Abstract

The online shopping consulting service (online customer service) is an important component of online shopping, and the rapid advancement of artificial intelligence technology has allowed online retailers to apply this technology to customer service. This study explores an online retailer’s customer service innovation decisions. We develop a stylized model to investigate an online retailer’s choices of two different online shopping consulting service strategies, as well as the impact of the different strategies on both online retailer and consumers. This study demonstrates that providing AI customer service with higher performance and higher probability of consumer shopping problem resolution may not always benefit the online retailer. Existing studies have already shown that consumers prefer human customer service. However, this study shows that consumers do not always prefer human customer service, and they prefer AI customer service in some situations. Moreover, this study reveals that the probability of consumers’ shopping problems being resolved and the consulting cost can affect the online retailer’s choice of online customer service strategies.

1. Introduction

With the rapid development of next-generation digital technologies such as artificial intelligence and big data, online retailers are continually seeking innovative ways to enhance consumer shopping experiences and interactions [1,2,3]. Moreover, online marketplaces have experienced significantly intense competition in recent years [4]. Many organizations are using artificial intelligence (AI) to improve their customer service operations, especially in the online consumer market. AI chatbots are widely utilized in different industries as a typical AI customer service [5]. ChatGPT is a popular example of an AI chatbot, and other examples of chatbots include Jasper, Bing, and YouChat. In 2023, chatbot revenue was expected to hit USD 137.6 million—up from USD 40.9 million in 2018 [6]. Juniper Research predicted that consumer spending on retail purchases through chatbots would reach USD 142 billion by 2024.

In February 2024, Amazon launched Rufus, an AI shopping assistant that consumers can use to ask questions about products [7]. It is based on large-scale language modeling (LLM), ingesting information such as product details and reviews to answer some of the specific problems consumers are concerned with during the online shopping journey and to help them find the best products [8]. This AI shopping assistant is a typical online AI customer service that helps consumers shop. Prior to this, Amazon mainly helped consumers resolve problems by searching for reviews. However, this AI customer service (e.g., AI chatbot) is now being used by Amazon, Tmall, JD.com, and others. AI customer service can help consumers who shop online.

In the online shopping journey, consumers mainly learn about and purchase products through product images, texts, and online reviews provided by online retailers in their merchant interfaces [9,10]. Nevertheless, product pictures and texts alone cannot satisfy consumers’ need to evaluate products. Online reviews can contain fake or misleading information that can negatively impact the consumer’s shopping experience [11]. Fake reviews and brushing by online retailers have become commonplace. In addition, technological advances have made online retailers’ online shopping interfaces sophisticated, and some shopping rules have become more complex, which has greatly diminished consumers’ online shopping experience. However, online retailers can address these problems to some extent by providing additional online shopping consulting services. Such online shopping consulting services can answer consumers’ shopping-related questions, allay consumers’ concerns, increase the likelihood of purchasing through such services, and enhance the online shopping experience for consumers.

With the prevalence of online shopping and the adoption of services that help consumers shop, a key decision in online retailer operations is the choice of online shopping consulting services (i.e., online customer service choice). Online retailers usually use one of the two online customer service models: a human customer service model (model H), under which online retailers hire employees to answer shopping problems that consumers encounter online, and an AI customer service model (model A), under which online retailers utilize artificial intelligence technology to answer shopping problems encountered by consumers online. Human customer service can provide consumers with personalized shopping consulting services and communicate with them emotionally, but it also has the disadvantages of higher operating costs and limited responsiveness. On the contrary, AI customer service has the advantages of relatively low cost and high service efficiency. Intercom’s report showed that 61% of consumers prefer AI customer service for fast replies [12]. However, AI customer service is less capable of dealing with complex issues that require emotional communication. Furthermore, not every consumer is willing to accept AI customer service. Some consumers report that they do not like AI chatbots and that they distract them from shopping online [13]. According to the data gathered by SurveyMonkey, 43% of people prefer to receive customer service from a human rather than a chatbot [14]. To the best of our knowledge, there is no research showing why a type of online shopping consulting service is better and under what conditions. Our study attempts to fill this gap. In addition to the above conflicting intuitions, we have also noticed the consumer acceptance of AI in practice [15,16]. However, few studies have thoroughly explored the impacts of consumer acceptance of AI on online retailers’ customer service strategy choices.

Motivated by the above research gaps and the observations of practice, this study seeks to evaluate the efficacy of AI against human customer service in online retail and identify the circumstances in which either is advantageous, focusing on the following research questions: (1) How does the online shopping consulting service affect the online retailer and consumers? (2) Which online shopping consulting service strategy (human customer service or AI customer service) is more profitable for the online retailer? Which online shopping consulting service strategy do consumers prefer? (3) How does consumers’ acceptance of AI customer service affect online retailers’ online shopping consulting service strategies? To address these questions, we construct an analytical model in which an online retailer sells products directly to consumers and makes online customer service strategy choices. The online retailer considers two potential strategies: (1) a human customer service and (2) an AI customer service. In addition, we have performed an analysis to examine the impact of factors such as consulting cost and the probability that the consumer’s shopping problem can be resolved. Through a comparative analysis of the profits obtained in the two cases, we are able to discern the equilibrium strategies for the online retailer. We further explore the circumstances under which the online retailer is better off using which online customer services and the implications for the interaction between the online retailer and consumers.

The results of our research can be summarized as follows: First, our findings highlight the key factors influencing the online retailer’s choice of the customer service strategy (human or AI customer service), including the probability of the consumer’s shopping problems being resolved, consumer acceptance of AI customer service, and the consulting cost. Second, our analysis demonstrates that providing AI customer service with higher performance and a higher probability of consumer shopping problem resolution may not always benefit the online retailer. Third, existing studies have already shown that consumers prefer human customer service, but our results show that consumers do not always prefer human customer service, and they prefer AI customer service in some situations. Specifically, when the consulting cost is high and the probability of AI customer service resolving consumer problems is higher, the online retailer is better off choosing AI customer service. To sum up, these findings have important implications for online retailers in choosing the optimal customer service strategy, revealing the important role of online customer service management for the online retail industry while providing valuable strategic insights for online retailers.

Our paper makes three main contributions to the literature. This study presents an innovative analytical methodology for assessing customer service initiatives and provides insights into consumer preferences and retailer profitability. First, to the best of our knowledge, our study is among the first theoretical studies to explore the problem of customer service strategy choice for the online retailer in online sales marketplaces, extensively discussing the conditions under which two different customer service strategies (human customer service or AI customer service) are more optimal. Previous studies have focused on the effects of customer service strategies on online retailers [17], but the lack of attention to the differences in the effects of human and AI customer service strategies has been detrimental to a deeper understanding of the laws governing the role of AI customer service strategies. Second, we examine the customer service strategies of online retailer and explore the impact of different customer service strategies on service levels and their intrinsic mechanisms. There are also studies focusing on the impact of AI technology on online sales [18], but the impact on the service level is under-researched, which is not conducive to the comprehensiveness and depth of the analysis of the impact of customer service strategies on the service level and the analysis of the mechanism of the impact of AI customer service. In this online sales market, we also consider the consumer acceptance degree of AI customer service. Finally, we consider the probability of consumers’ shopping problems being resolved under different customer service strategies and how the probability influences the online retailer’s choice of customer service strategies and product pricing, further enriching the understanding of the intrinsic link between customer service and consumer behavior, which has not been investigated in previous studies. Most of the previous studies on online retailers’ service research have focused on consumer service preferences [19,20], but the probability of consumers’ shopping problems being resolved has been neglected in the context of customer service, which is not conducive to the identification of an interaction between the customer service strategy and consumer behavior and the exploration of the mechanism of the influence of the probability of consumers’ shopping problems being resolved on the online retailer’s choice of customer service strategies.

The remainder of the paper is organized as follows: In Section 2, we review the relevant literature. We describe the model in Section 3. In Section 4, we analyze the optimal outcomes for each strategy, namely the H and A strategies, and make comparisons. Numerical studies are also provided to illustrate our findings in Section 5. We present our conclusions and future research directions in Section 6. All proofs are given in the Appendix A.

2. Literature Review

Our study relates primarily to three streams of the literature: pricing strategy, the use of AI in retail operations, and decision-making in online retailing.

Our research contributes to the literature on pricing strategies. Cachon et al. [21] and Taylor [22] investigated several pricing schemes on an on-demand service platform, including dynamic pricing, by constructing a stylized model. Diao et al. [23] investigated how consumer fairness preferences in a supply chain affect firms’ two-period dynamic pricing for two-period product sales and found that consumer fairness preferences can lead to a win–win situation for manufacturers and retailers. Mamadehussene [24] examined the impact of price-matching guarantees on market competition by constructing a structural model and analyzing data from the automotive tire market and found that PMGs weaken competition more than they strengthen it. Wu and Zhao [25] focused on the competition between online and traditional offline retailers, comparing and analyzing retailer pricing, profits, and welfare under two scenarios, one in which the online retailer uses a random pricing strategy and one in which it does not. Yang et al. [26] studied the intriguing interaction between market competition and price fairness regulation by focusing on the pricing strategy of “loyalty penalty”. Balakrishnan et al. [27] explored the benefits of introducing a free delivery subscription (FDS) program for firms and consumers, as well as a firm’s optimal FDS pricing strategies. Huang et al. [28] investigated price signaling strategies in the presence of supplier cost information asymmetry and two retailer inequality aversion scenarios. Current research focuses on the impact of different factors on product pricing strategies and their outcomes. However, there are significant knowledge gaps regarding the impact of online customer service on product pricing strategies and the differences in the impact of different customer service strategies on pricing. To fill these gaps, our study aims to provide a comprehensive analysis of how these two different customer service strategies affect pricing.

In recent years, several papers have investigated the use of AI in retail operations. Artificial intelligence and other emerging technologies are transforming the operations management of businesses in terms of cost, efficiency, and decision-making [29]. Leung et al. [30] explored AI-based automation to eliminate the possibility of consumers internalizing the outcome of their consumption experience. Li and Li [31] considered the relationship between regret retailers and suppliers in a decentralized supply chain, studied the impact of artificial intelligence technology on retailers’ order decisions, and found that higher automation of retailers’ decisions does not necessarily lead to higher profits. Additionally, Peng et al. [32] examined how the enthusiasm required to perform a task affects consumer acceptance of AI services through a joint choice-based experiment and a survey on tasks performed by AI. Wang et al. [33] focused on the use of AI for product design in the fast fashion sector and explored the issue of retailers’ choice between manual and AI-assisted design strategies and their implications for retailers. Many scholars have focused on the use of chatbots empowered by AI technology in business. Han et al. [34] investigated the impact of positive emotions expressed by AI-enabled chatbots (AI agents) on consumers’ service evaluations and the underlying mechanisms through laboratory experiments. Marjerison et al. [15] pointed out that in the context of the widespread use of chatbots in e-commerce, consumer acceptance of AI, including chatbot technology, is critical in determining the success of AI use. Seymour et al. [35] explored consumers’ perceptions and behaviors when using digital agents (customer service represented by chatbots) through four experiments. In terms of modeling research, He et al. [18] focused on e-commerce platform supply chains and explored the strategic interactions between different customer service strategies (i.e., human or AI services) and different sales models (i.e., agency or resale models) and their impacts on the parties involved. Yu and Guo [19] examined the service design issues of firms under competition from different types of service providers (i.e., AI services and human services). In general, research shows people would rather interact with a human customer service agent than a chatbot. Sometimes, consumers do not want to talk to a real person when they are shopping online [36]. Wang et al. [37] explored the impact and underlying mechanisms of a retail platform’s use of AI technology on consumer returns. With the constant development of AI technology, more and more scholars are paying attention to the application of AI technology in the field of retailing products and its impact, but there is a lack of research on the customer service strategies of online retailers. We investigate the effects of AI technology-enabled AI customer service on online retailers and consumers.

Our work is also related to the literature on decision-making in online retailing. De et al. [38] empirically investigated the impact of website technology on consumers and product sales by analyzing server data. Ha et al. [39] studied the channel choice problem (agency sales and resale) of manufacturers selling products through platform retailers and considered how service effort plays a role in manufacturers’ channel choice. Fan et al. [40] considered a marketplace of manufacturers and independent retailers with online channels and examined the impact of online purchase and in-store pickup strategies on online service in the channel and the role of service decisions in relation to each other. Liu et al. [41] examined the impact of online retailers’ after-sales service on their related decisions and the effect of consumers’ sensitivity to after-sales service on their product pricing. Park et al. [42] investigated a “Try-Before-You-Buy” online retailer’s decision on how many items to send to a consumer. Lu et al. [43] explored blockchain adoption strategies of online retailers in the context of a dual-channel supply chain. Zhou et al. [17] examined the adoption decisions of online retailers’ recommender systems under competitive environments. Existing studies have focused on online retailers’ channel strategies, sales formats, and operational models. In contrast, we focus on the issue of online retailers’ decision-making on two different types of customer service strategies and further explore the differences between the two customer service strategies and their implications.

3. Model Setup

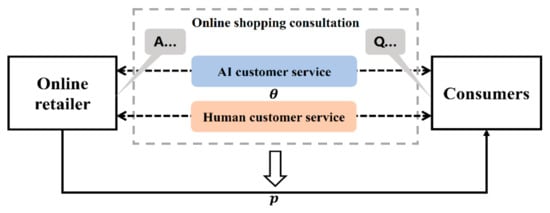

We consider an online marketplace, which consists of an online retailer and consumers. The online retailer can directly sell its products to consumers. Consumers can learn about and evaluate products through the pictures, text, and online reviews of the products provided by the online retailer [44]. The basic valuation of a consumer is a draw from a uniform distribution [45,46]. Consumers make a one-time purchase decision. Moreover, the online retailer also provides online customer service to help consumers resolve problems they may encounter during the shopping journey. We also denote this online customer service as the online shopping consulting service. Figure 1 shows the model structure under customer service. We use subscript to denote different customer service models and , where denotes that the online retailer provides human customer service and denotes that the online retailer provides AI customer service. In this paper, online customer service is also called online shopping consulting services.

Figure 1.

The model structure under customer service.

In this model, we consider two types of consumers, and we follow Chen et al. [47], Montes et al. [48], and Tang et al. [49] to segment the consumer market. We assume that the total amount of consumers is normalized to one, and each consumer has a unit demand. The data show that one-third of consumers believe that one of the key characteristics of good customer service is the ability to resolve consumer problems [50]. This suggests that there are consumers who have shopping problems and need to use the customer service of online retailers when shopping online. Therefore, we assume that the quantity of consumers () is the quantity of consumers who still have personalized shopping questions after browsing through the information provided by the online retailer, such as the text and pictures of the product. Correspondingly, is the quantity of consumers who do not have other shopping-related questions after browsing through the information provided by the online retailer. A questionnaire study by Daroch et al. [51] found a one-half split between consumers who make more than six online purchases per month and those who make less than six online purchases per month. This provides data support for consumer segmentation. Moreover, this consumer segmentation corresponds to reality. When consumers are shopping online, some of them will buy directly by browsing the product pictures, text introduction, and online reviews provided by online retailers. However, the other consumers cannot resolve their personalized problems through the information provided by online retailers, and at this time, they need the customer service offered by online retailers.

For consumers who use customer services, we denote as the additional utility that the consumer obtains from the customer service provided by the online retailer. This additional utility also represents the service level of the corresponding consulting service. Consumers will pay the consulting cost , such as the time and effort paid by the consumer, in the process of using human or the AI customer service for consulting on shopping problems. This consulting cost is similar to the hassle cost in consumer online purchase research [52,53]. A 2024 Gartner study noted that AI-enabled chatbots can handle 70% of interactions with customers [54]. Neither AI customer service nor human customer service can completely resolve all consumers’ shopping problems. Therefore, there is a certain probability that customer service resolves consumer problems. This type of probability is widely used in the literature related to auditing, inspection, and diagnosis [55,56,57]. Combining the literature and reality, we assume the probability that a consumer’s problem is resolved through a customer shopping consulting service offered by an online retailer is , and the probability that it remains unresolved is . The probability of the customer service resolving problems also reflects the accuracy and effectiveness of the customer service. In the case that a consumer’s shopping problem is not resolved, the consumer does not end up purchasing the product. We assume the cost of providing customer service to consumers by an online retailer takes the quadratic form (), which aligns with the existing literature [18,58,59]. Here, is a positive cost coefficient, and the cost is set in the quadratic form, which indicates that the higher the level of service, the higher the cost paid by the online retailer [60,61].

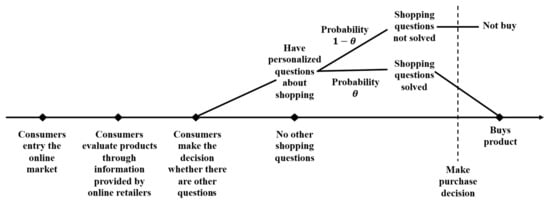

In addition, with the rapid development of AI technology, Zhu et al. [16] suggest that in the context of AI chatbots that have been widely used, there exists a certain degree of consumer acceptance of such AI chatbots, and this degree of acceptance is not high. This consumer acceptance of AI technology reflects the degree of consumer preference or sensitivity to AI customer service [18]. Following the settings in the relevant literature [62,63], we assume that the consumer acceptance of AI customer service is , where . Consumers’ degree of acceptance of AI customer service is smaller than that of human customer service. Based on reality, will not be 0 or 1. When , it indicates that consumers do not accept AI customer service at all, and when , consumers have a completely accepting attitude toward AI customer service, which indicates that consumers’ attitude toward human customer service is the same as that toward AI customer service. However, neither of these two scenarios exists. In reality, consumers are accepting of this AI customer service and AI technology to a certain extent. is also denoted as the degree of consumer sensitivity to the AI customer service offered by online retailers. Following Lal and Sarvary [64] and Plambeck and Taylor [65], after evaluating the product information provided by the online retailer, the expected utility of a consumer who still has shopping questions is , where is the product retail price and is an indicator function, taking 1 when the condition in brackets is satisfied and 0 otherwise [66]. In addition, we also assume that . This suggests that there is a lower bound on the cost coefficient of the service cost that online retailers have to pay when providing customer service (online shopping consulting services) to consumers. The sequence of events under each online customer service model is shown in Figure 2. First, the online retailer sets the retail price of products and decides which customer service strategy to use, i.e., human or AI customer service. Then, consumers enter the marketplace and decide if they have any more shopping problems through product presentations, etc. Consumers with personalized shopping questions also have to go through customer service. Finally, consumers make their purchase decisions. In Table 1, we compile all of the notations that appear in the paper.

Figure 2.

Sequence of events.

Table 1.

Summary of key notations in this paper.

Furthermore, we use the case of not providing online customer service (online shopping consulting services) as the benchmark. The quantity of consumers who still have problems after browsing the information provided by the online retailer is . In the case where no customer service is provided and the consumer’s shopping problem is not solved, the consumer will not end up purchasing the item. Only consumers who do not have problems, i.e., , will buy the item. We use the subscript to make the distinction. Therefore, the profit of the online retailer is . We can obtain the optimal price of the item for the online retailer as and the optimal profit as .

4. Results and Analysis

In this section, we first analyze the equilibrium results for the cases model H and model A. We then compare the two cases to determine the impact of the two different service strategies.

4.1. Human Customer Service (Model H)

Under the human customer service case, online retailers sell products directly to consumers and employ a number of employees to provide online shopping consulting services to consumers. Online retailers train these employees to better resolve problems during the online shopping journey of consumers, thus promoting the sale of products. This training covers aspects such as product and service knowledge, communication skills, and teamwork. By training in this way, online retailers can ensure that online human customer service has the necessary skills and qualities to provide high-quality online shopping consulting services [67].

Therefore, in this case, the online retailer’s profits are provided by . The optimal price and service level can be obtained by maximizing the streamer’s profit. By solving the profit and organizing the results, we can obtain Lemma 1.

Lemma 1.

Under the human customer service model, in equilibrium, if , no transactions occur in equilibrium. If , in equilibrium, the retail price and optimal service level are and , and the firm’s profit is .

When , consumers will not buy the product, and no transaction will occur if the time or cost spent in communicating with the customer service is too high and the problem is not resolved. Therefore, we have the condition that ; that is, there is an upper bound on the cost of consumers in the shopping consultation process, which coincides with the reality of consumers shopping online.

Corollary 1.

In the case of using human customer service, when , , , and ; when , , , and ; when , , , and ; and when , , , and .

Proposition 1.

In the case of using human customer service, the impact of the quantity of consumers with shopping problems and the probability of the problem being resolved by the online retailer are shown below:

- (1)

- As the quantity of consumers with shopping problems increases, the optimal price, service level, and profit first decrease and then increase.

- (2)

- The optimal price, service level, and profit are increasing in .

Corollary 1 and Proposition 1 show that the optimal product price, service level, and profit under human customer service exhibit a U-shaped relationship with the quantity of consumers with shopping problems and increase as the probability of the problem being resolved increases. The higher the probability that the online customer service provided by an online retailer resolves consumer-related shopping problems, the higher the service level of that human customer service. An increase in service level not only increases the utility of online shopping for consumers but also leads to an increase in the cost of service for the online retailer. To counteract the effects of rising service costs, the online retailer increases the product price. The increased probability that a consumer’s shopping problem will be resolved can increase the demand for the product, thus contributing to the online retailer’s profitability. When the probability of shopping problems being resolved is low, it results in a portion of consumers being lost, and the demand for the product decreases. In this scenario, the greater the quantity of consumers with shopping problems, the lower the proportion of product demand converted by resolving consumer problems. The online retailer also has no incentive to improve the service level of human customer service and turns to attracting consumers to buy by lowering product prices. With the dual pressures of existential service costs and lost product demand, the online retailer is less profitable. By contrast, when the probability of shopping problems being resolved is low, it leads to an increase in demand for the product. In this scenario, the higher the conversion rate of product demand, the more the online retailer is prompted to improve the service level of human customer service. Moreover, this increased service level increases the utility of the products purchased by consumers, which affords the online retailer enough confidence to make more profit by increasing the product price.

4.2. AI Customer Service (Model A)

Under the AI customer service strategy, the online retailer sells products to consumers while also offering them AI online shopping consulting services to help them make purchases. This AI customer service utilizes e-commerce data to understand consumers’ shopping problems and provide relevant answers through natural language processing technology. In addition, this AI customer service differs from human customer service in terms of the probability of the problem being resolved and the service level.

Therefore, in this case, the online retailer’s profits are provided by . The optimal price and service level can be obtained by maximizing the streamer’s profit. By solving the profit and organizing the results, we can obtain Lemma 2.

Lemma 2.

Under the AI customer service model, in equilibrium, if , no transactions occur in equilibrium. If , in equilibrium, the retail price and optimal service level are and , and the firm’s profit is .

When , consumers will not buy the product, and no transaction will occur if the time or cost spent in communicating with the customer service is too high and the problem is not resolved. Therefore, we have the condition that ; that is, there is an upper bound on the cost of consumers in the shopping consultation process, which coincides with the reality of consumers shopping online.

Proposition 2.

In the case of using AI customer service, the impact of the quantity of consumers with shopping problems and the probability of the problem being resolved on online retailer are shown below:

- (1)

- When the consumer acceptance of AI customer service is low, as the quantity of consumers with shopping problems increases, the optimal price, service level, and profit decrease; when the consumer acceptance of AI customer service is high, as the quantity of consumers with shopping problems increases, the optimal price, service level, and profit increase.

- (2)

- The optimal price, service level, and profit are increasing in .

Proposition 2 shows that the optimal product price, service level, and profit under AI customer service exhibit a U-shaped relationship with the quantity of consumers with shopping problems and increase as the probability of the problem being resolved increases. Different from the model H, the impact of the quantity of consumers with shopping problems on the equilibrium outcomes is mainly related to the acceptance degree of AI customer service by consumers. Consumers’ acceptance degree of AI customer service reflects the acceptance or approval of AI technology, and not everyone is willing to embrace AI technology. Under the AI customer service case, when consumers’ acceptance degree of AI customer services is low, they do not like to use such AI customer services, and the usage of such services is low. An increase in the quantity of consumers with shopping problems makes online retailers less motivated to improve their service level, which leads to a lower service level of AI customer service. In addition, when AI customer service does not improve the online shopping experience of consumers, an increasing quantity of consumers with shopping problems makes online retailers reduce their prices to attract consumers but still cannot prevent a decline in profits. However, the situation of online retailer improves to a greater extent when consumers are more accepting of AI customer service. An increase in the quantity of consumers with shopping problems allows the online retailer to improve their service level and make more profit by increasing the product price.

4.3. Comparative Analysis

In this subsection, we compare the equilibrium outcomes under the human customer service and AI customer service cases. We focus on how different strategies can affect the product pricing, service levels, and profits of the online retailer.

Proposition 3.

By comparing the product price of different cases,

- (1)

- When and , the product price of human customer service is higher.

- (2)

- When , if , the product price of AI customer service is higher; if , the product price of human customer service is higher.

Proposition 3 demonstrates that the comparison of the equilibrium price for the two different cases is mainly related to the probability of the shopping problem being resolved and the consulting costs. When human customer service is better at resolving consumer problems and the consulting cost is less than , the online retailer has a higher product price under human customer service. This is because consumers’ acceptance degree of AI customer service does not reach the level of their acceptance of human customer service; as a result, a higher probability of consumer problem resolution can be translate into higher product demand. The online retailer can increase the product price while enhancing the consumer shopping experience through human customer service. However, when AI customer service is more effective in resolving consumer problems and the consulting cost is greater, the online retailer charges a higher product price under AI customer service. Meanwhile, when AI customer service is more effective in resolving consumer problems and the consulting cost is less, the online retailer charges a higher product price under human customer service. The intuition is as follows: Under a certain level of consumers’ acceptance degree of AI customer service, a higher probability of AI customer service resolving the consumers’ shopping problems indicates that AI customer service performs better and can increase the conversion of consumers with shopping problems into actual demand; the larger consulting cost leads consumers to incur a greater cost under both customer service models. This makes consumers prefer AI customer service, and therefore, the online retailer has less incentive to reduce its product price. On the contrary, the higher the probability that AI customer service resolves consumers’ shopping problems, the higher the demand conversion rate, but the smaller consulting cost makes consumers prefer human customer service with a certain level of acceptance degree of AI customer service. Therefore, the online retailer using human customer service will set higher product prices.

Proposition 4.

By comparing the service level of different cases,

- (1)

- When and , the service level of human customer service is higher.

- (2)

- When , if , the service level of AI customer service is higher; if , the service level of human customer service is higher.

Proposition 4 illustrates the impact of the probability of shopping problems being resolved and the consulting cost on the comparison of service level in two different cases. On the one hand, when the probability of resolving a consumer’s shopping problems is higher with human customer service and the consulting cost is less than , the service level of the online retailer will be higher in the case of using human customer service. In the situation where consumers have an innate preference for human customer service, similar consulting costs will make consumers more inclined to use human customer service, which in turn will motivate the online retailer to continuously improve the service level of human customer service and increase the additional utility that consumers obtain from the service. On the other hand, two different scenarios are presented when AI customer service has a higher probability of resolving consumer problems. In the scenario where the consulting cost is higher, the service level of the online retailer is higher when they use AI customer service. When the cost that consumers spend on shopping problem consultation is quite high in both different customer service cases and the AI customer service is more effective, the online retailer will improve the service level of the AI customer service. However, in the scenario where the consulting cost is low, the online retailer will have a higher service level when using human customer service. This is contrary to our intuition. Consumers spend less on shopping problem consultation in both customer service cases. Even though AI customer service is more effective, more consumers will prefer human customer service due to their innate preference for and bias against human customer service. As a result, the online retailer that use human customer service will invest more in the service to improve the service level.

Proposition 5.

The online retailer’s preference over the two strategies is as follows:

- (1)

- When , if , the online retailer prefers AI customer service; if , the online retailer prefers human customer service.

- (2)

- When , human customer service is preferred.

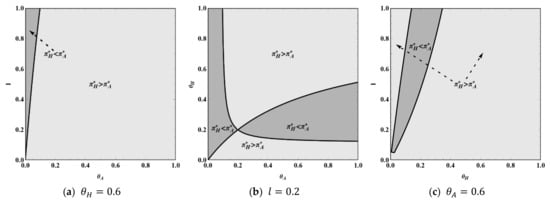

Proposition 5 shows that when the probability of problem resolution is higher for human customer service, the online retailer’s profit is higher under model H than under model A; when the probability of problem resolution is higher for AI customer service, there are situations where the online retailer is better off in both different strategies. Intuitively, we would think that the higher the probability of a consumer’s shopping problem being resolved, the more profitable the online retailer would be. This result tells us that the truth is not so simple and that different models have different scenarios. To the extent that there is consumer acceptance of AI customer service, that is, consumers exhibit some bias against AI technology compared to human service, the higher the probability that human customer service will solve the consumer’s shopping problems, the greater the consumer preference for human customer service. Additionally, consulting costs are not a consideration for the online retailer making service decisions. Human customer service can increase the percentage of consumers with shopping problems that are converted into product demand, which in turn increases the profitability of the online retailer. To understand another result, it is important to note that consumers have two different attitudes and are more likely to accept human customer service than AI customer service. For consumers, the availability of online shopping consulting services can improve their shopping experience, and it is more important for the service to be able to resolve the shopping problems that consumers encounter. Therefore, if the probability of AI customer service resolving consumers’ shopping problems is higher despite the higher consulting cost spent by consumers, the online retailer will increase their investment in AI customer service to further increase consumers’ utility. Along with a better service experience, consumer bias against AI customer service becomes less important. However, when consumers spend less on consulting costs, they will prefer the online retailer to provide human customer service in situations where consumers are more willing to accept human service. In this case, the online retailer will choose to provide human customer service. Figure 3 confirms the correctness of the outcomes obtained in Proposition 5.

Figure 3.

The impact of AI customer service on online retailer. (a) ; (b) ; (c) .

5. Numerical Case Study

In this section, to gain more insights from the analytical findings, we conduct simulation analysis. We compare the equilibrium solutions of the different customer service strategy models. Referring to the studies conducted by Genc and De Giovanni [68], He et al. [18], and Shu et al. [69]; combining the actual data related to the reality; and meeting the relevant constraints to ensure positive equilibrium solutions, we set the parameters as follows: , , , , and . The results are presented in the following subsections.

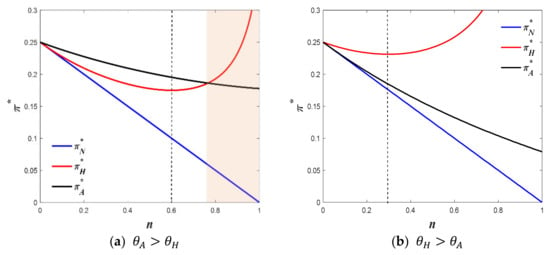

5.1. Comparison of the Results with and Without Customer Service

Figure 4 shows a comparison of the online retailer’s profits in the without customer service model, the human customer service model, and the AI customer service model, as well as how it changes with the quantity of consumers with shopping problems. Regardless of whether or , there are always benefits to using customer service for the online retailer. As the quantity of consumers who have shopping questions increases, the online retailer’s profits in the without customer service model and the human customer service model decrease. On the contrary, as the quantity of consumers who have shopping questions increases, the online retailer’s profit in the human customer service model decreases first and then increases. In Figure 4a, we find that the online retailer is better off using AI customer service when the quantity of consumers with shopping problems is small, and the online retailer is better off using manual customer service when the quantity of consumers with shopping problems is large. Moreover, in Figure 4b, we find that when the probability that the consumer’s shopping problem can be resolved is higher, as the quantity of consumers with shopping problems increases, the online retailer is always better off using a human customer service strategy. This is due to the fact that there is a certain level of consumer acceptance of AI customer service, and product demand further increases in the scenario where human customer service is more effective in resolving the consumer’s shopping problems.

Figure 4.

The changes in equilibrium profits of the online retailer with . (a) ; (b) .

5.2. Effects of Consumer Acceptance of AI Customer Service

We define the profit difference between the online retailer’s profits under two different service strategies as . Figure 5 illustrates that the profit difference increases as consumer acceptance of AI customer service increases, and this change in turn becomes more dramatic as the quantity of consumers with shopping problems increases. When the probability of a consumer’s shopping problems being resolved is higher for the human service strategy (as shown in Figure 5a), the profit difference is largest for the small quantity of consumers with shopping problems if consumer acceptance of AI customer service is low; the profit difference is largest for the moderate quantity of consumers with shopping problems if consumer acceptance of AI customer service is moderate; and the profit difference is largest for the large quantity of consumers with shopping problems if consumer acceptance of AI customer service is large. When the probability of a consumer’s shopping problems being resolved is higher for the AI service strategy (as shown in Figure 5b), the profit difference is always negative, and its absolute value becomes larger as the quantity of consumers with shopping problems increases. In the scenario where AI customer service is more effective in resolving the consumer’s shopping problems, the more consumers experience shopping problems, the higher the proportion of these consumers that convert into product demand, and an increase in consumer acceptance of AI customer service further promotes this effect.

Figure 5.

The changes in profit difference with under different customer service strategies. (a) ; (b) .

6. Conclusions

Shopping experience and online service are important to online retailers. In this competitive online shopping marketplace, online retailers provide help and guidance to consumers in their online purchases by offering online shopping consulting service (i.e., online customer service). In this paper, we develop an analytical model to study the implications of different online customer service models (human or AI customer service) on consumers and the online retailer. We examine how the probability that the consumer’s shopping problem can be resolved, consumer acceptance of AI customer service, and the consulting cost affect the equilibrium price and service level of the online retailer under different models. As far as we know, our study is among the first to examine which type of online customer service is better for the online retailer and under what conditions.

Our analysis shows several interesting results. First, our analysis demonstrates that providing AI customer service with higher performance and higher probability of consumer shopping problem resolution may not always benefit the online retailer. Specifically, while AI customer service performs better when the consulting cost is low, it is more beneficial for the online retailer to use human customer service due to the level of consumer acceptance of AI customer service. However, when the consulting cost is high, the probability that human customer service resolves the problem is not as high as an AI customer service, and when the cost to the consumer is not low, it is more profitable for the online retailer to use AI customer service. Second, existing studies have already shown that consumers prefer human customer service [70], but our results show that consumers do not always prefer human customer service, and they prefer AI customer service in some situations. When the consulting cost is high and the probability of AI customer service resolving consumer problems is higher, consumers perceive human customer service as not only more costly for themselves but also less effective in resolving problems, leading more consumers to prefer AI customer service. Therefore, online retailers can use AI customer service in a timely manner to convert consumers with shopping problems into product demand. Third, we find that the probability of a consumer’s shopping problems being resolved and the consulting cost can affect the online retailer’s choice of the online customer service model (model H or model A). For consumers, the main criterion for evaluating whether the online shopping consulting services provided by online retailers are good or not is the cost spent by consumers in the consulting process and the probability of their related shopping problems being resolved. No matter which type of online shopper service an online retailer chooses to provide, it should endeavor to invest more in these two aspects so as to enhance the service experience that consumers receive in online shopping.

Building upon the derived results, we summarize the following managerial insights: First, the choice of customer service strategy for the online retailer can be influenced by a variety of factors, such as consumer segmentation, the consumer’s acceptance of AI customer service, and the probability that the consumer’s shopping problems are resolved. The online retailer should strategically evaluate these factors to determine the most effective customer service strategy. Second, regardless of the customer service strategy chosen by the online retailer, the online retailer should invest more in customer service and increase the ability of both human and AI customer service strategies to resolve consumer shopping problems through enhanced training and data training. This will allow the online retailer to form better interactions with consumers while improving service quality. Online retailers should increase their investment in AI customer service-related technology while increasing consumer acceptance of AI customer service and even AI technology through publicity and other means. Moreover, the online retailer should also adjust the product price when adopting different online customer service strategies so that the product’s price is not unreasonable and does not affect the product’s demand. It is also important for the online retailer to understand the impact of consumer preferences on product sales under different customer service strategies.

There are several valuable future research directions to extend our research. First, in the face of a fierce competitive environment, online retailers can sustain their efforts in terms of service. Future research directions could consider the different preferences of consumers for AI and human customer services in competitive environments and examine how different service strategies would affect the competition between two online retailers. Second, with multiple sales channels coexisting and digital media advancing, the factors influencing consumer shopping behavior have become more diverse. Considering the impact of AI customer service on retailers’ channel strategies and exploring the impact of customer service strategies on retailers’ competition in the context of advertising are noteworthy research directions. Third, online customer service provides consumers with a more in-depth understanding of the product they are looking to purchase, as opposed to information such as the text, pictures, and online reviews of the product, and it would be interesting to explore the impact of different types of online customer services on return issues.

Author Contributions

Conceptualization, L.Z. and W.W.; methodology, L.Z. and W.W.; software, L.Z.; validation, L.Z.; formal analysis, L.Z.; investigation, W.W.; writing—original draft preparation, L.Z.; writing—review and editing, L.Z. and W.W.; supervision, W.W.; funding acquisition, W.W. All authors have read and agreed to the published version of the manuscript. All authors contributed equally to this paper.

Funding

This work was supported by the National Natural Science Foundation of China (Grant No. 72072047; Grant No. 72472039), the Fundamental Research Funds for the Central Universities (Grant No. HIT.HSS.ESD202310), and the Research Project on Higher Education of Heilongjiang Higher Education Association (Grant No. 23GJYBC011).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Proof of Lemma 1.

Taking the first derivatives of , we obtain and . Taking the second derivatives of , we obtain , , , and . Therefore, the Hessian matrix of the second derivatives of an online retailer’s profit function is . Hence, . And when , we have . It means that the online retailer’s profit function under this scenario is jointly concave in and . From the first-order-condition, we can obtain and . We substitute equations and into the online retailer’s profit function, and we find that the online retailer’s optimal profit is . For reasonableness, we show that and , which is not possible for . Combining the results in the case of using the human shopping assistant, Lemma 1 is proved. □

Proof of Lemma 2.

Taking the first derivatives of , we obtain and . Taking the second derivatives of , we obtain , , , and . Therefore, the Hessian matrix of the second derivatives of the online retailer’s profit function is . Hence, , while . It means that the online retailer’s profit function under this scenario is jointly concave in and . From the first-order-condition, we can obtain and . We substitute equations and into the online retailer’s profit function, and we show that the online retailer’s optimal profit is . For reasonableness, we show that and , which is not possible for . Combining the results in the case of using the human shopping assistant, Lemma 2 is proved. □

Proof of Corollary 1 and Proposition 1.

We take the first partial derivative of the online retailer’s price as . When , we have ; when , we have . We take the first partial derivative of the online retailer’s price as . We take the first partial derivative of the online retailer’s service level as . When , we have ; when , we have . We take the first partial derivative of the online retailer’s service level as . We take the first partial derivative of the online retailer’s profit as . When , we have ; when , we have . We take the first partial derivative of the online retailer’s profit as . □

Proof of Proposition 2.

We take the first partial derivative of the online retailer’s price as . When , we have ; when , we have . We take the first partial derivative of the online retailer’s price as and . We take the first partial derivative of the online retailer’s service level as . When , we have ; when , we have . We take the first partial derivative of the online retailer’s service level as and . We take the first partial derivative of the online retailer’s profit as . When , we have ; when , we have . We take the first partial derivative of the online retailer’s profit as and . In addition, we know that and . It can also be . Hence, we can obtain . We can also obtain . We can also obtain . Thus, we have , and . □

Proof of Proposition 3.

We have . Rearranging this equation, we show that . We want ; then, we can obtain the following condition: and . We want ; then, we can obtain the following condition: and ; and . □

Proof of Proposition 4.

We have . Rearranging this equation, we show that . We want ; then, we can obtain the following condition: and . We want ; then, we can obtain the following condition: and ; and . □

Proof of Proposition 5.

We have . Rearranging this equation, we show that . We want ; then, we can obtain the following condition: and . In addition, we denote . We want ; then, we can obtain the following condition: , , and . □

References

- Madanaguli, A.; Dhir, A.; Talwar, S.; Clauss, T.; Kraus, S.; Kaur, P. Diving into the uncertainties of open innovation: A systematic review of risks to uncover pertinent typologies and unexplored horizons. Technovation 2023, 119, 102582. [Google Scholar] [CrossRef]

- Poushneh, A. Humanizing voice assistant: The impact of voice assistant personality on consumers’ attitudes and behaviors. J. Retail. Consum. Serv. 2021, 58, 102283. [Google Scholar] [CrossRef]

- Rohit, K.; Shankar, A.; Katiyar, G.; Mehrotra, A.; Alzeiby, E.A. Consumer engagement in chatbots and voicebots. A multiple-experiment approach in online retailing context. J. Retail. Consum. Serv. 2024, 78, 103728. [Google Scholar] [CrossRef]

- Kannan, K.; Saha, R.L.; Khern-am-nuai, W. Identifying perverse incentives in buyer profiling on online trading platforms. Inform. Syst. Res. 2022, 33, 464–475. [Google Scholar] [CrossRef]

- Sidaoui, K.; Jaakkola, M.; Burton, J. AI feel you: Customer experience assessment via chatbot interviews. J. Serv. Manag. 2020, 31, 745–766. [Google Scholar] [CrossRef]

- Stanley, H. 12 Online Shopping Trends Shaping 2024. 2022. Available online: https://www.shopify.com/in/enterprise/blog/online-shopping-trends-ecommerce (accessed on 10 May 2024).

- Weise, K. Amazon Enters Chatbot Fray with Shopping Tool. 2024. Available online: https://www.nytimes.com/2024/02/01/technology/amazon-earnings.html?searchResultPosition=1 (accessed on 4 May 2024).

- Palmer, A. Amazon Announces AI Shopping Assistant Called Rufus. 2024. Available online: https://www.cnbc.com/2024/02/01/amazon-announces-ai-shopping-assistant-called-rufus.html?&qsearchterm=Rufus (accessed on 10 May 2024).

- Ismagilova, E.; Dwivedi, Y.K.; Slade, E. Perceived helpfulness of ewom: Emotions, fairness and rationality. J. Retail. Consum. Serv. 2020, 53, 101748. [Google Scholar] [CrossRef]

- Duan, Y.R.; Liu, T.H.; Mao, Z.X. How online reviews and coupons affect sales and pricing: An empirical study based on e-commerce platform. J. Retail. Consum. Serv. 2022, 65, 102846. [Google Scholar] [CrossRef]

- Salminen, J.; Kandpal, C.; Kamel, A.M.; Jung, S.G.; Jansen, B.J. Creating and detecting fake reviews of online products. J. Retail. Consum. Serv. 2022, 64, 102771. [Google Scholar] [CrossRef]

- Intercom. The Intercom Customer Service Trends Report 2024. Available online: https://www.intercom.com/campaign/customer-service-trends-2024?utm_source=ii-blog&utm_medium=internal&utm_campaign=20240110_nb_wc_all_global_gl_all_all_all_cst24_customerservicetrendsreport2024?utm_content=post (accessed on 17 April 2025).

- Bowes, P. Chatbots Hold Great Promise for Retailers—But What Do Consumers Think? 2021. Available online: https://www.pitneybowes.com/us/blog/chatbots.html (accessed on 10 May 2024).

- Garner, M. Enhancing Customer Service with AI: A Human-Centric Approach. 2024. Available online: https://www.forbes.com/sites/forbesbusinesscouncil/2024/04/02/enhancing-customer-service-with-ai-a-human-centric-approach/?sh=d9b68db45279 (accessed on 10 May 2024).

- Marjerison, R.K.; Dong, H.; Kim, J.-M.; Zheng, H.; Zhang, Y.; Kuan, G. Understanding user acceptance of AI-driven chatbots in China’s e-commerce: The roles of perceived authenticity, usefulness, and risk. Systems 2025, 13, 71. [Google Scholar] [CrossRef]

- Zhu, Y.M.; Zhang, J.M.; Wu, J.F.; Liu, Y.Y. AI is better when I’m sure: The influence of certainty of needs on consumers’ acceptance of AI chatbots. J. Bus. Res. 2022, 150, 642–652. [Google Scholar] [CrossRef]

- Zhou, Z.; Xu, Y.W.; Ren, Y.F.; Yu, J. Strategic adoption of the recommender system under online retailer competition and consumer search. Electron. Commer. Res. Appl. 2024, 64, 101376. [Google Scholar] [CrossRef]

- He, P.; Wang, T.Y.; Mardani, A.; Wang, X.J.; Chen, Z.S. Selling mode selection and AI service strategy in an E-commerce platform supply chain. Comput. Ind. Eng. 2024, 197, 110560. [Google Scholar] [CrossRef]

- Yu, S.Q.; Guo, C.X. Service design under asymmetric service provider competition: Applications of AI services. Transp. Res. Part E Logist. Transp. Rev. 2024, 182, 103424. [Google Scholar] [CrossRef]

- Owusu, P.; Li, Z.W.; Mensah, T.A.; Omari-Sasu, A.Y. Consumer response to E-commerce service failure: Leveraging repurchase intentions through strategic recovery policies. J. Retail. Consum. Serv. 2025, 82, 104137. [Google Scholar] [CrossRef]

- Cachon, G.P.; Daniels, K.M.; Lobel, R. The role of surge pricing on a service platform with self-scheduling capacity. Manuf. Serv. Oper. Manag. 2017, 19, 368–384. [Google Scholar] [CrossRef]

- Taylor, T.A. On-demand service platforms. Manuf. Serv. Oper. Manag. 2018, 20, 704–720. [Google Scholar] [CrossRef]

- Diao, W.; Harutyunyan, M.; Jiang, B.J. Consumer fairness concerns and dynamic pricing in a channel. Mark. Sci. 2022, 42, 569–588. [Google Scholar] [CrossRef]

- Mamadehussene, S. Measuring the competition effects of price-matching guarantees. Quant. Mark. Econ. 2021, 19, 261–287. [Google Scholar] [CrossRef]

- Wu, J.H.; Zhao, C.C. The online retailer’s randomized pricing strategy to compete with an offline retailer. Int. J. Electron. Commer. 2023, 27, 210–235. [Google Scholar] [CrossRef]

- Yang, Z.S.; Fu, X.Y.; Gao, P.; Chen, Y.-J. Fairness regulation of prices in competitive markets. Manuf. Serv. Oper. Manag. 2024, 26, 1897–1917. [Google Scholar] [CrossRef]

- Balakrishnan, A.; Sundaresan, S.; Mohapatra, C. Subscription Pricing for Free Delivery Services. Prod. Oper. Manag. 2024, 33, 943–961. [Google Scholar] [CrossRef]

- Huang, H.; Wu, D.D.; Xu, H.Y. Signaling or not? The pricing strategy under fairness concerns and cost information asymmetry. Eur. J. Oper. Res. 2025, 321, 789–799. [Google Scholar] [CrossRef]

- Mithas, S.; Chen, Z.-L.; Saldanha, T.J.V.; De Oliveira Silveira, A. How will artificial intelligence and Industry 4.0 emerging technologies transform operations management? Prod. Oper. Manag. 2022, 31, 4475–4487. [Google Scholar] [CrossRef]

- Leung, E.; Paolacci, G.; Puntoni, S. Man versus machine: Resisting automation in identity-based consumer behavior. J. Mark. Res. 2018, 55, 818–831. [Google Scholar] [CrossRef]

- Li, M.; Li, T. AI automation and retailer regret in supply chains. Prod. Oper. Manag. 2021, 31, 83–97. [Google Scholar] [CrossRef]

- Peng, C.; van Doorn, J.; Eggers, F.; Wieringa, J.E. The effect of required warmth on consumer acceptance of artificial intelligence in service: The moderating role of AI-human collaboration. Int. J. Inf. Manag. 2022, 66, 102533. [Google Scholar] [CrossRef]

- Wang, Y.W.; Choudhary, V.; Yin, S.Y. Product design enhancement for fashion retailing. Serv. Sci. 2023, 15, 157–171. [Google Scholar] [CrossRef]

- Han, E.; Yin, D.Z.; Zhang, H. Bots with feelings: Should AI agents express positive emotion in customer service? Inform. Syst. Res. 2022, 34, 1296–1311. [Google Scholar] [CrossRef]

- Seymour, M.; Yuan, L.Y.; Riemer, K.; Dennis, A.R. Less artificial, more intelligent: Understanding affinity, trustworthiness, and preference for digital humans. Inform. Syst. Res. 2024; ahead of print. [Google Scholar] [CrossRef]

- Jin, J.; Walker, J.; Reczek, R.W. Avoiding embarrassment online: Response to and inferences about chatbots when purchases activate self-presentation concerns. J. Consum. Psychol. 2025, 35, 185–202. [Google Scholar] [CrossRef]

- Wang, Q.; Ji, X.; Zhao, N.G. Embracing the power of AI in retail platform operations: Considering the showrooming effect and consumer returns. Transp. Res. Part E Logist. Transp. Rev. 2024, 182, 103409. [Google Scholar] [CrossRef]

- De, P.; Hu, Y.; Rahman, M.S. Technology usage and online sales: An empirical study. Manag. Sci. 2010, 56, 1930–1945. [Google Scholar] [CrossRef]

- Ha, A.Y.; Tong, S.; Wang, Y.J. Channel structures of online retail platforms. Manuf. Serv. Oper. Manag. 2022, 24, 1547–1561. [Google Scholar] [CrossRef]

- Fan, X.; Tian, L.; Wang, C.; Wang, S. Optimal service decisions in an omni-channel with buy-online-and-pick-up-in-store. J. Oper. Res. Soc. 2022, 73, 794–810. [Google Scholar] [CrossRef]

- Liu, Y.; Gan, W.X.; Zhang, Q. Decision-making mechanism of online retailer based on additional online comments of consumers. J. Retail. Consum. Serv. 2021, 59, 102389. [Google Scholar] [CrossRef]

- Park, Y.S.; Sim, J.G.; Kim, B.S. Online retail operations with “Try-Before-You-Buy”. Eur. J. Oper. Res. 2022, 299, 987–1002. [Google Scholar] [CrossRef]

- Lu, Q.H.; Liao, C.H.; Chen, X.F. The blockchain adoption strategies of online retailer in a dual-channel supply chain. Int. J. Prod. Econ. 2024, 274, 109322. [Google Scholar] [CrossRef]

- Zhu, F.; Zhang, X. Impact of online consumer reviews on sales: The moderating role of product and consumer. J. Mark. 2010, 74, 133–148. [Google Scholar] [CrossRef]

- Jiang, L.F.; Dimitrov, S.; Mantin, B. P2P marketplaces and retailing in the presence of consumers’ valuation uncertainty. Prod. Oper. Manag. 2017, 26, 509–524. [Google Scholar] [CrossRef]

- Gurnani, H.; Singh, S.; Tang, S.; Wang, H.Q. Service provision in distribution channels. J. Mark. Res. 2022, 59, 926–940. [Google Scholar] [CrossRef]

- Chen, Y.X.; Narasimhan, C.; Zhang, Z.J. Consumer heterogeneity and competitive price-matching guarantees. Mark. Sci. 2001, 20, 300–314. [Google Scholar] [CrossRef]

- Montes, R.; Sand-Zantman, W.; Valletti, T.M. The value of personal information in online markets with endogenous privacy. Manag. Sci. 2019, 65, 1342–1362. [Google Scholar] [CrossRef]

- Tang, P.; Chen, J.Q.; Raghunathan, S. Physical stores as warehouses for online channels: Implications for channel choices under competition. Inform. Syst. Res. 2023, 34, 1554–1581. [Google Scholar] [CrossRef]

- Statista. Important Aspects of a Good Customer Service Experience U.S. & Worldwide 2018. 2022. Available online: https://www.statista.com/statistics/810614/important-aspects-of-a-good-customer-service-experience/ (accessed on 15 April 2025).

- Daroch, B.; Nagrath, G.; Gupta, A. A study on factors limiting online shopping behaviour of consumers. Rajagiri Manag. J. 2021, 15, 39–52. [Google Scholar] [CrossRef]

- Nageswaran, L.; Hwang, E.H.; Cho, S.H. Offline returns for online retailers via partnership. Manag. Sci. 2024, 71, 279–297. [Google Scholar] [CrossRef]

- Gao, F.; Su, X. Omnichannel retail operations with buy-online-and-pick-up-in-store. Manag. Sci. 2016, 63, 2478–2492. [Google Scholar] [CrossRef]

- Gartner. Case Study: Generative AI Chatbot Resolves 75% of Customer Interactions. 2024. Available online: https://www.gartner.com/en/documents/5333363 (accessed on 15 April 2025).

- Choi, W.J.; Jerath, K.; Sarvary, K. Consumer privacy choices and (un)targeted advertising along the purchase journey. J. Mark. Res. 2023, 60, 889–907. [Google Scholar] [CrossRef]

- Zheng, H.; Wu, H.M.; Tian, L. Healthcare service enhancement with patient search. J. Bus. Res. 2022, 152, 398–409. [Google Scholar] [CrossRef]

- Dai, T.; Singh, S. EXPRESS: Artificial intelligence on call: The physician’s decision of whether to use ai in clinical practice. J. Mark. Res. 2025; Articles in Advance. [Google Scholar] [CrossRef]

- Li, L.; Li, G. Integrating logistics service or not? The role of platform entry strategy in an online marketplace. Transp. Res. Part E Logist. Transp. Rev. 2023, 170, 102991. [Google Scholar] [CrossRef]

- Xiao, Y.; Yu, J.; Zhou, S.X. Commit on effort or sales? Value of commitment in live-streaming e-commerce. Prod. Oper. Manag. 2024, 33, 2241–2258. [Google Scholar] [CrossRef]

- Krishnan, V.; Zhu, W. Designing a family of development-intensive products. Manag. Sci. 2006, 52, 813–825. [Google Scholar] [CrossRef]

- Jiang, B.J.; Yang, B.C. Quality and pricing decisions in a market with consumer information sharing. Manag. Sci. 2018, 65, 272–285. [Google Scholar] [CrossRef]

- Boyacı, T.; Akçay, Y. Pricing when customers have limited attention. Manag. Sci. 2018, 64, 2995–3014. [Google Scholar] [CrossRef]

- Branco, F.; Sun, M.; Villas-Boas, J.M. Optimal search for product information. Manag. Sci. 2012, 58, 2037–2056. [Google Scholar] [CrossRef]

- Lal, R.; Sarvary, M. When and how is the internet likely to decrease price competition? Mark. Sci. 1999, 18, 485–503. [Google Scholar] [CrossRef]

- Plambeck, E.L.; Taylor, T.A. Supplier evasion of a buyer’s audit: Implications for motivating supplier social and environmental responsibility. Manuf. Serv. Oper. Manag. 2015, 18, 184–197. [Google Scholar] [CrossRef]

- Geylani, T.; Dukes, A.J.; Srinivasan, K. Strategic manufacturer response to a dominant retailer. Mark. Sci. 2007, 26, 164–178. [Google Scholar] [CrossRef]

- Chen, S.; Li, X.; Liu, K.; Wang, X. Chatbot or human? The impact of online customer service on consumers’ purchase intentions. Psychol. Mark. 2023, 40, 2186–2200. [Google Scholar] [CrossRef]

- Genc, T.S.; De Giovanni, P. Trade-in and save: A two-period closed-loop supply chain game with price and technology dependent returns. Int. J. Prod. Econ. 2017, 183, 514–527. [Google Scholar] [CrossRef]

- Shu, B.C.; Wei, J.; Cao, H. Optimal pricing and collection decisions in a two-period closed-loop supply chain considering channel inconvenience. Transp. Res. Part E Logist. Transp. Rev. 2025, 194, 103869. [Google Scholar] [CrossRef]

- Frank, D.-A.; Chrysochou, P.; Mitkidis, P.; Otterbring, T.; Ariely, D. Navigating uncertainty: Exploring consumer acceptance of artificial intelligence under self-threats and high-stakes decisions. Technol. Soc. 2024, 79, 102732. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).