The Causality and Uncertainty of the COVID-19 Pandemic to Bursa Malaysia Financial Services Index’s Constituents

Abstract

1. Introduction

1.1. The Main Market Sectorial Indices and the KLFIN

1.2. Motivation and Impact behind Causal Analysis Using the KLFIN

2. Literature Review

2.1. Bursa Malaysia’s Large-, Mid- and Small-Cap: Performance Comparisons Pre- and Post-COVID-19

2.1.1. Performance of the Caps

2.1.2. The LEAP and the ACE Markets: Inducements of Growth to the Mid- and Small-Caps

2.2. Bursa Malaysia Financial Services Index: Perception and Evolution

2.2.1. Analysis and Performance

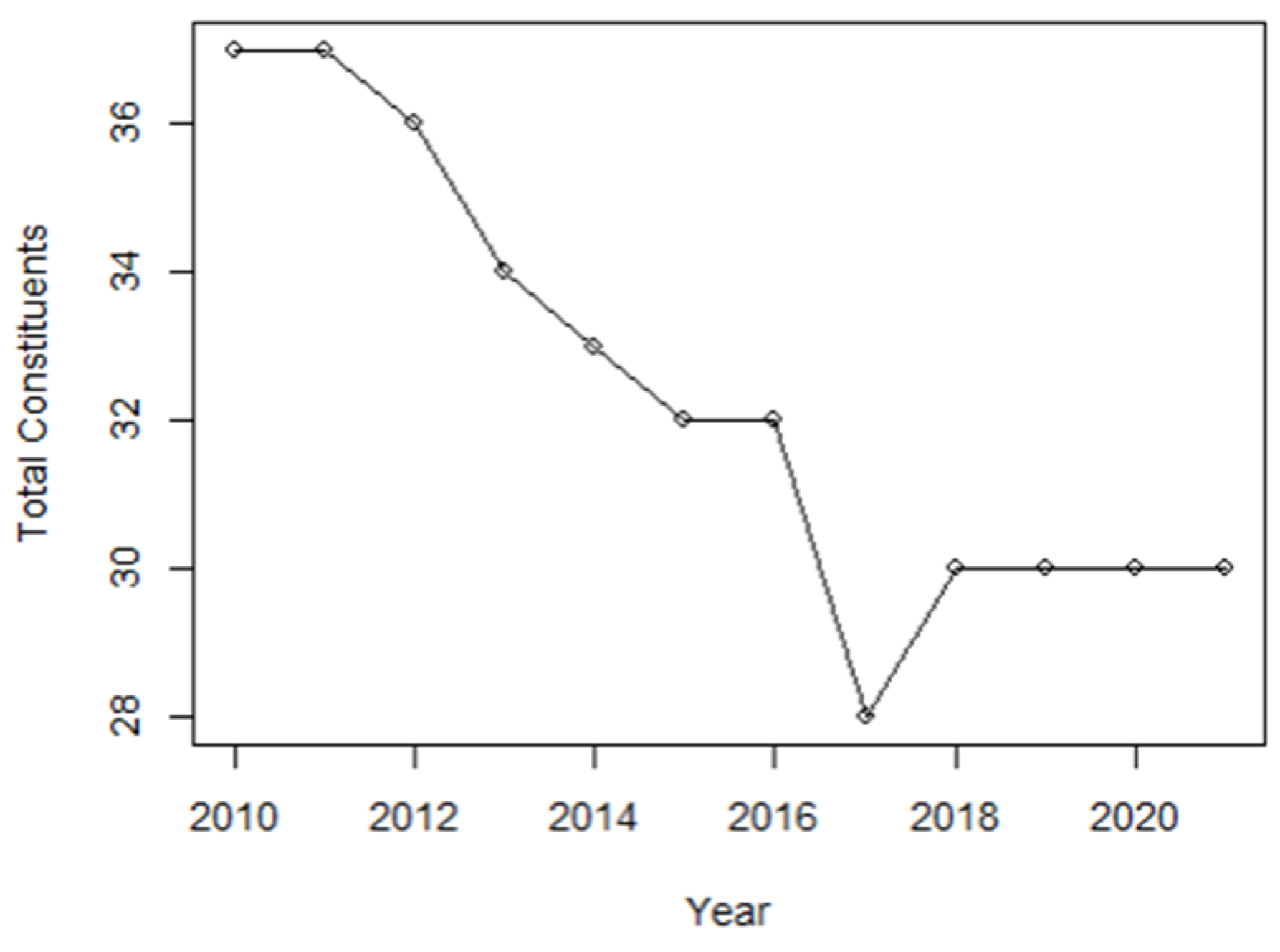

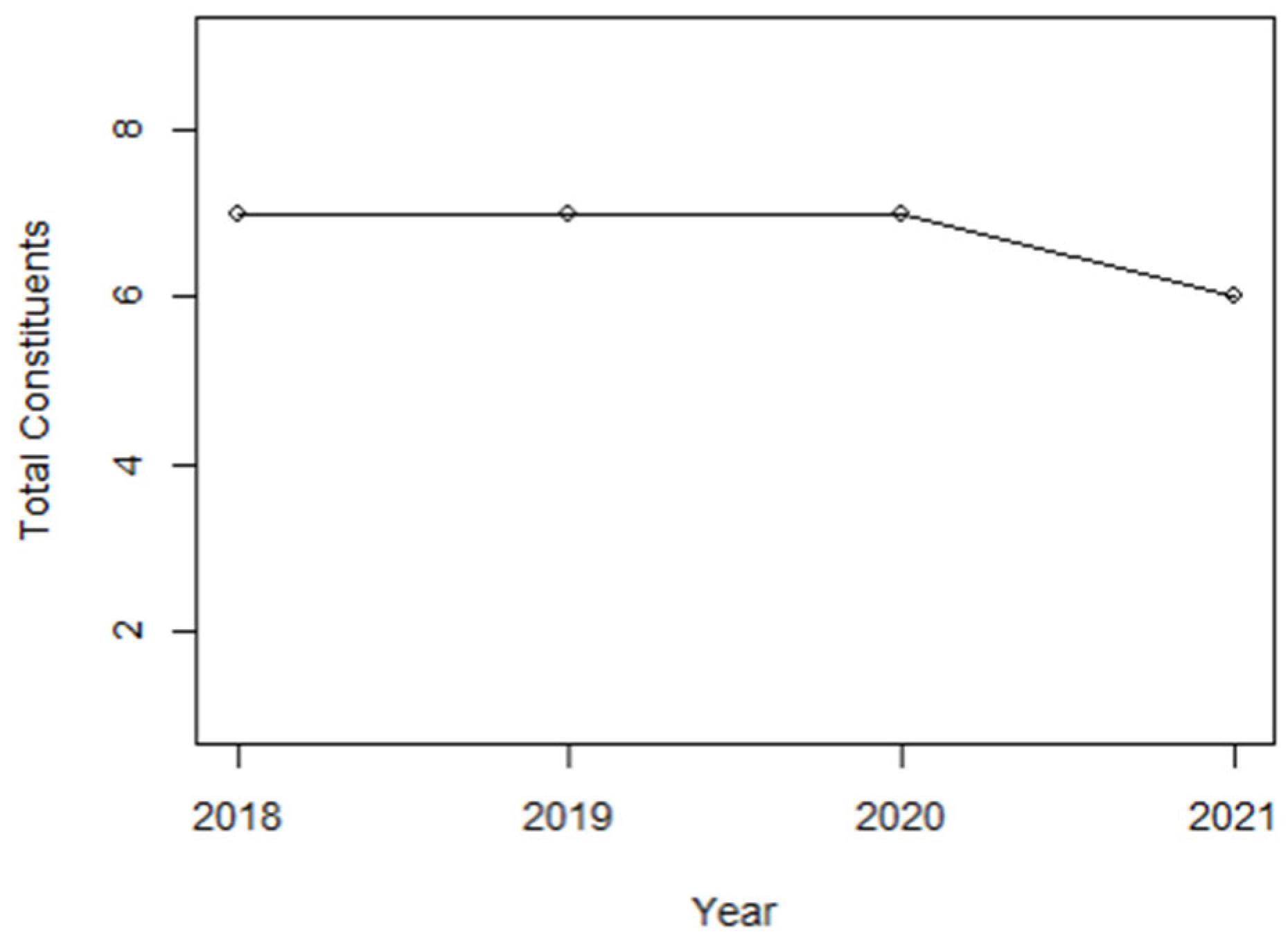

2.2.2. Evolution of the KLFIN’s Total Constitution

2.3. Causality

2.3.1. Causality: Overview, Background and Granger Causality

2.3.2. Causality: A Non-Linear View and the Uncertainty of the Constituents’ Performance

2.3.3. Causality: Effects of Financial Information Flow in International Financial Networks and the COVID-19 Pandemic

3. Methods

3.1. Stock Data

3.2. Data Processing and Testing

3.3. The Lag Time and Binning Criterion

3.3.1. G-Causality’s Lag Time

3.3.2. Transfer Entropy’s Binning

3.3.3. Comparative Criteria

4. Results

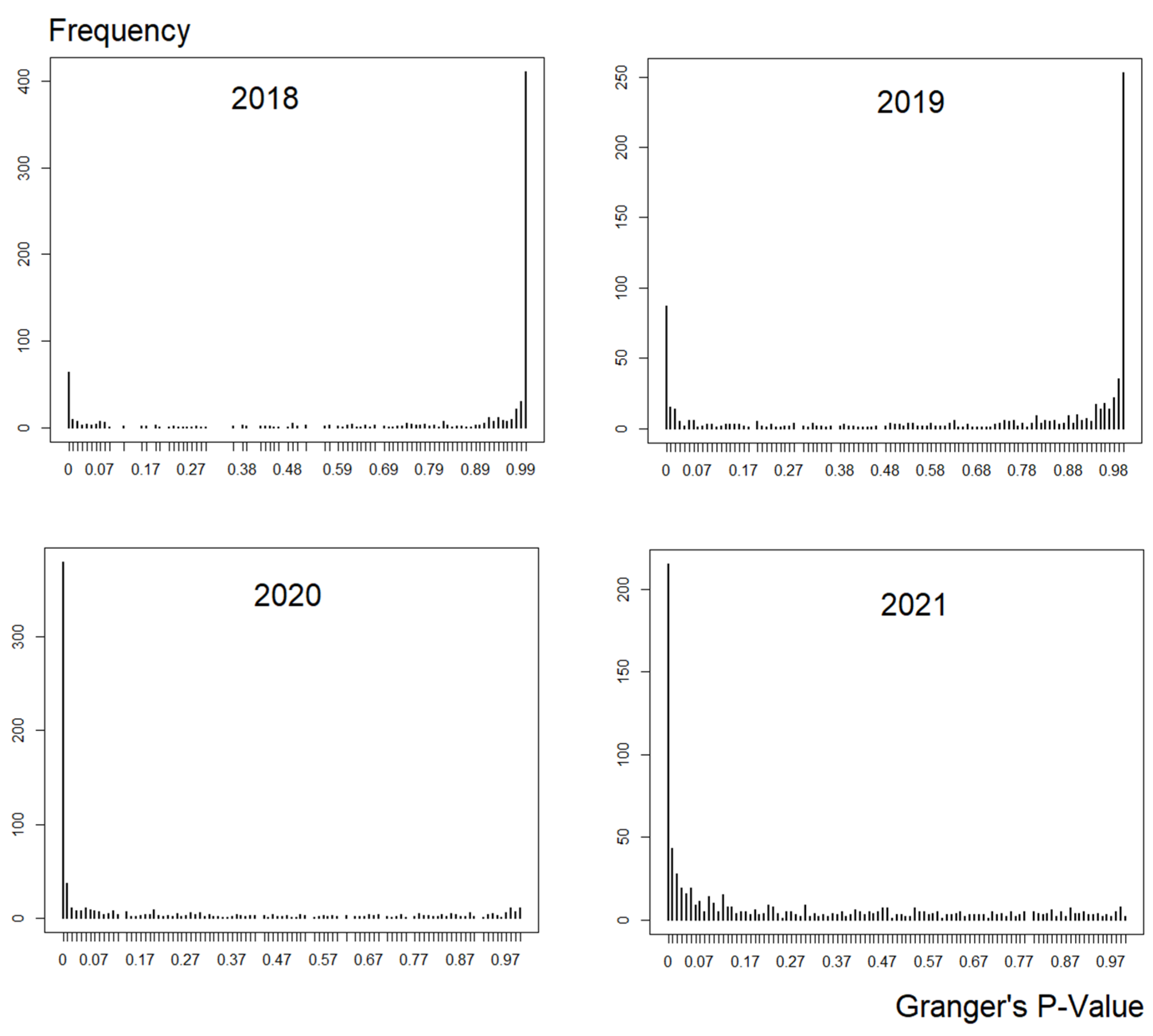

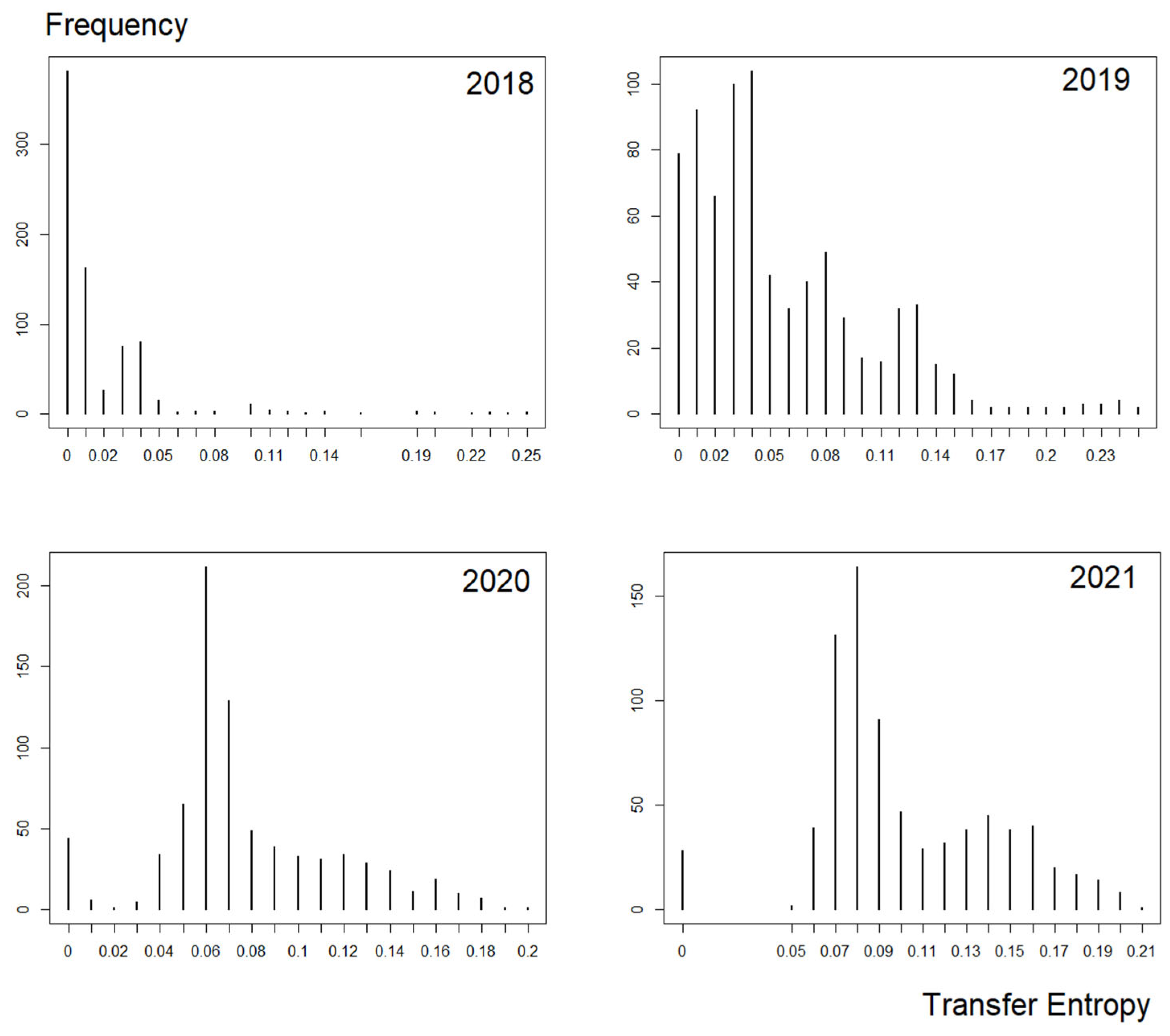

4.1. KLFIN Causality Preliminaries: Processing and G-Causality Distribution

4.2. KLFIN G-Causality Market Capitalization Network

4.3. KLFIN Transfer Entropy Market Capitalization Network

4.4. KLFIN Network by Bursa Malaysia’s Sub-Sector

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. KLFIN Market Capitalization Value and Size

| Instrument | Instrument Name | BM Sub-Sector | BM Market Cap (RM) | BM Market Size |

|---|---|---|---|---|

| MBBM.KL | Malayan Banking | Banking | 106.7 B | Large |

| PUBM.KL | Public Bank | Banking | 89.1 B | Large |

| CIMB.KL | CIMB Group Holdings | Banking | 51.6 B | Large |

| HLBB.KL | Hong Leong Bank | Banking | 44.1 B | Large |

| RHBC.KL | RHB Bank | Banking | 24.5 B | Large |

| HLCB.KL | Hong Leong Financial Group | Banking | 22.1 B | Large |

| AMMB.KL | AMMB Holdings | Banking | 10.3 B | Large |

| BIMB.KL | Bank Islam Malaysia ** | Banking | 6.1 B | Large |

| ALLI.KL | Alliance Bank Malaysia | Banking | 5.4 B | Large |

| BMYS.KL | Bursa Malaysia ** | Other Financials | 5.4 B | Large |

| LOND.KL | LPI Capital | Insurance | 5.4 B | Large |

| MBSS.KL | Malaysia Building Society | Other Financials | 4.3 B | Large |

| AFIN.KL | Affin Bank | Banking | 4.1 B | Large |

| ANCR.KL | Aeon Credit Service (M) | Other Financials | 3.8 B | Large |

| TAKA.KL | Syarikat Takaful Malaysia Keluarga ** | Insurance | 2.9 B | Large |

| AINM.KL | Allianz Malaysia | Insurance | 2.3 B | Large |

| OSKH.KL | OSK Holdings | Other Financials | 1.9 B | Mid |

| HLGC.KL | Hong Leong Capital | Other Financials | 1.4 B | Mid |

| REDI.KL | RCE Capital ** | Other Financials | 1.3 B | Mid |

| MPHB.KL | MPHB Capital | Insurance | 1.0 B | Mid |

| MNRB.KL | MNRB Holdings | Insurance | 783.1 M | Mid |

| KNNK.KL | Kenanga Investment Bank | Other Financials | 747.0 M | Mid |

| INSS.KL | Insas | Other Financials | 520.5 M | Mid |

| MNLF.KL | Manulife Holdings | Insurance | 514.1 M | Mid |

| PACO.KL | Pacific and Orient | Insurance | 299.9 M | Mid |

| APES.KL | Apex Equity Holdings | Other Financials | 195.5 M | Small |

| MAAS.KL | MAA Group | Insurance | 135.8 M | Small |

| ECMI.KL | Ecm Libra Group | Other Financials | 87.6 M | Small |

| JHHS.KL | Johan Holdings | Other Financials | 86.4 M | Small |

References

- Sekuriti, Suruhanjaya about the SC. Available online: https://www.sc.com.my/about/about-the-sc (accessed on 1 May 2022).

- Misman, F.N.; Roslan, S.; Mat Aladin, M.I. General Election and Stock Market Performance: A Malaysian Case. Int. J. Financ. Res. 2020, 11, 139–145. [Google Scholar] [CrossRef]

- Sekuriti, Suruhanjaya. SC and Bursa Malaysia Grant Waiver for Companies Seeking to List. Available online: https://www.sc.com.my/resources/media/media-release/sc-and-bursa-malaysia-grant-waiver-for-companies-seeking-to-list (accessed on 1 May 2022).

- Malaysia, Bursa. Initial Public Offering: How Do You Apply? Available online: https://bursaacademy.bursamarketplace.com/en/article/equities/initial-public-offering-how-do-you-apply-1 (accessed on 30 April 2022).

- Malaysia, Bursa. Listing on Bursa Malaysia. Available online: https://www.bursamalaysia.com/listing/get_listed/listing_process (accessed on 30 April 2022).

- Malaysia, Bursa. Going Public: A Practical Guide to Listing on Bursa Malaysia. Available online: https://www.bursamalaysia.com/sites/5d809dcf39fba22790cad230/assets/5ea8ea6339fba25885eecafa/Going_public_guide_2020.pdf (accessed on 30 April 2022).

- Malaysia, Bursa. FTSE Bursa Malaysia KLCI. Available online: https://www.bursamalaysia.com/trade/our_products_services/indices/ftse_bursa_malaysia_indices/ftse_bursa_malaysia_klci (accessed on 4 April 2022).

- Alyasa-Gan, S.S.; Che-Yahya, N. Intended Use of IPO Proceeds and Survival of Listed Companies in Malaysia. J. Risk Financ. Manag. 2022, 15, 145. [Google Scholar] [CrossRef]

- Malaysia, Bursa. Listing on Bursa Malaysia. Available online: https://www.bursamalaysia.com/listing/get_listed/listing_criteria (accessed on 2 May 2022).

- Malaysia, Bursa. Gain Your Share of Wealth on the Stock Market. Available online: https://www.bursamalaysia.com/about_bursa/media_centre/articles/gain-your-share-of-wealth-on-the-stock-market (accessed on 1 May 2022).

- Che-Yahya, N.; Alyasa-Gan, S.S. Explaining Dividend Payout: Evidence from Malaysia’s Blue-Chip Companies. J. Asian Financ. Econ. Bus. 2020, 7, 783–793. [Google Scholar] [CrossRef]

- Mohd Jaapar, A.; Ahmad Chukari, N.; Tarmizi, S.N.S. The Effect of COVID-19 Pandemic on Large-cap Stocks in Malaysia. Malays. J. Sci. Health Technol. 2021, 7, 8–14. [Google Scholar] [CrossRef]

- Sekuriti, Suruhanjaya. Securities Commision Malaysia Annual Report 2021: Capital Market Review and Outlook; Securities Commision Malaysia: Malaysia, 2021; pp. 15–21. [Google Scholar]

- Siti Sarah Alyasa-Gan, N.C.Y. IPO Initial Motivations and Survival of Malaysian Companies. Empir. Econ. Lett. 2021, 2, 103–113. [Google Scholar]

- Shari, W. Survival of the Malaysian initial public offerings. Manag. Sci. Lett. 2019, 9, 607–620. [Google Scholar] [CrossRef]

- Khamis, A.; Seong, C.M.; Xuan, K.; Hang, G.C.; WengHao, W.; Chung, A.Y. Investigate the Effect of Macroeconomics Factor to Malaysian Stock Market Using Granger Causality Analysis. Int. J. Appl. Sci. Res. 2021, 4, 65–72. [Google Scholar]

- Malaysia, Bursa. Understanding Indices. Available online: https://www.bursamalaysia.com/reference/insights/securities/investing_basic/understanding_indices (accessed on 28 May 2022).

- Malaysia, Bursa. Bursa Malaysia Sectorial Index Series. Available online: https://www.bursamalaysia.com/sites/5d809dcf39fba22790cad230/assets/61a6f54b39fba22db47c75b6/BM_Sectorial_Index_Series_Factsheet_Nov21.pdf (accessed on 30 November 2021).

- Group, F.R. FTSE Russell Factsheet: FTSE Bursa Malaysia KLCI. Available online: https://research.ftserussell.com/Analytics/FactSheets/temp/b63173e5-aed2-4d95-99a4-24a8e5beb636.pdf (accessed on 30 April 2022).

- Abdullah, N.I.R. Maybank Traders’ Almanac—KLFIN Index: Consolidation with a Chance of Rebound; Maybank: Malaysia, 2018; pp. 1–7. [Google Scholar]

- Malaysia, Bursa. Anticipation of OPR Hike Spurred Trading in Financial Stocks; Bursa Malaysia: Malaysia, 2022. [Google Scholar]

- Shamsabadi, H.A.; Rasiah, D. An Empirical Study on Performance and Risk-Return Relationship of Industries within Bursa Malaysia. Aust. J. Basic Appl. Sci. 2013, 1, 156–165. [Google Scholar]

- Bank, Public. Public Bank 2018 Annual Report; Public Bank: Malaysia, 2018; pp. 1–302. [Google Scholar]

- Maybank. Maybank Annual Report 2018; Maybank: Malaysia, 2018; pp. 1–141. [Google Scholar]

- Abdullah, N.I.R. Traders ’ Almanac Technical Trading Ideas—KLFIN Rebound off 50-Day EMA Line; Maybank Investment Bank Berhad: Malaysia, 2022; pp. 1–8. [Google Scholar]

- Malaysia, Bursa. Indices Information: BM Financial Services. Available online: https://www.bursamalaysia.com/trade/trading_resources/listing_directory/indices-profile?stock_code=0010I (accessed on 30 April 2022).

- David Ng, C.Y.; Lim, B.K.; Chong, H.L. Sectoral analysis of calendar effects in Malaysia: Post financial crisis (1998–2008). Afr. J. Bus. Manag. 2011, 5, 5600–5611. [Google Scholar] [CrossRef]

- Sekuriti, Suruhanjaya. Senarai Sekuriti Patuh Syariah Oleh Majlis Penasihat Syariah Suruhanjaya Sekuriti Malaysia (25/5/2018); Suruhanjaya Sekuriti Malaysia: Malaysia, 2018; pp. 1–37. [Google Scholar]

- Sekuriti, Suruhanjaya. Senarai Sekuriti Patuh Syariah Oleh Majlis Penasihat Syariah Suruhanjaya Sekuriti Malaysia (30/11/2018); Suruhanjaya Sekuriti Malaysia: Malaysia, 2018; pp. 1–39. [Google Scholar]

- Sekuriti, Suruhanjaya. Senarai Sekuriti Patuh Syariah Oleh Majlis Penasihat Syariah Suruhanjaya Sekuriti Malaysia (29/11/2019); Suruhanjaya Sekuriti Malaysia: Malaysia, 2019; pp. 1–36. [Google Scholar]

- Malaysia, Securities Commission. List of Shariah Compliant Securities (29/5/2020); Suruhanjaya Sekuriti Malaysia: Malaysia, 2020; pp. 1–26. [Google Scholar]

- Malaysia, Securities Commission. List of Shariah Compliant Securities (27/11/2020); Suruhanjaya Sekuriti Malaysia: Malaysia, 2020; pp. 1–30. [Google Scholar]

- Malaysia, Securities Commission. List of Shariah Compliant Securities (28/5/2021); Suruhanjaya Sekuriti Malaysia: Malaysia, 2021; pp. 1–30. [Google Scholar]

- Malaysia, Securities Commission. List of Shariah Compliant Securities (26/11/2021); Suruhanjaya Sekuriti Malaysia: Malaysia, 2021; pp. 1–29. [Google Scholar]

- Granger, C.J.W. Investigating Causal Relations by Econometric Models and Cross-spectral Methods. Econometrica 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Mutual, Public. Impact of Large- and Small-Cap Stocks on Fund Performance. Available online: https://www.publicmutual.com.my/Menu/Learning-Hub/Impact-of-Large-and-Small-Cap-Stocks-on-Fund-Performance (accessed on 30 April 2022).

- Academy, B. Mid & Small Cap Stocks Deliver Better Returns Over the Long Term. Available online: https://bursaacademy.bursamarketplace.com/en/article/equities/mid-small-cap-stocks-deliver-better-returns-over-the-long-term#:~:text=In%20Malaysia%2C%20mid%20cap%20stocks,capitalisation%20of%20less%20than%20RM200m (accessed on 3 May 2022).

- ifca.asia. Robust Economy Lifts Corporate Earnings. Available online: https://ifca.asia/robust-economy-lifts-corporate-earnings-2/ (accessed on 28 May 2022).

- Yi, L.Y. More than 700 Companies Valued at Below US$100 Million on Bursa. Available online: https://www.theedgemarkets.com/article/more-700-companies-valued-below-us100-million-bursa (accessed on 28 May 2022).

- isaham. Maksud di Sebalik Market Cap. Available online: https://www.isaham.my/blog/maksud-di-sebalik-market-cap (accessed on 28 May 2022).

- Horng, L.M. Small-Mid Caps: Can 2020 Defy The Odds? RHB: Malaysia, 2020; p. 9. [Google Scholar]

- Malaysia, Securities Commission. Securities Commission Malaysia: Capital Market Masterplan 3; Securities Commission Malaysia: Malaysia, 2021; p. 122. [Google Scholar]

- Sekuriti, Suruhanjaya. Securities Commission Malaysia: Annual Report 2020; Securities Commission Malaysia: Malaysia, 2020; pp. 1–219. [Google Scholar]

- Rahman, A.R. Can SMEs Make the Leap? Malaysian Institute of Accountants: Malaysia, 2018; p. 5. [Google Scholar]

- Loke, A. Listing in Malaysia; BT Insight: Malaysia, 2019; pp. 22–23. [Google Scholar]

- Ghasemi, M.; Ab Razak, N.H. Determinants of Profitability in ACE Market Bursa Malaysia: Evidence from Panel Models. Int. J. Econ. Manag. 2017, 11, 847–869. [Google Scholar]

- Refinitiv. Datastream. Datastream Subscription Service. Available online: https://www.refinitiv.com/content/dam/marketing/en_us/documents/fact-sheets/datastream-economic-data-macro-research-fact-sheet.pdf (accessed on 30 April 2022).

- Viandiny, N.U. Analisis Keterkaitan Antar Indeks Harga Saham Sektor Keuangan: Studi Pada Negara Indonesia dan Malaysia. J. Ilm. Mhs. Fak. Ekon. Dan Bisnis Univ. Brawijaya 2017, 5, 9. [Google Scholar]

- Kok, S.C.; Munir, Q.; Lean, H.H. Informational Efficiency of Finance Stocks in Malaysia: A Two-Regime Nonlinear Threshold Autoregressive Approach. Int. J. Bus. Soc. 2019, 10, 59–74. [Google Scholar]

- Ramzani, A. Banking Needs Catalyst But Growth Prevails; Kenanga Research: Malaysia, 2020; pp. 1–12. [Google Scholar]

- Mantegna, R.N. Hierarchical Structure in Financial Markets. Eur. Phys. J. B 1999, 11, 193–197. [Google Scholar] [CrossRef]

- Bressler, S.L.; Seth, A.K. Wiener-Granger Causality: A well established methodology. NeuroImage 2011, 58, 323–329. [Google Scholar] [CrossRef]

- Pearl, J. Causality: Models, Reasoning and Inference, 2nd ed.; Cambridge University Press: USA, 2011; p. 464. [Google Scholar]

- Katerina Hlavácková-Schindler, M.P.M.V.J.B. Causality Detection Based on Information-Theoretic Approaches in Time Series Analysis. Phys. Rep. 2007, 441, 1–46. [Google Scholar] [CrossRef]

- Holland, P.W. Statistics and Causal Inference. J. Am. Stat. Assoc. 1986, 81, 945–960. [Google Scholar] [CrossRef]

- Oxford Learners Dictionaries. Available online: https://www.oxfordlearnersdictionaries.com/definition/english/causality?q=Causality (accessed on 30 April 2022).

- James, R.G.; Barnett, N.; Crutchfield, J.P. Information Flows? A Critique of Transfer Entropies. Phys. Rev. Lett. 2016, 116, 238701. [Google Scholar] [CrossRef]

- Stavroglou, S.; Pantelous, A.; Soramaki, K.; Zuev, K. Causality networks of financial assets. J. Netw. Theory Financ. 2017, 3, 17–67. [Google Scholar] [CrossRef]

- Shojaie, A.; Fox, E.B. Granger Causality: A Review and Recent Advances. Annu. Rev. Stat. Its Appl. 2022, 9, 289–319. [Google Scholar] [CrossRef]

- Chen, P.; Hsiao, C.-Y. Looking behind Granger causality. Munich Pers. RePEc Arch. 2010, 1, 5. [Google Scholar]

- Durcheva, M.; Tsankov, P. Granger causality networks of S&P 500 stocks. AIP Conf. Proc. 2021, 2333, 110014. [Google Scholar] [CrossRef]

- Mun, H.W.; Siong, E.C.; Thing, T.C. Stock Market and Economic Growth in Malaysia: Causality Test. Asian Soc. Sci. 2009, 4, 86–92. [Google Scholar] [CrossRef][Green Version]

- Ang, J.B.; McKibbin, W.J. Financial liberalization, financial sector development and growth: Evidence from Malaysia. J. Dev. Econ. 2007, 84, 215–233. [Google Scholar] [CrossRef]

- Granger, C.W.J.; Clive, W.J. Granger Prize Lecture: Time Series Analysis, Cointegration, and Applications. Available online: https://www.nobelprize.org/prizes/economic-sciences/2003/granger/lecture/ (accessed on 30 April 2022).

- Barnett, L.; Barrett, A.B.; Seth, A.K. Granger causality and transfer entropy are equivalent for gaussian variables. Phys. Rev. Lett. 2009, 103, 238701. [Google Scholar] [CrossRef]

- Siggiridou, E.; Koutlis, C.; Tsimpiris, A.; Kugiumtzis, D. Evaluation of Granger Causality Measures for Constructing Networks from Multivariate Time Series. Entropy 2019, 21, 1080. [Google Scholar] [CrossRef]

- Stokes, P.A.; Purdon, P.L. A study of problems encountered in Granger causality analysis from a neuroscience perspective. Proc. Natl. Acad. Sci. USA 2017, 114, E7063–E7072. [Google Scholar] [CrossRef]

- Diks, C.; Fang, H. Transfer Entropy for Nonparametric Granger Causality Detection: An Evaluation of Different Resampling Methods. Entropy 2017, 19, 372. [Google Scholar] [CrossRef]

- Zaremba, A.; Aste, T. Measures of Causality in Complex Datasets with Application to Financial Data. Entropy 2014, 16, 2309–2349. [Google Scholar] [CrossRef]

- Diks, C.; Fang, H. A Consistent Nonparametric Test for Granger Non-Causality Based on the Transfer Entropy. Entropy 2020, 22, 1123. [Google Scholar] [CrossRef]

- Raubitzek, S.; Neubauer, T. Combining Measures of Signal Complexity and Machine Learning for Time Series Analyis: A Review. Entropy 2021, 23, 1672. [Google Scholar] [CrossRef]

- Villaverde, A.F.; Ross, J.; Morán, F.; Banga, J.R. MIDER: Network inference with mutual information distance and entropy reduction. PLoS ONE 2014, 9, e96732. [Google Scholar] [CrossRef] [PubMed]

- Syczewska, E.M.; Struzik, Z.R. Granger Causality and Transfer Entropy for Financial Returns. Acta Phys. Pol. A 2015, 127, A-129–A-135. [Google Scholar] [CrossRef]

- Marks; Gelder, M. In Reply: Behaviour Therapy. Br. J. Psychiatry 1966, 112, 211–212. [Google Scholar] [CrossRef]

- Liu, A.; Chen, J.; Yang, S.Y.; Hawkes, A.G. The flow of information in trading: An entropy approach to market regimes. Entropy 2020, 22, 1064. [Google Scholar] [CrossRef]

- Maghyereh, A.; Abdoh, H.; Awartani, B. Have returns and volatilities for financial assets responded to implied volatility during the COVID-19 pandemic? J. Commod. Mark. 2021, 26, 100194. [Google Scholar] [CrossRef]

- Guo, X.; Zhang, H.; Tian, T. Development of stock correlation networks using mutual information and financial big data. PLoS ONE 2018, 13, e0195941. [Google Scholar] [CrossRef]

- Schreiber, T. Measuring Information Transfer. Phys. Rev. Lett. 2000, 2, 461–464. [Google Scholar] [CrossRef]

- Baek, S.K.; Jung, W.-S.; Kwon, O.; Moon, H.-T. Transfer Entropy Analysis of the Stock Market. arXiv 2005. [Google Scholar]

- Korbel, J.; Jiang, X.; Zheng, B. Transfer entropy between communities in complex financial networks. Entropy 2019, 21, 1124. [Google Scholar] [CrossRef]

- Cover, T.M.; Thomas, J. Elements of Information Theory; Wiley-Interscience: Hoboken, NJ, USA, 1991; Volume 1, p. 576. [Google Scholar]

- Behrendt, S.; Dimpfl, T.; Peter, F.J.; Zimmermann, D.J. RTransferEntropy—Quantifying information flow between different time series using effective transfer entropy. SoftwareX 2019, 10, 100265. [Google Scholar] [CrossRef]

- Fiedor, P. Granger-causal nonlinear financial networks. J. Netw. Theory Financ. 2015, 1, 53–82. [Google Scholar] [CrossRef]

- Huang, W.Q.; Wang, D. A return spillover network perspective analysis of Chinese financial institutions’ systemic importance. Phys. A Stat. Mech. Its Appl. 2018, 509, 405–421. [Google Scholar] [CrossRef]

- Chiang, T.C. Evidence of Economic Policy Uncertainty and COVID-19 Pandemic on Global Stock Returns. J. Risk Financ. Manag. 2022, 15, 28. [Google Scholar] [CrossRef]

- Gherghina, Ș.C.; Armeanu, D.Ș.; Joldeș, C.C. Stock market reactions to COVID-19 pandemic outbreak: Quantitative evidence from ARDL bounds tests and granger causality analysis. Int. J. Environ. Res. Public Health 2020, 17, 6729. [Google Scholar] [CrossRef]

- Hayat, M.A.; Ghulam, H.; Batool, M.; Naeem, M.Z.; Ejaz, A.; Spulbar, C.; Birau, R. Investigating the Causal Linkages among Inflation, Interest Rate, and Economic Growth in Pakistan under the Influence of COVID-19 Pandemic: A Wavelet Transformation Approach. J. Risk Financ. Manag. 2021, 14, 277. [Google Scholar] [CrossRef]

- Muhlack, N.; Soost, C.; Henrich, C.J. Does Weather Still Affect The Stock Market?: New Insights Into The Effects Of Weather On Returns, Volatility, And Trading Volume. Schmalenbach J. Bus. Res. 2021, 74, 1–35. [Google Scholar] [CrossRef]

- Azzouza, A. The effect of financial liberalization on Malaysian economic growth. Theor. Appl. Econ. 2021, XXVIII, 19–32. [Google Scholar]

- Hussin, M.Y.M.; Yusof, Y.A.; Muhammad, F.; Razak, A.A.; Hashim, E.; Marwan, N.F. The Integration of Islamic Stock Markets: Does a Problem for Investors. Labu. E-J. Muamalat Soc. 2013, 7, 17–27. [Google Scholar]

- Efendi, R.; Arbaiy, N.; Deris, M.M. A new procedure in stock market forecasting based on fuzzy random auto-regression time series model. Inf. Sci. 2018, 441, 113–132. [Google Scholar] [CrossRef]

- Zakaria, Z.; Shamsuddin, S. Relationship between Stock Futures Index and Cash Prices Index: Empirical Evidence Based on Malaysia Data. J. Bus. Stud. Q. 2012, 4, 103–112. [Google Scholar]

- Mathworks. Trend-Stationary vs. Difference-Stationary Processes. Available online: https://www.mathworks.com/help/econ/trend-stationary-vs-difference-stationary.html (accessed on 27 May 2022).

- Nau, R. Stationarity and Differencing. Available online: https://people.duke.edu/~rnau/411diff.htm (accessed on 25 May 2022).

- Sifat, I.M.; Thaker, H.M.T. Predictive power of web search behavior in five ASEAN stock markets. Res. Int. Bus. Financ. 2020, 52, 101191. [Google Scholar] [CrossRef]

- Nguyen, H.M.; Thai-Thuong Le, Q.; Ho, C.M.; Nguyen, T.C.; Vo, D.H. Does financial development matter for economic growth in the emerging markets? Borsa Istanb. Rev. 2021, 22, 688–698. [Google Scholar] [CrossRef]

- Sahabuddin, M.; Muhammad, J.; Dato’ Hjyahya, M.H.; Shah, S.M.; Rahman, M.M. The co-movement between shariah compliant and sectorial stock indexes performance in bursa Malaysia. Asian Econ. Financ. Rev. 2018, 8, 515–524. [Google Scholar] [CrossRef]

- Caserini, N.A.; Pagnottoni, P. Effective transfer entropy to measure information flows in credit markets. Stat. Methods Appl. 2021. [Google Scholar] [CrossRef]

- Kim, M.; Sayama, H. Predicting stock market movements using network science: An information theoretic approach. Appl. Netw. Sci. 2017, 2, 35. [Google Scholar] [CrossRef]

- Musa, M.H.; Razak, F.A. Directed network of Shariah-compliant stock in Bursa Malaysia. J. Phys. Conf. Ser. 2021, 1988, 012019. [Google Scholar] [CrossRef]

- Keskin, Z.; Aste, T. Information-theoretic measures for non-linear causality detection: Application to social media sentiment and cryptocurrency prices. R. Soc. Open Sci. 2020, 7, 200863. [Google Scholar] [CrossRef]

- Amblard, P.O.; Michel, O.J.J. On directed information theory and Granger causality graphs. J. Comput. Neurosci. 2011, 30, 7–16. [Google Scholar] [CrossRef]

- Malaysia, Bursa. Bursa Malaysia Sector Classification of Applicants or Listed Issuers; Bursa Malaysia: Malaysia, 2021; pp. 1–2. [Google Scholar]

- Malaysia, Bursa. APEX EQ HLD. Available online: https://www.bursamarketplace.com/mkt/themarket/stock/APES/profile (accessed on 15 July 2022).

- Malaysia, Bursa. PACIFIC & ORIENT. Available online: https://www.bursamarketplace.com/mkt/themarket/stock/PACO (accessed on 15 July 2022).

- Malaysia, Bursa. MAA GROUP. Available online: https://www.bursamarketplace.com/mkt/themarket/stock/MAAS/profile (accessed on 15 July 2022).

- Malaysia, Bank Negara. About the Bank. Available online: https://www.bnm.gov.my/introduction (accessed on 1 August 2022).

- Malaysia, Bank Negara. Financial Sector Blueprint 2022–2026; Bank Negara Malaysia: Malaysia, 2022; pp. 1–128. [Google Scholar]

- Abdul Razak, F.; Jensen, H.J. Quantifying ‘causality’ in complex systems: Understanding transfer entropy. PLoS ONE 2014, 9, e99462. [Google Scholar] [CrossRef]

- Papana, A. Connectivity Analysis for Multivariate Time Series: Correlation vs. Causality. Entropy 2021, 23, 1570. [Google Scholar] [CrossRef] [PubMed]

- Razak, F.A.; Jensen, H.J. Estimation of information theoretic measures on the Ising model. AIP Conf. Proc. 2014, 56–61. [Google Scholar] [CrossRef]

- Abdul Razak, F.; Ahmad Shahabuddin, F. Malaysian Household Income Distribution: A Fractal Point of View. Sains Malays. 2018, 47, 2187–2194. [Google Scholar] [CrossRef]

- Razak, F.A. The derivation of mutual information and covariance function using centered random variables. AIP Conf. Proc. 2014, 883–889. [Google Scholar] [CrossRef]

- Lloyd Demetrius, T.M. Robustness and network evolution—An entropic principle. Phys. A Stat. Mech. Its Appl. 2005, 346, 682–696. [Google Scholar] [CrossRef]

- Musa, M.H.; Zuhud, D.A.Z.; Ismail, M.; Bahaludin, H.; Razak, F.A. Correlation and Mutual Information Based Networks of Malaysian Stocks. 2022, 1–20, Work in progress. [Google Scholar]

| Constituent 1 | Constituent 2 | AIC | Wald-Significance’s p-Value | G-Causality |

|---|---|---|---|---|

| MPHB.KL | ALLI.KL | 1 | 0.01278 | Yes |

| MPHB.KL | AFIN.KL | 7 | 0.00105 | Yes |

| MPHB.KL | AMMB.KL | 1 | 0.02037 | Yes |

| MPHB.KL | HLBB.KL | 8 | 0.00002 | Yes |

| MPHB.KL | HLCB.KL | 1 | 0.00000 | Yes |

| MPHB.KL | INSS.KL | 1 | 0.00000 | Yes |

| MPHB.KL | LOND.KL | 1 | 0.00000 | Yes |

| MPHB.KL | MBBM.KL | 1 | 0.00000 | Yes |

| MPHB.KL | MBSS.KL | 1 | 0.00000 | Yes |

| MPHB.KL | OSKH.KL | 1 | 0.00000 | Yes |

| MPHB.KL | PUBML.KL | 1 | 0.00000 | Yes |

| MPHB.KL | REDI.KL | 1 | 0.00000 | Yes |

| MPHB.KL | RHBC.KL | 1 | 0.00000 | Yes |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zuhud, D.A.Z.; Musa, M.H.; Ismail, M.; Bahaludin, H.; Razak, F.A. The Causality and Uncertainty of the COVID-19 Pandemic to Bursa Malaysia Financial Services Index’s Constituents. Entropy 2022, 24, 1100. https://doi.org/10.3390/e24081100

Zuhud DAZ, Musa MH, Ismail M, Bahaludin H, Razak FA. The Causality and Uncertainty of the COVID-19 Pandemic to Bursa Malaysia Financial Services Index’s Constituents. Entropy. 2022; 24(8):1100. https://doi.org/10.3390/e24081100

Chicago/Turabian StyleZuhud, Daeng Ahmad Zuhri, Muhammad Hasannudin Musa, Munira Ismail, Hafizah Bahaludin, and Fatimah Abdul Razak. 2022. "The Causality and Uncertainty of the COVID-19 Pandemic to Bursa Malaysia Financial Services Index’s Constituents" Entropy 24, no. 8: 1100. https://doi.org/10.3390/e24081100

APA StyleZuhud, D. A. Z., Musa, M. H., Ismail, M., Bahaludin, H., & Razak, F. A. (2022). The Causality and Uncertainty of the COVID-19 Pandemic to Bursa Malaysia Financial Services Index’s Constituents. Entropy, 24(8), 1100. https://doi.org/10.3390/e24081100