Drivers of Mobile Banking Super-App Adoption: Across Different Service Integration Levels

Abstract

1. Introduction

2. Theoretical Background

2.1. Super-App Beyond Multi-App

2.2. IS Success Factors of the Banking Super-App

2.3. Integrated IS Success Model of the Banking Super-App

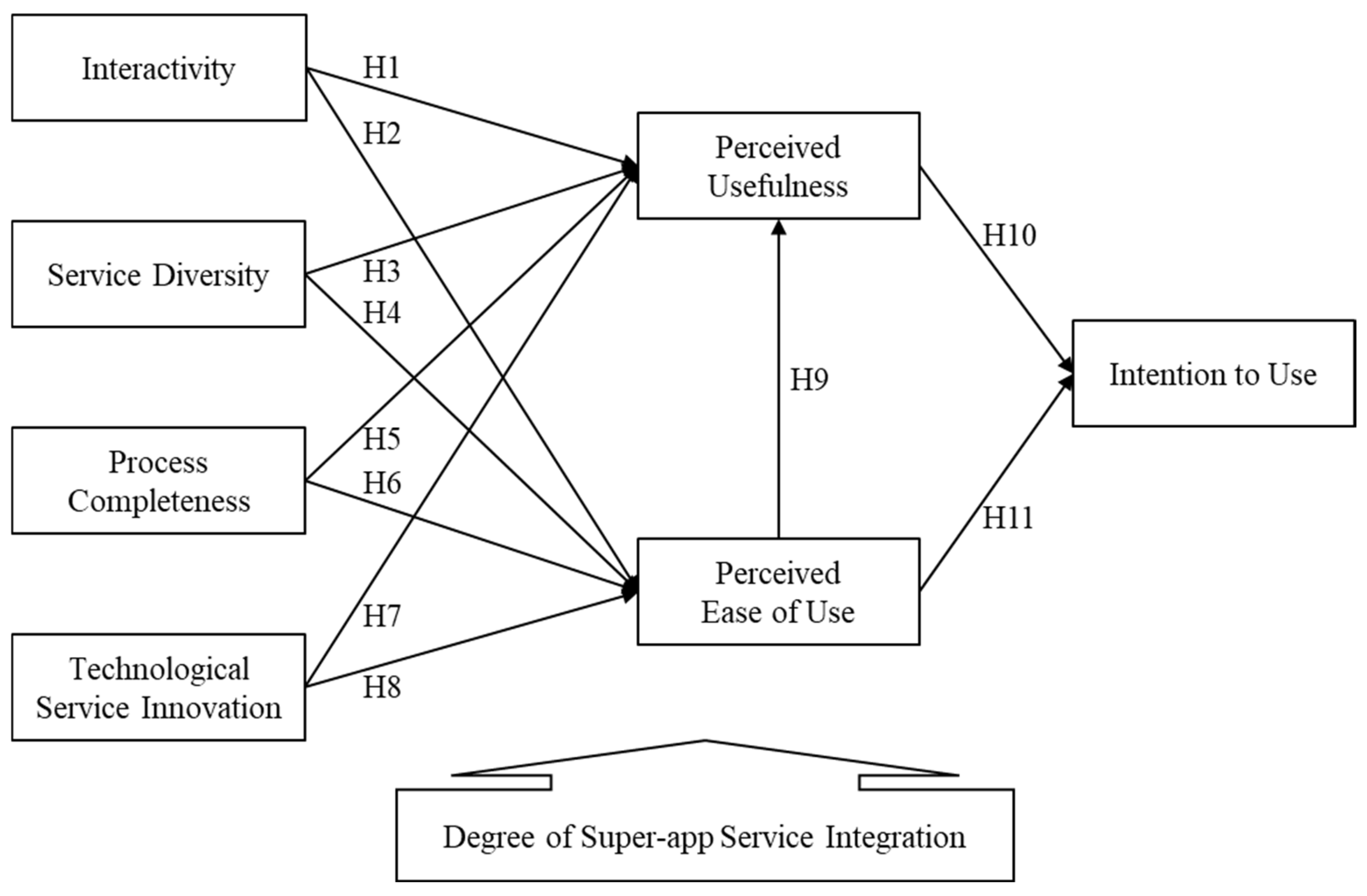

3. Hypotheses

3.1. System Quality

3.2. Information Quality

3.3. Service Quality

3.4. Perceived Usefulness, Perceived Ease of Use, and Intention to Use

3.5. Degree of Super-App Service Integration

4. Methods

5. Results

5.1. Measurement Model

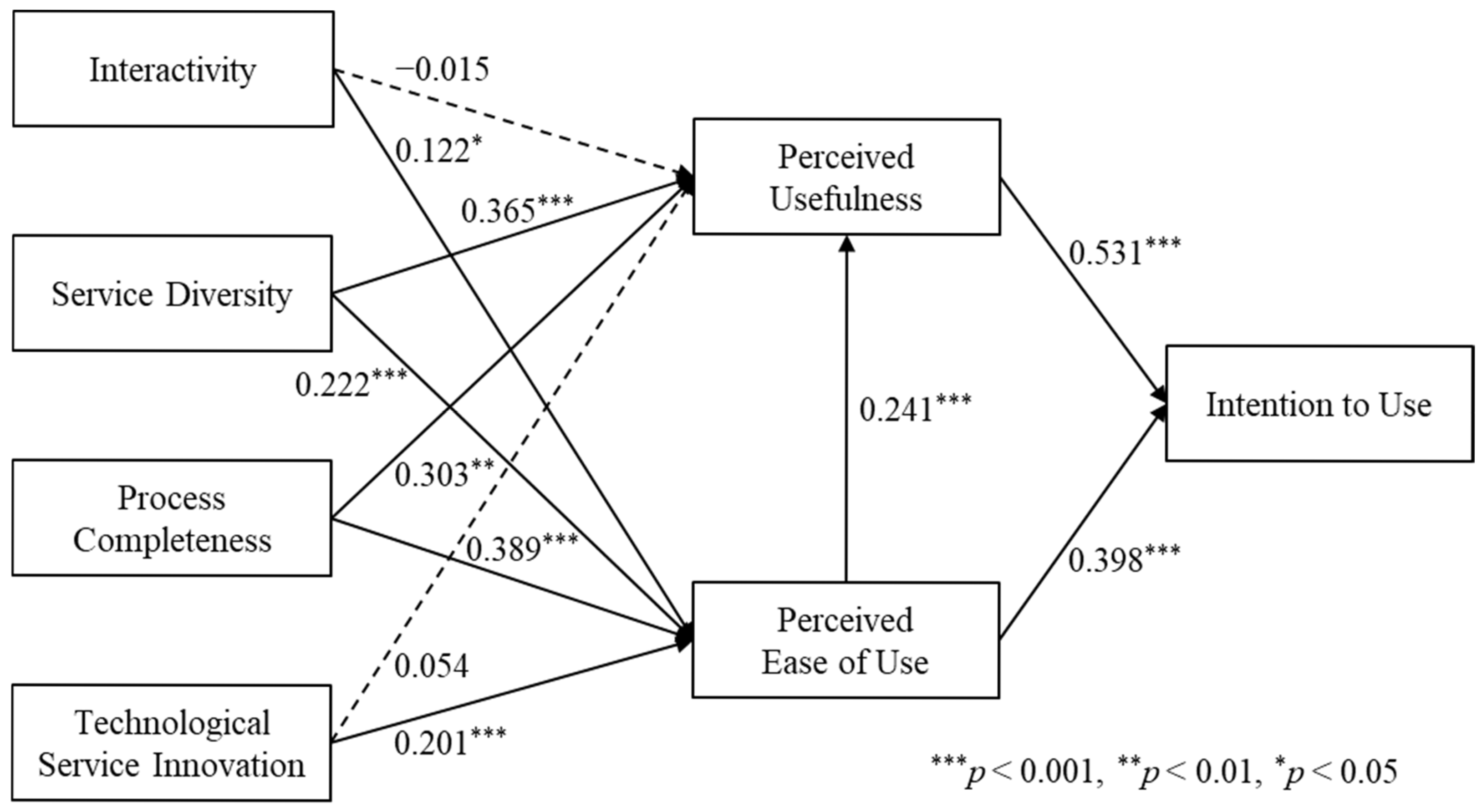

5.2. Structural Model

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Construct | Measurement Items | References |

|---|---|---|

| Interactivity | INT1: Mobile banking super-app allows me to quickly resolve issues. INT2: Mobile banking super-app promptly responds to my requests. INT3: Mobile banking super-app perfectly meets my requirements. INT4: Mobile banking super-app quickly rectifies problems, ensuring they do not recur. | [35,43] |

| Service Diversity | SD1: Mobile banking super-app offers a wide array of services. SD2: Mobile banking super-app caters to diverse consumer needs through various services. SD3: Mobile banking super-app features an extensive and diverse range of services. SD4: Mobile banking super-app contains a variety of informational content. | [35,43] |

| Process Completeness | PC1: I can complete tasks on my phone using the mobile banking super-app. PC2: Mobile banking super-app supports most of my mobile work processes. PC3: Mobile banking super-app streamlines my mobile tasks compared with traditional mobile banking services. PC4: The overall process of the mobile banking super-app is smooth, from finding financial products or services to signing up and canceling them. PC5: I believe there is a strong connection between the various services offered by the mobile banking super-app. | [31,43] |

| Technological Service Innovation | TSI1: Mobile banking super-app, which consolidates multiple services into one app, utilizes advanced screen design technologies. TSI2: Mobile banking super-app technology that suggests tailored financial products and searches across numerous industries holds new value. TSI3: The process of comparing and subscribing to financial products in mobile banking super-apps is technologically superior to that of general apps. TSI4: AI-powered technologies of the mobile banking super-app are impressive. TSI5: Mobile banking super-app, which integrates financial services, insurance premium inquiries, delivery, and ticket reservations, is innovative. | [43,58] |

| Perceived Usefulness | PU1: Mobile banking super-apps are generally more useful than apps offering only basic financial services. PU2: Mobile banking super-app accelerates the completion of my mobile tasks. PU3: Using the mobile banking super-app enhances the efficiency of my mobile work. PU4: Mobile banking super-app is worth using. | [10,51,60] |

| Perceived Ease of Use | PEOU1: Mobile banking super-app offers a clear and simple service interface. PEOU2: Mobile banking bank super-app is user-friendly. PEOU3: Mobile banking bank super-app’s screen design is easy to navigate. PEOU4: Mobile banking bank super-app makes finding desired services effortless. PEOU5: Using services in various fields, such as finance, delivery, reservations, and search, is simple and straightforward with the mobile banking super-app. | [10,51,60] |

| Intention to Use | ITU1: I intend to continue using the mobile banking super-app. ITU2: I plan to use the mobile banking super-app in the future. ITU3: I will prioritize the mobile banking super-app over other apps. ITU4: My life would be inconvenient without the mobile banking super-app. ITU5: I will recommend the mobile banking super-app to others. ITU6: I will speak positively about the mobile banking super-app to others. | [10,51,60] |

| Pre- and Post-survey Questions | Q1: Are you familiar with using mobile banking apps? Q2: Which mobile banking app do you use most frequently? Q3: What is your primary bank? Q4: Which mobile banking app do you personally consider a banking super-app? Q5: What level of service integration do you expect from a single mobile banking app? | - |

References

- Zhang, B.Z.; Ashta, A.; Barton, M.E. Do FinTech and financial incumbents have different experiences and perspectives on the adoption of artificial intelligence? Strateg. Change 2021, 30, 223–234. [Google Scholar] [CrossRef]

- Barroso, M.; Laborda, J. Digital transformation and the emergence of the Fintech sector: Systematic literature review. Digit. Bus. 2022, 2, 100028. [Google Scholar] [CrossRef]

- Roa, L.; Correa-Bahnsen, A.; Suarez, G.; Cortés-Tejada, F.; Luque, M.A.; Bravo, C. Super-app behavioral patterns in credit risk models: Financial, statistical and regulatory implications. Expert Syst. Appl. 2021, 169, 114486. [Google Scholar] [CrossRef]

- Deloitte. Digital Banking Maturity 2022. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/us-digital-banking-maturity-report-sep-22.pdf (accessed on 26 May 2025).

- Accenture. Rise of the “Super-App”: Opportunity or Threat? 2021. Available online: https://bankingblog.accenture.com/rise-of-the-super-app (accessed on 26 May 2025).

- Deloitte. Western Super-Apps: Forecasting Disruption from a Super Trend. 2022. Available online: https://www2.deloitte.com/content/dam/Deloitte/us/Documents/financial-services/us-fsi-western-super-apps.pdf (accessed on 26 May 2025).

- Venkatesh, V.; Morris, M.G.; Davis, G.B.; Davis, F.D. User acceptance of information technology: Toward a unified view. MIS Q. 2003, 27, 425–478. [Google Scholar] [CrossRef]

- Festini, A.; Roth, D. The Last Mile Problem and Its Innovative Challengers. In Disrupting Logistics. Future of Business and Finance; Wurst, C., Graf, L., Eds.; Springer: Cham, Switzerland, 2021. [Google Scholar]

- Steinberg, M.; Mukherjee, R.; Punathambekar, A. Media power in digital Asia: Super apps and megacorps. Media Cult. Soc. 2022, 44, 1405–1419. [Google Scholar] [CrossRef]

- Park, K. Danggeun Market, the South Korean Secondhand Marketplace App, Raises $33 Million Series C. TechCrunch. 2021. Available online: https://techcrunch.com/2021/08/17/south-korean-online-secondhand-marketplace-danggeun-market-raises-162m-at-a-2-7b-valuation/ (accessed on 26 May 2025).

- Shu, C. Viva Republica, Developer of Korean Financial Super App Toss, Raises $410M at a $7.4B Valuation. TechCrunch. 2021. Available online: https://techcrunch.com/2021/06/22/viva-republica-developer-of-korean-financial-super-app-toss-raises-410m-at-a-7-4b-valuation/ (accessed on 26 May 2025).

- DeLone, W.H.; McLean, E.R. Information systems success: The quest for the dependent variable. Inf. Syst. Res. 1992, 3, 60–95. [Google Scholar] [CrossRef]

- Peter, S.; DeLone, W.; McLean, E.R. Information systems success: The quest for the independent variables. J. Manag. Inf. Syst. 2013, 29, 7–62. [Google Scholar] [CrossRef]

- Martins, J.; Branco, F.; Gonçalves, R.; Au-Yong-Oliveira, M.; Oliveira, T.; Naranjo-Zolotov, M.; Cruz-Jesus, F. Assessing the success behind the use of education management information systems in higher education. Telemat. Inform. 2019, 38, 182–193. [Google Scholar] [CrossRef]

- McKnight, D.H.; Cummings, L.L.; Chervany, N.L. Initial trust formation in new organizational relationships. Acad. Manag. Rev. 1998, 23, 473–490. [Google Scholar] [CrossRef]

- Wei, K.; Li, Y.; Zha, Y.; Ma, J. Trust, risk and transaction intention in consumer-to-consumer e-marketplaces: An empirical comparison between buyers’ and sellers’ perspectives. Ind. Manag. Data Syst. 2019, 119, 331–350. [Google Scholar] [CrossRef]

- Kim, D.; Park, S.P.; Yi, S. Relevant and rich interactivity under uncertainty: Guest reviews, host responses, and guest purchase intention on Airbnb. Telemat. Inform. 2021, 65, 101708. [Google Scholar] [CrossRef]

- Gan, C.L.; Balakrishnan, V. Enhancing classroom interaction via IMMAP–an interactive mobile messaging app. Telemat. Inform. 2017, 34, 230–243. [Google Scholar] [CrossRef]

- Kang, J.Y.M.; Mun, J.M.; Johnson, K.K. In-store mobile usage: Downloading and usage intention toward mobile location-based retail apps. Comput. Hum. Behav. 2015, 46, 210–217. [Google Scholar] [CrossRef]

- Dibia, V.; Wagner, C. Success within app distribution platforms: The contribution of app diversity and app cohesivity. In Proceedings of the 2015 48th Hawaii International Conference on System Sciences, Kauai, HI, USA, 5–8 January 2015; pp. 4304–4313. [Google Scholar]

- Salehi, S.; Miremadi, I.; Nejati, M.G.; Ghafouri, H. Fostering the Adoption and Use of Super App Technology. IEEE Trans. Eng. Manag. Forthcom. 2023, 71, 4761–4775. [Google Scholar] [CrossRef]

- Küster, I.; Vila, N.; Canales, P. How does the online service level influence consumers’ purchase intentions before a transaction? A formative approach. Eur. J. Manag. Bus. Econ. 2016, 25, 111–120. [Google Scholar] [CrossRef]

- Tam, K.Y.; Ho, S.Y. Web personalization as a persuasion strategy: An elaboration likelihood model perspective. Inf. Syst. Res. 2005, 16, 271–291. [Google Scholar] [CrossRef]

- Hwang, M.I.; Lin, J.W. Information dimension, information overload and decision quality. J. Inf. Sci. 1999, 25, 213–218. [Google Scholar] [CrossRef]

- Lee, Y.W.; Strong, D.M.; Kahn, B.K.; Wang, R.Y. AIMQ: A methodology for information quality assessment. Inf. Manag. 2002, 40, 133–146. [Google Scholar] [CrossRef]

- Nicolaou, A.I.; McKnight, D.H. Perceived information quality in data exchanges: Effects on risk, trust, and intention to use. Inf. Syst. Res. 2006, 17, 332–351. [Google Scholar] [CrossRef]

- Sharma, S.K.; Sharma, M. Examining the role of trust and quality dimensions in the actual usage of mobile banking services: An empirical investigation. Int. J. Inf. Manag. 2019, 44, 65–75. [Google Scholar] [CrossRef]

- Chung, N.; Kwon, S.J. Effect of trust level on mobile banking satisfaction: A multi-group analysis of information system success instruments. Behav. Inf. Technol. 2009, 28, 549–562. [Google Scholar] [CrossRef]

- Geebren, A.; Jabbar, A.; Luo, M. Examining the role of consumer satisfaction within mobile eco-systems: Evidence from mobile banking services. Comput. Hum. Behav. 2021, 114, 106584. [Google Scholar] [CrossRef]

- Rogers, E.M. Diffusion of Innovations; Simon and Schuster: New York, NY, USA, 2010. [Google Scholar]

- Chan, R.; Troshani, I.; Rao Hill, S.; Hoffmann, A. Towards an understanding of consumers’ FinTech adoption: The case of Open Banking. Int. J. Bank Mark. 2022, 40, 886–917. [Google Scholar] [CrossRef]

- Chauhan, V.; Yadav, R.; Choudhary, V. Analyzing the impact of consumer innovativeness and perceived risk in internet banking adoption: A study of Indian consumers. Int. J. Bank Mark. 2019, 37, 323–339. [Google Scholar] [CrossRef]

- Clohessy, T.; Acton, T. Investigating the influence of organizational factors on blockchain adoption: An innovation theory perspective. Ind. Manag. Data Syst. 2019, 119, 1457–1491. [Google Scholar] [CrossRef]

- Tian, H.; Grover, V.; Zhao, J.; Jiang, Y. The differential impact of types of app innovation on customer evaluation. Inf. Manag. 2020, 57, 103358. [Google Scholar] [CrossRef]

- Dodds, W.B.; Monroe, K.B.; Grewal, D. Effects of price, brand, and store information on buyers’ product evaluations. J. Mark. Res. 1991, 28, 307–319. [Google Scholar]

- Zeithaml, V.A. Consumer perceptions of price, quality, and value: A means-end model and synthesis of evidence. J. Mark. 1988, 52, 2–22. [Google Scholar] [CrossRef]

- Chen, Y.M.; Hsu, T.H.; Lu, Y.J. Impact of flow on mobile shopping intention. J. Retail. Consum. Serv. 2018, 41, 281–287. [Google Scholar] [CrossRef]

- Luarn, P.; Lin, H.H. Toward an understanding of the behavioral intention to use mobile banking. Comput. Hum. Behav. 2005, 21, 873–891. [Google Scholar] [CrossRef]

- Rafdinal, W.; Senalasari, W. Predicting the adoption of mobile payment applications during the COVID-19 pandemic. Int. J. Bank Mark. 2021, 39, 984–1002. [Google Scholar] [CrossRef]

- Davis, F.D. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Q. 1989, 13, 319–340. [Google Scholar] [CrossRef]

- Jeong, B.O. Effects of perceived usefulness, perceived ease of use and perceived enjoyment on intention to use tourism application: Moderating effects of demographic characteristics. Int. J. Tour. Hosp. Res. 2016, 30, 101–121. [Google Scholar] [CrossRef]

- Elhajjar, S.; Ouaida, F. An analysis of factors affecting mobile banking adoption. Int. J. Bank Mark. 2020, 38, 352–367. [Google Scholar] [CrossRef]

- Wixom, B.H.; Todd, P.A. A theoretical integration of user satisfaction and technology acceptance. Inf. Syst. Res. 2005, 16, 85–102. [Google Scholar] [CrossRef]

- Mohammadi, H. Investigating users’ perspectives on e-learning: An integration of TAM and IS success model. Comput. Hum. Behav. 2015, 45, 359–374. [Google Scholar] [CrossRef]

- Rana, N.P.; Dwivedi, Y.K.; Williams, M.D.; Weerakkody, V. Investigating success of an e-government initiative: Validation of an integrated IS success model. Inf. Syst. Front. 2015, 17, 127–142. [Google Scholar] [CrossRef]

- Kim, H.W.; Xu, Y.; Koh, J. A comparison of online trust building factors between potential customers and repeat customers. J. Assoc. Inf. Syst. 2004, 5, 392–420. [Google Scholar] [CrossRef]

- Vance, A.; Elie-Dit-Cosaque, C.; Straub, D.W. Examining trust in information technology artifacts: The effects of system quality and culture. J. Manag. Inf. Syst. 2008, 24, 73–100. [Google Scholar] [CrossRef]

- Lee, S.; Kim, B.G. User, system, and social related factors affecting perceived usefulness for continuance usage intention of mobile apps. Int. J. Mob. Commun. 2021, 19, 190–217. [Google Scholar] [CrossRef]

- Gupta, P.; Prashar, S.; Vijay, T.S.; Parsad, C. Examining the influence of antecedents of continuous intention to use an informational app: The role of perceived usefulness and perceived ease of use. Int. J. Bus. Inf. Syst. 2021, 36, 270–287. [Google Scholar] [CrossRef]

- Peng, X.; Zhao, Y.C.; Zhu, Q. Investigating user switching intention for mobile instant messaging application: Taking WeChat as an example. Comput. Hum. Behav. 2016, 64, 206–216. [Google Scholar] [CrossRef]

- Zhou, T. An empirical examination of initial trust in mobile banking. Internet Res. 2011, 21, 527–540. [Google Scholar] [CrossRef]

- Ghasemaghaei, M.; Hassanein, K. A macro model of online information quality perceptions: A review and synthesis of the literature. Comput. Hum. Behav. 2016, 55, 972–991. [Google Scholar] [CrossRef]

- Montazemi, A.R.; Qahri-Saremi, H. Factors affecting adoption of online banking: A meta-analytic structural equation modeling study. Inf. Manag. 2015, 52, 210–226. [Google Scholar] [CrossRef]

- Lewis, W.; Agarwal, R.; Sambamurthy, V. Sources of influence on beliefs about information technology use: An empirical study of knowledge workers. MIS Q. 2003, 27, 657–678. [Google Scholar] [CrossRef]

- Mao, E.; Srite, M.; Bennett Thatcher, J.; Yaprak, O. A research model for mobile phone service behaviors: Empirical validation in the US and Turkey. J. Glob. Inf. Technol. Manag. 2005, 8, 7–28. [Google Scholar] [CrossRef]

- Elluminati. Top 6 Successful Super Apps Examples in Market—2023. Available online: https://www.elluminatiinc.com/super-apps-examples/ (accessed on 26 May 2025).

- Kim, H.; Niehm, L.S. The impact of website quality on information quality, value, and loyalty intentions in apparel retailing. J. Interact. Mark. 2009, 23, 221–233. [Google Scholar] [CrossRef]

- Lee, D.; Moon, J.; Kim, Y.J.; Mun, Y.Y. Antecedents and consequences of mobile phone usability: Linking simplicity and interactivity to satisfaction, trust, and brand loyalty. Inf. Manag. 2015, 52, 295–304. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis with Readings; MacMillan: New York, NY, USA, 1992. [Google Scholar]

- Fornell, C.; Larcker, D.F. Evaluating structural equation models with unobservable variables and measurement error. J. Mark. Res. 1981, 18, 39–50. [Google Scholar] [CrossRef]

- Hair, J.F.; Anderson, R.E.; Tatham, R.L.; Black, W.C. Multivariate Data Analysis, 5th ed.; Prentice-Hall International, Inc.: Hoboken, NJ, USA, 1998. [Google Scholar]

- Wünderlich, N.V.; Wangenheim, F.V.; Bitner, M.J. High tech and high touch: A framework for understanding user attitudes and behaviors related to smart interactive services. J. Serv. Res. 2013, 16, 3–20. [Google Scholar] [CrossRef]

- Kumari, R.; Tatavarthy, A.D.; Sahay, A. Too many cooks spoil the broth? Number of promotional gifts and impact on consumer choice. J. Retail. Consum. Serv. 2022, 69, 103083. [Google Scholar] [CrossRef]

- Alsabawy, A.Y.; Cater-Steel, A.; Soar, J. Determinants of perceived usefulness of e-learning systems. Comput. Hum. Behav. 2016, 64, 843–858. [Google Scholar] [CrossRef]

- ISO 9241-11:2018; Ergonomics of Human-System Interaction—Part 11: Usability: Definitions and Concepts (ISO 9241-11:2018). ISO: Geneva, Switzerland, 2018. Available online: https://www.iso.org/standard/63500.html (accessed on 26 May 2025).

| Measure | Item | Frequency | Percent |

|---|---|---|---|

| Gender | Male | 153 | 49.196% |

| Female | 158 | 50.804% | |

| Age | 20–29 years old | 61 | 19.614% |

| 30–39 years old | 62 | 19.936% | |

| 40–49 years old | 62 | 19.936% | |

| 50–59 years old | 61 | 19.614% | |

| 60–69 years old | 65 | 20.900% | |

| Education | High school | 52 | 16.720% |

| College/university | 221 | 71.061% | |

| Graduate school | 38 | 12.219% | |

| Perceived levels of mobile banking super-app integration | Basic | 114 | 36.656% |

| Intermediate | 137 | 44.051% | |

| Advanced | 60 | 19.293% | |

| Total | 311 | 100% |

| Construct | Item | Factor Loading | CR | AVE | Cronbach’s α |

|---|---|---|---|---|---|

| Interactivity | INT1 | 0.871 | 0.959 | 0.795 | 0.948 |

| INT2 | 0.867 | ||||

| INT3 | 0.902 | ||||

| INT4 | 0.841 | ||||

| Service Diversity | SD1 | 0.891 | 0.942 | 0.803 | 0.918 |

| SD2 | 0.901 | ||||

| SD3 | 0.909 | ||||

| SD4 | 0.883 | ||||

| Process Completeness | PC1 | 0.879 | 0.944 | 0.773 | 0.926 |

| PC2 | 0.863 | ||||

| PC3 | 0.895 | ||||

| PC4 | 0.871 | ||||

| PC5 | 0.887 | ||||

| Technological Service Innovation | TSI1 | 0.779 | 0.900 | 0.642 | 0.861 |

| TSI2 | 0.797 | ||||

| TSI3 | 0.841 | ||||

| TSI4 | 0.800 | ||||

| TSI5 | 0.786 | ||||

| Perceived Usefulness | PU1 | 0.885 | 0.945 | 0.810 | 0.922 |

| PU2 | 0.896 | ||||

| PU3 | 0.922 | ||||

| PU4 | 0.896 | ||||

| Perceived Ease of Use | PEOU1 | 0.908 | 0.950 | 0.791 | 0.934 |

| PEOU2 | 0.898 | ||||

| PEOU3 | 0.912 | ||||

| PEOU4 | 0.888 | ||||

| PEOU5 | 0.839 | ||||

| Intention to Use | ITU1 | 0.909 | 0.959 | 0.795 | 0.948 |

| ITU2 | 0.894 | ||||

| ITU3 | 0.893 | ||||

| ITU4 | 0.829 | ||||

| ITU5 | 0.891 | ||||

| ITU6 | 0.930 |

| INT | SD | PC | TSI | PU | PEOU | ITU | |

|---|---|---|---|---|---|---|---|

| INT | 0.871 | ||||||

| SD | 0.567 | 0.896 | |||||

| PC | 0.717 | 0.766 | 0.879 | ||||

| TSI | 0.588 | 0.618 | 0.656 | 0.801 | |||

| PU | 0.596 | 0.794 | 0.795 | 0.630 | 0.900 | ||

| PEOU | 0.645 | 0.713 | 0.778 | 0.665 | 0.763 | 0.889 | |

| ITU | 0.589 | 0.679 | 0.774 | 0.636 | 0.835 | 0.804 | 0.891 |

| Path | Overall | Basic | Intermediate | Advanced |

|---|---|---|---|---|

| INT → PU (H1) | −0.015 | −0.127 | 0.066 | −0.052 |

| INT → PEOU (H2) | 0.122 * | 0.104 | 0.023 | 0.340 * |

| SD → PU (H3) | 0.365 *** | 0.481 *** | 0.260 ** | 0.572 *** |

| SD → PEOU (H4) | 0.222 *** | 0.175 | 0.298 ** | −0.028 |

| PC → PU (H5) | 0.303 ** | 0.294 ** | 0.351 * | −0.103 |

| PC → PEOU (H6) | 0.389 *** | 0.538 *** | 0.362 ** | 0.317 |

| TSI → PU (H7) | 0.054 | 0.100 | −0.045 | 0.205 |

| TSI → PEOU (H8) | 0.201 *** | 0.110 | 0.247 ** | 0.306 * |

| PEOU → PU (H9) | 0.241 *** | 0.219 * | 0.287 ** | 0.316 ** |

| PU → ITU (H10) | 0.531 *** | 0.387 *** | 0.579 *** | 0.643 *** |

| PEOU → ITU (H11) | 0.398 *** | 0.546 *** | 0.331 *** | 0.304 *** |

| Hypothesis | Overall | Basic | Intermediate | Advanced |

|---|---|---|---|---|

| H1: Interactivity has a positive effect on perceived usefulness. | Reject | Reject | Reject | Reject |

| H2: Interactivity has a positive effect on perceived ease of use. | Accept | Reject | Reject | Accept |

| H3: Service diversity has a positive effect on perceived usefulness. | Accept | Accept | Accept | Accept |

| H4: Service diversity has a positive effect on perceived ease of use. | Accept | Reject | Accept | Reject |

| H5: Process completeness has a positive effect on perceived usefulness. | Accept | Accept | Accept | Reject |

| H6: Process completeness has a positive effect on perceived ease of use. | Accept | Accept | Accept | Reject |

| H7: Technological service innovation has a positive effect on perceived usefulness. | Reject | Reject | Reject | Reject |

| H8: Technological service innovation has a positive effect on perceived ease of use. | Accept | Reject | Accept | Accept |

| H9: Perceived ease of use has a positive effect on perceived usefulness. | Accept | Accept | Accept | Accept |

| H10: Perceived usefulness has a positive effect on intention to use. | Accept | Accept | Accept | Accept |

| H11: Perceived ease of use has a positive effect on intention to use. | Accept | Accept | Accept | Accept |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kim, D.; Hong, S.; Je, Y.; Ryu, M.H. Drivers of Mobile Banking Super-App Adoption: Across Different Service Integration Levels. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 143. https://doi.org/10.3390/jtaer20020143

Kim D, Hong S, Je Y, Ryu MH. Drivers of Mobile Banking Super-App Adoption: Across Different Service Integration Levels. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(2):143. https://doi.org/10.3390/jtaer20020143

Chicago/Turabian StyleKim, Dongyeon, Soongoo Hong, Youngmin Je, and Min Ho Ryu. 2025. "Drivers of Mobile Banking Super-App Adoption: Across Different Service Integration Levels" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 2: 143. https://doi.org/10.3390/jtaer20020143

APA StyleKim, D., Hong, S., Je, Y., & Ryu, M. H. (2025). Drivers of Mobile Banking Super-App Adoption: Across Different Service Integration Levels. Journal of Theoretical and Applied Electronic Commerce Research, 20(2), 143. https://doi.org/10.3390/jtaer20020143