1. Introduction

Crude oil, as a non-renewable resource and a crucial commodity, plays a significant role in the world’s economy. Over the past few decades, the crude oil price has experienced great fluctuations compared to the period from the Second World War to the early 1970s. For example, in June 2014, the West Texas Intermediate (WTI) crude oil price reached a peak of 105 US dollars per barrel, and then fell sharply to 59 US dollars per barrel in December 2014. In the early 1980s, many studies pointed out that oil price dynamics influenced economic activity (

Hamilton 1983;

Gisser and Goodwin 1986;

Mork 1989). On the other hand, currency markets have also suffered multiple crises in recent years, such as the Latin American currency crisis of 1994, the Asian financial crisis of 1997, and most recently the fluctuation in the exchange rate between the US dollar and Chinese Yuan after a trade war, as each country continued to dispute tariffs in 2018. With these notable events, every abnormal foreign exchange movement had a huge impact on the economy. Analyzing the relationship between crude oil prices and exchange rates yields considerable information about the increasing importance of oil and currency markets in economics for market operators, investors, and economists.

On the theoretical side, the extant literature (

Bénassy-Quéré et al. 2007;

Bodenstein et al. 2011;

Habib et al. 2016;

Beckmann et al. 2017) has pointed out that there are three channels between oil price shocks and exchange rates: the terms of trade channel, wealth effects channel, and portfolio reallocation channel. The terms of trade channel considers a simple two-country open economy static model, which has two goods sectors—a traded goods sector and a non-traded goods sector. When there is a positive term of trade shock, the price of a basket of traded goods or non-traded goods in the domestic economy is relatively higher than it is in a foreign economy, leading to the appreciation of domestic currency. Hence, when oil prices rise, the currency of an energy-dependent country will appreciate, and vice versa. The wealth effects channel reflects the short-term effects while the portfolio reallocation channel reflects the medium- and long-term effects. When there is a positive oil price shock, the wealth transfers from the oil-importing country to the oil-exporting country, leading to large shifts in current account balances and portfolio reallocation. For this purpose, in order to adjust to clear the trade balance and asset markets, the currency of the oil-exporting country appreciates, and the currency of oil-importing country depreciates.

Chen and Chen (

2007) provide a simple model to illustrate the above theory:

where p (p

*) is the log-linear approximation of the domestic (foreign) consumer price index, and p

T (p

T*) and p

N (p

N*) are the prices of the traded and non-traded sectors in the home country (foreign country), respectively. The α (α

*) weights correspond to expenditure shares on traded goods near the point of approximation for the domestic (foreign) country. The log of the real exchange rate q is defined as

where s is the log of the nominal exchange rate. Therefore, the real exchange rate could be written as

If α≃α

*, when the oil price rises, the price of the traded sector in the country which is more dependent on oil importation will increase, and thereby cause a depreciation.

2On the empirical side, there are also many studies that investigate the relationship between oil prices and exchange rates. Some of this literature finds a negative relationship.

Akram (

2009) uses quarterly data from 1990Q1 to 2007Q4, and a structural value at risk (VaR) model to analyze whether a decline in the US dollar contributes to higher commodity prices. Their results suggest that a weaker dollar leads to higher commodity prices, including oil prices.

Basher et al. (

2012) study the dynamic relationship between oil prices, exchange rates, and emerging market stock prices by modeling daily data from 1988 to 2008 using a structural VaR model. They find that positive shocks to oil prices lead to an immediate drop in the US dollar exchange rate, which has a statistically significant impact in the short-run.

Reboredo and Rivera-Castro (

2013) use a wavelet decomposition approach to investigate the relationship between oil prices (WTI) and US dollar exchange rates for a large set of currencies, including developed and emerging economies, net oil-exporting and oil-importing economies, and inflation-targeting countries. They find that oil price changes had no effect on exchange rates or vice versa in the pre-crisis period, but after the 2008 global financial crisis, they find a negative interdependence. By contrast, other research finds a positive relationship between oil prices and exchange rates.

Bénassy-Quéré et al. (

2007) study co-integration and causality between the real price of oil and the real value of the dollar from 1974 to 2005 using monthly data. Their results suggest that a 10% rise in the oil price coincides with a 4.3% appreciation of the dollar in the long run, and the causality runs from oil to the dollar.

Ding and Vo (

2012) use the multivariate stochastic volatility and the multivariate generalized autoregressive conditional heteroscedasticity (GARCH) models to investigate the volatility interactions between the oil market and the foreign exchange market. They divided the data into two parts to capture the structural breaks in the economic crisis, and they show that before the 2008 crisis, the two markets responded to shocks simultaneously and no interaction is found. However, during the financial crisis, they find a positive bidirectional volatility interaction between the two variables.

In addition to research in developed markets, other studies focus on this relationship in emerging markets. For example,

Narayan et al. (

2008) estimate the impact of oil prices on the nominal exchange rate on Fiji Island with GARCH and EGARCH

3 models. They find that a rise in oil prices leads to an appreciation of the Fijian dollar.

Narayan (

2013) uses exchange rate data from 14 Asian countries and demonstrates that a higher oil price leads to a future depreciation of the Vietnamese Dong, but a future appreciation of the local currencies of Bangladesh, Cambodia, and Hong Kong.

Analysis of the correlation between the currency and oil markets also provides abundant information about whether the oil price could act as a hedge or as a safe haven against exchange rate risk. Much literature investigates the relationship between different assets to examine whether these variables act as hedges against each other. The methods used in these papers are varied, such as linear regression, quantile regression, etc. Considering that the characteristics of skew and leptokurtic kurtosis often have asymmetric behaviors, and the oil price and exchange rates seem unsuitable for modeling with linear models, in this study, we propose a copula model to investigate the dependency between oil prices and exchange rates. Compared to traditional methods, a copula model has several advantages. First, it can provide a valid joint distribution in combination with any univariate distribution, which makes it more flexible in modeling multivariate distributions. Second, it can capture a wide range of dependence structures, such as asymmetric, nonlinear, and tail dependence in extreme events. Prior studies apply copula models to examine the relationship between oil prices and exchanges rates (

Patton 2006;

Wu et al. 2012;

Aloui et al. 2013;

Ji et al. 2019). However, most of them focus on developed markets.

In this study, we investigate the dependence structure between the oil and currency markets. Our contribution to the literature is twofold. First, we propose both constant and time-varying copula-GARCH-based models to measure the dependence between the two markets elastically. By using a copula model, we can study the co-movement between oil prices and exchange rates during bearish and bullish markets, and we can also examine whether oil acts as a hedge against exchange rate risk in BRICS countries. Second, we focus on exchange rate data from the BRICS countries, which is a group of five developing countries (Brazil, Russia, India, China, and South Africa), to determine whether the dependence structure in emerging markets is the same as that in developed countries.

The rest of this paper proceeds as follows. In

Section 2, we introduce the empirical methodology and estimation strategy.

Section 3 presents the data and discusses the empirical results. In the final section, we present our conclusions. The results of ARMA-GARCH model and the robustness analysis are presented in

Appendix A and

Appendix B, respectively.

2. Empirical Methodology

Sklar (

1959) introduced the notion of the copula, in which an n-dimensional distribution function which can be decomposed into two parts, namely, the marginal distribution and the copula.

We denote X ≡ [X

1, …, X

n]’ as the variable set of interest, and X

i follows the marginal distribution F

i for each i∈[0, n].

Following Sklar’s theorem, there exists a copula

with uniform marginals that can map the univariate marginal distribution F

i to the multivariate distribution function F.

The density of the multivariate distribution function F is

We first obtain standardized residuals using an autoregressive moving-average GARCH (ARMA-GARCH) model for the daily returns of crude oil prices and exchange rates. Then, we transform the standardized residuals into a uniform distribution. Finally, we input the transformed uniform variates into the copula function to model the dependence structure.

2.1. ARMA-GARCH Model

To model the daily returns of crude oil prices and exchange rates, we use autoregressive-moving-average (ARMA) models with two kinds of GARCH models––the standard GARCH (sGARCH) model and the Glosten–Jagannathan–Runkle GARCH (GJR-GARCH) model. In both GARCH models, we assume that the standard errors from the GARCH models follow a skewed t distribution.

We denote r

t as the daily returns, which follow

where ϕ

0 is a constant and ε

t is a white noise error item.

Table 1 presents the functions for the two GARCH models.

2.2. Marginal Distribution

Following

Patton (

2013), we consider both parametric and non-parametric models in modeling the marginal distribution.

For the parametric estimation, we choose the skewed t distribution as in

Hansen (

1994). The density function is

The skewed t distribution has two parameters to control its shape: a skewness parameter λ∈(−1, 1), which determines whether the mode of the density is skewed to the left or to the right, and a degrees of freedom parameter ν∈(2, ∞), which controls the kurtosis of the distribution. When λ = 0, we obtain the Student’s t distribution; when ν→∞, we obtain the skewed normal distribution; and when λ = 0 with ν→∞, we obtain the standard normal distribution. For this property, the skewed t distribution has more flexibility in fitting the data than do the normal distribution or the Student’s t distribution.

For the non-parametric estimation, we use the empirical distribution function (EDF):

where T is the length of the data and

it indicates the standardized residuals from the GARCH model.

2.3. Copula Model

2.3.1. Constant Copula Model

There are three families of copula model: elliptical copulas (Normal and Student’s t); Archimedean copulas (Gumbel, Clayton, and Frank); and quadratic copulas (Plackett). In this study, we chose the Normal, Plackett, Rotated Gumbel, and Student’s t copulas to investigate the dependence structure between oil prices and exchange rates.

4The normal and Student’s t copulas are based on an elliptical distribution, such as the normal or Student’s t distribution. The normal copula is symmetric and has no tail dependence. θ > 0 and θ < 0 lead to positive and negative dependence, respectively. The Student’s t copula is also symmetric, but can capture tail dependence in extreme events. When θ1 = 0 with θ2→∞, then it becomes independent between the two variables. Like the Normal copula, the Plackett copula is also symmetric and cannot capture either lower or upper tail dependence. 0 < θ < 1 implies negative dependence and θ > 1 implies positive dependence. The Gumbel copula can only capture extreme lower dependence, θ = 1 and θ→∞ indicate independence and perfectly negative dependence, respectively.

Table 2 summarizes the properties of the abovementioned bivariate copula models.

2.3.2. Time-Varying Copula Model

In this study, we examined the time-varying Student’s t copula using a Generalized Autoregressive Score (GAS) model.

Creal et al. (

2013) proposed the GAS model, which provides a general framework for modeling time variation. We consider δ

t as the parameter vector of the time-varying copula models, which we can express as the following function:

where f

t is the time-varying parameter vector in the GAS model. Following

Creal et al. (

2013), we can assume that f

t is given by the familiar autoregressive updating equation:

where ω is a constant, S

t−1 is a time-dependent scaling matrix, c (∙) is the density function of the copula model, and u

t is the vector of the probability integral transforms using the univariate marginals. According to

Creal et al. (

2013), we can set the scaling matrix S

t−1 to be equal to the pseudo-inverse information matrix:

For the time-varying Student’s t copula, we use the function δt = [1 − exp(−ft)] / [1 + exp(−ft)] to ensure that the parameter lies within (−1, 1).

4. Conclusions

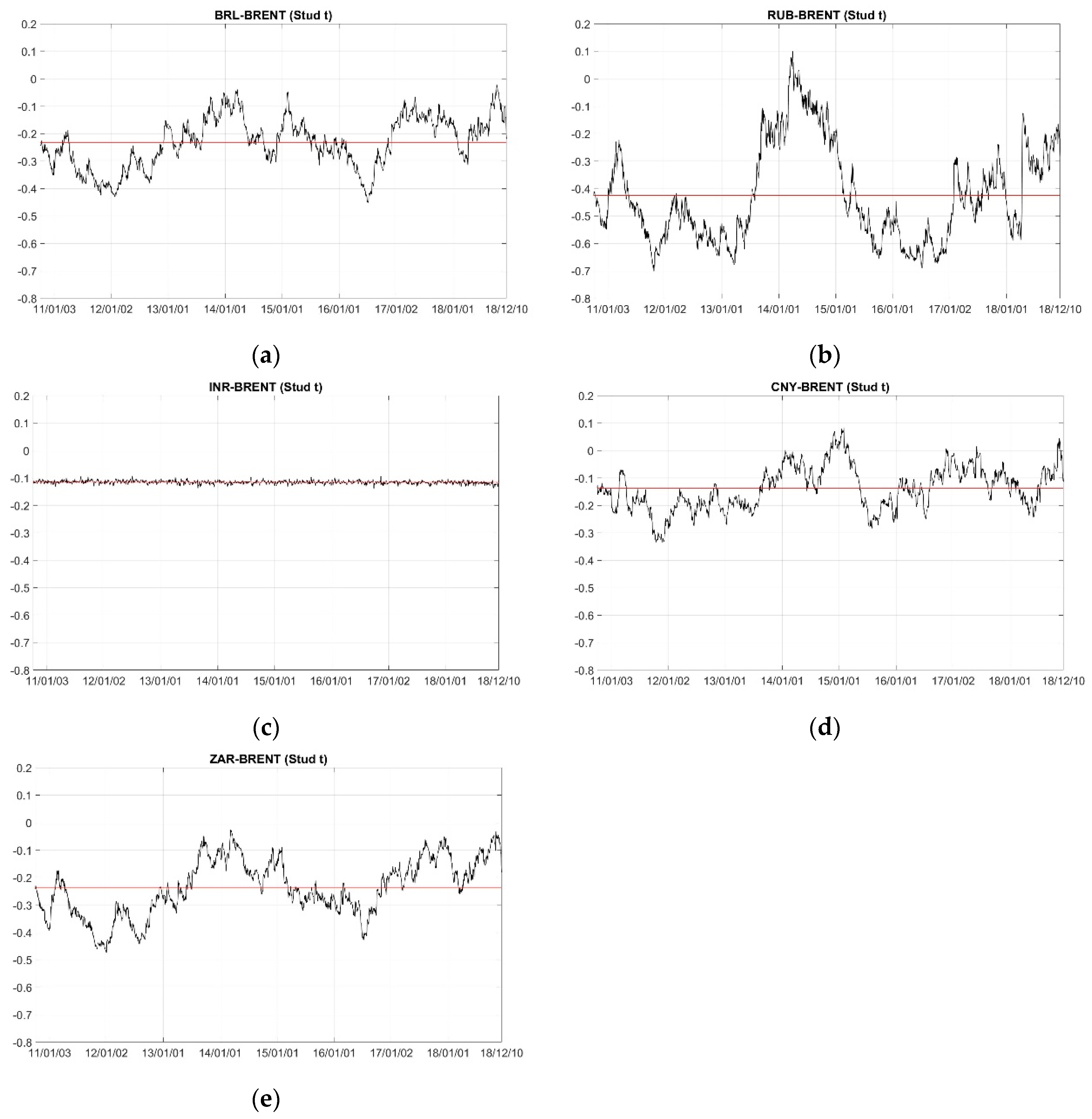

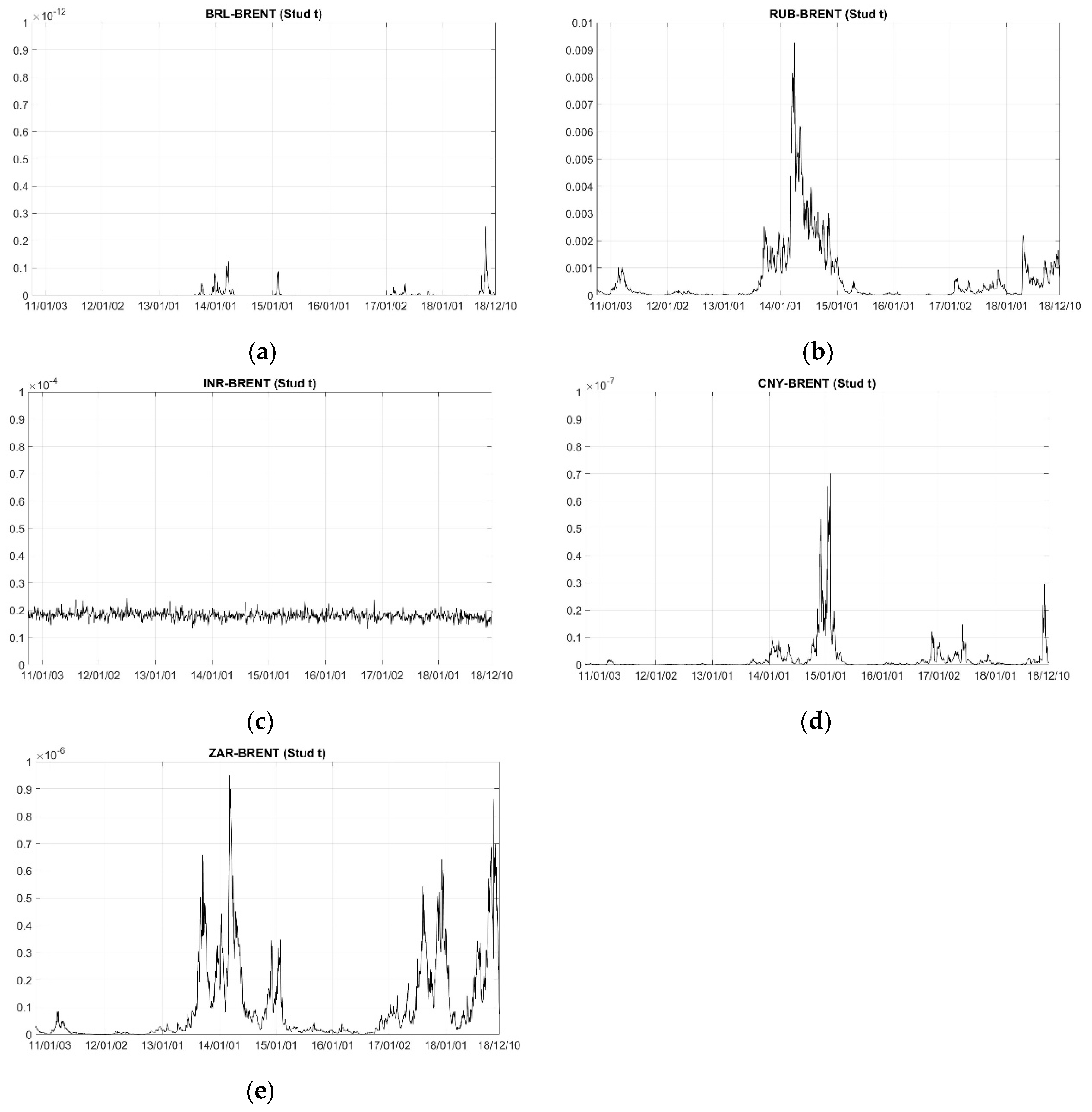

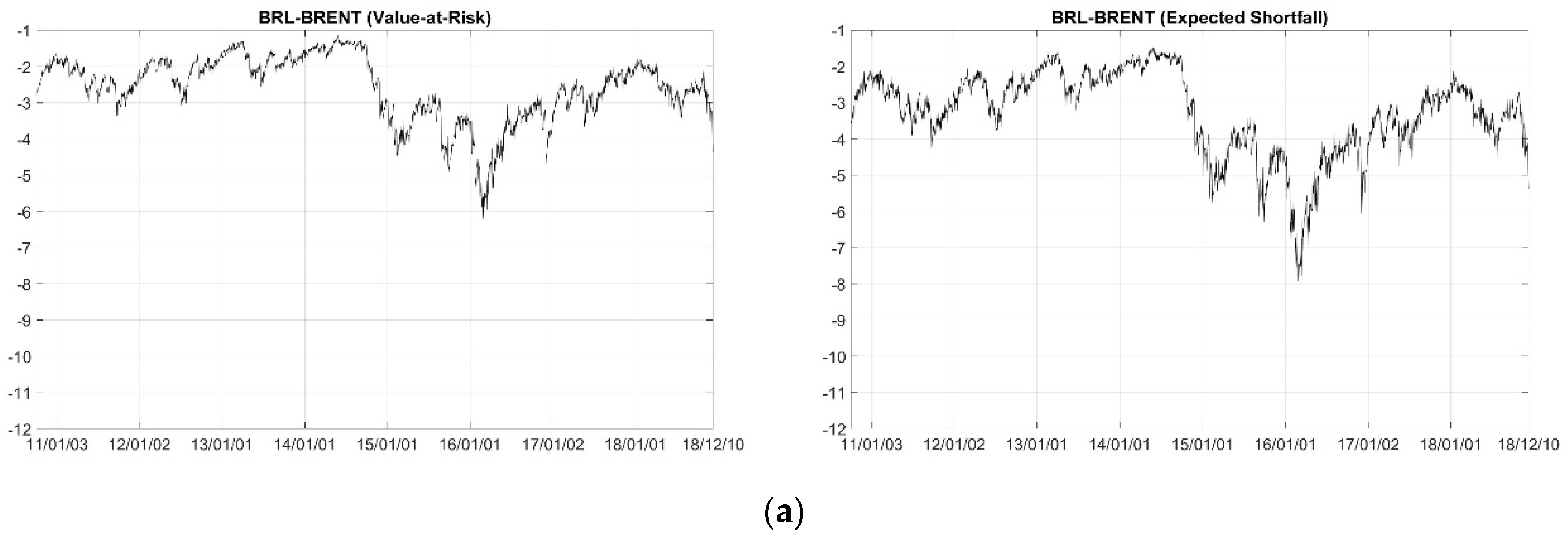

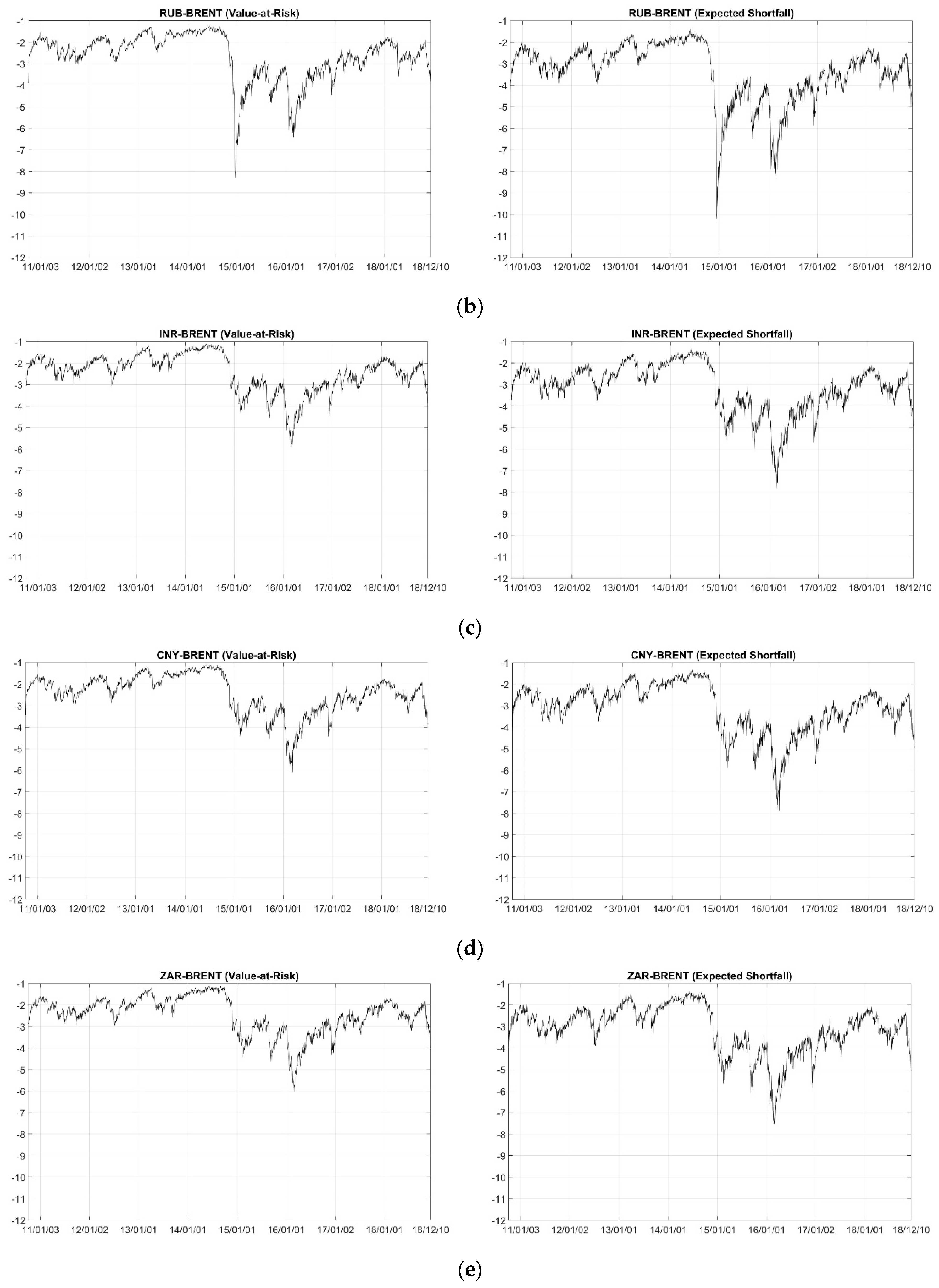

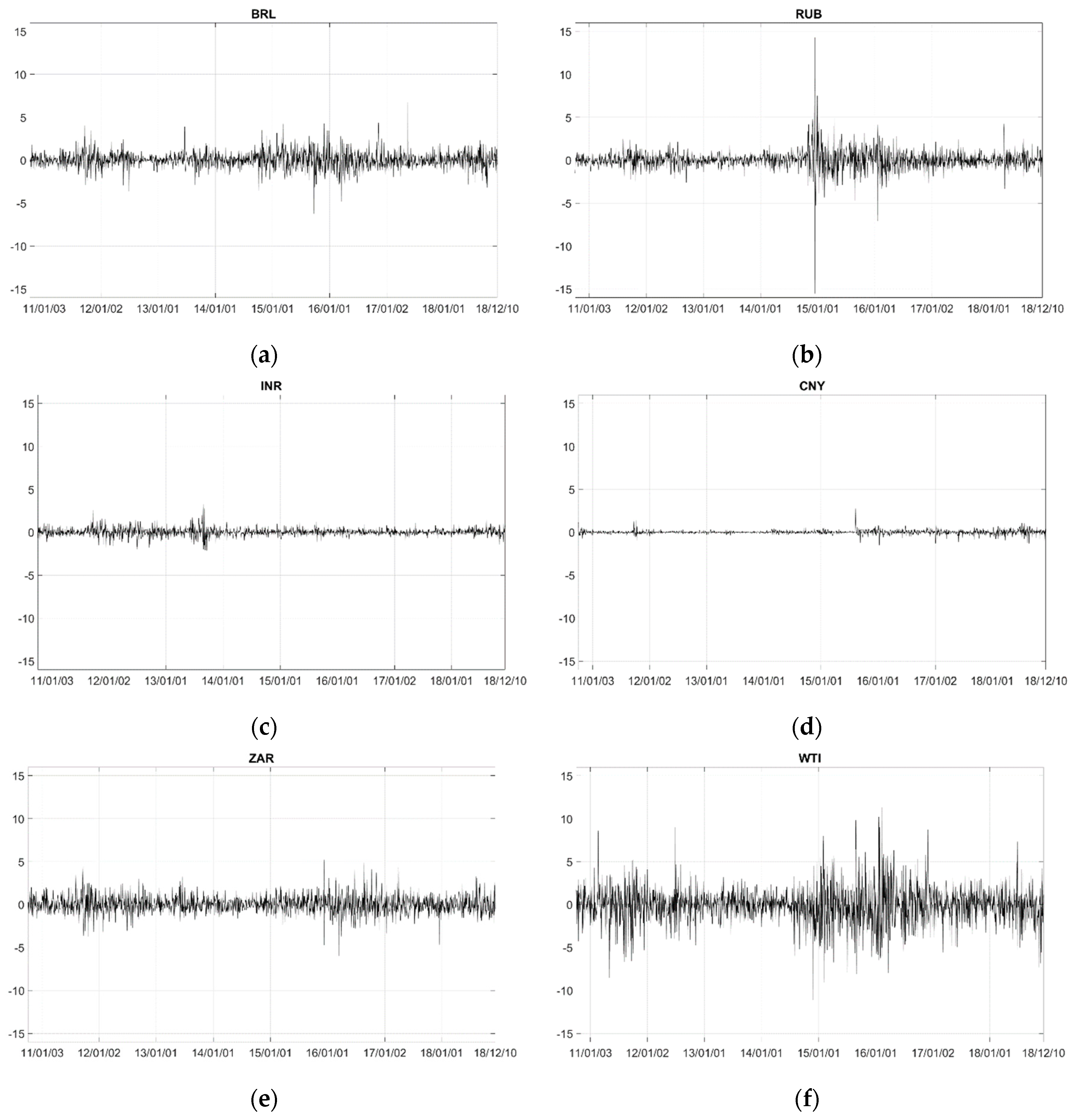

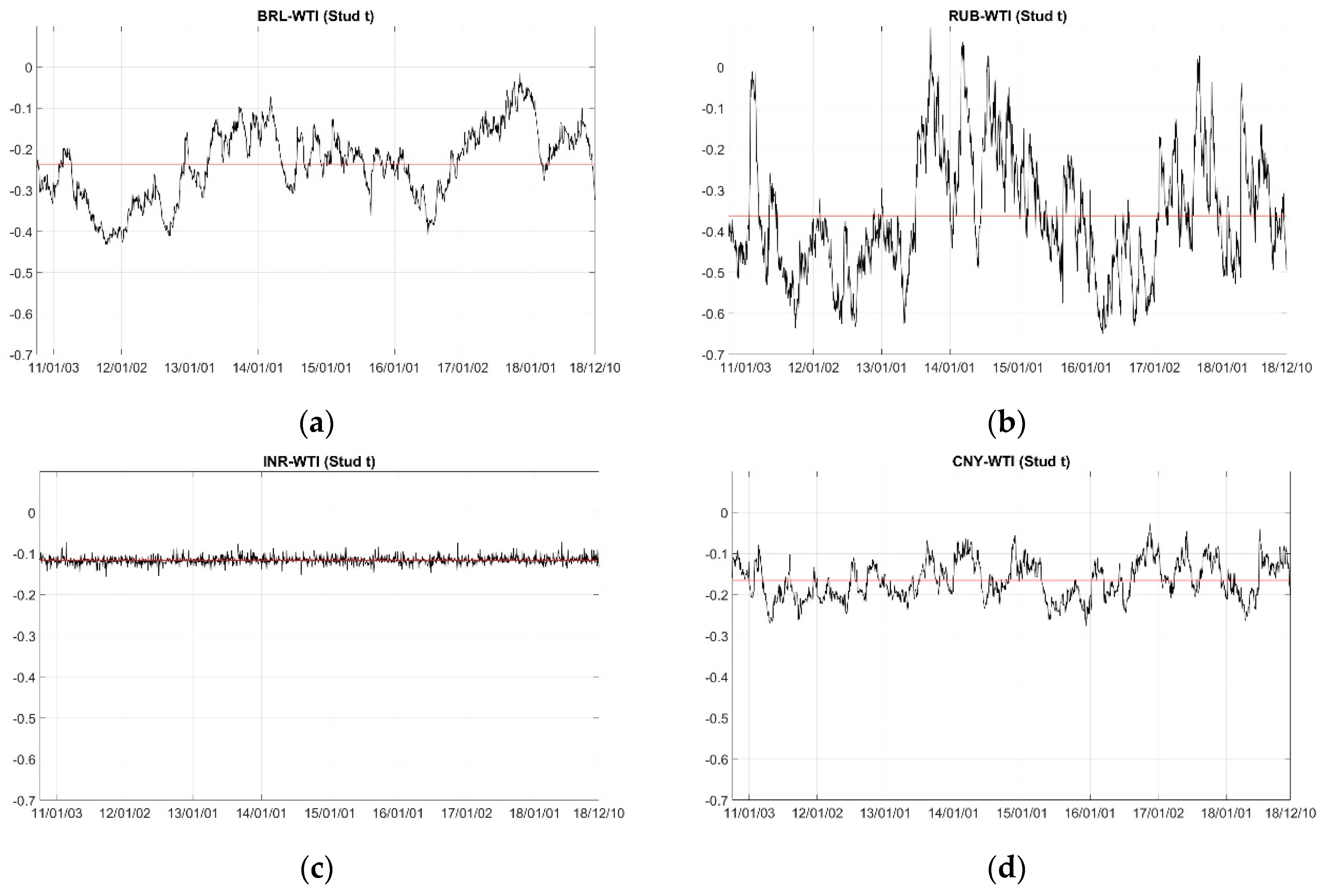

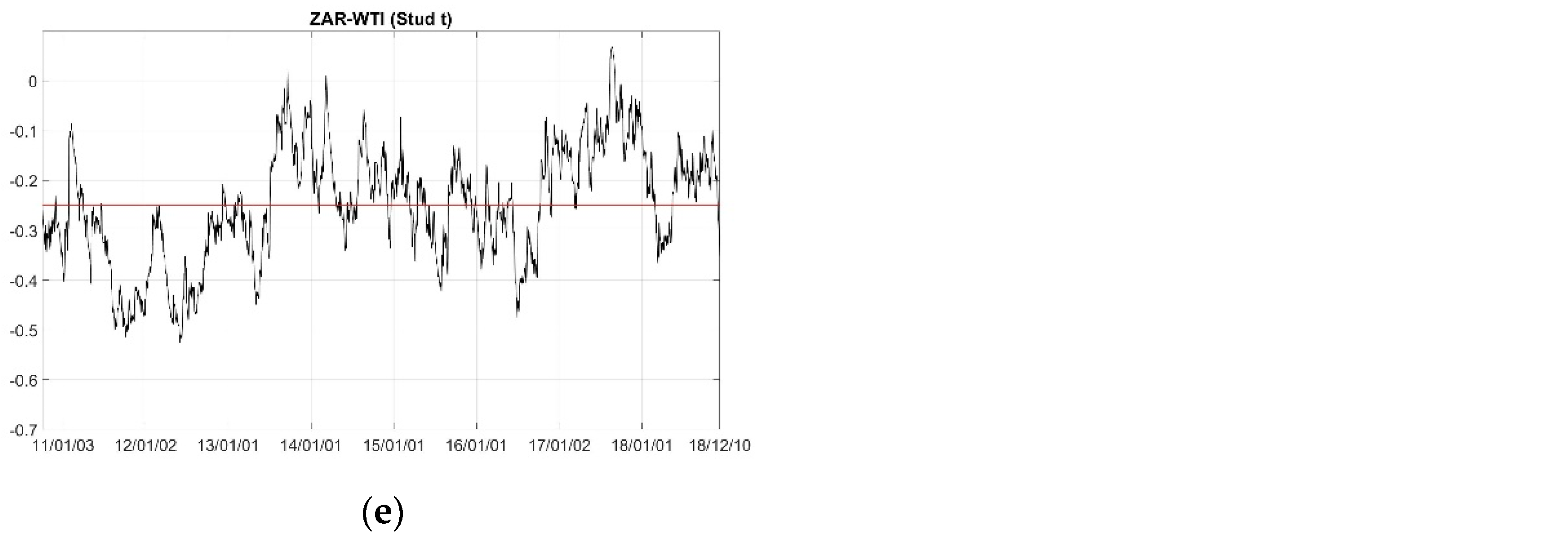

This study examined both the constant and dynamic dependencies between crude oil prices (WTI) and exchange rates for the BRICS countries, which includes oil-exporting and oil-importing economies, from 4 October 2010 to 11 December 2018. We employed constant and time-varying copula-GARCH-based models to capture the nonlinear, asymmetric, and tail dependence between the two variables.

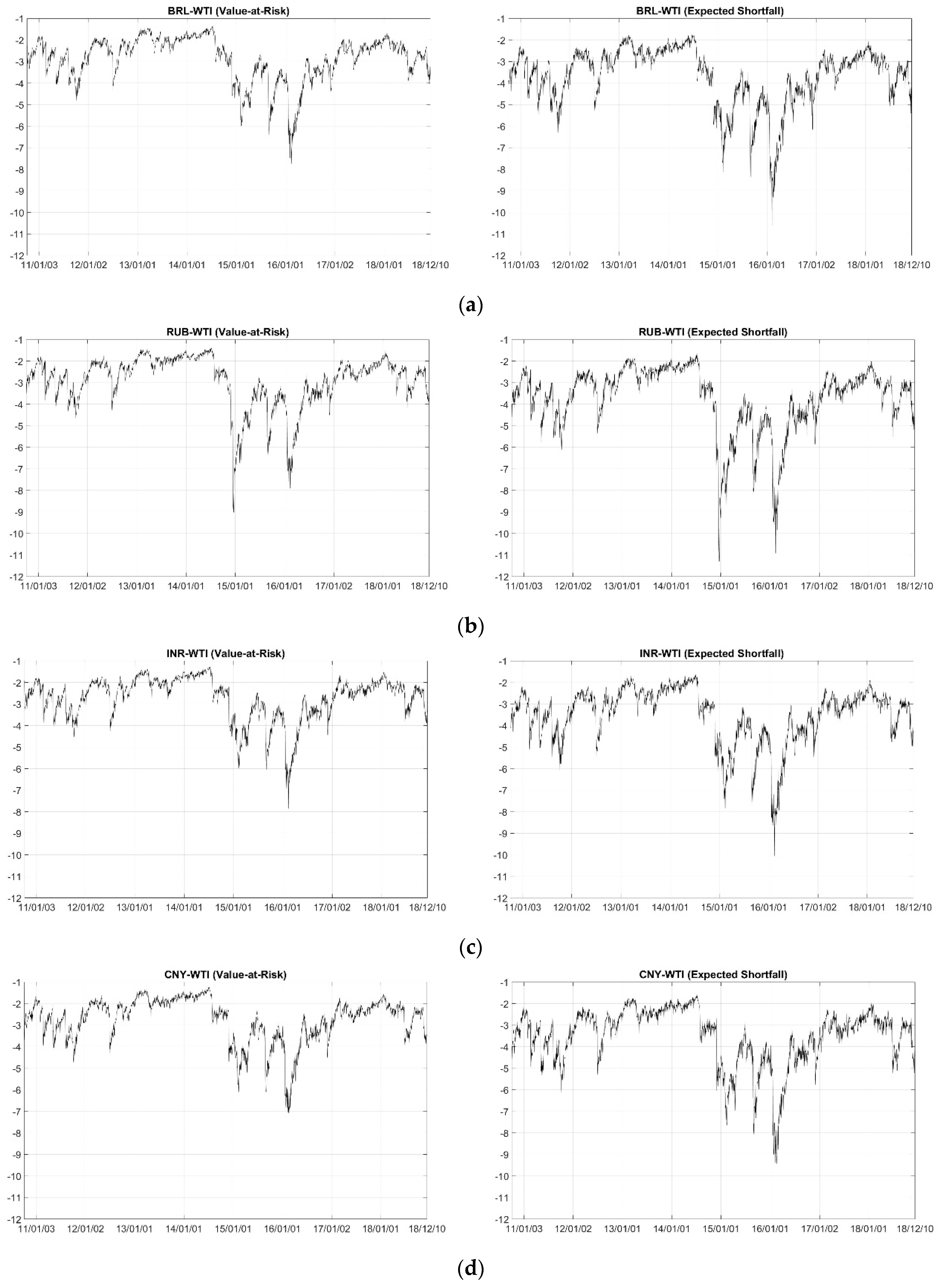

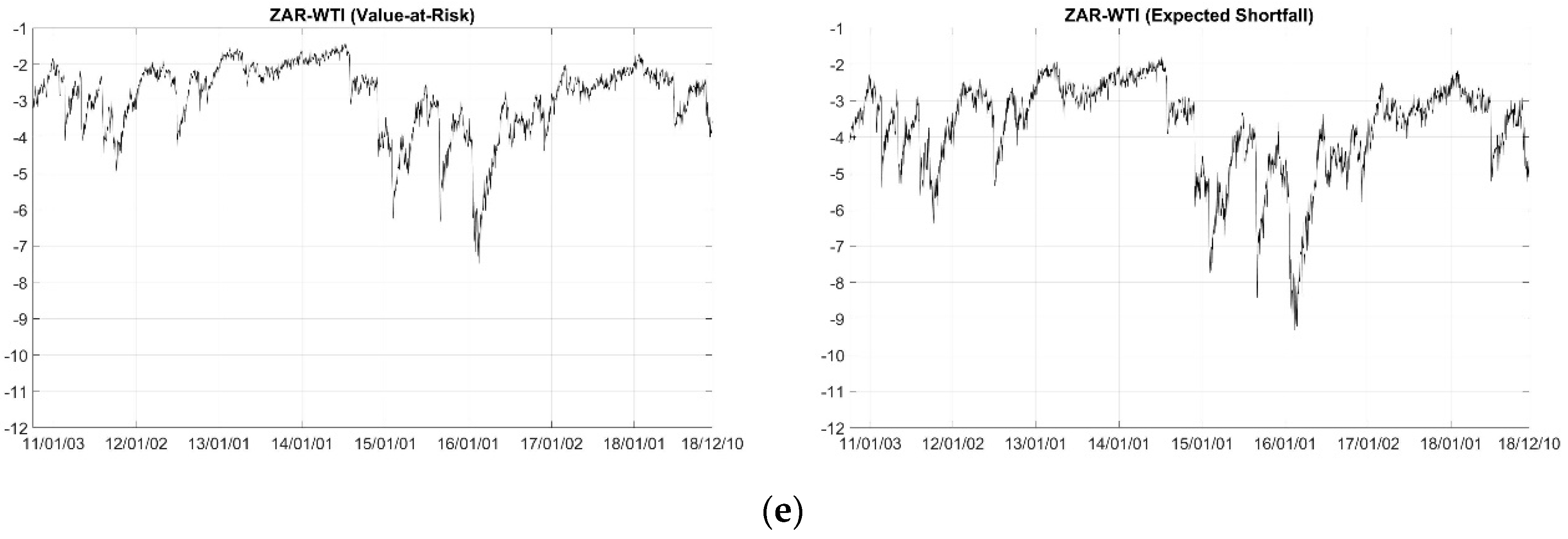

The empirical results showed, first, that a significant dependence existed in all exchange rate–oil price pairs, and the dependence is negative, which means that oil serves as a hedge against rising inflation in BRICS countries. For example, when one currency appreciates, consumers from that country will find the oil price less expensive and then increase their demand for oil, which will lead to a rise in the oil price. Second, in both the constant and time-varying copula models, the RUB–WTI pair has the strongest dependence, possibly because Russia is a large oil producer and has a high share of global oil exports, making Russia itself more dependent on oil. Third, from the goodness-of-fit test results, the Student’s t copula model has the best performance among all the constant copula models considered, while for the time-varying copula models, it was rejected for the BRL–WTI, INR–WTI, and ZAR–WTI pairs. We also measured risk management by treating the five exchange rate–oil price pairs as portfolios and calculating the dynamic values of VaR and ES. Both reached very low values for all pairs when the oil price experienced a sharp decrease.

The results of this paper offer us several suggestions. First, the significant correlation between oil price and exchange rate indicates that enterprises and governments in BRICS countries, when the oil price fluctuates, should pay attention to the exchange rate risk. Second, the negative relationship between oil price and exchange rate shows that the oil could be a hedge against inflation in BRICS countries, which is useful for foreign investors to manage exchange rate risk.

However, in this paper, we only considered bivariate copula models. For the future extension of this research, we will focus on a high-dimensional copula model, which could provide a more flexible analysis.