Financial Sustainability Evaluation and Forecasting Using the Markov Chain: The Case of the Wine Business

Abstract

:1. Introduction

2. Literature Review

3. Methods and Data

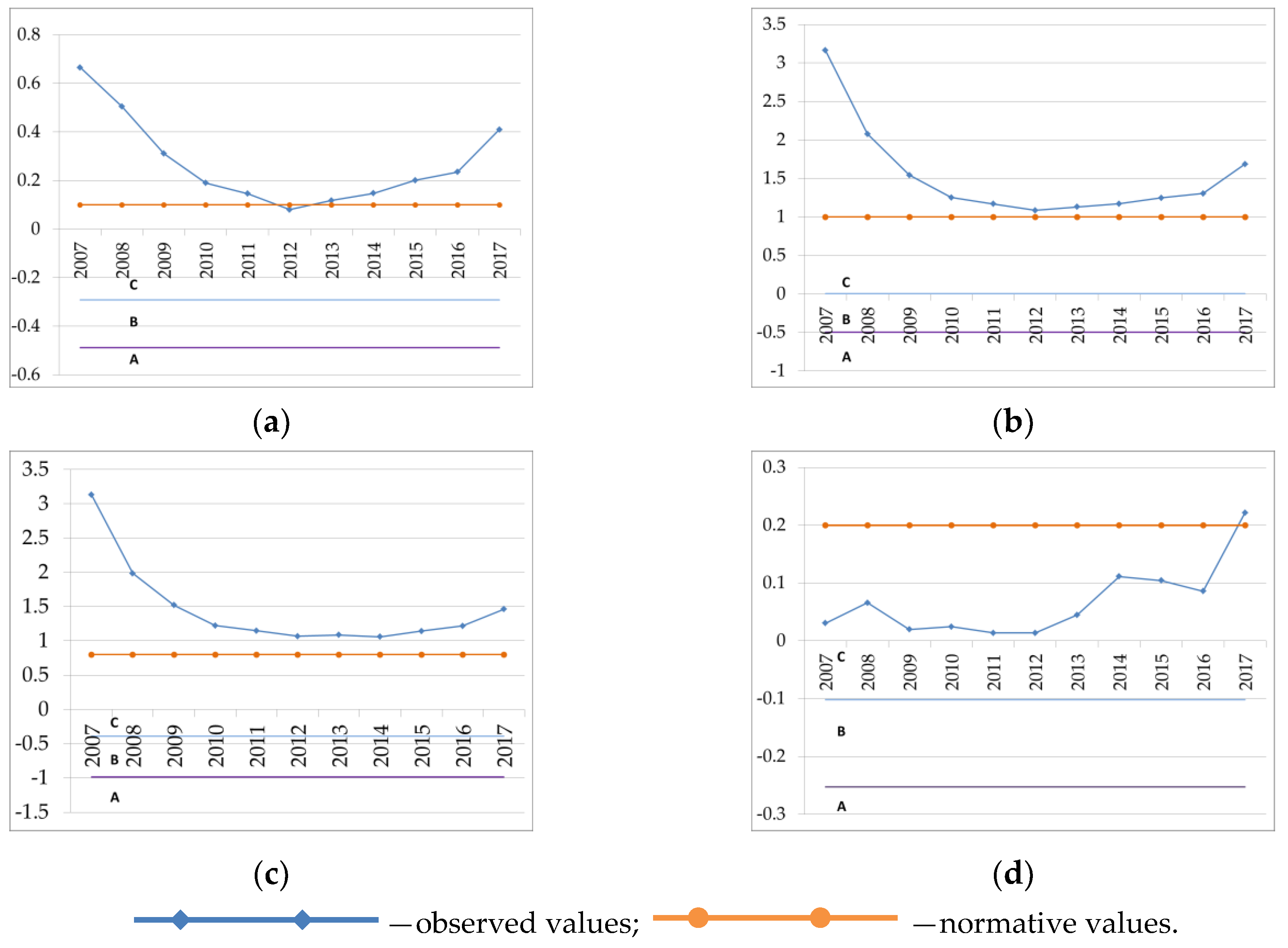

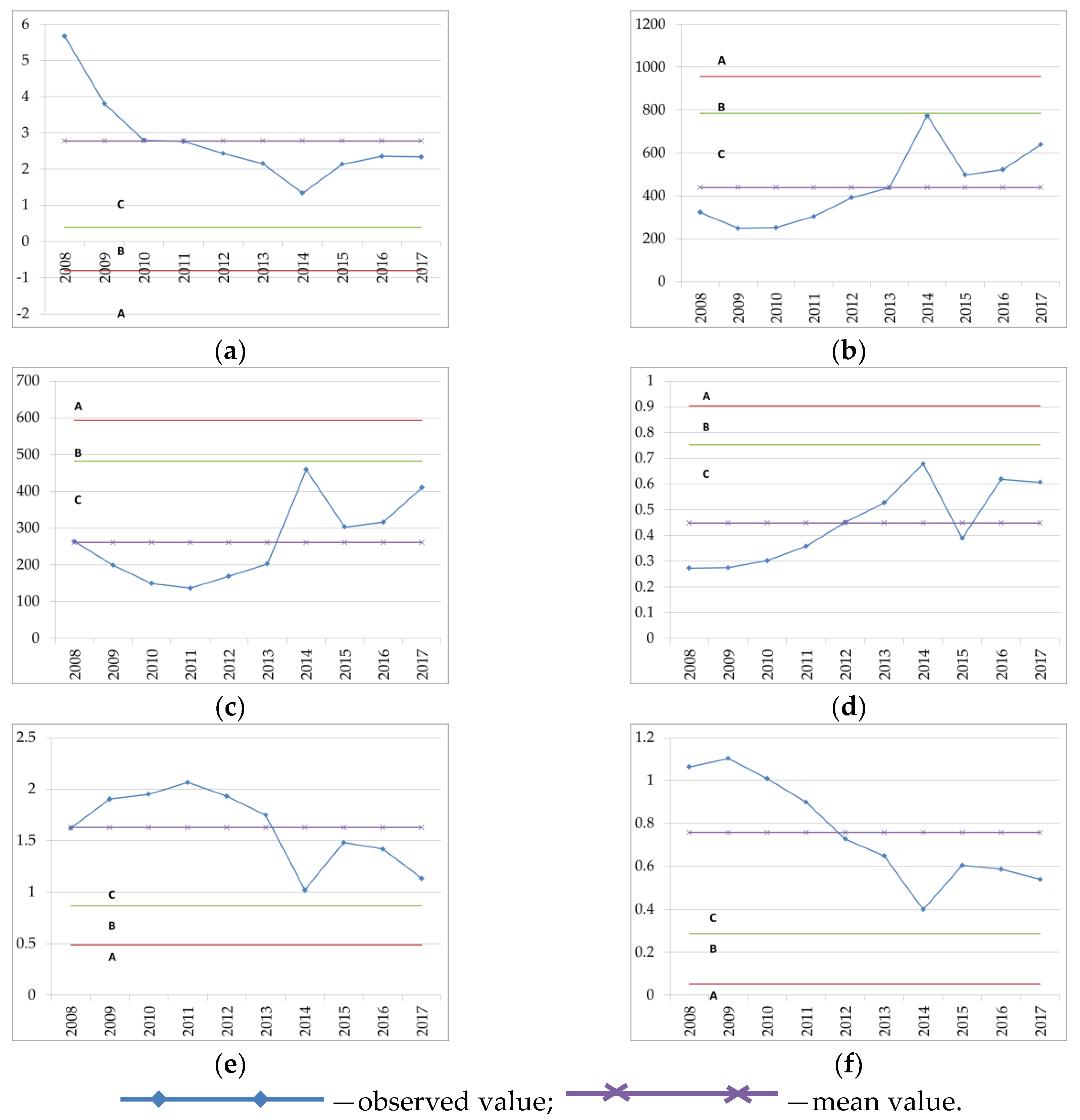

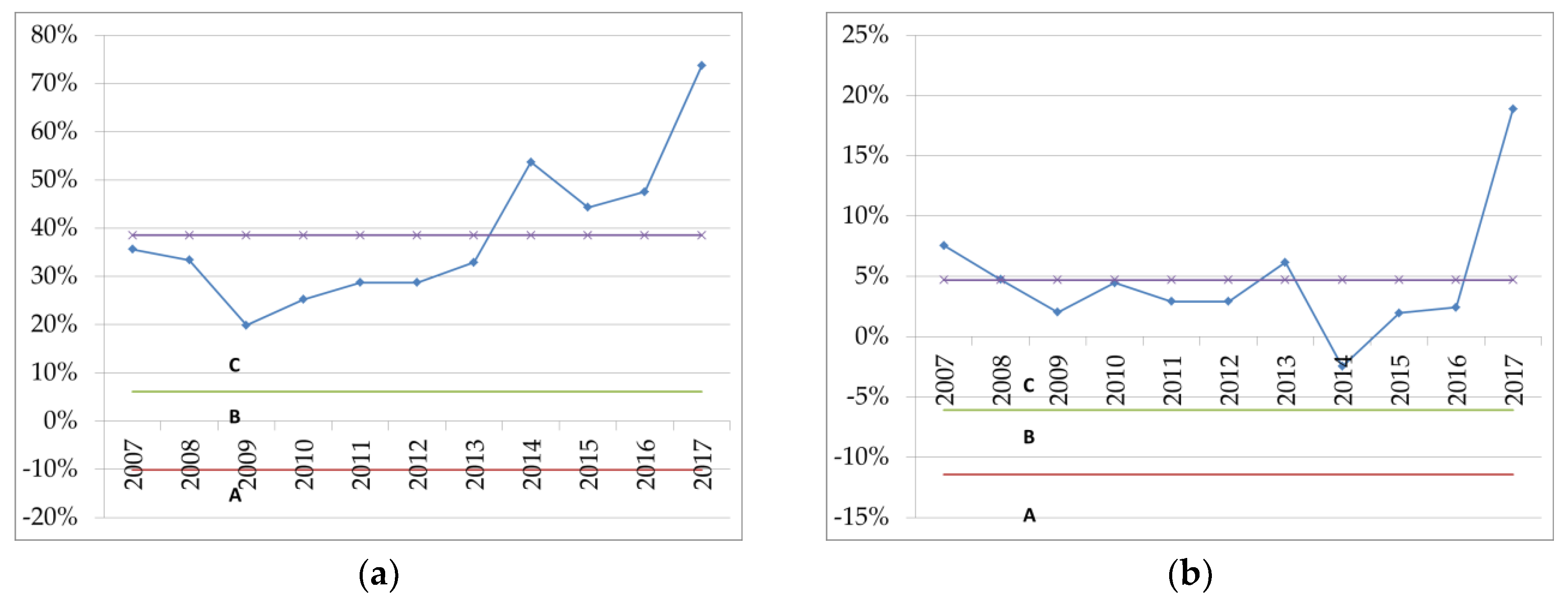

- C—the region characterizes the unstable state of the indicator,

- B—the region related to pre-crisis state of the indicator (preventive measures are required),

- A—characterizes the critical or crisis state of the indicator and requires the use of more radical activities to ensure financial security.

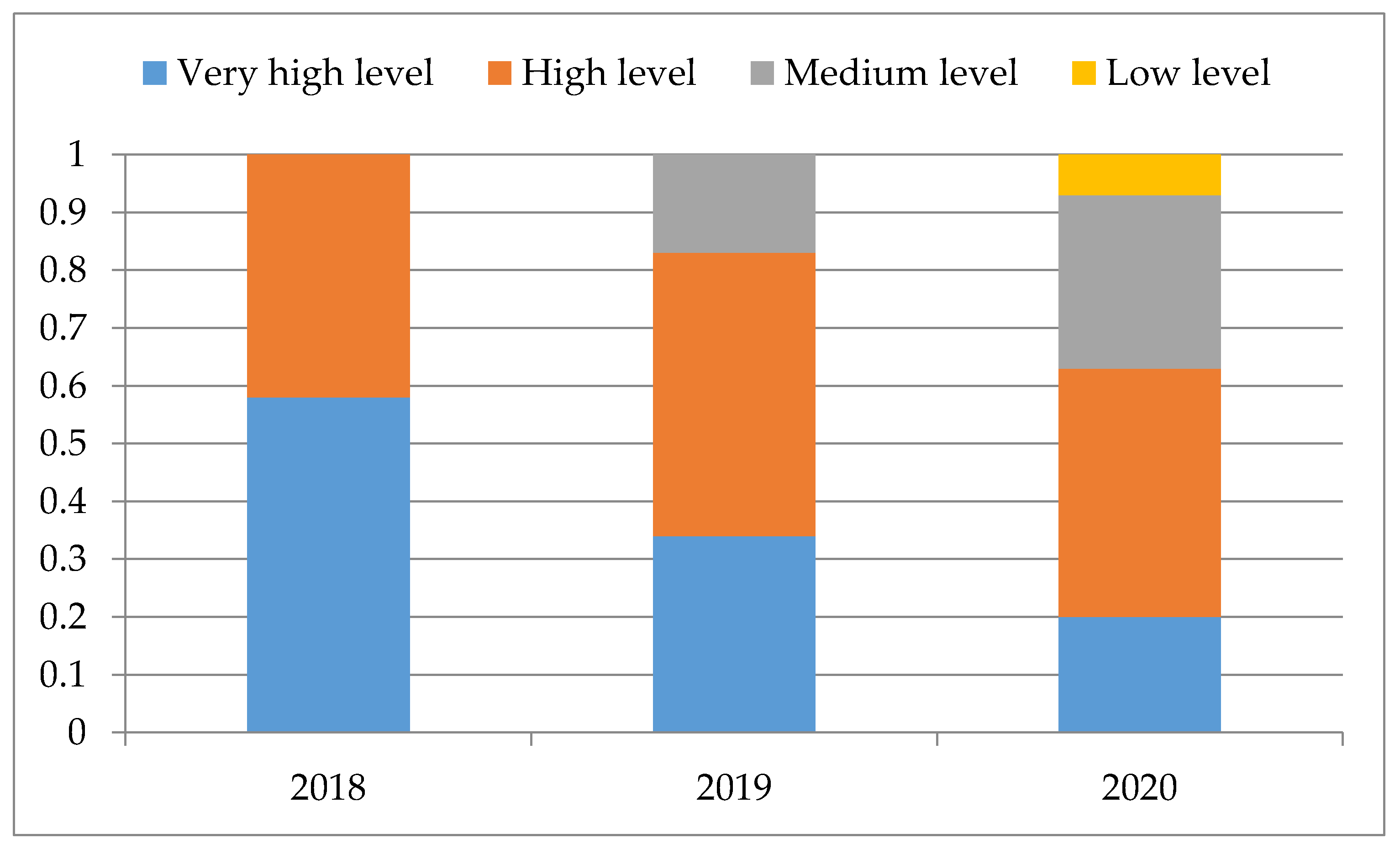

4. Results

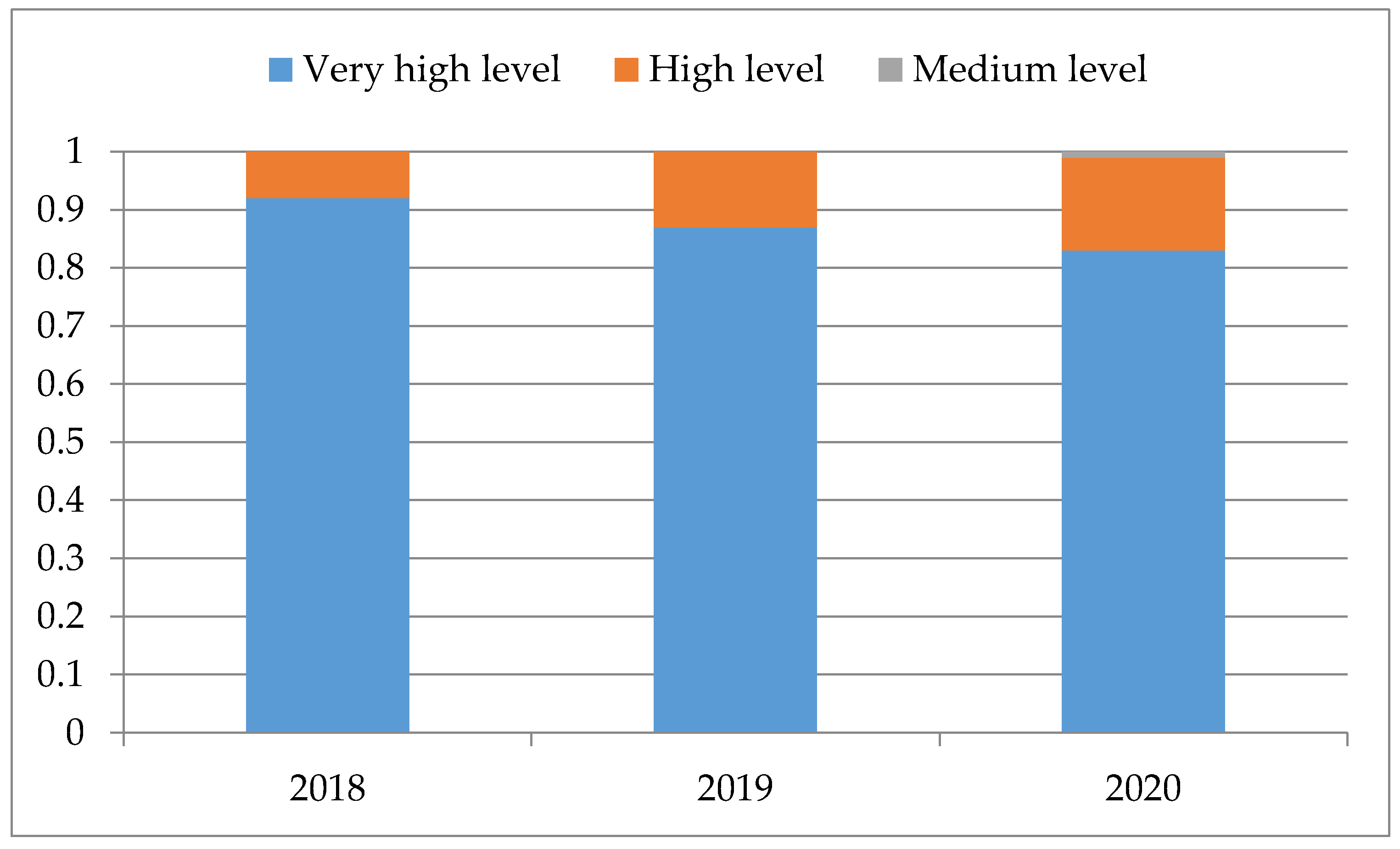

- recovery periods: 2010, 2015;

- periods of stability: 2007, 2011, 2012, 2013, 2016, 2017;

- downturn periods: 2008, 2009, 2014.

- ▪

- in the recovery periods (2 periods), the number of periods with increasing financial safety indicators is 1 (thus, ); the number of periods with stable level of the indicators is 1 ();

- ▪

- in the stability periods (6 periods), the number of business financial safety decreases is 1; the stationary level is 5;

- ▪

- in the downturn periods (3 periods), the number of business financial safety decreases is 2; the stationary level is 1.

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Becerra-Vicario, R.; Alaminos, D.; Aranda, E.; Fernández-Gámez, M.A. Deep Recurrent Convolutional Neural Network for Bankruptcy Prediction: A Case of the Restaurant Industry. Sustainability 2020, 12, 5180. [Google Scholar] [CrossRef]

- Coppola, A.; Scardera, A.; Amato, M.; Verneau, F. Income Levels and Farm Economic Viability in Italian Farms: An Analysis of FADN Data. Sustainability 2020, 12, 4898. [Google Scholar] [CrossRef]

- Guo, A.; Wei, H.; Zhong, F.; Liu, S.; Huang, C. Enterprise Sustainability: Economic Policy Uncertainty, Enterprise Investment, and Profitability. Sustainability 2020, 12, 3735. [Google Scholar] [CrossRef]

- Rioux, B.; Galkin, P.; Wu, K. An economic analysis of China’s domestic crude oil supply policies. Chin. J. Popul. Resour. Environ. 2019, 17, 217–228. [Google Scholar] [CrossRef] [Green Version]

- State Statistics Service of Ukraine. Available online: http://www.ukrstat.gov.ua/ (accessed on 5 March 2020).

- Song, M.; Fisher, R.; Kwoh, Y. Technological challenges of green innovation and sustainable resource management with large scale data. Technol. Forecast. Soc. Chang. 2019, 144, 361–368. [Google Scholar] [CrossRef]

- Afum, E.; Osei-Ahenkan, V.Y.; Agyabeng-Mensah, Y.; Owusu, J.A.; Kusi, L.Y.; Ankomah, J. Green manufacturing practices and sustainable performance among Ghanaian manufacturing SMEs: The explanatory link of green supply chain integration. Manag. Environ. Qual. Int. J. 2020. [Google Scholar] [CrossRef]

- Baranovskyi, О.І. Financial Security in Ukraine (Assessment Methodology and Support Mechanisms); Kyiv National University of Trade and Economics (KNUTE): Kyiv, Ukrainе, 2004. (In Ukrainian) [Google Scholar]

- Yermoshenko, M.M. State Financial Security: National Interests, Real Threats, Security Strategy; Kyiv National University of Trade and Economics (KNUTE): Kyiv, Ukrainе, 2001. (In Ukrainian) [Google Scholar]

- Kartuzov, Y.P. Definition of the enterprise financial security: Concept, content, value and functional aspects. Top. Issues Econ. 2012, 8, 172–181. (In Ukrainian) [Google Scholar]

- Moiseienko, I.P.; Marchenko, O.M. Management of the Enterprise Financial and Economic Security; Lviv State University of Internal Affairs (LvDUVS): Lviv, Ukrainе, 2011. (In Ukrainian) [Google Scholar]

- Telnova, G.V. General positions of the integrated corporative structure financial management concepts determination. Econ. Ann. XXI 2013, 3, 57–60. (In Ukrainian) [Google Scholar]

- Ursul, A.; Ursul, T. Environmental Education for Sustainable Development. Future Hum. Image 2018, 9, 115–125. [Google Scholar] [CrossRef]

- Vudvud, V.V. Financial security of the enterprise in the conditions of economic instability. Young Sci. 2015, 10, 98–102. (In Ukrainian) [Google Scholar]

- Acharya, V.; Cecchetti, S.G.; De Gregorio, J.; Kalemli-Özcan, Ș.; Lane, P.R.L.; Panizza, U. Corporate Debt in Emerging Economies: A Threat to Financial Stability? Brookings Institution, Committee for International Policy Reform: Washington, DC, USA, 2015; Available online: http://www.brookings.edu/research/papers/2015/09/corporate-debt-emerging-economies (accessed on 15 March 2020).

- Frank, M.Z.; Goyal, V.K. Capital Structure Decisions: Which Factors Are Reliably Important? Financ. Manag. 2009, 38, 1–37. [Google Scholar] [CrossRef] [Green Version]

- Carstina, S.; Siminica, M.; Circiumaru, D.; Tanasie, A. Correlation Analysis of the Indicators of Asset Management and Profitability. Int. J. Econ. Bus. Adm. 2015, 3, 3–21. [Google Scholar] [CrossRef]

- Hamid, U.; Won Kie, A. Further Test on Stock Liquidity Risk with a Relative Measure. Int. J. Econ. Bus. Adm. 2016, 4, 56–69. [Google Scholar]

- Nie, P.-Y.; Wang, C.; Chen, Y.-H.; Yang, Y.-C. Effects of switching costs on innovative investment. Technol. Econ. Dev. Econ. 2018, 24, 933–949. [Google Scholar] [CrossRef]

- Kravchenko, O.; Kucher, A.; Hełdak, M.; Kucher, L.; Wysmułek, J. Socio-Economic Transformations in Ukraine towards the Sustainable Development of Agriculture. Sustainability 2020, 12, 5441. [Google Scholar] [CrossRef]

- Khirivskyi, R.; Cherevko, H.; Yatsiv, I.; Pasichnyk, T.; Petryshyn, L.; Kucher, L. Assessment and Analysis of Sustainability of the Socio-Economic Development of Amalgamated Territorial Communities of the Region. Eur. J. Sustain. Dev. 2020, 9, 569. [Google Scholar] [CrossRef]

- Fetai, B. Financial Integration and Financial Development: Does Financial Integration Matter? Eur. Res. Stud. J. 2015, 18, 97–106. [Google Scholar] [CrossRef] [Green Version]

- Altman, E.I. Financial Ratios, Discriminant Analysis and the Prediction of Corporate Bankruptcy. J. Financ. 1968, 23, 589–609. [Google Scholar] [CrossRef]

- Bogdanova, T.K.; Shevgunov, T.Y.; Uvarova, O.M. Application of neural networks for solvency prediction for Russian companies of manufacturing industries. Bus. Inform. 2013, 2, 40–48. (In Russian) [Google Scholar]

- Ivashchenko, O.V. The theoretical fundamentals for assessing the level of enterprise financial security. Bull. Zaporizhzhya Nat. Univ. Econ. Sci. 2016, 1, 148–155. (In Ukrainian) [Google Scholar]

- Mahas, N.V. Rating estimation of financial security of enterprises. Effic. Econ. 2015, 5. Available online: http://www.economy.nayka.com.ua/?op=1&z=4090 (accessed on 15 March 2020). (In Ukrainian).

- Shtanhret, A.M.; Kotliarevskyi, Y.V.; Melnykov, O.V. Financial security of the enterprise: Methodological fundamentals of management. Financ. Ukr. 2013, 11, 56–65. (In Ukrainian) [Google Scholar]

- Shvets, Y.O.; Tsykalo, K.S. A methodological approach to assessing the level of industrial enterprises financial security. Sci. Bull. Int. Humanit. Univ. Ser. Econ. Manag. 2017, 25, 162–168. (In Ukrainian) [Google Scholar]

- Tkachuk, H.O. Financial security of the enterprise: Assessment of management effectiveness and risk assessment. Econ. Food Ind. 2013, 1, 62–64. (In Ukrainian) [Google Scholar]

- Khomutenko, A. Specific Methodological Approaches to Managing State Finances. Montenegrin J. Econ. 2018, 14, 73–82. [Google Scholar] [CrossRef]

- Harkusha, O.M. Formation of Effective Winery-Winemaking Subcomplex of AIC of Ukraine: Monograph; National Anti-Corruption Bureau (MDAA): Mykolaiv, Ukrainе, 2001. (In Ukrainian) [Google Scholar]

- Kucherenko, V.M. Trends in export-import activities of the wine industry. Econ. Strategy Prospects Dev. Trade Serv. 2015, 2, 279–292. (In Ukrainian) [Google Scholar]

- Nekrasova, L.A.; Nekrasova, K.I. Analysis and prospects of development of winemaking enterprises in Ukraine. Black Sea Econ. Stud. 2016, 6, 83–87. (In Ukrainian) [Google Scholar]

- Popova, M.M. State regulation of the development of the viticulture and wine industry in Ukraine: Current status, problems and directions of improvement. Econ. Financ. Right 2013, 10, 4–8. (In Ukrainian) [Google Scholar]

- Tintulov, Y.V. Improvement of the public administration system of the viticulture and wine subcomplex of Ukraine as a guarantee of its sustainable development. Econ. Innov. 2014, 58, 326–332. (In Ukrainian) [Google Scholar]

- Lavrysh, Y. Implementation of Transformative Sustainability Learning into Engineering Curricular. Future Hum. Image 2018, 9, 63–73. [Google Scholar] [CrossRef]

- Heldak, M.; Kucher, A.; Stacherzak, A.; Kucher, L. Structural Transformations in Agriculture in Poland and Ukraine: Towards Economic Sustainability. J. Environ. Manag. Tour. 2019, 9, 1827–1841. [Google Scholar] [CrossRef]

- Ma, B. Value Shaping of “Ecological Man”: External Standard and Internal Idea. Future Hum. Image 2020, 13, 57–65. [Google Scholar] [CrossRef]

- Kim, Y.; Choi, S.; Yi, M.Y. Applying Comparable Sales Method to the Automated Estimation of Real Estate Prices. Sustainability 2020, 12, 5679. [Google Scholar] [CrossRef]

- Bidzhoyan, D.; Bogdanova, T. Modelling the financial stability of an enterprise taking into account macroeconomic indicators. Bus. Inform. 2016, 37, 30–37. [Google Scholar] [CrossRef]

- Mamede, R.P. Financial (In)Stability and Industrial Growth: The Cases of Italy and Portugal; University Institute of Lisbon: Lisbon, Portugal, 2014. [Google Scholar] [CrossRef] [Green Version]

- Nassar, S. Financial Outlook of the United States Steel Industry and Its Role in the Economy Moving Forward. iBusiness 2019, 11, 51–56. [Google Scholar] [CrossRef] [Green Version]

- Shewhart, W.A. Economic Control of Quality of Manufactured Product; Van Nostrand: New York, NY, USA, 1931. [Google Scholar]

- Shewhart, W.A. Statistical Method from the Viewpoint of Quality Control; The Graduate School, The Deptartment of Agriculture: Washington, DC, USA, 1939. [Google Scholar]

- Faraz, A.; Saniga, E.; Montgomery, U. Percentile-based control chart design with an application to Shewhart X and S 2 control charts. Qual. Reliab. Eng. Int. 2018, 35, 116–126. [Google Scholar] [CrossRef] [Green Version]

- Markov, A.A. Propagation of the law of large numbers into quantities that depend on each other. Proc. Physics Math. Soc. Kazan Univ. 1906, 15, 135–156. (In Russian) [Google Scholar]

- Awwad, M. Influences of Frege’s Predicate Logic on Some Computational Models. Future Hum. Image 2018, 9, 5–19. [Google Scholar] [CrossRef]

| Informal Description of Graduations | Numerical Value |

|---|---|

| Very high financial security level | 0.8–1.0 |

| Sufficient financial security level | 0.64–0.8 |

| Medium financial security level | 0.37–0.64 |

| Low (pre-crisis) financial security level | 0.2–0.37 |

| Crisis (critical) financial security level | 0.0–0.2 |

| Indicator | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| X1 | 0.67 | 0.50 | 0.31 | 0.19 | 0.15 | 0.08 | 0.12 | 0.15 | 0.20 | 0.23 | 0.41 |

| X2 | 3.16 | 2.08 | 1.54 | 1.25 | 1.17 | 1.09 | 1.13 | 1.17 | 1.25 | 1.30 | 1.69 |

| X3 | 3.13 | 1.99 | 1.52 | 1.22 | 1.15 | 1.07 | 1.09 | 1.06 | 1.14 | 1.22 | 1.46 |

| X4 | 0.03 | 0.07 | 0.02 | 0.02 | 0.01 | 0.01 | 0.05 | 0.11 | 0.10 | 0.09 | 0.22 |

| X5 | 0.72 | 0.61 | 0.55 | 0.49 | 0.40 | 0.36 | 0.38 | 0.40 | 0.42 | 0.41 | 0.55 |

| X6 | 0.79 | 0.65 | 0.36 | 0.25 | 0.26 | 0.16 | 0.22 | 0.26 | 0.35 | 0.44 | 0.58 |

| X7 | - | 4.38 | 2.70 | 1.98 | 2.22 | 2.14 | 2.19 | 2.24 | 2.42 | 1.64 | 2.59 |

| X8 | - | 359.66 | 343.16 | 270.22 | 340.45 | 392.01 | 423.28 | 427.83 | 756.42 | 510.34 | 525.26 |

| X9 | - | 293.83 | 278.03 | 156.89 | 149.81 | 168.86 | 191.90 | 235.77 | 473.85 | 305.85 | 315.84 |

| X10 | - | 0.30 | 0.35 | 0.33 | 0.41 | 0.45 | 0.52 | 0.41 | 0.56 | 0.61 | 0.55 |

| X11 | - | 1.47 | 1.48 | 1.78 | 1.81 | 1.93 | 1.78 | 1.68 | 1.02 | 1.43 | 1.24 |

| X12 | - | 0.97 | 0.86 | 0.92 | 0.79 | 0.73 | 0.66 | 0.66 | 0.42 | 0.59 | 0.59 |

| X13 | 26.10% | 35.59% | 33.37% | 19.85% | 25.19% | 28.70% | 28.70% | 32.89% | 53.70% | 44.28% | 47.53% |

| X14 | 7.08% | 7.57% | 4.75% | 2.03% | 4.47% | 2.91% | 2.91% | 6.17% | −2.46% | 1.95% | 2.42% |

| X15 | 5.82% | 5.90% | 3.40% | 1.46% | 2.85% | 1.92% | 1.94% | 4.22% | −1.01% | 1.17% | 2.97% |

| X16 | 8.87% | 10.19% | 6.57% | 3.35% | 7.57% | 5.17% | 4.97% | 10.33% | −2.43% | 2.46% | 5.44% |

| Indicator | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | IPк | IGj |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| X1 | 1 | 1 | 1 | 1 | 1 | 0.5 | 1 | 1 | 1 | 1 | 1 | 0.95 | 0.88 |

| X2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1.00 | |

| X3 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1.00 | |

| X4 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 1 | 0.55 | |

| X5 | 1 | 1 | 1 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 1 | 0.68 | 0.68 |

| X6 | 1 | 1 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 1 | 1 | 0.68 | |

| X7 | 1 | 1 | 1 | 1 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.70 | 0.76 | |

| X8 | 1 | 1 | 1 | 1 | 1 | 1 | 0.25 | 0.5 | 0.5 | 0.5 | 0.78 | ||

| X9 | 1 | 1 | 1 | 1 | 1 | 1 | 0.5 | 0.5 | 0.5 | 0.5 | 0.80 | ||

| X10 | 1 | 1 | 1 | 1 | 1 | 0.5 | 0.5 | 1 | 0.5 | 0.5 | 0.80 | ||

| X11 | 1 | 1 | 1 | 1 | 1 | 1 | 0.5 | 0.5 | 0.5 | 0.5 | 0.80 | ||

| X12 | 1 | 1 | 1 | 1 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.70 | ||

| X13 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 0.5 | 1 | 1 | 1 | 1 | 0.68 | 0.70 |

| X14 | 1 | 1 | 0.5 | 1 | 0.5 | 0.5 | 1 | 0.5 | 0.5 | 0.5 | 1 | 0.73 | |

| X15 | 1 | 1 | 0.5 | 0.5 | 0.5 | 0.5 | 1 | 0.5 | 0.5 | 0.5 | 1 | 0.68 | |

| X16 | 1 | 1 | 0.5 | 1 | 0.5 | 0.5 | 1 | 0.5 | 0.5 | 0.5 | 1 | 0.73 | |

| It | 0.90 | 0.94 | 0.81 | 0.84 | 0.78 | 0.69 | 0.78 | 0.61 | 0.66 | 0.66 | 0.81 | 0.77 | |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rekova, N.; Telnova, H.; Kachur, O.; Golubkova, I.; Baležentis, T.; Streimikiene, D. Financial Sustainability Evaluation and Forecasting Using the Markov Chain: The Case of the Wine Business. Sustainability 2020, 12, 6150. https://doi.org/10.3390/su12156150

Rekova N, Telnova H, Kachur O, Golubkova I, Baležentis T, Streimikiene D. Financial Sustainability Evaluation and Forecasting Using the Markov Chain: The Case of the Wine Business. Sustainability. 2020; 12(15):6150. https://doi.org/10.3390/su12156150

Chicago/Turabian StyleRekova, Nataliya, Hanna Telnova, Oleh Kachur, Iryna Golubkova, Tomas Baležentis, and Dalia Streimikiene. 2020. "Financial Sustainability Evaluation and Forecasting Using the Markov Chain: The Case of the Wine Business" Sustainability 12, no. 15: 6150. https://doi.org/10.3390/su12156150