Social Policy Responses to the Covid-19 Crisis in China in 2020

Abstract

1. Introduction

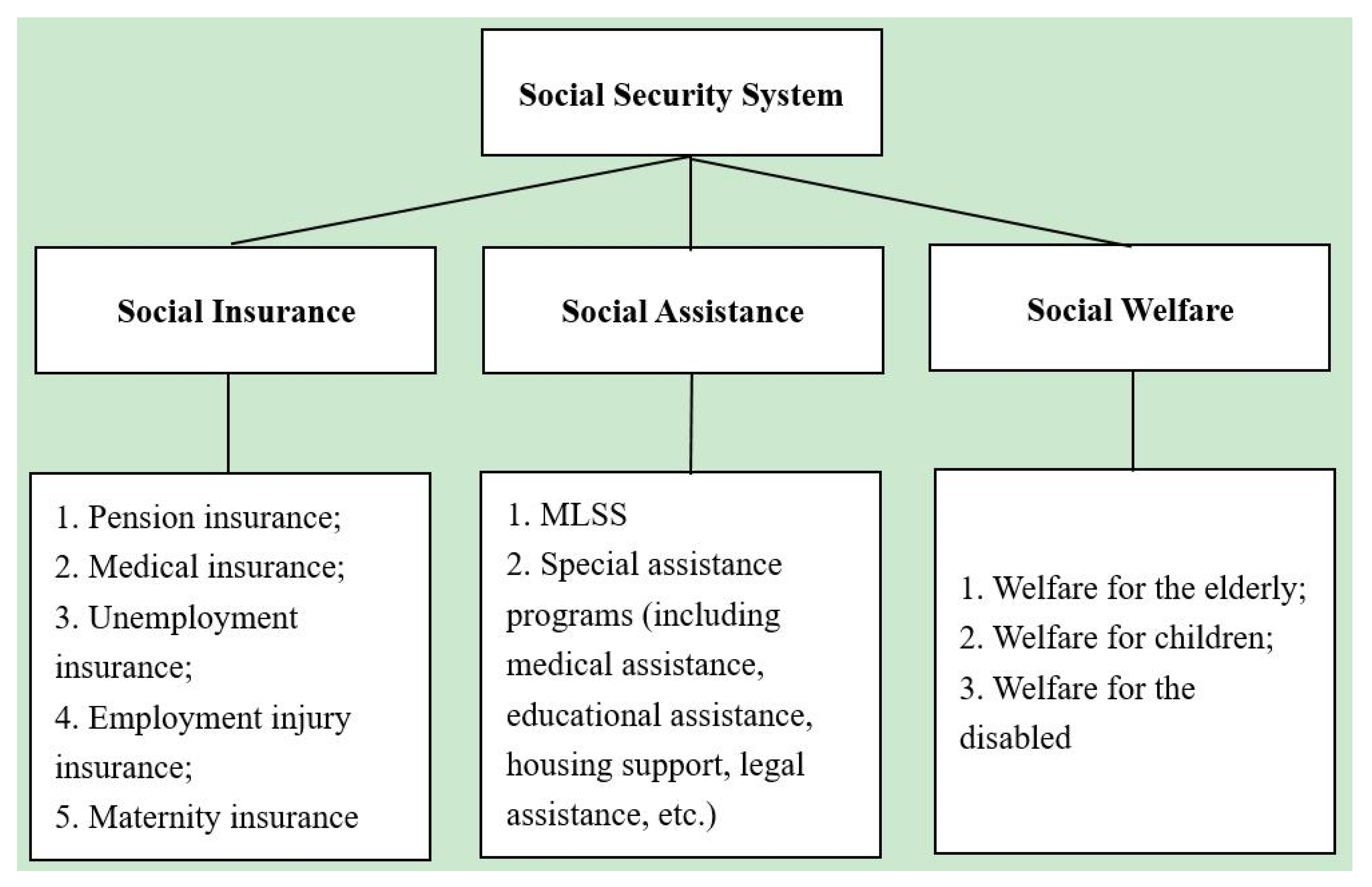

2. Analytical Framework: Crisis-Related Social Policy and Social Protection

3. Findings

3.1. Unemployment Insurance: Functions Must Be Improved and Beneficiaries Must Be Expanded

3.2. Welfare Organizations: Closed Management Has Mixed Advantages and Disadvantages, and a Social Compensation System Must Be Established Urgently

3.3. Social Insurance: The System Designed to Deal with Risks Faces New Risks and Challenges

3.3.1. Medical Insurance and Related Policies: Programs That Bear the Brunt

3.3.2. Employment Injury Insurance and Unemployment Insurance: Social Protection Policies That Played an Active Role

3.4. Social Assistance: Abolishing the Restrictions on Household Registration and Enriching the Form of Payment

3.5. Socio-Technical Adjustments and Digitalization: Performance-Enhancing Factors

4. Discussion

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Cheng, Y.; Yu, J.; Shen, Y.; Huang, B. Coproducing responses to COVID-19 with community-Based organizations: Lessons from Zhejiang province, China. Public Adm. Rev. 2020. [Google Scholar] [CrossRef]

- Cai, F.; Du, Y. The social protection system in ageing China. Asian Econ. Policy Rev. 2015, 10, 250–270. [Google Scholar] [CrossRef]

- Zhang, H. China’s social assistance: In need of closer coordination. Int. J. Sociol. Soc. Policy 2009, 29, 227–236. [Google Scholar] [CrossRef]

- Marshall, T.H. Citizenship and Social Class and Other Essays; Cambridge University Press: Cambridge, UK, 1950. [Google Scholar]

- Alber, J. Vom Armenhaus zum Wohlfahrtsstaat: Analysen zur Entwicklung der Sozialversicherung in Westeuropa; Campus: Frankfurt am Main, Germany, 1982. [Google Scholar]

- Esping-Andersen, G. The Three Worlds of Welfare Capitalism; Princeton University Press: Princeton, NJ, USA, 1990. [Google Scholar]

- Kaufmann, F.X. Herausforderungen des Sozialstaates; Campus: Frankfurt am Main, Germany, 1997. [Google Scholar]

- Gough, I. The Political Economy of the Welfare State; Macmillan Education LTD: London, UK, 1979. [Google Scholar]

- Loosemore, M. A grounded theory of construction crisis management. Constr. Manag. Econ. 1999, 17, 9–19. [Google Scholar] [CrossRef]

- Topper, B.; Lagadec, P. Fractal crises—A new path for crisis theory and management. J. Contingencies Crisis Manag. 2013, 21, 4–16. [Google Scholar] [CrossRef]

- Zylan, Y.; Soule, S.A. Ending welfare as we know it (again): Welfare state retrenchment, 1989–1995. Soc. Forces 2000, 79, 623–652. [Google Scholar] [CrossRef]

- Pierson, P. Dismantling the Welfare State? Reagan, Thatcher and the Politics of Retrenchment; Cambridge University Press: Cambridge, UK, 1994. [Google Scholar]

- Dahrendorf, R. Toward a theory of social conflict. J. Confl. Resolut. 1958, 2, 170–183. [Google Scholar] [CrossRef]

- Berkowitz, E.D.; Berkowitz, E.D. America’s Welfare State: From Roosevelt to Reagan; The Johns Hopkins University Press: Baltimore, MD, USA, 1991. [Google Scholar]

- Hort, S.O.; Kuhnle, S. The coming of East and South-East Asian welfare states. J. Eur. Soc. Policy 2000, 10, 162–184. [Google Scholar] [CrossRef]

- Kwon, S.; Holliday, I. The Korean welfare state: A paradox of expansion in an era of globalisation and economic crisis. Int. J. Soc. Welf. 2007, 16, 242–248. [Google Scholar] [CrossRef]

- Aikins, S. Global financial crisis and government intervention: A case for effective regulatory governance. Int. Public Manag. Rev. 2009, 10, 23–43. [Google Scholar]

- Kotz, D.M. The financial and economic crisis of 2008: A systemic crisis of neoliberal capitalism. Rev. Radic. Political Econ. 2009, 41, 305–317. [Google Scholar] [CrossRef]

- Wang, Z. Impact of COVID-19 on China’s employment protection and social security system. China Ind. Econ. 2020, 3, 7–15. [Google Scholar]

- Ministry of Human Resources and Social Security. Accelerate the Implementation of Periodic Tax and Fee Reduction to Stabilize Employment; Ministry of Human Resources and Social Security: Beijing, China, 2020. Available online: http://www.mohrss.gov.cn/SYrlzyhshbzb/dongtaixinwen/buneiyaowen/202003/t20200326_363672.html (accessed on 5 April 2020).

- Guo, J. How to Revive 600 Billion Unemployment Insurance Funds with the Benefit Rate has been Declining for Ten Years? Available online: https://finance.sina.cn/2020-04-01/detail-iimxxsth2963719.d.html?from=wap (accessed on 8 May 2020).

- Zhu, M. Evolution Mechanism of Safety Accidents and Rule of Law Path of Risk Management and Control in Old-age Care Institutions. Soc. Secur. Stud. 2020, 3, 67–74. [Google Scholar]

- Ma, H. 12 Confirmed COVID-19 and 1 death in Wuhan Social Welfare Home. The Beijing News. 21 February 2020. Available online: http://finance.sina.com.cn/wm/2020-02-21/doc-iimxxstf3402748.shtml (accessed on 15 April 2020).

- Ministry of Civil Affairs. Epidemic Prevention and Control and Livelihood Security in Civil Affairs. China News. 8 March 2020. Available online: http://www.chinanews.com/shipin/spfts/20200308/2619.shtml (accessed on 15 April 2020).

- National Healthcare Security Administration. The Per-Capita Medical Cost of Patients with Severe COVID-19 Exceeds 150000 Yuan, Being Reimbursed in Accordance with Regulations; National Healthcare Security Administration: Beijing, China, 2020. Available online: http://www.ccdi.gov.cn/yaowen/202004/t20200411_215163.html (accessed on 25 April 2020).

- Zheng, G.; Gui, Y. Reform and high-quality development of the medical security system with Chinese characteristics. Acad. Res. 2020, 4, 79–86. [Google Scholar]

- Zheng, B.; Chen, G. Social security fee reduction from the perspective of “tax wedge”: Fighting the epidemic and long-term reform. Tax. Res. 2020, 4, 5–13. [Google Scholar]

- National Health Commission. Care for the Health of Medical Staff and Improve Working Conditions; National Health Commission: Beijing, China, 2020. Available online: http://www.gov.cn/xinwen/2020-02/14/content_5478988.htm (accessed on 20 April 2020).

- Lin, M. Theoretical and policy focus of relative poverty: Establishing a governance system for relative poverty in China. Chin. Soc. Secur. Rev. 2020, 1, 85–92. [Google Scholar]

- Wuhan Red Cross Society. Public Announcement of Receiving Social Donation No.72; Wuhan Red Cross Society: Wuhan, China, 2020. Available online: http://www.wuhanrc.org.cn/info/1003/3144.htm (accessed on 15 May 2020).

- Zhang, H. Innovation and development of national emergency management institution and mechanism in the New Era. Frontiers 2019, 5, 4–15. [Google Scholar]

- Lake, R.W. Bring back big government. Int. J. Urban Reg. Res. 2002, 4, 815–822. [Google Scholar] [CrossRef]

- Beck, U. From industrial society to the risk society: Questions of survival, social structure and ecological enlightenment. Theory Cult. Soc. 1992, 9, 97–123. [Google Scholar] [CrossRef]

- Sachs, J.D. Crossing the valley of tears in East European reform. Challenge 1991, 34, 26–34. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Lu, Q.; Cai, Z.; Chen, B.; Liu, T. Social Policy Responses to the Covid-19 Crisis in China in 2020. Int. J. Environ. Res. Public Health 2020, 17, 5896. https://doi.org/10.3390/ijerph17165896

Lu Q, Cai Z, Chen B, Liu T. Social Policy Responses to the Covid-19 Crisis in China in 2020. International Journal of Environmental Research and Public Health. 2020; 17(16):5896. https://doi.org/10.3390/ijerph17165896

Chicago/Turabian StyleLu, Quan, Zehao Cai, Bin Chen, and Tao Liu. 2020. "Social Policy Responses to the Covid-19 Crisis in China in 2020" International Journal of Environmental Research and Public Health 17, no. 16: 5896. https://doi.org/10.3390/ijerph17165896

APA StyleLu, Q., Cai, Z., Chen, B., & Liu, T. (2020). Social Policy Responses to the Covid-19 Crisis in China in 2020. International Journal of Environmental Research and Public Health, 17(16), 5896. https://doi.org/10.3390/ijerph17165896