1. Introduction

Improving wine traceability is essential for combating counterfeit products in wine supply chains (WSC) and meeting the expectations of consumers who are increasingly concerned about the origin and quality of the wines. Foremost, combating counterfeit wine products is one of the long-standing issues in managing WSCs and has a significant negative impact on consumers and wine producers. Fraudulent wine constitutes approximately 20% of the entire wine market in the past five years [

1]. From December 2021 to May 2022, the European Anti-Fraud Office seized nearly 14.8 million litres of illicit wine across Europe [

2]. In addition, Recorded Future tracked more than 93 million bottles of counterfeit wine between January 2020 and June 2022 [

3]. Counterfeiters often replicate the appearance and packaging of well-known wine brands, using low-quality ingredients or substandard production methods to create bottles that appear authentic. For instance, in 2022, a major Italian wine producer was accused of blending low-quality wine with premium varieties and selling it under prestigious labels [

4]. In 2021, a posh wine retailer in New York was fined

$100K for fake bourbon sales [

5]. The vulnerability to counterfeiting has become one of the distinctive features of the WSC. First, the rarity and high value of some fine wines make them an attractive target for counterfeiters looking to make a quick profit. Second, the complex supply chain involved in the production and distribution of wines makes it difficult to identify all the actors involved in the fraud. Moreover, distinguishing itself from other luxury goods, wine is difficult to detect as fake even for experienced connoisseurs, as the taste and aroma of a particular vintage can vary depending on a variety of factors such as storage conditions and ageing. Meanwhile, the value of bottled wine products is greatly reduced after being opened and tested.

Meanwhile, consumers’ preference for the traceability and authenticity of wine products is also becoming increasingly important [

6,

7,

8]. Several factors drive consumers’ preference for traceability, including concerns about product safety, environmental sustainability, ethical production practices, etc. Consumers want to know where the wine comes from, how it was produced, and whether it was produced in an environmentally friendly way. They also want to know whether the wine was produced using ethical labour practices and whether the workers involved in the production process were treated fairly.

Many efforts have been made to improve the traceability of the WSC. For example, the wine producer, Paumanok Vineyards (New York, USA), used genotyping and DNA marking of the wine and packaging to ensure product traceability. Comtes von Neipperg, a vineyard in France, applied a translucent polymer seal or stick-on label with a unique configuration of bubbles for wine authentication and anti-counterfeiting [

9]. Unfortunately, those traceability efforts are unable to eliminate wine counterfeiting and cannot gain consumers’ full trust in traceable information about the wine products. Meanwhile, the emergence of blockchain technology has brought a tremendous improvement in traceability due to its unique ability to provide robust anti-counterfeiting and traceability measures [

10,

11,

12]. The blockchain-based tracing system (BTS) provides an immutable ledger that allows for secure and transparent tracking of wines from farm to table. This ensures that all stakeholders in the wine industry, from manufacturers to consumers, can have confidence in the authenticity and quality of the product. With blockchain-based traceability, any issues or concerns can be easily identified and addressed, which leads many technology giants to invest in BTS and provide blockchain-as-a-service (BaaS) for the WSC, like Alibaba and IBM (detailed in

Table 1). The global BaaS market size stood at USD 1.90 billion in 2019 and is projected to reach USD 24.94 billion by 2027 [

13]. Additionally, few top leading wine manufacturers like Moutai (China), Diageo (UK) or retailers like Walmart (U.S.), JD (China) have opted to build their own BTS.

However, the adoption of blockchain in WSCs has faced several obstacles. One of the biggest hurdles is the cost of purchasing BaaS solutions or implementing a BTS by WSC members. The pricing of different third-party BTS providers is illustrated in

Table 1. The price may not seem much at first glance, but it can add up quickly over time and across multiple nodes in WSCs. Plus, implementing BTS by WSC members themselves also requires investing in hardware, software, maintenance, and security. The exact cost of implementing a BTS varies depending on the complexity and scale of the system, with an estimate of around USD 40K to USD 300K [

18]. Therefore, both options pose significant financial challenges for WSC members who want to adopt blockchain in the wine industry.

In addition, consumer privacy is another concern for blockchain technologies, which also applies to the WSC. A KPMG report shows 56% of customers distrust companies’ privacy policies [

19]. Even though blockchain is pseudonymous [

20], hackers can link pseudo-identities to real ones and infer 80% of transactions. Ironically, they can reveal all their past purchases whenever they want due to blockchain’s immutability. It can be a more serious issue in WSCs, as the target customers of high-valued fine wines are normally individuals with high social status and wealth [

21] and are therefore sensitive to the leak of personal information. At the same time, as one popular choice of luxury gifts, some consumers want to conceal the wine’s former ownership and regifting history. Obviously, blockchain’s transparency and immutability increase their privacy concerns. Hence, ensuring data security while utilising the benefits of blockchain technology presents a significant challenge in the wine industry.

Motivated by the observations of real-world practices, this study seeks to address the following questions:

What are the optimal wholesale and retail prices and level of traceability effort for the WSC members with blockchain adoption for WSC traceability and authenticity?

How does the adoption of BTS affect the WSC performance? Is it possible that adopting blockchain does more harm than good?

How does the adoption of a third-party’s BTS or self-implementation affect WSC members’ operational decisions and performance?

To address the above research questions, we develop a consumer utility-based analytical model and conduct a Stackelberg game-theoretical analysis. To better understand the value of blockchain to the WSC, we compare the two scenarios with and without blockchain, and derive the condition for adopting blockchain. Our analysis uncovers the value of blockchain in tracing wine products within the WSC and includes extended modelling to discuss the preferable choice of using blockchain technology.

To the best of our knowledge, this paper is one of the pioneering analytical operations management (OM) studies that explore blockchain-based traceability in WSC with the consideration of different ways to adopt BTS (e.g., outsourcing or self-implementation). Compared to studies that discuss the value of blockchain-based traceability in the general supply chain [

22,

23], our research focusses on wine products and emphasises the interaction between the WSC’s unique characteristics (counterfeit vulnerability, privacy concerns, and traceability preference) and blockchain technology, complementing existing research on blockchain-based traceability. Compared to studies that examine the value of blockchain in combating counterfeits [

24,

25,

26,

27], we additionally consider the influence of non-blockchain-based traceability efforts on wine authenticity. This assumption, which is more closely aligned with wine industry practices, enables us to provide practitioners with novel insights into the potential benefits of blockchain-based authenticity. Compared to the limited research that examines various modes of blockchain adoption [

27,

28], our study enriches the topic by providing a comparative analysis between outsourcing BTS and self-implementing BTS by different WSC members. Our findings yield several significant implications that offer guidance to managers on the effective implementation of BTS.

The remainder of this paper is organised as follows.

Section 2 presents the literature review.

Section 3 describes the basic analytical models for the WSC without BTS adoption (Model N) and with third-party BTS adoption (Model B). In

Section 4, the two basic models are compared, and the values of blockchain in WSC are examined.

Section 5 presents an extended analysis of the various approaches to implementing blockchain in WSC, and

Section 6 concludes the study.

3. The Basic Model

As a high-value-added product with a complex production process, the traceability of wine products is an important issue in the wine industry. The more detailed the traceability, like raw material origin, brewing year, storage method, etc., the more the consumers’ expectations in terms of quality, collection value, or eco-production preference can be guaranteed. In addition, as one of the most obvious exogenous benefits of wine traceability, the level of traceability is positively correlated with the ability of consumers to identify the authenticity of wine, which means the more effort manufacturers spend on wine traceability, the higher possibility that customers can distinguish the wine authenticity when the WSC suffers counterfeiting.

Meanwhile, blockchain technology has significantly improved wine traceability in the supply chain. Its decentralised and transparent ledger system guarantees that traceability information cannot be tampered with. This means that the BTS can not only transmit basic production and processing information, but also eliminate wine counterfeiting. The same is true for non-blockchain-based tracing systems; the higher the level of traceability efforts in the BTS, the better the traceability preferences of consumers can be satisfied.

In our study, we consider whether the manufacturer and the retailer decide to use blockchain to enhance traceability in the WSC. Each agent in the WSC makes its own pricing decision. To enhance readability, the definitions of different models and some important variables are described in

Table 3.

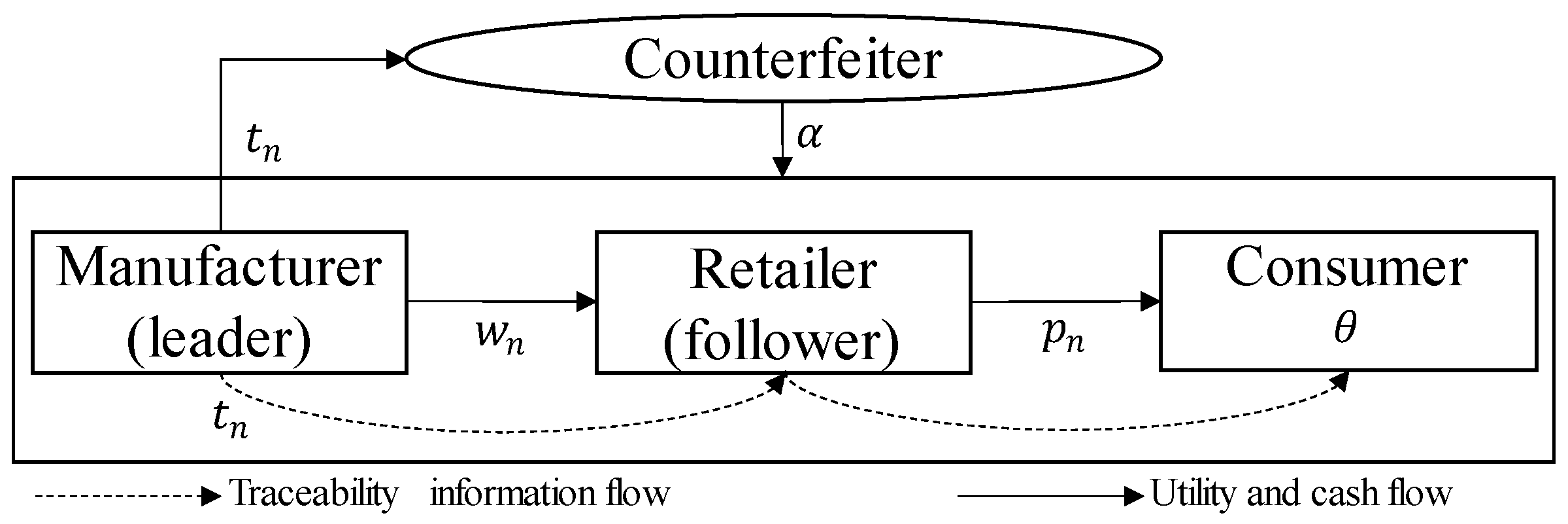

3.1. Model N: Non-Blockchain-Based Tracing Systems

In Model N, we assume the wine traceability-sensitive consumer

has the possibility

to buy fake wine. Following [

26,

27], we investigate the situation where all the supply chain members have a perception that wine counterfeiting might occur. In addition, to describe the manufacturer’s traceability efforts for wine without using blockchain, we denote

as the non-blockchain-based traceability (NBT) effort. Meanwhile, considering the increased NBT efforts can enhance consumers’ ability to distinguish authentic wine. Thus,

indicates the probability that consumers successfully identify the authentic wine, and

represents the probability of failing to identify the counterfeit wine. This assumption is in line with previous studies [

47].

We consider a single consumer market in which consumers have a heterogeneous valuation

of the wine. We assume

follows a distribution

, which is a uniform distribution with a lower bound of 0 and an upper bound of 1. When the consumer decides whether to buy the wine, they will consider factors including (i) the retail price

; (ii) the level of traceability, which we denote by

; and (iii) the level of consumers suffering from counterfeit

, where

and

represent the likelihood of buying counterfeit wine and the failure rate of identifying the fake one, respectively. Noting that consumers choose to buy the wine when the consumers’ utility

. Then, the demand function is given as follows:

The structure of the WSC in Model N is shown in

Figure 1, and the sequence of events is as follows. The manufacturer determines the wholesale price

and NBT effort

as the WSC leader. Then, the retailer determines the retail price

as the follower. To focus on our main research problem and avoid trivial cases, we assume that the manufacturer’s production cost and the retailer’s selling cost are zero [

26,

50,

52]. However, we consider the NBT cost

incurred by the manufacturer in implementing non-blockchain-based measures, which is given by

, where

and represents the NBT cost coefficient [

53,

54,

55,

56]. Intuitively, improving the traceability level indicates more information sharing among WSC members, like stricter wine distribution monitoring, more advanced security measures, etc. Those lead to a non-trivial cost when the desirable NBT level is higher. It is therefore reasonable to apply a quadratic cost structure, which reflects the fact that the marginal NBT cost increases for achieving a higher traceability level.

Thus, the profit functions of the manufacturer (

) and the retailer (

) are given as follows:

Using backward induction, we derive the optimal decisions of the WSC without blockchain. For a given , checking the second-order condition of Equation (3), we find that , which implies that Equation (3) is a concave function. Then, by solving the first-order condition of Equation (3), we derive the optimal retail price for given and . Putting into the demand function Equation (1), we derive the optimal demand for given , i.e., . Then, putting it into Equation (2), we find that is jointly concave in and when , so we derive the analytical closed-form expressions of the equilibrium wholesale price , the traceability effort , and the retail price , where, . Note that it is reasonable to set , which indicates that exerting effort to improve the identifiability of genuine wine is expensive. Hence, we yield the optimal profit of both manufacturer and retailer as follows: , .

Choi [

24] finds that the increase in fake certification leads to a monotonic decrease in market price and supply chain profit. Different from their findings, we find that wine counterfeiting (

) increases WSC prices when

, and the WSC.

Where

profits rise with

when

. This is counterintuitive and depends on the value of the NBT cost coefficient (

. When

is small, it allows wine manufacturers to improve traceability more efficiently, helping consumers better identify genuine wines. The prevalence of counterfeit wine may lead consumers to be more willing to pay a higher price for the increase in NBT levels (i.e., due to distrust of counterfeit wine or the need to show their social status), resulting in increased profits for authentic wines. Moreover, we also find that wine counterfeiting induces traceability improvement when

is lower than a certain threshold, or (

) are low; WSC prices, profits, and NBT effort increase with traceability sensitivity

but decrease with NBT cost coefficient

monotonically. All the sensitivity analyses results of Model N are summarised in

Table 4.

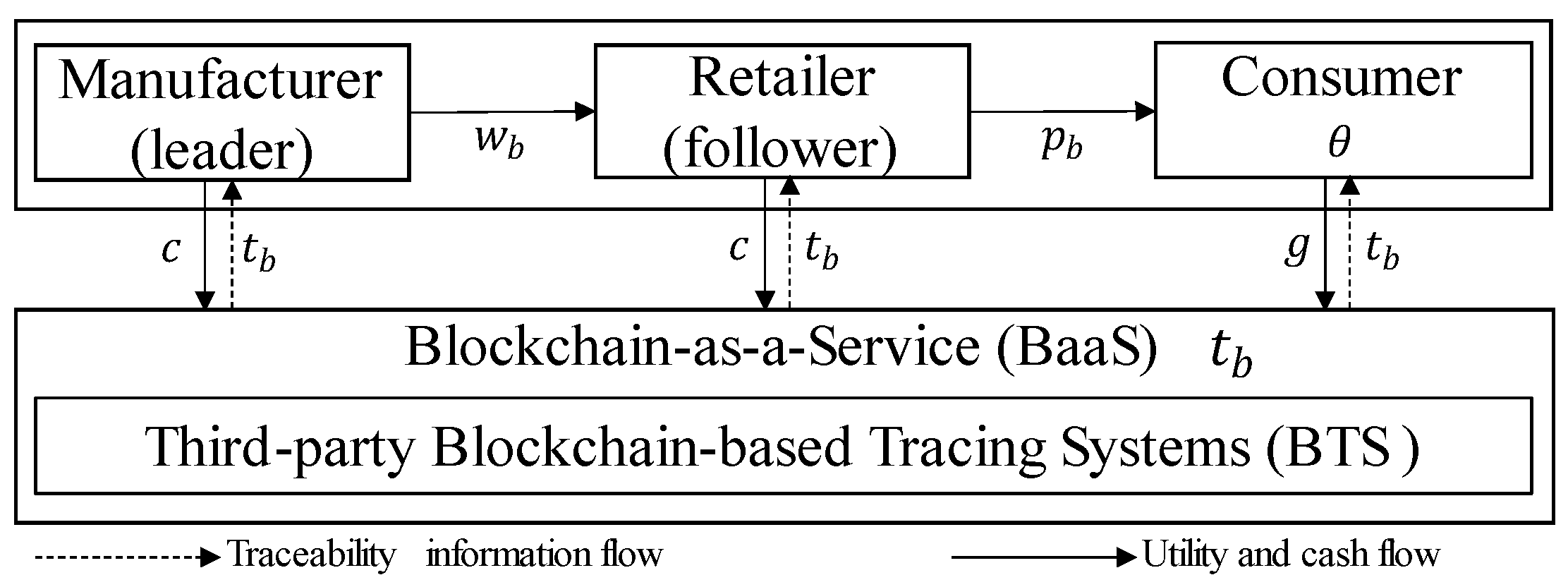

3.2. Model B: Adopting Third-Party BTS

We now consider the case that the WSC members purchase a third-party BTS from a technology company (i.e., IMB, Alibaba) to enhance wine traceability. The structure of the WSC in Model B is shown in

Figure 2.

First, in Model B, technology giants provide third-party BTS as BaaS to WSC, offering a basic blockchain-based traceability (BBT) level

, and charging a unit service fee

to each WSC member.

can be considered a basic level of wine traceability effort in the context of blockchain adoption and is an exogenous variable. The case of endogenous traceability efforts will be discussed in the extended analysis. It should be noted that

due to the real-time visibility and data access provided by the BTS to all WSC participants, facilitating enhanced collaboration and trust compared to non-blockchain-based tracing systems. Second, the BTS ensures that data are stored and verified by multiple nodes in a network, which makes it impossible to tamper with or manipulate, so the possibility of purchasing a counterfeit wine is set to zero [

24]. Third, when consumers buy wine products endorsed by the BTS, there may be concern about their personal information being collected and misused [

57], or exposing unwanted details of the wine’s previous exchanges when regifting it. Following [

26,

50], we denote the dis-utilities associated with the consumer privacy concern as

We summarise the impact of blockchain on model set-ups in

Table 5.

As discussed above, we have the consumers’ utility function

. Following [

28,

48], and the same market assumptions in Model N, the demand for wine at a given price

and BBT effort

is expressed as the following:

We set the constant parameter

as the unit service fee for using third-party BTS, which means the manufacturer and the retailer should respectively pay for using the third-party BTS service [

50]. This is also consistent with industrial practice. For instance, the Microsoft Azure Blockchain Service charges USD 0.10 per transaction unit per hour for their standard version of BaaS services [

58]. Following the same approach in Model N, we present the profit functions of the manufacturer and the retailer below.

Since the proofs of the optimal solutions for Model B are similar to Model N, we omit them and similarly for the extended model. Using backward induction, we derive the optimal decisions under Model B. First, the equilibrium wholesale price and retail price are

, where

; the abbreviation also captures the non-economic effect of adopting third-party BTS. Substituting

and

into Equations (5) and (6), respectively, we derive the optimal profits at the optimal prices under Model B as follows:

. All the sensitivity analyses results of Model B are summarised in

Table 6.

From the derived optimal decisions of the retailer and the manufacturer when blockchain technology is adopted, we find that higher consumer privacy concern yields lower prices and profits for the WSC. Liu et al. [

50] derived similar results but in a different supply chain context. In addition, we extend the conclusions of Fan et al. [

23] to show that a higher level of BBT and consumer traceability sensitivity can also result in higher prices and profits for the WSC. Moreover, we find that an increase in BTS service fees not only increases the retail price but also reduces the profits of the whole WSC. Although this conclusion seems intuitive, it is novel compared to existing blockchain-based OM studies, which find that the optimal wholesale price is independent of BTS service fees [

23,

24,

27,

50,

52]. Meanwhile, it also means that the third-party BTS providers can influence the wine’s retail price. Therefore, compared to outsourcing wine traceability to a third-party BTS, is it wise and beneficial to self-implement BTS and endogenously determine traceability efforts? We will explore this in

Section 5.

4. Value of Blockchain in the WSC

Now, we examine the value of adopting blockchain technologies in combating fake wine. We need to understand when blockchain is beneficial to supply chain members.

4.1. Effects of Using Blockchain on WSC Prices

By comparing the optimal solutions under Model N and Model B (i.e., , ), we derive the following proposition.

Proposition 1. The prices in the WSC with blockchain are higher than those without blockchain if and only if any of the following conditions hold: (i) when ,

; (,

.

Proposition 1 shows the effect of blockchain adoption on the pricing decision of the manufacturer and retailer, noting that parameter is a critical factor, which captures the non-economic effect of adopting third-party BTS. Specifically, if consumers are less concerned about their personal information, or the third-party BTS provides a higher level of traceability effort, then the manufacturer and retailer can increase their prices by using blockchain. The results are reasonable because if most consumers are keen to find ways to buy wine with more traceability information, they could be wine traceability-sensitive rather than price-sensitive. Thus, a higher price is acceptable with blockchain adoption, particularly for luxury wine products. Moreover, if the third-party BTS can provide more reassuring consumer information protection, it will further encourage people to buy blockchain-certified wines. In addition, from Proposition 1, we can see that although the third-party BTS provider charges a unit service fee to each member of the WSC, all the costs in the equilibrium result act on the retail price. Hence, there has an increase in the retail price when .

4.2. Effects of Using Blockchain on WSC Profits

Comparing the optimal expected profits under Model N and Model B (i.e., , ), we derive the following proposition.

Proposition 2. Using blockchain to improve the traceability and authenticity of the WSC has a positive impact on the profits of the manufacturer and retailer, only if any of the following conditions hold: (i) when , we have ; (ii) when , we have .

The most critical factor in determining whether supply chain firms should use blockchain is its cost. Proposition 2 gives the necessary conditions on costs to determine whether the manufacturer and the retailer can benefit from blockchain. When is small enough, using blockchain becomes beneficial to both manufacturer and retailer. Meanwhile, we find that the manufacturer is more likely to benefit from the adoption of blockchain than the retailer, as the manufacturer can reach the conditions for profitable blockchain adoption earlier than the retailer when service fees charged by third-party BTS decline. Additionally, we notice that the non-economic impact of adopting BTS can also influence the decision on blockchain adoption. For example, lowering the upper bound of can further increase the threshold of that makes using blockchain more profitable (i.e., when, we still have ). That means it is necessary to reduce consumer concerns about personal privacy or ensure that the third-party BTS provides a higher level of wine traceability.

Proposition 2 indicates that using blockchain may not be necessary for WSC. For WSC members who have not adopted blockchain, the NBT cost coefficient can also affect the value of and. . Based on Proposition 2, we derive the following corollary.

Corollary 1. When , we have , .

It is clear from Corollary 1 that there exists a threshold for

that abandoning blockchain is more profitable. This highlights the fact that if the NBT level can be efficiently improved, WSC members should not blindly vote for using blockchain. Some studies [

25,

27,

50,

59,

60,

61] have used similar methods to demonstrate the value of blockchain by comparing the equilibrium results of whether the BTS is used or not. Enriching existing research, we show that WSC members who do not adopt blockchain can achieve comparable outcomes by efficiently improving their NBT levels. Additionally, some studies [

22,

46,

60] also analyse the value of blockchain from a cost-benefit perspective. The comparison of the optimal results for models B and N is summarised in

Table 7.

We differ from them by emphasising the cost coefficient of the NBT effort and advocating for judicious consideration of the value of blockchain in wine traceability.

5. Extension: Self-Implementation of the BTS

Now, we examine the scenario in which WSC members self-implement their own BTS. Although some well-known wine manufacturers and retailers like Diageo or JD have already implemented their own BTS, WSC members may have conflicting interests or incentives that hinder their willingness to participate in the self-implementation of BTS due to the high investment and uncertain benefits. In the following analysis, we will discuss the cases where manufacturers and retailers lead the implementation of BTS and explore the optimal strategy for using blockchain (i.e., outsourcing or self-implementation). In the WSC, we assume that whoever leads the implementation of the BTS will have the right to determine the self-implemented blockchain-based traceability (SBT) efforts. Other WSC agents may need to bear a certain share of the SBT cost, which is consistent with industry practice.

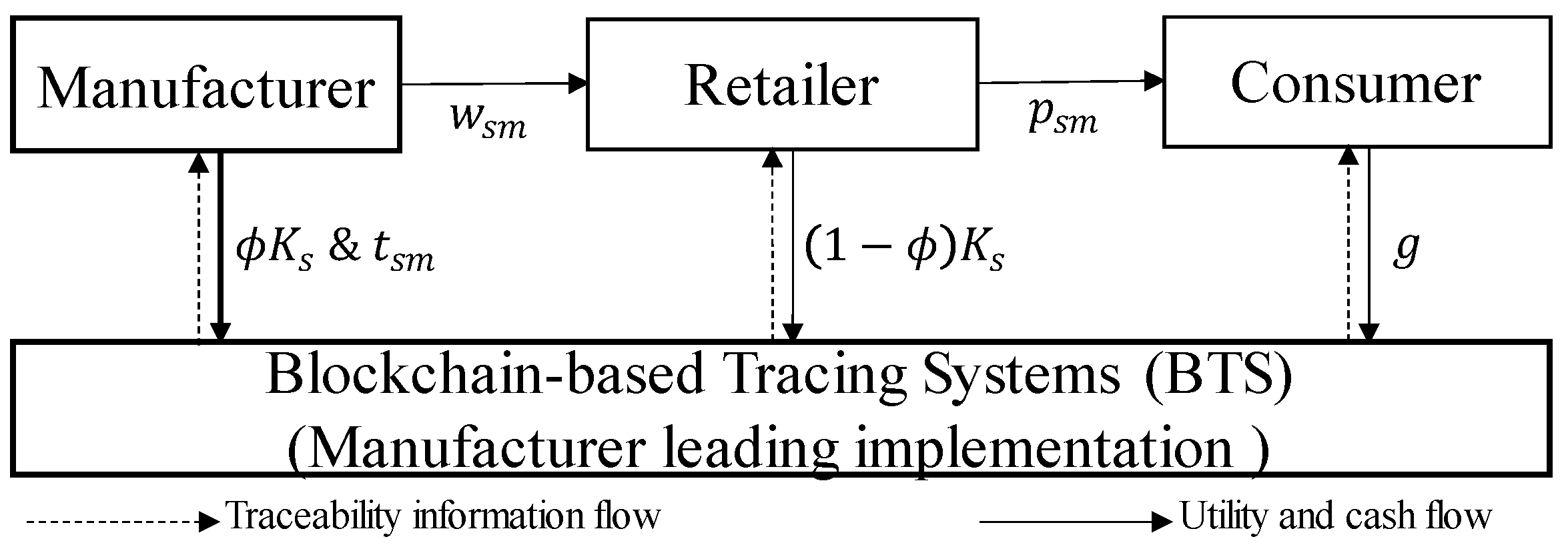

5.1. Model SM: Manufacturer Leading the Implementation of the BTS

First, we explore the situation of the manufacturer leading the BTS implementation. For example, the Spirits maker Diageo announced the launch of a blockchain-based track-and-trace system for its bottles to combat counterfeiting, boost the company’s sustainability practices, and ensure the wine traceability is self-controlled and more flexible [

62]. In Model SM, the manufacturer takes the lead to implement the BTS across the entire WSC and determines the level of SBT effort

and the wholesale price

first. Then, the retailer decides on the retail price

. Consumer privacy concerns

are consistent with the settings in Model B. The structure of the WSC in Model SM is shown in

Figure 3, and the decision structure of the WSC in Model SM is shown in

Table 3. Following the same market assumptions in the basic model, we have the demand and profit function in Model SM.

Specifically,

indicates the cost coefficient of wine traceability when the manufacturer or the retailer self-implements the BTS;

refers to the proportion of the SBT cost paid by the manufacturer;

represents the SBT cost of the WSC, where

. Considering a higher traceability level means more data need to be recorded and verified on the blockchain, which increases the complexity and resource consumption of the system, it is reasonable to apply a quadratic cost structure. This has also been validated by previous studies [

61,

63]. However, this study further considers the cost structure of endogenous traceability efforts when adopting the BTS. For the manufacturer or the retailer who wants to self-implement the BTS, they should reference the existing third-party BTS in the market when designing their own BTS, and their requirement for the SBT level should be higher than that of BBT (

). Otherwise, they will have no incentive to implement blockchain technology themselves. Hence, the SBT cost structure consists of the sum of the BBT effort level part

and the enhancement part

. Song et al. [

64] considered a similar cost structure for blockchain-based information disclosure, but with a binary constant cost.

Following the same approach above, the equilibrium decisions are given in

Table 8.

Next, we conduct sensitivity analyses of the above extended models with respect to the key parameters to gain more insights. We report the results of the sensitivity analyses derived from checking the corresponding first-order derivatives of the optimal solutions. All the sensitivity analyses results of Model SM are summarised in

Table 9.

For the retailer: (i) decreases with when or . When the retailer needs to spend less than of the SBT cost, the increasing consumer privacy concerns make the retailer’s profit decrease, which is similar to the case in Model B. While the difference is that when the retailer needs to spend more than of the cost, it is the higher cost coefficient () that causes the negative utility to affect the retailer’s profit. (ii) decreases with when . When the retailer needs to absorb a higher SBT cost (), retailer’s profit decreases with the level of BBT effort . This is reasonable, because with a relatively low cost coefficient (), the rational retailer will call for increasing the SBT level to obtain profit growth. Recall that endogenous SBT effort is referred to BBT effort . An increase in is equivalent to narrowing the improvement margin of , which in turn leads to a decrease in retailer profit. (iii) An increase in can result in a decrease in retail prices while simultaneously increasing retailer profit under specific conditions, that is, or and . Noting that the cost coefficient will increase when the manufacturer covers at least 2/3 of the cost. This is because if ks is low, it is difficult for the retailer to gain a profit advantage from further expansion of φ.

For the manufacturer, we find that (i) an increase in the manufacturer’s SBT cost share φ↑ results in a decrease in the wholesale price , while simultaneously reducing the manufacturer’s profitability and input of SBT efforts . (ii) decreases with when and increases with when . Similar to the analysis of retailer profit, the SBT cost coefficient plays a key role in these effects. If the is too high, the increasing level of BBT efforts will conversely lead to lower profitability for manufacturers. In this case, the manufacturer should give up self-implementing the BTS. (iii) In the SM model, it is the manufacturer determines the level of SBT effort ; so, in the setting where endogenous are considered, we find that increase with the , but decrease with the . Like our assumption, the endogenous SBT effort is an enhancement in the level of BBT effort ; therefore, the level of BBT provided by the third-party BTS can be considered a benchmark in Model SM, whereby is monotonically increasing with . However, the increasing privacy concerns implies that consumers do not trust blockchain technology, and under such a condition the manufacturer will reduce the level of SBT effort , which means reducing the investment in blockchain technology.

5.2. Model SR: Retailer Leading the Implementation of the BTS

Now, we explore the situation that the retailer leads the BTS implementation. JD, one of the largest online wine retailers in China, uses its self-implemented blockchain platform to provide the highest level of traceability for partner wine brands such as Lafite (France), Torres (Spain), and Penfolds (Australia), ensuring the authenticity of the wine sold on its platform [

65]. All partner brand products sold on JD have exclusive blockchain traceability codes for consumers to track the product’s supply chain journey [

66].

In Model SR, when we consider the retailer leading the implementation of the BTS, the demand and the profit functions are as follows:

where

refers to the SBT level set by the retailer, and the cost function of SBT can be rewritten as

. Like the derivations and analyses conducted for Model SM, we can derive the equilibrium decisions for Model SR. The equilibrium decisions under Model SR are similar to those for Model SM and are summarised in

Table 10.

Then, by comparing the findings under Model B, Model SM, and Model SR, we have some insights into the way of using the BTS as follows.

5.3. Explore the Optimal Strategy for Implementing Blockchain

To figure out which way of using blockchain technology is more beneficial to WSC members, we compare the equilibrium decisions for each of the three models that have adopted the blockchain, and the comparison results are summarised in

Table 11,

Table 12, and

Table 13, respectively. First, we compare Model SM to Model SR, and derive the following proposition.

Proposition 3. For given , we have (i) , when ; (ii) , , , and when .

From Proposition 3, we find that the different cost-sharing arrangements will yield the following outcomes. When the manufacturer and the retailer share the SBT cost equally, there is no difference in who leads the implementation of the BTS. Otherwise, under any cost-sharing arrangement, the demand and manufacturer’s profit are strictly larger in Model SM. So, the manufacturer always benefits from leading the implementation of the BTS. When the manufacturer shares less than 50% of the cost, there are higher wholesale and retail prices, as well as a higher level of SBT in Model SM. However, the retailer profit is smaller in Model SM. When the manufacturer shares more than 50% of the cost, the comparison results of the retail price, wholesale price, SBT effort, and retailer profit will be reversed. It means that the wholesale and retail prices and SBT levels are higher when the BTS lead covers fewer costs. For the retailer, once they need to absorb higher costs, they should choose to take the lead in implementing the tracing system themselves.

By comparing Model SM to Model B, we derive the following proposition.

Proposition 4. For given , we have ; ; , when ; , when ; , when .

In Model SM, manufacturer-led implementation of the BTS can increase demand and wholesale price directly, while it is conditional to raising the retail price, as well as manufacturer and retailer profits. A decrease in service fee leads to a decrease in the retail price in Model B. Thus, if is smaller than the certain thresholds, the retail price in Model SM is higher. Meanwhile, it is worth noting that is strictly larger than . That means if the cost coefficient can be controlled within a certain range, manufacturer-led BTS implementation can achieve a price advantage compared with Model B. For the manufacturer and the retailer, there is a threshold of that determines whether it is profitable for the manufacturer to self-implement the BTS or to outsource, respectively.

Similar to the above analysis, we compared Model SR to Model B and obtained the following findings like Proposition 4. For given , we have when ; ; , when ; , when ; , when . Different from the comparison results between Model SM and Model B, some special cases make the demand higher in Model B compared with Model SR. When the manufacturer has to cover more than two-thirds of the cost of SBT effort (), it is a better option for the whole supply chain to seek outsourced third-party BTS. In addition, the retailer-led implementation of the BTS can increase the retail price directly. The other findings are similar to those in Proposition 4.

6. Conclusions

6.1. Concluding Remarks

Motivated by the real-world practices of using blockchain to enhance traceability, this study explores the value of blockchain-based traceability in the WSC. Considering rampant WSC counterfeiting and consumers’ attitude towards wine traceability and information privacy, we develop consumer utility-based analytical models to study the cases without and with blockchain in the basic models. We derive the optimal solutions and uncover the value of blockchain in tracing wine products for the WSC through the comparison of the two scenarios. Furthermore, we extend our analyses to discuss the situation where WSC members endogenously determine the level of BTS traceability effort. By comparing the optimal solutions, we explore an optimal strategy for implementing the BTS and provide managerial insights on whether to use blockchain in the WSC and how to use it. The main findings are summarised as follows.

(i) Wine counterfeiting can increase prices and decrease profitability for WSC members, as well as reduce NBT effort when NBT costs are high. In addition, higher consumer sensitivity and a lower NBT cost coefficient can increase WSC profits. However, there exist thresholds for

that make the WSC prices and profits increase with the wine counterfeiting. This differs from [

24] but is consistent with industrial practice, such as the example of Paumanok and Comtes von Neipperg. This is mainly due to our consideration of NBT’s role in enhancing consumers’ ability to identify counterfeit products. This finding indicates that WSC may not need to adopt blockchain to eliminate counterfeiting. The increase in counterfeit wine can somehow increase consumers’ traceability sensitivity. If WSC can efficiently improve the NBT level, consumers will accept the price increase, and WSC’s profits will also increase.

(ii) When blockchain is adopted, we find that WSC prices and profits increase with higher traceability sensitivity and BBT effort but decrease with higher consumer privacy concerns. This finding extends the results of Liu et al. [

50] to the WSC and adds to the work of Fan et al. [

23] by considering the impact of the BBT effort. Additionally, we found that the optimal wholesale price is independent of BTS service fees.

(iii) The adoption of blockchain can increase the WSC prices under certain conditions. We have derived the threshold for third-party BTS service fees, which will determine whether to trace wine products through blockchain. Meanwhile, the moderating effect of consumer traceability preferences and privacy concerns should be considered when paying BTS service fees. Additionally, compared to studies investigating the value of blockchain from a cost-benefit perspective [

22,

46,

60], we find that if the NBT effort can effectively work on improving WSC traceability, it may not be necessary for WSC to adopt blockchain. Eliminating counterfeit wines through BTS may not align with the interests of WSC members.

(iv) Different from Shen et al. [

27], who considered endogenous quality decisions when using blockchain, we consider the traceability effort the endogenous decision variable, and our analysis focusses more on the cost sharing of SBT, leading to some new conclusions. We find that increasing the manufacturer’s SBT cost share lowers WSC prices and manufacturer profitability but can increase the retailer’s profit under certain conditions. Endogenous SBT effort increases with BBT effort but decreases with consumer privacy concerns. The impact of other key parameters on WSC prices and profits remains consistent with the basic model, with added threshold conditions.

(v) Self-implementing the BTS can increase the wholesale price directly, while it is conditional to raising the demand, retail price, and WSC profits, depending on the service fee of the third-party BTS. Equal SBT cost sharing between the manufacturer and the retailer results in no difference in BTS implementation leadership. Otherwise, the manufacturer benefits from leading. For the retailer, when the manufacturer shares less than half of the cost, the retail price is higher in Model SM, but the retailer profit is smaller. When the manufacturer shares more than half of the cost, these results are reversed.

6.2. Managerial Implications

Our research provides several managerial implications for the operations of the WSC with blockchain.

The operational solutions of the WSC in determining the adoption of blockchain. In non-blockchain-based tracing systems, the probability of identifying counterfeit wine is related to the level of wine traceability, so wine merchants need to weigh the trade-off between NBT costs and combating counterfeits. For the WSC members who do not adopt the BTS, targeting submarkets valuing wine traceability and reducing NBT costs are advantageous strategies, which can further avoid price dropping due to rampant counterfeiting. When the BTS is adopted, wine merchants need to notice the potential increase in retail price resulting from the rise in third-party BTS service fees. Moreover, alleviating privacy concerns and enhancing cybersecurity are crucial for blockchain adoption in the WSC.

The value of blockchain in the WSC. Manufacturers and retailers can increase prices with blockchain adoption, as traceability-sensitive consumers may prioritise traceability over price. Enhanced consumer information protection by BTS further incentivises purchases of blockchain-certified wine. In addition to the two mentioned value-adding measures that result in price growth, WSC members also need to be aware of the forced price increase caused by the service fees charged by a third-party BTS. When the service fees of the BTS are relatively low, using blockchain is always a more profitable choice. However, when the service fees of the BTS increase, if a third-party BTS cannot provide BBT levels that match their service prices, or if consumer privacy concerns exceed a certain level, using blockchain is not economically viable. In this case, using blockchain technology to satisfy consumer traceability preferences may not be financially rewarding for the WSC. This is because some consumers might be reluctant (e.g., because of concerns about privacy issues) to buy blockchain-certified wine products. Considering the benefits that blockchain brings to the WSC, the manufacturer is more likely to accept the transition to adopt the BTS due to the relatively small impact of service fees, which may harm the retailer’s interests.

The implications of the ways to adopt blockchain. Compared to purchasing a third-party BTS, WSC members need to pay extra attention to two key factors when self-implementing the BTS: the cost coefficient and the cost-sharing arrangement of SBT. Taking the manufacturer-led BTS implementation as an example, if the cost borne by the retailer exceeds one-third, only when the cost coefficient reaches the threshold will the negative utility of the blockchain affect the retailer’s profit. Moreover, if the SBT cost coefficient is too high, an increase in the BBT effort level may instead reduce the manufacturer’s profit. If the SBT cost coefficient can be controlled, self-implementing the BTS can achieve a more competitive advantage over outsourcing. Meanwhile, WSC members should promptly determine the threshold of third-party BTS service fees that can determine whether outsourcing the BTS or self-implementing the BTS is more profitable. In addition, when the BTS leader bears less SBT cost, both the prices and traceability level of the WSC will be higher. Plus, the retailer needs to pay extra attention once they need to bear higher costs. They should choose to lead the BTS implementation themselves.

6.3. Future Studies

We note some potential directions for future research. Firstly, the WSC is a complex system. Given the numerous stages involved in wine production and processing, it would be interesting to explore a multi-level supply chain model. Additionally, as crypto-currency transactions are becoming more common within the WSC, it would be valuable to investigate the impact of crypto-currency on the fairness of WSC transactions and WSC structure. Finally, it would be interesting to investigate how the risk-averse attitudes of WSC members may influence their investments in a BTS.