Techno-Economic and Life Cycle Cost Analysis through the Lens of Uncertainty: A Scoping Review

Abstract

:1. Introduction

- What are the main sources of uncertainty in TEA and LCCA?

- Which methods/tools were used to cope with these uncertainties?

- Which probability distribution functions were used to define the uncertainties?

2. Background

2.1. Techno-Economic Analysis

2.2. Life Cycle Cost Analysis

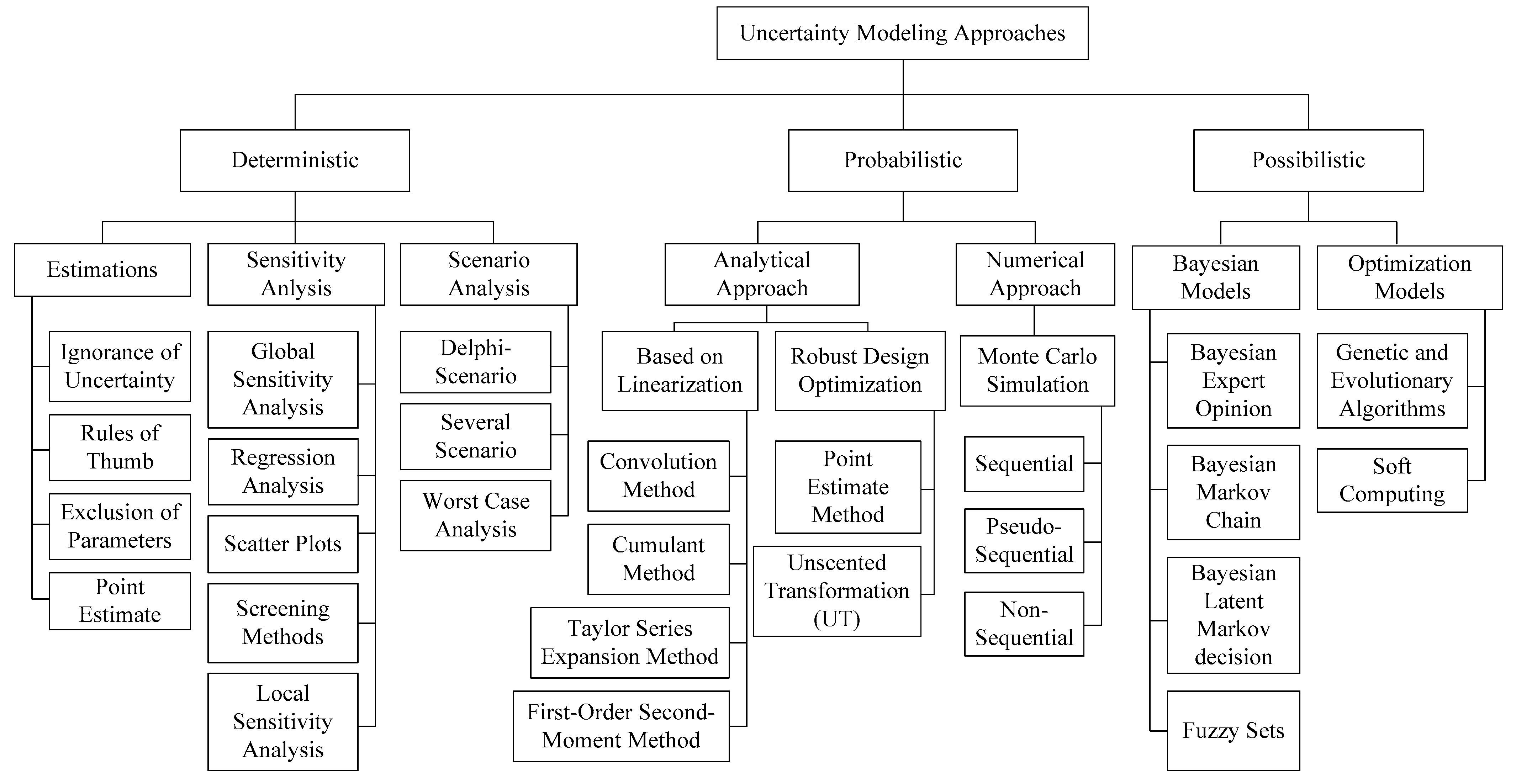

2.3. Uncertainty

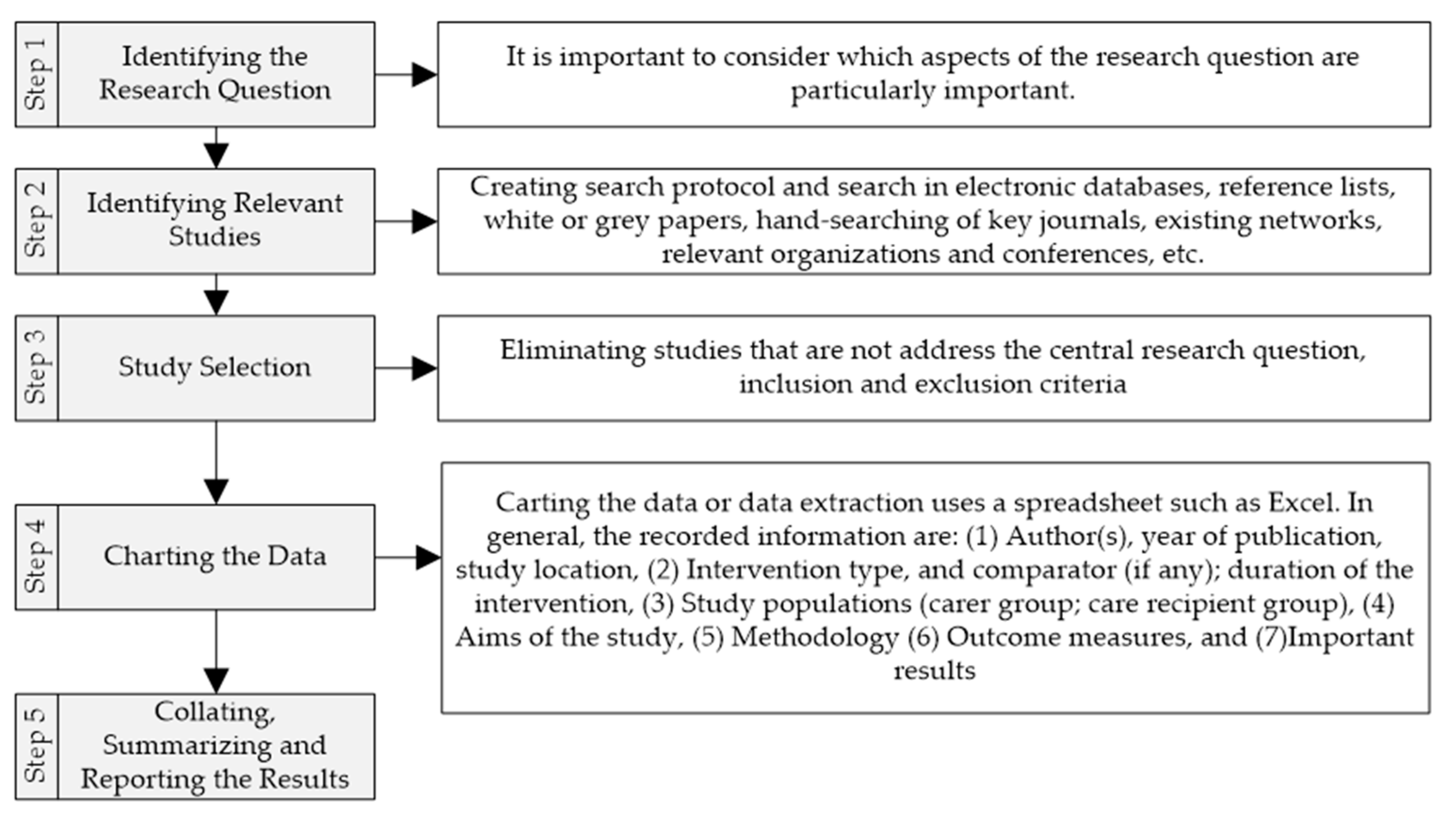

3. Methodology

- Analyzing the scope, range, and nature of the study,

- An assessment of the feasibility of conducting a comprehensive systematic review,

- Sharing and summarizing findings, and

- Knowledge gaps identification

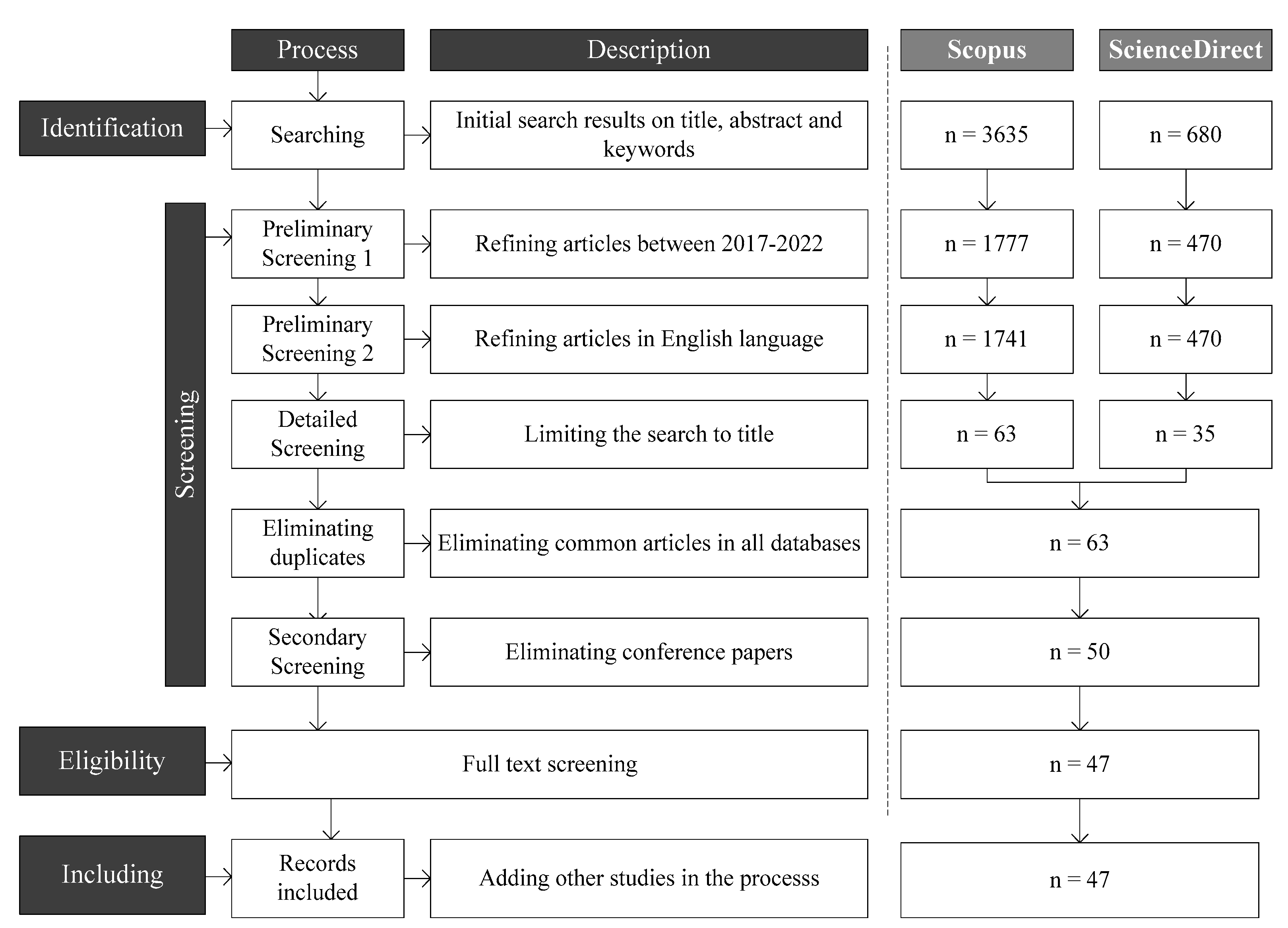

3.1. Searching Procedure

- Three main research questions were defined (stage 1).

- A preliminary search was conducted in two scientific databases, Scopus and ScienceDirect (stage 2), using the following search strings. These search strings are:For Scopus:TITLE-ABS-KEY ((techno-economic OR (life AND cycle AND cost*)) AND(uncertainty))For ScienceDirect:(techno-economic OR life cycle cost) AND uncertaintyThe initial search was not limited at this level. Titles, abstracts, and keywords were searched across the selected databases. Thus, 3635 and 680 documents (in all categories) were indexed in Scopus and ScienceDirect, respectively.

- The main interest was to study the most recent studies. Therefore, the studies conducted in the last 5 years were chosen (2017–April 2022). As a result of applying this limit, the number of documents decreased to 1777 for Scopus and 470 for ScienceDirect, respectively (stage 2).

- In the next step, the language of the studies was also limited to English. Consequently, only a few documents were removed from Scopus. The remaining studies were indexed in Scopus and ScienceDirect as 1741 and 470, respectively (stage 2 continued).

- Limiting the search strings only to the title (stage 2 continued), the number of articles dropped significantly (63 and 35 for Scopus and ScienceDirect).

- All the documents obtained from ScienceDirect were repeated in the Scopus list. Therefore, in this step, by trimming the list and removing duplicates, 63 documents remained (stage 3). The remaining articles were listed in Excel to perform the necessary investigation.

- A full-text screening was conducted to determine the eligibility of the studies. Accordingly, three studies were deemed non-relevant and were eliminated from the list (stage 3 continued). The list contained 60 publications at this stage.

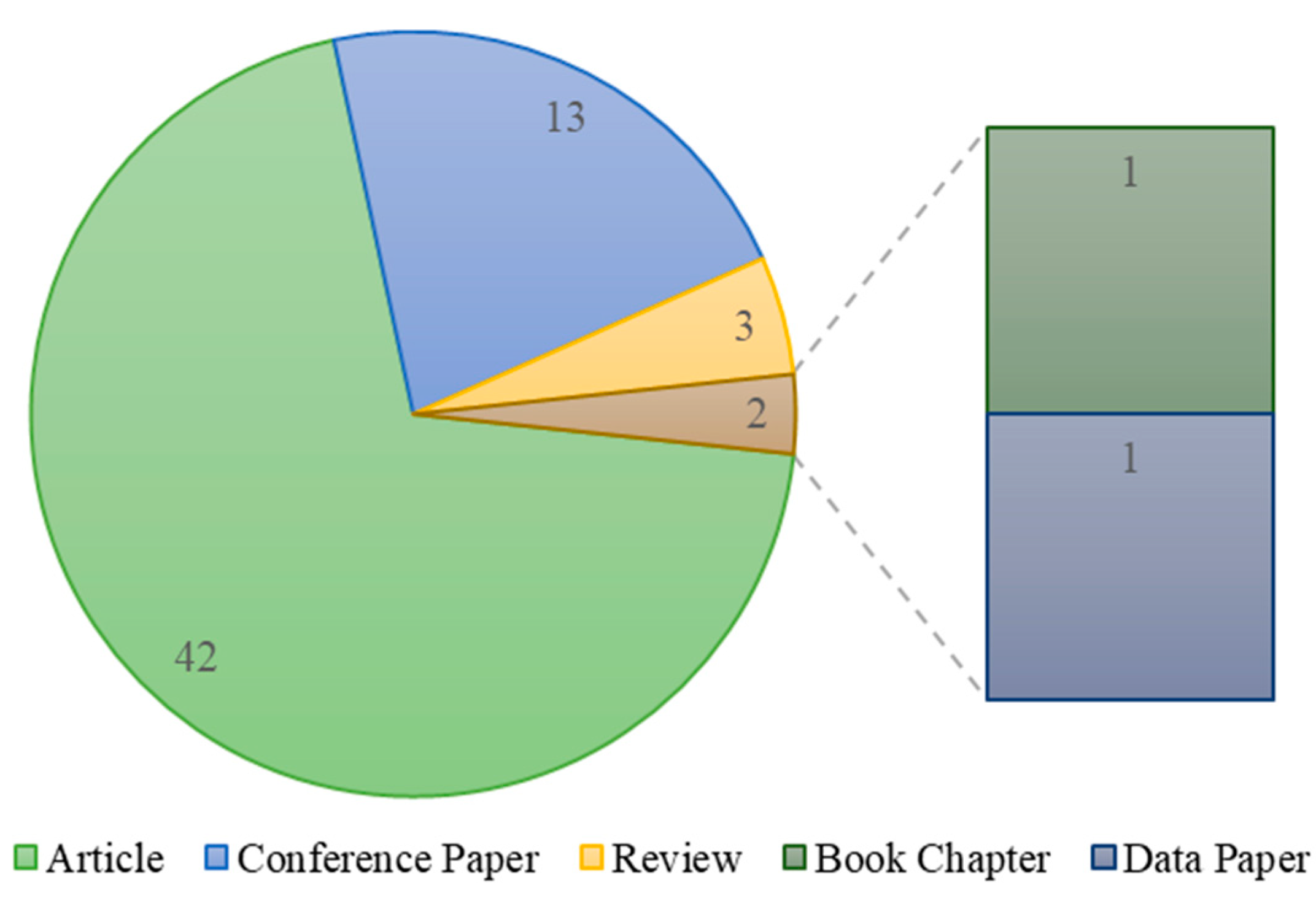

- To obtain more credible results, the results were limited to only journal papers, and book chapters and conference papers were eliminated. All in all, the final list included 47 studies.

- The Bolographic information was extracted and reported (stages 4 and 5), including the title, country of origin, year of publication, the study’s aim and scope, methodology, barriers and challenges, and other observations.

3.2. Limitation

4. Results and Discussion

4.1. Descriptive Analysis

4.1.1. Number of Publications

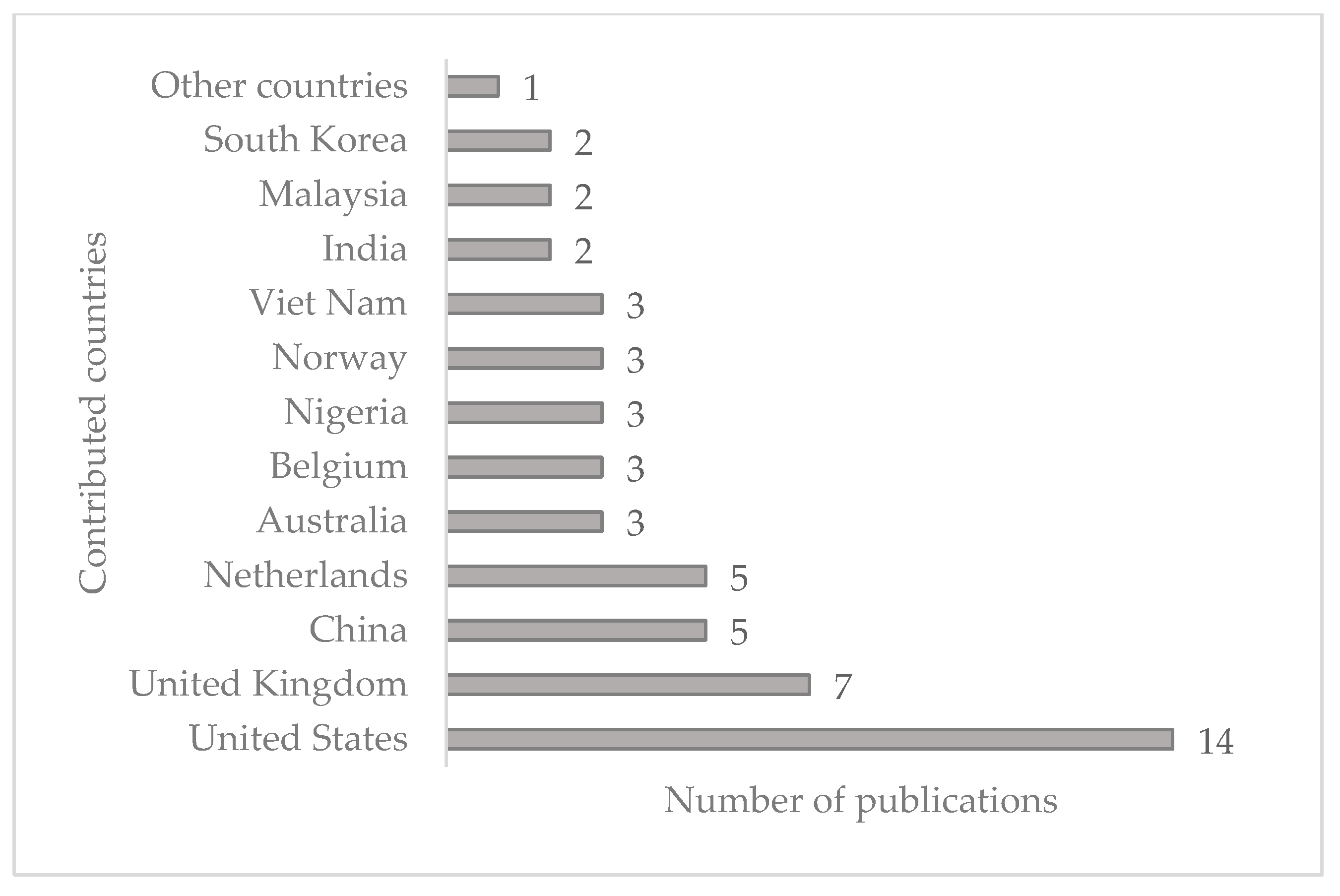

4.1.2. The Origin of Studies

4.1.3. Publications by Document Type

4.1.4. Publications by Subject Area

4.2. Content-Based Analysis

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Nomenclature

| ANN | Artificial Neural Network | NPB | Non-Parametric Bootstrapping |

| ANOVA | Analysis of Variance | PM | Pedigree Matrix |

| ARIMA | Auto-Regressive Integrated Moving Average | PN | Petri Net |

| DNN | Deep Neural Networks | Probability Distribution Function | |

| FOATSE | First Order Analysis Taylor Series Expansion | PA | Profitability Analysis |

| GA | Genetic Algorithm | RO | Robust Optimization |

| GBM | Geometric Brownian Motion | SAA | Sample Average Approximation |

| GABCAO | Global Artificial Bee Colony Algorithm Optimization | ScA | Scenario Analysis |

| GSA | Global Sensitivity Analysis | SFA | Seismic Fragility Assessment |

| LIDRA | Low Impact Development Rapid Assessment | SPA | Semi-Probabilistic Approach |

| MRJD | Mean -Reversion and Jump-Diffusion | SA | Sensitivity Analysis |

| MCS | Monte Carlo Simulation | SIM | Sobol’s Indices Methodology |

| MLFD | Multi-Level Factorial Design | SPCE | Sparse Polynomial Chaos Expansion |

| MOO | Multi-Objective Optimization | SRA | System Reliability Analysis |

| MMO | Multiple Model Optimization | SUA | System Uncertainty Analysis |

| MSO | Multi-Scenario Optimization | UA | Uncertainty Analysis |

| N/A | Not applicable | HOM | Hazard Occurrence Model |

| NIPCE | Non-Intrusive Polynomial Chaos Expansion |

Appendix A

| Definition | Reference |

|---|---|

| “The evaluation of the technic performance or potential and the economic feasibility of a new technology that aims to improve the social or environmental impact of a technology currently in practice, and which helps decision-makers in directing research and development or investments.” | [17] |

| “The techno-economic evaluation incorporates results from both investment and performance analysis to select the most cost-efficient solution for a certain scenario and performance requirements.” | [18] |

| “Iterative process illustrating the valorization of potential technologies. It adopts design techniques to estimate costs and revenues aimed at identifying profitability. Next, risk analysis is performed in support of risk reduction strategies.” | [19] |

| “Techno-economic modelling methods are typically used to evaluate the economic feasibility of new technologies and services. Techno-economic modelling combines forecasting network design and investment analysis methods, typically utilizing the spreadsheet-based tool.” | [81] |

| “TEA is a methodology framework to analyse the technical and economic performance of a process, product or service and includes studies on the economic impact of research, development, demonstration, and deployment of technologies, quantifying the cost of manufacturing and market opportunities.” | [82] |

| “The TEA model is an integrated model, with direct linkages between the economic and technological parts. The dynamic character of TEA, where a change in one parameter directly affects all output indicators, is key to identifying the most influencing parameters for a feasible technology.” | [83] |

| “The techno-economic analysis (TEA) involves evaluating a process/technology through a process simulation approach.” | [84] |

| Definition | Reference |

|---|---|

| In an LCCA, all the significant net expenditures arising during the ownership of an asset are identified and quantified in order to optimize the total cost of asset ownership. | [85] |

| The life cycle cost of a product (LCCA) involves the total cost throughout its entire lifespan. | [86] |

| As a result of LCCA analysis, an estimate of the total incremental costs associated with developing, producing, using, and retiring a particular product can be determined | [87] |

| A conventional life cycle cost analysis assesses all costs associated with the life cycle of a product that are directly borne by the main producer or user | [88] |

| The LCCA is a type of investment calculus that incorporates a life-cycle perspective beyond that offered by traditional investment calculus. As well as considering investment costs, it also considers operating costs over the product’s expected lifetime. | [89] |

| The LCCA methodology enables comparisons of costs over a given period, taking into account relevant integral economic factors | [90] |

| In LCCA, all present and future costs essential to a system are summed together in present value during a given life cycle. | [91] |

| A life cycle cost assessment is a method of evaluating life-cycle costs in a systematic manner. It can examine a project’s entire life cycle, a selected period of time, or a selected stage in its life cycle | [92] |

Appendix B

| Reference | Sources of Uncertainty | |

|---|---|---|

| 1 | [56] | The grid electricity and diesel price, grid electricity’s greenhouse gas emissions, energy consumption, annual solar irradiance, average ambient temperature, inflation rate, economic and environmental parameters |

| 2 | [9] | Variations in the feedstock, plant capacities, manufacturing parameters, and capital and operating costs |

| 3 | [63] | Syngas and transportation fuel prices, biomass quality, supply and pricing |

| 4 | [64] | Main indicators of profitability such as internal rate of return, cost of goods, and performance forecast variables, such as product purity and annual throughput) |

| 5 | [66] | Input variables of biodiesel production, profitability indicators |

| 6 | [7] | Different input parameters, including feed grade, kinetic coefficients, and metal price |

| 7 | [68] | Input parameters such as electricity selling price and cost of Ca(OH)2 |

| 8 | [93] | Economic parameters |

| 9 | [94] | A historical time series of wind directions and speeds in the years between 2000–2019, mean wind speeds, power density, most probable wind speeds, maximum energy carrying speeds, and predominant wind directions in wind passes are presented in this section |

| 10 | [95] | Feedstock composition, HTL yield model, aqueous-phase product treatment, utility consumption, and equipment sizing and costing |

| 11 | [96] | Biodiesel production input variables and profitability indicators |

| 12 | [97] | Process parameters such as materials and energy demands, production costs, and unit production costs |

| 13 | [98] | Various distributed energy resources (DERs) data, wind, solar and electric vehicles (EVs) |

| 14 | [99] | Wide range of system parameters (Electrolyzer, PV, and economic parameters) |

| 15 | [3] | Review |

| 16 | [100] | Coefficients of cost correlation and parameters of scenarios |

| 17 | [101] | System parameters including electrolyzer, PV, H2 tank, battery bank, fuel cell) and economic parameters |

| 18 | [102] | Solvent property uncertainties on a rate-based absorb model (density, viscosity, solubility, surface tension, equilibrium between vapor and liquid, chemical reaction kinetics, heat of reaction, specific heat capacity) |

| 19 | [103] | Several geological and structural parameters are uncertain, including the stress field, the location and orientation of natural fractures and faults, the temperature distribution, and the pressure distribution within the reservoir |

| 20 | [104] | Model parameters |

| 21 | [105] | Technical and financial parameters |

| 22 | [106] | The price of energy, technological uncertainty regarding internal combustion, hybrid, plug-in hybrid, battery, and fuel cell electric under various progress scenarios for 2035 and 2050 |

| 23 | [107] | Parameters of the PV-electrolyzer system from a technical and economic perspective |

| 24 | [108] | The uncertainty of bio-crude yields, quality, utility consumption, and efficiency, as well as key economic indicators |

| 25 | [109] | Process and economic variables |

| 26 | [110] | Process and economic variables |

| 27 | [111] | Economic key factors |

| 30 | [112] | Economic key factors |

| 31 | [113] | Economic key factors |

| 32 | [114] | Number of people inside the room |

| 33 | [115] | Estimate feedstock requirements, costs, life-cycle energy usage, greenhouse gas emissions for grower payments and field operations, and major parameters associated with the transportation of corn stover feedstock |

| 34 | [116] | Technical and economic parameters |

| 35 | [117] | Technical parameters and environmental uncertainties |

| 36 | [118] | Price of biodiesel and feedstock, the efficiency of biodiesel conversion, and operating costs |

| 37 | [119] | Post-combustion CO2 capture techno-economic parameters |

| 38 | [69] | Technical, economic, and environmental parameters (electricity and heat loads, wind and PV generation, EE unit factors for EE evaluation) |

References

- Giacomella, L. Techno Economic Assessment (TEA) and Life Cycle Costing Analysis (LCCA): Discussing Methodological Steps and Integrability. Insights Reg. Dev. 2021, 3, 176–197. [Google Scholar] [CrossRef]

- Sun, Y.; Carmichael, D.G. Uncertainties Related to Financial Variables within Infrastructure Life Cycle Costing: A Literature Review. Struct. Infrastruct. Eng. 2018, 14, 1233–1243. [Google Scholar] [CrossRef]

- van der Spek, M.; Fout, T.; Garcia, M.; Kuncheekanna, V.N.; Matuszewski, M.; McCoy, S.; Morgan, J.; Nazir, S.M.; Ramirez, A.; Roussanaly, S.; et al. Uncertainty Analysis in the Techno-Economic Assessment of CO2 Capture and Storage Technologies. Critical Review and Guidelines for Use. Int. J. Greenh. Gas Control 2020, 100, 103113. [Google Scholar] [CrossRef]

- Carmichael, D. Infrastructure Investment: An Engineering Perspective, 1st ed.; CRC Press: Boca Raton, FL, USA, 2014; p. 238. ISBN 978-0-429-07185-0. [Google Scholar]

- Saravi, M.; Goh, Y.M.; Newnes, L.; Mileham, A.; Morton, K.; Beedall, D. Modeling Uncertainty in Through-Life Costing at the Early Design Stages: I; American Society of Mechanical Engineers Digital Collection: Washington, DC, USA, 2012; pp. 1033–1042. [Google Scholar]

- Billinton, R.; Huang, D. Aleatory and Epistemic Uncertainty Considerations in Power System Reliability Evaluation. In Proceedings of the 10th International Conference on Probablistic Methods Applied to Power Systems, Rincón, Puerto Rico, 25–29 May 2008; pp. 1–8. [Google Scholar]

- Amini, S.H.; Noble, A. Design of Cell-Based Flotation Circuits under Uncertainty: A Techno-Economic Stochastic Optimization. Minerals 2021, 11, 459. [Google Scholar] [CrossRef]

- Harenberg, D.; Marelli, S.; Sudret, B.; Winschel, V. Uncertainty quantification and global sensitivity analysis for economic models. SSRN Electron. J. 2017, 10, 1–49. [Google Scholar]

- Zhenzhen, Z.; Kai, L. Understanding the Impacts of Plant Capacities and Uncertainties on the Techno-Economic Analysis of Cross-Laminated Timber Production in the Southern U.S. J. Renew. Mater. 2021, 10, 53. [Google Scholar] [CrossRef]

- Tricco, A.; Lillie, E.; Zarin, W.; O’Brien, K.; Colquhoun, H.; Levac, D.; Moher, D.; Peters, M.; Horsley, T.; Weeks, L.; et al. PRISMA Extension for Scoping Reviews (PRISMA-ScR): Checklist and Explanation. Ann. Intern. Med. 2018, 169, 467–473. [Google Scholar] [CrossRef]

- Rethlefsen, M.L.; Kirtley, S.; Waffenschmidt, S.; Ayala, A.P.; Moher, D.; Page, M.J.; Koffel, J.B.; Blunt, H.; Brigham, T.; Chang, S.; et al. PRISMA-S: An Extension to the PRISMA Statement for Reporting Literature Searches in Systematic Reviews. Syst. Rev. 2021, 10, 39. [Google Scholar] [CrossRef]

- Sarkis-Onofre, R.; Catalá-López, F.; Aromataris, E.; Lockwood, C. How to Properly Use the PRISMA Statement. Syst. Rev. 2021, 10, 117. [Google Scholar] [CrossRef]

- Selçuk, A.A. A Guide for Systematic Reviews: PRISMA. Turk. Arch. Otorhinolaryngol. 2019, 57, 57–58. [Google Scholar] [CrossRef]

- Barahmand, Z.; Eikeland, M.S. A Scoping Review on Environmental, Economic, and Social Impacts of the Gasification Processes. Environments 2022, 9, 92. [Google Scholar] [CrossRef]

- Liberati, A.; Altman, D.G.; Tetzlaff, J.; Mulrow, C.; Gøtzsche, P.C.; Ioannidis, J.P.A.; Clarke, M.; Devereaux, P.J.; Kleijnen, J.; Moher, D. The PRISMA Statement for Reporting Systematic Reviews and Meta-Analyses of Studies That Evaluate Health Care Interventions: Explanation and Elaboration. PLoS Med. 2009, 6, e1000100. [Google Scholar] [CrossRef]

- Sherif, Y.S.; Kolarik, W.J. Life Cycle Costing: Concept and Practice. Omega 1981, 9, 287–296. [Google Scholar] [CrossRef]

- Kuppens, T.; Van Dael, M.; Vanreppelen, K.; Thewys, T.; Yperman, J.; Carleer, R.; Schreurs, S.; Van Passel, S. Techno-Economic Assessment of Fast Pyrolysis for the Valorization of Short Rotation Coppice Cultivated for Phytoextraction. J. Clean. Prod. 2015, 88, 336–344. [Google Scholar] [CrossRef]

- Kantor, M.; Wajda, K.; Lannoo, B.; Casier, K.; Verbrugge, S.; Pickavet, M.; Wosinska, L.; Chen, J.; Mitcsenkov, A. General Framework for Techno-Economic Analysis of next Generation Access Networks. In Proceedings of the 2010 12th International Conference on Transparent Optical Networks, Munich, Germany, 27 June–1 July 2010; pp. 1–4. [Google Scholar]

- Van Dael, M.; Kuppens, T.; Lizin, S.; Van Passel, S. Techno-Economic Assessment Methodology for Ultrasonic Production of Biofuels. In Production of Biofuels and Chemicals with Ultrasound; Biofuels and Biorefineries; Fang, Z., Smith, R., Jr., Richard, L., Qi, X., Eds.; Springer Netherlands: Dordrecht, The Netherlands, 2015; pp. 317–345. ISBN 978-94-017-9624-8. [Google Scholar]

- Kara, S. Life Cycle Cost. In CIRP Encyclopedia of Production Engineering; Laperrière, L., Reinhart, G., Eds.; Springer: Berlin/Heidelberg, Germany, 2014; pp. 751–757. ISBN 978-3-642-20617-7. [Google Scholar]

- Kubba, S. Chapter 8—Green Design and Construction Economics. In Green Construction Project Management and Cost Oversight; Kubba, S., Ed.; Architectural Press: Boston, MA, USA, 2010; pp. 304–342. ISBN 978-1-85617-676-7. [Google Scholar]

- Lee, D.B. Fundamentals of Life-Cycle Cost Analysis. Transp. Res. Rec. 2002, 1812, 203–210. [Google Scholar] [CrossRef]

- Sun, L. Chapter 8—LCCA-Based Design Method for Asphalt Pavement. In Structural Behavior of Asphalt Pavements; Sun, L., Ed.; Butterworth-Heinemann: Oxford, UK, 2016; pp. 549–600. ISBN 978-0-12-849908-5. [Google Scholar]

- Directive 2014/24/EU of the European Parliament and of the Council of 26 February 2014 on Public Procurement. Available online: https://www.legislation.gov.uk/eudr/2014/24/contents (accessed on 29 August 2022).

- Directive 2014/25/EU of the European Parliament and of the Council of 26 February 2014 on Procurement by Entities Operating in the Water, Energy, Transport and Postal Services Sectors. Available online: http://data.europa.eu/eli/dir/2014/25/oj/eng (accessed on 29 August 2022).

- Qu, J. Uncertainty of Cash Flow and Corporate Innovation. Mod. Econ. 2020, 11, 881. [Google Scholar] [CrossRef]

- Carmichael, D.G. An Alternative Approach to Capital Investment Appraisal. Eng. Econ. 2011, 56, 123–139. [Google Scholar] [CrossRef]

- Istrefi, K.; Mouabbi, S. Subjective Interest Rate Uncertainty and the Macroeconomy: A Cross-Country Analysis. J. Int. Money Financ. 2018, 88, 296–313. [Google Scholar] [CrossRef]

- Cole, R.J.; Sterner, E. Reconciling Theory and Practice of Life-Cycle Costing. Build. Res. Inf. 2000, 28, 368–375. [Google Scholar] [CrossRef]

- Fisher, G. Cost Considerations in Systems Analysis; RAND Corporation: Santa Monica, CA, USA, 1970. [Google Scholar]

- Finnveden, G.; Hauschild, M.Z.; Ekvall, T.; Guinée, J.; Heijungs, R.; Hellweg, S.; Koehler, A.; Pennington, D.; Suh, S. Recent Developments in Life Cycle Assessment. J. Environ. Manag. 2009, 91, 1–21. [Google Scholar] [CrossRef]

- Heijungs, R.; Lenzen, M. Error Propagation Methods for LCA—A Comparison. Int. J. Life Cycle Assess. 2014, 19, 1445–1461. [Google Scholar] [CrossRef]

- Cherubini, E.; Franco, D.; Zanghelini, G.M.; Soares, S.R. Uncertainty in LCA Case Study Due to Allocation Approaches and Life Cycle Impact Assessment Methods. Int. J. Life Cycle Assess. 2018, 23, 2055–2070. [Google Scholar] [CrossRef]

- Ilg, P.; Scope, C.; Muench, S.; Guenther, E. Uncertainty in Life Cycle Costing for Long-Range Infrastructure. Part I: Leveling the Playing Field to Address Uncertainties. Int. J. Life Cycle Assess. 2017, 22, 277–292. [Google Scholar] [CrossRef]

- Goh, Y.M.; Newnes, L.B.; Mileham, A.R.; McMahon, C.A.; Saravi, M.E. Uncertainty in Through-Life Costing—Review and Perspectives. IEEE Trans. Eng. Manag. 2010, 57, 689–701. [Google Scholar] [CrossRef]

- Barahmand, Z.; Jayarathna, C.; Ratnayake, C. Sensitivity and Uncertainty Analysis in a Circulating Fluidized Bed Reactor Modeling. In Proceedings of the Linköping Electronic Conference Proceedings, Virtual, 5–7 October 2020; Linköping University Press: Linköping, Finland, 2021. [Google Scholar]

- Aien, M.; Hajebrahimi, A.; Fotuhi-Firuzabad, M. A Comprehensive Review on Uncertainty Modeling Techniques in Power System Studies. Renew. Sustain. Energy Rev. 2016, 57, 1077–1089. [Google Scholar] [CrossRef]

- Beaudrie, C.E.H.; Kandlikar, M.; Ramachandran, G. Chapter 5—Using Expert Judgment for Risk Assessment. In Assessing Nanoparticle Risks to Human Health, 2nd ed.; Ramachandran, G., Ed.; William Andrew Publishing: Oxford, UK, 2016; pp. 91–119. ISBN 978-0-323-35323-6. [Google Scholar]

- Petersen, B.J.; Youngren, S.H.; Walls, C.L. CHAPTER 17—Modeling Dietary Exposure with Special Sections on Modeling Aggregate and Cumulative Exposure. In Handbook of Pesticide Toxicology, 2nd ed.; Krieger, R.I., Krieger, W.C., Eds.; Academic Press: San Diego, CA, USA, 2001; pp. 443–455. ISBN 978-0-12-426260-7. [Google Scholar]

- Schwela, D. Risk Assessment, Uncertainty. In Encyclopedia of Toxicology, 3rd ed.; Wexler, P., Ed.; Academic Press: Oxford, UK, 2014; pp. 165–171. ISBN 978-0-12-386455-0. [Google Scholar]

- Mendoza Beltran, A.; Heijungs, R.; Guinée, J.; Tukker, A. A Pseudo-Statistical Approach to Treat Choice Uncertainty: The Example of Partitioning Allocation Methods. Int. J. Life Cycle Assess. 2016, 21, 252–264. [Google Scholar] [CrossRef]

- Spatial Variability. Wikipedia. Available online: https://en.wikipedia.org/wiki/Spatial_variability (accessed on 23 May 2022).

- Patrick, C.J.; McCluney, K.E.; Ruhi, A.; Gregory, A.; Sabo, J.; Thorp, J.H. Multi-Scale Biodiversity Drives Temporal Variability in Macrosystems. Front. Ecol. Environ. 2021, 19, 47–56. [Google Scholar] [CrossRef]

- Uncertain Data. Wikipedia. Available online: https://en.wikipedia.org/wiki/Uncertain_data (accessed on 23 May 2022).

- Savela, C. Kennedy Space Center Reliability. Available online: https://extapps.ksc.nasa.gov/Reliability/ (accessed on 23 May 2022).

- Thunnissen, D. Uncertainty Classification for the Design and Development of Complex Systems. In Proceedings of the 3rd Annual Predictive Methods Conference, Veros Software, Newport Beach, CA, USA, 1 June 2003. [Google Scholar]

- Indeed Measures of Variation: Definitions, Examples and Careers. Available online: https://www.indeed.com/career-advice/career-development/measures-of-variation (accessed on 23 May 2022).

- Jain, V.K. Data Science and Analytics (with Python, R and SPSS Programming); Khanna Publishing House: New Delhi, India, 2018; ISBN 978-93-86173-67-6. [Google Scholar]

- Waldon, B. A Novel Probabilistic Approach to Linguistic Imprecision. In Measurements, Numerals and Scales: Essays in Honour of Stephanie Solt; Palgrave Studies in Pragmatics, Language and Cognition; Gotzner, N., Sauerland, U., Eds.; Springer International Publishing: Cham, Switzerland, 2022; pp. 307–327. ISBN 978-3-030-73323-0. [Google Scholar]

- Fisher, P. Uncertainty, Semantic. In Encyclopedia of GIS; Shekhar, S., Xiong, H., Eds.; Springer US: Boston, MA, USA, 2008; pp. 1194–1196. ISBN 978-0-387-35973-1. [Google Scholar]

- Vanhuyse, F.; Fejzić, E.; Ddiba, D.; Henrysson, M. The Lack of Social Impact Considerations in Transitioning towards Urban Circular Economies: A Scoping Review. Sustain. Cities Soc. 2021, 75, 103394. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews. Int. J. Surg. 2021, 88, 105906. [Google Scholar] [CrossRef]

- Barahmand, Z.; Eikeland, M.S. Life Cycle Assessment under Uncertainty: A Scoping Review. World 2022, 3, 692–717. [Google Scholar] [CrossRef]

- Mays, N.; Roberts, E.; Popay, J. Synthesising Research Evidence. In Studying the Organisation and Delivery of Health Services; Routledge: London, UK, 2001; ISBN 978-0-203-48198-1. [Google Scholar]

- Arksey, H.; O’Malley, L. Scoping Studies: Towards a Methodological Framework. Int. J. Soc. Res. Methodol. 2005, 8, 19–32. [Google Scholar] [CrossRef] [Green Version]

- Coppitters, D.; Verleysen, K.; De Paepe, W.; Contino, F. How Can Renewable Hydrogen Compete with Diesel in Public Transport? Robust Design Optimization of a Hydrogen Refueling Station under Techno-Economic and Environmental Uncertainty. Appl. Energy 2022, 312, 118694. [Google Scholar] [CrossRef]

- EIA U.S. Energy Information Administration—EIA—Independent Statistics and Analysis. Available online: https://www.eia.gov/environment/emissions/carbon/ (accessed on 21 May 2022).

- Liu, N.; Ma, Z.; Kang, J. Changes in Carbon Intensity in China’s Industrial Sector: Decomposition and Attribution Analysis. Energy Policy 2015, 87, 28–38. [Google Scholar] [CrossRef]

- Thomakos, D.D.; Alexopoulos, T.A. Carbon Intensity as a Proxy for Environmental Performance and the Informational Content of the EPI. Energy Policy 2016, 94, 179–190. [Google Scholar] [CrossRef]

- Whiston, M.M.; Lima Azevedo, I.M.; Litster, S.; Samaras, C.; Whitefoot, K.S.; Whitacre, J.F. Hydrogen Storage for Fuel Cell Electric Vehicles: Expert Elicitation and a Levelized Cost of Driving Model. Environ. Sci. Technol. 2021, 55, 553–562. [Google Scholar] [CrossRef] [PubMed]

- Abraham, S.; Raisee, M.; Ghorbaniasl, G.; Contino, F.; Lacor, C. A Robust and Efficient Stepwise Regression Method for Building Sparse Polynomial Chaos Expansions. J. Comput. Phys. 2017, 332, 461–474. [Google Scholar] [CrossRef]

- Humbird, D.; Davis, R.; Tao, L.; Kinchin, C.; Hsu, D.; Aden, A.; Schoen, P.; Lukas, J.; Olthof, B.; Worley, M.; et al. Process Design and Economics for Biochemical Conversion of Lignocellulosic Biomass to Ethanol: Dilute-Acid Pretreatment and Enzymatic Hydrolysis of Corn Stover; National Renewable Energy Lab. (NREL): Golden, CO, USA, 2011. [Google Scholar]

- Lo, S.L.Y.; How, B.S.; Teng, S.Y.; Lam, H.L.; Lim, C.H.; Rhamdhani, M.A.; Sunarso, J. Stochastic Techno-Economic Evaluation Model for Biomass Supply Chain: A Biomass Gasification Case Study with Supply Chain Uncertainties. Renew. Sustain. Energy Rev. 2021, 152, 111644. [Google Scholar] [CrossRef]

- McNulty, M.J.; Kelada, K.; Paul, D.; Nandi, S.; McDonald, K.A. Introducing Uncertainty Quantification to Techno-Economic Models of Manufacturing Field-Grown Plant-Made Products. Food Bioprod. Process. 2021, 128, 153–165. [Google Scholar] [CrossRef]

- McNulty, M.J.; Kelada, K.; Paul, D.; Nandi, S.; McDonald, K.A. Techno-Economic Process Modelling and Monte Carlo Simulation Data of Uncertainty Quantification in Field-Grown Plant-Based Manufacturing. Data Brief 2021, 38, 107317. [Google Scholar] [CrossRef]

- Oke, E.O.; Adeyi, O.; Okolo, B.I.; Ude, C.J.; Adeyi, J.A.; Salam, K.K.; Nwokie, U.; Nzeribe, I. Heterogeneously Catalyzed Biodiesel Production from Azadiricha Indica Oil: Predictive Modelling with Uncertainty Quantification, Experimental Optimization and Techno-Economic Analysis. Bioresour. Technol. 2021, 332, 125141. [Google Scholar] [CrossRef]

- Verweij, B.; Ahmed, S.; Kleywegt, A.J.; Nemhauser, G.; Shapiro, A. The Sample Average Approximation Method Applied to Stochastic Routing Problems: A Computational Study. Comput. Optim. Appl. 2003, 24, 289–333. [Google Scholar] [CrossRef]

- Alfonso-Cardero, A.; Pagés-Díaz, J.; Contino, F.; Rajendran, K.; Lorenzo-LLanes, J. Process Simulation and Techno-Economic Assessment of Vinasse-to-Biogas in Cuba: Deterministic and Uncertainty Analysis. Chem. Eng. Res. Des. 2021, 169, 33–45. [Google Scholar] [CrossRef]

- Hosseini, S.H.R.; Allahham, A.; Walker, S.L.; Taylor, P. Uncertainty Analysis of the Impact of Increasing Levels of Gas and Electricity Network Integration and Storage on Techno-Economic-Environmental Performance. Energy 2021, 222, 119968. [Google Scholar] [CrossRef]

- Asghari, V.; Hsu, S.-C.; Wei, H.-H. Expediting Life Cycle Cost Analysis of Infrastructure Assets under Multiple Uncertainties by Deep Neural Networks. J. Manag. Eng. 2021, 37, 04021059. [Google Scholar] [CrossRef]

- Thang, V.V. Optimal Reinforcement Framework for Distribution System Based on Life Cycle Cost and Considering Uncertainties. Int. J. Sustain. Energy 2020, 39, 804–821. [Google Scholar] [CrossRef]

- Nguyen, L.K.; Na, S.; Hsuan, Y.G.; Spatari, S. Uncertainty in the Life Cycle Greenhouse Gas Emissions and Costs of HDPE Pipe Alternatives. Resour. Conserv. Recycl. 2020, 154, 104602. [Google Scholar] [CrossRef]

- Micheli, L.; Cao, L.; Laflamme, S.; Alipour, A. Life-Cycle Cost Evaluation Strategy for High-Performance Control Systems under Uncertainties. J. Eng. Mech. 2020, 146, 04019134. [Google Scholar] [CrossRef]

- Thang, V.V.; Ha, T.; Thang, V.V.; Ha, T. Optimal Siting and Sizing of Renewable Sources in Distribution System Planning Based on Life Cycle Cost and Considering Uncertainties. AIMSE 2019, 7, 211–226. [Google Scholar] [CrossRef]

- Li, W.; Ghosh, A.; Bbosa, D.; Brown, R.; Wright, M.M. Comparative Techno-Economic, Uncertainty and Life Cycle Analysis of Lignocellulosic Biomass Solvent Liquefaction and Sugar Fermentation to Ethanol. ACS Sustain. Chem. Eng. 2018, 6, 16515–16524. [Google Scholar] [CrossRef]

- Yu, Z.; Montalto, F.; Behr, C. Probabilistic Green Infrastructure Cost Calculations Using a Phased Life Cycle Algorithm Integrated with Uncertainties. J. Hydroinformatics 2018, 20, 1201–1214. [Google Scholar] [CrossRef]

- Thang, V.V.; Minh, N.D. Optimal Allocation and Sizing of Capacitors for Distribution Systems Reinforcement Based on Minimum Life Cycle Cost and Considering Uncertainties. Open Electr. Electron. Eng. J. 2017, 11, 165–176. [Google Scholar] [CrossRef]

- Zhang, D.; Hu, H.; Roberts, C.; Dai, L. Developing a Life Cycle Cost Model for Real-Time Condition Monitoring in Railways under Uncertainty. Proc. Inst. Mech. Eng. Part F J. Rail Rapid Transit 2017, 231, 111–121. [Google Scholar] [CrossRef]

- Tao, Z.; Zophy, F.G.; Wiegmann, J. Asset Management Model and Systems Integration Approach. Transp. Res. Rec. 2000, 1719, 191–199. [Google Scholar] [CrossRef]

- Cai, H.; Lin, J.; Han, S. Chapter 4—Efficient Methods for Deep Learning All Student Authors Have Contributed Equally to This Work and Are Listed in the Alphabetical Order. In Advanced Methods and Deep Learning in Computer Vision; Computer Vision and Pattern Recognition; Davies, E.R., Turk, M.A., Eds.; Academic Press: Cambridge, MA, USA, 2022; pp. 159–190. ISBN 978-0-12-822109-9. [Google Scholar]

- Smura, T.; Kiiski, A.; Hämmäinen, H. Virtual Operators in the Mobile Industry: A Techno-Economic Analysis. Netnomics 2007, 8, 25–48. [Google Scholar] [CrossRef]

- Zimmermann, A.W.; Wunderlich, J.; Müller, L.; Buchner, G.A.; Marxen, A.; Michailos, S.; Armstrong, K.; Naims, H.; McCord, S.; Styring, P.; et al. Techno-Economic Assessment Guidelines for CO2 Utilization. Front. Energy Res. 2020, 8, 5. [Google Scholar] [CrossRef]

- Thomassen, G.; Van Dael, M.; Van Passel, S. The Potential of Microalgae Biorefineries in Belgium and India: An Environmental Techno-Economic Assessment. Bioresour. Technol. 2018, 267, 271–280. [Google Scholar] [CrossRef]

- Rajendran, K.; Murthy, G.S. Techno-Economic and Life Cycle Assessments of Anaerobic Digestion—A Review. Biocatal. Agric. Biotechnol. 2019, 20, 101207. [Google Scholar] [CrossRef]

- Woodward, D.G. Life Cycle Costing—Theory, Information Acquisition and Application. Int. J. Proj. Manag. 1997, 15, 335–344. [Google Scholar] [CrossRef]

- Yang, S.; Ma, K.; Liu, Z.; Ren, J.; Man, Y. Chapter 5—Development and Applicability of Life Cycle Impact Assessment Methodologies. In Life Cycle Sustainability Assessment for Decision-Making; Ren, J., Toniolo, S., Eds.; Elsevier: Amsterdam, The Netherlands, 2020; pp. 95–124. ISBN 978-0-12-818355-7. [Google Scholar]

- Asiedu, Y.; Gu, P. Product Life Cycle Cost Analysis: State of the Art Review. Int. J. Prod. Res. 1998, 36, 883–908. [Google Scholar] [CrossRef]

- Hunkeler, D.; Lichtenvort, K.; Rebitzer, G. Environmental Life Cycle Costing; CRC Press: Boca Raton, FL, USA, 2008; ISBN 978-0-429-14044-0. [Google Scholar]

- Gluch, P.; Baumann, H. The Life Cycle Costing (LCC) Approach: A Conceptual Discussion of Its Usefulness for Environmental Decision-Making. Build. Environ. 2004, 39, 571–580. [Google Scholar] [CrossRef]

- Jacob-Lopes, E.; Zepka, L.Q.; Deprá, M.C. Chapter 5—Assistant’s Tools toward Life Cycle Assessment. In Sustainability Metrics and Indicators of Environmental Impact; Jacob-Lopes, E., Zepka, L.Q., Deprá, M.C., Eds.; Elsevier: Amsterdam, The Netherlands, 2021; pp. 77–90. ISBN 978-0-12-823411-2. [Google Scholar]

- Buker, M.S.; Mempouo, B.; Riffat, S.B. Performance Evaluation and Techno-Economic Analysis of a Novel Building Integrated PV/T Roof Collector: An Experimental Validation. Energy Build. 2014, 76, 164–175. [Google Scholar] [CrossRef]

- ISO 15686-5; Buildings and Constructed Assets—Service Life Planning—Part 5: Life-Cycle Costing. International Organization for Standardization: Geneva, Switzerland, 2017. Available online: https://www.standard.no/nettbutikk/produktkatalogen/produktpresentasjon/?ProductID=927611 (accessed on 23 May 2022).

- Hsu, H.-W.; Chang, Y.-H.; Wang, W.-C. Techno-Economic Analysis of Used Cooking Oil to Jet Fuel Production under Uncertainty through Three-, Two-, and One-Step Conversion Processes. J. Clean. Prod. 2021, 289, 125778. [Google Scholar] [CrossRef]

- Balaguru, V.S.S.; Swaroopan, N.J.; Raju, K.; Alsharif, M.H.; Kim, M.-K. Techno-Economic Investigation of Wind Energy Potential in Selected Sites with Uncertainty Factors. Sustainability 2021, 13, 2182. [Google Scholar] [CrossRef]

- Li, S.; Jiang, Y.; Snowden-Swan, L.J.; Askander, J.A.; Schmidt, A.J.; Billing, J.M. Techno-Economic Uncertainty Analysis of Wet Waste-to-Biocrude via Hydrothermal Liquefaction. Appl. Energy 2021, 283, 116340. [Google Scholar] [CrossRef]

- Oke, E.O.; Okolo, B.I.; Adeyi, O.; Adeyi, J.A.; Ude, C.J.; Osoh, K.; Otolorin, J.; Nzeribe, I.; Darlinton, N.; Oladunni, S. Process Design, Techno-Economic Modelling, and Uncertainty Analysis of Biodiesel Production from Palm Kernel Oil. Bioenerg. Res. 2021, 15, 1355–1369. [Google Scholar] [CrossRef]

- Adeyi, O.; Adeyi, A.J.; Oke, E.O.; Okolo, B.I.; Olalere, A.O.; Otolorin, J.A.; Taiwo, A.E. Techno-Economic and Uncertainty Analyses of Heat- and Ultrasound-Assisted Extraction Technologies for the Production of Crude Anthocyanins Powder from Hibiscus Sabdariffa Calyx. Cogent Eng. 2021, 8, 1947015. [Google Scholar] [CrossRef]

- Dixit, M.; Kundu, P.; Jariwala, H.R. Techno-Economic Analysis-Based Optimal Incorporation of Distributed Energy Resources in Distribution Network under Load Uncertainty. Int. J. Ambient Energy 2021, 42, 605–611. [Google Scholar] [CrossRef]

- Yates, J.; Daiyan, R.; Patterson, R.; Egan, R.; Amal, R.; Ho-Baille, A.; Chang, N.L. Techno-Economic Analysis of Hydrogen Electrolysis from Off-Grid Stand-Alone Photovoltaics Incorporating Uncertainty Analysis. Cell Rep. Phys. Sci. 2020, 1, 100209. [Google Scholar] [CrossRef]

- Cortes-Peña, Y.; Kumar, D.; Singh, V.; Guest, J.S. BioSTEAM: A Fast and Flexible Platform for the Design, Simulation, and Techno-Economic Analysis of Biorefineries under Uncertainty. ACS Sustain. Chem. Eng. 2020, 8, 3302–3310. [Google Scholar] [CrossRef]

- Nadal, A.; RUBY, A.; BOURASSEAU, C.; Riu, D.; Bérenguer, C. Accounting for Techno-Economic Parameters Uncertainties for Robust Design of Remote Microgrid. Int. J. Electr. Power Energy Syst. 2020, 116, 105531. [Google Scholar] [CrossRef]

- Kuncheekanna, V.N.; Jakobsen, J.P.; Knuutila, H.K. Effect of Uncertainties in Solvent Properties on the Techno-Economic Performances of a CO2 Absorber. Chem. Eng. Trans. 2020, 81, 997–1002. [Google Scholar] [CrossRef]

- Pollack, A.; Mukerji, T. Accounting for Subsurface Uncertainty in Enhanced Geothermal Systems to Make More Robust Techno-Economic Decisions. Appl. Energy 2019, 254, 113666. [Google Scholar] [CrossRef]

- Kiani-Moghaddam, M.; Shivaie, M.; Weinsier, P.D. A Techno-Economic Multi-Objective Model for Hybrid Harmonic Filter Planning Considering Uncertainty in Non-Linear Loads. Int. J. Electr. Power Energy Syst. 2019, 112, 339–352. [Google Scholar] [CrossRef]

- Vrijdag, A.; Boonen, E.-J.; Lehne, M. Effect of Uncertainty on Techno-Economic Trade-off Studies: Ship Power and Propulsion Concepts. J. Mar. Eng. Technol. 2019, 18, 122–133. [Google Scholar] [CrossRef]

- Chen, Y.; Melaina, M. Model-Based Techno-Economic Evaluation of Fuel Cell Vehicles Considering Technology Uncertainties. Transp. Res. Part D Transp. Environ. 2019, 74, 234–244. [Google Scholar] [CrossRef]

- Coppitters, D.; De Paepe, W.; Contino, F. Surrogate-Assisted Robust Design Optimization and Global Sensitivity Analysis of a Directly Coupled Photovoltaic-Electrolyzer System under Techno-Economic Uncertainty. Appl. Energy 2019, 248, 310–320. [Google Scholar] [CrossRef]

- Jiang, Y.; Jones, S.B.; Zhu, Y.; Snowden-Swan, L.; Schmidt, A.J.; Billing, J.M.; Anderson, D. Techno-Economic Uncertainty Quantification of Algal-Derived Biocrude via Hydrothermal Liquefaction. Algal Res. 2019, 39, 101450. [Google Scholar] [CrossRef]

- Bailera, M.; Hanak, D.P.; Lisbona, P.; Romeo, L.M. Techno-Economic Feasibility of Power to Gas–Oxy-Fuel Boiler Hybrid System under Uncertainty. Int. J. Hydrogen Energy 2019, 44, 9505–9516. [Google Scholar] [CrossRef]

- Parsons, S.; Abeln, F.; McManus, M.C.; Chuck, C.J. Techno-Economic Analysis (TEA) of Microbial Oil Production from Waste Resources as Part of a Biorefinery Concept: Assessment at Multiple Scales under Uncertainty. J. Chem. Technol. Biotechnol. 2019, 94, 701–711. [Google Scholar] [CrossRef]

- Lee, B.; Heo, J.; Kim, S.; Kim, C.-H.; Ryi, S.-K.; Lim, H. Integrated Techno-Economic Analysis under Uncertainty of Glycerol Steam Reforming for H2 Production at Distributed H2 Refueling Stations. Energy Convers. Manag. 2019, 180, 250–257. [Google Scholar] [CrossRef]

- Dimitriou, I.; Goldingay, H.; Bridgwater, A.V. Techno-Economic and Uncertainty Analysis of Biomass to Liquid (BTL) Systems for Transport Fuel Production. Renew. Sustain. Energy Rev. 2018, 88, 160–175. [Google Scholar] [CrossRef]

- Tang, Z.-C.; Xia, Y.; Xue, Q.; Liu, J. A Non-Probabilistic Solution for Uncertainty and Sensitivity Analysis on Techno-Economic Assessments of Biodiesel Production with Interval Uncertainties. Energies 2018, 11, 588. [Google Scholar] [CrossRef]

- Sinha, A.; Thakkar, H.; Rezaei, F.; Kawajiri, Y.; Realff, M.J. Direct Air Capture of CO2 in Enclosed Environments: Design under Uncertainty and Techno-Economic Analysis. In Computer Aided Chemical Engineering; 13 International Symposium on Process Systems Engineering (PSE 2018); Eden, M.R., Ierapetritou, M.G., Towler, G.P., Eds.; Elsevier: Amsterdam, The Netherlands, 2018; Volume 44, pp. 2179–2184. [Google Scholar]

- Baral, N.R.; Quiroz-Arita, C.; Bradley, T.H. Uncertainties in Corn Stover Feedstock Supply Logistics Cost and Life-Cycle Greenhouse Gas Emissions for Butanol Production. Appl. Energy 2017, 208, 1343–1356. [Google Scholar] [CrossRef]

- van der Spek, M.; Ramirez, A.; Faaij, A. Challenges and Uncertainties of Ex Ante Techno-Economic Analysis of Low TRL CO2 Capture Technology: Lessons from a Case Study of an NGCC with Exhaust Gas Recycle and Electric Swing Adsorption. Appl. Energy 2017, 208, 920–934. [Google Scholar] [CrossRef]

- Gonzalez-Garay, A.; Gonzalez-Miquel, M.; Guillen-Gosalbez, G. High-Value Propylene Glycol from Low-Value Biodiesel Glycerol: A Techno-Economic and Environmental Assessment under Uncertainty. ACS Sustain. Chem. Eng. 2017, 5, 5723–5732. [Google Scholar] [CrossRef]

- Xia, Y.; Tang, Z.-C. A Novel Perspective for Techno-Economic Assessments and Effects of Parameters on Techno-Economic Assessments for Biodiesel Production under Economic and Technical Uncertainties. RSC Adv. 2017, 7, 9402–9411. [Google Scholar] [CrossRef]

- van der Spek, M.; Sanchez Fernandez, E.; Eldrup, N.H.; Skagestad, R.; Ramirez, A.; Faaij, A. Unravelling Uncertainty and Variability in Early Stage Techno-Economic Assessments of Carbon Capture Technologies. Int. J. Greenh. Gas Control 2017, 56, 221–236. [Google Scholar] [CrossRef]

| Type | Source | Ref. |

|---|---|---|

| Variability | An unpredictable result of changes in systems (involving time, space, or other variables) | [38] |

| Systematic errors | Bias in sampling procedures or measuring equipment | [38] |

| Measurement error | Errors that appear random due to imperfections in the measurement equipment and observational methods | [38] |

| Random errors | A measurement error caused by varying factors between measurements | Oxford definition |

| Parameter uncertainty | Measurement errors, sampling errors, variability, and surrogate data contribute to incomplete knowledge of parameters | [39] |

| Model uncertainty | Our limitations in representing physical systems may result in uncertainty when we approximate a model in order to solve a problem. | [38] |

| Scenario uncertainty | A level of uncertainty associated with specifying an exposure scenario that is consistent with the purpose and scope of the exposure assessment | [40] |

| Exposure factor Uncertainty | Contributes to the specification of numerical values for human exposure | [40] |

| Uncertainty due to choices | Different choices of partitioning methods, etc. | [41] |

| Spatial variability | The phenomenon occurs when the value of a quantity is different at different spatial locations. A descriptive spatial statistic such as the range can be used to assess spatial variability. | [42] |

| Temporal variability | A measure of the frequency and magnitude of fluctuations in ecosystem structure such as standing stocks of resources and species abundance | [43] |

| Data uncertainty | This type of data contains noise that causes it to deviate from the correct or original values. | [44] |

| Completeness uncertainty | Like modeling uncertainties, completeness uncertainties occur at the beginning of the probabilistic risk analysis process. In probabilistic risk analysis, there is uncertainty as to whether all significant phenomena and significant relationships have been considered. | [45] |

| Aleatory uncertainty | Samples and parameters are intrinsically random | [38] |

| Epistemic uncertainty | An insufficient understanding of fundamental phenomena | [38] |

| Ambiguity | Being open to multiple interpretations | Oxford definition |

| Volitional uncertainty | Whether or not an individual will follow through on an individual’s commitment | [46] |

| Statistical variation | A measure of how widely distributed a group of data is | [47,48] |

| Subjective judgment | A lack of certainty in the interpretation of data or the estimations of experts | [38] |

| Linguistic imprecision | Depends on the utterance alternatives available to the speaker in the context | [49] |

| Inherent randomness | Resulting from the irreducibility of a system to a deterministic system | [38] |

| Disagreement | Lack of consensus or approval, inconsistency or correspondence | Oxford definition |

| Approximation | Nearly accurate but not exactly correct value or quantity | Oxford definition |

| Semantic uncertainty | Occurs when humans give names to things, especially when those things are mapped as geographic data | [50] |

| Interpretational uncertainty | Occurs when interpreters use inconsistent decoding methodologies to extract information from data or models. | Helmholtz dictionary |

| Engineering | 27% |

| Energy | 22% |

| Environmental Science | 19% |

| Chemical Engineering | 7% |

| Chemistry | 5% |

| Earth and Planetary Sciences | 4% |

| Agricultural and Biological Sciences | 3% |

| Materials Science | 2% |

| Physics and Astronomy | 2% |

| Biochemistry, Genetics, and Molecular Biology | 2% |

| Business, Management, and Accounting | 2% |

| Computer Science | 2% |

| Social Sciences | 1% |

| Decision Sciences, Economics and Finance, Mathematics | 1% |

| Techno-economic analysis (TEA) | 33 |

| Life cycle cost analysis (LCCA) | 13 |

| Techno-economic-environmental analysis (TEEA) | 1 |

| Model/Tool | Trials | Application | ||

|---|---|---|---|---|

| 1 | UQ by SPCE | N/A | Uniform | Heavy-duty transport (Bus) |

| 2 | SA By MCS | 1000 | Mostly Uniform and a Triangular | Economic feasibility of cross-laminated timber |

| 3 | MCS | Probability distributions | Biomass gasification | |

| 4 | MCS | 20,000 and 60,000 | Normal, Triangular, Logistic, Scaled beta | Field-grown bioproducts manufacturing |

| 5 | MCS, SA | 100,000 | Normal | Bio-catalyzed biodiesel production |

| 6 | SAA by MCS SA | uniform, normal, and lognormal | Cell-Based Flotation Circuits | |

| 7 | SA, UA by MCS | 10,000 | Normal | Anaerobic digestion of Cuban sugarcane vinasses |

| 8 | MCS, SA | 10,000 | Triangular | Cooking oil to jet fuel production |

| 9 | ScA | N/A | Weibull distribution | Wind energy potential in selected sites |

| 10 | MCS | 10,000 | Normal, Triangular, Logistic, Lognormal, | Wet waste hydrothermal liquefaction (HTL) |

| 11 | MCS, SA | 30,000 | Normal | Biodiesel production from palm kernel oil |

| 12 | MCS | 100,000 | Normal | Technologies for the extraction of crude anthocyanin powder |

| 13 | GABCAO | N/A | N/A | Distribution network |

| 14 | MCS | 50,000 | Two-half-Lognormal | An off-grid stand-alone photovoltaic system for hydrogen electrolysis |

| 15 | Review | N/A | CO2 Capture and Storage (CCS) technologies | |

| 16 | MCS, SA | Biorefineries | ||

| 17 | GSA, MCS, RO by (MCS + GA) | Uniform, Weibull, Beta | Design of remote micro-grid | |

| 18 | MCS, SIM | 10,000 | Normal, | Performances of a CO2 Absorber |

| 19 | MMO | N/A | Enhanced Geothermal System (EGS) | |

| 20 | MOM | N/A | Hybrid harmonic filter planning | |

| 21 | SUA | N/A | Ship power and propulsion concepts | |

| 22 | ScA, SA | N/A | Fuel cell vehicles | |

| 23 | GSA by MCS + SIM | 100,000 | Normal | Directly coupled photovoltaic-electrolyzer system |

| 24 | MCS | 10,000 | Normal, Pareto, Lognormal, Triangular, Maximum extreme | Algal-derived bio-crude via hydrothermal liquefaction |

| 25 | ANN + MCS | Uniform, Normal | Power to gaseoxy-fuel boiler hybrid system | |

| 26 | MCS | 10,000 | Triangular, Boot-strapped, Uniform, Linear | Incorporating microbial oil production into the concept of a biorefinery |

| 27 | MCS, SA, PA | Triangular | A distributed hydrogen refueling station using glycerol steam reforming | |

| 28 | NIPCE | N/A | Directly coupled photovoltaic-electrolyzer system | |

| 29 | GBM, ARIMA, and MRJD | N/A | Normal, | Profitability assessment of offshore wind energy |

| 30 | MCS, SA | 1,000,000 | Normal | Biomass-to-liquid systems for the production of transportation fuels |

| 31 | NLOA, SA | N/A | Interval Uncertainties | Biodiesel Production |

| 32 | NIPCE, MCS | Normal | CO2 capture from enclosed environments | |

| 33 | SA | N/A | Normal, Uniform, Lognormal, Triangular | Butanol production from corn stover |

| 34 | SA | N/A | N/A | Very early stage CO2 capture technologies |

| 35 | SA, PM, MCS | 3000 | Normal, Lognormal | Producing high-value propylene glycol from low-value biodiesel glycerol |

| 36 | MCS, SA | Uniform | biodiesel production | |

| 37 | PM, SA | N/A | Very early stage CO2 capture technologies | |

| 38 | MCS | 1000 | Normal | Gas and electricity network integration and storage |

| Reference | Sources of Uncertainty | |

|---|---|---|

| 1 | [71] | Deterioration, hazards and the hazard responses of assets, costs volatility |

| 4 | [73] | Electricity prices, renewable energy sources, and load uncertainties |

| 5 | [74] | Model parameter and scenario uncertainties |

| 6 | [75] | Measurement sensors which provide the state information; activated dampers, which produce reactive forces and provide additional damping; and controllers, which control actuator outputs based on state measurements. |

| 9 | [76] | Energy price and electrical demand, wind speed |

| 12 | [77] | Capital and operating costs |

| 13 | [2] | |

| 14 | [78] | Uncertainties in the cost calculation |

| 17 | [79] | Energy price and electrical demand |

| 19 | [34] | Review |

| 22 | [80] | Uncertainty in the input data |

| Model/Tool | Trials | Probability Distribution Function | Application | |

|---|---|---|---|---|

| 1 | DNN | N/A | Different PDFs | Infrastructure asset management |

| 2 | SPA by MCS | 100,000 | Uniform | The service life of a viaduct (a bridge) |

| 3 | MCS | Slab track mono-block sleeper system for Indonesian urban metro railway | ||

| 4 | MSO | N/A | Normal, Weibull, Beta | Optimal reinforcement framework for distribution system |

| 5 | MCS, NPB | 1000 | Uniform | HDPE pipe alternatives |

| 6 | MCS | binomial, Uniform | High-performance control systems | |

| 7 | SFA, HOM by MCS | Four-story modern ductile reinforced concrete building in Los Angeles | ||

| 8 | ScA | N/A | Railway turnouts | |

| 9 | MSO | N/A | Normal, Beta, Weibull | Distribution system planning |

| 10 | MCS | Normal, Uniform, Lognormal, Triangular, Weibull | Uncertainty in LCCA | |

| 11 | FOTSE | N/A | Normal, Uniform, Lognormal | Highway bridge structures |

| 12 | ScA | N/A | Lignocellulose biomass solvent liquefaction and sugar fermentation to ethanol | |

| 13 | Review | N/A | Financial variables within the infrastructure | |

| 14 | LIDRA by MCS | Triangular | Green infrastructure | |

| 15 | ScA | N/A | Deep extra heavy oil green field | |

| 16 | MOO with RA | N/A | Normal | Maintenance for bridges |

| 17 | MOO | N/A | Normal | Distribution systems reinforcement |

| 18 | MCS | Normal, Triangular | Buildings’ energy efficiency measures | |

| 19 | Review | N/A | Long-range infrastructure | |

| 20 | MCS | 1000 | Uniform, Lognormal | Pavement industry |

| 21 | SA by MLFD + n-way ANOVA | N/A | Bridge | |

| 22 | PN + MCS | Weibull, Exponential, Lognormal, Normal | Real-time condition monitoring in railways |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Barahmand, Z.; Eikeland, M.S. Techno-Economic and Life Cycle Cost Analysis through the Lens of Uncertainty: A Scoping Review. Sustainability 2022, 14, 12191. https://doi.org/10.3390/su141912191

Barahmand Z, Eikeland MS. Techno-Economic and Life Cycle Cost Analysis through the Lens of Uncertainty: A Scoping Review. Sustainability. 2022; 14(19):12191. https://doi.org/10.3390/su141912191

Chicago/Turabian StyleBarahmand, Zahir, and Marianne S. Eikeland. 2022. "Techno-Economic and Life Cycle Cost Analysis through the Lens of Uncertainty: A Scoping Review" Sustainability 14, no. 19: 12191. https://doi.org/10.3390/su141912191

APA StyleBarahmand, Z., & Eikeland, M. S. (2022). Techno-Economic and Life Cycle Cost Analysis through the Lens of Uncertainty: A Scoping Review. Sustainability, 14(19), 12191. https://doi.org/10.3390/su141912191