Entropy Based Student’s t-Process Dynamical Model

Abstract

1. Introduction

2. Related Work

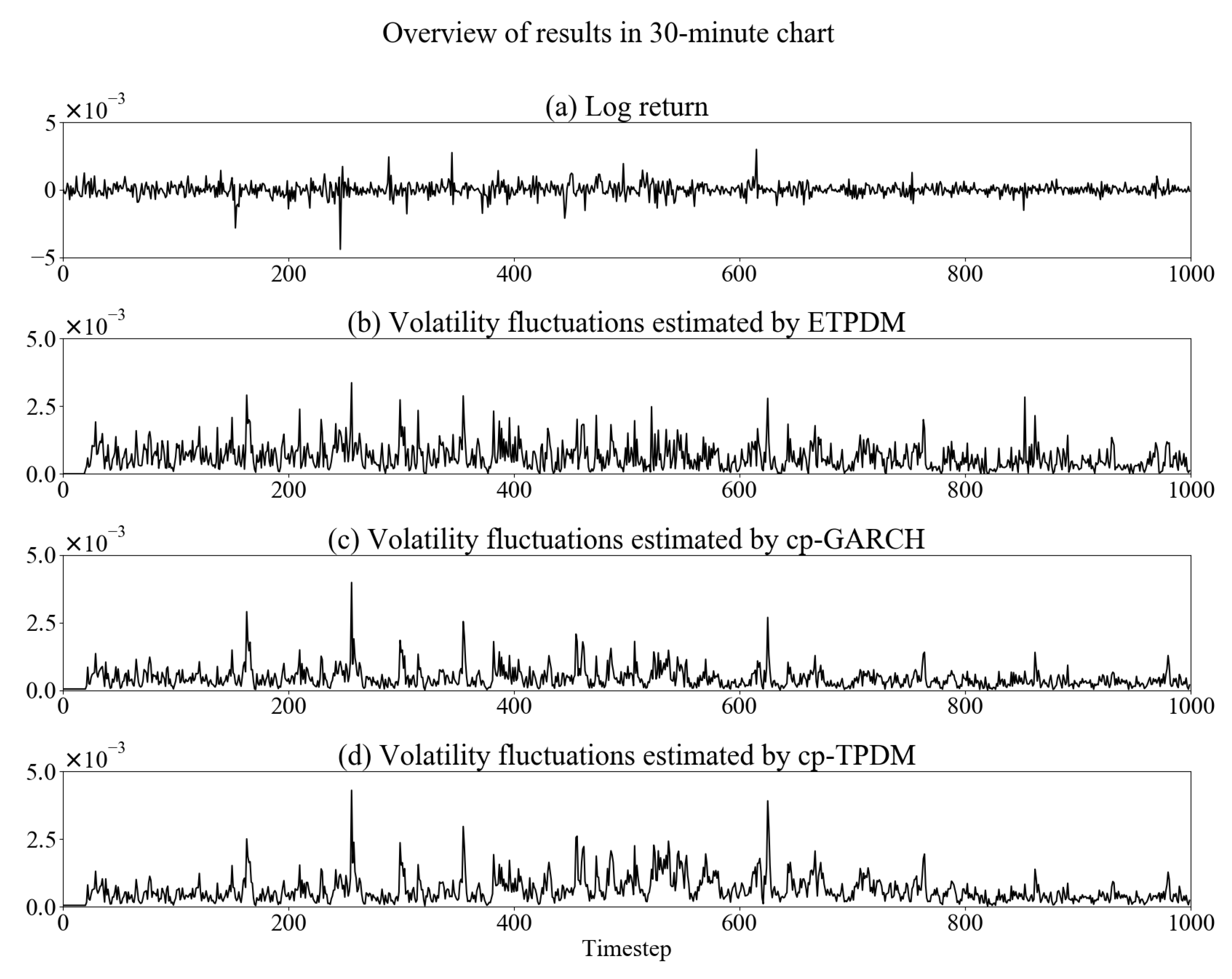

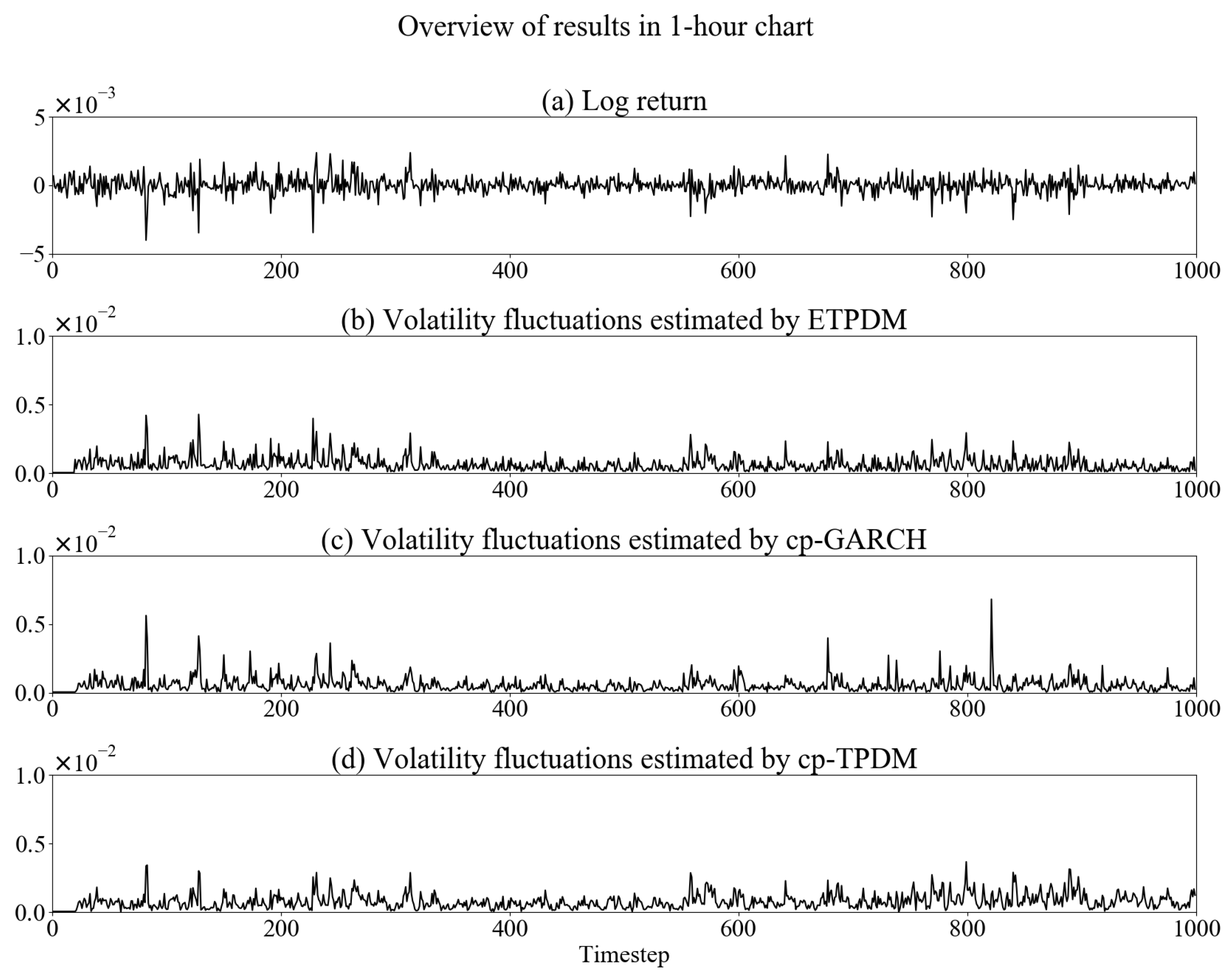

2.1. Volatility Fluctuation Models

2.2. Gaussian Process

2.3. Student’s t-Process

2.4. Student’s t-Process Latent Variable Model

3. Proposed Model

3.1. Student’s t-Process Dynamical Model

3.2. Particle Filter

3.3. Entropy-Based Particle Filter

| Algorithm 1 Entropy Based Student’s t-Process Dynamical Model (ETPDM) |

|

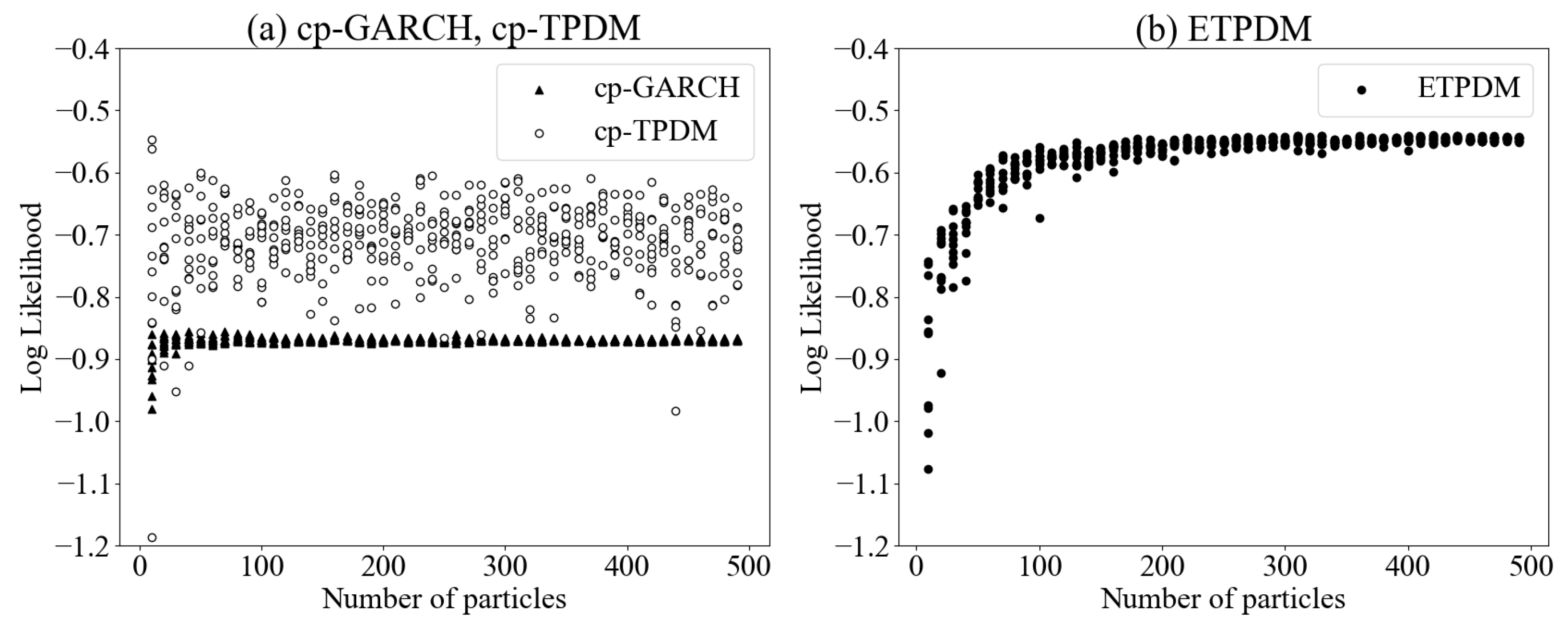

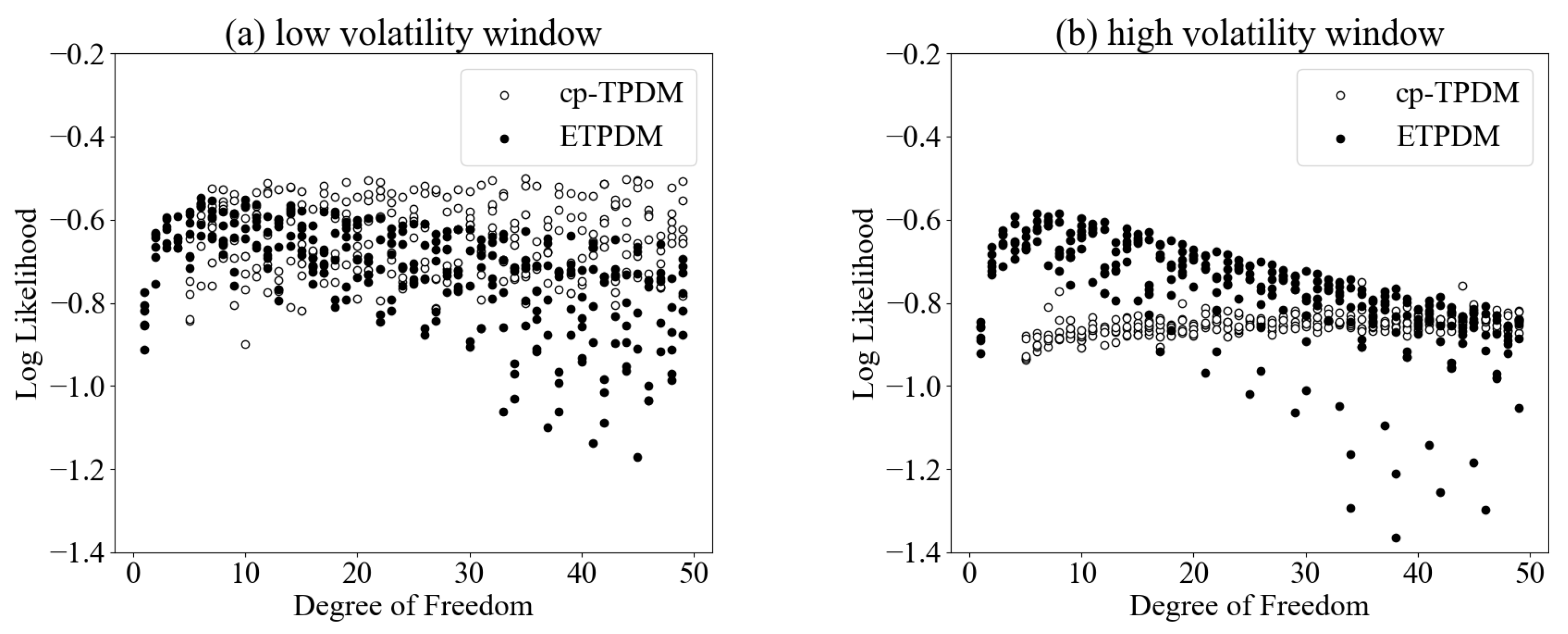

4. Numerical Experiments

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Cochrane, J.H. Asset Pricing: Revised Edition; Princeton University Press: Princeton, NJ, USA, 2009. [Google Scholar]

- Mandelbrot, B.B. The variation of certain speculative prices. In Fractals and Scaling in Finance; Springer: Berlin/Heidelberg, Germany, 1997; pp. 371–418. [Google Scholar]

- Shang, Y.; Dong, Q. Oil volatility forecasting and risk allocation: Evidence from an extended mixed-frequency volatility model. In Applied Economics; Routledge: London, UK, 2021; pp. 1127–1142. [Google Scholar]

- Hou, Y.; Li, S.; Wen, F. Time-varying volatility spillover between Chinese fuel oil and stock index futures markets based on a DCC-GARCH model with a semi-nonparametric approach. Energy Econ. 2019, 83, 119–143. [Google Scholar] [CrossRef]

- Horvath, B.; Muguruza, A.; Tomas, M. Deep Learning Volatility. arXiv 2019, arXiv:1901.09647. [Google Scholar] [CrossRef]

- Rasmussen, C.; Williams, C. Gaussian Processes for Machine Learning; Adaptative Computation and Machine Learning Series; The MIT Press: Cambridge, MA, USA, 2006. [Google Scholar]

- Gonzalvez, J.; Lezmi, E.; Roncalli, T.; Xu, J. Financial Applications of Gaussian Processes and Bayesian Optimization. arXiv 2019, arXiv:1903.04841. [Google Scholar] [CrossRef]

- Nirwan, R.S.; Bertschinger, N. Applications of Gaussian process latent variable models in finance. In Advances in Intelligent Systems and Computing; Springer: Berlin/Heidelberg, Germany, 2019; pp. 1209–1221. [Google Scholar]

- Shah, A.; Wilson, A.; Ghahramani, Z. Student-t processes as alternatives to Gaussian processes. In Artificial Intelligence and Statistics; 2014; pp. 877–885. Available online: http://proceedings.mlr.press/v33/shah14.html (accessed on 30 March 2021).

- Uchiyama, Y.; Nakagawa, K. TPLVM: Portfolio Construction by Student’s t-Process Latent Variable Model. Mathematics 2020, 8, 449. [Google Scholar] [CrossRef]

- Sarkka, S. Baysian Filtering and Smoothing; Cambridge University Press: Cambridge, UK, 2013. [Google Scholar]

- Murata, M.; Hiramatsu, K. On Ensemble kalman Filter, Particle Filter, and Gaussian Particle Filter. Trans. Inst. Syst. Control Inf. Eng. 2016, 29, 448–462. [Google Scholar]

- Nakano, S.; Ueno, G.; Haguchi, T. Merging particle filter for sequential data assiimilation. Nonlinear Process. Geophys. 2007, 14, 395–408. [Google Scholar] [CrossRef]

- Murata, M.; Nagano, H.; Kashino, K. Monte Carlo filter particle filter. In Proceedings of the 2015 European Control Conference (ECC), Linz, Austria, 15–17 July 2015; Volume 14, pp. 2836–2841. [Google Scholar]

- Eyink, G.L.; Kim, S. A Maximum Entropy Method for Particle Filtering. J. Stat. Phys. 2006, 123, 1071–1128. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroskedasticity. J. Econ. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Bollerslev, T. Glossary to arch (garch). CREATES Res. Pap. 2008, 49, 1–46. [Google Scholar] [CrossRef]

- Teräsvirta, T. An introduction to univariate GARCH models. In Handbook of Financial Time Series; Springer: Berlin/Heidelberg, Germany, 2009; pp. 17–42. [Google Scholar]

- Nakagawa, K.; Uchiyama, Y. GO-GJRSK Model with Application to Higher Order Risk-Based Portfolio. Mathematics 2020, 8, 1990. [Google Scholar] [CrossRef]

- Lawrence, N.D. Gaussian process latent variable models for visualisation of high dimensional data. NIPS 2003, 2, 5. [Google Scholar]

- Kato, T. Introduction of Particle Filter and Its Implementation. IPSJ SIG Tech. Rep. 2007, 157, 161. [Google Scholar]

- Wu, Y.; Hernández-Lobato, J.M.; Ghahramani, Z. Gaussian Process Volatility Model. In Advances in Neural Information Processing Systems 27; Ghahramani, Z., Welling, M., Cortes, C., Lawrence, N.D., Weinberger, K.Q., Eds.; Curran Associates, Inc.: Red Hook, NY, USA, 2014; pp. 1044–1052. [Google Scholar]

- Vințe, C.; Ausloos, M.; Furtună, T.F. A Volatility Estimator of Stock Market Indices Based on the Intrinsic Entropy Model. Entropy 2021, 23, 484. [Google Scholar] [CrossRef]

- Cover, T.M.; Thomas, J.A. Elements of Information Theory; John Wiley & Sons: Hoboken, NJ, USA, 1991. [Google Scholar]

- Kullback, S.; Leibler, R.A. On information and sufficiency. Ann. Math. Stat. 1951, 22, 79–86. [Google Scholar] [CrossRef]

- Wu, Y.; Hernndez-Lobato, J.M.; Ghahramani, Z. Gaussian process volatulity model. In Advances in Neural Information Processing Systems; The MIT Press: Cambridge, MA, USA, 2014. [Google Scholar]

- Fleming, J.; Kirby, C. A closer look at the Relation between GARCH and Stochastic Autoregressive volatility. J. Financ. Econ. 2003, 1, 365–419. [Google Scholar]

- Jacquier, E.; Polson, N.G.; Rossi, P.E. Bayesian analysis of stochastic volatility models withfat-tails and correlated errors. J. Econ. 2004, 122, 185–212. [Google Scholar] [CrossRef]

| Window Type | Mean | Variance | Skewness | Kurtosis |

|---|---|---|---|---|

| high volatility window | −0.974 | 5.22 | ||

| low volatility window | −0.531 | 3.56 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Nono, A.; Uchiyama, Y.; Nakagawa, K. Entropy Based Student’s t-Process Dynamical Model. Entropy 2021, 23, 560. https://doi.org/10.3390/e23050560

Nono A, Uchiyama Y, Nakagawa K. Entropy Based Student’s t-Process Dynamical Model. Entropy. 2021; 23(5):560. https://doi.org/10.3390/e23050560

Chicago/Turabian StyleNono, Ayumu, Yusuke Uchiyama, and Kei Nakagawa. 2021. "Entropy Based Student’s t-Process Dynamical Model" Entropy 23, no. 5: 560. https://doi.org/10.3390/e23050560

APA StyleNono, A., Uchiyama, Y., & Nakagawa, K. (2021). Entropy Based Student’s t-Process Dynamical Model. Entropy, 23(5), 560. https://doi.org/10.3390/e23050560