Abstract

In light of increasingly prominent environmental issues, inspiring green supply chain (GSC) members to engage in collaborative innovation is crucial to improve environmental performance. In this paper, in relation to a two-level GSC consisting of manufacturers and suppliers, differential equations involving the greenness of intermediate and final products as state variables are constructed considering the effect of digital capability on green innovation. Subsequently, designs for three incentive mechanisms—the greenness reward, the R&D effort reward, and the digital construction reward—are presented, and their long-term dynamic effects on the economic, environmental, and social benefits are compared and analyzed. Finally, the impacts of consumer green preference and the contribution of digital capability to the advancement of green innovation are explored. The findings show that all these incentives can boost economic, environmental, and social benefits while motivating the supplier. To achieve the best incentive effect, the reward coefficient should fall within a specific range. The digital construction reward mechanism is the most favourable in the initial stage, while the R&D effort reward mechanism is the most appropriate in the long term. The promotion effects of digital capability on green innovation and consumer green preference have the potential to enhance economic, environmental, and social performance.

1. Introduction

Green supply chains (GSCs) are currently the primary development path due to global resource and environmental restrictions [1]. Green supply chain management, which emphasizes the triple bottom line principle, has emerged as a cutting-edge topic in contemporary supply chain management [2]. Numerous manufacturing companies are dedicated to developing and producing eco-friendly products that minimize emissions and pollution while conserving energy during production, notwithstanding various challenges including international green barriers, government regulations, and heightened consumer awareness of environmental issues [3]. However, how can a product be made more ecologically friendly? It is imperative that manufacturers continue to develop innovative green solutions. Several studies have shown that green innovation prioritizes minimizing negative environmental effects through product development, innovation, and process optimization to reduce pollutant emissions and energy consumption during the production process. This is in contrast to traditional innovation, which focuses only on financial gains [4]. Because of their higher eco-efficiency and enhanced environmental reputation, businesses that adopt green innovation frequently have a competitive edge over their rivals [5].

Nevertheless, the high expenses, risks, and “double externalities” associated with green innovation significantly diminish firms’ incentives to pursue it [6]. Research indicates that vertical cooperation and synergy between supply chain members are necessary for the highest performance of green innovation [5], as firms’ efforts alone do not yield the best results [7]. According to Chen et al. [8], cooperative green research and development (R&D) can benefit companies, society, and the environment while also reducing or eliminating the negative environmental effects of goods or services. Therefore, collaborating and working together to innovate is the greatest way for supply chain actors to improve the performance of green innovation. How can the manufacturer, who is the centre of the supply chain, inspire suppliers to collaborate in implementing green innovation?

In the era of the digital economy, data has become an indispensable innovation resource [9] and a critical strategic tool for manufacturing companies [10]. This has resulted in increased decision accuracy and the creation of global value opportunities for the supply chain [11,12], as well as significant changes to most of the planning, production, sales, and supply chain [13]. Therefore, the ability to obtain, refine, analyze, and integrate data has become necessary for enterprises and supply chains to generate commercial value and enhance competitiveness [14,15]. According to dynamic capability theory [16], digital capability is a dynamic capability that acquires data resources through digital technology and refines, integrates, updates and reconstructs them, cultivating and building the ability to transform data as a factor of production into business model innovation [17]. It enables companies to gain faster access to the specialized knowledge resources that are required for new product creation [18] and give business a competitive advantage. Businesses with a strong digital presence can obtain the technical expertise required to successfully innovate and create new goods [19]. At present, many scholars have reached a consensus on the relationship between digital capabilities and corporate green innovation [20,21,22]. The majority of studies now focus on the positive relationship between the two from the standpoint of empirical research. However, few studies have examined the dynamic impact of digital capabilities on green innovation from a game theory viewpoint.

The purpose of this study is to develop a set of scientific and rational incentives for the manufacturer in the context of enterprises’ digital transformation. These incentives will encourage the supplier to fully engage in collaborative GSC innovation, ultimately contributing to the sustainable development of GSCs. However, incentive strategies of the supply chain proposed in the existing literature mainly focus on traditional contracts, such as cost-sharing mechanisms [23], two-part tariff contracts [24], and revenue-sharing mechanisms [25]. It is worthwhile to explore further the design of incentive contracts from the angle of direct incentivization of target product greenness. Considering the current trend of digital transformation, a quantitative model characterizing the relationship between digitalization and green innovation is needed. Its influence on GSC decision making and incentive contract selection is also inadequate. Furthermore, design of an incentive mechanism for the core manufacturer and supplier has remained unexplored from the standpoint of digitalization.

Based on this, this research examines the optimal equilibrium strategy of each participant in the manufacturer-led GSC from the perspective of game theory and studies the influence of different incentive mechanisms in the dynamic environment. To better describe the dynamic process of product greenness, we constructed a differential equation with the greenness of the intermediate and final products as the state variables and considered digital capability as the driving factor of greenness in the model. On the basis of the standard scenario, we designed three incentive mechanisms from the perspectives of product greenness (direct incentive) and its driving factors (indirect incentives): the greenness reward, the R&D effort reward, and the digital construction reward. The long-term dynamic impact of the three incentive mechanisms on the economic, environmental and social benefits of the GSC were compared and analyzed. This article mainly answers the following three questions:

(1) How have the economic benefits, environmental benefits, and social welfare of the GSC evolved over time as a result of different incentive schemes?

(2) Which is the most advantageous incentive mechanism for the economic benefits, environmental benefits, and social welfare of the GSC, and how should the reward coefficient be determined?

(3) What is the impact of consumers’ green preference and the promotion of digital capability on green product innovation and the economic benefits, environmental benefits, and social welfare of the GSC?

By answering the aforementioned questions, this study offers recommendations for supply chain managers to formulate incentive mechanisms. It also provides a point of reference for businesses implementing digital transformation, green innovation practices, and other useful issues, such as how to make products greener and enhance the performance of the GSC in terms of the economy, the environment, and society.

The primary contributions of this article are as follows:

(1) The differential equation is used to describe the changes in the greenness of intermediate and final products with the green innovation efforts of GSC members. The optimal decision making and incentive contracts of the GSC are analyzed dynamically rather than statically. Green innovation, pollutant emissions, and energy efficiency are all dynamic phenomena [5,26,27]. The product’s greenness and the pertinent decisions made in the subsequent stage will be influenced by the innovation efforts within GSC participators in the preceding stage. As a result, the analysis of dynamic tactics in this study utilizing differential game theory is more accurate.

(2) This study examines the dynamic relationship between enterprises’ digital capability and product green innovation, taking digital capability as a driving factor of product greenness into the model. This leads to a discussion of how optimal decision making in GSC changes dynamically, which not only enriches the theory of digital-driven green innovation but also improves the field of optimal decision making in GSC.

(3) Three reward (or incentive) strategies are proposed, different from previous research on GSCs. According to this study, a reward strategy that successfully motivates suppliers to actively collaborate with manufacturers to creatively sustain long-term efforts on product greenness, as opposed to passively accepting them, may be a more effective and efficient incentive mechanism. Thus, in light of product greenness and its influencing elements, this study suggests three realistic, scientific, and reasonable incentive contracts—the greenness reward mechanism, the R&D effort reward mechanism, and the digital construction reward mechanism. The study of dynamic contracts can accurately characterize the long-term decision-making problem in the GSC, which is an extension and supplement to the research on collaborative supply chain innovation and incentive schemes.

The rest of the paper is organized as follows. Section 2 reviews the literature and proposes a research gap. Section 3 describes the problems and puts forward three incentive mechanisms. Section 4 establishes the models and presents the Stackelberg equilibrium results for different scenarios. Section 5 makes a comparative analysis of optimal strategies. Section 6 conducts numerical simulation for further analysis. Section 7 gives some enlightenment for managers. Finally, the conclusion and future research directions are given in Section 8. The proof process is detailed in the Appendix B.

2. Literature Review

2.1. Digitalization of the Supply Chain

The current research findings about the digitalization of the supply chain primarily address the qualitative effects of digitalization on supply chain decision making. From a qualitative standpoint, digitalization has brought a number of improvements and new opportunities to the supply chain. Big data, as digital innovation technology, can assist in identifying supply chain risks [28], supporting enterprises in a complex and volatile environment [29], and identifying and mitigating social problems in the supply chain [30]. The improvement of digital capabilities can help enterprises improve their R&D capabilities, enhance environmental performance, and strengthen the stability of supply chain systems under challenging circumstances [31,32,33]. From a game theory perspective, research has concentrated on the influence of the target advertising and marketing brought by big data on supply chain participants’ decision making, profits, and environmental advantages [34,35,36]. Businesses obtain consumers’ preference information through big data, thus influencing the optimal decision making of supply chain members [1,37] and affecting the financing activities of the supply chain [38]. Digital empowerment also has an impact on the green collaborative innovation of the supply chain by constructing an evolutionary game model [39]. Digital process optimization in the digital supply chain can bring economic and environmental benefits to the supply chain [13].

The qualitative research on the application of digitalization in the supply chain has primarily focused on the beneficial impact of digitalization as a contemporary technology and tool in the supply chain. The majority of these studies are theoretical and empirical studies based on the data obtained from the survey. The way that digitalization is applied in supply chain decision making is that retailers use big data to collect consumer preference information and conduct targeted advertising marketing. This contributes to the quantitative impact of digitalization on the supply chain. However, the participants involved are relatively simple and the research has been only conducted from the perspective of retailers. There might be more achievements if the research subjects are expanded to include additional supply chain members.

2.2. Digitalization and Green Innovation

Data-driven innovation is recognized as an emerging approach to augmenting innovation through gathering, evaluating, and processing consumer data [9]. In the process of enterprise operation, the use of big data has made a positive contribution to the new dynamic trend of consumer management and enterprise survival. For instance, open media data can help enterprises promptly identify market opportunities, such as using search log data to determine consumers’ willingness to consume [40]. On the one hand, this can provide a reference for companies to achieve accurate and personalized recommendations and foster their business model innovation [41,42]. On the other hand, it assists businesses in obtaining consumers’ cognitive information about competing brands and fully leveraging the competitiveness of their products. Numerous academics have attested to the fact that digital capabilities positively promote the green innovation of enterprises. Waqas et al. [22] found that big data analytics could enhance the industrial sector’s benefits to the economy and environment in China by driving green innovation. Tian et al. [10] discussed the influence and transmission process of big data capabilities on green process innovation and discovered that big data insight capabilities play a central role in green process innovation. Ning et al. [43] confirmed the beneficial effects of enterprise digitalization on green innovation, based on data from listed companies in the manufacturing industry.

In the existing literature, research on the relationship between digital capability and green innovation has mainly concentrated on theoretical and empirical studies based on actual investigation. These have primarily been qualitative research projects demonstrating the promotional effect of digitalization on green innovation or environmental performance. However, only qualitative research is not enough. We also need to conduct quantitative explorations into the connections between digital capability and green innovation.

2.3. Cooperation and Incentive Mechanism of Supply Chain

Green innovation with merely the company’s efforts will not achieve effective green supply chain management, particularly for businesses with complicated industrial chains [44]. Instead, companies upstream in the supply chain ought to be cooperative and vertically integrated [7], which could encourage businesses to invest resources in the innovation process and help them keep their competitive edge [45]. Relationships with other supply chain partners also affect green innovation performance [11,46], which can help companies lower carbon emissions and improve their environmental benefits [47]. As a result, a fair incentive mechanism should be created to encourage close coordination between enterprises upstream and downstream in the supply chain. Incentives should be designed to internalize the costs and benefits of the entire supply chain system in relation to the decisions of each participant. The current research on incentive mechanisms mainly focuses on the following: two-part tariffs [48], cost-sharing mechanisms [37], and revenue-sharing schemes [49]. Some scholars have explored the impact of incentives on the collaborative innovation behaviour of supply chain subjects from the perspective of market mechanisms and government cost subsidies [50]. There are also novel incentives, such as the blockchain-based government incentive scheme for data governance in the manufacturing supply chain [51] and the new biform game model to encourage ecological innovation [52].

Research on supply chain cooperation and incentive mechanisms is related to supply chain coordination, so each study usually investigates only one incentive mechanism to achieve supply chain coordination. These studies’ viewpoints might be overly constrained. It may be more valuable to talk about the incentive effects generated by several incentive contracts from a participator within the supply chain.

2.4. Research Gap of GSC

In summary, the extant literature significantly enriches the research findings regarding GSCs and furnishes a specific point of reference for firms’ operation and administration. However, there are also some shortcomings, which mainly show up in the following three aspects:

(1) Few studies have examined how digitalization affects supply chain decisions through suppliers and manufacturers. The majority of research on the topic focuses on retailers’ use of big data for marketing and targeted advertising;

(2) The relationship between digitalization and green innovation is primarily an empirical study. It is uncommon to use game theory to investigate this relationship and how digitalization influences GSCs’ decision making in light of it;

(3) Incentives for digital construction are not typically included in the usual incentive mechanisms—cost-sharing, two-part tariff contracts, revenue-sharing, etc.—that have been the subject of research on supply chain cooperation models and incentive strategies. Furthermore, most existing work only addresses one or two incentive mechanisms. Comparative study and simultaneous exploration of numerous incentive schemes from various viewpoints are uncommon.

This paper makes up for the shortcomings of previous research by discussing the dynamic effects of digitalization on suppliers’ and manufacturers’ green innovation, as well as designing three distinct incentive schemes based on the three dimensions of green reward, R&D effort reward, and digital construction reward. These schemes serve as a guide for core manufacturers within the supply chain to encourage suppliers to actively engage in collaborative innovation.

3. Problem Description

3.1. Model Background

In a two-echelon GSC consisting of a supplier and a manufacturer, the supplier is responsible for supplying green intermediate products (such as green parts) while the manufacturer is in charge of producing and marketing green final products. In addition, the manufacturer has a central position and is the leader of the supply chain. In reality, a representative example is the partnership between manufacturers of new energy vehicles (NEVs) and battery suppliers. The latter conducts R&D on green batteries (intermediate products) and supplies them to the former to produce NEVs (final products) which are ultimately sold to consumers. For instance, Chinese BAIC New Energy (a NEV manufacturer) and CATL (a green battery supplier) have reached cooperation on the development and allocation of super-rechargeable batteries, aggregating their respective superior resources and improving energy replenishment and the driving experience of users (BAIC New Energy and CATL reached cooperation, Shenxing supercharged battery will help polar Fox car. https://baijiahao.baidu.com/s?id=1780143702128461051&wfr=spider&for=pc, accessed on 9 October 2023.). In our model, the supplier’s unit cost to produce green intermediate products is , the unit price of selling them to the manufacturer is , the manufacturer’s unit cost to make green final products is , and the unit price of green final products retailing in the market is .

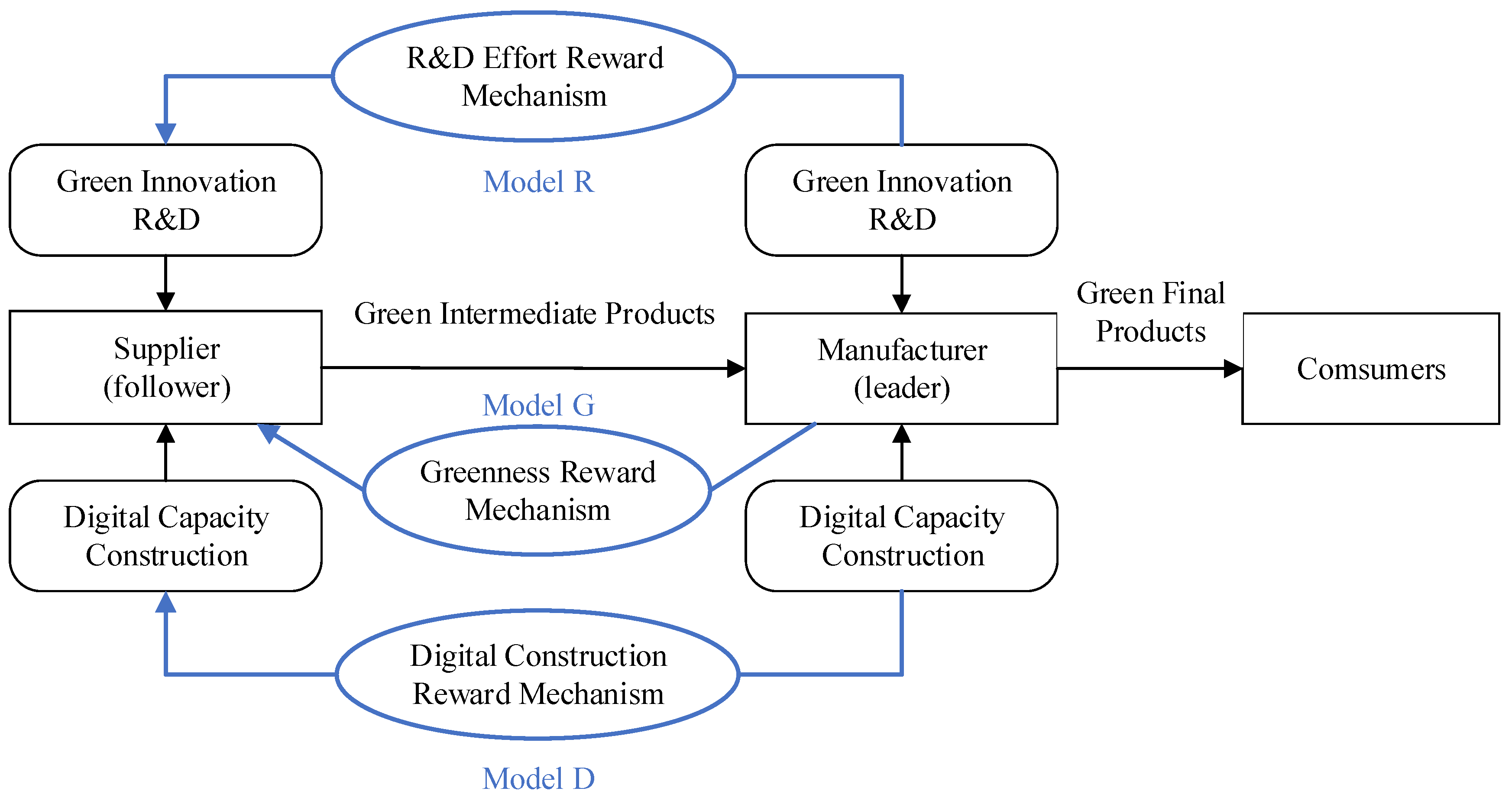

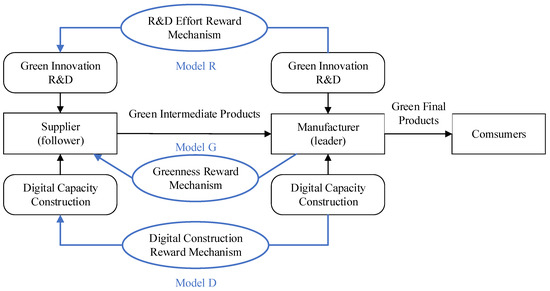

In order to meet green standards for products, suppliers and manufacturers need to carry out their green innovation, so they invest in green innovation R&D of green intermediate and final products respectively. Simultaneously, under the current wave of the digital economy, all enterprises, including manufacturers and suppliers, are committed to digital transformation. They are actively engaged in digital construction to enhance their digital capabilities. The current research indicates that data can spur innovation [9,11]. Additionally, enhancing an organization’s digital capabilities can significantly promote the green innovation behaviour of manufacturing firms and enhance their environmental performance [20,22,43]. Thus, active digital construction by suppliers and manufacturers can increase the greenness of products and meet the current environmental protection requirements. The structure of the process and the interaction between the manufacturer and supplier are shown in Figure 1.

Figure 1.

The structure of the incentive models.

3.2. Definitions of Parameters and Variables

For businesses to implement digital construction, investments are required. Assuming that the digital capability levels of the manufacturer and supplier are and , respectively, referring to the research of Hao et al. [27] and Kumar Jena and Singhal [13], the cost to the manufacturer and supplier to carry out digital construction is set as a quadratic function of the digital capability level, i.e., and , where and are the cost coefficients of digital construction for the manufacturer and supplier, respectively. Similarly, with reference to the studies by Zhou et al. [53] and Meng et al. [6], the manufacturer and supplier adopt a classical quadratic convex form for green innovation R&D costs for final and intermediate products, i.e., and , where and are the green innovation R&D effort levels of the manufacturer and supplier, and and are the cost coefficients of green innovation R&D of the manufacturer and supplier, respectively.

In this study, the green level or greenness of products refers to products’ degree of friendliness toward both humans and the environment, such as content of hazardous materials, levels of energy consumption, recyclability, etc. [54]. The equipment and facilities employed in green production will keep wearing out and green technologies will eventually become outdated over time. Therefore, there is a natural attenuation impact on product greenness [5], which is commonly cited in the literature on green innovation and environmental decision making (such as Zhu et al. [5], Chang et al. [55], and Hao et al. [27]). Hence, this study employs differential equations to characterize the dynamic changes in the greenness of intermediate and final products. The digitalization of the manufacturer and supplier is beneficial to the greenness of both intermediate and final products. Meanwhile, the green innovation R&D of the manufacturer and supplier can lower energy consumption and pollutant emissions while also raising the green level of products. As a consequence, the greenness of intermediate and final products is a time-varying dynamic variable determined by both the green innovation R&D effort level and digital capability level. The greenness of intermediate products also has a positive effect on the greenness of final products; thus, the equations for the greenness state of intermediate products and final products at time t are, respectively, as follows:

where and , respectively, represent the effective coefficients for the supplier and manufacturer to carry out green innovation R&D efforts; and , respectively, denote the effective coefficients of digital construction promoting product green innovation by the supplier and manufacturer; is the influence coefficient of the greenness of intermediate products on the greenness of final products; and , respectively, refer to the decay factor of greenness of intermediate and final products. Let and . Equations (1) and (2) indicate that the greenness of intermediate and final products are positively correlated with the green innovation R&D effort and digital capability of suppliers and manufacturers, respectively, which is consistent with reality. This linear relationship has been widely used in the literature on environmental games and innovation games (e.g., Liu and De Giovanni [3], Zhu et al. [5] and Chang et al. [55]).

The proliferation of the Internet and digital technology has enabled consumers to access information on the production processes and raw materials of goods, giving them a better understanding of the environmental impact of both final and intermediate products. For instance, the greenness of green batteries and NEVs can be known by consumers through advertising, news, and other channels. For one thing, higher product greenness can enhance customers’ consumption experience or reduce use cost to draw in budget-conscious buyers, which would subsequently boost product sales. For another, as the idea of green environmental protection becomes more widely accepted, consumers’ recognition of green products gradually increases. This draws in more customers who are environmentally conscious or have green preferences, which in turn influences their purchasing behaviour. As a result, in addition to the influence of sales price, the market demand for final products is also affected by the greenness of intermediate and final products, which is a significant factor influencing consumers’ decisions to buy [56], in accordance with the presumptions made in the research by Liu et al. [57], Zhou and Ye [58], and Chen et al. [2] that market demand is affected by price and non-price factors and is the product of the two factors, namely:

the market demand for final products can therefore be expressed as:

where is the total market potential; refers to the sensitivity of consumers to the retail price of final products; and , respectively, represent the consumers’ preference for the greenness of final and intermediate products and also stand for consumers’ environmental awareness. The expression of the demand function is widely used in the literature on GSCs [54], which can characterize consumers’ sensitivity to retail price and environmental awareness. Moreover, the market demand function decreases with the rise of the retail price and increases with the rise of the greenness of final and intermediate products.

Consumer surplus, related to the consumer’s net income, is the difference between the whole amount that consumers are willing to pay and the total amount they actually pay when buying goods. It is a measure of the additional benefits that the buyer believes they are receiving. According to Panda et al. [59], Chen et al. [2], and Kumar Jena and Singhal [13], the consumer surplus in this study can be expressed as:

where , .

Through further solution, we can obtain:

Environmental benefits are used to express the positive externalities when enterprises produce green products, based on the research by Meng et al. [6], Chen et al. [2], and Hu et al. [34]. They can be defined as the product of the greenness of all products and the amount of demand, i.e.:

In this study, social welfare is mainly composed of three parts: corporate profits, environmental benefits, and consumer welfare, with reference to previous research [60] and Meng et al. [6], namely:

Bringing Equations (4) and (5) into Equations (6), we obtain the following:

The parameters, decision variables, and other variables involved in this research are described in Appendix A.

3.3. Model Assumptions

Assumption 1:

To ensure the profitability of suppliers and manufacturers, we assume and

.

Assumption 2:

To ensure that all variables are non-negative, we assume the constraint condition is satisfied.

Assumption 3:

For the sake of calculation, it is assumed that the production of one unit of final product necessitates the consumption of one unit of intermediate goods.

Assumption 4:

The manufacturer and the supplier are both risk-neutral and rational economic people, fully pursuing their profit maximization.

3.4. Incentive Contract Design

Given that consumers’ purchasing decisions and the performance of the entire supply chain are significantly influenced by the greenness of products [54], the manufacturer, as the GSC’s leader, needs to develop reasonable incentive mechanisms to motivate the supplier to engage in green collaborative innovation and maximize the greenness of products. Based on the scenario in this study, the manufacturer can encourage the supplier in two ways: direct incentives and indirect incentives. The former means that the manufacturer directly rewards the greenness of intermediate products enhanced by suppliers, and the latter indirectly promotes the improvement of product greenness through rewarding R&D efforts and digital construction based on the influencing factors of product greenness. Specifically, the manufacturer can incentivize the supplier through three key mechanisms:

(1) Greenness Reward Mechanism (Model G): The manufacturer rewards the supplier according to the greenness of intermediate products. The amount the manufacturer needs to pay to the supplier at time is , where represents the reward coefficient of greenness;

(2) R&D Effort Reward Mechanism (Model R): The manufacturer rewards the supplier according to the cost of the green innovation R&D effort of intermediate products. The amount the manufacturer needs to pay to the supplier at time is , where is the reward coefficient of the R&D effort;

(3) Digital Construction Reward Mechanism (Model D): The manufacturer rewards the supplier according to the supplier’s digital construction cost. The amount the manufacturer needs to pay to the supplier at time is , where is the reward coefficient of digital construction.

To describe the growth of the overall economic benefits of the GSC brought by three incentive mechanisms, the influence degree of the incentive mechanism, represented by , is put forward to indicate how much the profit margin of the GSC improves when implementing the incentive mechanisms in comparison to the non-incentive case [61]. The calculation formula is as follows:

where .

4. Game Model and Solution

In this section, the dynamic game model is constructed and the equilibrium results are achieved for four scenarios: no incentive, the greenness reward mechanism, the R&D effort reward mechanism, and the digital construction reward mechanism. All the proofs of propositions that arise below are shown in Appendix B.

4.1. Basic Model (Model B)

This situation is the benchmark of the other three incentive scenarios, which mainly discuss the optimal decision of the manufacturer in the absence of any incentives for the supplier, so it is also called the non-incentive scenario. Based on the differential game, the goals of both the supplier and manufacturer are to seek profit maximization for an infinite period and the two constitute a manufacturer-dominated Stackelberg game. The order of decision making is as follows: first, the manufacturer decides its green innovation R&D effort level of final products , digital capability level , and the retail price of the final product . Then, the supplier determines its green innovation R&D effort level of intermediate products , digital capability level , and wholesale prices . The profit functions for the supplier and manufacturer, respectively, are as follows:

The Hamilton–Jacobi–Bellman equation (hereinafter referred to as the HJB equation) is used to obtain the equilibrium result of the problem. The optimal profit value functions of the supplier and manufacturer at time are transformed into the following:

The time is omitted for simplicity of writing. According to the optimal control theory, the following HJB equations need to be satisfied:

Proposition 1.

In the non-incentive scenario, the optimal selling prices of intermediate and final products, the optimal green innovation R&D effort level, and the digital capability level of the manufacturer and the supplier, respectively, are as follows:

The greenness trace of intermediate products is as follows:

where represents the evolution rate

, is the stable value of greenness of intermediate products.

The greenness trace of the final products is as follows:

where represents the evolution rate and is the stable value of the greenness of final products.

The optimal profits of the manufacturer and the supplier are as follows:

where .

Proposition 2.

In the non-incentive scenario, the evolution trajectories of the optimal profits of the manufacturer and the supplier are as follows:

Proposition 1 demonstrates that the optimal selling prices of green intermediate and final products, the optimal green innovation R&D effort level, and the digital capability level of the manufacturer and the supplier have no relationship with the greenness, while profits are positively correlated with the greenness of intermediate and final products. The evolution rates of the greenness of intermediate and final products are the same as the decay factors of their corresponding greenness. In addition, the convergence of the greenness is related to the stable value. When , the greenness of intermediate products gradually rises with time and converges to and its growth law has a marginally decreasing effect. Similarly, when , the greenness of final products gradually grows over time and converges to . This is consistent with the actual situation. Due to the financial and technological constraints of green innovation R&D efforts, the advancement of the greenness of intermediate and final products gradually declines over time and the promotion effect of digital capability level on green innovation also gradually weakens.

4.2. Greenness Reward Mechanism (Model G)

Under this incentive mechanism, the manufacturer rewards the supplier according to the greenness of intermediate products, and the reward amount is , where is the reward coefficient of the unit greenness of intermediate products. The supplier and the manufacturer constitute a manufacturer-lead Stackelberg game, and the decision making order is the same as Model B. The profit functions for the supplier and manufacturer, respectively, are as follows:

Proposition 3.

Under the greenness reward mechanism, the optimal selling prices of intermediate and final products, the optimal green innovation R&D effort level; and the digital capability level of the manufacturer and the supplier, respectively, are as follows:

The greenness trace of intermediate products is as follows:

where represents the evolution rate; is the stable value of greenness of the intermediate products.

The greenness trace of the final products is as follows:

where represents the evolution rate; is the stable value of the greenness of final products.

The optimal profits of the manufacturer and the supplier are as follows:

Proposition 4.

Under the greenness reward mechanism, the evolution trajectories of the optimal profits of the manufacturer and the supplier are as follows:

Proposition 3 shows that under the greenness reward mechanism, the optimal selling prices of green intermediate and final products, the optimal green innovation R&D effort level, and the digital capability level of the manufacturer and the supplier do not change with the greenness, while their profits increase with the rise of the greenness of the intermediate and final products. A larger greenness reward coefficient has the potential to incentivize the supplier to fortify their green innovation R&D efforts and digital construction, ultimately leading to greener intermediate and final products. However, it does not influence the optimal decisions of the manufacturer.

4.3. R&D Effort Reward Mechanism (Model R)

In this incentive scenario, the manufacturer rewards the supplier according to the cost of green innovative R&D efforts for intermediate products, and the reward amount is , where denotes the reward coefficient for green innovation R&D efforts. The supplier and the manufacturer constitute a manufacturer-led Stackelberg game, and the decision-making order is the same as Model B. The profit functions for the supplier and the manufacturer, respectively, are as follows:

Proposition 5.

Under the R&D effort reward mechanism, the optimal selling prices of intermediate and final products, the optimal green innovation R&D effort level, and the digital capability level of the manufacturer and the supplier, respectively, are as follows:

The greenness trace of intermediate products is as follows:

where represents the evolution rate; is the stable value of greenness of intermediate products.

The greenness trace of the final products is as follows:

where represents the evolution rate; is the stable value of the greenness of final products.

The optimal profits of the manufacturer and the supplier are as follows:

Proposition 6.

Under the R&D effort reward mechanism, the evolution trajectories of the optimal profits of the manufacturer and the supplier are as follows:

Proposition 5 shows that under the R&D effort incentive mechanism, the greenness of intermediate and final products does not affect the optimal selling prices of green intermediate and final products, the optimal green innovation R&D effort level, orthe digital capability level of the manufacturer and the supplier but make a difference to the players’ profits. The manufacturer’s optimal decision making is unaffected by the R&D effort reward coefficient. Nevertheless, a higher R&D effort reward coefficient can motivate the supplier to increase its green innovation R&D effort level for intermediate products, thereby advancing the enhancement of the greenness of intermediate and final products.

4.4. Digital Construction Reward Mechanism (Model D)

Under this incentive situation, the manufacturer rewards the supplier according to the cost of digital construction, and the reward amount is , where is the reward coefficient of the digital construction by the supplier. The supplier and the manufacturer constitute a manufacturer-led Stackelberg game, and the decision-making order is the same as Model B. The profit functions for the supplier and the manufacturer, respectively, are as follows:

Proposition 7.

Under the digital construction reward mechanism, the optimal selling prices of intermediate and final products, the optimal green innovation R&D effort level, and the digital capability level of the manufacturer and the supplier, respectively, are as follows:

The greenness trace of intermediate products is as follows:

where represents the evolution rate; is the stable value of the greenness of intermediate products.

The greenness trace of the final products is as follows:

where represents the evolution rate; is the stable value of the greenness of intermediate products.

The optimal profits of the manufacturer and the supplier are as follows:

Proposition 8.

Under the digital construction reward mechanism, the evolution trajectories of the optimal profits of the manufacturer and the supplier are as follows:

Proposition 7 shows that under the incentive mechanism of digital construction, when the greenness of intermediate and final products improves, the profits of the manufacturer and the supplier increase but the optimal selling prices and the optimal green innovation R&D effort level and digital capability level remain unchanged. The reward coefficient of digital construction has no impact on the manufacturer’s optimal decision making but has a positive effect on the optimal digital capability level of the supplier. The rise of the reward coefficient of digital construction then increases the improvement of the greenness of the intermediate and final products.

5. Comparative Analysis

This section compares the optimal decisions of the manufacturer and the supplier in four scenarios—the non-incentive scenario, greenness reward scenario, R&D effort reward scenario, and digital construction reward scenario. Additionally, the pros and cons of each incentive mechanism are analyzed in terms of its effects on economic benefits, environmental benefits, and social welfare. Then, the following propositions can be obtained:

Proposition 9.

In the scenarios of no incentive, greenness reward, R&D effort reward, and digital construction reward, the relationships of green innovation R&D effort level and digital capability level of the supplier are as follows:

(I) when , ;

(II) when , ;

(III) when , ;

(IV) when , .

Proposition 9 shows that the green innovation R&D effort level and digital capability level of the supplier under the three incentive mechanisms are higher than those in the non-incentive scenario, indicating that the three incentive mechanisms contribute to the development of the supplier’s green innovation R&D and digital contribution. Out of the three incentive mechanisms, the digital construction incentive mechanism provokes the least enthusiasm from the supplier for green innovation R&D, and the R&D effort incentive mechanism gains the lowest digital capability level for the supplier. When choosing an incentive mechanism, the manufacturer must take into account the value of the corresponding incentive coefficient, since this determines which mechanism has the greatest incentive effect on the supplier.

Proposition 10.

In the scenarios of no incentive, greenness reward, R&D effort reward, and digital construction reward, there are the following relationships between stable values of demand and the greenness of intermediate and final products, consumer surplus, and environmental benefits:

(I) when , , , , , ;

(II) when , , , , ;

(III) when , , , , ;

(IV) when , , , , ;

(V) when , , , , , ;

(VI) when , , , , .

Proposition 10 demonstrates that, in contrast to the non-incentive scenario, the three incentive mechanisms have a promoting effect on demand and the greenness of intermediate and final products, environmental benefits, and consumer welfare in the long run. The changing trend of the latter three mechanisms and the greenness of products is consistent. Which incentive the manufacturers should choose to achieve the strongest incentive effect (the highest environmental benefits and consumer welfare) depends on the setting of the reward coefficients of the three incentive mechanisms.

Proposition 11.

The stable profit of the supplier in the non-incentive scenario is the lowest, and that in the greenness reward mechanism, R&D effort incentive mechanism, and digital construction incentive mechanism is increased, i.e., , , .

Proposition 12.

Compared with the non-incentive scenario, the relationships among the stable profits of the manufacturer in the three mechanisms of the greenness reward, the R&D effort reward, and the digital construction reward are as follows:

(I) when , ;

(II) when , ;

(III) when , .

Propositions 11 and 12 examine the long-term incentive effects of the three incentive mechanisms from the standpoint of economic benefits. They reveal that the three incentive mechanisms boost the supplier’s profits over time; consequently, they have effects for the supplier. However, the optimal incentive mechanism for a given supplier depend on the actual parameters, which are further elaborated on in Section 6. For the manufacturer, the three incentive mechanisms do not always increase profits, in fact, the manufacturer can only benefit from the incentive mechanism if specific conditions of the incentive coefficient are met.

Proposition 13.

In the scenarios of no incentive, the greenness reward, the R&D effort reward and the digital construction reward, the stable greenness of intermediate and final products, the green innovation R&D effort level, and the digital capability level of the manufacturer and the supplier are positively correlated with consumer green preference for the intermediate and final products and , the effective coefficient of green innovation R&D efforts by the manufacturer and the supplier and , the effective coefficient of digital construction promoting product green innovation by the manufacturer and the supplier and , and the influence coefficient of the greenness of intermediate products on the greenness of final products However, they are negatively related to consumers’ sensitivity to the retail price of final products and the decay factors of the greenness of intermediate and final products and .

According to Proposition 13, consumers can encourage the manufacturer and the supplier to conduct R&D on green products and to be more willing to carry out digital construction if they have a greater awareness of environmental protection and a greater preference for green products. The same effect can be obtained when greater effective conversion rates of the digital construction and green innovation R&D efforts of the manufacturer and the supplier are achieved, which eventually encourages the supplier and the manufacturer to make greener intermediate and final products. If consumers are more sensitive to the retail price, or the greenness of the intermediate and final products decays quickly, the manufacturer and the supplier will be much less inclined to engage in green innovation R&D efforts and digital construction and will lose their enthusiasm for making green final and intermediate products.

6. Numerical Simulation and Analysis

For the sake of further evaluating and examining the influence of the three incentive mechanisms on optimal decision making by the manufacturer and the supplier, numerical simulation was used to numerically analyze the four differential game models. Drawing on the research by Gu et al. [62] and Zhu et al. [5], the NEV industry and its power battery supply chain were selected as the application cases for this research. According to the actual cases, pertinent data regarding actual production and operations were obtained through investigation. Then, they were standardized and applied to the model in this study. As a consequence, the benchmark parameters were assigned as follows:, , , , , , , , , , , , , , , , , , , , , , . Through numerical simulation of the model’s optimal decisions under different scenarios, the benefits and drawbacks of each incentive mechanism were examined and contrasted.

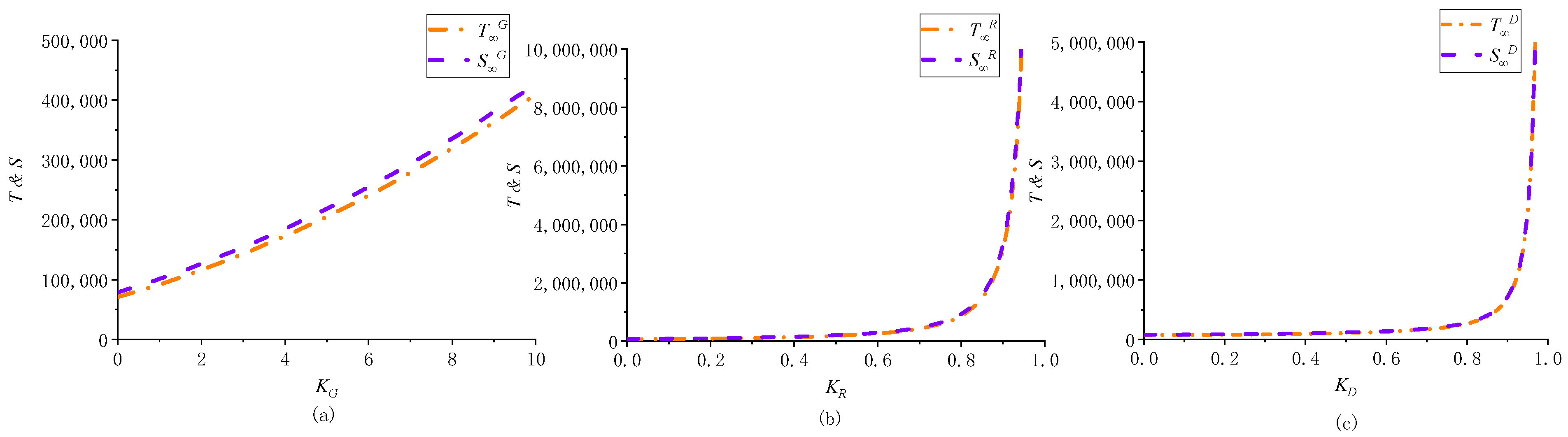

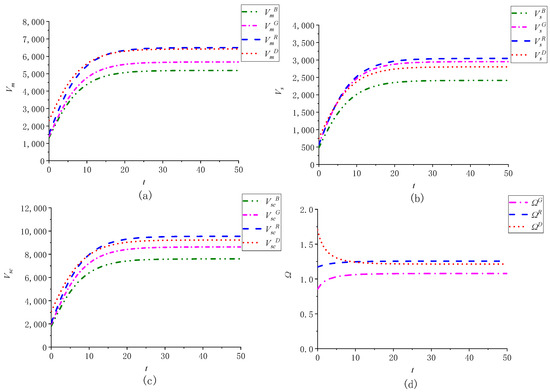

6.1. Evolution Trajectory of Economic Benefits, Environmental Benefits and Social Welfare

6.1.1. Evolution Trajectory of Economic Benefits

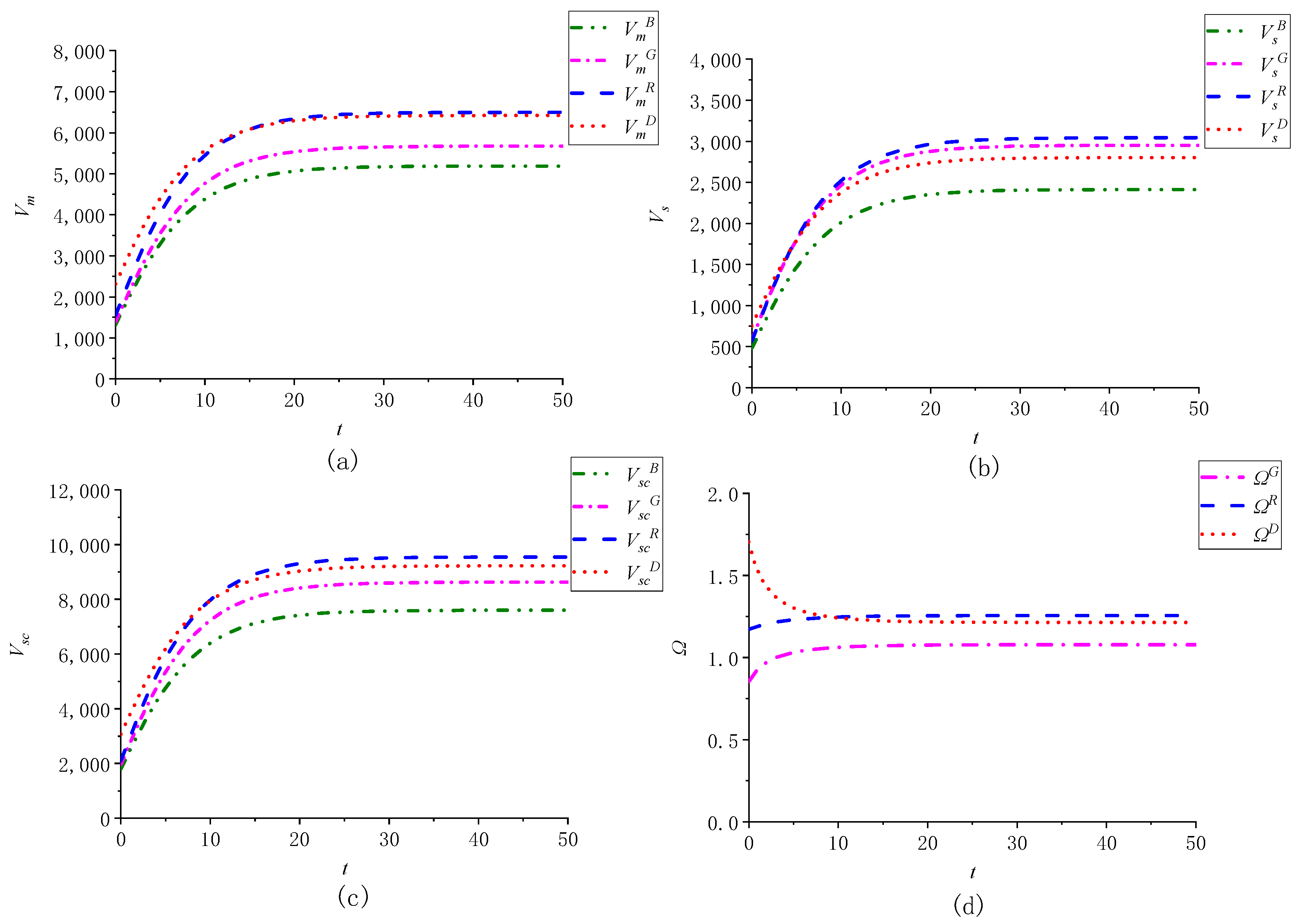

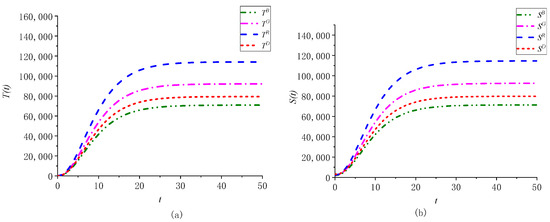

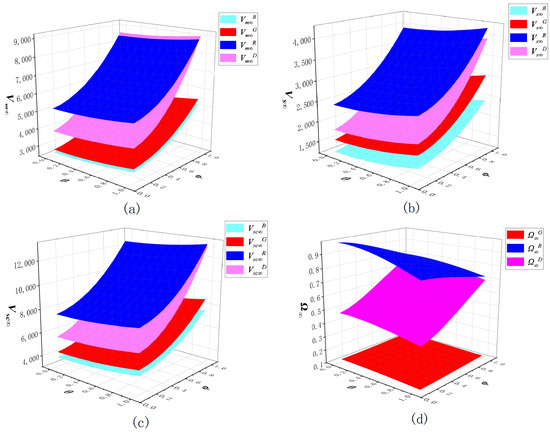

As can be seen in Figure 2, the profits of the manufacturer, the supplier, and the whole supply chain all increase over time in the four scenarios, eventually reaching a stable value (maximum). The mechanisms of the greenness reward, the R&D effort reward and the digital construction reward all result in higher profits for the manufacturer and the supplier than in the non-incentive scenario, indicating that the three incentive mechanisms are beneficial to the manufacturer and the supplier; they all had incentive effects, which further verified Propositions 11 and 12. Under this numerical simulation, the comparative analysis of the three incentive mechanisms revealed that the benefits to the manufacturer and the supplier were the greatest under the digital construction reward mechanism in the initial stage, and its influence degree was far more than and . As time passed, the profits of the manufacturer and the supplier under the R&D effort reward mechanism grew rapidly, and finally and reached the same level. Nevertheless, the supplier’s stable profits under Mode R were greater than those under the other two incentive mechanisms. Hence, the manufacturer and the supplier benefit from the digital construction reward mechanism in the short term and are attracted to the R&D effort reward mechanism in the long run.

Figure 2.

Evolution trajectory of economic benefits in the four models. (a) Evolution trajectory of the manufacturer’s profit in the four models. (b) Evolution trajectory of the supplier’s profit in the four models. (c) Evolution trajectory of the whole supply chain’s profit in the four models. (d) Evolution trajectory of the influence degree of the incentive mechanism in Model G, R and D.

6.1.2. Evolution Trajectory of Environmental Benefits

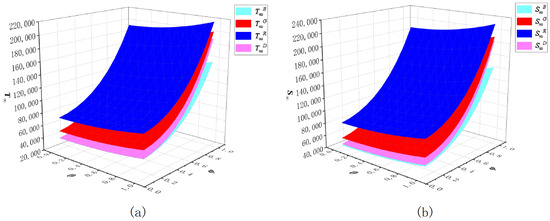

Figure 3a illustrates that the GSC’s environmental benefits in the four scenarios grew over time and finally reached a steady-state value (maximum). Moreover, the environmental benefits under the three incentive mechanisms were greater than those without incentives; , indicating that the three reward mechanisms were friendly to the environment. The added value of environmental benefits under the R&D effort reward was the largest, while that under the digital construction reward was the least. Therefore, the incentive mechanism of R&D effort reward was the most environmentally friendly, which supports Proposition 10.

Figure 3.

Evolution trajectory of environmental benefits and social welfare in the four models. (a) Evolution trajectory of environmental benefits in the four models. (b) Evolution trajectory of social welfare in the four models.

6.1.3. Evolution Trajectory of Social Welfare

Figure 3b shows that the social benefits generated by the GSC in the four scenarios gradually increased over time and finally reach their steady-state values (maximum). Comparing the four models, social welfare under the three incentive mechanisms was greater than that in the non-incentive scenario; , indicating that the three incentive mechanisms all improved the GSC’s social welfare. Furthermore, the R&D effort reward mechanism was associated with the largest enhancement of social welfare, while the digital construction reward mechanism achieved the least improvement. Thus, when considering social welfare, the R&D effort reward mechanism was the most advantageous to the GSC, further confirming Proposition 10.

6.2. Sensitivity Analysis of the Reward Coefficient

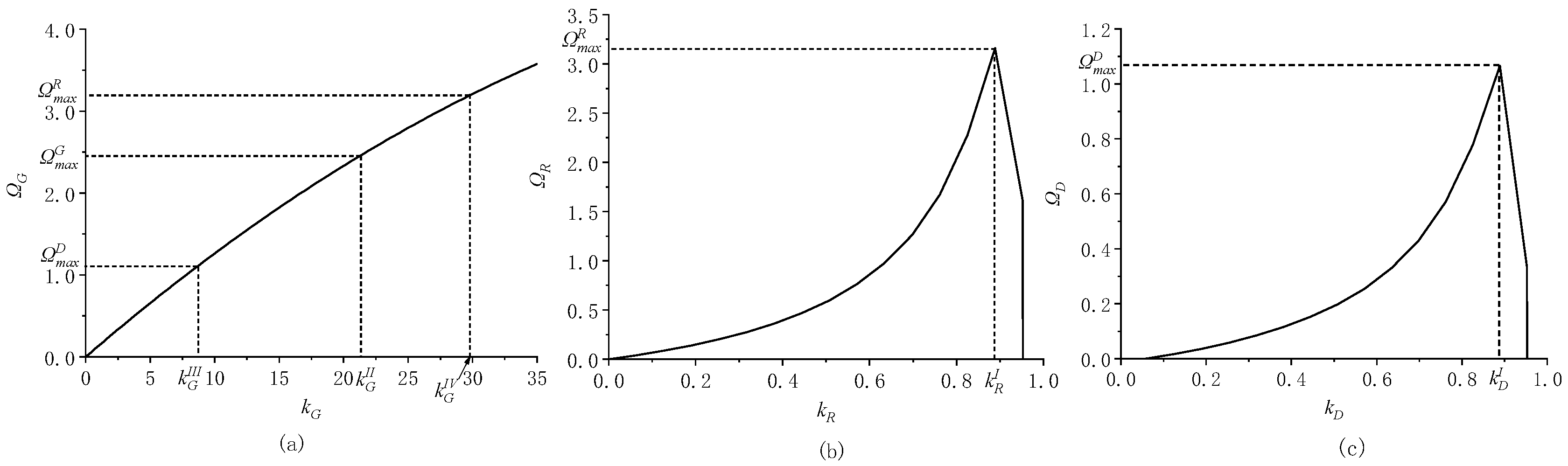

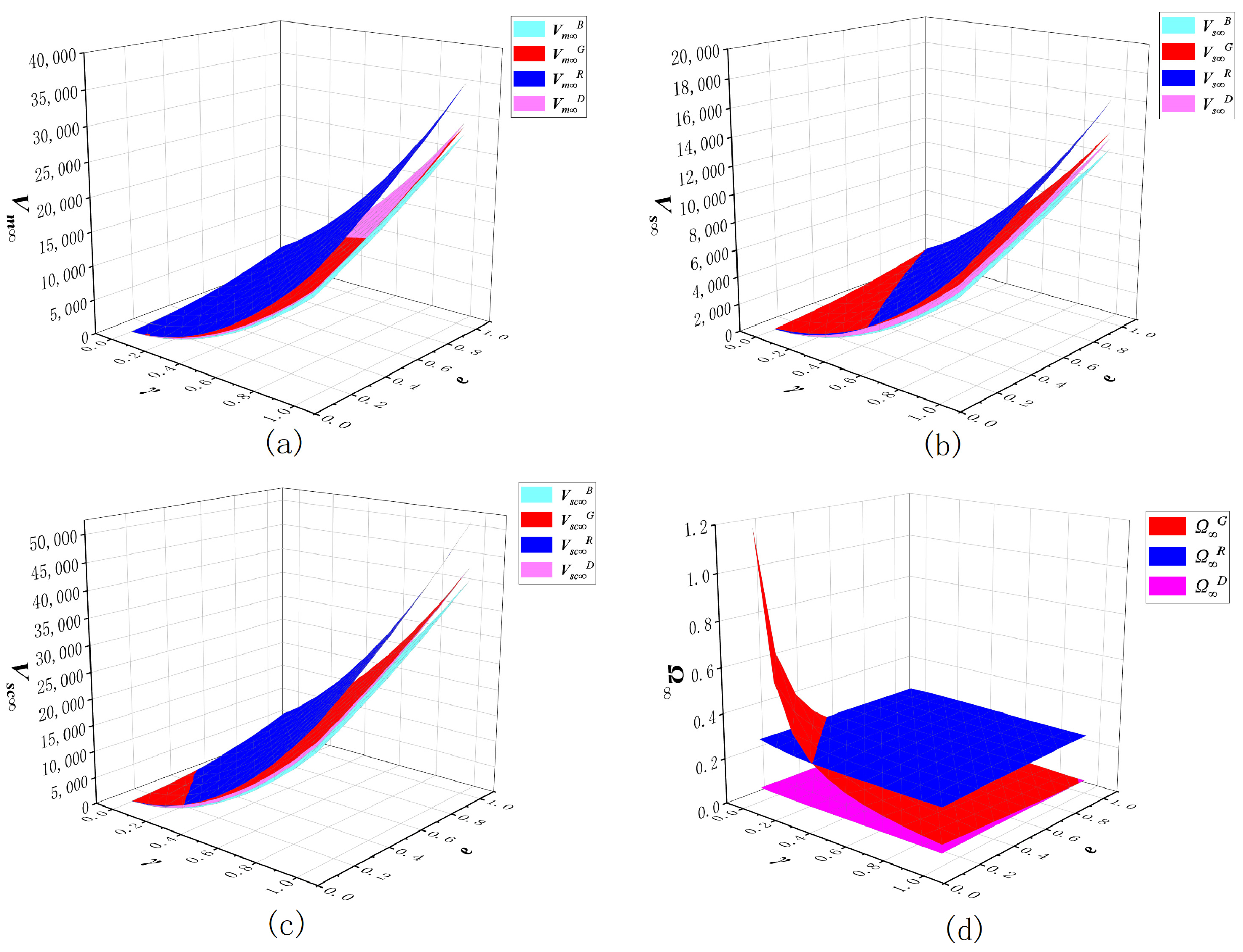

To provide a clearer understanding of the impacts of the three incentive mechanisms, this section discusses the impacts of the greenness reward coefficient , the R&D effort reward coefficient , and the digital construction reward coefficient on the economic benefits, environmental benefits, and social welfare of the GSC. It is evident from Section 3.4 that , , and are all positive and and are both less than 1. Since the manufacturer is a rational economic agent, as shown by Section 3.3, the manufacturer’s profit cannot be negative, otherwise the incentive contract will not be fulfilled. According to the model constructed in Section 4.2 and the assignment of each parameter, we calculated that . As a result, we can obtain , and . Since each indicator varies dynamically over time, this section addresses the influence of the reward coefficient on the steady-state value of each indicator from a long-term perspective.

6.2.1. The Impact of the Reward Coefficient on Economic Benefits

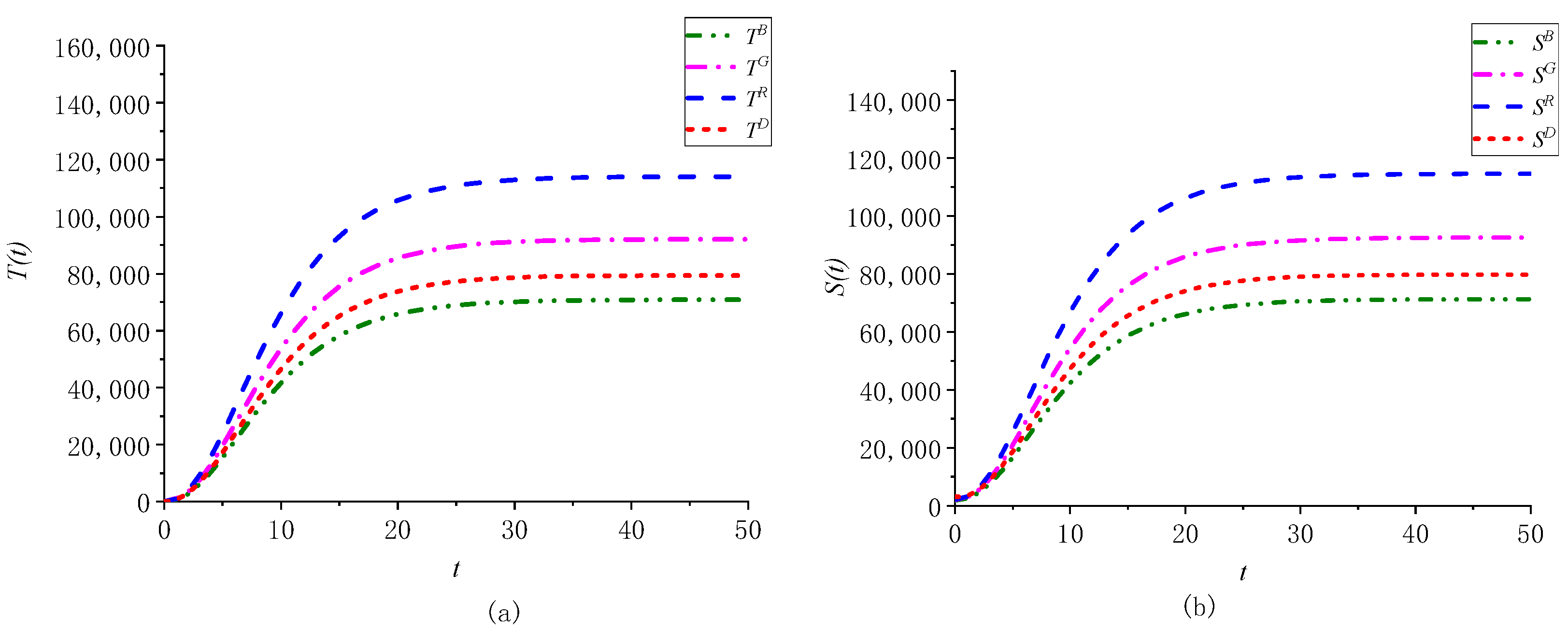

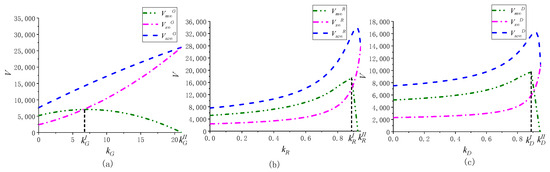

Figure 4 shows the impacts of the greenness reward coefficient , the R&D effort reward coefficient , and the digital construction reward coefficient on the stable profits of the manufacturer, the supplier, and the overall GSC. As can be seen from Figure 4a, when the greenness reward coefficient , the stable profits of the manufacturer, the supplier, and the overall GSC gradually increased with the rise in . However, the manufacturer’s stable profit increased slowly, while those of the supplier and overall supply chain increased rapidly. When increased to , the manufacturer’s profit was equal to the supplier’s; thereafter, the supplier’s profit continued to grow and was greater than the manufacturer’s, while the manufacturer’s profit tended to decline until increased to , the manufacturer’s profit dropped to zero. Figure 4b indicates that the supplier’s stable profit increased gradually with the rise of the R&D effort reward coefficient , while the stable profits of the manufacturer and the overall GSC increased first and then decreased sharply. In other words, when increased to , the stable profits of the manufacturer and the overall GSC reached their maximum, and when increased to , the manufacturer’s profit was nil. Figure 4c demonstrates that with the increase in the digital construction reward coefficient , the supplier’s stable profit gradually increased, but the stable profits of the manufacturer and the overall GSC increased first and then decreased sharply. That is to say, when increased to , the stable profits of the manufacturer and the overall GSC reached their maximum, and when increased to , the manufacturer’s profit was nil.

Figure 4.

The impacts of , , and on the stable profits of the manufacturer, the supplier, and the overall GSC. (a) The impacts of on the stable profits of the manufacturer, the supplier, and the overall GSC. (b) The impacts of on the stable profits of the manufacturer, the supplier, and the overall GSC. (c) The impacts of on the stable profits of the manufacturer, the supplier, and the overall GSC.

Figure 5 shows the effects of the greenness reward coefficient , the R&D effort reward coefficient , and the digital construction reward coefficient on the influence degree of the incentive mechanism. It can be seen from the figure that the generated by the greenness reward mechanism increased with the greenness reward coefficient , indicating that the greenness reward mechanism was effective. With the increase in the R&D effort reward coefficient , first increased and then decreased. When , reached the maximum , the overall GSC profit increased three-fold compared with that in the non-incentive scenario. The varying trend of was the same as that of , that is, first increased and then decreased with the increase in . When , reached the maximum . Since , this indicates that the maximum incentive effect of the R&D effort reward mechanism was greater than that of the digital construction reward mechanism, which suggests that the R&D effort reward mechanism was slightly superior. In order to further compare the incentive effects of Model G, Model R, and Model D, the range of was expanded, and it was found that when , could be greater than , and when , could be greater than . As can be seen from Figure 4, will not exceed . Therefore,, which indicates that the R&D effort reward mechanism can have the strongest incentive effect. When , , and the incentive effect of the greenness reward mechanism is better than that of the digital construction reward mechanism.

Figure 5.

The impacts of , , and on the influence degree of the incentive mechanism. (a) The impacts of on the influence degree of the incentive mechanism. (b) The impacts of on the influence degree of the incentive mechanism. (c) The impacts of on the influence degree of the incentive mechanism.

6.2.2. The Impact of the Reward Coefficient on Environmental Benefits

The impacts of the greenness reward coefficient , the R&D effort reward coefficient , and the digital construction reward coefficient on the environmental benefits of the GSC are shown in Figure 6. It can be seen from the figure that , and all had positive impacts on environmental benefits; that is, with the rise of , , and , the steady-state value of environmental benefits , , and all increased. The difference is that the growth rate of was relatively stable under the effect of , while and grew slowly at the beginning and gradually accelerated when and were greater than 0.7. When and were closer to 1, and became larger and grew faster.

Figure 6.

The impacts of , , and on the GSC’s environmental benefits and social welfare. (a) The impacts of on the GSC’s environmental benefits and social welfare. (b) The impacts of on the GSC’s environmental benefits and social welfare. (c) The impacts of on the GSC’s environmental benefits and social welfare.

6.2.3. The Impact of the Reward Coefficient on Social Welfare

Figure 6 indicates that the greenness reward coefficient , the R&D effort reward coefficient , and the digital construction reward coefficient all had positive impacts on the social welfare, that is, with the increase of , and , the steady-state value of social welfare , , and grew gradually and followed a similar growth trend to that of environmental benefits. That is, the growth rate of was relatively stable, while the growth rates of and varied from slow to fast and peaked when and were infinitely close to 1.

6.3. Sensitivity Analysis of the Effective Coefficient of Digital Construction Promoting Green Innovation

According to Section 3, we know that the effective coefficients of digital construction promoting product green innovation by the manufacturer and the supplier represent the proportion of digital construction converted effectively into product greenness. They describe the rate at which digital construction contributes to green innovation. As a result, the ranges of and are (0,1). Thus, this section discusses the impact of and on the economic benefits, environmental benefits, and social welfare of GSC under the three incentive mechanisms.

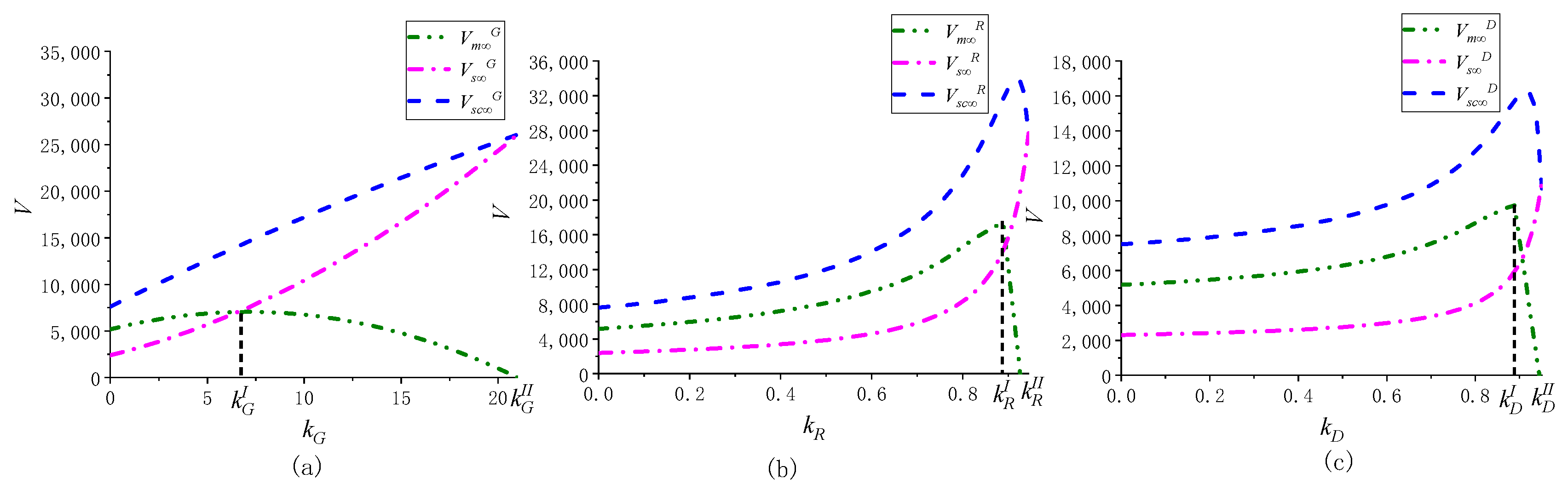

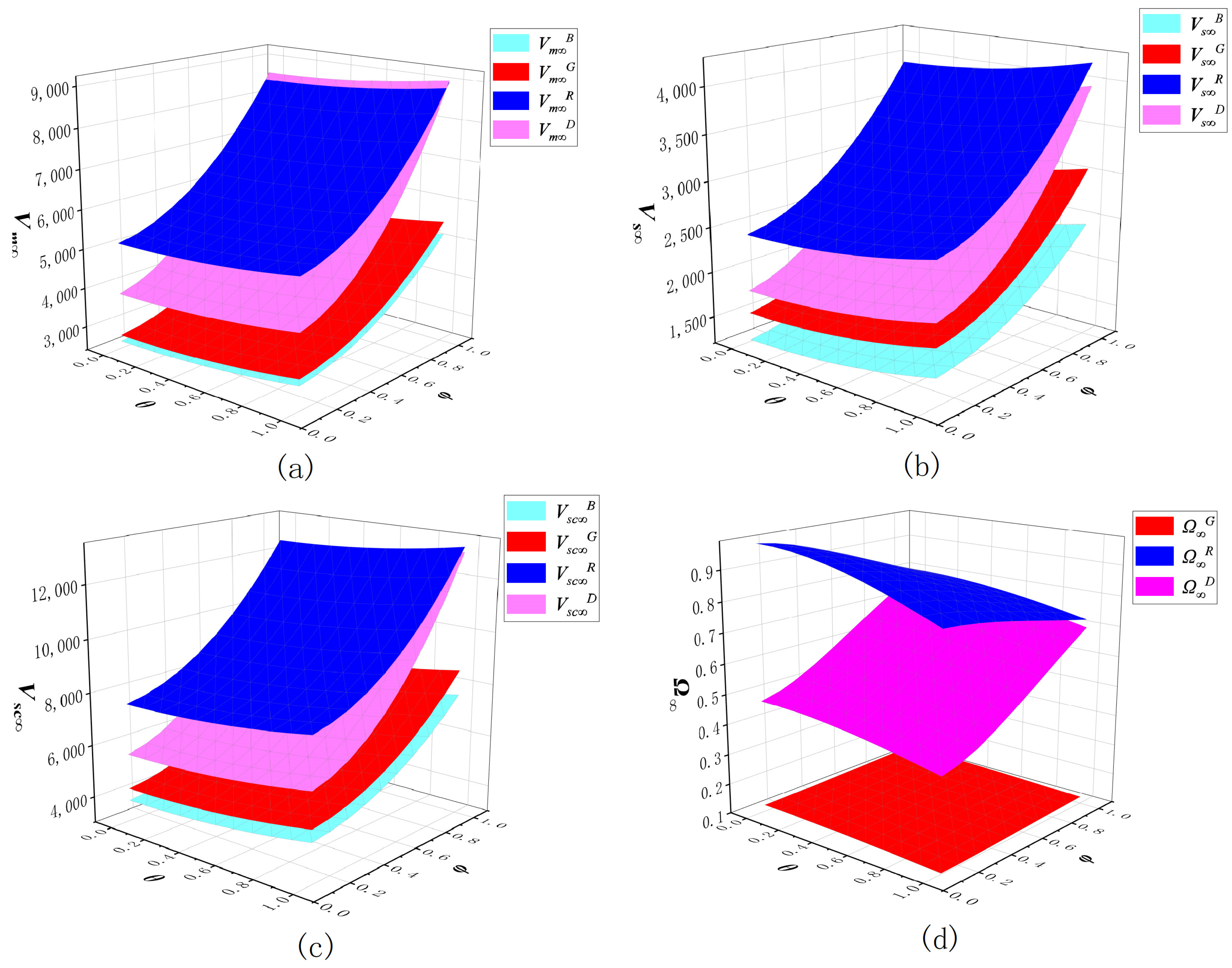

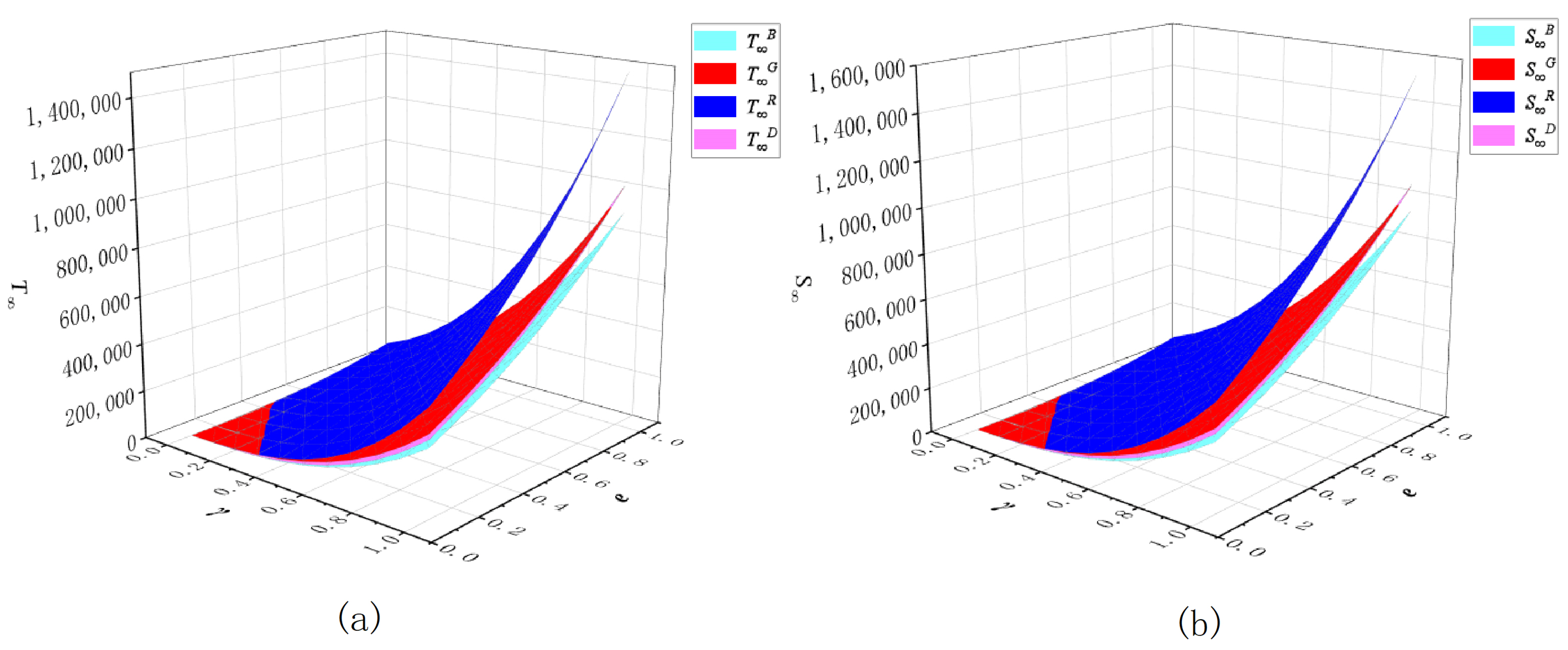

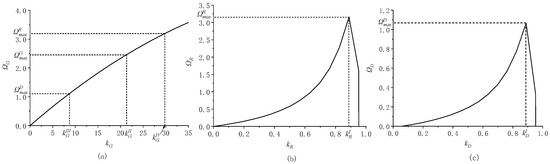

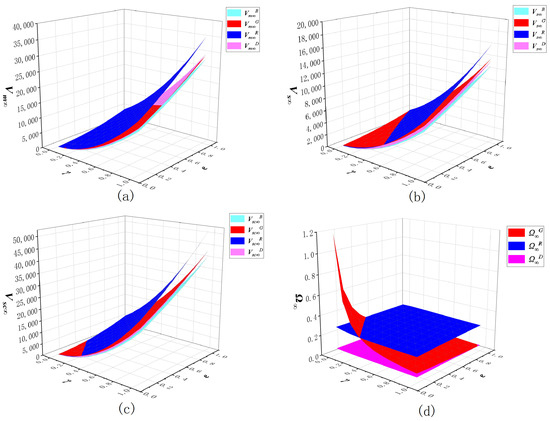

6.3.1. The Impact of the Effective Coefficient of Digital Construction Promoting Green Innovation on Economic Benefits

The impacts of digital construction promoting product green innovation and on the GSC’s economic benefits under different scenarios are shown in Figure 7. The profits of the manufacturer, the supplier, and the whole GSC increase with the increase in and in the four scenarios, indicating that the stronger the promotion effect of digital construction on green innovation, the greater the economic benefits of the GSC. Thus, the manufacturer and the supplier should strengthen digital construction, particularly in areas like green innovation. Specifically, the impact of on the economic benefits is weak, while the impact of on profits is obvious, especially under the digital construction reward mechanism. With the increase of , the growth rate of the profits of the manufacturer, the supplier and the whole GSC gradually accelerates in Model D, bringing their profits closer to those under the R&D effort reward mechanism. This suggests that the stronger the promotion effect of the supplier’s digital construction on green innovation, the more evident is the incentive effect of the digital construction reward mechanism.

Figure 7.

The impacts of and on the GSC’s economic benefits in the four models. (a) The impacts of and on the manufacturer’s profit in the four models. (b) The impacts of and on the supplier’s profit in the four models. (c) The impacts of and on the whole GSC’s profit in the four models. (d) The impacts of and on the influence degree of the incentive mechanism in Model G, R and D.

Figure 7d shows that the incentive effect of the greenness reward mechanism was weaker under this numerical simulation, whereas the R&D effort reward mechanism and the digital construction reward mechanism exhibited stronger incentives. Moreover, the effective coefficients of digital construction promoting product green innovation and had a minor impact on , but a substantial influence on and . With the growth of , steadily dropped and continuously rose. Nonetheless, the minimum remained greater than the maximum . As a result, the R&D effort reward mechanism was found to be the most effective incentive to improve the GSC’s economic benefits, regardless of how the and altered.

6.3.2. The Impact of the Effective Coefficient of Digital Construction Promoting Green Innovation on Environmental Benefits

The impacts of the effective coefficient of digital construction promoting product green innovation and on environmental benefits in different scenarios are shown in Figure 8a. It is evident that the environmental benefits in the four scenarios increased as and grew, indicating that the stronger the promotion effect of digital construction on green innovation, the greater the environmental benefits of the GSC. Consequently, the manufacturer and the supplier should strengthen digital construction to boost the GSC’s environmental benefits. In particular, had a more evident effect on environmental benefits than . Thus, it is necessary for the supplier to enhance their environmental performance by leveraging digitalization to further green product innovation. Comparing the four scenarios, it was found that still held no matter how and changed within this numerical simulation.

Figure 8.

The impacts of and on the GSC’s environmental benefits and social welfare in the four models. (a) The impacts of and on environmental benefits in the four models. (b) The impacts of and on social welfare in the four models.

6.3.3. The Impact of the Effective Coefficient of Digital Construction Promoting Green Innovation on Social Welfare

The impacts of and on social welfare in the different scenarios are shown in Figure 8b. It can be seen that the social welfare in the four scenarios increased as and rose, indicating that the stronger the promotion effect of digital construction on green innovation, the greater the social welfare of the GSC. Specifically, the effect of on social welfare was weaker, while the effect of was more pronounced. Therefore, it is necessary for the supplier to strive to strengthen the position of digital construction in encouraging green product innovation to improve social welfare. Comparing the four scenarios, it was discovered that remained true regardless of the changes in and under this numerical simulation.

6.4. Sensitivity Analysis of Consumer Green Preference

According to Section 3, consumers’ preference for the greenness of intermediate and final products indicates the probability that consumers will purchase green products. It also characterizes the level of consumers’ environmental awareness. As a result, the ranges of and are (0, 1). Therefore, the impacts of and on the economic benefits, environmental benefits, and social welfare of the GSC under the three incentive mechanisms are discussed in this section.

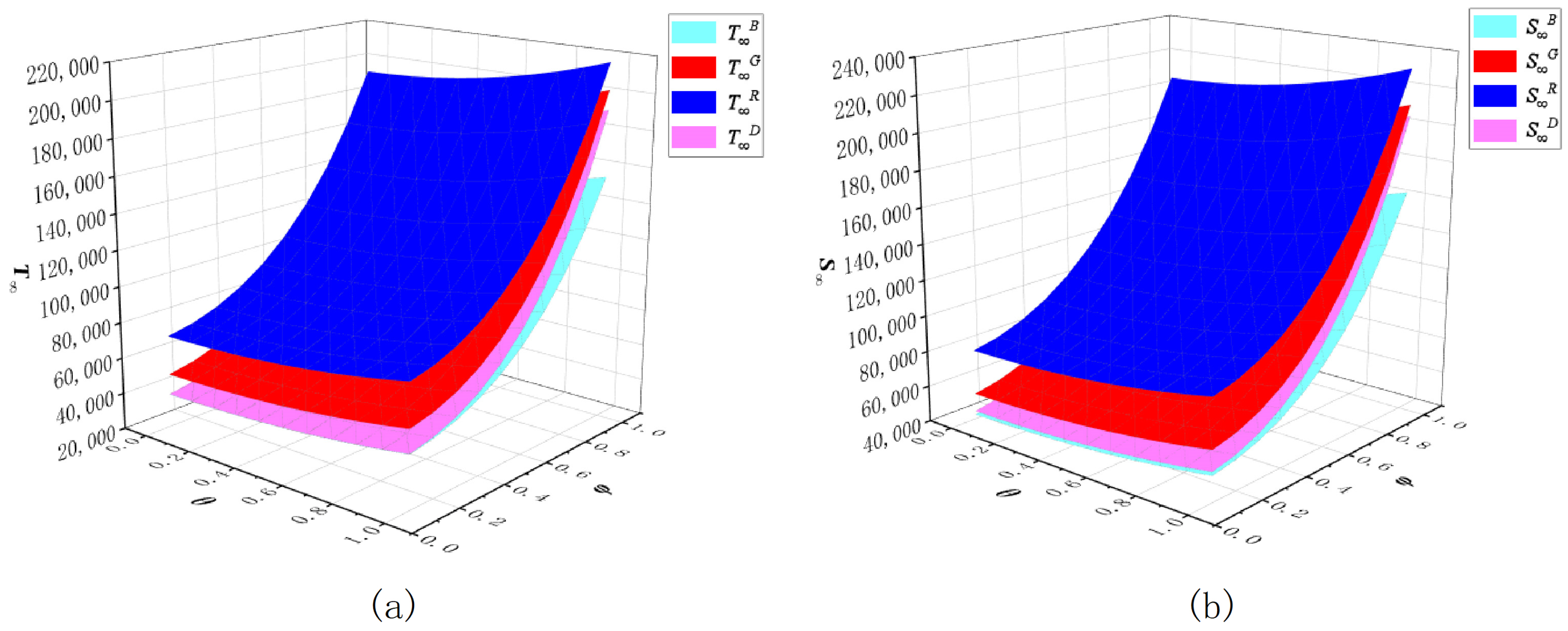

6.4.1. The Impacts of Consumer Green Preference on Economic Benefits

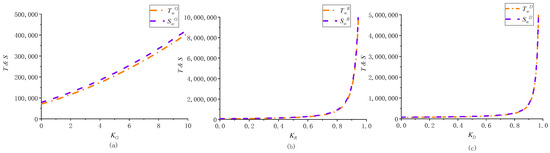

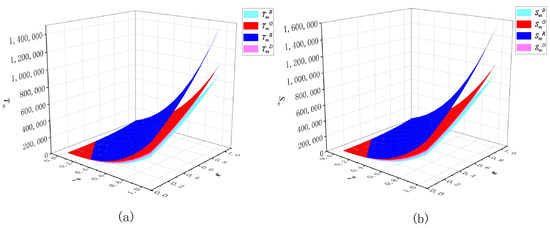

The influences of consumers’ preference for the greenness of intermediate and final products and on the GSC’s economic benefits in different scenarios are shown in Figure 9. It was observed that the profits of the manufacturer, the supplier and the whole supply chain increased as and increased in the four scenarios, indicating that the stronger the consumer’s preference for greenness, the greater the economic benefits to the GSC.

Figure 9.

The impacts of and on the GSC’s economic benefits in the four models. (a) The impacts of and on the manufacturer’s profit in the four models. (b) The impacts of and on the supplier’s profit in the four models. (c) The impacts of and on the whole GSC’s profit in the four models. (d) The impacts of and on the influence degree of the incentive mechanism in Model G, R and D.

As can be seen from Figure 9d, under this numerical simulation, as and increased, the degree of influence of the R&D effort reward and the digital construction reward, i.e., and , remained relatively stable and basically did not change, while the degree of influence of the greenness reward gradually decreased. Thus, when and were small, the greenness reward mechanism provided the strongest incentive, and when and were large, the R&D effort reward mechanism was the optimal choice since the stable profits of the manufacturer, the supplier, and the whole supply chain were at their largest. When consumers’ preference for greenness is low, their desire to buy green products is not very strong, so the greenness of final products can be directly improved via rewarding the supplier according to the greenness of intermediate products. When consumers’ preference for greenness increases, consumers will actively purchase more environmentally friendly items. The manufacturer can encourage the supplier’s green innovation by compensating them for their R&D efforts, which will indirectly raise the final products’ greenness.

6.4.2. The Impacts of Consumer Green Preference on Environmental Benefits

The influence of consumers’ preference for the greenness of intermediate and final products and on the environmental benefits of the GSC in different scenarios is indicated in Figure 10a. It was observed that the environmental benefits of the GSC in the four scenarios increased as and grew, indicating that the stronger the consumer’s preference for greenness, the greater the environmental benefits to the GSC. Comparing the four scenarios, it was evident that the R&D effort reward mechanism was more environmentally friendly when and were large, while the greenness reward mechanism could bring more environmental benefits when and were small.

Figure 10.

The impacts of and on the GSC’s environmental benefits and social welfare in the four models. (a) The impacts of and on environmental benefits in the four models. (b) The impacts of and on social welfare in the four models.

6.4.3. The Impacts of Consumer Green Preference on Social Welfare

The influence of consumers’ preference for the greenness of intermediate and final products and on the social welfare of the GSC in different scenarios is indicated in Figure 10b. In the figure, it is obvious that the trend of social welfare change under the four scenarios is consistent with that of the environmental benefits, that is, the social welfare increases as and grow. This suggests that the strong consumer preference for greenness will result in high social welfare of the GSC; so, raising consumers’ green awareness and improving their preferences will be essential. Comparing the four scenarios, it was found that the green degree reward mechanism was the optimal choice since was able to bring more social benefits when and were small. When the contrary was the case, the R&D effort reward mechanism was the most suitable option.

7. Managerial Implications

This study offers insightful information about how various incentives affect GSC members’ optimal decisions as well as the economic, environmental, and social benefits to the supply chain. We discuss the selection of incentive mechanisms and the management of various enterprises in different situations from the standpoint of the manufacturer and the supplier, based on the research findings.

For the manufacturer, we have the following recommendations. First, the manufacturer still needs to carry out green innovation to improve the greenness of final products in the long run for the purpose of fulfilling corporate social responsibility. Second, the manufacturer should implement incentive mechanisms to motivate the supplier to collaborate on green innovation, although the three incentive contracts have no impact on the manufacturer’s optimal decisions in relation to the green innovation R&D effort level and the digital capability level. The reason is that the three incentive contracts can increase the GSC’s environmental and social benefits while also raising the manufacturer’s revenue in most circumstances (when the reward coefficient is below a certain threshold). Third, as the core enterprise of the supply chain, the manufacturer has a good reputation and social status, so he should take on the duty of enhancing consumers’ environmental awareness. The manufacturer needs to increase the green publicity of products, stimulate consumer interest in purchasing eco-friendly goods, and improve the performance of the incentive mechanism. At this stage, paying more attention to green innovation R&D efforts will yield superior outcomes. In addition, the manufacturer should choose the optimal incentive contract according to the different stages of supply chain members’ cooperation to achieve the best incentive effect. Specifically, there is a lack of smooth communication and information transmission between the two players in the early stages of cooperation. At this point, the manufacturer should choose to implement the digital construction incentive mechanism, which can increase their earnings by facilitating the real-time transmission and sharing of information within the GSC. When the cooperation has reached stability, more efforts should be focused on green innovation R&D. The implementation of the R&D effort reward mechanism can achieve collaborative innovation.

The supplier should constantly adjust their tactics as a follower in accordance with the manufacturer’s decision. Whichever incentive mechanism the manufacturer chooses to carry out can improve the supplier’s green innovation R&D effort level, digital capability level, and profits. Thus, the supplier prefers incentive contracts and will actively cooperate with the manufacturer to take action. Secondly, the supplier should pay more attention to increasing the effective conversion rate of digital construction to product greenness to boost their own profits as well as environmental performance and social welfare when engaging in digital construction. At this stage, the digital construction reward mechanism has a greater motivating effect. Additionally, the supplier ought to aggressively increase investment in green innovation R&D, paying especial attention to the effective transformation outcomes of R&D investment in product green innovation, which can help the GSC’s collaborative innovation achieve better performance.

8. Conclusions and Future Research Directions

8.1. Conclusions

This study constructed a two-echelon GSC consisting of upstream suppliers and downstream manufacturers, who are responsible for green innovation of intermediate and final products respectively. To characterize the dynamic change of product greenness over time, this research used a differential equation to describe the greenness variations in intermediate and final products and the green innovation efforts and digital capability level of GSC members. in the research model, the manufacturer implemented three incentive mechanisms for the supplier to improve the greenness of final products. They were the greenness reward mechanism, the R&D effort reward mechanism, and the digital construction reward mechanism, which were all conducive to fostering collaborative innovation between the supplier and the manufacturer. Through constructing a differential game model, the optimal equilibrium decision making of the manufacturer and the supplier and the evolutionary trajectory of the economic benefits, environmental benefits, and social welfare of the GSC under the four scenarios were dynamically analyzed. The optimal decisions were compared and analyzed from the short-term and long-term perspectives through comparing the three incentive mechanisms with the non-incentive situation to identify the best incentive mechanism. Based on the outcomes of the analysis and numerical simulations, the following conclusions are drawn:

(1) On the whole, the greenness reward mechanism, the R&D effort reward mechanism, and the digital reward mechanism all have a motivational effect on the supplier, which is conducive to green collaborative innovation between the supplier and the manufacturer. In contrast to the non-incentive scenario, the three incentive mechanisms can raise the greenness of intermediate and final products, improve the supplier’s green innovation R&D effort level and digital capability level, boost product sales, and increase the economic benefits, environmental benefits, and social welfare of the GSC.

(2) Throughout its evolution, the R&D effort reward mechanism can bring more environmental benefits and social welfare to the GSC. However, in terms of economic benefits, the digital construction reward mechanism has the strongest incentive effect in the initial stage. Therefore, at this point, it is imperative to aggressively promote both parties’ digital construction and work together to strengthen their respective digital capabilities. In the long run, the R&D effort reward mechanism will bring more profits to the manufacturer, supplier, and the whole supply chain than the other two incentive mechanisms. It is more conducive to improving the economic benefits of the GSC through actively promoting the supplier’s green innovative R&D efforts for intermediate products.

(3) An increase in the incentive coefficient can bring more environmental benefits and social welfare to the GSC under the three incentive mechanisms. However, economic benefits have different laws; no matter what kind of incentive mechanism the manufacturer adopts, its profits will decrease and eventually reach zero if the incentive coefficient is too large. Only when the incentive coefficient is within a certain threshold range can the best incentive effect be achieved. Out of the three incentive mechanisms, the R&D effort reward mechanism has a better incentive effect than the other two.

(4) In this study, the stronger the promotion of the digital capability to green innovation, the greater were the economic benefits, environmental benefits, and social welfare of the GSC under the four scenarios. Among them, the value conversion rate of the digital capability to green innovation of the supplier had a stronger impact on the economic benefits of the GSC. Consequently, it is imperative for the manufacturer and the supplier to strengthen their digital construction, which particularly fosters green innovation and enhances the value conversion rate of digital capabilities.

(5) According to the current study results, the economic benefits, environmental benefits, and social welfare of the GSC increased with the strength of the consumer’s preference for greenness under the four scenarios. As a result, the manufacturer and the supplier should increase publicity of the greenness of intermediate and final products, raise consumers’ green awareness, and improve their green preference. When consumers’ preference for greenness is low, the incentive effect of the greenness reward mechanism is optimal. When consumers’ preference for greenness is high, the R&D effort reward mechanism is the best option for the manufacturer.

8.2. Limitations and Future Directions

There are several promising directions in this research that should be examined and investigated more in the future. This study solely examines certain market demand. However, given the impact of numerous uncontrollable factors, the market demand may be ambiguous. In light of this, future research may explore the green collaborative innovation incentive mechanism between manufacturers and suppliers in the context of uncertain demand. In addition, due to the high-risk nature of green innovation and the fact that different supply chain participants have varying attitudes towards risk, it can be argued in future research that manufacturers and suppliers have a risk appetite (risk-averse or risk-averse). Additionally, we consider the manufacturer as the chain’s leader in this study. Further research under different power structures is necessary to see whether the findings of this work are relevant when the supply chain’s power structure varies.

Author Contributions

Conceptualization, W.C. and Q.L.; Methodology, W.C.; Software, F.Y.; Validation, W.C., Q.L. and L.T.; Formal Analysis, Q.W.; Investigation, L.T.; Resources, Q.W.; Data Curation, F.Y.; Writing—Original Draft Preparation, W.C.; Writing—Review and Editing, Q.L.; Visualization, F.Y.; Supervision, Q.W.; Project Administration, W.C.; Funding Acquisition, W.C., Q.L. and L.T. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the National Social Science Foundation of China (Grant No. 22XTQ008), Zhejiang Provincial Education Science Planning Project (Grant No. 2023SCG308), Visiting Scholars Program of China (Grant No. FX2023085), Shaanxi Innovation Ability Support Plan (Grant No. 2024ZC-YBXM-069) and Shaanxi Province Social Science Fund Project (Grant No. 2023R041).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

We have shared all research data in the paper.

Acknowledgments

We are thankful to the editor and anonymous reviewers for valuable comments and suggestions on an earlier draft of this paper.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A. Notation and Description

| Notation | Description |

| Parameters | |

| Unit production cost of intermediate products under digital construction | |

| Unit production cost of final products under digital construction | |

| Market potential | |

| Consumers’ sensitivity to the retail price of final products | |

| Consumers’ preference for the greenness of final products | |

| Consumers’ preference for the greenness of intermediate products | |

| The effective coefficient of green innovation R&D efforts by the manufacturer | |

| The effective coefficient of digital construction promoting product green innovation by the manufacturer | |

| The effective coefficient of green innovation R&D efforts by the supplier | |

| The effective coefficient of digital construction promoting product green innovation by the supplier | |

| Influence coefficient of the greenness of intermediate products on the greenness of final products | |

| The decay factor of the greenness of final products | |

| Decay factor of greenness of intermediate products | |

| Cost coefficient of the manufacturer’s digital construction | |

| Cost coefficient of the manufacturer’s green innovation R&D | |

| Cost coefficient of the supplier’s green innovation R&D | |

| Cost coefficient of the supplier’s digital construction | |

| Discount factor | |

| Reward coefficient of the manufacturer for the greenness of intermediate products () | |

| Reward coefficient of the manufacturer to the supplier for green R&D efforts of intermediate products () | |

| Reward coefficient of the manufacturer to the supplier for ) | |

| Decision variables | |

| Retail price of final products at time | |

| Selling price of intermediate products at time | |

| Green innovation R&D effort level of the manufacturer for final products at time | |

| Green innovation R&D effort level of the supplier for intermediate products at time | |