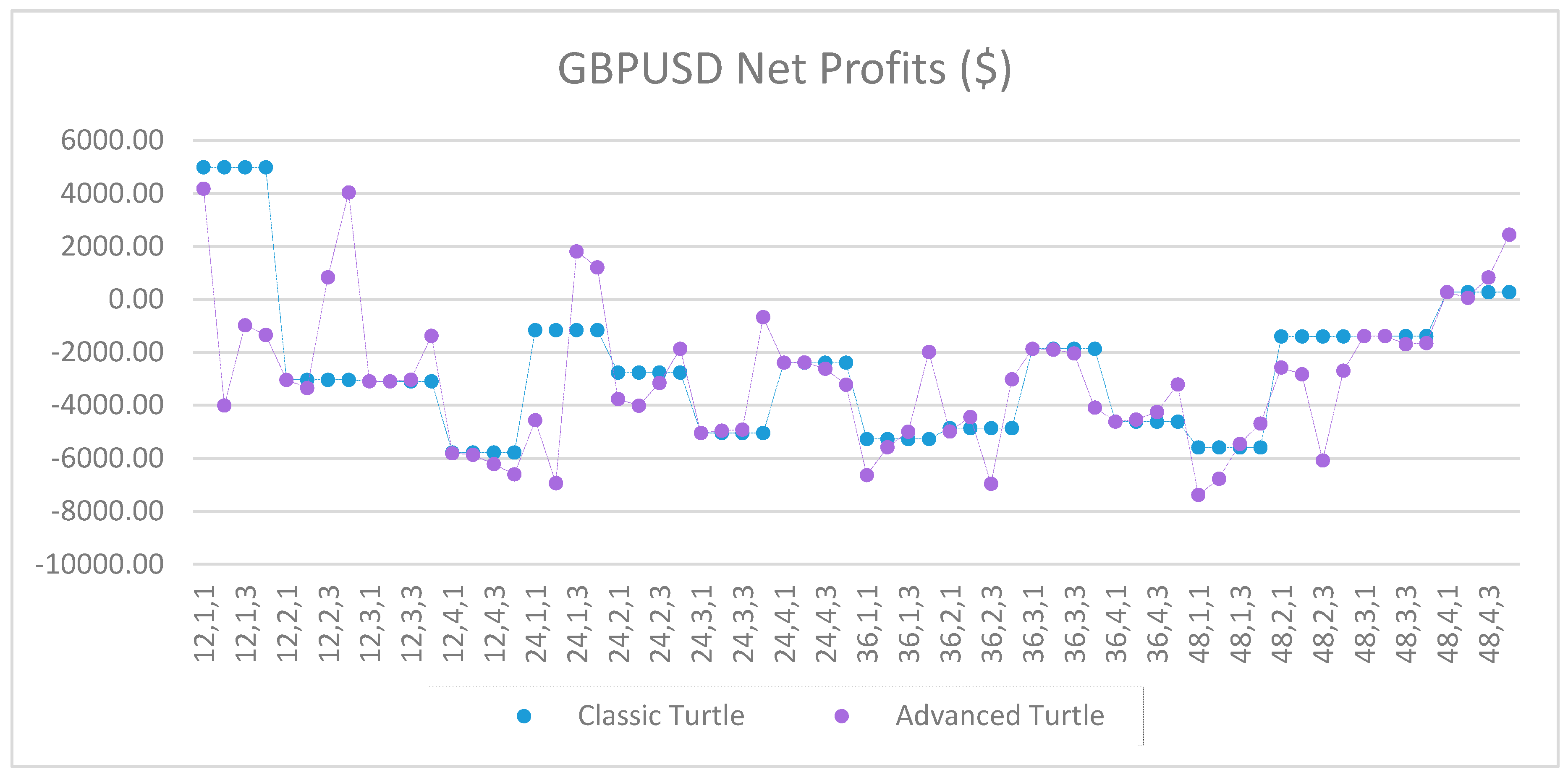

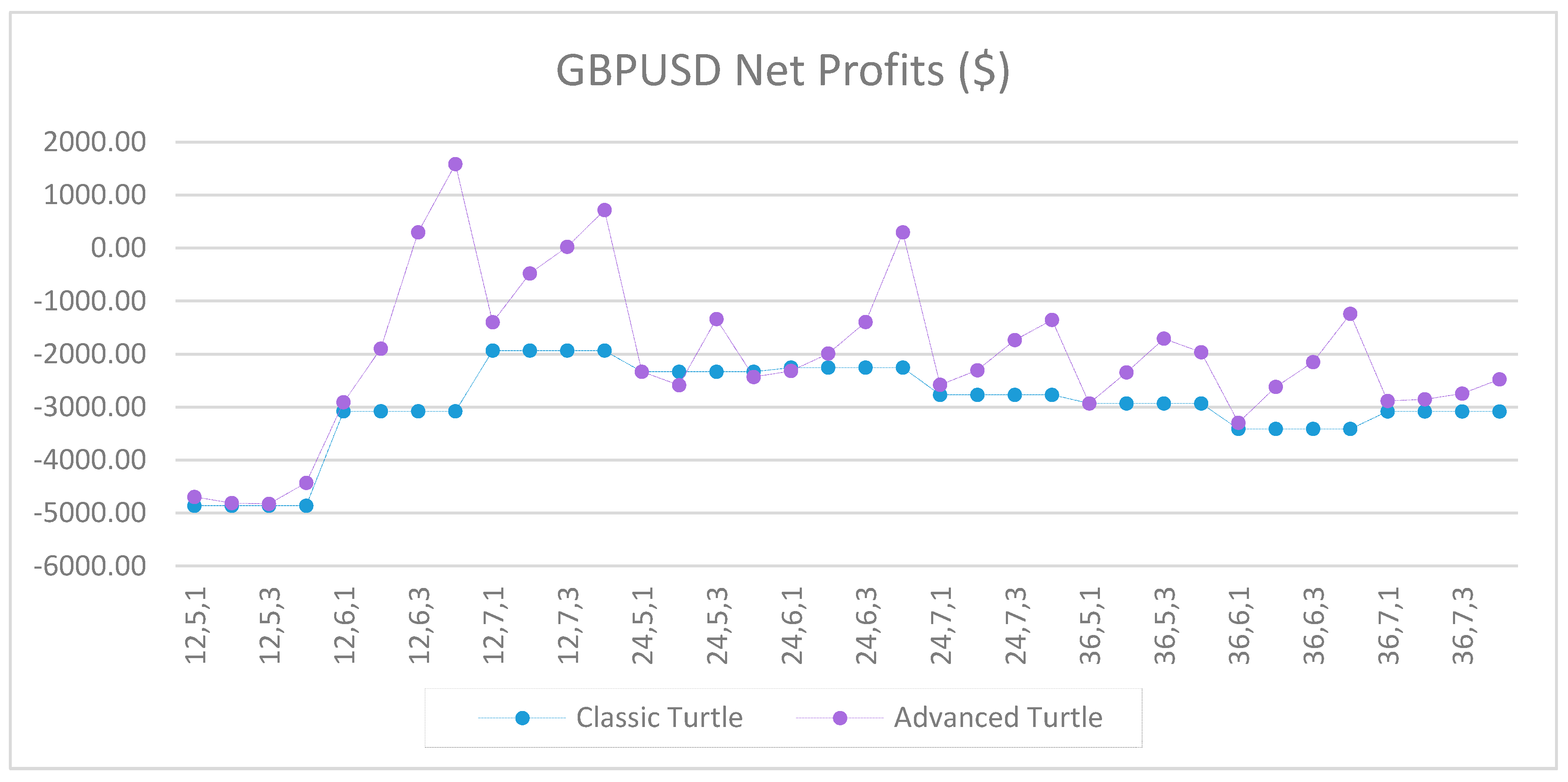

Figure A5.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A5.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

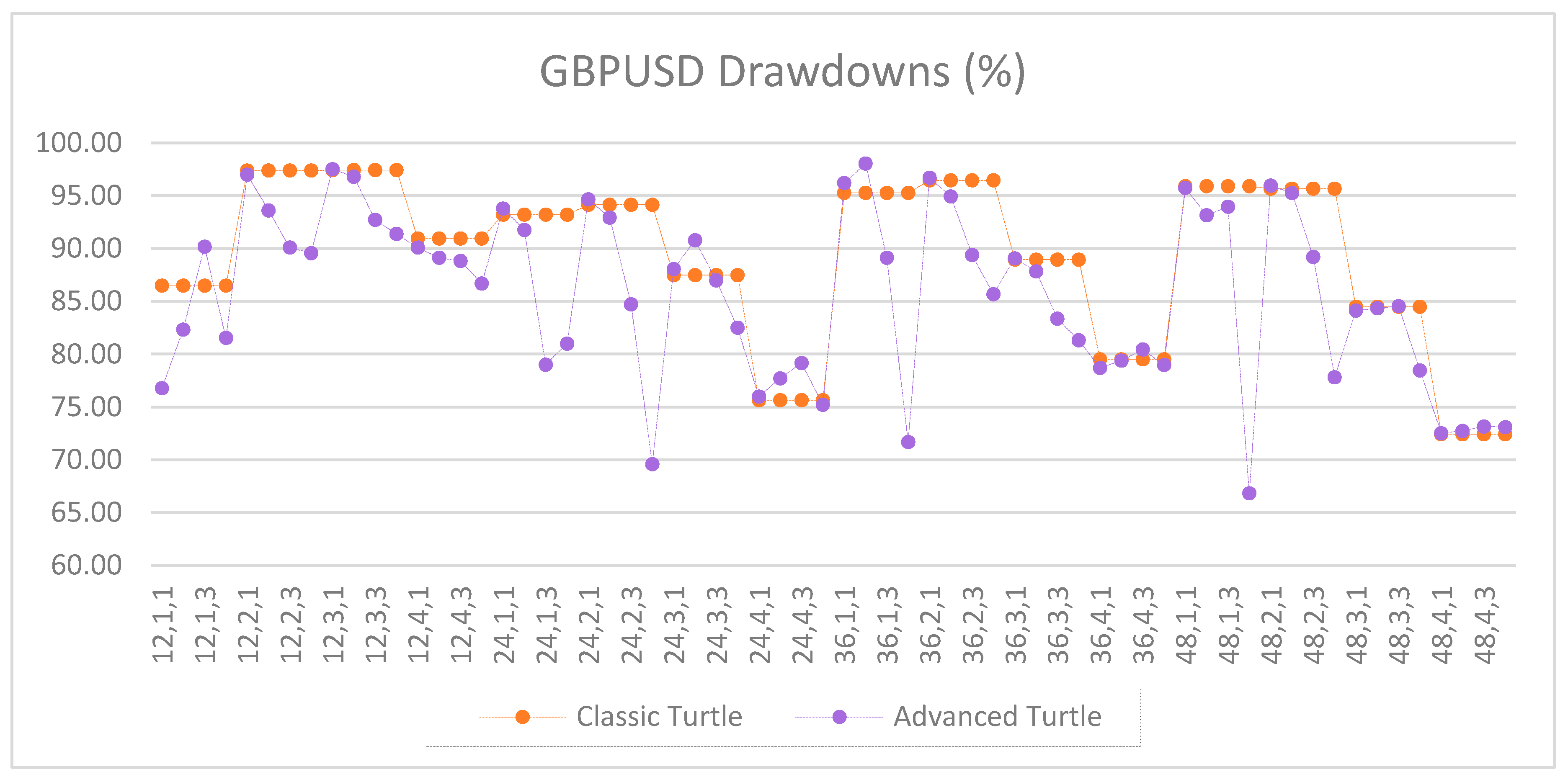

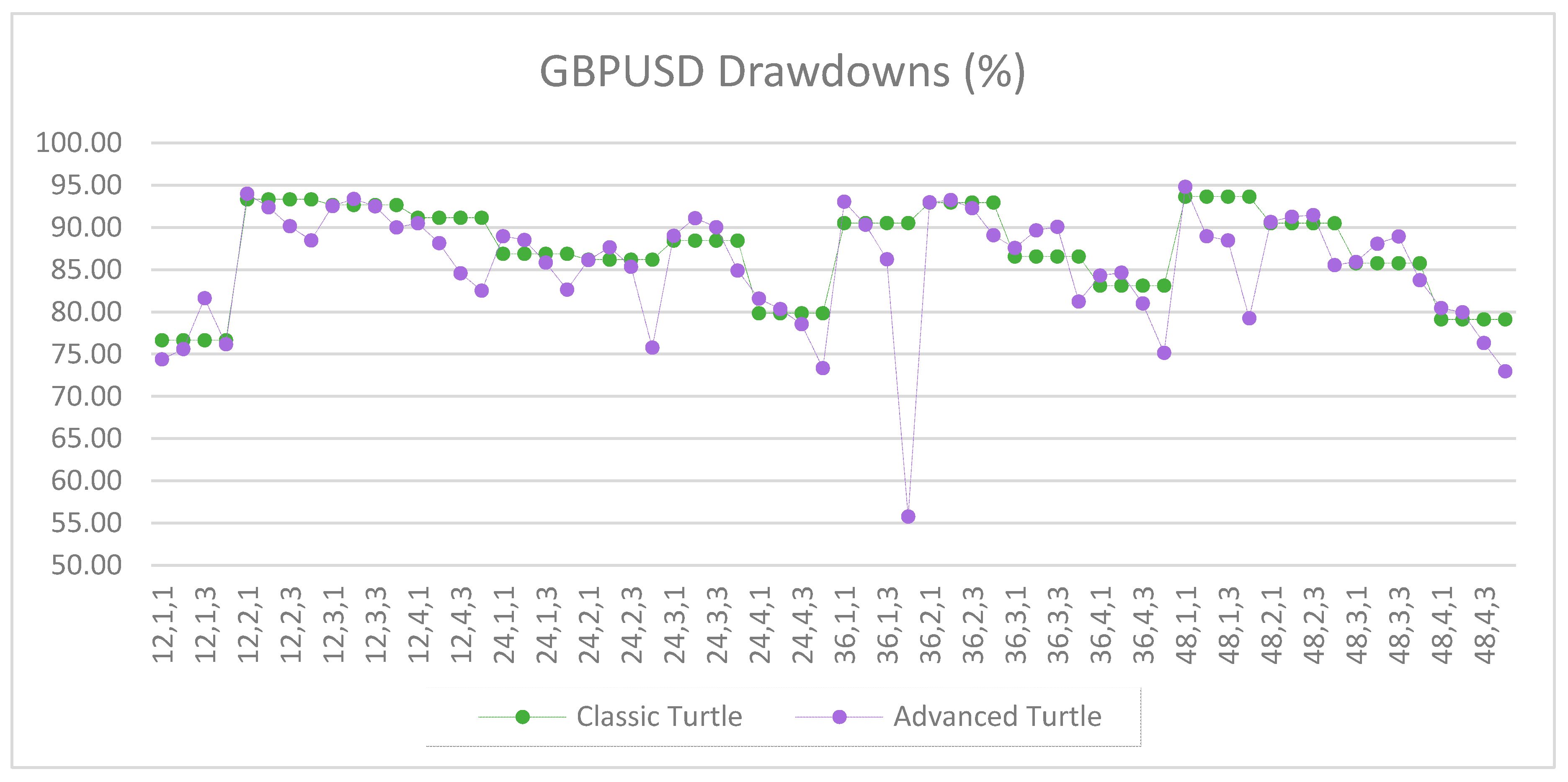

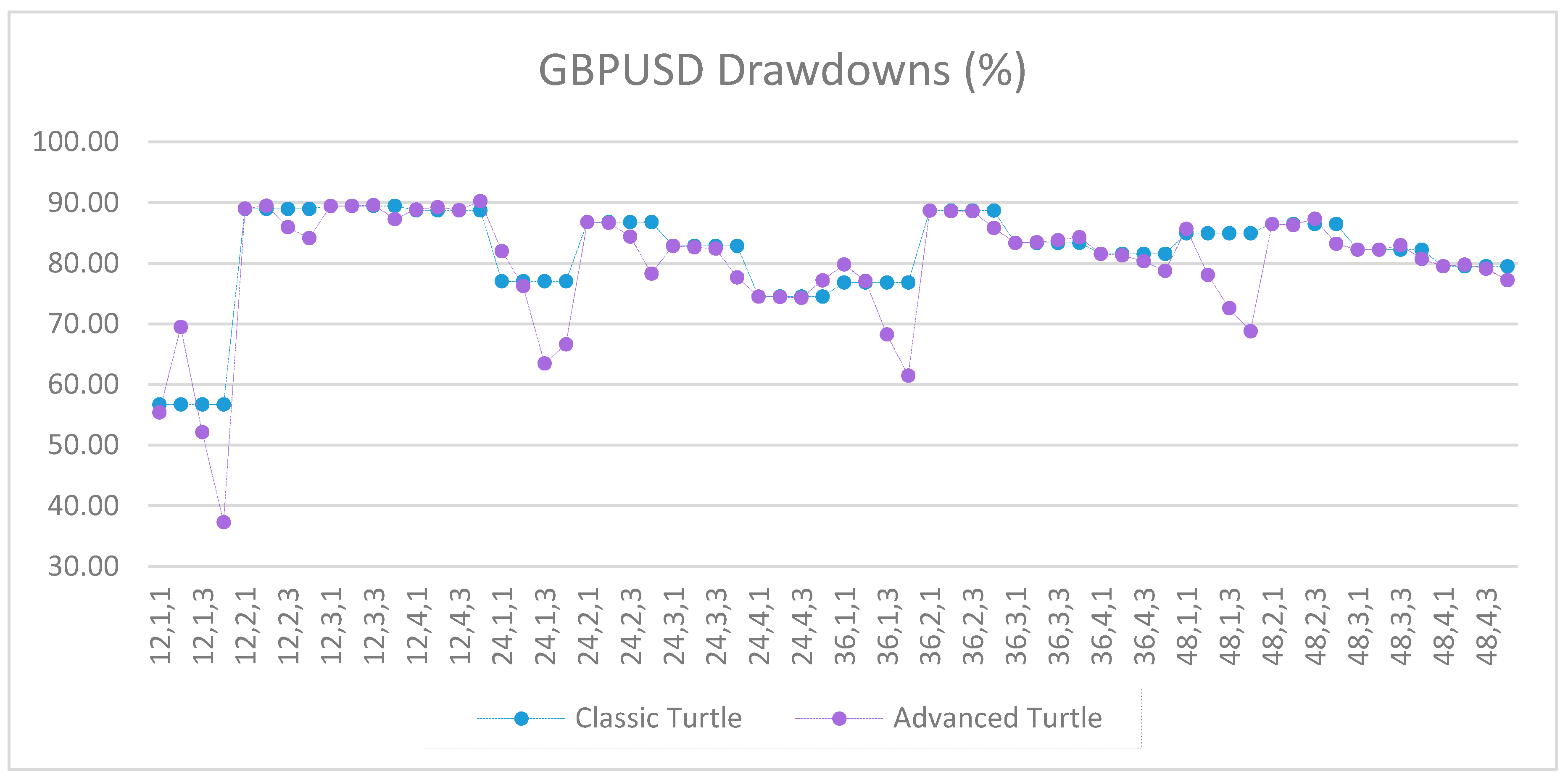

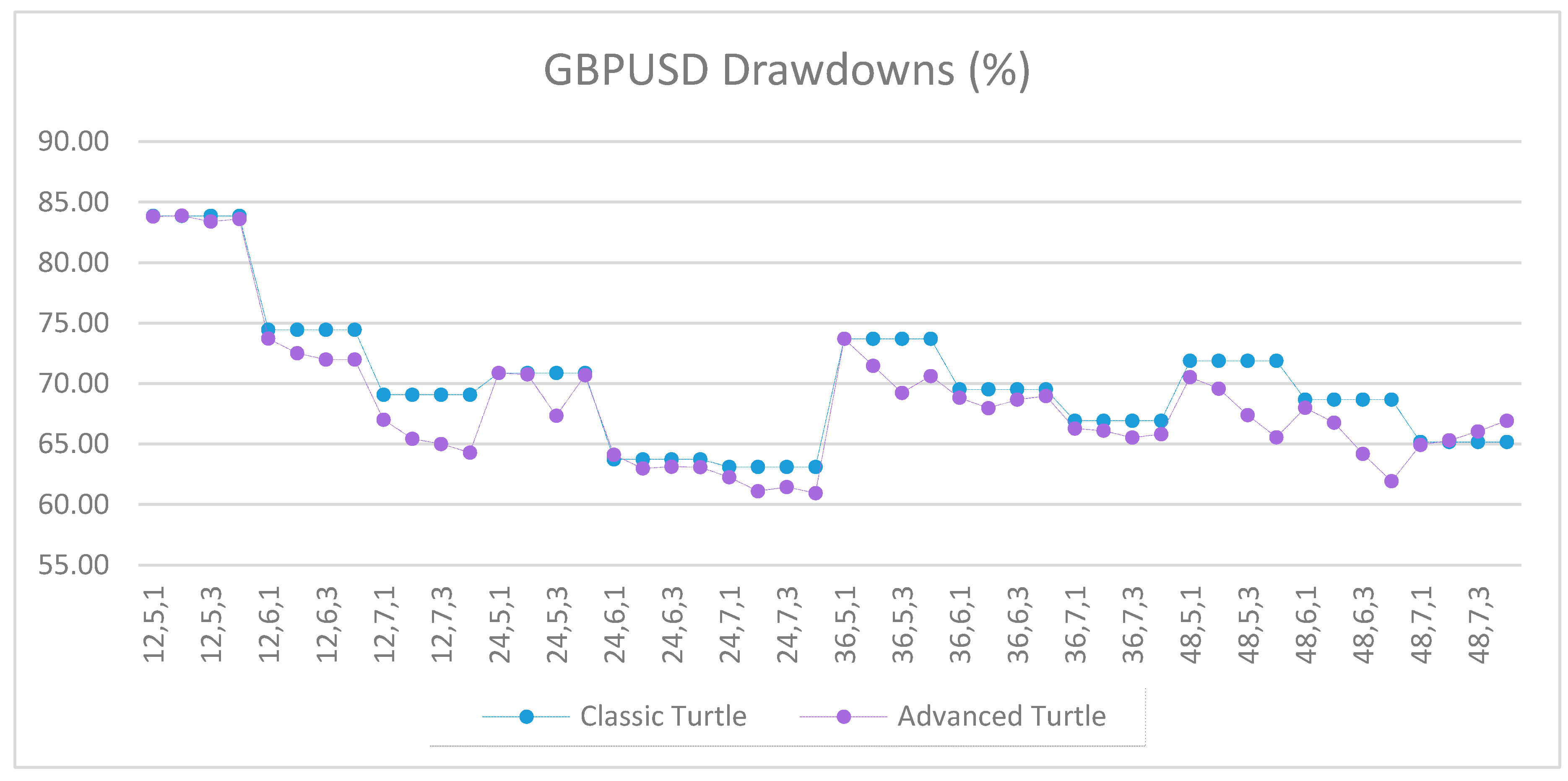

Figure A6.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A6.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

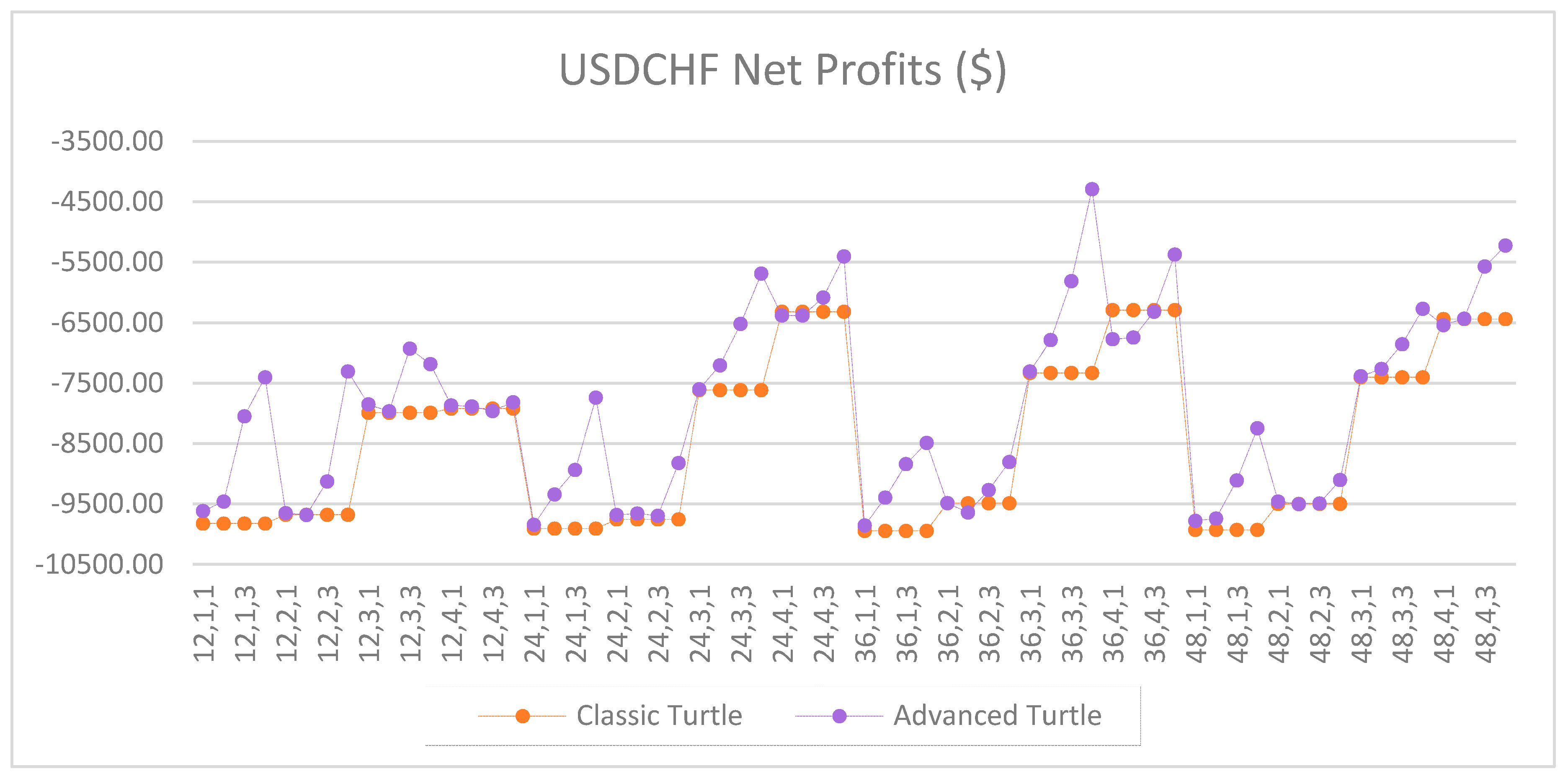

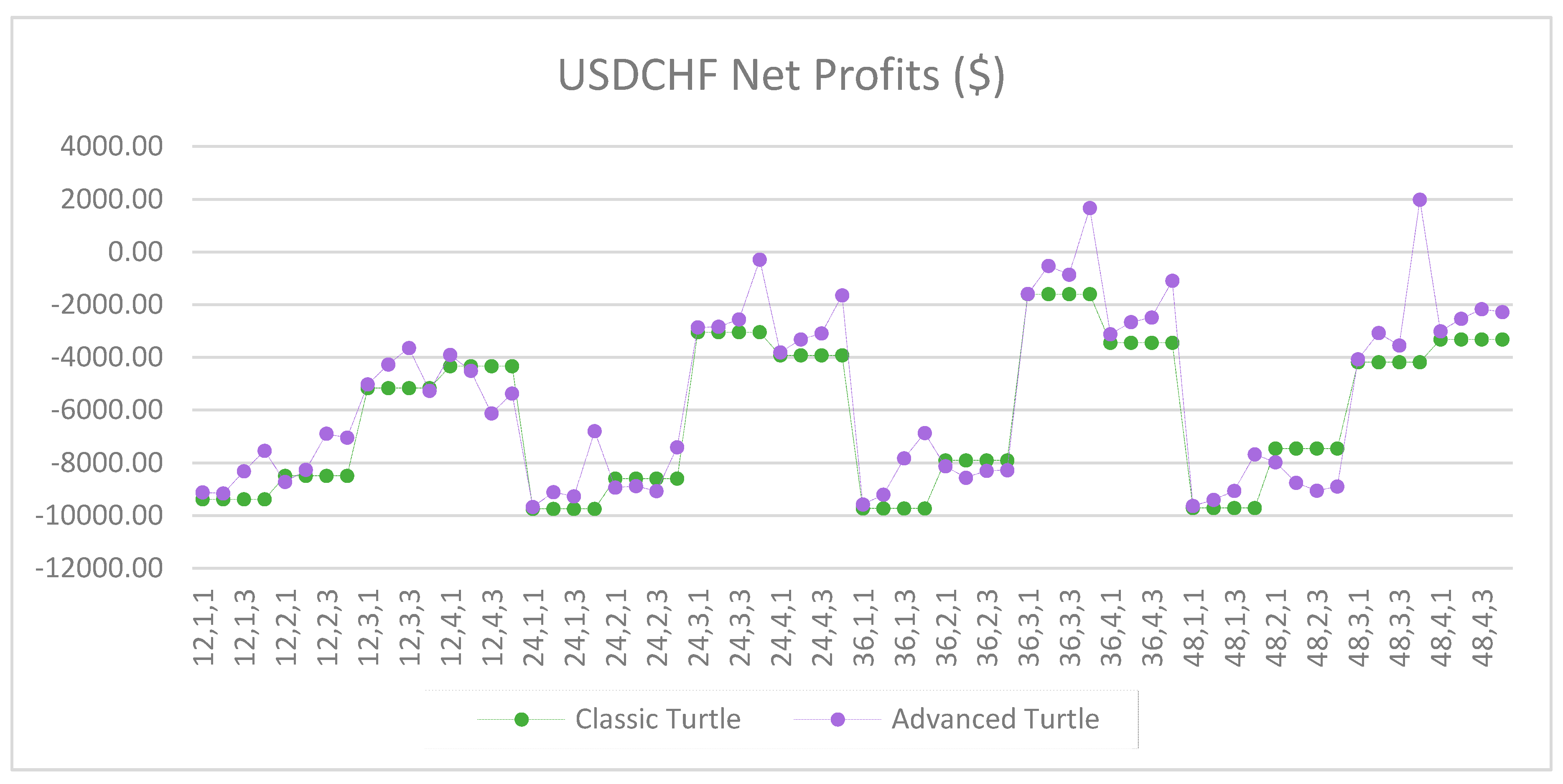

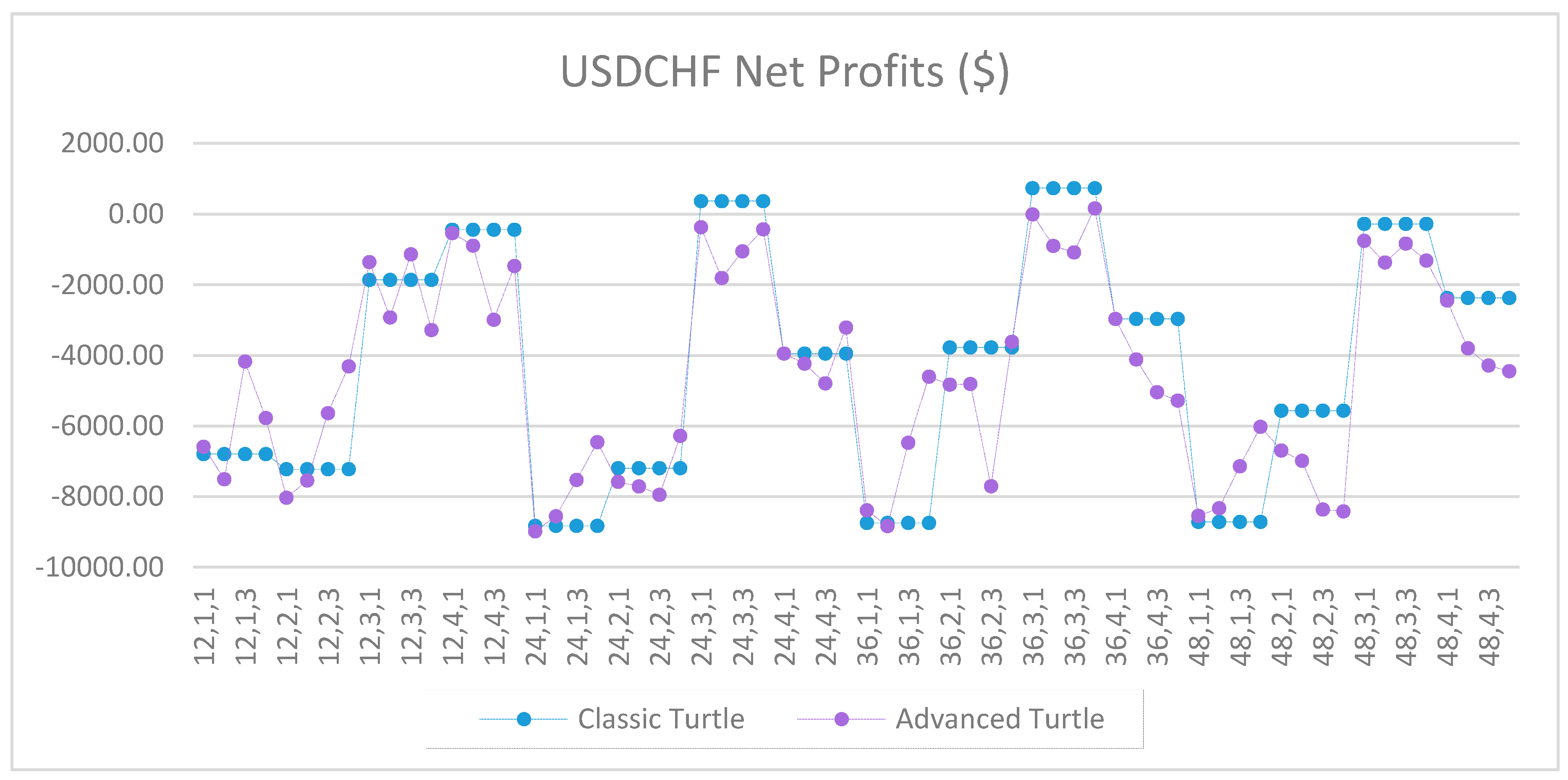

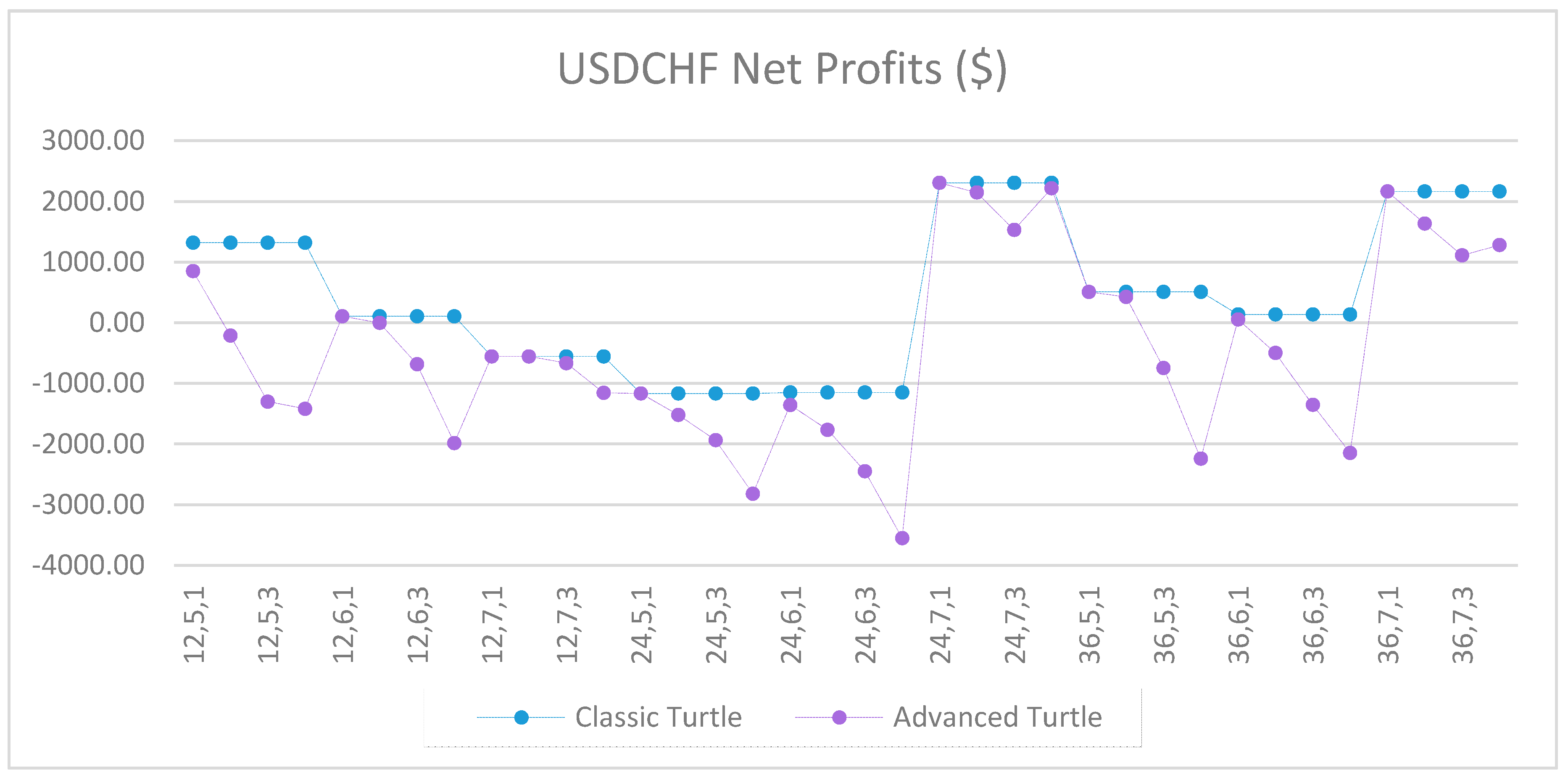

Figure A7.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A7.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

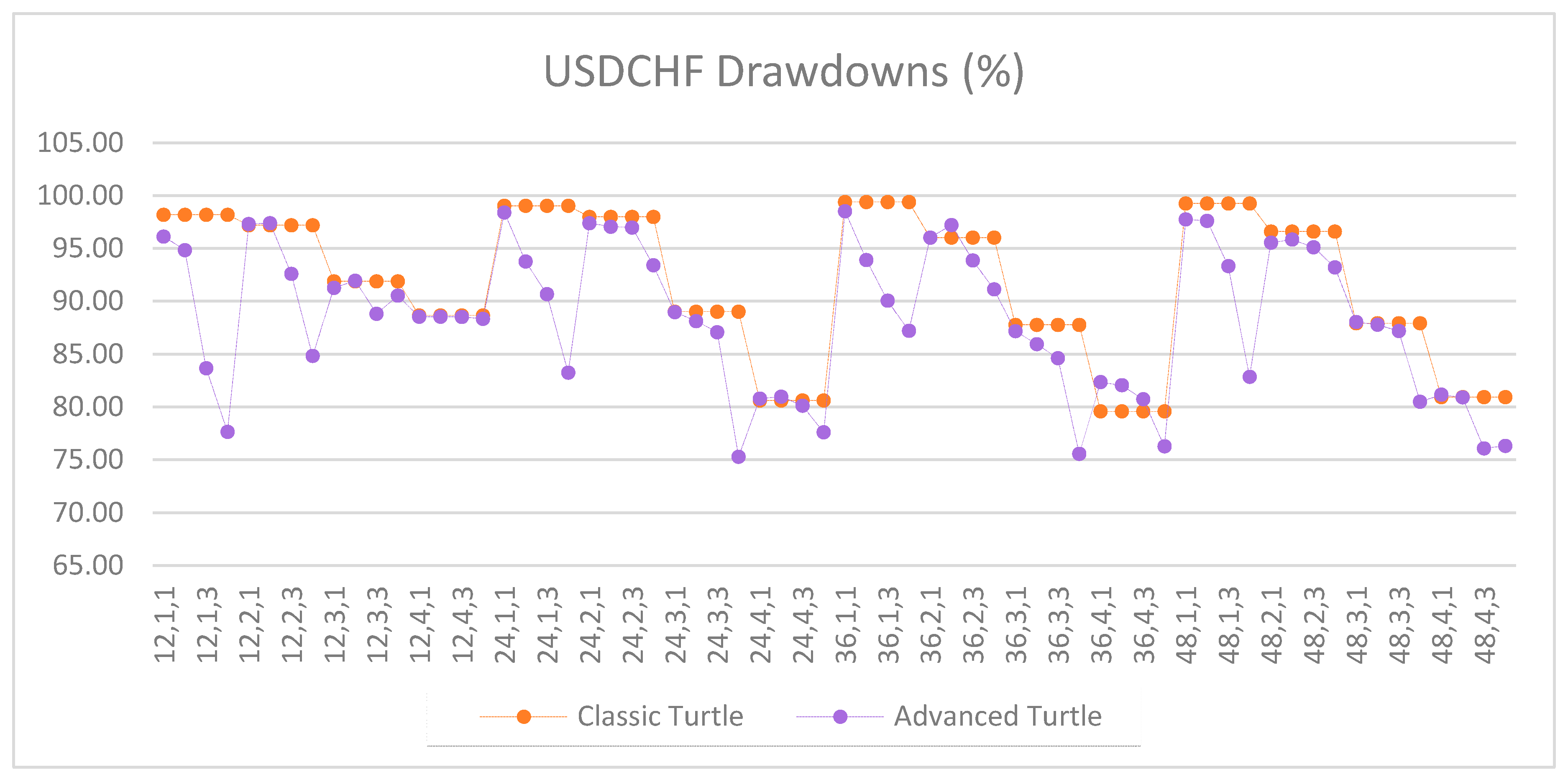

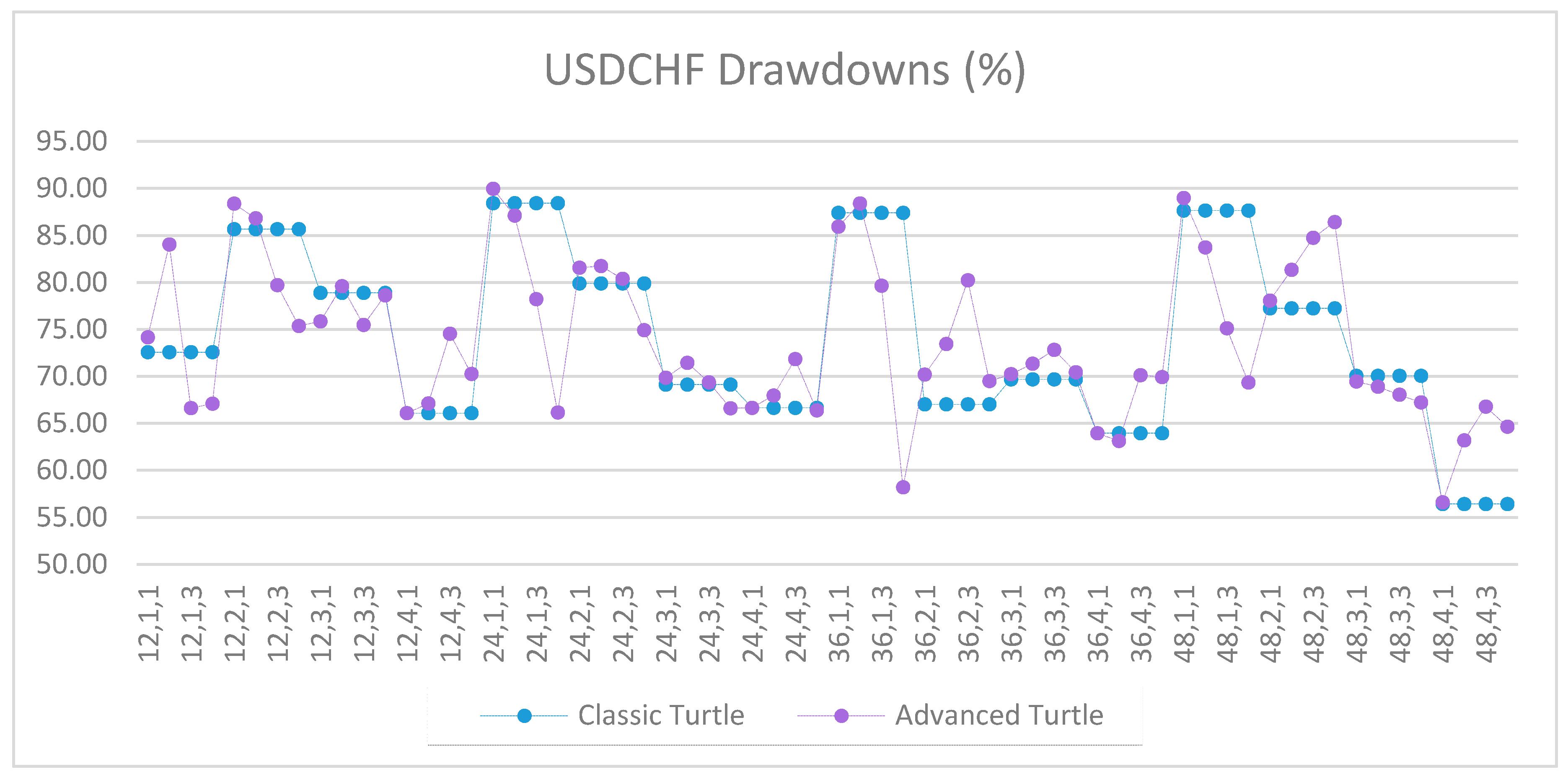

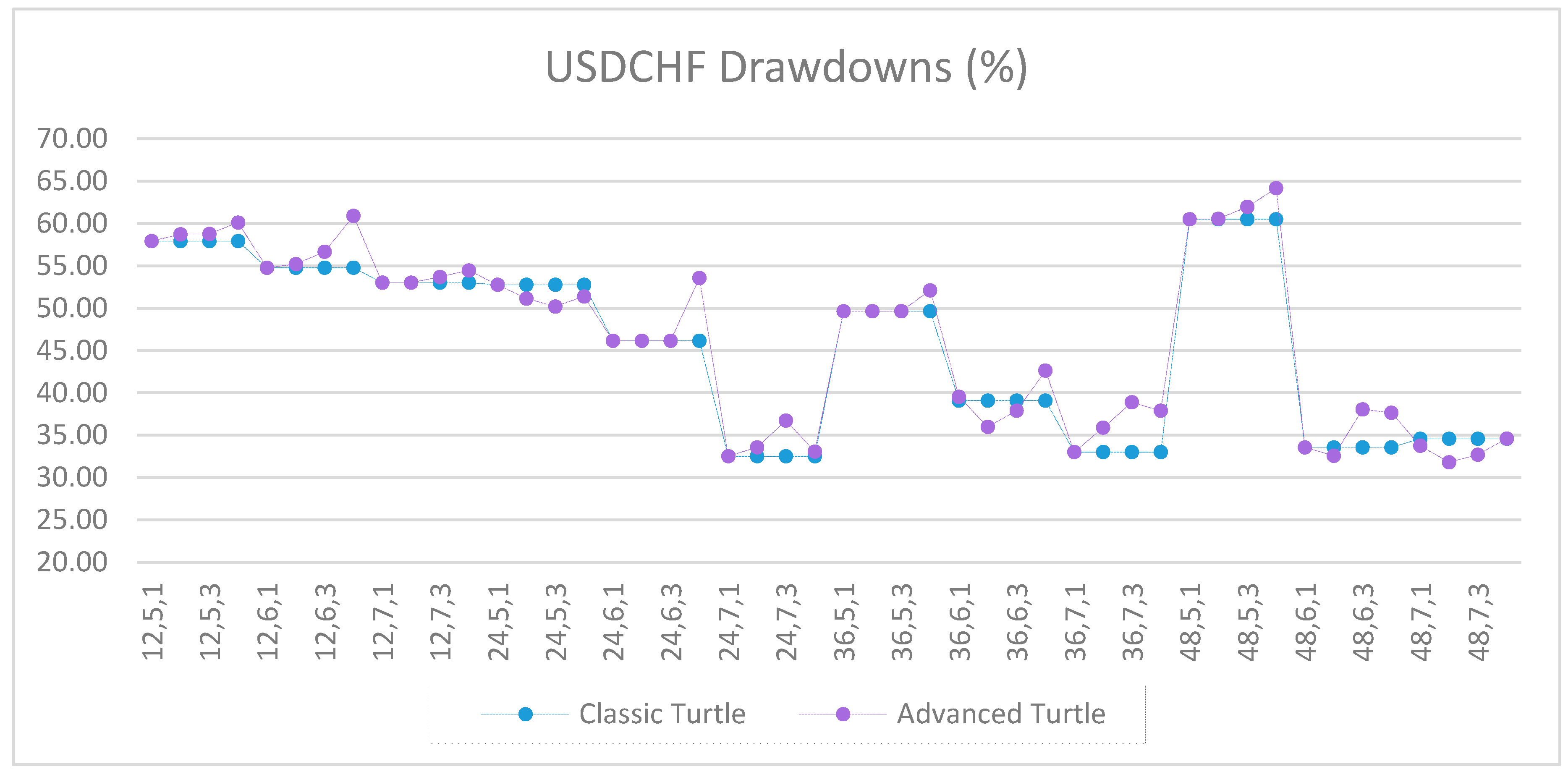

Figure A8.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A8.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

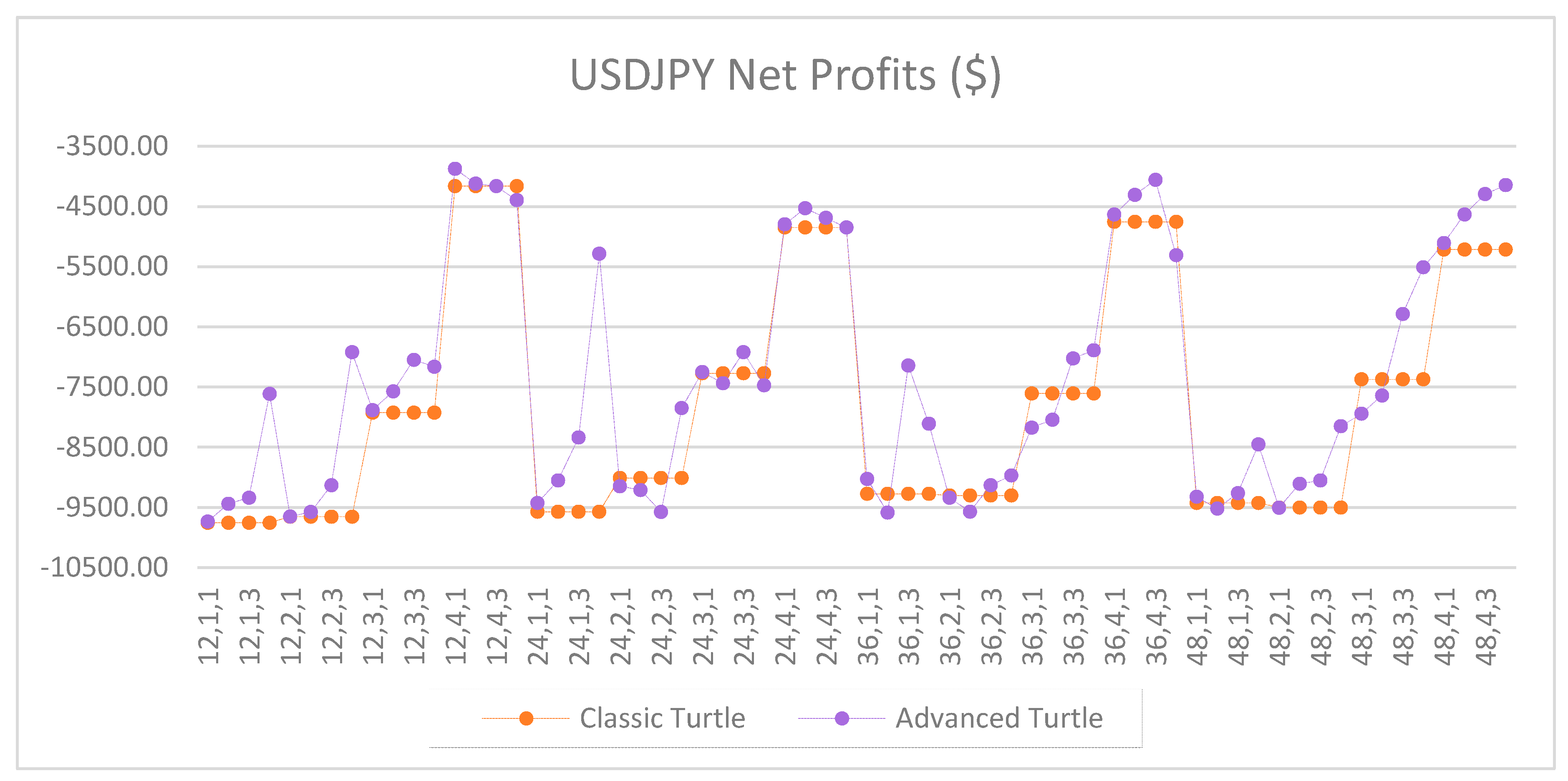

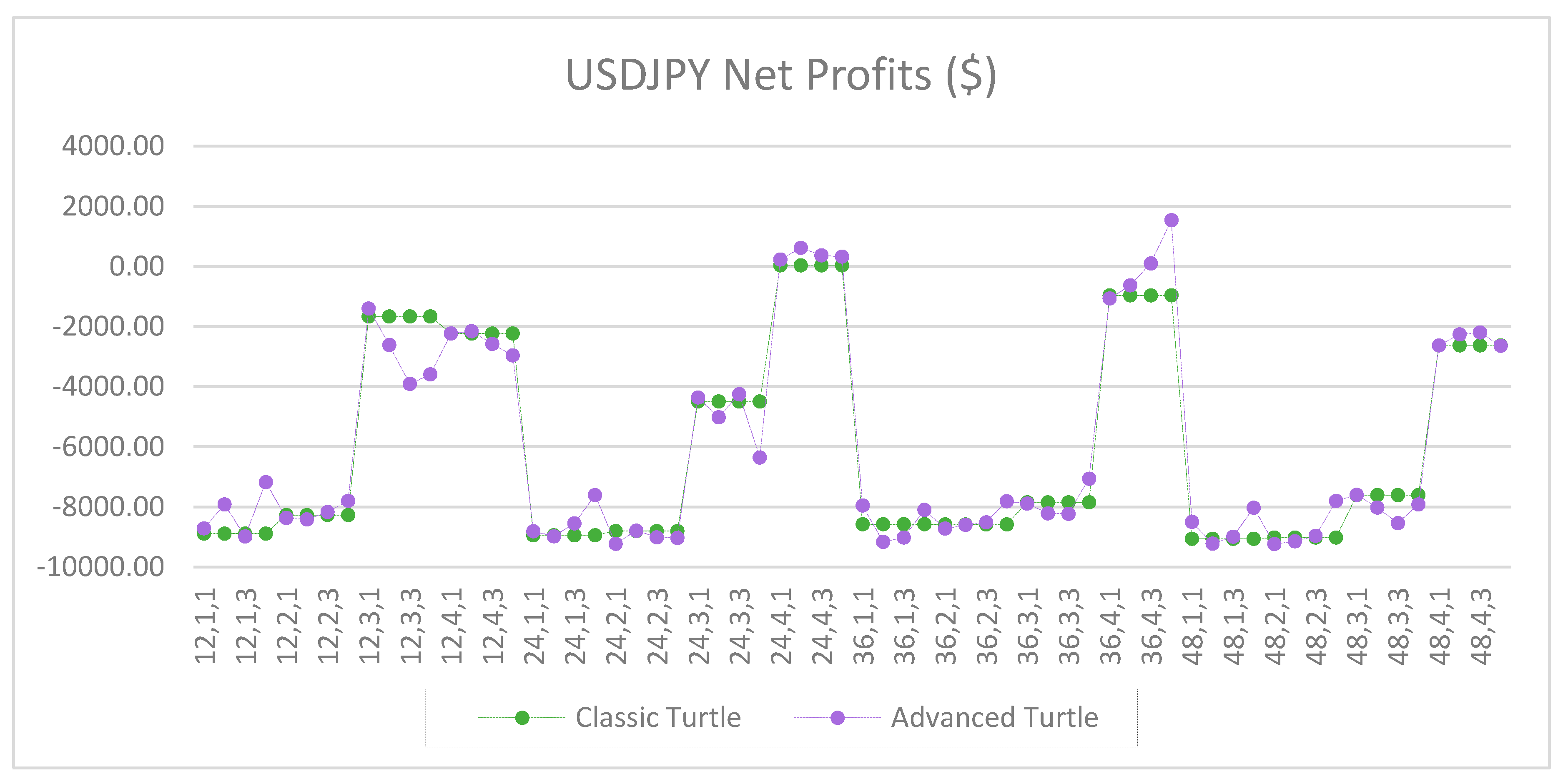

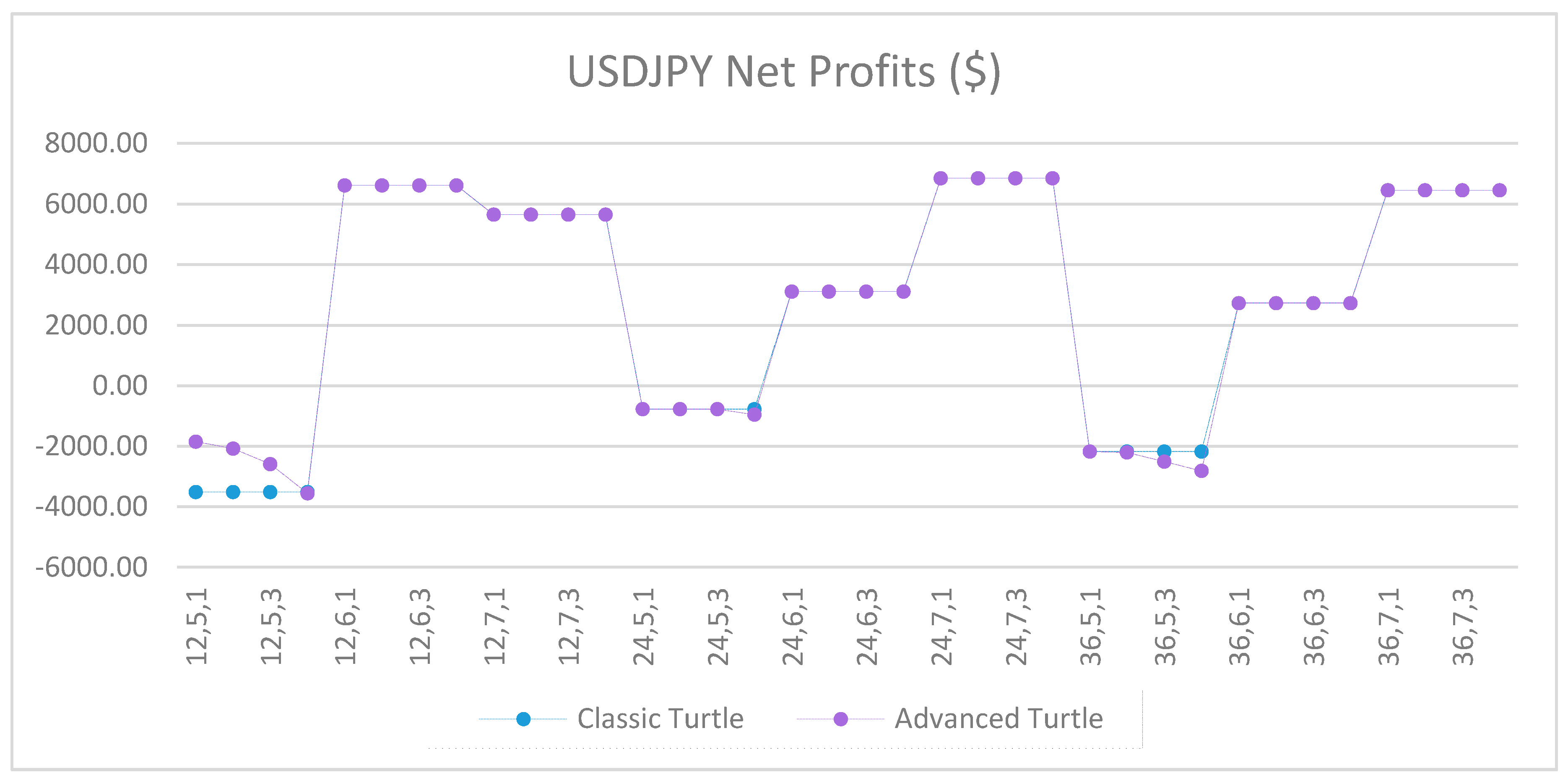

Figure A9.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A9.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

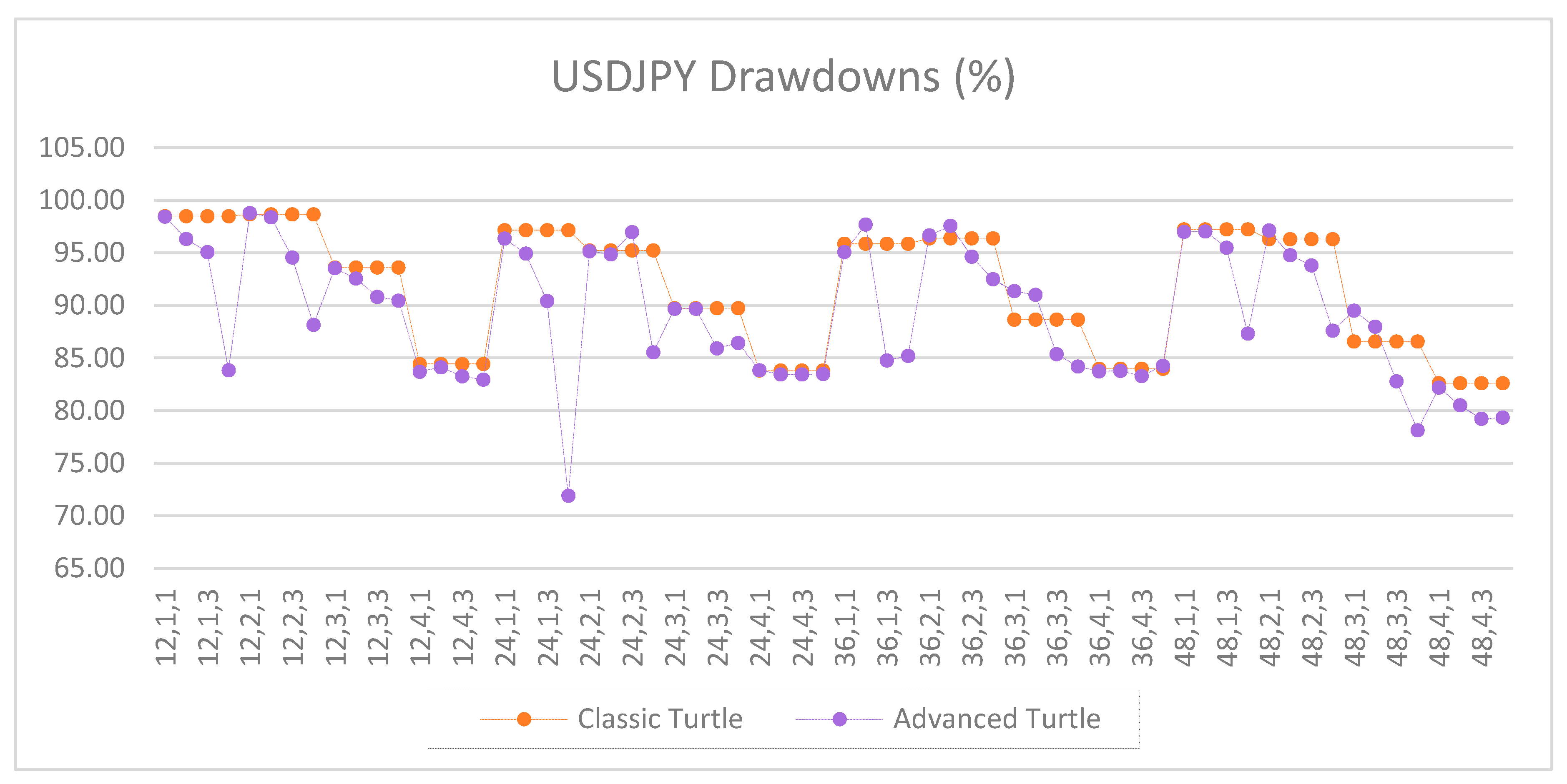

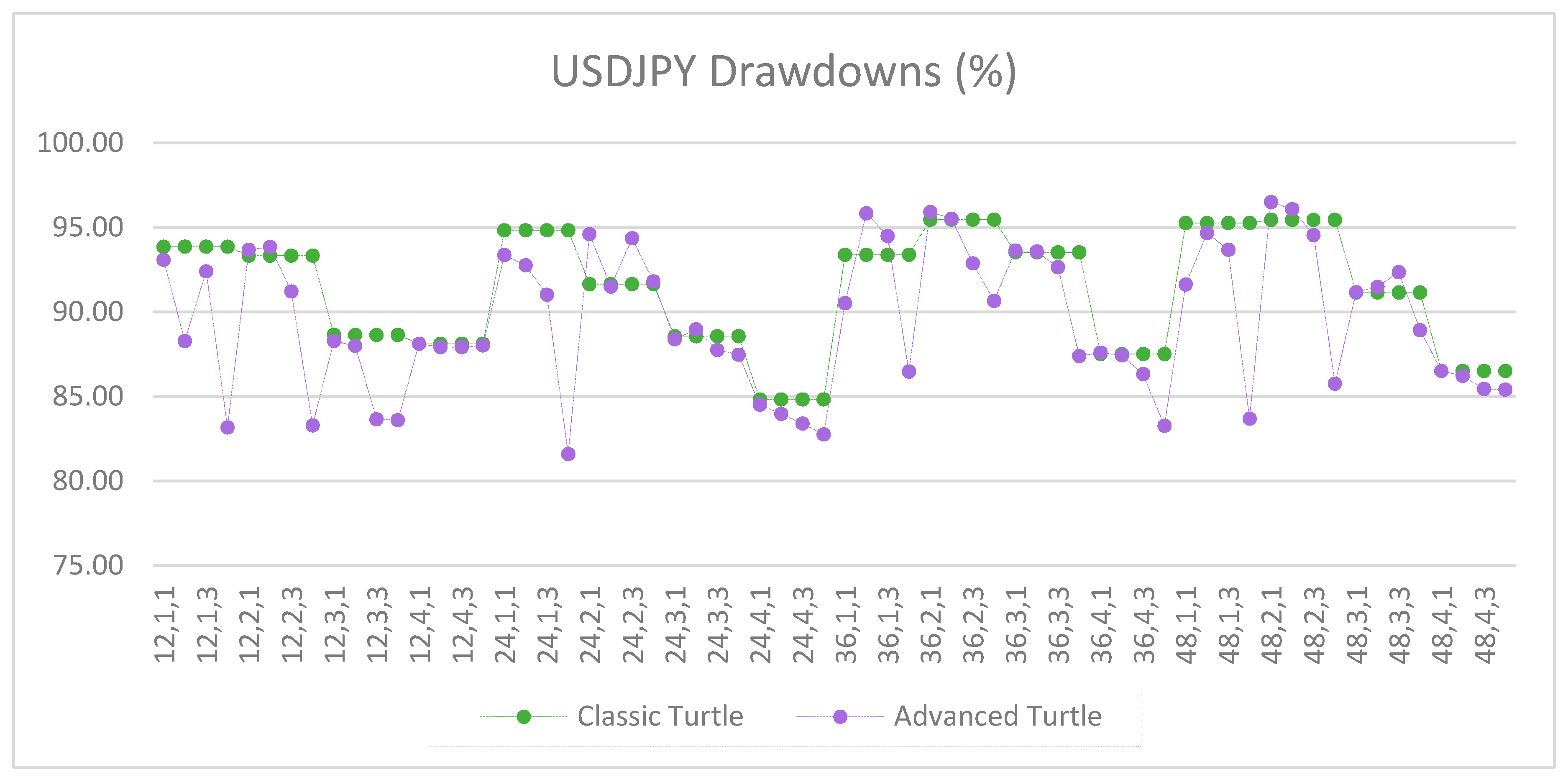

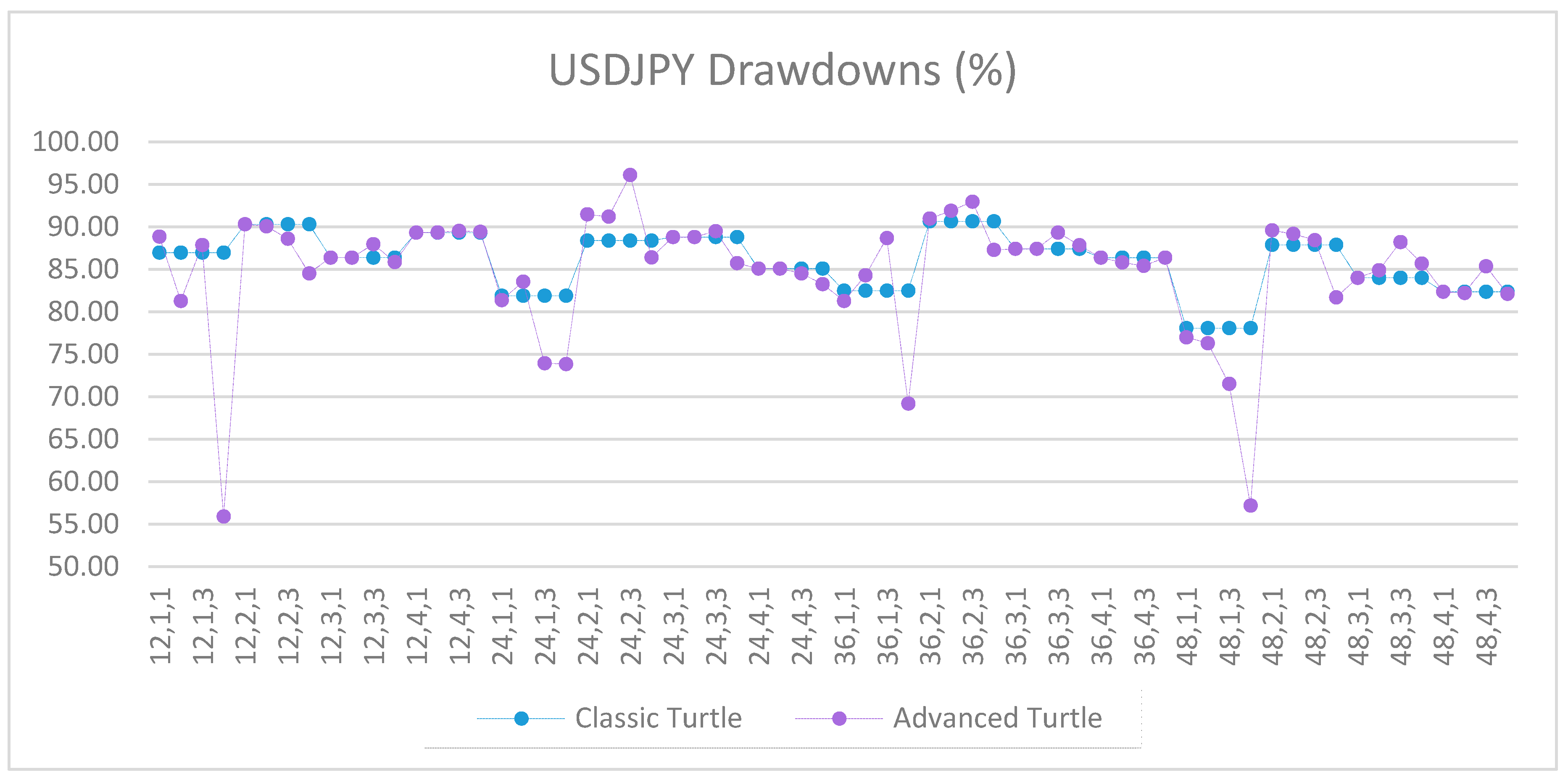

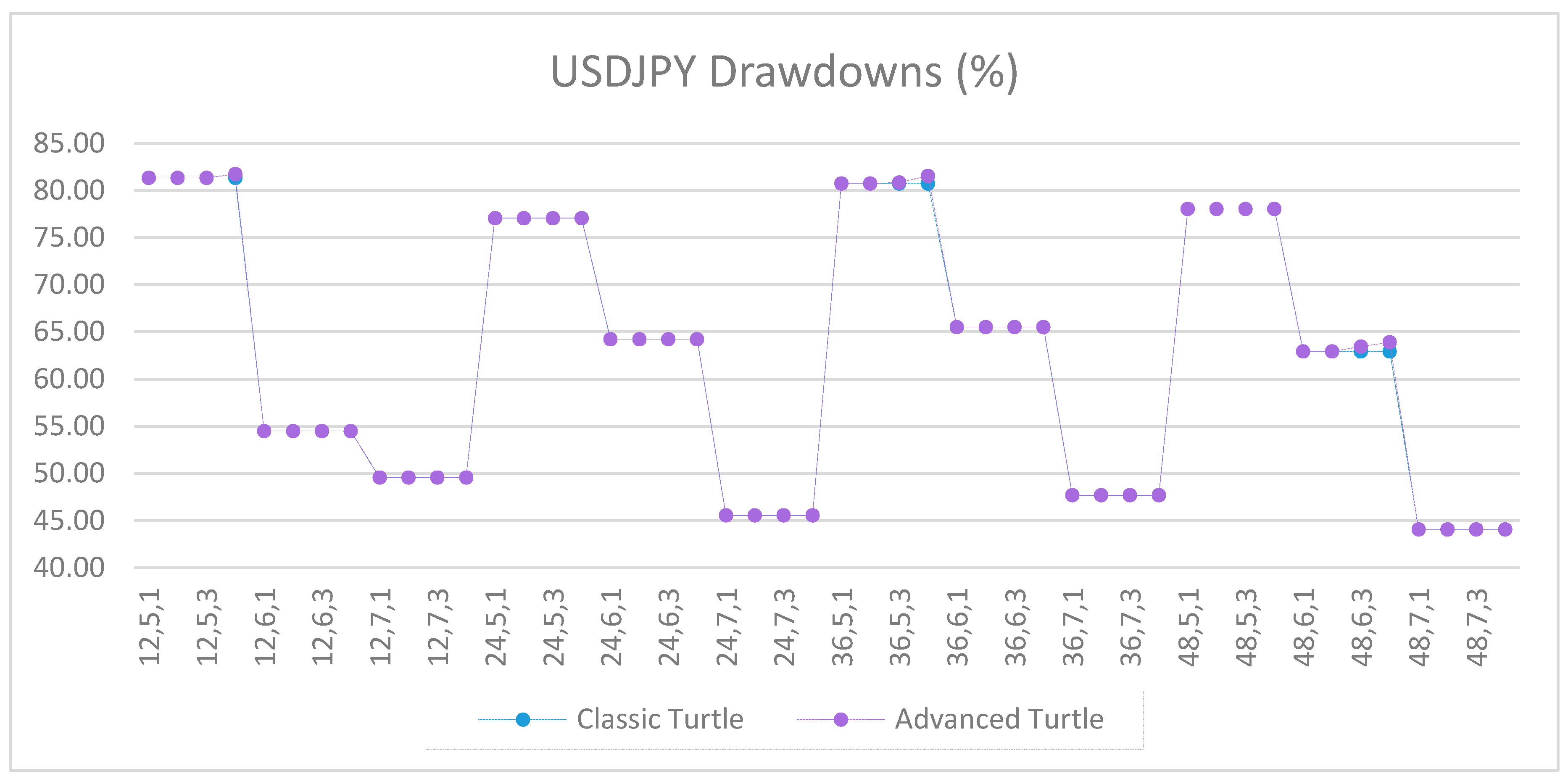

Figure A10.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A10.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

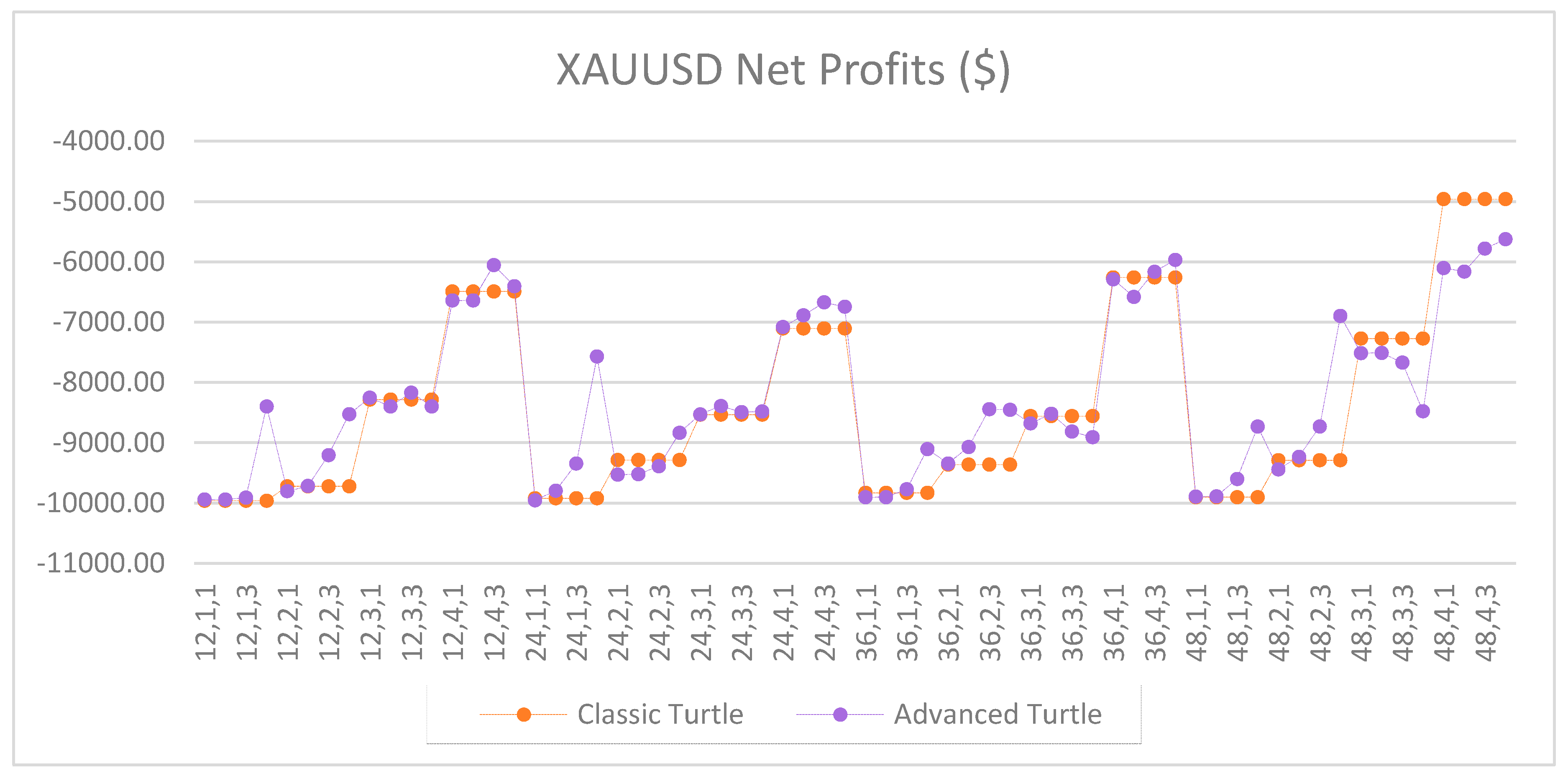

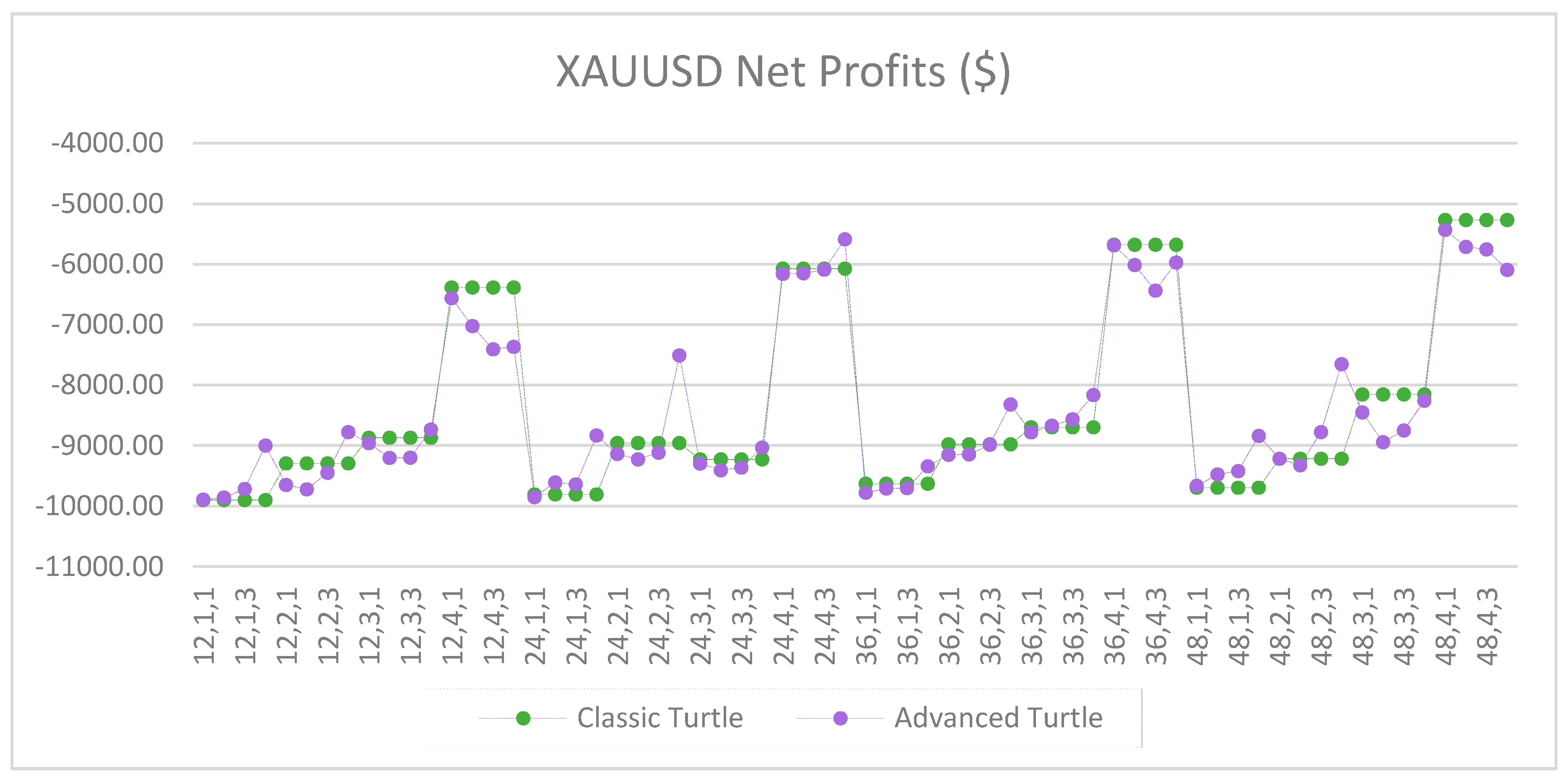

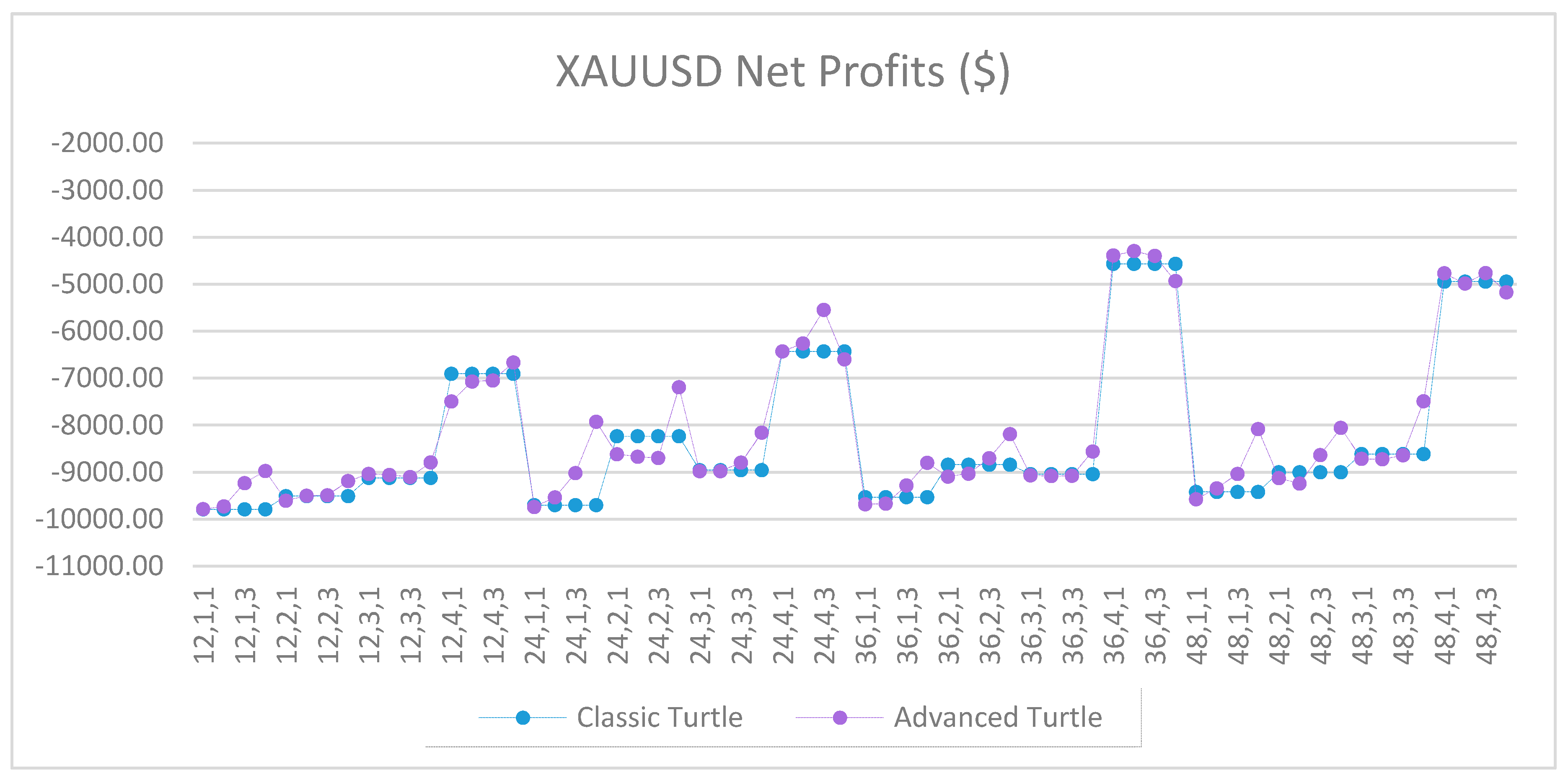

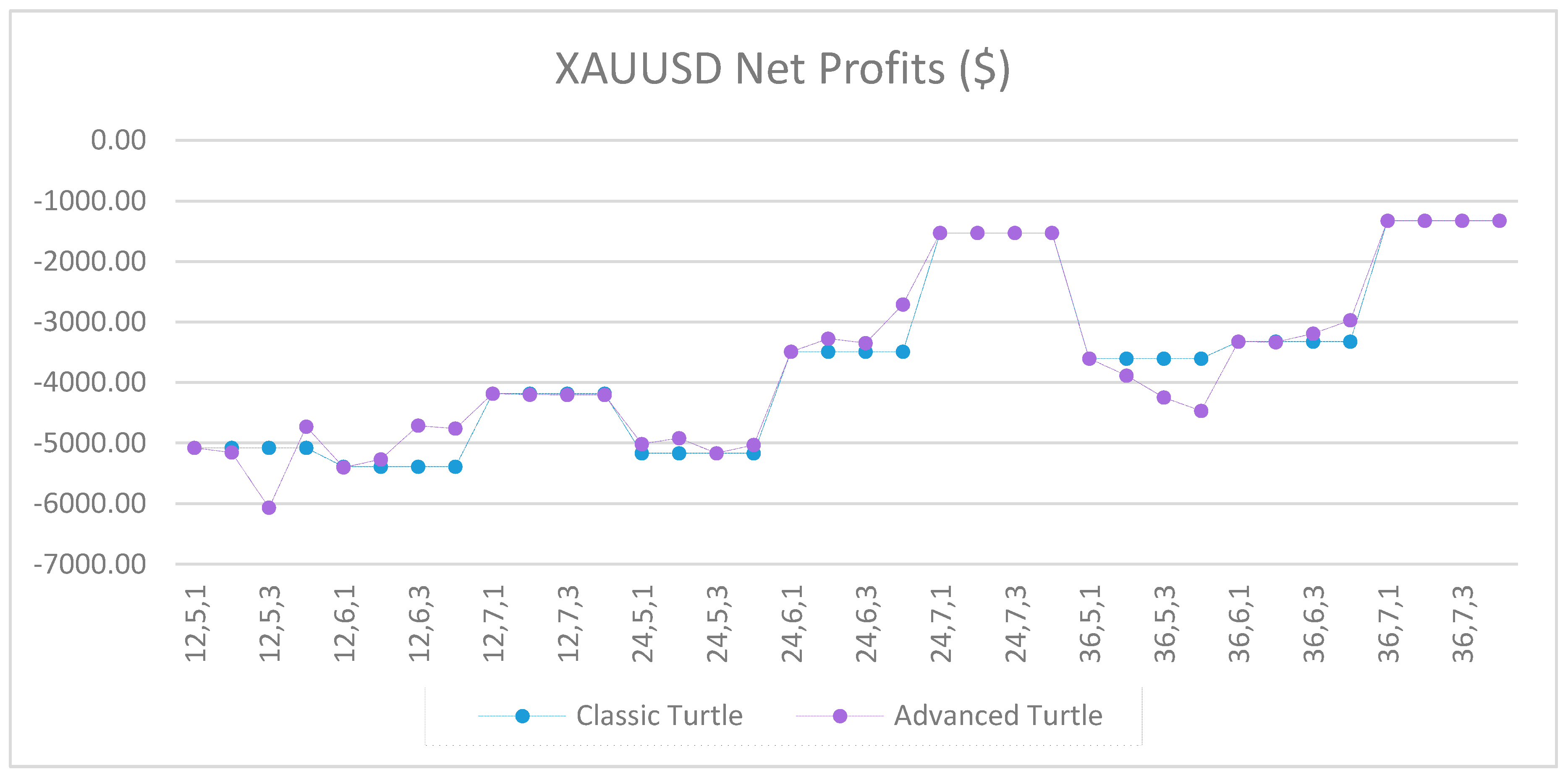

Figure A11.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A11.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

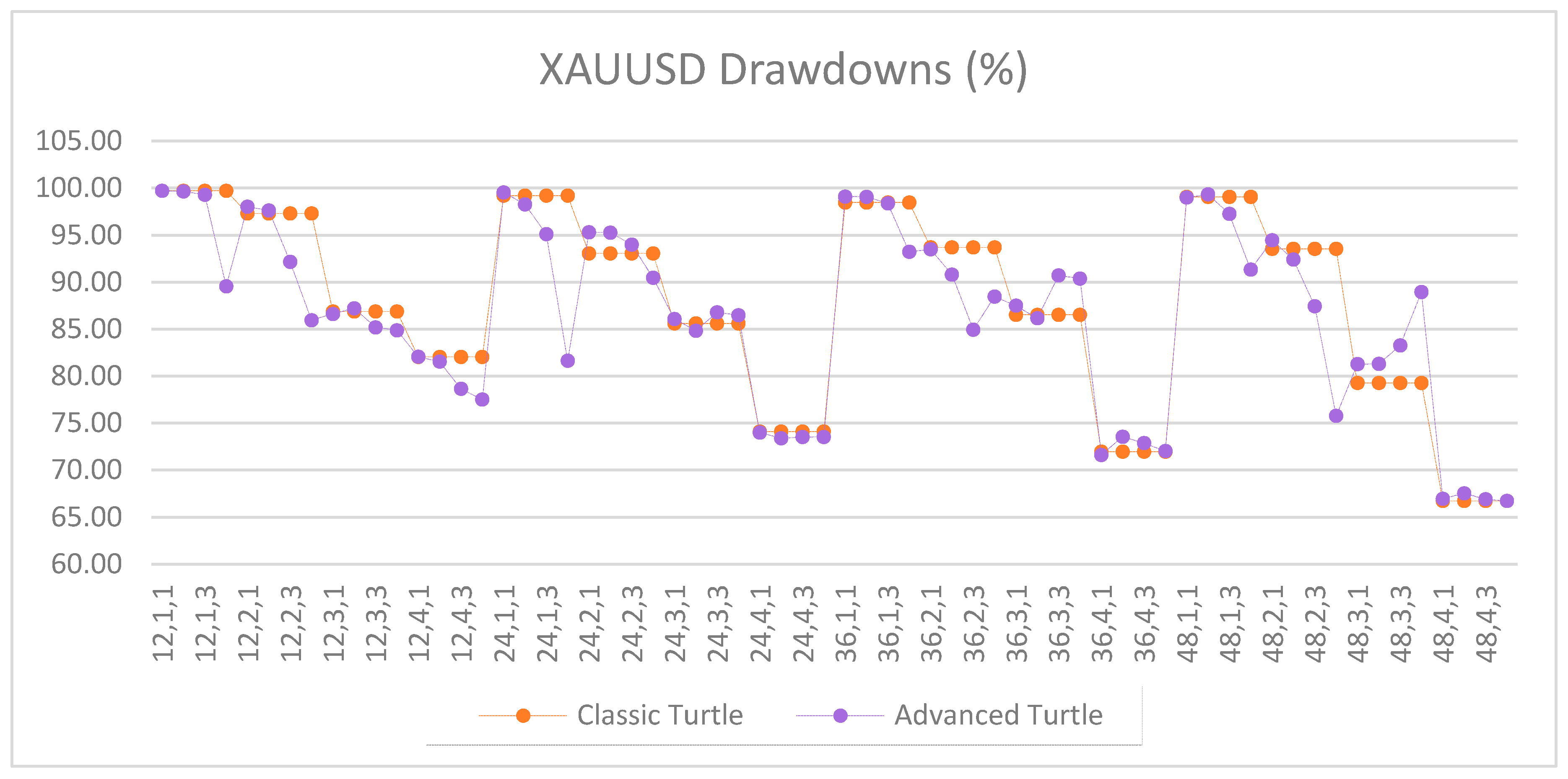

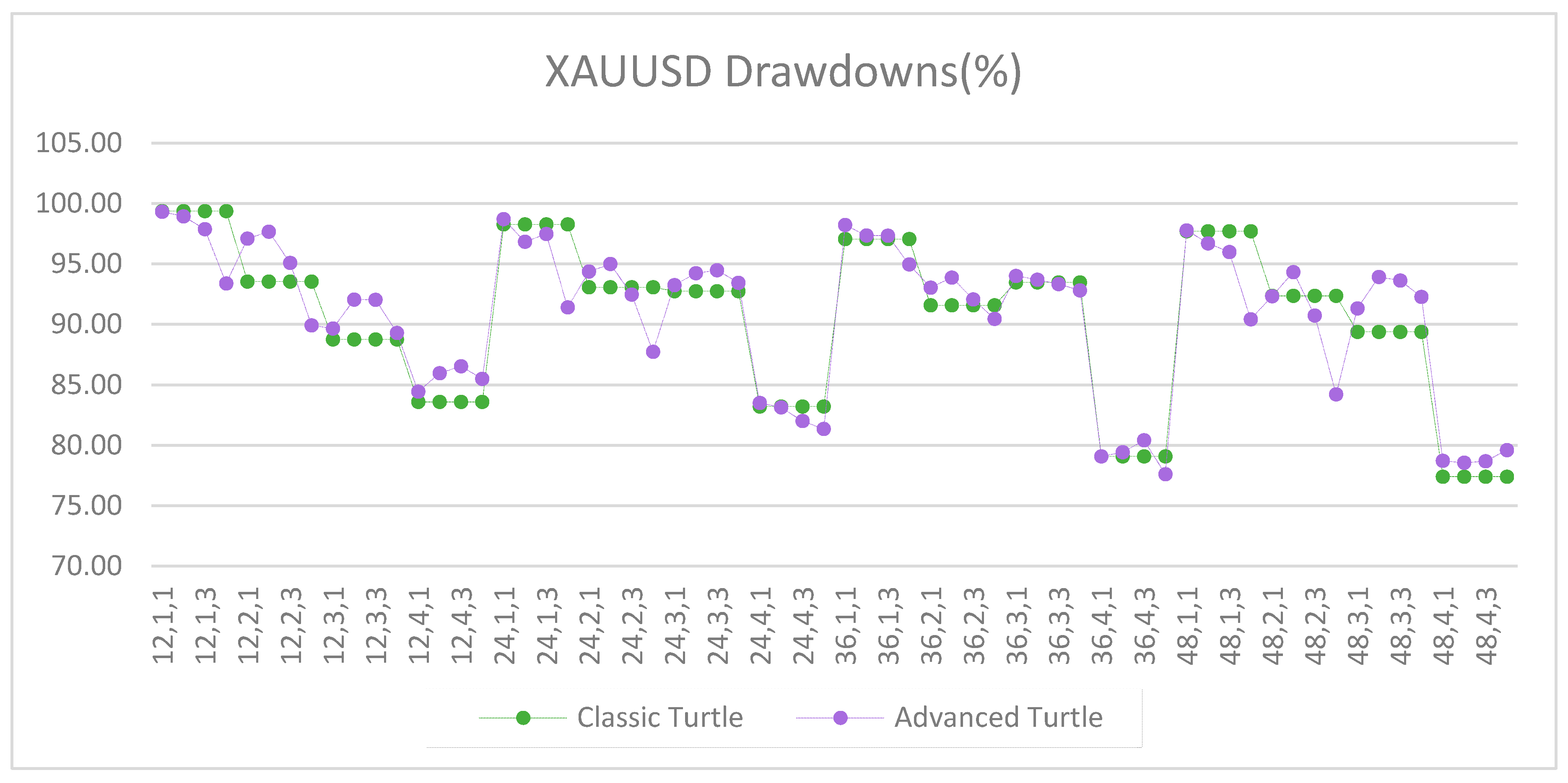

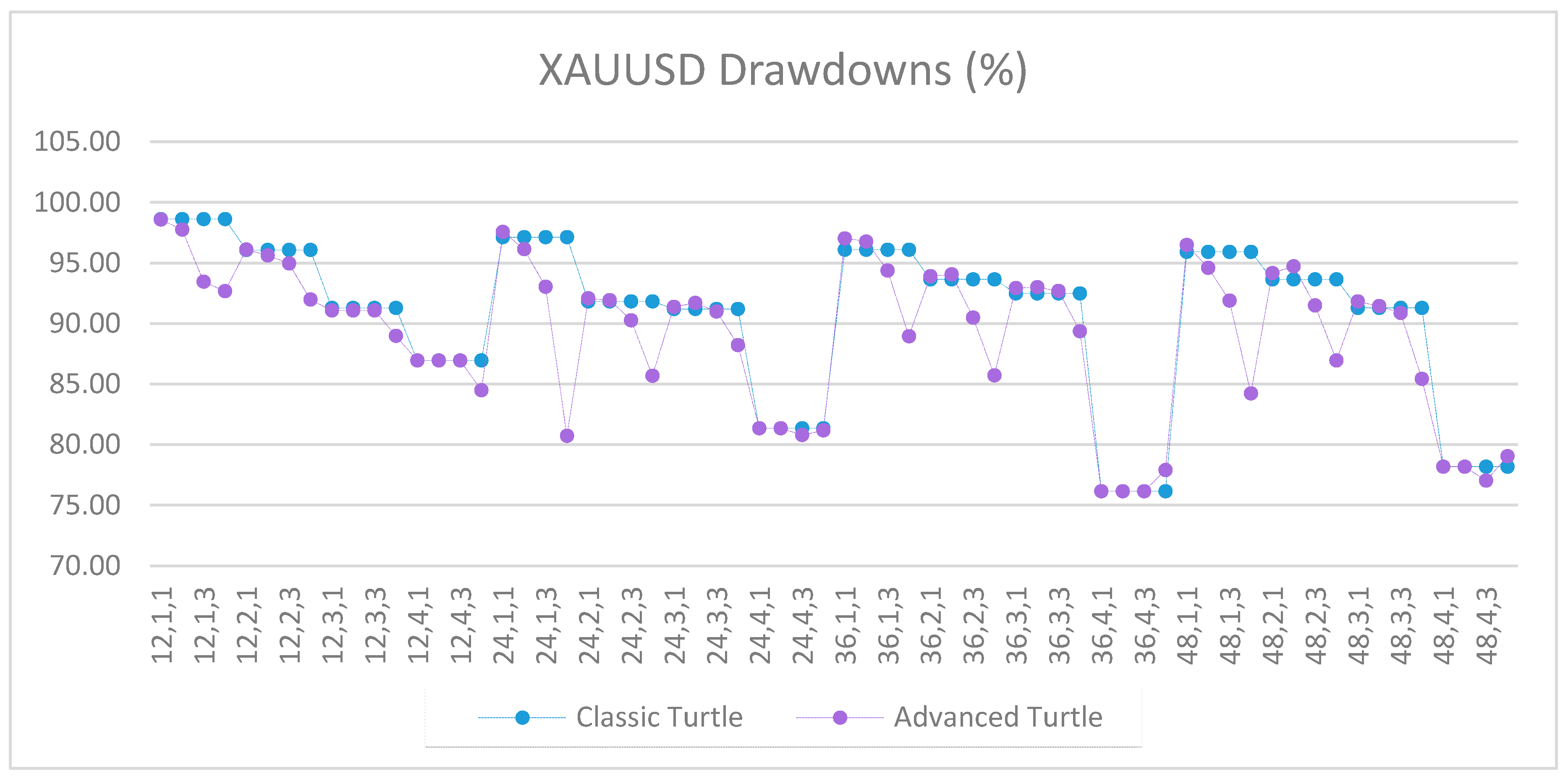

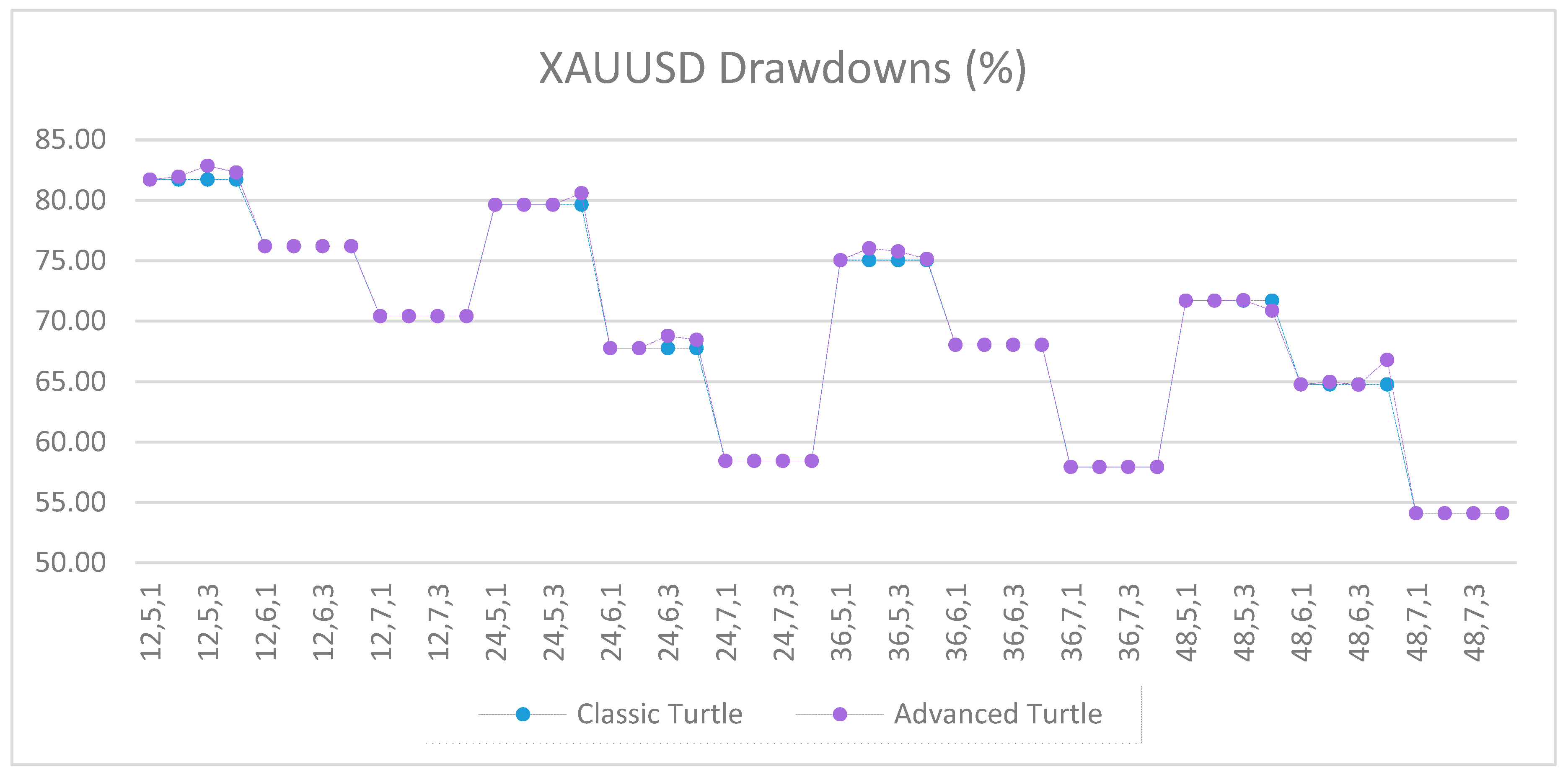

Figure A12.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A12.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

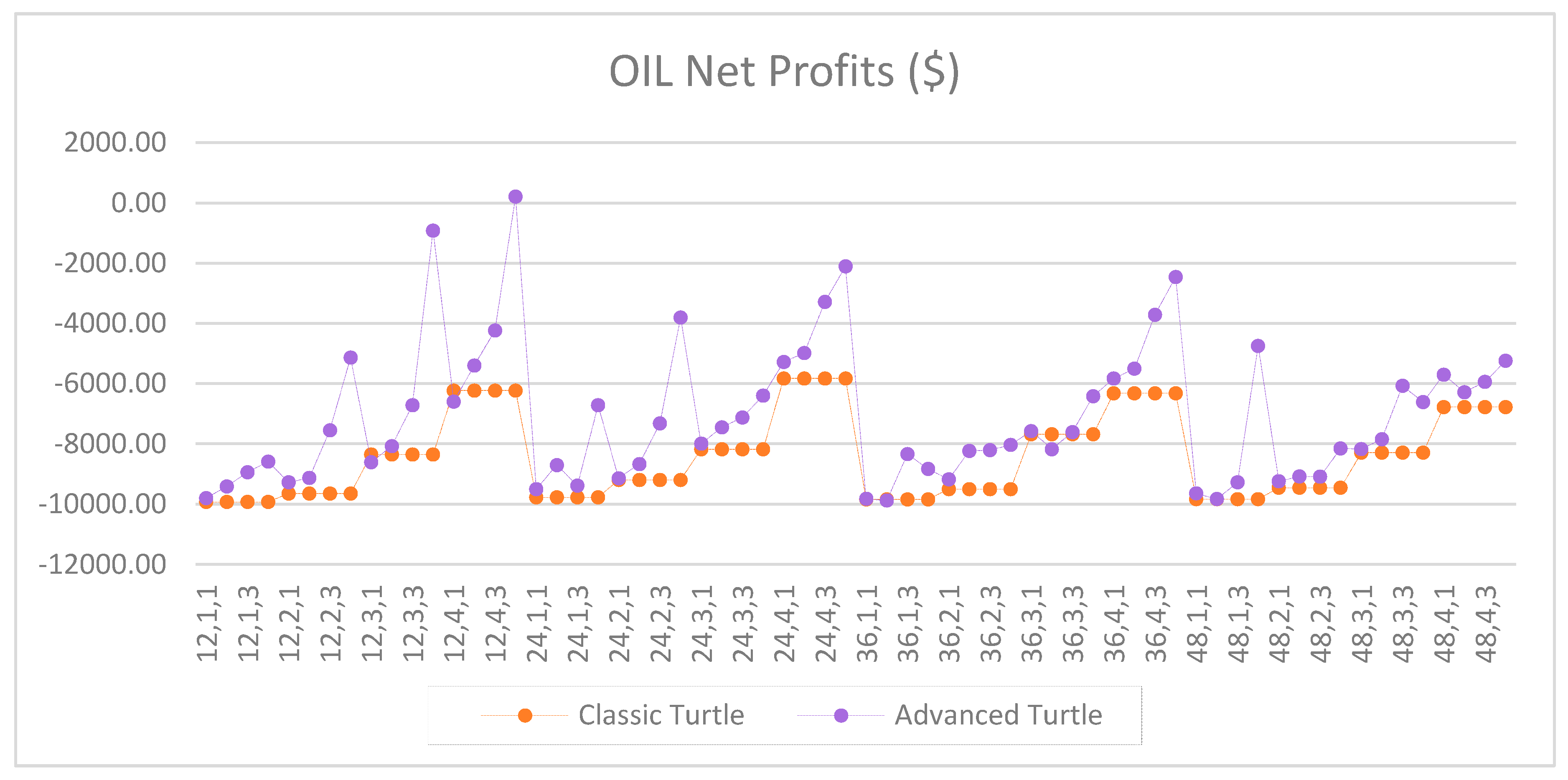

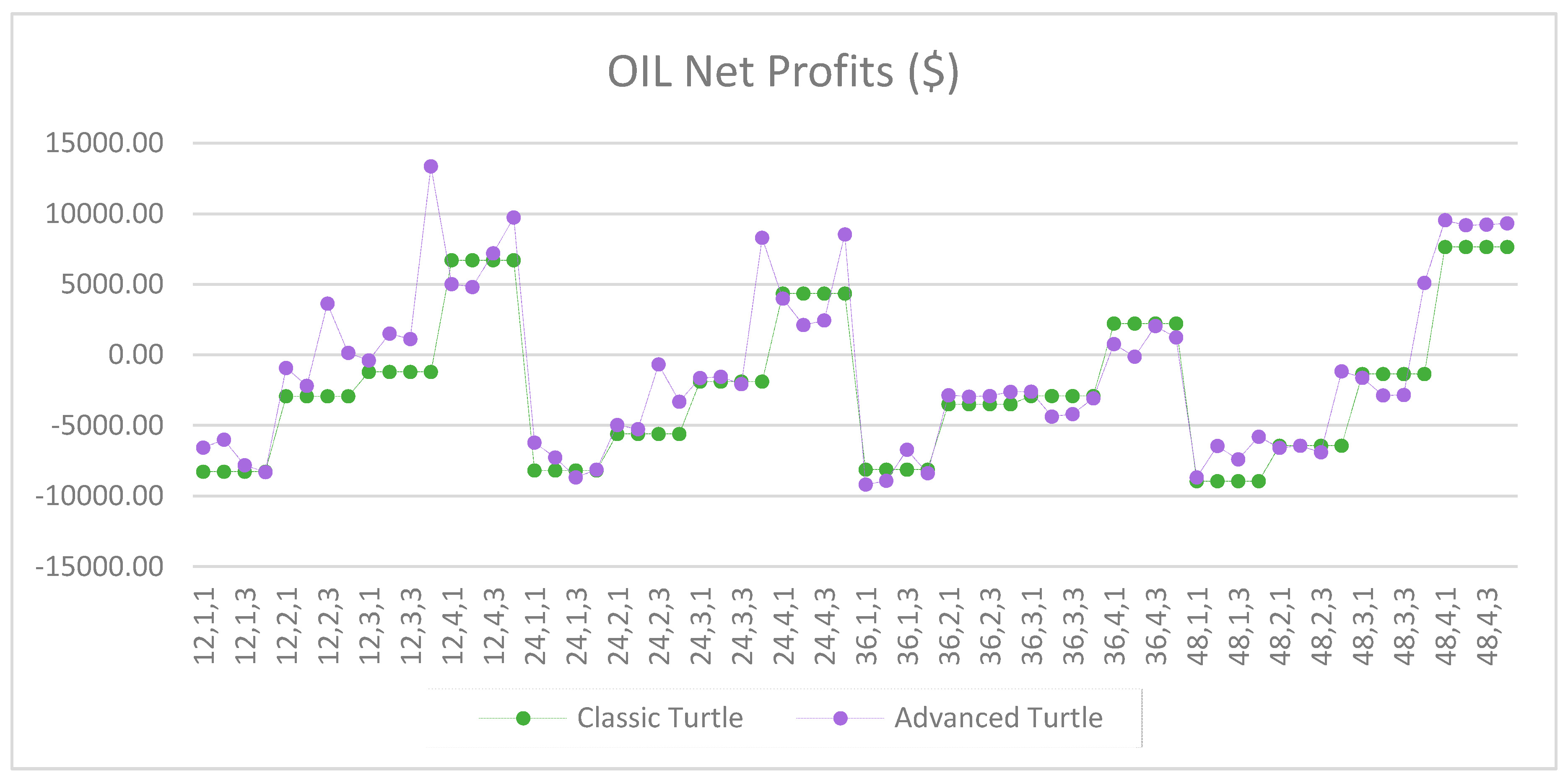

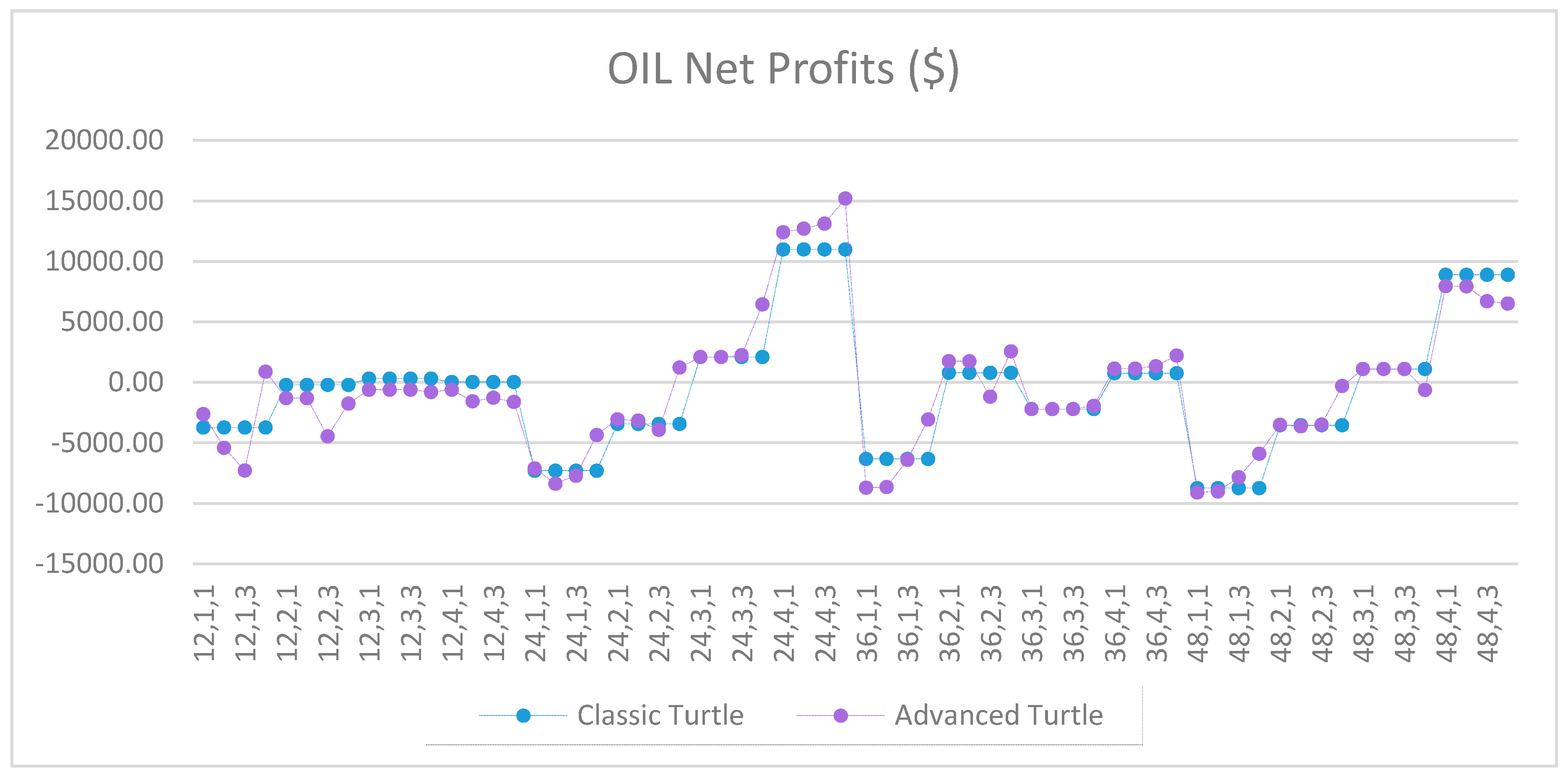

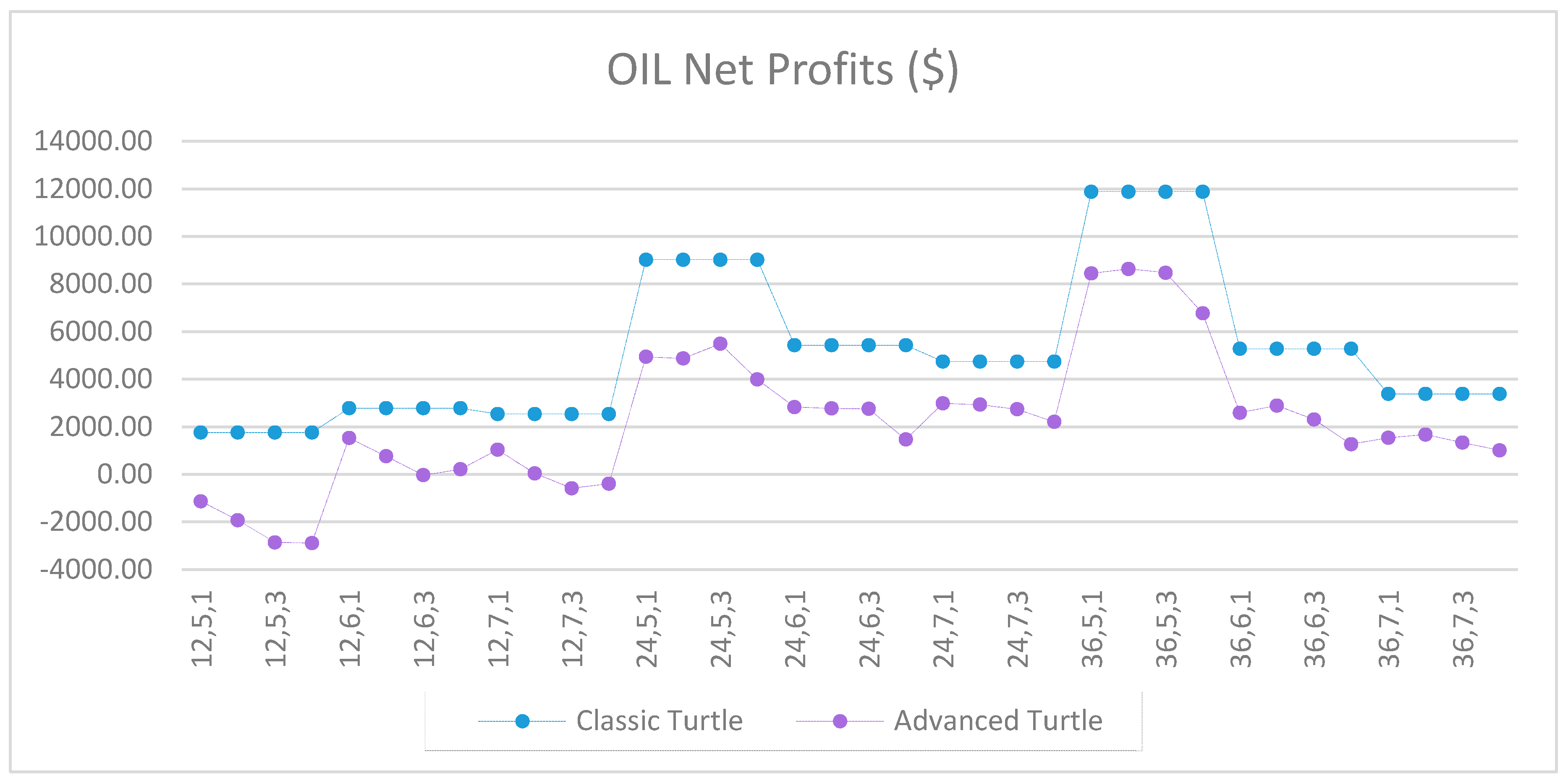

Figure A13.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A13.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

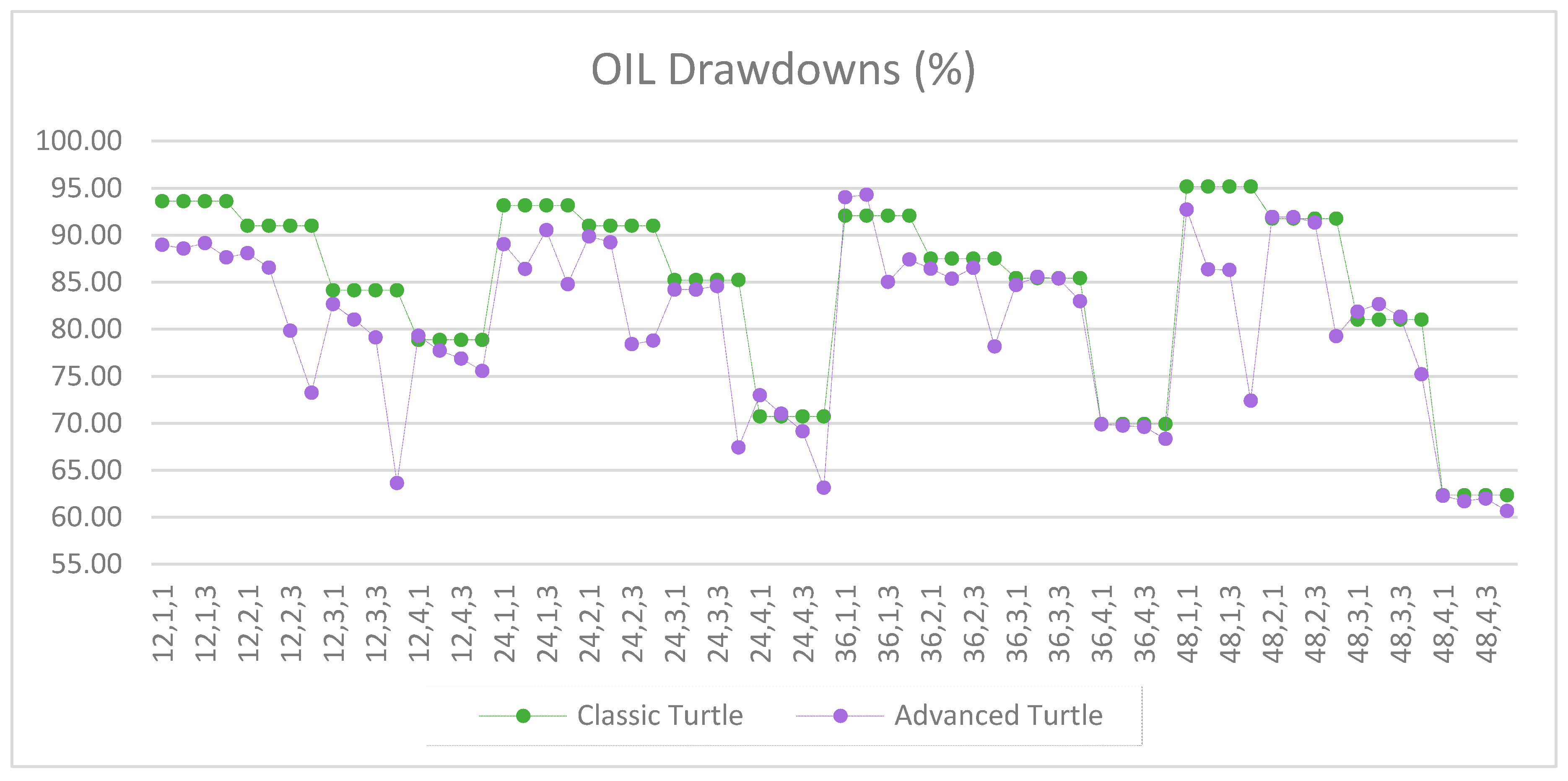

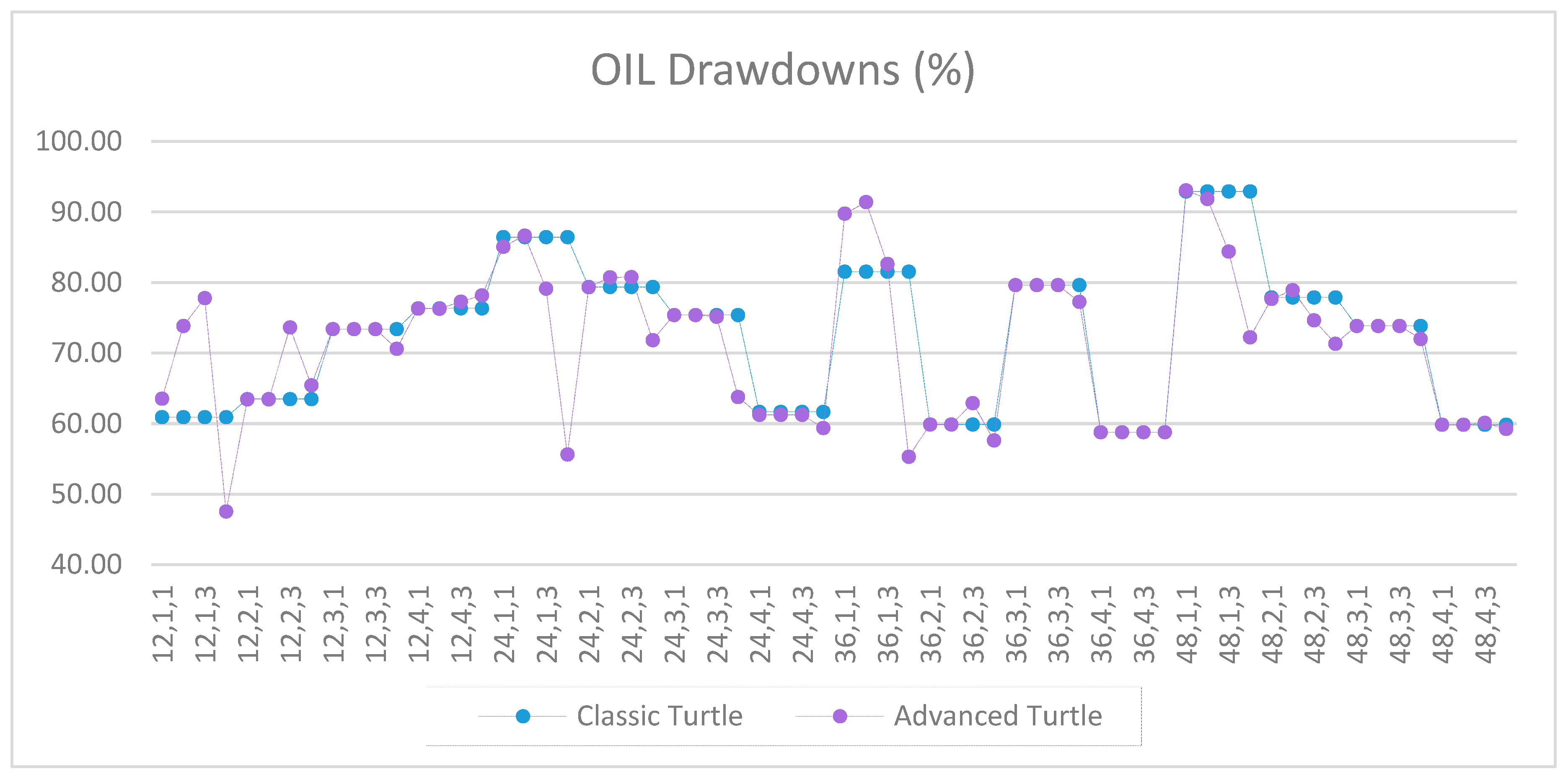

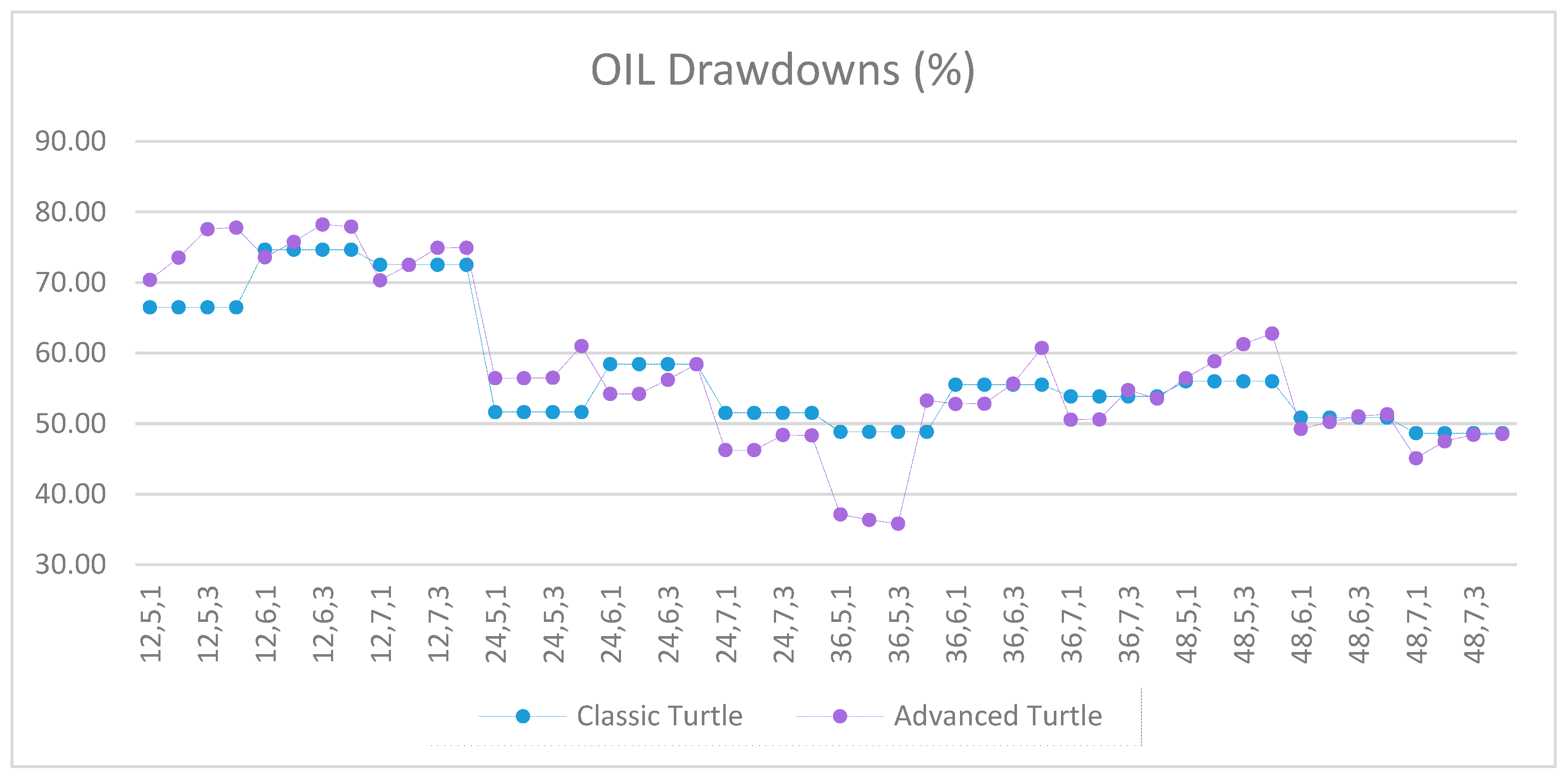

Figure A14.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A14.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

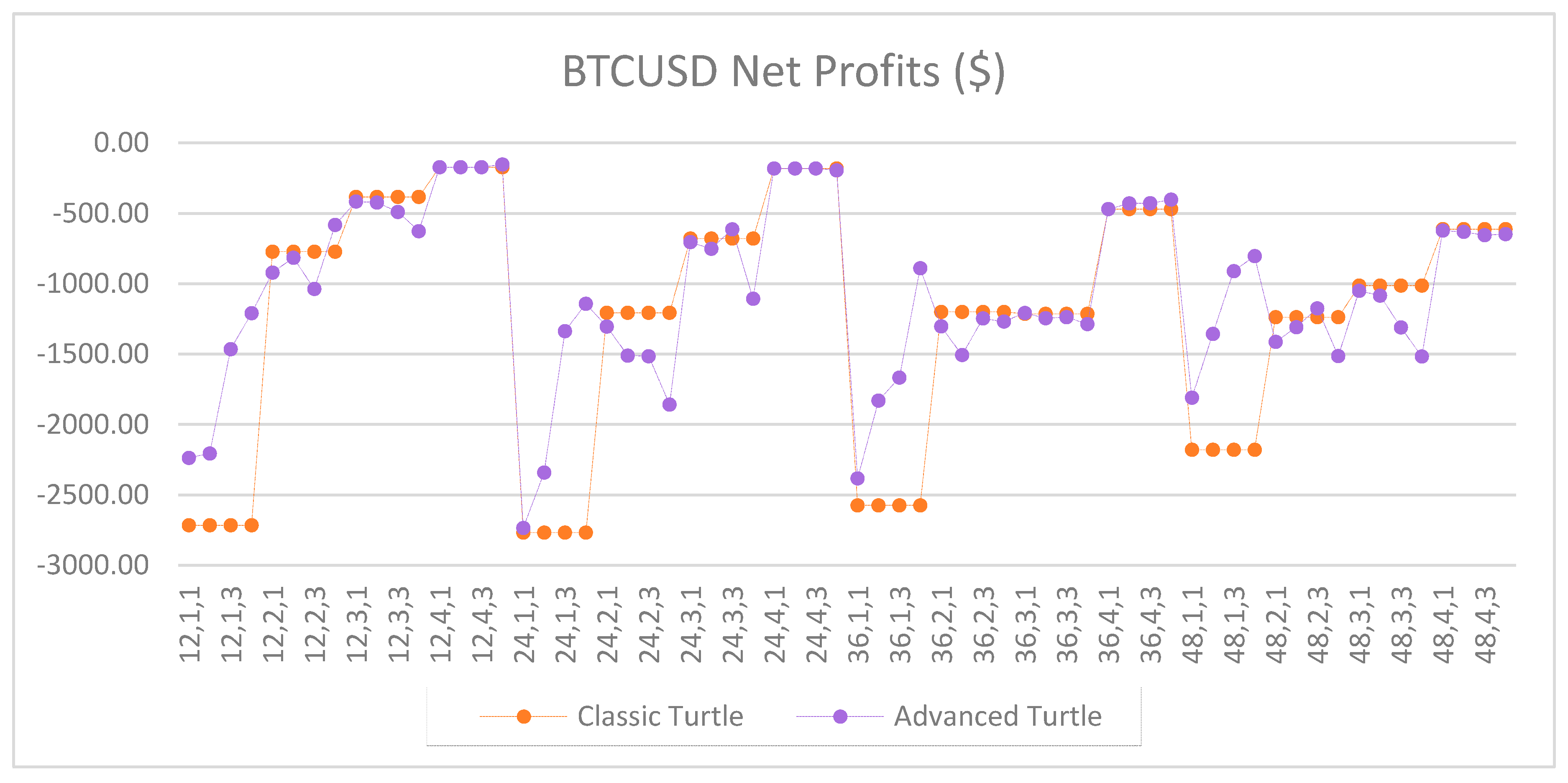

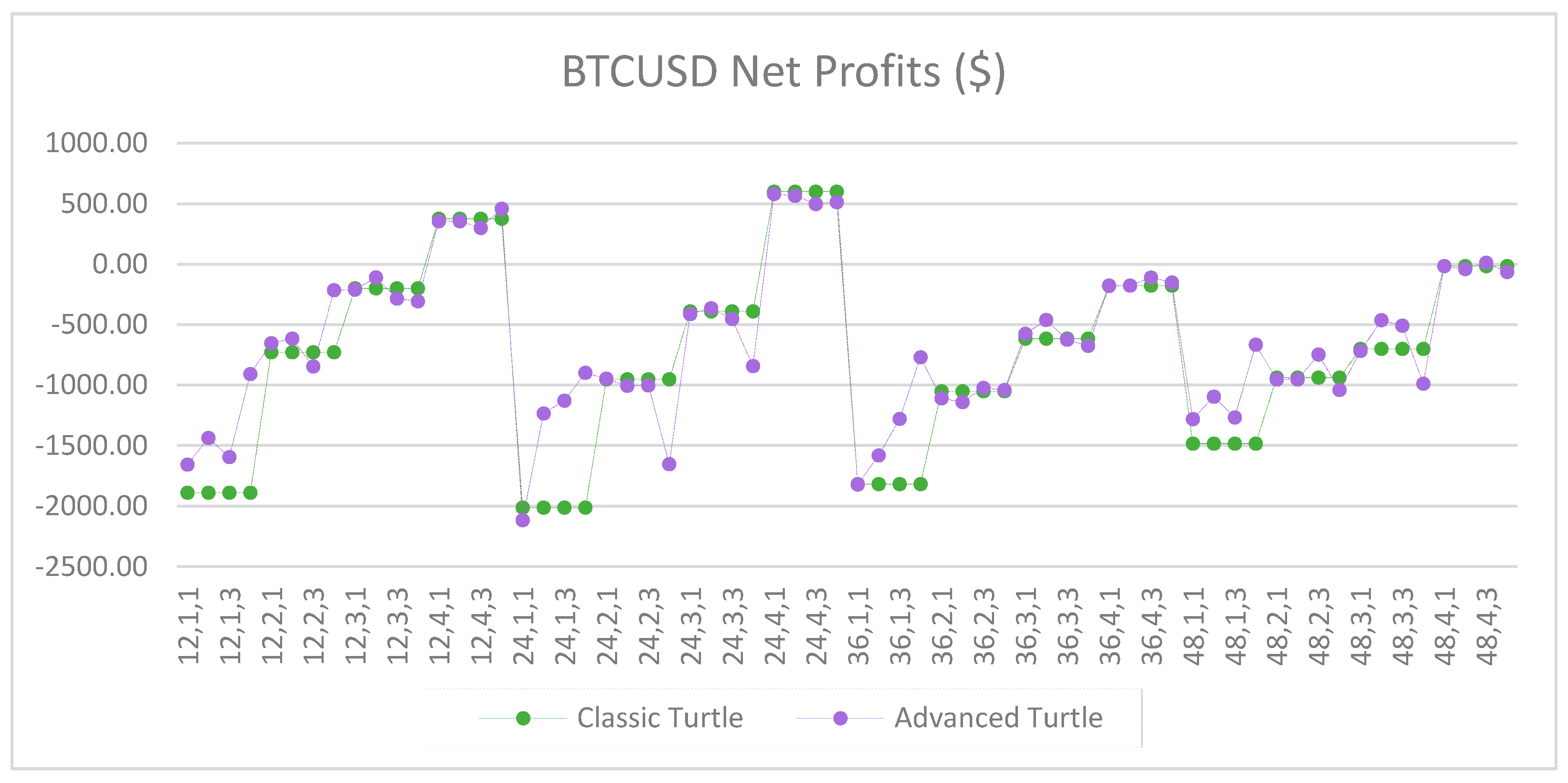

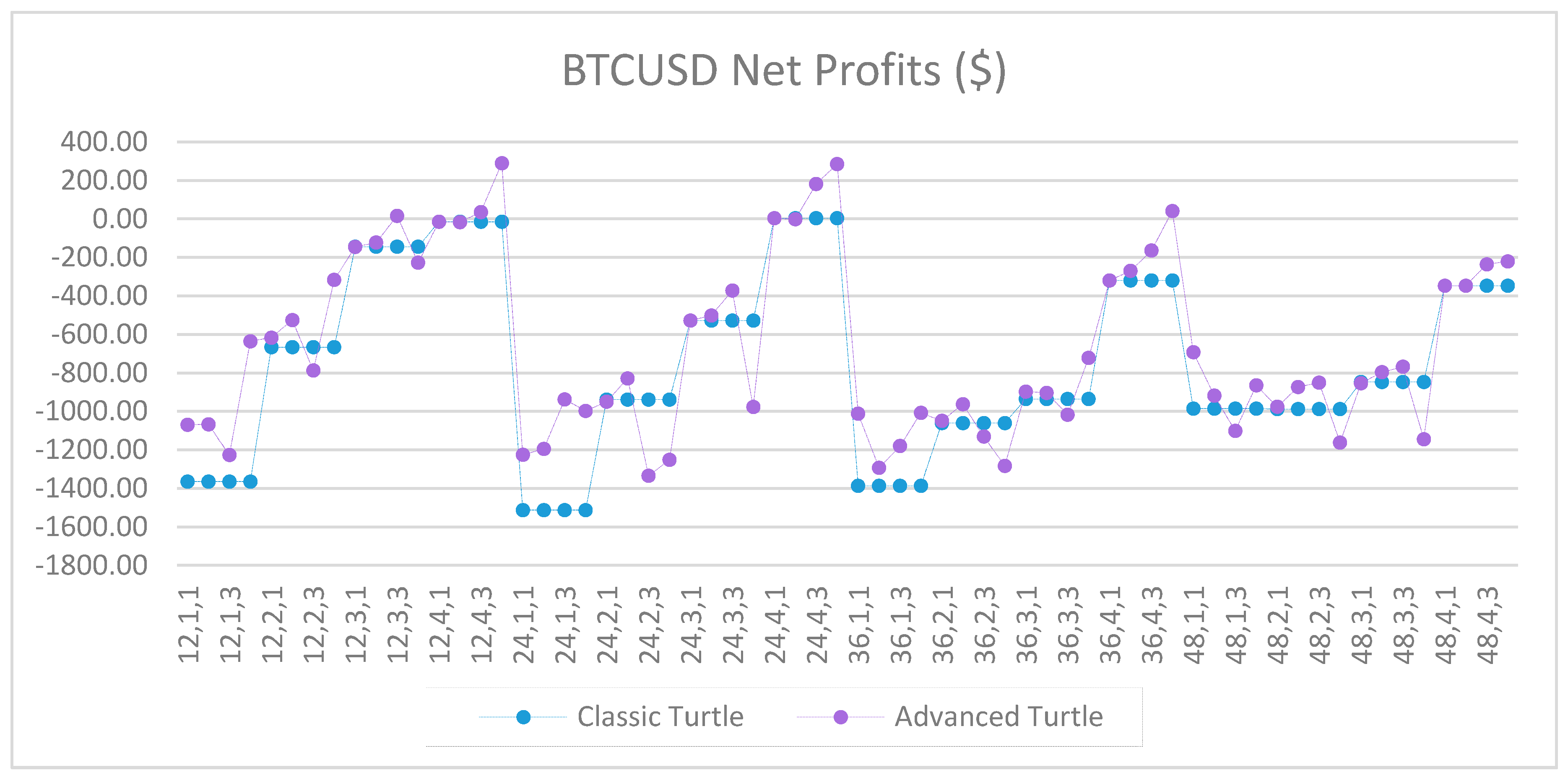

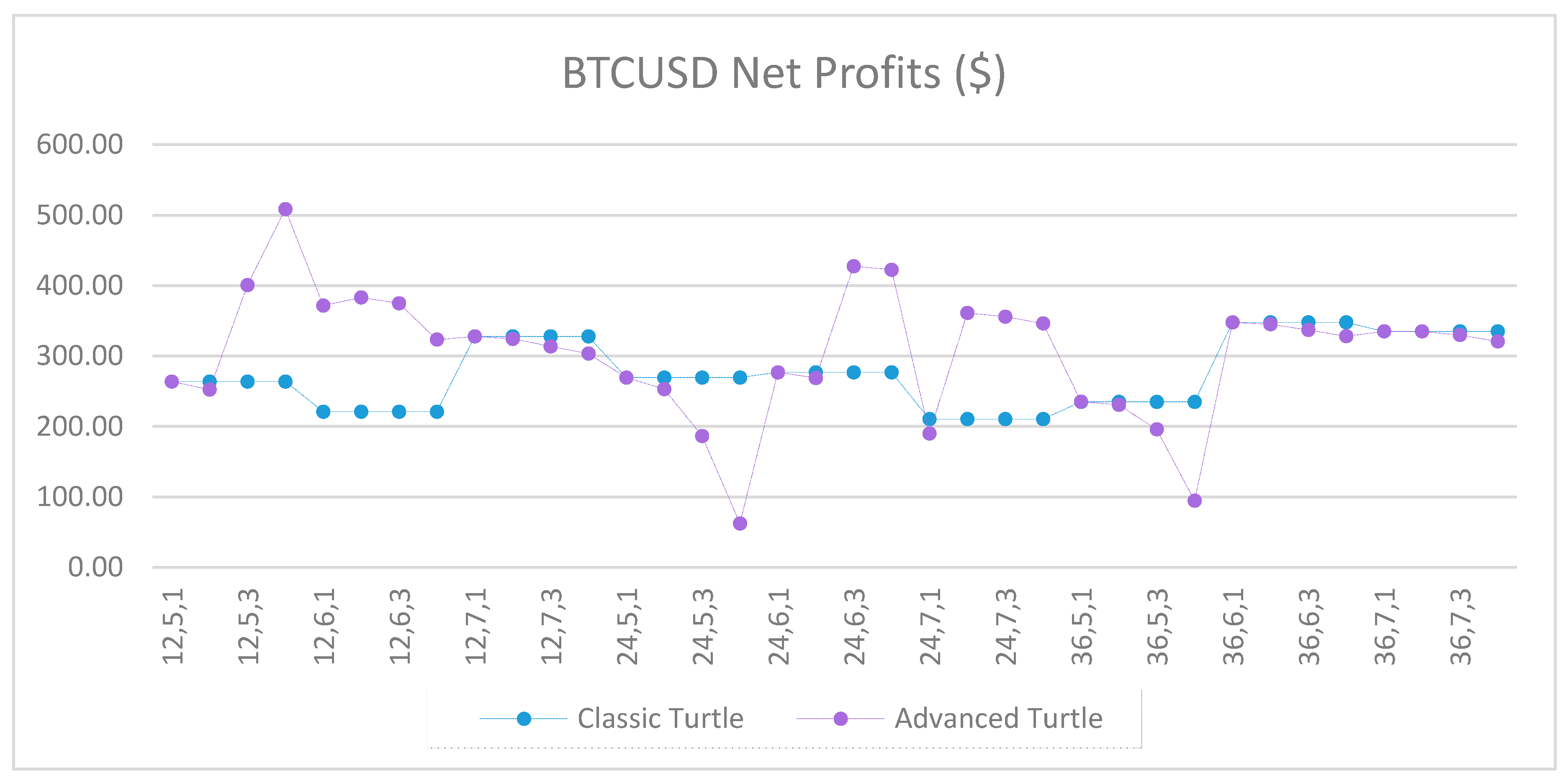

Figure A15.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A15.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

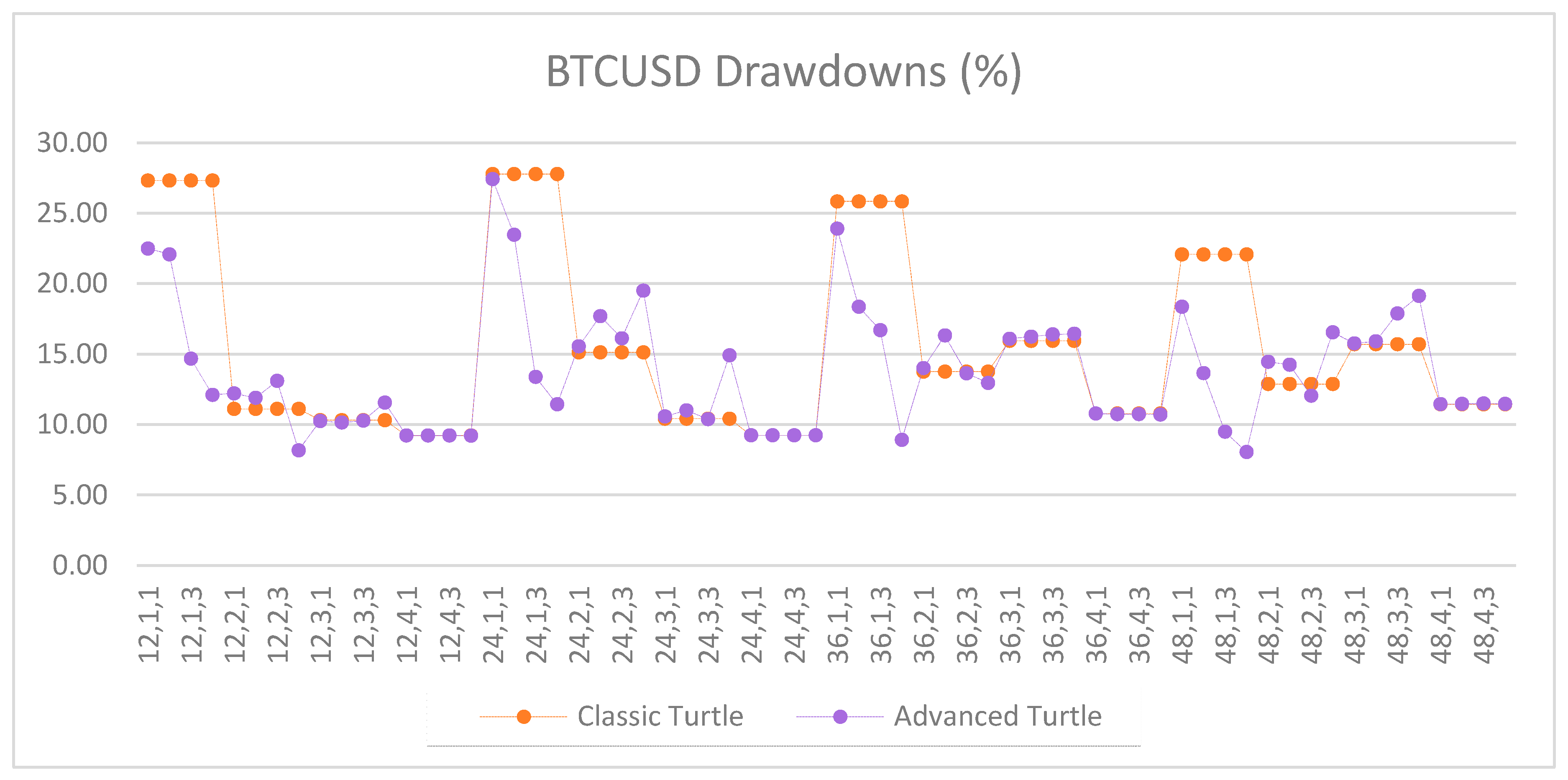

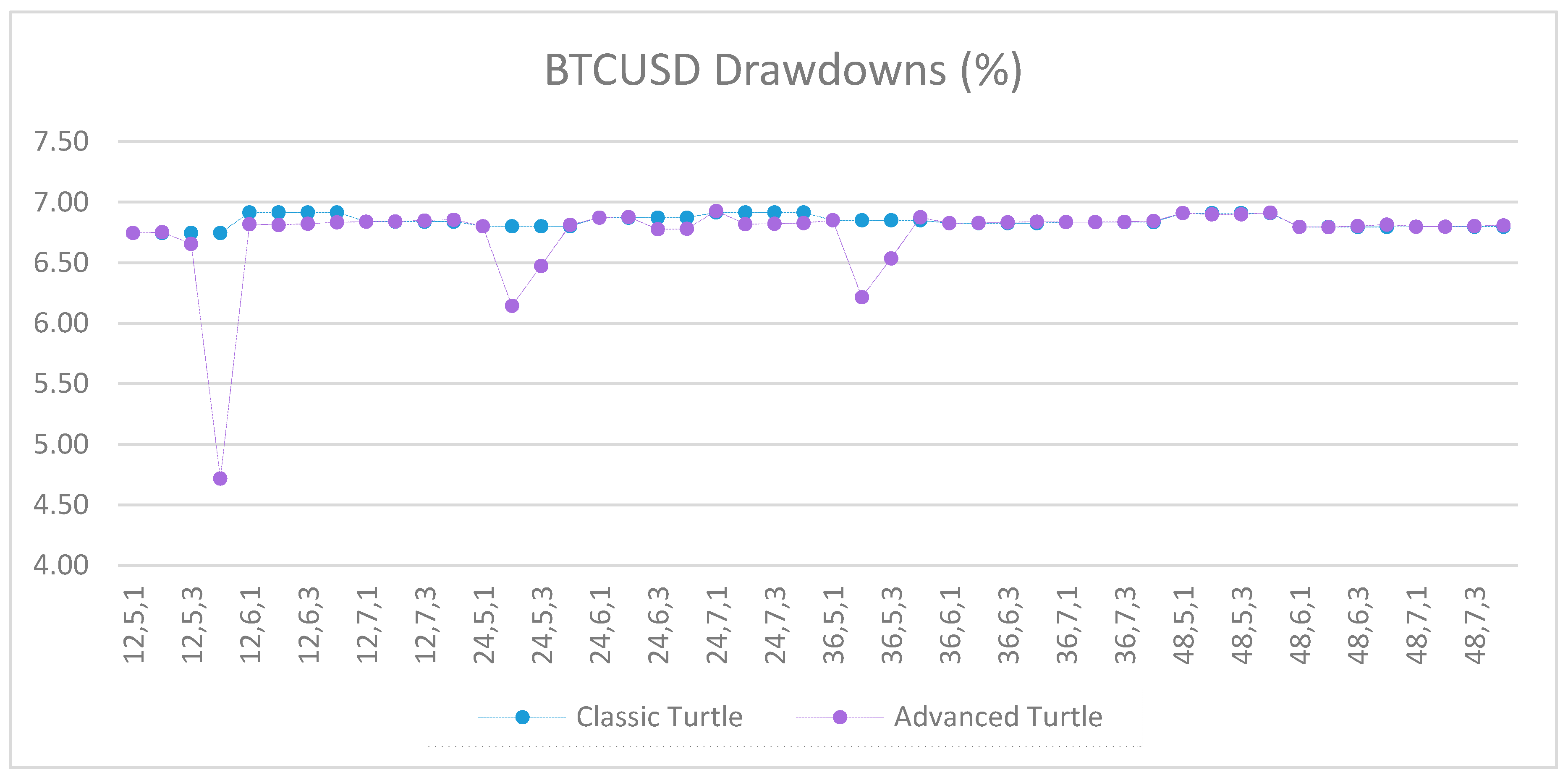

Figure A16.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A16.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the fast parameters (20, 40).

Figure A17.

Net profits of AUDUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A17.

Net profits of AUDUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A18.

Drawdowns of AUDUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A18.

Drawdowns of AUDUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

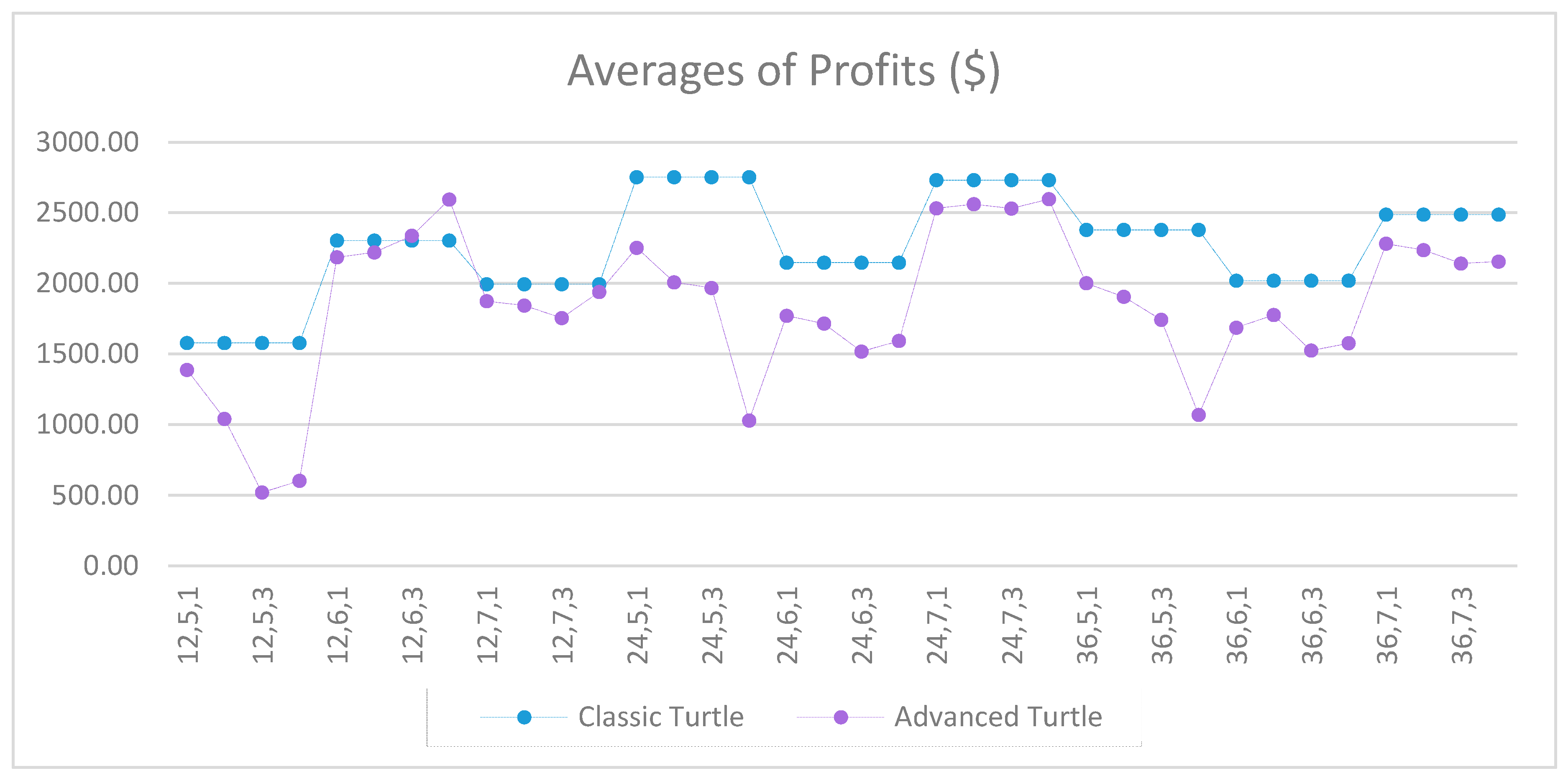

Figure A19.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A19.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

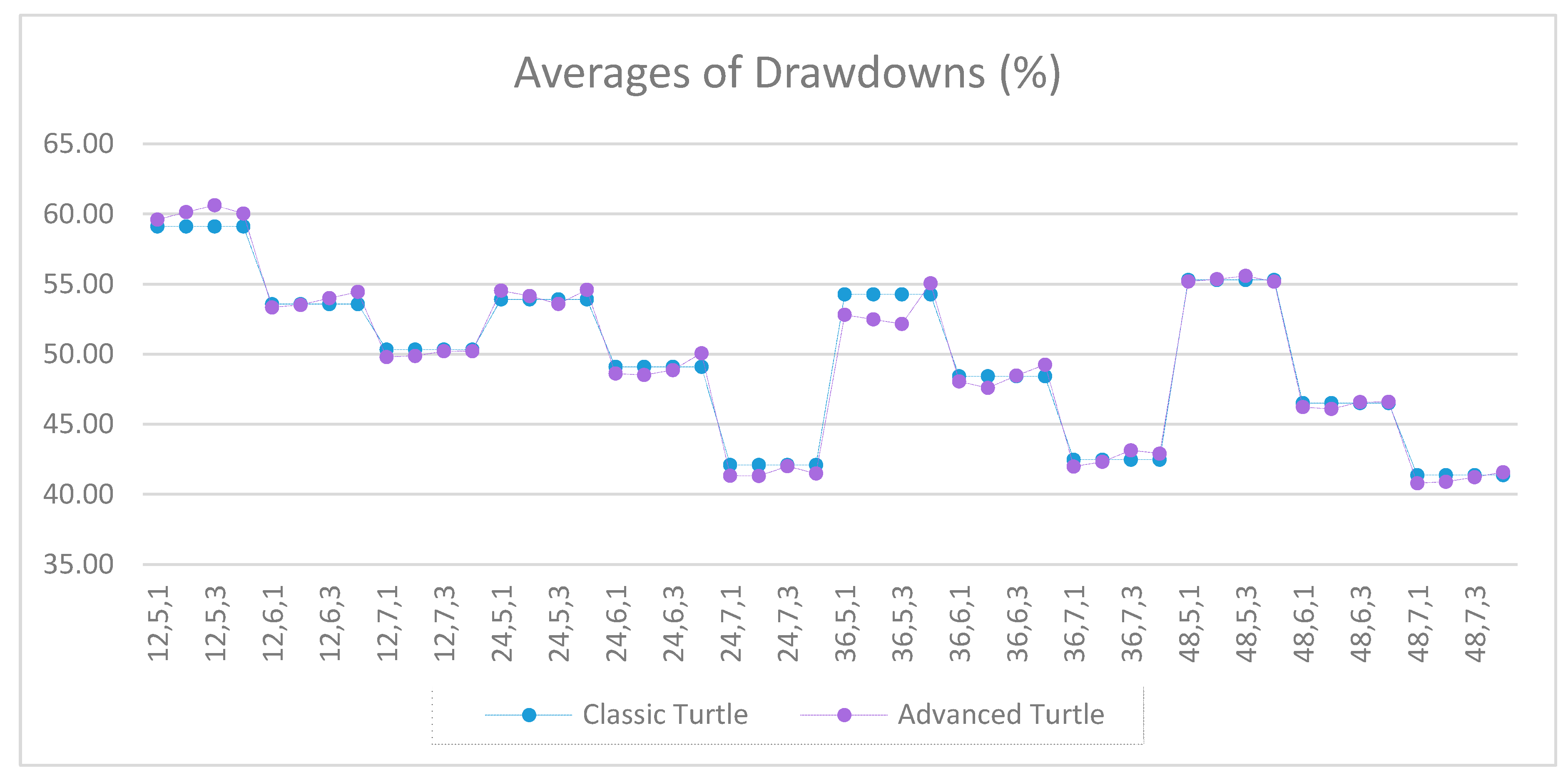

Figure A20.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A20.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A21.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A21.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A22.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A22.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A23.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A23.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A24.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A24.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A25.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A25.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A26.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A26.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A27.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A27.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A28.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A28.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A29.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A29.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A30.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A30.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A31.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A31.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A32.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A32.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the medium parameters (40, 80).

Figure A33.

Net profits of AUDUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A33.

Net profits of AUDUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A34.

Drawdowns of AUDUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A34.

Drawdowns of AUDUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A35.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A35.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A36.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A36.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A37.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A37.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A38.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A38.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A39.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A39.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A40.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A40.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A41.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A41.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A42.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A42.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A43.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A43.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A44.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A44.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A45.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A45.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A46.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A46.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A47.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A47.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A48.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A48.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160).

Figure A49.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A49.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A50.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A50.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A51.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A51.

Net profits of EURUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A52.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A52.

Drawdowns of EURUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A53.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A53.

Net profits of GBPUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A54.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A54.

Drawdowns of GBPUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A55.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A55.

Net profits of USDCHF between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A56.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A56.

Drawdowns of USDCHF as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A57.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A57.

Net profits of USDJPY between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A58.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A58.

Drawdowns of USDJPY as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A59.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A59.

Net profits of XAUUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A60.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A60.

Drawdowns of XAUUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A61.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A61.

Net profits of OIL between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A62.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A62.

Drawdowns of OIL as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A63.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A63.

Net profits of BTCUSD between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A64.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.

Figure A64.

Drawdowns of BTCUSD as percentage of equity between the classic and the advanced Turtle systems for every combination of N, X, Y for the slow parameters (80, 160), where X ≥ 5.