Blockchain as an Enabler of Generic Business Model Realization

Abstract

1. Introduction

1.1. Research Questions

- RQ1: How do blockchain-based business models influence the dynamics of industries adopting this technology?

- RQ2: What are the defining features of blockchain-based business models?

- RQ3: To what extent do blockchain technologies enable the creation of entirely new business models?

1.2. Motivation and Structure

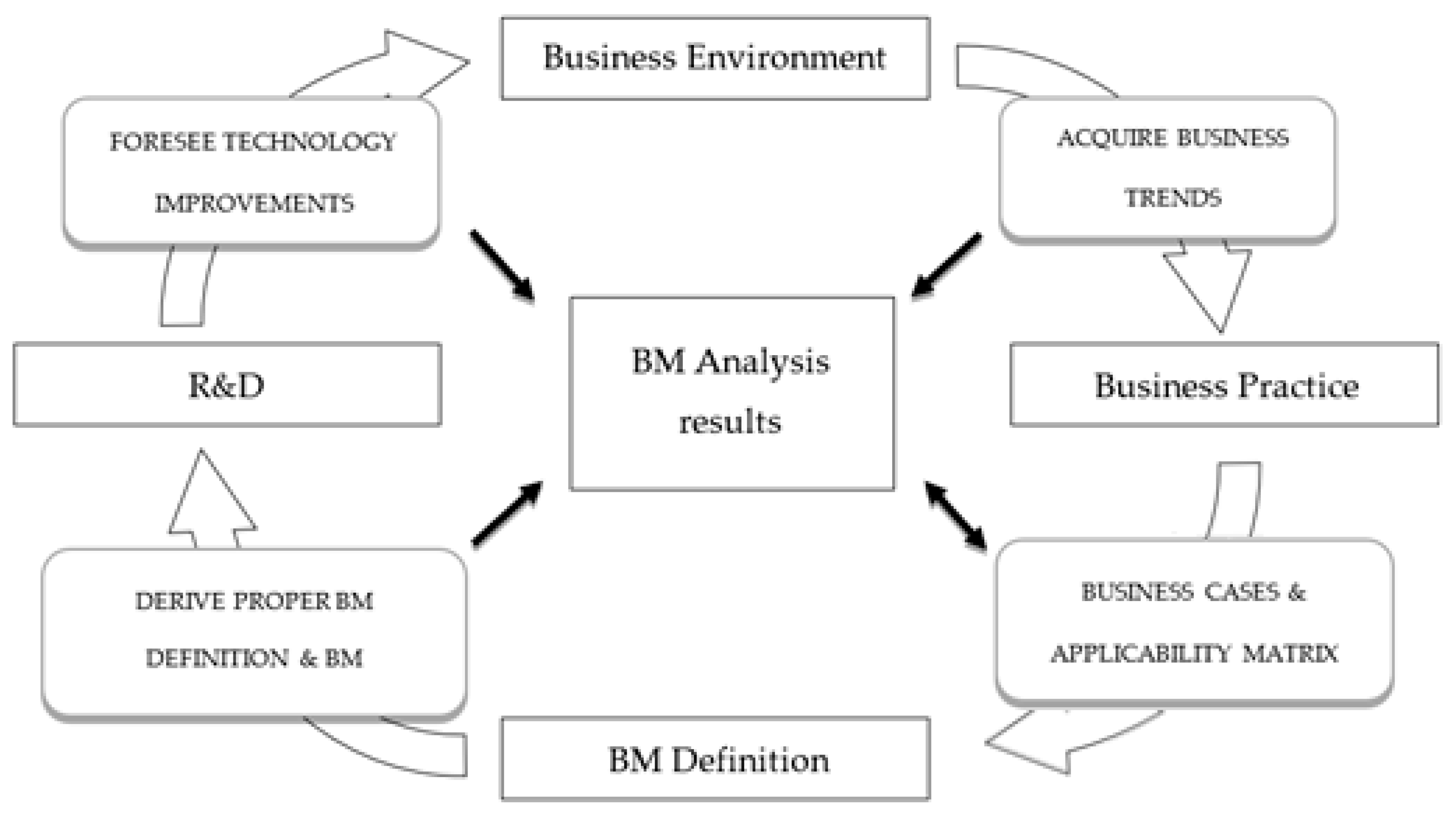

2. Related Works and Methodological Approach

2.1. Research Method

2.2. IT-Aligned Business Models

- Cost structure and revenue streams (i.e., finance related);

- Key resources, key activities, value proposition, and channels (i.e., resource related);

- Customer segments, customer relationships, and key partnerships (i.e., partner related).

- Value proposition—represents the business logic of creating value for stakeholders (usually customers);

- Value architecture—both technological and organizational architecture for the organization;

- Value finance—issues related to costs, pricing, and revenues;

- Value network—transactions through coordination and collaboration among parties.

- Unbundling BMs—includes three sub-models: customer relationship business, product innovation business, and infrastructure business. These three types are often implemented by one organization, but the authors argue that the “ideal” solution is to keep them separate in order to avoid conflicts.

- Long-tail BMs—focusing on niches, offering many different goods that sell infrequently and in relatively small quantities.

- Multi-sided platforms—intermediary model, where at least two groups of platform customers are brought together in order to facilitate interactions between them.

- Free BMs—offering a free-of-charge offer to at least one group of customers. In most cases, it assumes that other groups of customers finance the non-paying group (e.g., through advertisements).

- Open BMs—assumes that a company can create value through collaboration with other parties.

- Brokerage—a variant of a multi-sided platform, where the main revenue stream is transaction fees paid by customers.

- Advertising—fees from advertisers and a company selling advertisement space are the main revenue stream.

- Infomediary—the main value offered for customers is datasets (e.g., about users, users’ behaviors, etc.).

- Merchant—using the Internet as a distribution channel, often as an addition to traditional channels.

- Manufacturer (Direct)—shortened distribution channels by offering own goods to final customers (excluding intermediaries).

- Affiliate—fees from affiliation links displayed on one webpage and targeted at another constitute a revenue stream.

- Community—value built on and offered to a specific community.

- Subscription—paid services, offered in flat, stable price plans.

- Utility/usage—fees based on actual service usage.

- Content provider—new data/content/information as a product sold to customers.

2.3. Main Directions of Research Related to Blockchain

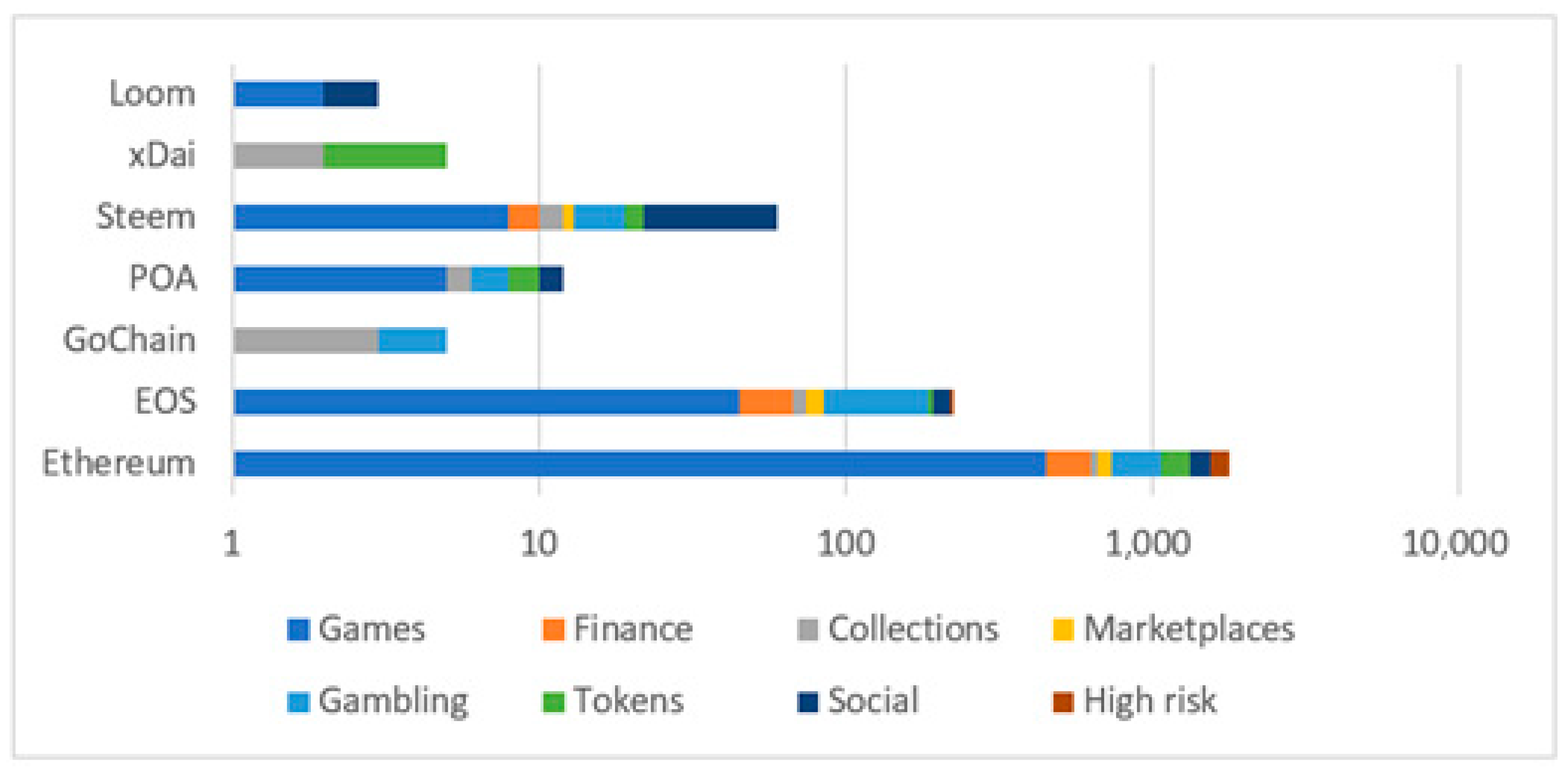

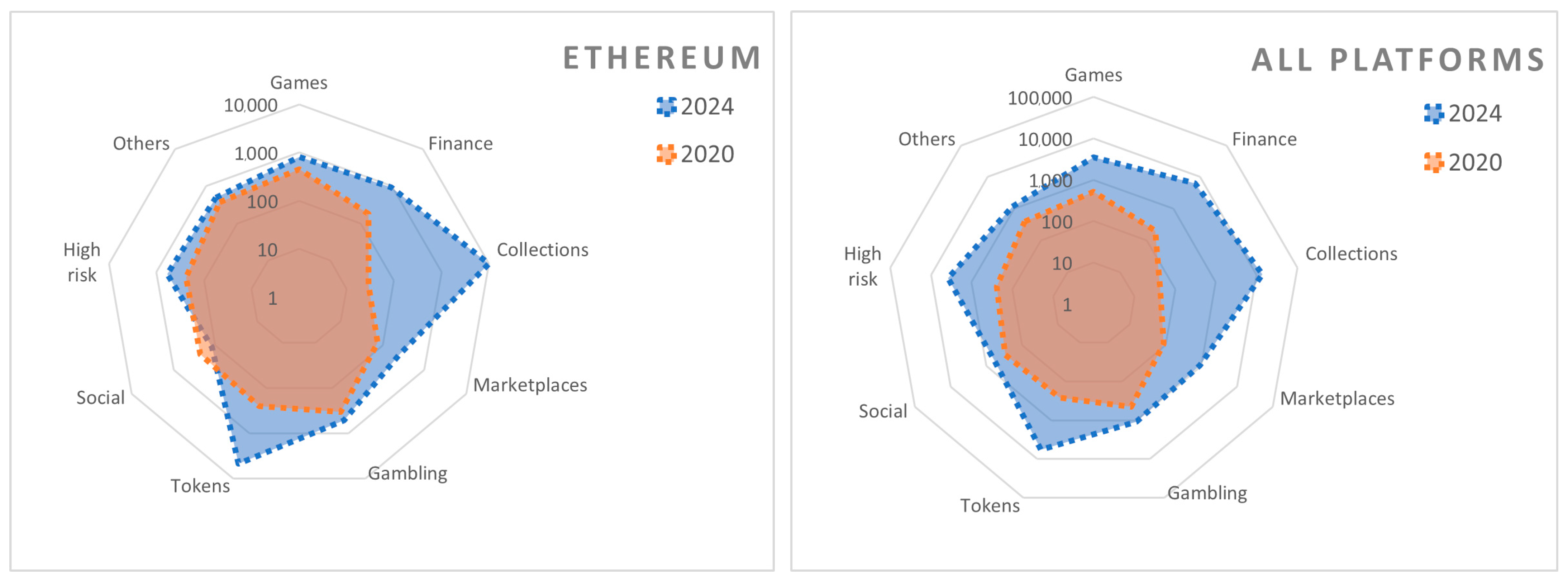

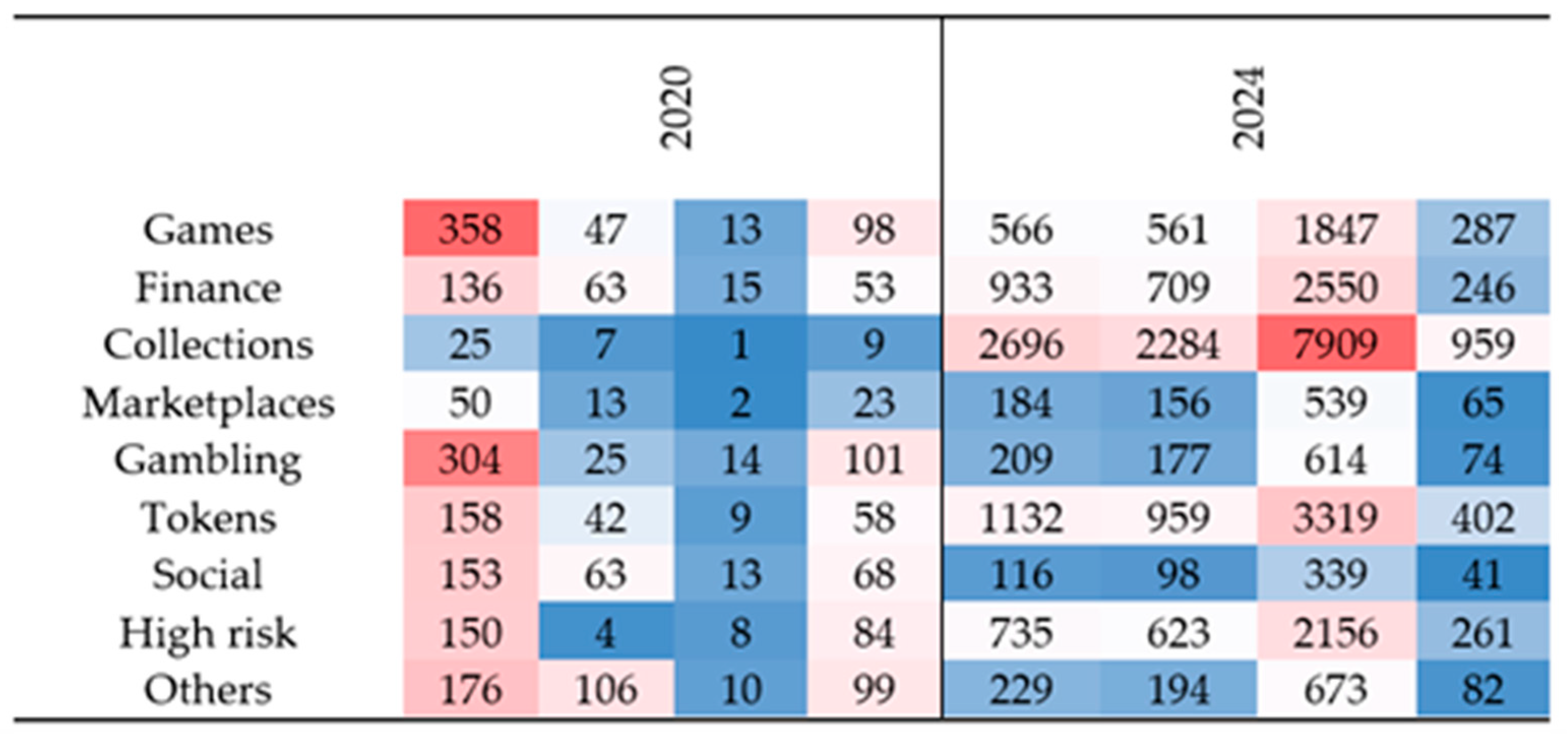

3. Current Trends in Blockchain Business Uses

4. Blockchain as a Business Model Enabler

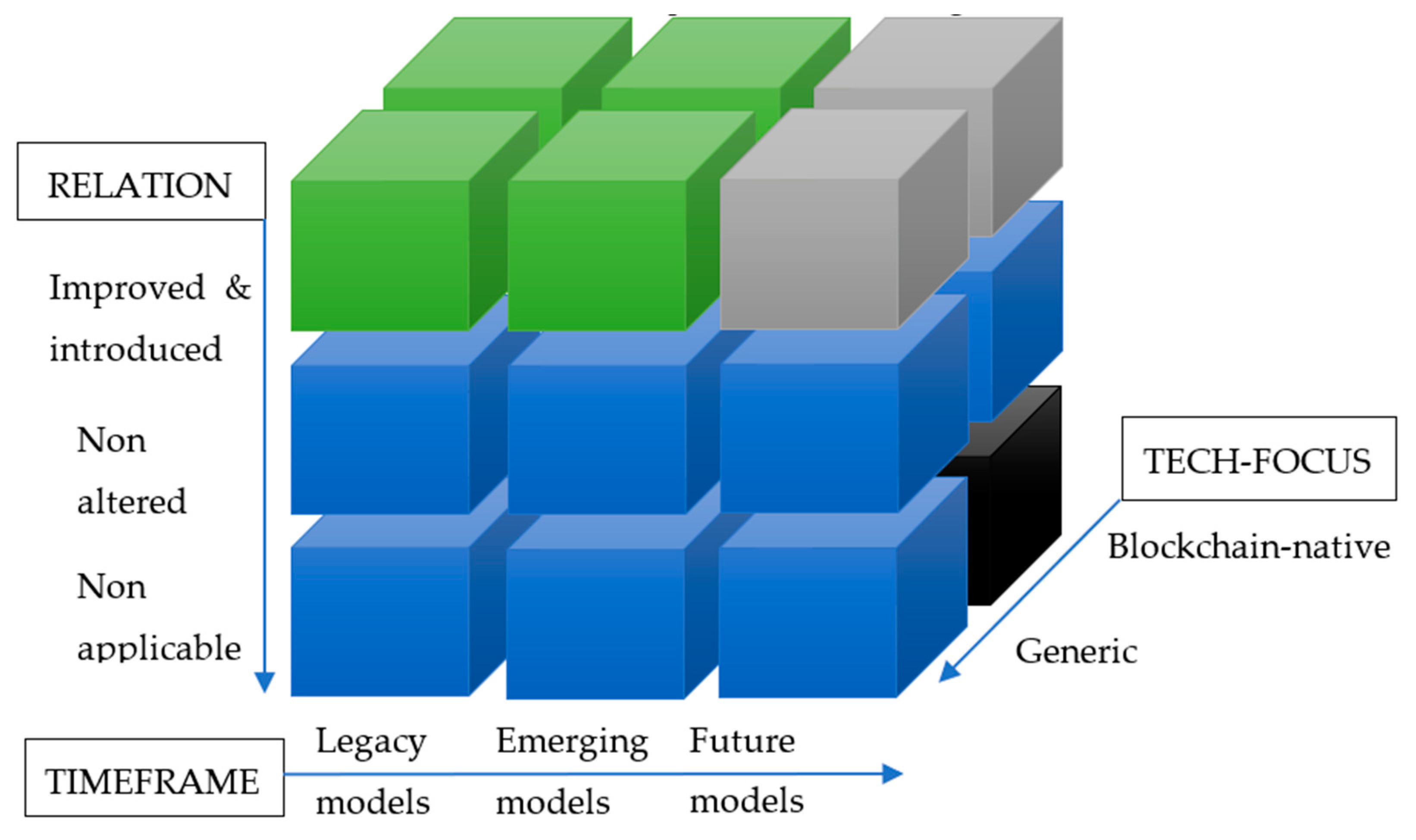

- Timeframe: differentiates between legacy models (existing and old), emerging models (existing but new), and future models.

- Tech-Focus: categorizes BMs as either generic (applicable across multiple domains) or blockchain-native (designed exclusively for blockchain ecosystems).

- Relation: captures the alignment of BMs with blockchain capabilities, distinguishing between compatible, partially compatible, and non-applicable models.

- Existing and improved generic models: traditional BMs adapted to leverage blockchain technology (Section 4.1).

- Existing but blockchain-only models: BMs that emerged exclusively within blockchain ecosystems (Section 4.2).

- Future and introduced models: innovative BMs that are currently conceptual but demonstrate significant potential for blockchain application (Section 4.3).

4.1. Business Models to Which Blockchain May Introduce Improvements

- Model 2—the core element is to provide a specific service/product on the premises, usually in “as a service” architecture. The model has been defined and successfully used in the past. The difference is only the object being distributed—in this case, it is a blockchain-based solution. Thus, the value network and value finance are the same as in the “old” models, while the value technology and value proposition have the same assumptions, but the underlying technology is different.

- Model 3—the main value proposition is to provide a platform (including related services) for developing blockchain-based applications. This pattern is very similar to the platform provider. In fact, value technology is specific and shaped to support blockchain requirements; most insights from the original model might be adopted here.

- Model 4—it is a software developer/provider pattern but focused on blockchain-based applications. The value proposition is ready-to-install software, targeted at customers that are interested in adopting blockchain technologies but are not able to develop it themselves. However, blockchain-based software might be handled and distributed in the same manner as any other software.

- Model 6—the value proposition in this pattern is mentoring/advising services targeted at a customer who uses blockchain technologies but has no adequate skills or knowledge. However, in the mentor/educator model, the subject taught is for the most part irrelevant to the other elements of the BM.

- Model 7—this is a special case of other models, as P2P services are an integral element of blockchains.

- Model 8—the three-sided model has been defined previously and might be implemented for any type of platform and is not limited to blockchain-based platforms.

- Models 9 and 11—these are special cases of intermediary BMs.

4.2. Business Models Specific to Blockchain Architecture

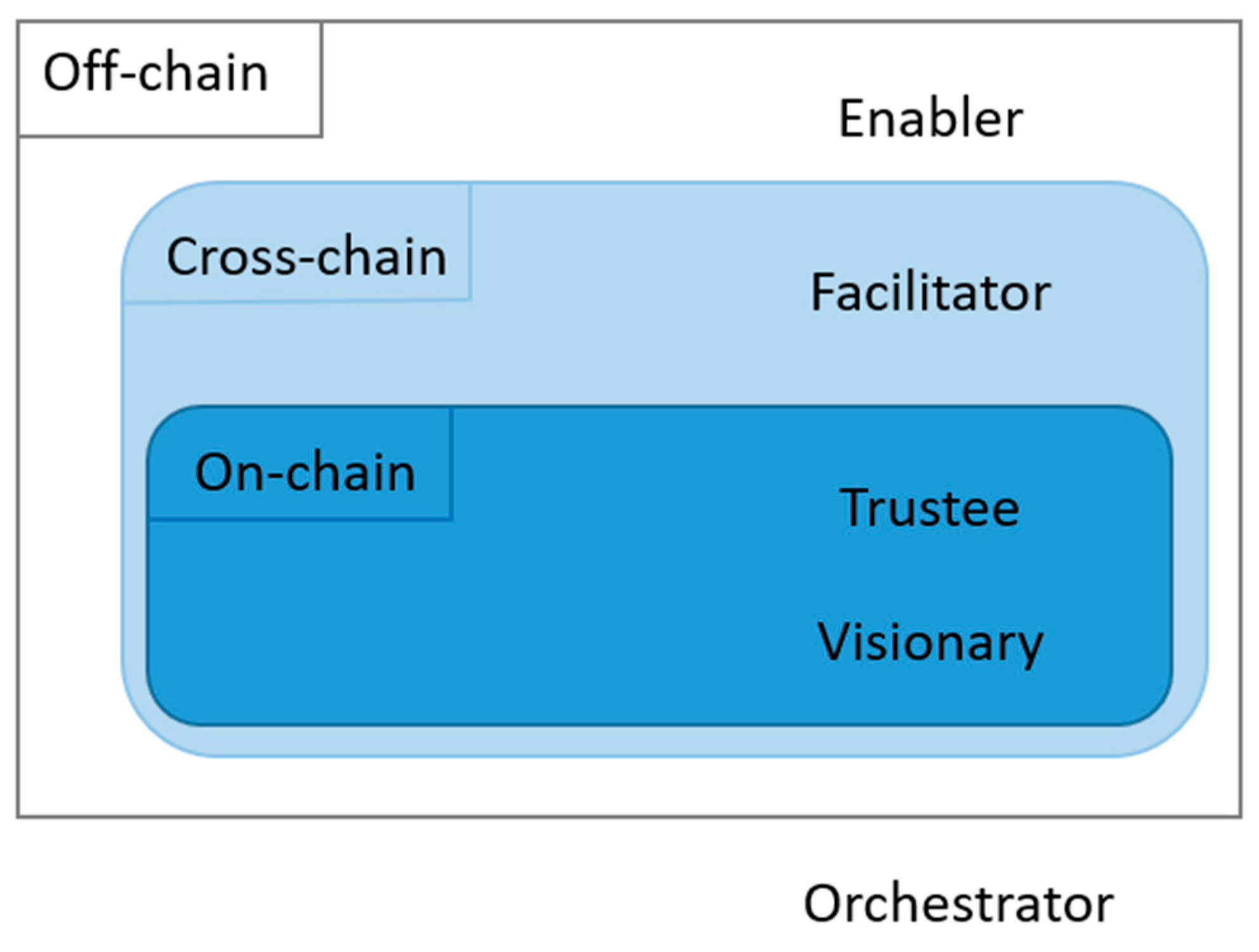

- Facilitator—provides value by improving or allowing functionality (e.g., oracles—which is another, not mentioned earlier business niche)—the BMs that follow this archetype are numbered 11, 13, 14, and 15.

- Enabler—lays the foundational ground (technology provider)—the BMs that follow this archetype are numbered 5 and 7.

- Trustee—provides value in the form of raised social capital (e.g., trust) by securing information (i.e., by mining)—the BMs that follow this archetype are numbered 9 and 10.

- Innovator (Visionary)—provides value by solving an issue in the given field in a decentralized manner—the BMs that follow this archetype are numbered 1 and 12b.

- Combinator (Orchestrator)—combines common BMs (of offering products or services) with new blockchain technology—the BMs that follow this archetype are numbered 2, 3, 4, 6, 8, and 12a.

4.2.1. Utility Token

4.2.2. Network Fee

4.2.3. Mining

4.2.4. Exchanges

4.3. Toward New Business Models Possible with Blockchain

4.3.1. Market Orchestration

4.3.2. Scalability Providers

4.3.3. Blockchain Connector

5. Business Model Applicability

6. Conclusions and Future Works

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Zatwarnicki, M.; Zatwarnicki, K.; Stolarski, P. Effectiveness of the Relative Strength Index Signals in Timing the Cryptocurrency Market. Sensors 2023, 23, 1664. [Google Scholar] [CrossRef] [PubMed]

- Stolarski, P.; Lewoniewski, W.; Abramowicz, W. Cryptocurrencies Perception Using Wikipedia and Google Trends. Information 2020, 11, 234. [Google Scholar] [CrossRef]

- Deloitte. Deloitte’s 2021 Global Blockchain Survey. A New Age of Digital Assets. 2021. Available online: https://www2.deloitte.com/us/en/insights/topics/understanding-blockchain-potential/global-blockchain-survey.html (accessed on 30 October 2024).

- PWC. Blockchain Technologies Could Boost the Global Economy US$1.76 Trillion by 2030 Through Raising Levels of Tracking, Tracing and Trust. PWC. 2020. Available online: https://www.pwc.com/gx/en/news-room/press-releases/2020/blockchain-boost-global-economy-track-trace-trust.html (accessed on 30 October 2024).

- Hevner, A.R.; March, S.; Park, J.; Ram, S. Design Science in Information Systems Research. MIS Q. 2004, 28, 75–105. [Google Scholar] [CrossRef]

- Weking, J.; Mandalenakis, M.; Hein, A.; Hermes, S.; Böhm, M.; Krcmar, H. The Impact of Blockchain Technology on Business Models—A Taxonomy and Archetypal Patterns. Electron. Mark. 2020, 30, 285–305. [Google Scholar] [CrossRef]

- Österle, H.; Becker, J.; Frank, U.; Hess, T.; Karagiannis, D.; Krcmar, H.; Loos, P.; Mertens, P.; Oberweis, A.; Sinz, E.J. Memorandum on Design-Oriented Information Systems Research. Eur. J. Inf. Syst. 2011, 20, 7–10. [Google Scholar] [CrossRef]

- Zott, C.; Amit, R.; Massa, L. The Business Model: Recent Developments and Future Research. J. Manag. 2011, 37, 1019–1042. [Google Scholar] [CrossRef]

- Snihur, Y.; Markman, G. Business Model Research: Past, Present, and Future. J Manag. Stud. 2023, 60, e1–e14. [Google Scholar] [CrossRef]

- Nowiński, W.; Kozma, M. How Can Blockchain Technology Disrupt the Existing Business Models? Entrep. Bus. Econ. Rev. 2017, 5, 173–188. [Google Scholar] [CrossRef]

- Wirtz, B.W.; Pistoia, A.; Ullrich, S.; Göttel, V. Business Models: Origin, Development and Future Research Perspectives. Long Range Plan. 2016, 49, 36–54. [Google Scholar] [CrossRef]

- DaSilva, C.M.; Trkman, P. Business Model: What It Is and What It Is Not. Long Range Plan. 2014, 47, 379–389. [Google Scholar] [CrossRef]

- Stewart, D.W.; Zhao, Q. Internet Marketing, Business Models, and Public Policy. J. Public Policy Mark. 2000, 19, 287–296. [Google Scholar] [CrossRef]

- Bouwman, H. The Sense and Nonsense of Business Models; Faculty of Business and Economics: Lausanne, Switzerland, 2002; pp. 1–6. [Google Scholar]

- Osterwalder, A.; Pigneur, Y.; Tucci, C.L. Clarifying Business Models: Origins, Present, and Future of the Concept. Commun. Assoc. Inf. Syst. 2005, 16, 1–25. [Google Scholar] [CrossRef]

- Rappa, M. Business Models on the Web. Digital Enterprise. Optimize Processes, Customer Experiences, Drive Growth and Innovation! 2011. Available online: http://digitalenterprise.org/models/models.html (accessed on 30 October 2024).

- Timmers, P. Business Models for Electronic Markets. Electron. Mark. 1998, 8, 3–8. [Google Scholar] [CrossRef]

- Chesbrough, H. The Role of the Business Model in Capturing Value from Innovation: Evidence from Xerox Corporation’s Technology Spin-off Companies. Ind. Corp. Change 2002, 11, 529–555. [Google Scholar] [CrossRef]

- Zhu, Q. Research on Business Model Innovation of Enterprises in the Context of Digital Transformation. iBusiness 2024, 16, 239–249. [Google Scholar] [CrossRef]

- Al-Debei, M.M.; Avison, D. Developing a Unified Framework of the Business Model Concept. Eur. J. Inf. Syst. 2010, 19, 359–376. [Google Scholar] [CrossRef]

- Ranerup, A.; Henriksen, H.Z.; Hedman, J. An Analysis of Business Models in Public Service Platforms. Gov. Inf. Q. 2016, 33, 6–14. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; Wiley & Sons: New York, NY, USA, 2013; ISBN 978-0-470-87641-1. [Google Scholar]

- Chen, Y.; Bellavitis, C. Blockchain Disruption and Decentralized Finance: The Rise of Decentralized Business Models. J. Bus. Ventur. Insights 2020, 13, e00151. [Google Scholar] [CrossRef]

- Morkunas, V.J.; Paschen, J.; Boon, E. How Blockchain Technologies Impact Your Business Model. Bus. Horiz. 2019, 62, 295–306. [Google Scholar] [CrossRef]

- Marikyan, D.; Papagiannidis, S.; Rana, O.F.; Ranjan, R. Blockchain: A Business Model Innovation Analysis. Digit. Bus. 2022, 2, 100033. [Google Scholar] [CrossRef]

- Taherdoost, H.; Madanchian, M. Blockchain-Based New Business Models: A Systematic Review. Electronics 2023, 12, 1479. [Google Scholar] [CrossRef]

- Zare, J.; Persaud, A. Digital Transformation and Business Model Innovation: A Bibliometric Analysis of Existing Research and Future Perspectives. Manag. Rev. Q 2024. [Google Scholar] [CrossRef]

- Nakamoto, S. A Peer-to-Peer Electronic Currency. 2008. Available online: https://nakamotoinstitute.org/library/bitcoin/ (accessed on 30 October 2024).

- Back, A.; Corallo, M.; Dashjr, L.; Friedenbach, M.; Maxwell, G.; Miller, A.; Poelstra, A.; Timón, J.; Wuille, P. Enabling Blockchain Innovations with Pegged Sidechains; Blockstream: Victoria, BC, Canada, 2014; Available online: https://blockstream.com/sidechains.pdf (accessed on 30 October 2024).

- Buterin, V. A Next-Generation Smart Contract and Decentralized Application Platform. 2014. Available online: https://ethereum.org/content/whitepaper/whitepaper-pdf/Ethereum_Whitepaper_-_Buterin_2014.pdf (accessed on 30 October 2024).

- Rosenfeld, M. Overview of Colored Coins. 2012. Available online: https://bitcoil.co.il/BitcoinX.pdf (accessed on 30 October 2024).

- Schwartz, D.; Youngs, N.; Britto, A. The Ripple Protocol Consensus Algorithm. 2014. Available online: https://ripple.com/files/ripple_consensus_whitepaper.pdf (accessed on 30 October 2024).

- Gavin Wood Ethereum: A Secure Decentralised Generalized Transaction Ledger. 2019. Available online: https://ethereum.github.io/yellowpaper/paper.pdf (accessed on 30 October 2024).

- Poon, J.; Dryja, T. The Bitcoin Lightning Network: Scalable Off-Chain Instant Payments. 2016. Available online: https://lightning.network/lightning-network-paper.pdf (accessed on 30 October 2024).

- Wei, D. B-Money. Available online: http://www.weidai.com/bmoney.txt (accessed on 30 October 2024).

- Malone, D.; O’Dwyer, K.J. Bitcoin Mining and Its Energy Footprint. In Proceedings of the 25th IET Irish Signals & Systems Conference 2014 and 2014 China-Ireland International Conference on Information and Communities Technologies (ISSC 2014/CIICT), Limerick, Ireland, 26–27 June 2014; Institution of Engineering and Technology: Limerick, Ireland, 2014; pp. 280–285. [Google Scholar]

- Tschorsch, F.; Scheuermann, B. Bitcoin and Beyond: A Technical Survey on Decentralized Digital Currencies. IEEE Commun. Surv. Tutor. 2016, 18, 2084–2123. [Google Scholar] [CrossRef]

- Gridcoin Whitepaper. 2020. Available online: https://gridcoin.us/assets/img/whitepaper.pdf (accessed on 30 October 2024).

- Hussein, Z.; Salama, M.A.; El-Rahman, S.A. Evolution of Blockchain Consensus Algorithms: A Review on the Latest Milestones of Blockchain Consensus Algorithms. Cybersecurity 2023, 6, 30. [Google Scholar] [CrossRef]

- Dang, D.T.; Hwang, D. Consensus-Based Methods for Distributed Systems, Blockchain, and Voting: A Survey. J. Inf. Telecommun. 2024, 1–24. [Google Scholar] [CrossRef]

- Kormiltsyn, A.; Udokwu, C.; Karu, K.; Thangalimodzi, K.; Norta, A. Improving Healthcare Processes with Smart Contracts. In Business Information Systems; Abramowicz, W., Corchuelo, R., Eds.; Lecture Notes in Business Information Processing; Springer International Publishing: Cham, Switzerland, 2019; Volume 353, pp. 500–513. ISBN 978-3-030-20484-6. [Google Scholar]

- Taherdoost, H. Privacy and Security of Blockchain in Healthcare: Applications, Challenges, and Future Perspectives. Sci 2023, 5, 41. [Google Scholar] [CrossRef]

- Siyal, A.A.; Junejo, A.Z.; Zawish, M.; Ahmed, K.; Khalil, A.; Soursou, G. Applications of Blockchain Technology in Medicine and Healthcare: Challenges and Future Perspectives. Cryptography 2019, 3, 3. [Google Scholar] [CrossRef]

- Ajakwe, S.O.; Saviour, I.I.; Ihekoronye, V.U.; Nwankwo, O.U.; Dini, M.A.; Uchechi, I.U.; Kim, D.-S.; Lee, J.M. Medical IoT Record Security and Blockchain: Systematic Review of Milieu, Milestones, and Momentum. BDCC 2024, 8, 121. [Google Scholar] [CrossRef]

- Weerawarna, R.; Miah, S.J.; Shao, X. Emerging Advances of Blockchain Technology in Finance: A Content Analysis. Pers. Ubiquit. Comput. 2023, 27, 1495–1508. [Google Scholar] [CrossRef]

- Renduchintala, T.; Alfauri, H.; Yang, Z.; Pietro, R.D.; Jain, R. A Survey of Blockchain Applications in the FinTech Sector. J. Open Innov. Technol. Mark. Complex. 2022, 8, 185. [Google Scholar] [CrossRef]

- Daidai, F.; Tamnine, L. Blockchain Technology in Finance: A Literature Review. In Digital Technologies and Applications; Motahhir, S., Bossoufi, B., Eds.; Lecture Notes in Networks and Systems; Springer Nature: Cham, Switzerland, 2023; Volume 668, pp. 218–229. ISBN 978-3-031-29856-1. [Google Scholar]

- Lee, S.; Kim, S. Blockchain as a Cyber Defense: Opportunities, Applications, and Challenges. IEEE Access 2022, 10, 2602–2618. [Google Scholar] [CrossRef]

- Dai, F.; Shi, Y.; Meng, N.; Wei, L.; Ye, Z. From Bitcoin to Cybersecurity: A Comparative Study of Blockchain Application and Security Issues. In Proceedings of the 2017 4th International Conference on Systems and Informatics (ICSAI), Hangzhou, China, 1–13 November 2017; IEEE: Hangzhou, China, 2017; pp. 975–979. [Google Scholar]

- Prashanth, M.S.; Karnati, R.; Velpuru, M.S.; Reddy, H.V. Blockchain in Cyber Security: A Comprehensive Review. In Proceedings of the 5th International Conference on Data Science, Machine Learning and Applications, Hyderabad, India, 15–16 December 2023; Kumar, A., Gunjan, V.K., Senatore, S., Hu, Y.-C., Eds.; Lecture Notes in Electrical Engineering. Springer Nature: Singapore, 2025; Volume 1273, pp. 1181–1191, ISBN 978-981-9780-30-3. [Google Scholar]

- TRUiC Team 20 Best Blockchain Startups. 2025. Available online: https://startupsavant.com/startups-to-watch/blockchain (accessed on 30 October 2024).

- Krisztian Sandor JPMorgan Renames Blockchain Platform to Kinexys, to Add On-Chain FX Settlement for USD, EUR. 2024. Available online: https://finance.yahoo.com/news/jpmorgan-renames-blockchain-platform-kinexys-164254948.html (accessed on 30 October 2024).

- Visa Visa Website. 2025. Available online: https://usa.visa.com/solutions/crypto.html (accessed on 30 October 2024).

- Jellason, N.P.; Ambituuni, A.; Adu, D.A.; Jellason, J.A.; Qureshi, M.I.; Olarinde, A.; Manning, L. The Potential for Blockchain to Improve Small-Scale Agri-Food Business’ Supply Chain Resilience: A Systematic Review. BFJ 2024, 126, 2061–2083. [Google Scholar] [CrossRef]

- Bianchini, D.; De Antonellis, V.; Garda, M.; Melchiori, M. Resource-Based Blockchain Integration in Agri-Food Supply Chains. In Web Information Systems Engineering—WISE 2024; Barhamgi, M., Wang, H., Wang, X., Eds.; Lecture Notes in Computer Science; Springer Nature: Singapore, 2025; Volume 15438, pp. 327–342. ISBN 978-981-9605-69-9. [Google Scholar]

- Calandra, D.; Secinaro, S.; Massaro, M.; Dal Mas, F.; Bagnoli, C. The Link between Sustainable Business Models and Blockchain: A Multiple Case Study Approach. Bus. Strat. Environ. 2023, 32, 1403–1417. [Google Scholar] [CrossRef]

- Morar, C.D.; Popescu, D.E. A Survey of Blockchain Applicability, Challenges, and Key Threats. Computers 2024, 13, 223. [Google Scholar] [CrossRef]

- Gangwal, A.; Gangavalli, H.R.; Thirupathi, A. A Survey of Layer-Two Blockchain Protocols. J. Netw. Comput. Appl. 2023, 209, 103539. [Google Scholar] [CrossRef]

- Merhej, J.; Harb, H.; Abouaissa, A.; Idoumghar, L. Toward a New Era of Smart and Secure Healthcare Information Exchange Systems: Combining Blockchain and Artificial Intelligence. Appl. Sci. 2024, 14, 8808. [Google Scholar] [CrossRef]

- Bobrova, P.; Perego, P.; Boiano, R. Design and Development of a Smart Fidget Toy Using Blockchain Technology to Improve Health Data Control. Sensors 2024, 24, 6582. [Google Scholar] [CrossRef]

- Wang, G.; Wang, Q.; Chen, S. Exploring Blockchains Interoperability: A Systematic Survey. ACM Comput. Surv. 2023, 55, 1–38. [Google Scholar] [CrossRef]

- Dritsas, E.; Trigka, M. Machine Learning for Blockchain and IoT Systems in Smart Cities: A Survey. Future Internet 2024, 16, 324. [Google Scholar] [CrossRef]

- Kim, H.; Xiao, Z.; Zhang, X.; Fu, X.; Qin, Z. Rethinking Blockchain Technologies for the Maritime Industry: An Overview of the Current Landscape. Future Internet 2024, 16, 454. [Google Scholar] [CrossRef]

- Kapengut, E.; Mizrach, B. An Event Study of the Ethereum Transition to Proof-of-Stake. Commodities 2023, 2, 96–110. [Google Scholar] [CrossRef]

- Qazi, S.; Khawaja, B.A.; Alamri, A.; AlKassem, A. Fair Energy Trading in Blockchain-Inspired Smart Grid: Technological Barriers and Future Trends in the Age of Electric Vehicles. World Electr. Veh. J. 2024, 15, 487. [Google Scholar] [CrossRef]

- Juan, A.A.; Perez-Bernabeu, E.; Li, Y.; Martin, X.A.; Ammouriova, M.; Barrios, B.B. Tokenized Markets Using Blockchain Technology: Exploring Recent Developments and Opportunities. Information 2023, 14, 347. [Google Scholar] [CrossRef]

- Vitelaru, E.; Persia, L. Fractional Vehicle Ownership and Revenue Generation Through Blockchain Asset Tokenization. Transp. Telecommun. J. 2023, 24, 120–127. [Google Scholar] [CrossRef]

- Zhu, K.; Wu, F.; Wang, F.; Shen, T.; Wu, H.; Xue, B.; Liu, Y. Blockchain-Based Digital Asset Circulation: A Survey and Future Challenges. Symmetry 2024, 16, 1287. [Google Scholar] [CrossRef]

- Zheng, P.; Jiang, Z.; Wu, J.; Zheng, Z. Blockchain-Based Decentralized Application: A Survey. IEEE Open J. Comput. Soc. 2023, 4, 121–133. [Google Scholar] [CrossRef]

- Sharp, M.; Njilla, L.; Huang, C.-T.; Geng, T. Blockchain-Based E-Voting Mechanisms: A Survey and a Proposal. Network 2024, 4, 426–442. [Google Scholar] [CrossRef]

- Ning, W.; Zhu, Y.; Song, C.; Li, H.; Zhu, L.; Xie, J.; Chen, T.; Xu, T.; Xu, X.; Gao, J. Blockchain-Based Federated Learning: A Survey and New Perspectives. Appl. Sci. 2024, 14, 9459. [Google Scholar] [CrossRef]

- Mohammed, M.A.; De-Pablos-Heredero, C.; Montes Botella, J.L. A Systematic Literature Review on the Revolutionary Impact of Blockchain in Modern Business. Appl. Sci. 2024, 14, 11077. [Google Scholar] [CrossRef]

- Ferro, E. Business Models for Blockchain-Based Ventures: An Exploratory Study. 2018. Available online: http://enricoferro.blogspot.com/2018/07/bm4btc.html#.XK5P5ZgzaM8 (accessed on 30 October 2024).

- 101 Blockchains Top 7 Enterprise Blockchain Business Models. Available online: https://101blockchains.com/blockchain-business-models/ (accessed on 30 October 2024).

| Component | Definition | Application in Study |

|---|---|---|

| Knowledge Base | Theoretical foundations from prior research. | Existing BM definitions and ISRF theory (Section 2.2). |

| Business Environment | Real-world context, trends, and business needs. | Trends in blockchain usage and empirical data from decentralized applications (Section 3). |

| Artifact | The output of the research process (models, frameworks, etc.). | Blockchain-specific business models (Section 4). |

| Rigor Cycle | Iterative refinement using insights from the knowledge base. | Refinement of BMs through comparison with existing theories. |

| Relevance Cycle | Iterative refinement using insights from the business environment. | Refinement of BMs based on practical needs and market trends. |

| Design Cycle | The core iterative process of designing and refining artifacts. | Development, evaluation, and reformulation of blockchain business models. |

| No. | Business Model | Interactions with BMs | Examples | Comment | Framework Alignment |

|---|---|---|---|---|---|

| 1 | Utility Token The model focuses on providing utility tokens that are partially distributed to customers (e.g., cryptocurrency), partially kept by the provider who can make a profit when the value of the utility token changes. | Often used with Development Platforms or Exchanges to ensure token utility and liquidity. | e.g., Ethereum (ETH), Binance Coin (BNB) | This is a new BM pattern. It will be explored in the following section. | Emerging, blockchain-native, compatible |

| 2 | Blockchain as a Service Distributed Assets as a Service The model provides blockchain solutions (or the whole “ecosystem”) for the customer, using “as a service” architecture. | Can integrate with Development Platforms for end-to-end blockchain solution provisioning. | IBM Blockchain Platform | This is not really a novel BM pattern; it is a standard software/platform as a service provider. | Legacy, generic, partially compatible |

| 3 | Development Platforms Merged Services Provides a complex blockchain-oriented infrastructure for customers who develop blockchain applications. | Frequently paired with Blockchain as a Service to streamline application deployment. | Hyperledger Fabric (https://hyperledger-fabric.readthedocs.io/en/latest/blockchain.html (accessed on 18 January 2025)) | This is not really a novel BM pattern; it is a standard software/platform as a service provider. | Legacy, generic, partially compatible |

| 4 | Blockchain-based software products ICO as a Service Provides ready-to-use blockchain technology/blockchain-based applications to customers | Complements Professional Services, as customers may require training to implement solutions effectively. | ConsenSys (blockchain solutions) (https://consensys.io/solutions (accessed on 18 January 2025)) | Basically a software provider, only focuses on a specific technology. | Emerging, generic, compatible |

| 5 | Network Fee Charge Generates revenues through transaction fees associated with the blockchain itself. | Works well with P2P Blockchain and Exchanges to support transactional use cases. | Bitcoin transaction fees, Ethereum gas fees | Some elements of this BM are very similar to previously known ones but putting them together with blockchain-specific technology makes it a new model. | Emerging, blockchain-native, compatible |

| 6 | Blockchain Professional Services Training services provided by domain experts to customers (usually startups or other businesses that want to implement blockchain solutions but do not have the required knowledge). | Often supports Blockchain-based Software Products or P2P Blockchain by offering expertise. | ConsenSys Academy (https://consensys.io/academy (accessed on 18 January 2025)) | Mentoring/training providers. | Legacy, generic, partially compatible |

| 7 | P2P Blockchain Peer-to-peer powered business, enables end users to interact with each other directly. | Relies on Network Fee Charge model for transactional operations. | Binance P2P (https://p2p.binance.com (accessed on 18 January 2025)) | Not really a BM, as this is part of all previous patterns. | Legacy, blockchain-native, compatible |

| 8 | Three-sided Platform Connects three types of actors: users, publishers, and advertisers. | Extends utility by integrating with Utility Token model for incentivization mechanisms. | Brave Browser (https://brave.com (accessed on 18 January 2025)) | Not only for blockchain, known patterns. | Legacy, generic, partially compatible |

| 9 | Light Intermediation A variation of intermediary patterns, offering reduced intermediary involvement compared to traditional models. | Complements P2P Blockchain and Liquidity Providers for seamless transactions. | OpenSea (https://opensea.io/ (accessed on 18 January 2025)) (NFT platform) | Variation of intermediary patterns. | Emerging, generic, compatible |

| 10 | Mining:

| Works closely with Utility Token and Network Fee Charge models to sustain the network’s operation. | NiceHash (https://www.nicehash.com/ (accessed on 18 January 2025)) (mining marketplace) | This is a new BM. It will be explored in the following section. | Emerging, blockchain-native, compatible |

| 11 | Liquidity providers:

| Complements Exchanges and Development Platforms for enhanced financial interactions. | Balancer (https://balancer.fi/ (accessed on 18 January 2025)) | Variation of intermediary patterns. | Legacy, blockchain-native, compatible |

| 12 | Exchanges:

| Works closely with Scalability Providers and Market Orchestration to bridge gaps between ecosystems. | Binance (https://www.binance.com/en (accessed on 18 January 2025)) (centralized exchange), Uniswap (https://app.uniswap.org/ (accessed on 18 January 2025)) (decentralized exchange) | New BM (a variation of the multi-sided platform). | Emerging, blockchain-native, compatible |

| 13 | Market Orchestration Focuses on coordinating blockchain network participants to create value. Not yet matured. | Might connect to Scalability Providers and Blockchain Connectors to maximize network efficiency. | Polkadot (https://polkadot.com/ (accessed on 18 January 2025)) | New BM (a variation of the multi-sided platform). | Future, blockchain-native, compatible |

| 14 | Scalability Providers Focuses on enhancing the scalability of blockchain networks through technological innovations. Not yet matured. | Might work with Development Platforms and Market Orchestration to handle increased traffic efficiently | Layer 2 solutions, like the Lightning network (https://lightning.network/ (accessed on 18 January 2025)) | Innovative BM. It will be covered later. | Future, blockchain-native, compatible |

| 15 | Blockchain Connectors An emerging model that enables seamless interactions between different blockchains or systems. Not yet matured. | Might work with Scalability Providers and Market Orchestration to bridge gaps between ecosystems. | Cosmos (https://cosmos.network/ (accessed on 18 January 2025)) | Innovative BM. It will be covered later. | Future, blockchain-native, compatible |

| BM Element | Description |

|---|---|

| Value proposition | Introducing decentralization and/or automation |

| Value architecture | Token creation, smart contract, and dApps (decentralized applications) |

| Value finance | Token as a carrier of costs and revenues |

| Value network | Rules of conduct and transactions stored on the blockchain (all business aspects are on-chain); transactions agreed by chosen consensus protocol |

| BM Element | Description |

|---|---|

| Value proposition | Unique feature-rich platform |

| Value architecture | Timestamped, graph of information blocks. |

| Value finance | Association of services with cryptocurrency |

| Value network | A network of peers; blockchain is more secure with a growing number of nodes |

| BM Element | Description |

|---|---|

| Value proposition | Provision of trust and security for immutable information storage/processing |

| Value architecture | Non-federated (solo) or intermediate (pool. cloud) computational resource sharing (within the pool and with the whole blockchain network) |

| Value finance | Costs generated by lost physical resources; incentives in cryptocurrency; intermediated form assumes both cost and revenue distribution |

| Value network | Full nodes realizing selected proof (work, stake, storage, etc.); federation by employing specific communication protocols (e.g., Stratum) |

| BM Element | Description |

|---|---|

| Value proposition | Measuring value and provision of means to exchange value nominated in digital money or fiat |

| Value architecture | Classic (centralized) platforms or decentralized applications running on the blockchain |

| Value finance | Normal costs of the centralized platform; decentralization externalizes most of the costs; costs of “frozen” capital can be minimized with prediction/data mining techniques |

| Value network | Networking of many tokens within one blockchain or networking of cryptocurrencies and tokens across two or more blockchains and forks; networking of information. Value transfer and users across blockchain platforms |

| BM Element | Description |

|---|---|

| Value proposition | Synchronization of services and introduction of a cause-and-effect chain between decentralized components executed within one or spanning across a couple of blockchain platforms |

| Value architecture | Loosely coupled services executed as part of blockchain platform logic or within blockchain network (smart contracts); possible execution as part of the consensus protocol |

| Value finance | Service subscription or pay-per-unit where a unit can be defined as a single synchronization operation or decentralized process instance execution |

| Value network | Synchronization and capability of collaboration among potentially anonymous parties within workflows. Value-added and extensive supply chains; provision of infrastructure to execute decentralized business processes |

| BM Element | Description |

|---|---|

| Value proposition | Removal of architectural flaws and bottlenecks from decentralized platforms |

| Value architecture | Service is an addition or extension to blockchain. Accessible and compatible with blockchain network; possibly blockchain-on-blockchain architectures |

| Value finance | R&D and development costs; revenues from temporal one’s or else’s value storage; fees in the form of tips from rounding-off micropayments |

| Value network | Temporal transfer of value outside blockchain; micropayments increase the liquidity of the network |

| BM Element | Description |

|---|---|

| Value proposition | Inter-blockchain network information transfer; provision of cross-border data or trigger of events caused by outside factors; revenues from service subscription or pay-per-unit where a unit is a single signal of the amount of relayed data |

| Value architecture | Service is an extension to the blockchain accessible through public API |

| Value finance | R&D and development costs; infrastructure costs |

| Value network | Binding outside data and events to blockchain users and smart contracts |

| No. | BMs | Potential Sectors of Use | ||||||

|---|---|---|---|---|---|---|---|---|

| F | S | R | I | L | D | T | ||

| 1 | Utility Token | X | X | X | X | X | ||

| 2 |

| X | X | X | ||||

| 3 |

| X | X | X | ||||

| 4 |

| X | X | |||||

| 5 | Network Fee Charge | X | X | X | X | |||

| 6 | Blockchain Professional Services | X | X | X | X | X | X | X |

| 7 | P2P Blockchain | X | X | X | X | X | ||

| 8 | Three-sided Platform | X | X | X | ||||

| 9 | Light Intermediation | X | X | X | X | X | X | X |

| 10 | Mining | X | X | |||||

| 11 | Liquidity Providers | X | X | X | ||||

| 12 | Exchanges | X | X | X | ||||

| 13 | Market Orchestration | X | X | X | X | X | X | X |

| 14 | Scalability Providers | X | X | X | ||||

| 15 | Blockchain Connectors | X | X | X | X | X | ||

| No. | Business Model | Business Cases | ||||||

|---|---|---|---|---|---|---|---|---|

| F | S | R | I | L | D | T | ||

| 1 | Utility Token | Starbase, Bankex | Sikoba | LikeCoin | Witnet | IOTA | ||

| 2 |

| Blogboard, Engrave+ | ENS Nifty | Storj | ||||

| 3 |

| Open Zeppelin, Quixxi | WRIO OS+ | TradeLens | ||||

| 4 |

| Iconomi | Slant | ICO Compiler+, tokenGen | ||||

| 5 | Network Fee Charge | Sharpay | AcreWise+ | Streamr Marketplace | ||||

| 6 | Blockchain Professional Services | CuBE ON | SpringRole | Randao, blockchain-council | IPSE+ | blockchaintrainingalliance | ||

| 7 | P2P Blockchain | WeiLend | StiB P2P+ | blockimmo | Kleros | DIA data | ||

| 8 | Three-sided Platform | LegalContracts | ||||||

| 9 | Light Intermediation | Daxia+ | BTU Hotel | Talao, OracleChain+ | MarriageOnTheBlock+ | MyWish | Aigang+ | |

| 10 | Mining | Mining Expert, NiceHash, AntPool | MonitorChain | |||||

| 11 | Liquidity Providers | CashflowRelay | Doma | |||||

| 12 | Exchanges | Optimum+, Teradex, SmartExchange | Law4all | |||||

| 13 | Market Orchestration | Hydro+ | Slock It+ | FeeSimple+ | SelfKey | T2CR | Azrael | Oaken+ |

| 14 | Scalability Providers | mRaiden | ||||||

| 15 | Blockchain Connectors | NaviAddress+, Proof of Physical Address+, Provable | Interledger | |||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Stolarski, P.; Lewańska, E.; Abramowicz, W. Blockchain as an Enabler of Generic Business Model Realization. Blockchains 2025, 3, 6. https://doi.org/10.3390/blockchains3010006

Stolarski P, Lewańska E, Abramowicz W. Blockchain as an Enabler of Generic Business Model Realization. Blockchains. 2025; 3(1):6. https://doi.org/10.3390/blockchains3010006

Chicago/Turabian StyleStolarski, Piotr, Elżbieta Lewańska, and Witold Abramowicz. 2025. "Blockchain as an Enabler of Generic Business Model Realization" Blockchains 3, no. 1: 6. https://doi.org/10.3390/blockchains3010006

APA StyleStolarski, P., Lewańska, E., & Abramowicz, W. (2025). Blockchain as an Enabler of Generic Business Model Realization. Blockchains, 3(1), 6. https://doi.org/10.3390/blockchains3010006