Risk Assessment of Live-Streaming Marketing Based on Hesitant Fuzzy Multi-Attribute Group Decision-Making Method

Abstract

1. Introduction

2. Literature Review

2.1. Live-Streaming E-Commerce Risk Research

2.2. Risk Identification Research

2.3. Risk Assessment Research

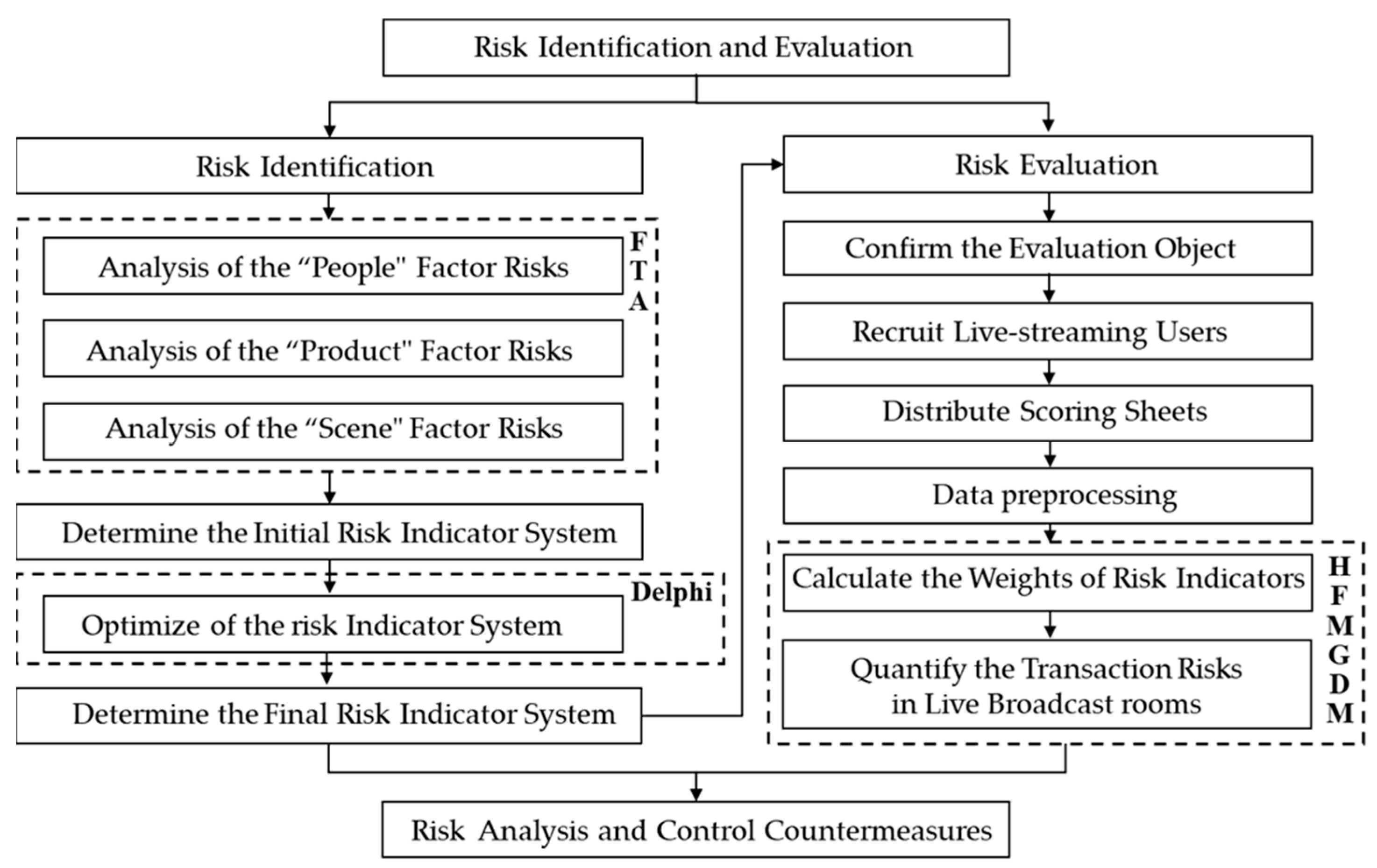

3. Live-Streaming Marketing Risk Analysis

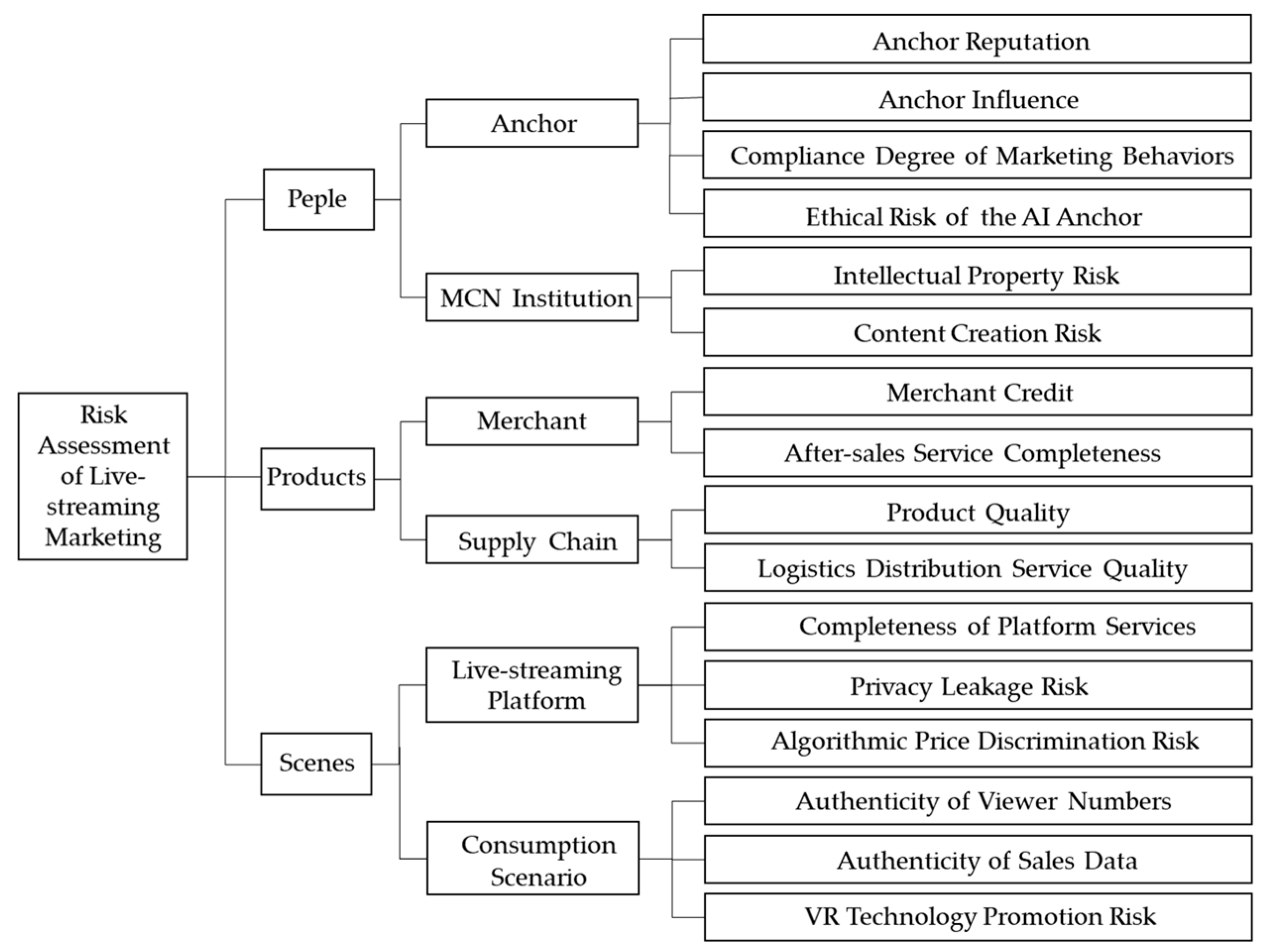

3.1. Identification and Analysis of Risk Factors in Live-Streaming Marketing

3.1.1. Analysis of the “People” Factor Risks in Live-Streaming Marketing

3.1.2. Analysis of the “Product” Factor Risks in Live-Streaming Marketing

3.1.3. Analysis of the “Scene” Factor Risks in Live-Streaming Marketing

3.2. Construction of the Risk Indicator System for Live-Streaming Marketing

4. Methodologies

4.1. Delphi Method

4.2. Hesitant Fuzzy Multi-Attribute Group Decision-Making Method

4.2.1. The Definition of Hesitant Fuzzy Non-Probabilistic Entropy

- (1)

- Enp (α) = 0, if and only if α = {0}, or α = {1};

- (2)

- Enp (α) = 1, if and only if α = αc;

- (3)

- Enp (α) = Enp (αc);

- (4)

- Enp (α) ≤ Enp (β), then

4.2.2. Hesitant Fuzzy Multi-Attribute Group Decision-Making Method Based on Entropy Weight Method

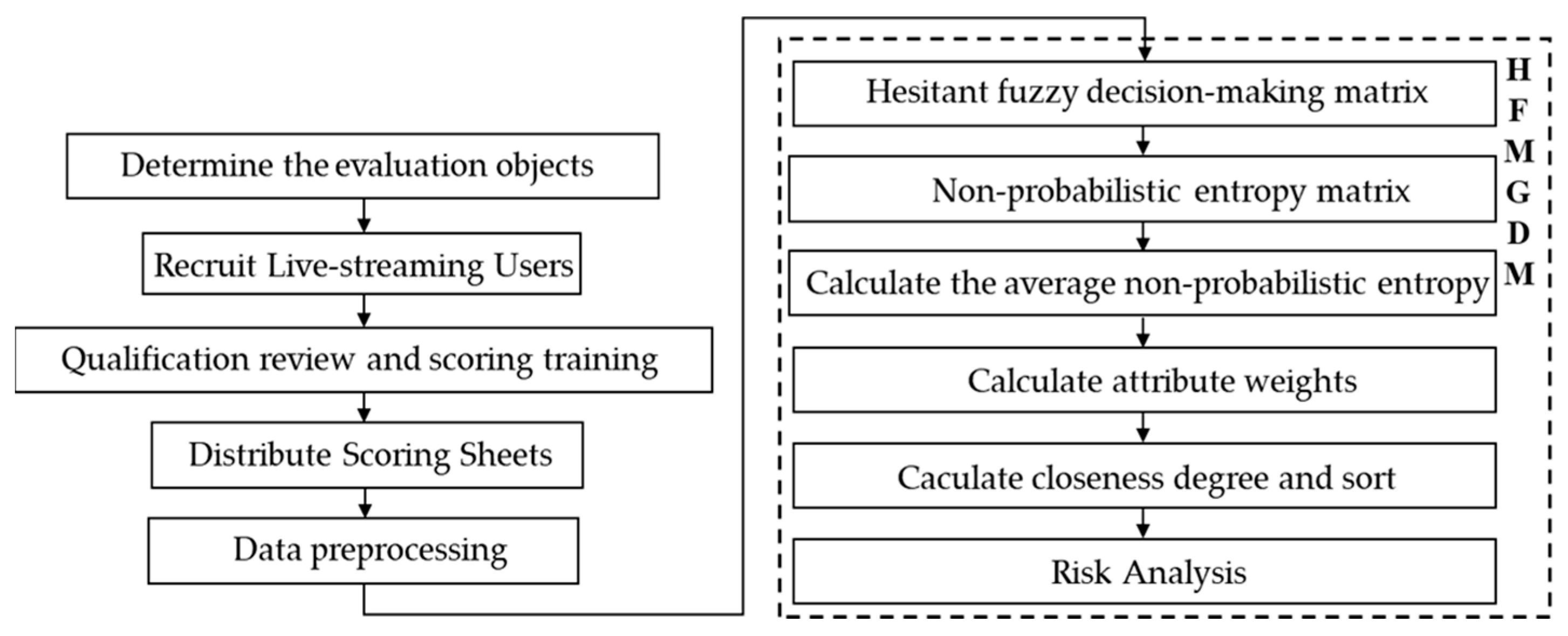

4.3. Risk Identification and Evaluation Model for Live-Streaming Marketing

5. Empirical Analysis of the Evaluation of Live-Streaming Marketing Risks

5.1. Risk Factor Framework Based on the Delphi Method

5.2. Comprehensive Evaluation of Live-Streaming Marketing Risks Based on Hesitant Fuzzy Multi-Attribute Group Decision-Making Method

- -

- They have shopped in the live broadcast rooms of the above three anchors;

- -

- They have at least two years of online shopping experience;

- -

- They watch at least three hours of live streaming a week;

- -

- They make purchases through live streaming at least three times a month;

- -

- They shop online for at least three commodities every month.

- (1)

- Determine the hesitant fuzzy decision-making matrix.

- (2)

- Calculate the hesitant fuzzy non-probabilistic entropy.

- (3)

- Calculate the average non-probabilistic entropy.

- (4)

- Calculate the attribute weights.

- (5)

- Calculate the weighted distances to the positive and negative ideal solutions.

- (6)

- Calculate the comprehensive evaluation value.

5.3. Risk Analysis and Control Countermeasures

5.3.1. Anchor Risk Analysis and Control Countermeasures

5.3.2. Consumption Scenarios Risk Analysis and Control Countermeasures

5.3.3. Merchant and Supply Chain Risk Analysis and Control Countermeasures

5.3.4. Live-Streaming Platforms Risk Analysis and Control Countermeasures

5.3.5. MCN Institutions Risk Analysis and Control Countermeasures

6. Conclusions and Suggestions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- SB/T 11240-2023; Specification for Management & Service of Live-Streaming E-Commerce Platform. Ministry of Commerce of the People’s Republic of China: Beijing, China, 2023.

- Li, H.; Wang, Z.; Yuan, Z.; Yan, X. Multidimensional Evaluation of Consumers’ Shopping Risks under Live-Streaming Commerce. Sustainability 2023, 15, 14060.5. [Google Scholar] [CrossRef]

- CNNIC (China Internet Network Information Center). The 53rd Statistical Report on China’s Internet Development Released. 2024. Available online: https://www.cnnic.net.cn/n4/2024/0321/c208-10962.html (accessed on 26 March 2024).

- Yu, B. Research on the Criminal Risks of MCN Institutions in Online Live-streaming Marketing Activities. Shandong Soc. Sci. 2021, 35, 187–192. [Google Scholar]

- Huang, M.; Ye, Y.; Wang, W. The Interaction Effect of Broadcaster and Product Type on Consumers’ Purchase Intention and Behaviors in Livestreaming Shopping. Nankai Bus. Rev. 2023, 26, 188–198. [Google Scholar]

- Zhang, N.; Wei, X.; Zhang, Z. Game theory analysis on credit risk assessment in E-commerce. Inform. Process. Manag. 2022, 59, 102763. [Google Scholar]

- Wang, L.; Song, H. E-Commerce Credit Risk Assessment Based on Fuzzy Neural Network. Comput. Intell. Neurosci. 2022, 2022, 10. [Google Scholar] [CrossRef]

- Maseeh, H.I.; Jebarajakirthy, C.; Pentecost, R.; Arli, D.; Weaven, S.; Ashaduzzaman, M. Privacy concerns in e-commerce: A multilevel meta-analysis. Psychol. Mark. 2021, 38, 1779–1798. [Google Scholar] [CrossRef]

- Karoui, K. Security novel risk assessment framework based on reversible metrics: A case study of DDoS attacks on an E-commerce web server. Int. J. Netw. Manag. 2016, 26, 553–578. [Google Scholar] [CrossRef]

- Liu, X.; Ahmad, S.F.; Anser, M.K.; Ke, J.; Irshad, M.; Ul-Haq, J.; Abbas, S. Cyber security threats: A never-ending challenge for e-commerce. Front. Psychol. 2022, 13, 927398. [Google Scholar] [CrossRef]

- Song, B.; Yan, W.; Zhang, T. Cross-border e-commerce commodity risk assessment using text mining and fuzzy rule-based reasoning. Adv. Eng. Inform. 2019, 40, 69–80. [Google Scholar] [CrossRef]

- García-Salirrosas, E.; Rondon-Eusebio, R. Influence of Retail e-Commerce Website Design on Perceived Risk in Online Purchases. In Proceedings of the 2022 7th International Conference on Business and Industrial Research (ICBIR), Bangkok, Thailand, 19–20 May 2022; pp. 732–737. [Google Scholar]

- Urrea, N.T.; Vishkaei, B.M.; De Giovanni, P. Operational Risk Management in E-Commerce: A Platform Perspective. IEEE Trans. Eng. Manag. 2024, 71, 3807–3819. [Google Scholar] [CrossRef]

- Zhou, L.; Wang, J.; Li, F.; Xu, Y.; Zhao, J.; Su, J. Risk Aversion of B2C Cross-Border e-Commerce Supply Chain. Sustainability 2022, 14, 8088. [Google Scholar] [CrossRef]

- Mu, W. Analysis and Warning Model of Logistics Risks of Cross-Border E-Commerce. Discrete. Dyn. Nat. Soc. 2022, 2022, 10. [Google Scholar] [CrossRef]

- Yu, H.; Yu, J. On Tax Risk Management of Cross-Border E-Commerce Export Enterprises. Int. Tax. China 2024, 37, 64–69. [Google Scholar]

- Su, J.; Wang, D.; Zhang, F.; Xu, B.; Ouyang, Z. A Multi-Criteria Group Decision-Making Method for Risk Assessment of Live-Streaming E-Commerce Platform. J. Theor. Appl. Electron. Commer. Res. 2023, 18, 1126–1141. [Google Scholar] [CrossRef]

- Peng, Y.; Wang, Y.; Li, J.; Yang, Q. Impact of AI-Oriented Live-Streaming E-Commerce Service Failures on Consumer Disengagement—Empirical Evidence from China. J. Theor. Appl. Electron. Commer. Res. 2024, 19, 1580–1598. [Google Scholar] [CrossRef]

- Kim, B.; Chen, Y.; Kim, D. Key factors influencing customer loyalty in live commerce: The role of perceived value and perceived risk. Soc. Behav. Personal. 2023, 51, e12656. [Google Scholar] [CrossRef]

- Ghasemi, F.; Sari, M.H.M.; Yousefi, V.; Falsafi, R.; Tamosaitiene, J. Project Portfolio Risk Identification and Analysis, Considering Project Risk Interactions and Using Bayesian Networks. Sustainability 2018, 10, 1609. [Google Scholar] [CrossRef]

- Xiao, Q.; Luo, F.; Li, Y. Risk Assessment of Seaplane Operation Safety Using Bayesian Network. Symmetry 2020, 12, 888. [Google Scholar] [CrossRef]

- Mukherjee, N.; Hugé, J.; Sutherland, W.J.; McNeill, J.; Van Opstal, M.; Dahdouh-Guebas, F.; Koedam, N. The Delphi Technique in Ecology and Biological Conservation: Applications and Guidelines. Methods Ecol. Evol. 2015, 6, 1097–1109. [Google Scholar] [CrossRef]

- Lei, X.; MacKenzie, C.A. Assessing risk in different types of supply chains with a dynamic fault tree. Comput. Ind. Eng. 2019, 137, 106061. [Google Scholar] [CrossRef]

- Sherwin, M.D.; Medal, H.R.; MacKenzie, C.A.; Brown, K.J. Identifying and mitigating supply chain risks using fault tree optimization. IISE Trans. 2020, 52, 236–254. [Google Scholar] [CrossRef]

- Xu, C.; Wang, C.; Ding, Y.; Wang, W. Investigation of extremely severe traffic crashes using fault tree analysis. Transp. Lett. 2020, 12, 149–156. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, K.; Xu, C.; Shi, Q.; He, J.; Li, P.; Shi, T. Evaluation of the Safety Performance of Highway Alignments Based on Fault Tree Analysis and Safety Boundaries. Traffic Inj. Prev. 2018, 19, 409–416. [Google Scholar] [CrossRef]

- Kaur, S.; Singh, S.; Gupta, S.; Wats, S. Risk Analysis in Decentralized Finance (DeFi): A Fuzzy-AHP Approach. Risk Manag. 2023, 25, 13. [Google Scholar] [CrossRef]

- Li, S.; Gu, X. Education: Based on Literature Review and Delphi-AHP Method. Educ. Technol. Soc. 2023, 26, 187–202. [Google Scholar]

- Fan, H.; Lu, J.; Chang, Z.; Ji, Y. A Bayesian Network-Based TOPSIS Framework to Dynamically Control the Risk of Maritime Piracy. Marit. Policy Manag. 2024, 51, 1582–1601. [Google Scholar] [CrossRef]

- Torra, V.; Narukawa, Y. On hesitant fuzzy sets and decision. In Proceedings of the 18th IEEE International Conference on Fuzzy Systems, Jeju Island, Republic of Korea, 20–24 August 2009; pp. 1378–1382. [Google Scholar]

- De Luca, A.; Termini, S. A definition of a non-probabilistic entropy in the setting of fuzzy sets theory. Inf. Control. 1972, 20, 301–312. [Google Scholar] [CrossRef]

- Kosko, B. Fuzzy entropy and conditioning. Inf. Sci. 1986, 40, 165–174. [Google Scholar] [CrossRef]

- Tan, J.; Liu, G. Study on Non-probabilistic Entropy for Hesitant Fuzzy Set and its Application. Oper. Res. Manag. Sci. 2024, 33, 173–179. [Google Scholar]

- Qu, G.; Xue, R.; Li, T.; Qu, W.; Xu, Z. A Stochastic Multi-Attribute Method for Measuring Sustainability Performance of a Supplier Based on a Triple Bottom Line Approach in a Dual Hesitant Fuzzy Linguistic Environment. Int. J. Environ. Res. Public. Health 2020, 17, 2138. [Google Scholar] [CrossRef]

- Gao, Z.; Zhang, Z.; Peng, D. The Hesitant Fuzzy EGRAS Method for Evaluating the Risk of Returning to Poverty. Stat. Decis. 2022, 38, 15–19. [Google Scholar]

- Zhao, W. Growth and Risk Analysis of Live-streaming E-commerce from the Perspective of Consumer Interests. J. Commer. Econ. 2021, 18, 108–110. [Google Scholar]

- Feng, H. Problems Existing in the Live-streaming E-commerce Industry and Governance Countermeasures. People’s Trib. 2023, 32, 104–106. [Google Scholar]

- Wang, L. Research on supply chain risk management of Yantai Apple livebroadcast e-commerce based on entropy weight method and OWA. Master’s Thesis, Nanchang University, Nanchang, China, 2023. [Google Scholar]

- Huang, Y.; Li, Y.; TEO BSX. The mechanism of e-commerce anchor attributes on consumers′ purchase intention based on grounded theory. Cent. Eur. Manag. J. 2023, 31, 1172–1192. [Google Scholar]

- Zhong, D.; Wu, F.; Huang, Z.; Chen, Y. Navigating the human-digital nexus: Understanding consumer intentions with AI anchors in live commerce. Behav. Inform. Technol. 2025, 1–16. [Google Scholar] [CrossRef]

- Zhang, S. Ethical Scrutiny and Risk Avoidance of AI Anchors in the Age of Artificial Intelligence. Contemp. TV 2022, 37, 84–87. [Google Scholar]

- Han, X. Historicising Wanghong economy: Connecting Platforms through Wanghong and Wanghong Incubators. Celebr. Stud. 2021, 12, 317–325. [Google Scholar] [CrossRef]

- Liu, M.; Huo, F. Analysis of Legal Risks in the MCN Industry. Netinfo Secur. 2021, 21, 94–96. [Google Scholar]

- Hu, C.; Chen, W.; Zhou, Y.; Chen, C.; Sun, S. Regulation Mechanism of Live-streaming E-commerce Based on Evolutionary Gametheory. J. Manag. Sci. China 2023, 26, 126–141. [Google Scholar]

- Hangzhou.com.cn. Consumer Association of Puyang City, Henan Province Issues “3•15” Warning, Exposing Consumer Risks in the Era of AI and Big Data 2025. Available online: https://xiaofei.hangzhou.com.cn/xfjs/content/2025-03/18/content_9780626.html (accessed on 21 March 2025).

- Yu, Q.; Jia, R.; Zhang, X. Analysis on the Influencing Factors of Customer Satisfaction under the E-commerce Model of Live Broadcast Assisting Agriculture. China Collect. Econ. 2022, 38, 54–56. [Google Scholar]

- Zhang, C.; Zhang, J.; Yang, Q. Identifying Critical Risk Factors in Green Product Certification Using Hybrid Multiple-Criteria Decision-Making. Sustainability 2022, 14, 4513. [Google Scholar] [CrossRef]

- Zhang, C.; Tang, L.; Zhang, J.; Wang, Z. Using Social Network Analysis to Identify the Critical Factors Influencing Residents’ Green Consumption Behavior. Systems 2023, 11, 254. [Google Scholar] [CrossRef]

- Zadeh, L.A. Fuzzy sets. Inf. Control. 1965, 8, 338–353. [Google Scholar] [CrossRef]

- Farhadinia, B. Information measures for hesitant fuzzy sets and interval-valued hesitant fuzzy sets. Inf. Sci. 2013, 240, 129–144. [Google Scholar] [CrossRef]

- Xu, Z.; Xia, M. Hesitant fuzzy entropy and cross-entropy and their use in multiattribute decision-making. Int. J. Intell. Syst. 2012, 27, 799–822. [Google Scholar] [CrossRef]

- Wang, Y.; Miao, M. Application of exponential hesitation fuzzy entropy in multi-attribute decision making. Control. Decis. 2022, 37, 1460–1468. [Google Scholar]

- Lv, J.; Guo, S.; Guo, F. Study on hesitant fuzzy information measures and their clustering application. Comput. Intell. Neurosci. 2019, 2019, 5370763. [Google Scholar] [CrossRef]

| First-Level Risk Indicators | Second-Level Risk Indicators | Third-Level Risk Indicators | Risk Description |

|---|---|---|---|

| “People” Risks | Anchor | Anchor Reputation [37] | The social evaluation and trustworthiness of the anchor formed based on professionalism, credibility, and public feedback. |

| Anchor Influence [38,39] | The guiding role and social effect of the anchor on the audience’s attitude, decision-making, and behavior through content dissemination, interactive behavior, and public image. | ||

| Compliance Degree of Marketing Behaviors [36] | The degree of compliance with norms and standards when the anchor is engaged in marketing activities such as product promotion and advertising. | ||

| Ethical Risk of the AI Anchor [41] | Potential risks of AI anchors violating human values and moral norms in the live-streaming marketing process. | ||

| MCN Institution | Intellectual Property Risk [43] | The risks arising from the violation of intellectual property laws due to the unauthorized use of others’ works, trademarks, or patents in live-streaming or promotions. | |

| Content Creation Risk [43] | The risks faced due to the violation of laws and regulations by releasing false propaganda, illegal advertisements, or harmful information in live-streaming or content. | ||

| “Product” Risks | Merchant | Merchant Credit [36] | The accumulated credit and reputation of the merchant. |

| Degree of Account Standardization [1] | The degree of standardization of various types of information in the merchant’s account. | ||

| After-sales Service Completeness [36] | The level of support and services provided by the merchant after consumers have purchased products. | ||

| Supply Chain | Product Quality [36] | The level at which the goods offered by the merchant meet customer needs, expectations, and standards. | |

| Logistics Distribution Service Quality [46] | The level of a series of logistics management and distribution services. | ||

| “Scene” Risks | Live-streaming Platform | Completeness of Platform Services [37] | The degree to which the platform systematically meets user needs and continuously optimizes in aspects such as user experience and after-sales service. |

| Privacy Leakage Risk [2] | Platforms rely on big data to analyze users’ behaviors, preferences, and consumption habits, but the collection and storage of a large amount of user data may trigger the risk of privacy leakage. | ||

| Algorithmic Price Discrimination Risk [45] | Big data analysis may lead to price discrimination through algorithms. The use of algorithms to manipulate the background to offer differentiated prices and other services to different users will damage the rights and interests of consumers. | ||

| Rationality of Interface Setting [2] | The degree to which the presentation of information and the operation process are optimized through scientific layout and intuitive design, so as to enhance the user experience. | ||

| Consumption Scenario | Authenticity of Viewer Numbers [36] | The degree to which technical means and rule-based constraints are utilized to ensure the authenticity of the viewer data in the live-streaming room, the absence of false volume-brushing behaviors, and the accurate reflection of the actual viewer size. | |

| Authenticity of Sales Data [36] | The degree to which technical monitoring and rule constraints are used to ensure the authenticity and credibility of transaction data (such as transaction volume and sales amount), and the absence of false order brushing or manipulation behaviors. | ||

| VR Technology Promotion Risk [45] | The excessive beautification or false presentation of products using VR technology may mislead consumers about the actual effects of the products, resulting in negative impacts. |

| Expert | Duty | Gender | Age | Specialist Topic | Location | Seniority |

|---|---|---|---|---|---|---|

| A | Professor | Male | 52 | Risk Management | Beijing | 20–25 |

| B | Professor | Female | 47 | Live-streaming Marketing | Liaoning | 15–20 |

| C | Associate Professor | Male | 42 | Marketing | Beijing | 10–15 |

| D | Professor | Male | 57 | Multi-attribute Decision-making | Taiwan, China | 10–15 |

| E | Research Fellow | Female | 36 | Live-streaming Marketing | Shandong | 10–15 |

| F | Senior Manager | Male | 49 | Marketing | Shanghai | 15–20 |

| Second-Level Risk Indicators | Third-Level Risk Indicators | Necessity Scoring | Mean Value | Standard Deviation | CDI | Whether to Eliminate | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | ||||||

| Anchor | Anchor Reputation | 5 | 4 | 5 | 5 | 5 | 4 | 4.667 | 0.471 | 0.101 | No |

| Anchor Influence | 3 | 4 | 4 | 4 | 4 | 3 | 3.667 | 0.471 | 0.129 | No | |

| Compliance Degree of Marketing Behaviors | 5 | 5 | 5 | 5 | 5 | 4 | 4.833 | 0.373 | 0.077 | No | |

| Ethical Risk of the AI Anchor | 5 | 5 | 5 | 4 | 5 | 5 | 4.833 | 0.373 | 0.077 | No | |

| MCN Institution | Intellectual Property Risk | 4 | 4 | 5 | 5 | 4 | 4 | 4.333 | 0.471 | 0.109 | No |

| Content Creation Risk | 4 | 3 | 4 | 4 | 4 | 3 | 3.667 | 0.471 | 0.129 | No | |

| Merchant | Merchant Credit | 5 | 4 | 5 | 4 | 5 | 5 | 4.667 | 0.471 | 0.101 | No |

| Degree of Account Standardization | 3 | 3 | 4 | 4 | 3 | 2 | 3.167 | 0.687 | 0.217 | No | |

| After-sales Service Completeness | 4 | 4 | 5 | 5 | 5 | 4 | 4.500 | 0.500 | 0.111 | No | |

| Supply Chain | Product Quality | 5 | 5 | 5 | 5 | 5 | 4 | 4.833 | 0.373 | 0.077 | No |

| Logistics Distribution Service Quality | 5 | 4 | 4 | 5 | 4 | 4 | 4.333 | 0.471 | 0.109 | No | |

| Live-streaming Platform | Completeness of Platform Services | 4 | 4 | 4 | 5 | 5 | 4 | 4.333 | 0.471 | 0.109 | No |

| Privacy Leakage Risk | 5 | 5 | 5 | 5 | 5 | 5 | 5.000 | 0.000 | 0.000 | No | |

| Algorithmic Price Discrimination Risk | 4 | 5 | 5 | 4 | 5 | 4 | 4.500 | 0.500 | 0.111 | No | |

| Rationality of Interface Setting | 2 | 3 | 3 | 3 | 3 | 2 | 2.667 | 0.471 | 0.177 | Yes | |

| Consumption Scenario | Authenticity of Viewer Numbers | 3 | 3 | 5 | 4 | 4 | 3 | 3.667 | 0.745 | 0.203 | No |

| Authenticity of Sales Data | 4 | 3 | 4 | 5 | 5 | 3 | 4.000 | 0.816 | 0.204 | No | |

| VR Technology Promotion Risk | 5 | 5 | 5 | 4 | 4 | 5 | 4.667 | 0.471 | 0.101 | No | |

| Second-Level Risk Indicators | Third-Level Risk Indicators | Necessity Scoring | Mean Value | Standard Deviation | CDI | Whether to Eliminate | |||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| A | B | C | D | E | F | ||||||

| Anchor | Anchor Reputation | 5 | 4 | 5 | 5 | 5 | 4 | 4.667 | 0.471 | 0.101 | No |

| Anchor Influence | 3 | 4 | 4 | 4 | 4 | 3 | 3.667 | 0.471 | 0.129 | No | |

| Compliance Degree of Marketing Behaviors | 5 | 5 | 5 | 5 | 5 | 4 | 4.833 | 0.373 | 0.077 | No | |

| Ethical Risk of the AI Anchor | 5 | 5 | 5 | 4 | 5 | 5 | 4.833 | 0.373 | 0.077 | No | |

| MCN Institution | Intellectual Property Risk | 4 | 4 | 5 | 5 | 4 | 4 | 4.333 | 0.471 | 0.109 | No |

| Content Creation Risk | 4 | 3 | 4 | 4 | 4 | 3 | 3.667 | 0.471 | 0.129 | No | |

| Merchant | Merchant Credit | 5 | 4 | 5 | 4 | 5 | 5 | 4.667 | 0.471 | 0.101 | No |

| Degree of Account Standardization | 3 | 3 | 3 | 3 | 3 | 2 | 2.833 | 0.373 | 0.132 | Yes | |

| After-sales Service Completeness | 4 | 4 | 5 | 5 | 5 | 4 | 4.500 | 0.500 | 0.111 | No | |

| Supply Chain | Product Quality | 5 | 5 | 5 | 5 | 5 | 4 | 4.833 | 0.373 | 0.077 | No |

| Logistics Distribution Service Quality | 5 | 4 | 4 | 5 | 4 | 4 | 4.333 | 0.471 | 0.109 | No | |

| Live-streaming Platform | Completeness of Platform Services | 4 | 4 | 4 | 5 | 5 | 4 | 4.333 | 0.471 | 0.109 | No |

| Privacy Leakage Risk | 5 | 5 | 5 | 5 | 5 | 5 | 5.000 | 0.000 | 0.000 | No | |

| Algorithmic Price Discrimination Risk | 4 | 5 | 5 | 4 | 5 | 4 | 4.500 | 0.500 | 0.111 | No | |

| Rationality of Interface Setting | 2 | 3 | 3 | 3 | 3 | 2 | 2.667 | 0.471 | 0.177 | Yes | |

| Consumption Scenario | Authenticity of Viewer Numbers | 3 | 4 | 4 | 4 | 4 | 3 | 3.667 | 0.471 | 0.129 | No |

| Authenticity of Sales Data | 4 | 4 | 4 | 5 | 5 | 3 | 4.167 | 0.687 | 0.165 | No | |

| VR Technology Promotion Risk | 5 | 5 | 5 | 4 | 4 | 5 | 4.667 | 0.471 | 0.101 | No | |

| Anchor | The Platform That the Anchor Has Settled in | Main Types of Goods for Live-Streaming Sales | Product Promotion Style |

|---|---|---|---|

| L | Taobao | Beauty products, maternal and infant products, pet products, etc. | Provide professional and detailed explanations, possess great infectiousness, and be proficient in using exaggerated emotions and language to drive the purchasing atmosphere. |

| Y | Douyin | Food products, daily necessities, etc. | Mainly featuring humorous and funny, exaggerated performances, creating joyous scenes through interactions between brothers. |

| D | Douyin | Agricultural products, food products, books, etc. | Knowledge-based live-selling. The anchor incorporates cultural knowledge and life insights while introducing products. |

| A1 | A2 | A3 | A4 | |

| L | {0.4, 0.5, 0.6, 0.7, 0.8, 0.9} | {0.4, 0.5, 0.6, 0.7, 0.8} | {0.4, 0.5, 0.6, 0.7} | {0.1, 0.2, 0.3} |

| Y | {0.8, 0.9, 1.0} | {0.7, 0.8, 0.9, 1.0} | {0.5, 0.6, 0.7, 0.8, 0.9, 1.0} | {0.1, 0.2, 0.3} |

| D | {0.1, 0.2, 0.3, 0.4, 0.6} | {0.2, 0.3, 0.4, 0.5, 0.6, 0.7} | {0.1, 0.2, 0.3, 0.4, 0.5} | {0.1, 0.2, 0.3} |

| B1 | B2 | C1 | C2 | |

| L | {0.2, 0.3, 0.4, 0.5, 0.6} | {0.3, 0.4, 0.6, 0.7, 0.8} | {0.2, 0.3, 0.4, 0.5} | {0.1, 0.2, 0.3, 0.4, 0.5} |

| Y | {0.5, 0.6, 0.7, 0.8} | {0.3, 0.4, 0.5, 0.7, 0.8, 0.9} | {0.3, 0.4, 0.5, 0.6, 0.7} | {0.2, 0.3, 0.4, 0.5, 0.6, 0.7} |

| D | {0.3, 0.4, 0.5, 0.6, 0.7, 0.9} | {0.2, 0.3, 0.4, 0.5, 0.6, 0.7} | {0.1, 0.2, 0.4, 0.5, 0.6} | {0.1, 0.2, 0.3, 0.4, 0.5} |

| D1 | D2 | E1 | E2 | |

| L | {0.1, 0.2, 0.3, 0.5} | {0.2, 0.3, 0.4, 0.5} | {0.1, 0.2, 0.3, 0.4, 0.5} | {0.2, 0.3, 0.4, 0.5} |

| Y | {0.4, 0.5, 0.6, 0.7, 0.8, 0.9} | {0.2, 0.3, 0.4, 0.6} | {0.3, 0.4, 0.5, 0.6} | {0.2, 0.3, 0.4, 0.5, 0.6} |

| D | {0.1, 0.2, 0.3, 0.4, 0.5} | {0.1, 0.2, 0.3, 0.4} | {0.3, 0.4, 0.5, 0.6} | {0.2, 0.3, 0.4, 0.5, 0.6} |

| E3 | F1 | F2 | F3 | |

| L | {0.2, 0.3, 0.4, 0.5} | {0.1, 0.3, 0.4, 0.5} | {0.1, 0.2, 0.3, 0.4, 0.5} | {0.1, 0.2, 0.3, 0.4} |

| Y | {0.3, 0.4, 0.5, 0.6} | {0.4, 0.5, 0.6, 0.7, 0.8, 0.9, 1.0} | {0.4, 0.5, 0.6, 0.7, 0.8, 0.9, 1.0} | {0.1, 0.2, 0.3, 0.4, 0.6} |

| D | {0.3, 0.4, 0.5, 0.6} | {0.1, 0.2, 0.3, 0.4, 0.5, 0.6} | {0.2, 0.3, 0.4, 0.5, 0.6} | {0.1, 0.2, 0.3} |

| A1 | A2 | A3 | A4 | B1 | B2 | C1 | C2 | |

| L | 0.57948 | 0.68825 | 0.82616 | 0.26864 | 0.68825 | 0.80943 | 0.55709 | 0.46442 |

| Y | 0.14286 | 0.21822 | 0.39361 | 0.26864 | 0.55709 | 0.71288 | 1.00000 | 0.83576 |

| D | 0.51797 | 0.83576 | 0.46442 | 0.26864 | 0.79349 | 0.83576 | 0.60776 | 0.46442 |

| D1 | D2 | E1 | E2 | E3 | F1 | F2 | F3 | |

| L | 0.42200 | 0.55709 | 0.46442 | 0.55709 | 0.55709 | 0.51674 | 0.46442 | 0.36116 |

| Y | 0.57948 | 0.62765 | 0.82616 | 0.68825 | 0.82616 | 0.49526 | 0.49526 | 0.51797 |

| D | 0.46442 | 0.36116 | 0.82616 | 0.68825 | 0.82616 | 0.57948 | 0.68825 | 0.26864 |

| Second-Level Risk Indicators | Weight | Third-Level Risk Indicators | Weight |

|---|---|---|---|

| Anchor | 0.31775 | Anchor Reputation (A1) | 0.08566 |

| Anchor Influence (A2) | 0.06123 | ||

| Compliance Degree of Marketing Behaviors (A3) | 0.06405 | ||

| Ethical Risk of the AI Anchor (A4) | 0.10681 | ||

| MCN Institution | 0.07804 | Intellectual Property Risk (B1) | 0.04679 |

| Content Creation Risk (B2) | 0.03125 | ||

| Merchant | 0.10079 | Merchant Credit (C1) | 0.04066 |

| After-sales Service Completeness (C2) | 0.06014 | ||

| Supply Chain | 0.14547 | Product Quality (D1) | 0.07468 |

| Logistics Distribution Service Quality (D2) | 0.07079 | ||

| Live-streaming Platform | 0.13340 | Completeness of Platform Services (E1) | 0.04300 |

| Privacy Leakage Risk (E2) | 0.05191 | ||

| Algorithmic Price Discrimination Risk (E3) | 0.03849 | ||

| Consumption Scenario | 0.22455 | Authenticity of Viewer Numbers (F1) | 0.06857 |

| Authenticity of Sales Data (F2) | 0.06582 | ||

| VR Technology Promotion Risk (F3) | 0.09017 |

| The Live Broadcast Room of the Anchor | Distance to the Positive Ideal Solution (d+) | Distance to the Negative Ideal Solution (d−) |

|---|---|---|

| L | 1.32390 | 0.84150 |

| Y | 1.03439 | 1.26531 |

| D | 1.44586 | 0.79683 |

| The Live Broadcast Room of the Anchor | Comprehensive Evaluation Value | Risk Level |

|---|---|---|

| L | 0.38861 | medium-low risk |

| Y | 0.55021 | medium risk |

| D | 0.35530 | medium-low risk |

| Anchor Risk | MCN Institution Risk | Merchant Risk | Supply Chain Risk | Platform Risk | Consumption Scenario Risk | |

|---|---|---|---|---|---|---|

| L | 0.49220 | 0.46661 | 0.33228 | 0.32608 | 0.34350 | 0.30420 |

| Y | 0.62647 | 0.61505 | 0.47216 | 0.52607 | 0.43363 | 0.55192 |

| D | 0.32702 | 0.51704 | 0.34205 | 0.29354 | 0.43363 | 0.32925 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, C.; Wang, Y.; Zhang, J. Risk Assessment of Live-Streaming Marketing Based on Hesitant Fuzzy Multi-Attribute Group Decision-Making Method. J. Theor. Appl. Electron. Commer. Res. 2025, 20, 120. https://doi.org/10.3390/jtaer20020120

Zhang C, Wang Y, Zhang J. Risk Assessment of Live-Streaming Marketing Based on Hesitant Fuzzy Multi-Attribute Group Decision-Making Method. Journal of Theoretical and Applied Electronic Commerce Research. 2025; 20(2):120. https://doi.org/10.3390/jtaer20020120

Chicago/Turabian StyleZhang, Changlu, Yuchen Wang, and Jian Zhang. 2025. "Risk Assessment of Live-Streaming Marketing Based on Hesitant Fuzzy Multi-Attribute Group Decision-Making Method" Journal of Theoretical and Applied Electronic Commerce Research 20, no. 2: 120. https://doi.org/10.3390/jtaer20020120

APA StyleZhang, C., Wang, Y., & Zhang, J. (2025). Risk Assessment of Live-Streaming Marketing Based on Hesitant Fuzzy Multi-Attribute Group Decision-Making Method. Journal of Theoretical and Applied Electronic Commerce Research, 20(2), 120. https://doi.org/10.3390/jtaer20020120