2.1. The Portuguese Electricity System

Portugal’s electricity system operates within the Iberian energy framework, integrating domestic generation, cross-border exchanges, and wholesale trading through the

Mercado Ibérico de Electricidade (MIBEL). It is characterised by a high share of renewable generation, a small number of dominant market participants, and a regulated transmission network that interfaces with a liberalised retail segment [

6,

11].

From a commodity-market perspective, electricity in Portugal shares the fundamental properties of the wider European power sector: non-storability at scale (except via limited pumped-hydro and battery storage), inelastic short-term demand, and the requirement for instantaneous balance between supply and consumption [

3,

16]. These attributes make wholesale price volatility and system flexibility critical for market functioning and retail price formation.

Generation is dominated by hydroelectric, wind, and solar photovoltaic resources, complemented by natural gas-fired plants that provide dispatchable capacity [

11]. Hydroelectric output is highly dependent on annual hydrological conditions, while wind production is seasonally variable but forecastable at short horizons. Solar generation is concentrated in daylight hours with seasonal variation, and combined-cycle gas turbines (CCGT) are used to cover demand peaks and provide balancing services [

17].

The national transmission grid is operated by

Rede Eléctrica Nacional (REN) under a regulated monopoly model. REN ensures physical balancing, manages interconnections, and coordinates with the Spanish transmission system operator,

Red Eléctrica de España, for cross-border operations [

18]. Portugal’s interconnection capacity with Spain is significant relative to domestic demand, enabling active participation in MIBEL’s day-ahead and intraday markets. However, interconnection with the broader European network remains limited, making the Iberian Peninsula effectively a semi-isolated zone, which can amplify price effects of local supply–demand imbalances [

19].

Wholesale prices are set primarily in MIBEL’s day-ahead market, operated by OMIE using a marginal pricing mechanism. Generators submit supply offers and consumers or their retailers submit demand bids; the market-clearing price is determined by the marginal unit required to meet demand [

6]. Intraday markets and balancing services allow adjustments for deviations between forecasted and actual system conditions.

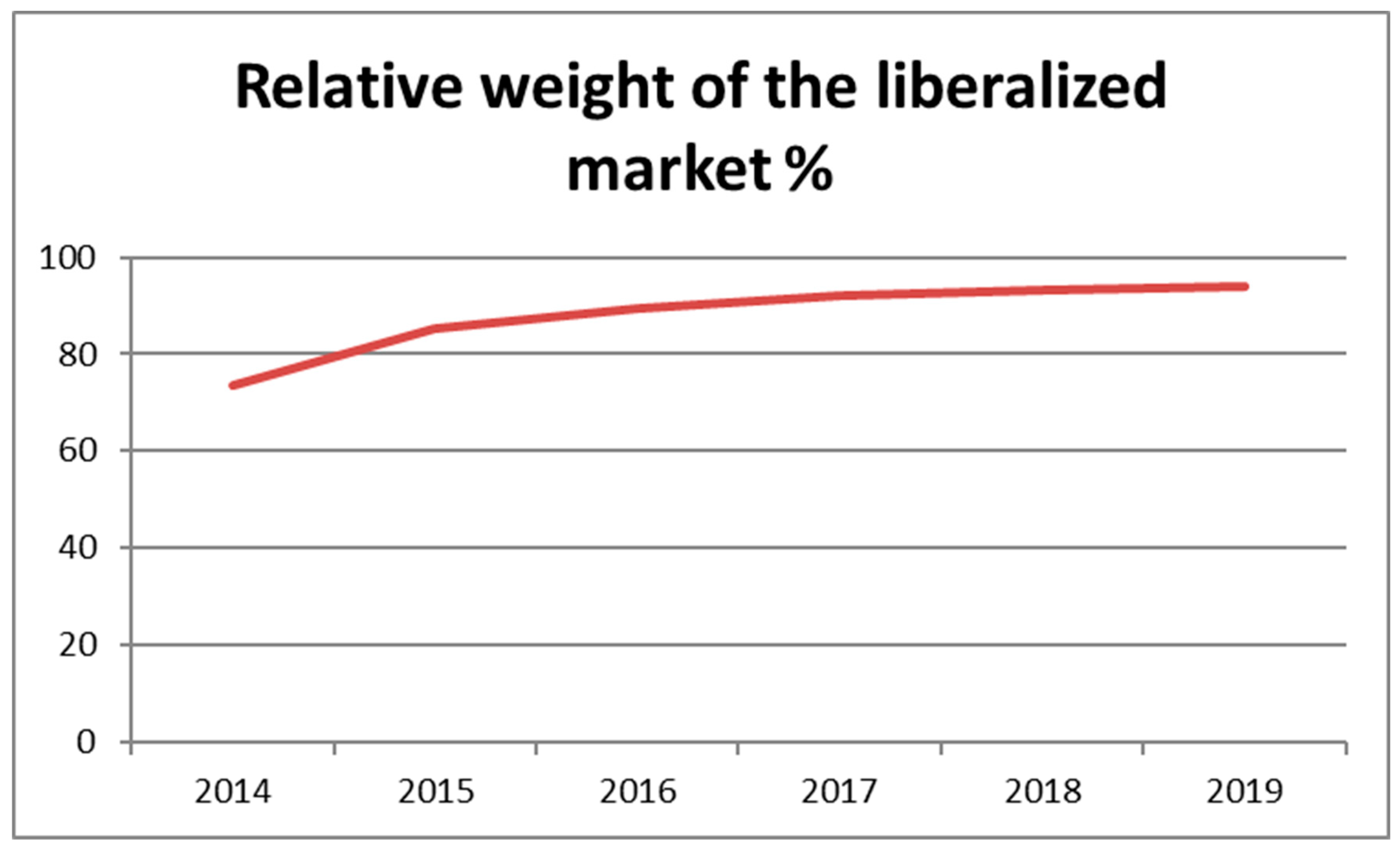

The retail market is formally fully liberalised, with multiple licenced suppliers competing for household and business customers. The removal of regulated tariffs for new customers in January 2013 marked the final step in opening the market, although a transitional regulated tariff was retained for a limited period for certain consumers [

11]. Retail electricity prices consist of an energy component—determined competitively and influenced by wholesale prices—as well as network charges set by the regulator and taxes and levies imposed by the government [

20,

21].

The interplay of high renewable penetration, reliance on natural gas for balancing, limited interconnection beyond the Iberian market, and a concentrated supplier structure creates a distinctive competitive environment. These features shape market concentration, switching behaviour, and wholesale-to-retail price pass-through—core dimensions analysed in this study.

2.2. Analytical Framework

This study applies a multi-layered analytical framework to assess the performance of the Portuguese household electricity retail market following liberalisation, integrating structural competition analysis, behavioural engagement metrics, and econometric identification. The design is grounded in competition theory, behavioural economics, and price transmission analysis, reflecting the focus on market structures, price formation, and the interaction between supply and demand in liberalised commodity sectors.

Liberalisation in electricity markets aims to replace vertically integrated monopolies with competitive supply arrangements, theoretically leading to lower concentration, more competitive pricing, and greater consumer choice [

22]. However, electricity is a unique commodity: it is homogeneous, non-storable at scale without specialised infrastructure, and vital for daily life [

23,

24]. These characteristics mean that market structure and consumer behaviour are mutually reinforcing determinants of competitive outcomes. Market concentration shapes the ability of suppliers to influence prices, while consumer engagement determines the extent to which competitive offers lead to actual market share shifts. Without active consumer participation, even markets with multiple suppliers may exhibit inertia and sustain high concentration.

We evaluate liberalisation outcomes through three complementary lenses: market structure, consumer engagement, and price transmission.

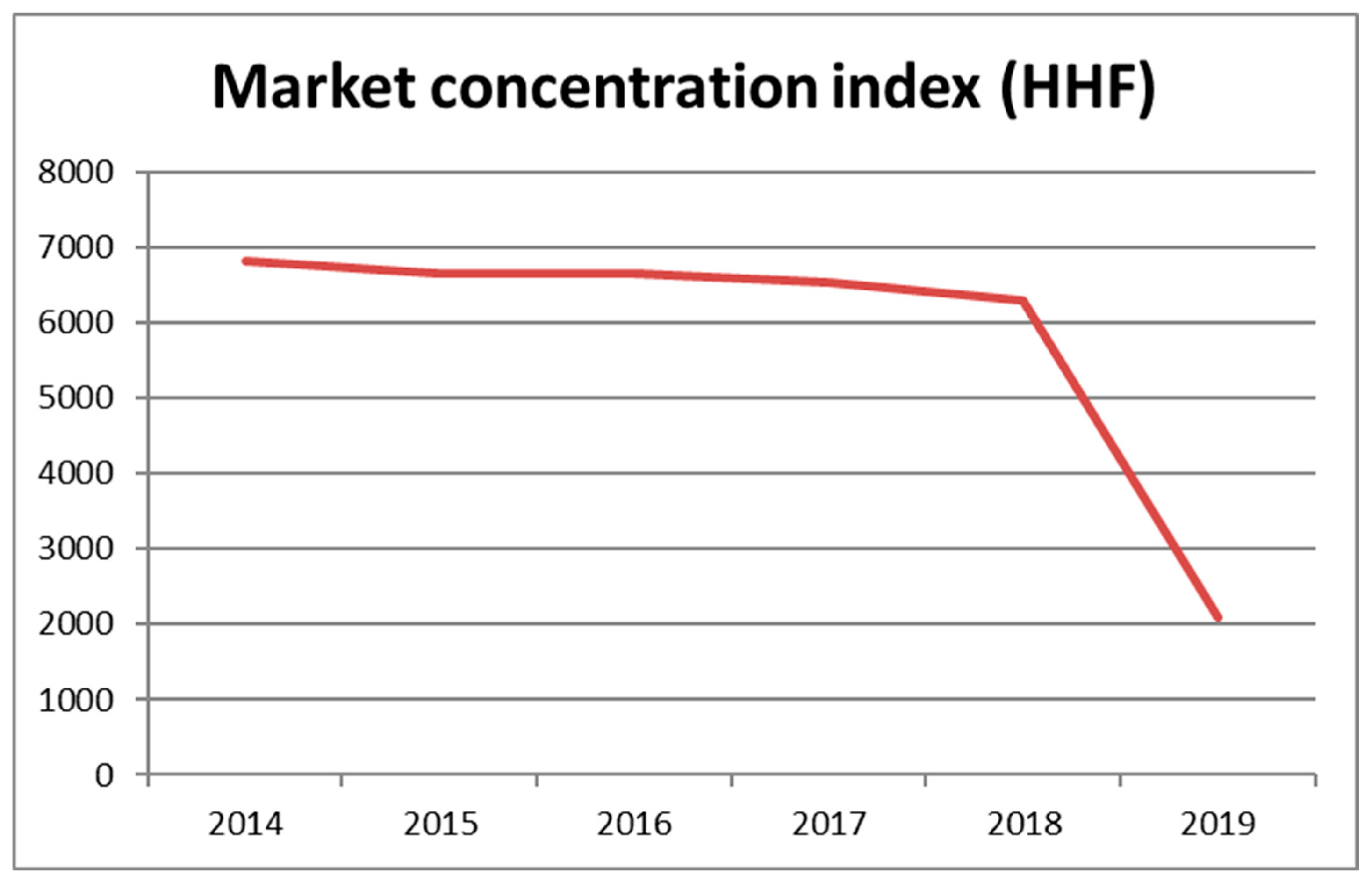

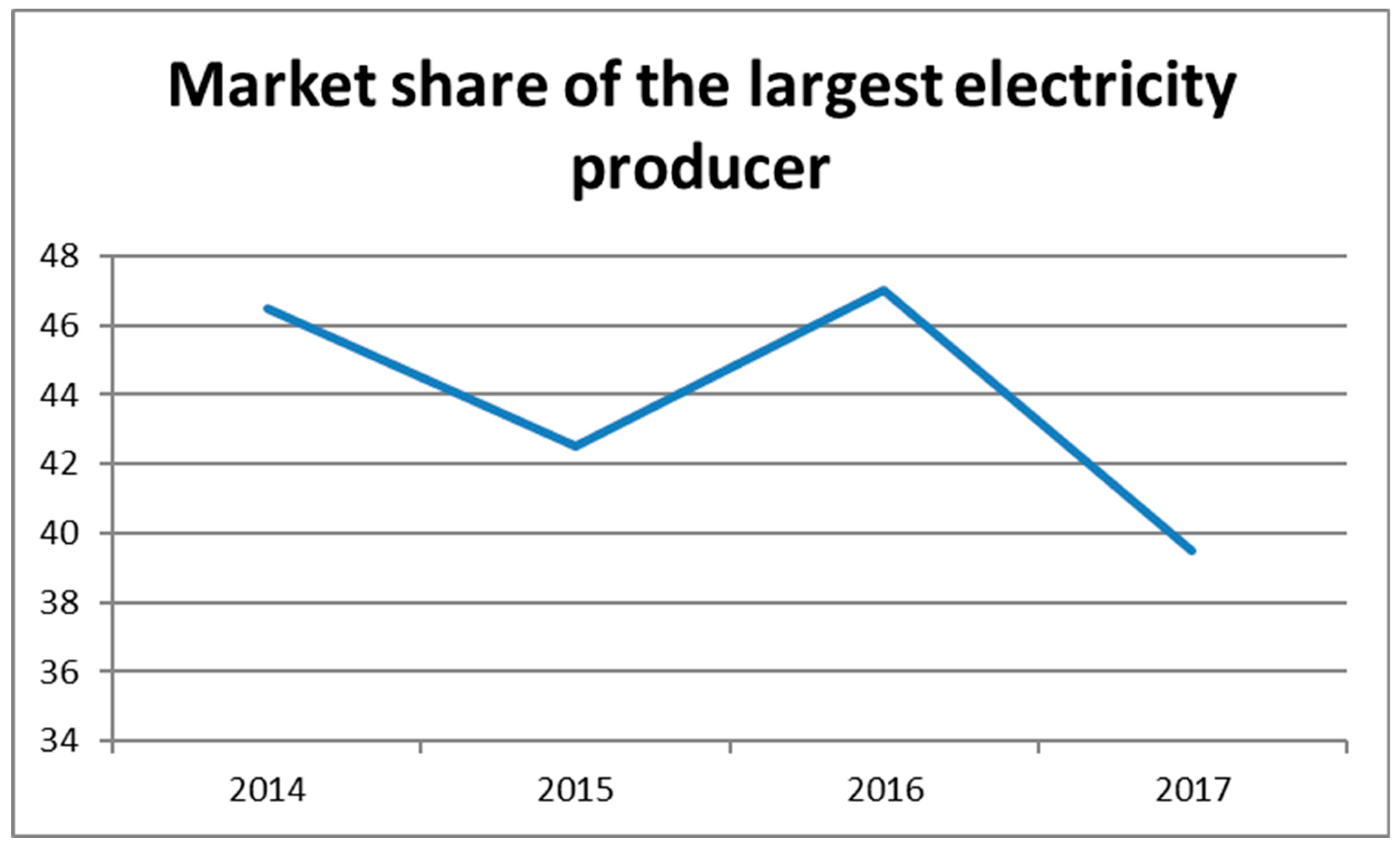

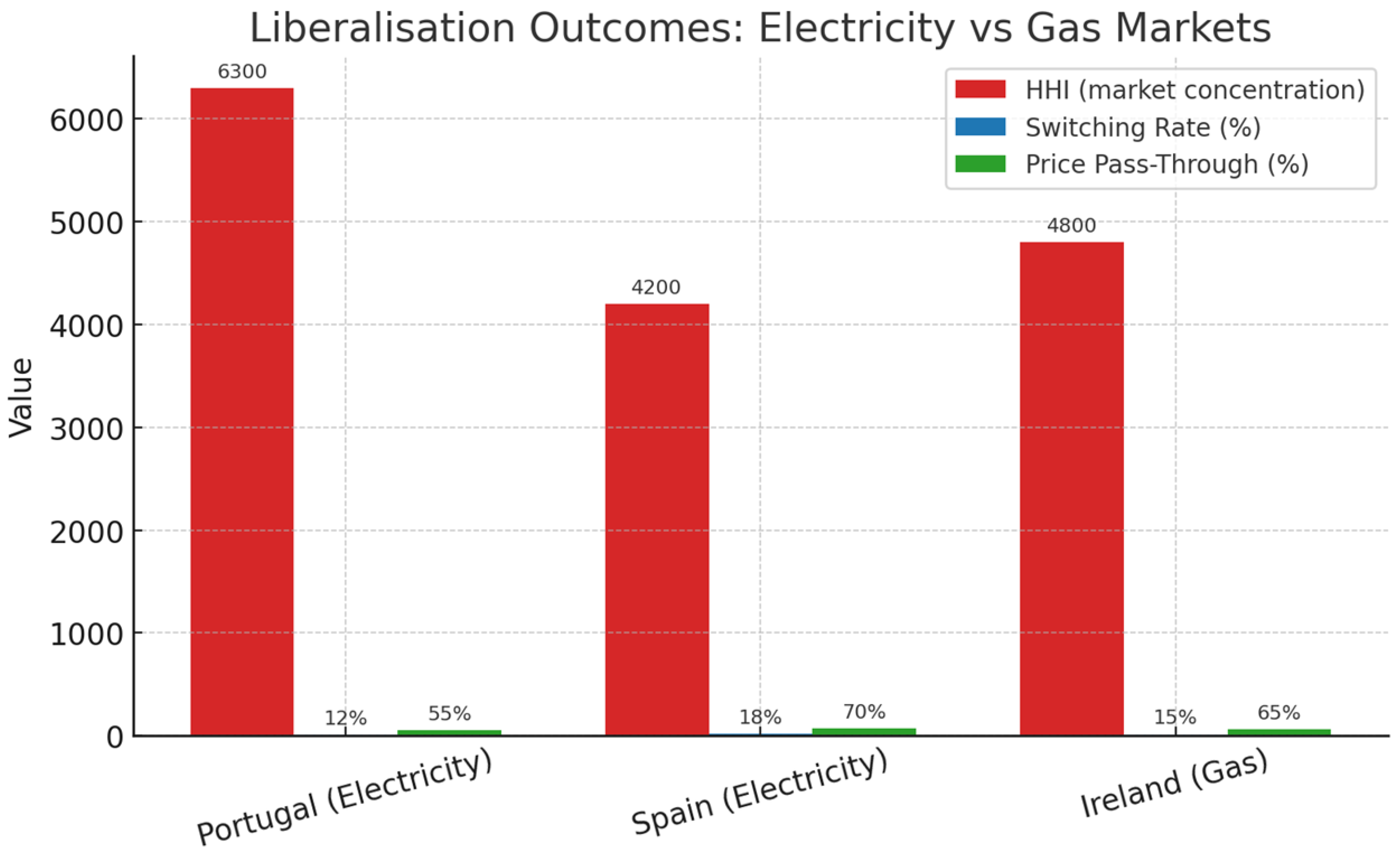

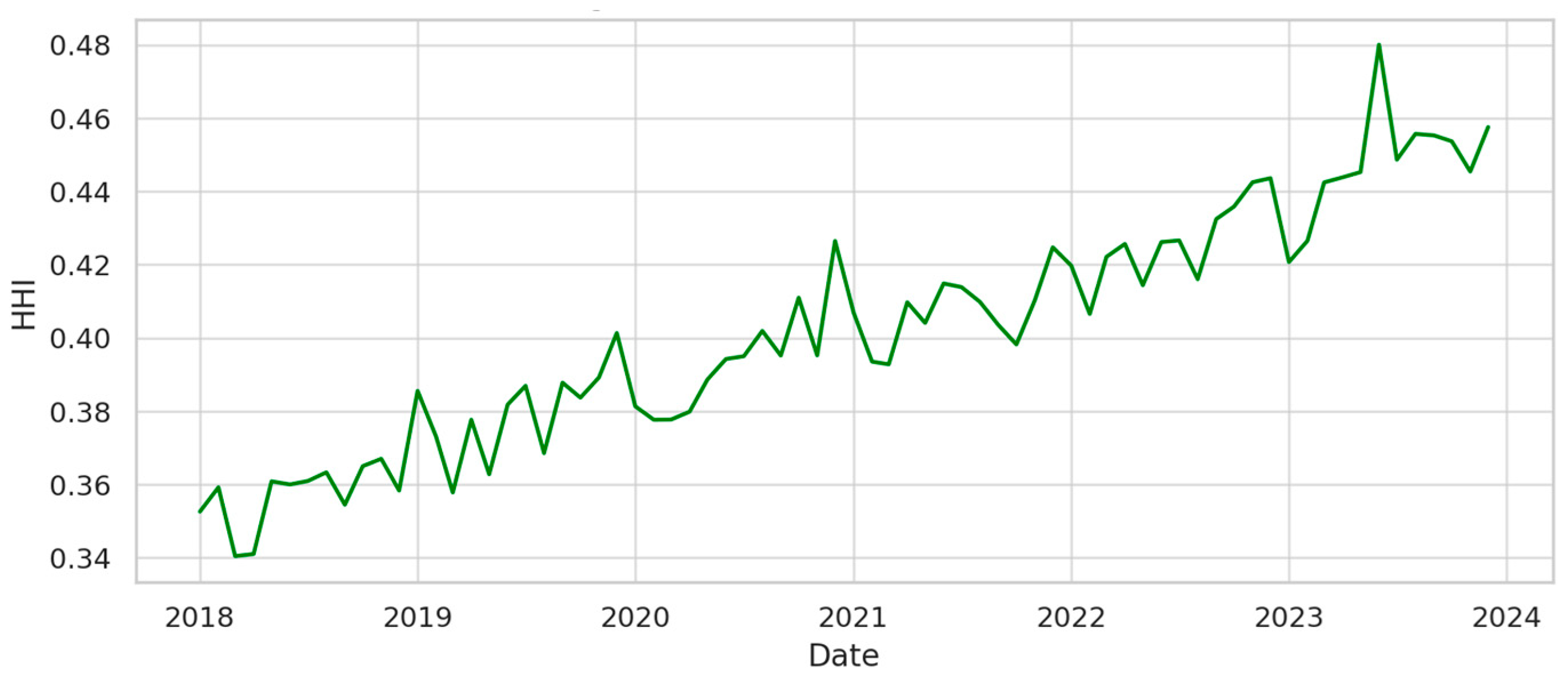

Market concentration is measured with the HHI and the CR4, computed monthly from household consumption shares. Following antitrust benchmarks, HHI values above 2000 indicate oligopoly, and values above 6000 suggest high concentration.

Consumer switching is measured as the proportion of households changing supplier each month. Both gross switching (all moves) and net switching (those altering market share distribution) are analysed to assess competitive discipline.

Wholesale-to-retail price pass-through is assessed using a nonlinear autoregressive distributed lag (NARDL) model [

25]. Wholesale price changes are decomposed into positive (increases) and negative (decreases) components. This enables estimation of asymmetric short-run and long-run pass-through elasticities, testing whether cost increases are transmitted more fully or rapidly than decreases.

To measure market structure, the HHI is used, calculated monthly from supplier market shares based on household consumption volumes. HHI reflects both the number of competitors and the distribution of their market shares, with larger suppliers weighted more heavily, and is widely recognised in antitrust analysis as a proxy for potential market power. Values above 2000 are generally considered indicative of oligopoly, and values above 6000 suggest high concentration and limited competitive pressure.

where S

i is the market share (percentage) of supplier ii in month t, and Nt denotes the number of active suppliers.

For interpretative simplicity and to align with policy benchmarks, the four-firm concentration ratio (CR4) is also calculated, representing the combined share of the four largest suppliers in the market.

Together, these indices provide complementary perspectives: HHI is sensitive to the full distribution of shares, while CR4 highlights the dominance of the largest firms.

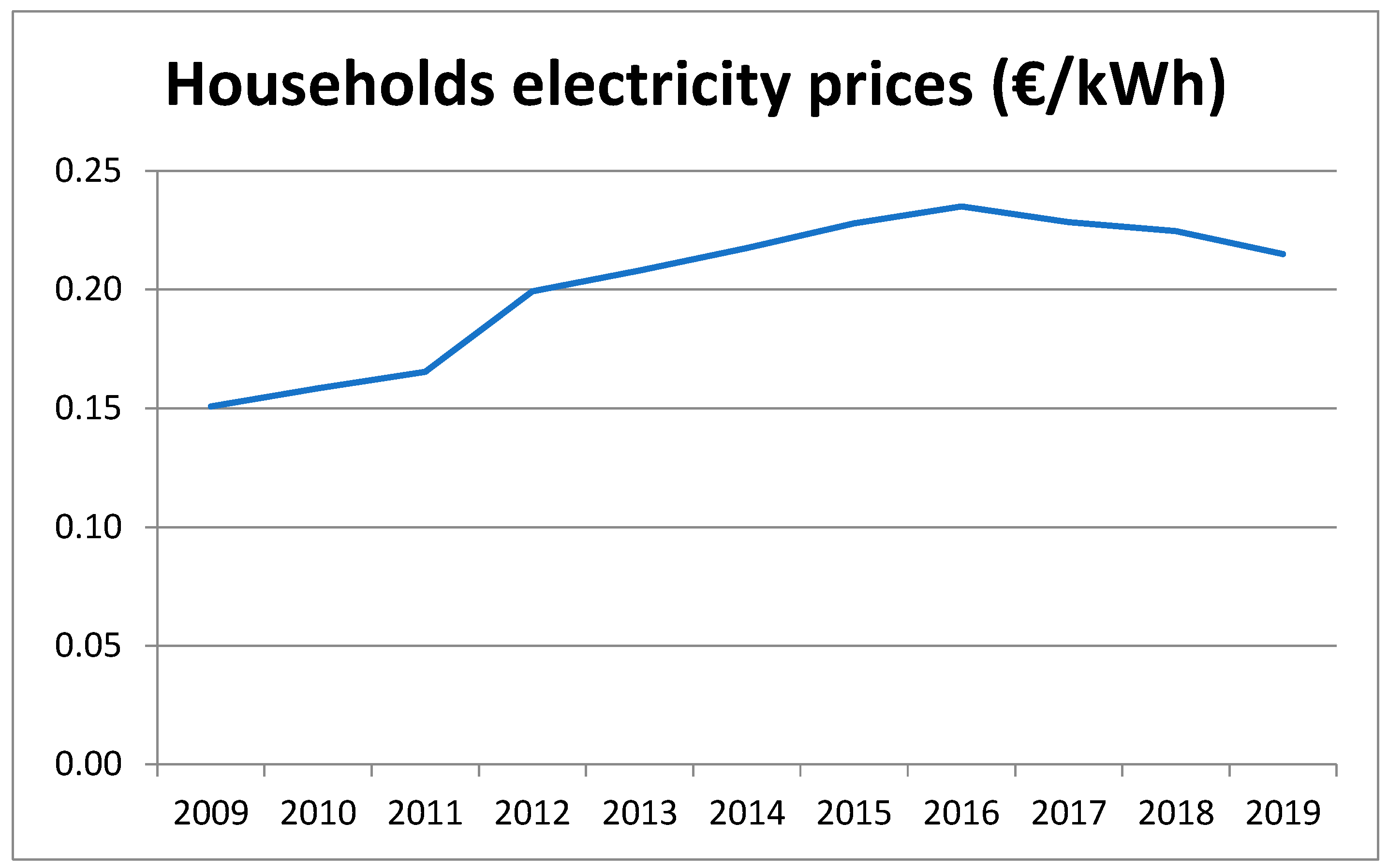

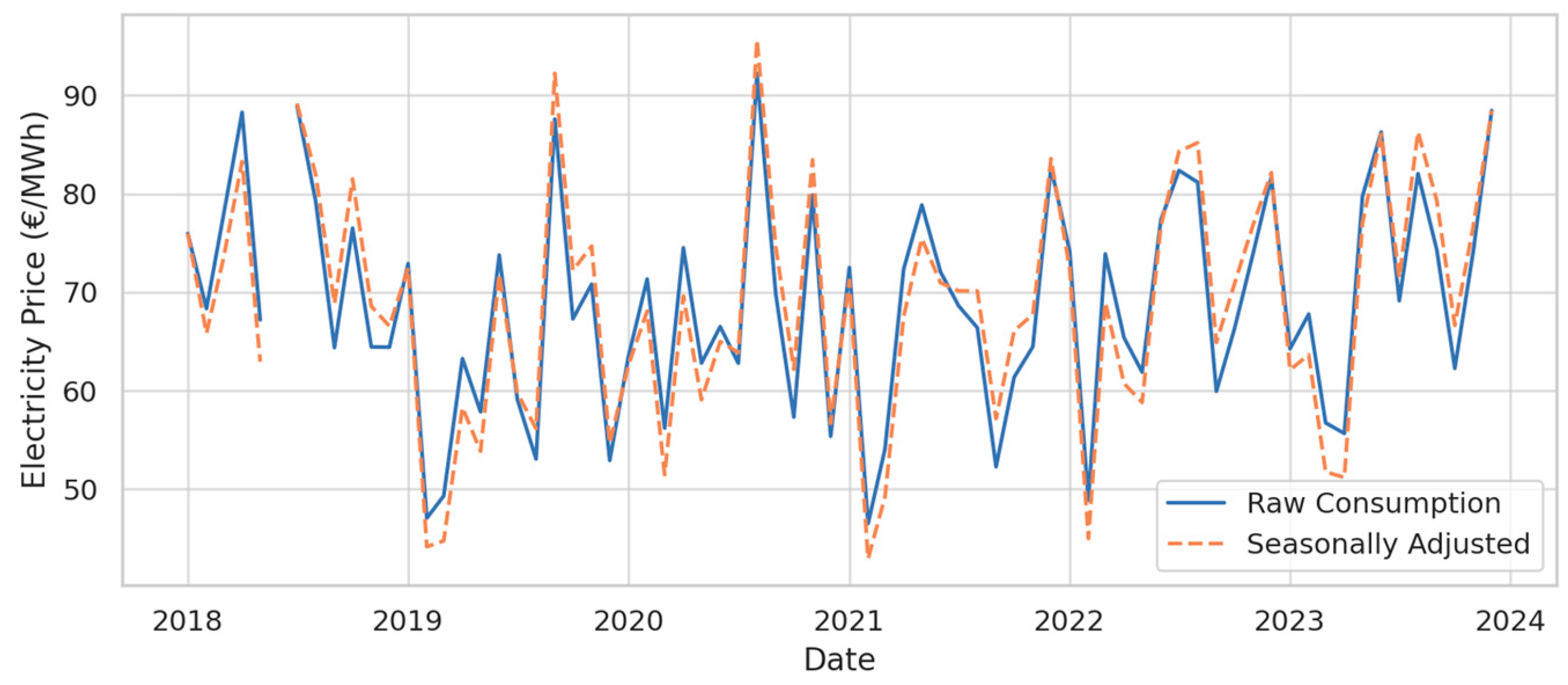

Retail prices are another critical indicator, sourced from [

8,

9,

10,

11,

26] and Eurostat’s Harmonised Index of Consumer Prices for electricity. Prices are expressed in real EUR/kWh (2021 base year) and decomposed into energy cost, network charges, and taxes or levies. This decomposition allows isolation of the competitive component—energy costs—from regulated or policy-driven components, providing insight into how effectively wholesale price changes are transmitted to consumers. In commodity markets, pass-through efficiency is a key measure of how well prices at the point of production or wholesale translate into consumer-level prices. If retail prices respond asymmetrically—adjusting quickly to cost increases but slowly to decreases—this may indicate market power, supplier risk aversion, or behavioural pricing strategies.

Consumer engagement is measured by monthly supplier switching rates, calculated as the proportion of all household customers who change supplier in a given month.

where Switche

st is the number of household customers changing supplier in month t, and TotalCustomer

st is the total number of household customers.

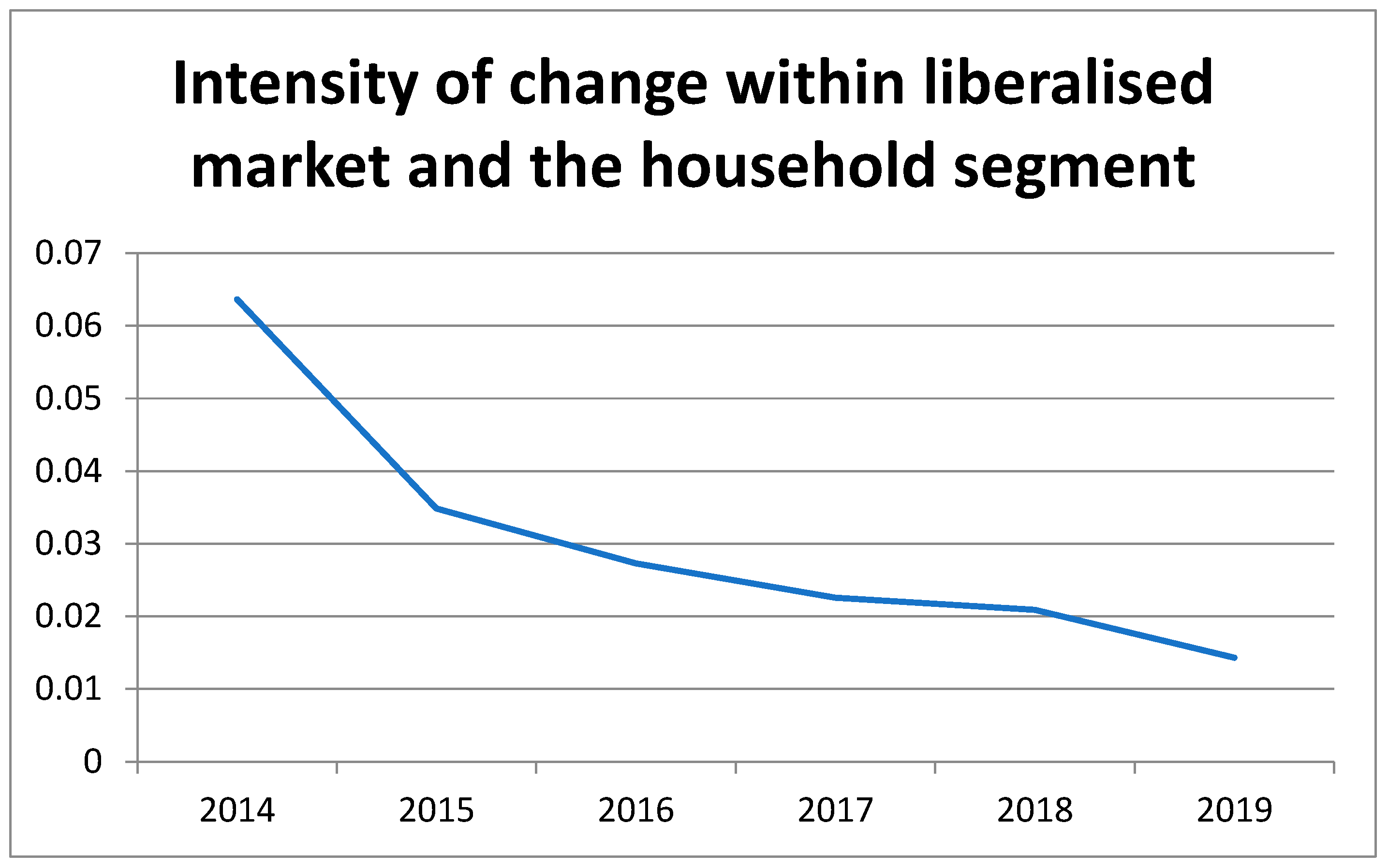

Switching intensity is analysed over time and across regions; we also compute supplier churn (entries/exits).

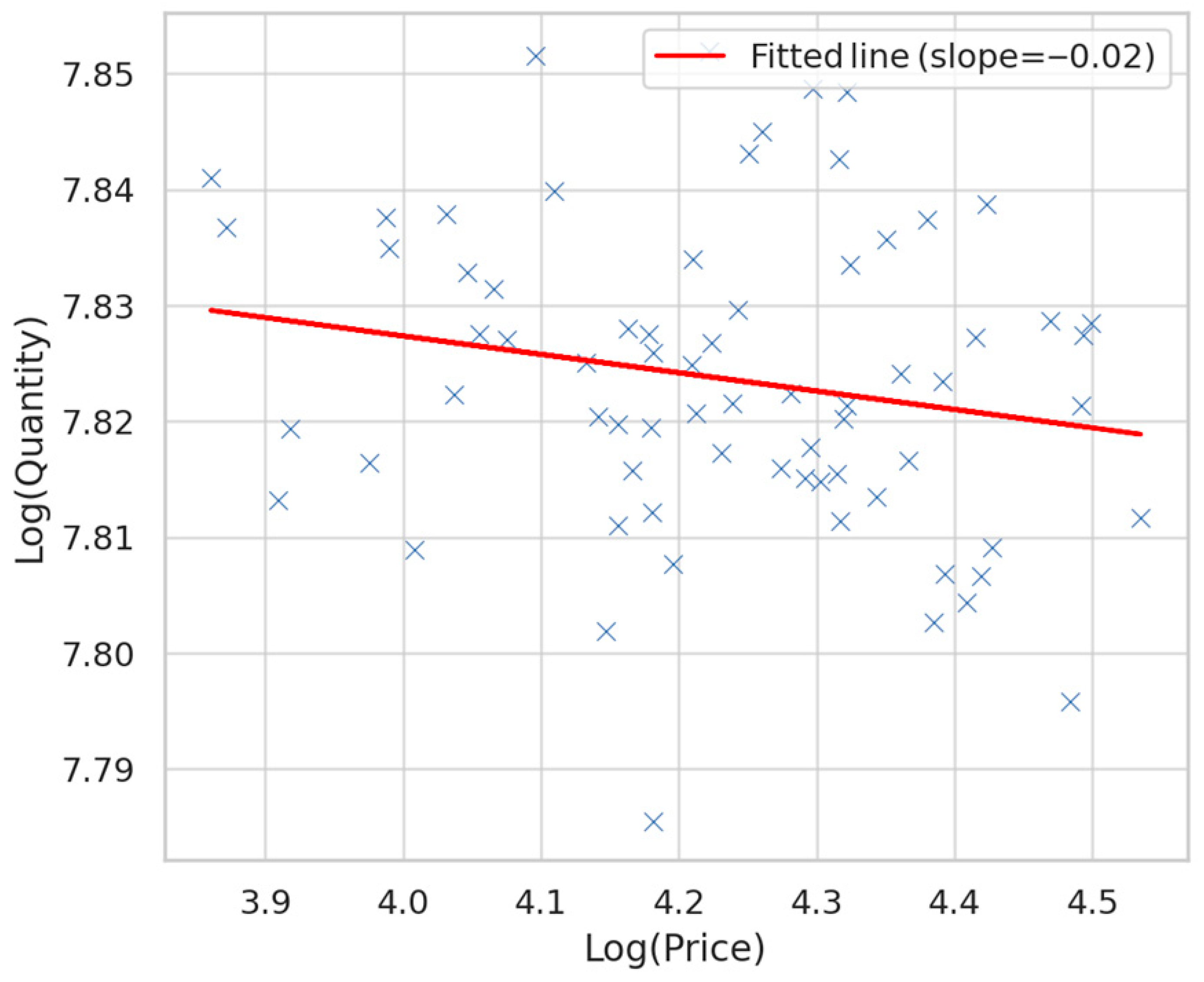

The core elasticity estimation uses a log-linear specification:

where

Qt is household electricity consumption (aggregate or per household);

Pret,t is the real retail price (EUR/kWh);

Xt is a vector of controls (HDD/CDD, real income Yt, major policy dummies, number of suppliers Nt, energy efficiency stock proxies);

δt represents time fixed effects (month/year) to absorb common shocks;

β is interpreted as the short-run price elasticity.

If monthly/quarterly data are available, dynamic specification with lagged dependent variables can be estimated:

In panel (regional) form, for region ii,

Here, αi represents region (fixed) effects capturing time-invariant heterogeneity.

Both gross switching (all changes) and net switching (changes that alter the market share distribution) are examined. Sustained high switching rates are associated with competitive discipline, forcing suppliers to adjust pricing and improve service quality. Conversely, low or declining rates, particularly after an initial post-liberalisation surge, may indicate behavioural barriers such as status quo bias, limited information, or perceived complexity of switching processes—common issues documented in liberalised energy markets globally.

The study covers January 2008 to December 2022, allowing analysis across pre-liberalisation, transition, and fully liberalised periods. January 2013, when regulated tariffs for new customers were removed, is treated as the main intervention point. This temporal structure enables causal inference by comparing pre- and post-reform patterns while controlling for exogenous factors.

Econometric identification proceeds in three stages. An event-study specification estimates dynamic responses to the January 2013 reform across market concentration, switching, and prices. This approach examines both the immediate and lagged effects of reform, capturing possible adjustment periods or temporary effects.

where Y

i,t is the outcome variable (HHI, retail price, or switching rate) for market i in month t; Dt = k is an indicator equal to 1 if month t is k months from the reform; γi and δt are market and time fixed effects; and βk measures the effect relative to the month immediately before the intervention (β−1 = 0 for normalisation).

A difference-in-differences model estimates the average treatment effect of deregulation, contrasting treated (previously regulated) and untreated groups before and after the intervention, controlling for wholesale prices, weather variation (heating and cooling degree days), seasonality, and the number of active suppliers.

where Post equals 1 for all months after January 2013, Treat

i identifies consumer groups previously subject to regulated tariffs, and X

i,t includes wholesale prices, weather variables, and seasonal dummies.

To assess price transmission, an asymmetric autoregressive distributed lag (ARDL) model is employed, decomposing wholesale price changes into positive and negative movements and estimating separate short-run and long-run pass-through elasticities.

where W

t+ and W

t− denote positive and negative monthly changes in wholesale prices. The null hypothesis β

j+ = β

j− tests for symmetry; rejection implies that prices adjust differently to increases and decreases, which may reflect market power, menu costs, or strategic pricing. Testing whether coefficients on positive and negative changes are equal provides evidence on asymmetry, which in commodity markets is often linked to structural supply constraints, contracting practices, and strategic pricing.

We estimate a nonlinear autoregressive distributed lag (NARDL) model following [

25] to allow for asymmetric pass-through of wholesale prices (W) to retail prices (R). The model is

where W

t+ = ∑maxΔWt,0) and W

t− = ∑minΔWt,0). Lag orders p and q are selected via the Akaike Information Criterion. All variables are tested for integration order (ADF, KPSS), and the bound testing approach of [

27] is applied to determine cointegration.

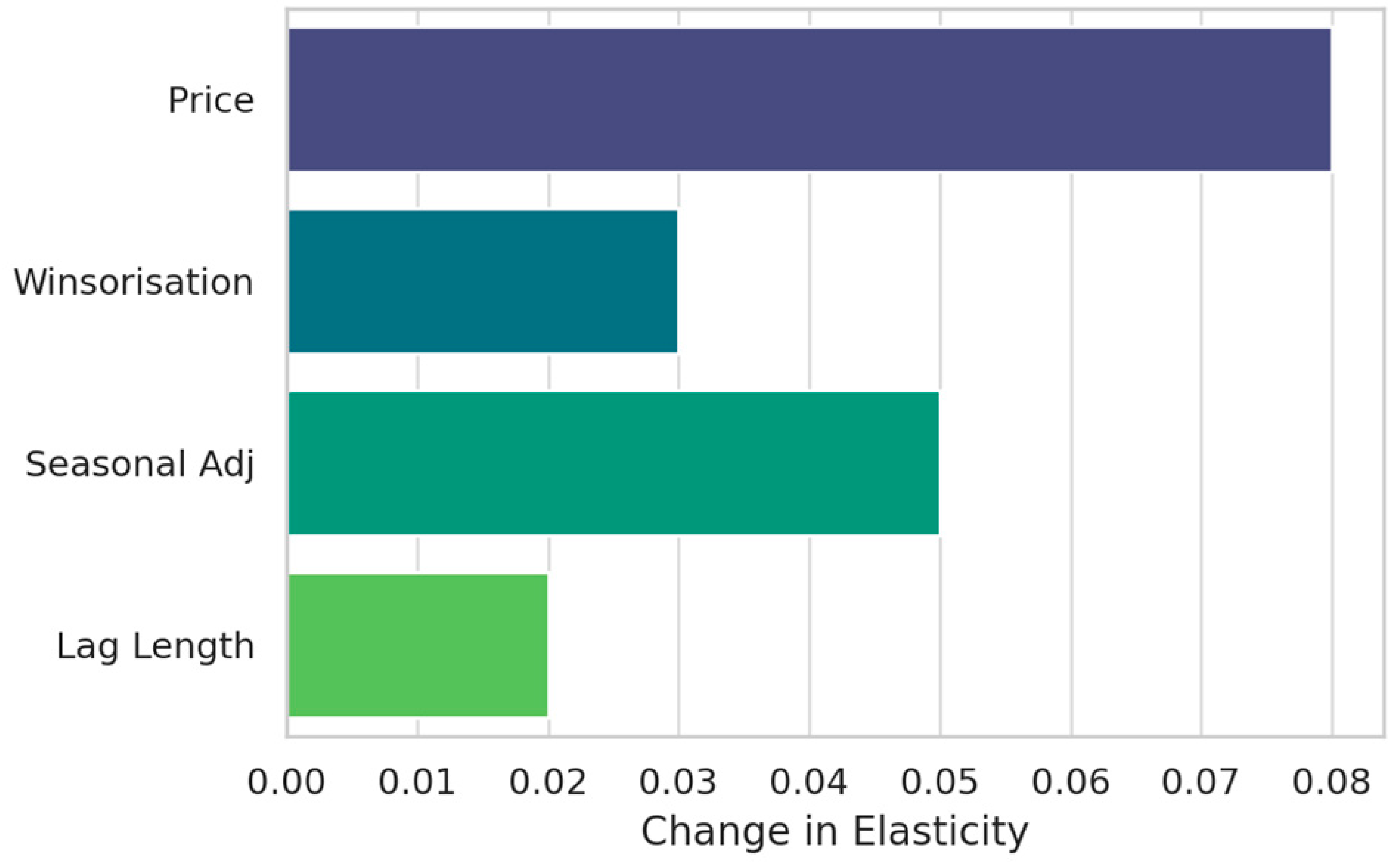

Robustness is addressed by excluding high-volatility years such as 2022 to avoid crisis-driven distortions, recalculating concentration measures excluding inactive suppliers, applying alternative concentration metrics such as CR3, CR5, and the Gini coefficient, and measuring retail price dispersion via the interquartile range of supplier offers. Sensitivity analyses include testing alternative lag structures in ARDL models, varying the set of control variables in DiD specifications, and conducting placebo tests with pseudo-intervention dates to verify identification validity. Stationarity tests (ADF, KPSS) ensure the suitability of time-series models, with cointegration testing used to justify long-run elasticity estimation.

2.3. Data

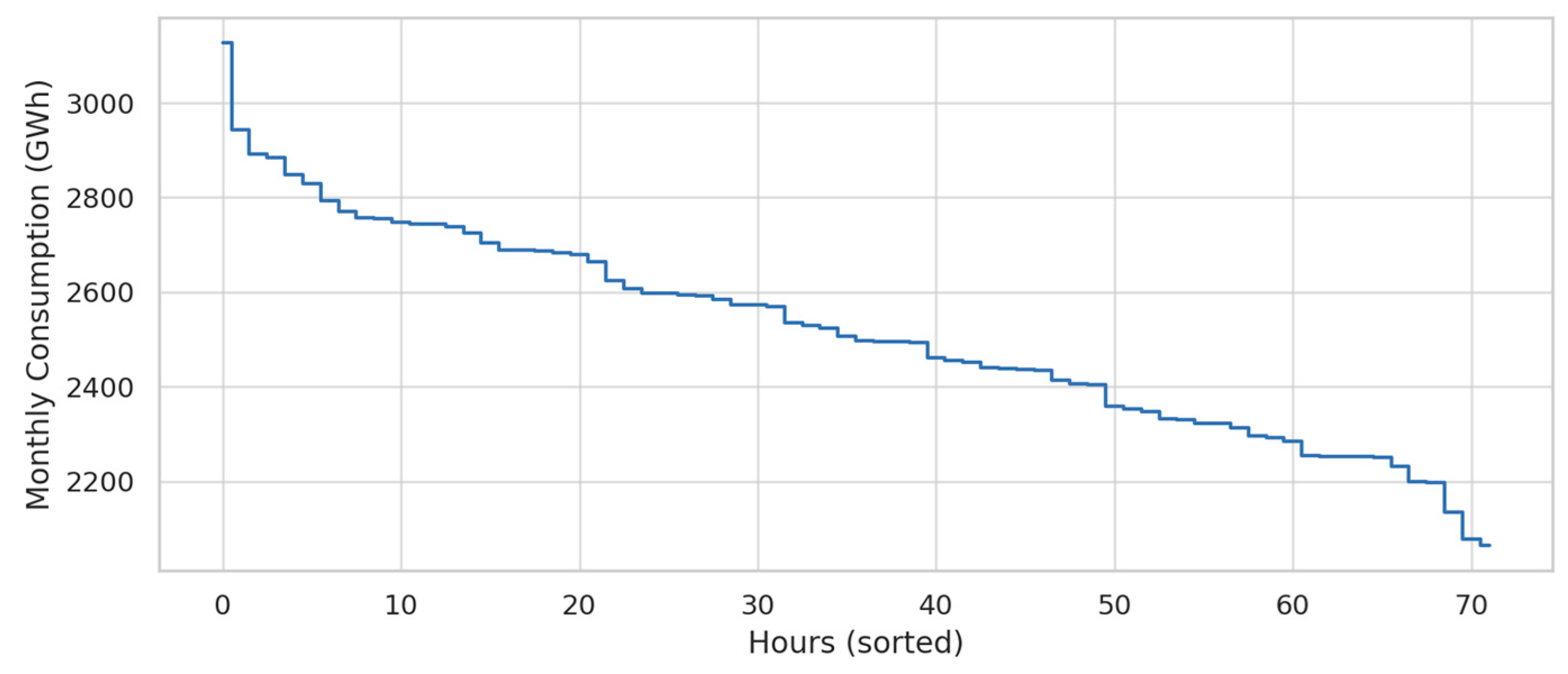

The primary dataset covers January 2014–December 2019, corresponding to the fully liberalised period of Portugal’s household electricity retail market. This timeframe avoids transitional effects of partial regulation before 2013 and excludes distortions from the COVID-19 pandemic and the 2021–2022 energy crisis. For robustness, we also extend the sample to 2008–2022, capturing the evolution from the regulated regime to recent shocks.

Monthly data are sourced from

ERSE (Energy Services Regulatory Authority): supplier market shares, retail prices, and switching statistics.

DGEG (Directorate-General for Energy and Geology): wholesale day-ahead prices, consumption, and generation.

Eurostat: harmonised consumer price indices and exchange rates.

ENTSO-E: interconnection capacity and utilisation.

All monetary variables are expressed in constant euros (2021 base year) using the HICP deflator. Market shares and switching data are harmonised across reporting changes after 2014. The January 2013 removal of regulated tariffs for new customers is treated as the primary policy intervention for econometric identification [

28].

The key variables used in this study are

All price series are deflated using the Eurostat HICP for all items (2021 = 100) to express values in constant euros. Market share and switching data are cleaned for missing observations and harmonised to account for changes in ERSE’s reporting format after 2014. Wholesale and retail price series are aligned at a monthly frequency, with wholesale prices converted from EUR/MWh to EUR/kWh for comparability [

31].

The empirical analysis uses the primary sample 2014–2019 for the household retail market (consistent with ERSE reporting available to the author). Where higher-frequency data are available (monthly or quarterly prices, switching events and wholesale price series), analyses are performed at the highest feasible frequency to exploit temporal variation; annual aggregates are used for concentration indices and cross-sectional comparisons. Where appropriate, extended samples (e.g., 2010–2020) are used for robustness checks if data availability permits.

Table 1 lists the principal variables, their definitions and typical sources. All series are documented and saved to enable replication.

Time series are first aligned to a common temporal frequency appropriate for each model, with monthly models using monthly price and consumption data and the HHI model using annual market-share data. When up- or down-sampling is required, only non-seasonal series are linearly interpolated, while counts or proportions are not interpolated unless explicitly justified. Monthly or quarterly consumption and price series are seasonally adjusted using X-13ARIMA-SEATS or seasonal dummy variables, with degree-day controls retained to capture weather-driven variation. Extreme values are inspected, and those identified as reporting errors are corrected or excluded; for robustness, continuous variables are winsorised at the 1st and 99th percentiles during elasticity estimation. Missing data are transparently reported and addressed: short gaps of up to two periods are interpolated, whereas longer gaps lead to sample truncation or aggregation. Listwise deletion is applied when missingness is minimal, with multiple imputation considered and documented for more substantial gaps. Finally, time series are tested for stationarity using ADF and KPSS tests; non-stationary but cointegrated series are modelled with error-correction frameworks, while other non-stationary series are differenced. Quantity and price variables are log-transformed for elasticity estimation [

32,

33,

34,

35,

36].

The primary dataset covers January 2014 to December 2019, chosen to avoid transitional effects of partial regulation before 2013 and to exclude distortions caused by the COVID-19 pandemic and the 2021–2022 energy crisis. This period ensures consistent regulatory and market conditions. For robustness, we extend the dataset to 2008–2022, covering pre-liberalisation years and recent shocks. This two-tier approach ensures that the main findings reflect stable liberalised market dynamics, while robustness checks confirm that conclusions are not sensitive to the broader temporal window.