1. Introduction

The traditional retail banking delivery system has changed because of innovations in information technology [

1,

2]. Nowadays, in addition to physical branches, banks use ATMs, telebanking, and electronic channels to deliver their services [

3]. One of these electronic channels is mobile banking or m-banking.

Mobile banking enables customers to access bank accounts at any time and place through mobile devices (e.g., smartphones) to, among other operations, view statements and account balances, transfer money, make bills and peer-to-peer payments, and sell stocks [

4,

5]. Other mobile-based innovations in banking services are mobile shopping apps (e.g., [

6]) and mobile payment (e.g., [

7,

8]).

Mobile banking is a self-service technology that benefits consumers and banks. Mobile banking enables banks to lower operating costs [

9] and to gather data about bank consumers’ habits [

10,

11]. These advantages allow banks to improve their efficiency [

2,

12,

13], productivity and profitability [

14].

For consumers, some of the main advantages of mobile banking over conventional banking are ubiquity, immediacy, localization, instant connectivity, and proactive functionality [

15]. Therefore, mobile banking provides convenience and real-time services [

16], so that it is an efficient alternative to branch-visiting banking [

17,

18]. However, mobile banking also includes a wide variety of disadvantageous characteristics, such as privacy concerns, distrust, security risks, financial risks, and consumer uncertainty [

5,

19]. For these reasons, despite its advantages and the very high number of mobile phones in circulation, the adoption level of mobile banking is not up to the mark [

20].

Currently, many users of banking services have not yet adopted mobile banking, especially in developing countries [

21]. However, in these countries, the promotion of mobile banking can contribute to the deepening of financial services, facilitating financial inclusion and economic growth [

22]. Since financial inclusion and economic growth at the global level are part of the millennium development goals and sustainable development goals, financial inclusion of basic financial services is a global necessity, especially in developing countries [

23]. Thus, mobile banking deserves “the attention of banks located in developing countries” ([

24], p. 133).

To encourage the use of mobile banking by consumers, it is necessary to identify and understand the barriers that generate resistance to its adoption [

20] and the drivers that lead to it [

25]. This stream of research is part of the general framework of the acceptance and use of technological innovations, made up of several information systems/information technology (IS/IT) theories and models. Among these theories, a recent review of mobile banking [

26] has found that the Technology Acceptance Model (TAM, [

27]), followed by the Unified Theory of Acceptance and Use of Technology (UTAUT, [

28]) were the main conceptual frameworks and models adopted by scholars to explain consumers’ intentions of using mobile banking. Given that UTAUT is the result of a comprehensive review of the previously proposed technology adoption models and it “has proven to outperform the eight standalone models and provides a better prediction power” ([

29], p. 774), our study is based on this theory.

An important feature of UTAUT is that it considers the use of the new technology in an organizational context. To adapt the UTAUT model to the consumer context, Venkatesh et al. [

30] proposed a new version of UTAUT known as UTAUT2. Thus, since our study targets consumer, it uses UTAUT2 as theoretical basis to explain the intention to adopt mobile banking by consumers who currently do not use this technology in their relationships with banks. This is in line with previous studies that examine the determinants of adoption and use of new technologies by consumers (e.g., [

31,

32]). Moreover, we focus on behavioral intentions because the results of Jadil et al.’s [

10] meta-analysis showed that “usage intention is the most critical predictor of use behavior” (p. 354).

Our study considers all antecedents of UTAUT2 except habit, which refers to the extent to which an individual believes that the behavior is set to be automatic [

30]. To examine the role of habit, customers should have a rich experience in using such technology [

33]. Hence, studies that consider habit (e.g., [

34]) analyze the use of mobile banking by current users. Since our study explains the consumer intention to adopt mobile banking, consumers are not yet in the habit of using mobile banking and this habit cannot be measured.

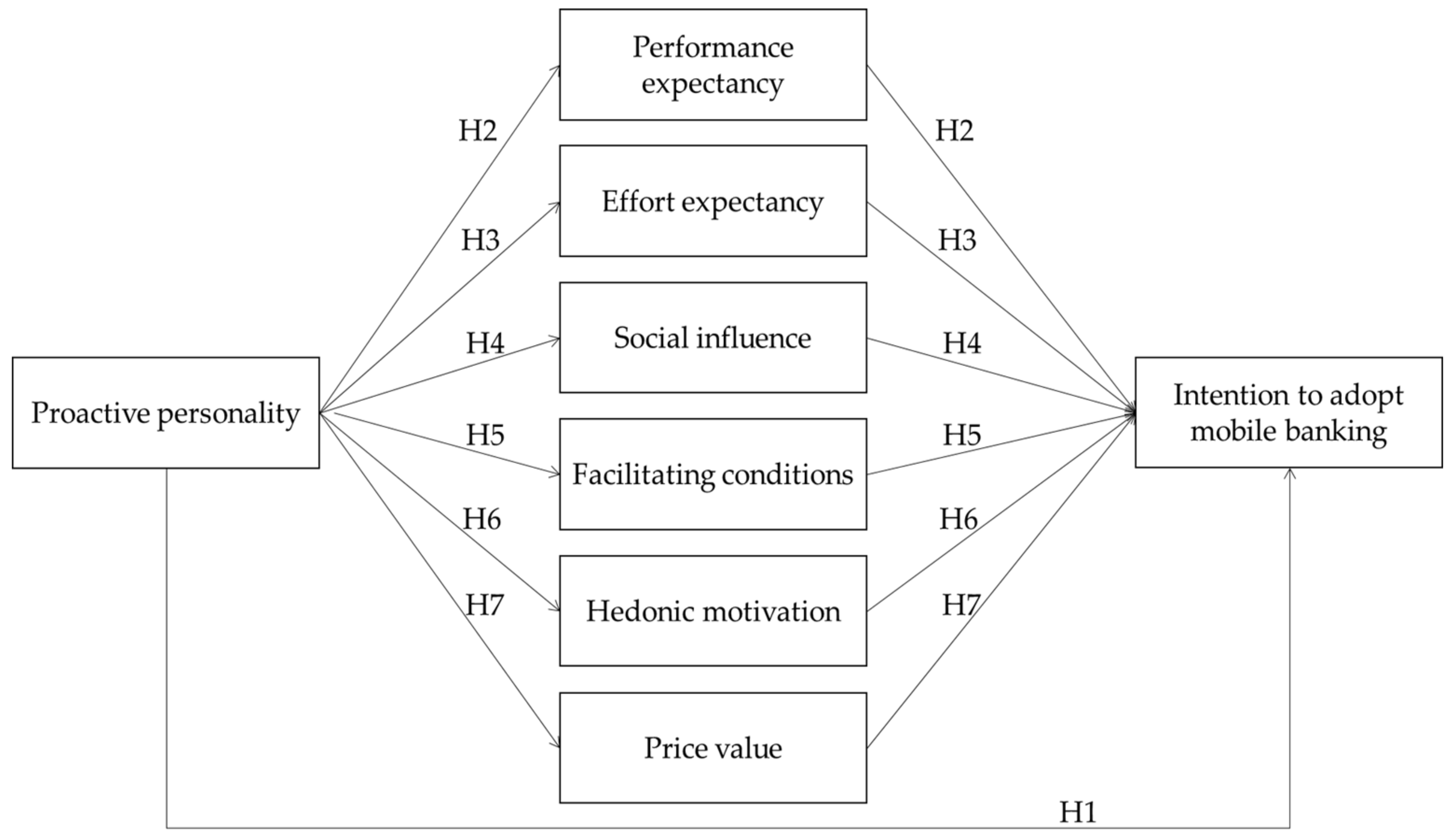

Our study proposes an extension of the UTAUT2 to explain consumers’ intentions to adopt mobile banking. In particular, our investigation adds proactive personality, an individual difference, as a direct antecedent of the UTAUT2 drivers and as an indirect antecedent of the behavioral intentions to adopt m-banking.

Proactive personality is a personality variable that affects motivational aspects and processes [

35,

36,

37,

38]. Proactive personality has been studied in plenty of fields, such as employee behavioral and well-being outcomes, entrepreneurial behavior and co-worker emotions and behaviors [

39,

40,

41] and has proven its effect on many outcomes regarding human behavior [

42,

43].

Although some studies on mobile banking have analyzed the relationship between behavioral intentions and personality variables, the lack of attention to personality variables in models such as the UTAUT2 is surprising, considering the results of the general psychological and technology acceptance research. While the first has shown that personality traits have an important impact on individual behavior [

44,

45], the second revealed their influence on internet usage [

46] and mobile apps [

47]. Additionally, in the Theory of Reasoned Action [

48], one of the first theories used to explain the adoption of technological innovations, personality was explicitly identified as a relevant exogenous or external variable (see [

49]).

In the mobile banking context, only a few TAM-based studies have analyzed the effect of personality variables as antecedents to exogenous model variables (for example, Gu et al. [

50] and Singh and Srivastava [

51] examined the impact of self-efficacy on perceived ease of use), but none have explicitly considered the mediating effect of these exogenous variables on the personality traits–intention to adopt a mobile banking relationship. This gap is even stronger in the UTAUT/UTAUT2-based studies because these models overlook personal, dispositional factors, in favor of perceptions [

52], and the few investigations that have examined the influence of personality variables have only analyzed the direct relationship between personality variables and behavioral intention (for self-efficacy, see [

53]) or have considered these variables as moderators (for innovativeness, see [

54]).

Therefore, our study, which expands UTAUT2, makes several relevant contributions to the mobile banking literature. First, it performs an updated review of the literature on mobile banking. Second, to the best of our knowledge, this is the only study that combines proactive personality with UTAUT2 in the mobile banking context. Therefore, it contributes to the scarce research that relates personality traits to behavioral intention of using mobile banking. Moreover, integrating proactive personality, expands UTAUT2. This extension follows the recommendation of Tamilmani et al. [

55], who after making a systematic literature review and theory evaluation of UTAUT2, identified as lines of improvement the incorporation of exogenous mechanisms to increase its explanatory power. Third, previous investigations have mostly focused on technological perceptions and neglected the effects of personality traits on user adoption of mobile commerce [

56]. An exception is Agyei et al. [

57], who analyzed the effect of basic personality traits on TAM drivers, which in turn predicted the intention to adopt mobile banking. Nevertheless, the limited research on personality variables and adoption of mobile banking has focused mostly on direct effects without taking into consideration indirect ones [

58]. In this line, our study examines the indirect relationship between proactive personality and behavioral intention through UTAUT2 drivers; that is, proposes and tests a partial mediation model in which the UTAUT2 drivers mediate the proactive personality–behavioral intention relationship. To the best of our knowledge, no study has analyzed the UTAUT2 drivers as mediators between a distal individual antecedent and the behavioral intention to use mobile banking.

5. Discussion

This study aimed to explore mobile banking adoption from a personality perspective. Specifically, this research attempted to understand how the proactive personality trait affects m-banking intention. For this, the research employed an extended UTAUT2 model as the theoretical lens. The proposed model relates proactive personality to behavioral intention through seven relationships (H1–H7), one direct relationship and six indirect ones, through the UTAUT2 drivers.

Several results of the empirical analysis are relevant. First, although proactive personality was predicted to positively impact the mobile banking adoption intention, findings showed that proactive personality only had a direct effect on mobile banking adoption among respondents when the UTAUT2 constructs were not included in the analysis and ceased to be significant when the UTAUT2 constructs were included.

Second, proactive personality is positively and significantly related to all UTAUT2 drivers, with high coefficients. Therefore, individuals who are forward thinkers are more likely to have positive performance and effort expectations regarding mobile banking, as it has been argued that being a forward thinker increases your sense of positive future expectations [

121]. In the same line, people described by their abilities to identify new opportunities and solve problems perceive mobile banking as useful and easy to use. These results are in line with those of Agyei et al. [

57], who in their study on the impact of Big Five personality traits on users’ intention to adopt mobile banking through TAM drivers, found that performance utility (corresponding to performance expectancy in UTAUT2) was significantly related to agreeableness, conscientiousness, neuroticism, and openness to new experiences; in addition, the effects of agreeableness, conscientiousness, and openness to new experiences on perceived ease of use (corresponding to effort expectancy in UTAUT2) were also significant.

At the same time, findings show that individuals with a proactive personality usually have the perception that their social environment supports the use of new technologies, probably because they would have selected reference groups, opinionated leaders, colleagues, and friends that match their forward-thinking, action-orientated, and opportunity-seeking characteristics. Therefore, proactive individuals perceive greater social influence toward mobile banking.

Results also indicated the positive influence of proactive personality on facilitating conditions and price value. Since proactive individuals try gathering social and political knowledge [

122] and, as a result, acquire and identify more support, they will perceive greater facilitating conditions. Furthermore, mobile banking technology will create new opportunities and help proactive individuals improve their skills and perform better. Therefore, action-oriented proactive individuals will greatly appreciate the retrieved benefits of mobile banking in comparison to its price.

Finally, hedonic motivation was also affected by proactive personality. The more proactive individuals are, the more hedonically motivated toward mobile banking they will be, based on the assumption that they prefer to resolve threats, achieve goals, and alter situations, and that mobile banking technologies may serve the goals and visions of these proactive individuals.

Therefore, findings highlight the relevance of proactive personality in explaining the exogenous UTAUT2 variables.

Third, regarding the influence of the UTUAT2 exogenous variables, two of these antecedents, price value and hedonic motivation, were not related to customers’ intention to adopt mobile banking, while the other UTAUT2 drivers (performance expectation, effort expectations, social influence, and facilitating conditions) are significantly related to behavioral intention.

Performance expectancy emerged as the most relevant predictor of consumer behavioral intention, as it had the greatest influence (0.649). This result is in line with existing research on mobile banking, since Jadil et al.’s [

10] meta-analysis of the UTAUT model, including 127 empirical studies from 2004 to 2020, showed that performance expectancy (0.401) was “the strongest antecedent of usage intention” (p. 354). Similarly, Tamilmani et al.’s [

164] meta-analysis of UTAUT2 found that the relationship between performance expectancy and behavioral intentions was the most employed and one of the strongest paths.

Effort expectancy was also a significant positive predictor of behavioral intention, reaffirming this relationship in the consumer m-banking domain. In our study, its relative position was the third place (0.146), while in Jadil et al.’s [

10] meta-analysis of the UTAUT model in mobile banking research, effort expectancy had the second highest coefficient on the intention to use (0.199). It seems that effort expectancy is particularly relevant in the case of mobile banking technology, since in Tamilmani et al.’s [

164] UTAUT2 meta-analysis, the relationship between effort expectancy and behavioral intention, although the second most employed, was the weakest.

In addition to performance expectancy and effort expectancy, social influence and facilitating conditions emerged as significant predictors of consumer intention to adopt mobile banking. Social influence and facilitating conditions occupied, respectively, the fourth and second place for their impact on the intention to adopt (0.118 and 0.195). This is in line with Tamilmani et al.’s [

164] UTAUT2 meta-analysis, where facilitating conditions had a greater role in affecting behavioral intentions than social influence, while in Jadil et al.’s [

10] meta-analysis of the UTAUT model in mobile banking research, social influence had greater path values than facilitating conditions (0.193 and 0.139).

However, price value and hedonic motivation were found to have a non-significant impact on customers’ intention to adopt mobile banking.

The non-influence of the value price is explained by the fact that mobile banking is a technology done through mobile devices, in other words, through free applications or mobile web browsers on a smartphone or tablet. Since the sample encompasses bank customers’ who already have mobile devices with Internet access, the cost–benefit ratio is probably not relevant to the adoption of mobile innovations. The non-significant relationship between price-value and intention to adopt mobile banking is in line with the results of the meta-analytic evaluation of UTAUT2 performed by Tamilmani et al. [

164], who found that half of the studies reported non-significant values and argued that this happened “when the users perceived the product/service offering examined as free of charge” (p. 1001), as it occurs in the case of mobile banking.

Regarding hedonic motivation, even if the positive impact of hedonic motivation or similar factors such as fun, enjoyment, playfulness and perceived entertainment on behavior has been demonstrated by some previous literature on technology adoption [

141], other studies have also found a non-significant effect of hedonic motivation on behavior [

165]. It appears that the path between hedonic motivation and behavior depends on the subject addressed. Mobile banking technology is not considered a fun and entertaining technology; in fact, it is categorized as a self-business and serious financial service, not employed for its entertaining nature. Consequently, the level of fun and pleasure derived from using mobile banking is not reason enough for customers to decide whether to adopt it. This is in line with that of Tamilmani et al. [

164] who found that studies that reported a non-significant effect of hedonic value were focused on utilitarian value.

Third, the indirect effect of proactive personality occurs only through performance expectation, effort expectations, social influence, and facilitating conditions. Forward thinkers find new opportunities easy to imagine and anticipate and predict the future benefits and conveniences of employing new technologies. In this line, proactive banking customers assume that mobile banking is useful and easy to use, which will result in greater intentions to adopt this technology.

Regarding the indirect effect of proactive personality through facilitating conditions, we argue that proactive individuals try gathering social and political knowledge [

122] and, as a result, acquire and identify more support, which implies that they will perceive greater facilitating conditions, which will help their adoption of mobile banking.

Finally, proactive personality indirectly influences behavioral intention through social influence. Individuals with a proactive personality usually have the perception that their social environment supports the use of new technologies, probably because they would have selected reference groups, opinionated leaders, colleagues, and friends that match their forward-thinking, action-orientated, and opportunity-seeking characteristics. Therefore, proactive individuals will perceive greater social influence toward mobile banking, which will impact their mobile banking adoption intentions.

The support found for the indirect effect of proactive personality on behavioral intention implies a fully mediated relationship. This result is in line with previous literature that considers personality a distal antecedent of behavior and customer perceptions regarding new technology proximal antecedents [

166]. This finding is important because none of the previous studies analyzed proactive personality as a direct and indirect antecedent of consumer behavioral intention to adopt m-banking.

5.1. Theoretical Implications

Our study contributes to the theory and research in several relevant ways. A first theoretical contribution comes from the review of the recent mobile banking UTAUT/UTAUT2-based literature. Another major contribution stems from the empirical validation of the proposed extended UTAUT2 model. Since previous research on the drivers of the UTAUT2 factors is still limited and there is a lack of studies that examine the impact of users’ attributes [

99], this investigation contributes to the literature on the UTAUT2 model by extending it and examining the foregoing influence of an external personal variable, proactive personality, on the UTAUT2 variables. Further, since personality is a key factor in understanding individual attitudes and behavior [

167], in particular consumer behavior [

168], this investigation contributes integrating two research streams—psychological studies and technological innovation adoption studies—by analyzing the relationship between a previously unanalyzed personality trait and mobile banking adoption. Finally, since prior research has mostly centered on the direct antecedents of mobile banking [

58], this investigation contributes to research on mobile banking by testing the indirect effect of proactive personality on mobile banking adoption intention through the UTAUT2 drivers.

5.2. Managerial Implications

Meuter et al. ([

169], p. 78) stated that “for many firms, often the challenge is not managing the technology, but rather getting consumers to try the technology”. Results of the current study help understand the different factors that influence banking customers’ intentions toward adopting mobile banking technology. The results show the importance of proactive personality and its significant indirect influence on the behavioral intentions of respondents regarding mobile banking through the UTAUT2 drivers.

Proactive individuals have more favorable perceptions of the UTAUT2 drivers than non-proactive individuals and these perceptions mediate the influence of the proactive personality on the intention to adopt mobile banking. However, not all UTAUT2 drivers have a significant effect on the intention to adopt mobile banking, so that the effect of proactive personality on the intention to adopt mobile banking only occurs through performance expectancy, effort expectancy, social influence, and facilitating conditions.

The results suggest the relevance of incorporating proactive personality as a criterion for market segmentation and the need to consider this personality trait to help expanse mobile banking services among customers. Bank managers should not only base their market segmentation on traditional demographic factors but use more fine-grained segmentation criteria to recognize overlooked segments.

To target first individuals with high proactivity facilitates the adoption of mobile banking, since such individuals have more favorable perceptions of the UTAUT2 drivers. For instance, given the significant impact of performance expectancy on behavioral intention, advertising messages should address the usefulness of mobile banking using proactive characteristics.

A greater challenge is to encourage the adoption of mobile banking by non-proactive individuals, who are more prone to perceiving problems to its adoption. Consequently, banks should try influencing perceptions of performance expectancy, effort expectancy, social influence and facilitating conditions, particularly performance expectancy, given its greater relative weight in behavioral intention. To achieve this, banks should spend more time on teaching and educating their clients about the utilitarian advantages and benefits of using mobile banking when performing various financial tasks. Additionally, banks need to encourage developers to focus on adding value. Furthermore, they should develop simple and friendly mobile applications, with unassuming and attractive interfaces, to help their customers’ effort expectations and to increase the convenience of using mobile banking.

Moreover, the positive impact of facilitating conditions on behavioral intentions indicate that banks should provide training programs and support material, which may lead to better understanding and use of mobile banking by consumers. Developers can also provide an additional package of online training to ensure that consumers can see a demonstration or obtain relevant help when using mobile banking. Additionally, banks and financial service providers should implement and make known effective procedures and infrastructures to assist customers with mobile banking and cope with any problems that could arise while using the mobile technology, therefore increasing their perceptions of the support available. Making the necessary resources available to consumers for adopting mobile banking will make the system easier to use and increase usage intention.

Finally, the significance of social influence on behavioral intentions indicates that banks should allocate resources and efforts toward a more active use of societal influence to motivate consumers. Advertising messages should encourage the use of mobile banking through testimonial celebrities. Banks should also improve their use of social media to promote interpersonal word-of-mouth communications to increase the adoption of mobile applications by consumers.

5.3. Limitations and Future Research

Despite all the contributions made by this investigation, there are still some limitations. The main limitation is the possibility of common method bias in the obtained results since all constructs used are self-reported [

170]. Another limitation of the study derives from the cross-sectional nature of the data, as the study was conducted at a specific moment in time, and, consequently, it would be necessary to carry out a longitudinal study to reaffirm the causal relationships. Furthermore, the current study has not considered cultural factors, which may be specific to the Lebanese culture, such as masculinity, femininity, communism, individualism, etc. These characteristics may play an important role in causing specific psychological concerns, adopting certain beliefs, and predicting behavior intentions [

171,

172]. Regarding future studies, researchers might duplicate the proposed model in a different innovation context. They could also study the impact of the Big Five personality traits alongside customer proactive personality on mobile shopping intention. As well, they may also consider investigating the effects of customer proactive personality in a cross-cultural context.