Abstract

Distributed ledger technology, also known as the blockchain, is gaining traction globally. Blockchain offers a secure validation mechanism and decentralized mass collaboration. Cryptocurrencies make use of this technology as a new asset class for investors worldwide. Cryptocurrencies are being used by companies to raise capital via initial coin offerings (ICOs). The substantial inflow of unregulated capital into a transactional and transnational industry has aroused interest from not just investors, but also national securities and monetary regulatory agencies. In this paper, we review the Security and Exchange Commission’s initial statements and subsequent pronouncements on ICO’s to illustrate the potential problems with applying an older legal framework to an ever-evolving ecosystem. Recognizing the inability of enforcement within existing regulatory frameworks, we discuss the importance of regulation of the crypto asset class and internal collaboration between government agencies and developers in the establishment of an ecosystem that integrates investor protection and investments.

JEL Codes:

G23; G28

1. Introduction

Blockchain has recently emerged as a secure, peer-to-peer platform for verifying digital events and validating transactions in an increasingly decentralized economy. It facilitates security verification, background checks, and payments, even of small amounts. Entrepreneurs benefit from the creation of transparent and accountable supply chains, and the reduction of background checks for identity verification. Perhaps most importantly for entrepreneurs, several barriers to entry for individuals and firms with good, but unfunded ideas are further lowered as they have been in recent years with the new, less regulated methods of raising capital and seeking financing (Ahlstrom et al. 2018a).

Yet with blockchain and related technologies such as cryptocurrency, there are also some concerns that have arisen alongside this important new technology with respect to security and the required regulation, especially given the very nascent nature of this technology and its potential for disruption. Thus, in this paper, we explain the regulatory and security issues around blockchain and initial coin offerings (ICOs) in an increasingly decentralized economy. We examine ICO structures, and how this crowdfunding mechanism has the promise for economic innovation. We explain how fraud may be carried out within the context of these innovative asset classes, and the evolving regulatory struggles. Given the value that entrepreneurship can generate for economies and societies (Ahlstrom 2010), it is crucial that these financial innovations are better understood so as to facilitate their regulation and development (Crafts 2006; Spulber 2008).

In the spring of 2016, an entity called the Decentralized Autonomous Organization (DAO became one of the most successful crowdfunded entities in history, with an ICO that raised over US$150 million worth of Ether, a cryptocurrency, in less than thirty days (Popper 2016a). The DAO, funded through Ether by equity investors situated globally, was not registered as a legal entity in any sovereign jurisdiction, and additionally, had no employees. As such, it did not have within its “structure,” a board of directors, a chief executive officer or a management team (Dale 2016). The rationale behind the crowdfunding was the creation of new software applications, but before the venture could be executed, it was hit with a cyber-attack that effectively drained DAO of a third of the capital raised (Popper 2016b). It was soon made clear that the ICO initiated by DAO violated a long list of securities laws. Many entrepreneurs, while appreciating the desire to find exemptions from registration under the US Securities Act of 1933, and to raise money with security “tokens,” argued that a new structure was needed to accomplish both goals: raise capital and launch a successful blockchain protocol.

Across the globe, another digital venture investment fund from India called GainBitCoin, guaranteed its investors a monthly return of 10% on their crypto-token investment. The scheme was a multi-level-marketing scheme that aimed to extract the liquid bitcoin from the investors and provide returns in the form of another cryptocurrency called the MCAP. The value of the MCAP is negligible to the market. The mastermind of the scheme, one Amit Bhardwaj, was arrested by the Enforcement Directorate and charged with defrauding investors to the tune of $300 million through this nouveau Ponzi scheme (Anupam 2018).

Along with cryptocurrency investment funds DAO and GainBitCoin, multiple ICOs (also called token sales) are still being launched worldwide. In 2017, these ICOs raised a collective $5.6 billion, of which only 48% were successful (Williams-Grut 2018). In late May 2017, SingularityNet, a decentralized marketplace for AI, raised $36 million in 30 seconds (Alois 2017). Bancor, a company that is developing a cryptocurrency exchange platform, raised in excess of $153 million in just three hours (Suberg 2017).

As investors risk their unsecured capital investments, the market participants started questioning the silence of the regulators. In July 2017, the question was answered by the Securities and Exchange Commission (SEC) of the United States, in a report detailing its findings after its investigation in the DAO. In the report, the SEC stated that the method used to raise equity in the DAO was in fact not a currency, but a security.1 This report used the 70-year-old Howey Test in that the report indicated that ICOs are subject to federal securities law as they primarily profit from the efforts of others. In May 2017, the SEC chairman mentioned the usage of the term coin/token does not circumvent the fact that capital is eventually raised from the public, classifying it as a security and not a currency (Roberts 2018).2

The scale of these fintech marketplace developments clearly creates new avenues for entrepreneurial financing but also for financial fraud (Ahlstrom et al. 2018a). Thus, in this paper, we explain the current issues and overview some of the regulatory developments and highlight current regulatory uncertainty. Hence, the paper is organized as follows. Section 2 and Section 3 provide an overview of blockchain and initial coin offerings, respectively, in terms of the new technology, the evolving regulatory process, and regulatory needs. Section 4 and Section 5 provide more details about crypto and cybersecurity fraud, respectively. Section 6 discusses regulatory developments in select countries around the world and different paces of regulatory development. A discussion of the implications of managing crypto risks, challenges, and regulatory uncertainty follows in the last two sections.

2. Blockchain

A person or a group of persons (depending on what you believe) under the name of Satoshi Nakamoto3 published a whitepaper that introduced the world to the Bitcoin, a decentralized cryptocurrency system that is neither produced nor regulated by any government.4 It introduced a cryptographically proven electronic payment system, allowing parties to transact directly without an intermediary (Arslanian and Fischer 2019). The technology aimed to move the focus from centralized institutions to peer-to-peer transactions in the market with the equanimity of control distribution as a key goal. The peer-to-peer architecture of the technology itself, as well as its open source accessibility and privacy, ensures, through encryption, the direct exchange of value between parties without interference from banks, governments, and other intermediaries. From an underground unknown currency, Bitcoin has now become a globally recognized asset, with Bitcoin futures contracts being traded on the Chicago Mercantile Exchange Inc. (CME) and the CBOE Futures Exchange (CFE), holding a market cap more than $136 billion.5 Bitcoin is both a cryptocurrency and a worldwide payment system. It is based on a technology called the Bitcoin Blockchain. Blockchain is a distributed public ledger that uses a cryptographic consensus protocol known as “proof of work” to allow the exchange of value between two parties. It is a ledger which can be used to virtually record any type of transaction, from cryptocurrency transfers to medical records to real estate chains of title. It is set up as a peer-to-peer network that allows its participants to agree on the state of the ledger at any given time by reaching consensus through a mathematical protocol. Owing to the fact that every individual participant works to ensure that the blockchain is accurate and secure, it is not dependent on the actions of any single central authority (Tapscott and Tapscott 2016). The blockchain aims to solve the double spend problem—the problem that until that time had prevented the widespread use of digital currencies. Although the blockchain is pseudonymous, it is not truly anonymous. The anonymity is removed in the transactional purchase of the cryptocurrency with the national fiat currency (Extance 2015). These exchanges which facilitate such transactions are regulated under the national law and are subject to national know your client (KYC) and anti-money laundering requirements. However, some operators that keep the proceeds of their transactions in cryptocurrency or exchange the cryptocurrency via cash or a private transaction are still impervious to regulation.

3. Initial Coin Offerings

Initial coin offerings (ICOs) could be seen as a new form of crowdoffering in which participants exchange fiat currencies or existing cryptocurrency tokens for entity-specific tokens (Amsden and Schweizer 2018). ICOs have exploded as the preferred mechanism used by blockchain entities to raise funds. Bellevatis et al. (2019) provide theoretical rationales and empirical evidence from 73 countries over 2013 to 2017 for the view that the cross-country diffusion of ICOs depend on governmental financial regulators, the media, and academic institutions as they affect the institutional legitimacy of ICOs. They also show that bans on ICOs in China and South Korea have internationally mobile governance implications that affect the diffusion of ICOs in other countries. This spillover in diffusion and effects of regulation from one country to the next shows that a harmonized and coordinated approach to regulation is appropriate, as these markets are internationally integrated and the effect of regulations is not limited to national borders.

ICOs are often compared with initial public offerings (IPOs), with which companies sell stock shares to the public for the first time. Both of them are used to raise equity for budding companies, both produce substantial amounts of cash, and both have the potential to make company founders instantly wealthy. This is where the similarity lies. On the flip side, IPOs are heavily regulated (Carpentier et al. 2012) In the U.S, the Securities Act of 1933 and the Securities Exchange Act of 1934 subject firms seeking to raise funds to registration, ongoing compliance and disclosure requirements. These regulations ensure that firms raising funds provide truthful, sufficient and accurate information. Owing to the extensive and exhaustive complex requirements of an IPO, the launching of the same requires a months-long process that requires hiring an investment bank and legal counsel. The acts require every security offered to the public in the US to be either registered with the SEC or meet one of the several complex enumerated exemptions from registration.

In the traditional world of raising capital, companies with exciting ideas for new products or services first have to build a prototype or beta to demonstrate to investors the validity of the idea. Post the demonstrated functionality of the product, and usually post a certain level of adaptation, a company can seek out venture funding to further develop or scale the idea. Entrepreneurs are then forced to give up significant equity in their own creations in exchange for early seed round capital. This limits those entrepreneurs with ideas who do not have a network of wealthy accredited investors. It also limits who can invest as most early round fundraising are limited to wealthy accredited investors. ICOs stand for a substantial shift in the way ideas are developed and commercialized. They allow developers with strong ideas for new applications/products/services on the blockchain to raise funds from those who would ultimately utilize the product/service built.

The issued tokens in an ICO do not grant the purchasers any form of equity or ownership interest in the issuing company. Instead, most ICOs issue some form of an application token or crypto-asset that has some utility within the software program being developed. These tokens can be used to power decentralized applications built on the blockchain or to purchase products or services in the issuing entity decentralized software of protocol. Although primarily designed to be used as payment within the issuing entity blockchain ecosystem, app tokens may also operate as an independent store of value that can be traded through online cryptocurrency exchanges. Therefore, ICOs are less like IPOs and more akin to pre-orders, with investors purchasing assets which would have value within the issuing entity system once the system is actually built, if at all.

ICOs also differ from IPOs in that, to date, they largely have not complied with any registration or disclosure requirements under US securities laws (Arnold et al. 2019; Day and Osborne 2018). Some of these ICOs have raised immense sums of money (Rohr and Wright 2018). Some ICOs are launched by companies with no established track record, no history of bringing a viable product to the marketplace. There have been ICOs—like the DAO’s token sale—launched by developers without ever forming a corporation or other legal entity. Other ICOs have completed multi-million dollar fundraisers by marketing tokens that are explicitly held out as having no “rights, uses, purpose, attributes, functions or features” (Williams-Grut 2018).

4. Types of Cryptocurrency Frauds and Regulatory Uncertainty

4.1. Fictitious Assets

Digital assets, unregistered with the regulatory authorities, promise substantial returns (Roberts 2017). However, these assets are neither registered with the regulatory authorities, nor securitized by the firm. Hence, with the absence of a registered prospectus certifying the security, information about the management, or financial statements, the asset being sold to the public lacks credibility.

With the substantial increase in the issuance of crypto-securities and the absence of a clear common understanding of the industry or the issues, regulators are understandably rushing towards securing the interests of the investors with significant effort towards the regulation and regularization of the ICOs. To illustrate, we refer to the SECs and Commodity Futures Trading Commissions cryptocurrency hearing in February 2018 which established that every ICO that the SEC had seen so far would be considered a security, only recently to be refuted and negated with the exclusion of the Bitcoin and Ether as neither securities or currencies (Oyedele 2017). The continual advent toward the incorporation and inclusion of regulation for the world’s fastest growing industry has left many dazzled, dazed, and confused. On 11 February 2019, the SEC issued guidelines on ICOs in an attempt to formalize the sector, and confirmed, among other things, that ICOs are a security regardless of how it is referred to by marketplace participants, issuers, and promoters.6

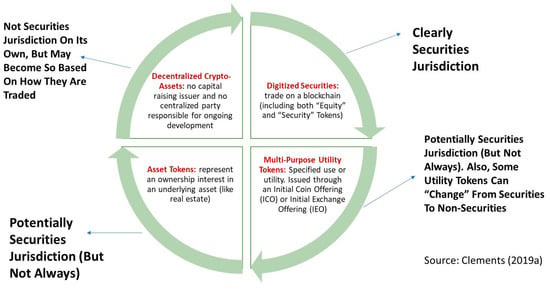

However, legal scholars have raised concerns about regulatory uncertainty with different types of crypto assets (Clements 2019a, 2019b). Digitized securities are clearly within the realm of securities regulation, while decentralized crypto-assets, asset tokens, and multi-purpose utility tokens are not necessarily within the realm of securities regulation, as graphically summarized by Clements (2019a) reproduced here in Figure 1.

Figure 1.

Crypto-Assets: Evolution of Form and Jurisdictional Uncertainty.

The rationale behind the negation of addressing the crypto assets as a currency is the decentralization of the issuing authority, negating the possibility of the asset being addressed as a general ledger—which is the accepted mode of payment for debt and can be used to trade within the economy backed by the central bank of the government. The rationale behind the negation of the digital assets as a security is the absence of a third party that is expecting to seek a return on the investment—the absence of which negates the assets being a security. The SECs analysis, however, has been received without much criticism. The reasons are substantive. There is not much historical understanding of the industry, and, hence, not many legal experts working toward the regulatory aspects of the same. The limited knowledge of the disruptive nature of the technology is another reason. Lawyers tend to accommodate newer technology in older frameworks. The SECs report on the DAO was not just a one-time investigation. The report on the DAO was a message by the SEC to future ICOs that it is on alert, and it has the resources to not just investigate, but also to enforce. The SECs scrutiny into the ICO industry threatens future fundraisers with legal implications. The so-called promise of democratization without substantive implementation is under threat as the increased regulatory constraints would impose substantial compliance requirements as the SEC expands upon investigative and enforcement challenges regarding the ICOs such as tracing of money, international scope, and the ability to freeze cryptocurrency assets.

It is important for investor protection that crypto-assets be within securities regulation jurisdiction. The US Securities Act of 1933 governs the issue of new securities in the public domain. The Act requires that investors receive financial and other significant information concerning securities being offered for public sale, and prohibits deceit, misrepresentations, and other fraud in the sale of securities. The regulations safeguard the disclosure of pertinent financial information regarding the security being offered for sale in the US by firms raising funds for outside investors. In the case of an ICO, none of these companies have filed any registration with the SEC as they do not consider their offering a security. In the absence of any formal documentation, the investment in these assets is held at the mercy of the companies issuing the ICO, with the SEC unable to hold the company accountable. The SEC in recent disclosures has indicated that the ICOs are similar to securities being issued via other exchanges and need to be registered with the agency. Compliance is to ensure not only the protection of the investor’s capital, but also to ensure the growth of the industry, and innovation brought about through the capital raising mechanism.

4.2. Fake Investment Funds/Advisors

With asset management one of the key drivers for growth, many cryptocurrency investment funds have propped up trying to entice investors with unsubstantiated substantial returns. Most of these schemes run on multi-level marketing schemes that induce the investor into not only contributing toward the scheme, but also participating in the business to increase returns. As the Bitcoin futures have been listed on the CME and CFE, the increase and decrease in the price of the asset can be bet against in the market, increasing the investors’ interest toward the asset. The inclusion of the bitcoin on these established exchanges lures investors into the purchase of the asset as assumptions of legitimacy are made.

With a clear classification of crypto-currencies as securities and this being within the domain of securities regulators, the next step would be the regulation of the investment funds and their advisors. In the U.S for example, the Investment Company Act of 1940 regulates the organization of companies, including mutual funds, which engage primarily in the investing, reinvesting, and trading securities. The Act requires these companies to disclose information about the fund, and its investment objectives, as well as the investment company structure and operations, to the investing public. The same Act also regulates investment advisors, requiring firms or sole practitioners compensated for advising others about securities investments to register with the SEC, and conform to regulations designed to protect investors. To the extent that ICOs are weakly regulated, their investment funds and advisors are likewise scantly within registration compliance. The SEC eventually would ensure the regulation of these funds in accordance with the rules and regulations of the two acts regulating the non-digital securities.

4.3. Unregulated Manipulated Crypto-Exchanges

Market manipulation is a deliberate creation of a false price for a product, security, commodity, or currency. With minimal regulation binding these assets, and the assets being traded on portals which are also not bound with much regulation—investors may be exposed to multiple counts of market manipulation. Not unlike more traditional securities or commodities exchanges, there are numerous instances in the past where market manipulative if not fraudulent trades are carried out on portals, including but not limited to churning and ramping. Researchers found that just one person was able to drive the price of the bitcoin up from $100 to $1000 with the use of bots (Gandal et al. 2018). Some of these exchanges may also not adhere to the filing of the prerequisite KYC documentation. With the absence of the regulatory oversight, these exchanges operating on a global scale act as money laundering schemes and move money across geographic boundaries without much regulation. In 2006, the operators of a US-based Exchange called GoldAge Inc., were indicted “on charges of operating an illegal digital currency exchange and money transmittal business. They were charged with transmitting $30 million to digital currency accounts owned by clients limited identification documentation, with transaction fees of up to $100,000 (U.S. Department of Justice National Drug Intelligence Center 2008).

5. Cyber-Security Fraud

Ownership of cryptocurrency has led to a demand for methods of storage. Cryptocurrency is stored in forms of “cryptocurrency wallets” where sensitive information is encrypted and securely stored (Bauer and Ahmad 2017) There are desktop wallets, mobile app wallets and online wallets, also known as an “Exchange”. The Exchange provider stores the encrypted information on behalf of the owner (although Exchanges are considered the storage method most vulnerable to theft or fraud and may not be subject to regulatory oversight (FINRA 2018). Bauer and Ahmad 2017 identified a few popular methods utilized by cyber-criminals or hackers.

5.1. Exchange Hacks

Exchanges are counterintuitive to the decentralized nature of cryptocurrency (Valdivia et al. 2019). Their vulnerability can be exemplified by the Mt. Gox hack in 2014, and approximately 25,000 investors lost approximately 650,000 bitcoins (approximate value of $400 million). Investors had no recourse as Exchanges not only unregulated, but also uninsured (Bauer and Ahmad 2017). The cryptocurrencies’ anonymity and encryption, is thus a double edged sword. A study funded by the US Department of Homeland Security found that 33% of Bitcoin Trading Platforms have been hacked (Gandal et al. 2018).

Cryptocurrency hacks significantly reduce the price discovery of the hacked currency (Corbet et al. 2018). Moreover, cryptocurrency hacks increase both the volatility of the hacked currency and cross-cryptocurrency correlations (Corbet et al. 2018). Significant regulation, surveillance, and enforcement are needed to protect all cryptocurrencies, in view of the disruption they cause internally and spillovers to other related crypto markets. It is consistent with the shift toward a global approach to financial regulation (see also Chan and Milne 2019).

Cryptocurrency hacks also give rise to abnormal returns in the hours prior to the actual hacking event, but those abnormal returns revert to zero at the time of the public announcement of the hack (Corbet et al. 2018). This evidence suggests that current regulatory and surveillance efforts are too slow to be an effective protection for investors.

In the future, regulation and computerized market surveillance (Aitken et al. 2015a; Aitken et al. 2015b; Cumming et al. 2015; Cumming and Johan 2008, 2019; Cumming et al. 2011) could be improved in crypto marketplaces. To this end, a number of stylized facts identified from studies of the volatility and price discovery process from cryptocurrencies provide guidance as to some of the pronounced issues that are distinct from other securities trading (Corbet et al. 2018). For example, cryptocurrencies exhibit weekend-volatility effects, which suggests pronounced surveillance is needed in traditional aftermarket trading period. Similarly, intra-day volatility is significantly influenced by international trading times, which suggests significant cross-market surveillance would help detect market manipulation in crypto markets. Moreover, intra-day volatility is influenced by periods of substantial volatility in the markets for oil and exchange rates, which indicates significant cross-product surveillance would help detect market manipulation in crypto markets.

5.2. Social Media Identity Hacking

The ubiquitous use of social media has led to innovative methods of identity theft. It is unfortunately extremely simple for hackers to obtain information such as email addresses, mobile phone numbers and personal details such as pet names and childhood nicknames (common passwords use by online users). Exchanges that unfortunately rely on the traditional two factor identification will thus be vulnerable to hackers seeking to transfer cryptocurrency held in investors’ wallets. The stolen cryptocurrency can then be converted to real currency or other encrypted cryptocurrencies (Bauer and Ahmad 2017).

5.3. Ransomware

Since 2016, cybersecurity experts have noted an increase in ransomware attacks. Liska (2019) noted 46 attacks in 2016, 38 in 2017 and 53 in 2018. In the first quarter of 2019, 21 attacks have been reported. After a more recent attack on the city of Riviera Beach, Florida in June 2019, city official paid hackers 65 Bitcoin $592,000 in digital currency (Mazzei 2019). Bauer and Ahmad 2017 highlighted two ransomware attacks that gained worldwide attention, WannaCry and Petyah and they find that the same modus operendi is used where the computer systems of a company, or city, is held hostage and data will only be released upon payment of a ransom. The peer-to-peer architecture of the cryptocurrency or rather the direct exchange of value between hostage without interference from other intermediaries enables payment of ransom remotely and anonymously.

5.4. Crypto-Jacking

Bauer and Ahmad 2017 identifies a method used by hackers to “mine” cryptocurrencies. Hackers use malware to hijack a mobile device or computer by using its processing power to mine a cryptocurrency. Not only are owners of these devices unaware of the crypto-jacking but even websites may oblivious to their role in the distribution of the malware. Other more nefarious sites encourage the distribution to share in the profit of the mining.

5.5. Taxation Fraud

Tax havens enable taxpayers to conceal earnings from home country tax authorities by offering an environment with little taxation, where the activity is usually not subject to information exchange because of strict bank secrecy regulations (Westhuizen 2017). Worldwide, revenue loss as a result of unattributed earnings add up to $255 billion, with $40 billion to $70 billion for the U.S alone (Brunson 2012; Marian 2013). As a result, there is considerable international pressure for the tax havens to minimize their taxation of income earned by foreign investors (Dharmapala and Hines 2009). Cryptocurrencies, while having no “jurisdiction” per se, possess the two crucial elements of a traditional tax haven: The absence of jurisdiction of operation and anonymity (Marian 2013). Therefore, they would not be subject to taxation at source.

Marian (2013) suggests that the concealment of earnings may be further extended. One example is the usage of tax-exempt buying agents to exchange financial contract obligations. Under the swap, the agent receives bitcoin, buys a security with legal currency value, and any dividends earned would be paid in bitcoin value to the swap holder. Losses or gains would be paid the same way. At all times, the bitcoin holder would be untraceable, and the agent would also have no tax liability because of his tax-exempt status. Currently, the US Internal Revenue Service (IRS) has through IRS Notice 2014–21 categorized cryptocurrency as property. General taxation principles applicable to property transactions apply to transactions using virtual currency. According to the notice, a taxpayer receiving virtual currency as income must declare it as income calculated at fair market value at the date of payment or receipt. Any transaction of the virtual currency with respect to a property has to be adjusted with respect to its adjusted cost base and gain or loss depending upon the fair market value at the time. Any gain or loss on the exchange of the cryptocurrency is considered as capital gains on the asset. Currently, the IRS Criminal Investigation Division is training its agents to detect Cryptocurrency wallets in its efforts to minimize tax fraud and evasion (IRS 2018).

There are of course many other possible illegal uses including criminal money laundering and terrorism. Organizations such as Al-Sadaqah is targeting Muslims in the West to raise capital to supply fighters with resources in Syria (Stalinsky 2018). As the potential for illegality is real, regulation and surveillance are needed. Some regulatory trends are discussed in the next section.

6. Current International Regulatory Trends

To illustrate the differing pace of regulatory development across markets, we highlight key issues in select jurisdictions.

6.1. Canada

While Canada allows the usage of digital currency to buy goods and services on the internet, and its usage in stores that accept digital currencies, digital currencies are not considered legal tender. Canada still only considers banknotes and coins issued by the Bank of Canada as legal tender. Digital currencies are however considered a commodity and are subject to the barter rules of the Income Tax Act (Al-Shikarchy et al. 2017). It allows digital currency to be bought and sold on Exchanges. Digital currencies are subject to the Income Tax Act and GST/HST also applies to the fair market value of any goods or services bought using digital currency. In that regard, goods purchased using digital currency must be included in the seller’s income for tax purposes.7

6.2. India

In January 2018, Arun Jaitley, the Finance Minister of India, declared the Bitcoin as not being legal tender. Being a virtual currency (VC), and having no physical attributes, the Indian government deemed to be neither currency nor coin, thus without the formal authorization by the Reserve Bank of India to enable the VC to be used as a medium of exchange. This is not terribly surprising as the very nature of the VC would make the country’s stringent currency control measures ineffectual (Nupur 2018). Having said that, India has determined that the growth in capital from the asset class will be taken into consideration as capital gains. The Income Tax Department, the Securities and Exchange Board of India, and the Ministry of Finance have sought details from various crypto-exchanges about their transactions (Jain and Kumar 2018). India has currently banned the usage of cryptocurrency as an asset class by both businesses and financial institutions. The conversion of Indian currency to cryptocurrency is illegal within India. The conversion between different ICOs is however still allowed.

6.3. China

The Chinese government has decided to stifle the cryptocurrency industry by completely not recognizing of VCs, banning the trading of VCs and the issuance of Initial Coin Offerings. In September, 2017, seven central government regulators issued the Announcement on Preventing Financial Risks from Initial Coin Offerings (ICO Rules) for purposes of investor protection (Pilarowski and Yue 2017). The ICO Rules essentially prohibit the Exchanges from dealing with VC, converting VC into legal tender and setting prices for VC. This, however, has led to capital raising from domestic Chinese investors by platforms relocated to Hong Kong and other offshore centers (Perper 2018). China is however known to have the highest number of bitcoin miners in the world (Huang 2018).

6.4. United Kingdom

With its threat to leave the European Union, the United Kingdom was impacted by political and economic uncertainty that motivated many U.K. platforms to relocate to Paris, Amsterdam, and Frankfurt. The U.K. Financial Conduct Authority announced that it would be working with the United Kingdom Treasury Committee in order to analyze the risks and opportunities related to cryptocurrencies and blockchain technologies (Tomzack 2018).

6.5. Norway & Sweden

Norway, like many other jurisdictions, considers the Bitcoin as a taxable asset, but not as a currency. Norway Bank is, however, moving toward the direct integration of the currency (Mandelli 2017). Similarly Sweden has embraced the technology and plans to launch its own currency called the E-Krona.

6.6. The European Union

In January 2019, the EU released a set of guidelines for ICOs.8 There are clear differences across European countries, but these guidelines will help to harmonize policies and regulations pertaining to ICOs and crypto assets. Future research could empirically examine the implications of the introduction of these guidelines on marketplace volatility and uncertainty, among other things, when more time has passed and data are available (see also (Corbet et al. 2018) for earlier work that pre-dates these guidelines). Regulatory approaches and their effects on markets in other regions around the world could likewise be examined in more detail in future work.

7. Contributions

This paper contributes to the nascent research on new financing techniques and their growing importance (Cumming et al. 2019). It also adds to research on regulation and encouraging innovation (Butenko and LaRouche 2015). Effective regulation is crucial to encouraging innovation (Spulber 2008). Though as Butenko and LaRouche (2015) highlight, regulation and effective enforcement often lag behind innovation.

The law and technology literature shows potential for harmful innovation, while the law and economic literature is more concerned with identifying market failures and the flow of information, and motivating innovation (Butenko and LaRouche 2015; Crafts 2006). In the case of the rapidly changing crypto-currency market and other entrepreneurial applications of blockchain technology, there is a need for a sort of intersection of the law and technology with the law and economics literatures. Blockchain applications are not exogenous to the regulatory process, which creates a need for law and economics perspectives. However, blockchain applications are not all necessarily positive, particularly as they may better enable financing of illegal activities and other illegal market misconduct, which requires law and technology perspectives and the regulation of innovation.

At this early stage of legal and institutional developments, there is much research that needs to be done to better understand the appropriate legal and surveillance/enforcement regimes that will minimize negative externalities from blockchain applications, while not stifling innovation. Further, additional work on international cooperation and harmonization of regulation is needed, as financial innovations with blockchain are clearly designed with little regard to national borders. Some of the regulatory changes reviewed here could be the subject of future empirical studies on the causes and consequences of financial regulation in blockchain and cryptocurrencies. Moreover, the blockchain and cryptocurrency markets offer a natural setting for intersecting the law and technology and law and economics literatures as advocated by Butenko and LaRouche (2015). Inclusive institutions are critical for technological development and economic growth (Acemoglu and Robinson 2012; Ahlstrom et al. 2018b; Tomizawa et al. 2019). More work is needed to better understand how laws and institutions enable the most economic growth at the minimal expected costs with blockchain and cryptocurrencies.

8. Conclusions

This paper reviewed the Security and Exchange Commission’s initial statements on ICOs, and subsequent pronouncements and the evolving legal framework. Enforcement is problematic with the existing regulatory framework and there is a greater need for collaboration between government agencies and developers to establish an ecosystem which integrates investor protection and investment.

On the positive side, the distributed ledger technology backed by the blockchain industry is set to revolutionize the world in effectively mitigating trust constraints while reducing transaction costs. The crowdfunding for software development has already reduced the distance between venture capitalists and ventures. The ability for an entrepreneur to raise millions of dollars in equity within days shows the interest of the general public toward not just the venture, but also the equity stake or tokens received in return. The ever-expansive interest is reflective of the world’s interest in the asset class and the world’s trust in the asset class.

On the negative side, the inherent nature of the crypto-assets can facilitate fraud. There are multiple cases of investors losing their capital from investing in the nouveau offerings, resulting in the much evaded and much-negated skepticism toward the industry. Despite these concerns, there is much regulatory uncertainty. Debate even continues regarding the categorization of crypto assets as currency or securities (Agrawal 2018; Clements 2019a). The Pecora Commission in the post-1930’s Depression and Dodd-Frank in the post-2008 Financial Crisis are examples of how regulation and solid institutions substantially helped in avoiding (or mitigating) economic crises. The inherent “trust” nature of the technology backing the crypto-assets should not determine or undermine the regulation’s guarding the industry for decades. At the end of the day, the conversion of fiat currency to any asset is guarded by various securities laws governing the industry. These laws ensure the protection of not just the investors’ capital, but also the extreme volatility and possible future economic ripple effects which can be caused.

If blockchain and its ancillary technologies can be regulated and managed, it may be that it will enables a whole new wave of entrepreneurs and engineers to build and implement this infrastructure and facilitate faster advances along this key technological trajectory (Dunbar and Ahlstrom, 1995). The major opportunities in the blockchain may be comparable to the internet of the 1990s, with new Amazons and Alibabas waiting to be founded and built up. In the next five years, we will see a number of critical innovations and their applications emerge come from it.

Given that cryptocurrencies like bitcoin operate independently of geographic location or central banks, Blockchain can thus allow entrepreneurs from virtually anywhere in the world access to startup funds and developmental capital. What microfinance and other disruptive funding methods started (Bonini et al. 2019; Newman et al. 2017), blockchain technology can bring much further along. Blockchain can be a major facilitator of entrepreneurship, which is a crucial part of a growing economy (Tomizawa et al. 2019). It needs a regulatory framework that will protect investors and firms alike (Peng et al. 2017), while not discouraging needed innovation and continuing the facilitation of entrepreneurial financing.

Author Contributions

Conceptualization, D.J.C., S.J. and A.P.; Methodology, D.J.C. and S.J.; Software, D.J.C. and S.J.; Validation, D.J.C. and S.J.; Formal Analysis, D.J.C. and S.J.; Investigation, D.J.C., S.J. and A.P.; Resources, D.J.C., S.J. and A.P.; Data Curation, D.J.C., S.J. and A.P.; Writing-Original Draft Preparation, D.J.C., S.J. and A.P.; Writing-Review & Editing, D.J.C. and S.J.; Visualization, D.J.C. and S.J.; Supervision, D.J.C. and S.J.; Project Administration, D.J.C. and S.J.; Funding Acquisition, D.J.C. and S.J.

Funding

This research was funded by Social Sciences and Humanities Research Council of Canada, and The Phil Smith Center for Free Enterprise.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Acemoglu, Daron, and James A. Robinson. 2012. Why Nations Fail: The Origins of Power, Prosperity, and Poverty. New York: Crown Publishing. [Google Scholar]

- Agrawal, Neeraj. 2018. SEC Chairman Clayton: Bitcoin Is Not a Security. Available online: https://coincenter.org/link/sec-chairman-clayton-bitcoin-is-not-a-security (accessed on 27 April 2018).

- Ahlstrom, David. 2010. Innovation and growth: How business contributes to society. The Academy of Management Perspectives 24: 11–24. [Google Scholar]

- Ahlstrom, David, Douglas J. Cumming, and Silvio Vismara. 2018a. New methods of entrepreneurial firm financing: Fintech, crowdfunding and corporate governance implications. Corporate Governance: An International Review 26: 310–13. [Google Scholar] [CrossRef]

- Ahlstrom, David, Xiaohua Yang, Liang Wang, and Changqi Wu. 2018b. A global perspective of entrepreneurship and innovation in China. Multinational Business Review 26: 302–18. [Google Scholar] [CrossRef]

- Aitken, Michael, Douglas Cumming, and Feng Zhan. 2015a. High Frequency Trading and End-of-Day Price Dislocation. Journal of Banking and Finance 59: 330–49. [Google Scholar] [CrossRef]

- Aitken, Michael, Douglas Cumming, and Feng Zhan. 2015b. Exchange Trading Rules, Surveillance, and Suspected Insider Trading. Journal of Corporate Finance 34: 311–30. [Google Scholar] [CrossRef]

- Al-Shikarchy, Mariam, Steven Baum, and Laura Gheorghiu. 2017. Gowling WLG, Canadian Taxation of Cryptocurrency … So Far. Lexology. Available online: https://www.lexology.com/library/detail.aspx?g=6283077e-9d32-4531-81a5-56355fa54f47 (accessed on 22 July 2019).

- Alois, J. D. 2017. Fastest ICO Ever? SingularityNet Raises $36 Million in 60 Seconds. Available online: https://www.crowdfundinsider.com/2017/12/126315-fastest-ico-ever-singularitynet-raises-36-million-60-seconds/ (accessed on 22 December2017).

- Amsden, Ryan, and Denis Schweizer. 2018. Are Blockchain Crowdsales the New ‘Gold Rush’? Success Determinants of Initial Coin Offerings. Available online: https://ssrn.com/abstract=3163849 (accessed on 16 April 2018).

- Anupam, Suprita. 2018. Who Is Amit Bhardwaj? The Real Story behind $300 Mn Bitcoin Ponzi Schemes and More. Available online: https://inc42.com/buzz/who-is-amit-bhardwaj-the-real-story-behind-300-mn-bitcoin-ponzi-schemes/ (accessed on 7 April 2018).

- Arnold, Laurin, Martin Brennecke, Patrick Camus, Gilbert Fridgen, Tobias Guggenberger, Sven Radszuwill, Alexander Rieger, Andre Schweizer, and Nils Urbach. 2019. Blockchain and Initial Coin Offerings: Blockchain’s Implications for Crowdfunding. In Business Transformation through Blockchain. Edited by Horst Treiblmaier and Roman Beck. Basingstoke and Cham: Palgrave, pp. 233–72. [Google Scholar]

- Arslanian, Henri, and Fabrice Fischer. 2019. The Rise of Bitcoin. In The Future of Finance. Cham: Palgrave Macmillan. [Google Scholar]

- Bauer, Sharon, and Imran Ahmad. 2017. The Lawyers Daily. Available online: https://www.wolfelawyers.com/resources/Cryptocurrency-and-Cybersecurity---The-Implications---The-Lawyer%27s-Daily.pdf (accessed on 17 November 2017).

- Butenko, Anna, and Pierre LaRouche. 2015. Regulation for innovativeness or regulation of innovation? Law, Innovation and Technology 7: 52–82. [Google Scholar] [CrossRef]

- Bellevatis, Cristiano, Douglas John Cumming, and Thomas Vanacker. 2019. The Cross-Country Diffusion of New Entrepreneurial Practices: The Case of Initial Coin Offerings. Working Paper. Auckland, Boca Raton and Ghent: Auckland Business School, Florida Atlantic University and Ghent University. [Google Scholar]

- Bonini, Stefano, Vincenzo Capizzi, and Douglas John Cumming. 2019. Emerging trends in entrepreneurial finance. Venture Capital: An International Journal of Entrepreneurial Finance 21: 133–36. [Google Scholar] [CrossRef]

- Brunson, Samuel D. 2012. Repatriating Tax-Exempt Investments: Tax Havens, Blocker Corporations, and Unrelated Debt-Financed Income. Northwest. Univ. Law Rev. 106: 225. [Google Scholar]

- Carpentier, Cecile, Douglas John Cumming, and Jean-Marc Suret. 2012. The Value of Capital Market Regulation: IPOs versus Reverse Mergers. Journal of Empirical Legal Studies 9: 56–91. [Google Scholar] [CrossRef]

- Chan, Ka Kei, and Alistair Milne. 2019. The Global Legal Entity Identifier System: How Can It Deliver? Journal of Risk and Financial Management 12: 39. [Google Scholar] [CrossRef]

- Clements, Ryan. 2019a. Crypto-Assets: Current Research and Public Policy Issues. Working Paper. Calgary: University of Calgary School of Public Policy. [Google Scholar]

- Clements, Ryan. 2019b. Regulating Fintech in Canada and the United States: Comparison, Challenges, and Opportunities. Publications SPP Research Paper 12. Calgary: University of Calgary School of Public Policy, p. 20. [Google Scholar]

- Corbet, Shaen, Douglas John Cumming, Brian Lucey, Maurice Peat, and Samuel Vigne. 2018. Investigating the Dynamics between Price Volatility, Price Discovery, and Criminality in Cryptocurrency Markets. Working Paper. Rochester: SSRN. [Google Scholar]

- Crafts, Nicholas. 2006. Regulation and productivity performance. Oxford Review of Economic Policy 22: 186–202. [Google Scholar] [CrossRef]

- Cumming, Douglas John, Bob Dannhauser, and Sofia Johan. 2015. Financial Market Misconduct and Agency Conflicts: A Synthesis and Future Directions. Journal of Corporate Finance 34: 150–68. [Google Scholar] [CrossRef]

- Cumming, Douglas John, Marc Deloof, Sophie Manigart, and Mike Wright. 2019. New directions in entrepreneurial finance. Journal of Banking & Finance 100: 252–60. [Google Scholar]

- Cumming, Douglas J., and Sofia Johan. 2008. Global Market Surveillance. American Law and Economics Review 10: 454–506. [Google Scholar] [CrossRef]

- Cumming, Douglas Johan, and Sofia Johan. 2019. Capital-Market Effects of Securities Regulation: Prior Prior Conditions, Implementation, and Enforcement Revisited. Finance Research Letters. [Google Scholar] [CrossRef]

- Cumming, Douglas J., Sofia A. Johan, and Dan Li. 2011. Exchange Trading Rules and Stock Market Liquidity. Journal of Financial Economics 99: 651–71. [Google Scholar] [CrossRef]

- Dale, Brady. 2016. The DAO: How the Employee less Company Has Already Made a Boatload of Money. Available online: http://observer.com/2016/05/dao-decenteralized-autonomous-organizatons/ (accessed on 20 May 2016).

- Day, Zero, and Charlie Osborne. 2018. SEC Pursues Dozens of Companies in Cryptocurrency ICO Crackdown. Available online: https://www.zdnet.com/article/sec-pursues-dozens-of-companies-in-cryptocurrency-ico-crackdown/ (accessed on 2 March 2018).

- Dharmapala, Dhammika, and James R. Hines, Jr. 2009. Which countries become tax havens? Journal of Public Economics 93.9-10: 1058–68. [Google Scholar] [CrossRef]

- Dunbar, Roger L. M., and David Ahlstrom. 1995. Seeking the institutional balance of power: Avoiding the power of a balanced view. Academy of Management Review 20: 171–192. [Google Scholar] [CrossRef]

- Commodities Futures Trading Comm’n v. McDonnell, 287 F. Supp. 3d 213, 226, 228. Available online: https://www.leagle.com/decision/287180197fsupp3d21314 (accessed on 19 July 2019).

- Extance, Andy. 2015. The future of cryptocurrencies: Bitcoin and beyond. Nature 526: 21–23. [Google Scholar] [CrossRef]

- FINRA Staff and BBB Institute. 2018. Storing and Securing Cryptocurrencies. Available online: http://www.finra.org/investors/highlights/storing-and-securing-cryptocurrencies (accessed on 19 July 2019).

- Gandal, Neil, J. T. Hamrick, Tyler Moore, and Tali Oberman. 2018. Price manipulation in the Bitcoin ecosystem. Journal of Monetary Economics 95: 86–96. [Google Scholar] [CrossRef]

- Huang, Zheping. 2018. This Could Be the Beginning of the End of China’s Dominance in Bitcoin Mining. Available online: https://qz.com/1172632/chinas-dominance-in-bitcoin-mining-under-threat-as-regulators-hit-where-it-hurts-electricity/ (accessed on 5 January 2018).

- Internal Revenue Service. 2018. IRS: Criminal Investigation Annual Report 2018. Available online: https://www.irs.gov/pub/irs-utl/2018_irs_criminal_investigation_annual_report.pdf (accessed on 22 July 2019).

- Jain, Rupam, and Manoj Kumar. 2018. India Sends Tax Notices to Cryptocurrency Investors as Trading Hits $3.5 Billion. Available online: https://www.reuters.com/article/us-markets-bitcoin-india-taxes/india-sends-tax-notices-to-cryptocurrency-investors-as-trading-hits-3-5-billion-idUSKBN1F8190 (accessed on 19 January 2018).

- Liska, Allen. 2019. Early Findings: Review of State and Local Government Ransomware Attacks. Available online: https://www.recordedfuture.com/state-local-government-ransomware-attacks/ (accessed on 22 July 2019).

- Mandelli, Anthony. 2017. Norway’s Largest Online Bank Adopts Direct Bitcoin Integration. Available online: https://www.ccn.com/banking-bitcoins-age-norway-bank-adopts-direct-bitcoin-integration/ (accessed on 16 May 2017).

- Marian, Omri. 2013. Are cryptocurrencies super tax havens. Michigan Law Review First Impressions 112: 38. [Google Scholar]

- Mazzei, Patricia. 2019. Hit by Ransomware Attack, Florida City Agrees to Pay Hackers $600,000. New York Times. Available online: https://www.nytimes.com/2019/06/19/us/florida-riviera-beach-hacking-ransom.html (accessed on 22 July 2019).

- Newman, Alexander, Susan Schwarz, and David Ahlstrom. 2017. Microfinance and entrepreneurship: An introduction. International Small Business Journal: Researching Entrepreneurship 35: 787–92. [Google Scholar] [CrossRef]

- Nupur, Anand. 2018. Arun Jaitley Has just Killed India’s Cryptocurrency Party. Available online: https://qz.com/india/1195316/budget-2018-busts-bitcoin-arun-jaitley-has-just-killed-indias-cryptocurrency-party/ (accessed on 1 February 2018).

- Oyedele, Akin. 2017. Bitcoin Futures Trading Gets the Green Light from US Regulators. Available online: http://www.businessinsider.com/bitcoin-price-futures-trading-exchanges-cftc-2017-12 (accessed on 1 December 2017).

- Peng, Mike W., David Ahlstrom, Shawn M. Carraher, and Weilei Stone Shi. 2017. An institution-based view of global IPR History. Journal of International Business Studies 48: 893–907. [Google Scholar] [CrossRef]

- Perper, Rosie. 2018. China Is Moving to Eliminate All Cryptocurrency Trading with a Ban on Foreign Exchanges. Available online: https://www.businessinsider.com/china-eliminates-all-cryptocurrency-trading-2018-2 (accessed on 5 February 2018).

- Pilarowski, Greg, and Lu Yue. 2017. China Bans Initial Coin Offerings and Cryptocurrency Trading Platforms, China Regulation Watch (21 September 2017). Available online: http://www.pillarlegalpc.com/en/news/2017/09/21/china-bans-initial-coin-offerings-and-cryptocurrency-trading-platforms/ (accessed on 22 July 2019).

- Popper, Nathaniel. 2016a. A Venture Fund With Plenty of Virtual Capital, but No Capitalist. Available online: https://www.nytimes.com/2016/05/22/business/dealbook/crypto-ether-bitcoin-currency.html?_r=1 (accessed on 21 May 2016).

- Popper, Nathaniel. 2016b. A Hacking of More than $50 Million Dashes Hopes in the World of Virtual Currency. Available online: https://www.nytimes.com/2016/06/18/business/dealbook/hacker-may-have-removed-more-than-50-million-from-experimental-cybercurrency-project.html (accessed on 17 June 2016).

- Roberts, Jeff John. 2018. Is the SEC Gunning for Ethereum and Ripple? Fat Chance. Available online: http://fortune.com/2018/05/01/sec-and-cryptocurrency-regulations/ (accessed on 1 May 2018).

- Roberts, Jeff John. 2017. Why Tech Investors Love ICOs—and Lawyers Don’t. Available online: http://fortune.com/2017/06/26/ico-initial-coin-offering-investing/ (accessed on 26 June 2017).

- Rohr, Jonathan, and Aaron Wright. 2018. Blockchain-Based Token Sales, Initial Coin Offerings, and the Democratization of Public Capital Markets Cardozo Legal Studies Research Paper No. 527. University of Tennessee Legal Studies Research Paper No. 338. Available online: https://ssrn.com/abstract=3048104 (accessed on 9 May 2019).

- Spulber, Daniel F. 2008. Unlocking technology: Antitrust and innovation. Journal of Competition Law 4: 915–66. [Google Scholar] [CrossRef][Green Version]

- Stalinsky, Steven. 2018. The Imminent Release of Telegram’s Cryptocurrency, ISIS’s Encryption App of Choice—An International Security Catastrophe in the Making. Available online: https://www.memri.org/reports/imminent-release-telegrams-cryptocurrency-isiss-encryption-app-choice-%E2%80%93-international (accessed on 30 March 2018).

- Suberg, William. 2017. SingularityNET Announces $36 million ICO Funding for AI Platform Expansion. Available online: https://cointelegraph.com/news/singularitynet-announces-36mln-ico-funding-for-ai-platform-expansion (accessed on 28 November 2017).

- Tapscott, Don, and Alex Tapscott. 2016. Blockchain Revolution: How the Technology behind Bitcoin Is Changing Money, Business and the World. London: Portfolio Penguin. [Google Scholar]

- Tomizawa, Aki, Li Zhao, Geneviève Bassellier, and David Ahlstrom. 2019. Economic growth, innovation, institutions, and the Great Enrichment. Asia Pacific Journal of Management. [Google Scholar] [CrossRef]

- Tomzack, Alex. 2018. Cryptocurrency Regulation to Be Welcoming for Business—United Kingdom. Available online: https://ethereumworldnews.com/cryptocurrency-regulation-to-be-welcoming-for-business-united-kingdom/ (accessed on 10 April 2018).

- Valdivia, Leonardo J., Carolina Del-Valle-Soto, Jafet Rodriguez, and Miguel Alcaraz. 2019. Decentralization: The Failed Promise of Cryptocurrencies. IT Professional 21: 33–40. [Google Scholar] [CrossRef]

- U.S. Department of Justice National Drug Intelligence Center. 2008. Money Laundering in Digital Currencies. Available online: https://www.justice.gov/archive/ndic/pubs28/28675/28675p.pdf (accessed on 3 June 2008).

- Westhuizen, Chinelle va der. 2017. Future Digital Money: The Legal Status and Regulation of Bitcoin in Australia. Working Paper. The University of Notre Dame Australia. [Google Scholar]

- Williams-Grut, Oscar. 2018. Only 8% of ICOs Were Successful Last Year. Available online: https://www.businessinsider.com/how-much-raised-icos-2017-tokendata-2017-2018-1 (accessed on 31 January 2018).

| 1 | |

| 2 | |

| 3 | |

| 4 | L.S (2 November 2015) Who is Satoshi Nakamoto, Economist at https://www.economist.com/the-economist-explains/2015/11/02/who-is-satoshi-nakamoto. |

| 5 | See Commodities Futures Trading Comm’n v. McDonnell, 287 F. Supp. 3d 213, 226, 228 (E.D.N.Y. 2018); Press Release No. 7731-18, U.S. Commodity Futures Trading Comm’n, CFTC Staff Issues Advisory for Virtual Currency Products (21 May 2018). |

| 6 | |

| 7 | Government of Canada at https://www.canada.ca/en/financial-consumer-agency/services/payment/digital-currency.html. |

| 8 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).