Information Theory Quantifiers in Cryptocurrency Time Series Analysis

Abstract

1. Introduction

2. Materials and Methods

2.1. Ordinal Patterns

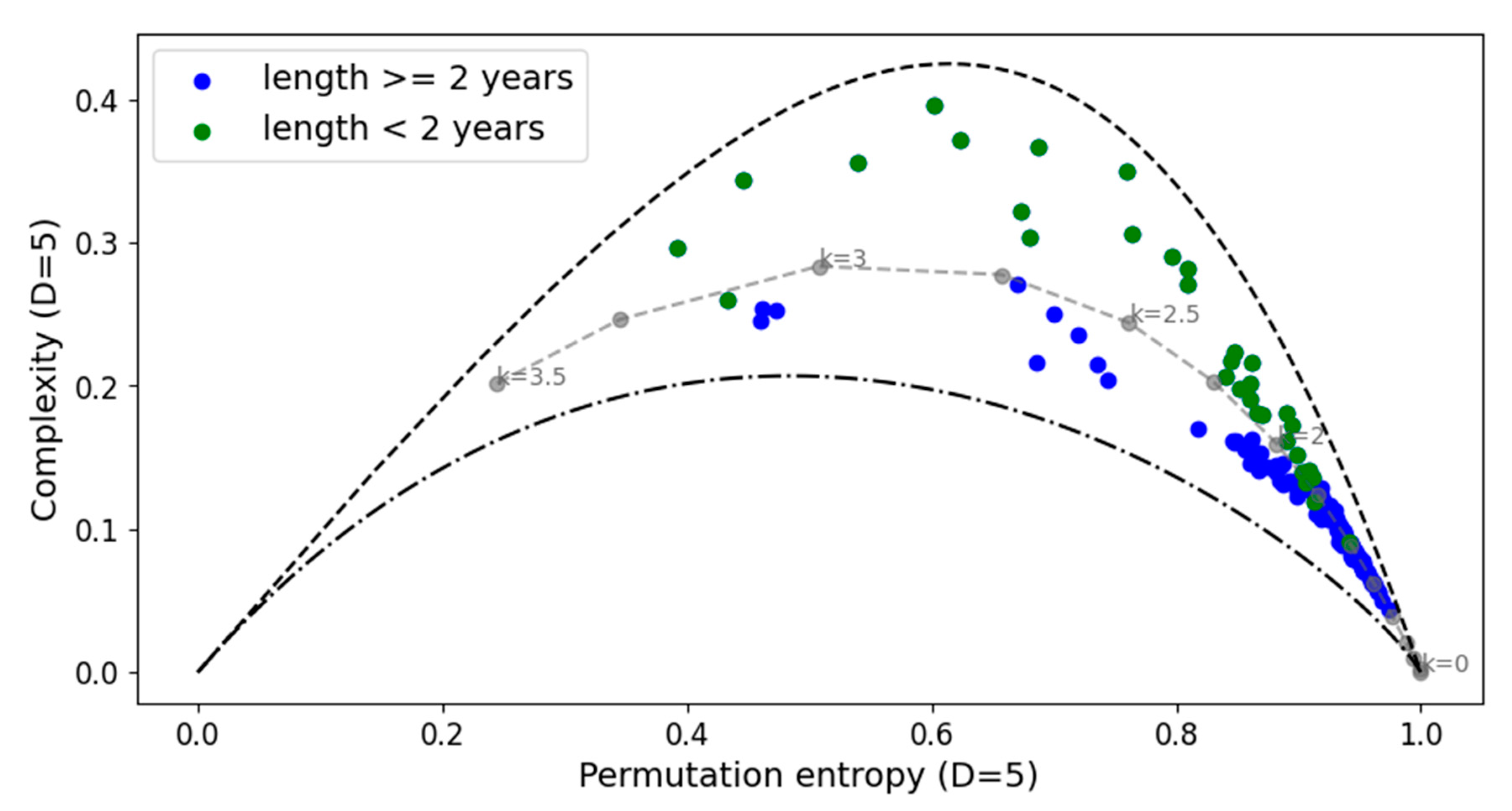

2.2. Complexity–Entropy Causality Plane (CECP)

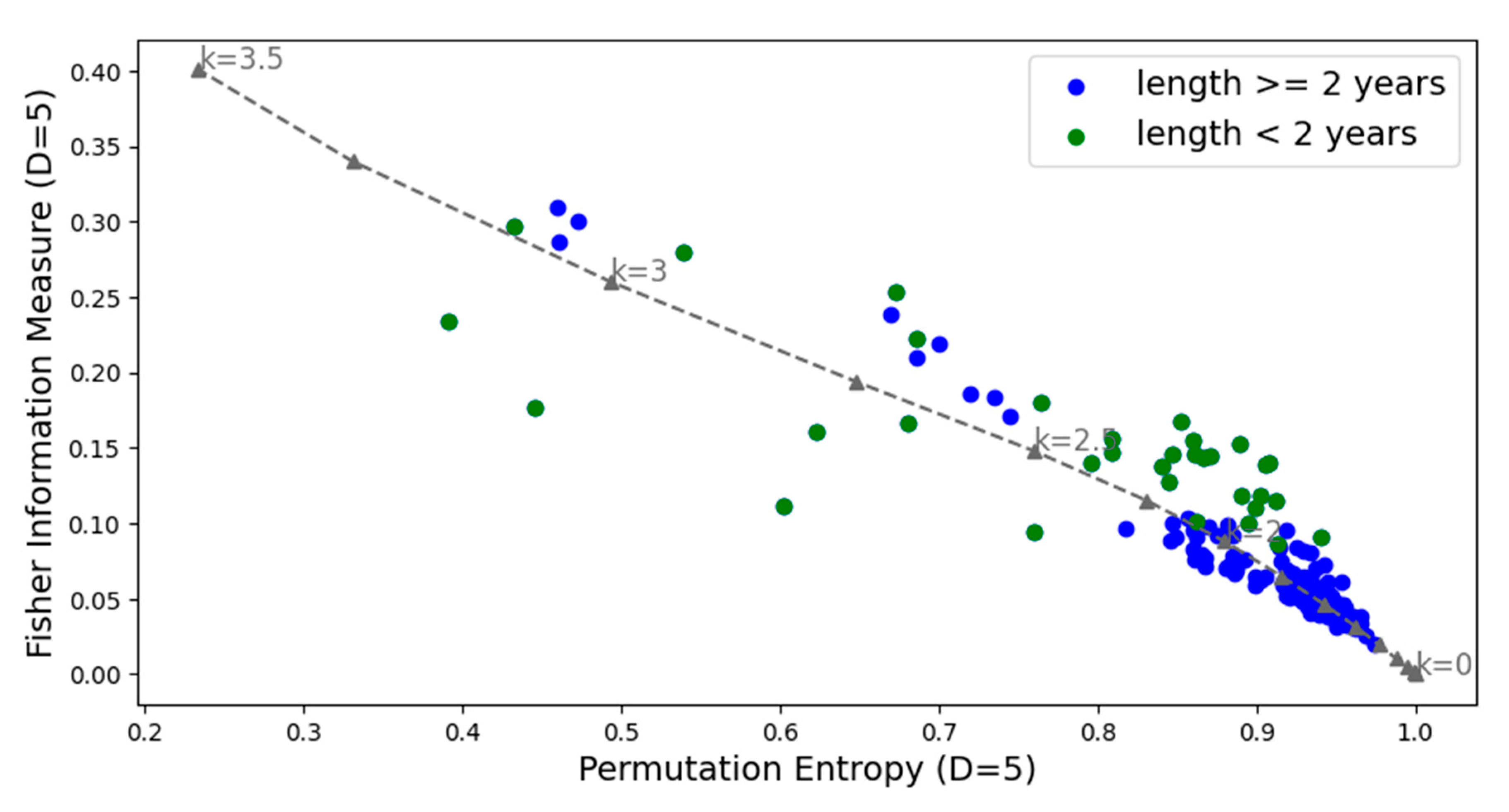

2.3. Fisher’s Information Measure (FIM)

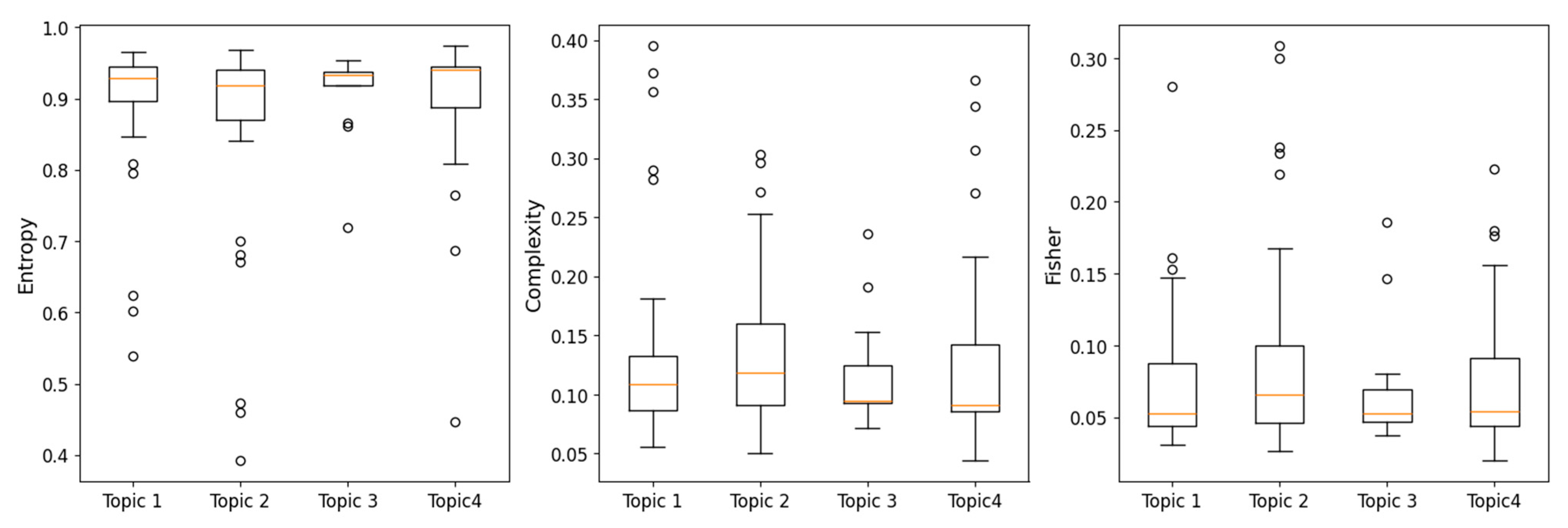

2.4. Clustering

2.5. Cryptocurrency Time Series

3. Results and Discussion

4. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Crypto | Length | Start | End |

|---|---|---|---|

| ARI | 927 | 20/12/2021 | 3/7/2024 |

| BAY | 250 | 1/11/2021 | 8/7/2022 |

| BCF | 298 | 25/5/2022 | 18/3/2023 |

| BTCD | 227 | 19/11/2023 | 2/7/2024 |

| BTCS | 301 | 19/12/2023 | 14/10/2024 |

| CBX | 1075 | 5/11/2021 | 14/10/2024 |

| CRYPT | 563 | 10/10/2021 | 25/4/2023 |

| DON | 992 | 28/8/2020 | 28/5/2023 |

| DP | 342 | 22/11/2021 | 31/10/2022 |

| FCN | 88 | 7/10/2021 | 3/1/2022 |

| FLO | 317 | 10/3/2021 | 20/1/2022 |

| FLT | 204 | 25/3/2024 | 14/10/2024 |

| GLD | 573 | 14/12/2021 | 9/7/2023 |

| GP | 45 | 1/12/2021 | 14/1/2022 |

| HYPER | 487 | 27/4/2021 | 11/9/2022 |

| NET | 58 | 8/3/2023 | 4/5/2023 |

| NOBL | 182 | 16/4/2024 | 14/10/2024 |

| PND | 136 | 28/3/2022 | 10/8/2022 |

| PTC | 95 | 12/7/2024 | 14/10/2024 |

| RPC | 450 | 24/1/2022 | 30/8/2023 |

| SAK | 373 | 8/9/2022 | 15/9/2023 |

| SLG | 720 | 19/7/2022 | 7/7/2024 |

| SLR | 434 | 18/11/2021 | 29/1/2023 |

| SOON | 505 | 14/10/2022 | 1/3/2024 |

| SRC | 71 | 5/8/2024 | 14/10/2024 |

| TES | 430 | 9/8/2023 | 14/10/2024 |

| TGC | 99 | 4/1/2022 | 12/4/2022 |

| TIT | 353 | 23/6/2023 | 9/6/2024 |

| TRI | 376 | 15/12/2020 | 27/12/2021 |

| TRK | 57 | 30/11/2021 | 2/2/2022 |

| TRUST | 755 | 31/7/2020 | 24/8/2022 |

| TTC | 712 | 29/7/2022 | 9/7/2024 |

| UNB | 1036 | 14/12/2021 | 14/10/2024 |

| UTC | 408 | 22/3/2022 | 5/6/2023 |

| Crypto | Length | Start | End |

|---|---|---|---|

| 42 | 2532 | 9/11/2017 | 14/10/2024 |

| AC | 1410 | 13/10/2020 | 25/8/2024 |

| ACOIN | 2527 | 9/11/2017 | 14/10/2024 |

| ADC | 2532 | 9/11/2017 | 14/10/2024 |

| AIB | 1998 | 9/11/2017 | 13/6/2023 |

| ANC | 2532 | 9/11/2017 | 14/10/2024 |

| ARG | 1162 | 10/8/2021 | 14/10/2024 |

| AUR | 2532 | 9/11/2017 | 14/10/2024 |

| BBR | 1656 | 27/11/2017 | 9/6/2022 |

| BCN | 2531 | 9/11/2017 | 14/10/2024 |

| BITB | 2532 | 9/11/2017 | 14/10/2024 |

| BITS | 2518 | 9/11/2017 | 14/10/2024 |

| BLC | 1537 | 9/11/2017 | 23/1/2022 |

| BLK | 2532 | 9/11/2017 | 14/10/2024 |

| BLOCK | 2532 | 9/11/2017 | 14/10/2024 |

| BLU | 2532 | 9/11/2017 | 14/10/2024 |

| BSD | 2284 | 9/11/2017 | 9/2/2024 |

| BSTY | 2532 | 9/11/2017 | 14/10/2024 |

| BTA | 2532 | 9/11/2017 | 14/10/2024 |

| BTB | 2105 | 10/1/2019 | 14/10/2024 |

| BTC | 3285 | 18/10/2015 | 14/10/2024 |

| BTS | 2532 | 9/11/2017 | 14/10/2024 |

| C2 | 2526 | 9/11/2017 | 14/10/2024 |

| CANN | 2532 | 9/11/2017 | 14/10/2024 |

| CASH | 1637 | 22/4/2020 | 14/10/2024 |

| CCN | 2055 | 1/3/2019 | 14/10/2024 |

| CLAM | 2532 | 9/11/2017 | 14/10/2024 |

| CLOAK | 2532 | 9/11/2017 | 14/10/2024 |

| CRW | 2532 | 9/11/2017 | 14/10/2024 |

| CSC | 2500 | 9/11/2017 | 14/10/2024 |

| CURE | 2532 | 9/11/2017 | 14/10/2024 |

| DASH | 2532 | 9/11/2017 | 14/10/2024 |

| DEM | 2461 | 9/11/2017 | 14/10/2024 |

| DGB | 2532 | 9/11/2017 | 14/10/2024 |

| DGC | 3285 | 18/10/2015 | 14/10/2024 |

| DIME | 2532 | 9/11/2017 | 14/10/2024 |

| DMD | 2532 | 9/11/2017 | 14/10/2024 |

| DOGE | 2532 | 9/11/2017 | 14/10/2024 |

| DOPE | 2532 | 9/11/2017 | 14/10/2024 |

| DTC | 2237 | 21/2/2018 | 14/4/2024 |

| ECC | 1762 | 9/11/2017 | 5/9/2022 |

| EFL | 2120 | 9/11/2017 | 14/10/2024 |

| EMC | 2532 | 9/11/2017 | 14/10/2024 |

| EMC2 | 2222 | 9/11/2017 | 12/12/2023 |

| EMD | 1573 | 9/11/2017 | 10/3/2022 |

| ENRG | 1601 | 9/11/2017 | 30/6/2022 |

| ETH | 2532 | 9/11/2017 | 14/10/2024 |

| EXCL | 1871 | 9/11/2017 | 23/12/2022 |

| FAIR | 1154 | 9/11/2017 | 10/5/2022 |

| FJC | 1689 | 9/11/2017 | 8/7/2022 |

| FRC | 3181 | 18/10/2015 | 14/10/2024 |

| FST | 1775 | 8/4/2019 | 15/2/2024 |

| FTC | 3285 | 18/10/2015 | 14/10/2024 |

| GAME | 2532 | 9/11/2017 | 14/10/2024 |

| GCN | 2104 | 9/11/2017 | 16/1/2024 |

| GRC | 2284 | 9/11/2017 | 9/2/2024 |

| GRN | 1922 | 21/5/2018 | 24/8/2023 |

| GRS | 2532 | 9/11/2017 | 14/10/2024 |

| HBN | 1821 | 9/11/2017 | 14/10/2024 |

| IFC | 2012 | 9/11/2017 | 14/10/2024 |

| IOC | 1673 | 9/11/2017 | 8/6/2022 |

| IXC | 3208 | 18/10/2015 | 14/10/2024 |

| KOBO | 2524 | 9/11/2017 | 14/10/2024 |

| LDOGE | 996 | 17/4/2020 | 14/10/2024 |

| LOG | 1795 | 9/11/2017 | 14/10/2024 |

| LTC | 3285 | 18/10/2015 | 14/10/2024 |

| MAX | 2531 | 9/11/2017 | 14/10/2024 |

| MEC | 2533 | 18/10/2015 | 2/11/2023 |

| MINT | 2284 | 9/11/2017 | 9/2/2024 |

| MNC | 1301 | 21/2/2019 | 13/9/2022 |

| MONA | 2532 | 9/11/2017 | 14/10/2024 |

| MUE | 1674 | 9/11/2017 | 9/6/2022 |

| NAV | 2532 | 9/11/2017 | 14/10/2024 |

| NLG | 1839 | 9/11/2017 | 21/11/2022 |

| NMC | 3285 | 18/10/2015 | 14/10/2024 |

| NOTE | 2312 | 9/11/2017 | 3/5/2024 |

| NTRN | 2532 | 9/11/2017 | 14/10/2024 |

| NVC | 3002 | 18/10/2015 | 14/10/2024 |

| NXS | 2333 | 9/11/2017 | 14/10/2024 |

| NXT | 2532 | 9/11/2017 | 14/10/2024 |

| NYAN | 1206 | 1/9/2018 | 14/2/2023 |

| NYC | 2522 | 9/11/2017 | 14/10/2024 |

| OK | 2532 | 9/11/2017 | 14/10/2024 |

| OMNI | 2532 | 9/11/2017 | 14/10/2024 |

| ORB | 2051 | 9/11/2017 | 24/6/2023 |

| PHO | 1516 | 9/11/2017 | 23/1/2022 |

| PIGGY | 1097 | 14/10/2021 | 14/10/2024 |

| PINK | 2284 | 9/11/2017 | 9/2/2024 |

| PLNC | 2496 | 9/11/2017 | 14/10/2024 |

| POP | 1466 | 10/10/2020 | 14/10/2024 |

| POT | 2529 | 9/11/2017 | 14/10/2024 |

| PPC | 3285 | 18/10/2015 | 14/10/2024 |

| PXC | 3071 | 18/10/2015 | 14/10/2024 |

| PXI | 2532 | 9/11/2017 | 14/10/2024 |

| QRK | 2530 | 9/11/2017 | 14/10/2024 |

| RBT | 2532 | 9/11/2017 | 14/10/2024 |

| RBY | 2532 | 9/11/2017 | 14/10/2024 |

| RDD | 2532 | 9/11/2017 | 14/10/2024 |

| RED | 2337 | 23/5/2018 | 14/10/2024 |

| SKC | 1356 | 4/5/2020 | 19/1/2024 |

| SMC | 1667 | 9/11/2017 | 2/6/2022 |

| SMLY | 2275 | 9/11/2017 | 9/2/2024 |

| SONG | 2532 | 9/11/2017 | 14/10/2024 |

| SPHR | 1673 | 9/11/2017 | 9/6/2022 |

| SPR | 2532 | 9/11/2017 | 14/10/2024 |

| START | 2532 | 9/11/2017 | 14/10/2024 |

| STV | 1306 | 19/3/2021 | 14/10/2024 |

| SUPER | 1765 | 9/11/2017 | 12/9/2022 |

| SXC | 1199 | 4/7/2021 | 14/10/2024 |

| SYS | 2532 | 9/11/2017 | 14/10/2024 |

| TAG | 2520 | 9/11/2017 | 14/10/2024 |

| THC | 2532 | 9/11/2017 | 14/10/2024 |

| TIPS | 2532 | 9/11/2017 | 14/10/2024 |

| TRC | 3037 | 18/10/2015 | 9/2/2024 |

| TROLL | 2491 | 9/11/2017 | 14/10/2024 |

| UBQ | 2225 | 9/11/2017 | 12/12/2023 |

| UFO | 2188 | 9/11/2017 | 14/10/2024 |

| UNIT | 2532 | 9/11/2017 | 14/10/2024 |

| UNO | 2532 | 9/11/2017 | 14/10/2024 |

| USNBT | 1650 | 9/11/2017 | 16/5/2022 |

| VIA | 2532 | 9/11/2017 | 14/10/2024 |

| VRC | 1669 | 9/11/2017 | 4/6/2022 |

| VTC | 2532 | 9/11/2017 | 14/10/2024 |

| WBB | 2521 | 9/11/2017 | 14/10/2024 |

| WDC | 2759 | 18/10/2015 | 14/10/2024 |

| XBC | 2532 | 9/11/2017 | 14/10/2024 |

| XCN | 2532 | 9/11/2017 | 14/10/2024 |

| XCO | 2393 | 9/11/2017 | 28/5/2024 |

| XCP | 2532 | 9/11/2017 | 14/10/2024 |

| XDN | 2532 | 9/11/2017 | 14/10/2024 |

| XEM | 2532 | 9/11/2017 | 14/10/2024 |

| XLM | 2532 | 9/11/2017 | 14/10/2024 |

| XMR | 2532 | 9/11/2017 | 14/10/2024 |

| XMY | 2225 | 9/11/2017 | 12/12/2023 |

| XPD | 2532 | 9/11/2017 | 14/10/2024 |

| XPM | 2532 | 9/11/2017 | 14/10/2024 |

| XPY | 2517 | 9/11/2017 | 14/10/2024 |

| XQN | 2526 | 9/11/2017 | 14/10/2024 |

| XRP | 2532 | 9/11/2017 | 14/10/2024 |

| XST | 2349 | 9/11/2017 | 14/10/2024 |

| XVG | 2532 | 9/11/2017 | 14/10/2024 |

| XWC | 2532 | 9/11/2017 | 14/10/2024 |

| ZET | 2532 | 9/11/2017 | 14/10/2024 |

References

- Drożdż, S.; Kwapień, J.; Oświęcimka, P.; Stanisz, T.; Wątorek, M. Complexity in Economic and Social Systems: Cryptocurrency Market at around COVID-19. Entropy 2020, 22, 1043. [Google Scholar] [CrossRef]

- Kim, K.; Lee, M. The Impact of the COVID-19 Pandemic on the Unpredictable Dynamics of the Cryptocurrency Market. Entropy 2021, 23, 1234. [Google Scholar] [CrossRef] [PubMed]

- García-Medina, A.; Hernández, C.J.B. Network Analysis of Multivariate Transfer Entropy of Cryptocurrencies in Times of Turbulence. Entropy 2020, 22, 760. [Google Scholar] [CrossRef]

- Kwapień, J.; Wątorek, M.; Drożdż, S. Cryptocurrency Market Consolidation in 2020–2021. Entropy 2021, 23, 1674. [Google Scholar] [CrossRef] [PubMed]

- Fernandes, L.H.S.; Bouri, E.; Silva, J.W.L.; Bejan, L.; de Araujo, F.H.A. The resilience of cryptocurrency market efficiency to COVID-19 shock. Physica A 2022, 607, 128218. [Google Scholar] [CrossRef] [PubMed]

- Dehouche, N. Revisiting the volatility of bitcoin with approximate entropy. Cogent Econ. Financ. 2022, 10, 2013588. [Google Scholar] [CrossRef]

- Valencia, F.; Gómez-Espinosa, A.; Valdés-Aguirre, B. Price Movement Prediction of Cryptocurrencies Using Sentiment Analysis and Machine Learning. Entropy 2019, 21, 589. [Google Scholar] [CrossRef]

- Stosic, D.; Stosic, D.; Ludermir, T.B.; Stosic, T. Exploring disorder and complexity in the cryptocurrency space. Phys. A Stat. Mech. Its Appl. 2019, 525, 548–556. [Google Scholar] [CrossRef]

- Liu, F.; Fan, H.-Y.; Qi, J.-Y. Blockchain Technology, Cryptocurrency: Entropy-Based Perspective. Entropy 2022, 24, 557. [Google Scholar] [CrossRef]

- Puoti, F.; Pittorino, F.; Roveri, M. Quantifying Cryptocurrency Unpredictability: A Comprehensive Study of Complexity and Forecasting. arXiv 2025, arXiv:2502.09079. [Google Scholar]

- Pele, D.T.; Mazurencu-Marinescu-Pele, M. Using High-Frequency Entropy to Forecast Bitcoin’s Daily Value at Risk. Entropy 2019, 21, 102. [Google Scholar] [CrossRef] [PubMed]

- Rodriguez-Rodriguez, N.; Miramontes, O. Shannon Entropy: An Econophysical Approach to Cryptocurrency Portfolios. Entropy 2022, 24, 1583. [Google Scholar] [CrossRef]

- Zunino, L.; Zanin, M.; Tabak, B.M.; Pérez, D.G.; Rosso, O.A. Complexity-entropy causality plane: A useful approach to quantify the stock market inefficiency. Phys. A Stat. Mech. Its Appl. 2010, 389, 1891–1901. [Google Scholar] [CrossRef]

- Bariviera, A.F.; Zunino, L.; Rosso, O.A. An analysis of high-frequency cryptocurrencies prices dynamics using permutation-information-theory quantifiers. Chaos 2018, 28, 075511. [Google Scholar] [CrossRef] [PubMed]

- Sigaki, H.Y.D.; Perc, M.; Ribeiro, H.V. Clustering patterns in efficiency and the coming-of-age of the cryptocurrency market. Sci. Rep. 2019, 9, 1440. [Google Scholar] [CrossRef]

- Bandt, C.; Pompe, B. Permutation Entropy: A Natural Complexity Measure for Time Series. Phys. Rev. Lett. 2002, 88, 174102. [Google Scholar] [CrossRef]

- Zanin, M.; Olivares, F. Ordinal patterns-based methodologies for distinguishing chaos from noise in discrete time series. Commun. Phys. 2021, 4, 190. [Google Scholar] [CrossRef]

- Suriano, M.; Caram, L.F.; Rosso, O.A. Daily streamflow of Argentine Rivers Analysis Using Information Theory Quantifiers. Entropy 2024, 26, 56. [Google Scholar] [CrossRef]

- Serinaldi, F.; Zunino, L.; Rosso, O.A. Complexity–entropy analysis of daily stream flow time series in the continental United States. Stoch. Environ. Res. Risk Assess. 2014, 28, 1685–1708. [Google Scholar] [CrossRef]

- Rosso, O.A.; Larrondo, H.A.; Martín, M.T.; Plastino, A.; Fuentes, M.A. Distinguishing Noise from Chaos. Phys. Rev. Lett. 2007, 99, 154102. [Google Scholar] [CrossRef]

- Stosic, T.; Telesca, L.; Vicente de Souza Ferreira, D.; Stosic, B. Investigating anthropically induced effects in streamflow dynamics by using permutation entropy and statistical complexity analysis: A case study. J. Hydrol. 2016, 540, 1136–1145. [Google Scholar] [CrossRef]

- Shannon, C.E. A Mathematical Theory of Communication. Bell System Technol. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Calbet, X.; López-Ruiz, R. Tendency towards maximum complexity in a nonequilibrium isolated system. Phys. Rev. E Stat. Nonlinear Soft Matter Phys. 2001, 63, 066116. [Google Scholar] [CrossRef]

- Rosso, O.A.; Olivares, F.; Plastino, A. Noise versus chaos in a causal Fisher-Shannon plane. Pap. Phys. 2015, 7, 1852–4249. [Google Scholar] [CrossRef]

- Fisher, R.A. On the mathematical foundations of theoretical statistics. Philos. Trans. R. Soc. Lond. Ser. A 1922, 222, 309–368. [Google Scholar] [CrossRef]

- Frieden, B. Science from Fisher Information: A Unification; Cambridge University Press: Cambridge, UK, 2004. [Google Scholar] [CrossRef]

- Sánchez-Moreno, P.; Yanez, R.; Dehesa, J. Discrete densities and Fisher information. In Proceedings of the 14th International Conference on Difference Equations and Applications, Instanbul, Turkey, 21–25 July 2008; Bohner, M., Ed.; Difference Equations and, Applications. Ugur–Bahçeşehir University Publishing Company: Istanbul, Turkey, 2009; pp. 291–298. [Google Scholar]

- Hasan, M.; Rahman, A.; Karim, M.R.; Khan, M.S.I.; Islam, M.J. Normalized approach to find optimal number of topics in Latent Dirichlet Allocation (LDA). In International Conference on Trends in Computational and Cognitive Engineering: Proceedings of TCCE 2020; Springer: Singapore, 2021; pp. 341–354. [Google Scholar] [CrossRef]

- Porta, A.; Bari, V.; Marchi, A.; De Maria, B.; Castiglioni, P.; di Rienzo, M.; Guzzetti, S.; Cividjian, A.; Quintin, L. Limits of permutation-based entropies in assessing complexity of short heart period variability. Physiol. Meas. 2015, 36, 755–765. [Google Scholar] [CrossRef]

- Pessa, A.A.; Ribeiro, H.V. Ordpy: A Python package for data analysis with permutation entropy and ordinal network methods. Chaos 2021, 31, 063110. [Google Scholar] [CrossRef] [PubMed]

- Timmer, J.; Koenig, M. On generating power law noise. Astron. Astrophys. 1995, 300, 707–710. [Google Scholar]

- Hunter, J.D. Matplotlib: A 2D Graphics Environment. Comput. Sci. Eng. 2007, 9, 90–95. [Google Scholar] [CrossRef]

- Waskom, M.L. Seaborn: Statistical data visualization. J. Open Source Softw. 2021, 6, 3021. [Google Scholar] [CrossRef]

- Jordahl, K.; Van den Bossche, J.; Fleischmann, M.; Wasserman, J.; McBride, J.; Gerard, J.; Fleischmann, M.; Tratner, J.; Perry, M.; Farmer, C.; et al. Geopandas/Geopandas: v0.8.1 (Version v0.8.1); Zenodo: Geneva, Switzerland, 2020. [Google Scholar] [CrossRef]

- Staniek, M.; Lehnertz, K. Parameter selection for Permutation Entropy Measurements. Int. J. Bifurc. Chaos 2007, 17, 3729–3733. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Suriano, M.; Caram, L.F.; Caiafa, C.; Merlino, H.D.; Rosso, O.A. Information Theory Quantifiers in Cryptocurrency Time Series Analysis. Entropy 2025, 27, 450. https://doi.org/10.3390/e27040450

Suriano M, Caram LF, Caiafa C, Merlino HD, Rosso OA. Information Theory Quantifiers in Cryptocurrency Time Series Analysis. Entropy. 2025; 27(4):450. https://doi.org/10.3390/e27040450

Chicago/Turabian StyleSuriano, Micaela, Leonidas Facundo Caram, Cesar Caiafa, Hernán Daniel Merlino, and Osvaldo Anibal Rosso. 2025. "Information Theory Quantifiers in Cryptocurrency Time Series Analysis" Entropy 27, no. 4: 450. https://doi.org/10.3390/e27040450

APA StyleSuriano, M., Caram, L. F., Caiafa, C., Merlino, H. D., & Rosso, O. A. (2025). Information Theory Quantifiers in Cryptocurrency Time Series Analysis. Entropy, 27(4), 450. https://doi.org/10.3390/e27040450