Abstract

This study investigates the impact of geopolitical risk, firm characteristics, and macroeconomic variables on the performance of non-financial firms listed on the Egyptian Stock Exchange. The study analyzes a panel dataset consisting of 182 Egyptian firms over the period 2014–2023. Using the panel Generalized Method of Moments (GMM) regression technique, the study examines the effect of geopolitical risk on the return on assets. This study controls for firm characteristics such as liquidity, leverage, and growth opportunities and controls for macroeconomic variables such as inflation and GDP. This empirical evidence investigates the moderating role of FinTech on such relationship. The results reveal a significant and negative relationship between geopolitical risk and firms’ performance. Liquidity, growth opportunities, and inflation show positive and significant impacts. In contrast, leverage and GDP demonstrate significant negative relationships. Remarkably, FinTech moderates the relationship significantly and positively. Therefore, investors ought to proceed with prudence when positioning cash within elevated political volatility. The significant positive moderating effect of FinTech on this connection provides a vital strategic insight: enterprises with enhanced FinTech integration may demonstrate increased resilience to geopolitical shocks.

Keywords:

geopolitical risk; firm performance; FinTech; growth; leverage; liquidity; panel GMM estimation JEL Classification:

G15; G32; O33; F51; M21

1. Introduction

Geopolitical risk has become a crucial factor in financial market dynamics, particularly in emerging nations where political and security events significantly impact investor behavior [1]. Egypt, a crucial nation in the Middle East and North Africa (MENA) area, has undergone significant geopolitical changes in recent decades, encompassing political upheavals, regional conflicts, security issues, and global tensions [2]. These trends prompt critical enquiries into the translation of such risks into financial market results, especially concerning stock market performance [3]. The association between geopolitical risk and firm performance in the Middle East is of dominant importance due to its potential influence on economic stability, investment, and financial markets in the region. Geopolitical risk, which includes political tensions, military conflicts, terrorism, and social unrest, can significantly affect investor sentiment and lead to increased market volatility [4]. The Arab Spring uprisings that commenced in late 2010 and continued into 2011 had significant repercussions on the economics and financial markets of the impacted nations, particularly Egypt. The ensuing political turmoil resulted in substantial drops in stock market indexes, with the Egyptian Stock Exchange (EGX30) seeing a depreciation exceeding 50 percent in value in 2011. Furthermore, persistent geopolitical tensions in the Middle East, including the Israeli–Palestinian conflict and the Syrian Civil War, sporadically affected financial markets and intensified uncertainty for regional investors [5]. The civil war in Libya, which began in 2011, together with the ongoing crisis in South Sudan, has affected oil production, resulting in heightened price volatility and reduced investor confidence [6].

As a central emerging economy in the MENA area, Egypt’s financial market is intensely vulnerable to local and regional geopolitical events, which can undermine investor confidence, affect capital mobility, and modify risk perceptions [7]. Comprehending this link is crucial for formulating resilient investment strategies and efficient risk management instruments, particularly in contexts characterized by persistent political instability and external shocks [8]. This study enhances the existing literature on non-economic factors influencing financial market behavior, especially in under-explored areas such as Egypt. Furthermore, the results can guide policymakers and regulators in formulating strategies to bolster market resilience and safeguard investors under increased geopolitical volatility. This study offers useful insights for institutional investors, financial analysts, and decision-makers by empirically investigating the relationship between political events and firm performance in Egypt.

Nevertheless, despite its importance, there is a lack of empirical research examining this link within the Egyptian setting through systematic quantitative methodologies [1,9]. This study seeks to address this deficiency by empirically examining the influence of geopolitical risk on non-financial firms listed on the market stock exchange in Egypt. The study evaluates the extent to which geopolitical changes affect firm performance by utilizing recognized geopolitical risk indexes. This contributes to the expanding literature on political uncertainty and financial performance while providing practical implications for risk management, investment strategy, and policy development in Egypt and comparable emerging nations.

The Geopolitical Risk (GPR) Index, created by Caldara & Iacoviello [10], effectively quantifies the influence of geopolitical events on the global economy and financial markets. The GPR Index offers a reliable and standardized metric for monitoring and assessing the impact of geopolitical events over time by analyzing the prevalence of stories in prominent international newspapers that address geopolitical risks. Consisting of eight categories, the GPR Index (Caldara & Iacoviello, [11]) provides insights into the varied effects of war threats, peace threats, military buildups, nuclear threats, terror threats, war initiations, war escalations, and terrorist acts on stock markets, investor sentiment, and corporate performance.

This research provides multiple significant contributions to the existing literature. Firstly, this study is the first investigation of the moderating influence of FinTech on the relationship between geopolitical risk and business performance, particularly in the context of Egypt, an emerging market characterized by a dynamic political and economic environment. Secondly, it fills a significant need in the literature by redirecting attention from developed economies to the inadequately examined MENA area, offering context-specific insights on the impact of external shocks on enterprises in these markets. Thirdly, by integrating FinTech as a moderator, the study presents a unique viewpoint on how financial technology might function as a resilience tool that potentially alleviates the adverse impacts of geopolitical uncertainty on company performance. Fourthly, the findings include practical consequences for policymakers, investors, and company managers, as they underscore the strategic significance of FinTech adoption in enhancing institutional and financial resilience in the face of uncertain geopolitical circumstances.

The structure of this empirical evidence is as follows: The first section introduces the research. The literature review and theoretical framework in the second section combine existing research on geopolitical risks and financial markets and highlights the gap this study fills, notably in the GCC. The third section describes the data sources, variable selection, and econometric models used to empirically analyze geopolitical risk and stock returns. The fourth section interprets the results and compares them to the existing literature. The fifth section concludes and discusses the important findings, their relevance to investors and policymakers, and future study.

2. Literature Review

2.1. Theoretical Background

2.1.1. Efficient Market Hypothesis (EMH)

The EMH states that financial markets are “informationally efficient,” meaning asset prices represent all available information at any time [12]. Since market prices respond instantly to new knowledge, Eugene Fama’s theory states that risk-adjusted returns cannot continually exceed average market returns [13]. The EMH can be weak, semi-strong, or strong depending on the sort of information considered, past prices, all publicly available information, or all information (public and private). The EMH helps explain how investors process geopolitical risk and stock market performance [14]. Geopolitical events including military war, diplomatic friction, sanctions, and political instability increase market risks and uncertainties. As investors modify their expectations for company profitability, risk premiums, and economic conditions, the EMH expects stock prices to quickly reflect this new information. Public information like geopolitical changes should be priced into stocks promptly in semi-strong form efficiently [15]. Therefore, under the EMH, abnormal gains from geopolitical news should be short-lived because rational investors move quickly. Empirically investigating this relationship in Egypt, where the economy is sensitive to regional political dynamics, will help evaluate whether stock markets in this nation respond well to geopolitical shocks [16].

2.1.2. Behavioral Finance Theory

Behavioral Finance Theory claims that psychological factors and cognitive biases influence investor behavior and market results, challenging rationality in financial decision-making [17]. The Efficient Market Hypothesis assumes investors analyze all information logically and effectively. Behavioral finance suggests that emotional responses, overreaction, herding, and other psychological biases can make markets inefficient [18]. Behavioral finance can explain how investors may react irrationally to wars, political instability, terrorism, and diplomatic tensions in the context of geopolitical risk and stock returns [19]. These risks often cause market overreactions or underreactions due to fear, anxiety, or overconfidence. Investors may panic-sell assets under geopolitical tensions, assuming worst-case situations without thoroughly assessing company or economy fundamentals [20]. Even without significant economic repercussions, this behavior can generate dramatic stock price falls, which may be corrected if sensible evaluations dominate [21]. Behavioral finance can help explain Egypt market dynamics, where geopolitical events greatly influence investor opinion. The hypothesis posits that geopolitical events may cause stock market volatility due to investor psychology as much as fundamentals. Thus, behavioral finance research can examine stock return anomalies like high volatility or momentum after geopolitical shocks [22]. Policymakers, investors, and financial institutions in politically sensitive countries like Egypt must understand these behavioral patterns to improve risk management and market stability.

2.2. Previous Studies and Hypothesis Development

2.2.1. Geopolitical Risk and Firm Performance

Several studies have examined the influence of diverse geopolitical risk categories on stock market performance and firms’ performance [1,3,8,9,23,24,25]. For example, Schneider & Troeger [23] revealed that increased political instability, marked by frequent governmental transitions, social unrest, or political upheaval, is associated with reduced stock market returns and reduced performance. Meanwhile, Duyvesteyn et al. [26] indicated a negative correlation between the probability of government collapse and overall political risk levels concerning stock market performance. Political instability’s impact on stock markets may be mitigated by variables including institutional quality, economic conditions, and investor mood [27]. Trade wars, characterized by the introduction of trade barriers and retaliatory actions between nations, have been a notable source of geopolitical risk in recent years [28].

Additionally, Fajgelbaum et al. [29] identified adverse impacts on stock market returns in both the US and China resulting from increasing trade tensions between the two countries, whereas Baker et al. [1] demonstrated diminished global stock market values amid intensified trade policy uncertainty. Global conflicts, encompassing wars and military clashes, may substantially influence stock market performance. Ardalan & Massoudi [30] provided a comprehensive analysis of the effects of geopolitical risks, clarifying the impact of various geopolitical events on global markets. This thorough methodology has enabled a more profound comprehension of the impact of various political events, such as conflicts, trade tensions, and diplomatic disputes, on asset markets and risk premiums. Recent research has examined moderating factors in the complex link between geopolitical risk and stock market performance. Nguyen et al. [31] emphasized the importance of institutional resilience, demonstrating that nations with flexible and adaptive institutions exhibit enhanced stock market stability throughout geopolitical crises. Furthermore, Mohammad et al. [32] examined the influence of investor attitude on stock market reactions to global geopolitical crises, revealing that changes in sentiment might exacerbate market fluctuations, resulting in increased price volatility.

More recent studies, including that by Alnafrah [33], have examined the intersection of environmental risks, geopolitical risk, and ESG investment, providing significant insights into the influence of sustainability factors on stock market returns in the context of increased geopolitical challenges. Zhang et al. [8] conducted an analysis of 32 countries and regions, utilizing dynamic panel data, and discovered that geopolitical risk (GPR) substantially elevates stock market volatility, especially in growing economies, crude-oil-exporting nations, and stable countries. This expands the range of prior research by including a varied array of nations and areas. Guo & Shi [34] employed a quantile regression methodology to investigate the effects of GPR and investor attitude on the volatility of the Chinese stock market. Their findings revealed that whereas GPR and investor mood did not exert a substantial impact on the market level, they demonstrated asymmetric and heterogeneous effects at the industry level, especially at market extremes. In a global setting, Hao et al. [35] employed the cross-quantilogram approach to examine GPR’s prediction ability regarding volatility spillovers among foreign markets, identifying substantial directional spillover effects driven by GPR. This methodology offers a detailed perspective on how geopolitical threats can predict market fluctuations.

Böyükaslan et al. [36] examined Turkey within the context of sector-specific responses to geopolitical risks, emphasizing the function of GPR as a net transmitter of shocks to the stock market. The electrical supply sector altered its function because of structural energy sector reforms, demonstrating the dynamic interaction between geopolitical concerns and particular market reactions. This research highlights the significance of sectoral dynamics in comprehending the wider effects of GPR. Pan et al. [37] examined volatility connectivity in China’s sectoral stock markets and revealed substantial volatility interconnectivity and nonlinear causation effects of global GPR, underscoring the interrelation of sectoral markets within a vast economy. Their study emphasizes the propagation of sector-specific volatilities over the larger market, shaped by global geopolitical influences.

Saâdaoui et al. [38] investigated the correlation between GPR and the Saudi stock market with a wavelet packet multiresolution cross-causality methodology to enhance the comprehension of market sensitivities. They discerned substantial correlation during crises such Brexit, COVID-19, and the Russian–Ukrainian war, underscoring the susceptibility of the Saudi market to global geopolitical occurrences. This research offers a detailed perspective on how particular geopolitical crises can exert extensive and enduring effects on regional economies. Recent studies emphasize the intricate interaction among geopolitical threats, economic policy uncertainties, and market dynamics. Hasan et al. [39] demonstrated that Islamic equity indexes exhibit greater resilience to geopolitical risks and economic policy uncertainty compared to oil market volatility. The consumer goods, oil and gas, and finance industries exhibit robust hedging capacities against geopolitical risks shocks. Ahmed et al. [40] examined global equity market interconnectedness amid the Russia–Ukraine crisis, observing heightened market interconnections and structural alterations resulting from the conflict, which influenced investment strategies. Based on the previous discussion of several previous studies, this study develops the following hypothesis:

Hypothesis 1.

There is a significant impact of geopolitical risk on Egyptian firm performance.

2.2.2. Role of FinTech as a Moderator

The influence of geopolitical risk on corporate performance has been extensively examined, although the moderating effect of FinTech in this context is still insufficiently investigated. Prior studies have predominantly investigated the direct impacts of geopolitical uncertainty on firm-specific outcomes, including profitability, investment behavior, and stock returns [41]. Research conducted by Caldara and Iacoviello [1] and others utilizing the Geopolitical Risk (GPR) Index indicates that elevated political instability is typically correlated with diminished company performance, heightened volatility, and decreased investment confidence. Nevertheless, these investigations frequently neglect the intermediary processes that may alleviate such adverse effects. An increasing body of literature has begun to investigate the impact of technology and digital finance on corporate performance in times of uncertainty.

FinTech enables organizations to reinvent processes and enhance consumer experiences, thus securing a competitive advantage in the swiftly evolving industry [42]. The implementation of FinTech significantly influences organizations’ competitive advantage. Research has validated the beneficial impacts of FinTech services on sustainability, organizational capability, and attractiveness [43,44]. The integration of financial technology enhances organizational capability, rendering the business more competitive in the marketplace and, as a result, more resilient and sustainable [44]). Furthermore, the growing utilization of FinTech generates competitive pressure among firms that leverage this platform to enhance services provided to SMEs and private enterprises [45].

Studies on FinTech adoption underscore its capacity to improve operational efficiency, expand access to money, and foster transparency, all of which are crucial in times of volatility. Research by Vives [46] and Thakor [47] presents persuasive evidence about the beneficial impact of FinTech on corporate adaptability, especially in fluctuating financial contexts. However, these studies mostly evaluate the direct impact of FinTech on corporate performance or financial inclusion, without connecting it to geopolitical factors. Only a limited number of emerging studies try to connect FinTech with geopolitical risk [48]. Certain regional evaluations, especially in Asia and select European regions, indicate that FinTech infrastructures can enhance financial resilience, enabling enterprises to sustain liquidity and stakeholder communication during crises [49]. Nevertheless, these investigations frequently lack the implementation of a stringent moderating framework or the statistical evaluation of the interaction effect [50,51]. Moreover, limited attention is given to the MENA area, characterized by significant political instability and an expanding FinTech sector.

The lack of contextual studies on rising economies, characterized by noticeable institutional gaps and political risk, constitutes a substantial research gap. Research in established markets indicates that FinTech enhances investor confidence and market liquidity among shocks; however, it is uncertain if these impacts are applicable in less stable situations [52]. Moreover, prior research has inadequately addressed firm-level performance indicators such as profitability, productivity, or return on assets in their examination of how FinTech might mitigate geopolitical pressures [53,54,55,56,57]. Based on the previous discussion, we developed the following hypothesis:

Hypothesis 2.

Fintech moderates the relationship between geopolitical risk and firm performance.

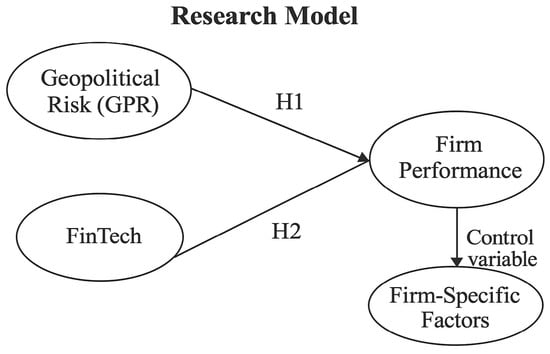

Based on the previous discussion, Figure 1 illustrates the model to investigate the impact of geopolitical risk on firm performance while moderating for FinTech.

Figure 1.

Research model. Source: authors’ analysis.

3. Methodology

3.1. Sample Used

The study sample comprised all non-financial companies listed on the Egyptian Stock Exchange from 2014 to 2023. The original sample had 227 companies; however, the final sample was reduced to 182 companies due to absent data. Data for the study were predominantly sourced from the Refinitiv Eikon platform, which offered comprehensive financial and market insights. Supplementary data were obtained from the World Bank database and the Egyptian Stock Exchange website when necessary to guarantee thoroughness and precision. In addition, the dataset comprised the Geopolitical Risk (GPR) Index, created by Caldara & Iacoviello [11], which serves as a comprehensive and standardized measure to evaluate the severity of geopolitical tensions over time. This thorough methodology for data gathering sought to improve the reliability and validity of the study’s results.

3.2. Model Development

3.2.1. Dependent Variable: Firm Performance (FP)

Firm performance denotes the efficacy with which a company employs its resources to generate profits and fulfill its strategic goals [58]. This study measures corporate performance through return on assets (ROA), a recognized financial statistic indicating a corporation’s capacity to generate earnings from its total assets [59]. Return on assets (ROA) is determined by dividing net income by total assets, providing a clear indication of management’s efficiency in utilizing the company’s asset base to generate profits [33]. This statistic is especially applicable in scenarios involving external threats, such as geopolitical instability, as it encompasses both operational performance and asset utilization, rendering it a strong predictor of financial health [60]. ROA facilitates significant comparisons among enterprises and industries and is less affected by variations in capital structure than other profitability metrics [61,62].

3.2.2. Independent Variable: Geopolitical Risk (GPR)

The Geopolitical Risk (GPR) Index, developed by Caldara & Iacoviello [11], is a comprehensive and standardized measure of the severity of geopolitical conflicts over time. The GPR Index is derived from an advanced textual analysis of an extensive collection of articles from prominent international newspapers. The procedure encompasses multiple essential stages: A comprehensive database of newspaper stories is examined utilizing textual analysis methods to pinpoint certain keywords associated with global events, including terrorist operations, armed conflicts, political tensions, and other disruptions [30]. The occurrence of these keywords is subsequently quantified to assess the prevalence of geopolitical discourse in the media. This frequency is adjusted by the total number of articles produced within a specified period to allow for fluctuations in overall news volume [40]. The normalized keyword counts are ultimately consolidated to create the GPR Index, where elevated values signify increased geopolitical tension. During periods of heightened geopolitical tensions, such as elections, regional conflicts, or governmental instability, investor confidence typically diminishes, frequently resulting in decreased stock prices [36]. Foreign investors may retract funds due to perceived dangers, adversely impacting market liquidity and valuations [30].

3.2.3. Moderating Variable: FinTech Index (FintechInd)

The progression of FinTech in Egypt; encompassing digital lending, mobile payments, and blockchain-based financial solutions, can assist organizations in alleviating certain detrimental impacts. FinTech promotes financial inclusion, expands liquidity availability, and facilitates real-time financial decision-making, thus enabling enterprises to respond more effectively to external shocks. The availability and integration of FinTech services may mitigate the adverse effects of geopolitical tensions by providing enterprises with enhanced flexibility, resilience, and access to alternative financial and operational resources. In this context, FinTech acts as a mitigating factor, diminishing the adverse correlation between geopolitical risk and corporate performance, and perhaps preserving or enhancing business results during political and economic instability.

We employ a FinTech index as an indicator of the extent of FinTech adoption. The index is developed by a content analysis methodology guided by machine-learning algorithms. According to the previous literature, eleven essential FinTech-related terms have been revealed, as detailed in Table 1 below. Subsequently, we examined the annual reports of companies in Egypt employing natural language processing (NLP) to ascertain the frequency of these terms [55]. The FinTech index is calculated as the ratio of the total frequency of selected FinTech terms to the entire word count in the report, yielding a standardized measure of FinTech importance inside a company’s strategic and operational dialogue [63]. This proxy is particularly appropriate for the Egyptian setting, where Fintech adoption may not consistently be explicitly revealed using quantitative metrics. Through textual analysis, we extract indirect but significant indicators of digital transformation present in narrative disclosures, facilitating a comprehensive evaluation of fintech level.

Table 1.

Selected FinTech terminologies.

3.2.4. Control Variables: (Firm Characteristics)

Leverage (Debt Ratio)

Leverage, defined as the degree to which a corporation employs debt to finance its activities, can significantly influence the relationship between geopolitical risk and firm performance [64]. During periods of intensified geopolitical uncertainty, highly leveraged enterprises may face increased financial susceptibility due to heightened exposure to interest rate volatility, diminished investor confidence, and limited access to external funding. In contrast, companies with moderate or low leverage are generally more capable of withstanding shocks and sustaining operational stability. Leverage serves as a control variable, accounting for variations in enterprises’ financial structures that may affect their responses to geopolitical concerns [65].

Growth Opportunities (Market-to-Book Ratio)

The connection between growth opportunities, typically assessed through the market-to-book ratio, and firm performance is occasionally interpreted as an indication of investor anticipations for a company’s future potential. A high market-to-book ratio indicates that the market appraises the company well above its book value, signifying robust expected growth and profitability [66]. In principle, companies with greater growth prospects ought to generate superior stock returns by reinvesting profits into value-augmenting initiatives [67]. Nonetheless, empirical data may be inconsistent, particularly in emerging markets such as Egypt, where macroeconomic unpredictability, regulatory volatility, or restricted access to capital might hinder enterprises from achieving their anticipated development [68]. Consequently, although a high market-to-book ratio indicates optimism, actual firm performance may fluctuate based on the firm’s effectiveness in converting its growth potential into concrete financial performance.

Liquidity (Liq)

Liquidity can control the relationship between geopolitical risk and firms’ performance by influencing a firm’s ability to withstand external shocks [69]. When geopolitical tensions rise, market uncertainty increases, often leading to reduced investor confidence and stock price volatility [70]. Firms with high liquidity risk, meaning they have limited liquid assets relative to their obligations, are more vulnerable during these periods, as they may struggle to meet operational needs or respond to unexpected financial pressures, leading to sharper declines in their performance [7]. Conversely, firms with lower liquidity risk, having stronger cash reserves or better access to funding, can navigate geopolitical uncertainties more effectively, preserving their market value and offering more stability to investors. Thus, liquidity risk acts as a crucial control factor [35].

3.2.5. Control Variables: (Macroeconomic Variables)

Gross Domestic Product (GDP)

GDP growth signifies the comprehensive expansion of an economy, which often fosters increased company earnings and bolsters investor confidence [71]. As GDP increases, firms typically encounter heightened demand, resulting in elevated revenues and profits, which can subsequently elevate companies’ performance. Conversely, phases of sluggish or negative GDP growth frequently indicate economic recessions, diminishing consumer expenditure and business investment, which can adversely affect corporate performance [66]. In emerging markets like Egypt, companies’ performance is notably responsive to GDP variations because macroeconomic factors directly influence market sentiment and business cycles. Consequently, GDP functions as a vital metric for investors assessing the prospective trajectory and robustness of a company’s performance [30].

Inflation (Inf)

Typically, light and expected inflation may be accommodated by enterprises via pricing modifications and preserving profitability [72]. Nevertheless, elevated or unforeseen inflation typically diminishes purchasing power, escalates input expenses, and generates uncertainty, which can adversely affect business profits [26]. In emerging economies such as Egypt, inflation volatility is typically more severe, and its detrimental impact on firm performance is more evident due to poorer monetary transmission channels and heightened sensitivity to external shocks. Consequently, investors meticulously observe inflation patterns, as sustained inflationary pressures may adversely affect stock market performance and diminish the company’s performance [73]. Table 2 provides a summary of the variable measurements.

Table 2.

Summary of variable measurements.

3.3. Model

The following models have been developed based on the previous studies to empirically investigate the impact of geopolitical risk on companies’ performance in Egypt during the last ten years. The models control for firm characteristics (such as profitability, liquidity, and growth opportunities) and for macroeconomic variables (such as GDP and inflation). We utilized the panel GMM estimator proposed by Blundell and Bond [78] (1998) to mitigate potential endogeneity and unobserved heterogeneity. Within this concept, lagged levels of the endogenous variables served as instruments for their differenced forms, while lagged differences functioned as instruments for their levels. Lagged values of firm performance, leverage, and growth were instrumented using their own previous values from t − 2 and earlier, based on the premise that these values are uncorrelated with the error term yet correlated with the endogenous regressors. The exogenous macroeconomic variables (GDP and inflation) were incorporated without instrumentation.

The initial diagnostics revealed that the Hansen test for over-identifying limitations produced a p-value exceeding 0.1, signifying the validity of the instruments and their lack of correlation with the error term. The Arellano–Bond tests for serial correlation in the first-differenced errors indicate significant AR (1) and the absence of second-order autocorrelation (AR (2)), thus validating the moment requirements. The difference-in-Hansen tests further verify the validity of the instrument subsets employed for the GMM-style instruments. The initial estimates affirm the robustness and significance of the instruments, validating the application of the GMM technique in assessing the causal effect of geopolitical risk on corporate performance.

where

FPi,t = α0 + α1 FPi,t−1 + α2 GPRt + α3 FinTechIndi,t + α4 Liqi,t + α5 GrOppi,t + α6 Levi,t + α7 GDPt + α8 Inft + e

FPi,t = α0 + α1 FPi,t−1 + α2 GPRt + α3 FinTechIndi,t + α4 GPRt × FinTechIndi,t + α5 Liqi,t + α6 GrOppi,t + α7 Levi,t + α8 GDPt + α9 Inft + e

FP stands for firm performance and is measured by the return on assets ratio.

GPR stands for geopolitical risk and is measured using the index constructed by Caldara & Iacoviello [11].

FinTechInd is the FinTech index and is measured through content analysis of annual reports.

Liq is liquidity and is measured by the current ratio (current assets divided by current liabilities).

GrOpp is growth opportunities and is measured by the market-to-book ratio.

Lev stands for leverage and is measured by the debt ratio.

GDP is gross domestic product and is measured by the growth in GDP.

Inf is inflation and is measured by the growth in consumer price index.

e stands for the error term.

4. Results and Analysis

4.1. Descriptive Statistics

Table 3 below provides the descriptive statistics for the selected variables. Several important insights are provided by the descriptive statistics that were performed on the sample of Egyptian firms over the timespan of 2014 to 2023.

Table 3.

Descriptive statistics.

The examination of Egyptian companies indicates an average performance value of 4.1 percent, signifying a low mean return within the sample. This indicates that whereas certain organizations excel, others may lag, resulting in an overall average performance. The variables leverage and liquidity demonstrate the greatest standard deviations among all analyzed financial indicators. The considerable diversity indicates substantial disparities in enterprises’ management of debt and short-term financial commitments, perhaps driven by factors including firm size, industry characteristics, and access to financial resources. This dispersion also indicates varying degrees of financial risk among the enterprises in the sample. Moreover, the reporting on financial technology (FinTech) significantly differs among non-financial organizations, revealing discrepancies in transparency and strategic coherence with digital innovation. Certain organizations aggressively recognize and integrate FinTech advancements into their operations or sustainability reports, whereas others either disregard it or offer scant references. This disparate reporting may result from variations in digital maturity, regulatory demands, or managerial agendas. It indicates that although FinTech is becoming a significant element in the financial ecosystem, its adoption and integration into company plans and disclosures vary across sectors in Egypt. This difference highlights the necessity for more organized norms or incentives for companies to standardize FinTech reporting, particularly as it becomes vital for strengthening competitiveness and operational resilience.

4.2. Correlation Matrix

Table 4 displays the correlation matrix, which illuminates correlations between the study variables and the performance of Egyptian firms. A negative association exists between geopolitical risk and firm performance, indicating that during times of elevated geopolitical tensions, firms may yield less returns. Geopolitical conflicts frequently generate an unstable business climate, obstructing strategies for the future and diminishing overall firm profitability.

Table 4.

Correlation matrix.

A negative correlation between leverage and company performance indicates that increased debt levels correspond to diminished firm performance. The result could suggest an adverse impact of debt servicing on corporate earnings, particularly during times of economic or political instability. Companies with significant debt may encounter increased financial risk and diminished decision-making flexibility, potentially hindering their capacity to invest in growth possibilities or successfully tackle market problems. In addition, a positive correlation between FinTech adoption and firm performance illustrates the potential advantages of incorporating technological innovation into financial processes. Financial technology solutions can augment efficiency, improve access to capital, and facilitate strategic decision-making. This favorable correlation indicates that companies utilizing FinTech are more adept at adjusting to market fluctuations, optimizing processes, and sustaining a competitive edge, even in unstable conditions.

4.3. Panel GMM Regression Results

Table 5 displays the outcomes of the panel GMM (Generalized Method of Moments) regression analysis. This study employed the panel GMM approach because of its effectiveness in mitigating possible concerns of endogeneity, unobserved heterogeneity, and autocorrelation, prevalent in panel data encompassing numerous companies over several years. Due to the fluctuating characteristics of firm returns and the potential correlation of some independent variables with historical or unobserved factors, GMM provides more dependable and unbiased coefficient estimates than conventional methods such as pooled OLS or fixed-effects models. The application of panel GMM guarantees that the results are more precise and indicative of the dependable correlations among geopolitical risk, FinTech index, leverage, liquidity, and firm performance in Egypt.

Table 5.

Panel GMM regression results.

The findings demonstrate that the Geopolitical Risk Index has a negative and statistically significant influence on the firm returns of Egyptian firms at the 1 percent significance level. The outcome illustrates a crucial understanding of the susceptibility of companies functioning in volatile political and economic contexts. This association indicates that heightened geopolitical tensions negatively impact corporate outcomes, including profitability and operational efficiency [79]. The Egyptian market, characterized by political upheaval and external disturbances, exhibits a business environment where increased risk undermines investor confidence, disrupts supply chains, and constrains both domestic and foreign investments. Companies functioning under these circumstances may postpone expansion, implement defensive strategies, or experience diminished access to finance, all of which contribute to deteriorated performance indicators such as return on assets [31].

This empirical finding strongly corresponds with the principles of Behavioral Finance Theory, which posits that investor decisions and market outcomes are frequently irrational, being swayed by emotions, biases, and risk perceptions [80]. During periods of geopolitical uncertainty, investors may excessively respond to news, engage in herd behavior, or display risk aversion, resulting in capital flight, stock price fluctuations, and diminished firm values. Managers may also become excessively cautious or postpone investment choices owing to perceived uncertainty, notwithstanding the robustness of their firm’s fundamentals [35].

In addition, the significant positive influence of financial technology (FinTech) on business performance, assessed by return on assets (ROA), in Egyptian non-financial firms underscores the increasing strategic significance of digital innovation in improving corporate efficiency, competitiveness, and resilience [81]. FinTech enables the automation of financial operations, expands access to credit via alternative lending platforms, improves data-driven decision-making, and optimizes payment and billing systems [82]. These improvements diminish operational expenses, enhance working capital management, and ultimately elevate returns in relation to the asset base, consequently positively impacting ROA [83].

The significant and positive moderating influence of FinTech on the connection between geopolitical risk and corporate performance in Egypt indicates a robust dynamic. Financial technology acts as a buffer against the adverse effects of geopolitical instability [84]. In an area characterized by political instability, violence, and economic volatility that can erode corporate trust and disrupt operations, FinTech serves as a resilience-enhancing instrument that assists enterprises in adapting and performing under duress [85]. From a critical standpoint, geopolitical risk generally diminishes business performance via mechanisms such as shortened investment, interrupted supply chains, and elevated financing costs. The integration of FinTech, via digital financial services and alternative finance platforms, allows firms to sustain liquidity, secure rapid financing, and enhance operational efficiency, thus alleviating the negative impacts of uncertainty [86]. In Egypt, where conventional banking institutions may impose stricter conditions amid political or economic upheaval, FinTech provides companies with quicker and more dependable financial services. The moderating role is especially crucial for non-financial enterprises that depend on reliable funding and transaction processes for effective operation [87]. Firms utilizing FinTech systems for invoicing and cash flow management are more adept at managing risk, circumventing delays, and engaging in strategic planning, even within volatile external conditions. FinTech solutions enhance information openness and decision-making, enabling corporations to react more swiftly to evolving geopolitical circumstances [88]. This theoretically endorses a resource-based view (RBV) of the enterprise, wherein technical skills, such as FinTech adoption, are regarded as strategic assets capable of generating a persistent competitive advantage. Companies that incorporate FinTech into their fundamental operations exhibit enhanced efficiency and resilience, showcasing superior performance stability in challenging circumstances [89].

Moreover, the findings indicate a substantial positive association between liquidity and Egyptian firms’ performance at the 5 percent significance level. This result demonstrates the essential importance of cash accessibility and financial adaptability in maintaining corporate operations, particularly in growing and unstable markets [28]. Liquidity, commonly assessed through the current ratio or fast ratio, reflects a company’s capacity to fulfill its short-term liabilities. In the Egyptian setting, when access to external financing may be limited by political, economic, or institutional considerations, substantial liquidity enables enterprises to sustain operations, capitalize on investment opportunities, and endure external shocks [30]. Companies with robust liquidity are less dependent on short-term loans and are more adept at handling unforeseen costs, delays in receivables, or disturbances resulting from inflation and currency volatility [90]. This financial reserve allows them to maintain operational continuity, remunerate suppliers and personnel punctually, and avert expensive borrowing or asset liquidation. As a result, these organizations are more inclined to attain superior return on assets (ROA), the metric employed for evaluating firm performance [70].

Furthermore, the results indicate a substantial and favorable influence of growth possibilities on non-financial Egyptian companies. This implies that investors appreciate firms with robust future potential and are prepared to pay a premium for anticipated earnings growth and market expansion [91]. This finding aligns with financial theory, indicating that enterprises with elevated growth potential are typically linked to higher values and enhanced performance [32]. It is essential to acknowledge that within Egypt’s developing financial industry, market expectations can fluctuate, and development forecasts may be influenced by macroeconomic and political factors [92,93].

Finally, the results indicate a significant positive effect of inflation on firm returns, coupled with a considerable negative effect of GDP growth on firm performance. Although inflation is generally perceived as harmful to businesses, in the Egyptian environment, inflation can enhance company performance, particularly for companies with robust pricing power or those operating in areas like consumer products or energy [39]. These companies may transfer increasing input costs to consumers, thus safeguarding or even enhancing profit margins [3]. Unexpectedly, a negative correlation between GDP and corporate success in Egypt may arise from structural inefficiencies in the distribution or experience of economic growth [40]. For instance, GDP growth may be propelled by industries such as oil, government services, or extensive infrastructure projects that do not directly advantage publicly traded non-financial companies [23].

5. Robustness of Results

Section 5 presents a comprehensive robustness analysis to verify the reliability and consistency of the primary findings. This section evaluates different model specifications and incorporates year fixed effects to control for unobserved temporal shocks. Specifically, to guarantee the robustness and validity of our findings, the model integrates alternative proxies for the principal variables analyzed in the study as provide in Table 6. For instance, instead of return on assets as a measure of firm performance, we used return on equity, and instead of debt ratio to measure leverage, we used debt to equity. In addition, we used the quick ratio instead of the current ratio to measure firm liquidity, whereas we used the change in total assets instead of market-to-book ratio as a proxy for firm growth. The results indicate that our principal findings are strong, exhibiting consistent signs, significance, and magnitudes of the estimated coefficients. This verifies that the positive connections observed among geopolitical risk, firm-specific characteristics, macroeconomic variables, and firm performance are consistent and not influenced by model-specific assumptions.

Table 6.

Robustness of Results—Panel GMM regression results.

6. Practical Implications

This study’s findings present significant implications for managers, policymakers, and investors in Egypt. Managers must prioritize digital transformation and the incorporation of FinTech solutions, including digital payments, data analytics, and alternative finance platforms, to maintain performance within external disruptions. Policymakers are urged to cultivate a conducive climate for FinTech advancement via supporting regulations, investment in digital infrastructure, and incentives for innovation. Moreover, investors may regard companies with strong liquidity, reduced leverage, and evident FinTech integration as more resilient and appealing investment choices in politically sensitive environments. More specifically, the findings indicate that FinTech significantly moderates the influence of geopolitical risk on company performance; nonetheless, widespread adoption of FinTech in the Egyptian market encounters considerable obstacles. Prominent among these are infrastructural constraints, like unreliable internet connectivity, inadequate digital payment systems in rural regions, and insufficient access to modern technical platforms for smaller enterprises. Moreover, regulatory obstacles, such as outdated financial legislation, a lack of explicit guidelines for digital financial services, and insufficient coordination among regulatory agencies, hinder FinTech innovation and scalability. Resolving these difficulties necessitates collaborative efforts from legislators, financial institutions, and technology providers to invest in digital infrastructure and cultivate a more conducive regulatory framework.

7. Limitations and Future Studies

This study offers significant insights into the association between geopolitical risk, firm-specific variables, and performance for Egyptian firms; nonetheless, numerous limitations should be recognized. The sample comprises only non-financial registered companies on the Egyptian Stock Exchange, perhaps limiting the generalizability of the findings to the wider MENA region. The study is confined to the period from 2014 to 2023; hence, it does not consider potential structural changes or regime transitions that may arise over extended durations. Extending the timeframe or implementing rolling-window analysis may yield more profound insights.

8. Conclusions

This study aimed to investigate the influence of geopolitical risk on corporate performance in Egypt, specifically emphasizing the moderating effect of financial technology (FinTech). The study analyzes a panel dataset consisting of 182 Egyptian firms over the period 2014–2023 using the panel Generalized Method of Moments (GMM) regression technique. The findings indicated that geopolitical risk adversely impacts firm performance, underscoring the susceptibility of Egyptian firms to political instability, regional conflicts, and economic volatility. This result corresponds with Behavioral Finance Theory, which asserts that investor sentiment and corporate decision-making are acutely responsive to perceived risks and uncertainties, particularly in emerging economies. The evidence confirmed that leverage adversely impacts firm performance, highlighting the risks of excessive debt during periods of geopolitical stress, whereas liquidity demonstrated a positive correlation, underscoring the significance of cash flow and short-term financial flexibility in mitigating external shocks.

The study’s primary contribution is the finding of FinTech as a beneficial and important moderator in the relationship between geopolitical risk and corporate performance. This indicates that companies investing in financial technologies are better equipped to endure the negative impacts of geopolitical difficulties, due to the efficiency, accessibility, and adaptability provided by digital tools. The results demonstrate that FinTech directly enhances corporate performance, highlighting its significant role in fostering innovation and efficiency within financial operations. The analysis indicated a positive correlation between inflation and performance, as well as a negative association between GDP and firm results, necessitating additional exploration of the structural dynamics of Egypt’s economy and its transmission mechanisms to firm-level performance.

This research contributes to the literature by providing empirical evidence on how FinTech can act as a strategic tool for reducing external risks and improving business resilience in Egypt. The research enhances both scholarly and practical discussions by illustrating that digital financial innovation serves as a catalyst for performance and a safeguard against macroeconomic and geopolitical instability. These findings endorse a cooperative initiative among corporations, politicians, and investors to facilitate digital transformation, judicious financial management, and proactive risk mitigation in uncertain circumstances.

Author Contributions

Conceptualization, B.A.K., M.S.A., M.S.A.-N. and M.M.; methodology, B.A.K.; software, B.A.K., M.S.A., M.S.A.-N. and M.M.; validation, M.S.A. and M.S.A.-N.; formal analysis, B.A.K., M.S.A., M.S.A.-N. and M.M.; resources, B.A.K., M.S.A., M.S.A.-N. and M.M.; data curation, B.A.K. and M.S.A.; writing—original draft, B.A.K., M.S.A., M.S.A.-N. and M.M.; writing—review and editing, B.A.K.; visualization, M.S.A.; project administration, B.A.K. and M.S.A.-N.; funding acquisition, M.S.A. All authors have read and agreed to the published version of the manuscript.

Funding

This work was supported and funded by the Deanship of Scientific Research at Imam Mohammad Ibn Saud Islamic University (IMSIU) (grant number: IMSIU-DDRSP2502).

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data that support the findings of this study are available from the Refinitiv Eikon Platform (LSEG), but restrictions apply to the availability of these data, which were used under subscription for the current study and so are not publicly available. The data are, however, available from the authors upon reasonable request and with the permission of LSEG.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Baker, S.R.; Bloom, N.; Davis, S.J.; Kost, K.; Sammon, M.; Viratyosin, T. The unprecedented stock market reaction to COVID-19. Rev. Asset Pricing Stud. 2020, 10, 742–758. [Google Scholar] [CrossRef]

- Alesina, A.; Özler, S.; Roubini, N.; Swagel, P. Political Instability and Economic Growth. J. Econ. Growth 1996, 1, 189–211. [Google Scholar] [CrossRef]

- Zhao, J. Time-varying impact of geopolitical risk on natural resources prices: Evidence from the hybrid TVP-VAR model with large system. Resour. Policy 2023, 82, 103467. [Google Scholar] [CrossRef]

- Bekaert, G.; Harvey, C.R.; Lundblad, C. Does financial liberalization spur growth? J. Financ. Econ. 2005, 77, 3–55. [Google Scholar] [CrossRef]

- Eissa, M.A.; Al Refai, H.; Chortareas, G. Heterogeneous impacts of geopolitical risk factors on stock markets in the Middle East: A quantile regression analysis across four emerging economies. J. Econ. Asymmetries 2024, 30, e00374. [Google Scholar] [CrossRef]

- Arezki, R.; Brückner, M. Rainfall, financial development, and remittances: Evidence from sub-Saharan Africa. J. Int. Econ. 2012, 87, 377–385. [Google Scholar] [CrossRef]

- Forbes, K.J.; Rigobon, R. No contagion, only interdependence: Measuring stock market co-movements. J. Financ. 2002, 57, 2223–2261. [Google Scholar] [CrossRef]

- Zhang, Y.; He, J.; He, M.; Li, S. Geopolitical risk and stock market volatility: A global perspective. Financ. Res. Lett. 2023, 53, 103620. [Google Scholar] [CrossRef]

- Umar, Z.; Bossman, A.; Choi, S.Y.; Teplova, T. Does geopolitical risk matter for global asset returns? Evidence from quantile-on-quantile regression. Financ. Res. Lett. 2022, 48, 102991. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring Geopolitical Risk; Federal Reserve Board Finance and Economics Discussion Series; American Economic Association: Nashville, TN, USA, 2018; pp. 2018–2076. [Google Scholar]

- Caldara, D.; Iacoviello, M. The GPR index: An approach to measuring geopolitical risk. Am. Econ. Rev. 2022, 112, 1194–1225. [Google Scholar] [CrossRef]

- Samuelson Paul, A. Rational Theory of Warrant Pricing. Ind. Manag. Rev. 1965, 6, 13–39. [Google Scholar]

- Fama, E.F. Efficient Capital Markets: A Review of Theory and Empirical Work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Malkiel, B.G. Efficient Market Hypothesis. In Finance; Eatwell, J., Milgate, M., Newman, P., Eds.; The New Palgrave; Palgrave Macmillan: London, UK, 1989. [Google Scholar] [CrossRef]

- Nyakurukwa, K.; Seetharam, Y. Alternatives to the efficient market hypothesis: An overview. J. Cap. Mark. Stud. 2023, 7, 111–124. [Google Scholar] [CrossRef]

- Lo, A.W. The adaptive markets hypothesis. J. Portf. Manag. 2024, 30, 15–29. [Google Scholar] [CrossRef]

- Thaler, R.H. (Ed.) Advances in Behavioral Finance, Volume II; Princeton University Press: Princeton, NJ, USA, 2005. [Google Scholar]

- Kediya, S.O.; Dhote, S.; Singh, D.K.; Bidve, V.S.; Pathan, S.; Mohare, R.V.; Suchak, A. Are AI and Chat Bots Services Effects the Psychology of Users in Banking Services and Financial Sector. J. ReAttach Ther. Dev. Divers. 2023, 6, 191–197. [Google Scholar]

- Khan, S.; Singh, D.K.; Singh, M.; Mena, D.F. Automatic Signature Verifier Using Gaussian Gated Recurrent Unit Neural Network. IET Biom. 2023, 2023, 5087083. [Google Scholar] [CrossRef]

- Singh, D.K.; Ghosh, S.; Khan, S.; Nimbarte, M. An In-Depth Analysis of Quantum Computing Frameworks: Exploring Prominent Platforms. Indian J. Tech. Educ. 2023, 46, 14–20. [Google Scholar]

- Barber, B.M.; Odean, T. The courage of misguided convictions. Financ. Anal. J. 1999, 55, 41–55. [Google Scholar] [CrossRef]

- Paul, R.I.K.; Ponnam, A.; Rubal, R.; Singh, D.K. How Perceived Value Advances Loyalty Progression? Evidence from Indian Quick Service Restaurants. Acad. Mark. Stud. J. 2023, 27, 1–13. [Google Scholar]

- Schneider, G.; Troeger, V.E. War and the world economy: Stock market reactions to international conflicts. J. Confl. Resolut. 2006, 50, 623–645. [Google Scholar] [CrossRef]

- Smales, L.A. Political uncertainty and financial market uncertainty in an Australian context. J. Int. Financ. Mark. Inst. Money 2014, 32, 415–435. [Google Scholar] [CrossRef]

- Tuncay, M. Do political risks matter in the financial markets?: Evidence from Turkey. Eurasian Bus. Rev. 2018, 8, 209–227. [Google Scholar] [CrossRef]

- Duyvesteyn, J.; Martens, M.; Verwijmeren, P. Political risk and expected government bond returns. J. Empir. Financ. 2016, 38, 498–512. [Google Scholar] [CrossRef]

- Cheng, P.; Li, K.; Choi, B.; Guo, X.; Wang, M. Impact of geopolitical risk on green international technology spillovers: FDI and import channels. Heliyon 2024, 10, e36972. [Google Scholar] [CrossRef] [PubMed]

- Bekaert, G.; Hoerova, M. The VIX, the variance premium and stock market volatility. J. Econom. 2014, 183, 181–192. [Google Scholar] [CrossRef]

- Fajgelbaum, P.D.; Goldberg, P.; Kennedy, P.J.; Khandelwal, A. The return to protectionism. Q. J. Econ. 2020, 135, 1–55. [Google Scholar] [CrossRef]

- Ardalan, A.; Massoudi, M. Geopolitical events and global financial markets. In Handbook of Research on Contemporary Global Business Strategies; IGI Global: Hershey, PA, USA, 2023; pp. 377–397. [Google Scholar]

- Nguyen, H.; Pham, A.V.; Pham, M.D.; Marty, M.H. Pham, Business resilience: Lessons from government responses to the global COVID-19 crisis. Int. Bus. Rev. 2023, 32, 102166. [Google Scholar] [CrossRef]

- Abdullah, M.; Tiwari, A.K.; Hossain, M.R.; Abakah, E.J. Geopolitical risk and firm-level environmental, social and governance (ESG) performance. J. Environ. Manag. 2024, 363, 121245. [Google Scholar] [CrossRef] [PubMed]

- Ibrahim, A. ESG practices mitigating geopolitical risks: Implications for sustainable environmental management. J. Environ. Manag. 2024, 358, 120923. [Google Scholar] [CrossRef] [PubMed]

- Guo, P.; Shi, J. Geopolitical risks, investor sentiment and industry stock market volatility in China: Evidence from a quantile regression approach. N. Am. J. Econ. Financ. 2024, 72, 102139. [Google Scholar] [CrossRef]

- Hao, X.; Ma, Y.; Pan, D. Geopolitical risk and the predictability of spillovers between exchange, commodity and stock markets. J. Multinatl. Financ. Manag. 2024, 73, 100843. [Google Scholar] [CrossRef]

- Böyükaslan, A.; Demirer, R.; Ergüney, E.B.; Gursoy, S. Geopolitical risks and the energy-stock market nexus: Evidence from Turkiye. Borsa Istanb. Rev. 2024, 24, 73–83. [Google Scholar] [CrossRef]

- Pan, C.; Zhang, W.; Wang, W. Global geopolitical risk and volatility connectedness among China’s sectoral stock markets. Financ. Res. Lett. 2023, 58, 104487. [Google Scholar] [CrossRef]

- Saâdaoui, F.; Ben Jabeur, S.; Goodell, J.W. Geopolitical risk and the Saudi stock market: Evidence from a new wavelet packet multiresolution cross-causality. Financ. Res. Lett. 2023, 53, 103654. [Google Scholar] [CrossRef]

- Hasan, M.B.; Hassan, M.K.; Alhomaidi, A. How do sectoral Islamic equity markets react to geopolitical risk, economic policy uncertainty, and oil price shocks? J. Econ. Asymmetries 2023, 28, e00333. [Google Scholar] [CrossRef]

- Ahmed, S.; Assaf, R.; Rahman, M.R.; Tabassum, F. Is geopolitical risk interconnected? Evidence from Russian-Ukraine crisis. J. Econ. Asymmetries 2023, 28, e00306. [Google Scholar] [CrossRef]

- Qin, Y.; Hong, K.; Chen, J.; Zhang, Z. Asymmetric effects of geopolitical risks on energy returns and volatility under different market conditions. Energy Econ. 2020, 90, 104851. [Google Scholar] [CrossRef]

- Trotta, A.; Rania, F.; Strano, E. Exploring the linkages between FinTech and ESG: A bibliometric perspective. Res. Int. Bus. Financ. 2024, 69, 102200. [Google Scholar] [CrossRef]

- Abdul-Rahim, R.; Bohari, S.A.; Aman, A.; Awang, Z. Benefit–Risk Perceptions of FinTech Adoption for Sustainability from Bank Consumers’ Perspective: The Moderating Role of Fear of COVID-19. Sustainability 2022, 14, 8357. [Google Scholar] [CrossRef]

- Najib, M.; Ermawati, W.J.; Fahma, F.; Endri, E.; Suhartanto, D. FinTech in the Small Food Business and Its Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Maryunita, L.; Trinugroho, I. Fintech Innovation and Bank Efficiency in Indonesia. Khazanah Soc. 2022, 4, 626–635. [Google Scholar] [CrossRef]

- Ntwiga, D.B. Technical Efficiency in the Kenyan Banking Sector: Influence of Fintech and Banks Collaboration. J. Financ. Econ. 2020, 8, 13–20. [Google Scholar] [CrossRef]

- Thakor, A.V. Fintech and banking: What do we know? J. Financ. Intermediation 2020, 41, 100833. [Google Scholar] [CrossRef]

- Alade, I.; Eroglu, Z.G. Disruptive innovations or enhancing financial inclusion: What does Fintech mean for Africa? Vanderbilt J. Transnatl. Law 2023, 56, 673. [Google Scholar] [CrossRef]

- Djimesah, I.E.; Zhao, H.; Okine, A.N.; Li, Y.; Duah, E.; Mireku, K.K. Analyzing the technology of acceptance model of Ghanaian crowdfunding stakeholders. Technol. Forecast. Soc. Chang. 2022, 175, 121323. [Google Scholar] [CrossRef]

- Xie, J.; Ye, L.; Huang, W.; Ye, M. Understanding FinTech Platform Adoption: Impacts of Perceived Value and Perceived Risk. J. Theor. Appl. Electron. Commer. Res. 2021, 16, 1893–1911. [Google Scholar] [CrossRef]

- Sarfraz, M.; Ye, Z.; Banciu, D.; Dragan, F.; Ivascu, L. Intertwining Digitalization and Sustainable Performance via the Mediating Role of Digital Transformation and the Moderating Role of FinTech Behavior Adoption. Stud. Inform. Control 2022, 31, 35–44. [Google Scholar] [CrossRef]

- Khaddam, A.; Alhanatleh, H. Role of artificial intelligence and BIG DATA capabilities on fintech services: Value co-creation theory. Innov. Mark. 2024, 20, 219–233. [Google Scholar] [CrossRef]

- Abu Khalaf, B.; Al-Shaer, A. The Impact of FinTech on Profitability: An Analysis of Determinants in Banks of Middle East and North Africa (MENA) Region. Int. J. Membr. Sci. Technol. 2023, 10, 61–67. [Google Scholar] [CrossRef]

- Abu Khalaf, B.; Al-Sharkas, A.; Sarea, A. Realizing opportunities: The influence of FinTech on the success of MENA banks. Discov. Sustain. 2025, 6, 501. [Google Scholar] [CrossRef]

- Afzal, A.M.; Abu Khalaf, B.; Al-Naimi, M.S.; Samara, E. The Impact of Fintech on the Stability of Middle Eastern and North African (MENA) Banks. Risks 2025, 13, 106. [Google Scholar] [CrossRef]

- Abu Khalaf, B.; Awad, A.B.; Omnia, A.; Gharios, R.T. The Role of FinTech in Determining the Performance of Banks: The Case of Middle East North Africa (MENA) Region. Int. J. Membr. Sci. Technol. 2023, 10, 1525–1535. [Google Scholar] [CrossRef]

- Cumming, D.; Johan, S.; Reardon, R. Global fintech trends and their impact on international business: A review. Multinatl. Bus. Rev. 2023, 31, 413–436. [Google Scholar] [CrossRef]

- Nguyen, C.P.; Schinckus, C.; Su, T.D.; Chong, F.H.L. Determinants of stock market returns in emerging markets: The linkage between institutional quality and macro liquidity. Int. J. Financ. Econ. 2022, 27, 4472–4486. [Google Scholar] [CrossRef]

- Wijaya, C.; Nurastuti, P.; Musiega, M.; Kurniawati, H. Determinants of stock returns: Evidence from property and real estate companies in Indonesia. Glob. Adv. Bus. Stud. 2025, 4, 49–56. [Google Scholar] [CrossRef]

- Ihsan, S.B.; Murni, S.; Sumarauw, J.S. Pengaruh Current Ratio, DER Dan ROA Terhadap Return Saham Pada Perusahaan Automotif Dan Komponen PERIODE 2013–2015. J. EMBA 2017, 5, 1793–1803. [Google Scholar]

- Banerjee, R.; Cavoli, T.; McIver, R.; Meng, S.; Wilson, J.K. Predicting long-run risk factors of stock returns: Evidence from Australia. Aust. Econ. Pap. 2023, 62, 377–395. [Google Scholar] [CrossRef]

- Abu Khalaf, B.; Alqahtani, M.S.; Al-Naimi, M.S. ESG Controversies and the Financial Performance of MENA Firms: The Moderating Role of Board Characteristics. Sustainability 2025, 17, 5055. [Google Scholar] [CrossRef]

- Ktit, M.; Abu Khalaf, B. Assessing the environmental, social, and governance performance and capital structure in Europe: A board of directors’ agenda. Corp. Board Role Duties Compos. 2024, 20, 139–148. [Google Scholar] [CrossRef]

- Abdelazim, A.; Khalaf, B.A. Do Board Characteristics Affect ESG Performance for European Banks? In The AI Revolution: Driving Business Innovation and Research. Studies in Systems, Decision and Control; Awwad, B., Ed.; Springer: Cham, Switzerland, 2024; Volume 525. [Google Scholar] [CrossRef]

- Abdullah, W.; Rahmati, S.; Mohammad, A.; Al-Hajj, N.; Khalaf, B.A. Does Non-performing Loans Affect Bank Lending Behavior? In The AI Revolution: Driving Business Innovation and Research. Studies in Systems, Decision and Control; Springer: Cham, Switzerland, 2024; Volume 525. [Google Scholar] [CrossRef]

- Basher, S.A.; Haug, A.A.; Sadorsky, P. The impact of oil shocks on the Saudi Arabian stock market. Energy Econ. 2018, 75, 354–363. [Google Scholar]

- Drakos, K. Terrorism activity, investor sentiment, and stock returns. Rev. Financ. Econ. 2010, 19, 128–135. [Google Scholar] [CrossRef]

- Elsayed, A.H.; Helmi, M.H. Volatility transmission and spillover dynamics across financial markets: The role of geopolitical risk. Ann. Oper. Res. 2021, 305, 1–22. [Google Scholar] [CrossRef]

- Aga, B.S.; Mogaddam, V.F.; dan Samadiyan, B. Relationship between liquidity and stock returns in companies in Tehran Stock Exchange. Appl. Math. Eng. Manag. Technol. 2013, 1, 278–285. [Google Scholar]

- Abu Khalaf, B.; Awad, A.B. Exploring the Bearing of Liquidity Risk in the Middle East and North Africa (MENA) Banks. Cogent Econ. Financ. 2024, 12, 2330840. [Google Scholar] [CrossRef]

- Ahmed, O.; Khalaf, B.A. The Impact of ESG on Firm Value: The Moderating Role of Cash Holdings. Heliyon 2025, 11, e41868. [Google Scholar] [CrossRef] [PubMed]

- Chen, A.H.; Siems, T.F. The effects of terrorism on global capital markets. Eur. J. Political Econ. 2004, 20, 349–366. [Google Scholar] [CrossRef]

- Abakah, E.J.; Abdullah, M.; Yousaf, I.; Tiwari, A.K.; Li, Y. Economic sanctions sentiment and global stock markets. J. Int. Financ. Mark. Inst. Money 2024, 91, 101910. [Google Scholar] [CrossRef]

- Al-Kubaisi, M.K.; Khalaf, B.A. Does Green Banking Affects Banks Profitability? J. Gov. Regul. 2023, 12, 157–164. [Google Scholar] [CrossRef]

- Ktit, M.A.; Abu Khalaf, B. Does Digital Transformation Reflect the Adjustment of Capital Structure? J. Risk Financ. Manag. 2025, 18, 168. [Google Scholar] [CrossRef]

- Walker, E.R.; McGee, R.E.; Druss, B.G. Mortality in mental disorders and global disease burden implications: A systematic review and meta-analysis. JAMA Psychiatry 2015, 72, 334–341. [Google Scholar] [CrossRef] [PubMed]

- Li, S.; Tu, D.; Zeng, Y.; Gong, C.; Yuan, D. Does geopolitical risk matter in crude oil and stock markets? Evidence from disaggregated data. Energy Econ. 2022, 113, 106191. [Google Scholar] [CrossRef]

- Blundell, R.; Bond, S. Initial conditions and moment restrictions in dynamic panel data models. J. Econom. 1998, 87, 115–143. [Google Scholar] [CrossRef]

- Bekaert, G.; Harvey, C.R.; Lundblad, C. Liquidity and expected returns: Lessons from emerging markets. Rev. Financ. Stud. 2007, 20, 1783–1831. [Google Scholar] [CrossRef]

- Hu, Z.; Borjigin, S. The amplifying role of geopolitical Risks, economic policy Uncertainty, and climate risks on Energy-Stock market volatility spillover across economic cycles. N. Am. J. Econ. Financ. 2024, 71, 102114. [Google Scholar] [CrossRef]

- Sajid Rabbia Huma Ayub Bushra, F. Malik, and Abida Ellahi. The Role of Fintech on Bank Risk-Taking: Mediating Role of Bank’s Operating Efficiency. Hum. Behav. Emerg. Technol. 2023, 2023, 7059307. [Google Scholar]

- Banna, H.; Hassan, M.K.; Rashid, M. Fintech-based financial inclusion and bank risk-taking: Evidence from OIC countries. J. Int. Financ. Mark. Inst. Money 2021, 75, 101447. [Google Scholar] [CrossRef]

- Arslanian, H.; Fischer, F. Fintech and the Future of the Financial Ecosystem. In The Future of Finance; Springer: Berlin/Heidelberg, Germany, 2019; Chapter 16; pp. 201–216. [Google Scholar]

- Khatib, S.F.; Abbas, A.F.; Igwe, M.N.; Yue, S.; Sulimany, H.G. Mind the Tides: A Systematic Review of the Geopolitical Risk Literature. Politics Policy 2025, 53, e70028. [Google Scholar] [CrossRef]

- Uddin, M.H.; Akter, S.; Mollah, S.; Al Mahi, M. Differences in bank and microfinance business models: An analysis of the loan monitoring systems and funding sources. J. Int. Financ. Mark. Inst. Money 2022, 80, 101644. [Google Scholar] [CrossRef]

- Babaei, G.; Giudici, P.; Raffinetti, E. Explainable FinTech lending. J. Econ. Bus. 2023, 125, 106126. [Google Scholar] [CrossRef]

- Hussain, S.; Rasheed, A. Financial inclusion based on financial technology and risky behaviour of micro-finance institutes: Evidence from South Asian micro-finance banks. Digit. Policy Regul. Gov. 2023, 25, 480–489. [Google Scholar] [CrossRef]

- Fang, L.; Zhao, P.; Huang, Z. Financial technology, macroeconomic uncertainty, and commercial banks’ proactive risk-taking in China. China Econ. Q. Int. 2023, 3, 77–87. [Google Scholar] [CrossRef]

- Liu, W.; Fan, H.; Xia, M. Credit scoring based on tree-enhanced gradient boosting decision trees. Expert Syst. Appl. 2022, 189, 116034. [Google Scholar] [CrossRef]

- Kisswani, K.M.; Elian, M.I. Analyzing the (a) symmetric impacts of oil price, economic policy uncertainty, and global geopolitical risk on exchange rate. J. Econ. Asymmetries 2021, 24, e00204. [Google Scholar] [CrossRef]

- Alqahtani, A.; Gupta, R.; Wilson, E. The resilience of Israel’s stock market against geopolitical shocks. J. Econ. Bus. 2020, 108, 105926. [Google Scholar]

- Guidolin, M.; La Ferrara, E. Diamonds are forever, wars are not: Is conflict bad for private firms? Am. Econ. Rev. 2007, 97, 1978–1993. [Google Scholar] [CrossRef]

- Awad, A.B.; Gharios, R.; Abu Khalaf, B.; Seissian, L.A. Bashar Abu Khalaf Lena Seissian Board Characteristics and Bank Performance: Empirical Evidence from the MENA Region. Risks 2024, 12, 81. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).