A New Adaptive Entropy Portfolio Selection Model

Abstract

1. Introduction

2. Entropy Model Description

2.1. Markowitz’s Mean-Variance Model

2.2. Information Entropy

- Non-negative: For , and , equality happens when one , and the others are zero, . If the entropy is incorporated in an objective function to determine portfolio weights, the obtained weights automatically become non-negative. This implies that a model with entropy always yields no short-selling. Due to the theoretical and practical reasons, the portfolio with no short-selling is preferred by most conservative investors [15];

- Extremum property: It has its maximum value , when and reaches the minimum value 0 when . As a result, is a good measurement of portfolio diversification [2];

- Strictly concave: So that the critical points are exactly maximizers.

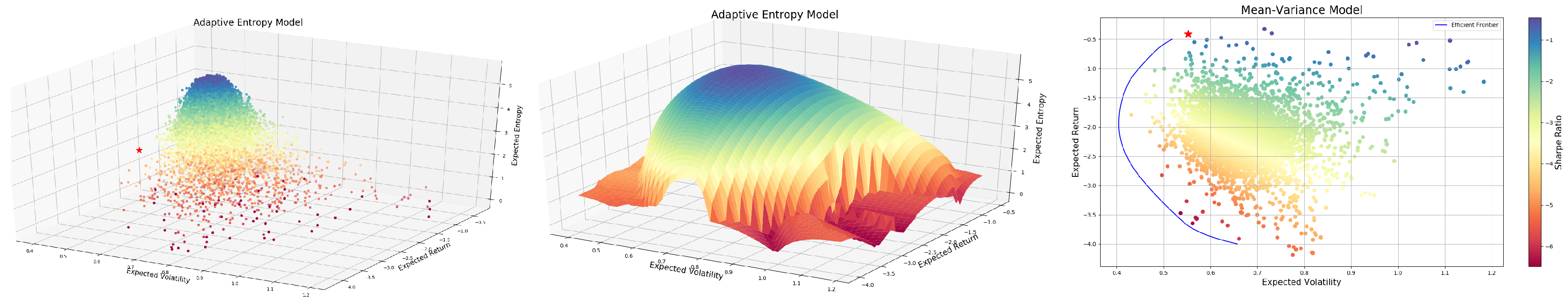

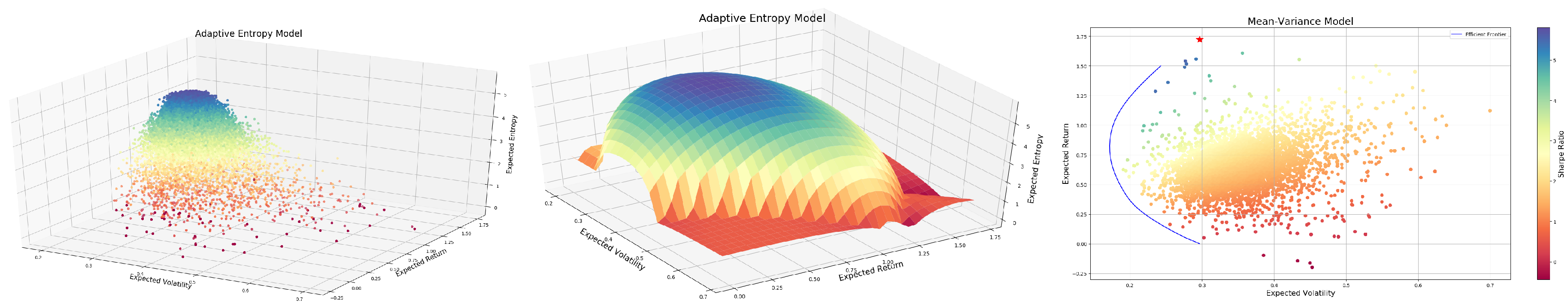

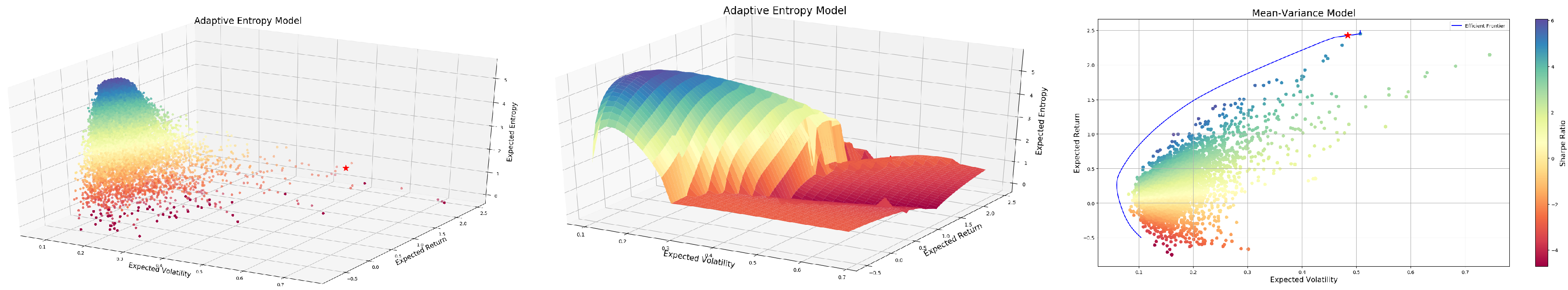

2.3. Adaptive Entropy Model

3. Empirical Study

3.1. Portfolio Performance Evaluation

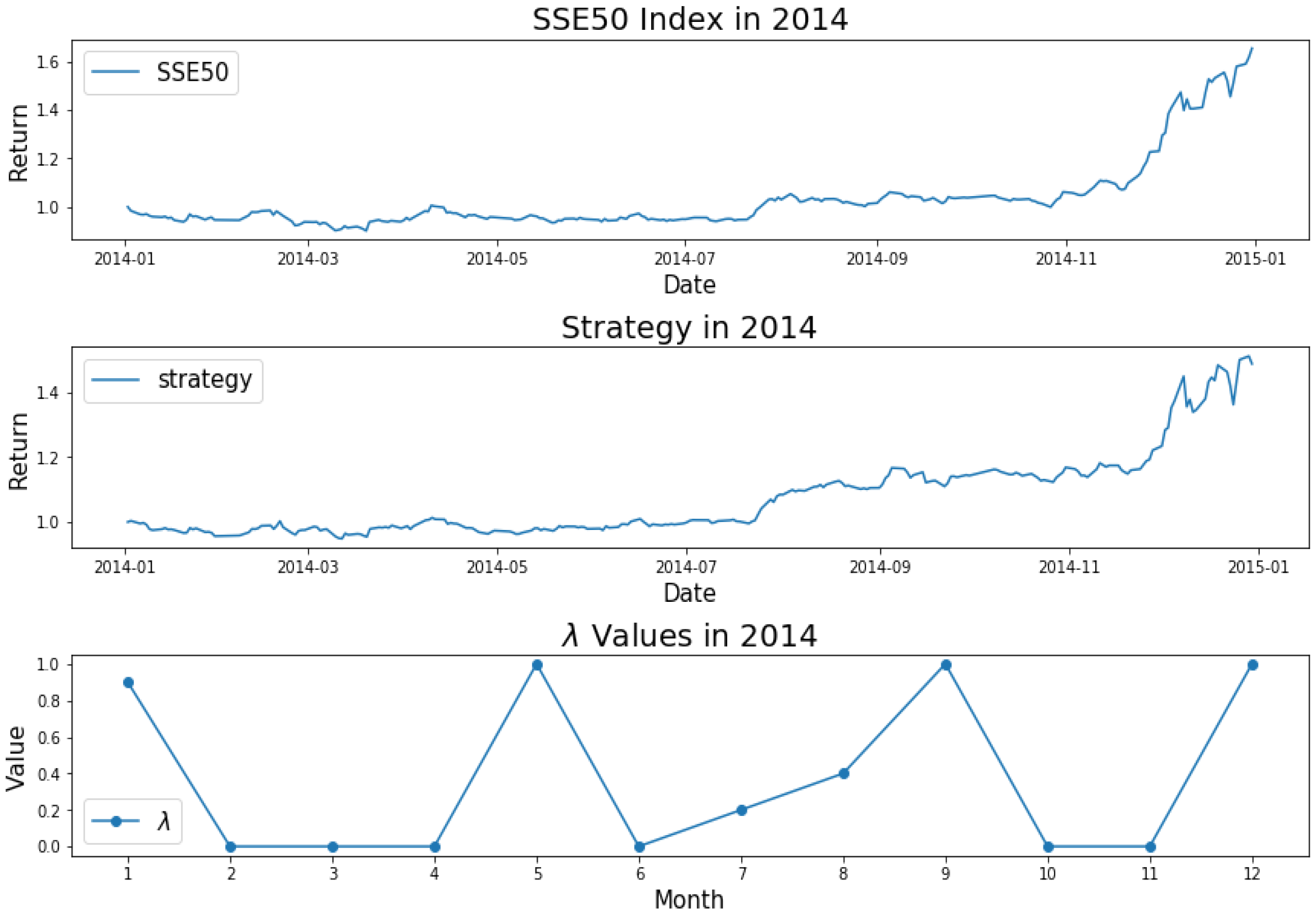

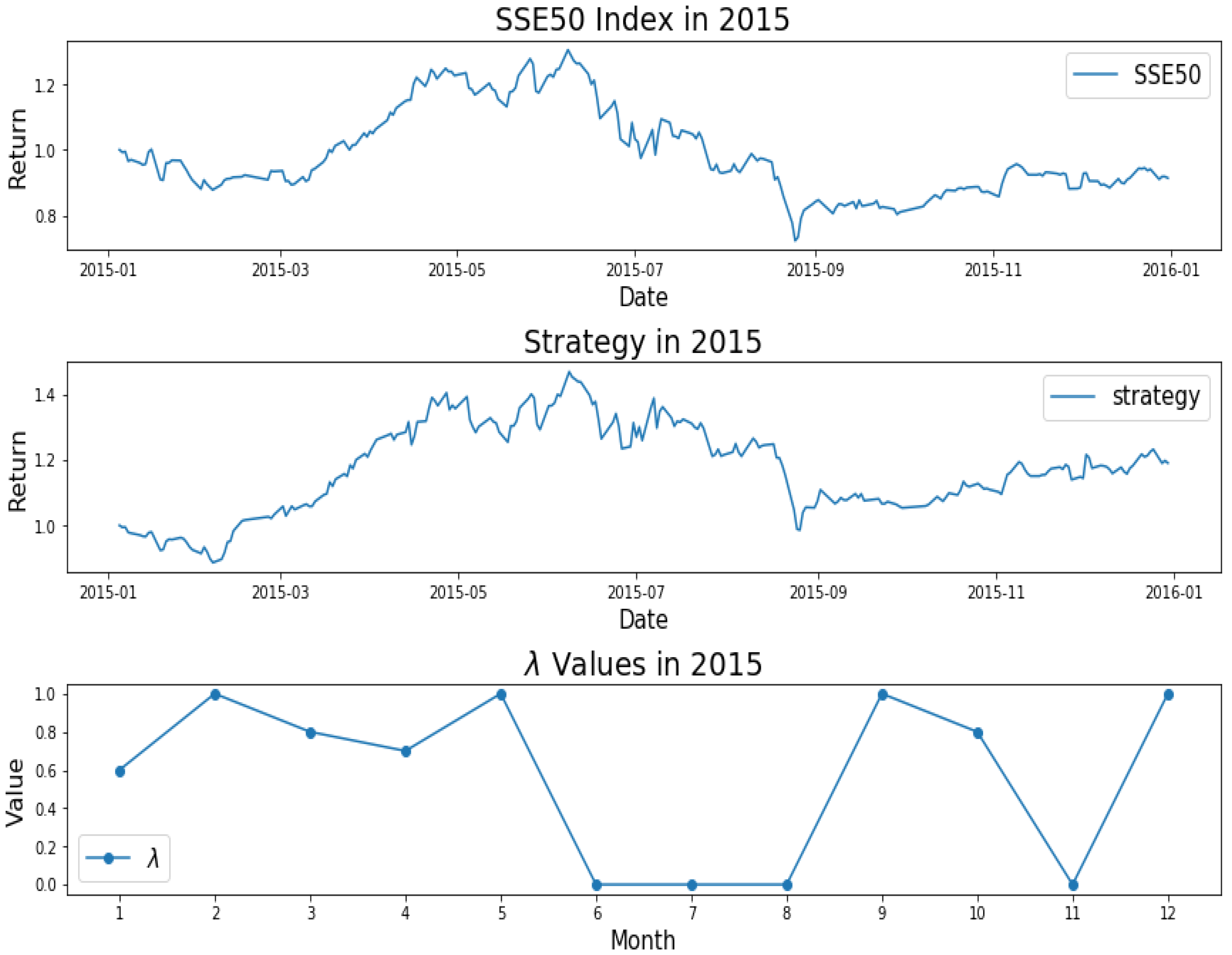

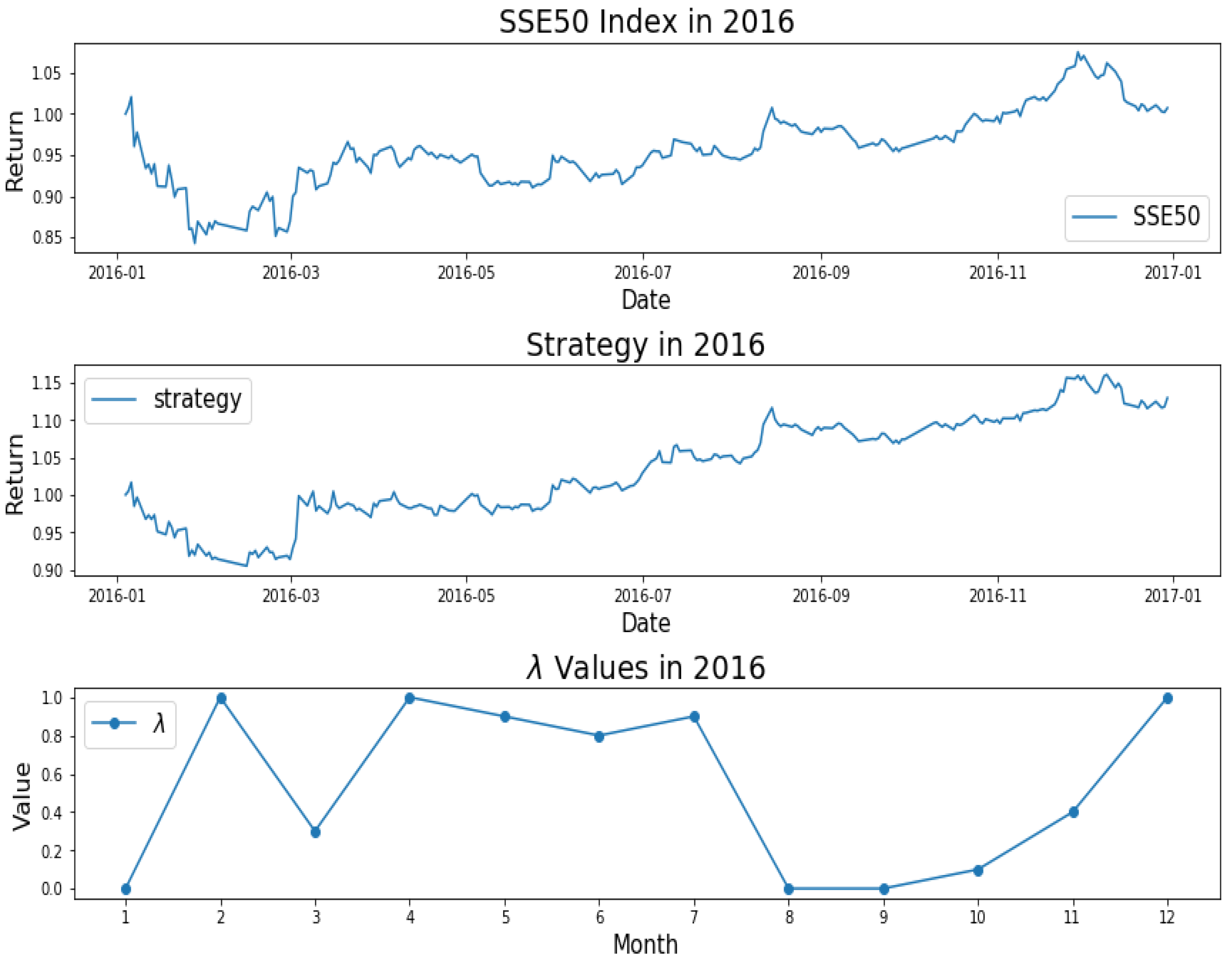

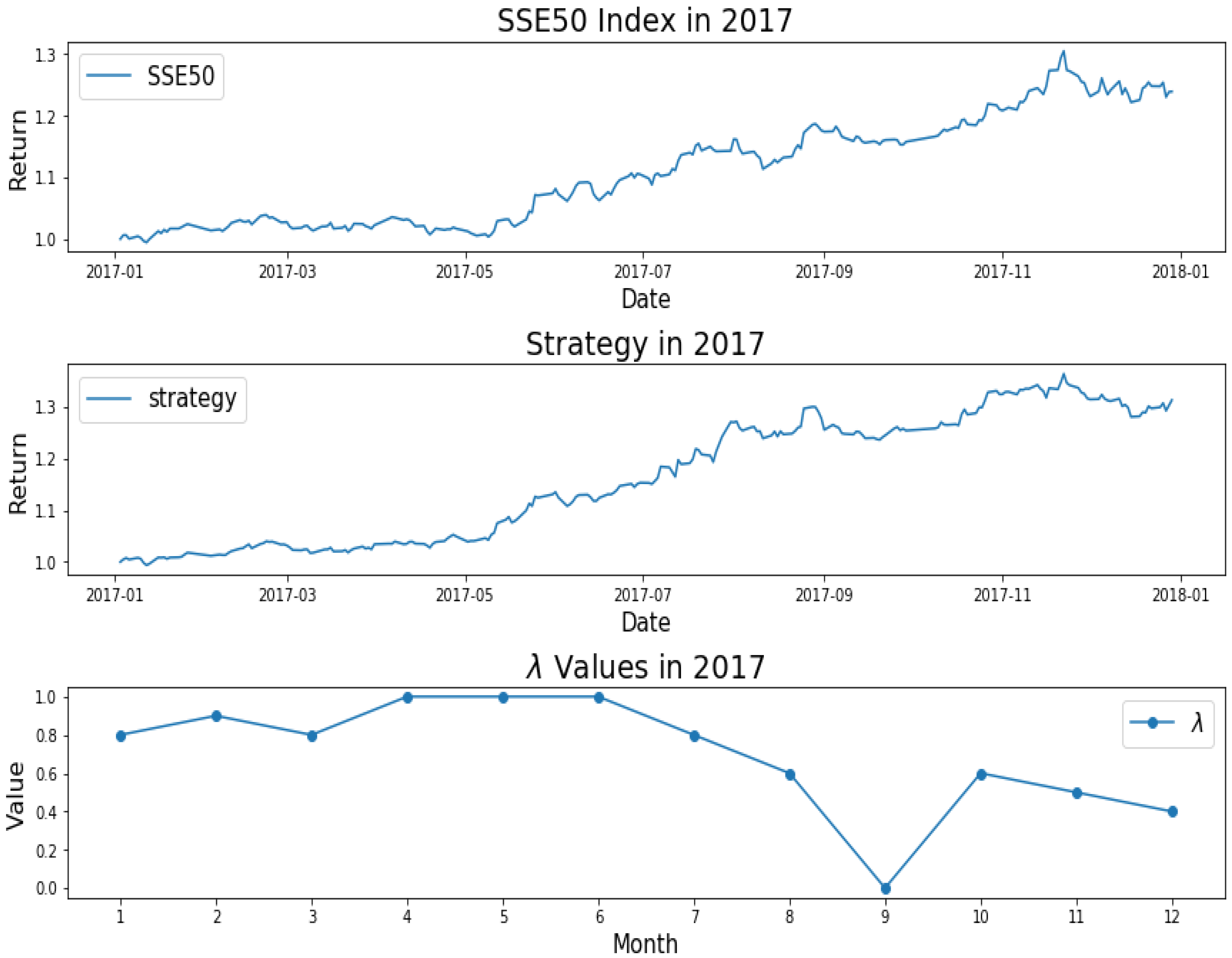

3.2. Results of the Empirical Study

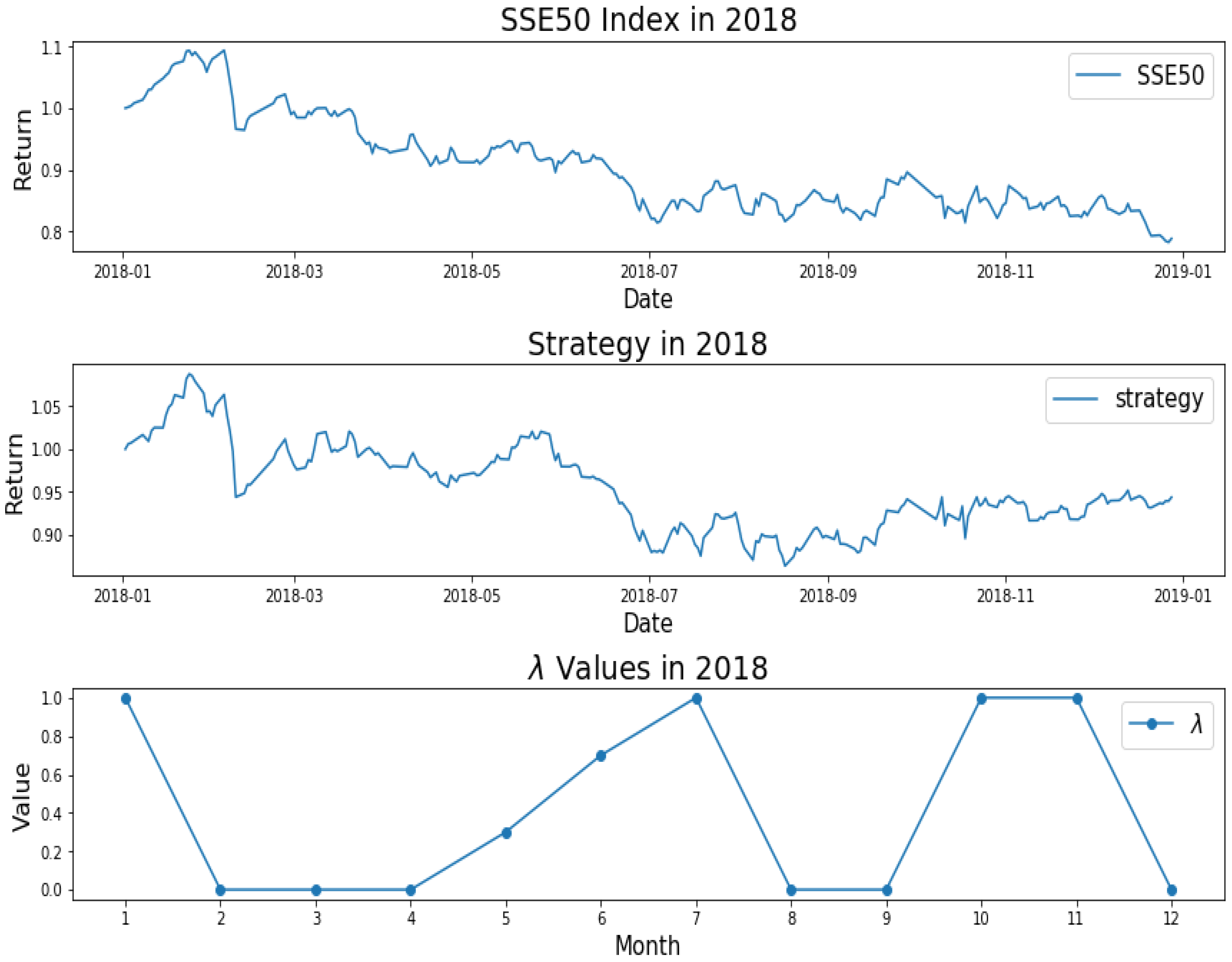

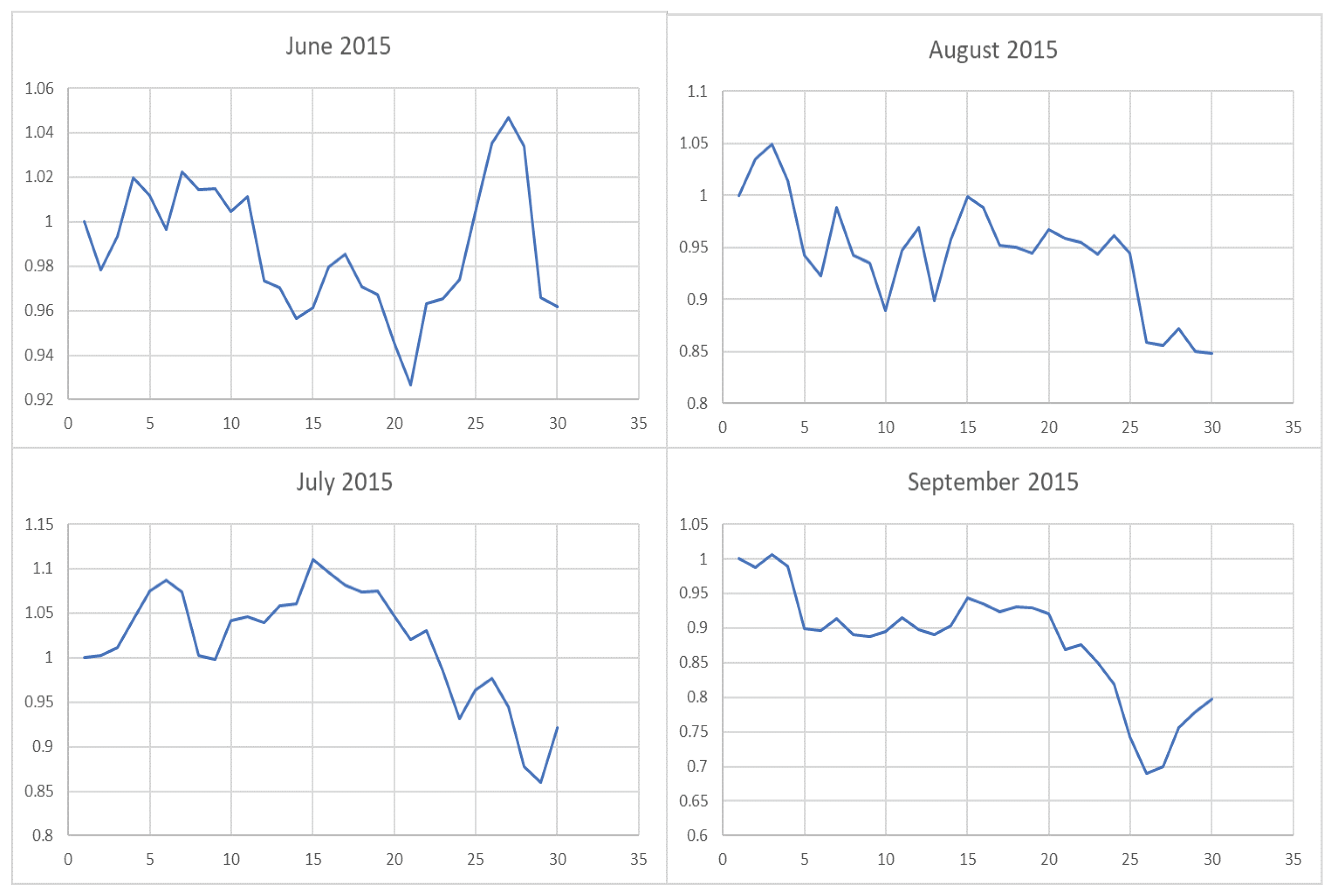

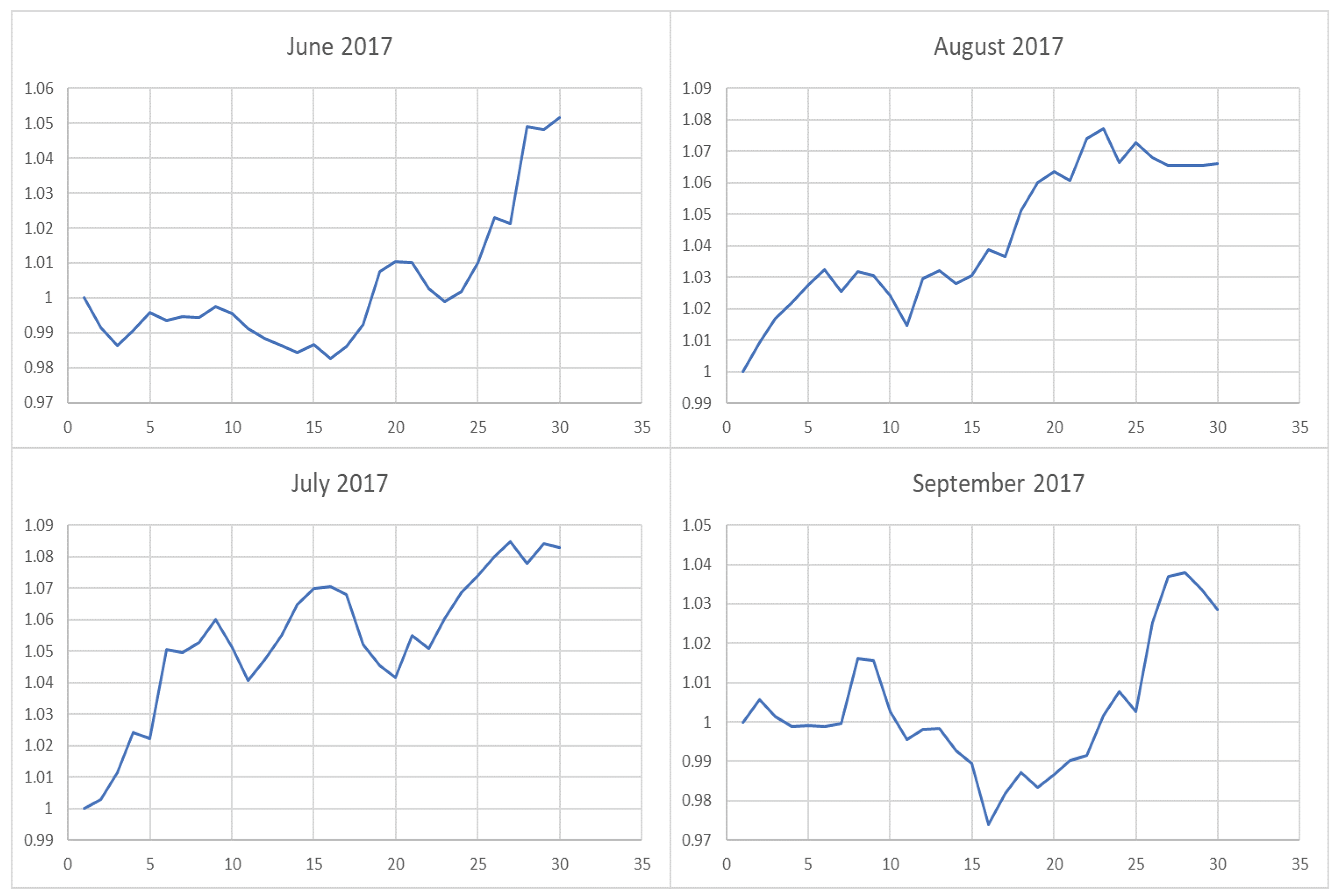

3.3. Results and Analysis

4. Conclusions

Author Contributions

Funding

Conflicts of Interest

Abbreviations

| AEM | Adaptive Entropy Model |

| SSE50 | Shanghai Stock Exchange 50 |

| MVM | Markowitz’s Mean-Variance Model |

| EMWA | Entropy Model Without Adaptive Effects |

| AMVM | Adaptive Mean-Variance Model |

Appendix A

References

- Markowitz, H. Portfolio selection. J. Financ. 1952, 7, 77–91. [Google Scholar]

- Bera, A.K.; Park, S.Y. Optimal portfolio diversification using the maximum entropy principle. Economet. Rev. 2008, 27, 484–512. [Google Scholar] [CrossRef]

- Dobbins, R.; Witt, S.F.; Fielding, J. Portfolio Theory and Investment Management; Blackwell Business: Oxford, UK, 1994. [Google Scholar]

- Gilmore, C.G.; McManus, G.M.; Tezel, A. Portfolio allocations and the emerging equity markets of Central Europe. J. Multinatl. Financ. Manag. 2005, 15, 287–300. [Google Scholar] [CrossRef]

- DeMiguel, V.; Garlappi, L.; Uppal, R. Optimal versus naive diversification: How inefficient is the 1/N portfolio strategy? Rev. Financ. Stud. 2007, 22, 1915–1953. [Google Scholar] [CrossRef]

- Dionisio, A.; Menezes, R.; Mendes, D.A. Uncertainty analysis in financial markets: Can entropy be a solution? In Proceedings of the 10th Annual Workshop on Economic Heterogeneous Interacting Agents, (WEHIA), Colchester, UK, 13–15 June 2005; pp. 13–15. [Google Scholar]

- Philippatos, G.C.; Gressis, N. Conditions of equivalence among EV, SSD, and EH portfolio selection criteria: The case for uniform, normal and lognormal distributions. Manag. Sci. 1975, 21, 617–625. [Google Scholar] [CrossRef]

- Usta, I.; Kantar, Y.M. Analysis of multi-objective portfolio models for the istanbul stock exchange. In Proceedings of the 2nd International Workshop on Computational and Financial Econometrics, (CFE), Neuchatel, Switzerland, 19–21 June 2008; pp. 19–21. [Google Scholar]

- Samanta, B.; Roy, T.K. Multi-objective portfolio optimization model. Tamsui Oxf. J. Math. Sci. 2005, 21, 55. [Google Scholar]

- Hoskisson, R.E.; Hitt, M.A. Johnson, R.A.; Moesel, D.D. Construct validity of an objective (entropy) categorical measure of diversification strategy. Strategy Manag. J. 1993, 14, 215–235. [Google Scholar] [CrossRef]

- Zhou, R.; Cai, R.; Tong, G. Applications of entropy in finance: A review. Entropy 2013, 15, 4909–4931. [Google Scholar] [CrossRef]

- Usta, I.; Kantar, Y.M. Mean-variance-skewness-entropy measures: A multi-objective approach for portfolio selection. Entropy 2011, 13, 117–133. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell. Syst. Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Jana, P.; Roy, T.K.; Mazumder, S.K. Multi-objective mean-variance-skewness model for portfolio optimization. Adv. Model. Optim. 2007, 9, 181–193. [Google Scholar]

- Jana, P.; Roy, T.K.; Mazumder, S.K. Multi-objective possibilistic model for portfolio selection with transaction cost. J. Comput. Appl. Math. 2009, 228, 188–196. [Google Scholar] [CrossRef]

- Philippatos, G.C.; Wilson, C.J. Entropy, market risk, and the selection of efficient portfolios. Appl. Econ. 1972, 4, 209–220. [Google Scholar] [CrossRef]

- Zhu, Y.; Cao, C. Portfolio based on Black-Litterman model with entropy compensation. J. Univ. Sci. Technol. China 2015, 12, 11. [Google Scholar]

- Young, T.W. Calmar ratio: A smoother tool. Futures 1991, 20, 40. [Google Scholar]

| Year | Model | (%) | Annualized | Maximum | Calmar | Sharpe | Win | |

|---|---|---|---|---|---|---|---|---|

| Return (%) | Drawdown (%) | Ratio | Ratio | Rate (%) | ||||

| 2014 | AEM | 2.27 | 0.76 | 50.30 | 8.20 | 6.13 | 2.51 | 55.79 |

| EMWA | 1.49 | 0.66 | 42.30 | 6.23 | 6.95 | 2.52 | 54.96 | |

| AMVM | −18.1 | 0.8 | 17.24 | 33.83 | 0.51 | 0.53 | 52.8 | |

| MVM | 2.84 | 0.78 | 52.31 | 8.21 | 6.37 | 2.54 | 54.96 | |

| Benchmark | 0 | 1 | 63.58 | 9.88 | 6.44 | 2.85 | 50.83 | |

| 2015 | AEM | 26.09 | 0.76 | 19.71 | 32.99 | 0.60 | 0.56 | 53.11 |

| EMWA | 24.76 | 0.77 | 18.28 | 34.34 | 0.53 | 0.51 | 54.77 | |

| AMVM | 24.05 | 0.71 | 18.05 | 32.9 | 0.55 | 0.46 | 54.02 | |

| MVM | 11.24 | 0.78 | 4.70 | 39.10 | 0.12 | 0.13 | 53.94 | |

| Benchmark | 0 | 1 | −8.41 | 44.66 | −0.19 | −0.21 | 51.04 | |

| 2016 | AEM | 12.81 | 0.66 | 13.30 | 11.00 | 1.21 | 0.88 | 52.28 |

| EMWA | 11.32 | 0.65 | 11.80 | 10.25 | 1.15 | 0.80 | 53.53 | |

| AMVM | 3.24 | 0.79 | 3.83 | 22.12 | 0.17 | 0.14 | 50.21 | |

| MVM | 14.58 | 0.65 | 15.06 | 9.05 | 1.66 | 0.98 | 52.30 | |

| Benchmark | 0 | 1 | 0.742 | 17.47 | 0.04 | 0.04 | 49.60 | |

| 2017 | AEM | 16.15 | 0.65 | 32.16 | 6.10 | 5.27 | 3.04 | 57.44 |

| EMWA | 10.92 | 0.63 | 26.30 | 6.08 | 4.33 | 2.53 | 56.61 | |

| AMVM | 20.17 | 0.89 | 42.08 | 16.38 | 2.57 | 1.58 | 59.09 | |

| MVM | 10.95 | 0.75 | 29.44 | 7.64 | 3.85 | 2.54 | 60.33 | |

| Benchmark | 0 | 1 | 24.60 | 6.38 | 3.86 | 2.22 | 53.72 | |

| 2018 | AEM | 7.80 | 0.63 | −5.77 | 20.57 | −0.28 | −0.33 | 49.80 |

| EMWA | 6.80 | 0.65 | −7.32 | 21.25 | −0.34 | −0.41 | 51.04 | |

| AMVM | 2.24 | 0.8 | −15.19 | 33.71 | −0.45 | −0.47 | 50.21 | |

| MVM | 7.00 | 0.63 | −6.70 | 22.07 | −0.30 | −0.37 | 49.80 | |

| Benchmark | 0 | 1 | −21.70 | 28.46 | −0.76 | −1.00 | 49.80 | |

| 2014–2018 | AEM | 14.72 | 0.72 | 20.6 | 33.14 | 0.62 | 0.96 | 53.74 |

| EMWA | 11.88 | 0.71 | 17.74 | 34.43 | 0.52 | 0.83 | 54.31 | |

| AMVM | 10.67 | 0.8 | 17.24 | 33.83 | 0.51 | 0.53 | 52.8 | |

| MVM | 11 | 0.74 | 17.04 | 38.86 | 0.44 | 0.77 | 54.31 | |

| Benchmark | 0 | 1 | 8.2 | 44.7 | 0.18 | 0.33 | 51.15 |

| Date | Model | Expected-Returns | Expected-Volatilities | Entropy | Value |

|---|---|---|---|---|---|

| 201508 | AEM | −1.94 | 0.40 | 1.81 | 0 |

| 201508 | MVM | −0.41 | 0.55 | 1.0 | ∖ |

| 201603 | AEM | 1.69 | 0.28 | 0.65 | 0.3 |

| 201603 | MVM | 1.72 | 0.30 | 0 | ∖ |

| 201708 | AEM | 2.40 | 0.46 | 0.63 | 0.6 |

| 201708 | MVM | 2.43 | 0.48 | 0.35 | ∖ |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Song, R.; Chan, Y. A New Adaptive Entropy Portfolio Selection Model. Entropy 2020, 22, 951. https://doi.org/10.3390/e22090951

Song R, Chan Y. A New Adaptive Entropy Portfolio Selection Model. Entropy. 2020; 22(9):951. https://doi.org/10.3390/e22090951

Chicago/Turabian StyleSong, Ruidi, and Yue Chan. 2020. "A New Adaptive Entropy Portfolio Selection Model" Entropy 22, no. 9: 951. https://doi.org/10.3390/e22090951

APA StyleSong, R., & Chan, Y. (2020). A New Adaptive Entropy Portfolio Selection Model. Entropy, 22(9), 951. https://doi.org/10.3390/e22090951