Collective Dynamics, Diversification and Optimal Portfolio Construction for Cryptocurrencies

Abstract

1. Introduction

2. Data

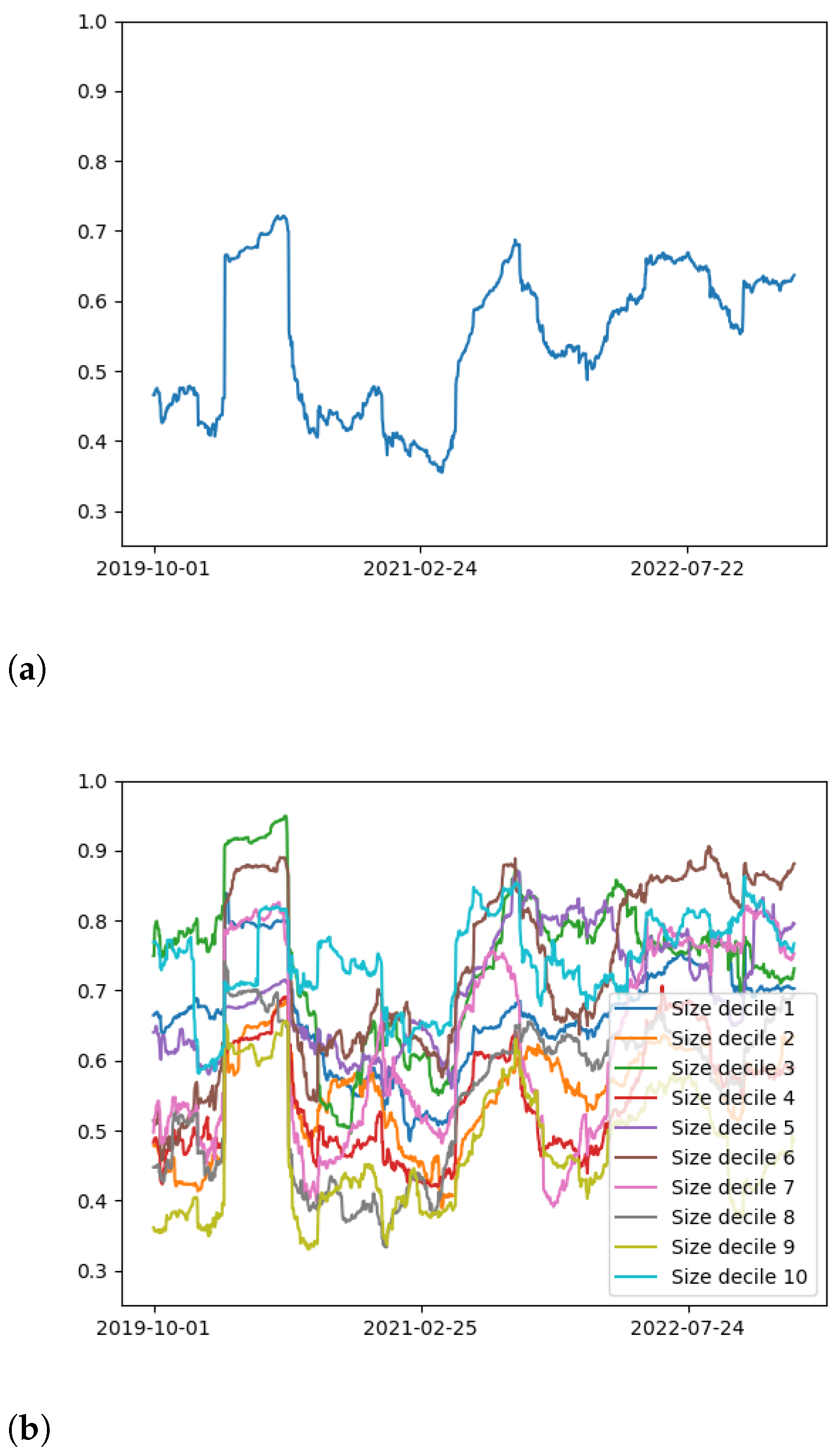

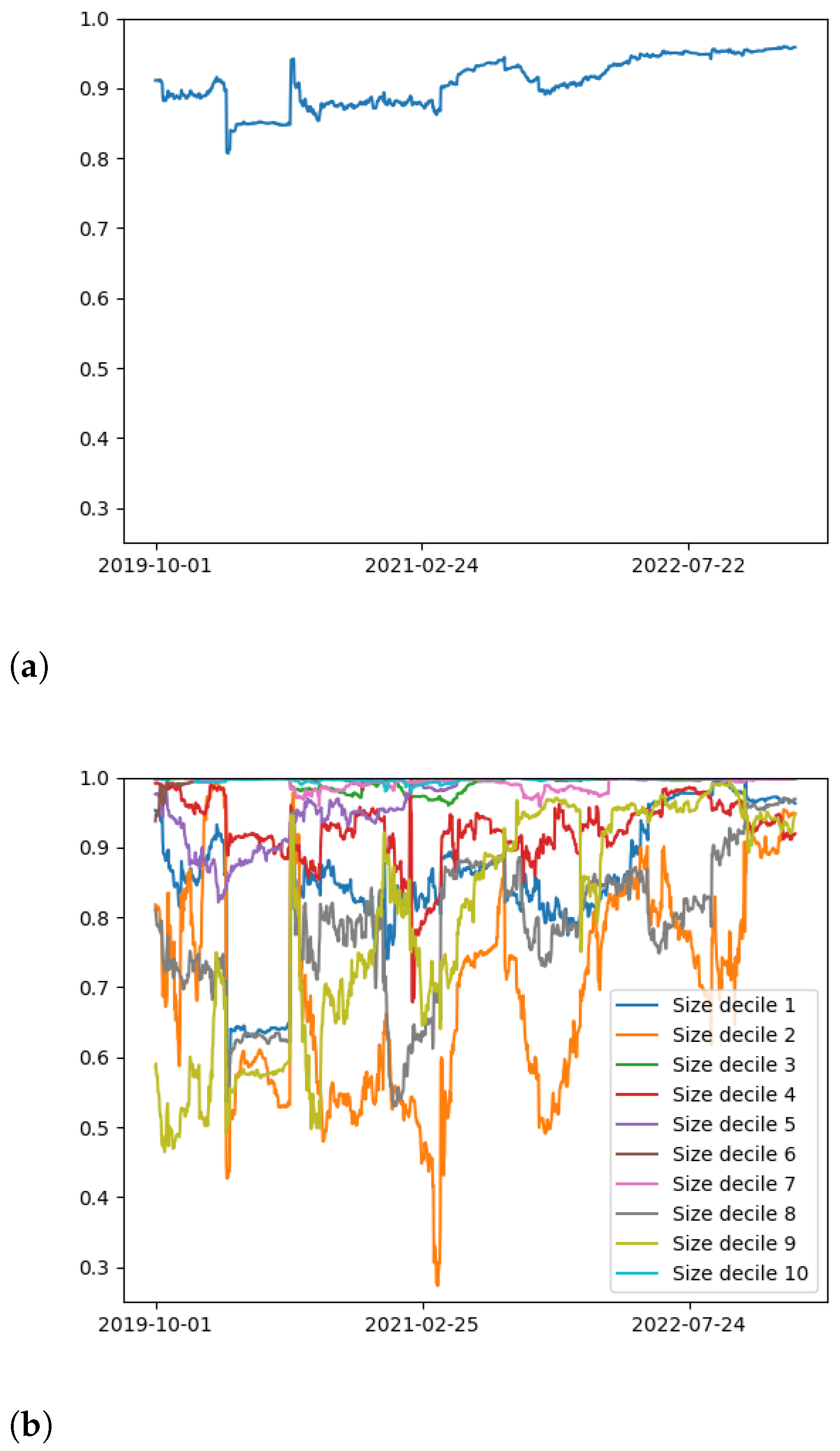

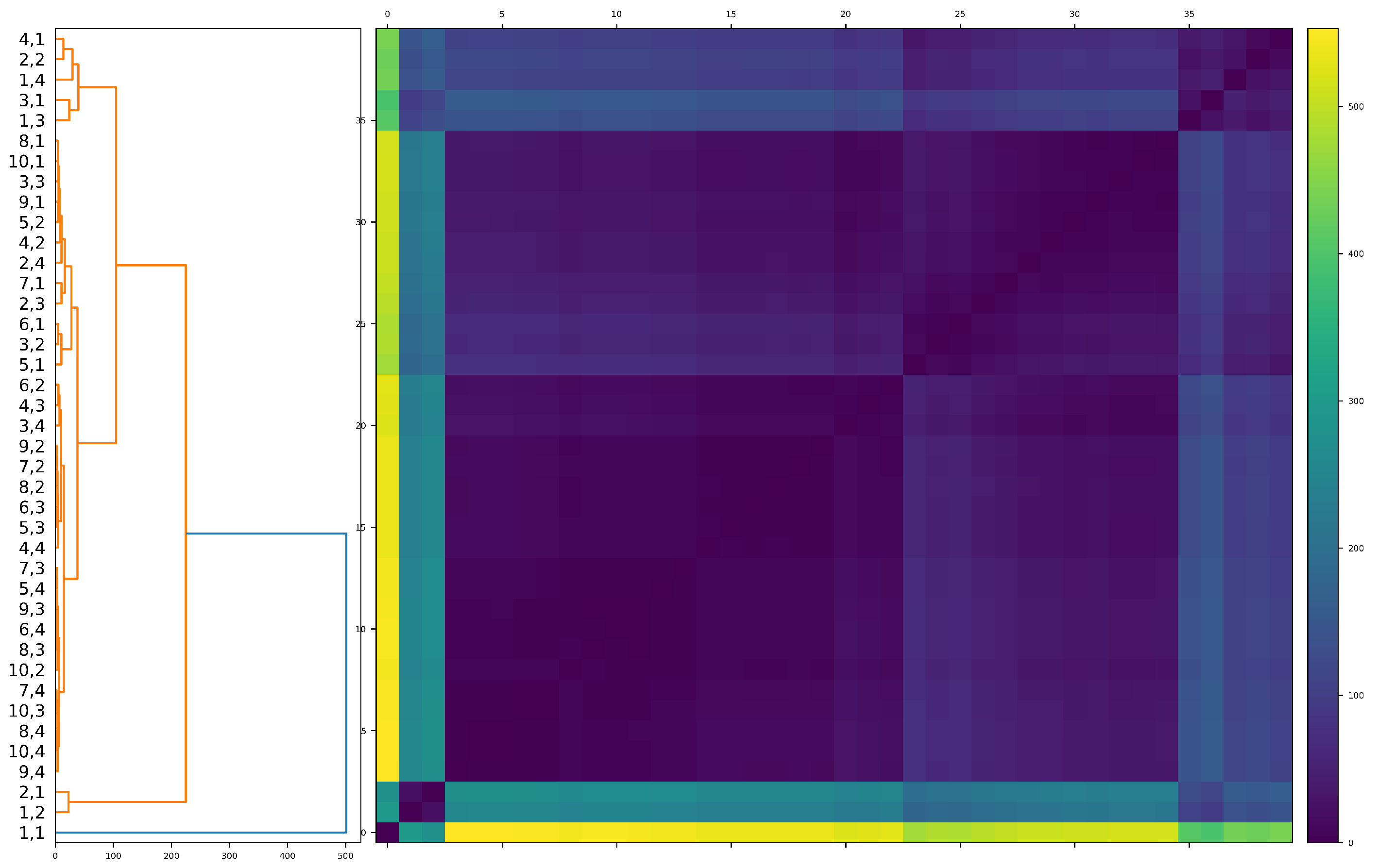

3. Collective Dynamics and Uniformity

4. Portfolio Sampling

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Fenn, D.J.; Porter, M.A.; Williams, S.; McDonald, M.; Johnson, N.F.; Jones, N.S. Temporal evolution of financial-market correlations. Phys. Rev. E 2011, 84, 026109. [Google Scholar] [CrossRef] [PubMed]

- Laloux, L.; Cizeau, P.; Bouchaud, J.P.; Potters, M. Noise Dressing of Financial Correlation Matrices. Phys. Rev. Lett. 1999, 83, 1467–1470. [Google Scholar] [CrossRef]

- Münnix, M.C.; Shimada, T.; Schäfer, R.; Leyvraz, F.; Seligman, T.H.; Guhr, T.; Stanley, H.E. Identifying States of a Financial Market. Sci. Rep. 2012, 2, 644. [Google Scholar] [CrossRef] [PubMed]

- Kim, D.H.; Jeong, H. Systematic analysis of group identification in stock markets. Phys. Rev. E 2005, 72, 046133. [Google Scholar] [CrossRef] [PubMed]

- Pan, R.K.; Sinha, S. Collective behavior of stock price movements in an emerging market. Phys. Rev. E 2007, 76, 046116. [Google Scholar] [CrossRef]

- Wilcox, D.; Gebbie, T. An analysis of cross-correlations in an emerging market. Phys. Stat. Mech. Its Appl. 2007, 375, 584–598. [Google Scholar] [CrossRef]

- Conlon, T.; Ruskin, H.; Crane, M. Random matrix theory and fund of funds portfolio optimisation. Phys. Stat. Mech. Its Appl. 2007, 382, 565–576. [Google Scholar] [CrossRef]

- Bouchaud, J.P.; Potters, M. Theory of Financial Risk and Derivative Pricing; Cambridge University Press: Cambridge, UK, 2003. [Google Scholar] [CrossRef]

- Burda, Z.; Görlich, A.; Jarosz, A.; Jurkiewicz, J. Signal and noise in correlation matrix. Phys. Stat. Mech. Its Appl. 2004, 343, 295–310. [Google Scholar] [CrossRef]

- Sharifi, S.; Crane, M.; Shamaie, A.; Ruskin, H. Random matrix theory for portfolio optimization: A stability approach. Phys. Stat. Mech. Its Appl. 2004, 335, 629–643. [Google Scholar] [CrossRef]

- Heckens, A.J.; Krause, S.M.; Guhr, T. Uncovering the dynamics of correlation structures relative to the collective market motion. J. Stat. Mech. Theory Exp. 2020, 2020, 103402. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Association between COVID-19 cases and international equity indices. Phys. Nonlinear Phenom. 2021, 417, 132809. [Google Scholar] [CrossRef]

- James, N.; Menzies, M.; Chan, J. Changes to the extreme and erratic behaviour of cryptocurrencies during COVID-19. Phys. Stat. Mech. Its Appl. 2021, 565, 125581. [Google Scholar] [CrossRef]

- James, N. Dynamics, behaviours, and anomaly persistence in cryptocurrencies and equities surrounding COVID-19. Phys. Stat. Mech. Its Appl. 2021, 570, 125831. [Google Scholar] [CrossRef]

- Ferreira, P.; Kristoufek, L.; de Area Leão Pereira, E.J. DCCA and DMCA correlations of cryptocurrency markets. Phys. Stat. Mech. Its Appl. 2020, 545, 123803. [Google Scholar] [CrossRef]

- Engle, R. Autoregressive Conditional Heteroskedasticity with Estimates of the Variance of United Kingdom Inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized Autoregressive Conditional Heteroskedasticity. J. Econom. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Taylor, S. Financial Returns Modelled by the product of two stochastic processes, a study of daily sugar prices 1961–1979. In Time Series Analysis: Theory and Practice 1; North-Holland: Amsterdam, The Netherlands, 1982; pp. 203–226. [Google Scholar]

- Taylor, S. Modelling Financial Time Series; Wiley: New York, NY, USA, 1986. [Google Scholar]

- Taylor, S.J. Modelling Stochastic Volatility: A review and comparative study. Math. Financ. 1994, 4, 183–204. [Google Scholar] [CrossRef]

- Nelson, D. Conditional heteroskedasticity in asset returns: A new approach. Econometrica 1991, 59, 347–370. [Google Scholar] [CrossRef]

- Glosten, L.R.; Jagannathan, R.; Runkle, D.E. On the Relation between the Expected Value and the Volatility of the Nominal Excess Return on Stocks. J. Financ. 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Zakoian, J. Threshold heteroskedastic models. J. Econ. Dyn. Control. 1994, 18, 931–955. [Google Scholar] [CrossRef]

- So, M.; Li, W.; Lam, K. On a Threshold Stochastic Volatility Model. J. Forecast. 2002, 22, 473–500. [Google Scholar] [CrossRef]

- Cai, J. A Markov Model of Switching-Regime ARCH. J. Bus. Econ. Stat. 1994, 12, 309–316. [Google Scholar]

- Hamilton, J.; Susmel, R. Autoregressive conditional heteroskedasticity and changes in regime. J. Econom. 1994, 64, 307–333. [Google Scholar] [CrossRef]

- Gray, S. Modelling the conditional distribution of interest rates as a regime-switching process. J. Financ. Econom. 1996, 2, 211–250. [Google Scholar]

- So, M.; Lam, K.; Li, W. A stochastic volatility model with markov switching. J. Bus. Econ. Stat. 1998, 16, 244–253. [Google Scholar]

- Andersen, T.; Bollerslev, T.; Diebold, F.; Labys, P. Modeling and forecasting realized volatility. Econometrica 2003, 71, 579–625. [Google Scholar] [CrossRef]

- Hwang, S.; Satchell, S. GARCH Model with Cross-sectional Volatility: GARCHX Models. Appl. Financ. Econ. 2007, 15, 203–216. [Google Scholar] [CrossRef]

- Hansen, P.R.; Huang, Z.; Shek, H.H. Realized GARCH: A joint model for returns and realized measures of volatility. J. Appl. Econom. 2011, 27, 877–906. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Optimally adaptive Bayesian spectral density estimation for stationary and nonstationary processes. Stat. Comput. 2022, 32, 45. [Google Scholar] [CrossRef]

- Cerqueti, R.; Giacalone, M.; Mattera, R. Skewed non-Gaussian GARCH models for cryptocurrencies volatility modelling. Inf. Sci. 2020, 527, 1–26. [Google Scholar] [CrossRef]

- Wan, Y.; Si, Y.W. A formal approach to chart patterns classification in financial time series. Inf. Sci. 2017, 411, 151–175. [Google Scholar] [CrossRef]

- Stehlík, M.; Helperstorfer, C.; Hermann, P.; Šupina, J.; Grilo, L.; Maidana, J.; Fuders, F.; Stehlíková, S. Financial and risk modelling with semicontinuous covariances. Inf. Sci. 2017, 394–395, 246–272. [Google Scholar] [CrossRef]

- Chu, C.S.J.; Santoni, G.J.; Liu, T. Stock market volatility and regime shifts in returns. Inf. Sci. 1996, 94, 179–190. [Google Scholar] [CrossRef]

- yong Chen, G.; Gan, M.; long Chen, G. Generalized exponential autoregressive models for nonlinear time series: Stationarity, estimation and applications. Inf. Sci. 2018, 438, 46–57. [Google Scholar] [CrossRef]

- Cerqueti, R.; Giacalone, M.; Panarello, D. A Generalized Error Distribution Copula-based method for portfolios risk assessment. Phys. Stat. Mech. Its Appl. 2019, 524, 687–695. [Google Scholar] [CrossRef]

- Drożdż, S.; Kwapień, J.; Oświęcimka, P. Complexity in Economic and Social Systems. Entropy 2021, 23, 133. [Google Scholar] [CrossRef]

- Liu, Y.; Cizeau, P.; Meyer, M.; Peng, C.K.; Stanley, H.E. Correlations in economic time series. Phys. Stat. Mech. Its Appl. 1997, 245, 437–440. [Google Scholar] [CrossRef]

- James, N.; Menzies, M.; Chan, J. Semi-metric portfolio optimization: A new algorithm reducing simultaneous asset shocks. Econometrics 2023, 11, 8. [Google Scholar] [CrossRef]

- Basalto, N.; Bellotti, R.; Carlo, F.D.; Facchi, P.; Pantaleo, E.; Pascazio, S. Hausdorff clustering of financial time series. Phys. Stat. Mech. Its Appl. 2007, 379, 635–644. [Google Scholar] [CrossRef]

- Wątorek, M.; Kwapień, J.; Drożdż, S. Financial Return Distributions: Past, Present, and COVID-19. Entropy 2021, 23, 884. [Google Scholar] [CrossRef]

- Prakash, A.; James, N.; Menzies, M.; Francis, G. Structural Clustering of Volatility Regimes for Dynamic Trading Strategies. Appl. Math. Financ. 2021, 28, 236–274. [Google Scholar] [CrossRef]

- Drożdż, S.; Grümmer, F.; Ruf, F.; Speth, J. Towards identifying the world stock market cross-correlations: DAX versus Dow Jones. Phys. Stat. Mech. Its Appl. 2001, 294, 226–234. [Google Scholar] [CrossRef]

- James, N.; Menzies, M.; Chin, K. Economic state classification and portfolio optimisation with application to stagflationary environments. Chaos Solitons Fractals 2022, 164, 112664. [Google Scholar] [CrossRef]

- Gębarowski, R.; Oświęcimka, P.; Wątorek, M.; Drożdż, S. Detecting correlations and triangular arbitrage opportunities in the Forex by means of multifractal detrended cross-correlations analysis. Nonlinear Dyn. 2019, 98, 2349–2364. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. A new measure between sets of probability distributions with applications to erratic financial behavior. J. Stat. Mech. Theory Exp. 2021, 2021, 123404. [Google Scholar] [CrossRef]

- Sigaki, H.Y.D.; Perc, M.; Ribeiro, H.V. Clustering patterns in efficiency and the coming-of-age of the cryptocurrency market. Sci. Rep. 2019, 9, 1440. [Google Scholar] [CrossRef]

- Drożdż, S.; Kwapień, J.; Oświęcimka, P.; Stanisz, T.; Wątorek, M. Complexity in Economic and Social Systems: Cryptocurrency Market at around COVID-19. Entropy 2020, 22, 1043. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Collective correlations, dynamics, and behavioural inconsistencies of the cryptocurrency market over time. Nonlinear Dyn. 2022, 107, 4001–4017. [Google Scholar] [CrossRef]

- Drożdż, S.; Minati, L.; Oświęcimka, P.; Stanuszek, M.; Wątorek, M. Competition of noise and collectivity in global cryptocurrency trading: Route to a self-contained market. Chaos Interdiscip. J. Nonlinear Sci. 2020, 30, 023122. [Google Scholar] [CrossRef]

- Wątorek, M.; Drożdż, S.; Kwapień, J.; Minati, L.; Oświęcimka, P.; Stanuszek, M. Multiscale characteristics of the emerging global cryptocurrency market. Phys. Rep. 2021, 901, 1–82. [Google Scholar] [CrossRef]

- Drożdż, S.; Gębarowski, R.; Minati, L.; Oświęcimka, P.; Wątorek, M. Bitcoin market route to maturity? Evidence from return fluctuations, temporal correlations and multiscaling effects. Chaos Interdiscip. J. Nonlinear Sci. 2018, 28, 071101. [Google Scholar] [CrossRef]

- Drożdż, S.; Minati, L.; Oświęcimka, P.; Stanuszek, M.; Wątorek, M. Signatures of the Crypto-Currency Market Decoupling from the Forex. Future Internet 2019, 11, 154. [Google Scholar] [CrossRef]

- Kwapień, J.; Wątorek, M.; Bezbradica, M.; Crane, M.; Mai, T.T.; Drożdż, S. Analysis of inter-transaction time fluctuations in the cryptocurrency market. Chaos Interdiscip. J. Nonlinear Sci. 2022, 32, 083142. [Google Scholar] [CrossRef]

- Wątorek, M.; Kwapień, J.; Drożdż, S. Multifractal Cross-Correlations of Bitcoin and Ether Trading Characteristics in the Post-COVID-19 Time. Future Internet 2022, 14, 215. [Google Scholar] [CrossRef]

- Wątorek, M.; Kwapień, J.; Drożdż, S. Cryptocurrencies Are Becoming Part of the World Global Financial Market. Entropy 2023, 25, 377. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Spatio-temporal trends in the propagation and capacity of low-carbon hydrogen projects. Int. J. Hydrog. Energy 2022, 47, 16775–16784. [Google Scholar] [CrossRef]

- Perc, M.; Miksić, N.G.; Slavinec, M.; Stožer, A. Forecasting COVID-19. Front. Phys. 2020, 8, 127. [Google Scholar] [CrossRef]

- Machado, J.A.T.; Lopes, A.M. Rare and extreme events: The case of COVID-19 pandemic. Nonlinear Dyn. 2020, 100, 2953–2972. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Distributional trends in the generation and end-use sector of low-carbon hydrogen plants. Hydrogen 2023, 4, 174–189. [Google Scholar] [CrossRef]

- Merritt, S.; Clauset, A. Scoring dynamics across professional team sports: Tempo, balance and predictability. EPJ Data Sci. 2014, 3, 4. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Equivalence relations and Lp distances between time series with application to the Black Summer Australian bushfires. Phys. Nonlinear Phenom. 2023, 448, 133693. [Google Scholar] [CrossRef]

- Khan, M.K.; Khan, M.I.; Rehan, M. The relationship between energy consumption, economic growth and carbon dioxide emissions in Pakistan. Financ. Innov. 2020, 6, 1. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Global and regional changes in carbon dioxide emissions: 1970–2019. Phys. A Stat. Mech. Its Appl. 2022, 608, 128302. [Google Scholar] [CrossRef]

- Manchein, C.; Brugnago, E.L.; da Silva, R.M.; Mendes, C.F.O.; Beims, M.W. Strong correlations between power-law growth of COVID-19 in four continents and the inefficiency of soft quarantine strategies. Chaos Interdiscip. J. Nonlinear Sci. 2020, 30, 041102. [Google Scholar] [CrossRef] [PubMed]

- Ribeiro, H.V.; Mukherjee, S.; Zeng, X.H.T. Anomalous diffusion and long-range correlations in the score evolution of the game of cricket. Phys. Rev. E 2012, 86, 022102. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Estimating a continuously varying offset between multivariate time series with application to COVID-19 in the United States. Eur. Phys. J. Spec. Top. 2022, 231, 3419–3426. [Google Scholar] [CrossRef]

- Li, H.J.; Xu, W.; Song, S.; Wang, W.X.; Perc, M. The dynamics of epidemic spreading on signed networks. Chaos Solitons Fractals 2021, 151, 111294. [Google Scholar] [CrossRef]

- Blasius, B. Power-law distribution in the number of confirmed COVID-19 cases. Chaos Interdiscip. J. Nonlinear Sci. 2020, 30, 093123. [Google Scholar] [CrossRef]

- James, N.; Menzies, M.; Chok, J.; Milner, A.; Milner, C. Geometric persistence and distributional trends in worldwide terrorism. Chaos Solitons Fractals 2023, 169, 113277. [Google Scholar] [CrossRef]

- Clauset, A.; Kogan, M.; Redner, S. Safe leads and lead changes in competitive team sports. Phys. Rev. E 2015, 91, 062815. [Google Scholar] [CrossRef]

- James, N.; Menzies, M. Dual-domain analysis of gun violence incidents in the United States. Chaos Interdiscip. J. Nonlinear Sci. 2022, 32, 111101. [Google Scholar] [CrossRef]

- Perc, M.; Donnay, K.; Helbing, D. Understanding Recurrent Crime as System-Immanent Collective Behavior. PLoS ONE 2013, 8, e76063. [Google Scholar] [CrossRef]

- Singh, P.; Watorek, M.; Ceglarek, A.; Fąfrowicz, M.; Lewandowska, K.; Marek, T.; Sikora-Wachowicz, B.; Oswiecimka, P. Analysis of fMRI Signals from Working Memory Tasks and Resting-State of Brain: Neutrosophic-Entropy-Based Clustering Algorithm. Int. J. Neural Syst. 2022, 32, 2250012. [Google Scholar] [CrossRef]

- James, N.; Menzies, M.; Bondell, H. In search of peak human athletic potential: A mathematical investigation. Chaos Interdiscip. J. Nonlinear Sci. 2022, 32, 023110. [Google Scholar] [CrossRef]

- Markowitz, H. Portfolio Selection. J. Financ. 1952, 7, 77. [Google Scholar] [CrossRef]

- Sharpe, W.F. Mutual Fund Performance. J. Bus. 1966, 39, 119–138. [Google Scholar] [CrossRef]

- Almahdi, S.; Yang, S.Y. An adaptive portfolio trading system: A risk-return portfolio optimization using recurrent reinforcement learning with expected maximum drawdown. Expert Syst. Appl. 2017, 87, 267–279. [Google Scholar] [CrossRef]

- Calvo, C.; Ivorra, C.; Liern, V. Fuzzy portfolio selection with non-financial goals: Exploring the efficient frontier. Ann. Oper. Res. 2014, 245, 31–46. [Google Scholar] [CrossRef]

- Soleimani, H.; Golmakani, H.R.; Salimi, M.H. Markowitz-based portfolio selection with minimum transaction lots, cardinality constraints and regarding sector capitalization using genetic algorithm. Expert Syst. Appl. 2009, 36, 5058–5063. [Google Scholar] [CrossRef]

- Vercher, E.; Bermúdez, J.D.; Segura, J.V. Fuzzy portfolio optimization under downside risk measures. Fuzzy Sets Syst. 2007, 158, 769–782. [Google Scholar] [CrossRef]

- Bhansali, V. Putting Economics (Back) into Quantitative Models. J. Portf. Manag. 2007, 33, 63–76. [Google Scholar] [CrossRef]

- Moody, J.; Saffell, M. Learning to trade via direct reinforcement. IEEE Trans. Neural Netw. 2001, 12, 875–889. [Google Scholar] [CrossRef] [PubMed]

- James, N.; Menzies, M.; Gottwald, G.A. On financial market correlation structures and diversification benefits across and within equity sectors. Phys. A Stat. Mech. Its Appl. 2022, 604, 127682. [Google Scholar] [CrossRef]

- Cryptocurrencies. Yahoo Finance. 2023. Available online: https://finance.yahoo.com/crypto/ (accessed on 14 February 2023).

- Bambrough, B. Here’s What Caused Bitcoin’s ‘Extreme’ Price Plunge. Forbes. 2020. Available online: https://www.forbes.com/sites/billybambrough/2020/03/19/major-bitcoin-exchange-bitmex-has-a-serious-problem/ (accessed on 19 March 2020).

- Huang, K. Why Did FTX Collapse? Here’s What to Know. The New York Times. 2022. Available online: https://www.nytimes.com/2022/11/10/technology/ftx-binance-crypto-explained.html (accessed on 10 November 2022).

- Müllner, D. Fastcluster: Fast Hierarchical, Agglomerative Clustering Routines forRandPython. J. Stat. Softw. 2013, 53, 1–18. [Google Scholar] [CrossRef]

| Cryptocurrency | Ticker | Decile |

|---|---|---|

| Bitcoin | BTC | 1 |

| Ethereum | ETH | 1 |

| Tether | USDT | 1 |

| Binance Coin | BNB | 1 |

| USD Coin | USDC | 2 |

| XRP | XRP | 2 |

| Cardano | ADA | 2 |

| Polygon | MATIC | 2 |

| Dogecoin | DOGE | 3 |

| Litecoin | LTC | 3 |

| TRON | TRX | 3 |

| Wrapped Bitcoin | WBTC | 3 |

| Chainlink | LINK | 4 |

| Cosmos | ATOM | 4 |

| UNUS SED LEO | LEO | 4 |

| OKB | OKB | 4 |

| Ethereum Classic | ETC | 5 |

| Filecoin | FIL | 5 |

| Monero | XMR | 5 |

| Bitcoin Cash | BCH | 5 |

| Stellar | XLM | 6 |

| VeChain | VET | 6 |

| Crypto.com Coin | CRO | 6 |

| Algorand | ALGO | 6 |

| Quant | QNT | 7 |

| Fantom | FTM | 7 |

| Tezos | XTZ | 7 |

| Decentraland | MANA | 7 |

| EOS | EOS | 8 |

| Bitcoin BEP2 | BTCB | 8 |

| Theta Network | THETA | 8 |

| TrueUSD | TUSD | 8 |

| Rocket Pool | RPL | 9 |

| Chiliz | CHZ | 9 |

| USDP Stablecoin | USDP | 9 |

| Huobi Token | HT | 9 |

| KuCoin Token | KCS | 10 |

| Bitcoin SV | BSV | 10 |

| Dash | DASH | 10 |

| Zcash | ZEC | 10 |

| Number of Cryptocurrencies per Sector | ||||

|---|---|---|---|---|

| Number of Sectors | 1 | 2 | 3 | 4 |

| 1 | 1 | 0.759 | 0.668 | 0.645 |

| 2 | 0.774 | 0.651 | 0.598 | 0.587 |

| 3 | 0.681 | 0.605 | 0.581 | 0.576 |

| 4 | 0.641 | 0.587 | 0.572 | 0.565 |

| 5 | 0.613 | 0.583 | 0.565 | 0.559 |

| 6 | 0.607 | 0.57 | 0.565 | 0.557 |

| 7 | 0.593 | 0.565 | 0.559 | 0.555 |

| 8 | 0.582 | 0.564 | 0.557 | 0.552 |

| 9 | 0.552 | 0.565 | 0.557 | 0.553 |

| 10 | 0.581 | 0.560 | 0.554 | 0.552 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

James, N.; Menzies, M. Collective Dynamics, Diversification and Optimal Portfolio Construction for Cryptocurrencies. Entropy 2023, 25, 931. https://doi.org/10.3390/e25060931

James N, Menzies M. Collective Dynamics, Diversification and Optimal Portfolio Construction for Cryptocurrencies. Entropy. 2023; 25(6):931. https://doi.org/10.3390/e25060931

Chicago/Turabian StyleJames, Nick, and Max Menzies. 2023. "Collective Dynamics, Diversification and Optimal Portfolio Construction for Cryptocurrencies" Entropy 25, no. 6: 931. https://doi.org/10.3390/e25060931

APA StyleJames, N., & Menzies, M. (2023). Collective Dynamics, Diversification and Optimal Portfolio Construction for Cryptocurrencies. Entropy, 25(6), 931. https://doi.org/10.3390/e25060931