Abstract

Although more and more private equity (PE) firms are integrating environmental, social, and governance (ESG) factors into their investment strategies, there is no clear understanding of their reasons, the details of their activities, the tools they use or the barriers they face. Our study covers these gaps and provides an overview of current trends. We adopted a mixed-method approach, using both qualitative and quantitative data. We first interviewed ESG and PE experts and then submitted a survey to top PE players. Most PE firms integrate ESG issues because investors and other stakeholders pay increasing attention to them. We found that the tools used to assess ESG factors are checklists and that only a few PE firms used external advice from industry experts. Among the main barriers that PE firms face are difficulties in finding information and the lack of a comprehensive way to measure ESG issues. Our findings reveal that PE firms have two main approaches to ESG integration—risk management and value creation—and that the former is dominant. We contribute to the literature by explaining ESG integration in the PE industry and showing that an opportunity for value creation is being missed.

1. Introduction

Environmental, social, and governance factors (ESG) are more salient than ever. Corporations are increasingly experiencing external pressure to change their behavior and focus on ESG factor integration into their business activities. First, a growing number of ethical consumers are pushing companies to provide environmentally friendly products [1,2,3,4]. Second, employees are urging companies to provide work-life balance and have started to decide whether to apply for jobs based on aspects other than salary [5,6,7]. Third, governments play significant roles in shaping business behavior, especially publicly traded firms, due to their stringent regulations and reporting guidelines [8]. Last, investors are becoming increasingly interested in ESG investments [9,10,11]. The largest asset managers and hedge funds have integrated ESG factors into investment decision-making to reduce long-term risks and ultimately enhance return. Today, many are aware that corporations are accountable for their impacts on the natural environment and society. For instance, manufacturing firms inevitably generate impacts on the surrounding natural environment through their production activities, which can deplete natural resources, raise global warming, and pollute air and water. Similarly, business activities inevitably generate an impact on people, such as on their employees’ happiness, fulfilment, and safety. All these aspects have been earning the attention of a wide audience, and managing ESG factors is becoming an imperative that companies cannot avoid, as evident in the growing number of companies working towards responsible environmental footprints, minimizing their carbon emissions, promoting equal opportunities, and work-like balance and guaranteeing human rights [12,13,14].

Since the early 2000s, scholars have empirically investigated the sign and strength of the relationship between ESG performance and financial performance [15,16,17,18,19,20], a branch of research rooted in the strategic management and business ethics field. Despite this growing interest in understanding ESG factors and their links to firm performance, however, only recently has the finance literature started to address this topic [21,22,23], and only a few studies have investigated ESG integration into the private equity (PE) industry. A recent article suggested that we are in the era of PE 4.0, since a growing number of PE firms have been adding the management of ESG issues to their existing capabilities [24]. Although an increasing number of PE firms are integrating ESG factors into their strategies and investment decisions [25], there is no clear understanding of their reasons, the details of their activities, the tools they use or the barriers they face. Many questions remain unanswered, and answering them might be useful to extend research and shed light on the current state of ESG integration in the PE industry. Thus, the present research covers these gaps and ultimately provides an overview of current trends and future possibilities. To this end, we conducted our research to answer the following questions:

- RQ1: Do PE firms consider ESG factors important?

- RQ2: Why do PE firms believe that ESG factors are important?

- RQ3: What kinds of activities do PE firms engage in relative to ESG factors?

- RQ4: What tools do PE firms mainly use for ESG integration?

- RQ5: What criteria do PE firms rely on when deciding whether to perform ESG due diligence?

- RQ6: What are the dominant barriers to ESG integration into PE?

We adopted a mixed-method approach, using both qualitative and quantitative data. Specifically, we first interviewed ESG and PE experts and then submitted a research survey to 23 top PE players in July 2019. Thanks to the interviews and survey results, we could grasp the current trends that characterize PE firms and ESG integration. Our findings have both theoretical and practical implications. First, they contribute to the sustainable finance literature. Many studies have tried to define ESGs [26] but have left largely unexplored the reasons financial institutions, and specifically PE firms, show interest in these issues. Our study provides a comprehensive understanding of the motivations behind the decision to integrate ESG factors into PE activities, the tools firms use and the barriers they face during integration. Second, we make important insights available on how top PE players integrate ESG factors. We hope that our findings help PE firms who want to engage in these activities, too.

In the pages that follow, we describe the methodology used in our research study, report the main findings, and discuss their implications for scholars and practitioners. We also review the limitations of our analysis and suggest future research directions.

2. ESG Factors and Their Integration into Private Equity

“ESG” stands for “environmental”, “social”, and “governance”. “E” stands for “environmental” and deals with company commitments to the defence of the natural environment and resources [27]. Of the various “E” initiatives that companies can embrace, the following are the most common: limiting harm to biodiversity and ecology, ensuring a responsible environmental footprint, minimizing the impact of products and packaging, minimizing carbon emissions, reducing waste, and preventing the mistreatment of animals. “S” stands for “social” and deals with company commitments to social issues [28]. Of the various “S” activities that companies can implement, the following are the most common: protecting human rights, fighting child labor, engaging stakeholders, protecting diversity, protecting and promoting equal opportunity, protecting privacy and data, providing support in humanitarian crises, supporting community development, supporting employee safety, education and health, and promoting work-life balance. “G” stands for “governance” and deals with governance committed to guaranteeing the rights and responsibilities of stakeholders. It includes board composition, committee structure, bribery and corruption prevention, whistleblowing, codes of conduct, and fair compensation policies.

ESG factors are one type of information that has been gaining attention in the finance literature. ESG issues are now compelling investors to reshape the role of finance [29,30]; indeed, over the past several years, climate change and social impact have become defining factors in companies’ long-term prospects. Recently, Larry Fink, BlackRock’s founder and chief executive—one of the most important American global investment management corporations—stated that ESG aspects are a top issue that cannot be neglected and that his firm would make investment decisions with sustainability as a core goal [31]. More and more financial institutions are placing sustainability at the centres of their investment approaches [32]. In 2016, the Global Sustainable Investment Alliance estimated the market for sustainable investment strategies to have reached 22.89 trillion USD of assets under management [33]. While this number suggests a significant shift toward ESG integration, the reasons, tools, and barriers that characterize this transition remain largely unexplored.

Of the various financial market participants that promote sustainable development, PE has recently taken the floor. A PE fund’s main activity consists of buying stakes in private companies to make a profit by later by selling those stakes for a higher price than the initial investment. Usually, a PE life cycle has four main phases. The first is dedicated to seeking capital from investors (fundraising). Later, a PE firm identifies investment opportunities (sourcing). Usually, PE firms gather all the necessary information about target companies through different due diligences. As soon as a PE firm closes a transaction, it starts managing portfolio companies (portfolio). PE firms increase the value of the companies in their portfolios in many ways: organically expanding a business, completing a series of acquisitions in the same industry, and improving an underperforming business. Last, the PE firm sells the companies for a return on investment (exit) [34,35,36,37].

As explained in the literature, the official intersection of PE and ESG can be dated to 2009, when the United States Private Equity Council made the first move toward responsible investment by adopting guidelines covering environmental, health, safety, labor, governance, and social issues [38]. Recently, researchers have highlighted that in the early days of ethical investing, the focus was on using negative screens to exclude companies in certain industries or sectors for moral or ethical reasons [39]. Over time, partially due to concerns about reliance on negative screening, ethical and socially responsible investing evolved into ESG integration. In line with Cappucci’s (2018) study, we believe that ESG integration into investment strategies faces the challenge of investment managers who adopt ESG competing with managers who are not and thus bear none of the costs of ESG integration. Despite PE’s quick transition to ESG integration, we contend that PE firms’ integration of ESG aspects is still in its infancy and that the literature lacks a clear understanding of their activities relative to ESG factors, what assessment tools they prefer, what criteria they rely on when deciding whether to perform an ESG due diligence, and the dominant barriers they face when considering ESG issues in their investment strategies.

3. Materials and Methods

We started our research with a literature review of articles related to ESG factors and PE. To identify relevant studies, we focused on scientific papers published in English in peer-reviewed international journals, because these are considered certified knowledge, which enhances the reliability of the analysis. We imposed a time constraint from 1970 until 2019. To identify suitable papers, we conducted searches using two search strings: “private equity” and “ESG”. We applied these criteria to the ISI Web of Science, specifically searching for any paper whose title, abstract or keywords included “private equity” and “ESG”. The database search returned only four responses [40,41,42,43]. Since only a few studies have been found in this limited area, we decided to explore the field by interviewing ESG and PE experts. Thanks to Boston Consulting Group’s principal investors and private equity (PIPE) practice, we had the opportunity to interview four experts in the field: the heads of sustainability teams at four PE funds operating globally. The first interviewee worked for a France-based PE investment company with $96 billion in total assets; the second worked for an Italian-based PE investment company with Euro 10.2 billion in total assets; the third worked for a PE fund focused on market opportunities in North America and Europe and with approximately $33 billion in assets under management; and the fourth worked for an international investment firm with Euro 23 billion in assets under management with offices in London, New York, Paris, and Hamburg. We conducted four in-depth interviews with each. Initially, we asked questions related to ESG integration into PE activities; we then asked them to help us identify the possible weaknesses of the survey research we built in order to refine it. Rather than a straightforward question-and-answer format, we allowed a discussion with each interviewee. These are the questions we asked during the conversations:

- Do you have direct experience with ESG factor integration into PE activities?

- Do you think there is a need to integrate ESG factors into due diligence? If so, why?

- What are the dominant barriers to ESG integration into PE?

- How are ESG factors integrated into PE activities?

- In which ESG aspects are you most interested?

- Do you think that ESG factors depend on the industry?

- Do you have ESG experts on your team?

- Do you refer to external experts?

- Do you have your own ESG assessment methodology?

- Do you refer to standards?

- Do you refer to external ESG assessment experts?

- Did your investors explicitly ask for ESG integration?

- Have you ever increased the value of a firm in your portfolio through ESG initiatives?

- Do you think that ESG public information is enough?

All the interviews were performed face-to-face and lasted one hour. Then, we continued our research through a survey. Thanks to Boston Consulting Group PIPE practice, we identified 23 PE fund managers available to answer our survey who were mainly located in Italy, Switzerland, the United States, the United Kingdom, and France. In July 2019, we submitted an online survey to these 23 leading PE firms. All participants were provided with the following explanatory introduction.

The purpose of this survey is to map the current adoption of ESG (i.e., Environmental, Social, and Governance) factors in the Private Equity industry and understand your firm’s current and target best practices. The survey is 9 questions long, and its completion takes 5 minutes. We inform you that the questionnaire is anonymous and that answers will be used exclusively for statistical purposes. Thank you for your time and feedback.

Then, participants were asked to answer nine questions. The first three regarded ESG factors and PE, while the remaining six were related to ESG factors and due-diligence activities. The survey was in English, and five established PE experts revised its structure and contents to ensure its clarity and effectiveness. In the Appendix A, we report the survey each participant volunteered to complete.

4. Results

The interviews with ESG and PE experts gave us a deep understanding of current trends. We conducted four semi-structured interviews and made follow-up conference calls, thereby increasing the reliability of our interpretations. The interviews revealed that PE firms have already started incorporating ESG factors into their activities and that a growing number of PE firms have “an internal committee responsible for ESG topics, with both top managers from investment teams and support functions participating”. In addition, all the interviewees stated that there is a need to integrate ESG factors because of investors’ pressure. Moreover, they reported that “the logic behind ESG factors integration is to comply with regulations and standards” and specified that “when we perform an ESG due diligence we employ external advisors specialized in compliance assessments”. One interviewee stated that “most PE firms do not have standardized ESG procedures, neither at [the] due diligence level nor at [the] portfolio level”. The interviewees revealed that they “do not do the ESG business assessment for value creation”. Last, an interviewee explained that most PE firms “performed due diligence regarding environmental issues thanks to the help of specialist advisors”, but conversely, “social and governance issues were rarely checked and in case [they are] done internally”.

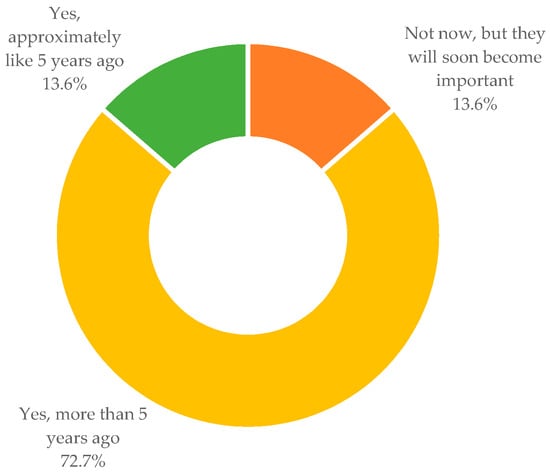

To understand the importance attributed to ESG factors by PE firms, we started the survey by asking, “Does your firm consider ESG factors important in private equity activities?” The possible answers were (i) Yes, more than 5 years ago, (ii) Yes, approximately 5 years ago, (iii) Not now, but they will become important soon, and (iv) Not at all. As reported in Figure 1, most respondents answered that they considered ESG factors more important than they did 5 years before (72.7%), so we can assume that the importance that PE firms attribute to ESG factors is rising.

Figure 1.

Does your firm consider environmental, social, and governance (ESG) factors important in private equity (PE) activities?

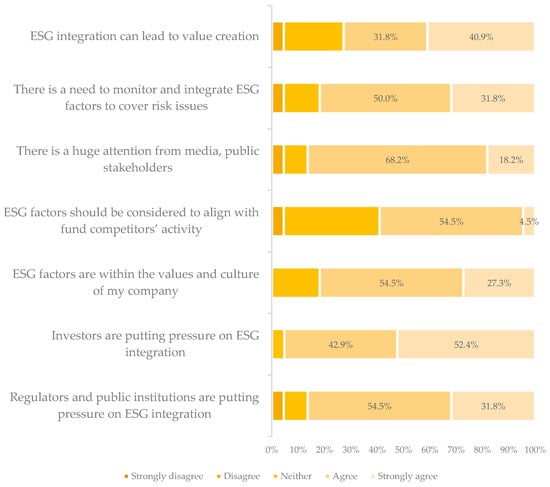

We then asked, “Why are ESG factors becoming increasingly important?” to understand the reasons why PE firms feel this urgency. Respondents had to answer on a 5-point Likert scale: 1 (strongly disagree), 2 (disagree), 3 (neither), 4 (agree), and 5 (strongly agree). The possible answers were (i) regulators and public institutions are putting pressure on ESG integration, (ii) investors are putting pressure on ESG integration, (iii) ESG factors are within the values and culture of my company, (iv) ESG factors should be considered to align with fund competitors’ activity, (v) there is huge attention from media and public stakeholders, (vi) there is a need to monitor and integrate ESG factors to cover risk issues, (vii) ESG integration can lead to value creation, and (viii) other reasons. As presented in Figure 2, most respondents answered that ESG factors were becoming increasingly important for several reasons.

Figure 2.

Why are ESG factors becoming increasingly important?

First, investors pressure ESG integration (52.4% of respondents strongly agreed and 42.9% agreed). Second, attention from media and public stakeholders’ pressures integration (18.2% of respondents strongly agreed and 68.2% agreed). Third, regulators and public institutions pressure ESG integration (31.8% of respondents strongly agreed and 54.5% agreed). Last, there is a need to monitor and integrate ESG factors to cover risk issues (31.8% of respondents strongly agreed and 50.0% agreed). Evidently, PE firms are integrating ESG issues due to the pressure exerted by investors, regulators and the media.

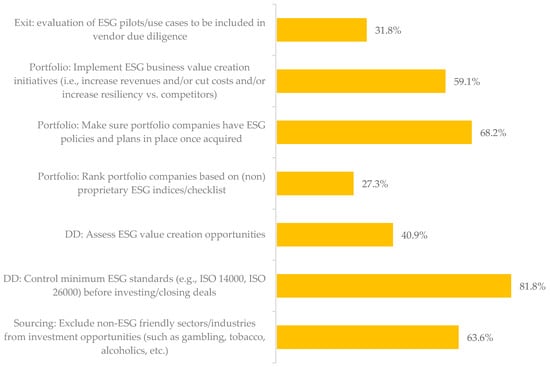

We then asked, “Regarding ESG, what does your firm do?” to understand what types of activities are done by PE firms in relation to ESG aspects. Specifically, our aim was to understand in what phases of a PE life cycle (sourcing, due diligence, portfolio and exit) ESG factors are considered. Figure 3 presents the results. Consistent with our expectations, most respondents answered that they focused on ESG aspects during the due-diligence phase by controlling minimum ESG standards (e.g., ISO 14000 and ISO 26000) before investing or closing a deal (81.8%). In addition, the results show that a few PE firms considered ESG factors during the due-diligence phase to assess value-creation opportunities (only 40.9%). Evidently, the focus is on the risk side, not the value-creation side. Moreover, many respondents answered that they considered ESG factors in the sourcing and portfolio phases, while little attention was given to ESGs in the exit phase (31.8%). Specifically, 68.2% of respondents stated that they ensured that portfolio companies had ESG policies and plans in place once acquired, 63.6% stated that they excluded non-ESG-friendly industries from investment opportunities (such as gambling, tobacco, alcoholics, etc.), and 59.1% stated that they implemented ESG value-creation initiatives.

Figure 3.

Regarding ESG, what does your firm do?

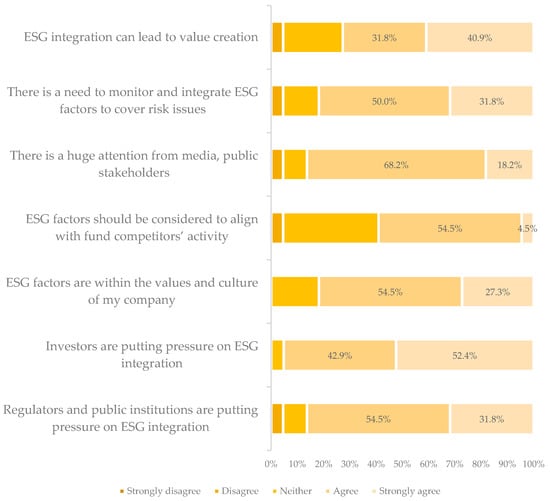

Then, we decided to understand the reasons PE firms consider ESG factors in their due-diligence activities. Respondents had to answer on a 5-point Likert scale: 1 (strongly disagree), 2 (disagree), 3 (neither), 4 (agree), and 5 (strongly agree), to the following items: (i) ESG integration can lead to value creation, (ii) there is a need to monitor and integrate ESG factors to cover risk issues, (iii) there is huge attention from media and public stakeholders (iv) ESG factors should be considered to align with fund competitors’ activity, (v) ESG factors are within the values and culture of my company, (vi) investors are putting pressure on ESG integration, and (vii) regulators and public institutions are putting pressure on ESG integration (Figure 4). As expected, the chief reason PE firms focused on ESG aspects in relation to due diligence was the pressure exerted by investors in this direction (52.4% strongly agreed and 42.9% agreed). Second, most respondents agreed that there was huge attention on ESG factors from the media and public stakeholders (18.2% strongly agreed and 68.2% agreed). Last, many respondents stated that there was a need to monitor and integrate ESG factors to cover risk issues (31.8% strongly agreed and 50.0% agreed). PE firms apparently feel urgency to focus on ESG due to the rising attention from a growing number of different actors and to assess risks.

Figure 4.

Considering your firm’s due-diligence activities, indicate how strongly you agree or disagree with each statement.

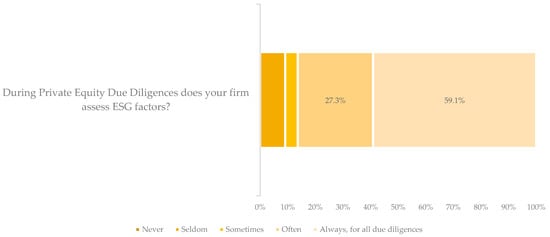

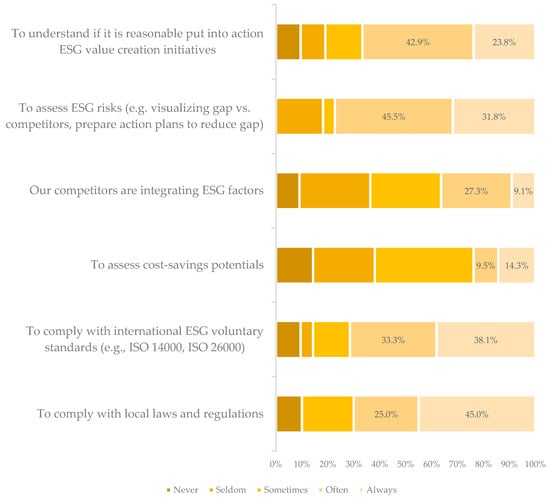

To understand the frequency of ESG integration into due diligence activities, we asked, “During private equity due diligence, does your firm assess ESG factors?” As reported in Figure 5, 59.1% of respondents stated that they assessed ESG aspects in all due diligence. We then asked, “What are the main reasons your firm performs ESG due diligence?” Respondents could answer on a 5-point Likert scale to the following answers: (i) to comply with local laws and regulations, (ii) to comply with international ESG voluntary standards (e.g., ISO 14000, ISO 26000), (iii) to assess cost-savings potentials, (iv) our competitors are integrating ESG factors, (v) to assess ESG risks (e.g., visualizing gap vs. competitors, prepare action plans to reduce gap), (vi) to understand if it is reasonable put ESG value-creation initiatives into action, and (vii) for other reasons (Figure 6).

Figure 5.

During PE due diligences, does your firm assess ESG factors?

Figure 6.

What are the main reasons your firm performs ESG due diligence?

The results show that most PE firms performed ESG due diligence to assess ESG risks (31.8% strongly agreed and 45.5% agreed), to comply with international ESG international voluntary standards (38.1% strongly agreed and 33.3% agreed), and to comply with local laws and regulations (45.0% strongly agreed and 25.0% agreed). Few respondents stated that they did it to assess cost-savings potentials or because their competitors were doing so.

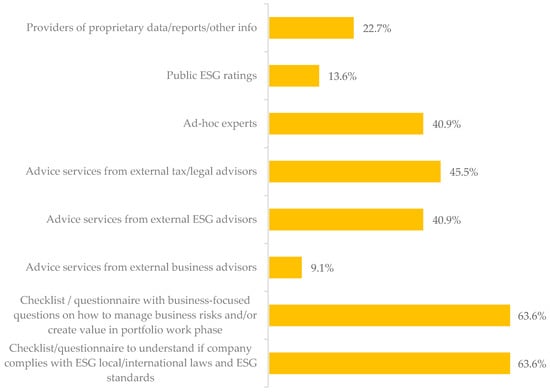

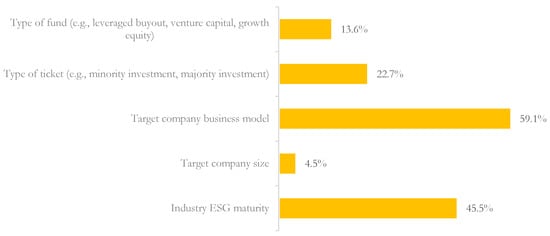

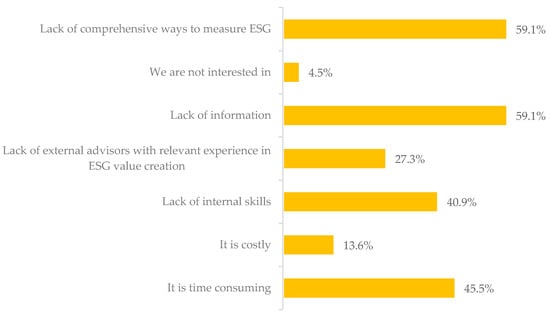

In the last part of the research survey, we asked, “When assessing ESG factors, which of the following tools does your firm use?”, “Which criteria does your firm rely on when deciding whether to perform an ESG due diligence?” and “Which are the dominant barriers for ESG integration into due diligence?”. Figure 7, Figure 8 and Figure 9 show the results.

Figure 7.

When assessing ESG factors, which of the following tools does your firm use?

Figure 8.

Which criteria does your firm rely on when deciding whether to perform an ESG due diligence?

Figure 9.

Which are the dominant barriers for ESG integration into due diligence?

To assess ESG factors, PE funds use two main tools: checklist-questionnaires with business-focused questions on how to manage business risks and create value in the portfolio work phase (63.6%) and checklist-questionnaires to understand whether a company complies with ESG local-international laws and ESG standards (63.6%). A modest number of PE firms used ad hoc experts (40.9%) and advice services from external ESG advisors (40.9%) or tax/legal advisors (45.4%). Few respondents used public ratings (13.6%), advice services from external business advisors (9.1%) or providers of proprietary data (22.7%). Interestingly, PE firms decided to perform an ESG due diligence relying on two primary criteria: the target company business model (59.1%) and industry ESG maturity (45.5%), while only a few PE firms performed it depending on the company size (4.5%) or ticket type (22.7%).

Despite the rising attention on ESG factors, PE firms still face barriers that prevent their effective integration into due-diligence activities. As reported in Figure 9, 59.1% of respondents declared that there was still a lack of both information related to environmental and social issues and of comprehensive ways to measure them. Moreover, more than 40.9% of PE firms agreed that there was a lack of internal skills and that this kind of activity was time-consuming.

5. Discussion

Many companies are redesigning their activities to create work environments that are healthy and fulfilling for employees and to deliver superior products and services without harming the natural environment. This change of route comes from the increasing awareness that ESG issues and financial returns are not necessarily at odds. In recent years, the attention on sustainable and responsible investments and the need to integrate ESG factors has significantly increased. Even though ESG issues are becoming the mainstream [44,45,46], there is no clear understanding of the reasons investors, particularly PE firms, are struggling to integrate them, what kinds of activities and tools they use to integrate ESG factors into investment decisions, what barriers they face, or what criteria they adopt to decide whether to integrate ESG factors. Moreover, are PE firms approaching ESG factors as levers to increase the values of portfolios to resell them? Due to our mixed-method approach, we built a comprehensive understanding of the current trends in the PE field relative to the integration of ESG factors and contributed the following findings to the literature.

First, it emerged that the interest in ESG factors is greater than ever and that PE firms are integrating them into their strategies and activities. The results show that most PE firms integrate ESG aspects because there is increasing attention on these issues from both investors and other stakeholders. Consistent with the overall ESG transition, various external forces are pushing the PE industry towards ESG integration. Not only investors but also other actors are urging PE firms to consider these aspects. These sources of pressure might lead PE firms to consider ESG factors as a way to reduce the risk of significant negative events rather than an opportunity to open up valuable new opportunities. In addition, it emerged that this emphasis on ESG factors is a way to manage risks since few PE firms approach companies’ environmental and social issues to create value. In line with these first results, we found that the tools mainly used to assess ESG factors are checklists and that only a few firms use external advice from industry experts. We contend that checklists are a useful tool for PE firms that want to perform a company’s ESG assessment to reduce risk, but external advice from industry experts should be used if the PE firm wants to open up market opportunities and spur innovation.

Furthermore, the criteria adopted by PE firms to decide whether to perform ESG due diligence are the company business model and the industry ESG maturity. As expected, among the main barriers that PE firms face are difficulties in finding information and the lack of a comprehensive way to measure these types of issues. Fortunately, more and more corporations are using the Global Reporting Initiative standards to better evaluate and report their economic, environmental, and social impacts [47]. We hope that this tool will also help PE firms.

This study contributes to the literature on PE and sustainability. While ESG factor integration has largely been investigated as a driver of corporate performance [48,49,50], few studies have examined ESG factor integration into PE activities, particularly how PE fund managers integrate ESG factors into their investment strategies. We have filled this gap by documenting how PE firms integrate sustainability into their activities, what tools they use, and what barriers they face. Our most important contribution is introducing ESG factors to the literature on PE.

Considering the results, PE firms have two main approaches to ESG integration—risk management and value creation—and the former is dominant. We recognize, of course, that this work has several limitations. First, we recognize that our results are based on small sample sizes that do not represent all PE firms. Second, we investigated only some aspects of PE activities. We recognize the need to expand this research to possible differences depending on strategy (e.g., leveraged buyout, growth capital, mezzanine capital, venture capital, etc.). Future studies could focus on each phase of a PE fund and explore how they integrate ESG factors. We hope that future research will deepen insights into this lively topic.

Evidently, to date, PE firms have focused on identifying the minimum levels of ESG integration necessary to shelter the companies in their portfolios from possible risks and scandals; their aim is not to identify and quantify business opportunities offered by ESG factors. The currently dominant PE approach can be acknowledged as conservative since it is characterized by considering ESG factors as a minimum requirement to fulfil in response to external pressures. The question that arises is therefore whether PE funds are duly considering the value-creation opportunities offered by integrating ESG aspects.

Author Contributions

Conceptualization, M.C.Z. and M.P.; Methodology, M.C.Z. and M.P.; Writing—original draft, M.C.Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research did not receive external funding.

Acknowledgments

We acknowledge Boston Consulting Group (BCG) principal investors and private equity (PIPE) practice team members for their valuable support and contribution to this research.

Conflicts of Interest

The authors declare no conflict of interest.

Appendix A

Research survey’s questions

- (1)

- Does your firm consider environmental, social and governance (ESG) factors important in Private Equity activities?

- Yes, more than 5 years ago

- Yes, approximately like 5 years ago

- Not now, but they will soon become important

- Not at all

- (2)

- Why ESG factors are becoming increasingly important? (1 = Strongly disagree, 2 = Disagree, 3 = Neither, 4 = Agree, 5 = Strongly agree)

- Regulators and public institutions are putting pressure on ESG integration

- Investors are putting pressure on ESG integration

- ESG factors are within the values and culture of my company

- ESG factors should be considered to align with fund competitors’ activity

- There is a huge attention from media, public stakeholders

- There is a need to monitor and integrate ESG factors to cover risk issues

- (3)

- Regarding ESG, what does your firm do?

- Sourcing: Exclude non-ESG friendly sectors/industries from investment opportunities (such as gambling, tobacco, alcoholics, etc.)

- DD: Control minimum ESG standards before investing/closing deals

- DD: assess ESG value creation opportunities

- Portfolio: Rank portfolio companies based on (non) proprietary ESG indices/checklist

- Portfolio: Make sure portfolio companies have ESG policies and plans in place once acquired

- Portfolio: Implement ESG business value creation (i.e., increase revenues and/or cut costs and/or increase resiliency versus competitors)

- Exit: evaluation of ESG pilots/use cases to be included in vendor due diligence

- Nothing

- Other (please specify)

- (4)

- Considering your firm due diligence activities, indicate how strongly do you agree or disagree with each statement. (1 = Strongly disagree, 2 = Disagree, 3 = Neither, 4 = Agree, 5 = Strongly agree)

- Environmental factors are more important today versus 5 years ago

- Environmental factors will become more important in 5 years versus today

- Social factors are more important today versus 5 years ago

- Social factors will become more important in 5 years versus today

- Governance factors are more important today versus 5 years ago

- Governance factors will become more important in 5 years versus today

- (5)

- During private equity due diligences, does your firm assess ESG factors?

- Always, for all due diligences

- Often

- Sometimes

- Seldom

- Not at all

- (6)

- Which are the main reasons why your firm perform ESG due diligences? (1 = Never, 2 = Seldom, 3 = Sometimes, 4 = Often, 5 = Always)

- To comply with local laws and regulations

- To comply with international ESG voluntary standards

- To assess cost-savings potentials

- Our competitors are integrating ESG factors

- To assess ESG risks (e.g., visualizing gap versus competitors, prepare action plans to reduce gap)

- To understand if it is reasonable put into action ESG value creation initiatives

- For other reasons

- (7)

- When assessing ESG factors, which of the following tools does your firm use?

- Checklist/questionnaire to understand if company complies with ESG local/international laws and ESG standards

- Checklist/questionnaire with business-focused questions on how to manage business risks and/or create value in portfolio work phase

- Advice services from external business advisors

- Advice services from external ESG advisors

- Advice services from external tax/legal/other advisors

- Ad-hoc experts (e.g., industry experts with previous work on ESG, former ESG directors of PE funds, etc.)

- Public ESG ratings

- Providers of proprietary data/reports/other info

- Others

- (8)

- Which criteria does your firm rely on when deciding whether to perform an ESG due diligence?

- Industry ESG maturity

- Target company size

- Target company business model

- Type of ticket (e.g., minority investment, majority investment)

- Type of fund (e.g., leveraged buyout, venture capital, growth equity)

- Other

- (9)

- Which are the dominant barriers for ESG integration into due diligence?

- It is time consuming

- It is costly

- Lack of internal skills

- Lack of external advisors with relevant experience in ESG value creation

- Lak of information

- We are not interested in

- Lack of comprehensive ways to measure ESG

- Other

References

- Freestone, O.M.; McGoldrick, P.J. Motivations of the ethical consumer. J. Bus. Ethics 2008, 79, 445–467. [Google Scholar] [CrossRef]

- Shaw, D.; Shiu, E. The role of ethical obligation and self-identity in ethical consumer choice. Int. J. Consum. Stud. 2002, 26, 109–116. [Google Scholar] [CrossRef]

- Pedrini, M.; Ferri, L.M. Socio-demographical antecedents of responsible consumerism propensity. Int. J. Consum. Stud. 2014, 38, 127–138. [Google Scholar] [CrossRef]

- Young, W.; Hwang, K.; McDonald, S.; Oates, C.J. Sustainable consumption: Green consumer behaviour when purchasing products. Sustain. Dev. 2010, 18, 20–31. [Google Scholar] [CrossRef]

- Perrons, D. The new economy and the work–life balance: Conceptual explorations and a case study of new media. Gend. Work Organ. 2003, 10, 65–93. [Google Scholar] [CrossRef]

- Di Fabio, A. Positive Healthy Organizations: Promoting well-being, meaningfulness, and sustainability in organizations. Front. Psychol. 2017, 8, 1938. [Google Scholar] [CrossRef]

- Pedrini, M.; Ferri, L.M.; Riva, E. Institutional pressures and internal motivations of work-life balance organisational arrangements in Italy. Int. J. Hum. Resour. Dev. Manag. 2018, 18, 257–281. [Google Scholar] [CrossRef]

- Guo, Y.; Xia, X.; Zhang, S.; Zhang, D. Environmental regulation, government R&D funding and green technology innovation: Evidence from China provincial data. Sustainability 2018, 10, 940. [Google Scholar]

- Amel-Zadeh, A.; Serafeim, G. Why and how investors use ESG information: Evidence from a global survey. Financ. Anal. J. 2018, 74, 87–103. [Google Scholar] [CrossRef]

- Escrig-Olmedo, E.; Rivera-Lirio, J.M.; Muñoz-Torres, M.J.; Fernández-Izquierdo, M.Á. Integrating multiple ESG investors’ preferences into sustainable investment: A fuzzy multicriteria methodological approach. J. Cleaner Prod. 2017, 162, 1334–1345. [Google Scholar] [CrossRef]

- Eccles, R.G.; Klimenko, S. The investor revolution. Harv. Bus. Rev. 2019, 97, 106–116. [Google Scholar]

- McWilliams, A.; Siegel, D. Corporate social responsibility: A theory of the firm perspective. Acad. Manag. Rev. 2001, 26, 117–127. [Google Scholar] [CrossRef]

- Bansal, P.; Roth, K. Why companies go green: A model of ecological responsiveness. Acad. Manag. Rev. 2000, 43, 717–748. [Google Scholar]

- Hemingway, C.A.; Maclagan, P.W. Managers’ personal values as drivers of corporate social responsibility. J. Bus. Ethics 2004, 50, 33–44. [Google Scholar] [CrossRef]

- Barnett, M.L.; Salomon, R.M. Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strateg. Manag. J. 2006, 27, 1101–1122. [Google Scholar] [CrossRef]

- Luo, X.M.; Bhattacharya, C.B. Corporate social responsibility, customer satisfaction, and market value. J. Mark. 2006, 70, 1–18. [Google Scholar] [CrossRef]

- Margolis, J.D.; Walsh, J.P. Misery loves companies: Rethinking social initiatives by business. Adm. Sci. Q. 2003, 48, 268–305. [Google Scholar] [CrossRef]

- Orlitzky, M.; Schmidt, F.L.; Rynes, S.L. Corporate social and financial performance: A meta-analysis. Organ. Stud. 2003, 24, 403–441. [Google Scholar] [CrossRef]

- Zhao, C.; Guo, Y.; Yuan, J.; Wu, M.; Li, D.; Zhou, Y.; Kang, J. ESG and corporate financial performance: Empirical evidence from China’s listed power generation companies. Sustainability 2018, 10, 2607. [Google Scholar] [CrossRef]

- Ramchander, S.; Schwebach, R.G.; Staking, K. The informational relevance of corporate social responsibility: Evidence from DS400 index reconstitutions. Strateg. Manag. J. 2012, 33, 303–314. [Google Scholar] [CrossRef]

- Schramade, W. Bridging sustainability and finance: The value driver adjustment approach. J. Appl. Corp. Financ. 2016, 28, 17–28. [Google Scholar]

- Eccles, R.G.; Serafeim, G.; Krzus, M.P. Market interest in nonfinancial information. J. Appl. Corp. Financ. 2011, 23, 113–127. [Google Scholar] [CrossRef]

- Lydenberg, S. Integrating systemic risk into modern portfolio theory and practice. J. Appl. Corp. Financ. 2016, 28, 56–61. [Google Scholar]

- Indahl, R.; Jacobsen, H.G. Private Equity 4.0: Using ESG to Create More Value with Less Risk. J. Appl. Corp. Financ. 2019, 31, 34–41. [Google Scholar] [CrossRef]

- Crifo, P.; Forget, V.D.; Teyssier, S. The price of environmental, social and governance practice disclosure: An experiment with professional private equity investors. J. Corp. Financ. 2015, 30, 168–194. [Google Scholar] [CrossRef]

- Halbritter, G.; Dorfleitner, G. The wages of social responsibility—Where are they? A critical review of ESG investing. Rev. Financ. Econ. 2015, 26, 25–35. [Google Scholar] [CrossRef]

- Goodland, R. The concept of environmental sustainability. Annu. Rev. Ecol. Syst. 1995, 26, 1–24. [Google Scholar] [CrossRef]

- Littig, B.; Griessler, E. Social sustainability: A catchword between political pragmatism and social theory. Int. J. Sustain. Dev. 2005, 8, 65–79. [Google Scholar] [CrossRef]

- Soppe, A. Sustainable corporate finance. J. Bus. Ethics 2004, 53, 213–224. [Google Scholar] [CrossRef]

- Eccles, R.G.; Kastrapeli, M.D.; Potter, S.J. How to Integrate ESG into Investment Decision-Making: Results of a Global Survey of Institutional Investors. J. Appl. Corp. Financ. 2017, 29, 125–133. [Google Scholar] [CrossRef]

- Odell, J.; Ali, U. ESG investing in emerging and frontier markets. J. Appl. Corp. Financ. 2016, 28, 96–101. [Google Scholar]

- Kirkland, R. Bring the problem forward: Larry Fink on climate risk. In The McKinsey Quarterly; Copyright McKinsey & Company, Inc.: New York, NY, USA, 2020. [Google Scholar]

- Urban, M.A.; Wójcik, D. Dirty banking: Probing the gap in sustainable finance. Sustainability 2019, 11, 1745. [Google Scholar] [CrossRef]

- GSIA. Global Sustainable Investment Review. 2016. Available online: http://www.gsi-alliance.org/wp-content/uploads/2017/03/GSIR_Review2016.F.pdf (accessed on 14 July 2020).

- Metrick, A.; Yasuda, A. The economics of private equity funds. Rev. Financ. Stud. 2010, 23, 2303–2341. [Google Scholar] [CrossRef]

- Phalippou, L.; Gottschalg, O. The performance of private equity funds. Rev. Financ. Stud. 2009, 22, 1747–1776. [Google Scholar] [CrossRef]

- Froud, J.; Williams, K. Private equity and the culture of value extraction. New Political Econ. 2007, 12, 405–420. [Google Scholar] [CrossRef]

- Schell, J.M. Private Equity Funds: Business Structure and Operations; Law Journal Press: New York, NY, USA, 2020. [Google Scholar]

- Crifo, P.; Forget, V.D. Think global, invest responsible: Why the private equity industry goes green. J. Bus. Ethics 2013, 116, 21–48. [Google Scholar] [CrossRef]

- Cappucci, M. The ESG integration paradox. J. Appl. Corp. Financ. 2018, 30, 22–28. [Google Scholar] [CrossRef]

- Majoch, A.A.; Hoepner, A.G.; Hebb, T. Sources of stakeholder salience in the responsible investment movement: Why do investors sign the principles for responsible investment? J. Bus. Ethics 2017, 140, 723–741. [Google Scholar] [CrossRef]

- Paetzold, F.; Busch, T. Unleashing the powerful few: Sustainable investing behaviour of wealthy private investors. Organ. Environ. 2014, 27, 347–367. [Google Scholar] [CrossRef]

- Bettinazzi, E.L.; Zollo, M. Stakeholder orientation and acquisition performance. Strateg. Manag. J. 2017, 38, 2465–2485. [Google Scholar] [CrossRef]

- Alsayegh, M.F.; Abdul Rahman, R.; Homayoun, S. Corporate economic, environmental, and social sustainability performance transformation through ESG disclosure. Sustainability 2020, 12, 3910. [Google Scholar] [CrossRef]

- Tarmuji, I.; Maelah, R.; Tarmuji, N.H. The impact of environment, social and governance (ESG) on economic performance: Evidence from ESG scores. Int. J. Trade Econ. Financ. 2016, 7, 67–74. [Google Scholar] [CrossRef]

- Ong, T.S.; Teh, B.H.; Ang, Y.W. The impact of environmental improvements on the financial performance of leading companies listed in Bursa Malaysia. Int. J. Trade Econ. Financ. 2014, 5, 386–391. [Google Scholar] [CrossRef]

- Brown, H.S.; De Jong, M.; Lessidrenska, T. The rise of the Global Reporting Initiative: A case of institutional entrepreneurship. Environ. Politics 2009, 18, 182–200. [Google Scholar] [CrossRef]

- Friede, G.; Busch, T.; Bassen, A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. J. Sustain. Financ. Investig. 2015, 5, 210–233. [Google Scholar] [CrossRef]

- Landi, G.; Sciarelli, M. Towards a more ethical market: The impact of ESG rating on corporate financial performance. Soc. Responsib. J. 2019, 15, 11–27. [Google Scholar] [CrossRef]

- Velte, P. Does ESG performance have an impact on financial performance? Evidence from Germany. J. Glob. Responsib. 2017, 8, 169–178. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).