Abstract

Carbon emissions trading is a market-based tool for solving environmental issues. This study used a difference-in-differences (DID) approach to estimate China’s carbon trading pilots to reduce PM2.5 concentrations. The results of this quasi-natural experiment show that the carbon trading policy effectively reduces PM2.5 by 2.7 μg/m3. We used a propensity score matching (PSM-DID) method to minimize selection bias to construct a treatment and a control group. The results show the policy effect is robust, with a PM2.5 concentration reduction of 2.6 μg/m3. Furthermore, we employed a series of robustness checks to support our findings, which notably indicate that the effect of carbon trading on reducing PM2.5 differs across regions over the years. The western region of China tends to be the most easily affected region, and the early years of carbon trading show slightly greater reduction effects. Our findings provide valuable policy implications for establishing and promoting carbon trading in China and other countries.

1. Introduction

The Carbon Emissions Trading Scheme (CETS) is market-oriented [1,2] and has become an appealing and increasingly popular tool for regulating carbon emissions [3]. Both the global regional and national carbon markets worldwide are growing rapidly. The primary mechanism behind carbon markets reaching environmental targets depends on price externalities [4], as well as on the incentive to change the behavior of enterprises and individuals [5,6].

In China, the carbon market has made significant progress and has become one of the world’s largest carbon trading systems [7]. China’s carbon trading pilot program started in Shenzhen in 2013, followed by Beijing, Tianjin, Shanghai, Chongqing, Guangdong, Hubei, and Fujian [8]. Regional carbon trading pilots have become the primary market-based environmental policy to reduce carbon emissions. By the end of 2018, the total trading volume of China’s carbon markets had reached 273 million tons, with a total turnover of approximately 782 million USD [9]. Based on the experience of regional carbon trading pilots, China launched a unified national carbon trading scheme and operated trading in July 2022 [10]. However, the current national carbon market is still in its infancy, with only the power sector involved.

Previous studies have constructed a comprehensive analytical framework to estimate the effect of the carbon market on reducing carbon emissions. Some studies applied a difference-in-differences (DID) approach to build a quasi-natural experiment by defining a treatment and a control group based on the status of adopting the carbon trading policy [11,12]. Most studies have documented that carbon trading pilots could help reduce carbon emissions. Generally, their findings imply that carbon markets encourage firms to transition toward using cleaner energies [13,14] and promote technological innovation [6,15]. The current research related to carbon trading can be summarized in the following three aspects.

The first focuses on describing the characteristics of the carbon trading policy. Some studies have reviewed China’s carbon trading market’s process, situation, challenges, and evolving processes [16,17,18]. They provide several suggestions for promoting carbon markets, such as enhancing transparency, improving liquidity, and accelerating the development of professional talent and teams in carbon trading. Some studies summarize the forms of carbon quotas allocation for specific characteristics. They found that the allocation methods will directly affect the carbon trading volumes [19,20,21].

The second important aspect is to evaluate the impact of carbon trading policy on economic effectiveness. One category of analysis focuses on testing the market efficiency of carbon trading policies. Some scholars examined the efficient market hypothesis in the European Union Emissions Trading Scheme (EU ETS) [22]. In contrast, some scholars have tested the efficiency of Chinese carbon trading pilots [23,24]. Based on measurements of market efficiency, some scholars proposed that inefficiency in some carbon trading pilots can be explained by irrational behaviors, poor information transparency, imperfect market mechanisms, and transaction costs [8,9]. Other studies focused on forecasting carbon prices. Some studies developed a novel hybrid framework for carbon price forecasting by considering the significance of multiple influencing factors [25,26].

The third category estimates the effects of reduction on carbon emissions. Some studies have concluded that carbon trading has a considerable impact on reducing carbon emissions [10,13,27] and mitigation costs [28]. However, some scholars suggest that the reduction effect of China’s carbon trading market is weak [29,30]. Since firms are the major participants in carbon trading, some studies have focused on specific sectors at the firm level to estimate the reduction effect [11,31]. Using firm-level data, scholars assessed the effects of carbon trading on carbon emissions using a DID model [5,32]. Regarding carbon neutrality, some studies have constructed indicators to investigate whether carbon trading can improve carbon reduction performance [1,8].

Compared with the significant reduction effects on carbon emissions, the elimination of air pollution has been underestimated. Relative to the direct target of reducing carbon emissions, few studies have explored the impact of the carbon market on reducing PM2.5 concentrations. Consequently, the co-benefits of the carbon market are often underestimated. Thus, the effect on air quality should be an integral part of the carbon market. Heavy polluters tend to decrease the direct use of costly, unacceptably polluting energies in the trading process. Furthermore, for firms with lower abatement costs, carbon trading can boost the application of green technologies because the transformation can create considerable benefits.

In this context, our study constructed a quasi-natural experiment to estimate the effect of carbon trading on PM2.5, and the main contributions of our study are summarized as follows: first, this study provided a new perspective for evaluating the effectiveness of the carbon trading scheme rather than emissions. Previous studies have focused on testing the economic and environmental effectiveness of China’s carbon trading policy, and their conclusions have indicated that the carbon trading policy can significantly reduce carbon emissions. However, few studies have investigated the possibility of the carbon trading policy in reducing PM2.5 concentrations. Second, we used a comparative exogenous approach to identify the impacts of the carbon trading policy. Considering that only some specific cities carried out the carbon trading policy, we employed the DID and propensity score matching DID models to construct a quasi-natural experiment between the treatment and control groups. Such methods can mitigate the endogenous effects of the models and more accurately identify the policy effect. Finally, based on a wide range of city-level historical data from 2007 to 2018, we used yearly PM2.5 concentration data and socioeconomic and meteorological factors to comprehensively examine the policy effect. Our study provides valuable implications for strengthening policy co-benefits and considering policy differences across different regions.

2. Methodology and Data

2.1. Model Specifications

We employed a standard DID model to estimate the effect of the carbon trading policy on PM2.5. The DID model has been widely used in econometric analyses and is an efficient approach for assessing the impact of a specific policy. The basic specification of the DID model was to set the treatment and control groups in a quasi-natural experiment. Rather than other characteristics, the policy is the primary intervention that causes differences between the treatment and control groups. The traditional ordinary least squares (OLS) are prone to endogeneity problems, resulting in biased estimation. Even using instrumental variables to reduce the potential negative impact, finding a suitable instrumental variable is difficult. Although the DID model has obvious advantages in identifying the causal effect, it is sometimes uneasy to find a similar control group since the only difference between the treated and control groups should be exposed to the policy intervention. Compared with other methods, the advantage of the DID model is more evident and it can estimate the effect of a specific intervention or treatment by comparing changes in outcomes over time [33]. Therefore, we set the DID specifications as follows:

where is the prefecture-level city and includes both those implementing and those not implementing the carbon trading policy in China; is the year variable ranging from 2007 to 2018; is the dependent variable of the PM2.5 concentration; is an interaction term that multiplies with , where is an indicator variable that implies whether or not a city implements the carbon trading policy; is a year dummy variable indicating that the will be 1 during the carbon trading policy period, otherwise it will be 0; lastly, is a series of control variables that may affect the PM2.5 concentration, including the population, proportion of secondary industrial added values, share of green land areas, number of industrial firms, per capita GDP, foreign direct investment, annual shine hours, annual average temperature, and annual precipitation. Therefore, the coefficient reports the policy effect of carbon trading on PM2.5. Specifically, if is less than 0, the carbon trading policy can reduce PM2.5; otherwise, it increases PM2.5. Furthermore, we use the city-specific fixed effect to control for all unobservable time-invariant determinants of PM2.5 across cities, while we include the year-fixed effect to control for city trends in PM2.5 during different periods. In addition, is a constant term and is the error term. Standard errors are clustered at the city level to control for the serial correlation of PM2.5 concentration.

2.2. Data Sources

Table 1 summarizes the statistics of the variables between the treatment and control groups. For the dependent variable, we found that the average concentration of PM2.5 in the treatment group was slightly lower than in the control group. With respect to control variables, there is evidence that the treatment and control groups differ in several dimensions. For example, the population is 5.72 million in the treatment group, while it is 4.21 million in the control group. The urban green land area percentage is 39.68% in the treatment group and 38.44% in the control group. In terms of the number of industrial firms and per capita GDP, they are 2291 and 53,430 CNY, respectively, in the treatment group, while the values in the control group are 1151 and 44,930, respectively, in the control group. The foreign direct investment in the treatment group (2.09 billion dollars) is higher than in the control group (0.62 billion dollars). Moreover, the annual shine hours, average temperature, and precipitation are higher in the treatment group than in the control group. For example, these three indicators are 1772 h, 19 °C, and 444 mm.

Table 1.

Summary statistics.

Concerning the seven carbon trading pilots in the treatment group, there are differences in some dimensions. Beijing, Tianjin, Shanghai, and Chongqing are the municipalities that are directly under the central government, which enjoys greater political advantages. The economic development levels among carbon trading cities are different, for example, the per capita GDP in Shenzhen (189,568 CNY), Guangzhou (155,491 CNY), Beijing (150,962 CNY), Shanghai (145,767 CNY), Chongqing (68,460 CNY) are higher than other cities in 2018. Correspondingly, these big cities have larger populations than other cities. For example, the populations were 21.54 million in Beijing and 24.75 million in Shanghai in 2018, while 11.08 million in Wuhan and 10.43 million in Dongguan. To eliminate the impacts of these differences, we treated these social-economic factors as control variables in the model.

The PM2.5 data were collected from the China National Urban Air Quality Real-time Publishing Platform. The datasets of the dependent variables (, , , , , ) were obtained from the City Statistical Yearbook. Furthermore, we collected data on sunshine, average temperature, and precipitation from the Public Weather Forecast “2345” Platform.

3. Results and Discussions

3.1. Effect of Reducing PM2.5

Table 2 presents the formal tests by reporting the coefficients estimated from the DID model. In Panel A, column (1) shows the estimated effect of implementing the carbon trading policy with a series of control variables without fixed effects. PM2.5 declined by 5.3 μg/m3, indicating that the carbon trading policy can effectively reduce the PM2.5 concentrations. Column (2) reports that the PM2.5 declines are statistically significant by 6.2 μg/m3 when a series of controls and city-fixed effects are included. Furthermore, the regressions in column (3) confirm that the carbon trading policy is strongly associated with reducing PM2.5. However, the year-fixed effect in column (3) indicates that after controlling for unobservable factors over the years, the estimated coefficient of the carbon trading policy can reduce PM2.5 by 2.7 μg/m3.

Table 2.

The effect of carbon trading on the reduction of PM2.5 concentrations.

3.2. Parallel Trend Test

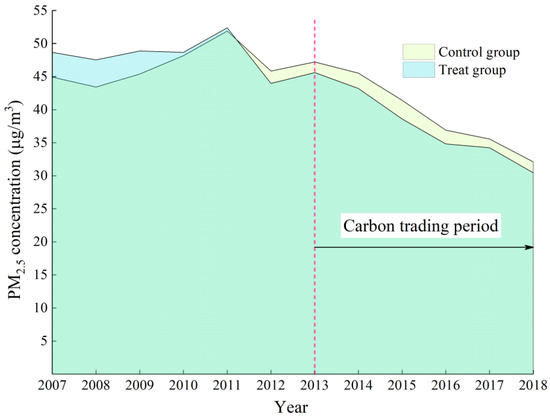

A parallel trend is a prerequisite for the reliability of the DID strategy. The basic assumption of the parallel trend is that there were no systematic differences between the treatment and control groups before the policy. We plotted the PM2.5 concentrations before and after implementing the carbon trading policy. The dashed vertical line in Figure 1 is the year when the carbon trading policy started, and we found that PM2.5 in the treatment group tended to be higher than that in the control group in most years before 2013; however, PM2.5 in the treatment group showed a decreasing trend after policy implementation. Therefore, Figure 1 provides evidence that the parallel trend assumption is satisfied in the quasi-natural experiment.

Figure 1.

PM2.5 concentrations before and after the initiation of carbon trading.

3.3. Placebo Test

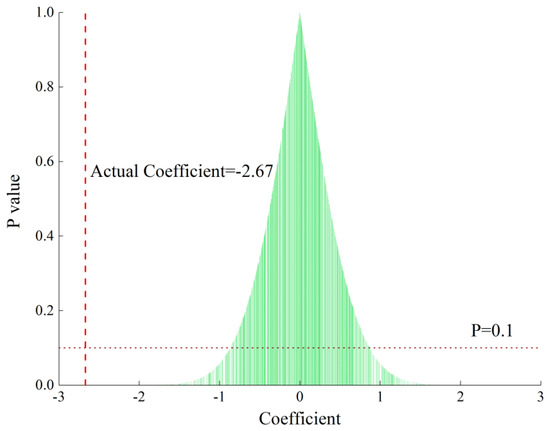

Our concern with the DID model framework is that other potential changes could drive the PM2.5 concentration. We created a placebo test by randomly selecting a sample from the treatment group. We then estimated a regression that included city and year-fixed effects. We repeated the exercise 1000 times and obtained the coefficients of the impact of the carbon trading policy on PM2.5. Figure 2 shows the estimates of the placebo test, and the dashed vertical line represents the actual coefficient obtained by using the actual treatment samples. We find that the true coefficient is far from the random regression results. The falsification exercise suggests that other potential changes did not drive our results.

Figure 2.

Placebo test for randomly selecting the samples.

3.4. Robustness Test

3.4.1. PSM-DID

Balance Test

For econometric analysis, we divided the factors that affect the PM2.5 concentrations into observable and unobservable characteristics. Although we included all possible observable factors in our DID model, some unobservable factors may still lead to bias in the estimated coefficients. The propensity score matching (PSM) approach is an efficient method for reducing endogeneity. First, we selected a series of covariates and used a logit model to estimate the propensity score for each observation. Second, we applied the calliper nearest neighbor matching approach to match each observation in the treatment group with observations in the control group based on the propensity scores. Finally, we estimated the coefficients of carbon trading on PM2.5 using the matched samples.

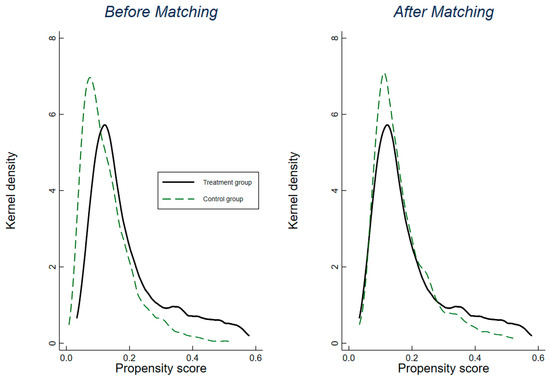

Before using the matched samples, we employed a balance test to evaluate the appropriateness of the treatment and control groups. Three approaches were used. The first measures the deviation of the normalized means for the covariates in the treatment and control groups. Figure S1 (Supplementary Materials) shows the standardized bias across covariates between the matched and unmatched observations. We found that the standardized bias of all covariates was less than 10% and negligible in the matched sample, suggesting that the matching process was effective. We then compared the common support to ensure sufficient overlap in the characteristics of the treatment and untreated units. The results in Figure S2 (Supplementary Materials) show that most of the observations in the treatment and untreated groups fall in the area of common support. Furthermore, we plotted a kernel density figure to test the differences between the matched treatment and control groups. The results suggest that the curve of the treatment group becomes close to the control group after matching (Figure 3). In conclusion, all three methods implied that the treatment and control groups were appropriately matched.

Figure 3.

Kernel density distribution before and after matching between treat and control groups. Notes: The logarithmic forms of the covariates were used when plotting.

Results of the PSM-DID Regression

We obtained the results of the PSM-DID regression. Table 2 (Panel B) provides the estimated coefficients of carbon trading on PM2.5 with different matching ratios. In Panel B, column (1) shows that when matching one treated observation with two untreated observations, PM2.5 would reduce by 2.6 μg/m3, comparable to the estimates in Panel A. In contrast, Panel B in Table 2 reports that the results were robust when we estimated the matching ratio of one to three and one to five.

3.4.2. Logarithmic Form of PM2.5

We provided the logarithmic form of PM2.5 to test the robustness of the estimation. To maintain the consistency of all variables, we adopted the logarithmic form of all positive variables. As shown in Table S1 (Supplementary Materials), column (1) reports that the carbon trading policy led to a 9.5% decrease in PM2.5. The results obtained by running the logarithmic form regression are consistent with those in the level form, further confirming the robustness of our estimations.

3.4.3. Winsorization Panels

Extreme values in the panel may bias the results and lead to incorrect estimations. Winsorization is an effective way to increase the credibility of statistical inferences. We winsorized the extreme values of each variable before estimating the DID model by replacing extreme values at two-sided thresholds. The thresholds were defined as the top 95% and bottom 5% data points. Column (2) in Table S1 (Supplementary Materials) shows that PM2.5 declined by 3.1 μg/m3 after implementing the carbon trading policy. The results estimated were very close to the estimates in column (3) of Table 2, implying that extreme values did not drive our results.

3.5. Heterogeneity Test

3.5.1. Heterogeneous Effects across Regions

To address the potential differences across regions, we divided the sample into groups based on geographical and economic characteristics, including the eastern, middle, and western regions. We interacted with the region dummy variable (Eastregion, Middleregion, and Westregion) with the carbon trading policy variable (ctspost). We found that the western region was the most easily affected by the carbon trading policy, with a PM2.5 reduction of 8.5 μg/m3 when controlling for the city and year-fixed effects in Panel A in Table 3. The middle region displayed a moderate impact caused by carbon trading, with a PM2.5 decrease of 5.0 μg/m3. In contrast, the coefficient for the eastern region was also statistically significant. Nevertheless, the reduction magnitude was smaller, with a 1.3 μg/m3 reduction in PM2.5.

Table 3.

Heterogeneous effect of carbon trading across regions.

3.5.2. Heterogeneous Effects over Years

To investigate yearly differences, we interacted with the variables of the year with carbon trading in the DID model. Panel B in Table 3 reports the coefficients modeled for the yearly heterogeneous effects. We found that the carbon trading policy could reduce PM2.5 annually and showed slightly greater reduction effects on PM2.5 in the first three years. Results indicate that when controlling for the city and year-fixed effects, the PM2.5 decreased by 2.2 μg/m3, 2.9 μg/m3, and 3.6 μg/m3 in 2013, 2014, and 2015, respectively. In contrast, the carbon trading policy reduced PM2.5 over the subsequent years, decreasing by 2.0 μg/m3, 2.1 μg/m3, and 3.1 μg/m3 in 2016, 2017, and 2018, respectively, when the city and year fixed effects were controlled. Our estimations imply that the overall reduction effects are stable, although they vary slightly over time.

3.6. Discussion

Numerous studies have demonstrated that the carbon market plays an important role in reducing carbon emissions in many countries. However, existing studies have mainly focused on the impact of the carbon market on reducing carbon emissions while ignoring the implications for air pollution control. In this context, this study investigated the potential impact of the carbon market on air quality. We adopted a DID approach to test the environmental effects of seven Chinese carbon trading pilots.

Our study indicates that the carbon trading policy in China not only succeeds in promoting carbon mitigation but can also significantly reduce PM2.5 concentrations. The empirical analysis reports that when controlling for year and city-fixed effects, PM2.5 concentrations can be reduced by 2.7 μg/m3, implying that the carbon trading policy effectively improves air quality. Compared with the other relevant studies currently, our findings provide further evidence supporting the co-benefits of the carbon market. Some scholars used monthly PM2.5 concentrations and weather data for 297 Chinese cities from January 2005 to December 2017, and their findings suggest that China’s carbon trading scheme can reduce PM2.5 concentrations by 4.8% [34]. In contrast, some scholars found that China’s carbon trading pilots lowered haze concentration and SO2 emissions by 0.933 μg/m3 and 0.7452 tons, respectively [35]. Overall, our findings are highly consistent with these studies but differ slightly in the magnitude of the reduction, mainly due to differences in research samples, periods, and empirical design.

Compared to other air pollution control policies, the carbon trading policy can also effectively reduce air pollutants. The Chinese government has adopted a series of policies to combat severe air pollution. For example, scholars have investigated the effectiveness of the clean winter heating policy in China [33,36]. Some scholars estimated that the net treatment effect of the clean winter heating policy would alleviate 3.4 μg/m3 of PM2.5 concentrations, the reduction effect of which is close to the carbon trading observed in this study [37]. Unlike cleaner heating policies [38], the carbon trading policy aims to promote energy transformation and green technology innovation to achieve reduction targets [39,40]. In our study, we used a sample that covers the year from 2007 to 2018 to estimate the effect of the carbon trading policy on reducing PM2.5. We chose five to six years before and after the carbon trading implementation year (2013) to provide a more comprehensive comparison. For the carbon trading pilots, the market-oriented policy has never been used before the carbon trading policy, and the environmental regulations pushed by the local governments were regarded as the primary policy in improving environmental quality. Therefore, implementing the carbon trading policy drives some enterprises to reduce their marginal costs of carbon emission mitigation through green technological innovation.

Unlike coercive government regulatory policies, carbon trading is a market-based system that uses a price mechanism to reduce carbon emissions. The carbon trading price reflects firms’ marginal cost of emissions [41], which encourages carbon trading among firms with different emission reduction costs. Specifically, if a firm has a low emission reduction cost and surplus carbon quota, it can trade with firms with high costs and an insufficient carbon quota in the market. This trading helps firms meet their emission reduction targets at the lowest cost. Therefore, China’s carbon trading pilots and the ongoing national carbon market are expected to play an expanding role in improving air quality.

4. Conclusions

This study investigated the environmental effects of China’s carbon trading pilots on PM2.5 concentrations. We constructed a quasi-natural experiment based on the adoption status of the carbon trading policy. In the empirical design, we defined cities implementing carbon trading as a treatment and others as a control group and tested air pollution reduction effects using a DID model. Our estimations indicate that the carbon trading policy effectively reduced PM2.5 concentrations by 2.7 μg/m3 after controlling for a series of years and city-fixed effects. The parallel trend test, placebo check, PSM-DID estimate, and other robustness tests support our findings. Furthermore, we examined the heterogeneity of carbon trading policies. Heterogeneous tests imply that carbon trading on PM2.5 concentrations differs across regions over the years. Specifically, the western region of China tends to be the most easily affected, and the early years of carbon trading show slightly increasing reduction effects.

Our findings provide insightful policy value for China and other countries. The carbon trading policy has proven efficient in reducing carbon emissions and air pollution. However, the role of carbon markets in reducing air pollutants has long been underestimated. Because developing countries face the dual task of improving air quality and reducing carbon emissions, carbon markets can be a crucial means of achieving coordinated effects. Therefore, we suggest that more countries explore establishing a carbon trading system. Specifically, governments should form reasonable carbon prices to enhance the vitality of carbon markets and establish a normative supervision system to guide the market. Considering the unbalanced development, China’s carbon quota should be inclined to the less developed regions to support their development. For heavy pollution industries, we suggest governments use the measures of carbon quota and price to restrict their development. As China’s national carbon market accelerates, the Chinese government should ensure that the carbon trading pilots are aligned with the national carbon market to achieve the long-term targets of air pollution control.

Further studies should focus on revealing the micro-mechanisms of the carbon market. If firm-level carbon trading data are available in the future, we hope to identify the behavioral characteristics of the firms involved in carbon trading. In addition to examining firms’ responses to the carbon market, we would also aim to examine the impact of the carbon price and trading scale on air pollution control. Furthermore, we plan to explore the impact of the national carbon market on collaborative mitigation when data are available and provide more targeted policy suggestions.

Supplementary Materials

The following supporting information can be downloaded at: https://www.mdpi.com/article/10.3390/ijerph192316208/s1, Figure S1: Standardized % bias across covariates between unmatched and matched observations. Figure S2: Common support between treated and untreated observations; Table S1: Robustness of the effects of carbon trading in reducing PM2.5 concentrations.

Author Contributions

Conceptualization, writing—review, and editing, Z.W.; supervision, C.C.; validation, Y.X.; review, H.M. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the Beijing Social Science Foundation (21GLC062).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Chen, X.; Lin, B. Towards carbon neutrality by implementing carbon emissions trading scheme: Policy evaluation in China. Energy Policy 2021, 157, 112510. [Google Scholar] [CrossRef]

- Ouyang, X.; Fang, X.; Cao, Y.; Sun, C. Factors behind CO2 emission reduction in Chinese heavy industries: Do environmental regulations matter? Energy Policy 2020, 145, 111765. [Google Scholar] [CrossRef]

- Bayer, P.; Aklin, M. The European Union emissions trading system reduced CO2 emissions despite low prices. Proc. Natl. Acad. Sci. USA 2020, 117, 8804–8812. [Google Scholar] [CrossRef] [PubMed]

- Lin, B.; Jia, Z. Impacts of carbon price level in carbon emission trading market. Appl. Energy 2019, 239, 157–170. [Google Scholar] [CrossRef]

- Cui, J.; Wang, C.; Zhang, J.; Zheng, Y. The effectiveness of China’s regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. 2021, 118, e2109912118. [Google Scholar] [CrossRef]

- Hu, J.; Pan, X.; Huang, Q. Quantity or quality? The impacts of environmental regulation on firms’ innovation–Quasi-natural experiment based on China’s carbon emissions trading pilot. Technol. Forecast. Soc. Change 2020, 158, 120122. [Google Scholar] [CrossRef]

- Sun, X.; Fang, W.; Gao, X.; An, H.; Liu, S.; Wu, T.; Beladi, H.; Chen, C. Complex causalities between the carbon market and the stock markets for energy intensive industries in China. Int. Rev. Econ. Financ. 2022, 78, 404–417. [Google Scholar] [CrossRef]

- Wang, X.Q.; Su, C.W.; Lobon, O.R.; Li, H.; Nicoleta-Claudia, M. Is China’s carbon trading market efficient? Evidence from emissions trading scheme pilots. Energy 2022, 245, 123240. [Google Scholar] [CrossRef]

- Ren, X.; Zhang, D.; Zhu, L.; Han, L. How do carbon prices react to regulatory announcements in China? A genetic algorithm with overlapping events. J. Clean. Prod. 2020, 277, 122644. [Google Scholar] [CrossRef]

- Chai, S.; Sun, R.; Zhang, K.; Ding, Y.; Wei, W. Is Emissions Trading Scheme (ETS) an Effective Market-Incentivized Environmental Regulation Policy? Evidence from China’s Eight ETS Pilots. Int. J. Environ. Res. Public Health 2022, 19, 3177. [Google Scholar] [CrossRef]

- Zhang, Y.; Li, S.; Luo, T.; Gao, J. The effect of emission trading policy on carbon emission reduction: Evidence from an integrated study of pilot regions in China. J. Clean. Prod. 2020, 265, 121843. [Google Scholar] [CrossRef]

- Zhou, B.; Zhang, C.; Song, H.; Wang, Q. How does emission trading reduce China’s carbon intensity? An exploration using a decomposition and difference-in-differences approach. Sci. Total Environ. 2019, 676, 514–523. [Google Scholar] [CrossRef] [PubMed]

- Xuan, D.; Ma, X.; Shang, Y. Can China’s policy of carbon emission trading promote carbon emission reduction? J. Clean. Prod. 2020, 270, 122383. [Google Scholar] [CrossRef]

- Zhang, J.; Wang, Z.; Du, X. Lessons learned from China’s regional carbon market pilots. Econ. Energy Environ. Policy 2017, 6, 19–38. [Google Scholar] [CrossRef]

- Wang, H.; Chen, Z.; Wu, X.; Nie, X. Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis?—Empirical analysis based on the PSM-DID method. Energy Policy 2019, 129, 930–938. [Google Scholar] [CrossRef]

- Weng, Q.; Xu, H. A review of China’s carbon trading market. Renew. Sustain. Energy Rev. 2018, 91, 613–619. [Google Scholar] [CrossRef]

- Zhang, Z. Carbon emissions trading in China: The evolution from pilots to a nationwide scheme. Climate Policy 2015, 15, S104–S126. [Google Scholar] [CrossRef]

- Zhou, K.; Li, Y. Carbon finance and carbon market in China: Progress and challenges. J. Clean. Prod. 2019, 214, 536–549. [Google Scholar] [CrossRef]

- Chi, Y.Y.; Zhao, H.; Hu, Y.; Yuan, Y.K.; Pang, Y.X. The impact of allocation methods on carbon emission trading under electricity marketization reform in China: A system dynamics analysis. Energy 2022, 259, 125034. [Google Scholar] [CrossRef]

- Han, R.; Yu, B.-Y.; Tang, B.-J.; Liao, H.; Wei, Y.-M. Carbon emissions quotas in the Chinese road transport sector: A carbon trading perspective. Energy Policy 2017, 106, 298–309. [Google Scholar] [CrossRef]

- Shi, B.; Li, N.; Gao, Q.; Li, G. Market incentives, carbon quota allocation and carbon emission reduction: Evidence from China’s carbon trading pilot policy. J. Environ. Manag. 2022, 319, 115650. [Google Scholar] [CrossRef] [PubMed]

- Montagnoli, A.; De Vries, F.P. Carbon trading thickness and market efficiency. Energy Econ. 2010, 32, 1331–1336. [Google Scholar] [CrossRef]

- Zhao, X.G.; Jiang, G.W.; Nie, D.; Chen, H. How to improve the market efficiency of carbon trading: A perspective of China. Renew. Sustain. Energy Rev. 2016, 59, 1229–1245. [Google Scholar] [CrossRef]

- Zhao, X.-g.; Wu, L.; Li, A. Research on the efficiency of carbon trading market in China. Renew. Sustain. Energy Rev. 2017, 79, 1–8. [Google Scholar] [CrossRef]

- Hao, Y.; Tian, C. A hybrid framework for carbon trading price forecasting: The role of multiple influence factor. J. Clean. Prod. 2020, 262, 120378. [Google Scholar] [CrossRef]

- Zhao, L.-T.; Miao, J.; Qu, S.; Chen, X.-H. A multi-factor integrated model for carbon price forecasting: Market interaction promoting carbon emission reduction. Sci. Total Environ. 2021, 796, 149110. [Google Scholar] [CrossRef]

- Dong, F.; Dai, Y.; Zhang, S.; Zhang, X.; Long, R. Can a carbon emission trading scheme generate the Porter effect? Evidence from pilot areas in China. Sci. Total Environ. 2019, 653, 565–577. [Google Scholar] [CrossRef]

- Yu, X.; Lo, A.Y. Carbon finance and the carbon market in China. Nat. Clim. Change 2015, 5, 15–16. [Google Scholar] [CrossRef]

- Tang, K.; Zhou, Y.; Liang, X.; Zhou, D. The effectiveness and heterogeneity of carbon emissions trading scheme in China. Environ. Sci. Pollut. Res. 2021, 28, 17306–17318. [Google Scholar] [CrossRef]

- Zhang, W.; Li, J.; Li, G.; Guo, S. Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China. Energy 2020, 196, 117117. [Google Scholar] [CrossRef]

- Shen, J.; Tang, P.; Zeng, H. Does China’s carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy Sustain. Dev. 2020, 59, 120–129. [Google Scholar] [CrossRef]

- Guo, J.; Gu, F.; Liu, Y.; Liang, X.; Mo, J.; Fan, Y. Assessing the impact of ETS trading profit on emission abatements based on firm-level transactions. Nat. Commun. 2020, 11, 2078. [Google Scholar] [CrossRef] [PubMed]

- Weng, Z.; Wang, Y.; Yang, X.; Cheng, C.; Tan, X.; Shi, L. Effect of cleaner residential heating policy on air pollution: A case study in Shandong Province, China. J. Environ. Manag. 2022, 311, 114847. [Google Scholar] [CrossRef] [PubMed]

- Liu, J.Y.; Woodward, R.T.; Zhang, Y.J. Has Carbon Emissions Trading Reduced PM2.5 in China? Environ. Sci. Technol. 2021, 55, 6631–6643. [Google Scholar] [CrossRef] [PubMed]

- Yan, Y.; Zhang, X.; Zhang, J.; Li, K. Emissions trading system (ETS) implementation and its collaborative governance effects on air pollution: The China story. Energy Policy 2020, 138, 111282. [Google Scholar] [CrossRef]

- Li, B.; Sun, Y.; Zheng, W.; Zhang, H.; Wang, Y. Evaluating the role of clean heating technologies in rural areas in improving the air quality. Appl. Energy 2021, 289, 116693. [Google Scholar] [CrossRef]

- Weng, Z.; Han, E.; Wu, Y.; Shi, L.; Ma, Z.; Liu, T. Environmental and economic impacts of transitioning to cleaner heating in Northern China. Resour. Conserv. Recycl. 2021, 172, 105673. [Google Scholar] [CrossRef]

- Chen, Z.; Tan, Y.; Xu, J. Economic and environmental impacts of the coal-to-gas policy on households: Evidence from China. J. Clean. Prod. 2022, 341, 130608. [Google Scholar] [CrossRef]

- Xie, L.; Zhou, Z.; Hui, S. Does environmental regulation improve the structure of power generation technology? Evidence from China’s pilot policy on the carbon emissions trading market (CETM). Technol. Forecast. Soc. Change 2022, 176, 121428. [Google Scholar] [CrossRef]

- Zhang, W.; Li, G.; Guo, F. Does carbon emissions trading promote green technology innovation in China? Applied Energy 2022, 315, 119012. [Google Scholar] [CrossRef]

- Wu, Q.; Wang, Y. How does carbon emission price stimulate enterprises’ total factor productivity? Insights from China’s emission trading scheme pilots. Energy Econ. 2022, 109, 105990. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).