1. Introduction

Blockchains emerged in 2008 as a ledger technology for decentralized recording of transactions and assets using chained blocks, rather than tables in centralized relational databases. The technology offers the promise of an encrypted and immutable audit trail with data security, privacy, and transparency. In principle, public blockchain data updates can be made autonomously in a decentralized peer-to-peer network, with a network consensus regarding update accuracy—in short, “the database system behaves like a single computer.”

1.

We describe how this blockchain database technology is being applied in service innovations in three diverse areas: Central Bank Digital Currencies and Stable Coins (CBDC), Healthcare (HC), and Non-Profit Organizations (NPOs). In these applications, blockchain technology is an electronic ledger of transactions, respectively, for a virtual medium of exchange, a set of unique medical patient records, and a decision-making tool for organizations, specifically decentralized autonomous organizations (DAOs).

The “single computer” blockchain solutions for the CBDC, HC, and NPO applications considered here all address existing problems that bear both similarities and differences, along with their own set of policy questions. For example, in the CBDC case, would individual retail customers have wallet access to the digital fiat currency at the Central Bank, or would, for example, commercial banks have wholesale access to the Central Bank and then be able to compete in issuing customized stablecoins

2 to retail clients? Should these retail clients be able to retain access to physical notes and coins, and how can their price relative to digital counterparts be “equilibriated”? How are multiple digital currencies across countries handled?

The CBDC solutions would be part of a replacement for the current global payments system that is routinely dismissed as “antiquated”. In HC, on the other hand, a major challenge involves patients’ medical records that are currently scattered across hospitals and other healthcare facilities but are not standardized across them. As observed during the coronavirus pandemic, this state-of-affairs severely hampers accurate public health analysis. Moreover, for hospital-provided care, it falls short in handling appropriately limited access to private medical records for specialist doctors from outside practices.

Finally, in NPOs, the extant problem to be solved is that of governance and diversity in what are often nonpecuniary activities and/or at small scale. Indeed, we chose NPOs as a third application because their problems tend to be the antithesis of those for large-scale payment systems and medical systems: viz., NPOs are often small group endeavors by volunteers involving artworks and in-kind assets. Smart contracts and Decentralized Autonomous Organization (DAO) capabilities tend to be more important than they are in the case of say CBDCs.

Given the heterogeneity of the problems to be solved in the three applications considered here, their blockchain solution is like a Swiss army knife: Privacy and security, for example, are important in payment and patient record data, while in the case of NPOs, authenticity of donated artwork is most important

3. Latency in update speed and network standardization are likely to be the most important features in payment systems. In contrast, latency in update speed is less important in documenting patient records and the authenticity of donated art work [

1].

Sticking with the Swiss army knife metaphor, the blockchain can also be broadly considered as a simplifying service delivery mechanism for the customer. All we need is a smartphone and access to authorize the blockchain to allow for payment of products and services (digital currency); verification/validation of medical and personal ID (non-fungible tokens); and voting for actions/services in a transparent, equitable manner (digital autonomous organization). If an organization could do everything on the blockchain, it would help institutionalize service innovation because actions that are traditionally performed in a bespoke manner could now be performed on a single visible decentralized database where pain points are more easily observed.

In practice, blockchain data systems are not a panacea against all pain points, especially security breaches. Points of vulnerability include smart contract code, wallets connected to exchange platforms, and the general enterprise integration into critical digital infrastructure (e.g., Gilbert and Gilbert [

2], Orcutt [

3]. In June 2025, there are reports that “…with crypto fraud now accounting for the majority of internet crime losses in the U.S.—

$9.3 billion reported in 2024”… “the USA Secret Service is using “techniques to identify fraudulent patterns in blockchain data…the agency’s strategy is to leverage blockchain transparency as a tactical advantage.”

4 This work on crypto hacking problems foreshadows that data security will be more of a challenge for the Swiss army knife in the CBDC-stablecoin applications than it is for the HC applications, where the correction and updating of patient records is likely to be center stage.

Finally, it is noteworthy that the current Web 2.0 network cloud in which blockchain data systems currently run tends not to incentivize data security; indeed, substantial data breaches occur on practically a daily basis. In contrast, Web 3.0, the “…catch-all term for the vision of a new, better internet…uses blockchains, cryptocurrencies, and NFTs to give power back to the users in the form of [data] ownership… Web1 was read-only, Web2 is read-write, Web3 will be read-write-own.”

5 The blessing and the curse of Web 3.0 is that standards for it are still evolving!

The plan of our paper is as follows: We discuss the three applications in the following three sections: in

Section 2, CBDC and the payments system; in

Section 3, HC; and in

Section 4, NPOs. In

Section 5, we conclude with a cautionary discussion of how the uncertainty in Web 3.0 protocols could slow down blockchain adoption.

2. Digital Currencies: CBDC and Stablecoins

Global payments are huge—consisting of trillions of USD daily. But the infrastructure for making these global payments is routinely labeled as antiquated, slow, and often simply inaccessible to the “unbanked masses: Defenders of the [payments] status quo should spend a month living in Argentina, Egypt, or Nigeria. If not convinced, they should take a walk through countless poor and immigrant communities in the U.S., where pseudo-financial services like check cashers dominate… If still not convinced, they should try sending a large international wire on Saturday morning. God help them!” (Malekan 2023). Industry member Bank of America concurs: “… the current financial system’s antiquated [payments’] infrastructure and numerous inefficiencies” could be revolutionized as CBDCs “… bring about real-time settlement, complete transparency, and lower costs

6” (Research Report

7, 22 January 2023).

Whether such a revamp in the global payments services should be termed evolutionary or revolutionary in its disruptive potential is beside the point—improving the efficiency, availability, and transparency of the global payment processing system is indisputably high on the list of services that would benefit productivity and citizen welfare. Some 114 countries are reported to be exploring Central Bank Digital Currencies (CBDC) to this end. CBDCs are simply digital versions of Central Bank-issued fiduciary money. “Wholesale CBDCs” (wCBDCs) are to be “… held in a wallet at a central bank that could be used by financial institutions to effect wholesale transactions, such as interbank payment clearing and settlement” (NYFRB, 2022). The Bank for International Settlements (2023) and the New York Federal Reserve Bank (2022) have studied (in Projects Dunbar

8 and Cedar, respectively) how these wCBDCs can be used to facilitate “… safe, rapid, and efficient transfer of central bank liabilities.” Indeed, a system of interchangeable wCBDCs could largely supplant the existing network of correspondent banks for cross-border payments

9.

In Fall 2022 the Federal Reserve Bank of New York reported that “Phase I of the Project Cedar experiment examined the potential application of distributed ledger technology (DLT), specifically blockchain, to enhance the functioning of wholesale cross-border payments. … Under simulated test scenarios based on market throughput estimates, FX spot trades were atomically settled in under ten seconds, validating the project objectives of enabling instant and atomic settlement using DLT while also revealing promising applications for blockchain in wholesale payments and presenting questions for future research.”

Given the wide-ranging promise of multi wCBDC along with the uncertainty as to precisely how it would be implemented, it is not surprising that governments have generally been slow to move—they would like to “have a seat at the table” but also remain flexible. Participants have a variety of vested interests in standard-setting in the technology: Presumably the U.S. would like to maintain the current primacy of USD on the global stage

10, while China and Russia have the opposite incentive. Countries with less developed payment infrastructure have fewer vested interests to impede adoption decisions. Together with a high “unbanked” citizenry, we might expect them to move more quickly, as we have seen for India and the Bahamas. But ironically, sometimes the lack of digital access and financial education infrastructure can be its own obstacle for these countries.

Would it be “institutions only” that have wallet access at a Central Bank, and if so, which institutions? How would these institutions be regulated? How could retail clients transact in the digital currency if the policy is that they do not have wallet access to the wholesale Central Bank Digital Currency (wCBDC)? One potential solution for retail access is to have approved financial institutions like commercial banks issue stablecoins with to-be-determined degrees of safe and credible backing.

One alternative would be to require that stablecoins have the same full Treasury backing as wCBDCs do. The bank-issued stablecoins could potentially offer a means by which banks compete with respect to complementary, if not complementary, features like wallets and delegated custody, and/or digital currency-denominated features like an inflation-indexed rate of return (with concomitant stablecoin backing to be credible). However, even stablecoin “private currencies”

11 that best replicated a CBDC with full plain vanilla Treasury backing would likely not always trade at par with the respective CBDC, even in a liquid marketplace for the coins.

Amazon is rumored to be looking into creating a marketplace infrastructure for tokens, and the Chinese tech firms Ant Group and Tencent have already launched their versions (though Tencent’s has been halted). If stablecoins were not continually priced at par with CBDC, retail clients would not be able to convert their stablecoins into paper currency at par, if a paper currency were to still exist. Under all alternatives, rules, regulations, and audits would presumably be required to ensure that the financial backing is transparent and “as advertised”. It helps that the liabilities (tokens outstanding) of stablecoin issuers would be visible on-chain (Malekan, 2023)

12. Moody’s is also reportedly studying scoring systems for up to twenty cases. Issuers of the stablecoins would also likely be required to comply with Know Your Client (KYC), Anti Money Laundering (AML), and fund segregation rules for their retail clients. With the June 2025 passage by the USA Federal Senate of a Bill titled “the Genius Act” ( Guiding and Establishing National Innovation for U.S. Stablecoins) to create a regulatory framework for stablecoins, considerable momentum has recently begun to build for stablecoins as the digital currency, rather than CBDC.

An alternative to a backed stablecoin digital currency for retail would be to establish technology providers who act like “bank utilities”. These utility-like entities would also provide convertibility at par between CBDC and paper currency. The utility blockchain ledgers would have access to a wallet at the Central Bank, much like commercial banks now hold reserve accounts at the Federal Reserve. Moreover, while “…the chief executive of credit card giant Visa remains confident that blockchain-powered solutions can be integrated into its services and offerings to power the next generation of payments,”

13 there are individuals for whom digital currency transactions via a retail account accessible to the “big brother” central bank is anathema: continued control of the monetary base and financial sanctioning power at best, communism. Yet others see more deliberate and sinister forces at play across countries, e.g., “Italy’s finance minister, Giancarlo Giorgetti, warned in April that the U.S. stablecoin policies presented an ‘even more dangerous’ threat to European financial stability than Trump’s trade war at worst!” (Reuters, 2025)

14.

3. Healthcare

Healthcare is the second largest sector (by equity market cap) in the S&P 500, at 14%, almost one and a half times that of the financial sector. Its critical role during the COVID-19 pandemic testified to its societal importance. As healthcare’s role has expanded in the past decades, the availability and security of comprehensive patient medical records (ailments, operations, doctors’ notes, medicines that a patient has been taking) have become commensurately problematic. The pandemic highlighted how public health data shortcomings can make it difficult both for citizens to self-manage themselves and reduce infection risks, and for healthcare systems to allocate resources appropriately by aggregating and using information like that on viral spread and treatment efficacy, with access to only existing single decentralized databases.

Blockchain data technology is a promising part of a solution to these significant problems. It can (i) allow storage of all medical history, surgeries, etc., on a secure blockchain that can be accessed by medical professionals upon verification and validation of a patient’s ID; (ii) help better plan and manage public healthcare needs; and (iii) allow citizens to transparently observe waiting times and ailments affecting the public health system.

These benefits have been validated in prototype blockchain applications, and conveniently Agbo, Mahmoud, and Eklund [

4,

5] provide a recent meta-analysis of them

15: “By applying blockchain to the management of [electronic medical records] (EMRs), patients will be in control of their own health data and able to decide how they are used… in pharmaceutical supply chain management, biomedical research/education and remote patient monitoring” ([

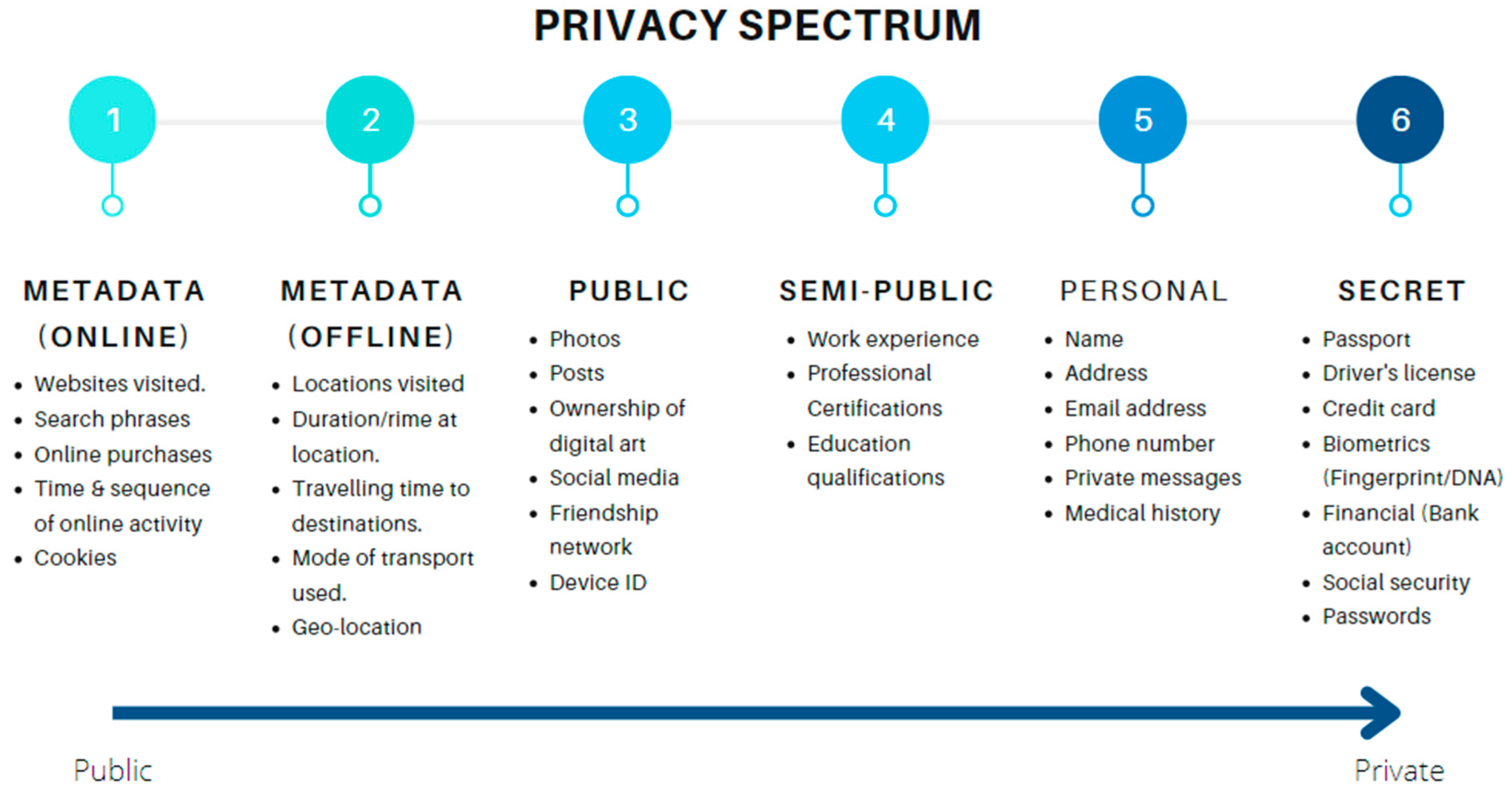

4] p. 22). In particular, privacy, i.e., control of one’s own personal medical information, is only one step behind passwords as most important on the following privacy spectrum shown

Figure 1.

Privacy in healthcare information is repeatedly mentioned as a key feature in blockchain applications included in the meta-analyses. For example, privacy, upcoming regulation, and the “…future scope of [healthcare] blockchain technology for successfully handling privacy and management of current and future medical records” are also central in a separate study by Onik et al. [

6]. In addition to the privacy feature, 48% of the 65 selected studies in Agbo, Mahmoud, and Eklund concerned electronic medical records (EMRs) with “…prototypes based on emerging blockchain paradigms, such as smart contracts, permissioned blockchain, off-chain storage, etc.” (p. 25).

Whilst there is clear evidence of improvements in healthcare services when using the prototype blockchain technology, there is, at best, slow momentum in the change in organizational structure per se. In its place, interoperability amongst existing entities has been the norm. The benefits of peer-to-peer network externalities can be gained with low switching costs given this interoperability. The healthcare nodes include participants like hospitals, clinics, drug supply, and patients in the case of medical records, and the nodes of “miners” involved in the decentralized network that validate and process transactions, treatments, etc. We return to this interoperability feature and technology uncertainty in

Section 5.

4. NPOs as Blockchain Organizations

NPOs are often “passion projects” started by a small group of highly motivated individuals dedicated to addressing a social or environmental cause for maximum impact. They often struggle for resources and infrastructure, and their long-term survival depends on a large, diverse, and preferably wealthy donor base for economic support, together with a large number of volunteers who make in-kind donations. All NPOs require an engaged stakeholder base sharing the same passion for the cause, as do the respective NPO’s executive committee members. Being small and nimble at inception, NPOs are well-placed to adopt blockchain infrastructure to underpin their receipt of donations, in-kind donations from well-meaning volunteers, and the support of an effective governance mechanism to foment an engaged stakeholder base.

Cryptocurrency markets have also minted a new generation of crypto millionaires from millennials and Gen Z with their acknowledged strong commitment to social and political causes

16. As such, for an NPO to accept donations using cryptocurrency fulfills the large, diverse, well-funded donor base requirement. Traditional means of making online donations, say by bank transfer or credit card payment, are still less efficient compared to donations with cryptocurrency

17. Even if not all engaged stakeholders of an NPO are well-resourced financially, they are still able to contribute via in-kind donations to the creation of content and share electronic artworks that are related to the NPO’s goals. In a non-blockchain setting, such in-kind donations of artworks, although well meant, can create an additional, expensive, and unwanted administrative workload for the NPO that may outweigh the economic benefits of receiving the in-kind donations in the first place. But with blockchain technology, NFTs can be used to generate a sustainable, long-term income stream

18 based on in-kind artwork donations to the NPO by artists, and the entire administrative workload of listing artworks, keeping track of transaction records and ownership, etc., is performed cheaply and effectively by blockchain miners. The NPO can focus its efforts on marketing the artworks and using the funds generated to achieve its strategic goals rather than being distracted by the administrative workload that comes with monetizing the artworks. Thus, blockchain functions as a service innovation by minimizing the ‘back office’ costs of automating the distribution of profits from the sales of artworks to the NPO to beneficiaries, keeping a record of historical prices and provenance of the artwork.

As NPOs are more heavily reliant upon an engaged stakeholder base than other types of organizations, the DAO governance structure that is made possible with blockchain enables a greater degree of involvement, commitment, and transparency across all stakeholders. As every NPO has a mission-based vision to accomplish, the executive committee can submit proposals of various solutions or projects with associated costs, milestones, and timelines to be voted on during a specified polling period. The blockchain enables the programming of smart contracts that pre-specify the resource requirements of each project prior to the poll being performed. Once the polling is complete, the smart contract immediately distributes the resources from the NPO’s treasury blockchain wallet into each project’s blockchain wallet as per the pre-specified agreement. In a DAO, voting rights can be assigned to governance tokens stored on the blockchain, thereby allowing only highly engaged stakeholders to partake in the governance structure. The result is an embedded flexibility when not all donors or volunteers choose to participate in the governance structure, where the capacity to do so is also administratively taken care of on the blockchain by allowing engaged stakeholders to purchase governance tokens in proportion to their degree of participation in the governance of the NPO.

Examples of NPOs that have effectively leveraged blockchain technology to facilitate crypto and NFT donations to NPOs, and offering greater information on how DAOs can disrupt traditional charity models by offering greater transparency and efficiency are the Giving Block

19 and Crypto Altruism

20. The Giving Block has facilitated NFT-related donations to an amount of almost USD 12 million to charities in 2021. In addition, it releases an annual report on crypto philanthropy, data, trends, and predictions. Crypto altruism focuses on promoting the positive social impact of blockchain and cryptocurrency technologies via having educational content, project spotlights and support for NPOs. They highlight how DAOs can automate governance and fund allocation, thereby reducing overheads and increasing donor trust.

5. Challenges for Blockchain Adoption, Including Web 3.0 Technology Uncertainty

We have provided examples of how blockchain database technology offers potential solutions to needs in payment systems, healthcare services, and NPO structure and management spaces. The blockchain database is an immutable ledger containing an encrypted and time-sequenced history of transactions or events in the format of linked (“chained”) equally sized blocks. The data is, in principle, updated within a secure decentralized peer-to-peer network. Yet, blockchain data implementations are bedeviled by the same overarching issues of content ownership as the Web in general. To explain, the global Web environment, usually dubbed Web 1.0 or Web1, historically provided “read-only” access to Internet nodes. In contrast, the current version, Web 2.0 or Web2, provides “read-write” access without access fees. One well-known consequence is that successful Web 2.0 servers tend to earn their revenues from stored data generated by users. The more data on users that a Web 2.0 server accumulates, the more valuable it becomes—companies “give away” Web 2.0 access services and yet have multi-billion-dollar market caps, not zero-dollar market caps! Cynics point out that Web 2.0 data “yearning to be free” means that Client users and their data have become “the product”, as exemplified in the intense current debate as to the public use of that data in training AI-LLM models.

Web 2.0’s misaligned incentives and de facto service provider ownership of data

21 makes attractive

22 a “Web3 [that] is meant to be decentralized, open to everyone (with a bottom-up design) and built on top of blockchain technologies and developments in the Semantic Web, which describes the Web as a network of meaningfully linked data”

23 owned, respectively, by the content originators

24. One aspect to be cautious of is that even if a “Web 3.0” makes significant progress toward solving the data ownership problem, blockchain technology and applications like the CBDC, HC, and the NPO ones above will foreseeably be held back by the development speed of Web 3.0 as well as that of the blockchain technology building block. The result is uncertainty to technology development, and that in turn provides one conceivable answer to Jamie Dimon’s lament at the 2023 World Economic Forum: “…the financial industry has been talking about using blockchain technology for 12 years and, to this point, …‘very little has been done’” (Fortune

25): All else equal, the option to delay decisions in the face of uncertainty is valuable.

The immutability, encryption, and autonomous updating of blockchain data considerably tightens data security relative to that of data stored on centralized servers in the current Internet and often used without consent. Thus, blockchain integrated with read-write-own Web 3.0 should enhance payment security in the cases of CBDC, patient record security in healthcare applications, and authenticity of (say) artworks in NPOs. Yet, the very decentralization and higher number of nodes in peer-to-peer blockchains in Web 3.0 also means more, not fewer, points of attack for hackers (e.g., Poremba (2023). Vulnerable access points in Web 3.0 include wallet identification, smart contracts that execute autonomously, “51% attacks”, and ironically, the apps using the very data now owned by the nodes qua content-service providers

26.

Buterin [

7] succinctly articulates a decentralized network end-vision: the nodes “…are politically decentralized (i.e., no one controls them) and architecturally decentralized (i.e., there is no infrastructural central point of failure)

but they are logically centralized (i.e., there is one commonly agreed state, and the system

behaves like a single computer)” (Emphasis added). However, the APIs needed to achieve the seamless interoperability of network components in the would-be single computer become entry points at which security may be compromised, even in a Web 3.0 environment. For example, consider HC: Patient data on the chain may be secure, but in everyday use on cloud platforms, decrypted images need to be sent to treating physicians; viewed by medical staff preparing for surgery; and viewed in the insurance pre-approval process and billing post-surgery. Also, relevant doctors’ unstructured notes need to be input—this is such a specialized function that a dominant company in health records, Epic Systems, is in currently in talks to partner with an AI startup (Albridge) in the “medical scribe technology” market.

Can a decentralized blockchain system running on a Web 3.0 network get the “single computer job done”? Note that the organization structure for decentralized administration of the tasks could be very different from that of a single computer/administrator. But is it likely to be? Coase [

8,

9] and Williamson [

10] analyzed how choice in administration between hierarchical firm boundaries and outsourcing (decentralization) depend on relative costs. But arguably their framework no longer has much explanatory power for the organizational structure of tech entities: Today’s companies, from Amazon, Google, and Uber, to Uniqlo and United Airlines, have essentially become nodes of Intellectual Property (IP) in networks of enabling contracts, supply chains, and “big data” with wheels or wings attached. Whether databases run on networked platforms that are Web 2.0 centralized or are Web 3.0 peer-to-peer decentralized does not really differentiate hierarchical organizations from decentralized ones.

What is the practitioner wisdom regarding the adoption of blockchain and Web 3.0 at the current time? “The first question you have to ask yourself is: ‘Why do you want to use a blockchain?’ If you don’t know the answer right now, you don’t need a blockchain. Period. Don’t let people confuse you with all this hype going on! … Blockchain sucks. Except in 2 or 3 edge cases. It’s slow, complex, expensive, and hard to work with” [

11].

A second opinion is Greenspan [

12]: “If your requirements are fulfilled by today’s relational databases, you’d be insane to use a blockchain. Why? Because products like Oracle and MySQL have decades of development behind them. They’ve been deployed on millions of servers running trillions of queries. They contain some of the most thoroughly tested, debugged, and optimized code on the planet, processing thousands of transactions per second without breaking a sweat. And what about blockchains? … this entire product category is still in its diapers.”

AWS (Amazon Web Services) offers a cloud version of the “single computer” look-alike: “AWS has created purpose-built tools for blockchain companies who want to run either a “centralized ledger database that maintains an immutable and cryptographically verifiable record of transactions, or a multi-party, fully managed blockchain network that helps eliminate intermediaries.”

27 As an illustration of technology-in-progress, the “… head of product at [AWS partner] Ava Labs, said the company’s focus has shifted from a single blockchain on which to launch apps, to having technology to allow for a variety of customized blockchains, which it calls subnets.”

28Bookending the “keep option alive” or “exercise option” adoption decision alternatives regarding public blockchain implementation in CBDC, healthcare, or NPOs, lie a range of what might best be described as currently piecemeal solutions. For example, Buterin (2023)

29 has recently added a “…stealth address system [that] is based on a mechanism that would allow any Ethereum wallet to generate cryptographically obfuscated public addresses called “stealth addresses’’ in order to receive funds in a private manner and access them using a special code called a “spending key… These proposed stealth addresses are a way to increase privacy on Ethereum by creating unique, anonymous addresses for each transaction.” IBM has proposed a “Security Zero Trust” approach that “… provides a framework for building a more secure network by assuming that all devices and users are untrusted until proven otherwise.” Still, others advocate using private permissioned blockchains with secure gateways to public blockchains, e.g., Ripple. BigChainDB has put forward “… a database with blockchain characteristics… BigChainDB works by offering an API on top of the underlying database, with the aim of acting as a substrate-agnostic layer that adds the key blockchain features of decentralization, immutability, and asset transferability” [

13]. The UK firm Aztec aims to preserve security on hybrid permissioned–permissionless blockchains by using a data encryption process that “sets out to bridge the gap between the public and private blockchain realms by employing a variety of zero-knowledge proofs called range proofs.”

Perhaps the most appropriate last word regarding the adoption of decentralized blockchain Web 3.0 technology in preference to more centralized relational database solutions is Hayek’s [

14] pre-computer age holy grail statement: “The peculiar character of the problem of a rational economic order is determined precisely by the fact that the knowledge of the circumstances of which we must make use never exists in concentrated or integrated form but solely as the dispersed bits of incomplete and frequently contradictory knowledge which all the separate individuals possess. The economic problem of society is thus not merely a problem how to allocate “given” resources. It is a problem of the utilization of knowledge which is not given to anyone in its totality” Hayek [

14]. That is, although at present there is no all-encompassing “single computer” or single database architecture that one may use to have perfect information to allocate resources effectively and efficiently, blockchain slowly but surely may be a component in that endeavor.