1. Introduction

There is a growing body of literature on the possible causes of the housing crisis of the past decade that eventually morphed into a full-blown recession during 2007–2009. The recession was of a magnitude not witnessed since the Great Depression of the 1930s and hence came to be known as the Great Recession. Naturally, there was a surge in interest in exploring the origin of this crisis to prevent its recurrence in future.

Mostly, four possible explanations have been offered for the housing bubble which burst in 2006 (See

McDonald and Stokes 2013c,

2015). First, there are those who blamed the financial innovations of the 1990s and early 2000s giving rise to lax credit standards and greater access to mortgage credit for high-risk subprime borrowers. Second, some researchers pointed to the growing US current account deficit requiring a massive capital inflow from abroad. The ‘global savings glut’

1 of the 1990s helped in channeling funds to the US and keeping the long-term interest rate under check. The third group placed the blame on a classic asset price bubble fueled by expectations of higher and higher home prices in future. Finally, there are those who held the Federal Reserve responsible for the run up in house prices by setting the target for the federal funds rate at very low levels during 2001–2004.

Our study is based on the explanation that focuses on the loose monetary policy of the Federal Reserve. We examine whether the interest rate policy of Federal Reserve played any role in the formation of the housing bubble and if so, how did it change since the bubble burst in 2006. Since structural stability in the relationship among variables is critical for such policy evaluation and analysis, we specifically investigate if the relationship between the federal funds rate, real GDP and the housing variables has been stable for all time periods or if there have been structural breaks in the relationship over time.

Controversy surrounds the role of the Federal Reserve to this day. Several papers have been written ranging from holding Federal Reserve primarily responsible to somewhat responsible to not responsible at all.

McDonald and Stokes (

2013b) provide an extensive literature review for the interested reader. For example,

Taylor (

2007) led the group that held monetary policy of Federal Reserve largely responsible for the turmoil in the housing market. Subsequently

Leamer (

2007),

McDonald and Stokes (

2013a,

2013b,

2015),

Iqbal and Vitner (

2013) arrived at a similar conclusion. On the other side of the aisle,

Bernanke (

2010) and

Dokko et al. (

2011) among others did not find evidence of any role played by the Federal Reserve in triggering the crisis.

Bernanke (

2010), in particular, considered low federal funds rate of 2002–2004 to be an appropriate response in the backdrop of a jobless recovery from the recession of the early 2000s as well as a growing concern of Japan style deflation taking hold.

Shiller (

2008) held a less extreme position arguing that although the period of very low funds rate coincided with rapidly rising house prices, the monetary policy was not necessarily an exogenous cause of the bubble. Still he agreed that the rate cuts might have boosted the housing boom beyond what would have otherwise occurred.

Miles (

2014) also held the Federal Reserve somewhat responsible while also attributing part of the blame to the global savings glut of the 1990s that was beyond the control of the Federal Reserve.

Some of these studies did focus on how the relationship between monetary policy and housing market variables has evolved over time.

Iqbal and Vitner (

2013) considered structural change caused by IT revolution and its subsequent bust in 2000–2001 to be a major contributor to the housing bubble. They used a dummy variable to isolate the time-period driving structural changes based on prior knowledge of historical events.

McDonald and Stokes (

2013a), on the other hand, carried out Granger causality tests between federal funds rate and house prices over different sub samples by choosing break dates based on known historical facts and concluded that there was a change in the relationship between funds rate and house prices after 2000. However, as

Miles (

2014) pointed out, “— changing the sample in this manner could lead to accusations, of ‘cherry picking’ different sample dates based on knowledge of the data and eventually would lead to inference problems”. To avoid data mining,

Miles (

2014) performed the Andrews-Quandt endogenous structural break test (

Andrews 1993) on the models. He found evidence of structural breaks in the impact of federal funds rate and the 30-year mortgage rate on both the house prices and residential fixed investment during the 1980s and the first half of the past decade.

While applying a test for structural break that endogenously determines the break point instead of guessing it based on prior knowledge is definitely a step in the right direction, Andrews and Quandt break test has its own share of limitations. First of all, it is a test for a single structural break point only and second of all, this test can only be applied to a single equation model. When all variables in the model are endogenous and may be subject to multiple structural breaks, Andrews-Quandt test will be inadequate.

Qu and Perron (

2007) method, by contrast, is much broader in scope as it allows for multiple structural changes occurring at unknown break dates within a system of equations. We add a new dimension to the literature by first applying the Qu and Perron structural break test to endogenously determine break dates before splitting the full sample into pre- and post-crisis period to analyze the role of Federal Reserve in the housing crisis.

Following

McDonald and Stokes (

2013a,

2013b,

2013c) and

Dokko et al. (

2011), we apply a vector autoregression (VAR) model since the variables involved are endogenous in nature. We estimate a small dimensional VAR model consisting of federal funds rate, real GDP and a housing market specific variable using quarterly data spanning 1960:Q1 to 2017:Q4 where Q1, Q2, Q3 and Q4 refer to quarter 1, quarter 2, quarter 3 and quarter 4 respectively from here on. We select three alternative measures of housing market activity to distinguish between price and volume of construction. Model 1 uses nominal house prices while Model 2 focuses on the share of residential investment in GDP. Finally, Model 3 uses housing starts as an indicator of housing market activity. First, we apply the

Qu and Perron (

2007) break test to examine if structural changes have occurred in all three models and if so, at what dates. Second, we split the sample into segments using the break dates identified by

Qu and Perron (

2007) tests for each model, specifically focusing on the pre and post housing crisis period. This, in turn, ensures stability in relationship within each subsample which is critical for policy evaluation and analysis. Finally, we conduct a variety of multivariate time series analysis for the pre- and post-crisis period (including multivariate Granger causality tests, impulse response analysis and forecast error variance decomposition) to make inference about role of Federal Reserve in the crisis. All three models exhibit structural breaks in the relationship between variables. We find evidence of one statistically significant break in Model 1, four statistically significant breaks in Model 2 and as many as five statistically significant breaks in Model 3. It is worth noting that the ‘potential’ break dates obtained using

Qu and Perron (

2007) method are similar across models although not all of them are statistically significant. The break date that is significant across all three models occurs at 1986:Q4 (or 1987:Q1); a period often used in the literature as a probable break point because of the financial deregulation of the early 1980s. Models 2 and 3 each exhibit three additional break dates at 1969:Q1, 2000:Q1 (or 1999:Q4) and 2008:Q4 respectively. The break date in the late 1960s could be attributed to the establishment of Government Sponsored Enterprises (GSE) such as Fannie Mae and Freddie Mac

2 around that time which made mortgage financing more affordable and thus enhanced liquidity in this market. The break date of 2000:Q1 coincided with the tech boom and bust in the late 1990s and early 2000s while the 2008:Q4 coincided with the Great Recession following the collapse of the housing market. Finally, we find a fifth break point in Model 3 at 1977:Q4 which overlaps with the great inflation of the 1970s.

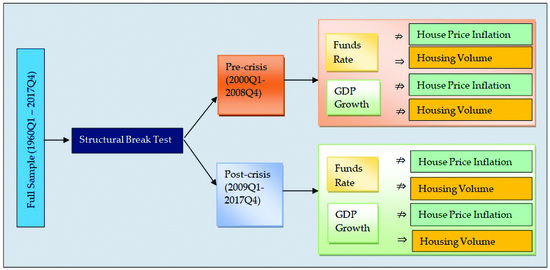

We use these endogenously determined break dates to split the full sample into subsamples, focusing on the last two subsamples. Based on the potential break dates from all three models, we choose 2000Q1–2008Q4 to be the pre-crisis period and 2009:Q1–2017:Q4 to be the post-crisis period. Our key findings can be summarized as follows. We do not find evidence of federal funds rate affecting house price inflation, either in the pre or post-crisis period. Our results contradict

McDonald and Stokes (

2013a,

2013b,

2013c) findings in this regard who have held the loose interest rate policy of the Federal Reserve responsible for the run-up in house prices. However, we find evidence of Federal Reserve influencing residential investment share and to some extent, housing starts in the pre-crisis period, both measuring of volume of construction activity in the housing market. In the post-crisis period, we observe a diminished role of the Federal Reserve in influencing the housing market variables. Instead, the macroeconomy as captured by real GDP growth gains strength in influencing housing variables although its impact is confined to residential investment share and housing starts again. House price inflation is mostly explained by its own past shocks in the post-crisis period suggesting a built-in momentum. Overall, our findings support Leamer’s assertion that housing sector experiences more of a volume cycle than a price cycle.

Our paper is organized as follows. In

Section 2, we summarize previous literature and place our work in context. In

Section 3, we provide a brief theoretical description of

Qu and Perron (

2007) method. In

Section 4, we start with a discussion of our VAR models and data. This is followed by a detailed discussion of our empirical results. We offer our concluding remarks in

Section 5.

2. Previous Literature

There is a growing body of literature assessing the role of the Federal Reserve in triggering and deepening the housing crisis of the past decade. As

Dokko et al. (

2011) pointed out, the residential investment share in GDP surged to 6.25% by late 2005, the highest share in a half century. This substantial increase in housing market activity in turn created a huge run-up in house prices. However, the bubble burst in 2006 when both residential investment share and house prices collapsed. During 2000–2006, the Federal Reserve first lowered the target for the federal funds rate from 6.5% in December 2000 down to 1% in June 2003. Subsequently it increased the target rate steadily until it reached 5.25% in June 2006. Obviously, question arose as to whether the interest rate policy of the Federal Reserve was responsible for the huge increase and subsequent decrease in housing market activity.

Taylor (

2007) led the group that held the Federal Reserve primarily responsible for the crisis. According to Taylor, the low interest rates made the housing finance cheap and attractive and led to a surge in housing starts which reached a 25-year high by the end of 2003 and remained high until the downturn began in early 2006.

Taylor (

2007) estimated a simple housing starts equation from 1959 to 2007 with the federal funds rate as the explanatory variable and found a statistically significant effect of the lagged value of the funds rate on housing starts. Next, he used a counterfactual scenario to address what would have happened had the Federal Reserve followed the interest rate prescribed by Taylor Rule as given below.

where

is the federal fund rate,

is the rate of inflation over the previous four quarters,

is the percent deviation of real GDP from the target, i.e.,

where

is real GDP and

is trend of real GDP [see,

Taylor (

1993) for details]. During 2002–2006, the Taylor rule based interest rate was calculated to be much higher than the actual funds rate. Based on counterfactual simulation results, Taylor concluded that the deviation of the actual funds rate from the Taylor rule might have been the cause of the boom and bust in housing starts and house price inflation.

McDonald and Stokes (

2013a,

2013b,

2013c,

2015) arrived at similar conclusions using a variety of model specifications in a VAR framework.

McDonald and Stokes (

2013a) applied the Granger causality test to study the effect of the federal funds rate on the Case Shiller Index of house prices in a two-variable VAR model and concluded that the Federal Reserve’s low interest rate during 2001–2004 helped cause the housing bubble.

McDonald and Stokes (

2013b) expanded the original VAR framework to also include the foreclosures, the unemployment rate and the 30-year standard mortgage interest rate and demonstrated using impulse response functions that negative shocks to the funds rate increased house prices. Closely following on the prior two papers,

McDonald and Stokes (

2013c) furthered the analysis by studying the effect of 30-year mortgage rate on house prices and concluded that unlike shocks to the funds rate, shocks to the mortgage rate did not have any statistically significant impact on house prices.

McDonald and Stokes (

2015) expanded the VAR framework to include federal deficit as a proxy for fiscal policy as well as the interest rate on adjustable rate mortgages and a measure of net capital inflow. The most important finding of this study was that the house prices were impacted by the federal funds rate and the interest on adjustable rate mortgage but not by the interest rate on 30-year mortgage.

Leamer (

2007,

2015) held the view that the housing downturn was built by the Federal Reserve. He put forward the explanation that the Federal Reserve can mostly affect the timing of home building but not the total over time. The low interest rate of the Federal Reserve can transfer home construction forward in time when construction that did not take place during recession occurs in its aftermath. On the other hand, low interest rate can also transfer construction backward in time by shifting construction that might have occurred at some point in future backward in time into the current period. In Leamer’s opinion, the low federal funds rate of 2002–2004 did not transfer construction forward in time since there was nothing to transfer. Instead, it had the effect of transferring construction backward in time by building more in 2003–2005 at the expense of building less in 2006–2008 thereby sowing the seed for the crisis.

Furthermore, Leamer observed that housing is the single most critical part of the U.S. business cycle. In fact, nine of the past eleven recessions were preceded by a housing downturn. This is because according to Leamer, homes prices primarily experience a volume cycle, not a price cycle. In the face of weak demand, home prices are slow to drop, instead volume decreases more. For real GDP growth and the associated job creation, what matters is the volume of activity in the housing market. Leamer acknowledged that the most recent housing crisis witnessed a sharp drop in house prices. This was due to loose lending standards that allowed the homeowners under financial distress to turn over ownership of property to the lending agencies that are not reluctant sellers. Still

Leamer (

2015) concluded that “I stick with my view that housing experiences a volume cycle not a price cycle, and that 2007–09 was a never-to-be-repeated exception”.

On the other side of the isle,

Dokko et al. (

2011) were of the view that the Federal Reserve’s interest rate policy was well aligned with the goals of the policy makers and not the primary contributor to the extraordinary surge in housing market activity. They employed two empirical models to support their view—The Federal Reserve Board’s FRB/US model and a reduced form seven variable VAR. Their simulation results based on the FRB/US model suggested that a much tighter monetary policy than what was pursued would have resulted in an unemployment rate far higher than what was realized at the time. For the VAR framework,

Dokko et al. (

2011) used a conditional forecast approach, conditional on other variables that entered the VAR. Their simulation exercises suggested that monetary policy could not have played a major role in the housing market boom.

Bernanke (

2010,

2015) defended the accommodative policy stance of the Federal Reserve during 2002–2004 by saying it was what was needed at the time to address the jobless recovery from the recession that technically ended in 2001. Furthermore, Federal Reserve’s policy response also partly reflected its concerns about a Japan type deflation setting in. In response to Taylor’s criticism that the funds rate was much lower than that prescribed by the Taylor’s rule, Bernanke questioned the methodology for computing the output or inflation gap in the Taylor rule. The deviation of the actual funds rate from the Taylor prescribed rate was much smaller when the forecast values of inflation or output were considered instead of their currently observed values. Using International Monetary Fund (IMF) data from a sample of 20 industrial countries, Bernanke also demonstrated that the relationship between monetary policy and house price appreciation was quite weak across countries. Bernanke concluded that the magnitude of house price increases during the early half of the past decade was too large to be explainable by accommodative monetary policy alone. What was needed instead was regulatory reform to control the explosion of exotic types of mortgages and the associated lax lending standards.

Shiller (

2008) and

Miles (

2014) took a stand in the middle. Shiller alluded to the fact that the house prices started appreciating in the late 1990s, much before the period of low interest rate of 2002–2004. In fact, the housing boom was already accelerating in the late 1990s amidst tightening of the interest rate by the Federal Reserve. The rise of alternative mortgage products and loose lending standards were more of a response to rising prices and not the other way around. In that sense, it was a speculative boom that was fueled by expectations of ever-rising house prices. For a while, rising house prices became a self-fulfilling prophecy; eventually further appreciations could not be sustained, and house prices collapsed. That said, rate cuts by the Federal Reserve during 2002–2004 certainly deepened the crisis albeit it was not the exogenous cause of the crisis.

Miles (

2014) emphasized the need to incorporate a proxy for long-term interest rate in addition to the federal funds rate. He alluded to the fact that long-term interest rates were held down even when the Federal Reserve was raising rates during 2004–2006 due to global factors beyond the control of the Federal Reserve. Using a reduced form model where the cyclical components of the housing variables were regressed on the lagged cyclical components of funds rate and a standard 30-year mortgage rate, Miles found the long-term rate to have independent and sometimes greater predictive power for housing than the funds rate. He concluded that while his results did not necessarily exonerate the Federal Reserve, they did point to other global factors beyond Federal Reserve’s control that kept the long-term interest at low levels for an extended period thereby sustaining the crisis.

The objective of our study is to reassess the role of the Federal Reserve in the recent housing crisis with special focus on structural stability in the relationships among variables. While some of the earlier papers discussed the possibility of structural changes occurring in relationships between these variables, except for

Miles (

2014), none of these papers applied statistical tests to endogenously determine break dates. For example,

McDonald and Stokes (

2013a) performed Granger causality tests over different subsamples (1987–2000 and 2000–2010) by arbitrarily choosing break points based on historical facts and concluded that the impact of funds rate on house prices strengthened over time.

Iqbal and Vitner (

2013) tested the structural change hypothesis by assigning a dummy variable equal to one for the period 2001:Q4–2006:Q3 and 0 otherwise. They found a statistically significant effect of the dummy variable on housing starts and house prices.

Miles (

2014), on the contrary, pointed out that choosing break points based on known facts may give rise to misleading inference from hypothesis testing. Instead, he formally tested for parameter instability over time by applying the Andrew-Quandt test (

Andrew 1993) for structural change and found evidence of significant structural breaks.

We concur with Miles that the break points in the relationships need to be determined endogenously within the model. This is because testing for parameter instability by splitting samples based on events known a priori is a form of data mining as the selection of the break date has been made after the data has been informally examined [See

Hansen (

1992)]. However, the Andrew-Quandt test is limited in scope as it can determine only one unknown break date in a single equation model. For our VAR model, we apply a more advanced test developed by

Qu and Perron (

2007) that can determine multiple unknown break dates in a multi equation framework. It is worth noting that

Ahamada and Sanchez (

2013) applied the

Qu and Perron (

2007) test to study the U.S. house price-macro link over time using a VAR framework. Using quarterly data from 1960:Q1 to 2009:Q3, they found evidence of two break points in the house price-real GDP relationship. However, they did not address the effect of the Federal Reserve’s interest rate policy on the housing variables in their study.

In this backdrop, first we test for stability in relationships among variables against the alternative of multiple structural breaks in a VAR framework using

Qu and Perron (

2007) method. Second, if the null hypothesis is rejected, we identify the number of breaks and estimate the break dates. We split the full sample into pre- and post-crisis period using the estimated break dates thereby ensuring structural stability within subsamples. Finally, we analyze the impact of Federal Reserve’s interest rate policy on housing variables by carrying out multivariate Granger causality tests for the pre- and the post-crisis period along with impulse response and forecast error variance decomposition analysis.

3. Qu-Perron Method for Detecting Structural Breaks

Structural changes have always been an important concern in econometric modelling of time series data typically spanning several decades. As

Bai (

2000) pointed out, correctly detecting and identifying structural changes in the relationships is critical as it can have profound implications for policy evaluation and analysis. While earlier econometric studies on this topic included

Chow (

1960) and

Quandt (

1960), recent studies included

Andrews (

1993),

Bai (

1997),

Liu et al. (

1997),

Bai and Perron (

1998),

Bai and Perron (

2003) among others. The test devised by

Andrews (

1993) was the first test for structural break where the break date was considered unknown when testing the null hypothesis of no break against the alternative of a single break.

Bai (

1997) studied the least squares estimation of a single change point in multiple regression and developed the asymptotic theory for it.

Liu et al. (

1997) studied multiple structural shifts in a linear regression model focusing on rate of convergence of the estimated break dates as well as the consistency of the selection criterion to determine the number of breaks.

Bai and Perron (

1998) extended previous work of

Bai (

1997) to include multiple structural changes occurring at unknown dates in a multiple regression model under much less restrictive set of assumptions than

Liu et al. (

1997). They studied theoretical issues in this paper pertaining to the limiting distribution of estimators and test statistics. Subsequently, in a companion paper,

Bai and Perron (

2003) considered practical issues related to empirical applications of the procedures and provided relevant algorithms for it.

To this date, only a handful of studies have dealt with multiple structural changes at unknown dates in a system of multivariate equations.

Bai (

2000) analyzed multiple structural changes in a segmented stationary VAR model focusing on the asymptotic behavior of break-point estimators.

Qu and Perron (

2007) provided a more comprehensive treatment of issues pertaining to estimation, inference and computation in case of multiple structural changes that occur in a variety of multiple equation time series models such as VAR, seemingly unrelated regression (SUR) and certain linear panel data models.

Qu and Perron (

2007) provided algorithms for structural changes resulting from changes in regression coefficients and/or the covariance matrix of errors across regimes. Furthermore,

Qu and Perron (

2007) considered both pure structural changes occurring due to changes in all regression coefficients across regimes as well as partial structural changes where only a subset of regression coefficients is allowed to vary but not all. In this study, we apply the

Qu and Perron (

2007) method for pure structural changes to our three alternative VAR models. What follows is a brief theoretical discussion of the

Qu and Perron (

2007) method for testing and estimating unknown break dates.

Consider the model given by

where we have

equations and

observations excluding the initial conditions. We consider

structural breaks in the system. The break dates are

. We also denote

and

.

is the vector of

variables.

is the vector of lagged values of

where we consider

number of lags. The disturbance term

has a mean value of

and covariance matrix

for

.

is the identity matrix. The matrix

is of order

with full column rank. It is the selection matrix with elements 0 or 1 specifying which regressors appear in each regression. The set of parameters in regime

consists of the

vector

and

.

For the purpose of estimation, we can rewrite the model using convenient notation

for

.

The model is estimated by restricted Quasi Maximum Likelihood method assuming that errors are serially uncorrelated.

Conditional on the given subsample, Gaussian likelihood—function can be written as

where

and the likelihood ratio is

The aim is to obtain values of that maximize subject to the restrictions .

Denoting log likelihood ratio and the restricted log likelihood ratio by

and

respectively, we can write the objective function as follows.

And the final estimates are .

Under a set of eight assumptions that are stated in details in

Qu and Perron (

2007), they have obtained that for

,

, and for

,

and

, where

is either a positive number independent of

or a sequence of positive numbers that satisfy

and

. They have also shown that the limiting distributions of conditional mean and covariance matrix of the errors in each regime estimated based upon unknown break dates are the same as in the case with known break dates.

Qu and Perron (

2007) have proposed a few test statistics for testing and subsequently identifying multiple break points in a system of

equations. In these tests, all time points except for some at the beginning and some at the end of the time series are considered probable break dates. The proportion of time points to be left out so that the first and the last sub-periods can be statistically distinguished is called the trimming parameter, and its value is often taken to be 0.15. The tests proposed by Qu and Perron are the following.

The test considers a likelihood ratio test for the null hypothesis of no structural break versus an alternative hypothesis of structural break with a pre-specified number of breaks, say .

The test and the test consider an equal weighting scheme and unequal weighting scheme, respectively, where weights depend on the number of regressors and the significance level of the tests. For these two tests, the alternative hypothesis is any number of breaks with some specified maximum.

The test is a sequential test for the null hypothesis of breaks versus the alternative of breaks.

It should be obvious that the size and power of these tests are important issues for the purpose of final inference. Like

Bai and Perron (

1998,

2003),

Qu and Perron (

2007) have suggested the following useful strategy. First, a researcher should use either or both of the double maximum tests i.e., the

test and the

test to see if at least one break is present. If these tests indicate the presence of at least one break, then

sequential break test can be constructed using global minimizers to determine the number of structural breaks. In our study, we first apply the

test to see whether there exists at least one structural break. If the null hypothesis of

is rejected, we then consider

to find out the actual number of breaks.

5. Concluding Remarks

In this paper, we reexamine the role of the Federal Reserve in triggering the housing crisis of the past decade. We specifically focus on the stability of the relationship between monetary policy as measured by the federal funds rate and a combination of housing variables capturing both price and volume in the housing market spanning almost six decades. We add a new dimension to the existing body of literature by applying

Qu and Perron (

2007) structural break test for changes occurring at multiple unknown break dates in a small dimensional VAR model. We subsequently use the

Qu and Perron (

2007) determined endogenous break dates to split up the full sample into segments focusing on the pre- and the post crisis period for carrying out multivariate time series analysis.

The Granger causality test results indicate that the interest rate policy of the Federal Reserve did not cause house price inflation, although it did cause residential investment share and housing starts in the pre-crisis period, both being measures of volume of activity in the housing market. Our impulse response analysis reinforces these results by demonstrating sluggishness in price responsiveness in the housing market and a diminished impact of Federal Reserve policy in the post-crisis period. In addition, the impulse response graphs and the forecast error variance decomposition both point to a stronger impact of real GDP growth on housing volume in the post-crisis period while dynamics of house price inflation suggests a built-in momentum.

Overall, our findings contradict those studies that held the Federal Reserve responsible for the run-up in house prices prior to the housing market collapse. However, we do find evidence of the Federal Reserve affecting housing volume in the pre-crisis period. Our results in this respect support

Leamer’s (

2015,

2007) assertion that housing is more of a volume cycle than a price cycle. Future research can proceed by expanding our VAR framework to also include a long-term interest rate to shed light on the debate surrounding the effect of long-term vis a vis short-term rate on housing variables [see

Miles (

2014),

McDonald and Stokes (

2013c)]. Another interesting extension would be to use a more advanced time- varying parameter VAR (TVP-VAR) model instead of a simple VAR to investigate the link between monetary policy and housing variables by considering the possible time-varying nature of the underlying structure of the macroeconomy [see

He et al. (

2018) and

Huber and Punzi (

2018) for details].